Shareholder Report

|

12 Months Ended |

|

Apr. 30, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

JOHN HANCOCK EXCHANGE-TRADED FUND TRUST

|

| Entity Central Index Key |

0001478482

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Apr. 30, 2025

|

| C000158043 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Multifactor Large Cap ETF

|

| Class Name |

Multifactor Large Cap ETF

|

| Trading Symbol |

JHML

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Multifactor Large Cap ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Multifactor Large Cap ETF/JHML |

|

|

$30 |

0.29% |

|

| Expenses Paid, Amount |

$ 30

|

| Expense Ratio, Percent |

0.29%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Multifactor Large Cap ETF (JHML) returned 9.16% for the year ended April 30, 2025. U.S. equities delivered a healthy gain in the 12 months ended April 30, 2025. Stocks moved steadily higher through mid-February on optimism about artificial intelligence and strength in the United States’ economic growth versus the rest of the world. However, the market subsequently gave back some of its prior gain on worries about the economic impact of protectionist U.S. trade policy.

TOP PERFORMANCE CONTRIBUTORS

Financial stocks | Financials made the largest contribution to absolute performance due to their strong return and sizable portfolio weighting. Berkshire Hathaway, Inc. was the leading contributor in the sector, followed by JPMorgan Chase & Co. and positions in several credit card providers.

Information technology | NVIDIA Corp., Apple, Inc., Broadcom, Inc., and Palantir Technologies, Inc. all contributed positively.

Other areas of strength | Holdings in the communication services, industrials, and utilities sectors, among others, further added to absolute performance. Meta Platforms, Inc. and Netflix, Inc. were leading contributors in communication services.

TOP PERFORMANCE DETRACTORS

Energy | A number of stocks in the sector posted losses due to a steady decline in oil prices. ConocoPhillips and the refiner Valero Energy Corp. were among the several modest detractors in the sector.

Certain individual stocks | The pharmaceutical giant Merck & Company, Inc. and the semiconductor stock Advanced Micro Devices, Inc. were the largest detractors in the fund as a whole.

The views expressed in this report are exclusively those of the portfolio management team at Dimensional Fund Advisors LP, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

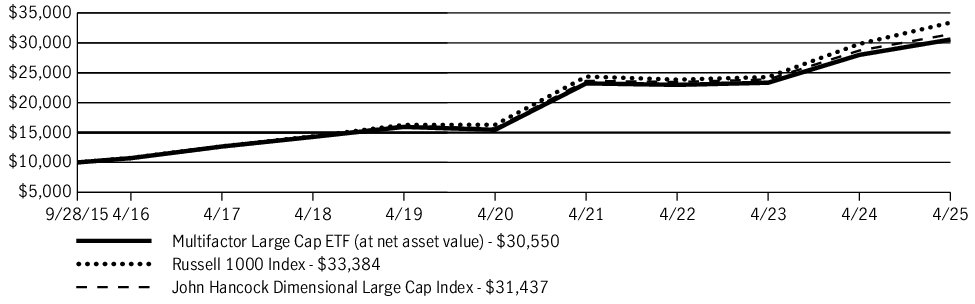

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

Since inception |

| Multifactor Large Cap ETF (at net asset value) |

9.16% |

14.60% |

12.35% |

| Russell 1000 Index |

11.94% |

15.42% |

13.40% |

| John Hancock Dimensional Large Cap Index |

9.46% |

14.93% |

12.69% |

|

| Performance Inception Date |

Sep. 28, 2015

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 891,550,519

|

| Holdings Count | Holding |

782

|

| Advisory Fees Paid, Amount |

$ 2,172,158

|

| Investment Company Portfolio Turnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$891,550,519 |

| Total number of portfolio holdings |

782 |

| Total advisory fees paid (net) |

$2,172,158 |

| Portfolio turnover rate |

4% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Microsoft Corp. |

3.8% |

| Apple, Inc. |

3.8% |

| NVIDIA Corp. |

2.9% |

| Amazon.com, Inc. |

2.6% |

| Alphabet, Inc., Class A |

1.8% |

| Meta Platforms, Inc., Class A |

1.8% |

| Berkshire Hathaway, Inc., Class B |

1.3% |

| Broadcom, Inc. |

1.2% |

| JPMorgan Chase & Co. |

1.2% |

| Eli Lilly & Company |

1.1% |

|

|

Sector Composition

| Information technology |

23.0% |

| Financials |

16.4% |

| Industrials |

12.1% |

| Health care |

10.8% |

| Consumer discretionary |

10.0% |

| Communication services |

7.3% |

| Consumer staples |

6.2% |

| Utilities |

4.3% |

| Energy |

3.6% |

| Materials |

3.3% |

| Real estate |

2.9% |

| Short-term investments and other |

0.1% |

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. |

3.8% |

| Apple, Inc. |

3.8% |

| NVIDIA Corp. |

2.9% |

| Amazon.com, Inc. |

2.6% |

| Alphabet, Inc., Class A |

1.8% |

| Meta Platforms, Inc., Class A |

1.8% |

| Berkshire Hathaway, Inc., Class B |

1.3% |

| Broadcom, Inc. |

1.2% |

| JPMorgan Chase & Co. |

1.2% |

| Eli Lilly & Company |

1.1% |

|

|

|

| C000175540 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Multifactor Developed International ETF

|

| Class Name |

Multifactor Developed International ETF

|

| Trading Symbol |

JHMD

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Multifactor Developed International ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Multifactor Developed International ETF/JHMD |

|

|

$41 |

0.39% |

|

| Expenses Paid, Amount |

$ 41

|

| Expense Ratio, Percent |

0.39%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Multifactor Developed International ETF (JHMD) returned 12.23% for the year ended April 30, 2025. International equities delivered strong, double-digit gains in the 12 months ended April 30, 2025, albeit with elevated volatility late in the period in response to shifts in U.S. trade policy. European stocks performed particularly well, reflecting positive sentiment regarding falling interest rates and supportive fiscal policy.

TOP PERFORMANCE CONTRIBUTORS

Financials | Financial stocks, particularly those based in Europe, made the largest contribution to absolute performance due to their strong return and sizable portfolio weighting. Swiss Re AG, HSBC Holdings PLC, and Deutsche Bank AG were among the many meaningful contributors in this area.

Industrials | European industrials also made a strong contribution, led by Rheinmetall AG and Vinci SA.

Communication services | European stocks led the way in this sector, as well, with the largest contributions coming from Deutsche Telecom AG and Orange SA.

TOP PERFORMANCE DETRACTORS

Materials and energy | Commodity-sensitive stocks, in general, lagged in the period. Glencore PLC and TotalEnergies SE were the largest detractors in the two sectors, respectively.

Other areas of weakness | Holdings in the information technology sector combined for a negative total return, primarily due to downturns in the semiconductor stocks ASML Holding NV and STMicroelectronics NV. The pharmaceutical stock Novo Nordisk A/S was the largest detractor in the fund as a whole.

