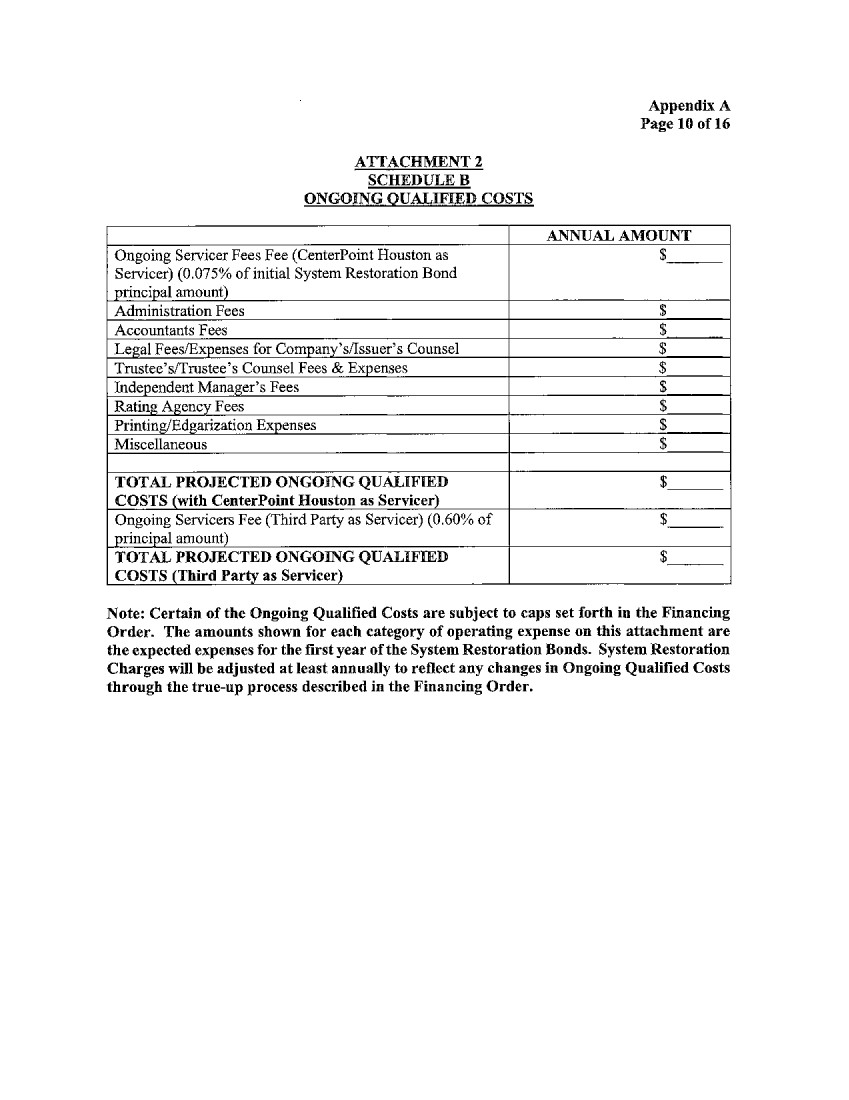

Exhibit 99.1

DOCKET NO. 57559

| APPLICATION OF CENTERPOINT |

§ |

PUBLIC UTILITY COMMISSION |

| ENERGY HOUSTON ELECTRIC, LLC |

§ |

|

| FOR A FINANCING ORDER FOR |

§ |

OF TEXAS |

| SYSTEM RESTORATION COSTS |

§ |

|

| ASSOCIATED WITH MAY 2024 |

§ |

|

| EMERGENCY OPERATIONS PLAN |

§ |

|

| STORMS |

§ |

|

FINANCING ORDER

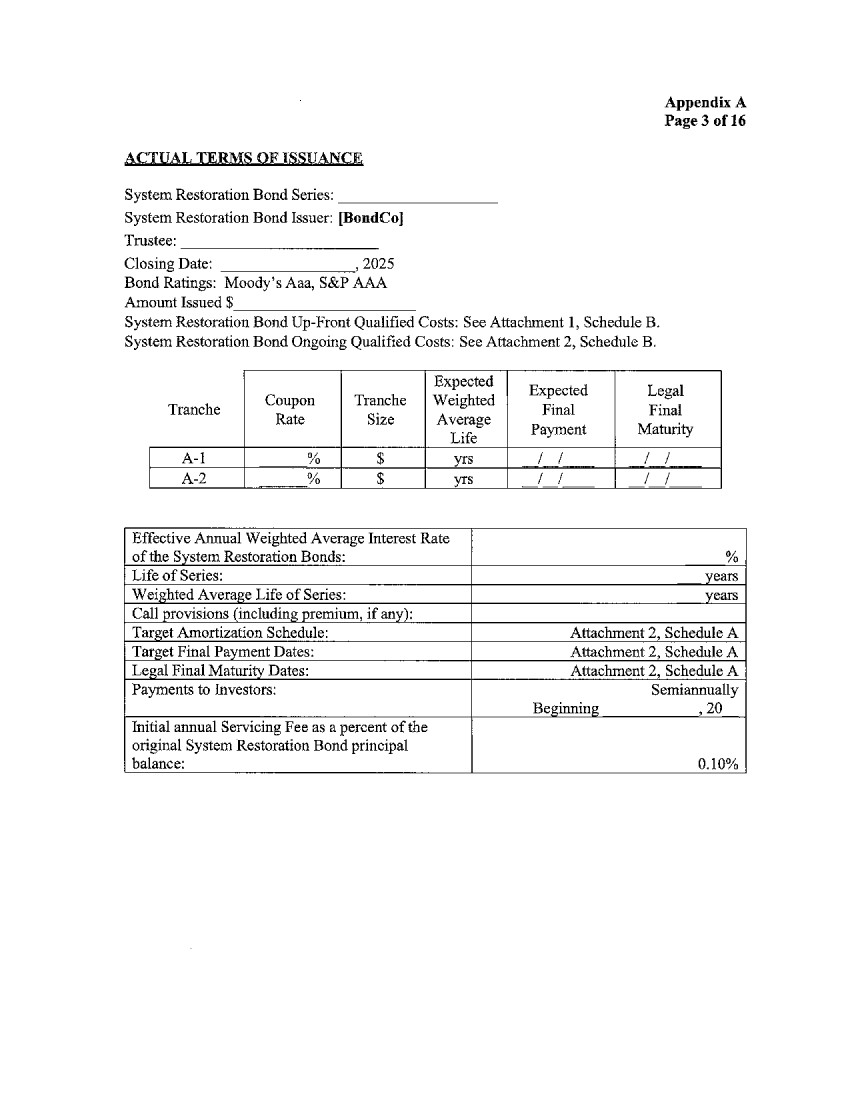

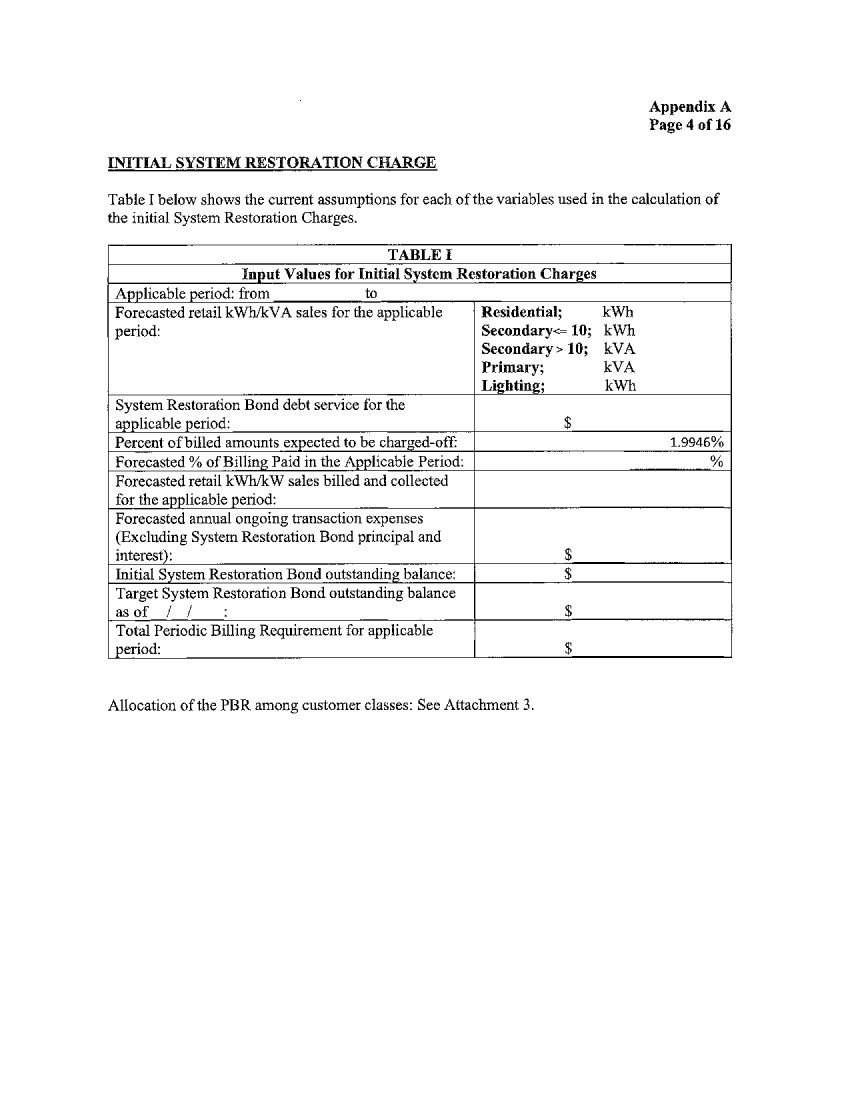

This

Financing Order addresses the application of CenterPoint Energy Houston Electric, LLC (CenterPoint Houston) under PURA1

chapter 36, subchapter I2 and chapter

39 subchapter G.3 In its application,

CenterPoint Houston seeks the following: (1) authorization of the issuance of system restoration bonds4

to securitize the system restoration costs and carrying costs approved by the Commission in Docket No. 57271,5

net of any insurance proceeds, government grants, and other sources of funding that have been received by CenterPoint Houston that

compensate CenterPoint Houston for system restoration costs at the time of the application for this Financing Order (the securitizable

balance); (2) to securitize certain other qualified costs incurred in connection with such securitization as further defined and

described below; (3) approval of the proposed securitization financing structure; (4) approval of system restoration charges

sufficient to recover the principal and interest on the system restoration bonds and to recover the ongoing qualified costs of supporting

and servicing the system restoration bonds; (5) approval of the tariff to implement the system restoration charges; and (6) approval

of the tariff to implement the accumulated deferred federal income tax credit (ADFIT Credit).

1 Public Utility

Regulatory Act, Tex. Util. Code §§ 11.001–66.016.

2 PURA §§

36.401–.406.

3 PURA §§

39.301–.313.

4 Under PURA §

36.403(e), “transition bonds” issued to securitize system restoration costs may be called “system restoration bonds.”

5 Application

of CenterPoint Energy Houston Electric, LLC For Determination of System Restoration Costs, Docket No. 57271, Order (Apr. 24, 2025).

| Docket No. 57559 | Financing Order | Page 1 of 82 |

On November 8, 2024,

CenterPoint Houston filed an application in Docket No. 57271 under PURA § 36.405 to quantify the reasonable and necessary

system restoration costs incurred in connection with two storm events taking place in May 2024: a May 16, 2024 storm that the

National Weather Service has officially named “the Houston Derecho” and a wave of strong thunderstorms that caused

extensive damage in the Houston area on May 28, 2024 (collectively, the Storms). As discussed in this Financing Order, the Commission

finds that CenterPoint Houston should be authorized to securitize and to cause the issuance of system restoration bonds in accordance

with this Financing Order. The Commission also finds that the securitization approved in this Financing Order meets all applicable requirements

of PURA.

In this Financing Order, the

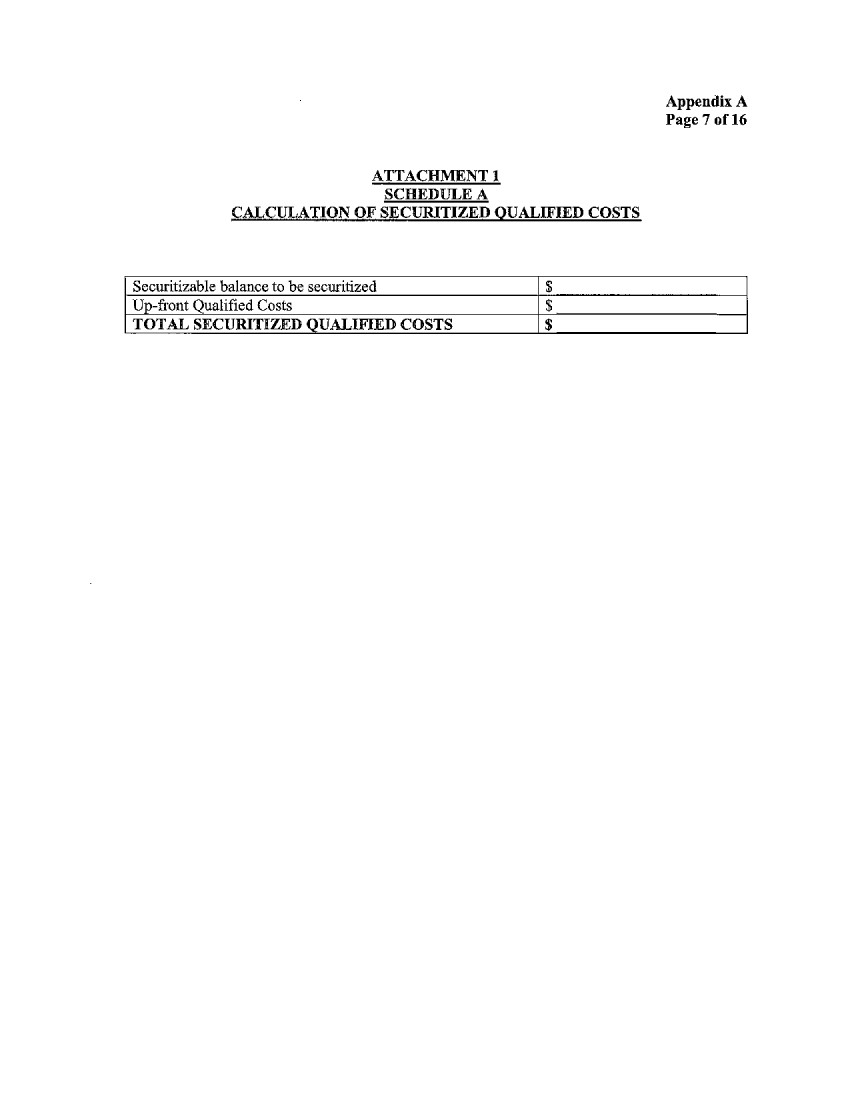

Commission approves the securitization of the sum of the Securitizable Balance plus up-front qualified costs as described in Ordering

Paragraphs 1 and 16. The Commission also approves the structure of the proposed securitization financing and issuance of system restoration

bonds in one or more series and approves system restoration charges in an amount to be calculated as provided in this Financing Order.

The Commission further approves the form tariff to implement the system restoration charges and the form tariff to implement the ADFIT

Credit. Finally, the Commission finds that the potential benefits of: (1) floating-rate system restoration bonds and interest-rate

swaps within the securitization financing structure, (2) the issuance of system restoration bonds denominated in foreign currencies,

and (3) the use of interest-rate hedges will not outweigh the incremental risk to customers. Therefore, the Commission concludes

that floating-rate system restoration bonds and interest-rate swaps should not be utilized within the securitization financing structure

and that CenterPoint Houston should not be authorized to issue system restoration bonds denominated in a foreign currency or use interest-rate

hedges.

