Pay vs Performance Disclosure - USD ($)

|

12 Months Ended |

Mar. 31, 2025 |

Mar. 31, 2024 |

Mar. 31, 2023 |

Mar. 31, 2022 |

Mar. 31, 2021 |

| Pay vs Performance Disclosure |

|

|

|

|

|

| Pay vs Performance Disclosure, Table |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year(1) | SCT Total

for First

PEO ($) | SCT Total

for

Second

PEO ($) | CAP for

First

PEO(2) ($) | CAP for

Second

PEO(2) ($) | Avg. SCT

Total for

non-PEO NEOs(2) ($) | Avg. CAP

to non-PEO

NEOs(2) ($) | Value of Initial Fixed

$100 | Net

Income ($ in Thousands) | Adjusted

EBIT(4) ($ in Thousands) | | TSR ($) | Peer

Group

TSR (3) ($) | | (a) | (b) | (b) | (c) | (c) | (d) | (e) | (f) | (g) | (h) | | | | | | | | | | | | | | | 2025 | 5,325,938 | — | (1,610,341) | | — | 1,360,850 | 166,465 | 72.26 | 272.34 | (5,138) | | 102,300 | | 2024 | 5,799,250 | — | 7,011,006 | — | 1,479,373 | 1,769,549 | 183.61 | 219.31 | 46,625 | 119,238 | | 2023 | 4,973,892 | — | 3,543,606 | — | 1,622,384 | 1,421,836 | 151.72 | 155.40 | 48,429 | 105,869 | | 2022 | 4,067,021 | — | 2,562,396 | — | 1,347,394 | 788,702 | 171.66 | 147.62 | 29,660 | 95,589 | | 2021 | 5,572,610 | 397,800 | | 9,019,389 | 423,480 | | 1,169,073 | 2,651,095 | 212.53 | 159.26 | 9,106 | 48,854 | |

|

|

|

|

|

| Company Selected Measure Name |

Adjusted EBIT

|

|

|

|

|

| Named Executive Officers, Footnote |

The PEOs and the Non-PEO NEOs for the indicated years were as follows: | | | | | | | | | | | | Year | First PEO | Second PEO | Other Non-PEOs | | 2025 | Mr. Wilson | N/A | Messrs. Brant, Chintapalli, Korman, Rustowicz and Ms. Williams | 2024 | Mr. Wilson | N/A | Messrs. Brant, Korman, Rustowicz, and Schadeberg | 2023 | Mr. Wilson | N/A | Messrs. Brant, Korman, Rustowicz, and Schadeberg | 2022 | Mr. Wilson | N/A | Messrs. Brant, Korman, Rustowicz, and Wozniak | 2021 | Mr. Wilson | Mr. Fleming | Messrs. Korman, McCormick, Rustowicz, and Wozniak |

|

|

|

|

|

| Peer Group Issuers, Footnote |

For the relevant fiscal year, represents the cumulative TSR (the “Peer Group TSR”) of the Dow Jones U.S. Diversified Industrials Index.

|

|

|

|

|

| Adjustment To PEO Compensation, Footnote |

DAVID J. WILSON (FIRST PRINCIPAL EXECUTIVE OFFICER) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | Summary

Compensation

Table

Total ($) | Minus:

Change

in

Present

Value of

NQDC ($) | Minus:

Change

in

Present

Value of

Pension ($) | Plus:

Pension

Service

Costs

Attributable

to the

Applicable

Year ($) | Minus:

Grant Date

Fair Value

of Equity

Awards

Granted

During

Applicable

Year ($) | | Plus: Year-

End Fair

Value of

Equity

Awards

Granted

During

Applicable

Year ($) | Plus:

Fair Value

of

Awards

Granted

and

Vested in

Applicable

Year ($) | Plus:

Change in

Fair Value

as of Year-

End of Any

Prior-Year

Awards that

Remain

Unvested as

of Year-End ($) | Plus:

