General Strategy Description. Due to the unique mechanics of the Fund’s strategy, which are described in detail below, the return an investor can expect to receive from an investment in the Fund has characteristics that are distinct from many other investment vehicles. It is important that an investor understand these characteristics before making an investment in the Fund. The Fund has adopted a policy pursuant to Rule 35d-1 under the 1940 Act to invest, under normal circumstances, at least 80% of its net assets (plus any borrowings for investment purposes) in investments that provide exposure to the SPDR® S&P 500® ETF Trust (the “Underlying ETF”).

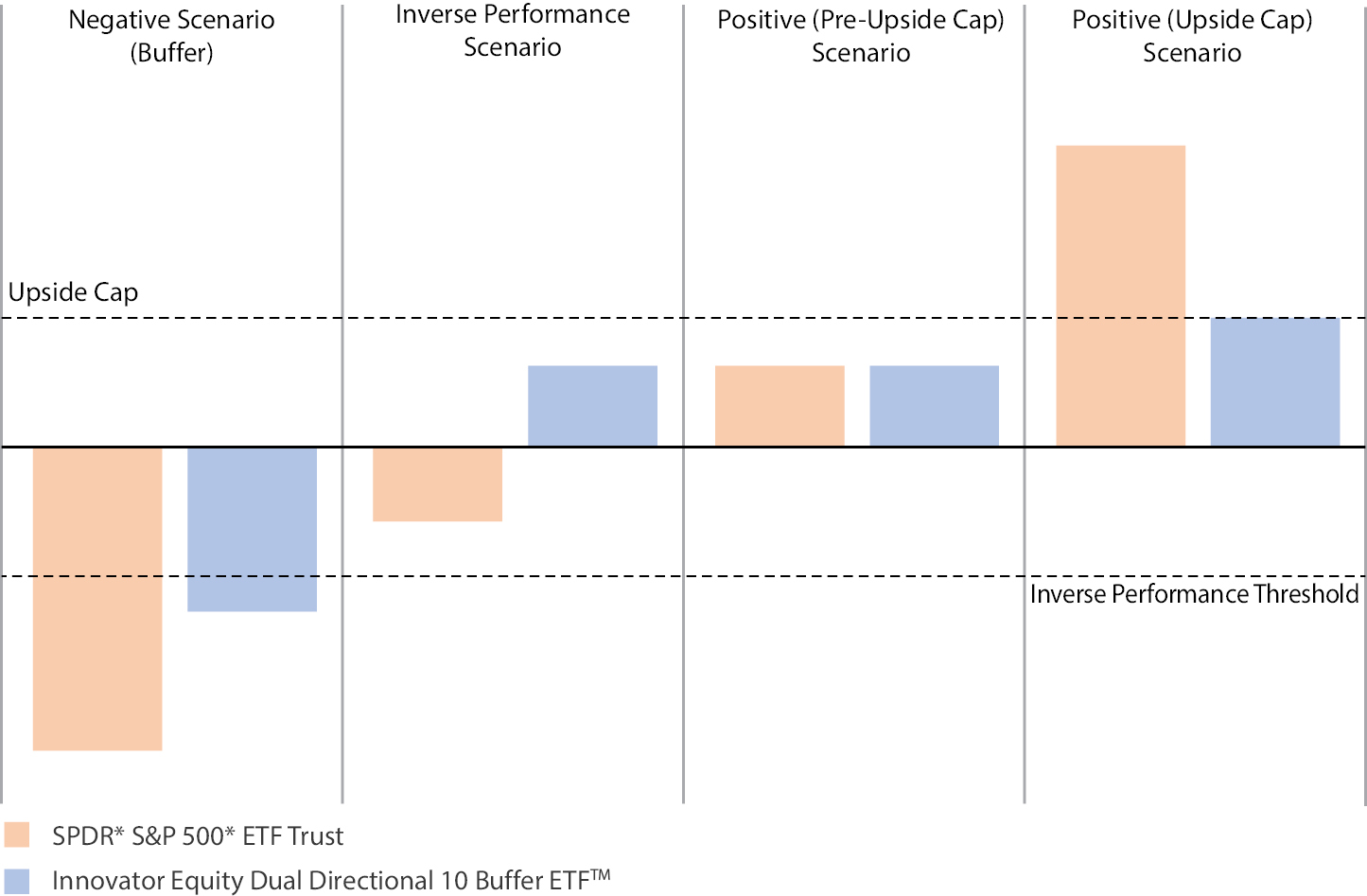

The Fund’s strategy has been specifically designed to produce the “Outcomes” described below based upon the performance of the Underlying ETF’s share price (i.e., its price return) over the duration of an approximately one-year period from July 1 through June 30 of the following year (the “Outcome Period”). The Fund seeks to provide shareholders who hold Shares for the entire Outcome Period with a “dual direction” of positive returns, meaning the Fund seeks to provide positive returns regardless of whether the Underlying ETF share price increases or decreases in value over the course of the Outcome Period, subject to certain limitations detailed herein. As discussed further below, the Fund seeks to provide the following Outcomes:

• Capital Appreciation:

• If the Underlying ETF experiences positive price returns over the course of the Outcome Period, the Fund seeks to provide the positive price performance of such returns over the course of the Outcome Period, limited by an upside return cap (the “Upside Cap”) that represents the maximum percentage return an investor can achieve from an investment in the Fund for the Outcome Period if the Underlying ETF appreciates in value; or

• If the share price of the Underlying ETF decreases in value by an amount less than or equal to 10% (the “Inverse Performance Threshold”) over the course of the Outcome Period, the Fund seeks to provide positive price returns that match the absolute value of Underlying ETF losses (“Inverse Performance”) up to a maximum return of 10.00% that shareholder can obtain via Inverse Performance (the “Inverse Performance Cap”) over the course of the Outcome Period.

• Buffered Returns:

