Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Feb. 28, 2025 |

Feb. 29, 2024 |

Feb. 28, 2023 |

Feb. 28, 2022 |

Feb. 28, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Fiscal Year | Summary Compensation Table Total for CEO ($)(1) | Compensation Actually Paid to CEO ($)(2) | Average Summary Compensation Table Total for Other NEOs ($)(3) | Average Compensation Actually Paid to Other NEOs ($)(4) | | Value of Fixed $100

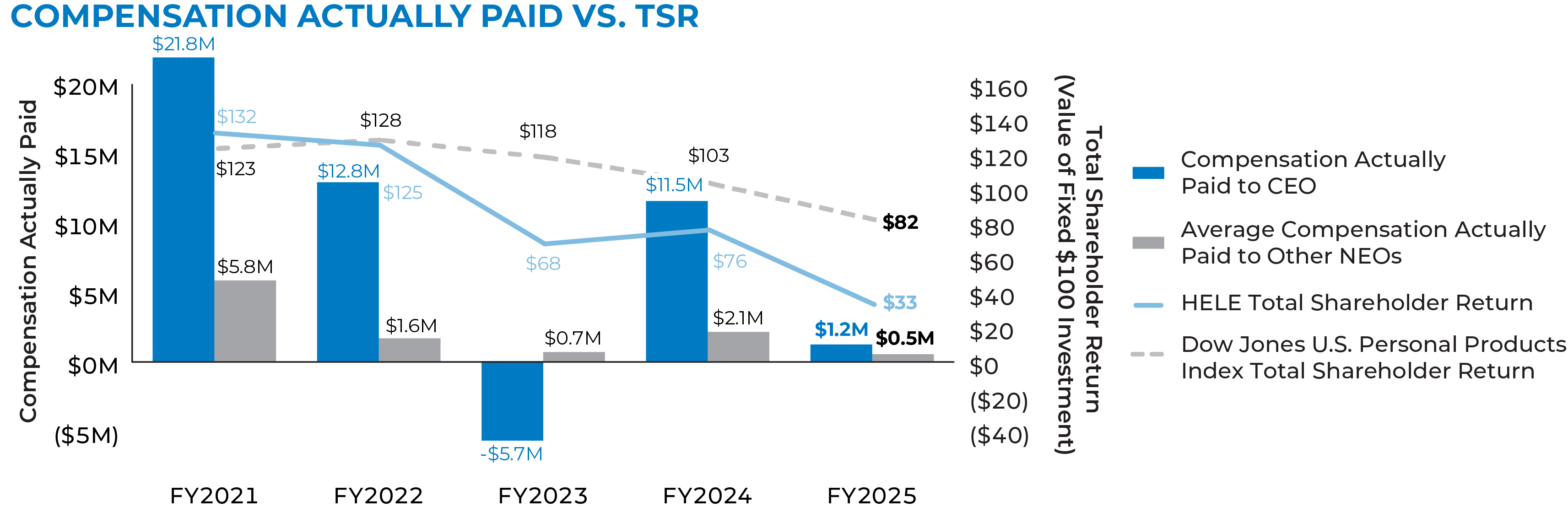

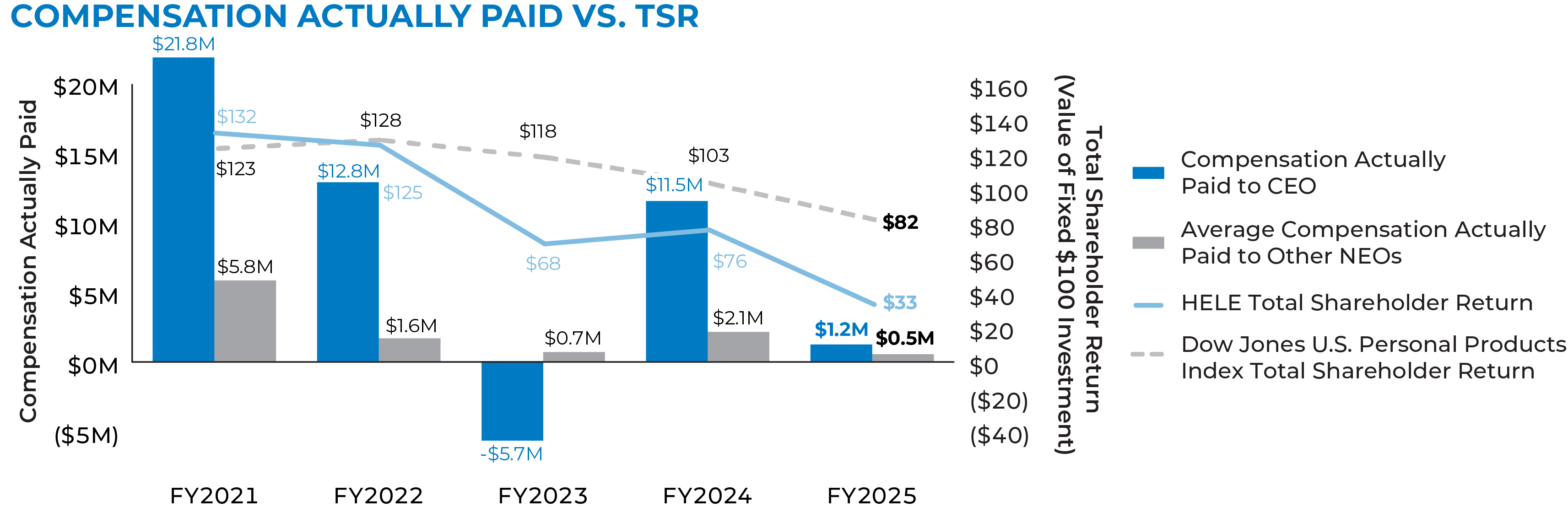

Investment Based On: | Net

Income

($) | Adjusted Income ($)(7) | | Total Shareholder Return ($)(5) | Dow Jones U.S. Personal Products Index ($)(6) | | 2025 | 5,311,324 | | 1,192,030 | | 2,004,229 | | 478,893 | | | 33 | | 82 | | 123,751,000 | | 162,428,000 | | | 2024 | 10,006,422 | | 11,524,531 | | 2,255,143 | | 2,119,573 | | | 76 | | 103 | | 168,594,000 | | 213,470,000 | | | 2023 | 7,965,812 | | (5,703,304) | | 1,703,795 | | 663,458 | | | 68 | | 118 | | 143,273,000 | | 227,663,000 | | | 2022 | 9,746,177 | | 12,841,678 | | 1,725,119 | | 1,637,221 | | | 125 | | 128 | | 223,764,000 | | 295,984,000 | | | 2021 | 9,420,012 | | 21,821,918 | | 3,043,699 | | 5,814,933 | | | 132 | | 123 | | 253,946,000 | | 293,650,000 | |

|

|

|

|

|

| Company Selected Measure Name |

adjusted income

|

|

|

|

|

| Named Executive Officers, Footnote |