Change in

Fair Value

as of

Vesting

Date of

Any Prior-

Year

Awards

that Vested

During

Applicable

Year ($) | Compensation

Actually Paid ($) | | | | | | | | | | | | | | | 2025 | 5,325,938 | 9,951 | — | — | 3,909,959 | | 1,390,504 | — | (4,340,800) | (66,074) | (1,610,341) | | | 2024 | 5,799,250 | 5,491 | — | — | 3,495,828 | | 4,352,194 | — | 448,465 | (87,584) | 7,011,006 | | 2023 | 4,973,892 | 2,900 | — | — | 2,816,047 | | 3,501,035 | — | (1,616,943) | (495,431) | 3,543,606 | | 2022 | 4,067,021 | 1,896 | — | — | 2,362,446 | | 1,840,059 | — | (993,714) | 13,371 | 2,562,396 | | 2021 | 5,572,610 | — | — | — | 3,543,080 | | 6,414,349 | 575,510 | — | — | 9,019,389 | |

RICHARD J. FLEMING (SECOND PRINCIPAL EXECUTIVE OFFICER) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | Summary

Compensation

Table

Total ($) | Minus:

Change

in

Present

Value of

NQDC ($) | Minus:

Change

in

Present

Value of

Pension ($) | Plus:

Pension

Service

Costs

Attributable

to the

Applicable

Year ($) | Minus:

Grant Date

Fair Value

of Equity

Awards

Granted

During

Applicable

Year ($) | Plus: Year-

End Fair

Value of

Equity

Awards

Granted

During

Applicable

Year ($) | Plus:

Fair Value

of

Awards

Granted

and

Vested in

Applicable

Year ($) | Plus:

Change in

Fair Value

as of Year-

End of Any

Prior-Year

Awards that

Remain

Unvested as

of Year-End ($) | Plus:

Change in

Fair Value

as of

Vesting

Date of

Any Prior-

Year

Awards

that Vested

During

Applicable

Year ($) | Compensation Actually Paid ($) | | | | | | | | | | | | | | 2025 | — | — | — | — | — | — | — | — | — | — | | 2024 | — | — | — | — | — | — | — | — | — | — | | 2023 | — | — | — | — | — | — | — | — | — | — | | 2022 | — | — | — | — | — | — | — | — | — | — | | 2021 | 397,800 | — | — | — | 254,079 | 75,660 | 204,099 | — | — | 423,480 | |

|

|

|

|

|

| Non-PEO NEO Average Total Compensation Amount |

$ 1,360,850

|

$ 1,479,373

|

$ 1,622,384

|

$ 1,347,394

|

$ 1,169,073

|

| Non-PEO NEO Average Compensation Actually Paid Amount |

$ 166,465

|

1,769,549

|

1,421,836

|

788,702

|

2,651,095

|

| Adjustment to Non-PEO NEO Compensation Footnote |

AVERAGE OF NON-PEO NEOs | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | Year | Summary

Compensation

Table Total ($) | Minus:

Change

in Present

Value of

NQDC ($) | Minus:

Change in Present

Value of

Pension ($) | Plus: Pension Service Costs

Attributable to the

Applicable Year ($) | Minus:

Grant Date

Fair Value

of Equity

Awards

Granted

During

Applicable

Year ($) | Plus: Year-End Fair Value of Equity Awards Granted During

Applicable Year ($) | Plus: Fair Value of Awards Granted and Vested in Applicable Year ($) | Plus: Change in Fair Value as of Year-End of Any Prior-Year

Awards that Remain

Unvested as

of Year-End ($) | Plus: Change in Fair Value as of Vesting Date of Any Prior-Year Awards that Vested During Applicable Year ($) | Compensation

