| ANNUAL SHAREHOLDER MEETING June 16, 2025 |

| Forward Looking Statements: This presentation may contain certain “forward-looking statements” representing Bank First Corporation’s expectations or beliefs concerning future events. Such forward-looking statements are about matters inherently subject to risks and uncertainties. Because of the risks and uncertainties inherent in forward-looking statements, readers are cautioned not to rely on them, whether included in this presentation or made elsewhere from time to time by Bank First Corporation or on its behalf. Bank First Corporation disclaims any obligation to update such forward-looking statements. In addition, statements regarding historical stock price performance do not indicate or guarantee future price performance. 2 FORWARD-LOOKING STATEMENTS |

| MIKE MOLEPSKE Chairman of the Board & Chief Executive Officer 3 WELCOME |

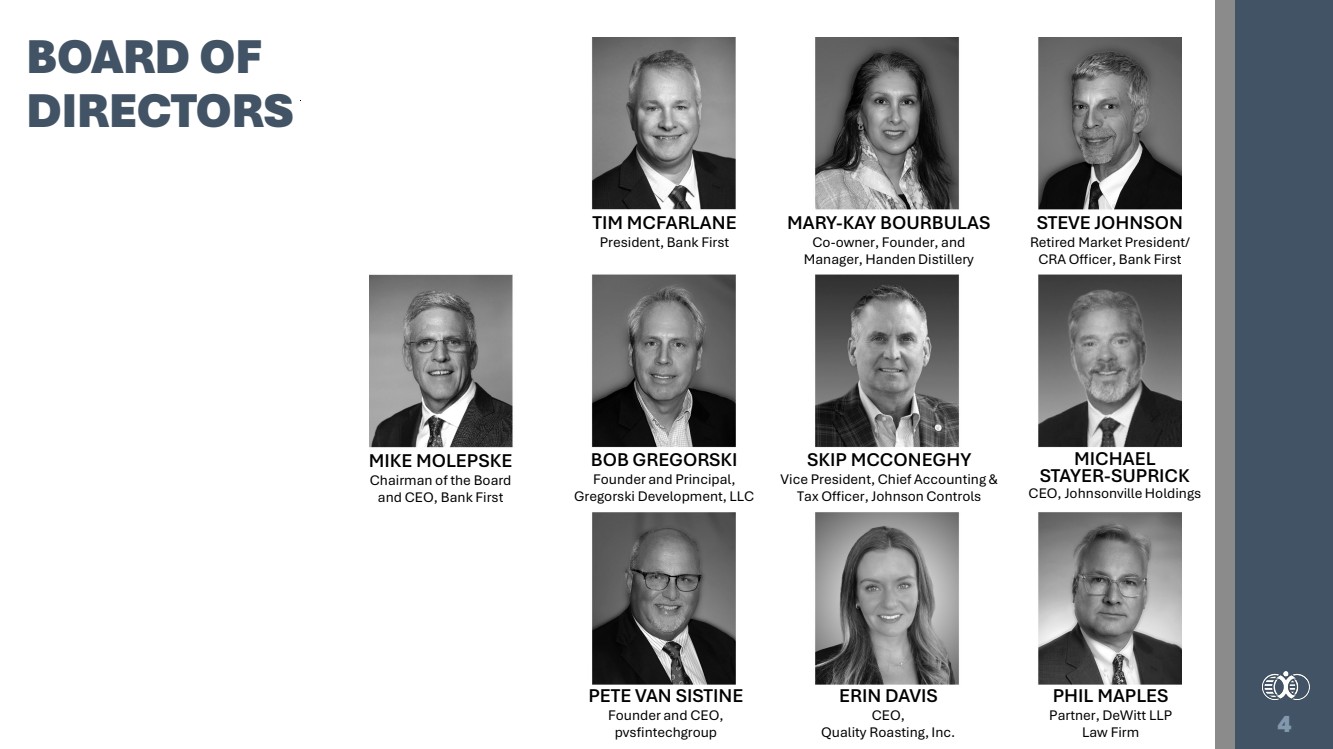

| 4 BOARD OF DIRECTORS MIKE MOLEPSKE Chairman of the Board and CEO, Bank First TIM MCFARLANE President, Bank First MARY-KAY BOURBULAS Co-owner, Founder, and Manager, Handen Distillery STEVE JOHNSON Retired Market President/ CRA Officer, Bank First BOB GREGORSKI Founder and Principal, Gregorski Development, LLC SKIP MCCONEGHY Vice President, Chief Accounting & Tax Officer, Johnson Controls MICHAEL STAYER-SUPRICK CEO, Johnsonville Holdings PETE VAN SISTINE Founder and CEO, pvsfintechgroup ERIN DAVIS CEO, Quality Roasting, Inc. PHIL MAPLES Partner, DeWitt LLP Law Firm |

