Shareholder Report

|

6 Months Ended |

12 Months Ended |

Jul. 01, 2024 |

Dec. 31, 2024

USD ($)

Holding

|

| Shareholder Report [Line Items] |

|

|

| Document Type |

|

N-CSR

|

| Amendment Flag |

|

false

|

| Registrant Name |

|

Natixis Funds Trust I

|

| Entity Central Index Key |

|

0000770540

|

| Entity Investment Company Type |

|

N-1A

|

| Document Period End Date |

|

Dec. 31, 2024

|

| C000178444 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

Mirova Global Green Bond Fund

|

| Class Name |

|

Class A

|

| Trading Symbol |

|

MGGAX

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about Mirova Global Green Bond Fund for the period of January 1, 2024 to December 31, 2024.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

|

| Additional Information Phone Number |

|

(800) 225-5478

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; white-space-collapse: preserve-breaks;">im.natixis.com/funddocuments</span>

|

| Expenses [Text Block] |

|

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

Class A |

$91 |

0.90% |

| Footnote |

Description |

Footnote† |

Annualized for periods less than one year (if applicable). | |

| Expenses Paid, Amount |

|

$ 91

|

| Expense Ratio, Percent |

|

0.90%

|

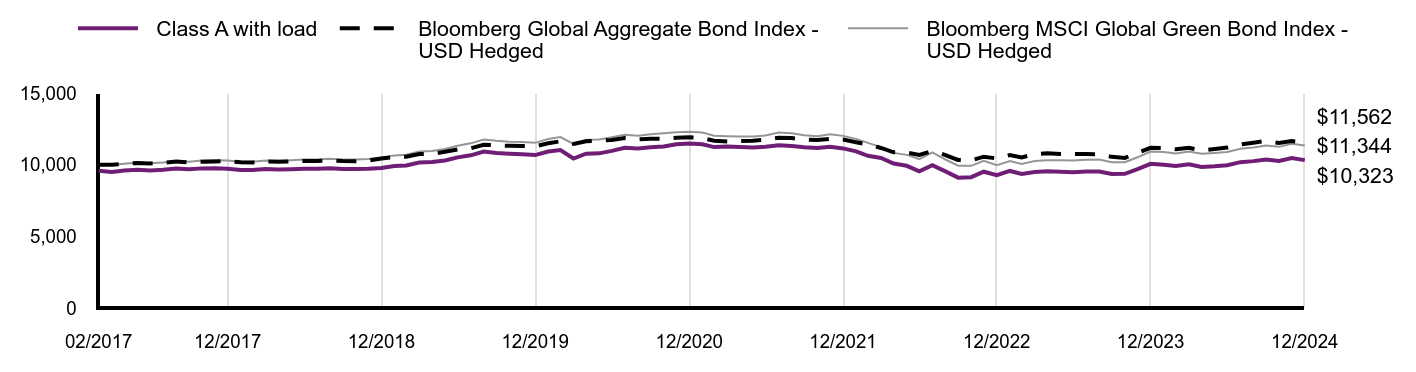

| Factors Affecting Performance [Text Block] |

|

How did the fund perform last year and what affected its performance?Explanation of Fund Performance In 2024, the Mirova Global Green Bond Fund lagged in overall performance which can be attributed to movements on the yield curve. Top Contributors to Performance •Allocation had a positive impact on the Fund during the year due to its long position on credit, while US and Euro credit spreads compressed. •Issue selection during the year was also positive. The largest contributors to this outperformance were among the corporate holdings, namely Altarea, Johnson Controls, and EIB. Top Detractors from Performance •The Fund's duration and curve strategy during the year incurred a cost, negatively impacting performance. •Yield curve positioning on the CAD zone, Euro zone and USD zone were negative throughout the year. •Among the worst detractors were Philips, Vestas, and Credit Mutuelle Arkea. |

| Performance Past Does Not Indicate Future [Text] |

|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance,

|

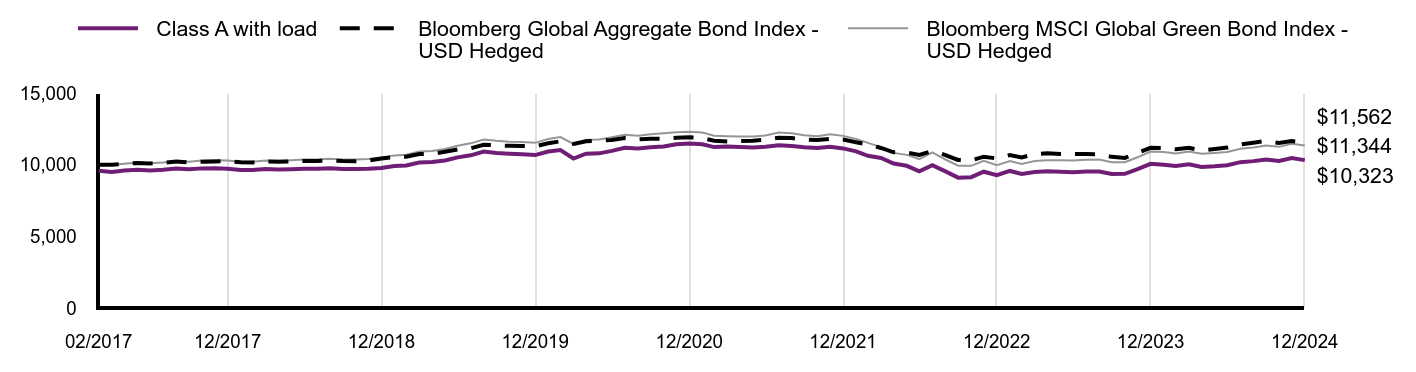

| Line Graph [Table Text Block] |

|

|

Class A with load |

Bloomberg Global Aggregate Bond Index - USD Hedged |

Bloomberg MSCI Global Green Bond Index - USD Hedged |

02/2017 |

$9,579 |

$10,000 |

$10,000 |

03/2017 |

$9,502 |

$9,995 |

$9,984 |

04/2017 |

$9,598 |

$10,063 |

$10,076 |

05/2017 |

$9,646 |

$10,122 |

$10,149 |

06/2017 |

$9,607 |

$10,094 |

$10,103 |

07/2017 |

$9,655 |

$10,127 |

$10,153 |

08/2017 |

$9,741 |

$10,219 |

$10,266 |

09/2017 |

$9,689 |

$10,172 |

$10,216 |

10/2017 |

$9,747 |

$10,215 |

$10,295 |

11/2017 |

$9,756 |

$10,231 |

$10,316 |

12/2017 |

$9,719 |

$10,253 |

$10,302 |

01/2018 |

$9,631 |

$10,180 |

$10,217 |

02/2018 |

$9,631 |

$10,157 |

$10,217 |

03/2018 |

$9,701 |

$10,242 |

$10,293 |

04/2018 |

$9,662 |

$10,203 |

$10,271 |

05/2018 |

$9,691 |

$10,242 |

$10,322 |

06/2018 |

$9,713 |

$10,261 |

$10,362 |

07/2018 |

$9,713 |

$10,263 |

$10,368 |

08/2018 |

$9,752 |

$10,295 |

$10,422 |

09/2018 |

$9,697 |

$10,256 |

$10,372 |

10/2018 |

$9,697 |

$10,236 |

$10,372 |

11/2018 |

$9,717 |

$10,286 |

$10,404 |

12/2018 |

$9,781 |

$10,434 |

$10,515 |

01/2019 |

$9,912 |

$10,545 |

$10,648 |

02/2019 |

$9,952 |

$10,557 |

$10,694 |

03/2019 |

$10,156 |

$10,747 |

$10,923 |

04/2019 |

$10,186 |

$10,753 |

$10,961 |

05/2019 |

$10,298 |

$10,908 |

$11,095 |

06/2019 |

$10,517 |

$11,061 |

$11,327 |

07/2019 |

$10,659 |

$11,148 |

$11,494 |

08/2019 |

$10,922 |

$11,400 |

$11,757 |

09/2019 |

$10,814 |

$11,348 |

$11,675 |

10/2019 |

$10,773 |

$11,328 |

$11,613 |

11/2019 |

$10,732 |

$11,315 |

$11,596 |

12/2019 |

$10,676 |

$11,292 |

$11,529 |

01/2020 |

$10,924 |

$11,495 |

$11,801 |

02/2020 |

$11,027 |

$11,636 |

$11,929 |

03/2020 |

$10,434 |

$11,455 |

$11,460 |

04/2020 |

$10,774 |

$11,640 |

$11,743 |

05/2020 |

$10,795 |

$11,673 |

$11,771 |

06/2020 |

$10,969 |

$11,732 |

$11,922 |

07/2020 |

$11,186 |

$11,860 |

$12,093 |

08/2020 |

$11,134 |

$11,774 |

$12,027 |

09/2020 |

$11,216 |

$11,817 |

$12,125 |

10/2020 |

$11,268 |

$11,818 |

$12,192 |

11/2020 |

$11,434 |

$11,885 |

$12,265 |

12/2020 |

$11,489 |

$11,922 |

$12,298 |

01/2021 |

$11,425 |

$11,858 |

$12,244 |

02/2021 |

$11,233 |

$11,673 |

$12,021 |

03/2021 |

$11,267 |

$11,627 |

$11,990 |

04/2021 |

$11,234 |

$11,658 |

$11,967 |

05/2021 |

$11,202 |

$11,684 |

$11,972 |

06/2021 |

$11,261 |

$11,741 |

$12,037 |

07/2021 |

$11,369 |

$11,887 |

$12,248 |

08/2021 |

$11,315 |

$11,863 |

$12,200 |

09/2021 |

$11,230 |

$11,751 |

$12,055 |

10/2021 |

$11,165 |

$11,720 |

$11,991 |

11/2021 |

$11,252 |

$11,804 |

$12,132 |

12/2021 |

$11,142 |

$11,756 |

$12,016 |

01/2022 |

$10,933 |

$11,571 |

$11,806 |

02/2022 |

$10,625 |

$11,417 |

$11,524 |

03/2022 |

$10,473 |

$11,171 |

$11,233 |

04/2022 |

$10,083 |

$10,871 |

$10,828 |

05/2022 |

$9,927 |

$10,856 |

$10,691 |

06/2022 |

$9,548 |

$10,691 |

$10,398 |

07/2022 |

$9,971 |

$10,963 |

$10,872 |

08/2022 |

$9,536 |

$10,677 |

$10,366 |

09/2022 |

$9,101 |

$10,334 |

$9,935 |

10/2022 |

$9,135 |

$10,299 |

$9,925 |

11/2022 |

$9,514 |

$10,562 |

$10,278 |

12/2022 |

$9,277 |

$10,437 |

$9,972 |

01/2023 |

$9,568 |

$10,677 |

$10,263 |

02/2023 |

$9,359 |

$10,507 |

$10,054 |

03/2023 |

$9,498 |

$10,740 |

$10,267 |

04/2023 |

$9,545 |

$10,795 |

$10,312 |

05/2023 |

$9,510 |

$10,753 |

$10,308 |

06/2023 |

$9,475 |

$10,746 |

$10,299 |

07/2023 |

$9,533 |

$10,750 |

$10,341 |

08/2023 |

$9,533 |

$10,736 |

$10,359 |

09/2023 |

$9,359 |

$10,551 |

$10,170 |

10/2023 |

$9,370 |

$10,476 |

$10,171 |

11/2023 |

$9,695 |

$10,836 |

$10,520 |

12/2023 |

$10,064 |

$11,183 |

$10,925 |

01/2024 |

$9,993 |

$11,161 |

$10,887 |

02/2024 |

$9,910 |

$11,084 |

$10,788 |

03/2024 |

$10,028 |

$11,184 |

$10,928 |

04/2024 |

$9,851 |

$11,004 |

$10,770 |

05/2024 |

$9,898 |

$11,101 |

$10,826 |

06/2024 |

$9,969 |

$11,198 |

$10,886 |

07/2024 |

$10,182 |

$11,414 |

$11,123 |

08/2024 |

$10,253 |

$11,539 |

$11,204 |

09/2024 |

$10,372 |

$11,673 |

$11,344 |

10/2024 |

$10,265 |

$11,515 |

$11,249 |

11/2024 |

$10,466 |

$11,652 |

$11,458 |

12/2024 |

$10,323 |

$11,562 |

$11,344 |

|

| Average Annual Return [Table Text Block] |

|

AATR |

1 Year |

5 Years |

Since Inception 2/28/17 |

Class A at NAV |

2.57% |

(0.67%) |

0.96% |

Class A with 4.25% MSCFootnote Reference1 |

(1.82%) |

(1.53%) |

0.41% |

Bloomberg Global Aggregate Bond Index - USD Hedged |

3.40% |

0.48% |

1.86% |

Bloomberg MSCI Global Green Bond Index - USD Hedged |

3.83% |

(0.32%) |

1.62% | |

| Performance Inception Date |

|

Feb. 28, 2017

|

| Previous Investment Adviser [Text Block] |

|

|

| Updated Performance Information Location [Text Block] |

|

visit im.natixis.com/en-us/products/mutual-funds/price-and-performance

|

| AssetsNet |

|

$ 38,096,678

|

| Holdings Count | Holding |

|

82

|

| Advisory Fees Paid, Amount |

|

$ 17,744

|

| InvestmentCompanyPortfolioTurnover |

|

10.00%

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$38,096,678 |

# of Portfolio Holdings (including overnight repurchase agreements and derivatives) |

82 |

Portfolio Turnover Rate |

10% |

Total Advisory Fees Paid (after waiver/reimbursement, if applicable) |

$17,744 | |

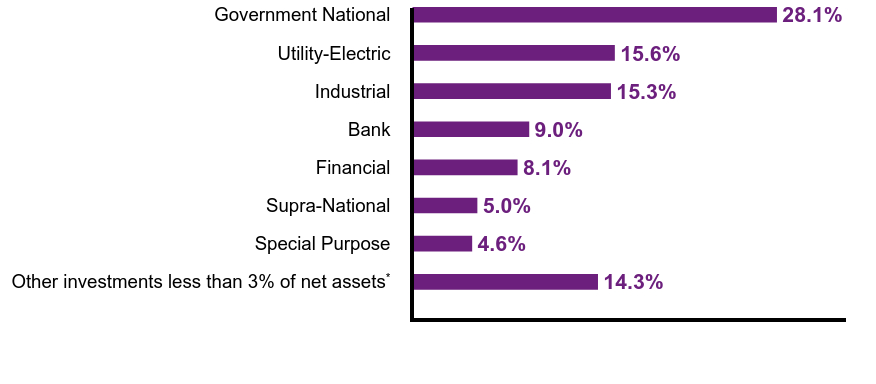

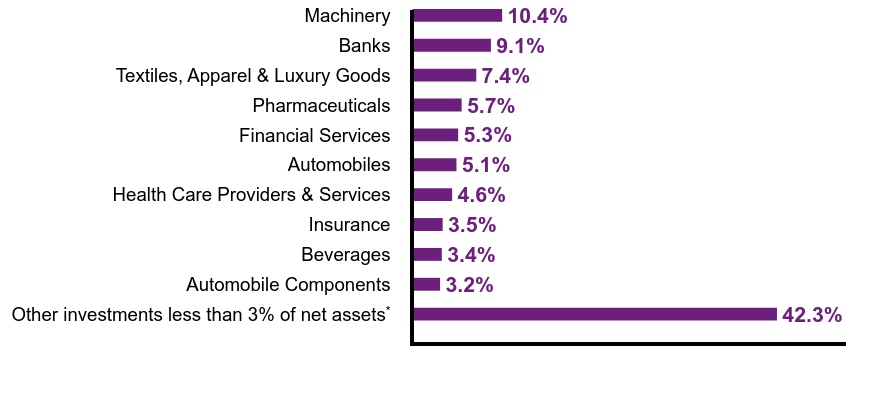

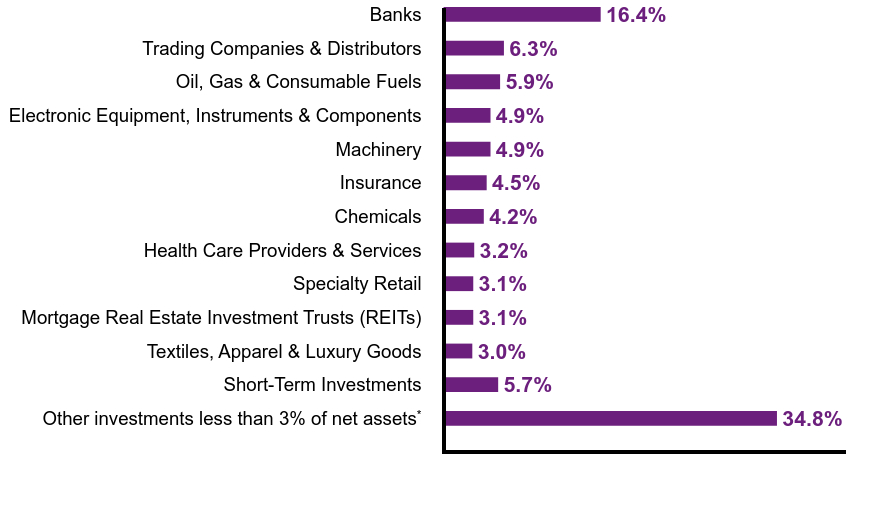

| Holdings [Text Block] |

|

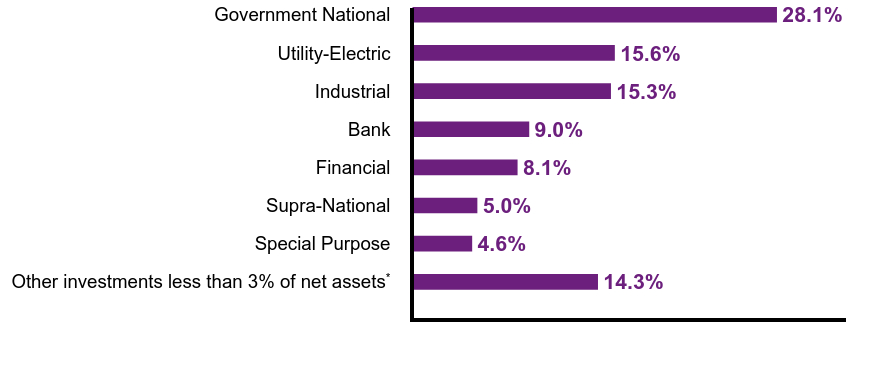

Value |

Value |

Other investments less than 3% of net assetsFootnote Reference* |

14.3% |

Special Purpose |

4.6% |

Supra-National |

5.0% |

Financial |

8.1% |

Bank |

9.0% |

Industrial |

15.3% |

Utility-Electric |

15.6% |

Government National |

28.1% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities (including futures contracts) |

