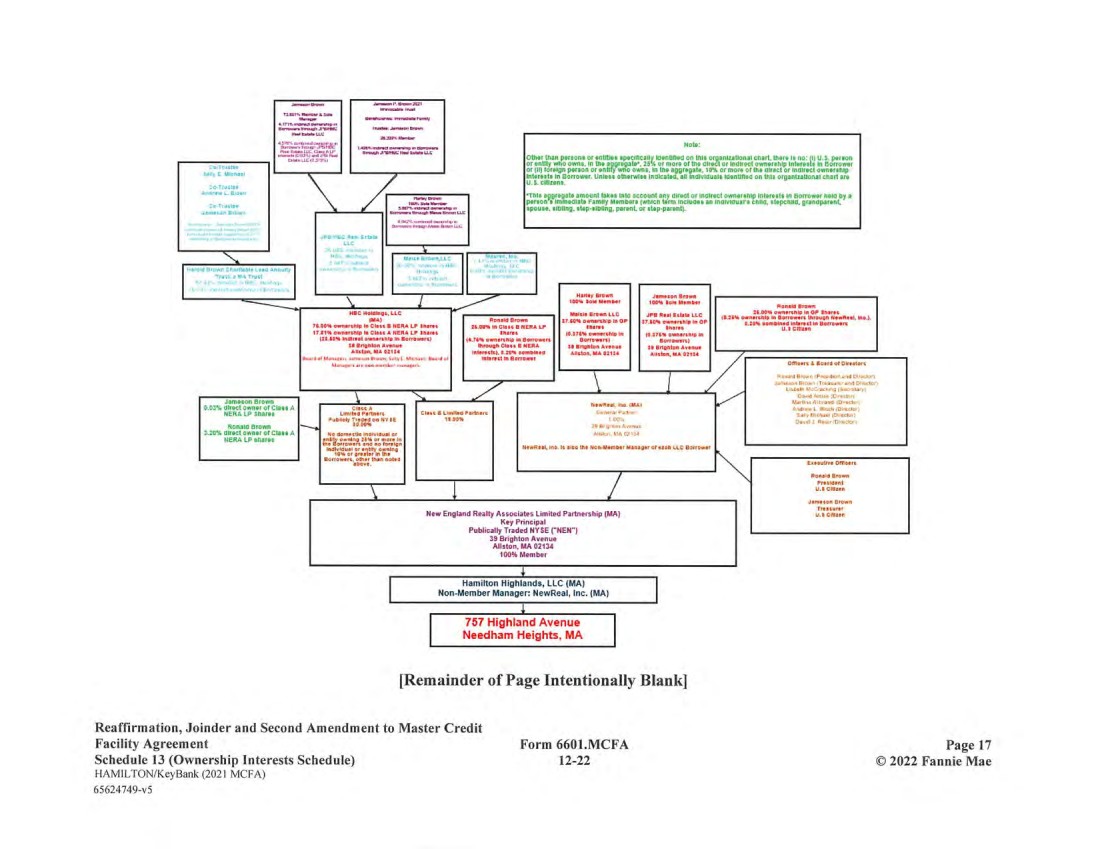

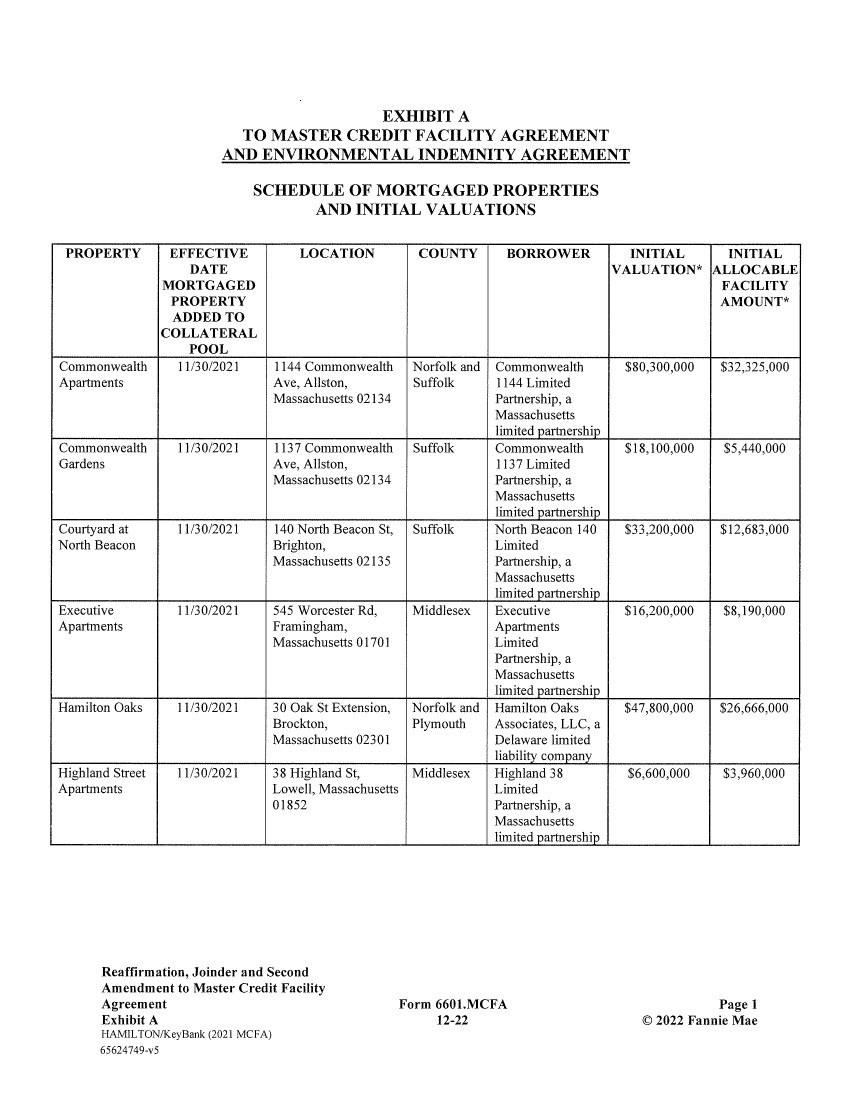

| REAFFIRMATION, JOINDER AND SECOND AMENDMENT TO MASTER CREDIT FACILITY AGREEMENT This REAFFIRMATION, JOINDER AND SECOND AMENDMENT TO MASTER CREDIT FACILITY AGREEMENT (this "Amendment") is made as of May 30, 2025, by and among (a) (1) the entities identified as Original Borrower set forth on Schedule I attached hereto (individually and collectively, "Original Borrower") and (2) the entity identified as Additional Borrower set forth on Schedule I attached hereto ("Additional Borrower"; together with Original Borrower, "Borrower"); (b) KEYBANK NATIONAL ASSOCIATION, a national banking association ("Original Lender"); and (c) FANNIE MAE, a corporation duly organized under the Federal National Mortgage Association Charter Act, as amended, 12 U.S.C. §1716 et seq., and existing under the laws of the United States ("Fannie Mae"). RECITALS A. Original Borrower and Original Lender are parties to or have joined into that certain Master Credit Facility Agreement dated as of November 30, 2021 (as amended, restated, replaced, supplemented, or otherwise modified from time to time, the "Master Agreement"). B. All of Original Lender's right, title and interest in the Master Agreement and the Loan Documents executed in connection with the Master Agreement or the transactions contemplated by the Master Agreement have been assigned to Fannie Mae pursuant to that certain Assignment of Master Credit Facility Agreement and Other Loan Documents, dated as of November 30, 2021, and Fannie Mae is the holder of each Note made prior to the date hereof. Further, Original Lender intends to sell, transfer and deliver to Fannie Mae any Note made pursuant to the Master Agreement on or after the date hereof. Fannie Mae has designated Original Lender as the servicer of the Advances made and contemplated by the Master Agreement. Notwithstanding the foregoing, Fannie Mae has not assumed (i) any of the obligations of Original Lender under the Master Agreement to make Future Advances, or (ii) any of the obligations of Original Lender which are servicing obligations delegated to Original Lender as servicer of the Advances. Accordingly, all references to "Lender" in this Amendment and the Loan Documents shall be deemed to be (a) "Original Lender" with respect to any Future Advances made under the Master Agreement and any servicing obligations with respect to the Outstanding Advances, and (b) "Fannie Mae" with respect to the Outstanding Advances sold to and held by Fannie Mae. C. Borrower has requested that Lender make one or more Future Advances pursuant to the Master Agreement and that the Mortgaged Property commonly known as Hamilton Highlands located in Norfolk County, Massachusetts (the "Additional Mortgaged Property") be added to the Collateral Pool. D. Additional Borrower desires to join into the Master Agreement as if it were an Original Borrower thereunder. Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 1 Fannie Mae 12-22 © 2022 Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 |

| E. The parties are executing this Amendment pursuant to the Master Agreement to reflect (i) the making of a Future Advance by Lender in the amount of $18,664,000, and a Future Advance by Lender in the amount of $40,000,000 (individually and collectively, the "Future Advance"); (ii) the addition of the Additional Mortgaged Property to the Collateral Pool; and (iii) the joinder of Additional Borrower into the Master Agreement and other Loan Documents as if it were an Original Borrower thereunder. AGREEMENTS: NOW, THEREFORE, the parties hereto, in consideration of the mutual promises and agreements contained in this Amendment and the Master Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, hereby agree as follows: Section 1. Recitals. The recitals set forth above are incorporated herein by reference as if fully set forth in the body of this Amendment. Section 2. Capitalized Terms. All capitalized terms used in this Amendment which are not specifically defined herein shall have the respective meanings set forth in the Master Agreement. Section 3. Future Advance. In connection with this Amendment, Lender is making the Future Advance to Borrower. Section 4. Addition of Mortgaged Property. The Additional Mortgaged Property is hereby added to the Collateral Pool under the Master Agreement. Section 5. Joinder. Additional Borrower hereby joins the Master Agreement and Loan Documents as if it were an Original Borrower thereunder. Borrower agrees that all references to "Borrower" in the Loan Documents (including, but not limited to, the Master Agreement and the Note) shall be deemed to include Additional Borrower and Original Borrower, and all references to "Mortgaged Property" in the Loan Documents (other than the Security Instruments executed by Original Borrower) shall be deemed to include the Additional Mortgaged Property. Section 6. Summary of Master Terms. The Summary of Master Terms attached to the Master Agreement is hereby amended by deleting Section I of the Summary of Master Terms and replacing it with Section I of the Summary of Master Terms attached hereto. Section 7. Schedule of Advance Terms. The Schedule of Advance Terms attached to the Master Agreement is hereby supplemented with Schedule 3.3 and Schedule 3.4 attached hereto. Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 2 © 2022 Fannie Mae |