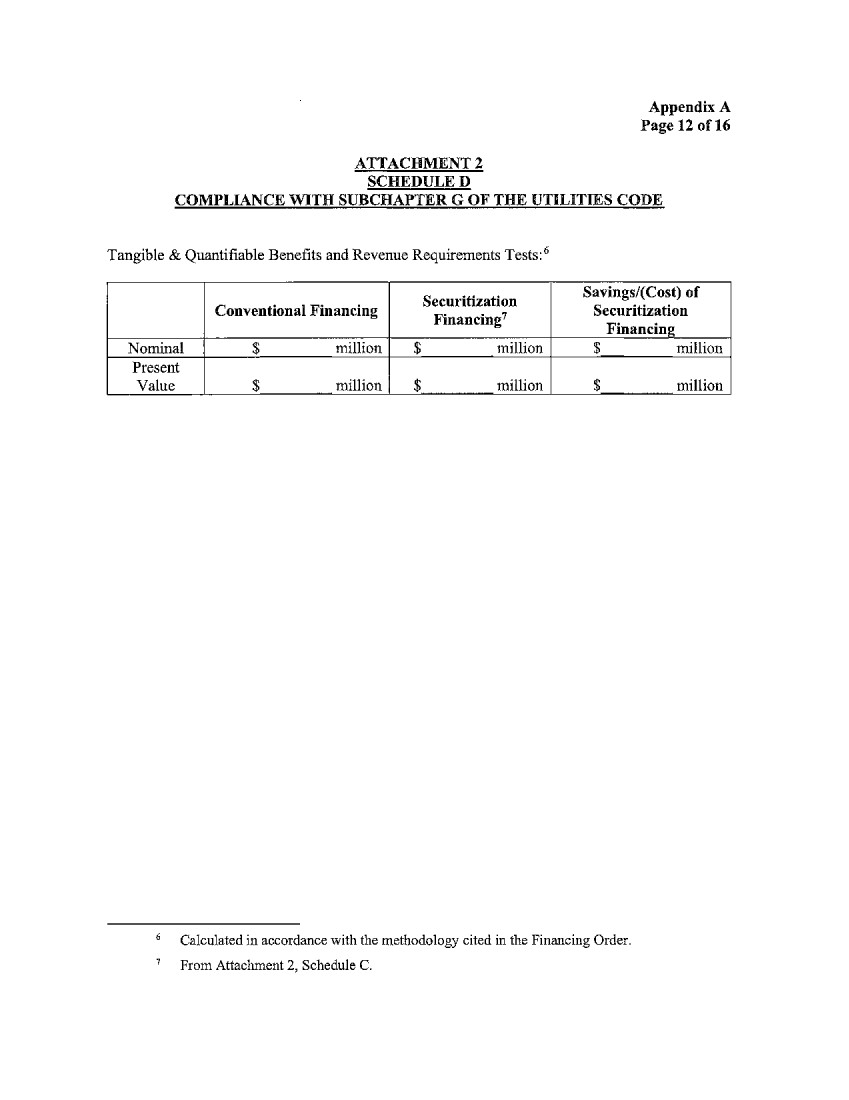

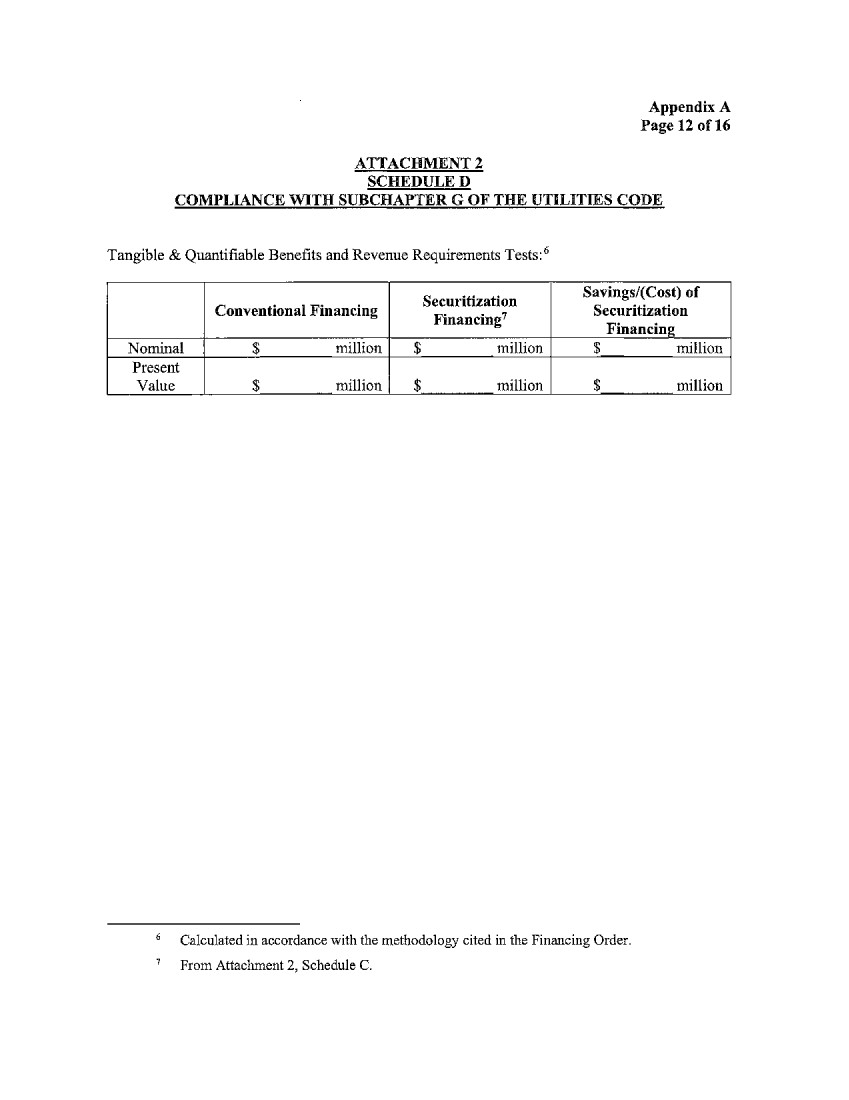

To

approve the securitization of the system restoration costs, the Commission must consider whether the proposed securitization meets the

financial tests set forth in PURA chapter 36, subchapter I and chapter 39, subchapter G. The three financial tests require that:

(1) the total revenues collected under this Financing Order are less than the revenues collected using conventional financing methods

(the total-revenues test),6 (2) the securitization of the system restoration costs provides greater tangible

and quantifiable benefits to ratepayers7

than would have been achieved without the issuance of the system restoration bonds (the tangible-and-quantifiable-benefits test),8

and (3) the amount securitized does not exceed the present value of the revenue requirement over the life of the proposed system

restoration bonds associated with the system restoration costs sought to be securitized (the present-value test).9

6 PURA §

39.303(a).

7 The term “customer”

used throughout this financing order will encompass the term “ratepayer” as it is used throughout PURA §§ 36.401–.406

and §§ 39.301–.313.

8 PURA §§

39.301 and 36.401(b)(2).

9 PURA §

39.301.

| Docket No. 57559 | Financing Order | Page 2 of 82 |

CenterPoint Houston submitted

evidence demonstrating that the proposed securitization will meet each of the financial tests set forth in PURA chapter 36, subchapter I

and PURA chapter 39, subchapter G. All of the calculations performed by CenterPoint Houston demonstrated that the transaction

would pass these tests. Considering the margin by which the proposed securitization passes the various tests, the Commission declines

to determine a particular number for each benefit conferred by the proposed securitization. Accordingly, in quantifying the benefit to

customers as a result of this securitization, the Commission refers to the ranges of benefits calculated under CenterPoint Houston’s

expected-case scenario, in which the system restoration bonds bear a 4.90% weighted-average interest rate, and a sensitivity case-scenario,

in which the system restoration bonds are subject to a 7.24% weighted-average interest rate.

CenterPoint Houston’s

evidence showed that, as a result of the securitization approved by this Financing Order, retail customers served at distribution voltage

in CenterPoint Houston’s service area (customers) will realize benefits. Based on the amount that CenterPoint Houston seeks to securitize,

CenterPoint Houston’s financial analysis indicated that, for the tangible-and-quantifiable-benefits test, such customers will realize

benefits estimated to be $85,000 on a present-value basis in the sensitivity-case scenario. At the expected weighted-average interest

rate of 4.90%, securitization confers benefits of $63 million on a present-value basis. In addition, under the sensitivity-case scenario,

the securitization will result in a reduction in the amount of revenues collected by CenterPoint Houston of $76,000, on a nominal basis,

when compared to the amount that would have been collected under the conventional financing methods that would otherwise be used to recover

the system restoration costs. In the expected case, the securitization will result in a reduction in the amount of revenues collected

by CenterPoint Houston of $88 million, on a nominal basis. Finally, under the present-value test, the present value of the amount CenterPoint

Houston initially sought to securitize—$408.5 million in the expected case and $407.5 million in the 7.24% sensitivity case—does

not exceed the present value of the revenue requirements using conventional financing. Accordingly, the Commission concludes that the

benefits for customers set forth in CenterPoint Houston’s evidence are fully indicative of the benefits that customers will realize

from the securitization approved here. In the issuance advice letter, CenterPoint Houston will be required to update the benefit analyses

to verify that the final structure of the securitization satisfies the statutory financial tests.

| Docket No. 57559 | Financing Order | Page 3 of 82 |

CenterPoint Houston provided

a general description of the proposed securitization transaction structure in its application and in the testimony and exhibits submitted

in support of its application. The proposed securitization transaction structure does not contain every relevant detail and, in certain

places, uses only approximations of certain costs and requirements. The final securitization transaction structure will depend, in part,

upon the requirements of the nationally-recognized credit rating agencies that will rate the system restoration bonds and, in part, upon

the market conditions that exist at the time the system restoration bonds are taken to the market.

While the Commission recognizes

the need for some degree of flexibility with regard to the final details of the securitization transaction approved in this Financing

Order, its primary focus is upon the statutory requirements—the most important of which is to ensure that securitization results

in tangible and quantifiable benefits to customers—that must be met before issuing a financing order.

In view of these obligations,

the Commission has established certain criteria in this Financing Order that must be met in order for the approvals and authorizations

granted in this Financing Order to become effective. This Financing Order grants authority to issue system restoration bonds and to impose,

collect, and receive system restoration charges only if the final structure of the securitization transaction complies in all material

respects with these criteria. The authority and approval granted in this Financing Order is effective only upon CenterPoint Houston filing

with the Commission an issuance advice letter demonstrating compliance of that issuance with the provisions of this Financing Order. If

market conditions make it desirable to issue the system restoration bonds in more than one series, then the authority and approval in

this Financing Order is effective as to each issuance, but only upon CenterPoint Houston filing with the Commission a separate issuance

advice letter for that issuance demonstrating compliance with the provisions of this Financing Order.

| Docket No. 57559 | Financing Order | Page 4 of 82 |

I. Discussion

and Statutory Overview

The

Texas Legislature amended PURA in 2009 to permit electric utilities to use securitization financing to recover costs of restoring service

and infrastructure associated with electric power outages as a result of hurricanes and other weather-related events or natural

disasters that occurred in 2008 or later.10

The Legislature provided this option for recovering qualified costs based on the conclusion that securitization financing will lower the

carrying costs associated with recovery of these costs relative to the costs that would be incurred using conventional utility financing

methods.11 As a precondition to the use

of securitization, the Legislature required that the Commission must ensure that the securitization will provide greater tangible and

quantifiable benefits to customers than would have been achieved without the issuance of the system restoration bonds.12

Consequently, a basic purpose of securitization financing—the recovery of an electric utility’s qualified costs—is conditioned

upon the other basic purpose—providing economic benefits to consumers of electricity in this state. The provisions for securitization

of system restoration costs were based on and incorporate relevant terms of the provisions in chapter 39, subchapter G of

PURA for securitization of transition costs adopted by the Texas Legislature in 1999, which have been used by CenterPoint Houston

and other electric utilities to reduce the costs of recovering costs associated with the transition to competition.13

Under chapter 36, subchapter

I of PURA, the qualified costs eligible for securitization by CenterPoint Houston include: (1) the system restoration costs determined

by the Commission in Docket No. 57271 (the proceeding to determine the amount of CenterPoint Houston’s system restoration costs

eligible for recovery and securitization), net of any insurance proceeds, government grants, or other sources of funding that compensate

CenterPoint Houston for system restoration costs incurred by CenterPoint Houston at the time of the application for this Financing Order,

with carrying costs on the unrecovered balance at CenterPoint Houston’s weighted average cost of capital as approved in its last

rate case; (2) costs of issuing, supporting and servicing the system restoration bonds and any costs of retiring and refunding existing

debt and equity securities; (3) costs to the Commission of acquiring professional services for the purposes of evaluating the proposed

securitization transaction; and (4) costs associated with ancillary agreements such as bond insurance policies, letters of credit,

reserve accounts, surety bonds, swap arrangements, hedging arrangements, liquidity or credit support arrangements, or other financial

arrangements entered into in connection with the issuance or payment of the transition bonds.14 Chapter 36, subchapter I

of PURA also expressly provides: (1) that the term transition bonds, as defined and used in chapter 39, subchapter G

of PURA, includes bonds issued under chapter 36 (i.e. system restoration bonds),15 (2) that the term transition charges,

as defined and used in subchapter G, includes all non-bypassable amounts approved by the Commission under a financing order to recover

system restoration costs (i.e. system restoration charges),16 (3) the term financing order as defined and used in chapter 39, subchapter G of PURA,

includes a financing order authorizing the securitization of system restoration costs, and (4) that the provisions of chapter 39,

subchapter G of PURA (i.e., the provisions with respect to the issuances of system restoration bonds, the imposition of system restoration

charges, and the creation of transition property (system restoration property))17 must govern financing orders allowing for

securitization of system restoration costs and all rights and interests established in such order, except to the extent that such provisions

conflict with the provisions of PURA chapter 36, subchapter I, in which case the latter provisions must control.18

10 PURA §

36.401(a).

11 Id.

12 PURA §

36.401(b)(2).

13

See, e.g., Application of CenterPoint Energy Houston Electric, LLC for Financing Order, Docket No. 30485, Financing Order (Mar.

16, 2005); Application of AEP Texas Central Company for a Financing Order, Docket No. 32475, Financing Order (June 21, 2006);

Application of CenterPoint Energy Houston Electric, LLC for Financing Order, Docket No. 34448, Financing Order (Sept. 18, 2007);

Application of AEP Texas Inc. for a Financing Order, Docket No. 49308, Financing Order (June 17, 2019); Application of Entergy

Texas, Inc for a Financing Order; Docket No. 52302, Order (Jan. 14, 2022).

14 PURA §

36.403(d).

15 PURA §

36.403(c).

16 PURA §

36.403(f).

17 The term “system

restoration property” used throughout this financing order will have the full effect as “transition property” as defined

under PURA § 39.302(8) and used throughout PURA §§ 36.401–.406.

18 PURA §

36.403(b).

| Docket No. 57559 | Financing Order | Page 5 of 82 |

To allow for securitization

of an electric utility’s qualified costs associated with system restoration costs, the Commission may authorize the issuance of

system restoration bonds. System restoration bonds are generally defined as evidences of indebtedness or ownership that are issued under

a financing order, are limited to a term of not longer than 15 years, and are secured by or payable from system restoration property,

which includes all rights and interests of an electric utility under a financing order at the time such rights are transferred to an assignee

or pledged in connection with the issuance of system restoration bonds.19 The net proceeds from the sale of system restoration

bonds must be used to reduce the amount of a utility’s recoverable system restoration costs.20 If system restoration

bonds are approved and issued, retail electric customers must pay the principal, interest, and related charges of the system restoration

bonds through system restoration charges.21 System restoration charges are non-bypassable charges that will be paid as a

component of the monthly charge for electric service.22 System restoration charges must be approved by the Commission under

a financing order.23

The Commission may adopt

a financing order only if it finds that the total amount of revenues to be collected under the financing order is less than the revenue

requirement that would be recovered using conventional financing methods and that the financing order is in accordance with the standards

of PURA §§ 36.401 and 39.301.24 The Commission must ensure that the net proceeds of system restoration bonds may

be used only for the purpose of reducing the amount of recoverable system restoration costs.25 In addition, the Commission

must ensure that: (1) securitization provides tangible and quantifiable benefits to customers greater than would have been achieved

absent the issuance of the system restoration bonds,26 and (2) the structuring and pricing of the system restoration

bonds result in the lowest system-restoration-bond charges in compliance with market conditions and the terms of a financing order.27

Finally, the amount securitized may not exceed the present value of the revenue requirement over the life of the proposed system restoration

bonds associated with the amounts sought to be securitized, and the present value calculation must use a discount rate equal to the proposed

interest rate on the system restoration bonds.28 All of these statutory requirements are designed to ensure that securitization

will provide real benefits to retail customers.

19 See

PURA § 39.302(6) and 39.304.

20 See

PURA § 36.401(a).

21 See

PURA § 36.403(f).

22 Id.

23 See

PURA § 39.302(7).

24 See

PURA §§ 36.402(a) through (c) and 36.403(d).

25 See

PURA § 36.401(a).

26 See

PURA § 36.401(b)(2).

27 See

PURA § 39.301.

28 Id.

| Docket No. 57559 | Financing Order | Page 6 of 82 |

The essential finding by the

Commission that is needed to issue a financing order is that customers will receive tangible and quantifiable benefits as a result of

securitization. This finding can only be made upon a showing of economic benefits to customers through an economic analysis. An economic

analysis is necessary to recognize the time value of money in evaluating whether and the extent to which benefits accrue from securitization.

Moreover, an economic analysis recognizes the concept that the timing of a payment can be as important as the magnitude of a payment in

determining the value of the payment. Thus, an analysis showing an economic benefit is necessary to quantify a tangible benefit to customers.

Economic benefits also depend

upon a favorable financial market—one in which system restoration bonds may be sold at an interest rate lower than the carrying

costs of the assets being securitized. The precise interest rate at which system restoration bonds can be sold in a future market, however,

is not known today. Nevertheless, benefits can be calculated based upon certain known facts (e.g., the amount of system restoration costs

to be securitized and the cost of the alternative to securitization) and assumptions (e.g., the interest rate of the system restoration

bonds, the term of the system restoration bonds, and the amount of other qualified costs). By analyzing the proposed securitization based

upon those facts and assumptions, a determination can be made as to whether tangible and quantifiable benefits result. To ensure that

benefits are realized, the securitization transaction must conform to the structure ordered by the Commission and an issuance advice letter

must be presented to the Commission immediately before issuance of the system restoration bonds demonstrating that the actual structure

and costs of the system restoration bonds will provide tangible and quantifiable benefits. The cost-benefit analysis contained in the

issuance advice letter must reflect the actual structure of the system restoration bonds.

| Docket No. 57559 | Financing Order | Page 7 of 82 |

CenterPoint Houston’s

financial analysis shows that securitizing the Securitizable Balance along with CenterPoint Houston’s other qualified costs in the

manner provided by this Financing Order will produce an economic benefit to customers of $63 million on a present value basis using

the expected weighted-average interest rate of 4.90%. A benefit of $85,000 will result even if the bond market is less favorable than

current market conditions and system restoration bonds have to be issued at the sensitivity-case weighted-average interest rate of 7.24%.29

The economic benefit to customers will be larger if a more favorable market allows the system restoration bonds to be issued at a lower

interest rate. In the issuance advice letter, CenterPoint Houston will be required to update the benefit analyses to verify that the final

system restoration bond structure and pricing satisfies the statutory financial tests.