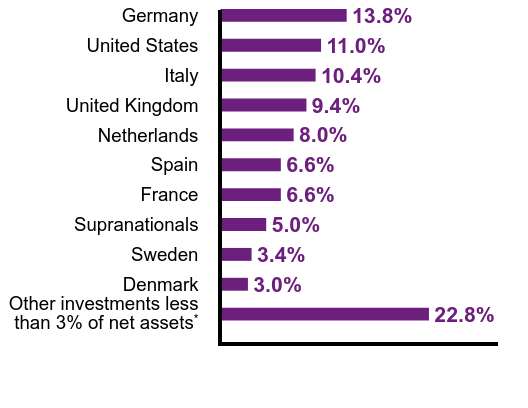

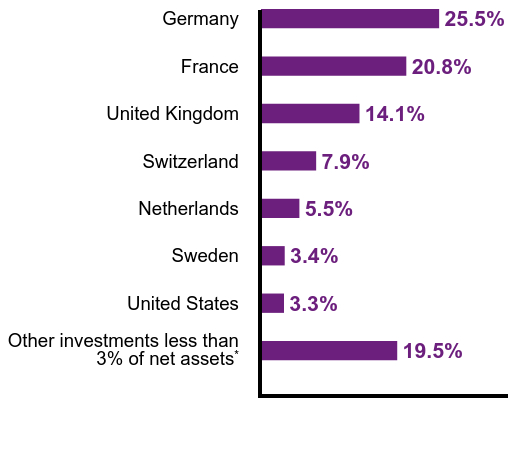

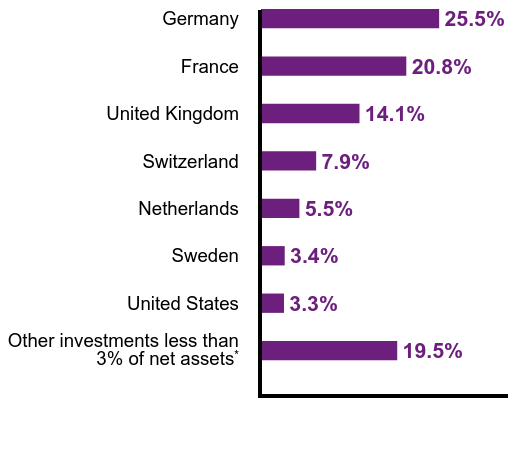

Value |

Value |

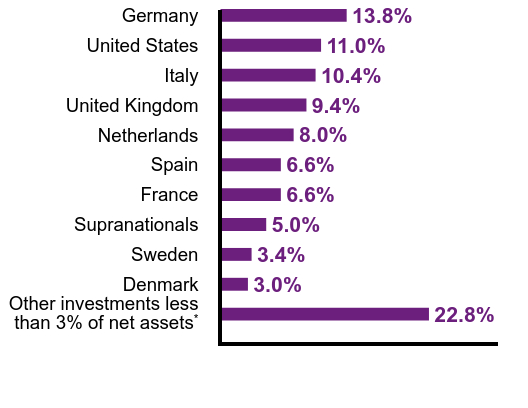

Other investments less than 3% of net assetsFootnote Reference* |

22.8% |

Denmark |

3.0% |

Sweden |

3.4% |

Supranationals |

5.0% |

France |

6.6% |

Spain |

6.6% |

Netherlands |

8.0% |

United Kingdom |

9.4% |

Italy |

10.4% |

United States |

11.0% |

Germany |

13.8% | |

| Credit Quality Explanation [Text Block] |

|

Credit ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

| C000178445 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

Mirova Global Green Bond Fund

|

| Class Name |

|

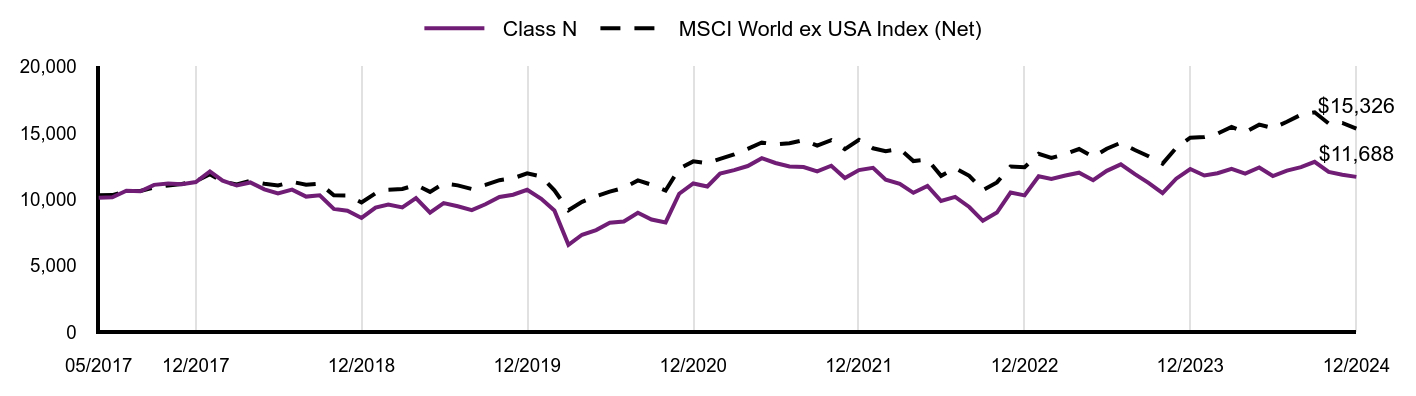

Class N

|

| Trading Symbol |

|

MGGNX

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about Mirova Global Green Bond Fund for the period of January 1, 2024 to December 31, 2024.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

|

| Additional Information Phone Number |

|

(800) 225-5478

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; white-space-collapse: preserve-breaks;">im.natixis.com/funddocuments</span>

|

| Expenses [Text Block] |

|

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

Class N |

$61 |

0.60% |

| Footnote |

Description |

Footnote† |

Annualized for periods less than one year (if applicable). | |

| Expenses Paid, Amount |

|

$ 61

|

| Expense Ratio, Percent |

|

0.60%

|

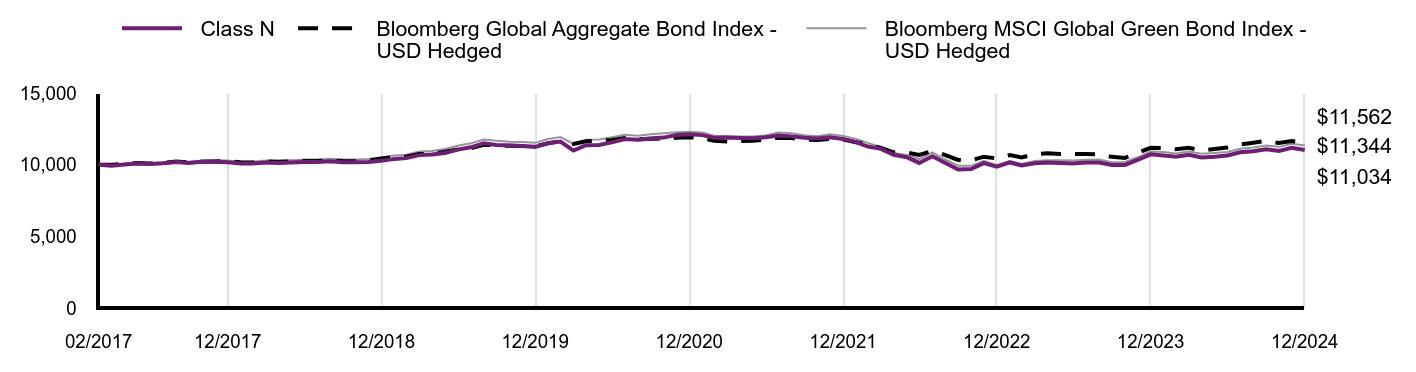

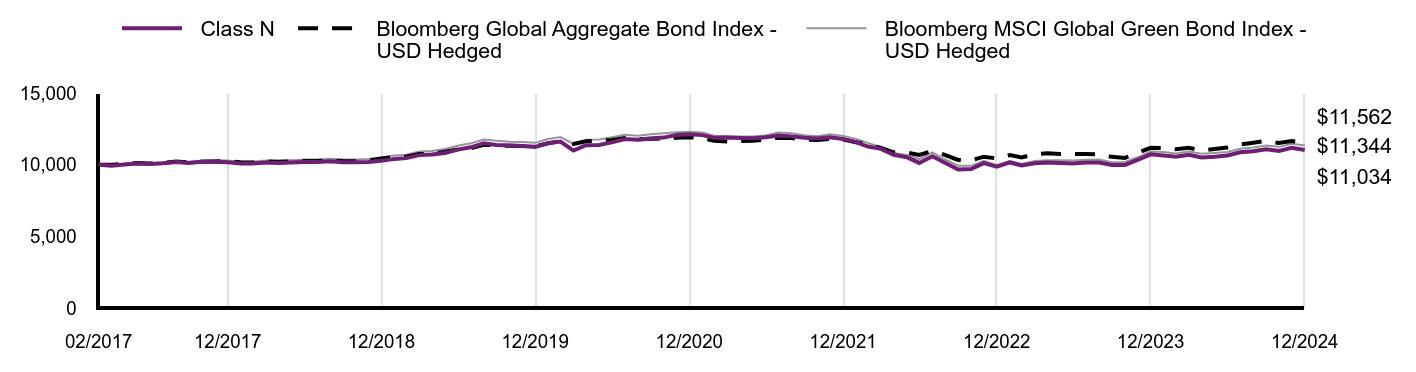

| Factors Affecting Performance [Text Block] |

|

How did the fund perform last year and what affected its performance?Explanation of Fund Performance In 2024, the Mirova Global Green Bond Fund lagged in overall performance which can be attributed to movements on the yield curve. Top Contributors to Performance •Allocation had a positive impact on the Fund during the year due to its long position on credit, while US and Euro credit spreads compressed. •Issue selection during the year was also positive. The largest contributors to this outperformance were among the corporate holdings, namely Altarea, Johnson Controls, and EIB. Top Detractors from Performance •The Fund's duration and curve strategy during the year incurred a cost, negatively impacting performance. •Yield curve positioning on the CAD zone, Euro zone and USD zone were negative throughout the year. •Among the worst detractors were Philips, Vestas, and Credit Mutuelle Arkea. |

| Performance Past Does Not Indicate Future [Text] |

|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance,

|

| Line Graph [Table Text Block] |

|

|

Class N |

Bloomberg Global Aggregate Bond Index - USD Hedged |

Bloomberg MSCI Global Green Bond Index - USD Hedged |

02/2017 |

$10,000 |

$10,000 |

$10,000 |

03/2017 |

$9,930 |

$9,995 |

$9,984 |

04/2017 |

$10,020 |

$10,063 |

$10,076 |

05/2017 |

$10,080 |

$10,122 |

$10,149 |

06/2017 |

$10,050 |

$10,094 |

$10,103 |

07/2017 |

$10,100 |

$10,127 |

$10,153 |

08/2017 |

$10,190 |

$10,219 |

$10,266 |

09/2017 |

$10,131 |

$10,172 |

$10,216 |

10/2017 |

$10,201 |

$10,215 |

$10,295 |

11/2017 |

$10,211 |

$10,231 |

$10,316 |

12/2017 |

$10,177 |

$10,253 |

$10,302 |

01/2018 |

$10,086 |

$10,180 |

$10,217 |

02/2018 |

$10,086 |

$10,157 |

$10,217 |

03/2018 |

$10,165 |

$10,242 |

$10,293 |

04/2018 |

$10,123 |

$10,203 |

$10,271 |

05/2018 |

$10,165 |

$10,242 |

$10,322 |

06/2018 |

$10,184 |

$10,261 |

$10,362 |

07/2018 |

$10,194 |

$10,263 |

$10,368 |

08/2018 |

$10,236 |

$10,295 |

$10,422 |

09/2018 |

$10,176 |

$10,256 |

$10,372 |

10/2018 |

$10,176 |

$10,236 |

$10,372 |

11/2018 |

$10,196 |

$10,286 |

$10,404 |

12/2018 |

$10,272 |

$10,434 |

$10,515 |

01/2019 |

$10,409 |

$10,545 |

$10,648 |

02/2019 |

$10,462 |

$10,557 |

$10,694 |

03/2019 |

$10,672 |

$10,747 |

$10,923 |

04/2019 |

$10,714 |

$10,753 |

$10,961 |

05/2019 |

$10,820 |

$10,908 |

$11,095 |

06/2019 |

$11,059 |

$11,061 |

$11,327 |

07/2019 |

$11,219 |

$11,148 |

$11,494 |

08/2019 |

$11,495 |

$11,400 |

$11,757 |

09/2019 |

$11,385 |

$11,348 |

$11,675 |

10/2019 |

$11,343 |

$11,328 |

$11,613 |

11/2019 |

$11,311 |

$11,315 |

$11,596 |

12/2019 |

$11,249 |

$11,292 |

$11,529 |

01/2020 |

$11,509 |

$11,495 |

$11,801 |

02/2020 |

$11,617 |

$11,636 |

$11,929 |

03/2020 |

$10,991 |

$11,455 |

$11,460 |

04/2020 |

$11,361 |

$11,640 |

$11,743 |

05/2020 |

$11,382 |

$11,673 |

$11,771 |

06/2020 |

$11,562 |

$11,732 |

$11,922 |

07/2020 |

$11,801 |

$11,860 |

$12,093 |

08/2020 |

$11,747 |

$11,774 |

$12,027 |

09/2020 |

$11,840 |

$11,817 |

$12,125 |

10/2020 |

$11,895 |

$11,818 |

$12,192 |

11/2020 |

$12,070 |

$11,885 |

$12,265 |

12/2020 |

$12,137 |

$11,922 |

$12,298 |

01/2021 |

$12,069 |

$11,858 |

$12,244 |

02/2021 |

$11,878 |

$11,673 |

$12,021 |

03/2021 |

$11,910 |

$11,627 |

$11,990 |

04/2021 |

$11,876 |

$11,658 |

$11,967 |

05/2021 |

$11,853 |

$11,684 |

$11,972 |

06/2021 |

$11,913 |

$11,741 |

$12,037 |

07/2021 |

$12,038 |

$11,887 |

$12,248 |

08/2021 |

$11,981 |

$11,863 |

$12,200 |

09/2021 |

$11,889 |

$11,751 |

$12,055 |

10/2021 |

$11,832 |

$11,720 |

$11,991 |

11/2021 |

$11,923 |

$11,804 |

$12,132 |

12/2021 |

$11,805 |

$11,756 |

$12,016 |

01/2022 |

$11,584 |

$11,571 |

$11,806 |

02/2022 |

$11,271 |

$11,417 |

$11,524 |

03/2022 |

$11,107 |

$11,171 |

$11,233 |

04/2022 |

$10,694 |

$10,871 |

$10,828 |

05/2022 |

$10,529 |

$10,856 |

$10,691 |

06/2022 |

$10,128 |

$10,691 |

$10,398 |

07/2022 |

$10,588 |

$10,963 |

$10,872 |

08/2022 |

$10,116 |

$10,677 |

$10,366 |

09/2022 |

$9,668 |

$10,334 |

$9,935 |

10/2022 |

$9,704 |

$10,299 |

$9,925 |

11/2022 |

$10,116 |

$10,562 |

$10,278 |

12/2022 |

$9,867 |

$10,437 |

$9,972 |

01/2023 |

$10,161 |

$10,677 |

$10,263 |

02/2023 |

$9,953 |

$10,507 |

$10,054 |

03/2023 |

$10,100 |

$10,740 |

$10,267 |

04/2023 |

$10,149 |

$10,795 |

$10,312 |

05/2023 |

$10,124 |

$10,753 |

$10,308 |

06/2023 |

$10,087 |

$10,746 |

$10,299 |

07/2023 |

$10,149 |

$10,750 |

$10,341 |

08/2023 |

$10,149 |

$10,736 |

$10,359 |

09/2023 |

$9,977 |

$10,551 |

$10,170 |

10/2023 |

$9,989 |

$10,476 |

$10,171 |

11/2023 |

$10,333 |

$10,836 |

$10,520 |

12/2023 |

$10,728 |

$11,183 |

$10,925 |

01/2024 |

$10,653 |

$11,161 |

$10,887 |

02/2024 |

$10,565 |

$11,084 |

$10,788 |

03/2024 |

$10,691 |

$11,184 |

$10,928 |

04/2024 |

$10,515 |

$11,004 |

$10,770 |

05/2024 |

$10,565 |

$11,101 |

$10,826 |

06/2024 |

$10,653 |

$11,198 |

$10,886 |

07/2024 |

$10,866 |

$11,414 |

$11,123 |

08/2024 |

$10,942 |

$11,539 |

$11,204 |

09/2024 |

$11,080 |

$11,673 |

$11,344 |

10/2024 |

$10,967 |

$11,515 |

$11,249 |

11/2024 |

$11,180 |

$11,652 |

$11,458 |

12/2024 |

$11,034 |

$11,562 |

$11,344 |

|

| Average Annual Return [Table Text Block] |

|

AATR |

1 Year |

5 Years |

Since Inception 2/28/17 |

Class N |

2.85% |

(0.39%) |

1.26% |

Bloomberg Global Aggregate Bond Index - USD Hedged |

3.40% |

0.48% |

1.86% |

Bloomberg MSCI Global Green Bond Index - USD Hedged |

3.83% |

(0.32%) |

1.62% | |

| Performance Inception Date |

|

Feb. 28, 2017

|

| Previous Investment Adviser [Text Block] |

|

|

| Updated Performance Information Location [Text Block] |

|

visit im.natixis.com/en-us/products/mutual-funds/price-and-performance

|

| AssetsNet |

|

$ 38,096,678

|

| Holdings Count | Holding |

|

82

|

| Advisory Fees Paid, Amount |

|

$ 17,744

|

| InvestmentCompanyPortfolioTurnover |

|

10.00%

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$38,096,678 |

# of Portfolio Holdings (including overnight repurchase agreements and derivatives) |

82 |

Portfolio Turnover Rate |

10% |

Total Advisory Fees Paid (after waiver/reimbursement, if applicable) |

$17,744 | |

| Holdings [Text Block] |

|

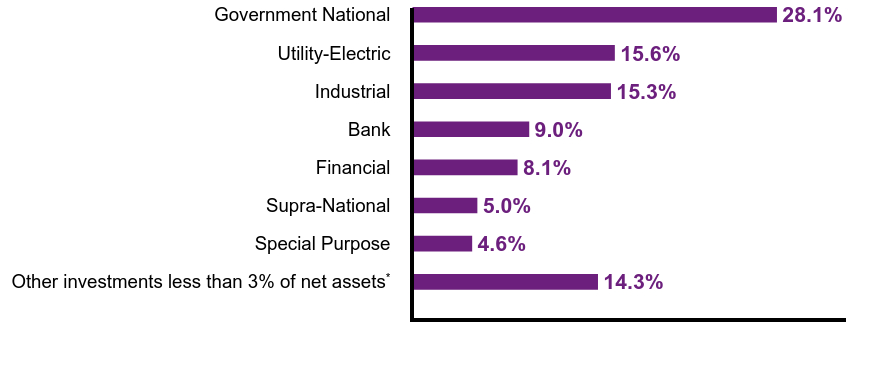

Value |

Value |

Other investments less than 3% of net assetsFootnote Reference* |

14.3% |

Special Purpose |

4.6% |

Supra-National |

5.0% |

Financial |

8.1% |

Bank |

9.0% |

Industrial |

15.3% |

Utility-Electric |

15.6% |

Government National |

28.1% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities (including futures contracts) |