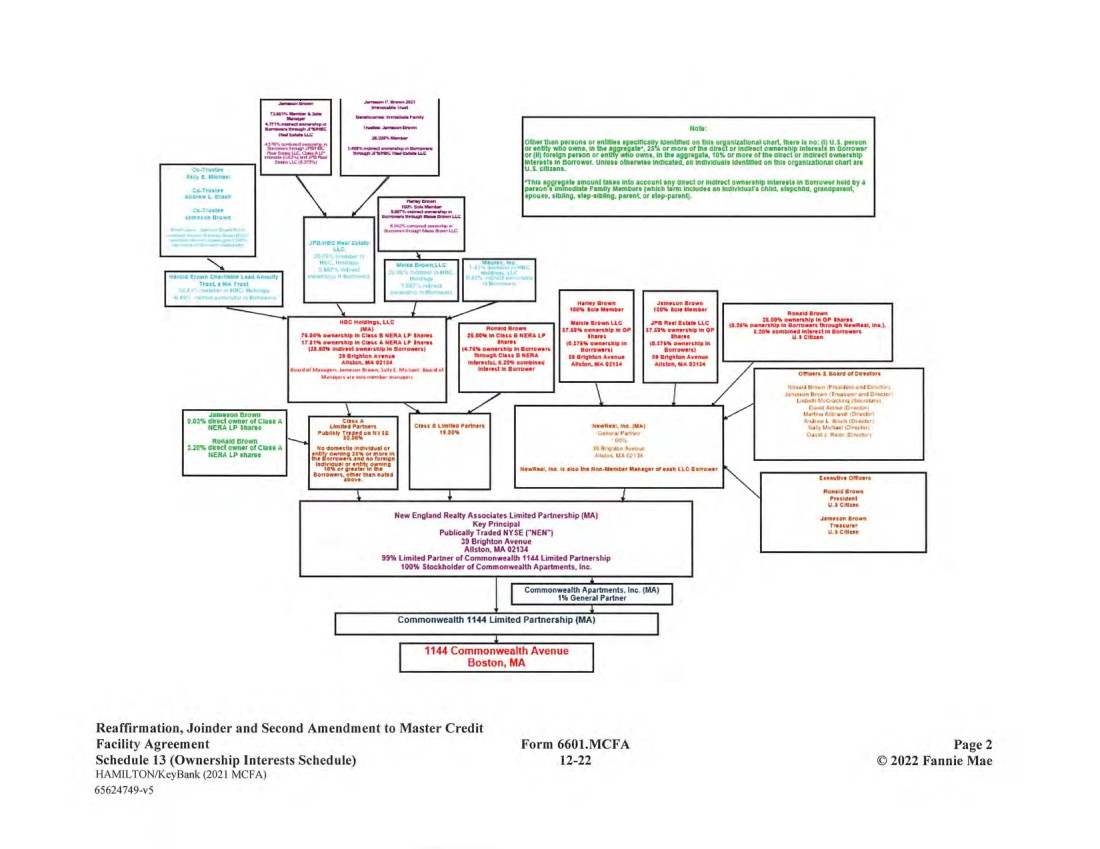

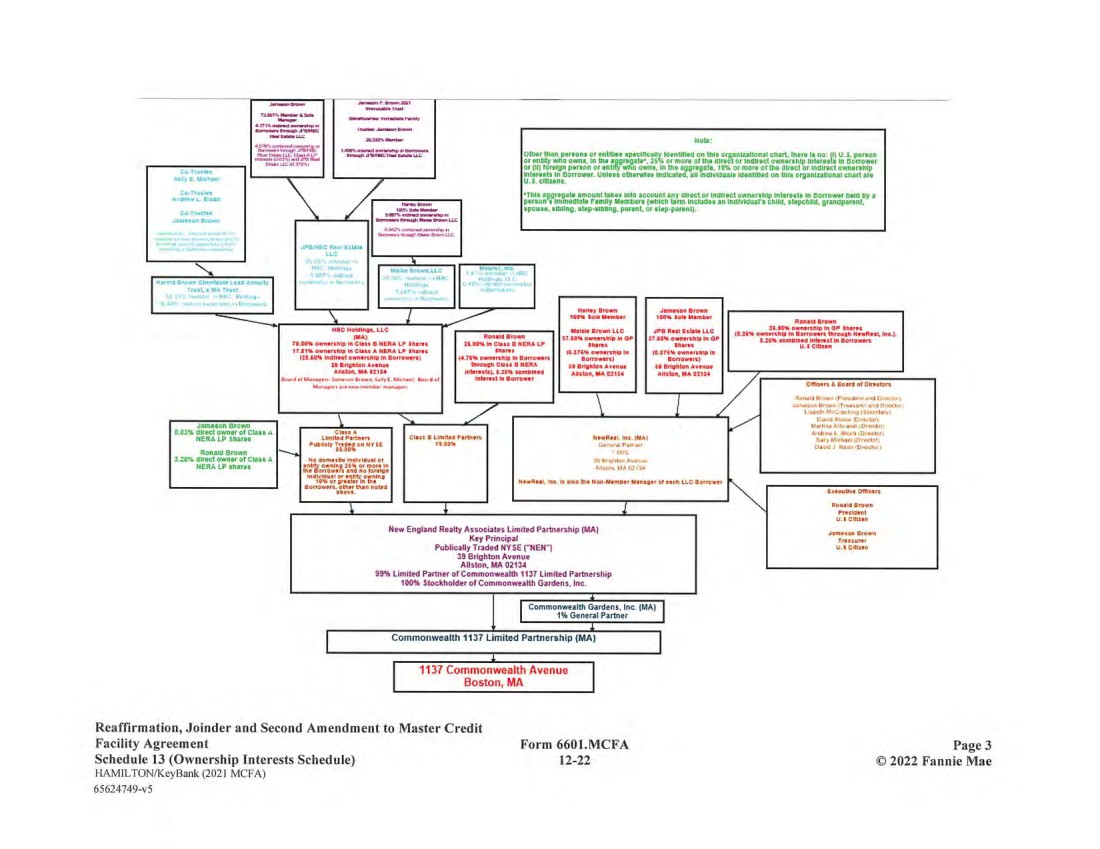

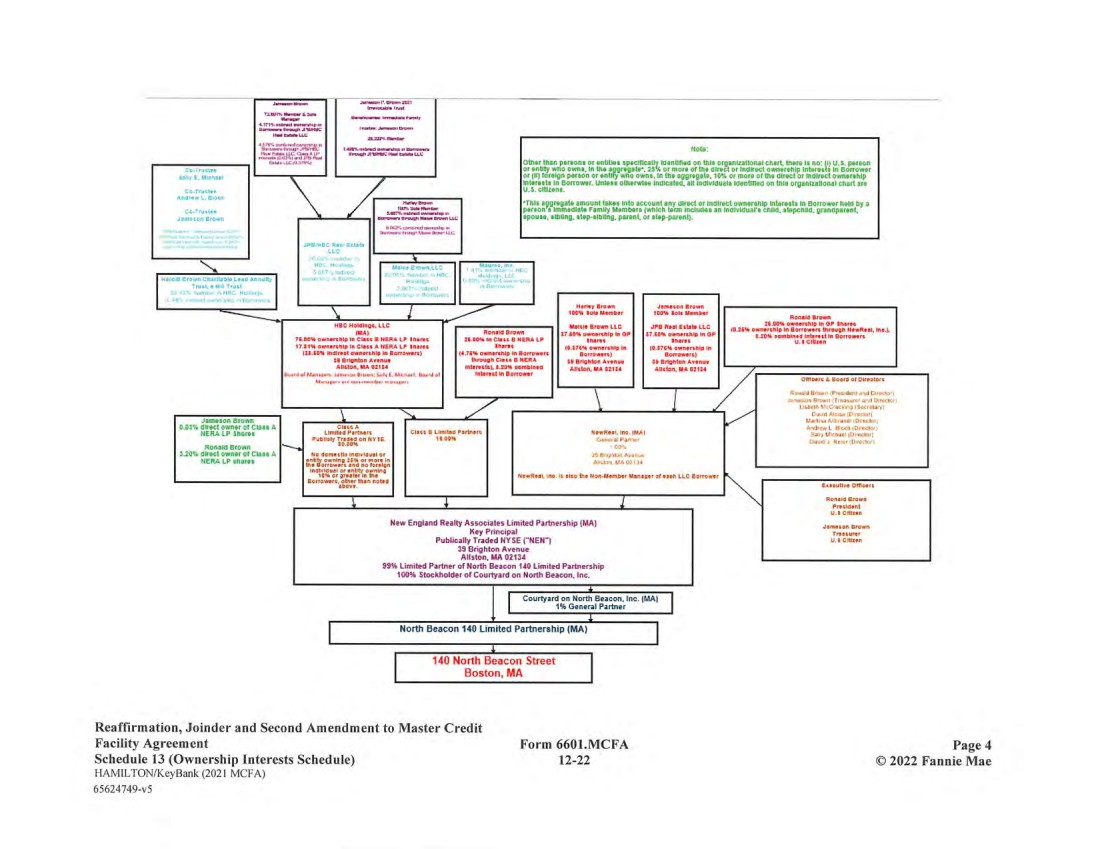

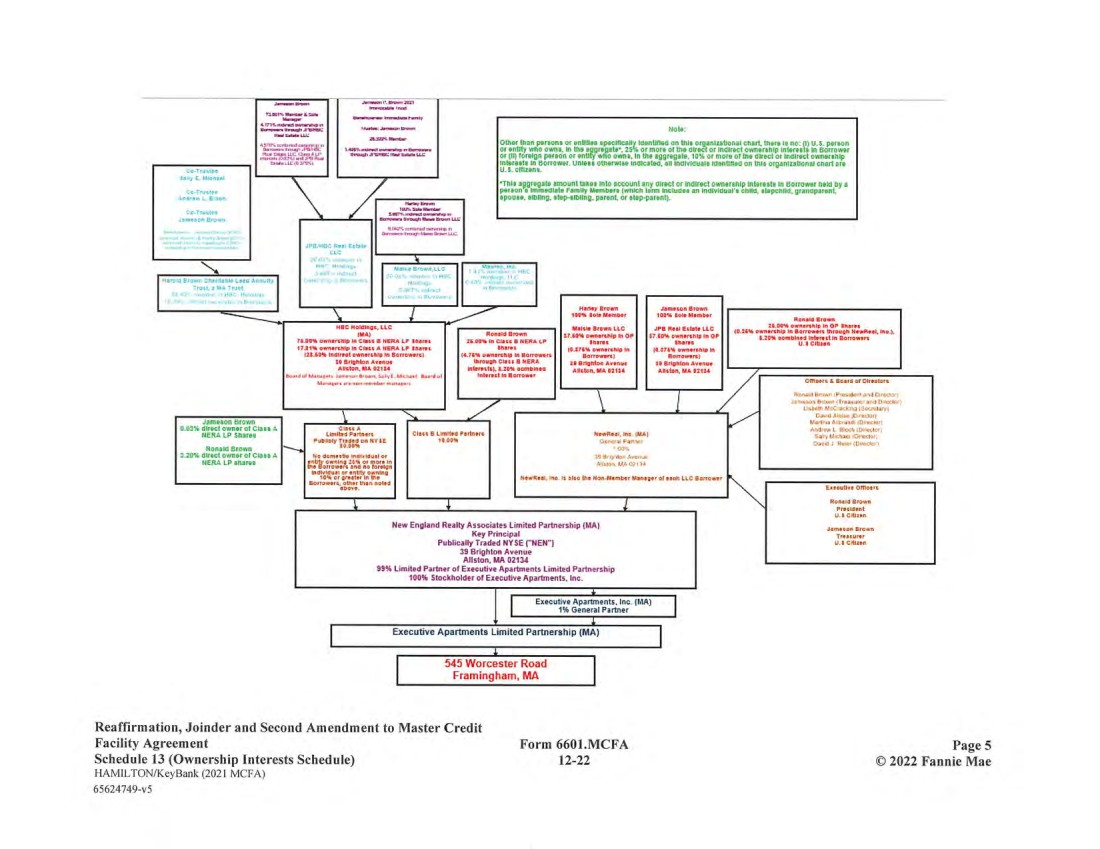

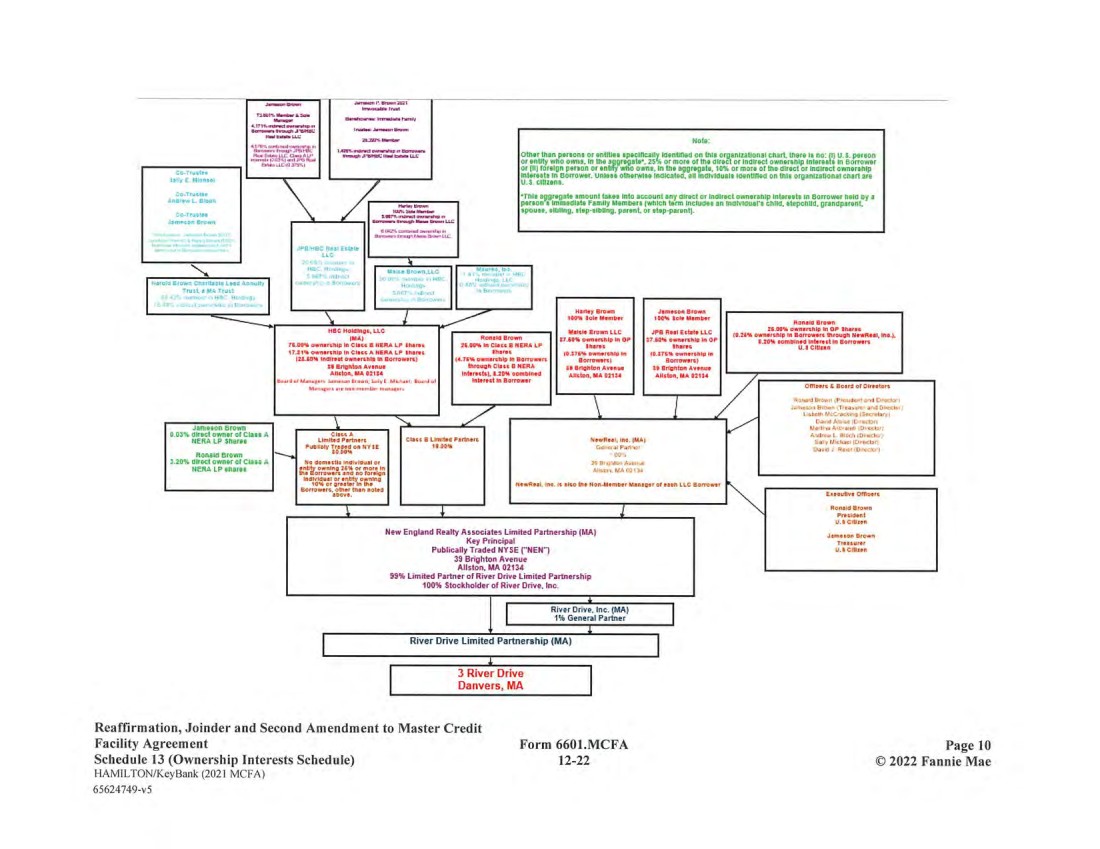

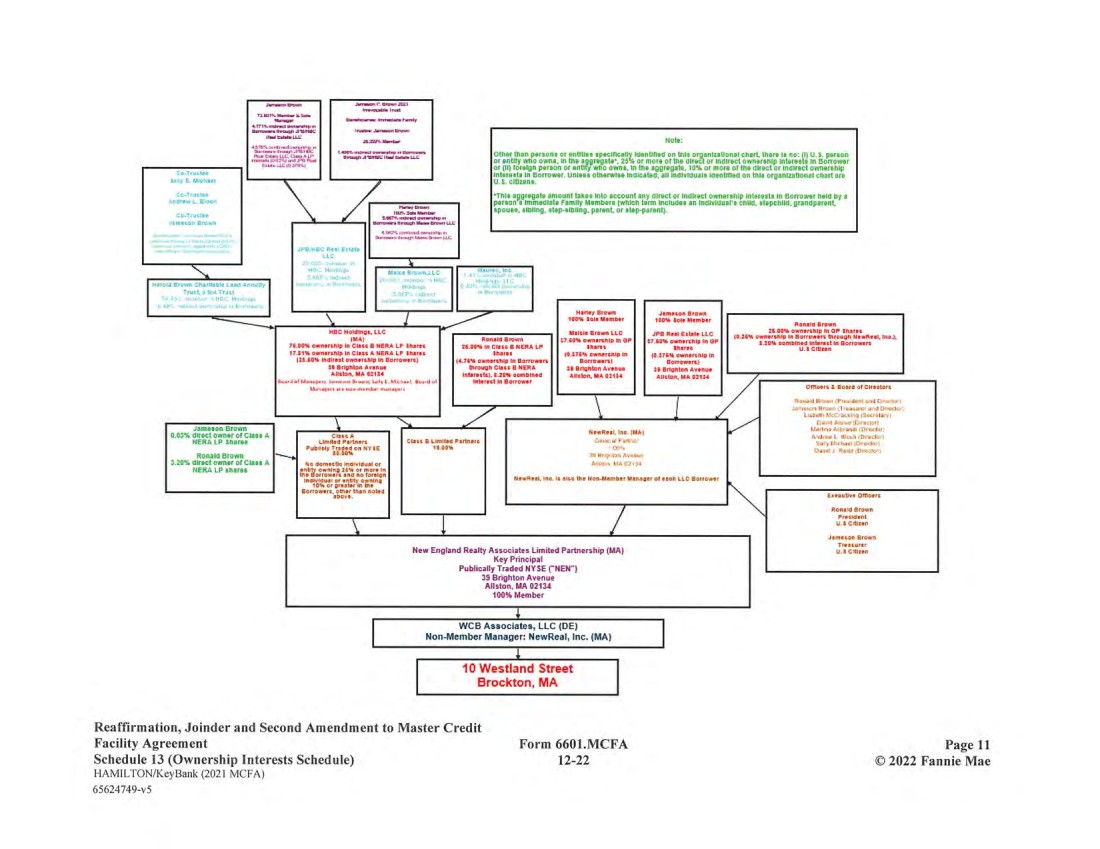

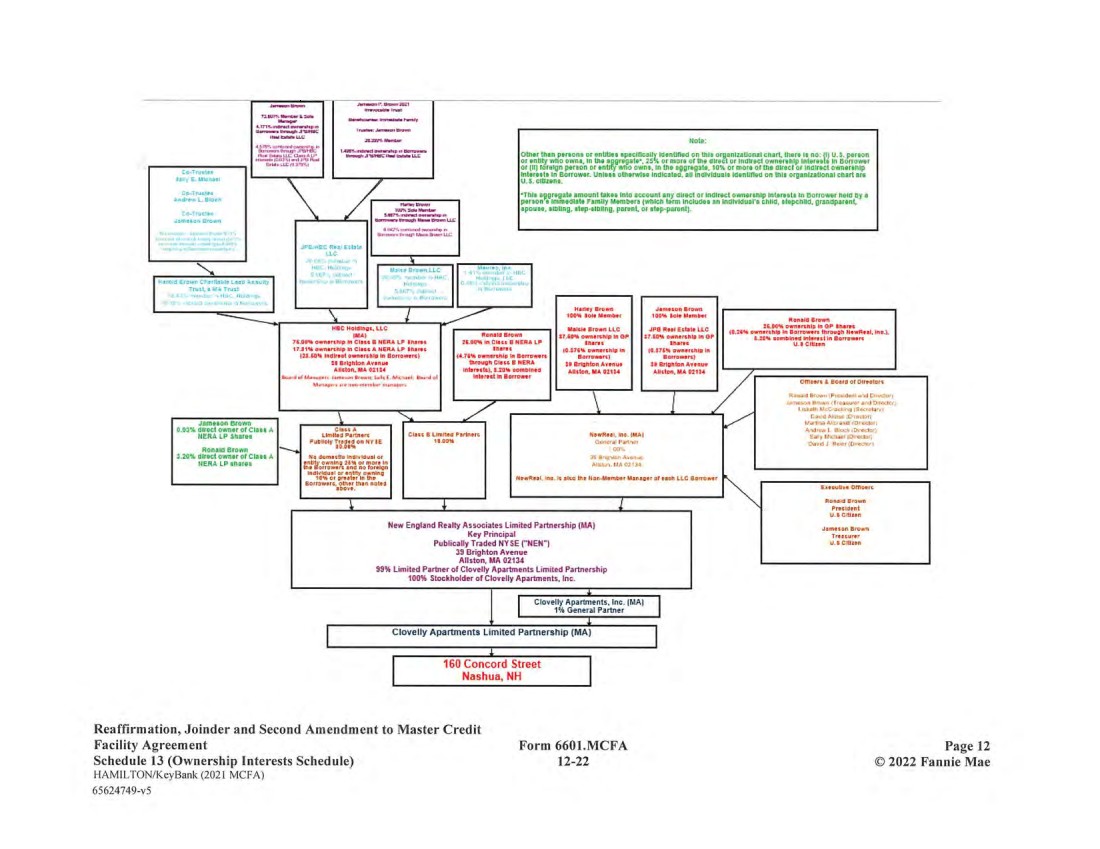

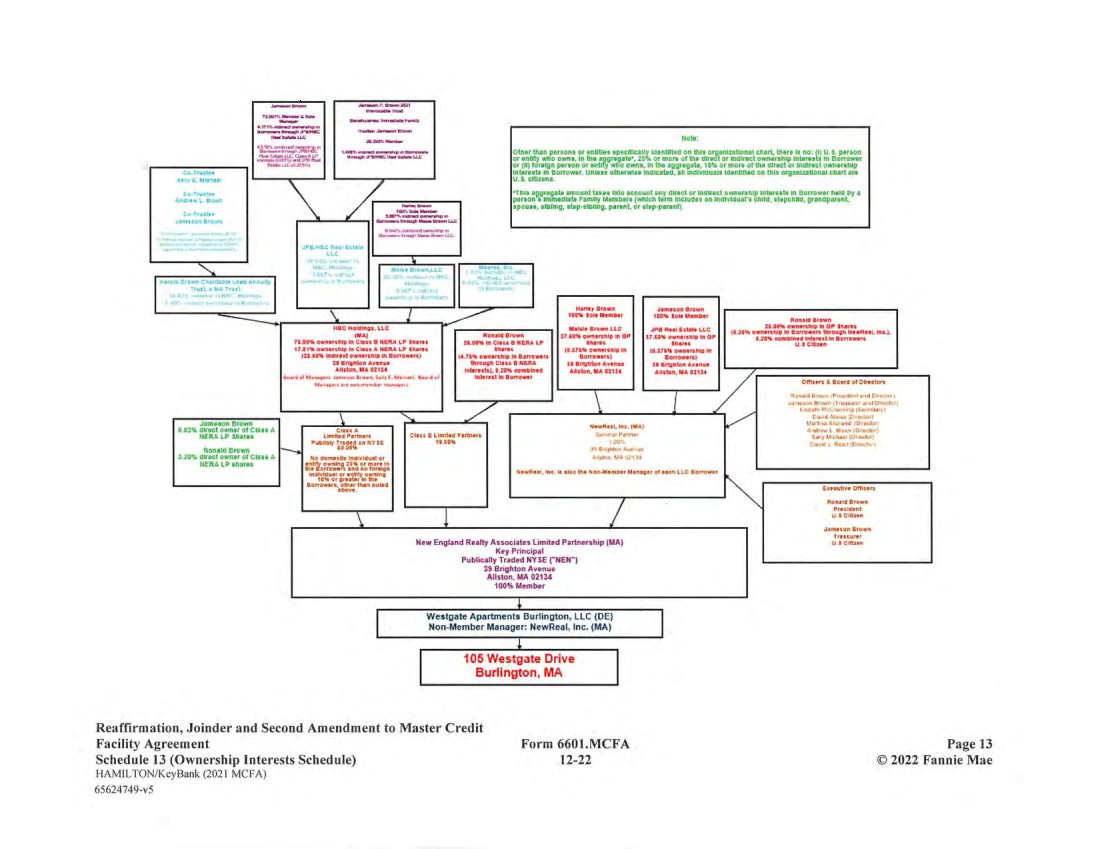

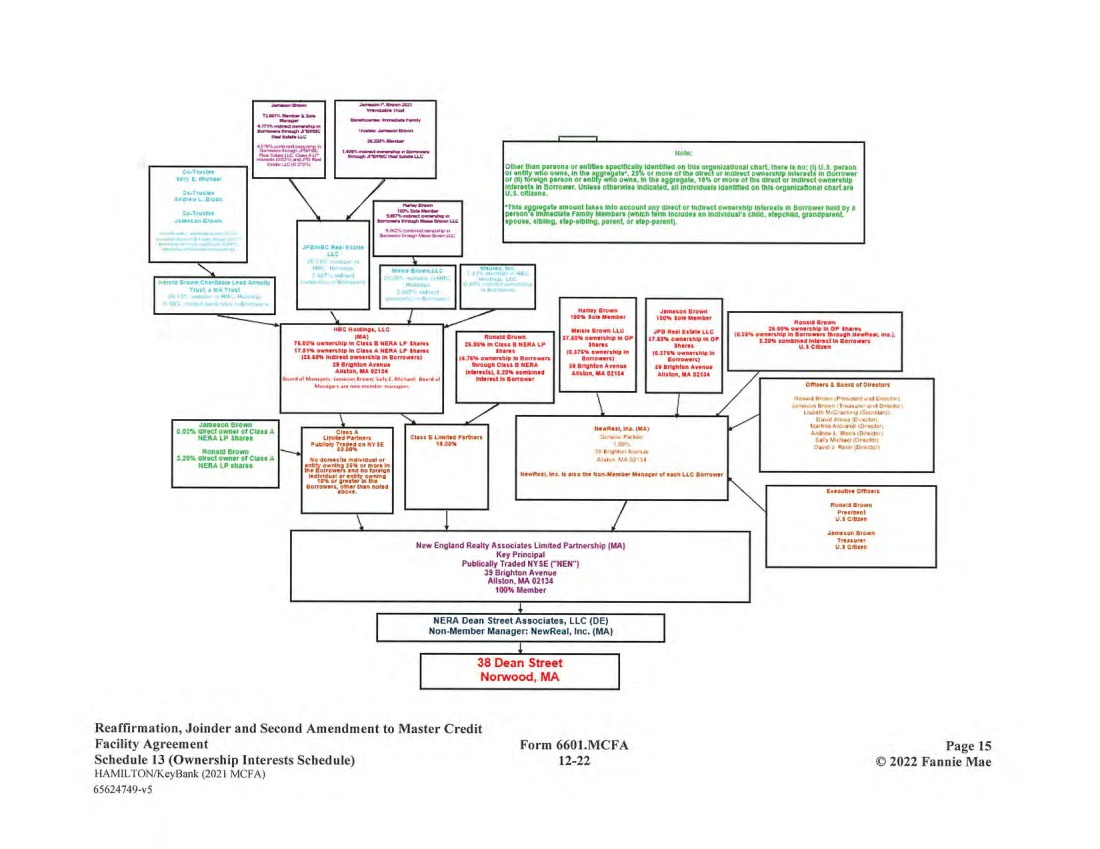

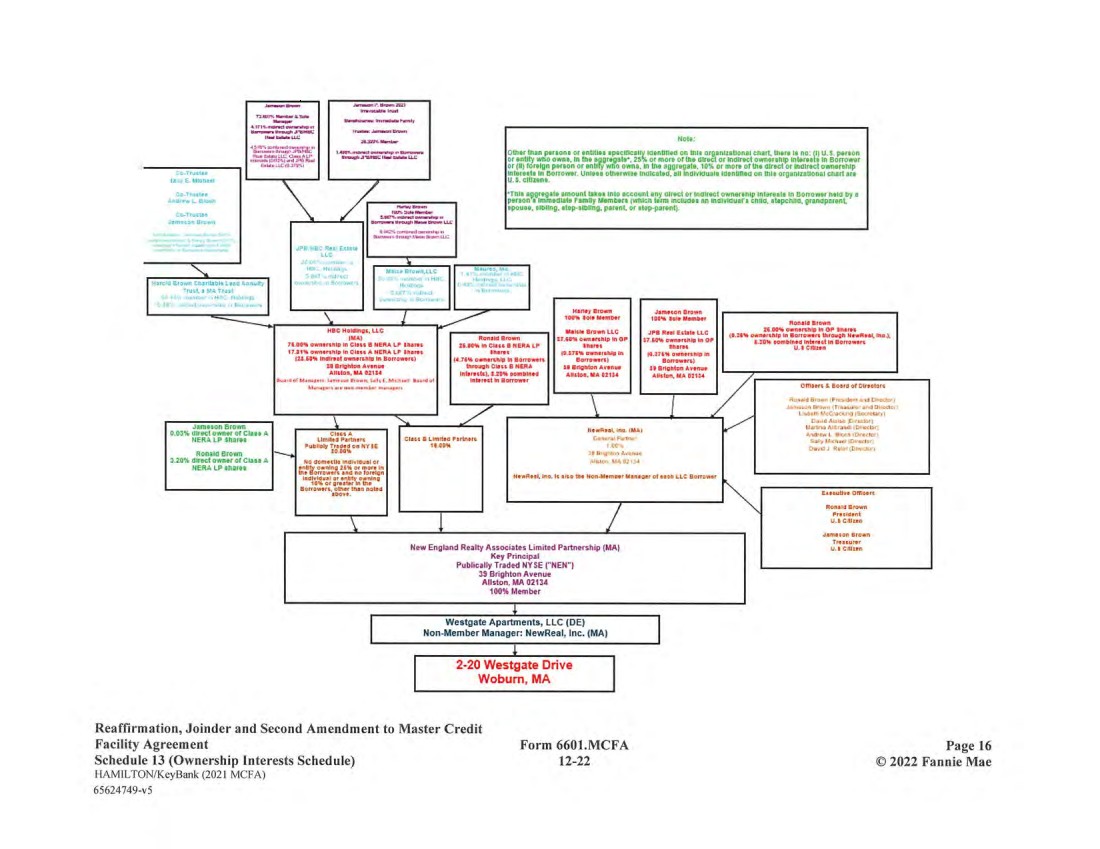

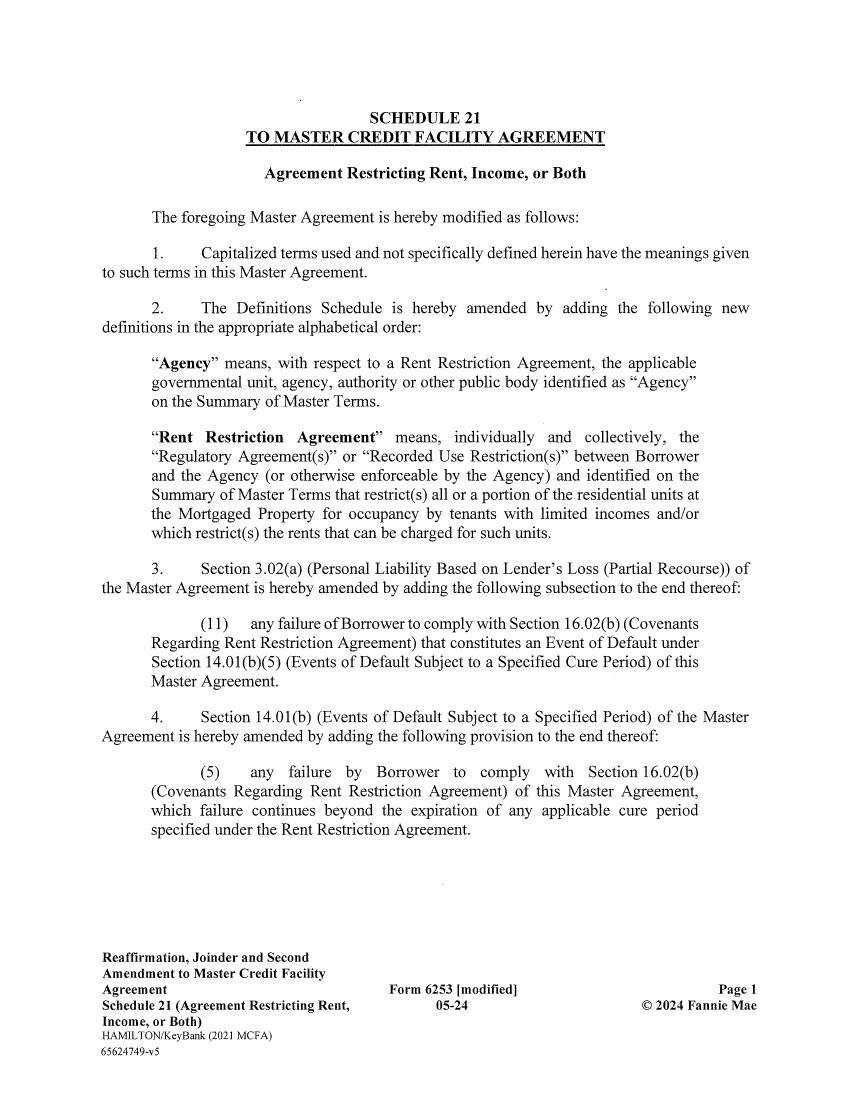

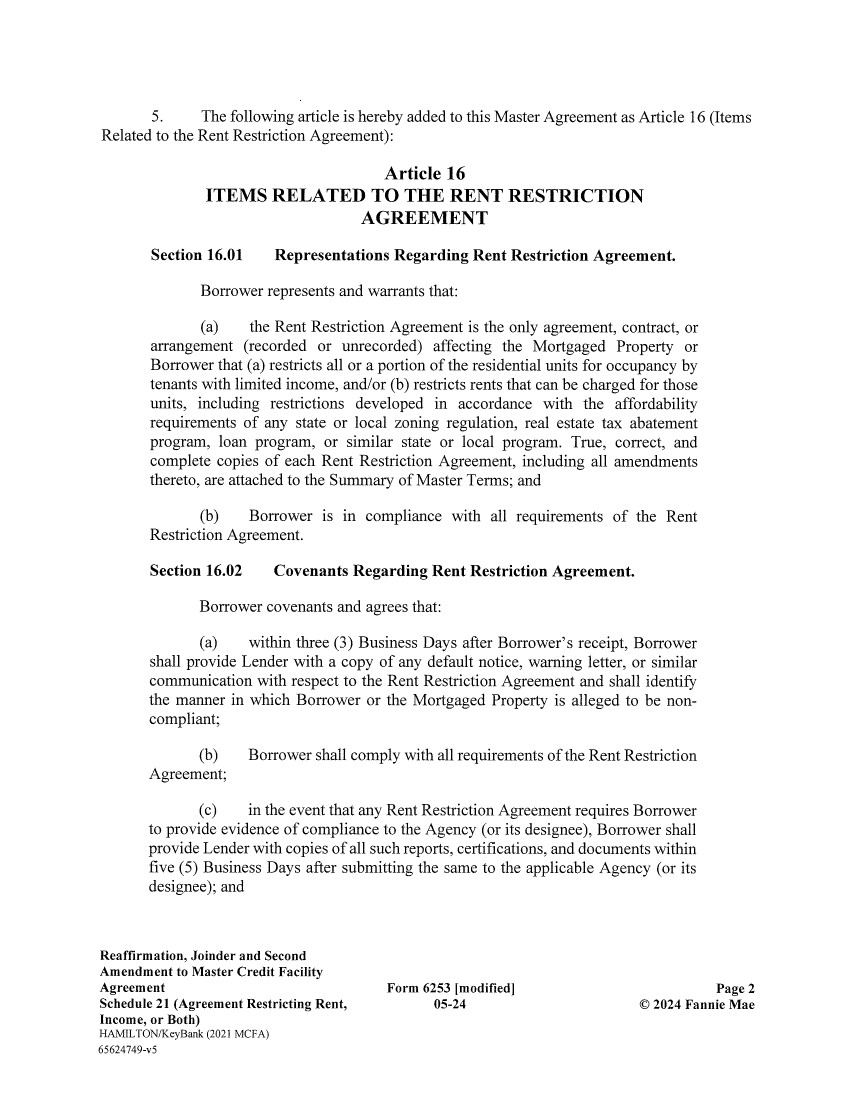

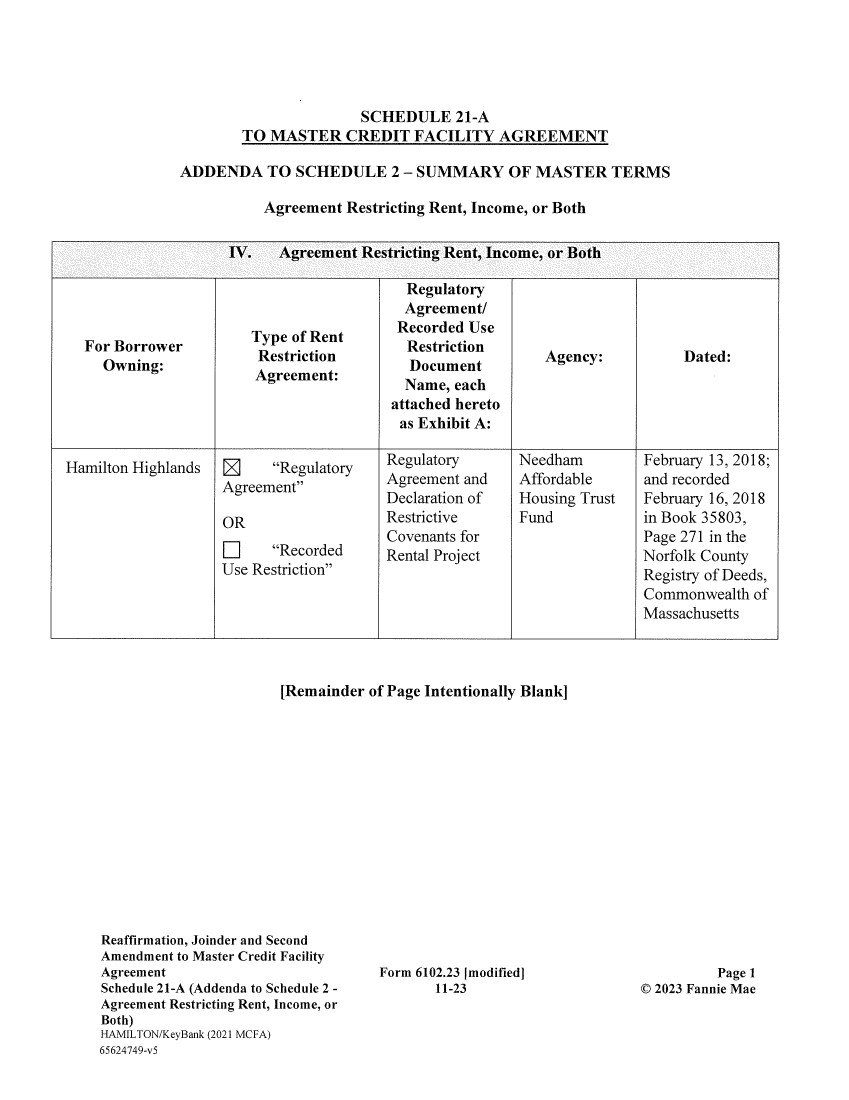

| Section 8. Prepayment Premium Schedule. The Prepayment Premium Schedule attached to the Master Agreement is hereby supplemented with Schedule 4.3 and Schedule 4.4 attached hereto. Section 9. Required Replacement Schedule. The Required Replacement Schedule attached to the Master Agreement is hereby supplemented with Schedule 5.2 attached hereto. Section 10. Required Repair Schedule. The Required Repair Schedule attached to the Master Agreement is hereby supplemented with Schedule 6.2 attached hereto. Section 11. Ownership Interests Schedule. The Ownership Interests Schedule attached to the Master Agreement is hereby amended by deleting Schedule 13 and replacing it with Schedule 13 attached hereto. Section 12. Agreement Restricting Rent, Income, or Both. Schedule 21 and Schedule 21-A attached hereto are hereby added to the Master Agreement. Section 13. Exhibit A. Exhibit A to each of the Master Agreement and the Environmental Indemnity Agreement is hereby deleted in its entirety and replaced with Exhibit A attached hereto. Section 14. Authorization. Borrower represents and warrants that Borrower is duly authorized to execute and deliver this Amendment and is and will continue to be duly authorized to perform its obligations under the Master Agreement, as amended hereby. Section 15. Compliance with Loan Documents. The representations and warranties set forth in the Loan Documents executed or assumed by Borrower, as amended hereby, are true and correct with the same effect as if such representations and warranties had been made on the date hereof, except for such changes as are specifically permitted under the Loan Documents. In addition, Borrower has complied with and is in compliance with all of its covenants set forth in the Loan Documents, as amended hereby. Section 16. No Event of Default. Borrower represents and warrants that, as of the date hereof, no Event of Default under the Loan Documents executed or assumed by Borrower, as amended hereby, or event or condition which, with the giving of notice or the passage of time, or both, would constitute an Event of Default, has occurred and is continuing. Section 17. Costs. Borrower agrees to pay all fees and costs (including attorneys' fees) incurred by Lender in connection with this Amendment. Section 18. Continuing Force and Effect of Loan Documents. Except as specifically modified or amended by the terms of this Amendment, all other terms and provisions of the Master Agreement and the other Loan Documents are incorporated by reference herein and in all respects shall continue in full force and effect including Section 15.01 (Choice of Law; Consent to Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 3 Fannie Mae 12-22 © 2022 Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 |