The Company’s principal executive officer for fiscal year 2025 was its former CEO, Noel M. Geoffroy, and for fiscal year 2021 through fiscal year 2024 was its former CEO, Julien R. Mininberg. The amounts represent the total compensation paid to our CEO for each reported fiscal year as reflected in the “Total” column of the Summary Compensation Table (“SCT”).The Company's other NEOs (1) for fiscal year 2025, were Brian Grass and Tessa Judge; (2) for fiscal year 2024, were Noel Geoffroy, Brian Grass, Tessa Judge and Matthew Osberg; (3) for fiscal year 2023, were Noel Geoffroy, Tessa Judge and Matthew Osberg; (4) for fiscal year 2022, were Matthew Osberg and Brian Grass and (5) for fiscal year 2021, was Brian Grass. The amounts represent the average of the total compensation paid to our other NEOs for each reported fiscal year as reflected in the “Total” column of the SCT.

|

|

|

|

|

| Peer Group Issuers, Footnote |

Reflects the cumulative total shareholder return of the Dow Jones U.S. Personal Products Index. Total shareholder return is calculated based on an assumed $100 investment as of February 29, 2020 and the reinvestment of any issued dividends. This peer group is used by the Company for purposes of Item 201(e) of Regulation S-K under the Exchange Act in the Company’s Annual Report on Form 10-K for fiscal year 2025.

|

|

|

|

|

| PEO Total Compensation Amount |

$ 5,311,324

|

$ 10,006,422

|

$ 7,965,812

|

$ 9,746,177

|

$ 9,420,012

|

| PEO Actually Paid Compensation Amount |

$ 1,192,030

|

11,524,531

|

(5,703,304)