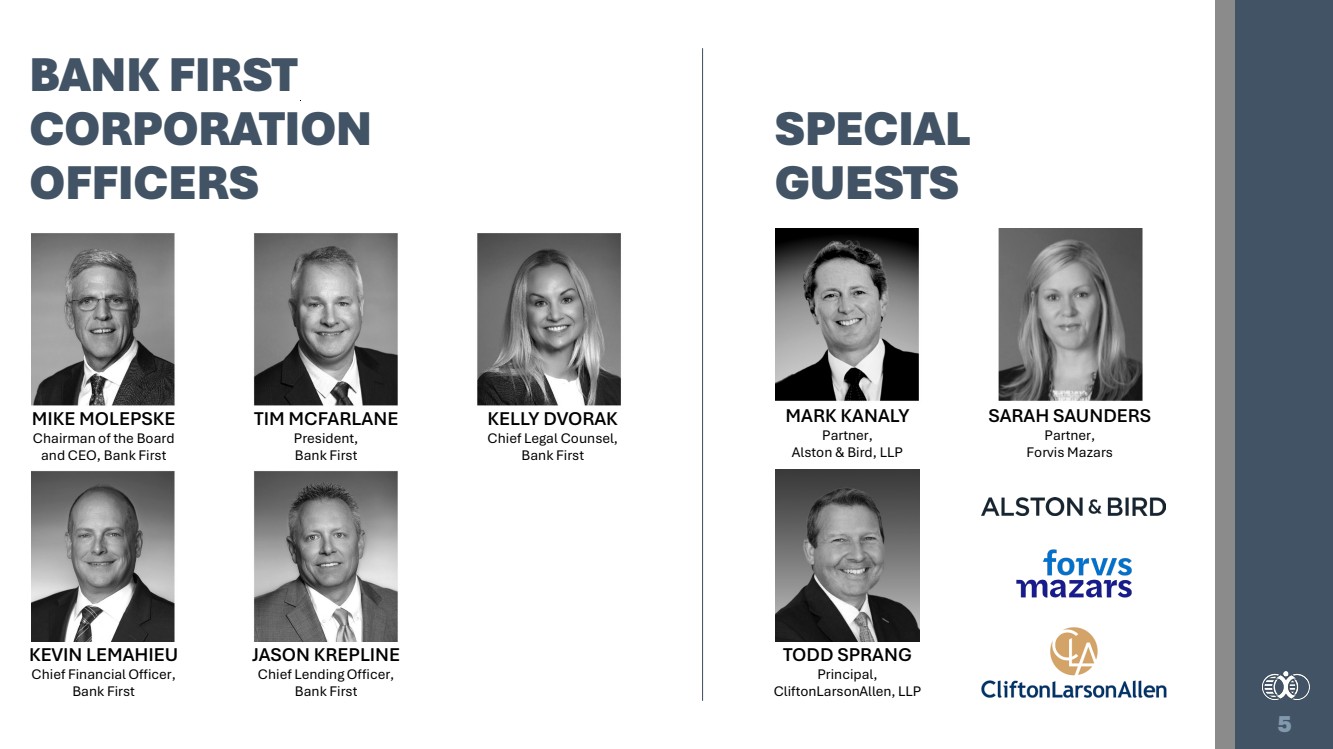

| 5 MIKE MOLEPSKE Chairman of the Board and CEO, Bank First TIM MCFARLANE President, Bank First KELLY DVORAK Chief Legal Counsel, Bank First KEVIN LEMAHIEU Chief Financial Officer, Bank First JASON KREPLINE Chief Lending Officer, Bank First BANK FIRST CORPORATION OFFICERS SPECIAL GUESTS MARK KANALY Partner, Alston & Bird, LLP SARAH SAUNDERS Partner, Forvis Mazars TODD SPRANG Principal, CliftonLarsonAllen, LLP |

| 6 SENIOR MANAGEMENT MIKE MOLEPSKE Chief Executive Officer TIM MCFARLANE President KELLY DVORAK Chief Legal Counsel KEVIN LEMAHIEU Chief Financial Officer JASON KREPLINE Chief Lending Officer MEGHANN KASPER Chief Credit Officer BRENDAN MARSTON Chief Operations Officer DEBBIE WEYKER SVP Marketing MATT LONGMEYER SVP Technology Director SCOTT TUMA VP Enterprise Risk Management SHAROL SCHROEDER SVP Human Resources JEFF ZIMMERLEE Chief Retail Officer |

| • Determination of Quorum • Approval of Minutes • Business to be Conducted 7 MEETING BUSINESS |