The views expressed in this report are exclusively those of the portfolio management team at Dimensional Fund Advisors LP, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

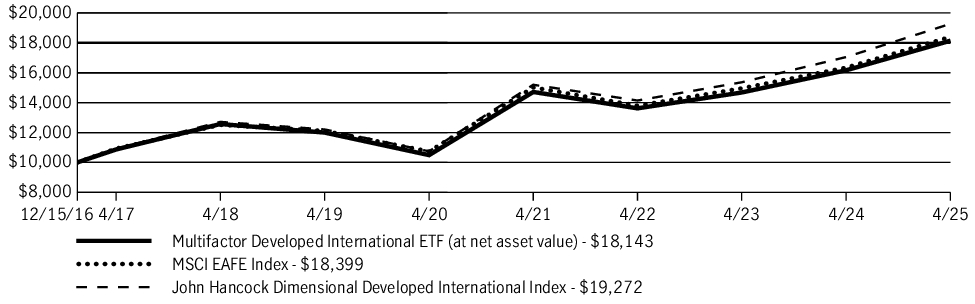

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

Since inception |

| Multifactor Developed International ETF (at net asset value) |

12.23% |

11.58% |

7.37% |

| MSCI EAFE Index |

12.57% |

11.37% |

7.55% |

| John Hancock Dimensional Developed International Index |

13.02% |

12.40% |

8.15% |

|

| Performance Inception Date |

Dec. 15, 2016

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 679,677,172

|

| Holdings Count | Holding |

585

|

| Advisory Fees Paid, Amount |

$ 2,189,125

|

| Investment Company Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$679,677,172 |

| Total number of portfolio holdings |

585 |

| Total advisory fees paid (net) |

$2,189,125 |

| Portfolio turnover rate |

13% |

|

| Holdings [Text Block] |

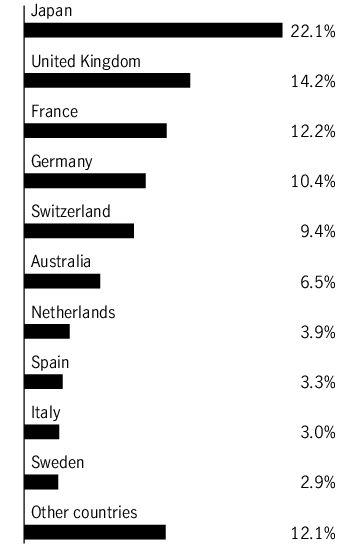

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Vinci SA |

1.7% |

| Novartis AG |

1.5% |

| Shell PLC |

1.3% |

| TotalEnergies SE |

1.2% |

| ASML Holding NV |

1.0% |

| BNP Paribas SA |

1.0% |

| Nestle SA |

0.9% |

| Novo Nordisk A/S, B Shares |

0.9% |

| Danone SA |

0.8% |

| Deutsche Telekom AG |

0.8% |

|

|

Sector Composition

| Financials |

23.2% |

| Industrials |

18.6% |

| Consumer discretionary |

9.7% |

| Health care |

9.1% |

| Consumer staples |

8.6% |

| Materials |

7.2% |

| Communication services |

6.0% |

| Information technology |

5.6% |

| Energy |

4.7% |

| Utilities |

4.4% |

| Real estate |

1.8% |

| Short-term investments and other |

1.1% |

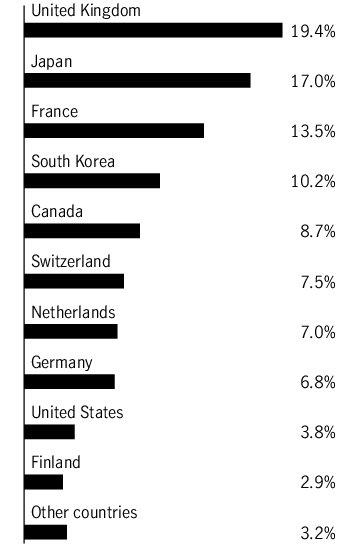

Country Composition

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Vinci SA |

1.7% |

| Novartis AG |

1.5% |

| Shell PLC |

1.3% |

| TotalEnergies SE |

1.2% |

| ASML Holding NV |

1.0% |

| BNP Paribas SA |

1.0% |

| Nestle SA |

0.9% |

| Novo Nordisk A/S, B Shares |

0.9% |

| Danone SA |

0.8% |

| Deutsche Telekom AG |

0.8% |

|

|

|

| C000158045 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Multifactor Mid Cap ETF

|

| Class Name |

Multifactor Mid Cap ETF

|

| Trading Symbol |

JHMM

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Multifactor Mid Cap ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Multifactor Mid Cap ETF/JHMM |

|

|

$42 |

0.41% |

|

| Expenses Paid, Amount |

$ 42

|

| Expense Ratio, Percent |

0.41%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Multifactor Mid Cap ETF (JHMM) returned 4.79% for the year ended April 30, 2025. Mid-cap stocks posted healthy gains in the 12 months ended April 30, 2025, but they finished well off of their intra-period high. After performing well until mid-January, the category fell sharply through early April on concerns that protectionist trade policy would pressure economic growth. Mid-cap stocks staged an impressive rebound in the final weeks of the period, however, allowing the asset class to finish in positive territory.

TOP PERFORMANCE CONTRIBUTORS

Financial stocks | Financials made the largest contribution to absolute performance due to their strong return and sizable portfolio weighting. Robinhood Markets, Inc. was a top performer, as were holdings in a number of non-bank financials.

Utilities | While the sector had only a modest portfolio weighting, it was nonetheless a sizable contributor due to the strong performance of the fund’s holdings. Vistra Corp., which was seen as a beneficiary of AI demand, was the leading contributor.

Other areas of strength | Holdings in the real estate, communication services, and information technology sectors, among others, further added to absolute performance. The technology stock AppLovin Corp. was the largest contributor in the portfolio as a whole.

TOP PERFORMANCE DETRACTORS

Materials and energy | Commodity-sensitive stocks, in general, lagged the broader mid-cap category in the period. Celanese Corp. and Diamondback Energy, Inc. were the largest detractors in the two sectors, respectively.

Healthcare | The fund’s holdings in the sector combined for a small loss and detracted from absolute performance.

The views expressed in this report are exclusively those of the portfolio management team at Dimensional Fund Advisors LP, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