To issue a financing order,

PURA also requires that the Commission find that the total amount of revenues collected under the financing order will be less than would

otherwise have been collected under conventional financing methods.30 In this proceeding, CenterPoint Houston’s financial

analysis of the amount sought to be securitized under sensitivity-case market conditions, in which the system restoration bonds bear a

7.24% weighted average interest rate, demonstrates that revenues will be reduced by $76,000 on a nominal basis under this Financing Order

compared to the amount that would be recovered under conventional financing methods. Under the base-case scenario in which the system

restoration bonds are issued at a 4.90% weighted average annual interest rate, securitization saves customers $88 million in nominal revenue.31

If system restoration bonds are issued in a more favorable market, this reduction in revenues will be larger.

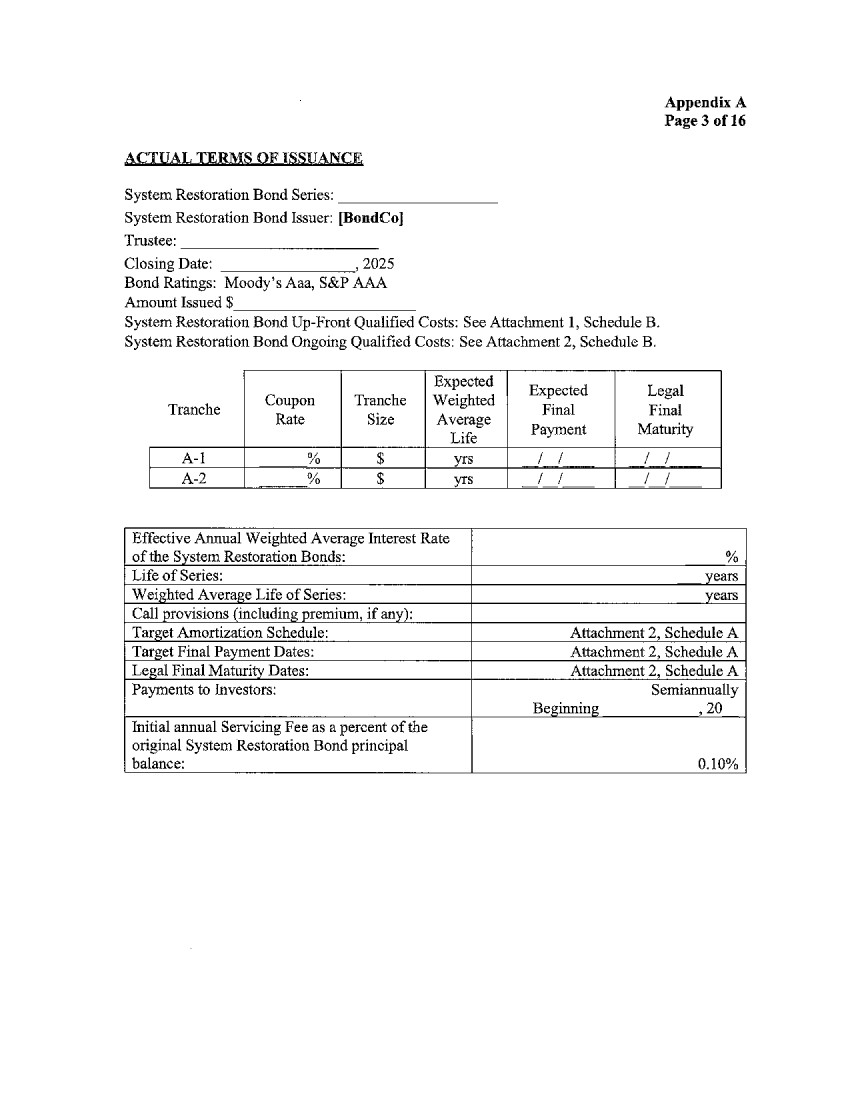

Before the system restoration

bonds may be issued, CenterPoint Houston must submit to the Commission an issuance advice letter in which it demonstrates, based upon

the actual market conditions at the time of pricing, that the proposed structure and pricing of the system restoration bonds will provide

real economic benefits to customers and comply with the statutory financial tests and terms of this Financing Order. As part of this submission,

CenterPoint Houston must also certify to the Commission that the structure and pricing of the system restoration bonds result in the lowest

system-restoration-bond charges in compliance with market conditions at the time of pricing and the terms of this Financing Order. The

form of certification that must be submitted by CenterPoint Houston is set out in appendix A to this Financing Order. The Commission,

by order, may stop the issuance of the system restoration bonds authorized by this Financing Order if CenterPoint Houston fails to make

this demonstration or certification.

29 Id.

30 See

PURA § 39.303(a).

31 Id.

| Docket No. 57559 | Financing Order | Page 8 of 82 |

PURA requires that system

restoration charges be charged for the use or availability of electric services to recover all qualified costs.32 System

restoration charges, like transition charges, can be recovered over a period that does not exceed 15 years.33 The Commission

concludes that this prevents the collection of system restoration charges from customers for services rendered after the 15-year period

but does not prohibit recovery of system restoration charges for service rendered during the 15-year period but not actually collected

until after the 15-year period.

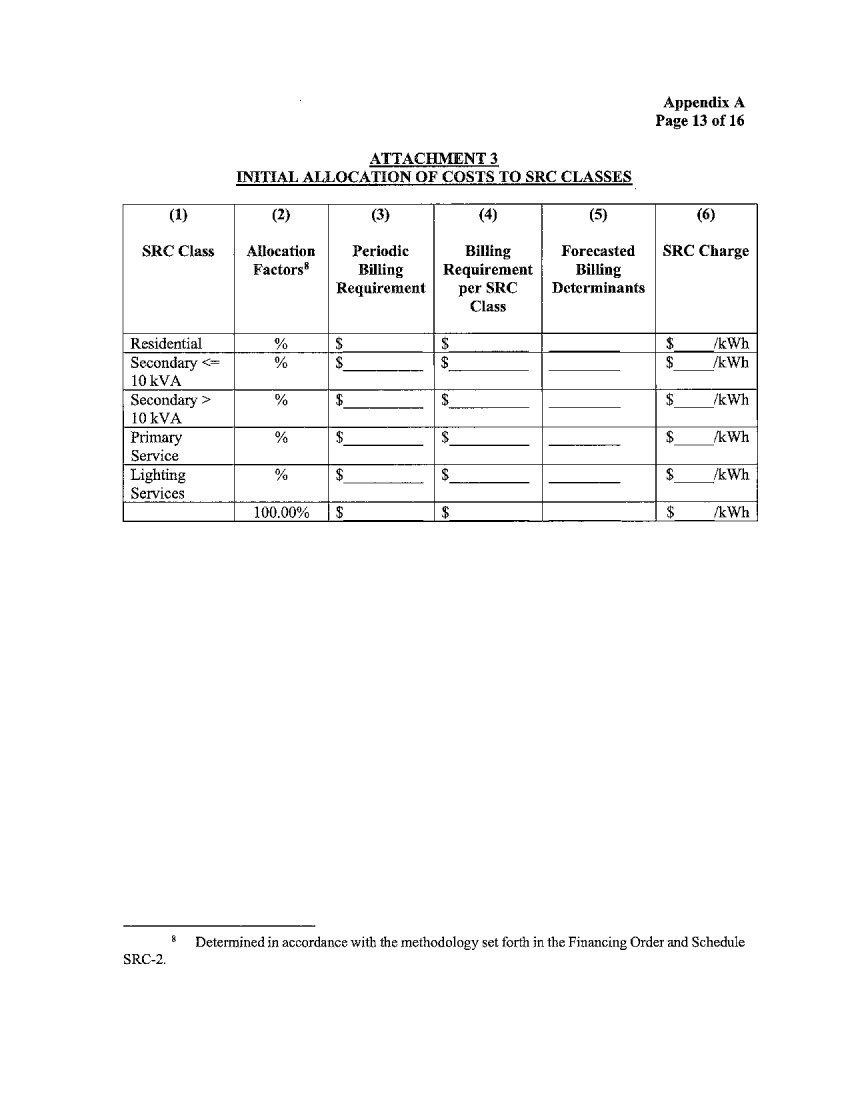

System restoration charges

constitute transition charges as defined in PURA § §39.302 and used in chapter 39, subchapter G of PURA34

and will be collected by an electric utility, its successors, an assignee, or other collection agents as provided for in this Financing

Order.35 System restoration charges must be functionalized and allocated to customers in the same manner as the corresponding

facilities relating to the system restoration costs and related expenses are functionalized and allocated in a utility’s current

base rates.36 The Commission further determines that, to ensure that the allocation of system restoration charges are functionalized

in such manner, the ADFIT benefits associated with the securitization transaction should be calculated and allocated in the manner described

in this Financing Order.

32 PURA

§ 36.403(f).

33 See

PURA § 39.303(b).

34 PURA

§ 36.403(f).

35 See

PURA § 39.302(7).

36 PURA

§ 36.403(g).

| Docket No. 57559 | Financing Order | Page 9 of 82 |

The rights to impose, collect,

and receive system restoration charges (including all other rights of an electric utility under the financing order) are only contract

rights until such rights are first transferred to an assignee or pledged in connection with the issuance of system restoration bonds.37

Upon the transfer or pledge of those rights, they become system restoration property and, as such, are afforded certain statutory protections

to ensure that the system restoration charges are available for system restoration bond retirement.38

This Financing Order contains

terms, as it must, ensuring that the imposition and collection of system restoration charges authorized herein must be non-bypassable.39

It also includes a mechanism requiring that system restoration charges be reviewed and adjusted at least annually, within 45 days of the

anniversary date of the issuance of the system restoration bonds, to correct any overcollections or undercollections during the preceding 12

months and to ensure the expected recovery of amounts sufficient to timely provide all payments of debt service and other required amounts

and charges in connection with the system restoration bonds.40 In addition to the required annual reviews, interim reviews

are allowed to ensure that the amount of the system restoration charges matches the funding requirements approved in this Financing Order.

These provisions will help to ensure that the amount of system restoration charges paid by customers does not exceed the amount necessary

to cover the costs of this securitization. To encourage utilities to undertake securitization financing, other benefits and assurances

are provided.

The State of Texas has pledged,

for the benefit and protection of financing parties and electric utilities, that it will not take or permit any action that would impair

the value of system restoration property, or, except for the true-up expressly allowed by law, reduce, alter, or impair the system restoration

charges to be imposed, collected, and remitted to financing parties, until the principal, interest, and any other charges incurred and

contracts to be performed in connection with the related system restoration bonds have been paid and performed in full.41

37 PURA §

39.304(a).

38

See PURA § 39.304(b).

39

See PURA §§ 36.404 and 39.306.

40

See PURA § 39.307.

41

See PURA § 39.310.

| Docket No. 57559 | Financing Order | Page 10 of 82 |

System restoration property

(whether associated with a single system restoration bond issuance covering the entire amount of system restoration costs authorized to

be financed with securitization or with one of multiple system restoration bond issuances, with each issuance covering only a portion

of the total amount authorized to be securitized) constitutes a present system restoration property right for purposes of contracts concerning

the sale or pledge of property, and the property will continue to exist for the duration of the pledge of the State of Texas as described

in the preceding paragraph.42 In addition, the interests of an assignee or pledgee in system restoration property (as well

as the revenues and collections arising from the system restoration property) are not subject to setoff, counterclaim, surcharge, or defense

by the electric utility or any other person or in connection with the bankruptcy of the electric utility or any other entity.43

Further, transactions involving the transfer and ownership of system restoration property and the receipt of system restoration charges

are exempt from state and local income, sales, franchise, gross receipts, and other taxes or similar charges.44 The creation,

granting, perfection, and enforcement of liens and security interests in system restoration property are governed by PURA § 39.309

and not by the Texas Business and Commerce Code.45

The Commission may, at the

request of an electric utility, adopt a financing order providing for the retiring and refunding of system restoration bonds only upon

making a finding that the future system restoration charges required to service the new system restoration bonds, including transaction

costs, will be less than the future system restoration charges required to service the system restoration bonds being retired or refunded.46

CenterPoint Houston has not requested, and this Financing Order does not grant, any authority to refinance the system restoration bonds

authorized by this Financing Order. This Financing Order does not preclude CenterPoint Houston from filing a request for a financing order

to retire or refund the system restoration bonds approved in this Financing Order upon a showing that the statutory criteria in PURA §

39.303(g) are met.47

To facilitate compliance and

consistency with applicable statutory provisions, this Financing Order adopts the definitions in PURA §§ 36.403 and 39.302.

42 See

PURA § 39.304(b).

43 See

PURA § 39.305.

44 See

PURA § 39.311.

45 See

PURA § 39.309(a).

46 See

PURA § 39.303(g).

47 Id.

| Docket No. 57559 | Financing Order | Page 11 of 82 |

II. Description

of Proposed Securitization Transaction

A description of the securitization

transaction proposed by CenterPoint Houston is contained in its application and the filing package submitted in support of the application.

A brief summary of the proposed securitization transaction is provided in this section. A more detailed description is included in the

section III.C, titled Structure of the Proposed Securitization and in the application and filing package submitted in support of

the application.

To facilitate the proposed

securitization, CenterPoint Houston has proposed that (depending on whether more than one series of system restoration bonds are issued)

one or more special purpose securitization funding entities (each referred to as BondCo) be created to which CenterPoint Houston will

transfer the rights to impose, collect, and receive system restoration charges along with the other rights arising under this Financing

Order, in each case allocable to the series of system restoration bonds the BondCo is issuing. Upon transfer to a BondCo (in connection

with the issuance of the particular series of system restoration bonds), these rights will become system restoration property as provided

by PURA § 39.304.48 If system restoration bonds are issued in more than one series, then the system restoration property

transferred as a result of each issuance must be only those rights associated with that portion of the total amount authorized to be securitized

by this Financing Order which is securitized by a particular system restoration bond issuance. The rights to impose, collect and receive

system restoration charges, along with the other rights arising under this Financing Order as they relate to any portion of the total

amount authorized to be securitized that remains unsecuritized, must remain with CenterPoint Houston and must not become system restoration

property until transferred to a BondCo in connection with a subsequent issuance of system restoration bonds.

48 PURA

§ 39.304.

| Docket No. 57559 | Financing Order | Page 12 of 82 |

CenterPoint Houston will create

a separate BondCo for the issuance of a particular series of the system restoration bonds, and the rights, obligations, structure, and

restrictions described in this Financing Order with respect to BondCo are applicable to each such purchaser of system restoration property

to the extent of the system restoration property transferred and sold to it and the system restoration bonds issued by it. BondCo will

issue system restoration bonds and will transfer the net proceeds from the sale of the system restoration bonds to CenterPoint Houston

in consideration for the transfer of the corresponding system restoration property. BondCo will be organized and managed in a manner designed

to achieve the objective of maintaining BondCo as a bankruptcy-remote entity that would not be affected by the bankruptcy of CenterPoint

Houston or any other affiliates of CenterPoint Houston or any of their respective successors. In addition, BondCo will have at least one

independent manager whose approval will be required for certain major actions or organizational changes by BondCo.

The system restoration bonds

will be issued under an indenture and administered by an indenture trustee.49 The system restoration bonds will be secured

by and payable solely out of the system restoration property created under this Financing Order and other collateral described in CenterPoint

Houston’s application. That collateral will be pledged to the indenture trustee for the benefit of the holders of the system restoration

bonds and to secure payment of certain qualified costs.

The servicer of the system

restoration bonds will collect the system restoration charges and remit those amounts to the indenture trustee on behalf of BondCo. The

servicer will be responsible for filing any required or allowed true-ups of the system restoration charges. If the servicer defaults on

its obligations under the servicing agreement, the indenture trustee may, on behalf of the holders of system restoration bonds, appoint

a successor servicer. CenterPoint Houston will act as the initial servicer for the system restoration bonds.

49

If more than one series of system restoration bonds is issued, each series will be issued under a separate indenture and be subject to

its own set of basic agreements (e.g., system restoration property purchase and sale agreement, system restoration property servicing

agreement, administration agreement). For purposes of this Financing Order, the description of the system restoration bonds applies to

each series of system restoration bonds.

| Docket No. 57559 | Financing Order | Page 13 of 82 |

Retail electric providers

(REPs) will be required to meet certain financial standards to collect system restoration charges under this Financing Order. If a REP

qualifies to collect system restoration charges, the servicer will bill to and collect from the REP the system restoration charges attributable

to the REP’s customers. The REP in turn will bill to and collect from its customers the system restoration charges attributable

to them. If any REP fails to qualify to collect system restoration charges or defaults in the remittance of those charges to the servicer

of the system restoration bonds, another entity can assume responsibility for collection of the system restoration charges from the REP’s

customers.