|

12,841,678

|

21,821,918

|

| Adjustment To PEO Compensation, Footnote |

The amounts reported represent the CAP to Ms. Geoffroy, our former CEO, computed in accordance with the PvP Rules. These amounts do not reflect the actual amount of compensation earned or received by or paid to Ms. Geoffroy in the applicable fiscal year (“FY”). In accordance with the PvP Rules, below are the adjustments made to the amount reported for Ms. Geoffroy in the “Total” column of the SCT for fiscal year 2025 to arrive at CAP: | | | | | | | | | Compensation Element | FY 2025 | SCT Reported Total Compensation(A) | $5,311,324 | | Minus Aggregate SCT Reported Equity Compensation(B) | (4,300,000) | | Plus Year-End Fair Value of Awards Granted During Fiscal Year 2025 & Outstanding(C) | 1,747,797 | | Plus or Minus (as applicable) Year-Over-Year Change in Fair Value of Awards Granted During Prior Fiscal Year(s) & Outstanding(C) | (1,536,600) | | Plus Vesting Date Fair Value of Awards Granted & Vested During Fiscal Year 2025(C) | — | | Plus or Minus (as applicable) Year-Over-Year Change in Fair Value of Awards Granted During Prior Fiscal Year(s) & Vesting During Fiscal Year 2025(C) | (30,491) | | Minus Prior Fiscal Year End Value of Awards Determined to Fail to Meet Vesting Conditions During Fiscal Year 2025(C) | — | | Plus Value of Dividends or Other Earnings Paid on Stock Awards Not Otherwise Included(C) | — | | | Compensation Actually Paid | $1,192,030 | |

(A) We have not reported any amounts in our SCT with respect to “Change in Pension and Nonqualified Deferred Compensation.” Consequently, we have no adjustments with respect to such items prescribed by the PvP Rules. (B) This amount reflects the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 of awards granted during fiscal year 2025 as reported in the “Stock Awards” column of the SCT. (C) In accordance with the PvP Rules, the fair values of Ms. Geoffroy’s unvested and outstanding equity awards were remeasured as of February 28, 2025, and as of each vesting date during fiscal year 2025 and reflect performance achievement projections (as applicable). The fair value of these stock awards included in CAP to Ms. Geoffroy is calculated consistent with the approach used to value the awards at the grant date as described in the Company’s Annual Report on Form 10-K for fiscal year 2025. For further information regarding the assumptions and methodologies used in determining the grant date fair values, see Notes 1 and 8 to the consolidated financial statements accompanying the Company’s Annual Report on Form 10-K for fiscal year 2025.

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 2,004,229

|

2,255,143

|

1,703,795

|

1,725,119

|

3,043,699

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 478,893

|

2,119,573

|

663,458

|

1,637,221

|

5,814,933

|

| Adjustment to Non-PEO NEO Compensation Footnote |

The amounts reported represent the average CAP to our other NEOs, computed in accordance with the PvP Rules. These amounts do not reflect the actual amount of compensation earned or received by or paid to our other NEOs as a group in the applicable fiscal year. In accordance with the PvP Rules, below are the adjustments made to the average of the amounts reported for our other NEOs as a group in the “Total” column of the SCT for fiscal year 2025 to arrive at CAP: | | | | | | | | | Compensation Element | FY 2025 | SCT Reported Total Compensation(A) | $2,004,229 | | Minus Aggregate SCT Reported Equity Compensation(B) | (1,425,000) | | Plus Year-End Fair Value of Awards Granted During Fiscal Year 2025 & Outstanding(C) | 590,392 | | Plus or Minus (as applicable) Year-Over-Year Change in Fair Value of Awards Granted During Prior Fiscal Year(s) & Outstanding(C) | (656,872) | | Plus Vesting Date Fair Value of Awards Granted & Vested During Fiscal Year 2025(C) | — | | Plus or Minus (as applicable) Year-Over-Year Change in Fair Value of Awards Granted During Prior Fiscal Year(s) & Vesting During Fiscal Year 2025(C) | (33,856) | | Minus Prior Fiscal Year End Value of Awards Determined to Fail to Meet Vesting Conditions During Fiscal Year 2025(C) | — | | Plus Value of Dividends or Other Earnings Paid on Stock Awards Not Otherwise Included(C) | — | | | Compensation Actually Paid | $478,893 | |

(A) We have not reported any amounts in our SCT with respect to “Change in Pension and Nonqualified Deferred Compensation.” Consequently, we have no adjustments with respect to such items prescribed by the PvP Rules. (B) This amount reflects the aggregate grant date fair value computed in accordance with FASB ASC Topic 718 of awards granted during fiscal year 2025 as reported in the “Stock Awards” column of the SCT. (C) In accordance with the PvP Rules, the fair values of our other NEOs unvested and outstanding equity awards were remeasured as of February 28, 2025 and as of each vesting date during fiscal year 2025 and reflect performance achievement projections (as applicable). The fair value of these stock awards included in CAP to our other NEOs is calculated consistent with the approach used to value the awards at the grant date as described in the Company’s Annual Report on Form 10-K for fiscal year 2025. For further information regarding the assumptions and methodologies used in determining the grant date fair values, see Notes 1 and 8 to the consolidated financial statements accompanying the Company’s Annual Report on Form 10-K for fiscal year 2025.