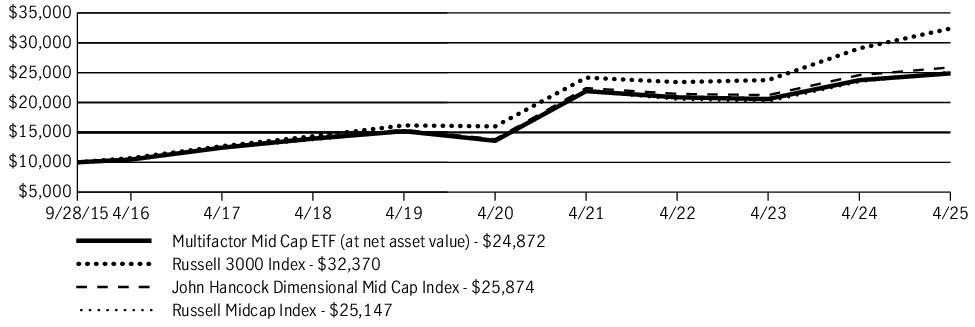

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

Since inception |

| Multifactor Mid Cap ETF (at net asset value) |

4.79% |

12.83% |

9.97% |

| Russell 3000 Index |

11.40% |

15.12% |

13.03% |

| John Hancock Dimensional Mid Cap Index |

5.23% |

13.30% |

10.42% |

| Russell Midcap Index |

7.33% |

12.96% |

10.09% |

|

| Performance Inception Date |

Sep. 28, 2015

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 3,790,239,969

|

| Holdings Count | Holding |

664

|

| Advisory Fees Paid, Amount |

$ 14,221,574

|

| Investment Company Portfolio Turnover |

12.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$3,790,239,969 |

| Total number of portfolio holdings |

664 |

| Total advisory fees paid (net) |

$14,221,574 |

| Portfolio turnover rate |

12% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| United Rentals, Inc. |

0.5% |

| The Hartford Financial Services Group, Inc. |

0.5% |

| Vistra Corp. |

0.5% |

| Fastenal Company |

0.5% |

| Fair Isaac Corp. |

0.5% |

| Take-Two Interactive Software, Inc. |

0.4% |

| Cencora, Inc. |

0.4% |

| Cheniere Energy, Inc. |

0.4% |

| Entergy Corp. |

0.4% |

| AMETEK, Inc. |

0.4% |

|

|

Sector Composition

| Industrials |

19.8% |

| Financials |

16.4% |

| Information technology |

13.1% |

| Consumer discretionary |

10.9% |

| Health care |

10.5% |

| Utilities |

6.0% |

| Real estate |

5.9% |

| Materials |

5.6% |

| Consumer staples |

4.7% |

| Energy |

4.0% |

| Communication services |

3.0% |

| Short-term investments and other |

0.1% |

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| United Rentals, Inc. |

0.5% |

| The Hartford Financial Services Group, Inc. |

0.5% |

| Vistra Corp. |

0.5% |

| Fastenal Company |

0.5% |

| Fair Isaac Corp. |

0.5% |

| Take-Two Interactive Software, Inc. |

0.4% |

| Cencora, Inc. |

0.4% |

| Cheniere Energy, Inc. |

0.4% |

| Entergy Corp. |

0.4% |

| AMETEK, Inc. |

0.4% |

|

|

|

| C000194897 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Multifactor Small Cap ETF

|

| Class Name |

Multifactor Small Cap ETF

|

| Trading Symbol |

JHSC

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Multifactor Small Cap ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Multifactor Small Cap ETF/JHSC |

|

|

$42 |

0.42% |

|

| Expenses Paid, Amount |

$ 42

|

| Expense Ratio, Percent |

0.42%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Multifactor Small Cap ETF (JHSC) returned 0.43% for the year ended April 30, 2025. Small-cap stocks produced a narrow gain in the 12 months ended April 30, 2025. After performing well through the end of 2024, small-cap stocks declined steadily until early April on concerns that protectionist trade policy would pressure economic growth. However, a late rally allowed the category to finish in positive territory for the full period.

TOP PERFORMANCE CONTRIBUTORS

Financial stocks | Financials made the largest contribution to absolute performance due to their strong return and sizable portfolio weighting. Western Alliance Bancorp and Axis Capital Holdings, Ltd. were among the top performers.

Healthcare | The sector, in general, benefited from its defensive nature. Intra-Cellular Therapies, Inc. was the top contributor in both healthcare and the fund as a whole.

TOP PERFORMANCE DETRACTORS

Energy | Small-cap energy stocks experienced sizable losses amid a steady decline in oil prices. Weatherford International PLC and Murphy Oil Corp. were among the many detractors in the sector.

Materials | The sector lagged due to volatility in commodity prices and the softer economic outlook. The chemical producer Olin Corp. was the leading detractor.

Other areas of weakness | Holdings in the information technology, industrials, and consumer discretionary sectors finished in negative territory. The biopharmaceutical company Viking Therapeutics, Inc. was the largest individual detractor.

The views expressed in this report are exclusively those of the portfolio management team at Dimensional Fund Advisors LP, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

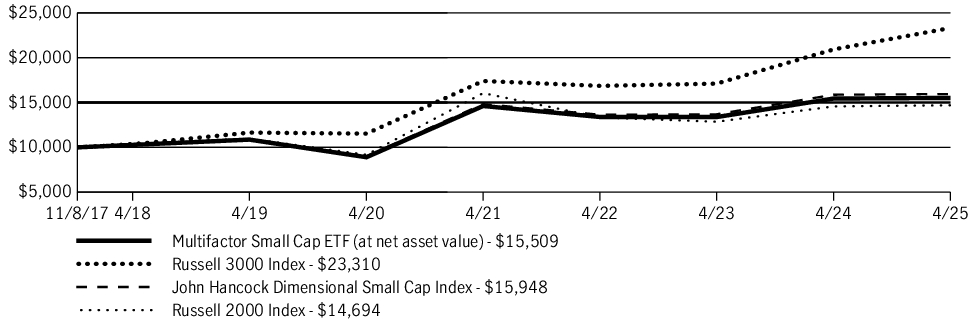

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

Since inception |

| Multifactor Small Cap ETF (at net asset value) |

0.43% |

11.74% |

6.04% |

| Russell 3000 Index |

11.40% |

15.12% |

11.98% |

| John Hancock Dimensional Small Cap Index |

0.50% |

12.15% |

6.44% |

| Russell 2000 Index |

0.87% |

9.88% |

5.28% |

|

| Performance Inception Date |

Nov. 08, 2017

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 484,048,518

|

| Holdings Count | Holding |

467

|

| Advisory Fees Paid, Amount |

$ 1,729,405

|

| Investment Company Portfolio Turnover |

66.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$484,048,518 |

| Total number of portfolio holdings |

467 |

| Total advisory fees paid (net) |

$1,729,405 |

| Portfolio turnover rate |

66% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Agree Realty Corp. |

0.5% |

| ExlService Holdings, Inc. |

0.5% |

| Planet Fitness, Inc., Class A |

0.5% |

| REVOLUTION Medicines, Inc. |

0.5% |

| CommVault Systems, Inc. |

0.5% |

| Esab Corp. |

0.5% |

| Casella Waste Systems, Inc., Class A |

0.5% |

| The AZEK Company, Inc. |

0.5% |

| UGI Corp. |

0.5% |

| Axis Capital Holdings, Ltd. |

0.5% |

|

|

Sector Composition

| Industrials |

21.6% |

| Financials |

20.2% |

| Consumer discretionary |

13.1% |

| Information technology |

12.2% |

| Real estate |

7.2% |

| Health care |

7.0% |

| Materials |

5.3% |

| Utilities |

4.7% |

| Energy |

3.8% |

| Consumer staples |

2.2% |

| Communication services |

1.9% |

| Short-term investments and other |

0.8% |

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Agree Realty Corp. |

0.5% |

| ExlService Holdings, Inc. |

0.5% |

| Planet Fitness, Inc., Class A |

0.5% |

| REVOLUTION Medicines, Inc. |

0.5% |

| CommVault Systems, Inc. |

0.5% |

| Esab Corp. |

0.5% |

| Casella Waste Systems, Inc., Class A |

0.5% |

| The AZEK Company, Inc. |

0.5% |

| UGI Corp. |

0.5% |

| Axis Capital Holdings, Ltd. |

0.5% |

|

|

|

| C000239874 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock International High Dividend ETF

|

| Class Name |

International High Dividend ETF

|

| Trading Symbol |

JHID

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock International High Dividend ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| International High Dividend ETF/JHID |

|

|

$49 |

0.46% |

|

| Expenses Paid, Amount |

$ 49

|

| Expense Ratio, Percent |

0.46%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

International High Dividend ETF (JHID) returned 13.84% for the year ended April 30, 2025. International equities delivered strong, double-digit gains in the 12 months ended April 30, 2025, albeit with elevated volatility late in the period in response to shifts in U.S. trade policy. Certain European stocks performed particularly well, reflecting positive sentiment regarding falling interest rates and supportive fiscal policy.