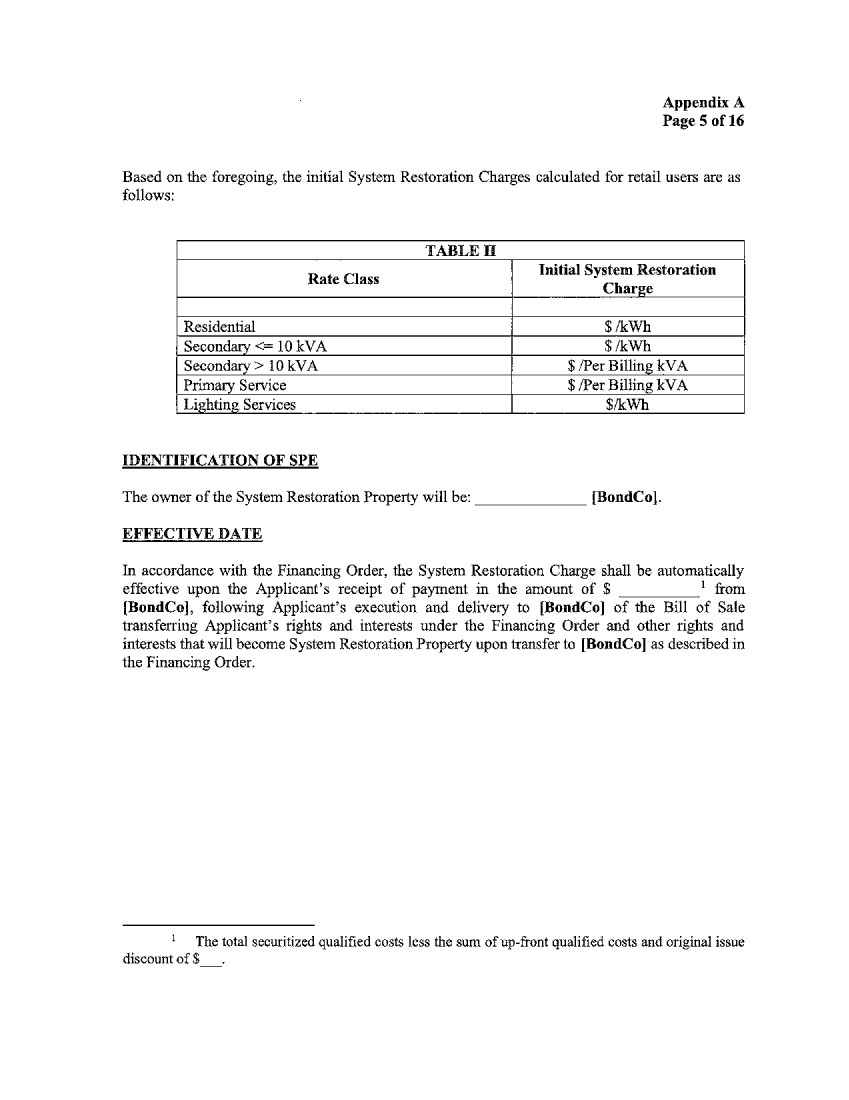

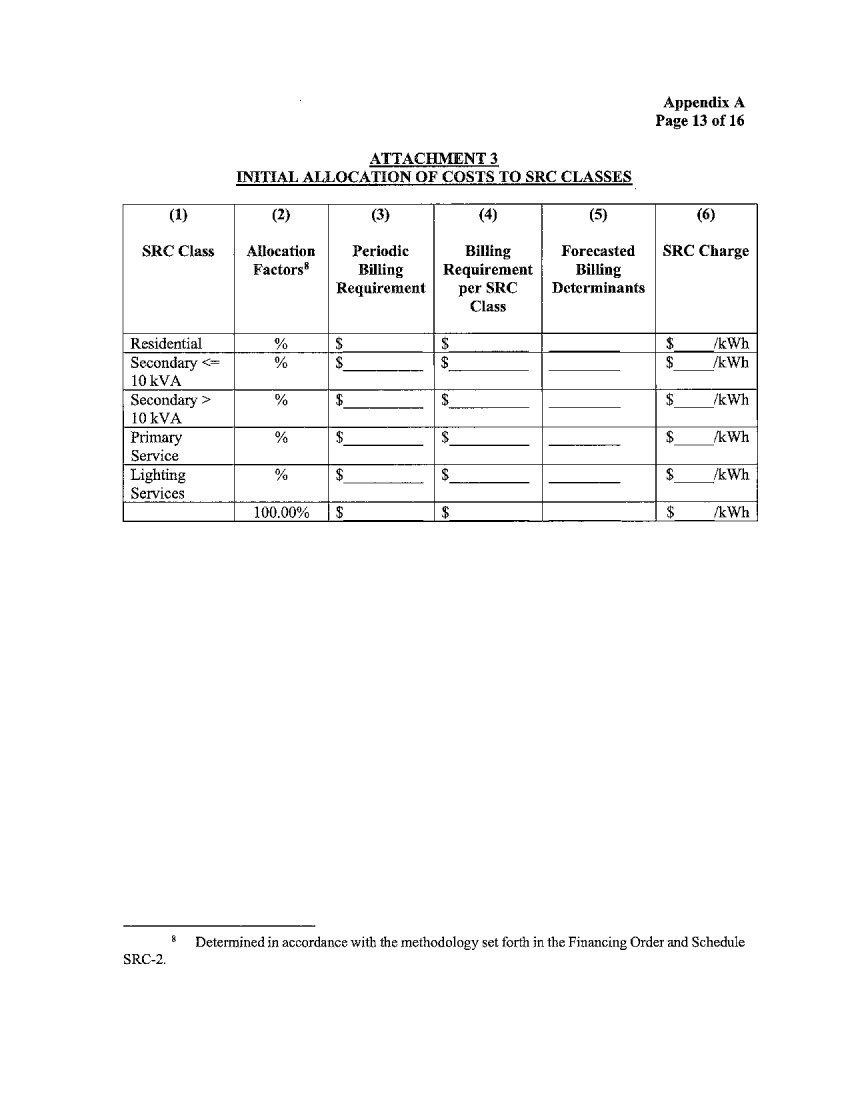

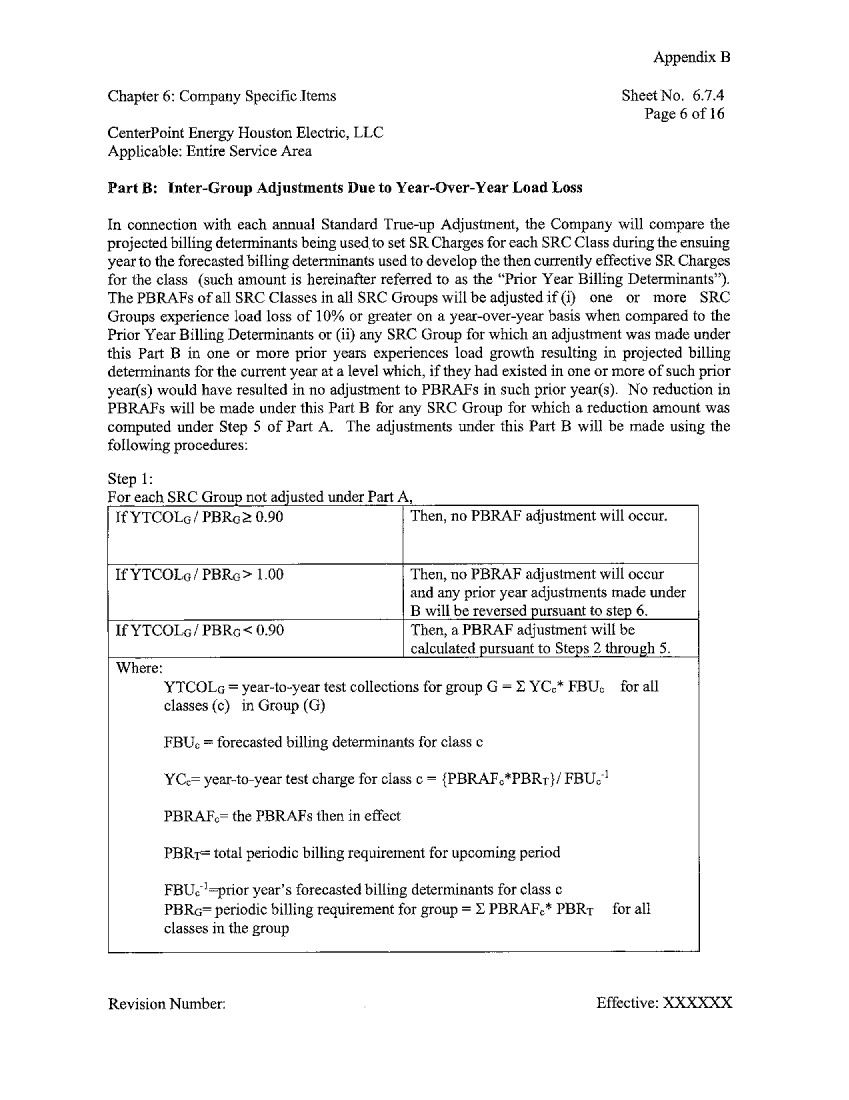

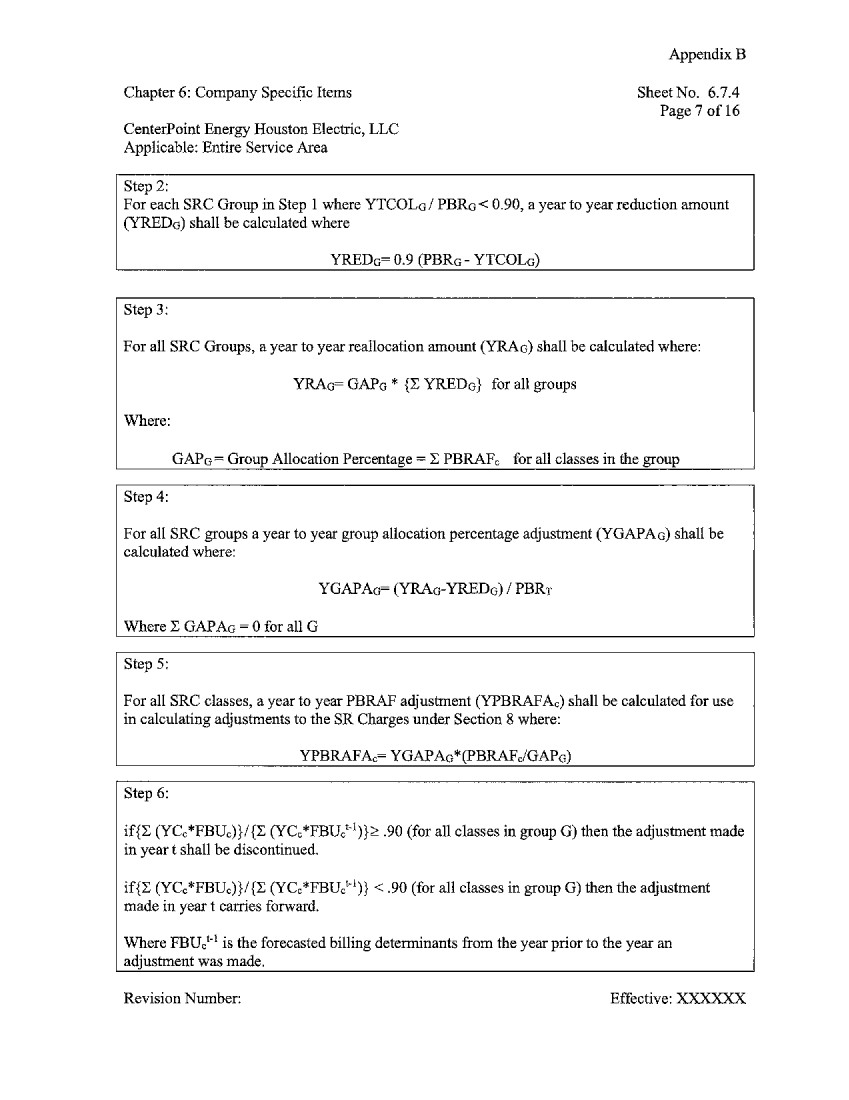

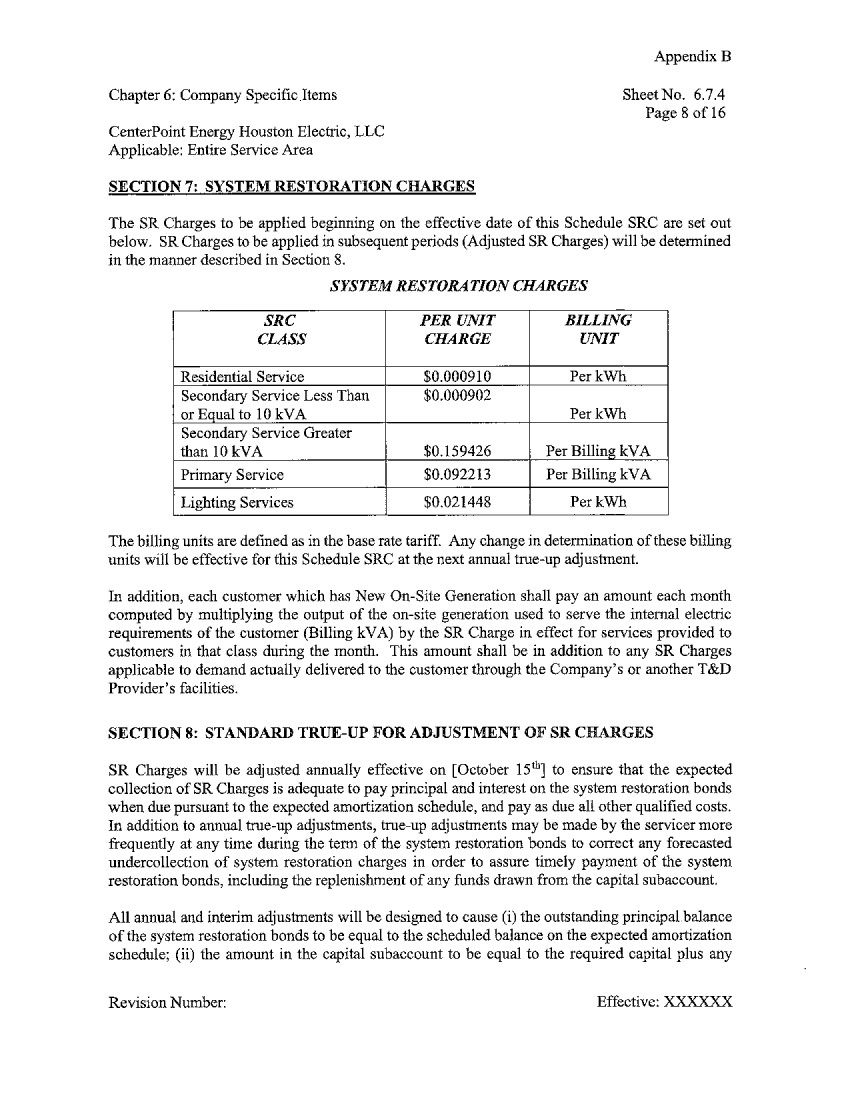

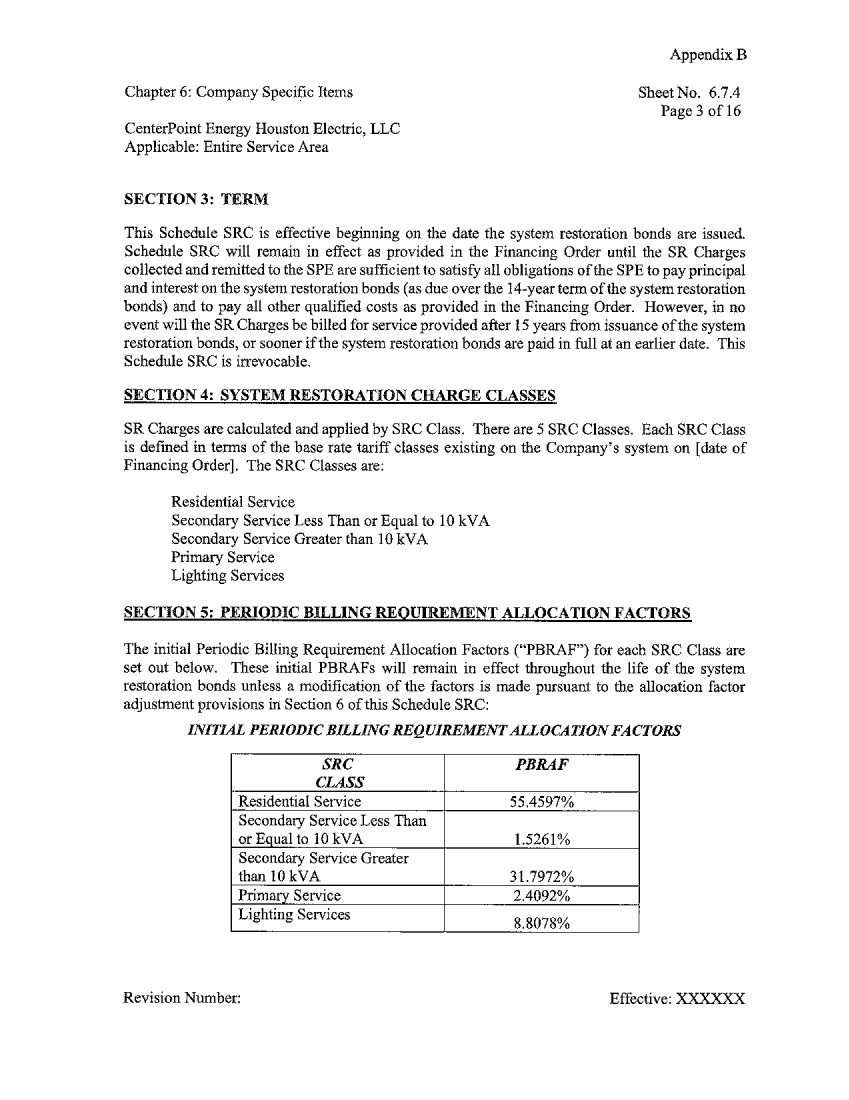

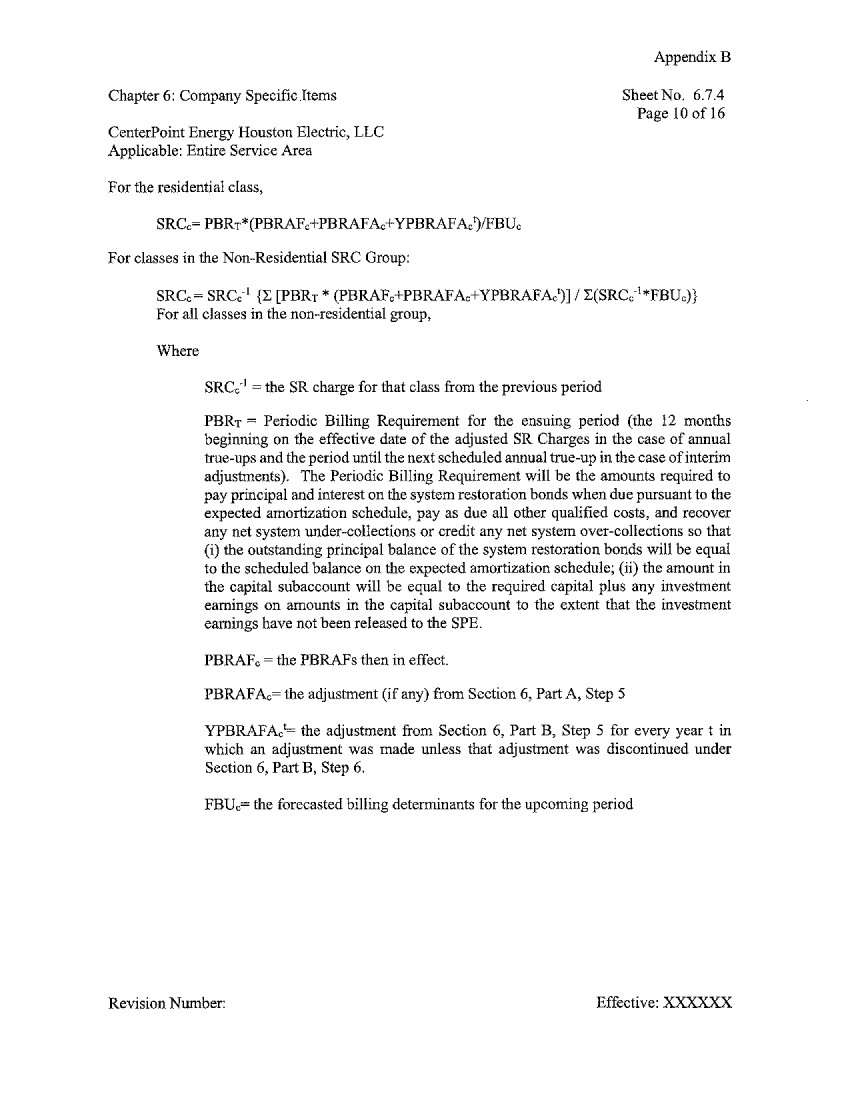

System restoration charges

will be calculated to ensure the collection of an amount sufficient to service the principal, interest, and related charges for the system