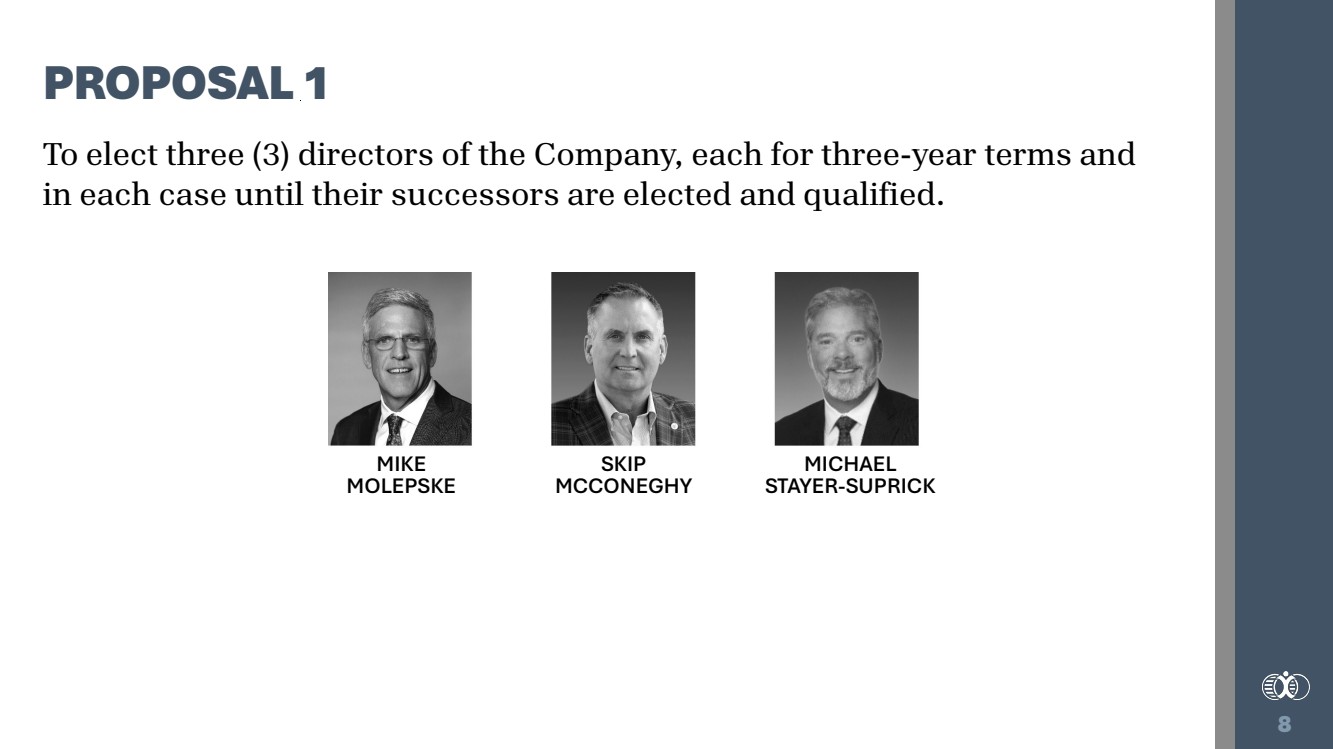

| To elect three (3) directors of the Company, each for three-year terms and in each case until their successors are elected and qualified. 8 PROPOSAL 1 MIKE MOLEPSKE SKIP MCCONEGHY MICHAEL STAYER-SUPRICK |

| 9 To ratify the appointment of FORVIS MAZARS, LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2025. PROPOSAL 2 To hold an advisory vote on the compensation of the Company’s named executive officers. PROPOSAL 3 |

| 10 LAURA KOHLER RETIRING DIRECTOR • Joined Bank First Corporation in 2022 • Served on the Compensation Committee • Brought deep expertise in HR, talent management, and organizational culture • Advised on compensation strategy, employee engagement, and retention • Supported succession planning and leadership development efforts • Contributed valuable insight on corporate culture and workforce strategy |

| TIM MCFARLANE President 11 STATE OF THE BANK |

| 12 We are a relationship-based bank focused on providing innovative solutions that are value-driven to the communities we serve. Staying true to our values OUR PROMISE |

| 13 S&P Global Market Intelligence - Top 10 U.S. Community Banks • Ranked #9 nationally among community banks with $3–$10 billion in assets for 2024, based on performance, growth, and balance sheet strength. Ranked #1 for Wisconsin banks! Forbes America’s Best Banks • Named #4 in America’s Best Banks by Forbes, recognizing Bank First’s strong performance across 10 key financial metrics in 2024. Ranked #1 for Wisconsin banks! Raymond James Community Bankers Cup • Ranked in the top 10% of U.S. community banks, based on profitability, efficiency, and financial stability among 202 qualifying institutions. Ranked #1 for Wisconsin banks! Bank Director – RankingBanking 2024 • Ranked #19 nationally among banks with less than $5 billion in assets for profitability, capital adequacy, and asset quality. Ranked #1 for Wisconsin banks! Small Business Administration - Wisconsin District FY24 Volume Lender Award • Recognized by the U.S. Small Business Administration as a top-volume lender in the $1 billion– $5 billion asset category; funded 36 SBA-backed loans totaling $10.8 million. 2024 AWARDS AND RECOGNITIONS |

| 14 STRATEGIC GROWTH ACROSS ALL CHANNELS ORGANIC Sustained growth driven by strong customer relationships and increased market share M&A Strengthening our presence through strategic partnerships and market expansion Waupaca Bancorporation (2017) Partnership Community Bancshares (2019) Tomah Bancshares (2020) Denmark Bancshares (2022) Hometown Bancorp (2023) DE NOVO Expanding our footprint to serve the needs of growing communities Sheboygan (2008) Oshkosh (2011) Appleton (2016) Sturgeon Bay (2025) |