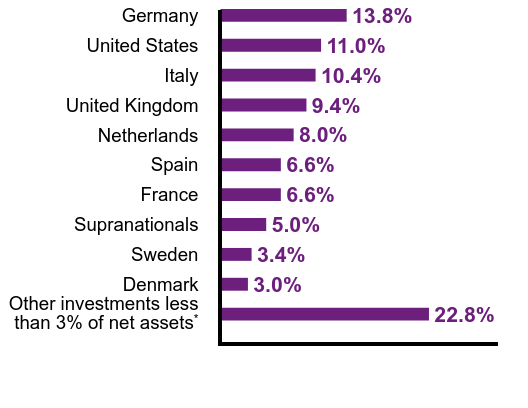

Value |

Value |

Other investments less than 3% of net assetsFootnote Reference* |

22.8% |

Denmark |

3.0% |

Sweden |

3.4% |

Supranationals |

5.0% |

France |

6.6% |

Spain |

6.6% |

Netherlands |

8.0% |

United Kingdom |

9.4% |

Italy |

10.4% |

United States |

11.0% |

Germany |

13.8% | |

| Credit Quality Explanation [Text Block] |

|

Credit ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

| C000178446 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

Mirova Global Green Bond Fund

|

| Class Name |

|

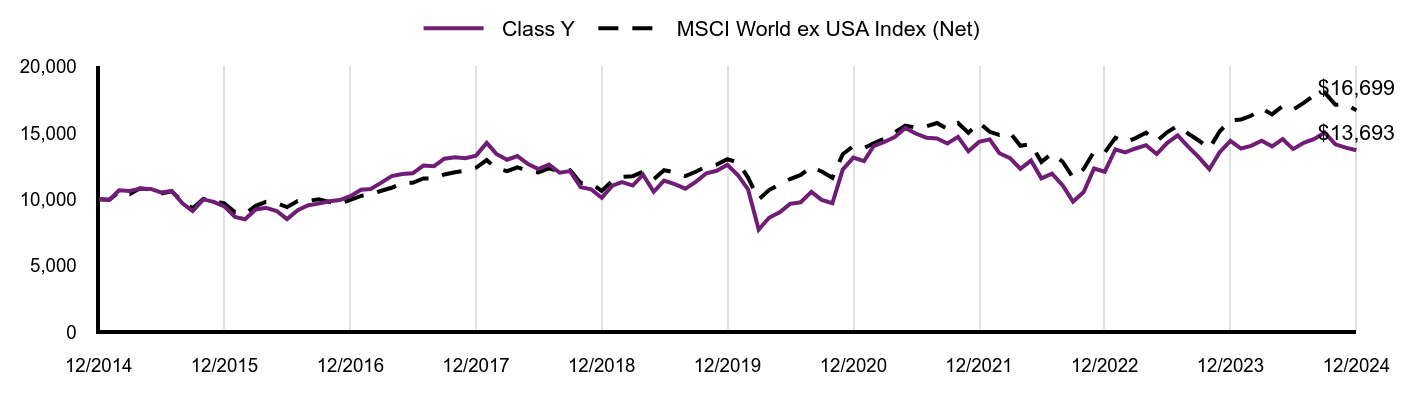

Class Y

|

| Trading Symbol |

|

MGGYX

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about Mirova Global Green Bond Fund for the period of January 1, 2024 to December 31, 2024.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

|

| Additional Information Phone Number |

|

(800) 225-5478

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; white-space-collapse: preserve-breaks;">im.natixis.com/funddocuments</span>

|

| Expenses [Text Block] |

|

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

Class Y |

$66 |

0.65% |

| Footnote |

Description |

Footnote† |

Annualized for periods less than one year (if applicable). | |

| Expenses Paid, Amount |

|

$ 66

|

| Expense Ratio, Percent |

|

0.65%

|

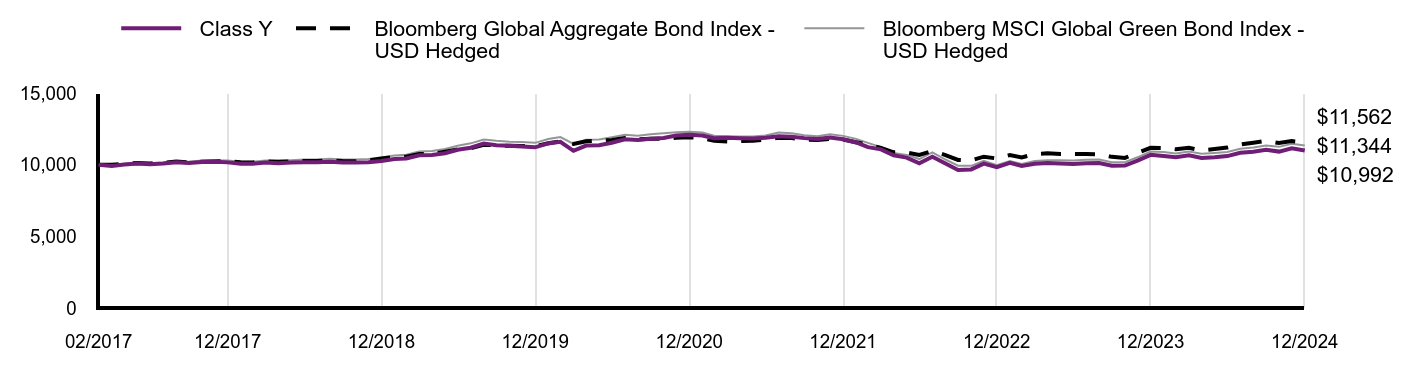

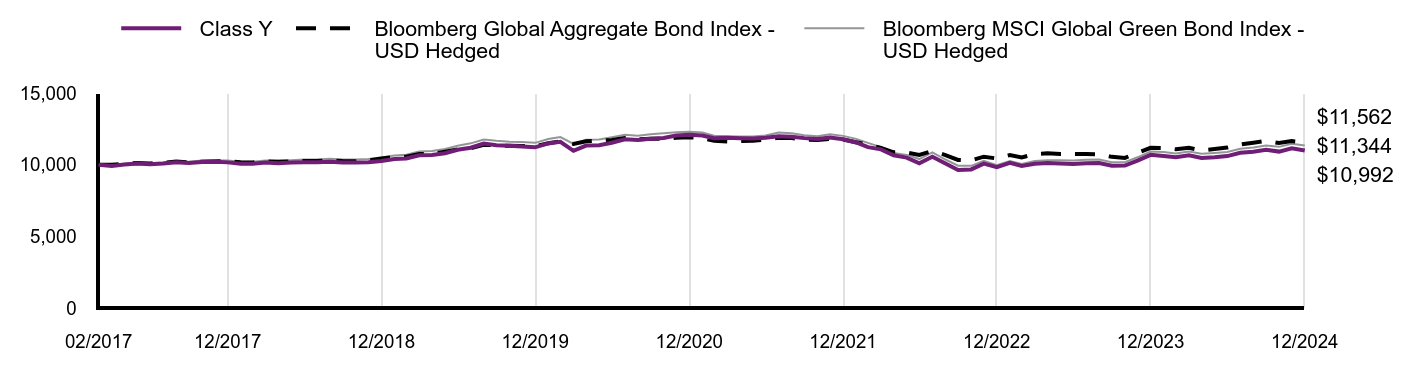

| Factors Affecting Performance [Text Block] |

|

How did the fund perform last year and what affected its performance?Explanation of Fund Performance In 2024, the Mirova Global Green Bond Fund lagged in overall performance which can be attributed to movements on the yield curve. Top Contributors to Performance •Allocation had a positive impact on the Fund during the year due to its long position on credit, while US and Euro credit spreads compressed. •Issue selection during the year was also positive. The largest contributors to this outperformance were among the corporate holdings, namely Altarea, Johnson Controls, and EIB. Top Detractors from Performance •The Fund's duration and curve strategy during the year incurred a cost, negatively impacting performance. •Yield curve positioning on the CAD zone, Euro zone and USD zone were negative throughout the year. •Among the worst detractors were Philips, Vestas, and Credit Mutuelle Arkea. |

| Performance Past Does Not Indicate Future [Text] |

|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance,

|

| Line Graph [Table Text Block] |

|

|

Class Y |

Bloomberg Global Aggregate Bond Index - USD Hedged |

Bloomberg MSCI Global Green Bond Index - USD Hedged |

02/2017 |

$10,000 |

$10,000 |

$10,000 |

03/2017 |

$9,920 |

$9,995 |

$9,984 |

04/2017 |

$10,020 |

$10,063 |

$10,076 |

05/2017 |

$10,080 |

$10,122 |

$10,149 |

06/2017 |

$10,040 |

$10,094 |

$10,103 |

07/2017 |

$10,090 |

$10,127 |

$10,153 |

08/2017 |

$10,180 |

$10,219 |

$10,266 |

09/2017 |

$10,130 |

$10,172 |

$10,216 |

10/2017 |

$10,191 |

$10,215 |

$10,295 |

11/2017 |

$10,201 |

$10,231 |

$10,316 |

12/2017 |

$10,166 |

$10,253 |

$10,302 |

01/2018 |

$10,075 |

$10,180 |

$10,217 |

02/2018 |

$10,075 |

$10,157 |

$10,217 |

03/2018 |

$10,153 |

$10,242 |

$10,293 |

04/2018 |

$10,112 |

$10,203 |

$10,271 |

05/2018 |

$10,153 |

$10,242 |

$10,322 |

06/2018 |

$10,171 |

$10,261 |

$10,362 |

07/2018 |

$10,171 |

$10,263 |

$10,368 |

08/2018 |

$10,213 |

$10,295 |

$10,422 |

09/2018 |

$10,162 |

$10,256 |

$10,372 |

10/2018 |

$10,162 |

$10,236 |

$10,372 |

11/2018 |

$10,183 |

$10,286 |

$10,404 |

12/2018 |

$10,257 |

$10,434 |

$10,515 |

01/2019 |

$10,405 |

$10,545 |

$10,648 |

02/2019 |

$10,436 |

$10,557 |

$10,694 |

03/2019 |

$10,656 |

$10,747 |

$10,923 |

04/2019 |

$10,688 |

$10,753 |

$10,961 |

05/2019 |

$10,804 |

$10,908 |

$11,095 |

06/2019 |

$11,042 |

$11,061 |

$11,327 |

07/2019 |

$11,190 |

$11,148 |

$11,494 |

08/2019 |

$11,477 |

$11,400 |

$11,757 |

09/2019 |

$11,367 |

$11,348 |

$11,675 |

10/2019 |

$11,324 |

$11,328 |

$11,613 |

11/2019 |

$11,282 |

$11,315 |

$11,596 |

12/2019 |

$11,218 |

$11,292 |

$11,529 |

01/2020 |

$11,489 |

$11,495 |

$11,801 |

02/2020 |

$11,597 |

$11,636 |

$11,929 |

03/2020 |

$10,970 |

$11,455 |

$11,460 |

04/2020 |

$11,339 |

$11,640 |

$11,743 |

05/2020 |

$11,361 |

$11,673 |

$11,771 |

06/2020 |

$11,539 |

$11,732 |

$11,922 |

07/2020 |

$11,778 |

$11,860 |

$12,093 |

08/2020 |

$11,724 |

$11,774 |

$12,027 |

09/2020 |

$11,816 |

$11,817 |

$12,125 |

10/2020 |

$11,871 |

$11,818 |

$12,192 |

11/2020 |

$12,045 |

$11,885 |

$12,265 |

12/2020 |

$12,099 |

$11,922 |

$12,298 |

01/2021 |

$12,043 |

$11,858 |

$12,244 |

02/2021 |

$11,852 |

$11,673 |

$12,021 |

03/2021 |

$11,883 |

$11,627 |

$11,990 |

04/2021 |

$11,849 |

$11,658 |

$11,967 |

05/2021 |

$11,826 |

$11,684 |

$11,972 |

06/2021 |

$11,884 |

$11,741 |

$12,037 |

07/2021 |

$11,997 |

$11,887 |

$12,248 |

08/2021 |

$11,952 |

$11,863 |

$12,200 |

09/2021 |

$11,859 |

$11,751 |

$12,055 |

10/2021 |

$11,791 |

$11,720 |

$11,991 |

11/2021 |

$11,893 |

$11,804 |

$12,132 |

12/2021 |

$11,774 |

$11,756 |

$12,016 |

01/2022 |

$11,554 |

$11,571 |

$11,806 |

02/2022 |

$11,229 |

$11,417 |

$11,524 |

03/2022 |

$11,076 |

$11,171 |

$11,233 |

04/2022 |

$10,664 |

$10,871 |

$10,828 |

05/2022 |

$10,499 |

$10,856 |

$10,691 |

06/2022 |

$10,099 |

$10,691 |

$10,398 |

07/2022 |

$10,558 |

$10,963 |

$10,872 |

08/2022 |

$10,087 |

$10,677 |

$10,366 |

09/2022 |

$9,640 |

$10,334 |

$9,935 |

10/2022 |

$9,675 |

$10,299 |

$9,925 |

11/2022 |

$10,075 |

$10,562 |

$10,278 |

12/2022 |

$9,838 |

$10,437 |

$9,972 |

01/2023 |

$10,132 |

$10,677 |

$10,263 |

02/2023 |

$9,923 |

$10,507 |

$10,054 |

03/2023 |

$10,070 |

$10,740 |

$10,267 |

04/2023 |

$10,119 |

$10,795 |

$10,312 |

05/2023 |

$10,083 |

$10,753 |

$10,308 |

06/2023 |

$10,058 |

$10,746 |

$10,299 |

07/2023 |

$10,107 |

$10,750 |

$10,341 |

08/2023 |

$10,119 |

$10,736 |

$10,359 |

09/2023 |

$9,936 |

$10,551 |

$10,170 |

10/2023 |

$9,948 |

$10,476 |

$10,171 |

11/2023 |

$10,291 |

$10,836 |

$10,520 |

12/2023 |

$10,693 |

$11,183 |

$10,925 |

01/2024 |

$10,605 |

$11,161 |

$10,887 |

02/2024 |

$10,530 |

$11,084 |

$10,788 |

03/2024 |

$10,655 |

$11,184 |

$10,928 |

04/2024 |

$10,480 |

$11,004 |

$10,770 |

05/2024 |

$10,518 |

$11,101 |

$10,826 |

06/2024 |

$10,605 |

$11,198 |

$10,886 |

07/2024 |

$10,831 |

$11,414 |

$11,123 |

08/2024 |

$10,906 |

$11,539 |

$11,204 |

09/2024 |

$11,044 |

$11,673 |

$11,344 |

10/2024 |

$10,918 |

$11,515 |

$11,249 |

11/2024 |

$11,144 |

$11,652 |

$11,458 |

12/2024 |

$10,992 |

$11,562 |

$11,344 |

|

| Average Annual Return [Table Text Block] |

|

AATR |

1 Year |

5 Years |

Since Inception 2/28/17 |

Class Y |

2.80% |

(0.41%) |

1.21% |

Bloomberg Global Aggregate Bond Index - USD Hedged |

3.40% |

0.48% |

1.86% |

Bloomberg MSCI Global Green Bond Index - USD Hedged |

3.83% |

(0.32%) |

1.62% | |

| Performance Inception Date |

|

Feb. 28, 2017

|

| Previous Investment Adviser [Text Block] |

|

|

| Updated Performance Information Location [Text Block] |

|

visit im.natixis.com/en-us/products/mutual-funds/price-and-performance

|

| AssetsNet |

|

$ 38,096,678

|

| Holdings Count | Holding |

|

82

|

| Advisory Fees Paid, Amount |

|

$ 17,744

|

| InvestmentCompanyPortfolioTurnover |

|

10.00%

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$38,096,678 |

# of Portfolio Holdings (including overnight repurchase agreements and derivatives) |

82 |

Portfolio Turnover Rate |

10% |

Total Advisory Fees Paid (after waiver/reimbursement, if applicable) |

$17,744 | |

| Holdings [Text Block] |

|

Value |

Value |

Other investments less than 3% of net assetsFootnote Reference* |

14.3% |

Special Purpose |

4.6% |

Supra-National |

5.0% |

Financial |

8.1% |

Bank |

9.0% |

Industrial |

15.3% |

Utility-Electric |

15.6% |

Government National |

28.1% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities (including futures contracts) |

Value |

Value |

Other investments less than 3% of net assetsFootnote Reference* |

22.8% |

Denmark |

3.0% |

Sweden |

3.4% |

Supranationals |

5.0% |

France |

6.6% |

Spain |

6.6% |

Netherlands |

8.0% |

United Kingdom |

9.4% |

Italy |

10.4% |

United States |

11.0% |

Germany |

13.8% | |

| Credit Quality Explanation [Text Block] |

|

Credit ratings are by S&P Global Ratings. A credit rating is an assessment provided by a nationally recognized statistical rating organization (NRSRO) of the creditworthiness of an issuer with respect to debt obligations except for those debt obligations that are only privately rated. Ratings are measured on a scale that generally ranges from AAA (highest) to D (lowest). The credit ratings shown relate to the creditworthiness of the issuers of the underlying securities in the Fund, and not to the Fund or its shares. Credit ratings are subject to change.

|

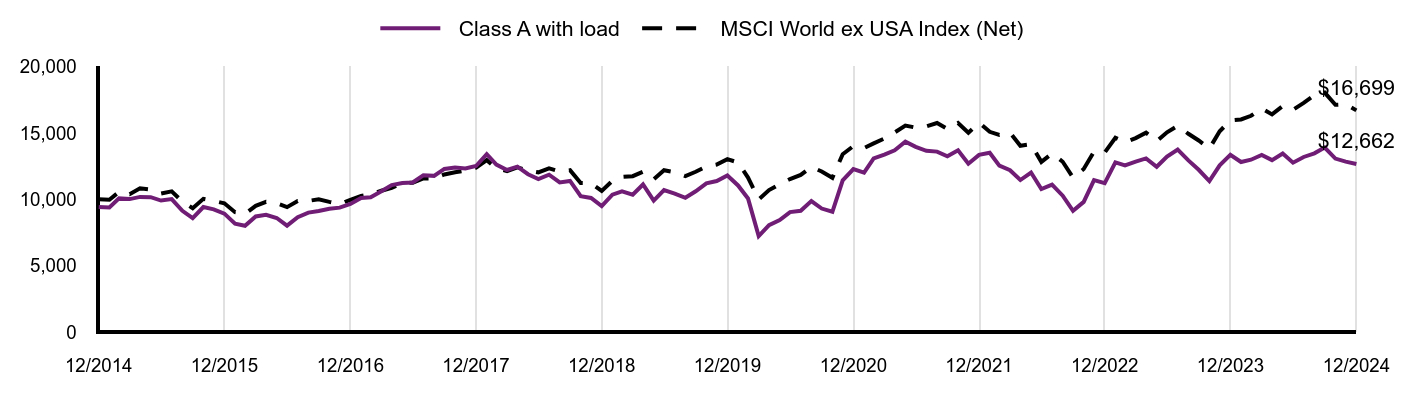

| C000167845 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

Mirova Global Sustainable Equity Fund

|

| Class Name |

|

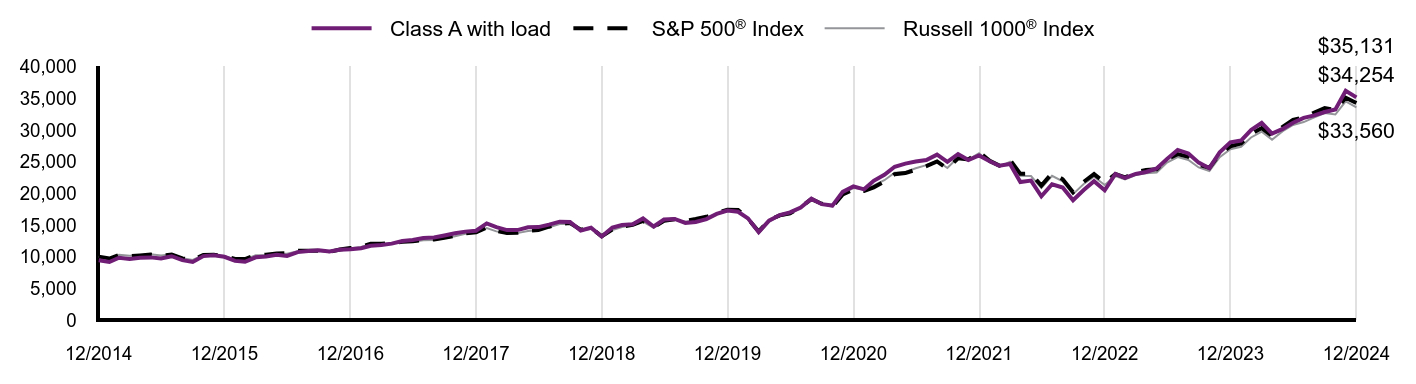

Class A

|

| Trading Symbol |

|

ESGMX

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about Mirova Global Sustainable Equity Fund for the period of January 1, 2024 to December 31, 2024.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

|

| Additional Information Phone Number |

|

(800) 225-5478

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; white-space-collapse: preserve-breaks;">im.natixis.com/funddocuments</span>