TOP PERFORMANCE CONTRIBUTORS

Financial stocks | Financials made the largest contribution to absolute performance due to their strong return and sizable portfolio weighting. The Italian stocks Poste Italiane SpA and Generali were the leading individual contributors in the sector.

Consumer staples | The U.K.-based tobacco producers British American Tobacco PLC and Imperial Brands PLC were the top contributors in the sector. The British supermarket operator Tesco PLC was also a key contributor.

European stocks | At the country level, Italy and the United Kingdom contributed most on an absolute basis.

TOP PERFORMANCE DETRACTORS

Consumer discretionary | Automotive stocks, which were hurt by sluggish global sales trends and concerns about the impact of U.S. tariffs, were the most notable detractors. The German automakers Volkswagen AG, Bayerische Motoren Werke AG, and Mercedes-Benz Group AG all weighed on fund performance in the period.

Industrials | Japanese companies, including Mitsubishi Corp. and Mitsui & Company, Ltd., were the primary source of weakness in the sector.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

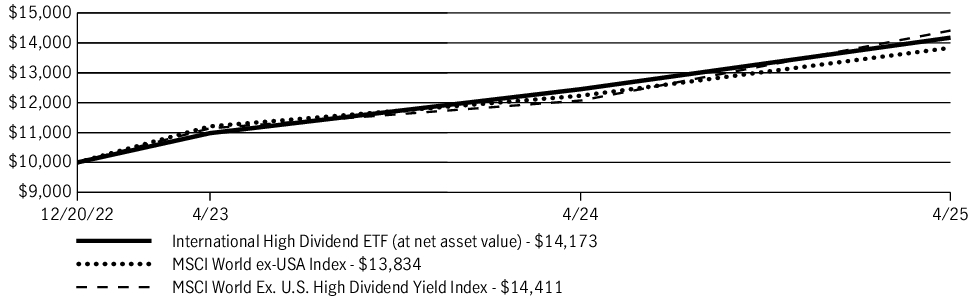

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

Since inception |

| International High Dividend ETF (at net asset value) |

13.84% |

15.91% |

| MSCI World ex-USA Index |

13.10% |

14.73% |

| MSCI World Ex. U.S. High Dividend Yield Index |

19.39% |

16.73% |

|

| Performance Inception Date |

Dec. 20, 2022

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 8,567,201

|

| Holdings Count | Holding |

100

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

43.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$8,567,201 |

| Total number of portfolio holdings |

100 |

| Total advisory fees paid (net) |

$0 |

| Portfolio turnover rate |

43% |

|

| Holdings [Text Block] |

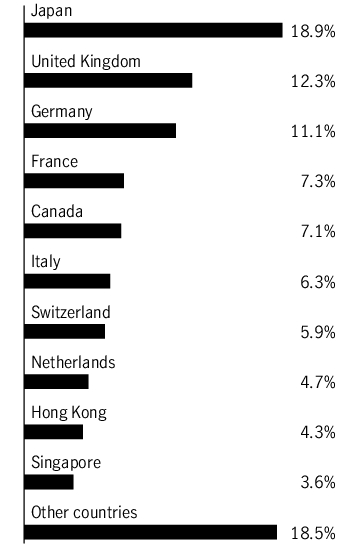

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Poste Italiane SpA |

2.2% |

| Imperial Brands PLC |

2.1% |

| Klepierre SA |

2.1% |

| Heidelberg Materials AG |

2.1% |

| NN Group NV |

2.1% |

| SAP SE |

2.0% |

| Engie SA |

2.0% |

| Generali |

2.0% |

| British American Tobacco PLC |

2.0% |

| Banco Bilbao Vizcaya Argentaria SA |

1.9% |

|

|

Sector Composition

| Financials |

27.0% |

| Industrials |

13.9% |

| Health care |

9.0% |

| Consumer staples |

9.0% |

| Energy |

7.8% |

| Materials |

7.6% |

| Utilities |

6.2% |

| Information technology |

5.9% |

| Consumer discretionary |

5.3% |

| Real estate |

3.9% |

| Communication services |

2.6% |

| Short-term investments and other |

1.8% |

Country Composition

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Poste Italiane SpA |

2.2% |

| Imperial Brands PLC |

2.1% |

| Klepierre SA |

2.1% |

| Heidelberg Materials AG |

2.1% |

| NN Group NV |

2.1% |

| SAP SE |

2.0% |

| Engie SA |

2.0% |

| Generali |

2.0% |

| British American Tobacco PLC |

2.0% |

| Banco Bilbao Vizcaya Argentaria SA |

1.9% |

|

|

|

| C000237881 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock U.S. High Dividend ETF

|

| Class Name |

U.S. High Dividend ETF

|

| Trading Symbol |

JHDV

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock U.S. High Dividend ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| U.S. High Dividend ETF/JHDV |

|

|

$36 |

0.34% |

|

| Expenses Paid, Amount |

$ 36

|

| Expense Ratio, Percent |

0.34%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

U.S. High Dividend ETF (JHDV) returned 9.88% for the year ended April 30, 2025. U.S. dividend-paying stocks posted a gain in the 12 months ended on April 30, 2025, with the bulk of the positive return occurring prior to the new year. During that time, equities were boosted by the combination of falling interest rates and positive economic growth. However, stocks experienced weaker returns and higher volatility from the start of 2025 onward due to concerns about the economic impact of tariffs.

TOP PERFORMANCE CONTRIBUTORS

Information technology stocks | A number of holdings in the sector produced double-digit returns, with the largest contributors to the fund's absolute performance coming from NVIDIA Corp., Apple, Inc., and IBM Corp.

Healthcare | The pharmaceutical stocks Pfizer, Inc., Bristol-Myers Squibb Company, and Eli Lilly & Company accounted for the bulk of the fund’s positive return in the sector.

Other areas of strength | Holdings in the consumer staples, utilities, and real estate sectors, among others, also added to absolute performance. The tobacco stocks Phillip Morris International, Inc. and Altria Group, Inc. were leading contributors in consumer staples.

TOP PERFORMANCE DETRACTORS

Materials | The fund’s holdings in the sector combined for a negative absolute return, largely as a result of positions in the chemical producers LyondellBasell Industries NV and Dow, Inc.