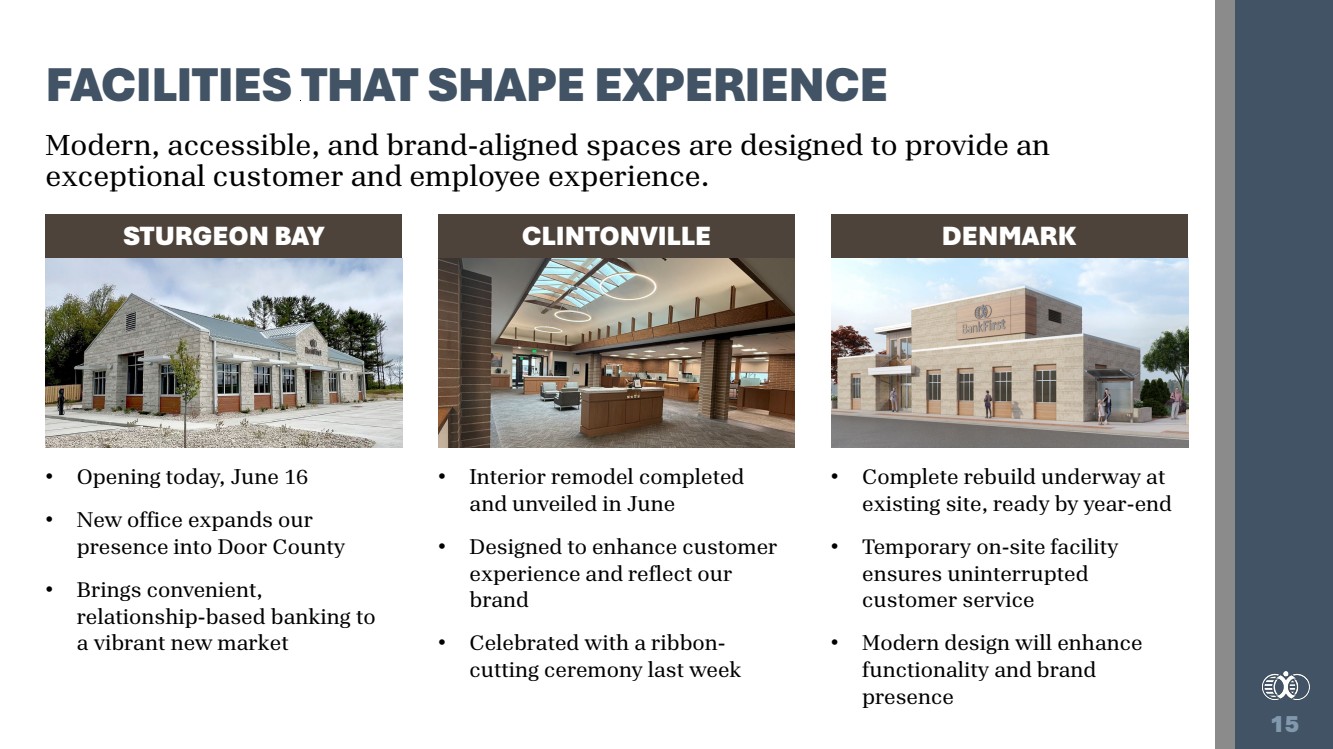

| 15 Modern, accessible, and brand-aligned spaces are designed to provide an exceptional customer and employee experience. FACILITIES THAT SHAPE EXPERIENCE STURGEON BAY • Opening today, June 16 • New office expands our presence into Door County • Brings convenient, relationship-based banking to a vibrant new market CLINTONVILLE • Interior remodel completed and unveiled in June • Designed to enhance customer experience and reflect our brand • Celebrated with a ribbon-cutting ceremony last week DENMARK • Complete rebuild underway at existing site, ready by year-end • Temporary on-site facility ensures uninterrupted customer service • Modern design will enhance functionality and brand presence |