| Jurisdiction), Section 15.02 (Waiver of Jury Trial), Section 15.05 (Counterparts), Section 15.08 (Severability; Entire Agreement; Amendments) and Section 15.09 (Construction) of the Master Agreement. Each Borrower, by execution of this Amendment, hereby reaffirms, assumes and binds itself to all of the obligations, duties, rights, covenants, terms and conditions that are contained in the Master Agreement and the other Loan Documents executed or assumed by it. [Remainder of Page Intentionally Left Blank] Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 4 © 2022 Fannie Mae |

| IN WITNESS WHEREOF, the parties hereto have signed and delivered this Amendment under seal (where applicable) or have caused this Amendment to be signed and delivered under seal (where applicable) by their duly authorized representatives. Where Applicable Law so provides, the parties hereto intend that this Amendment shall be deemed to be signed and delivered as a sealed instrument. ORIGINAL BORROWER: COMMONWEALTH 1144 LIMITED PARTNERSHIP, a Massachusetts limited partnership By: Commonwealth Apartments, Inc., a Massachusetts corporation, its General Partner By: (SEAL) Name: onald Brown Title: President COMMONWEALTH 1137 LIMITED PARTNERSHIP, a Massachusetts limited partnership By: Commonwealth Gardens, Inc., a Massachusetts corporation, its General Partner By: (SEAL) Name: Ronald Brown Title: President NORTH BEACON 140 LIMITED PARTNERSHIP, a Massachusetts limited partnership IC A Courtyard on North Beacon, Inc., a Massachusetts corporation, its General Partner By: (SEAL) Name: Ronald Brown Title: President Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v2 Form 6601.MCFA 12-22 Page S-1 C© 2022 Fannie Mae |

| EXECUTIVE APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership By: Executive Apartments, Inc., a Massachusetts corporation, its General Partner By: (SEAL) Name- ona Brown Title: President HAMILTON OAKS ASSOCIATES, LLC, a Delaware limited liability company By: NewReal, Inc., a Massachusetts corporation, its Manager By: (SEAL) Nam . on Brown Title: President HIGHLAND 38 LIMITED PARTNERSHIP, a Massachusetts limited partnership Highland 38, Inc., a Massachusetts corporation, its General Partner By: (SEAL) Name: Ronald Brown Title: President Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v2 Form 6601.MCFA 12-22 Page S-2 © 2022 Fannie Mae |

| OLDE ENGLISH APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership By: Olde English Apartments, Inc., a Massachusetts corporation, its General Partner By: (SEAL) NameV- ona4ldrown Title: President REDWOOD HILLS LIMITED PARTNERSHIP, a Massachusetts limited partnership By: Redwood Hills, Inc., a Massachusetts corporation, its General Partner By: EAL) Name: Ronald Brown Title: President RIVER DRIVE LIMITED PARTNERSHIP, a Massachusetts limited partnership River Drive, Inc., a Massachusetts corporation, its General Partner By: IIIIIII ≥ —SEAL) Name: onald Brown Title: President Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v2 Form 6601.MCFA 12-22 Page S-3 © 2022 Fannie Mae |