• If the Underlying ETF experiences losses over the course of the Outcome Period that exceed the Inverse Performance Threshold, the Fund seeks to provide returns that are 10% less than the Underlying ETF losses over the course of the Outcome Period (the “Buffer”).

The Fund invests in option contracts, specifically FLEX Options, to pursue its investment objective and seek to provide the Outcomes. The reference asset for all of the Fund’s FLEX Options is the Underlying ETF. The SPDR® S&P 500® ETF Trust is an exchange-traded unit investment trust that seeks to provide investment results that, before expenses, correspond generally to the price and

yield performance of the S&P 500® Index. The S&P 500® Index is a stock market index tracking the stock performance of 500 leading companies listed on stock exchanges in the United States. The Underlying ETF has exposure to equity securities of companies, including companies with large capitalizations. Through its use of FLEX Options on the Underlying ETF, the Fund has significant exposure to companies in the information technology sector. For more information on the Underlying ETF, please see the section of the prospectus entitled “Additional Information About the Fund’s Principal Investment Strategies.”

The current Outcome Period is from July 1, 2025 through June 30, 2026. Upon conclusion of the Outcome Period, the Fund will receive the cash value of all the FLEX Options it held for the prior Outcome Period. It will then invest in a new series of FLEX Options with an expiration date of approximately one year in the future, and a new Outcome Period will begin. The Outcomes may only be realized by investors who continuously hold Shares from the commencement of the Outcome Period until its conclusion. Investors who purchase Shares after the Outcome Period has begun or sell Shares prior to the Outcome Period’s conclusion may experience investment returns that are very different from those that the Fund seeks to provide.

The hypothetical graphical illustration provided below is designed to illustrate the Outcomes that the Fund seeks to provide for investors who hold Shares for the entirety of the Outcome Period. There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes for an Outcome Period. The returns that the Fund seeks to provide do not include the costs associated with purchasing Shares and certain expenses incurred by the Fund. The Fund will not receive or benefit from any dividend payments made by the Underlying ETF to the extent of its FLEX Options investments. The Fund is not an appropriate investment for income-seeking investors.