| KEVIN LEMAHIEU Chief Financial Officer 16 FINANCIAL REPORT |

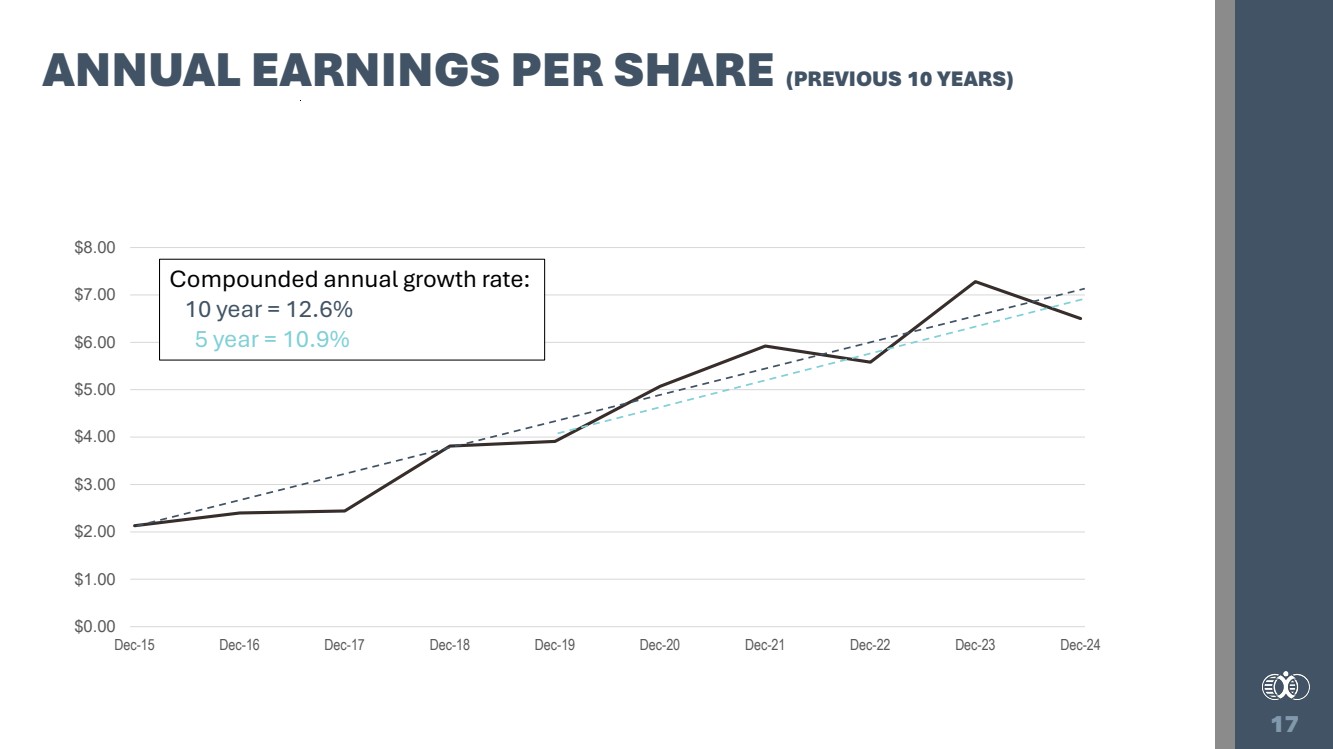

| 17 $0.00 $1.00 $2.00 $3.00 $4.00 $5.00 $6.00 $7.00 $8.00 Dec-15 Dec-16 Dec-17 Dec-18 Dec-19 Dec-20 Dec-21 Dec-22 Dec-23 Dec-24 Compounded annual growth rate: 10 year = 12.6% 5 year = 10.9% ANNUAL EARNINGS PER SHARE (PREVIOUS 10 YEARS) |

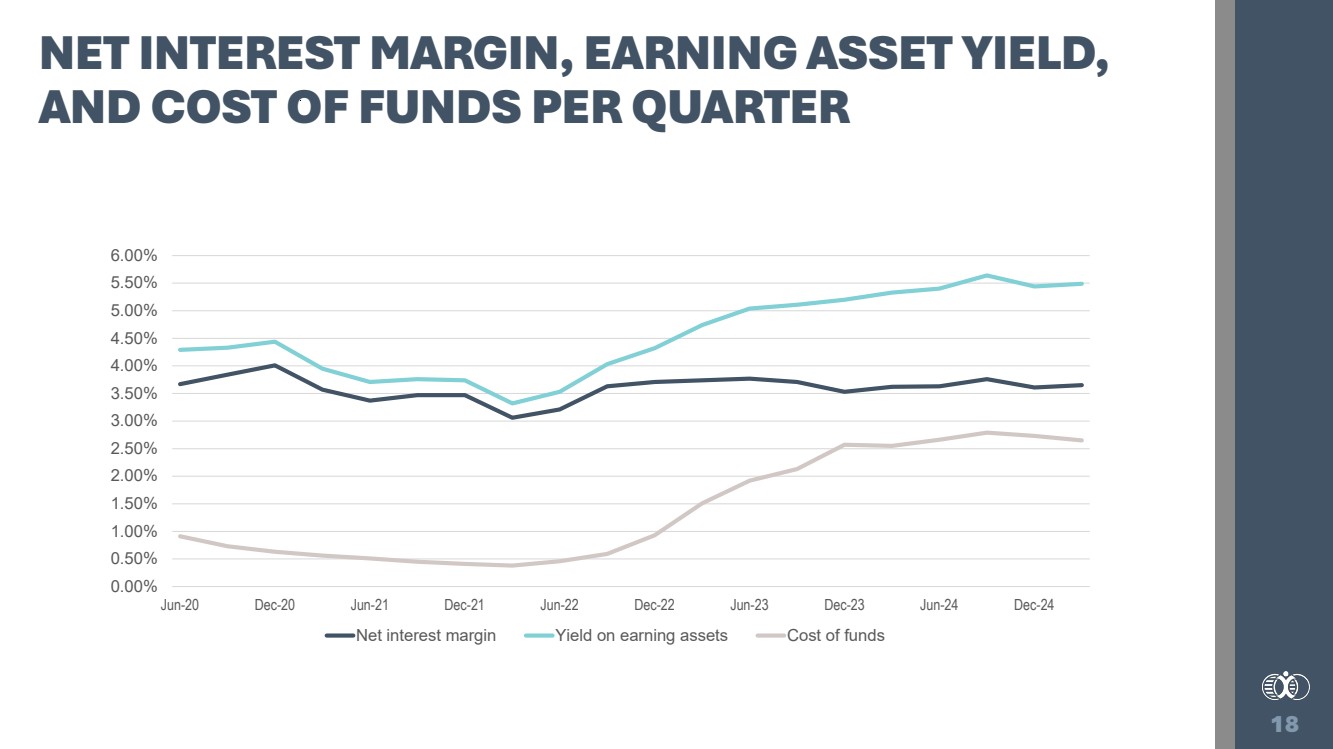

| 18 NET INTEREST MARGIN, EARNING ASSET YIELD, AND COST OF FUNDS PER QUARTER 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 4.50% 5.00% 5.50% 6.00% Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Jun-23 Dec-23 Jun-24 Dec-24 Net interest margin Yield on earning assets Cost of funds |