restoration bonds. The costs will be functionalized and allocated in the same manner as corresponding facilities and related expenses

are functionalized and allocated in CenterPoint Houston’s current base-rates.50 The system restoration charges will

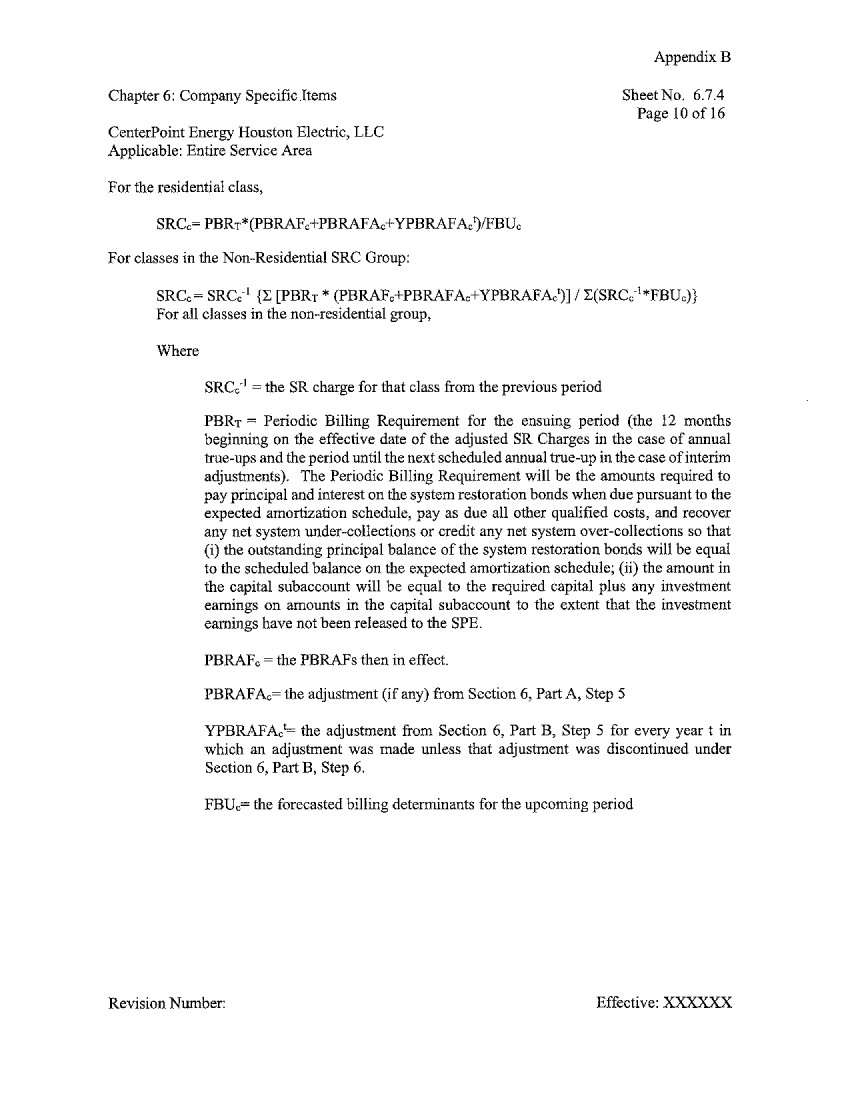

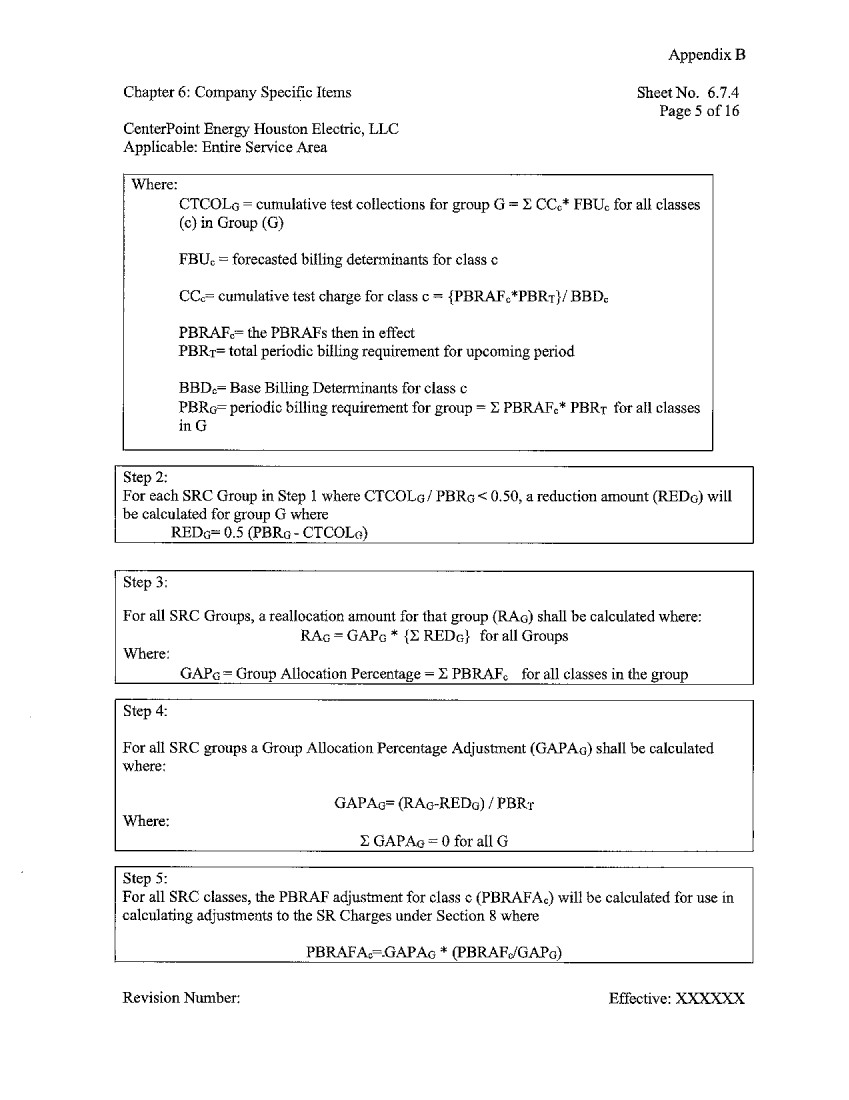

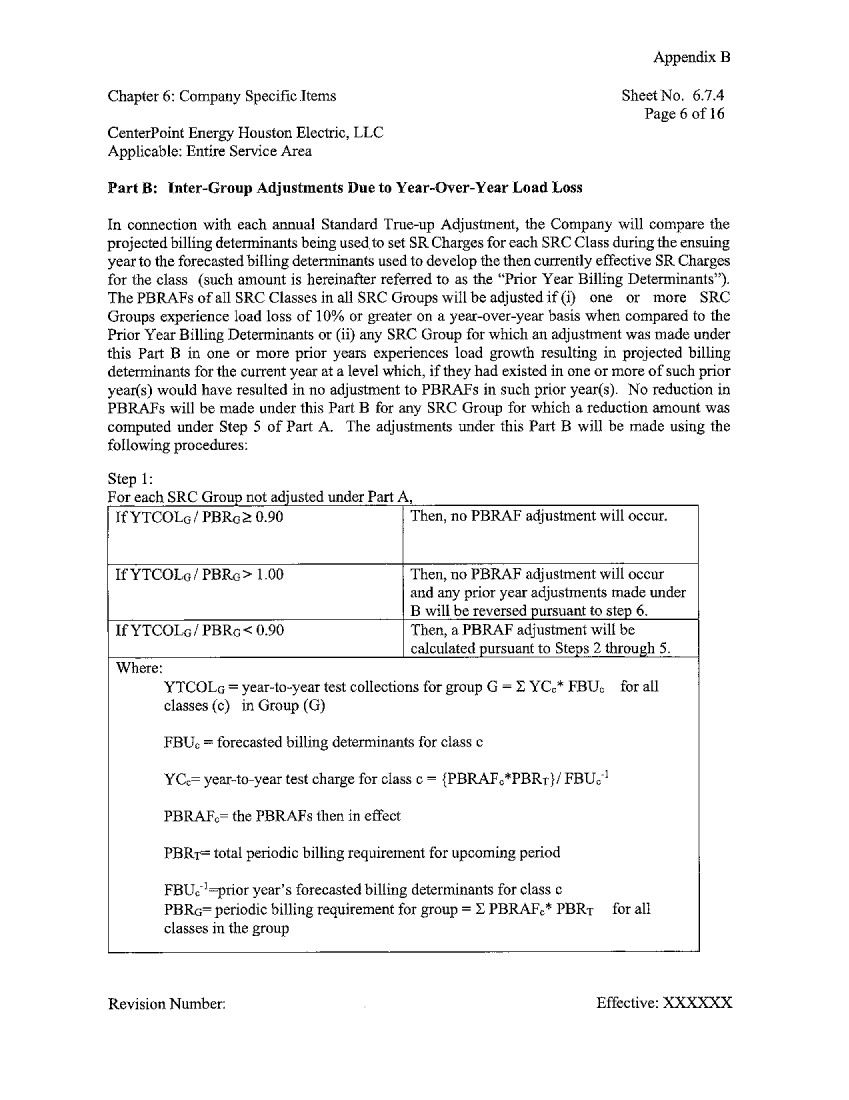

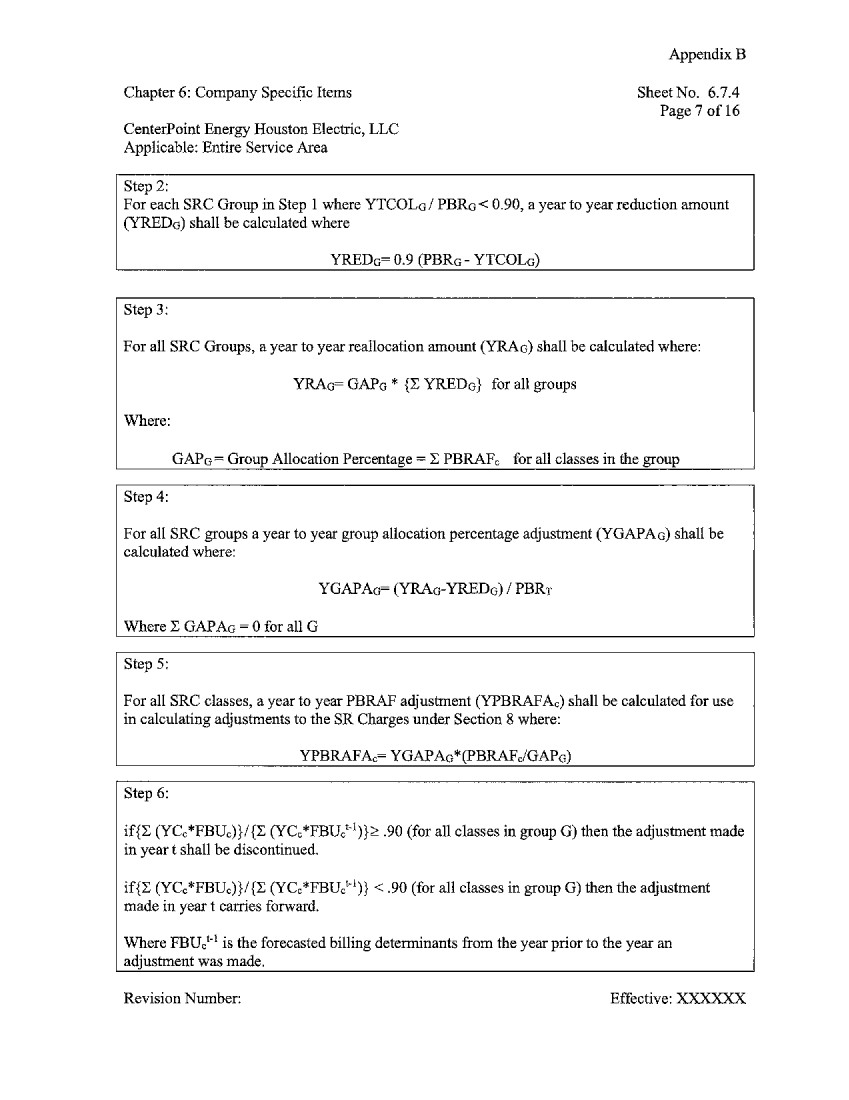

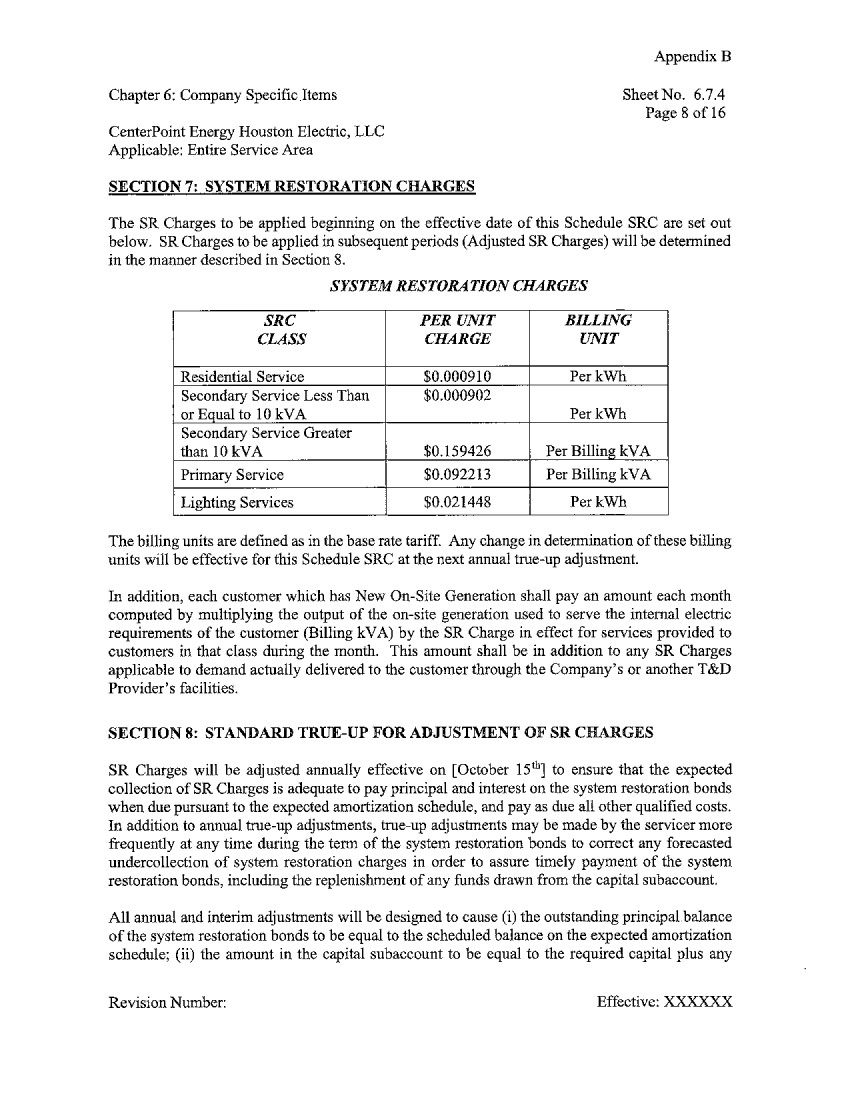

be calculated by the method described in Schedule SRC – System Restoration Charges (Schedule SRC), a pro forma copy

of which is contained in appendix B. In addition to the annual true-up required by PURA § 39.307, interim true-ups may be performed

as necessary to ensure that the amount collected from system restoration charges is sufficient to service the system restoration bonds.