|

|

|

|

|

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

|

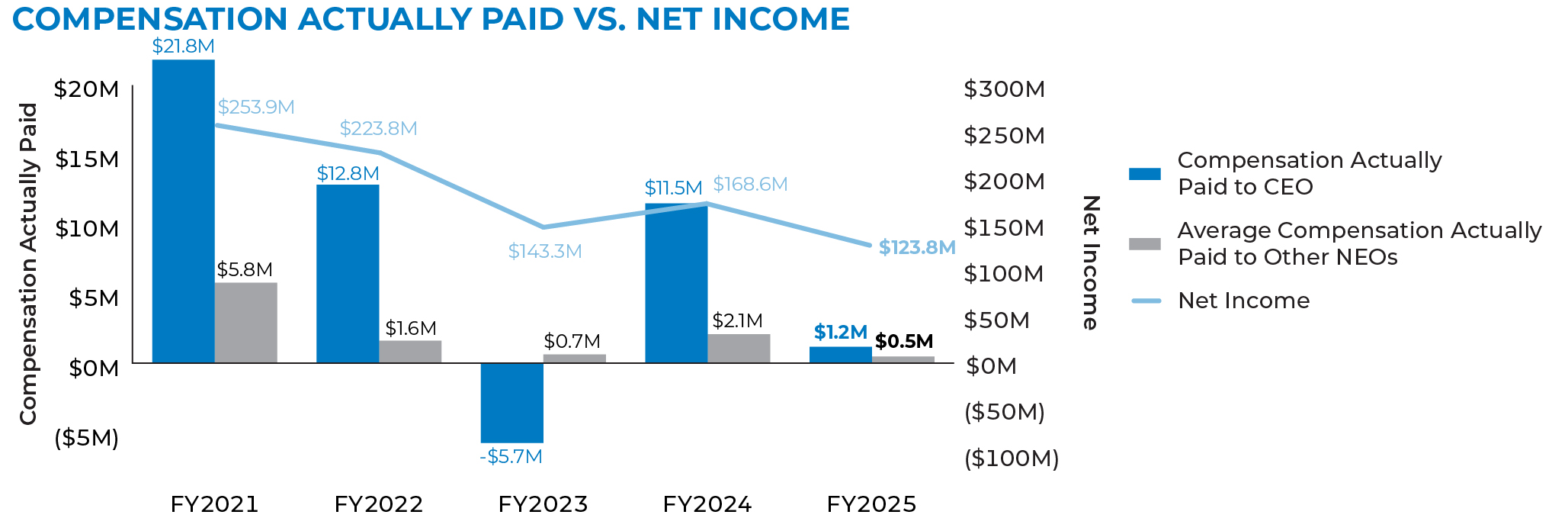

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

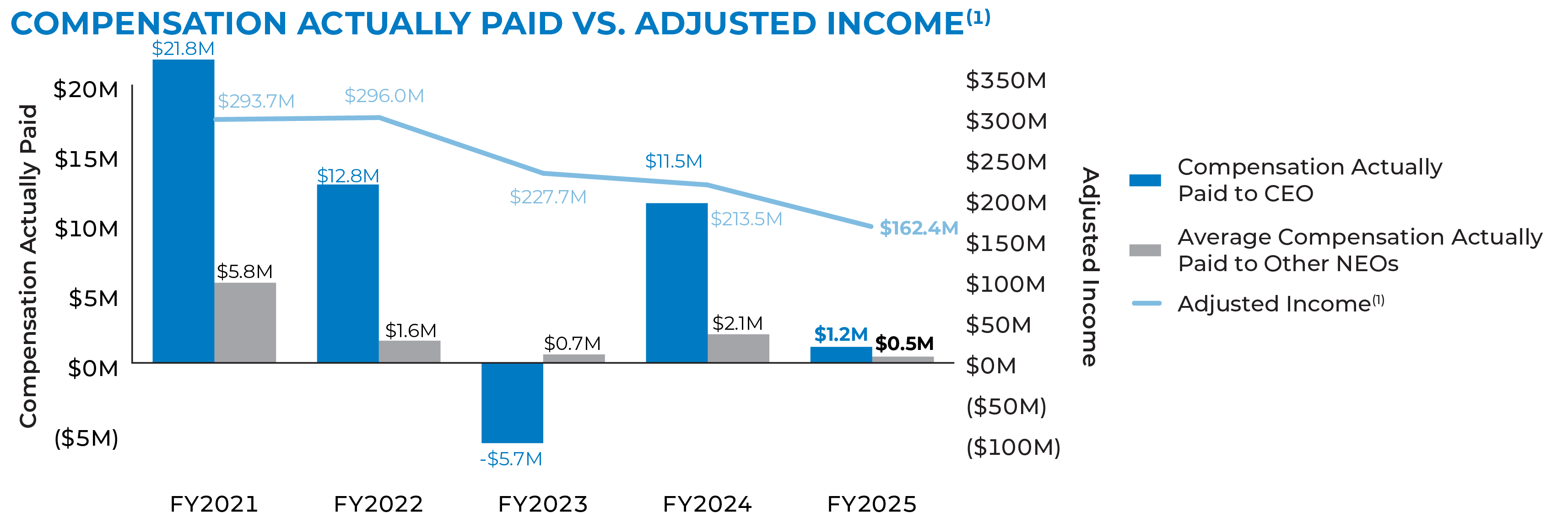

| Compensation Actually Paid vs. Company Selected Measure |

(1)For the PvP analysis, adjusted income aligns with the adjusted income values for our incentive awards.

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

|

| Tabular List, Table |

| | | | | | | Incentive Award | Financial Metric | | Annual Incentive Awards | ▪Adjusted Income | ▪Net Sales | | Long-Term Incentive Awards | ▪Cumulative Adjusted Diluted EPS | ▪Adjusted Cash Flow Productivity | ▪Relative TSR |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 33

|

76

|

68

|

125

|

132

|

| Peer Group Total Shareholder Return Amount |

82

|

103

|

118

|

128

|

123

|

| Net Income (Loss) |

$ 123,751,000

|

$ 168,594,000

|

$ 143,273,000

|

$ 223,764,000

|

$ 253,946,000

|

| Company Selected Measure Amount |

162,428,000

|

213,470,000

|

227,663,000

|

295,984,000

|

293,650,000

|

| PEO Name |

Noel M. Geoffroy

|

Julien R. Mininberg

|

Julien R. Mininberg

|

Julien R. Mininberg

|

Julien R. Mininberg

|

| Additional 402(v) Disclosure |

Reflects the Company’s total shareholder return calculated based on an assumed $100 investment as of February 29, 2020.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

▪Adjusted Income

|

|

|

|

|

| Non-GAAP Measure Description |

For the PvP analysis, adjusted income aligns with the adjusted income values for our incentive awards. Adjusted income is calculated as net income excluding the after-tax impact of acquisition-related expenses, asset impairment charges, Barbados tax reform, a charge for uncollectible receivables due to the bankruptcy of Bed, Bath & Beyond, Environmental Protection Agency compliance costs, gain on insurance recoveries, gain on sale of distribution and office facilities, intangible asset reorganization, restructuring charges, tax