The following table contains hypothetical examples designed to illustrate the Outcomes the Fund seeks to provide over an Outcome Period, based upon the performance of the Underlying ETF from -100% to 100%. The table is provided for illustrative purposes and does not provide every possible performance scenario for Shares over the course of an Outcome Period. There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes for an Outcome Period. The table is not intended to predict or project the performance of the FLEX Options or the Fund. Fund shareholders should not take this information as an assurance of the expected performance of the Underlying ETF or return on Shares. The actual overall performance of the Fund will vary with fluctuations in the value of the FLEX Options during the Outcome Period, among other factors. Please refer to the Fund’s website, www.innovatoretfs.com/ddtl, which provides updated information relating to this table on a daily basis throughout the Outcome Period; see also “Additional Information About the Fund’s Principal Investment Strategies” in the Fund’s prospectus for additional information regarding Fund performance profile.

|

Underlying ETF Performance |

Fund Performance* |

|

100% |

___% |

|

80% |

___% |

|

70% |

___% |

|

60% |

___% |

|

50% |

___% |

|

40% |

___% |

|

30% |

___% |

|

20% |

___% |

|

10% |

10% |

|

5% |

5% |

|

0% |

0% |

|

(2.50)% |

2.50% |

|

(5)% |

5% |

|

(10)% |

10% |

|

(15)% |

(5)% |

|

(20)% |

(10)% |

|

(30)% |

(20)% |

|

(40)% |

(30)% |

|

(50)% |

(40)% |

|

(60)% |

(50)% |

|

(70)% |

(60)% |

|

(80)% |

(70)% |

|

(90)% |

(80)% |

|

(100)% |

(90)% |

* The Fund’s returns listed herein are provided prior to taking into account any fees or expenses charged to shareholders. The Fund’s annual management fee of 0.79% of the Fund’s average daily net assets, any shareholder transaction fees, any acquired fund fees and expenses, and any extraordinary expenses incurred by the Fund will have the effect of reducing the returns listed herein.

The Fund’s investment adviser is Innovator Capital Management, LLC (“Innovator” or the “Adviser”) and the Fund’s investment sub-adviser is Milliman Financial Risk Management LLC (“Milliman” or the “Sub-Adviser”). The Fund is classified as a “non-diversified company” under the Investment Company Act of 1940, as amended (the “1940 Act”).

Use of FLEX Options. The Outcomes may be achieved by purchasing and selling call and put FLEX Options to create layers within the Fund’s portfolio. In general, an option contract is an agreement between a buyer and seller that gives the purchaser of the option the right to buy or sell a particular asset at a specified future date at an agreed upon price. FLEX Options are exchange-traded option contracts with uniquely customizable terms. The FLEX Options that comprise the Fund’s portfolio each reference the Underlying ETF and are set to expire on the last day of the Outcome Period. The customizable nature of FLEX Options allows the Sub-Adviser to select the share price at which the Underlying ETF will be exercised at the expiration of each FLEX Option. This is commonly known as the “strike price.” At the commencement of the Outcome Period, the Sub-Adviser specifically selects the strike price for each FLEX Option such that when the FLEX Options are exercised on the final day of the Outcome Period, the Outcomes may be obtained, depending on the performance of the Underlying ETF’s price return over the duration of the Outcome Period. The Fund utilizes European style option contracts, which are exercisable only on the expiration date of the option contract. Each of the FLEX Options purchased and sold throughout the Outcome Period are expected to have the same or substantially similar terms (i.e., strike price and expiration) as the corresponding FLEX Options purchased and sold on the first day of the Outcome Period.

The Outcome Period. The Outcomes sought by the Fund are based upon the Fund’s NAV at the outset of the Outcome Period. The Outcome Period begins on the day the FLEX Options are entered into and ends on the day they expire. Each FLEX Option’s value is ultimately derived from the performance of the Underlying ETF’s share price during that time. Because the terms of the FLEX Options don’t change, the Upside Cap, Inverse Performance, Inverse Performance Threshold and Buffer all relate to the Fund’s NAV and/or the share price of the Underlying ETF on the first day of the Outcome Period. There is no guarantee that the Fund will be successful in its attempt to provide the Outcomes.