In addition, an adjustment to the system restoration charge class allocations will be allowed under certain circumstances. The methodology

for making true-ups and class allocation adjustments and the circumstances under which each must be made are described in Schedule SRC.

The Commission determines

that CenterPoint Houston’s proposed system restoration charge structure should be utilized. This structure, which was used in each

of CenterPoint Houston’s prior securitizations, is designed to produce essentially level residential rates over the recovery period

if: (1) the actual year-to-year changes in customers’ loads match the changes forecasted at the time the system restoration

bonds are structured and (2) annual loads and costs match those used to develop each system restoration charge true-up. If the system

restoration bonds are issued in more than one series, the system restoration charges for each series must provide a substantially level

system restoration charge structure.

50 See

PURA § 36.403(g).

| Docket No. 57559 | Financing Order | Page 14 of 82 |

All of the transition bonds

and system restoration bonds issued in prior Texas securitizations have been issued with a fixed interest rate.51 A fixed

interest rate is necessary to assure that customers benefit from the securitization. Although the benefits of fixed rates can be achieved

through a combination of floating-rate bonds and interest-rate swaps, the Commission in prior securitizations in Texas concluded that

the possible benefit of floating-rate bonds did not outweigh the cost of preparing for and executing interest-rate swaps and the potential

risks swaps would impose on retail customers. As a result, the financing orders in those proceedings prohibited the use of interest-rate

swaps and thus, effectively, the issuance of floating-rate bonds. The Commission reaches the same conclusion in this proceeding and prohibits

CenterPoint Houston from issuing floating-rate system restoration bonds.

The Commission reaches a similar

conclusion that issuance of system restoration bonds denominated in foreign currency should likewise be prohibited. Denominating system

restoration bonds in foreign currency would create foreign currency risks for customers. While these risks can be reduced through use

of derivatives, the derivatives themselves create risks for customers.

Interest-rate hedges can also

be used to lock in interest rates or limit the variability of interest rates before issuance of the system restoration bonds. However,

the hedge is a bet on the direction of future market changes, which is neither necessary nor appropriate. Hedges also create additional

costs and risks if, for any reason, the system restoration bonds are not issued or the amount issued is different from the principal amount

hedged. As a result, this Financing Order prohibits CenterPoint Houston from issuing system restoration bonds denominated in foreign currencies

and from entering into interest-rate hedges.

CenterPoint Houston requested

approval of system restoration charges sufficient to recover the principal and interest on the system restoration bonds plus ongoing qualified

costs of supporting and servicing the system restoration bonds as described in this Financing Order and appendix C. CenterPoint Houston

requested that the system restoration charges be recovered from REPs, and through them from consumers, and that the amount of the system

restoration charges be calculated based upon the allocation methodology and billing determinants specified in Schedule SRC. CenterPoint

Houston also requested that certain standards related to the billing and collection of system restoration charges be applied to REPs,

as specified in Schedule SRC. To implement the system restoration charges and billing and collection requirements, CenterPoint Houston

requested approval of Schedule SRC.

51

E.g., Application of AEP Texas Central Company for a Financing Order, Docket No. 32475, Financing Order at 14 and 15 (June 21,

2006); Application of Entergy Gulf States, Inc. for a Financing Order, Docket No. 33586, Financing Order at 2 (Apr. 2, 2007);

Application of CenterPoint Houston Electric, LLC for a Financing Order, Docket No. 34448, Financing Order at 2 (Sep. 18, 2007);

Application of CenterPoint for a Financing Order, Docket No. 37200, Financing Order at 2 (Aug. 27, 2009); Application of Entergy

Texas, Inc. for a Financing Order, Docket No. 37247, Financing Order at 2 (Sept. 11, 2009); Application of AEP Texas Central Company

for a Financing Order, Docket No. 39931, Financing Order at 16 (June 17, 2019); Application of Entergy Texas, Inc. for a Financing

Order, Docket No. 52302, Order at 15 (Jan. 14, 2022).

| Docket No. 57559 | Financing Order | Page 15 of 82 |

CenterPoint Houston requested

authority to securitize and to cause the issuance of system restoration bonds in an aggregate principal amount not to exceed the sum of:

(1) the Securitizable Balance at the date of issuance of the system restoration bonds plus (2) its actual up-front qualified

costs of issuing, supporting, and servicing the system restoration bonds. CenterPoint Houston provided an illustrative analysis of the

costs and benefits of securitization using its estimate of the September 2, 2025 Securitizable Balance. CenterPoint Houston proposed

that these amounts be updated in the issuance advice letter to reflect the actual issuance date of the system restoration bonds and other

relevant current information as permitted by this Financing Order, and that CenterPoint Houston be authorized to securitize the updated

Securitizable Balance and up-front qualified costs as reflected in the issuance advice letter.

CenterPoint Houston requested

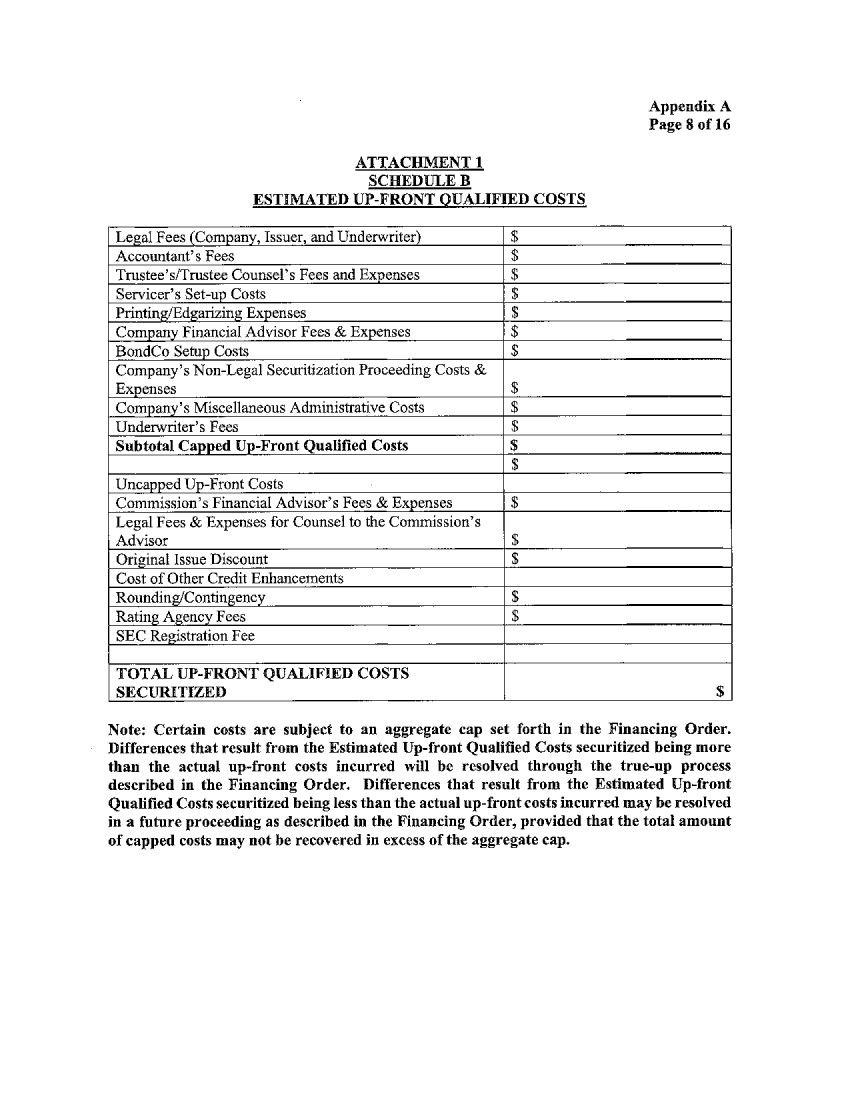

in the application that its up-front and ongoing costs of issuing and maintaining the system restoration bonds be recovered respectively

through the system restoration bonds and system restoration charges approved in this Financing Order. CenterPoint Houston estimated that

its up-front costs would total $5.2 million, while its ongoing costs of servicing the system restoration bonds would total $700,000 per

year for each year of the term of the system restoration bonds. The estimates were based on assumptions regarding a number of variables

that will directly affect the level of up-front and ongoing qualified costs including the following: (1) the total Securitizable

Balance will be $396 million; (2) only one series of system restoration bonds will be issued; (3) the financing order proceeding

will not be contested; (4) the financing order will not permit use of interest-rate or foreign-currency hedges, floating-rate system

restoration bonds, or system restoration bonds denominated in foreign currencies; and (5) CenterPoint Houston will act as the servicer.

| Docket No. 57559 | Financing Order | Page 16 of 82 |

The Commission finds that

CenterPoint Houston should be permitted to securitize its up-front costs of issuance in accordance with the terms of this Financing Order.

In the issuance advice letter, CenterPoint Houston must report the actual qualified costs securitized.

CenterPoint Houston is authorized

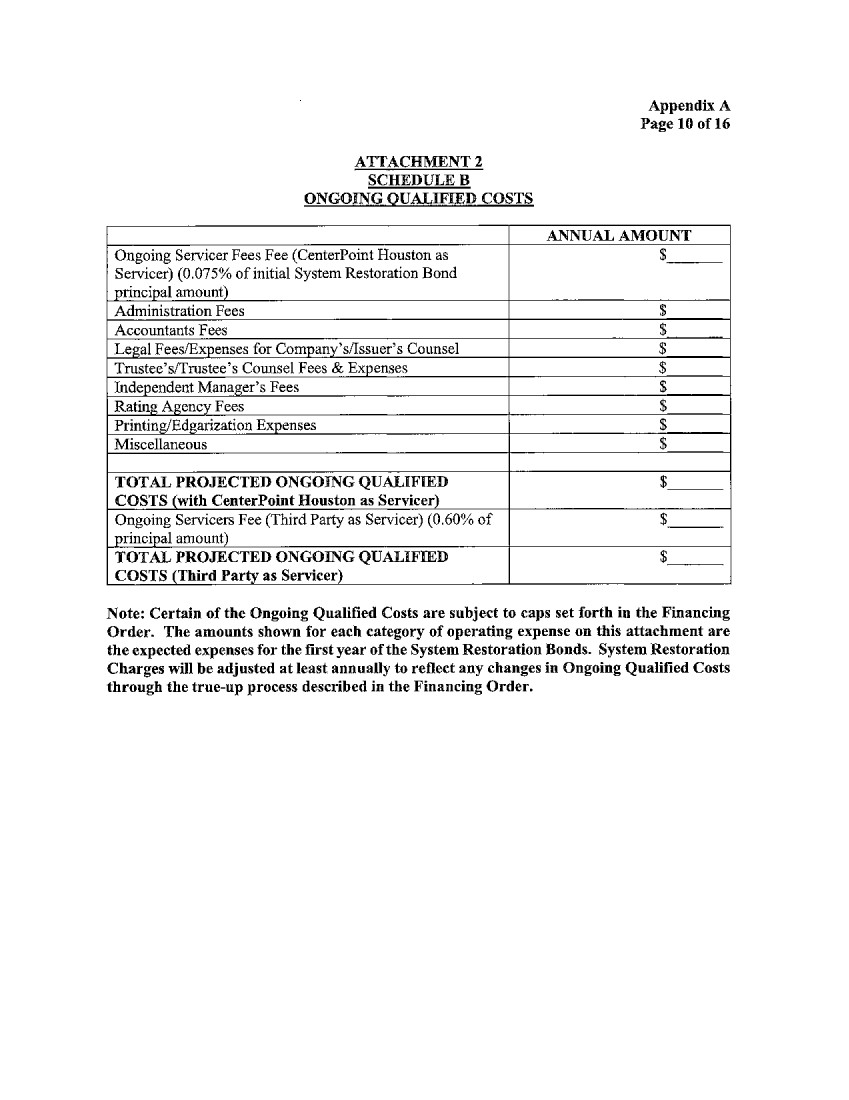

to recover directly through the system restoration charges its actual ongoing costs of servicing the system restoration bonds and providing

administration services to BondCo, subject to a cap on annual servicing fees equal to 0.075% of the initial principal amount of system

restoration bonds issued under this Financing Order and a cap on annual administrative fees of $100,000 for each BondCo plus reimbursable

third-party costs, which will apply as long as CenterPoint Houston continues to serve as the servicer or administrator, respectively.

Ongoing qualified costs, other than the servicer and administrative fees charged by CenterPoint Houston when it is the servicer and administrator,

are not capped. They are, however, estimated in appendix C. The estimated ongoing qualified costs should be updated in the issuance advice

letter to reflect more current information then available to CenterPoint Houston. In accordance with the terms of this Financing Order

and subject to the approval of the indenture trustee, the Commission will permit a successor servicer to CenterPoint Houston to recover

a higher servicer fee if CenterPoint Houston ceases to service the system restoration bonds.

CenterPoint Houston does not

anticipate incurring costs of refinancing or retiring debt or equity in connection with the use of the proceeds from the issuance of the

system restoration bonds.52 However, if costs of refinancing or retiring debt or equity are incurred, the Commission notes

that the cost of refinancing or retiring CenterPoint Houston’s existing debt or equity using the proceeds from the system restoration

bonds must remain uncapped. Commission experience with these expenses indicates that they vary widely and are not entirely within CenterPoint

Houston’s control. CenterPoint Houston should be authorized to record such costs as a regulatory asset included on its balance sheet

and to accrue carrying costs on such regulatory asset using the average weighted interest rate on the system restoration bonds, until

the costs are included in CenterPoint Houston’s next base-rate case, and that the costs, together with carrying costs, be evaluated

for recovery in CenterPoint Houston’s next base-rate case, subject to a showing that such costs were prudently incurred and are

reasonable and necessary.

52 Direct

Testimony of Patrica L. Martin at 19.

| Docket No. 57559 | Financing Order | Page 17 of 82 |

III. Findings

of Fact

The Commission makes the following

findings of fact.

| A. |

Identification and Procedure |

|

| 1. | CenterPoint Houston is a Texas limited liability company registered with the Texas secretary of state

under filing number 800119842. CenterPoint Houston is an indirect wholly-owned subsidiary of CenterPoint Energy, Inc. (CenterPoint

Energy), which is a public utility holding company under the Public Utility Holding Company Act of 2005. |

| 2. | CenterPoint Houston owns and operates for compensation in Texas facilities and equipment to transmit and

distribute electricity in the Electric Reliability Council of Texas (ERCOT) region. |

| 3. | CenterPoint Houston holds certificate of convenience and necessity number 30086 to provide service to

the public. |

| 2. | Background and Application |

| 4. | A storm that the National Weather Services has officially named “the Houston Derecho” and

a wave of strong thunderstorms struck CenterPoint Houston’s service territory on May 16, 2024, and May 28, 2024, respectively,

causing extensive damage to CenterPoint Houston’s system and widespread electric outages. These storms are collectively referred

to in this Financing Order as the Storms. |

| 5. | On November 8, 2024, CenterPoint Houston filed an application in Docket No. 57271 under PURA

§ 36.405 for determination of the amount of system restoration costs related to the Storms eligible for securitization or other recovery. |

| 6. | On January 24, 2025, CenterPoint Houston filed an application in this proceeding for a financing

order under PURA chapter 36, subchapter I and chapter 39, subchapter G to permit securitization of an amount equal to the following: (a) the

sum of the Securitizable Balance as of the date of issuance of the system restoration bonds, plus (b) up-front qualified costs. The

application includes exhibits, schedules, attachments, and testimony. |

| 7. | In Order No. 2 filed on February 7, 2025, the administrative law judge (ALJ) found CenterPoint

Houston’s application administratively complete. |

| Docket No. 57559 | Financing Order | Page 18 of 82 |

| 8. | On March 3, 2025, CenterPoint Houston filed the following: |

| a. | the affidavit of Alice S. Hart, supervisor for regulatory and litigation support for CenterPoint Houston,

attesting that CenterPoint Houston sent: (a) a copy of its application to all parties in its most recent comprehensive base rate

case, Docket No. 56211,53 and to all parties in Docket No. 57271, on January 24, 2025; and (b) notice

of the application to each municipality in CenterPoint Houston's service area and all certified retail electric providers listed on the

Commission’s website by first-class mail or electronic mail; and |

| b. | a publisher’s affidavit attesting to the publication of notice in the Houston Chronicle,

a newspaper of general circulation throughout CenterPoint Houston’s service area, on February 7 and 14, 2025. |

| 9. | In Order No. 6 filed on March 24, 2025, the ALJ found CenterPoint Houston’s notice sufficient. |

| 10. | In Order No. 3 filed on February 18, 2025, the ALJ granted the motions to intervene filed by

Houston Coalition of Cities (HCOC), Office of Public Utility Counsel (OPUC), and Texas Energy Association for Marketers (TEAM). |

| 11. | In Order No. 4 filed on March 6, 2025, the ALJ granted the motion to intervene filed by Texas

Coast Utilities Coalition (TCUC). |

| 5. | Testimony and Agreement |

| 12. | CenterPoint Houston’s application included the direct testimonies and exhibits of the following

five witnesses: Patricia L. Martin, Russel K. Wright, Charles C. Wang, John R. Durland, and Steffen Lunde. |

| 13. | On April 23, 2025, CenterPoint Houston filed an agreement resolving the issues among CenterPoint