Actually Paid ($) | | | | | | | | | | | | 2025 | 1,360,850 | 21,058 | — | — | 636,684 | 212,973 | 10,280 | (719,962) | | (39,934) | 166,465 | 2024 | 1,479,373 | 13,476 | 53 | 0 | 668,025 | 831,669 | — | 157,778 | (17,717) | 1,769,549 | 2023 | 1,622,384 | 8,205 | — | — | 814,420 | 701,707 | — | 33,962 | | (113,592) | 1,421,836 | 2022 | 1,347,394 | 6,473 | — | — | 668,073 | 520,369 | — | (404,240) | (275) | 788,702 | 2021 | 1,169,073 | 2,962 | — | — | 467,863 | 1,137,057 | — | 785,776 | | 30,014 | | 2,651,095 |

|

|

|

|

|

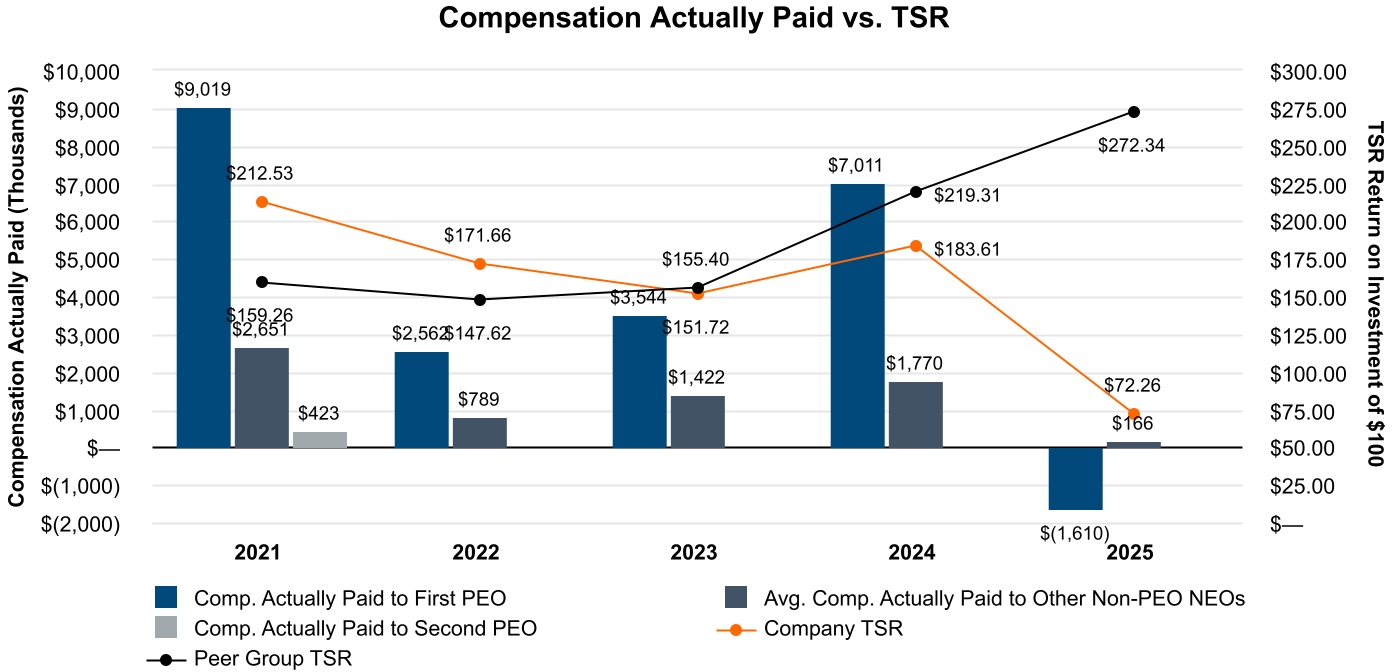

| Compensation Actually Paid vs. Total Shareholder Return |

|

|

|

|

|

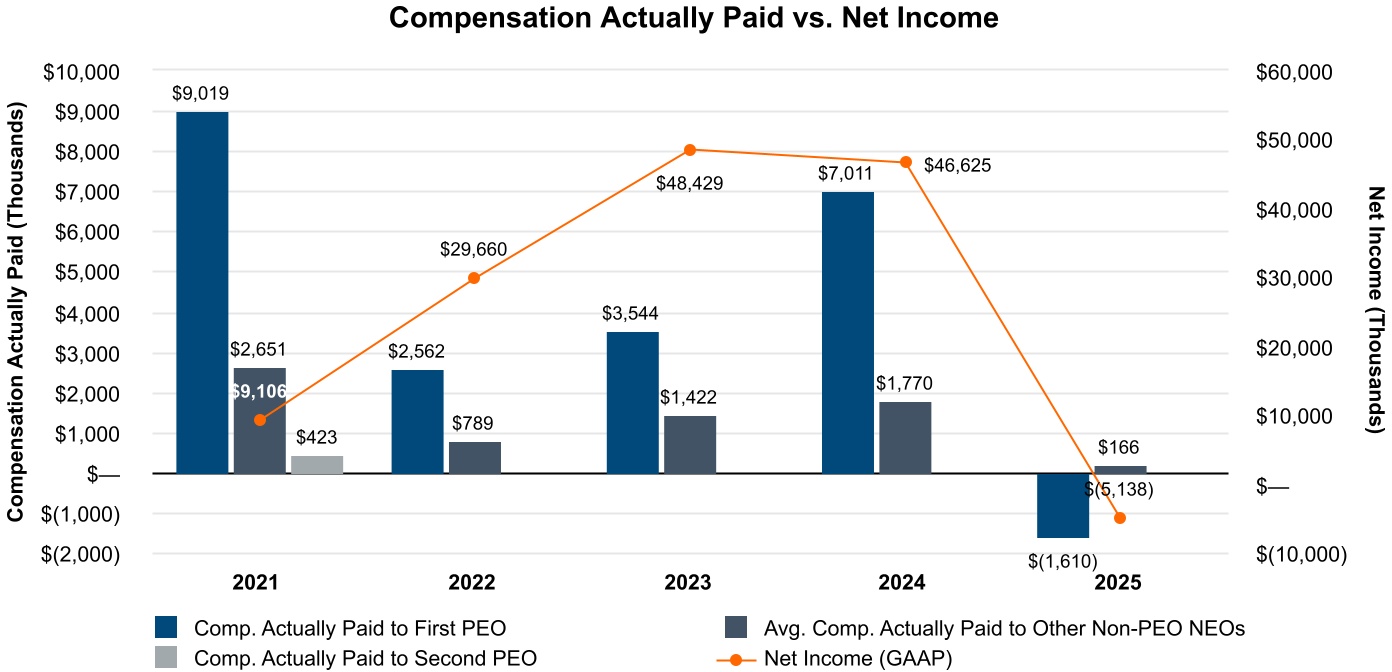

| Compensation Actually Paid vs. Net Income |

|

|

|

|

|

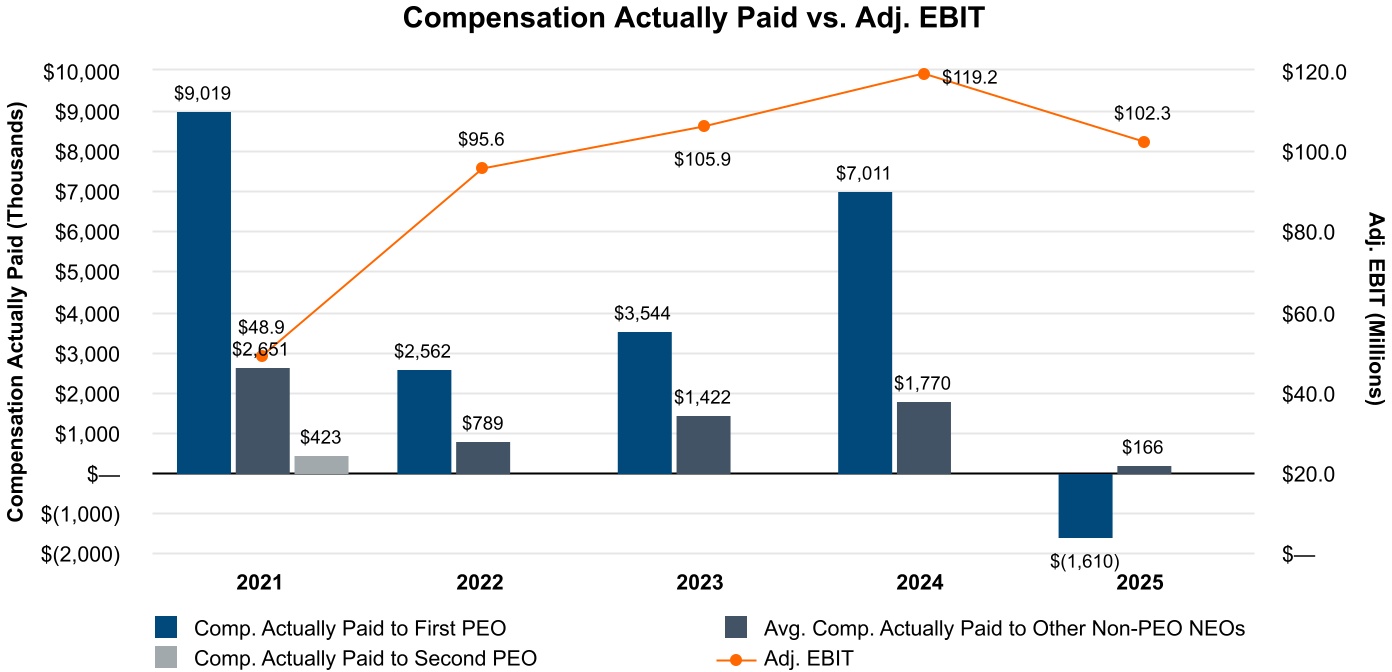

| Compensation Actually Paid vs. Company Selected Measure |

|

|

|

|

|

| Total Shareholder Return Vs Peer Group |

|

|

|

|

|

| Total Shareholder Return Amount |

$ 72.26

|

183.61

|

151.72

|

171.66

|

212.53

|

| Peer Group Total Shareholder Return Amount |

272.34

|

219.31

|

155.40

|

147.62

|