| WCB ASSOCIATES, LLC, a Delaware limited liability company By: NewReal, Inc., a Massachusetts corporation, its Manager By: AL) Name: Ronald Brown Title: President CLOVELLY APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership By: Clovelly Apartments, Inc., a Massachusetts corporation, its General Partner By: (SEAL) Name: onald Brown Title: President WESTGATE APARTMENTS BURLINGTON, LLC, a Delaware limited liability company I~ NewReal, Inc., a Massachusetts corporation, its Manager By: EAL) Name: onald Brown Title: President Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v2 Form 6601.MCFA 12-22 Page S-4 © 2022 Fannie Mae |

| SCHOOL STREET 9, LLC, a Delaware limited liability company By: NewReal, Inc., a Massachusetts corporation, its Manager SEAL) Name. Ronald Brown Title: President NERA DEAN STREET ASSOCIATES, LLC, a Delaware limited liability company By: NewReal, Inc., a Massachusetts corporation, its Manager By: (SEAL) Name: Ronald Brown Title: President WESTGATE APARTMENTS, LLC, a Delaware limited liability company NewReal, Inc., a Massachusetts corporation, its Manager By: (SEAL) Name: Ronald Brown Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v2 Title: President Form 6601.MCFA 12-22 Page S-5 © 2022 Fannie Mae |

| ADDITIONAL BORROWER: HAMILTON HIGHLANDS, LLC, a Massachusetts limited liability company NewReal, Inc., a Massachusetts corporation, its Manager By: (SEAL) Name onald Brown Title: President Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBainc (2021 MCFA) 65624749-v2 Form 6601.MCFA 12-22 Page S-6 cO 2022 Fannie Mae |

| ORIGINAL LENDER: KEYBANK NATIONAL ASSOCIATION, a national banking association By: (SEAL) Name: elly odgett Title: Vice President Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v3 Form 6601.MCFA 12-22 Page S-7 © 2022 Fannie Mae |

| FANNIE MAE: FANNIE MAE By: 41t ?Lt::L (SEAL) Name: Michael W. Dick Title: Assistant Vice President Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)KeyBsank (2021 MCFA) 65624749-v2 Form 6601.MCFA 12-22 Page S-8 © 2022 Fannie Mae |

| SCHEDULEI Borrower Original Borrower (a) COMMONWEALTH 1144 LIMITED PARTNERSHIP, a Massachusetts limited partnership (b) COMMONWEALTH 1137 LIMITED PARTNERSHIP, a Massachusetts limited partnership (c) NORTH BEACON 140 LIMITED PARTNERSHIP, a Massachusetts limited partnership (d) EXECUTIVE APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership (e) HAMILTON OAKS ASSOCIATES, LLC, a Delaware limited liability company (f) HIGHLAND 38 LIMITED PARTNERSHIP, a Massachusetts limited partnership (g) OLDE ENGLISH APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership (h) REDWOOD HILLS LIMITED PARTNERSHIP, a Massachusetts limited partnership (i) RIVER DRIVE LIMITED PARTNERSHIP, a Massachusetts limited partnership (j) WCB ASSOCIATES, LLC, a Delaware limited liability company (k) CLOVELLY APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership (1) WESTGATE APARTMENTS BURLINGTON, LLC, a Delaware limited liability company (m) SCHOOL STREET 9, LLC, a Delaware limited liability company (n) NERA DEAN STREET ASSOCIATES, LLC, a Delaware limited liability company (o) WESTGATE APARTMENTS, LLC, a Delaware limited liability company Additional Borrower (p) HAMILTON HIGHLANDS, LLC, a Massachusetts limited liability company Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 1 © 2022 Fannie Mae |