Houston, Commission Staff, OPUC, HCOC, and TCUC (the signatories). The only party this is not a signatory to the agreement, TEAM, does

not oppose the agreement. |

53 Application

of CenterPoint Energy Houston Electric, LLC, for Authority to Change Rates, Docket No. 56211, Order (Mar. 13, 2025).

| Docket No. 57559 | Financing Order | Page 19 of 82 |

| 14. | On April 23, 2025, CenterPoint Houston filed the testimony of Patricia L. Martin in support of the

agreement. |

| 15. | On April 30, 2025, Commission Staff filed the testimony of Darryl Tietjen in support of the agreement. |

| 16. | On April 30, 2025, CenterPoint filed an unopposed errata to the agreement. |

| 17. | In Order No. 11 filed on May 15, 2025, the ALJ admitted the following evidence into the record

of this proceeding: |

| a. | CenterPoint Houston’s application, including all attachments, schedules and supporting testimony

filed on January 24, 2025; |

| b. | CenterPoint Houston’s affidavit of notice filed on March 3, 2025; |

| c. | the agreement, including all attachments, filed on April 23, 2025; |

| d. | the testimony of Patricia L. Martin in support of the agreement, including all attachments, filed on April 23,

2025; |

| e. | the testimony of Darryl Tietjen in support of the agreement, including all attachments, filed on April 30,

2025; and |

| f. | the errata to the proposed financing order filed on April 30, 2025. |

| B. |

Qualified Costs and Amount to be Securitized |

|

| 1. | Identification and Amounts |

| 18. | Qualified costs are defined in PURA § 36.403(d) to include 100% of an electric utility’s

system restoration costs, including carrying costs at the electric utility’s weighted-average cost of capital as last approved in

the utility’s general rate case (calculated using a pre-tax basis), net of any insurance proceeds, government grants, or other sources

of funding that compensate the utility for system restoration costs received by the utility at the time it files an application for a

financing order, together with the costs of issuing, supporting, and servicing system restoration bonds and any costs of retiring and

refunding the electric utility’s existing debt and equity securities in connection with the issuance of system restoration bonds.54

Qualified costs also include the costs to the Commission of acquiring professional services for the purpose of evaluating proposed securitization

transactions and costs associated with ancillary agreements such as any bond insurance policy, letter of credit, reserve account, surety

bond, swap arrangement, hedging arrangement, liquidity or credit support arrangement or other financial arrangement entered into in connection

with the issuance or payment of the system restoration bonds. |

54 PURA §

36.403(d).

| Docket No. 57559 | Financing Order | Page 20 of 82 |

| 19. | The actual costs of issuing and supporting the system restoration bonds will not be known until the system

restoration bonds are issued, and certain ongoing costs relating to the system restoration bonds may not be known until such costs are

incurred. However, to satisfy the statutory obligation to ensure tangible and quantifiable benefits to customers, it is appropriate to

limit the amount of certain up-front qualified costs that may be included in the principal amount of the system restoration bonds so that

the sum of those up-front qualified costs does not exceed $5.2 million plus: (a) the cost of original-issue discount, credit enhancements

and other arrangements to enhance marketability as discussed in Ordering Paragraphs 5 and 22, (b) rating agency fees, (c) United

States Securities and Exchange Commission registration fees, (d) the cost of the Commission’s financial advisor and its legal

counsel, if any, and any additional costs incurred by CenterPoint Houston to comply with the requests and recommendations of the Commission’s

financial advisor, and (e) any costs incurred by CenterPoint Houston if this Financing Order is appealed. The amount of the up-front

qualified costs must be shown in the issuance advice letter to ensure compliance with all statutory requirements. |

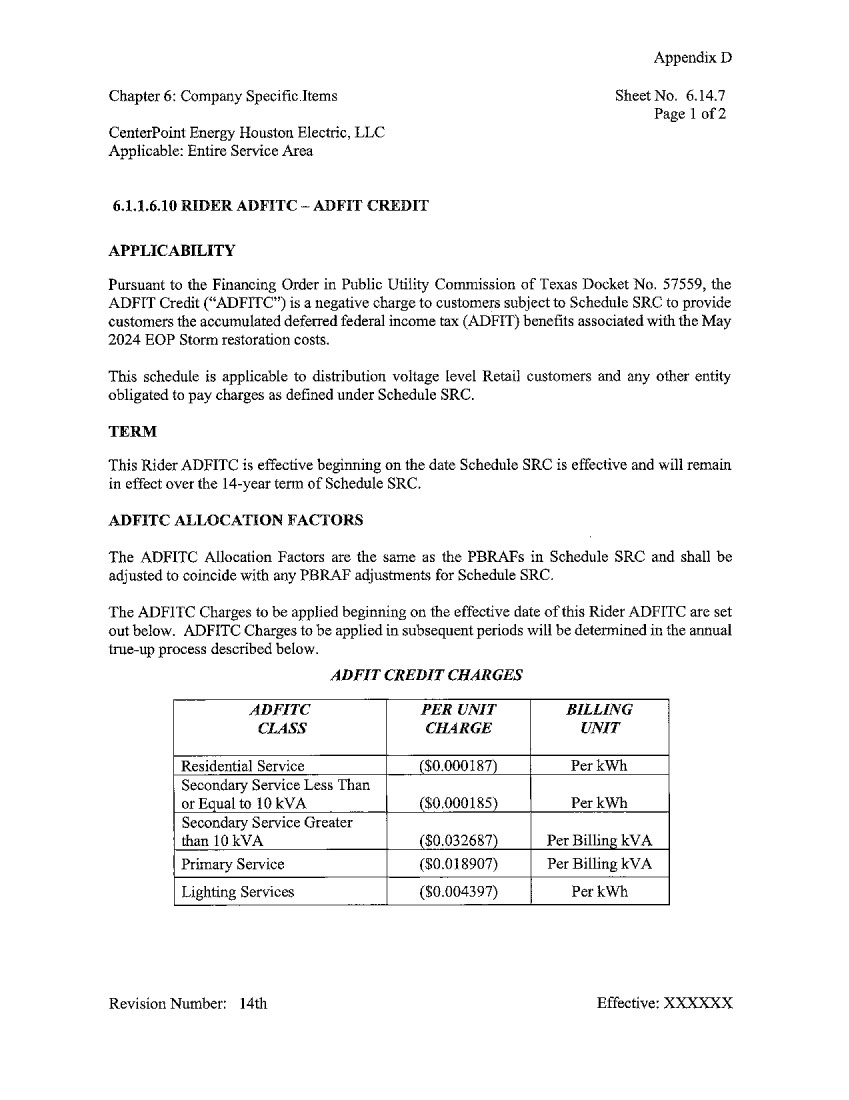

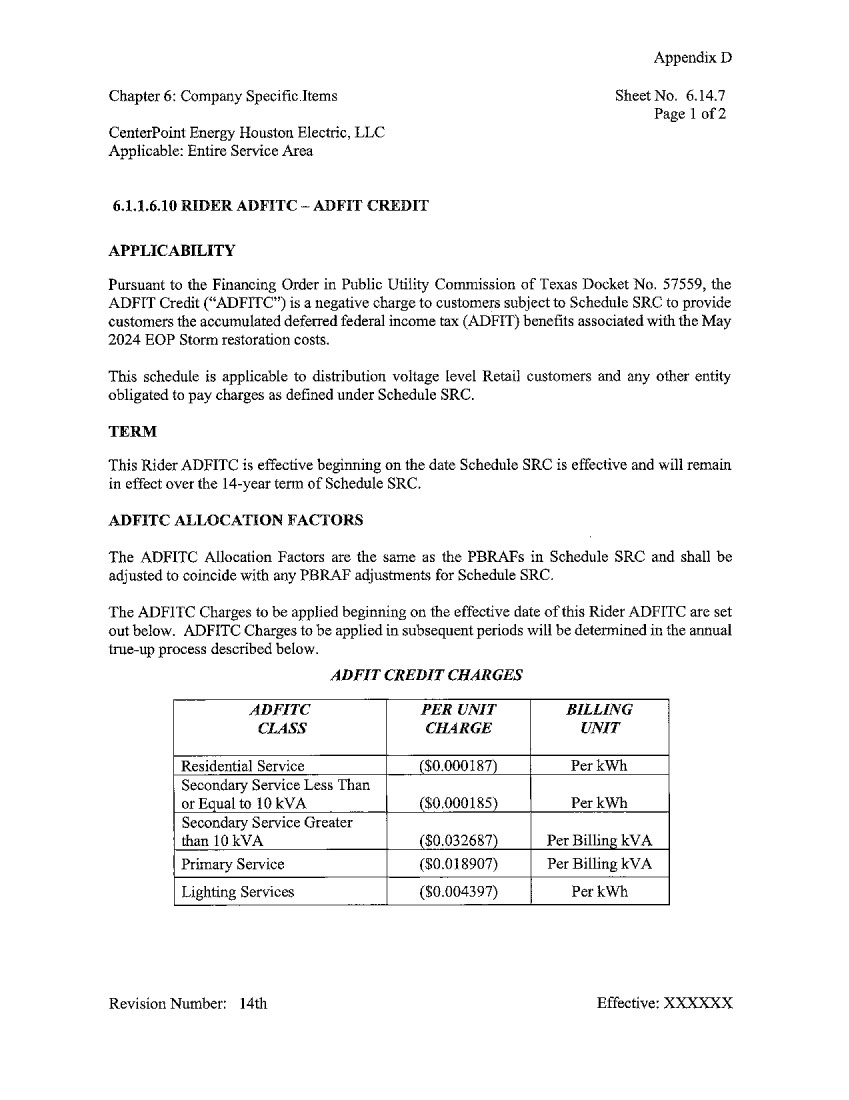

| 2. | Accumulated Deferred Federal Income Taxes |

| 20. | Accumulated deferred federal income taxes (ADFIT) associated with system restoration costs occurs because

of the timing difference between the regulatory and tax treatment of the system restoration costs. |

| 21. | CenterPoint Houston’s proposed Schedule ADFITC provides customers the benefits of a deferred tax

liability recorded by CenterPoint Houston. CenterPoint Houston’s proposed Schedule ADFITC is subject to adjustment on each

date that the system restoration charges are adjusted to: (a) correct any over-credit or under-credit of the amounts previously scheduled

to be provided to customers, (b) reflect the amounts scheduled to be provided to customers during the period the adjusted ADFITC

is to be effective, and (c) account for the effects, if any, on ADFIT of any insurance proceeds, government grants or other source

of funding that compensate CenterPoint Houston for system restoration costs incurred. The adjustment must be made through a separate filing

submitted by CenterPoint Houston at the same time as it submits the system restoration charge adjustment filing and using the same allocation

factors and billing determinants as the system restoration charge adjustment filing. |

| Docket No. 57559 | Financing Order | Page 21 of 82 |

| 3. | Balance to be Securitized |

| 22. | It is appropriate that CenterPoint Houston be authorized to cause system restoration bonds to be issued

in an aggregate principal amount equal to the Securitizable Balance at the time of issuance plus up-front qualified costs as described

in Ordering Paragraphs 1 and 16. The Securitizable Balance to be securitized must be equal to the balance of distribution-related

system restoration costs as determined in Docket No. 57271 plus Storms-related carrying costs using the rate approved in Docket No. 57271

through the date the system restoration bonds are issued, net of any insurance proceeds, government grants, and other sources of funding

received by CenterPoint Houston at the time that the financing application was filed that compensate CenterPoint Houston for the distribution-related

system restoration costs. In the issuance advice letter, CenterPoint Houston must update the amounts to reflect the Securitizable Balance

on the date of issuance and the amount of up-front qualified costs. |

| 23. | It is appropriate for CenterPoint Houston to recover the annual ongoing servicing fees and administration

fees and the other annual fixed operating costs directly through system restoration charges. It is also appropriate to impose additional

limits to ensure that the annual servicing fees incurred when CenterPoint Houston serves as servicer do not exceed 0.075% of the

initial principal balance of the system restoration bonds and that the annual administration fees incurred under the administration agreement

do not exceed $100,000 for each BondCo plus reimbursable third-party costs as shown in appendix C. In compliance with CenterPoint

Houston’s prior securitizations, the annual servicing fee payable to any other servicer not affiliated with CenterPoint Houston

will not exceed 0.60% of the initial principal amount of the system restoration bonds unless such higher rate is approved by the Commission.

Ongoing qualified costs other than the servicer and administration fees charged by CenterPoint Houston when it serves as servicer and

administrator will not be capped but are estimated in appendix C to this Financing Order. The servicing and administration fees collected

by CenterPoint Houston, or any affiliate of CenterPoint Houston, acting as servicer or administrator under the servicing agreement or

administration agreement, must be included as a revenue credit and reduce revenue requirements in each subsequent CenterPoint Houston

base-rate case. The expenses incurred by CenterPoint Houston or such affiliate to perform obligations under the servicing agreement and

should be included in each CenterPoint Houston base-rate case. |

| Docket No. 57559 | Financing Order | Page 22 of 82 |

| 24. | Because the actual structure and pricing of the system restoration bonds will not be known at the time

this Financing Order is issued, following determination of the final terms of the system restoration bonds and before issuance of the

system restoration bonds, CenterPoint Houston will file with the Commission for each series of system restoration bonds issued, and

no later than the end of the first business day after the pricing date for that series of system restoration bonds, an issuance advice

letter. The issuance advice letter will include CenterPoint Houston’s best estimate of total up-front qualified costs for such issuance.

The estimated total up-front qualified costs in the issuance advice letter may be included in the principal amount securitized. Within

60 days of issuance of the system restoration bonds, CenterPoint Houston must submit to the Commission a final accounting of the total

up-front qualified costs, as described in Finding of Fact 25. The issuance advice letter will report the actual dollar amount of the initial

system restoration charges and other information specific to the system restoration bonds to be issued. CenterPoint Houston’s

issuance advice letter must update the benefits analysis to verify that the final amount securitized satisfies the statutory financial

tests. All amounts that require computation will be computed using the mathematical formulas contained in the form of the issuance advice

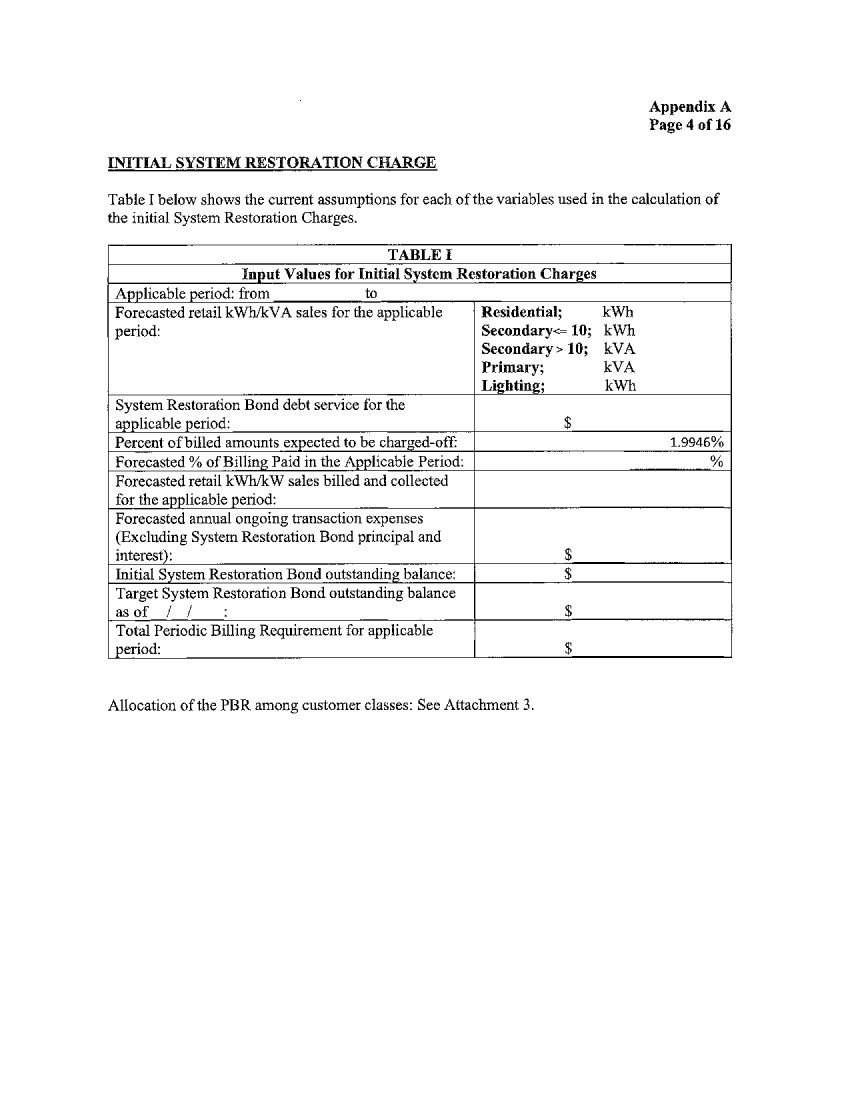

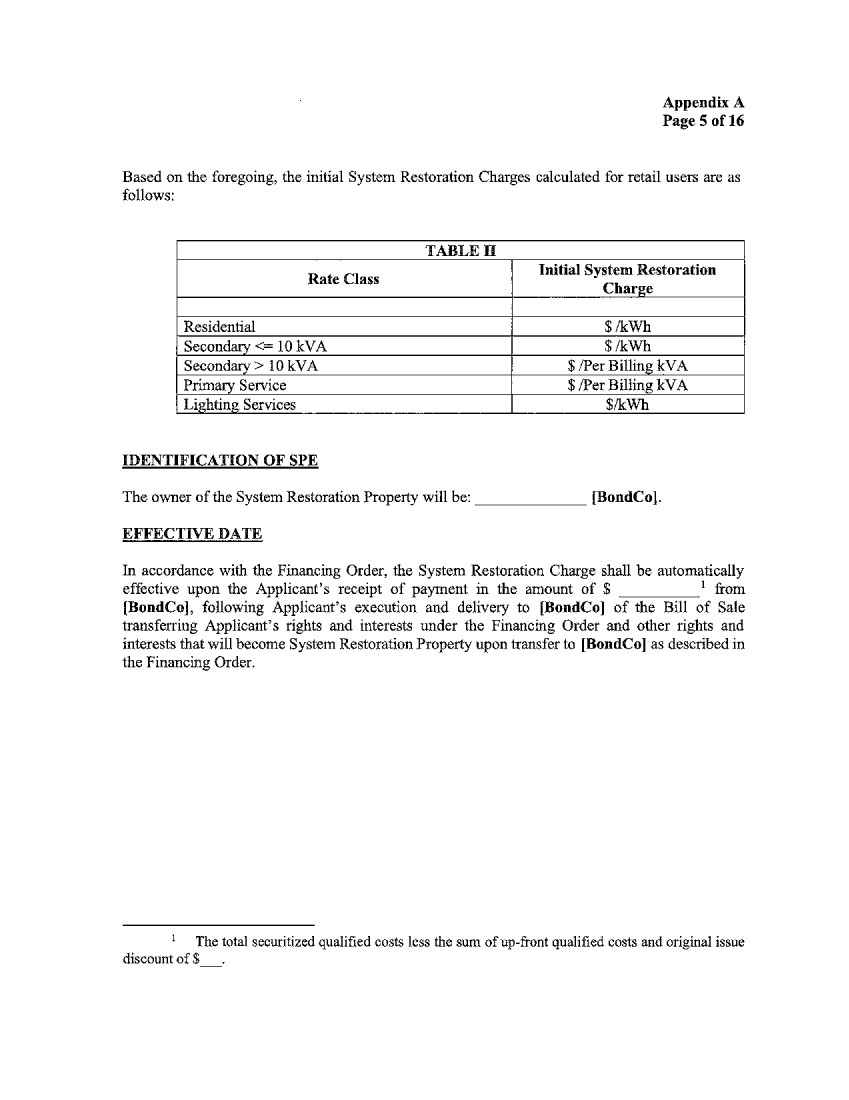

letter in appendix A to this Financing Order and Schedule SRC. The initial system restoration charges and the final terms of the