159.26

|

| Net Income (Loss) |

$ (5,138,000)

|

$ 46,625,000

|

$ 48,429,000

|

$ 29,660,000

|

$ 9,106,000

|

| Company Selected Measure Amount |

102,300,000

|

119,238,000

|

105,869,000

|

95,589,000

|

48,854,000

|

| PEO Name |

Mr. Wilson

|

Mr. Wilson

|

Mr. Wilson

|

Mr. Wilson

|

Mr. Fleming

|

| Additional 402(v) Disclosure |

Amounts represent compensation actually paid to our PEOs and the average compensation actually paid to our non-PEO NEOs for the relevant fiscal year, as determined under SEC rules (and described below). The graphs below describe the relationship between the compensation actually paid to our PEOs and the average of the compensation actually paid to our Non-PEO NEOs and (i) our cumulative TSR, (ii) our net income, and (iii) our Adjusted EBIT, in each case, for the fiscal years ended March 31, 2021, 2022, 2023, 2024, and 2025. In addition, the first graph below compares our cumulative TSR and peer group cumulative TSR for the fiscal years ended March 31, 2021, 2022, 2023, 2024, and 2025. TSR amounts reported in the graph assume an initial fixed investment of $100 and that all dividends, if any, were reinvested. The graphs above demonstrate that over the measurement period, Compensation Actually Paid (CAP) for the PEOs and Non-PEO NEOs generally trended directionally with the Company’s cumulative TSR, net income and Adjusted EBIT. During the time period, changes in CAP were largely attributable to the fluctuation in value of outstanding equity awards, which correlate with increases and decreases in stock price and cumulative TSR. PAY VERSUS PERFORMANCE TABULAR LIST We believe the following performance measures represent the most important financial performance measures used by us to link compensation actually paid to our PEOs and Non-PEO NEOs for the fiscal year ended March 31, 2025. The measures in this list are not ranked: •Adjusted EBIT •Adjusted Free Cash Flow •Adjusted ROIC For additional details regarding our most important financial performance measures, please see the sections titled “Elements of our Compensation Program for NEOs” and “Components of Compensation” in our Compensation Discussion and Analysis elsewhere in this proxy statement.