A shareholder that purchases Shares after the commencement of the Outcome Period will likely have purchased Shares at a different NAV than the NAV on the first day of the Outcome Period (i.e., the NAV upon which the Outcomes are based) and may experience investment outcomes very different from those sought by the Fund. Additionally, since the FLEX Options are exercisable only on the final day of the Outcome Period, a shareholder that sells Shares prior to the end of the Outcome Period may also experience investment outcomes very different from those sought by the Fund. To achieve the Outcomes sought by the Fund for the Outcome Period, an investor must be holding Shares at the time that the Fund enters into the FLEX Options and on the day those FLEX Options expire. Investors considering purchasing Shares after the commencement of the Outcome Period or selling Shares prior to the conclusion of the Outcome Period should understand the impact of such actions versus the Fund’s sought-after Outcomes.

Upside Cap on Potential Upside Returns. Unlike other investment products, the potential upside returns an investor can receive from an investment in the Fund over the Outcome Period is subject to the Upside Cap. The Upside Cap represents the maximum percentage return an investor can achieve from an investment in the Fund over the duration of the Outcome Period if the Underlying ETF experiences positive returns over the course of the Outcome Period. Therefore, even though the Fund’s returns are based upon the performance of the Underlying ETF’s share price, if the Underlying ETF’s share price experiences returns for

the Outcome Period in excess of the Upside Cap, the Fund will not participate in excess returns. The Upside Cap is determined on the first day of the Outcome Period and the Fund expects that the Upside Cap will be between 11.09% and 12.59% prior to taking into account any fees or expenses charged to shareholders. When the Fund’s annual Fund management fee of 0.79% of the Fund’s average daily net assets is taken into account, the Fund expects the Upside Cap to be between 10.30% and 11.80%. The Upside Cap will be further reduced by any shareholder transaction fees, any acquired fund fees and expenses, and any extraordinary expenses incurred by the Fund. The Upside Cap will change from one Outcome Period to the next based upon prevailing market conditions at the beginning of the Outcome Period. The Upside Cap is also set forth on the Fund’s website at www.innovatoretfs.com/ddtl.

Inverse Performance. In addition to seeking to provide positive returns if the Underlying ETF appreciates in value over the course of the Outcome Period, the Fund also seeks to provide positive returns if the Underlying ETF decreases in value over the course of the Outcome Period. If the Underlying ETF decreases in value over the course of the Outcome Period by an amount less than or equal to the Inverse Performance Threshold (-10%), the Fund seeks to provide returns that are equal to the absolute value of Underlying ETF losses, prior to taking into account any fees or expenses charged to shareholders, which will have the effect of lessening returns experienced by shareholders. The Inverse Performance Cap (i.e., the maximum return that shareholders can obtain via Inverse Performance) is 10.00%, prior to taking into account any fees or expenses charged to shareholders. When the Fund’s annual Fund management fee of 0.79% of the Fund’s average daily net assets is taken into account, the net Inverse Performance Cap is 9.21%. The Fund’s Inverse Performance Cap will be further reduced by any shareholder transaction fees, any acquired fund fees and expenses, and any extraordinary expenses incurred by the Fund.