system restoration bonds set forth in the issuance advice letter must become effective on the date of issuance of the system restoration

bonds unless before noon on the fourth business day after pricing the Commission issues an order finding that the proposed issuance does

not comply with the requirements of PURA and this Financing Order. |

| Docket No. 57559 | Financing Order | Page 23 of 82 |

| 25. | If the actual up-front qualified costs are less than the up-front qualified costs included in the principal

amount securitized, the Periodic Billing Requirement, defined below, for the first annual true-up adjustment must be reduced by the amount

of such unused funds (together with interest, if any, earned on the investment of such funds) and such unused funds (together with such

interest) must be available for payment of debt service on the bond payment date next succeeding such true-up adjustment. If the actual

up-front qualified costs are more than the up-front qualified costs included in the principal amount securitized, CenterPoint Houston

may request recovery of the remaining up-front qualified costs through a surcharge to CenterPoint Houston’s rates for distribution

service. |

| 26. | CenterPoint Houston will submit a draft issuance advice letter to the Commission Staff for review not

later than two weeks before the expected date of commencement of marketing the system restoration bonds. Within one week after receipt

of the draft issuance advice letter, Commission Staff will provide CenterPoint Houston comments and recommendations regarding the adequacy

of the information provided. |

| 27. | The issuance advice letter must be submitted to the Commission not later than the end of the first business

day after the pricing of the system restoration bonds. Commission Staff may request such revisions of the issuance advice letter as may

be necessary to assure the accuracy of the calculations and that the requirements of PURA and of this Financing Order have been met. The

initial system restoration charges and the final terms of the system restoration bonds set forth in the issuance advice letter must become

effective on the date of issuance of the system restoration bonds (which must not occur before the fifth business day after pricing) unless

before noon on the fourth business day after pricing the Commission issues an order finding that the proposed issuance does not comply

with the requirements of PURA and the Financing Order. CenterPoint Houston will provide notice to REPs of the rates associated with the

initial system restoration charges as soon as practicable after submittal of the issuance advice letter to the Commission. |

| 28. | The completion and filing of an issuance advice letter in the form of the issuance advice letter attached

as appendix A, including the certification from CenterPoint Houston discussed in Findings of Fact 29 and 98, is necessary to ensure that

any securitization actually undertaken by CenterPoint Houston complies with the terms of this Financing Order. |

| Docket No. 57559 | Financing Order | Page 24 of 82 |

| 29. | The certification statement contained in CenterPoint Houston’s certification letter must be worded

precisely as the statement in the form of the issuance advice letter approved by the Commission. Other aspects of the certification letter

may be modified to describe the particulars of the system restoration bonds and the actions that were taken during the transaction. |

| 5. | Tangible and Quantifiable Benefit |

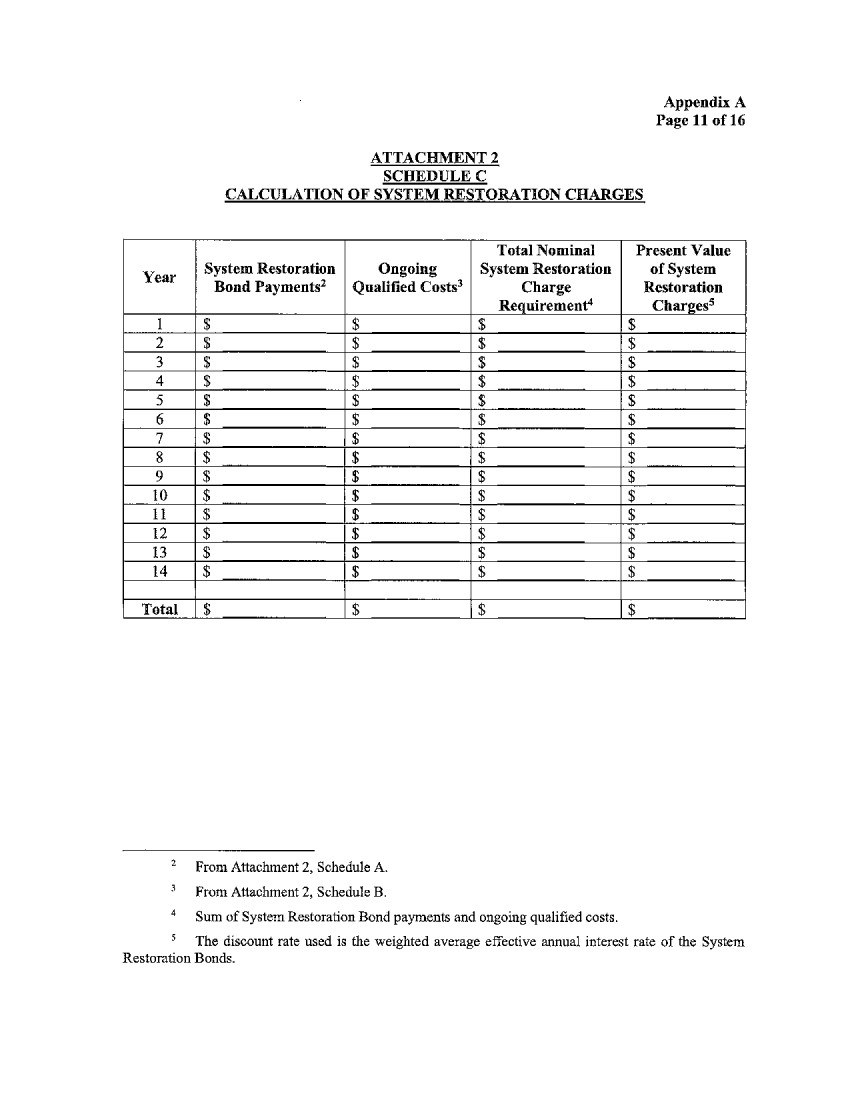

| 30. | The statutory requirements in PURA §§ 36.401 and 39.301 that direct the Commission to ensure

that securitization provides tangible and quantifiable benefits to customers greater than would be achieved absent the issuance of system

restoration bonds can only be determined using an economic analysis to account for the time value of money. An analysis that compares:

(a) in the aggregate, over the expected life of the system restoration bonds, the present value of the revenue requirement associated

with recovery of the Securitizable Balance through rates reflective of conventional utility financing, with (b) the present value

of the revenue required under securitization, is an appropriate economic analysis to demonstrate whether securitization provides economic

benefits to customers. |

| 31. | The financial analysis presented by CenterPoint Houston indicates that securitization of the Securitizable

Balance and other qualified costs as requested by CenterPoint Houston would result in $85,000 of tangible and quantifiable economic benefits

to customers on a present value basis if the system restoration bonds are issued at an average weighted-average interest rate of 7.24%

allowed by this Financing Order and with a 14-year expected life. Using the projected weighted-average interest rate of 4.90% and a 14-year

expected life, the benefits of securitization would be $63 million on a present-value basis. These estimates use CenterPoint Houston’s

Securitizable Balance as of September 2, 2025 (i.e. $396 million), as approved in Docket No. 57271, and assume that actual

up-front and ongoing qualified costs will be as shown on appendix C to this Financing Order. The benefits for customers set forth in CenterPoint

Houston’s evidence are fully indicative of the benefits customers will realize from the securitization approved in this Financing

Order; however, the actual benefit to customers will depend upon market conditions on the date of issuance of the system restoration bonds,

the actual scheduled maturity of the system restoration bonds, and the amount actually securitized. CenterPoint Houston will be required

to provide an updated tangible and quantifiable benefits analysis in its issuance advice letter to verify that this statutory test is

met. |

| Docket No. 57559 | Financing Order | Page 25 of 82 |

| 32. | The amount securitized may not exceed the present value of the revenue requirement over the life of the

proposed system restoration bonds associated with conventional (i.e., nonsecuritized) recovery of the authorized amounts where the present

value analysis uses a discount rate equal to the proposed interest rate on the system restoration bonds.55 The analysis presented

by CenterPoint Houston demonstrates that the proposed securitization meets this requirement whether the system restoration bonds are assumed

to bear interest at a weighted-average interest rate of 7.24%, at the projected weighted-average interest rate of 4.90%, or at other interest

rates less than 7.24%. Using a 4.90% weighted-average interest rate, the present value of the revenue requirements would be $408.5 million.

At the higher interest rate of 7.24%, the present value of the revenue requirements would be $407.5 million. These estimates use CenterPoint

Houston’s Securitizable Balance as of September 2, 2025, as approved in Docket No. 57271, an expected life of 14 years,

and assume that actual up-front and ongoing qualified costs will be as estimated on appendix C to this Financing Order. The benefits

for customers set forth in CenterPoint Houston’s evidence are fully indicative of the benefits customers will realize from the securitization

approved in this Financing Order; however, CenterPoint Houston will be required to provide an updated present value analysis in its issuance

advice letter to verify that this statutory test is met. |

| 7. | Total Amount of Revenue to be Recovered |

| 33. | The Commission is required to find that the total amount of revenues to be collected under this Financing

Order will be less than the revenue requirement that would be recovered over the life of the amounts that are securitized under this Financing

Order, using conventional financing methods.56 CenterPoint Houston’s analysis assumed that under conventional financing

methods, the costs would be recovered over the life of the system restoration bonds (for purposes of its analysis, 14 years) with carrying

costs equal to CenterPoint Houston’s pre-tax weighted-average cost of capital of 7.716%. The resulting total conventional revenues

would be $471 million. If 14-year system restoration bonds are issued at a 4.90% weighted-average interest rate, CenterPoint Houston’s

financial analysis indicates that the total amount of revenues to be collected under this Financing Order is expected to be $63 million

less than the revenue requirement that would be recovered using conventional utility financing methods. Using the projected weighted-average

interest rate of 4.90%, the benefits of securitization would be $88 million on a nominal basis. These estimates use CenterPoint Houston’s

Securitizable Balance as of September 2, 2025, as approved in Docket No. 57271, an expected life of 14 years, and assume that

actual up-front and ongoing qualified costs will be as estimated on appendix C to this Financing Order. The benefits for retail customers

set forth in CenterPoint Houston’s evidence are fully indicative of the benefits customers will realize from the securitization

approved in this Financing Order; however, CenterPoint Houston will be required to provide an updated total revenue analysis in its issuance

advice letter to verify that this statutory test is met. |

55 See

PURA § 39.301.

56 See

PURA § 39.303(a).

| Docket No. 57559 | Financing Order | Page 26 of 82 |

| C. |

Structure of the Proposed Securitization |

|

| 34. | For purposes of this securitization, CenterPoint Houston will create one or more BondCos, special purpose

securitization funding entities (each of which will be referred to as BondCo), each of which will be a Delaware limited liability company

with CenterPoint Houston as its sole member. If more than one series of system restoration bonds are issued, CenterPoint Houston will

create a separate BondCo for the issuance of a particular series of system restoration bonds and the rights, structure, and restrictions

described in this Financing Order with respect to BondCo will be applicable to each such purchaser of system restoration property to the

extent of the system restoration property sold to it and the system restoration bonds issued by it. BondCo will be formed for the limited

purpose of acquiring system restoration property, issuing system restoration bonds in one or more tranches, and performing other activities

relating thereto or otherwise authorized by this Financing Order. BondCo will not be permitted to engage in any other activities and will

have no assets other than system restoration property and related assets to support its obligations under the system restoration bonds.

Obligations relating to the system restoration bonds will be BondCo’s only significant liabilities. These restrictions on the activities

of BondCo and restrictions on the ability of CenterPoint Houston to take action on BondCo’s behalf are imposed to achieve the objective

that BondCo will be bankruptcy remote and not affected by a bankruptcy of CenterPoint Houston. BondCo will be managed by a board of managers

with rights and duties similar to those of a board of directors of a corporation. As long as the system restoration bonds remain outstanding,

BondCo will have at least one independent manager with no organizational affiliation with CenterPoint Houston other than acting as

independent manager for one or more other bankruptcy-remote subsidiaries of CenterPoint Houston or its affiliates. BondCo will not be

permitted to amend the provisions of the organizational documents that relate to the bankruptcy remoteness of BondCo without the consent

of the independent manager. Similarly, BondCo will not be permitted to institute bankruptcy or insolvency proceedings or to consent to

the institution of bankruptcy or insolvency proceedings against it, or to dissolve, liquidate, consolidate, convert, or merge without

the consent of the independent manager. Other restrictions to facilitate bankruptcy remoteness may also be included in the organizational

documents of BondCo as required by the rating agencies. |

| Docket No. 57559 | Financing Order | Page 27 of 82 |

| 35. | The initial capital of BondCo is expected to be not less than 0.5% of the initial principal amount of

the system restoration bonds issued by BondCo. Funding of BondCo at this level is intended to protect the bankruptcy remoteness of BondCo.

A sufficient level of capital is necessary to minimize this risk and, therefore, assist in achieving the lowest system restoration bond

charges possible. |

| 36. | BondCo will issue one series of system restoration bonds consisting of one or more tranches. The aggregate

amount of all tranches of all series of system restoration bonds issued under this Financing Order must not exceed the principal amount

approved by this Financing Order. BondCo will pledge to the indenture trustee, as collateral for payment of the system restoration bonds,

the system restoration property, including BondCo’s right to receive the system restoration charges as and when collected, and certain

other collateral described in CenterPoint Houston’s application. |

| Docket No. 57559 | Financing Order | Page 28 of 82 |

| 37. | Concurrent with the issuance of any of the system restoration bonds, CenterPoint Houston will transfer

to BondCo all of CenterPoint Houston’s rights under this Financing Order related to the amount of system restoration bonds BondCo

is issuing, including rights to impose, collect, and receive system restoration charges approved in this Financing Order. This transfer

will be structured so that it will qualify as a true sale within the meaning of PURA § 39.308 and that such rights will become system

restoration property concurrently with the sale to BondCo as provided in PURA § 39.304. By virtue of the transfer, BondCo will acquire

all of the right, title, and interest of CenterPoint Houston in the portion of the system restoration property arising under this Financing

Order that is related to the amount of system restoration bonds BondCo is issuing. |

| 38. | The use and proposed structure of BondCo and the limitations related to its organization and management

are necessary to minimize risks related to the proposed securitization transactions and to minimize the system restoration charges. Therefore,

the use and proposed structure of BondCo should be approved. |

| 2. | Credit Enhancement and Arrangements to Reduce Interest Rate Risk or Enhance Marketability |

| 39. | CenterPoint Houston requested approval to use additional forms of credit enhancement (including letters

of credit, reserve accounts, surety bonds, or guarantees) and other mechanisms designed to promote the credit quality and marketability

of the system restoration bonds if the benefits of such arrangements exceed their cost. CenterPoint Houston also asked that the costs

of any credit enhancements as well as the costs of arrangements to enhance marketability be included in the amount of qualified costs

to be securitized. CenterPoint Houston should be permitted to recover the up-front and ongoing costs of credit enhancements and arrangements

to enhance marketability, provided that the Commission’s designated representative and CenterPoint Houston agree in advance that

such enhancements and arrangements provide benefits greater than their tangible and intangible costs. If the use of original issue discount,

credit enhancements, or other arrangements is proposed by CenterPoint Houston, CenterPoint Houston must provide the Commission’s

designated representative copies of all cost-benefit analyses performed by or for CenterPoint Houston that support the request to use

such arrangements. This finding does not apply to the collection account or its subaccounts approved in this Financing Order. |

| Docket No. 57559 | Financing Order | Page 29 of 82 |