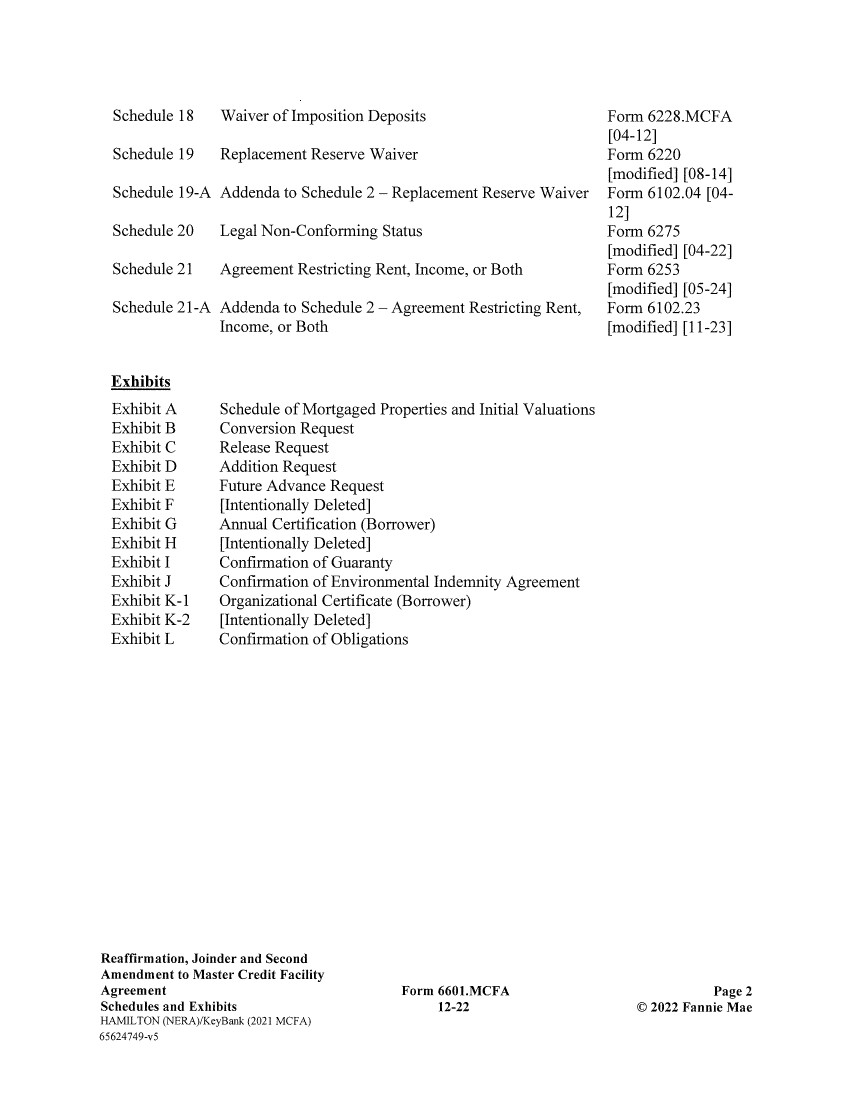

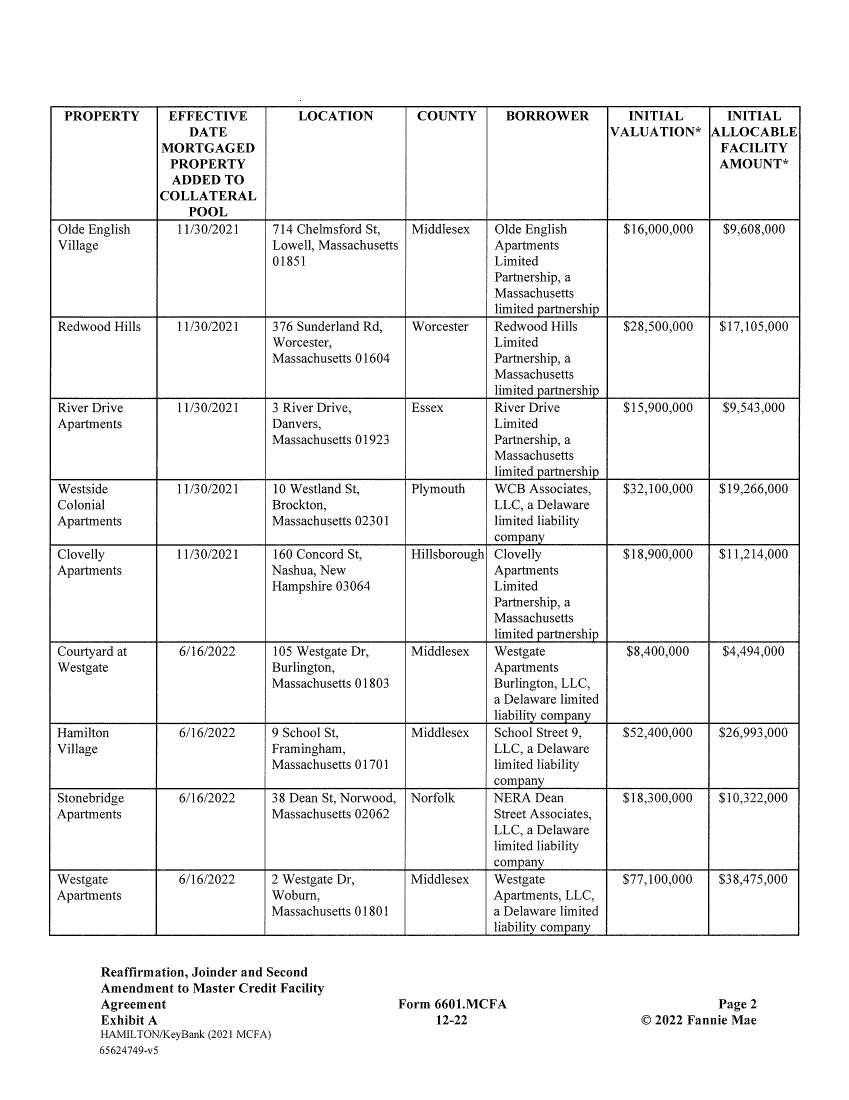

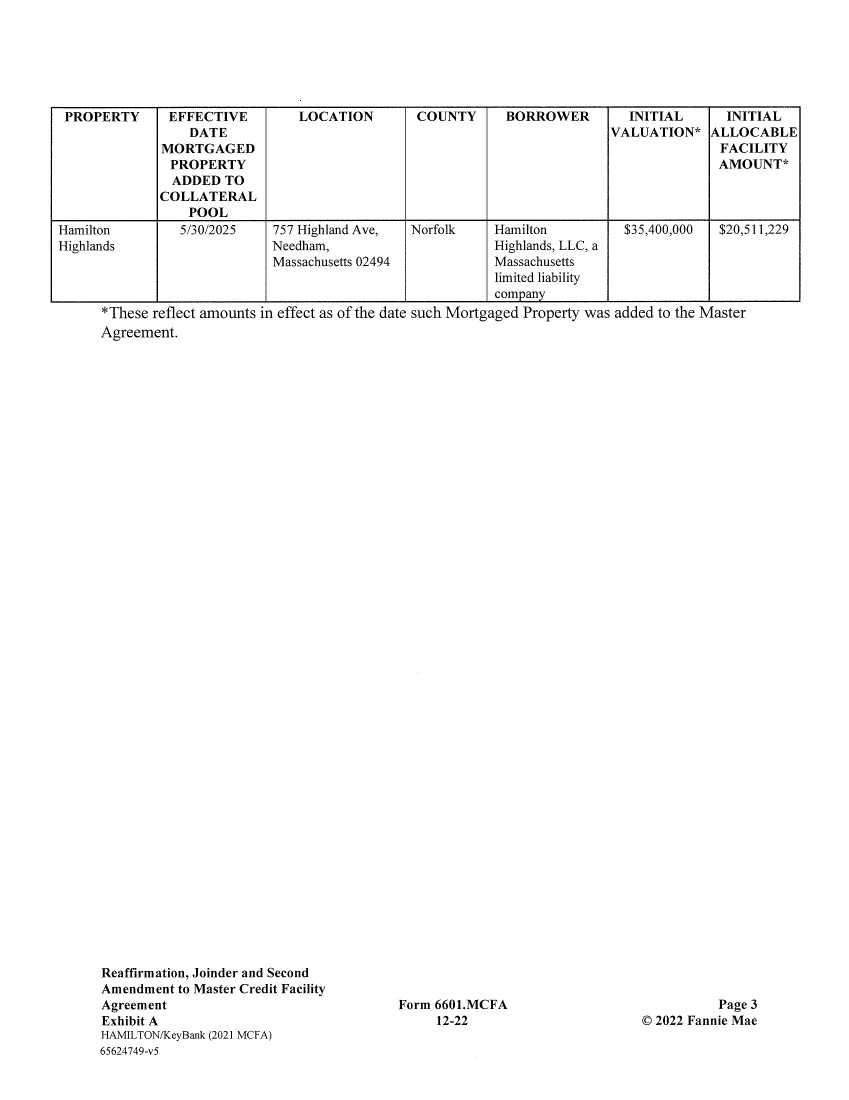

| SCHEDULES AND EXHIBITS The Schedules and Exhibits list attached to the Master Agreement is hereby deleted in its entirety and restated as follows: Schedules Schedule 1 Definitions Schedule — General Schedule 2 Summary of Master Terms Schedule 3.1 Schedule of Advance Terms Schedule 3.2 Schedule of Advance Terms Schedule 3.3 Schedule of Advance Terms Schedule 3.4 Schedule of Advance Terms Schedule 4.1 Prepayment Premium Schedule Schedule 4.2 Prepayment Premium Schedule Schedule 4.3 Prepayment Premium Schedule Schedule 4.4 Prepayment Premium Schedule Schedule 5 Required Replacement Schedule Schedule 5.1 Supplement to Required Replacement Schedule Schedule 5.2 Supplement to Required Replacement Schedule Schedule 6 Required Repair Schedule Schedule 6.1 Supplement to Required Repair Schedule Schedule 6.2 Supplement to Required Repair Schedule Schedule 7 General Conditions Schedule Schedule 8 Property-Related Documents Schedule Schedule 9 Conversion Schedule Schedule 10 Mortgaged Property Release Schedule Schedule 11 Mortgaged Property Addition Schedule Schedule 12 [Intentionally Deleted] Schedule 13 Ownership Interests Schedule Schedule 14 Future Advance Schedule Schedule 15 Letter of Credit Schedule Schedule 16 Exceptions to Representations and Warranties Schedule Schedule 17 SPE Requirements Schedule Form 6104.01.MCFA [05- 20] Form 6104.01.MCFA [05- 20] Form 6104.01.MCFA [05- 20] Form 6104.01.MCFA [05- 20] Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedules and Exhibits HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 1 © 2022 Fannie Mae |

| Schedule 18 Waiver of Imposition Deposits Form 6228.MCFA [04-12] Schedule 19 Replacement Reserve Waiver Form 6220 [modified] [08-14] Schedule 19-A Addenda to Schedule 2 — Replacement Reserve Waiver Form 6102.04 [04- 12] Schedule 20 Legal Non-Conforming Status Form 6275 [modified] [04-22] Schedule 21 Agreement Restricting Rent, Income, or Both Form 6253 [modified] [05-24] Schedule 21-A Addenda to Schedule 2 — Agreement Restricting Rent, Form 6102.23 Income, or Both [modified] [11-23] Exhibits Exhibit A Schedule of Mortgaged Properties and Initial Valuations Exhibit B Conversion Request Exhibit C Release Request Exhibit D Addition Request Exhibit E Future Advance Request Exhibit F [Intentionally Deleted] Exhibit G Annual Certification (Borrower) Exhibit H [Intentionally Deleted] Exhibit I Confirmation of Guaranty Exhibit J Confirmation of Environmental Indemnity Agreement Exhibit K-I Organizational Certificate (Borrower) Exhibit K-2 [Intentionally Deleted] Exhibit L Confirmation of Obligations Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 2 Schedules and Exhibits 12-22 © 2022 Fannie Mae HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 |

| Borrower hereby acknowledges and agrees that the Schedules and Exhibits referenced above are hereby incorporated fully into this Master Agreement by this reference and each constitutes a substantive part of this Master Agreement. Borrower Initials Borrower Initials Borrower Initials Borrower nitials Borrower Initials Borrower Initials Borrower Initials Borrower Initials Y n Borrower Initials Borrower Initials / 2 17 Borrower Initials orrower Initials Borrower Initials Borrower Initials /27 Borrower Initials Borrower Initials Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedules and Exhibits HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v2 Form 6601.MCFA 12-22 Initial Page © 2022 Fannie Mae |

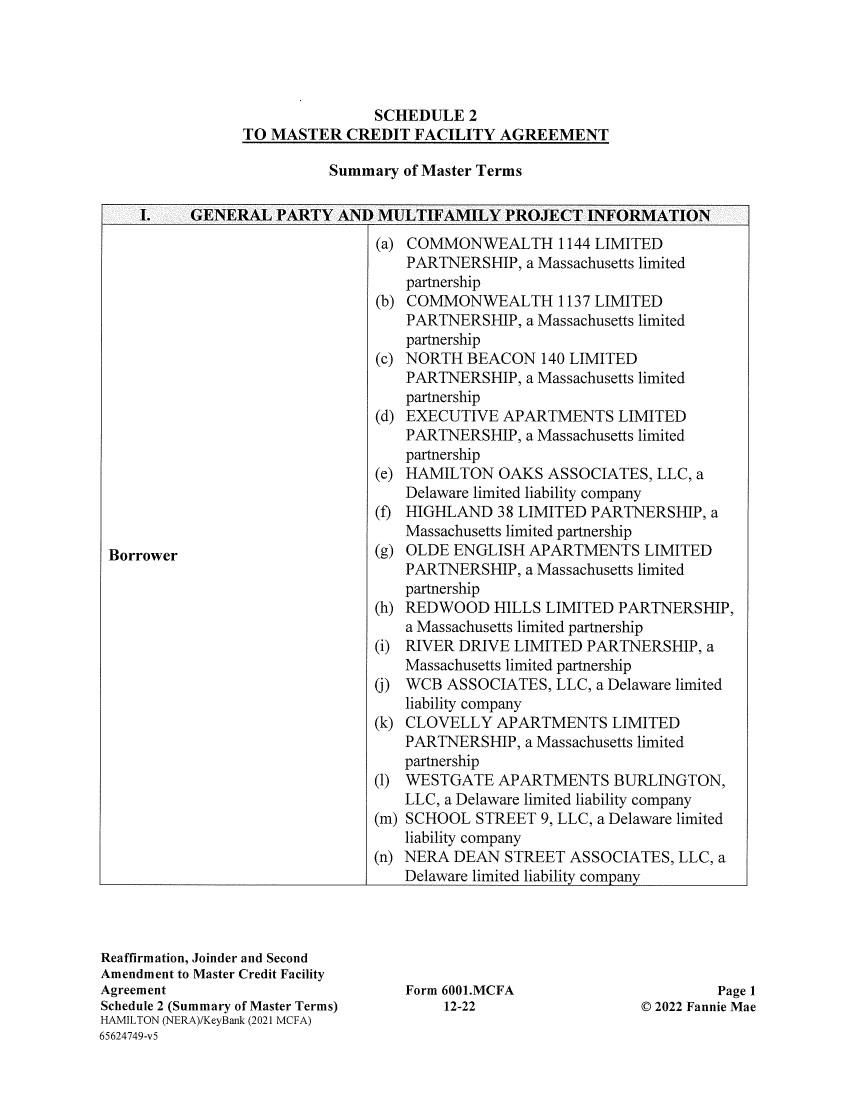

| SCHEDULE2 TO MASTER CREDIT FACILITY AGREEMENT Summary of Master Terms I. GENERAL PARTY AND MULTIFAMILY PROJECT INFORMATION (a) COMMONWEALTH 1144 LIMITED PARTNERSHIP, a Massachusetts limited partnership (b) COMMONWEALTH 1137 LIMITED PARTNERSHIP, a Massachusetts limited partnership (c) NORTH BEACON 140 LIMITED PARTNERSHIP, a Massachusetts limited partnership (d) EXECUTIVE APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership (e) HAMILTON OAKS ASSOCIATES, LLC, a Delaware limited liability company (f) HIGHLAND 38 LIMITED PARTNERSHIP, a Massachusetts limited partnership Borrower (g) OLDE ENGLISH APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership (h) REDWOOD HILLS LIMITED PARTNERSHIP, a Massachusetts limited partnership (i) RIVER DRIVE LIMITED PARTNERSHIP, a Massachusetts limited partnership (j) WCB ASSOCIATES, LLC, a Delaware limited liability company (k) CLOVELLY APARTMENTS LIMITED PARTNERSHIP, a Massachusetts limited partnership (1) WESTGATE APARTMENTS BURLINGTON, LLC, a Delaware limited liability company (m) SCHOOL STREET 9, LLC, a Delaware limited liability company (n) NERA DEAN STREET ASSOCIATES, LLC, a Delaware limited liability company Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 2 (Summary of Master Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6001.MCFA 12-22 Page 1 © 2022 Fannie Mae |