It is possible that the Fund will drop in value significantly at the end of the Outcome Period if the Inverse Performance Threshold is breached. The Inverse Performance Threshold is measured at the end of the Outcome Period when the Fund’s FLEX Options expire, and therefore the Inverse Performance Threshold is operative only on the final day of the Outcome Period. If the Underlying ETF decreases in value beyond the Inverse Performance Threshold at the end of the Outcome Period, the Fund will not provide any positive returns and rather will experience losses of the Underlying ETF offset by the Buffer. Accordingly, the Fund’s NAV could drop significantly as a result of the Inverse Performance Threshold being exceeded at the end of the Outcome Period, and any gains experienced by the Fund will be lost, offset by the Buffer. For example, if at the end of the Outcome Period the Underlying ETF has depreciated in value by -9%, the Fund seeks to provide returns of 9%, prior to taking into account any fees or expenses charged to shareholders. However, if the Underlying ETF depreciated by -11% over the course of the Outcome Period, the Fund would forfeit all gains and, through the operation of the Buffer, seek to provide returns of -1%. Large movements in the price of the Underlying ETF at the end of the Outcome Period exacerbates this risk. Separately, if the Outcome Period has begun and the Underlying ETF has decreased in value below its initial value the onset of the Outcome Period, an investor purchasing Shares at this point may not experience Inverse Performance to the extent of the Inverse Performance Threshold and will remain vulnerable to downside risks. An investment in the Fund is only appropriate for shareholders willing to bear those losses.

Buffer. The Buffer seeks to provide returns that, if the Underlying ETF experiences losses that exceed the Inverse Performance Threshold, are 10% less than the losses of the Underlying ETF over the course of the Outcome Period; however, there is no guarantee that the Fund will be successful in its attempt to provide buffered returns. After the Underlying ETF’s share price has decreased by more than 10%, the Fund will experience all subsequent losses on a one-to-one basis. The Buffer is provided prior to taking into account annual Fund management fees, transaction fees, any acquired fund fees and expenses, and any extraordinary expenses incurred by the Fund. These fees and any expenses will have the effect of reducing the Buffer amount for Fund shareholders for an Outcome Period. When the Fund’s annual management fee equal to 0.79% of the Fund’s daily net assets is taken into account, the net Buffer for an Outcome Period is 9.21%. The Fund’s strategy is designed to produce the Outcomes upon the expiration of its FLEX Options investments on the last day of the Outcome Period. Therefore, it should not be expected that the Buffer, including the net effect of the Fund’s annual management fee on the Buffer, will be provided at any point prior to the last day of the Outcome Period. If an investor is considering purchasing Shares during the Outcome Period, and the Fund has already decreased in value by an amount that exceeds the Inverse Performance Threshold, an investor purchasing Shares at that price will have increased gains available prior to reaching the Upside Cap but may not benefit from the Buffer that the Fund seeks to provide for the remainder of the Outcome Period as any subsequent losses will be experienced on a one-to-one basis. Conversely, if an investor is considering purchasing Shares during the Outcome Period and the Fund has already increased in value, then a shareholder may experience losses that exceed the Buffer, which is not guaranteed. A shareholder may lose their entire investment. While the Fund seeks to limit losses to 90% for shareholders who hold Shares for the entire Outcome Period, there is no guarantee it will successfully do so. An investment in the Fund is only appropriate for shareholders willing to bear those losses.

Fund Rebalance. The Fund is a continuous investment vehicle. It does not terminate and distribute its assets at the conclusion of each Outcome Period. On the termination date of an Outcome Period, the Sub-Adviser will invest in a new set of FLEX Options and another Outcome Period will commence. Approximately one week prior to the end of each Outcome Period, the Fund will file a prospectus supplement, which will alert existing shareholders that an Outcome Period is approaching its conclusion and disclose the anticipated ranges for the Upside Cap for the next Outcome Period. Following the close of business on the last day of the Outcome Period, the Fund will file a prospectus supplement that discloses the Fund’s final Upside Cap (both gross and net of the unitary management fee) for the next Outcome Period. This information is available on the Fund’s website, www.innovatoretfs.com/ddtl, which also provides information relating to the Outcomes, including the Fund’s position relative to the Upside Cap, Inverse Performance Threshold and Buffer, of an investment in the Fund on a daily basis. Important information relating to the Fund, including information relating to the Upside Cap, Inverse Performance Threshold and Buffer, is communicated on the Fund’s website.

The Fund’s website, www.innovatoretfs.com/ddtl, provides information relating to the Outcomes, including the Fund’s position relative to the Upside Cap, Inverse Performance Threshold and Buffer, of an investment in the Fund on a daily basis.