|

| Expenses [Text Block] |

|

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

Class A |

$128 |

1.20% |

| Footnote |

Description |

Footnote† |

Annualized for periods less than one year (if applicable). | |

| Expenses Paid, Amount |

|

$ 128

|

| Expense Ratio, Percent |

|

1.20%

|

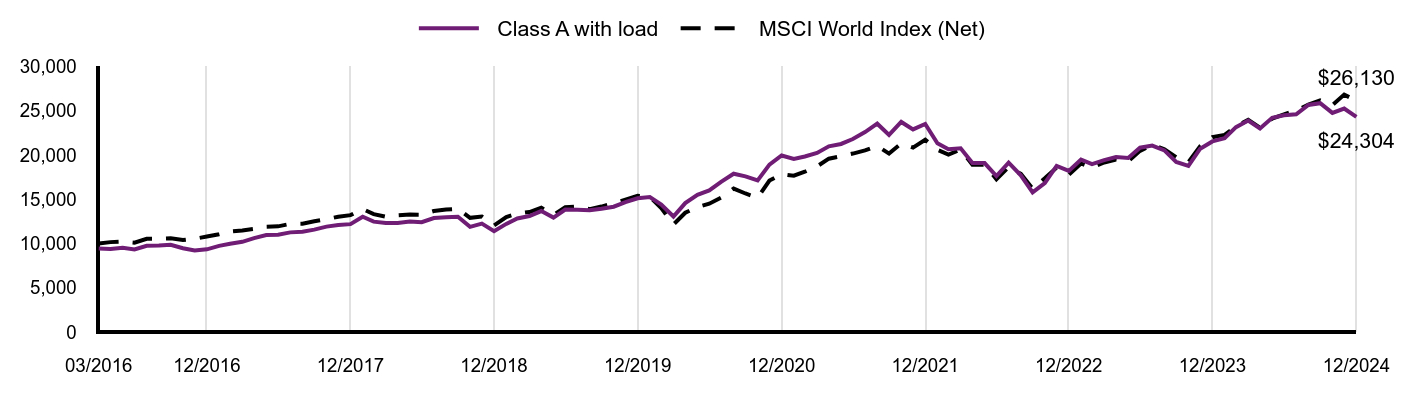

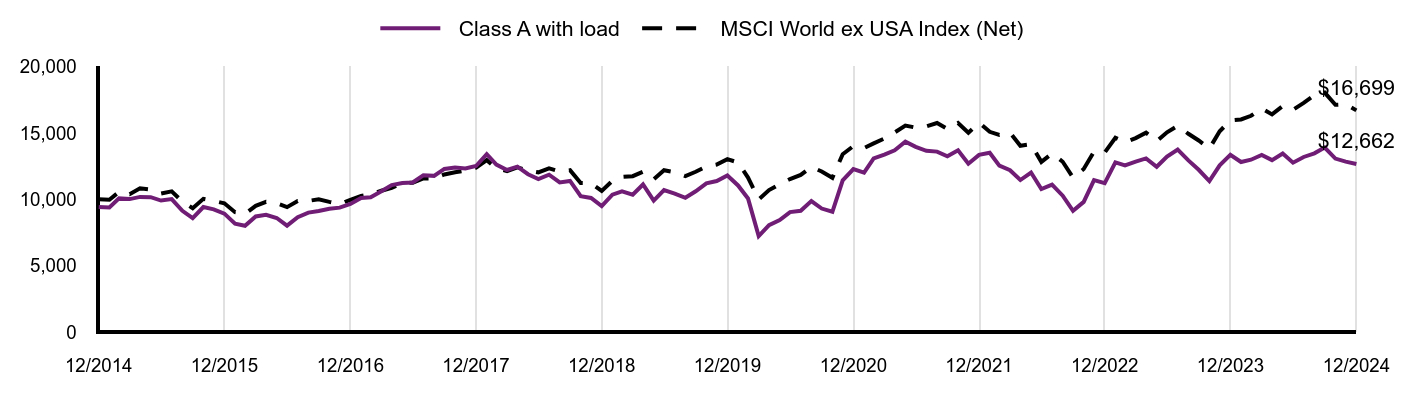

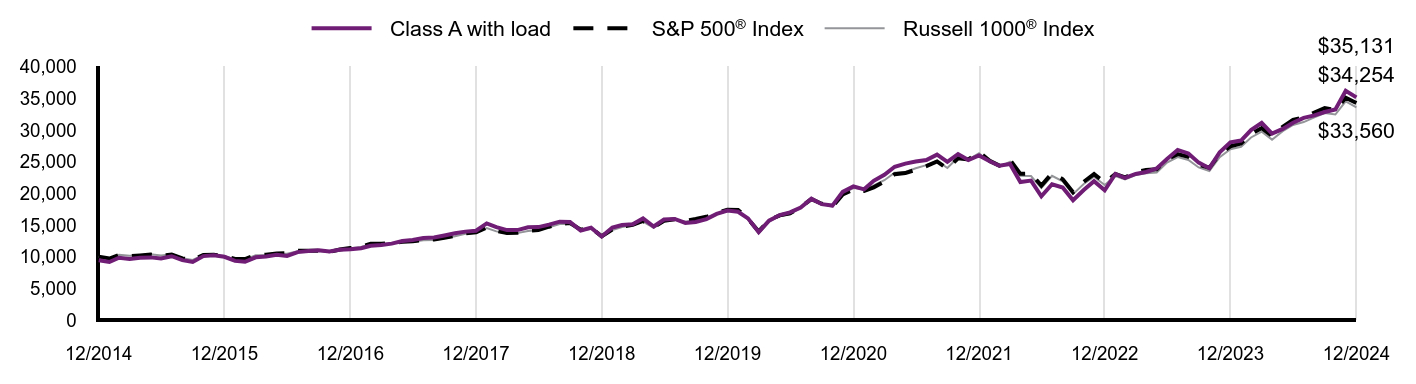

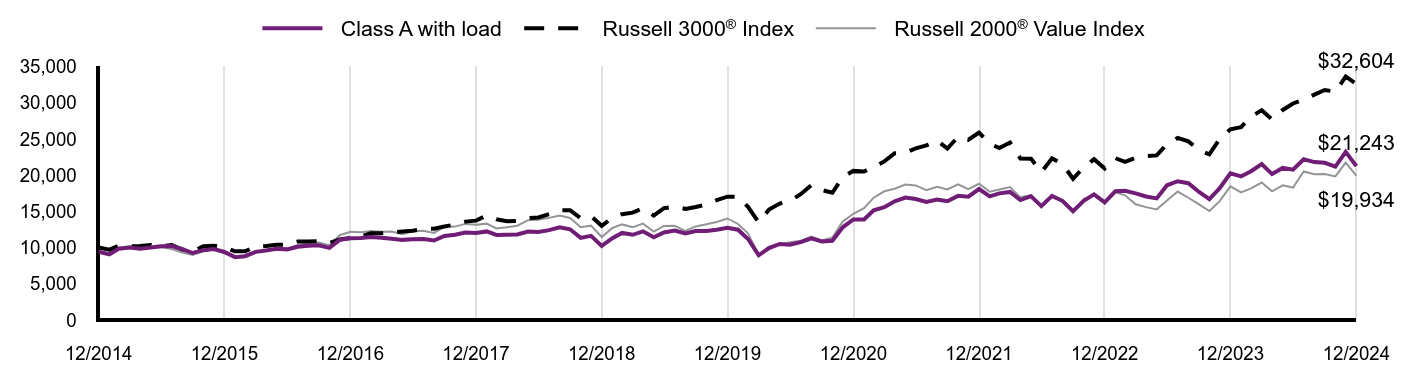

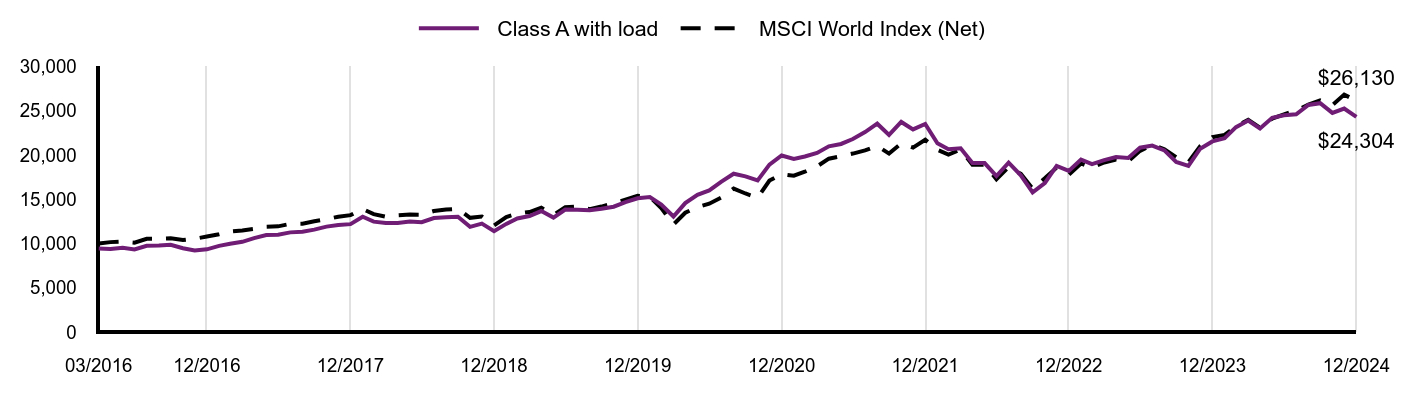

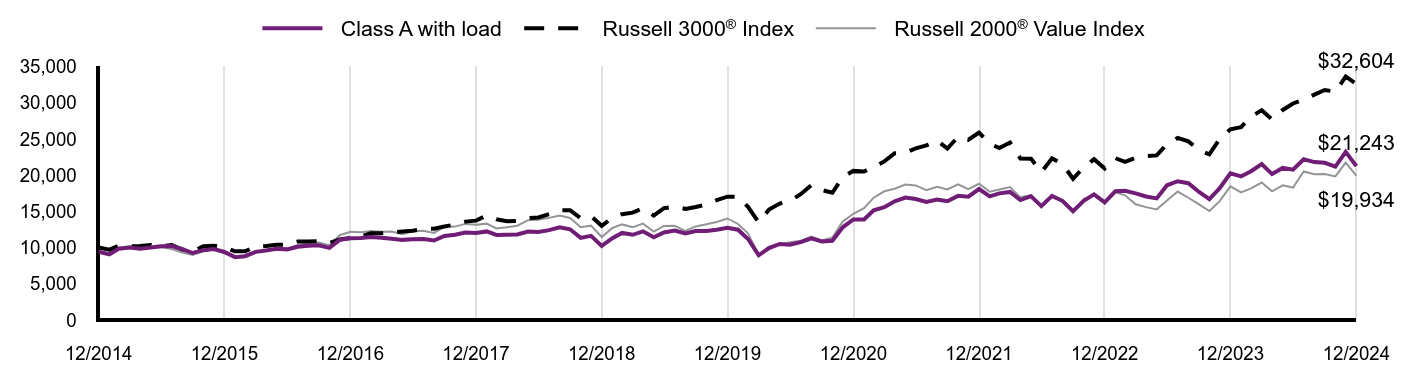

| Factors Affecting Performance [Text Block] |

|

How did the fund perform last year and what affected its performance?Explanation of Fund Performance While the Fund delivered strong absolute returns for the full year, it lagged in overall performance mainly due to fourth quarter results as the Fund was underexposed to some of the areas expected to benefit under a Trump presidency. This included U.S. stocks, bank and energy stocks, and lower quality and procyclical areas. Certain companies also faced industry-wide or company-specific challenges. Top Contributors to Performance • Lack of exposure to the Energy and Real Estate sectors and an underweight to Consumer Staples contributed to performance. • Stock selection in Health Care (Eli Lilly and Intuitive Surgical) and Materials (Smurfit Westrock and not owning mining companies) contributed. •Nvidia, Taiwan Semi and eBay were the largest contributors to performance. Top Detractors from Performance •An overweight to Health Care and Materials, and underweight to Communication Services, which was led by Magnificent 7 stocks the Fund does not own (Meta, Alphabet), detracted. •As U.S. equities outperformed, driven in part by the Magnificent 7, the Fund’s U.S. underweight and Europe overweight detracted. •Stock picks in Industrials (Vestas Wind Systems and AGCO Corp) and Financials (AIA Group and Legal & General) detracted from relative performance. •Vestas Wind Systems, Aptiv and Adobe were the largest detractors overall. The Fund continued to invest for the long term, in high-quality companies likely to benefit from the demographic, technological, environmental and governance related transitions expected to transform the world’s economies during the next decade. |