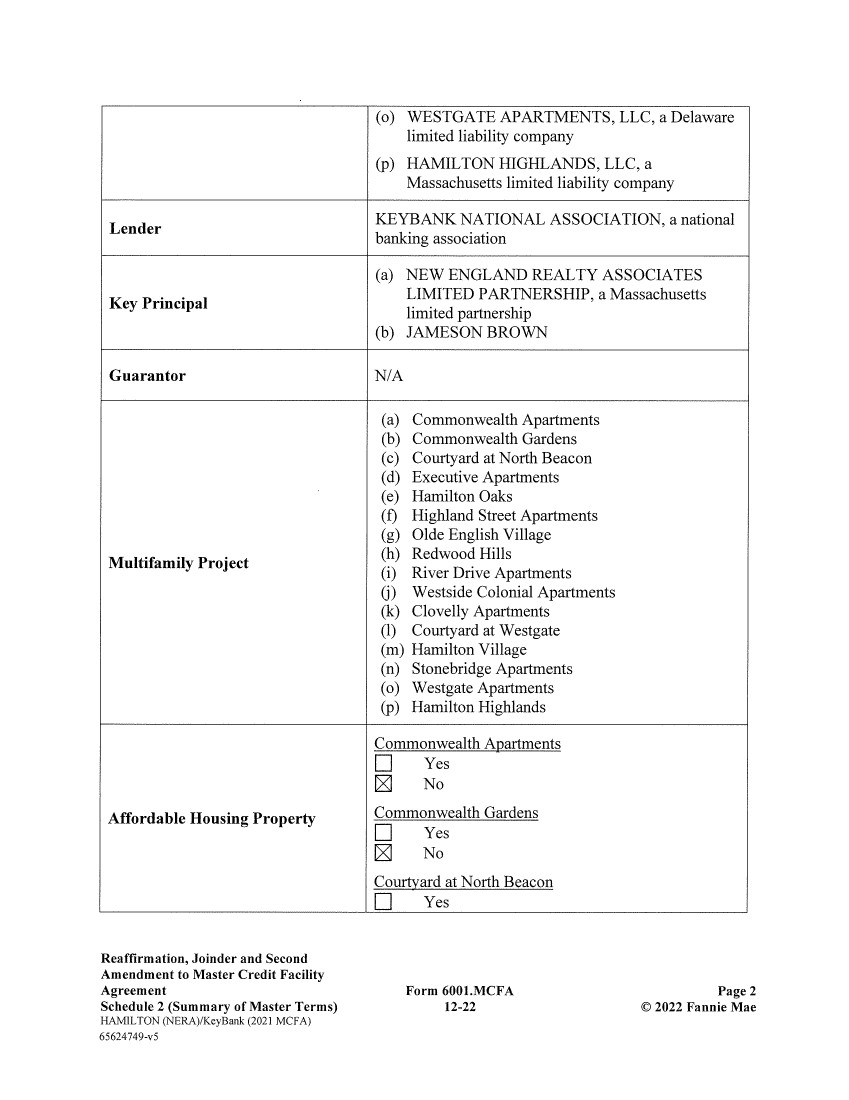

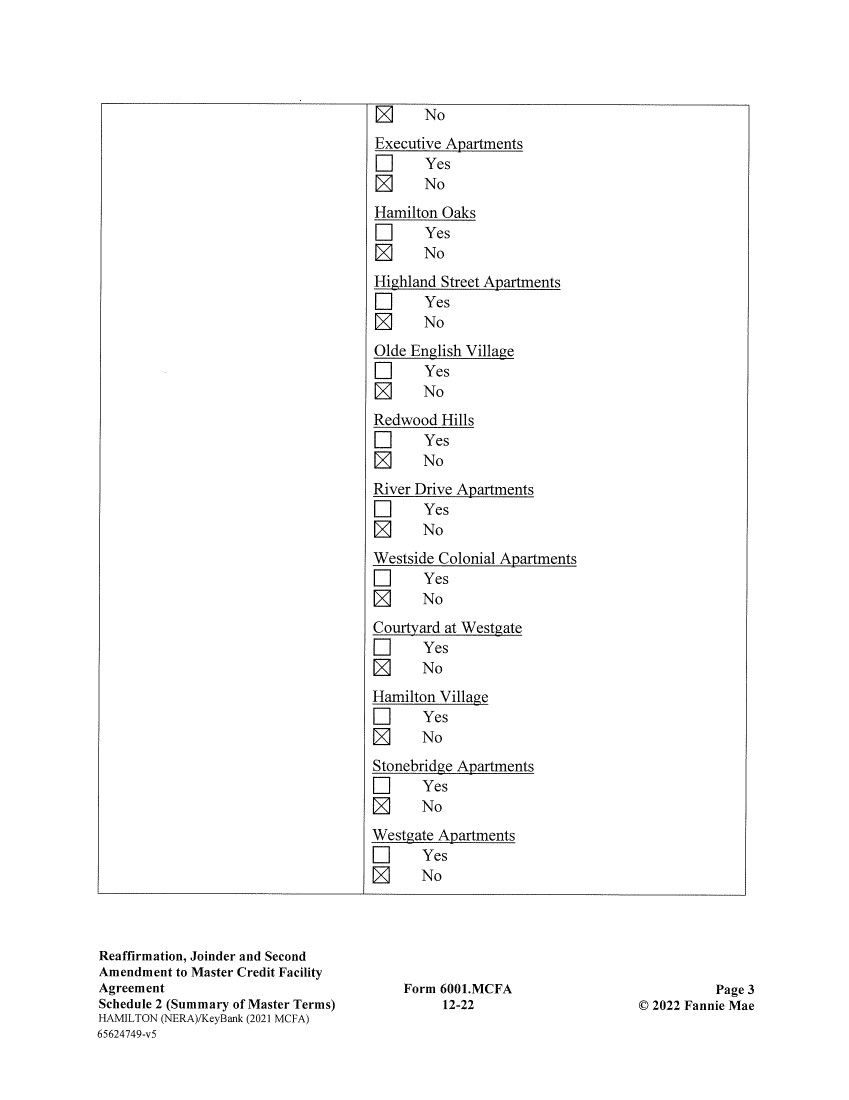

| (o) WESTGATE APARTMENTS, LLC, a Delaware limited liability company (p) HAMILTON HIGHLANDS, LLC, a Massachusetts limited liability company Lender KEYBANK NATIONAL ASSOCIATION, a national banking association (a) NEW ENGLAND REALTY ASSOCIATES Key Principal LIMITED PARTNERSHIP, a Massachusetts limited partnership (b) JAMESON BROWN Guarantor N/A (a) Commonwealth Apartments (b) Commonwealth Gardens (c) Courtyard at North Beacon (d) Executive Apartments (e) Hamilton Oaks (f) Highland Street Apartments (g) Olde English Village Multifamily Project (h) Redwood Hills (i) River Drive Apartments (j) Westside Colonial Apartments (k) Clovelly Apartments (1) Courtyard at Westgate (m) Hamilton Village (n) Stonebridge Apartments (o) Westgate Apartments (p) Hamilton Highlands Commonwealth Apartments ❑ Yes ® No Affordable Housing Property Commonwealth Gardens ❑ Yes ® No Courtyard at North Beacon ❑ Yes Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 2 (Summary of Master Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6001.MCFA 12-22 Page 2 © 2022 Fannie Mae |

| No Executive Apartments ❑ Yes No Hamilton Oaks ❑ Yes ® No Highland Street Apartments ❑ Yes ® No Olde English Village ❑ Yes No Redwood Hills ❑ Yes ® No River Drive Apartments ❑ Yes ® No Westside Colonial Apartments ❑ Yes ® No Courtyard at Westgate ❑ Yes ® No Hamilton Village ❑ Yes ® No Stonebridge Apartments ❑ Yes ® No Westgate Apartments ❑ Yes ® No Form 6001.MCFA 12-22 Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 2 (Summary of Master Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Page 3 © 2022 Fannie Mae |

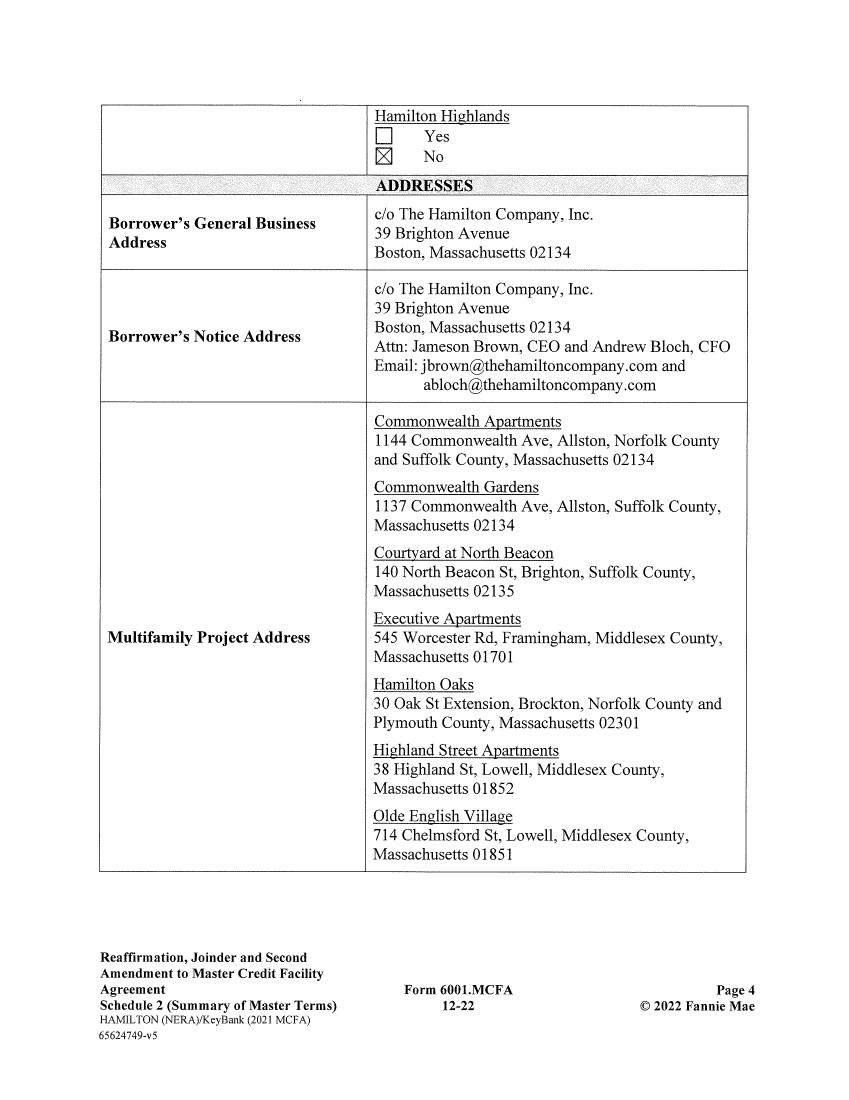

| Hamilton Highlands ❑ Yes ® No ADDRESSES Borrower's General Business c/o The Hamilton Company, Inc. Address 39 Brighton Avenue Boston, Massachusetts 02134 c/o The Hamilton Company, Inc. 39 Brighton Avenue Borrower's Notice Address Boston, Massachusetts 02134 Attn: Jameson Brown, CEO and Andrew Bloch, CFO Email: jbrown@thehamiltoncompany.com and abloch@thehamiltoncompany.com Commonwealth Apartments 1144 Commonwealth Ave, Allston, Norfolk County and Suffolk County, Massachusetts 02134 Commonwealth Gardens 1137 Commonwealth Ave, Allston, Suffolk County, Massachusetts 02134 Courtyard at North Beacon 140 North Beacon St, Brighton, Suffolk County, Massachusetts 02135 Executive Apartments Multifamily Project Address 545 Worcester Rd, Framingham, Middlesex County, Massachusetts 01701 Hamilton Oaks 30 Oak St Extension, Brockton, Norfolk County and Plymouth County, Massachusetts 02301 Highland Street Apartments 38 Highland St, Lowell, Middlesex County, Massachusetts 01852 Olde English Village 714 Chelmsford St, Lowell, Middlesex County, Massachusetts 01851 Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 2 (Summary of Master Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6001.MCFA 12-22 Page 4 © 2022 Fannie Mae |

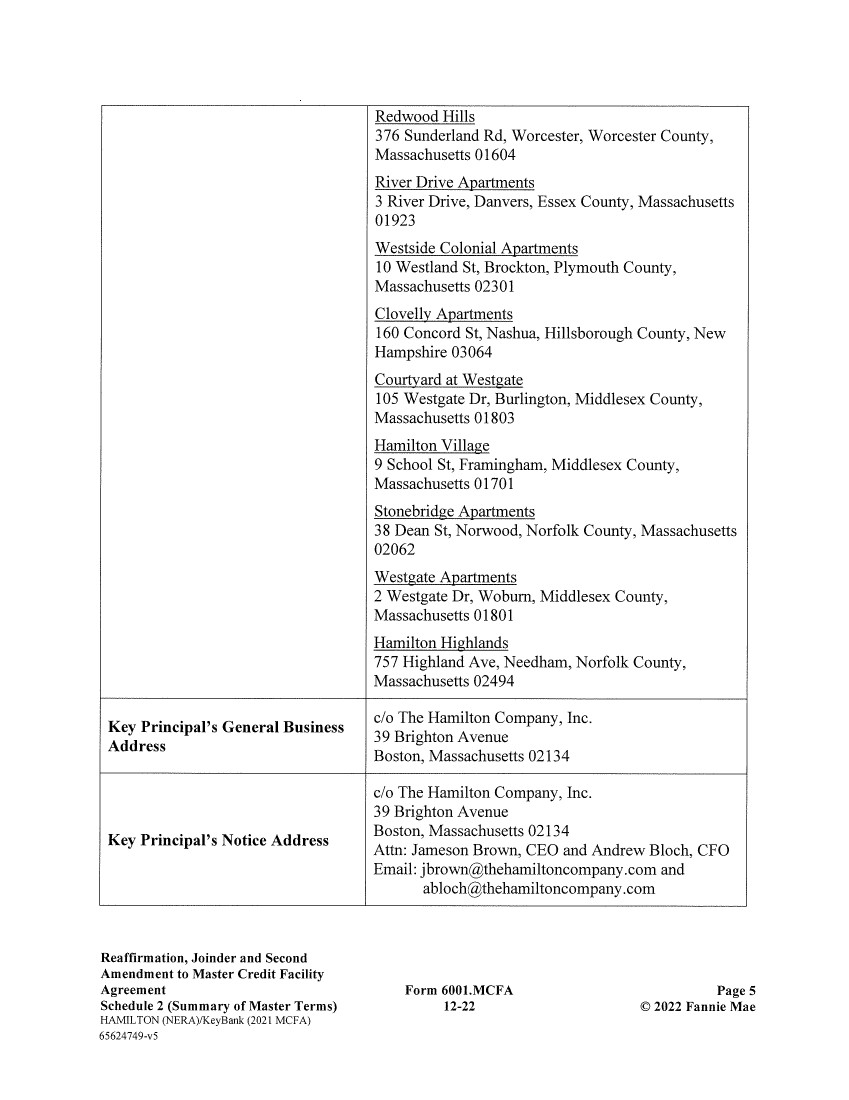

| Redwood Hills 376 Sunderland Rd, Worcester, Worcester County, Massachusetts 01604 River Drive Apartments 3 River Drive, Danvers, Essex County, Massachusetts 01923 Westside Colonial Apartments 10 Westland St, Brockton, Plymouth County, Massachusetts 02301 Clovelly Apartments 160 Concord St, Nashua, Hillsborough County, New Hampshire 03064 Courtyard at Westgate 105 Westgate Dr, Burlington, Middlesex County, Massachusetts 01803 Hamilton Village 9 School St, Framingham, Middlesex County, Massachusetts 01701 Stonebridge Apartments 38 Dean St, Norwood, Norfolk County, Massachusetts 02062 Westgate Apartments 2 Westgate Dr, Woburn, Middlesex County, Massachusetts 01801 Hamilton Highlands 757 Highland Ave, Needham, Norfolk County, Massachusetts 02494 Key Principal's General Business c/o The Hamilton Company, Inc. Address 39 Brighton Avenue Boston, Massachusetts 02134 c/o The Hamilton Company, Inc. 39 Brighton Avenue Boston, Massachusetts 02134 Key Principal's Notice Address Attn: Jameson Brown, CEO and Andrew Bloch, CFO Email: jbrown@thehamiltoncompany.com and abloch@thehamiltoncompany.com Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 2 (Summary of Master Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6001.MCFA 12-22 Page 5 © 2022 Fannie Mae |

| Guarantor's General Business N/A Address Guarantor's Notice Address N/A Lender's General Business 127 Public Square Address Cleveland, Ohio 44114 KeyBank Real Estate Capital — Servicing Department 11501 Outlook Street, Suite 300 Lender's Notice Address Overland Park, Kansas 66211 Mail code: KS-01-11-0501 Attention: Servicing Manager c/o KeyBank Real Estate Capital Lender's Payment Address Post Office Box 145404 Cincinnati, Ohio 45250 [Remainder of Page Intentionally Blank] Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 2 (Summary of Master Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6001.MCFA 12-22 Page 6 © 2022 Fannie Mae |