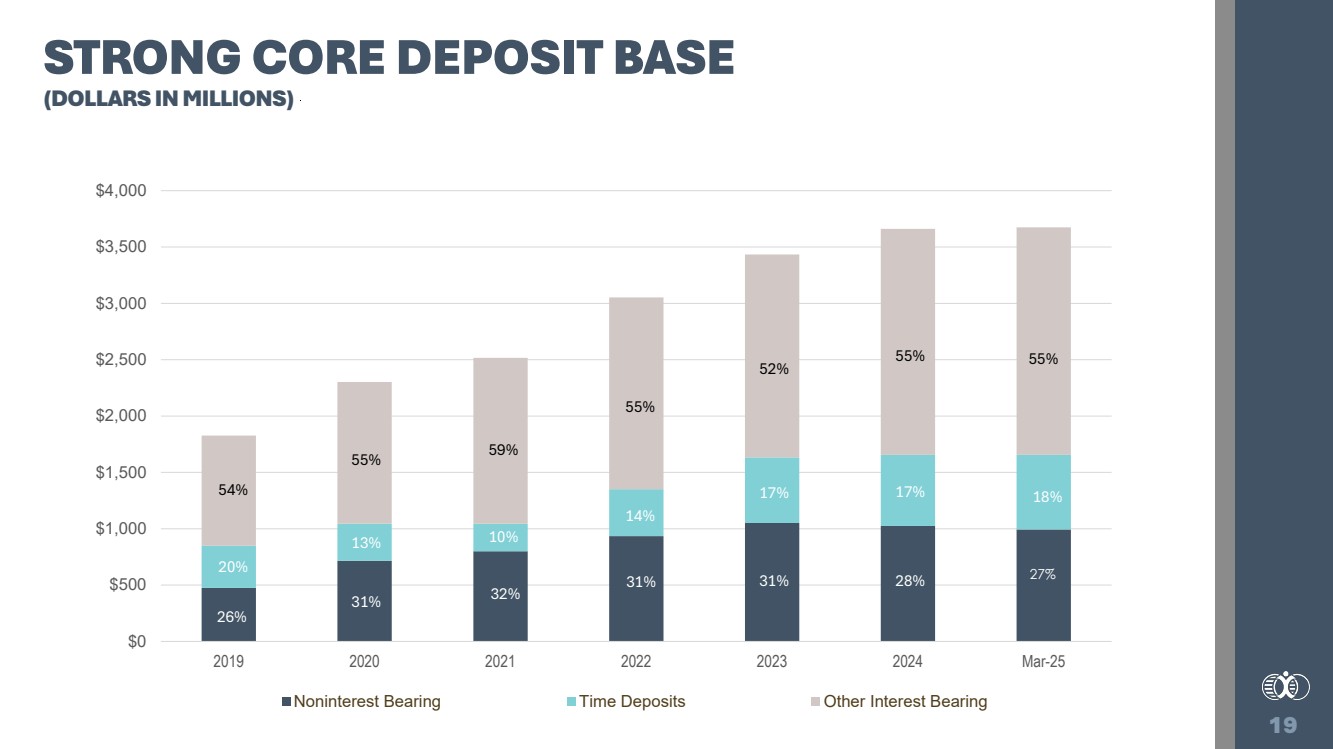

| 19 STRONG CORE DEPOSIT BASE (DOLLARS IN MILLIONS) $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2019 2020 2021 2022 2023 2024 Mar-25 Noninterest Bearing Time Deposits Other Interest Bearing 55% 55% 59% 55% 52% 55% 27% 28% 54% 17% 20% 26% 13% 31% 10% 32% 14% 31% 17% 31% 18% |