|

|

|

|

|

| Measure:: 1 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted EBIT

|

|

|

|

|

| Non-GAAP Measure Description |

In accordance with SEC rules, the Company is required to include in the Pay versus Performance table the “most important” financial performance measure (as determined by the Company) used to link compensation actually paid to our PEOs and Non-PEO NEOs to Company performance for the most recently completed fiscal year. The Company determined that Adjusted EBIT, which is a non-GAAP measure included in our incentive program, meets this requirement and therefore, we have included this performance measure in the Pay versus Performance table. Adjusted EBIT is defined as operating income as determined in accordance with GAAP adjusted for each of the adjustments used in the computation of Adjusted EBITDA other than depreciation and amortization expense,

|

|

|

|

|

| Measure:: 2 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted Free Cash Flow

|

|

|

|

|

| Measure:: 3 |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Name |

Adjusted ROIC

|

|

|

|

|

| First PEO [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Total Compensation Amount |

$ 5,325,938

|

$ 5,799,250

|

$ 4,973,892

|

$ 4,067,021

|

$ 5,572,610

|

| PEO Actually Paid Compensation Amount |

(1,610,341)

|

7,011,006

|

3,543,606

|

2,562,396

|

9,019,389

|

| Second PEO [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| PEO Total Compensation Amount |

0

|

0

|

0

|

0

|

397,800

|

| PEO Actually Paid Compensation Amount |

0

|

0

|

0

|

0

|

423,480

|

| PEO | First PEO [Member] | Aggregate Change in Present Value of Accumulated Benefit for All Pension Plans Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | First PEO [Member] | Pension Adjustments Service Cost |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | First PEO [Member] | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

3,909,959

|

3,495,828

|

2,816,047

|

2,362,446

|

3,543,080

|

| PEO | First PEO [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

1,390,504

|

4,352,194

|

3,501,035

|

1,840,059

|

6,414,349

|

| PEO | First PEO [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

4,340,800

|

448,465

|

1,616,943

|

993,714

|

0

|

| PEO | First PEO [Member] | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

575,510

|

| PEO | First PEO [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

66,074

|

87,584

|

495,431

|

13,371

|

0

|

| PEO | First PEO [Member] | Aggregate Change In Present Value Of NQDC [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

9,951

|

5,491

|

2,900

|

1,896

|

0

|

| PEO | Second PEO [Member] | Aggregate Change in Present Value of Accumulated Benefit for All Pension Plans Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | Second PEO [Member] | Pension Adjustments Service Cost |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | Second PEO [Member] | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

254,079

|

| PEO | Second PEO [Member] | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

75,660

|

| PEO | Second PEO [Member] | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | Second PEO [Member] | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

204,099

|

| PEO | Second PEO [Member] | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| PEO | Second PEO [Member] | Aggregate Change In Present Value Of NQDC [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Aggregate Change in Present Value of Accumulated Benefit for All Pension Plans Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

53

|

0

|

0

|

0

|

| Non-PEO NEO | Pension Adjustments Service Cost |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

0

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Aggregate Grant Date Fair Value of Equity Award Amounts Reported in Summary Compensation Table |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

636,684

|

668,025

|

814,420

|

668,073

|

467,863

|

| Non-PEO NEO | Year-end Fair Value of Equity Awards Granted in Covered Year that are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

212,973

|

831,669

|

701,707

|

520,369

|

1,137,057

|

| Non-PEO NEO | Year-over-Year Change in Fair Value of Equity Awards Granted in Prior Years That are Outstanding and Unvested |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

(719,962)

|

157,778

|

33,962

|

404,240

|

785,776

|

| Non-PEO NEO | Vesting Date Fair Value of Equity Awards Granted and Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

10,280

|

0

|

0

|

0

|

0

|

| Non-PEO NEO | Change in Fair Value as of Vesting Date of Prior Year Equity Awards Vested in Covered Year |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

39,934

|

17,717

|

113,592

|

275

|

30,014

|

| Non-PEO NEO | Aggregate Change In Present Value Of NQDC [Member] |

|

|

|

|

|

| Pay vs Performance Disclosure |

|

|

|

|

|

| Adjustment to Compensation, Amount |

$ 21,058

|

$ 13,476

|

$ 8,205

|

$ 6,473

|

$ 2,962

|