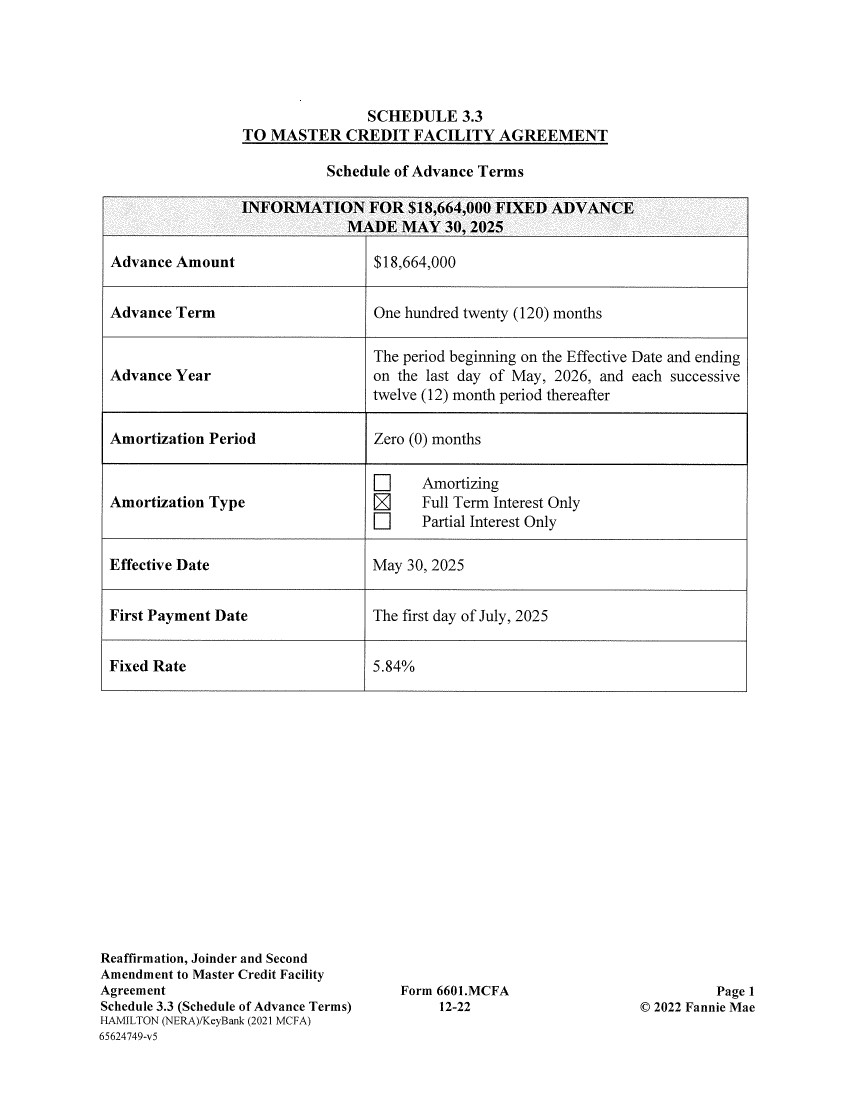

| SCHEDULE 3.3 TO MASTER CREDIT FACILITY AGREEMENT Schedule of Advance Terms INFORMATION FOR $18,664,000 FIXED ADVANCE MADE MAY 30, 2025 Advance Amount $18,664,000 Advance Term One hundred twenty (120) months Advance Year The period beginning on the Effective Date and ending on the last day of May, 2026, and each successive twelve (12) month period thereafter Amortization Period Zero (0) months Amortization Type ❑ Amortizing ® Full Term Interest Only ❑ Partial Interest Only Effective Date May 30, 2025 First Payment Date The first day of July, 2025 Fixed Rate 5.84% Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 3.3 (Schedule of Advance Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 1 © 2022 Fannie Mae |

| ❑ 30/360 (computed on the basis of a three hundred sixty (360) day year consisting of twelve (12) thirty (30) day months) or ® Actual/360 (computed on the basis of a three Interest Accrual Method hundred sixty (360) day year and the actual number of calendar days during the applicable month, calculated by multiplying the unpaid principal balance of the Advance by the Interest Rate, dividing the product by three hundred sixty (360), and multiplying the quotient obtained by the actual number of days elapsed in the applicable month) Interest Only Term One hundred twenty (120) months Interest Rate The Fixed Rate Interest Rate Type Fixed Rate The first day of June, 2035, or any earlier date on which Maturity Date the unpaid principal balance of the Advance becomes due and payable by acceleration or otherwise For Full Term Interest Only (Actual/360): (i) $90,831.47 for the First Payment Date; and (ii) for each Payment Date thereafter until the Advance is fully paid: (a) $84,776.04 if the prior month was a 28- Monthly Debt Service Payment day month; (b) $87,803.75 if the prior month was a 29- day month; (c) $90,831.47 if the prior month was a 30- day month; and (d) $93,859.18 if the prior month was a 31- day month Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 3.3 (Schedule of Advance Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 2 © 2022 Fannie Mae |

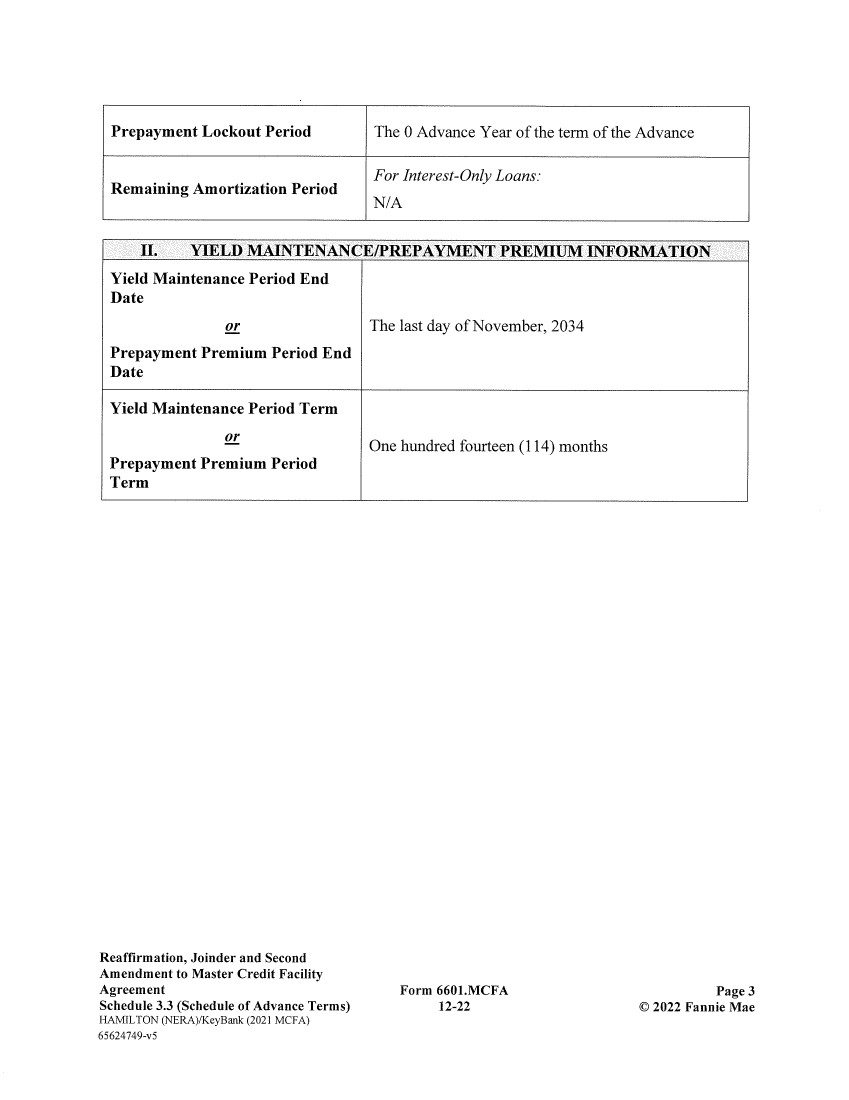

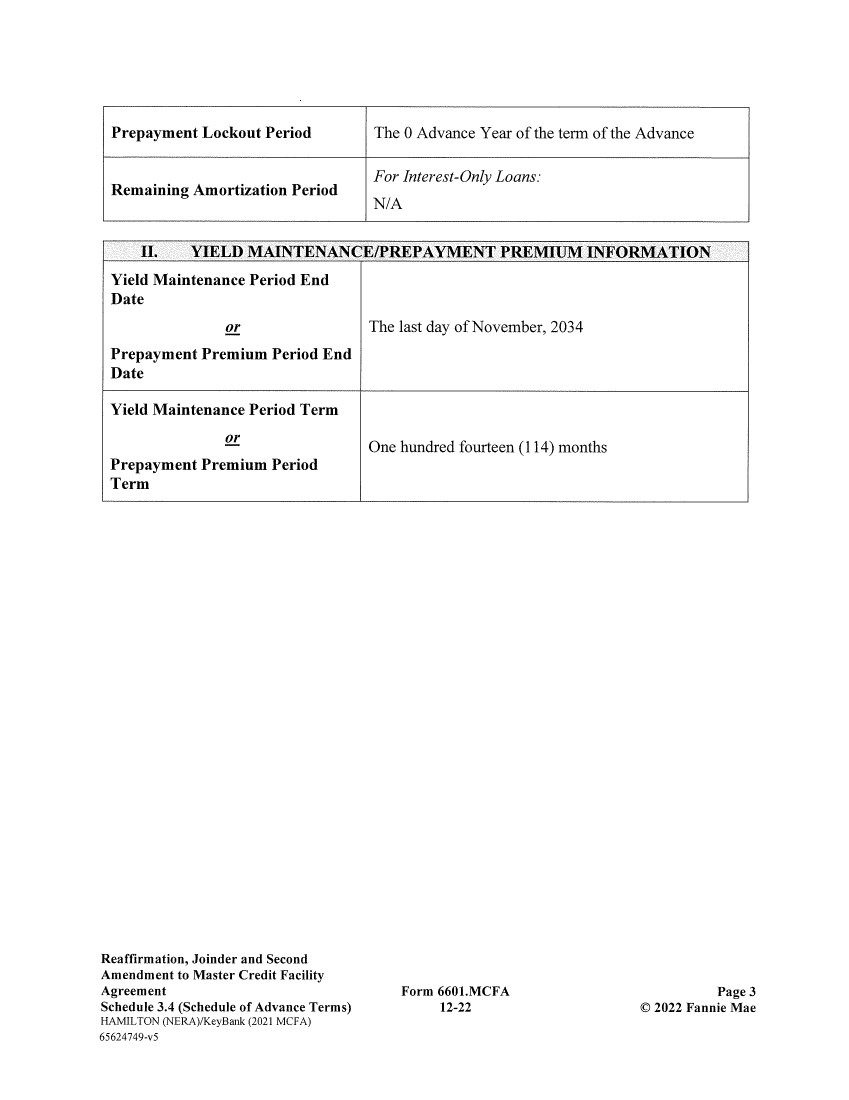

| Prepayment Lockout Period The 0 Advance Year of the term of the Advance For Interest-Only Loans: Remaining Amortization Period N/A H. YIELD MAINTENANCE/PREPAYMENT PREMIUM J1'FORMATIONI Yield Maintenance Period End Date or Prepayment Premium Period End Date Yield Maintenance Period Term or Prepayment Premium Period Term The last day of November, 2034 One hundred fourteen (114) months Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Schedule 3.3 (Schedule of Advance Terms) 12-22 HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Page 3 © 2022 Fannie Mae |

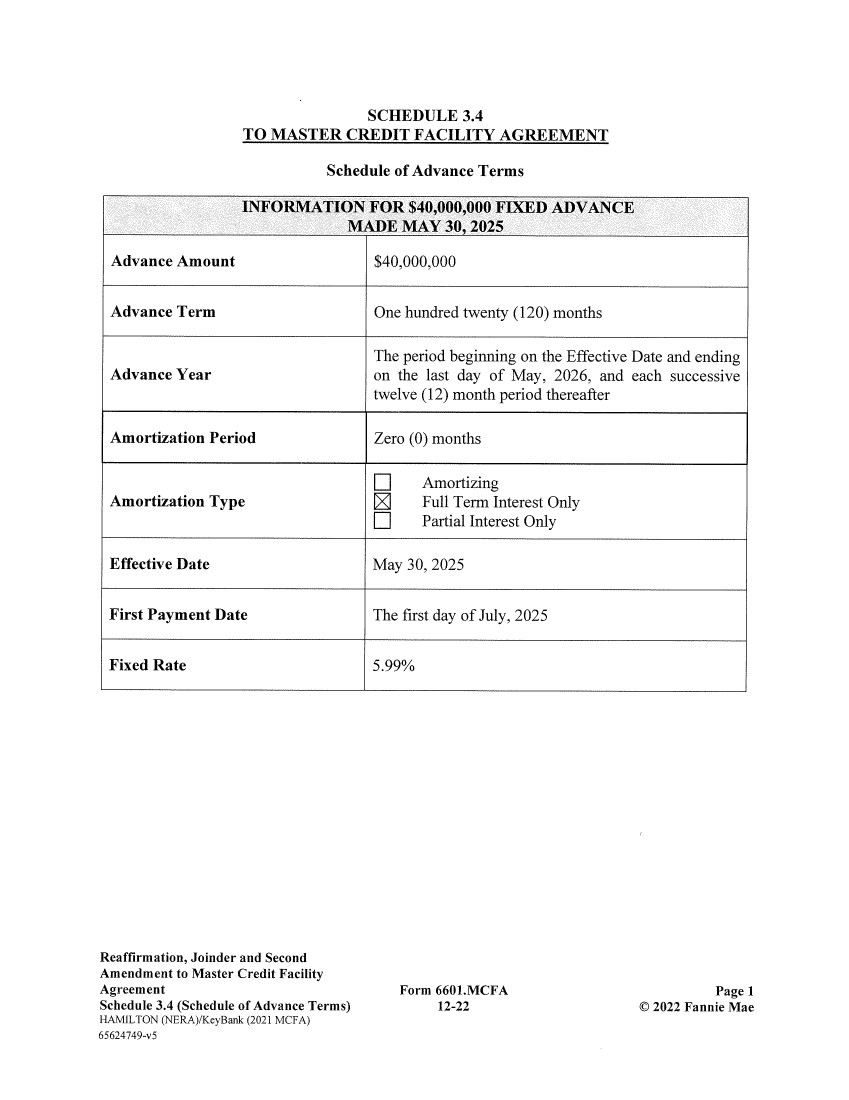

| SCHEDULE 3.4 TO MASTER CREDIT FACILITY AGREEMENT Schedule of Advance Terms INFORMATION FOR $40,000,000 FIXED ADVANCE MADE MAY 30, 2025 Advance Amount $40,000,000 Advance Term One hundred twenty (120) months Advance Year The period beginning on the Effective Date and ending on the last day of May, 2026, and each successive twelve (12) month period thereafter Amortization Period Zero (0) months Amortization Type ❑ Amortizing ® Full Term Interest Only ❑ Partial Interest Only Effective Date May 30, 2025 First Payment Date The first day of July, 2025 Fixed Rate 5.99% Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 3.4 (Schedule of Advance Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 1 © 2022 Fannie Mae |