Industrials | United Parcel Service, Inc. lost ground due to lower shipping volumes, and Vertiv Holdings Company—a producer of data center infrastructure—was pressured by reduced enthusiasm for AI in the latter part of the period.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

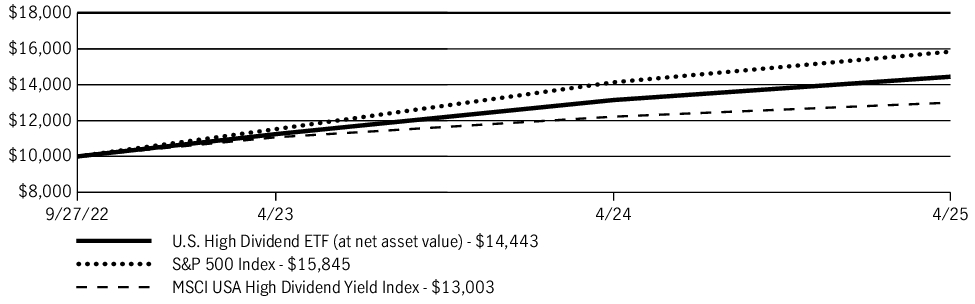

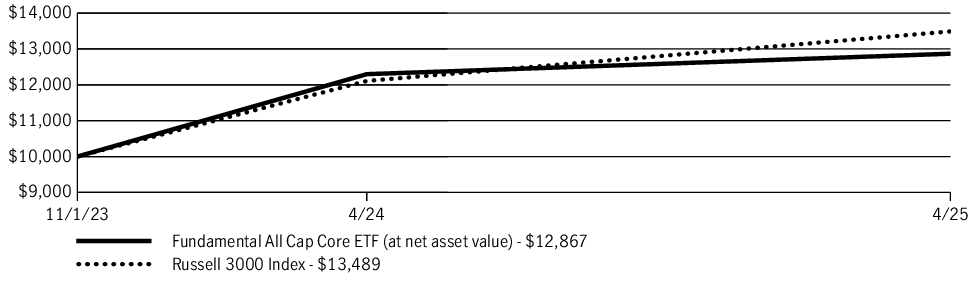

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

Since inception |

| U.S. High Dividend ETF (at net asset value) |

9.88% |

15.24% |

| S&P 500 Index |

12.10% |

19.43% |

| MSCI USA High Dividend Yield Index |

6.41% |

10.66% |

|

| Performance Inception Date |

Sep. 27, 2022

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 7,399,167

|

| Holdings Count | Holding |

83

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

37.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$7,399,167 |

| Total number of portfolio holdings |

83 |

| Total advisory fees paid (net) |

$0 |

| Portfolio turnover rate |

37% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Microsoft Corp. |

6.3% |

| Apple, Inc. |

6.2% |

| NVIDIA Corp. |

6.0% |

| Intuit, Inc. |

2.0% |

| CME Group, Inc. |

2.0% |

| Philip Morris International, Inc. |

2.0% |

| OneMain Holdings, Inc. |

2.0% |

| Altria Group, Inc. |

1.9% |

| Simon Property Group, Inc. |

1.9% |

| Bristol-Myers Squibb Company |

1.9% |

|

|

Sector Composition

| Information technology |

32.7% |

| Financials |

15.3% |

| Consumer staples |

8.6% |

| Industrials |

8.2% |

| Health care |

8.0% |

| Consumer discretionary |

7.1% |

| Real estate |

6.2% |

| Communication services |

4.3% |

| Energy |

3.1% |

| Utilities |

2.7% |

| Materials |

2.5% |

| Short-term investments and other |

1.3% |

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. |

6.3% |

| Apple, Inc. |

6.2% |

| NVIDIA Corp. |

6.0% |

| Intuit, Inc. |

2.0% |

| CME Group, Inc. |

2.0% |

| Philip Morris International, Inc. |

2.0% |

| OneMain Holdings, Inc. |

2.0% |

| Altria Group, Inc. |

1.9% |

| Simon Property Group, Inc. |

1.9% |

| Bristol-Myers Squibb Company |

1.9% |

|

|

|

| C000232625 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Preferred Income ETF

|

| Class Name |

Preferred Income ETF

|

| Trading Symbol |

JHPI

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Preferred Income ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Preferred Income ETF/JHPI |

|

|

$56 |

0.54% |

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

0.54%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Preferred Income ETF (JHPI) returned 7.30% for the year ended April 30, 2025. Preferred securities registered gains in the 12 months ended April 30, 2025, a time in which both the equity and fixed-income markets produced positive returns. Preferreds performed particularly well in the first five months of the period, when the U.S. Federal Reserve’s decision to start cutting interest rates fueled a rally in the bond market. The asset class began to lose steam in late 2024 once investors started to become less optimistic about the interest rate outlook, and it fell further in the period on concerns about rising tariffs. As a result, preferreds finished well off of their intra-period high.

TOP PERFORMANCE CONTRIBUTORS

Banking issues | The banking industry made the largest contribution to absolute performance due to its strong return and sizable portfolio weighting. The regional banks M&T Bank Corp. and KeyCorp were meaningful contributors at the individual security level.

Electric utilities | The sector performed well on expectations that the growth of artificial intelligence will lead to rising power demand. TXMN Energy, Inc. and Vistra Corp. were top contributors.

Communications and insurance | These sectors further contributed to absolute returns, led by U.S. Cellular Corp. and SBL Holdings, Inc., respectively.

TOP PERFORMANCE DETRACTORS

No major segment detracted | No major segment of the portfolio hurt absolute return. A number of individual securities posted losses, however, including SCE Trust (the issuing entity of Southern California Edison) and the pipeline operator Sempra.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