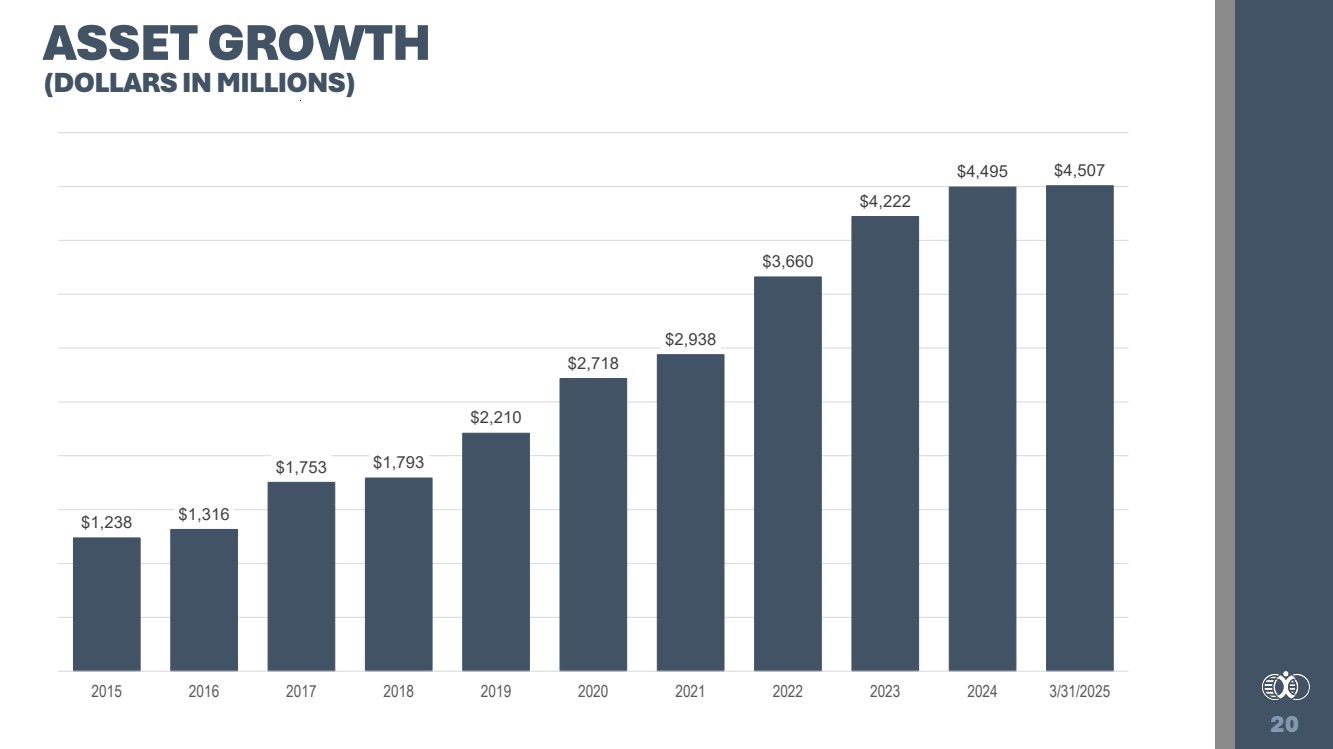

| 20 ASSET GROWTH (DOLLARS IN MILLIONS) $1,238 $1,316 $1,753 $1,793 $2,210 $2,718 $2,938 $3,660 $4,222 $4,495 $4,507 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 3/31/2025 |