| Performance Past Does Not Indicate Future [Text] |

|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance,

|

| Line Graph [Table Text Block] |

|

|

Class A with load |

MSCI World Index (Net) |

03/2016 |

$9,425 |

$10,000 |

04/2016 |

$9,369 |

$10,158 |

05/2016 |

$9,529 |

$10,215 |

06/2016 |

$9,331 |

$10,101 |

07/2016 |

$9,746 |

$10,528 |

08/2016 |

$9,764 |

$10,536 |

09/2016 |

$9,859 |

$10,592 |

10/2016 |

$9,463 |

$10,387 |

11/2016 |

$9,208 |

$10,537 |

12/2016 |

$9,345 |

$10,789 |

01/2017 |

$9,732 |

$11,049 |

02/2017 |

$9,967 |

$11,356 |

03/2017 |

$10,194 |

$11,477 |

04/2017 |

$10,609 |

$11,647 |

05/2017 |

$10,968 |

$11,893 |

06/2017 |

$10,987 |

$11,939 |

07/2017 |

$11,261 |

$12,224 |

08/2017 |

$11,336 |

$12,242 |

09/2017 |

$11,572 |

$12,516 |

10/2017 |

$11,912 |

$12,753 |

11/2017 |

$12,101 |

$13,029 |

12/2017 |

$12,189 |

$13,206 |

01/2018 |

$13,029 |

$13,903 |

02/2018 |

$12,476 |

$13,327 |

03/2018 |

$12,333 |

$13,036 |

04/2018 |

$12,322 |

$13,186 |

05/2018 |

$12,475 |

$13,269 |

06/2018 |

$12,418 |

$13,262 |

07/2018 |

$12,879 |

$13,677 |

08/2018 |

$12,975 |

$13,846 |

09/2018 |

$13,023 |

$13,923 |

10/2018 |

$11,880 |

$12,901 |

11/2018 |

$12,245 |

$13,047 |

12/2018 |

$11,392 |

$12,055 |

01/2019 |

$12,218 |

$12,993 |

02/2019 |

$12,834 |

$13,384 |

03/2019 |

$13,103 |

$13,560 |

04/2019 |

$13,667 |

$14,040 |

05/2019 |

$12,935 |

$13,230 |

06/2019 |

$13,838 |

$14,102 |

07/2019 |

$13,808 |

$14,172 |

08/2019 |

$13,757 |

$13,882 |

09/2019 |

$13,938 |

$14,177 |

10/2019 |

$14,159 |

$14,538 |

11/2019 |

$14,681 |

$14,943 |

12/2019 |

$15,109 |

$15,391 |

01/2020 |

$15,261 |

$15,297 |

02/2020 |

$14,400 |

$14,004 |

03/2020 |

$13,053 |

$12,151 |

04/2020 |

$14,573 |

$13,478 |

05/2020 |

$15,510 |

$14,129 |

06/2020 |

$16,008 |

$14,503 |

07/2020 |

$16,995 |

$15,197 |

08/2020 |

$17,891 |

$16,212 |

09/2020 |

$17,596 |

$15,653 |

10/2020 |

$17,128 |

$15,173 |

11/2020 |

$18,919 |

$17,113 |

12/2020 |

$19,954 |

$17,838 |

01/2021 |

$19,566 |

$17,661 |

02/2021 |

$19,842 |

$18,114 |

03/2021 |

$20,239 |

$18,716 |

04/2021 |

$20,983 |

$19,587 |

05/2021 |

$21,252 |

$19,869 |

06/2021 |

$21,810 |

$20,166 |

07/2021 |

$22,595 |

$20,527 |

08/2021 |

$23,545 |

$21,038 |

09/2021 |

$22,274 |

$20,164 |

10/2021 |

$23,741 |

$21,306 |

11/2021 |

$22,894 |

$20,839 |

12/2021 |

$23,509 |

$21,730 |

01/2022 |

$21,333 |

$20,580 |

02/2022 |

$20,657 |

$20,060 |

03/2022 |

$20,772 |

$20,610 |

04/2022 |

$19,088 |

$18,898 |

05/2022 |

$19,088 |

$18,912 |

06/2022 |

$17,624 |

$17,274 |

07/2022 |

$19,148 |

$18,646 |

08/2022 |

$17,707 |

$17,866 |

09/2022 |

$15,790 |

$16,205 |

10/2022 |

$16,838 |

$17,369 |

11/2022 |

$18,767 |

$18,577 |

12/2022 |

$18,206 |

$17,788 |

01/2023 |

$19,486 |

$19,047 |

02/2023 |

$18,983 |

$18,589 |

03/2023 |

$19,426 |

$19,163 |

04/2023 |

$19,785 |

$19,499 |

05/2023 |

$19,666 |

$19,304 |

06/2023 |

$20,827 |

$20,472 |

07/2023 |

$21,066 |

$21,159 |

08/2023 |

$20,527 |

$20,654 |

09/2023 |

$19,223 |

$19,763 |

10/2023 |

$18,780 |

$19,190 |

11/2023 |

$20,719 |

$20,989 |

12/2023 |

$21,541 |

$22,019 |

01/2024 |

$21,913 |

$22,283 |

02/2024 |

$23,150 |

$23,228 |

03/2024 |

$23,906 |

$23,975 |

04/2024 |

$23,000 |

$23,084 |

05/2024 |

$24,213 |

$24,115 |

06/2024 |

$24,489 |

$24,605 |

07/2024 |

$24,598 |

$25,039 |

08/2024 |

$25,667 |

$25,701 |

09/2024 |

$25,859 |

$26,172 |

10/2024 |

$24,766 |

$25,652 |

11/2024 |

$25,258 |

$26,830 |

12/2024 |

$24,304 |

$26,130 |

|

| Average Annual Return [Table Text Block] |

|

AATR |

1 Year |

5 Years |

Since Inception 3/31/16 |

Class A at NAV |

12.83% |

9.97% |

11.43% |

Class A with 5.75% MSCFootnote Reference1 |

6.37% |

8.68% |

10.68% |

MSCI World Index (Net) |

18.67% |

11.17% |

11.56% | |

| Performance Inception Date |

|

Mar. 31, 2016

|

| Previous Investment Adviser [Text Block] |

|

|

| Updated Performance Information Location [Text Block] |

|

visit im.natixis.com/en-us/products/mutual-funds/price-and-performance

|

| AssetsNet |

|

$ 974,101,733

|

| Holdings Count | Holding |

|

51

|

| Advisory Fees Paid, Amount |

|

$ 8,602,808

|

| InvestmentCompanyPortfolioTurnover |

|

18.00%

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$974,101,733 |

# of Portfolio Holdings (including overnight repurchase agreements) |

51 |

Portfolio Turnover Rate |

18% |

Total Advisory Fees Paid (after waiver/reimbursement, if applicable) |

$8,602,808 | |

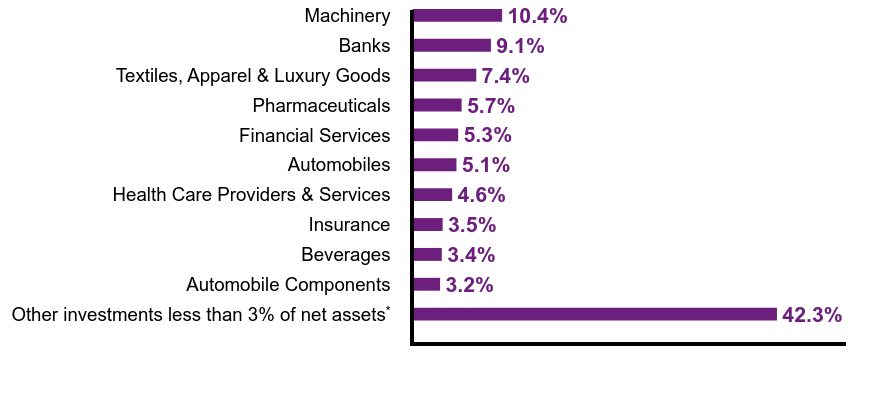

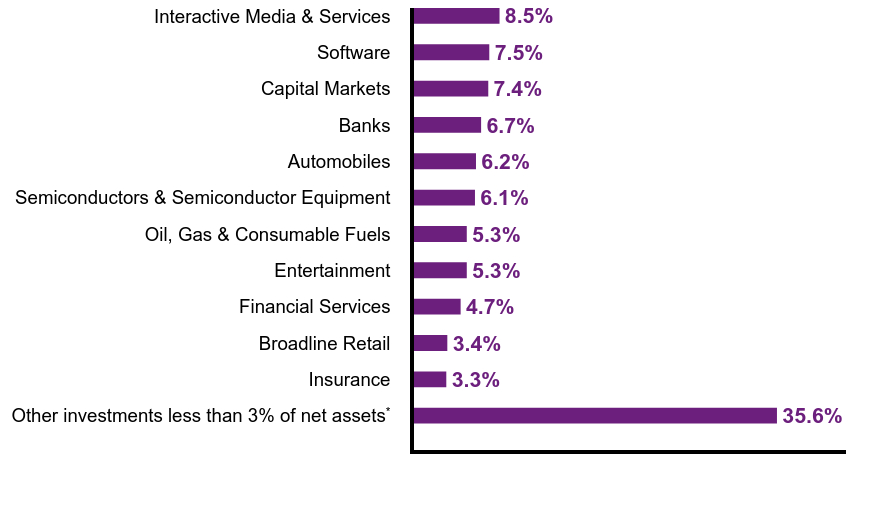

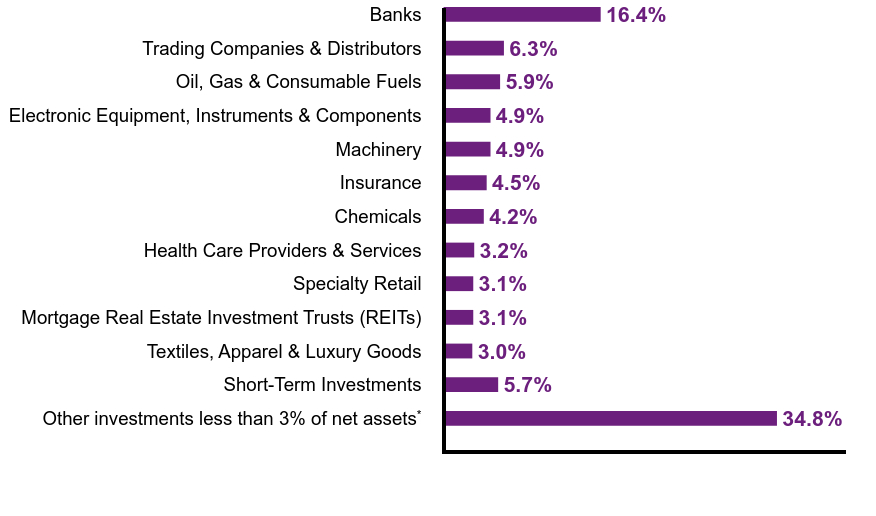

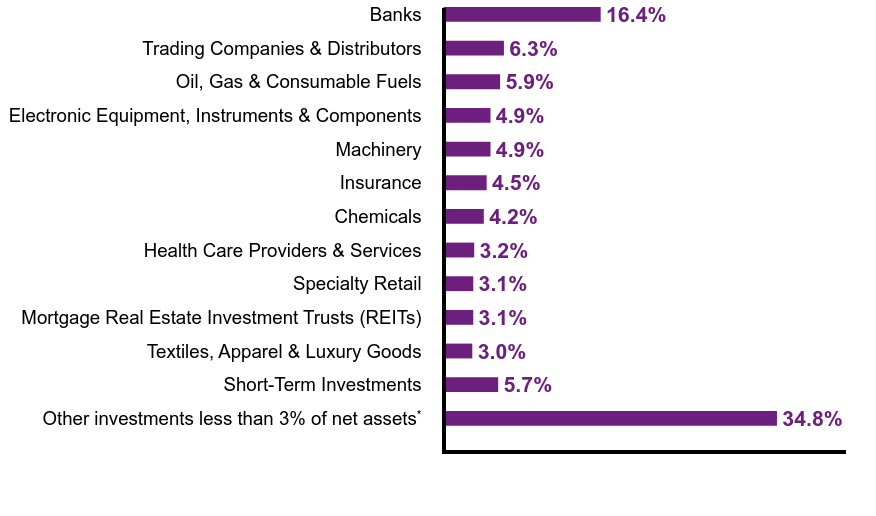

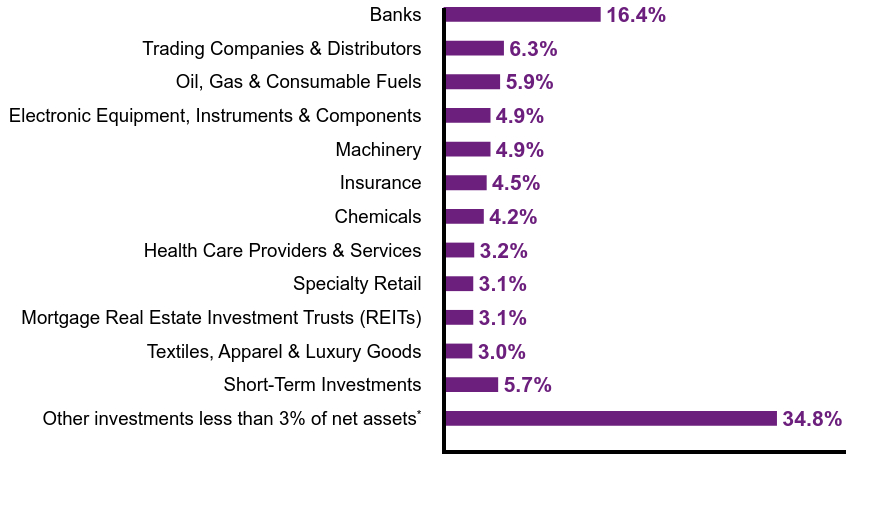

| Holdings [Text Block] |

|

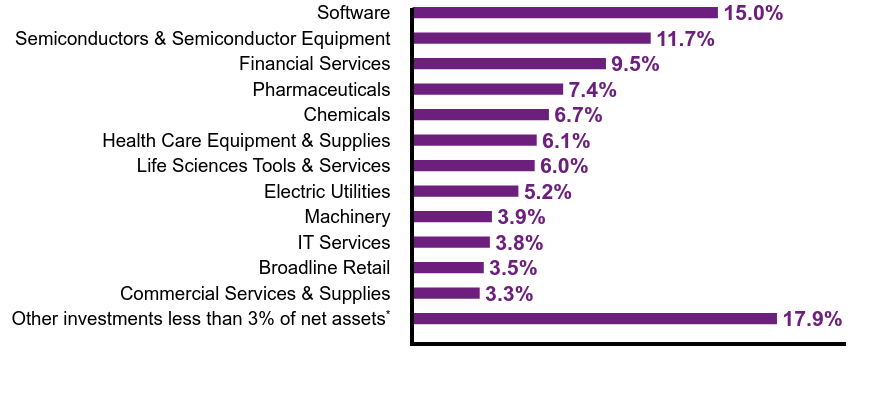

Value |

Value |

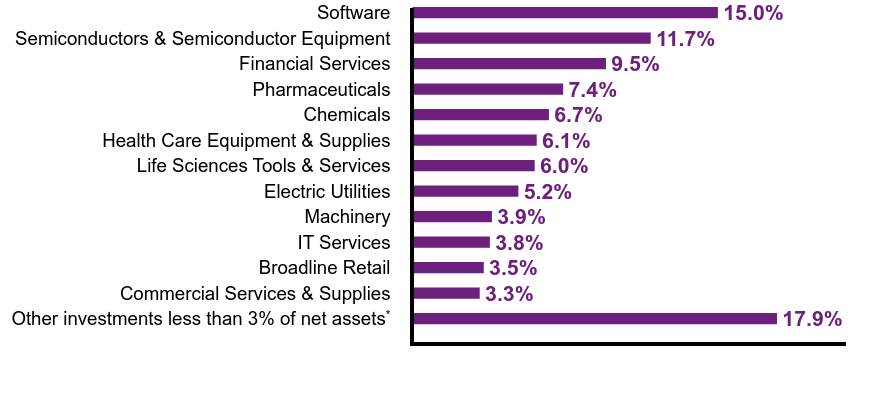

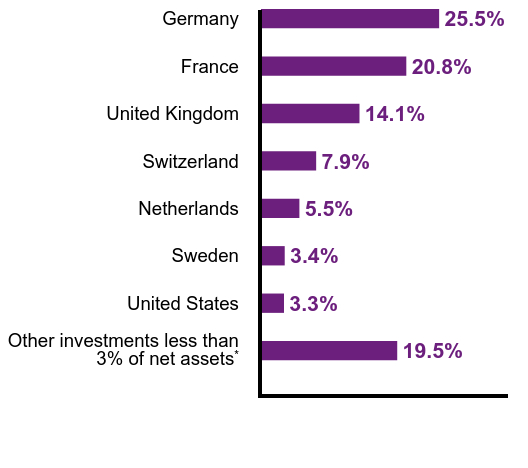

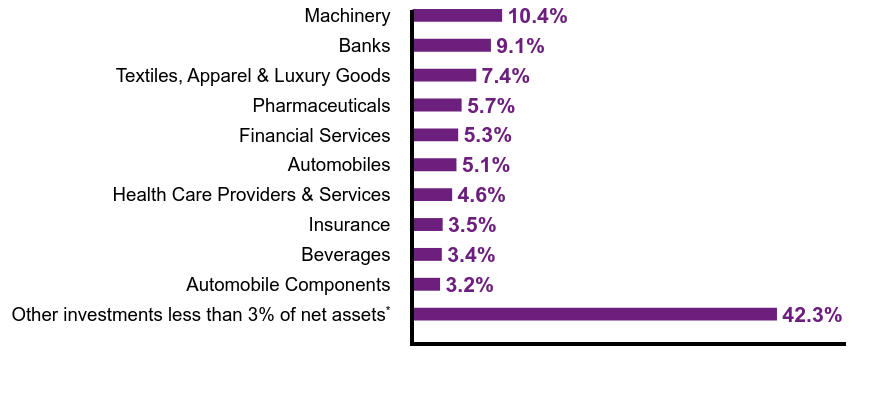

Other investments less than 3% of net assetsFootnote Reference* |

17.9% |

Commercial Services & Supplies |

3.3% |

Broadline Retail |

3.5% |

IT Services |

3.8% |

Machinery |

3.9% |

Electric Utilities |

5.2% |

Life Sciences Tools & Services |

6.0% |

Health Care Equipment & Supplies |

6.1% |

Chemicals |

6.7% |

Pharmaceuticals |

7.4% |

Financial Services |

9.5% |

Semiconductors & Semiconductor Equipment |

11.7% |

Software |

15.0% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities |

NVIDIA Corp. |

5.9% |

Microsoft Corp. |

5.5% |

Mastercard, Inc., Class A |

5.2% |

Eli Lilly & Co. |

3.8% |

Ecolab, Inc. |

3.7% |

eBay, Inc. |

3.5% |

Thermo Fisher Scientific, Inc. |

3.4% |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

3.2% |

Roper Technologies, Inc. |

3.0% |

Iberdrola SA |

2.9% |

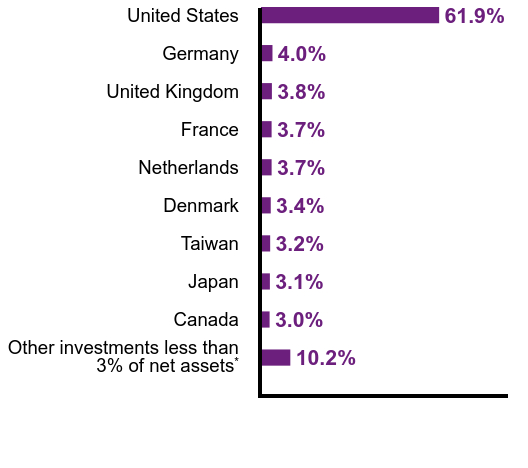

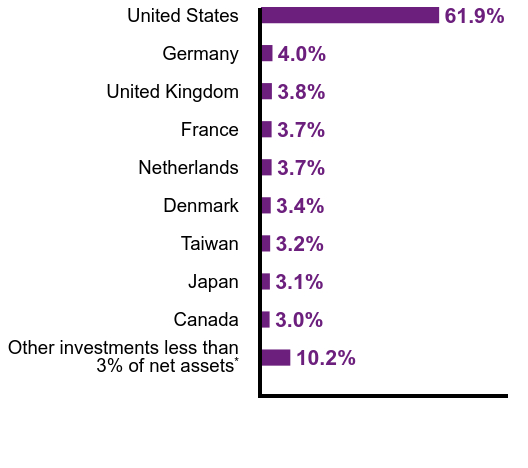

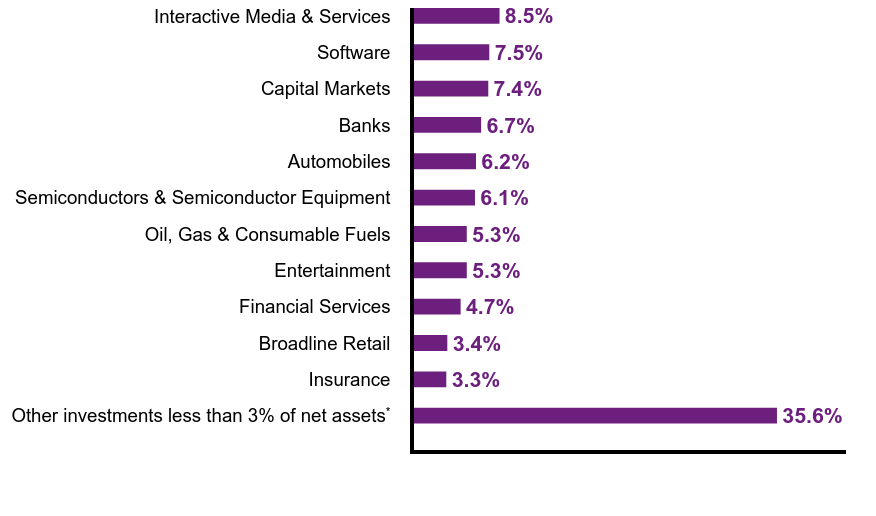

Value |

Value |

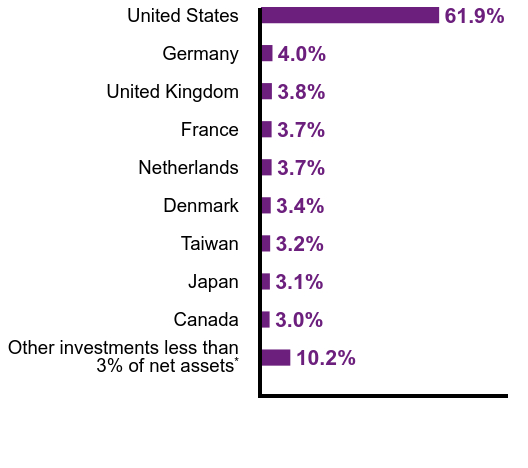

Other investments less than 3% of net assetsFootnote Reference* |

10.2% |

Canada |

3.0% |

Japan |

3.1% |

Taiwan |

3.2% |

Denmark |

3.4% |

Netherlands |

3.7% |

France |

3.7% |

United Kingdom |

3.8% |

Germany |

4.0% |

United States |

61.9% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities | |

| Material Fund Change [Text Block] |

|

There were no material fund changes during the period. |

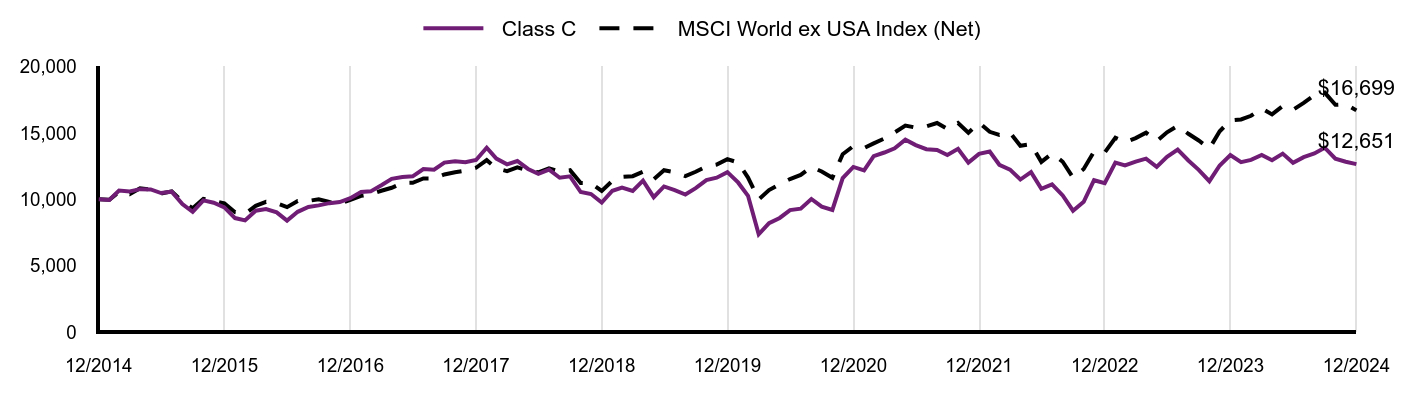

| C000167846 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

Mirova Global Sustainable Equity Fund

|

| Class Name |

|

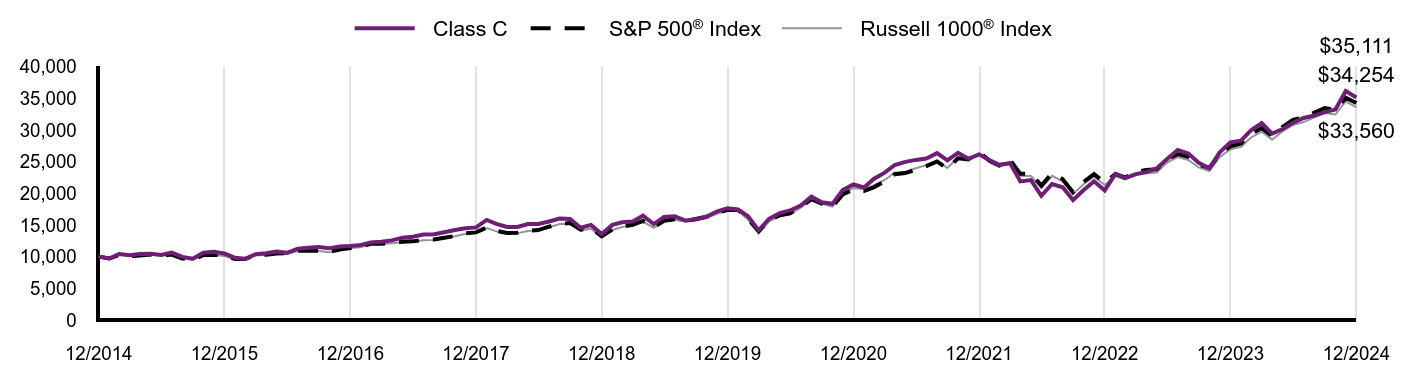

Class C

|

| Trading Symbol |

|

ESGCX

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about Mirova Global Sustainable Equity Fund for the period of January 1, 2024 to December 31, 2024.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

|

| Additional Information Phone Number |

|

(800) 225-5478

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; white-space-collapse: preserve-breaks;">im.natixis.com/funddocuments</span>