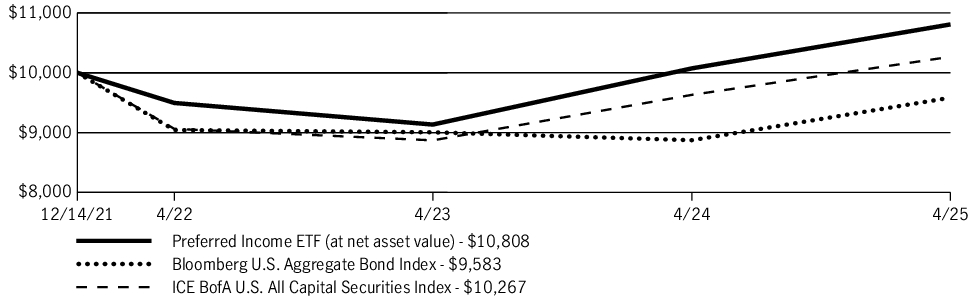

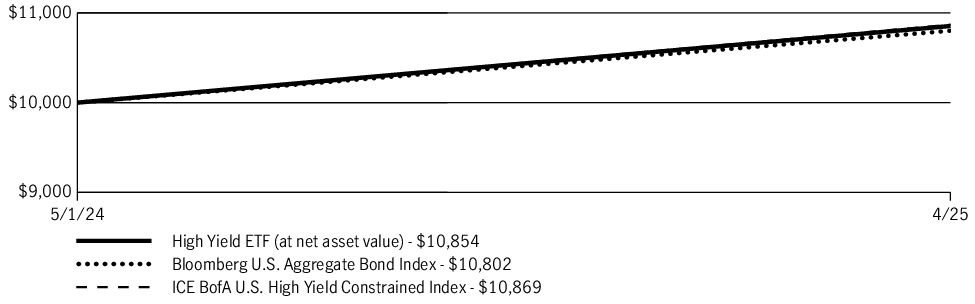

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

Since inception |

| Preferred Income ETF (at net asset value) |

7.30% |

2.33% |

| Bloomberg U.S. Aggregate Bond Index |

8.02% |

(1.25)% |

| ICE BofA U.S. All Capital Securities Index |

6.61% |

0.78% |

|

| Performance Inception Date |

Dec. 14, 2021

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 72,064,196

|

| Holdings Count | Holding |

171

|

| Advisory Fees Paid, Amount |

$ 84,414

|

| Investment Company Portfolio Turnover |

29.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$72,064,196 |

| Total number of portfolio holdings |

171 |

| Total advisory fees paid (net) |

$84,414 |

| Portfolio turnover rate |

29% |

|

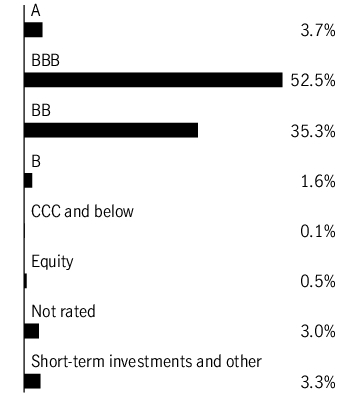

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Sector Composition

| Financials |

53.0% |

| Utilities |

26.6% |

| Energy |

6.3% |

| Communication services |

4.7% |

| Real estate |

2.3% |

| Industrials |

1.7% |

| Health care |

0.9% |

| Consumer discretionary |

0.7% |

| Information technology |

0.5% |

| Short-term investments and other |

3.3% |

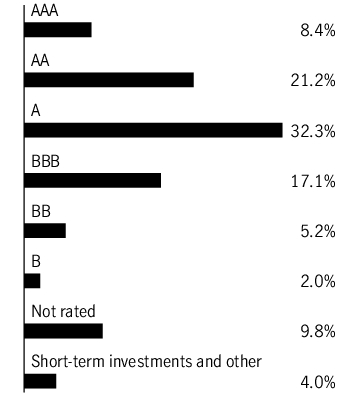

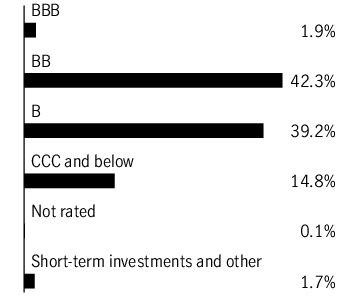

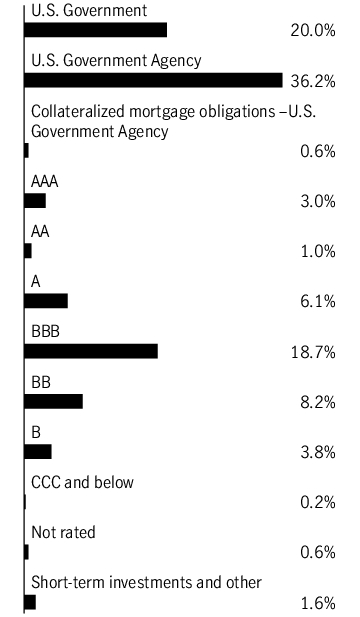

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 4-30-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 4-30-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| C000204467 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Multifactor Emerging Markets ETF

|

| Class Name |

Multifactor Emerging Markets ETF

|

| Trading Symbol |

JHEM

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Multifactor Emerging Markets ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Multifactor Emerging Markets ETF/JHEM |

|

|

$50 |

0.49% |

|

| Expenses Paid, Amount |

$ 50

|

| Expense Ratio, Percent |

0.49%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Multifactor Emerging Markets ETF (JHEM) returned 5.50% for the year ended April 30, 2025. Emerging-market stocks delivered gains in the 12 months ended April 30, 2025. Although a protectionist shift in U.S. trade policy fueled heightened volatility later in the period, the asset class was generally well supported by falling global interest rates and weakness in the U.S. dollar.

TOP PERFORMANCE CONTRIBUTORS

Financial stocks | Financials made the largest contribution to absolute performance due to their strong return and sizable portfolio weighting. The fund was helped by its positions in India, where HDFC Bank, Ltd. and ICICI Bank, Ltd. were top contributors. Holdings in a number of Chinese stocks also fueled positive results, led by China Construction Bank Corp. and Industrial & Commercial Bank of China, Ltd.

Communication services | The Chinese media technology company Tencent Holdings, Ltd., accounted for the majority of the fund’s strength in the sector.

Consumer discretionary | China was the key source of positive returns here, as well, led by Alibaba Group Holding, Ltd. and the electric vehicle maker BYD Company, Ltd.

TOP PERFORMANCE DETRACTORS

Materials and energy | Commodity-sensitive stocks, in general, lagged in the period. Tata Steel, Ltd. and Petroleo Brasileiro SA were among the top detractors, respectively, in the two sectors.

Information technology | The Korean technology giant Samsung Electronics Company, Ltd., which trailed its sector peers on concerns about its sluggish growth, was the leading detractor in both technology and the portfolio as a whole.

The views expressed in this report are exclusively those of the portfolio management team at Dimensional Fund Advisors LP, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

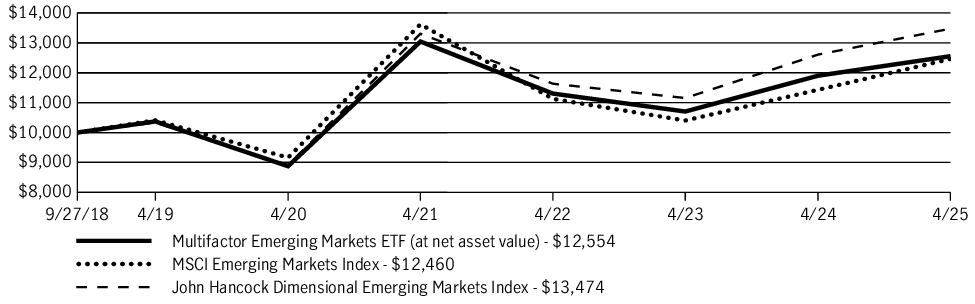

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

Since inception |

| Multifactor Emerging Markets ETF (at net asset value) |

5.50% |

7.19% |

3.51% |

| MSCI Emerging Markets Index |

9.02% |

6.35% |

3.39% |

| John Hancock Dimensional Emerging Markets Index |

6.88% |

8.62% |

4.63% |

|

| Performance Inception Date |

Sep. 27, 2018

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 577,309,977

|

| Holdings Count | Holding |

878

|

| Advisory Fees Paid, Amount |

$ 2,292,967

|

| Investment Company Portfolio Turnover |

13.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$577,309,977 |

| Total number of portfolio holdings |

878 |

| Total advisory fees paid (net) |

$2,292,967 |

| Portfolio turnover rate |

13% |

|

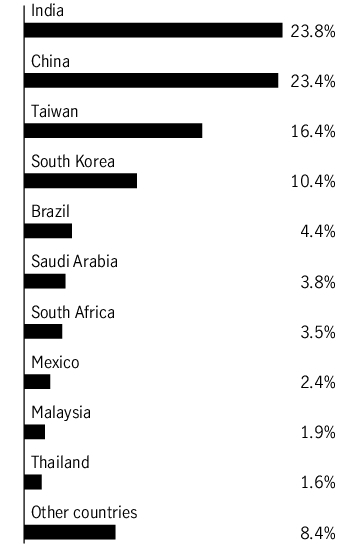

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total investments of the fund.