reform, amortization of intangible assets, and non-cash share-based compensation, as applicable. Adjusted income is subject to adjustment in the event the Company completes an acquisition of any stock or assets. Accordingly, the financial results from the acquisition of Osprey Pack, Inc. (“Osprey”) and Olive & June were excluded from adjusted income in fiscal year 2022 and fiscal year 2025, respectively, which is consistent with the determination of adjusted income for purposes of our annual incentive award for those fiscal years.

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

▪Net Sales

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

▪Cumulative Adjusted Diluted EPS

|

|

|

|

|

| Measure:: 4 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

▪Adjusted Cash Flow Productivity

|

|

|

|

|

| Measure:: 5 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

▪Relative TSR

|

|

|

|

|

| PEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ (4,300,000)

|

|

|

|

|

| PEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,747,797

|

|

|

|

|

| PEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(1,536,600)

|

|

|

|

|

| PEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(30,491)

|

|

|

|

|

| PEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| PEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(1,425,000)

|

|

|

|

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

590,392

|

|

|

|

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(656,872)

|

|

|

|

|

| Non-PEO NEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(33,856)

|

|

|

|

|

| Non-PEO NEO | Prior Year End Fair Value of Equity Awards Granted in Any Prior Year that Fail to Meet Applicable Vesting Conditions During Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

|

|

|

|

| Non-PEO NEO | Dividends or Other Earnings Paid on Equity Awards not Otherwise Reflected in Total Compensation for Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 0

|

|

|

|

|