|

| Expenses [Text Block] |

|

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

Class C |

$207 |

1.95% |

| Footnote |

Description |

Footnote† |

Annualized for periods less than one year (if applicable). | |

| Expenses Paid, Amount |

|

$ 207

|

| Expense Ratio, Percent |

|

1.95%

|

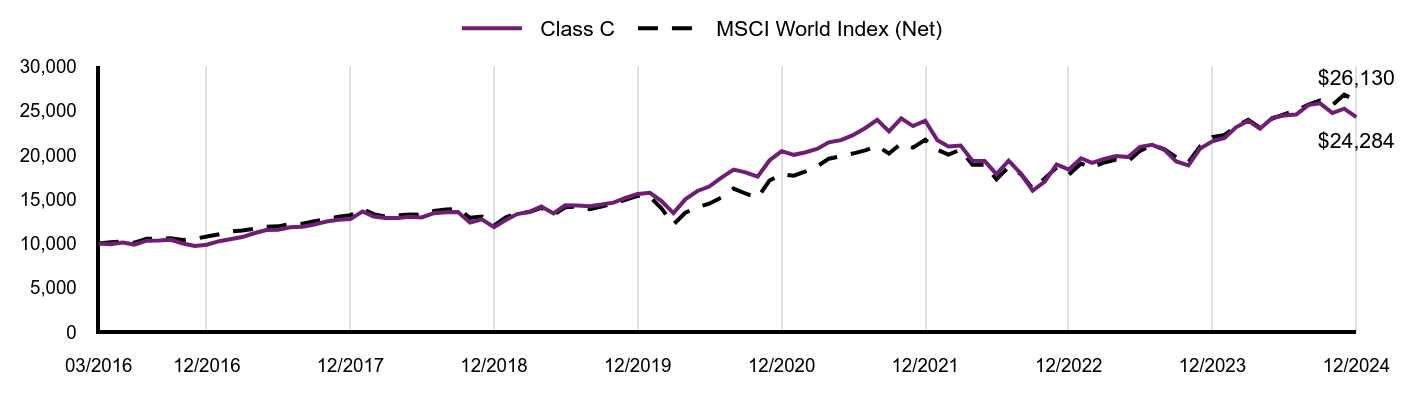

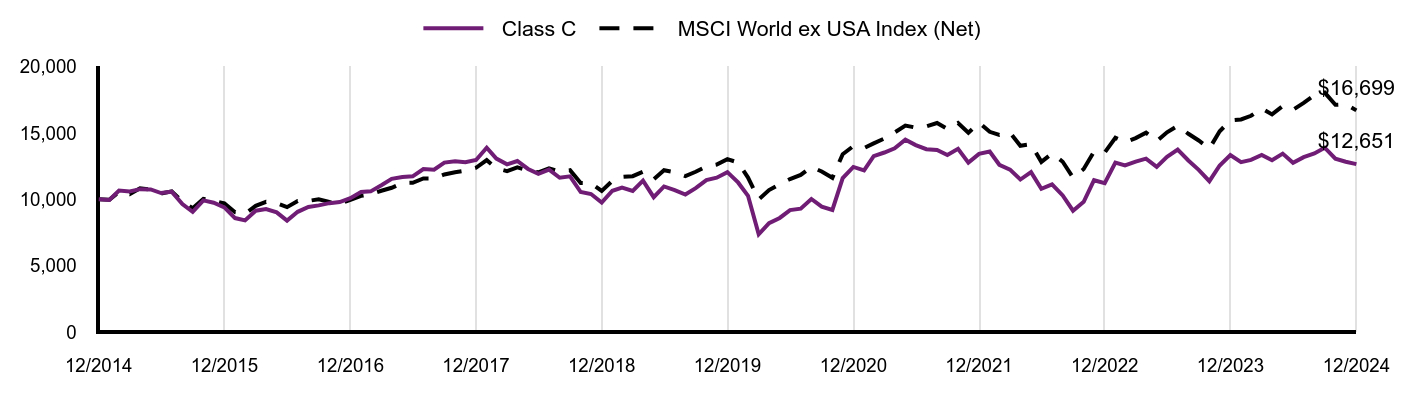

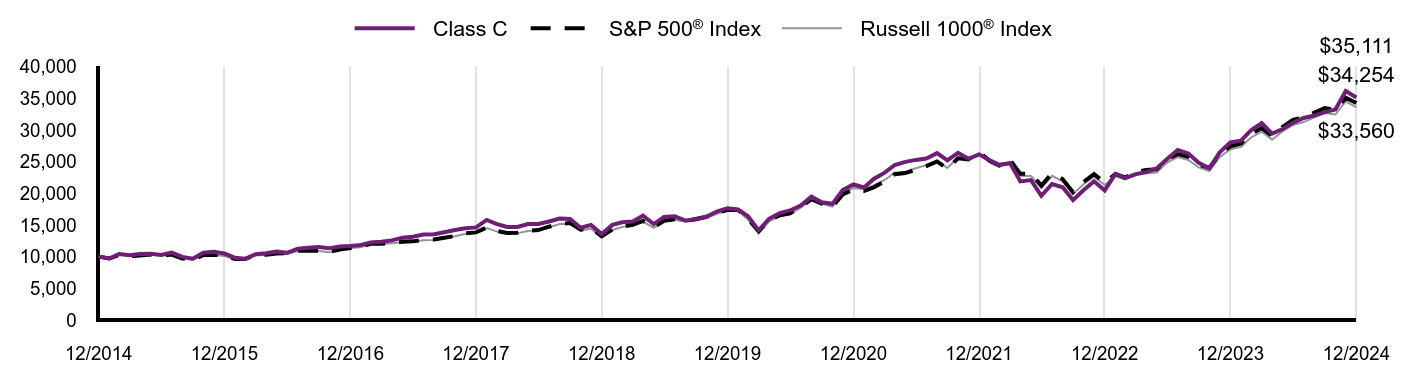

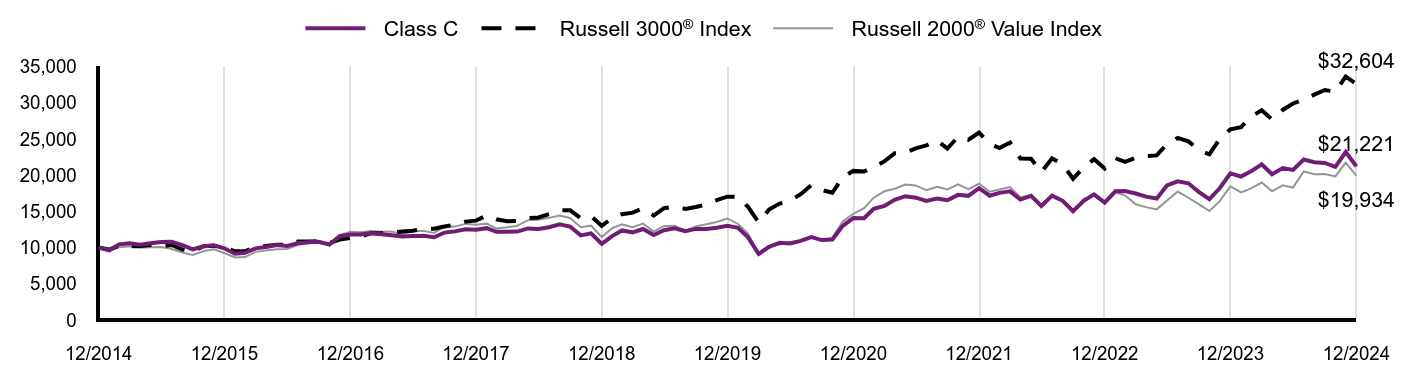

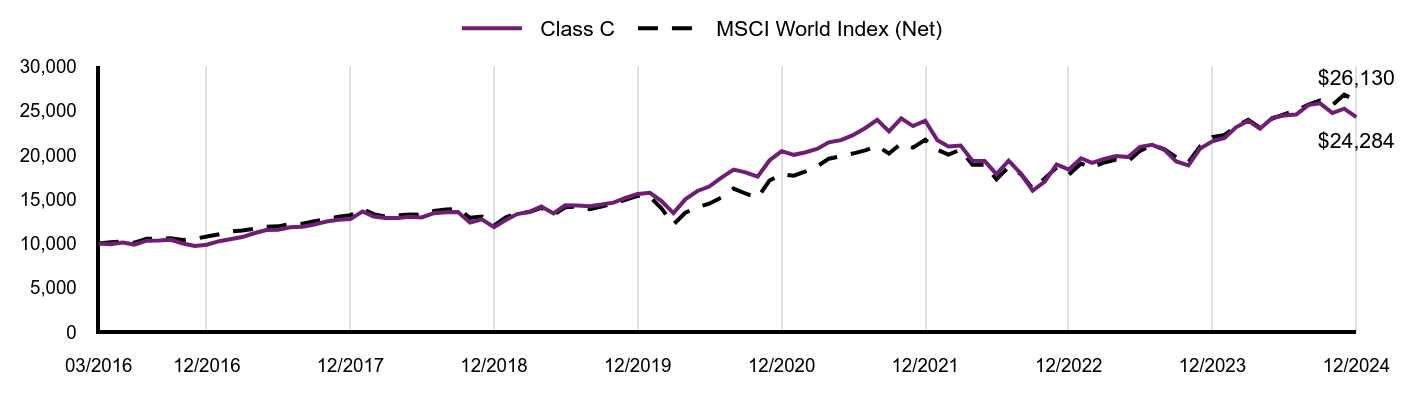

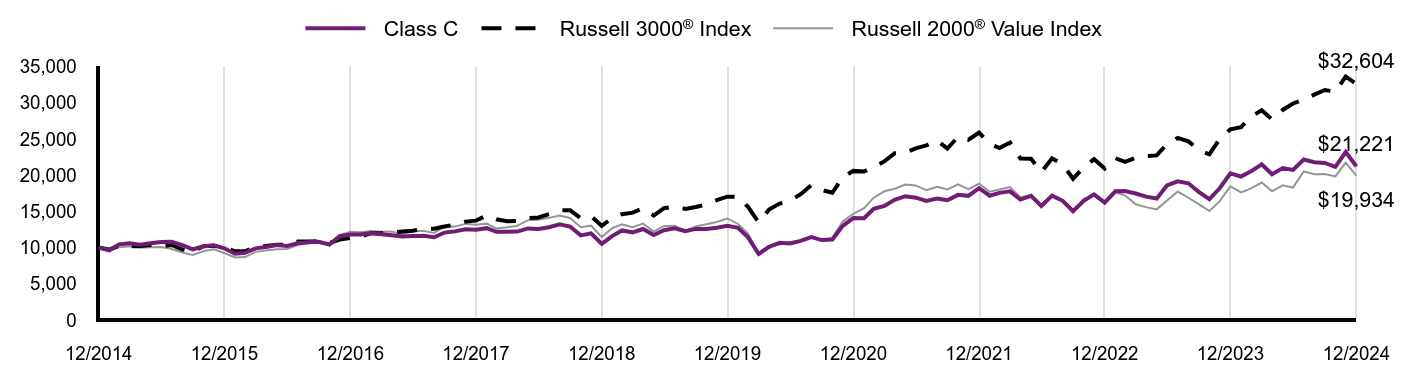

| Factors Affecting Performance [Text Block] |

|

How did the fund perform last year and what affected its performance?Explanation of Fund Performance While the Fund delivered strong absolute returns for the full year, it lagged in overall performance mainly due to fourth quarter results as the Fund was underexposed to some of the areas expected to benefit under a Trump presidency. This included U.S. stocks, bank and energy stocks, and lower quality and procyclical areas. Certain companies also faced industry-wide or company-specific challenges. Top Contributors to Performance • Lack of exposure to the Energy and Real Estate sectors and an underweight to Consumer Staples contributed to performance. • Stock selection in Health Care (Eli Lilly and Intuitive Surgical) and Materials (Smurfit Westrock and not owning mining companies) contributed. •Nvidia, Taiwan Semi and eBay were the largest contributors to performance. Top Detractors from Performance •An overweight to Health Care and Materials, and underweight to Communication Services, which was led by Magnificent 7 stocks the Fund does not own (Meta, Alphabet), detracted. •As U.S. equities outperformed, driven in part by the Magnificent 7, the Fund’s U.S. underweight and Europe overweight detracted. •Stock picks in Industrials (Vestas Wind Systems and AGCO Corp) and Financials (AIA Group and Legal & General) detracted from relative performance. •Vestas Wind Systems, Aptiv and Adobe were the largest detractors overall. The Fund continued to invest for the long term, in high-quality companies likely to benefit from the demographic, technological, environmental and governance related transitions expected to transform the world’s economies during the next decade. |