Top Ten Holdings

| Tencent Holdings, Ltd. |

3.8% |

| Taiwan Semiconductor Manufacturing Company, Ltd. |

3.7% |

| Alibaba Group Holding, Ltd. |

2.7% |

| Samsung Electronics Company, Ltd. |

2.6% |

| HDFC Bank, Ltd. |

1.5% |

| ICICI Bank, Ltd. |

1.4% |

| Reliance Industries, Ltd. |

1.4% |

| PDD Holdings, Inc., ADR |

1.4% |

| China Construction Bank Corp., H Shares |

1.0% |

| Meituan, Class B |

0.9% |

|

|

Sector Composition

| Financials |

25.5% |

| Information technology |

17.1% |

| Consumer discretionary |

15.0% |

| Communication services |

9.4% |

| Materials |

7.4% |

| Industrials |

6.8% |

| Consumer staples |

5.8% |

| Energy |

5.3% |

| Utilities |

3.2% |

| Health care |

3.0% |

| Real estate |

1.1% |

| Short-term investments |

0.4% |

|

|

Country Composition

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Tencent Holdings, Ltd. |

3.8% |

| Taiwan Semiconductor Manufacturing Company, Ltd. |

3.7% |

| Alibaba Group Holding, Ltd. |

2.7% |

| Samsung Electronics Company, Ltd. |

2.6% |

| HDFC Bank, Ltd. |

1.5% |

| ICICI Bank, Ltd. |

1.4% |

| Reliance Industries, Ltd. |

1.4% |

| PDD Holdings, Inc., ADR |

1.4% |

| China Construction Bank Corp., H Shares |

1.0% |

| Meituan, Class B |

0.9% |

|

|

|

| C000227987 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Mortgage-Backed Securities ETF

|

| Class Name |

Mortgage-Backed Securities ETF

|

| Trading Symbol |

JHMB

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Mortgage-Backed Securities ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Mortgage-Backed Securities ETF/JHMB |

|

|

$41 |

0.39% |

|

| Expenses Paid, Amount |

$ 41

|

| Expense Ratio, Percent |

0.39%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Mortgage-Backed Securities ETF (JHMB) returned 9.28% for the year ended April 30, 2025. Mortgage-backed securities (MBS) registered strong total returns in the 12-month period that ended on April 30, 2025. Falling inflation allowed the U.S. Federal Reserve (Fed) to cut interest rates by a full percentage point in the latter half of 2024, bringing the benchmark rate from a range of 5.25%-5.50% to 4.25%-4.50%. U.S. Treasury yields fell in response, boosting fixed-income categories—such as MBS—with above-average interest rate sensitivity.

TOP PERFORMANCE CONTRIBUTORS

Sector allocations | Allocations to commercial mortgage-backed securities (CMBS) interest only securities, GNMA 30 year mortgages, and U.S. agency credit were meaningful contributors to return.

Yield positioning and interest payments | The fund was positioned for a steepening of the yield curve which occurred. The fund's intermediate durations fared better than longer and shorter durations. Interest payments were significant contributors to return.

TOP PERFORMANCE DETRACTORS

Certain holdings outside of MBS | Small portfolio positions in multifamily commercial mortgage-backed securities (CMBS) finished with negative returns, as did other specific segments of CMBS and asset-backed securities.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

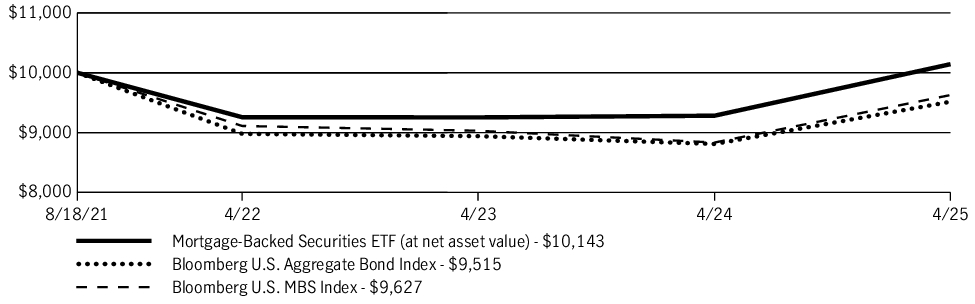

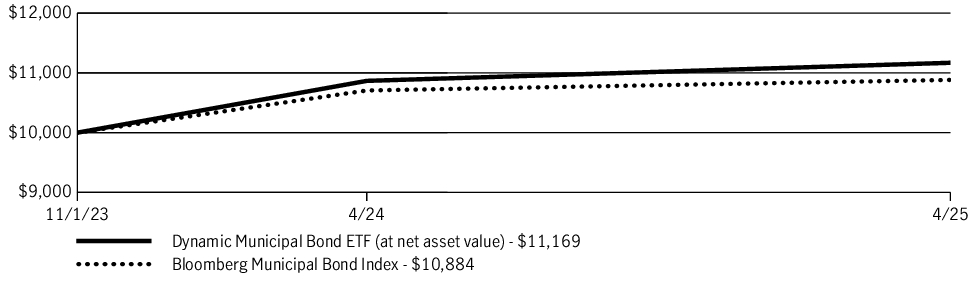

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

Since inception |

| Mortgage-Backed Securities ETF (at net asset value) |

9.28% |

0.39% |

| Bloomberg U.S. Aggregate Bond Index |

8.02% |

(1.34)% |

| Bloomberg U.S. MBS Index |

8.99% |

(1.02)% |

|

| Performance Inception Date |

Aug. 18, 2021

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 133,104,154

|

| Holdings Count | Holding |

368

|

| Advisory Fees Paid, Amount |

$ 82,330

|

| Investment Company Portfolio Turnover |

67.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$133,104,154 |

| Total number of portfolio holdings |

368 |

| Total advisory fees paid (net) |

$82,330 |

| Portfolio turnover rate |

67% |

|

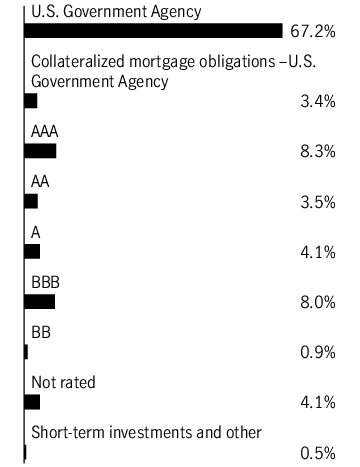

| Holdings [Text Block] |

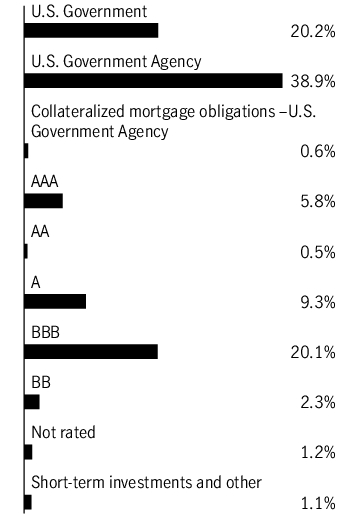

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Portfolio Composition

| U.S. Government Agency |

67.2% |

| Collateralized mortgage obligations – Commercial and residential |

15.9% |

| Asset-backed securities |

13.0% |

| Collateralized mortgage obligations – U.S. Government Agency |

3.4% |

| Short-term investments and other |

0.5% |

|

|

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 4-30-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 4-30-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| C000226213 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Corporate Bond ETF

|

| Class Name |

Corporate Bond ETF

|

| Trading Symbol |

JHCB

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Corporate Bond ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Corporate Bond ETF/JHCB |

|

|

$30 |

0.29% |

|

| Expenses Paid, Amount |

$ 30

|

| Expense Ratio, Percent |

0.29%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Corporate Bond ETF (JHCB) returned 7.74% for the year ended April 30, 2025. Investment-grade corporate bonds delivered solid returns in the 12 months ended April 30, 2025, with a decline in U.S. Treasury yields and the contribution from income offsetting the adverse effect of a modest increase in yield spreads. The asset class was well supported by the backdrop of accommodative U.S. Federal Reserve (Fed) policy, healthy corporate earnings, and generally positive investor risk appetites for the majority of the period.