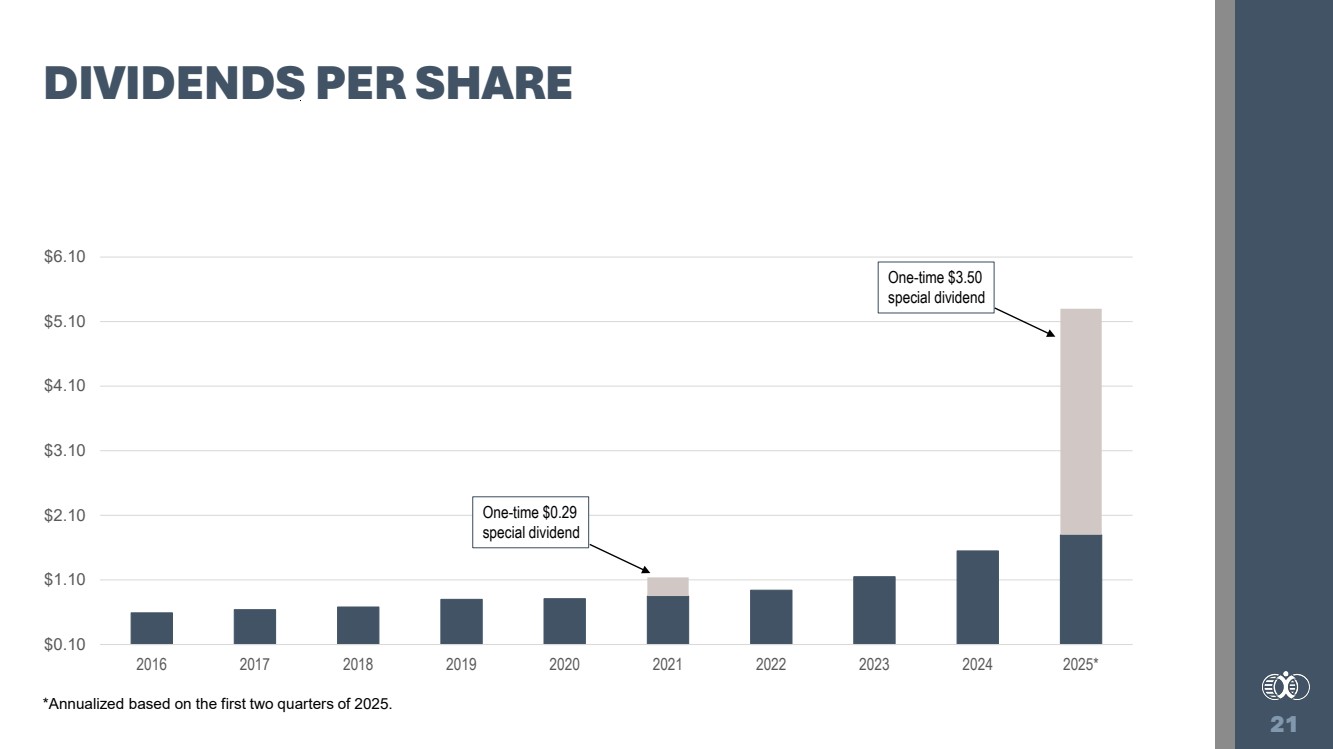

| 21 DIVIDENDS PER SHARE *Annualized based on the first two quarters of 2025. $0.10 $1.10 $2.10 $3.10 $4.10 $5.10 $6.10 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025* One-time $0.29 special dividend One-time $3.50 special dividend |

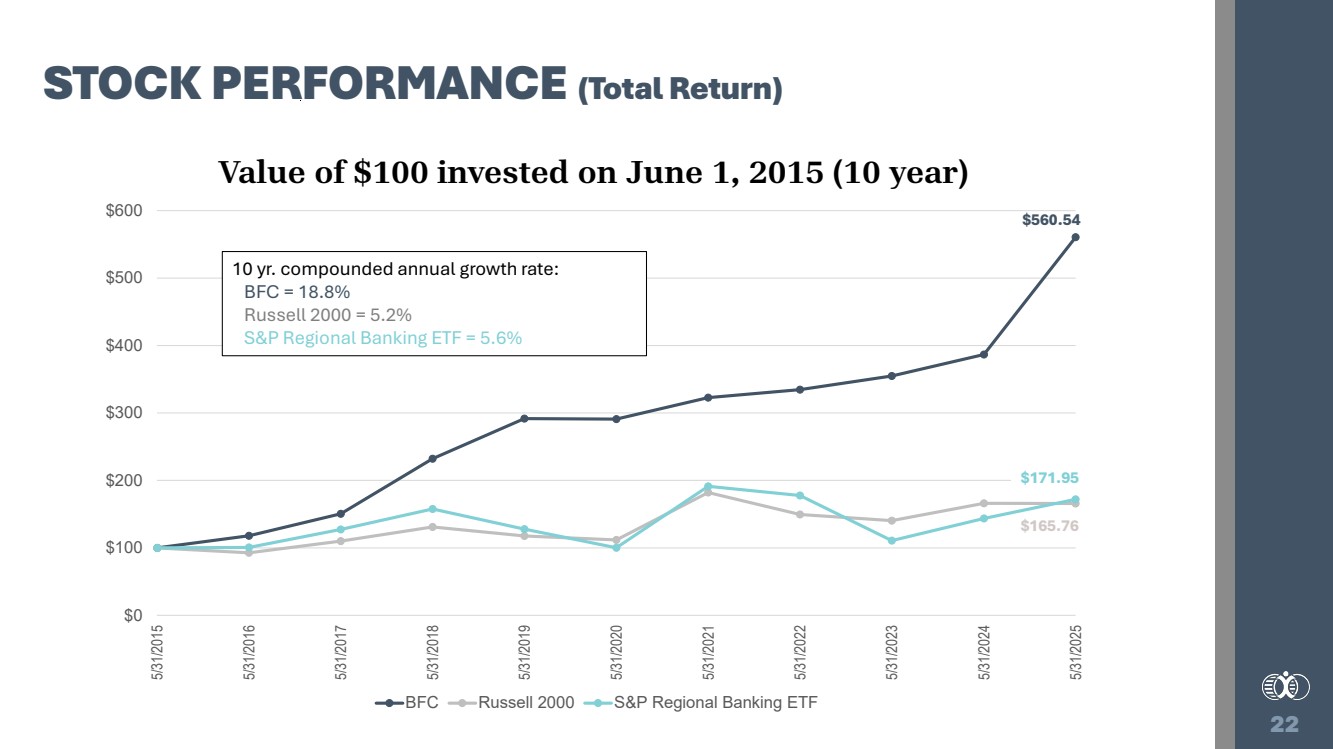

| 22 STOCK PERFORMANCE (Total Return) $0 $100 $200 $300 $400 $500 $600 5/31/2015 5/31/2016 5/31/2017 5/31/2018 5/31/2019 5/31/2020 5/31/2021 5/31/2022 5/31/2023 5/31/2024 5/31/2025 Value of $100 invested on June 1, 2015 (10 year) BFC Russell 2000 S&P Regional Banking ETF $560.54 $165.76 $171.95 10 yr. compounded annual growth rate: BFC = 18.8% Russell 2000 = 5.2% S&P Regional Banking ETF = 5.6% |

| 23 QUESTIONS / COMMENTS |

| 24 SHAREHOLDER SERVICES TEAM Please reach out to Bank First Shareholder Services at shareholderservices@bankfirst.com or 920-652-3360. Our dedicated team will be able to assist with any questions or concerns you may have. Business cards are available at the entrance. |

| Thank You! |