| Performance Past Does Not Indicate Future [Text] |

|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance,

|

| Line Graph [Table Text Block] |

|

|

Class C |

MSCI World Index (Net) |

03/2016 |

$10,000 |

$10,000 |

04/2016 |

$9,930 |

$10,158 |

05/2016 |

$10,100 |

$10,215 |

06/2016 |

$9,880 |

$10,101 |

07/2016 |

$10,320 |

$10,528 |

08/2016 |

$10,330 |

$10,536 |

09/2016 |

$10,420 |

$10,592 |

10/2016 |

$10,000 |

$10,387 |

11/2016 |

$9,720 |

$10,537 |

12/2016 |

$9,861 |

$10,789 |

01/2017 |

$10,262 |

$11,049 |

02/2017 |

$10,492 |

$11,356 |

03/2017 |

$10,732 |

$11,477 |

04/2017 |

$11,163 |

$11,647 |

05/2017 |

$11,533 |

$11,893 |

06/2017 |

$11,553 |

$11,939 |

07/2017 |

$11,833 |

$12,224 |

08/2017 |

$11,894 |

$12,242 |

09/2017 |

$12,134 |

$12,516 |

10/2017 |

$12,484 |

$12,753 |

11/2017 |

$12,684 |

$13,029 |

12/2017 |

$12,761 |

$13,206 |

01/2018 |

$13,630 |

$13,903 |

02/2018 |

$13,054 |

$13,327 |

03/2018 |

$12,892 |

$13,036 |

04/2018 |

$12,871 |

$13,186 |

05/2018 |

$13,023 |

$13,269 |

06/2018 |

$12,952 |

$13,262 |

07/2018 |

$13,430 |

$13,677 |

08/2018 |

$13,521 |

$13,846 |

09/2018 |

$13,562 |

$13,923 |

10/2018 |

$12,362 |

$12,901 |

11/2018 |

$12,728 |

$13,047 |

12/2018 |

$11,841 |

$12,055 |

01/2019 |

$12,695 |

$12,993 |

02/2019 |

$13,327 |

$13,384 |

03/2019 |

$13,590 |

$13,560 |

04/2019 |

$14,177 |

$14,040 |

05/2019 |

$13,401 |

$13,230 |

06/2019 |

$14,326 |

$14,102 |

07/2019 |

$14,294 |

$14,172 |

08/2019 |

$14,219 |

$13,882 |

09/2019 |

$14,400 |

$14,177 |

10/2019 |

$14,623 |

$14,538 |

11/2019 |

$15,155 |

$14,943 |

12/2019 |

$15,590 |

$15,391 |

01/2020 |

$15,729 |

$15,297 |

02/2020 |

$14,830 |

$14,004 |

03/2020 |

$13,438 |

$12,151 |

04/2020 |

$14,991 |

$13,478 |

05/2020 |

$15,938 |

$14,129 |

06/2020 |

$16,444 |

$14,503 |

07/2020 |

$17,456 |

$15,197 |

08/2020 |

$18,360 |

$16,212 |

09/2020 |

$18,048 |

$15,653 |

10/2020 |

$17,553 |

$15,173 |

11/2020 |

$19,382 |

$17,113 |

12/2020 |

$20,434 |

$17,838 |

01/2021 |

$20,024 |

$17,661 |

02/2021 |

$20,283 |

$18,114 |

03/2021 |

$20,682 |

$18,716 |

04/2021 |

$21,436 |

$19,587 |

05/2021 |

$21,687 |

$19,869 |

06/2021 |

$22,245 |

$20,166 |

07/2021 |

$23,032 |

$20,527 |

08/2021 |

$23,983 |

$21,038 |

09/2021 |

$22,671 |

$20,164 |

10/2021 |

$24,147 |

$21,306 |

11/2021 |

$23,272 |

$20,839 |

12/2021 |

$23,878 |

$21,730 |

01/2022 |

$21,663 |

$20,580 |

02/2022 |

$20,969 |

$20,060 |

03/2022 |

$21,066 |

$20,610 |

04/2022 |

$19,350 |

$18,898 |

05/2022 |

$19,337 |

$18,912 |

06/2022 |

$17,841 |

$17,274 |

07/2022 |

$19,362 |

$18,646 |

08/2022 |

$17,904 |

$17,866 |

09/2022 |

$15,964 |

$16,205 |

10/2022 |

$17,004 |

$17,369 |

11/2022 |

$18,944 |

$18,577 |

12/2022 |

$18,361 |

$17,788 |

01/2023 |

$19,641 |

$19,047 |

02/2023 |

$19,121 |

$18,589 |

03/2023 |

$19,553 |

$19,163 |

04/2023 |

$19,895 |

$19,499 |

05/2023 |

$19,768 |

$19,304 |

06/2023 |

$20,923 |

$20,472 |

07/2023 |

$21,152 |

$21,159 |

08/2023 |

$20,593 |

$20,654 |

09/2023 |

$19,274 |

$19,763 |

10/2023 |

$18,830 |

$19,190 |

11/2023 |

$20,745 |

$20,989 |

12/2023 |

$21,558 |

$22,019 |

01/2024 |

$21,926 |

$22,283 |

02/2024 |

$23,131 |

$23,228 |

03/2024 |

$23,880 |

$23,975 |

04/2024 |

$22,981 |

$23,084 |

05/2024 |

$24,193 |

$24,115 |

06/2024 |

$24,469 |

$24,605 |

07/2024 |

$24,577 |

$25,039 |

08/2024 |

$25,646 |

$25,701 |

09/2024 |

$25,838 |

$26,172 |

10/2024 |

$24,745 |

$25,652 |

11/2024 |

$25,237 |

$26,830 |

12/2024 |

$24,284 |

$26,130 |

|

| Average Annual Return [Table Text Block] |

|

AATR |

1 Year |

5 Years |

Since Inception 3/31/16 |

Class C at NAV |

11.99% |

9.14% |

10.67% |

Class C with 1.00% CDSCFootnote Reference1 |

10.99% |

9.14% |

10.67% |

MSCI World Index (Net) |

18.67% |

11.17% |

11.56% | |

| Performance Inception Date |

|

Mar. 31, 2016

|

| Previous Investment Adviser [Text Block] |

|

|

| Updated Performance Information Location [Text Block] |

|

visit im.natixis.com/en-us/products/mutual-funds/price-and-performance

|

| AssetsNet |

|

$ 974,101,733

|

| Holdings Count | Holding |

|

51

|

| Advisory Fees Paid, Amount |

|

$ 8,602,808

|

| InvestmentCompanyPortfolioTurnover |

|

18.00%

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$974,101,733 |

# of Portfolio Holdings (including overnight repurchase agreements) |

51 |

Portfolio Turnover Rate |

18% |

Total Advisory Fees Paid (after waiver/reimbursement, if applicable) |

$8,602,808 | |

| Holdings [Text Block] |

|

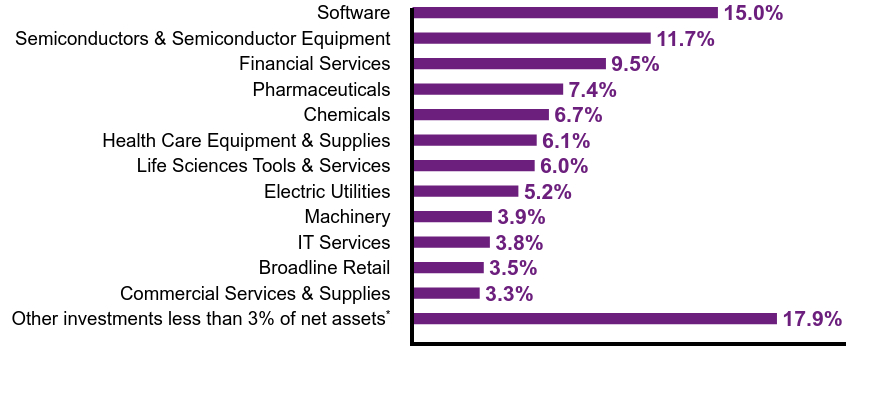

Value |

Value |

Other investments less than 3% of net assetsFootnote Reference* |

17.9% |

Commercial Services & Supplies |

3.3% |

Broadline Retail |

3.5% |

IT Services |

3.8% |

Machinery |

3.9% |

Electric Utilities |

5.2% |

Life Sciences Tools & Services |

6.0% |

Health Care Equipment & Supplies |

6.1% |

Chemicals |

6.7% |

Pharmaceuticals |

7.4% |

Financial Services |

9.5% |

Semiconductors & Semiconductor Equipment |

11.7% |

Software |

15.0% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities |

NVIDIA Corp. |

5.9% |

Microsoft Corp. |

5.5% |

Mastercard, Inc., Class A |

5.2% |

Eli Lilly & Co. |

3.8% |

Ecolab, Inc. |

3.7% |

eBay, Inc. |

3.5% |

Thermo Fisher Scientific, Inc. |

3.4% |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

3.2% |

Roper Technologies, Inc. |

3.0% |

Iberdrola SA |

2.9% |

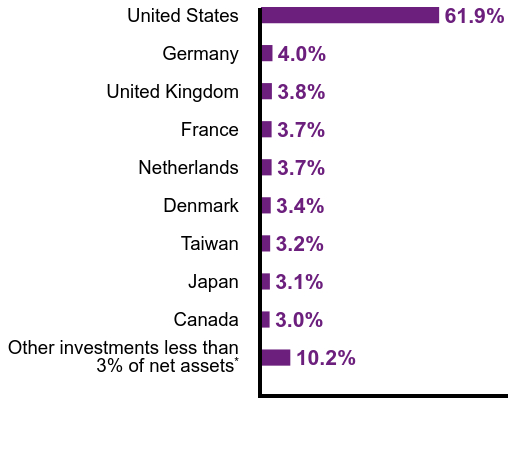

Value |

Value |

Other investments less than 3% of net assetsFootnote Reference* |

10.2% |

Canada |

3.0% |

Japan |

3.1% |

Taiwan |

3.2% |

Denmark |

3.4% |

Netherlands |

3.7% |

France |

3.7% |

United Kingdom |

3.8% |

Germany |

4.0% |

United States |

61.9% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities | |

| Material Fund Change [Text Block] |

|

There were no material fund changes during the period. |

| C000190736 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

Mirova Global Sustainable Equity Fund

|

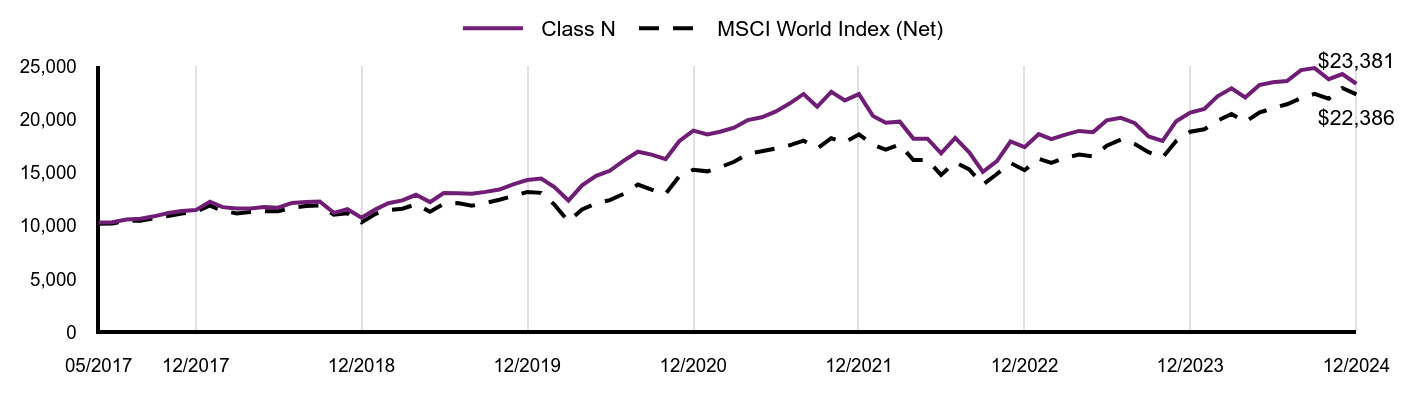

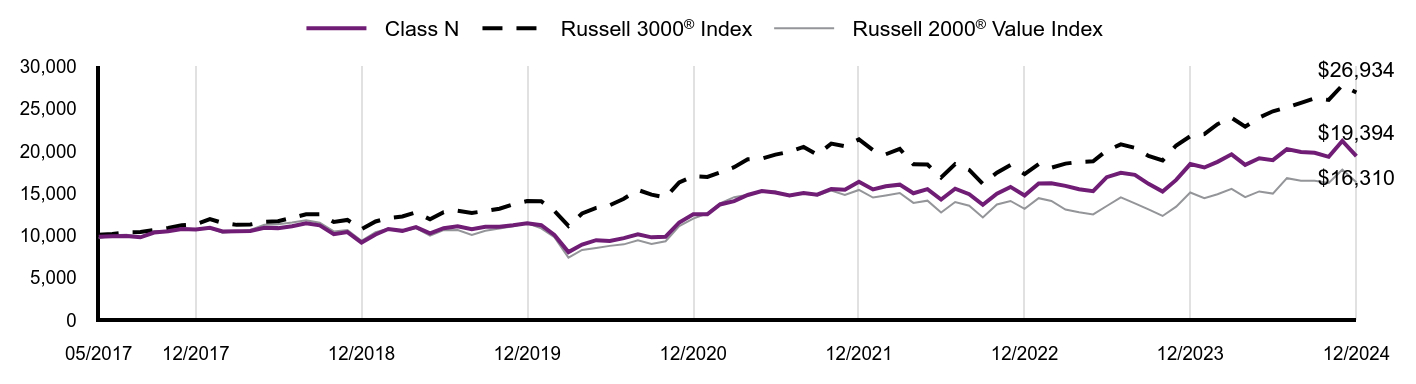

| Class Name |

|

Class N

|

| Trading Symbol |

|

ESGNX

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about Mirova Global Sustainable Equity Fund for the period of January 1, 2024 to December 31, 2024.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

|

| Additional Information Phone Number |

|

(800) 225-5478

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; white-space-collapse: preserve-breaks;">im.natixis.com/funddocuments</span>

|

| Expenses [Text Block] |

|

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

Class N |

$95 |

0.89% |

| Footnote |

Description |

Footnote† |

Annualized for periods less than one year (if applicable). | |

| Expenses Paid, Amount |

|

$ 95

|

| Expense Ratio, Percent |

|

0.89%

|

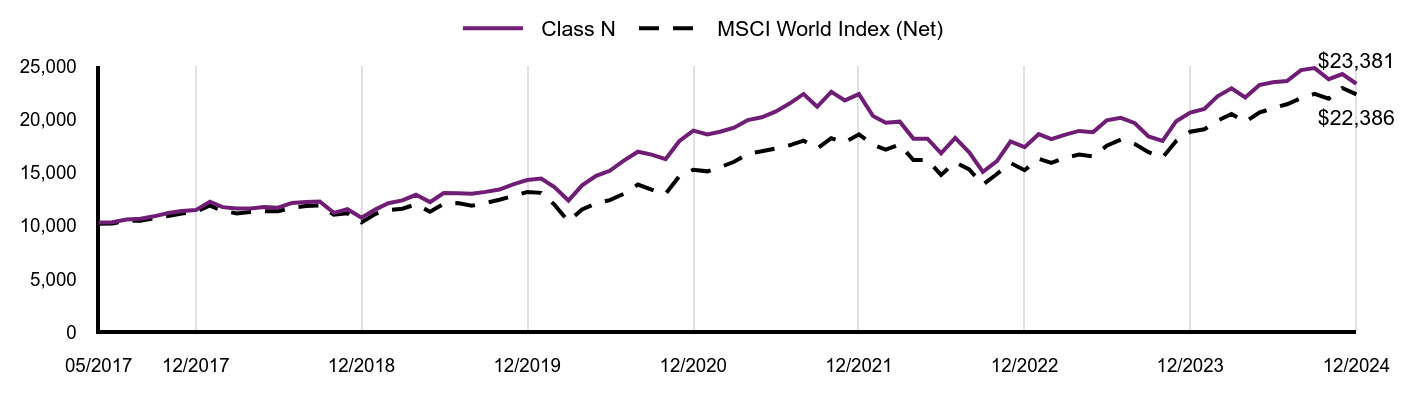

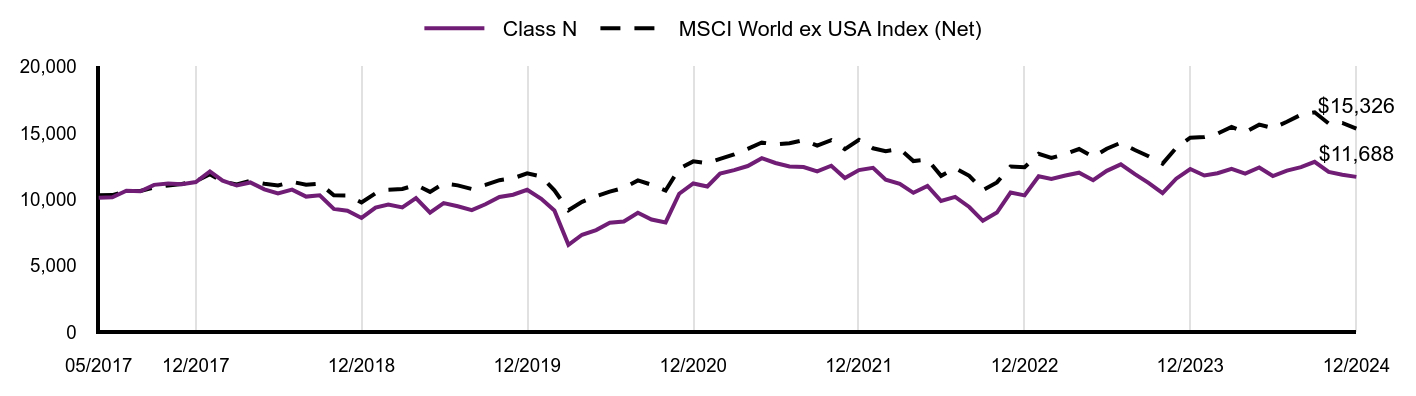

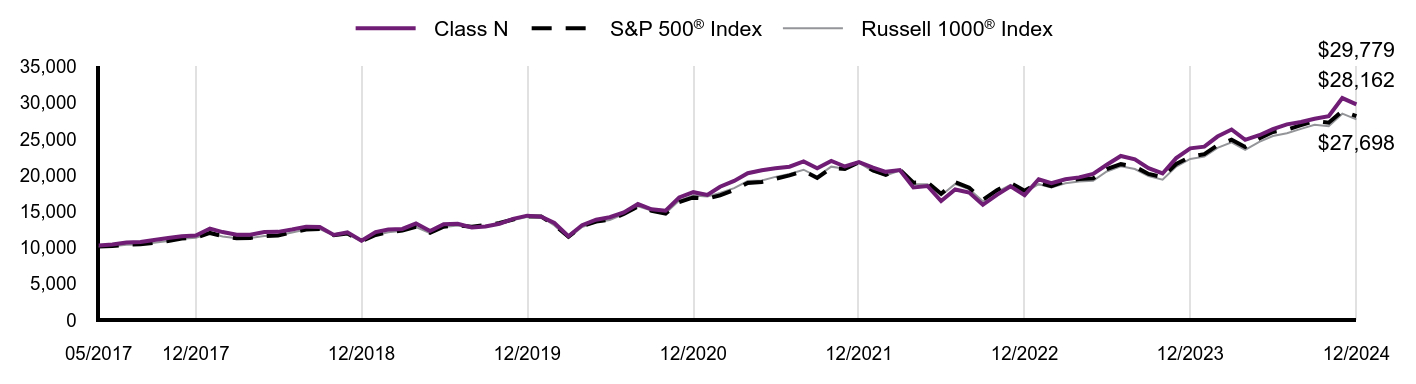

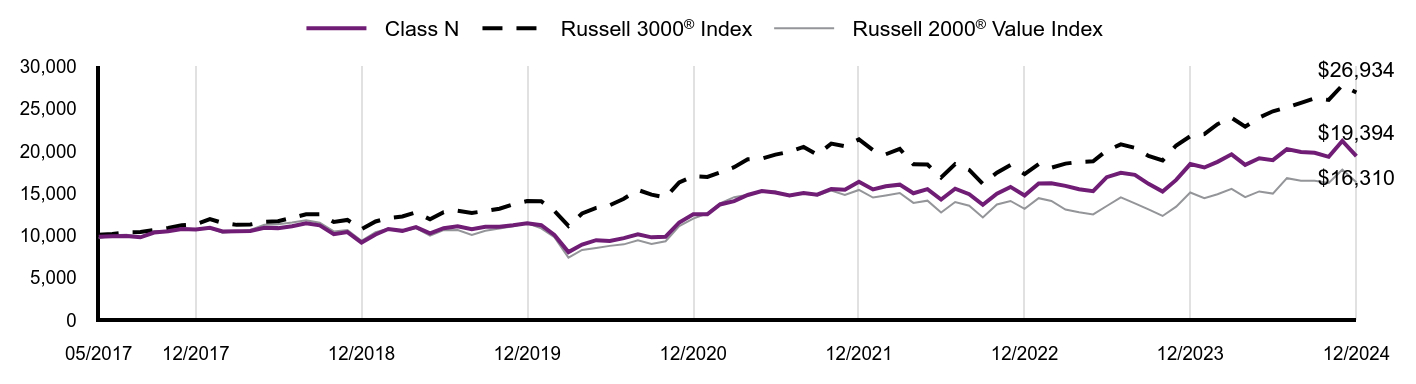

| Factors Affecting Performance [Text Block] |

|

How did the fund perform last year and what affected its performance?Explanation of Fund Performance While the Fund delivered strong absolute returns for the full year, it lagged in overall performance mainly due to fourth quarter results as the Fund was underexposed to some of the areas expected to benefit under a Trump presidency. This included U.S. stocks, bank and energy stocks, and lower quality and procyclical areas. Certain companies also faced industry-wide or company-specific challenges. Top Contributors to Performance • Lack of exposure to the Energy and Real Estate sectors and an underweight to Consumer Staples contributed to performance. • Stock selection in Health Care (Eli Lilly and Intuitive Surgical) and Materials (Smurfit Westrock and not owning mining companies) contributed. •Nvidia, Taiwan Semi and eBay were the largest contributors to performance. Top Detractors from Performance •An overweight to Health Care and Materials, and underweight to Communication Services, which was led by Magnificent 7 stocks the Fund does not own (Meta, Alphabet), detracted. •As U.S. equities outperformed, driven in part by the Magnificent 7, the Fund’s U.S. underweight and Europe overweight detracted. •Stock picks in Industrials (Vestas Wind Systems and AGCO Corp) and Financials (AIA Group and Legal & General) detracted from relative performance. •Vestas Wind Systems, Aptiv and Adobe were the largest detractors overall. The Fund continued to invest for the long term, in high-quality companies likely to benefit from the demographic, technological, environmental and governance related transitions expected to transform the world’s economies during the next decade. |

| Performance Past Does Not Indicate Future [Text] |

|

Performance data shown represents past performance and is no guarantee of, and is not necessarily indicative of, future results. Total return and value will vary, and you may have a gain or loss when shares are sold. Current performance may be lower or higher than quoted. For the most recent month-end performance,