TOP PERFORMANCE CONTRIBUTORS

Yield positioning and interest payments | The fund was well positioned for a steepening of the yield curve which occurred during the period. Intermediate-term issues generally provided the strongest returns. Interest payments were also significant contributors to return.

Banking issues | Holdings in this industry group made the largest contribution to absolute performance due to their strong return and sizable portfolio weighting. Deutsche Bank AG and Citizens Financial Group were meaningful contributors in this category.

TOP PERFORMANCE DETRACTORS

Asset allocation | Although allocation to the energy and communications sectors contributed to absolute performance, these sectors detracted relative to the Bloomberg U.S. Corporate Bond Index.

Individual security detractors | A narrow group of individual securities finished with losses, including Occidental Petroleum Corp. and pharmaceutical company Viatris, Inc.

The views expressed in this report are exclusively those of the portfolio management team at Manulife Investment Management (US) LLC, and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

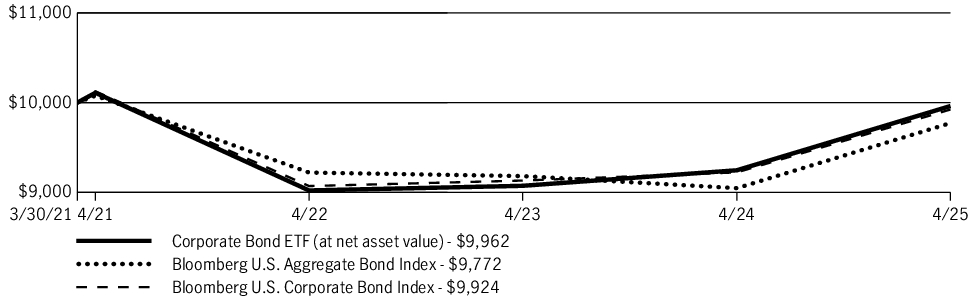

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

Since inception |

| Corporate Bond ETF (at net asset value) |

7.74% |

(0.09)% |

| Bloomberg U.S. Aggregate Bond Index |

8.02% |

(0.56)% |

| Bloomberg U.S. Corporate Bond Index |

7.60% |

(0.19)% |

|

| Performance Inception Date |

Mar. 30, 2021

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-6020.

|

| Net Assets |

$ 55,700,563

|

| Holdings Count | Holding |

88

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

45.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$55,700,563 |

| Total number of portfolio holdings |

88 |

| Total advisory fees paid (net) |

$0 |

| Portfolio turnover rate |

45% |

|

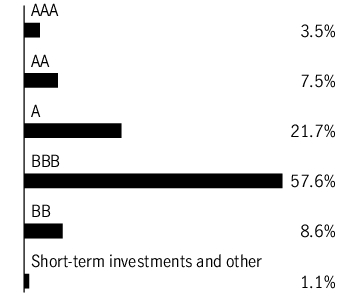

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Sector Composition

| Financials |

43.6% |

| Information technology |

10.7% |

| Industrials |

8.1% |

| Utilities |

8.0% |

| Communication services |

7.0% |

| Energy |

6.8% |

| Health care |

6.8% |

| Real estate |

3.4% |

| Consumer discretionary |

3.3% |

| Materials |

1.2% |

| Short-term investments and other |

1.1% |

Quality Composition

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 4-30-25 and do not reflect subsequent downgrades or upgrades, if any.

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Credit Quality Explanation [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc. “Not rated” securities are those with no ratings available from these agencies. All ratings are as of 4-30-25 and do not reflect subsequent downgrades or upgrades, if any.

|

| Credit Ratings Selection [Text Block] |

Ratings are from Moody’s Investors Service, Inc. If not available, we have used S&P Global Ratings. In the absence of ratings from these agencies, we have used Fitch Ratings, Inc.

|

| C000246920 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Disciplined Value International Select ETF

|

| Class Name |

Disciplined Value International Select ETF

|

| Trading Symbol |

JDVI

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Disciplined Value International Select ETF (the fund) for the period of May 1, 2024 to April 30, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-6020.

|

| Additional Information Phone Number |

800-225-6020

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last year ?

(Based on a hypothetical $10,000 investment)

| Fund |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

| Disciplined Value International Select ETF/JDVI |

|

|

$73 |

0.69% |

|

| Expenses Paid, Amount |

$ 73

|

| Expense Ratio, Percent |

0.69%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Disciplined Value International Select ETF (JDVI) returned 10.21% for the year ended April 30, 2025. International equities delivered strong, double-digit gains in the 12 months ended April 30, 2025, albeit with elevated volatility late in the period in response to shifts in U.S. trade policy. Certain European stocks performed particularly well, reflecting positive sentiment regarding falling interest rates and supportive fiscal policy.

TOP PERFORMANCE CONTRIBUTORS

Financial stocks | Financials made the largest contribution to absolute performance due to their strong return and sizable portfolio weighting. NatWest Group PLC, Allianz SE, and Nordea Bank Abp were the leading individual contributors in the sector.

Industrials | BAE Systems PLC, which benefited from expectations for rising defense spending in Europe, was the most notable contributor. Positions in Mitsubishi Heavy Industries, Ltd. and Siemens AG also helped results.

Country performance | At the country level, Japan and the United Kingdom contributed most to absolute performance.

TOP PERFORMANCE DETRACTORS

Information technology | The Korean technology giant Samsung Electronics Company, Ltd., which lagged its sector peers by a wide margin on concerns about its sluggish growth, was the largest detractor. Capgemini SE and SK Hynix, Inc. were further detractors of note.

Energy | Shares of Cenovus Energy, Inc. and MEG Energy Corp. fell sharply, weighing on the fund’s absolute performance.

The views expressed in this report are exclusively those of the portfolio management team at Boston Partners Global Investors, Inc., and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

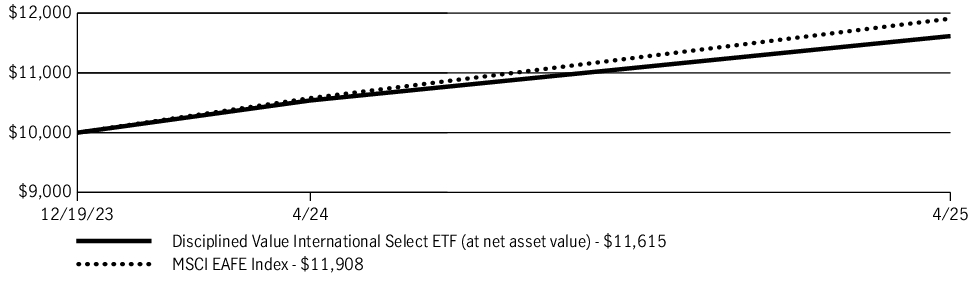

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|