|

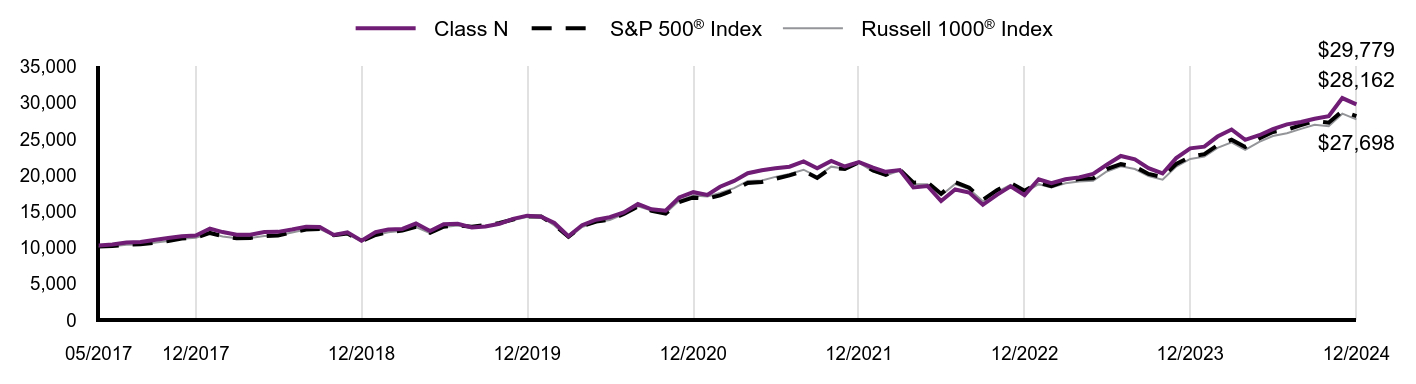

| Line Graph [Table Text Block] |

|

|

Class N |

MSCI World Index (Net) |

05/2017 |

$10,319 |

$10,189 |

06/2017 |

$10,337 |

$10,228 |

07/2017 |

$10,593 |

$10,473 |

08/2017 |

$10,673 |

$10,487 |

09/2017 |

$10,895 |

$10,723 |

10/2017 |

$11,213 |

$10,925 |

11/2017 |

$11,399 |

$11,162 |

12/2017 |

$11,481 |

$11,313 |

01/2018 |

$12,278 |

$11,910 |

02/2018 |

$11,759 |

$11,417 |

03/2018 |

$11,624 |

$11,168 |

04/2018 |

$11,623 |

$11,296 |

05/2018 |

$11,767 |

$11,367 |

06/2018 |

$11,713 |

$11,362 |

07/2018 |

$12,155 |

$11,717 |

08/2018 |

$12,245 |

$11,862 |

09/2018 |

$12,299 |

$11,928 |

10/2018 |

$11,217 |

$11,052 |

11/2018 |

$11,560 |

$11,177 |

12/2018 |

$10,762 |

$10,327 |

01/2019 |

$11,549 |

$11,131 |

02/2019 |

$12,129 |

$11,466 |

03/2019 |

$12,392 |

$11,616 |

04/2019 |

$12,923 |

$12,028 |

05/2019 |

$12,233 |

$11,334 |

06/2019 |

$13,093 |

$12,081 |

07/2019 |

$13,064 |

$12,141 |

08/2019 |

$13,017 |

$11,893 |

09/2019 |

$13,197 |

$12,146 |

10/2019 |

$13,414 |

$12,455 |

11/2019 |

$13,905 |

$12,802 |

12/2019 |

$14,319 |

$13,185 |

01/2020 |

$14,452 |

$13,105 |

02/2020 |

$13,650 |

$11,997 |

03/2020 |

$12,380 |

$10,409 |

04/2020 |

$13,813 |

$11,547 |

05/2020 |

$14,706 |

$12,104 |

06/2020 |

$15,186 |

$12,425 |

07/2020 |

$16,137 |

$13,019 |

08/2020 |

$16,981 |

$13,889 |

09/2020 |

$16,703 |

$13,410 |

10/2020 |

$16,271 |

$12,998 |

11/2020 |

$17,970 |

$14,660 |

12/2020 |

$18,964 |

$15,282 |

01/2021 |

$18,598 |

$15,130 |

02/2021 |

$18,858 |

$15,518 |

03/2021 |

$19,243 |

$16,034 |

04/2021 |

$19,964 |

$16,780 |

05/2021 |

$20,218 |

$17,022 |

06/2021 |

$20,754 |

$17,276 |

07/2021 |

$21,514 |

$17,585 |

08/2021 |

$22,421 |

$18,023 |

09/2021 |

$21,212 |

$17,274 |

10/2021 |

$22,616 |

$18,253 |

11/2021 |

$21,816 |

$17,853 |

12/2021 |

$22,409 |

$18,616 |

01/2022 |

$20,343 |

$17,631 |

02/2022 |

$19,705 |

$17,185 |

03/2022 |

$19,813 |

$17,657 |

04/2022 |

$18,213 |

$16,190 |

05/2022 |

$18,213 |

$16,202 |

06/2022 |

$16,830 |

$14,799 |

07/2022 |

$18,280 |

$15,974 |

08/2022 |

$16,920 |

$15,306 |

09/2022 |

$15,087 |

$13,883 |

10/2022 |

$16,099 |

$14,880 |

11/2022 |

$17,943 |

$15,915 |

12/2022 |

$17,408 |

$15,239 |

01/2023 |

$18,632 |

$16,317 |

02/2023 |

$18,156 |

$15,925 |

03/2023 |

$18,587 |

$16,417 |

04/2023 |

$18,939 |

$16,705 |

05/2023 |

$18,825 |

$16,538 |

06/2023 |

$19,937 |

$17,538 |

07/2023 |

$20,175 |

$18,127 |

08/2023 |

$19,664 |

$17,694 |

09/2023 |

$18,417 |

$16,931 |

10/2023 |

$18,009 |

$16,440 |

11/2023 |

$19,857 |

$17,981 |

12/2023 |

$20,664 |

$18,864 |

01/2024 |

$21,018 |

$19,090 |

02/2024 |

$22,204 |

$19,899 |

03/2024 |

$22,946 |

$20,539 |

04/2024 |

$22,085 |

$19,776 |

05/2024 |

$23,249 |

$20,659 |

06/2024 |

$23,523 |

$21,079 |

07/2024 |

$23,637 |

$21,451 |

08/2024 |

$24,664 |

$22,018 |

09/2024 |

$24,858 |

$22,421 |

10/2024 |

$23,808 |

$21,976 |

11/2024 |

$24,299 |

$22,985 |

12/2024 |

$23,381 |

$22,386 |

|

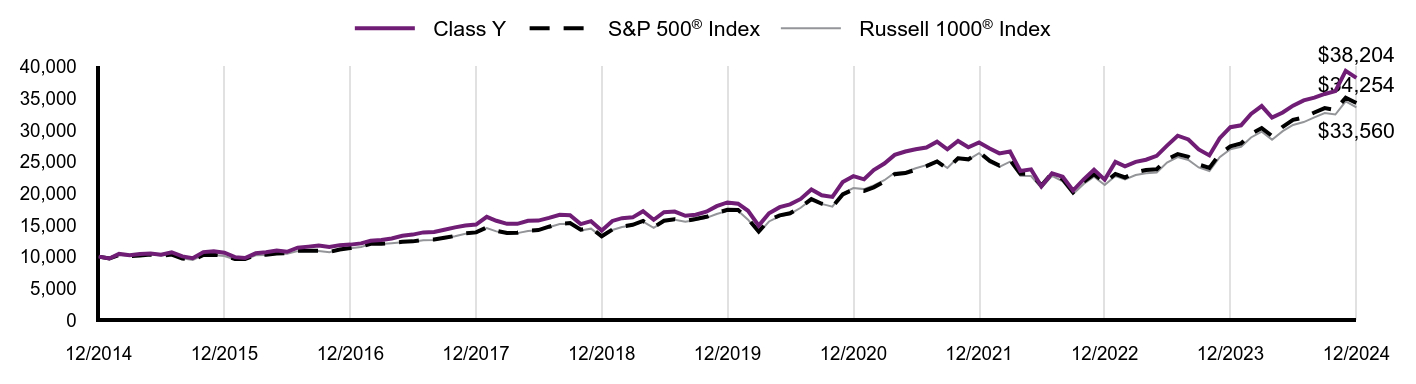

| Average Annual Return [Table Text Block] |

|

AATR |

1 Year |

5 Years |

Since Inception 5/1/17 |

Class N |

13.15% |

10.30% |

11.71% |

MSCI World Index (Net) |

18.67% |

11.17% |

11.04% | |

| Performance Inception Date |

|

May 01, 2017

|

| Previous Investment Adviser [Text Block] |

|

|

| Updated Performance Information Location [Text Block] |

|

visit im.natixis.com/en-us/products/mutual-funds/price-and-performance

|

| AssetsNet |

|

$ 974,101,733

|

| Holdings Count | Holding |

|

51

|

| Advisory Fees Paid, Amount |

|

$ 8,602,808

|

| InvestmentCompanyPortfolioTurnover |

|

18.00%

|

| Additional Fund Statistics [Text Block] |

|

Total Net Assets |

$974,101,733 |

# of Portfolio Holdings (including overnight repurchase agreements) |

51 |

Portfolio Turnover Rate |

18% |

Total Advisory Fees Paid (after waiver/reimbursement, if applicable) |

$8,602,808 | |

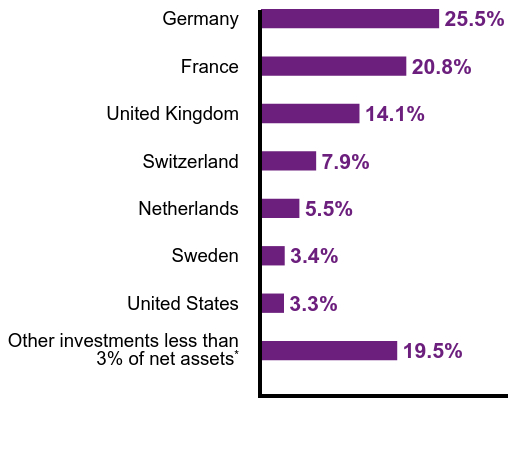

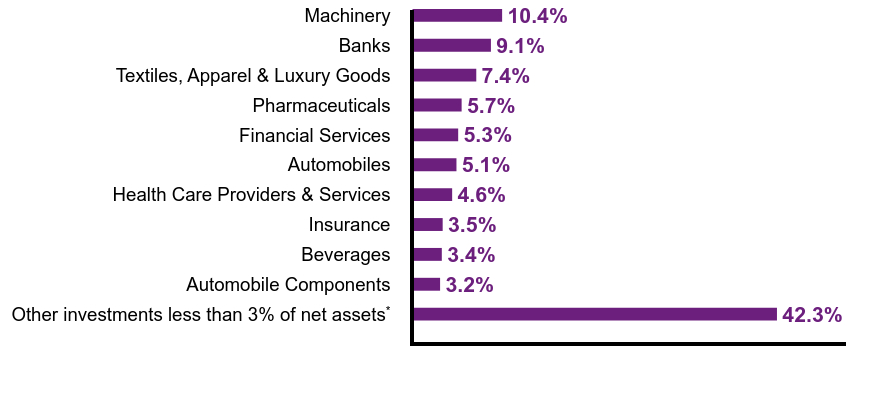

| Holdings [Text Block] |

|

Value |

Value |

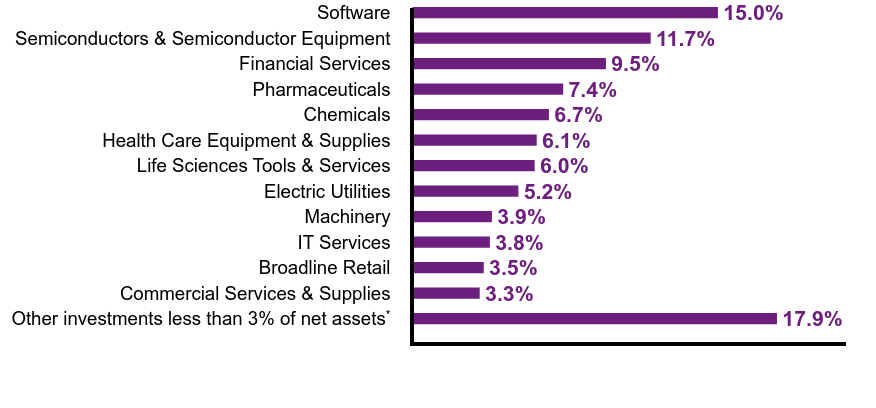

Other investments less than 3% of net assetsFootnote Reference* |

17.9% |

Commercial Services & Supplies |

3.3% |

Broadline Retail |

3.5% |

IT Services |

3.8% |

Machinery |

3.9% |

Electric Utilities |

5.2% |

Life Sciences Tools & Services |

6.0% |

Health Care Equipment & Supplies |

6.1% |

Chemicals |

6.7% |

Pharmaceuticals |

7.4% |

Financial Services |

9.5% |

Semiconductors & Semiconductor Equipment |

11.7% |

Software |

15.0% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities |

NVIDIA Corp. |

5.9% |

Microsoft Corp. |

5.5% |

Mastercard, Inc., Class A |

5.2% |

Eli Lilly & Co. |

3.8% |

Ecolab, Inc. |

3.7% |

eBay, Inc. |

3.5% |

Thermo Fisher Scientific, Inc. |

3.4% |

Taiwan Semiconductor Manufacturing Co. Ltd., ADR |

3.2% |

Roper Technologies, Inc. |

3.0% |

Iberdrola SA |

2.9% |

Value |

Value |

Other investments less than 3% of net assetsFootnote Reference* |

10.2% |

Canada |

3.0% |

Japan |

3.1% |

Taiwan |

3.2% |

Denmark |

3.4% |

Netherlands |

3.7% |

France |

3.7% |

United Kingdom |

3.8% |

Germany |

4.0% |

United States |

61.9% |

| Footnote |

Description |

Footnote* |

Net of other assets less liabilities | |

| Material Fund Change [Text Block] |

|

There were no material fund changes during the period. |

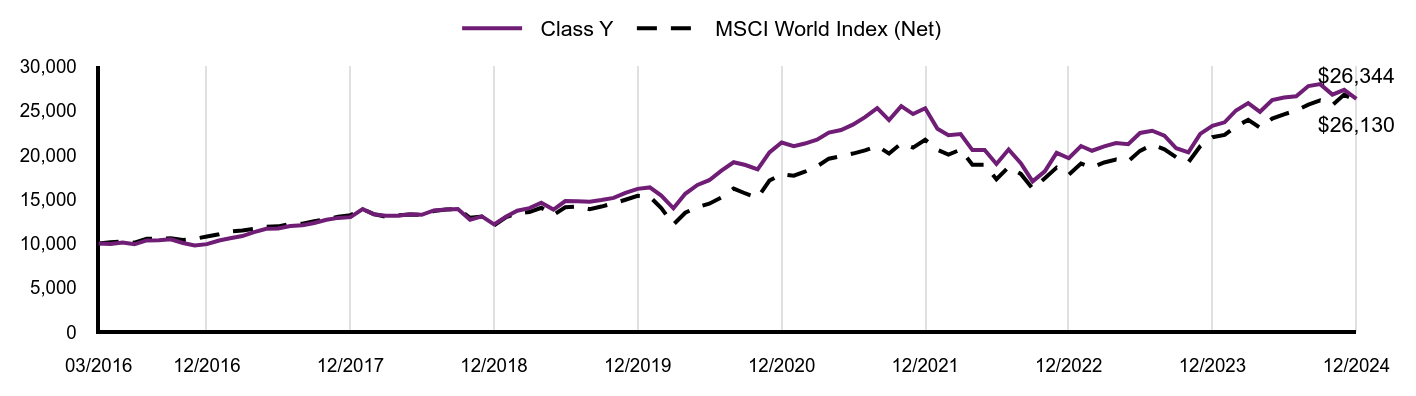

| C000167847 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

Mirova Global Sustainable Equity Fund

|

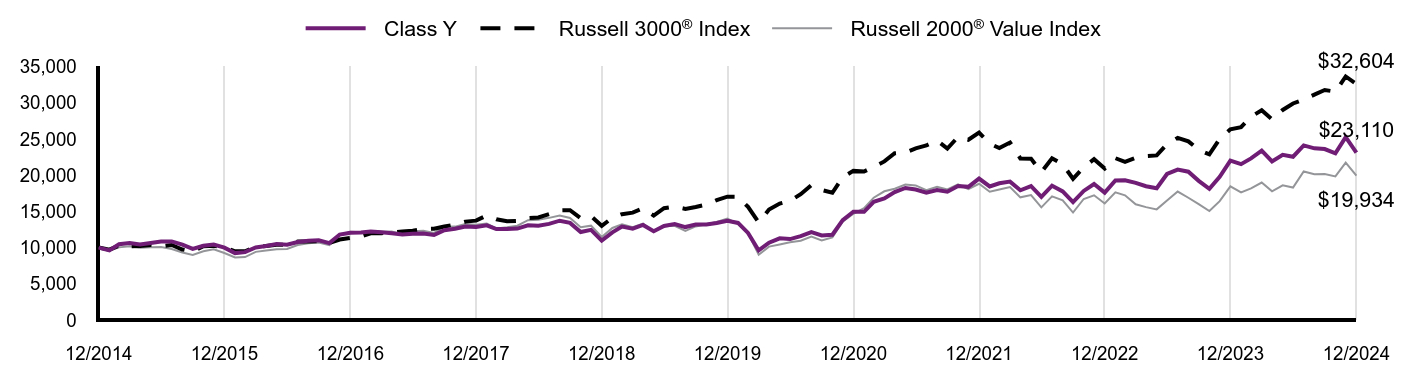

| Class Name |

|

Class Y

|

| Trading Symbol |

|

ESGYX

|

| Annual or Semi-Annual Statement [Text Block] |

|

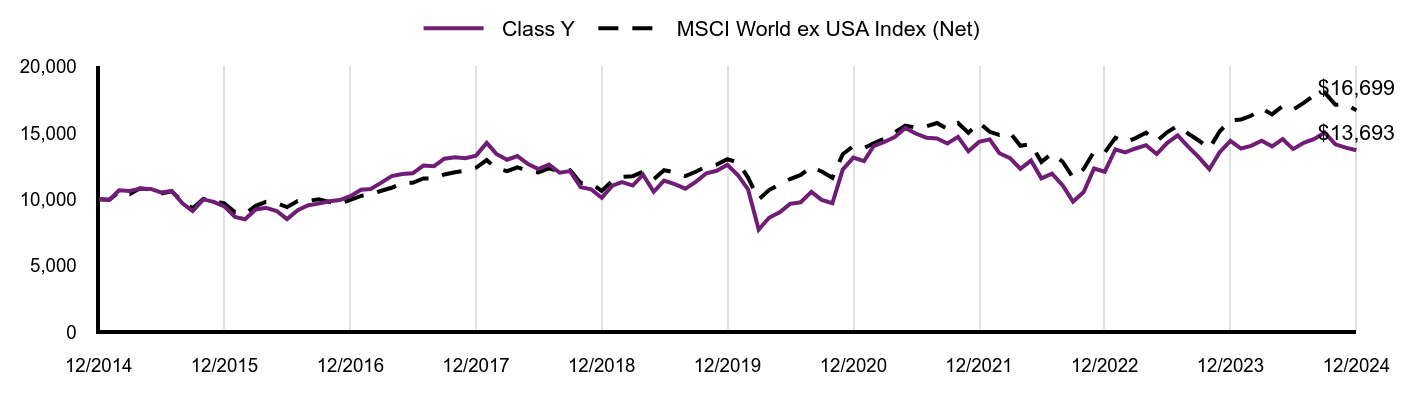

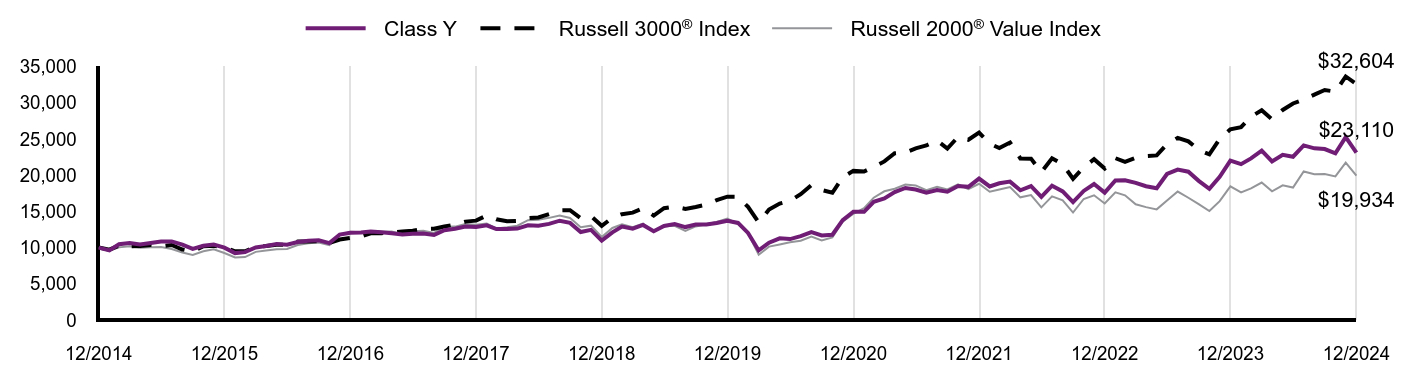

This annual shareholder report contains important information about Mirova Global Sustainable Equity Fund for the period of January 1, 2024 to December 31, 2024.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information (including tax information) about the Fund at im.natixis.com/funddocuments. You can also request the information by contacting us at (800) 225-5478 or by contacting your financial intermediary directly.

|

| Additional Information Phone Number |

|

(800) 225-5478

|

| Additional Information Website |

|

<span style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 12px; font-weight: 400; grid-area: auto; line-height: 18px; margin: 0px; overflow: visible; text-align: left; white-space-collapse: preserve-breaks;">im.natixis.com/funddocuments</span>

|

| Expenses [Text Block] |

|

What were the fund costs for the last year? (based on a hypothetical $10,000 investment)

Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investmentFootnote Reference† |

Class Y |

$101 |

0.95% |

| Footnote |

Description |

Footnote† |

Annualized for periods less than one year (if applicable). | |

| Expenses Paid, Amount |

|

$ 101

|

| Expense Ratio, Percent |

|

0.95%

|

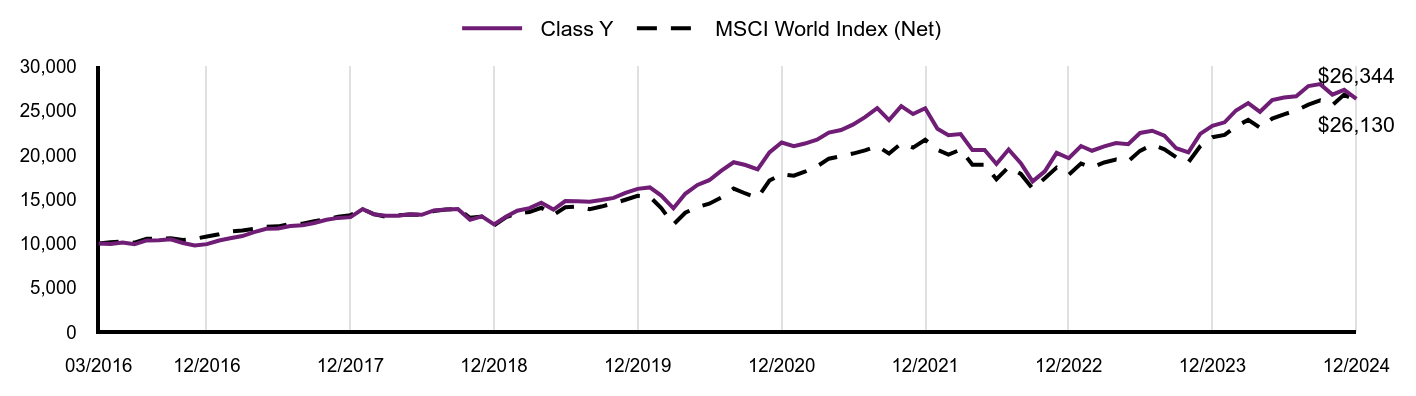

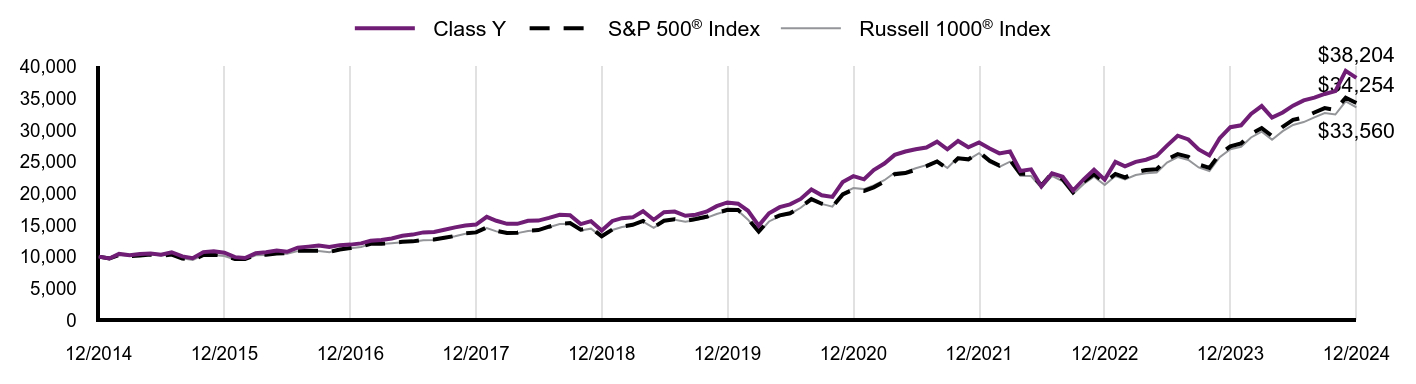

| Factors Affecting Performance [Text Block] |

|