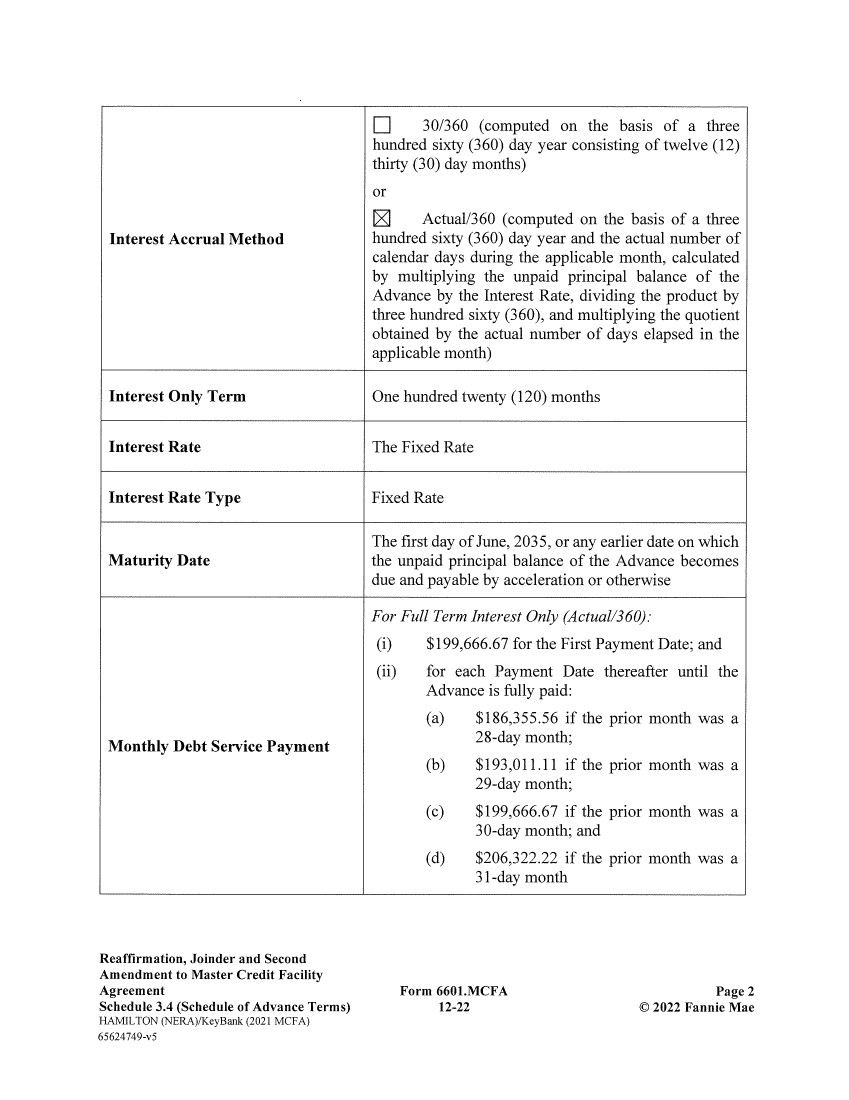

| ❑ 30/360 (computed on the basis of a three hundred sixty (360) day year consisting of twelve (12) thirty (30) day months) or ® Actual/360 (computed on the basis of a three Interest Accrual Method hundred sixty (360) day year and the actual number of calendar days during the applicable month, calculated by multiplying the unpaid principal balance of the Advance by the Interest Rate, dividing the product by three hundred sixty (360), and multiplying the quotient obtained by the actual number of days elapsed in the applicable month) Interest Only Term One hundred twenty (120) months Interest Rate The Fixed Rate Interest Rate Type Fixed Rate The first day of June, 2035, or any earlier date on which Maturity Date the unpaid principal balance of the Advance becomes due and payable by acceleration or otherwise For Full Term Interest Only (Actual/360): (i) $199,666.67 for the First Payment Date; and (ii) for each Payment Date thereafter until the Advance is fully paid: (a) $186,355.56 if the prior month was a Monthly Debt Service Payment 28-day month; (b) $193,011.11 if the prior month was a 29-day month; (c) $199,666.67 if the prior month was a 30-day month; and (d) $206,322.22 if the prior month was a 31-day month Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 3.4 (Schedule of Advance Terms) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 2 © 2022 Fannie Mae |

| Prepayment Lockout Period The 0 Advance Year of the term of the Advance For Interest-Only Loans: Remaining Amortization Period N/A 1 II. YIELD MAINTENANCE/PREPAYMENT PREMIUM INFORMATION I Yield Maintenance Period End Date or Prepayment Premium Period End Date Yield Maintenance Period Term or Prepayment Premium Period Term The last day of November, 2034 One hundred fourteen (114) months Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Schedule 3.4 (Schedule of Advance Terms) 12-22 HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Page 3 © 2022 Fannie Mae |

| SCHEDULE 4.3 TO MASTER CREDIT FACILITY AGREEMENT Prepayment Premium Schedule (Standard Yield Maintenance — Fixed Rate) 1. Defined Terms. All capitalized terms used but not defined in this Prepayment Premium Schedule shall have the meanings assigned to them in this Master Agreement. 2. Prepayment Premium. Any Prepayment Premium payable under Section 2.04 (Prepayment; Prepayment Lockout; Prepayment Premium) of this Master Agreement shall be computed as follows: (a) If the prepayment is made at any time after the Effective Date and before the Yield Maintenance Period End Date, the Prepayment Premium shall be the greater of: (1) one percent (1%) of the amount of principal being prepaid; or (2) the product obtained by multiplying: (A) the amount of principal being prepaid, by (B) the difference obtained by subtracting from the Fixed Rate on the Advance, the Yield Rate (as defined below) on the twenty-fifth Business Day preceding (i) the Intended Prepayment Date, or (ii) the date Lender accelerates the Advance or otherwise accepts a prepayment pursuant to Section 2.06 (Application of Collateral) of this Master Agreement, by (C) the present value factor calculated using the following formula: 1—(1 +r)-rh12 [r = Yield Rate Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 4.3 (Prepayment Premium Schedule) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6104.01 05-20 Page 1 © 2020 Fannie Mae |

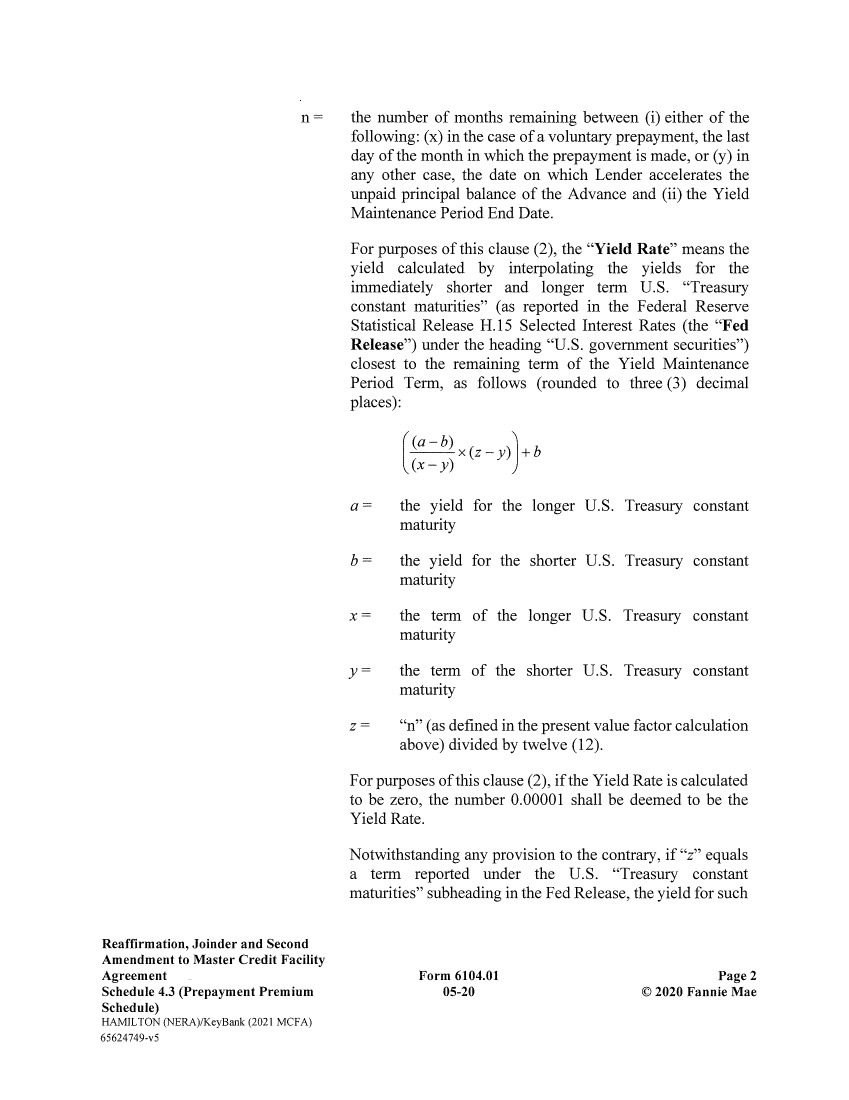

| n = the number of months remaining between (i) either of the following: (x) in the case of a voluntary prepayment, the last day of the month in which the prepayment is made, or (y) in any other case, the date on which Lender accelerates the unpaid principal balance of the Advance and (ii) the Yield Maintenance Period End Date. For purposes of this clause (2), the "Yield Rate" means the yield calculated by interpolating the yields for the immediately shorter and longer term U.S. "Treasury constant maturities" (as reported in the Federal Reserve Statistical Release H.15 Selected Interest Rates (the "Fed Release") under the heading "U.S. government securities") closest to the remaining term of the Yield Maintenance Period Term, as follows (rounded to three (3) decimal places): (ax— b)x(z—y) +b a = the yield for the longer U.S. Treasury constant maturity b = the yield for the shorter U.S. Treasury constant maturity x = the term of the longer U.S. Treasury constant maturity y = the term of the shorter U.S. Treasury constant maturity z = "n" (as defined in the present value factor calculation above) divided by twelve (12). For purposes of this clause (2), if the Yield Rate is calculated to be zero, the number 0.00001 shall be deemed to be the Yield Rate. Notwithstanding any provision to the contrary, if "z" equals a term reported under the U.S. "Treasury constant maturities" subheading in the Fed Release, the yield for such Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6104.01 Page 2 Schedule 4.3 (Prepayment Premium 05-20 © 2020 Fannie Mae Schedule) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 |

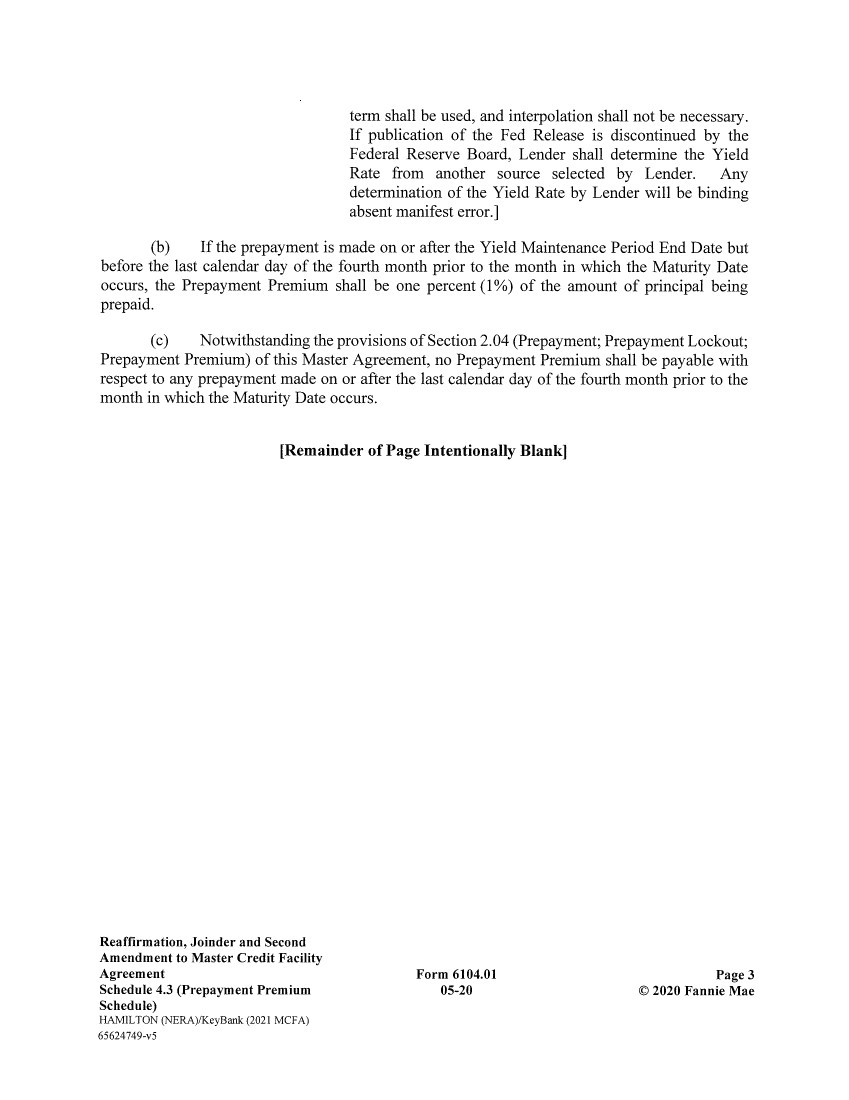

| term shall be used, and interpolation shall not be necessary. If publication of the Fed Release is discontinued by the Federal Reserve Board, Lender shall determine the Yield Rate from another source selected by Lender. Any determination of the Yield Rate by Lender will be binding absent manifest error.] (b) If the prepayment is made on or after the Yield Maintenance Period End Date but before the last calendar day of the fourth month prior to the month in which the Maturity Date occurs, the Prepayment Premium shall be one percent (1%) of the amount of principal being prepaid. (c) Notwithstanding the provisions of Section 2.04 (Prepayment; Prepayment Lockout; Prepayment Premium) of this Master Agreement, no Prepayment Premium shall be payable with respect to any prepayment made on or after the last calendar day of the fourth month prior to the month in which the Maturity Date occurs. [Remainder of Page Intentionally Blank] Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 4.3 (Prepayment Premium Schedule) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6104.01 05-20 Page 3 © 2020 Fannie Mae |

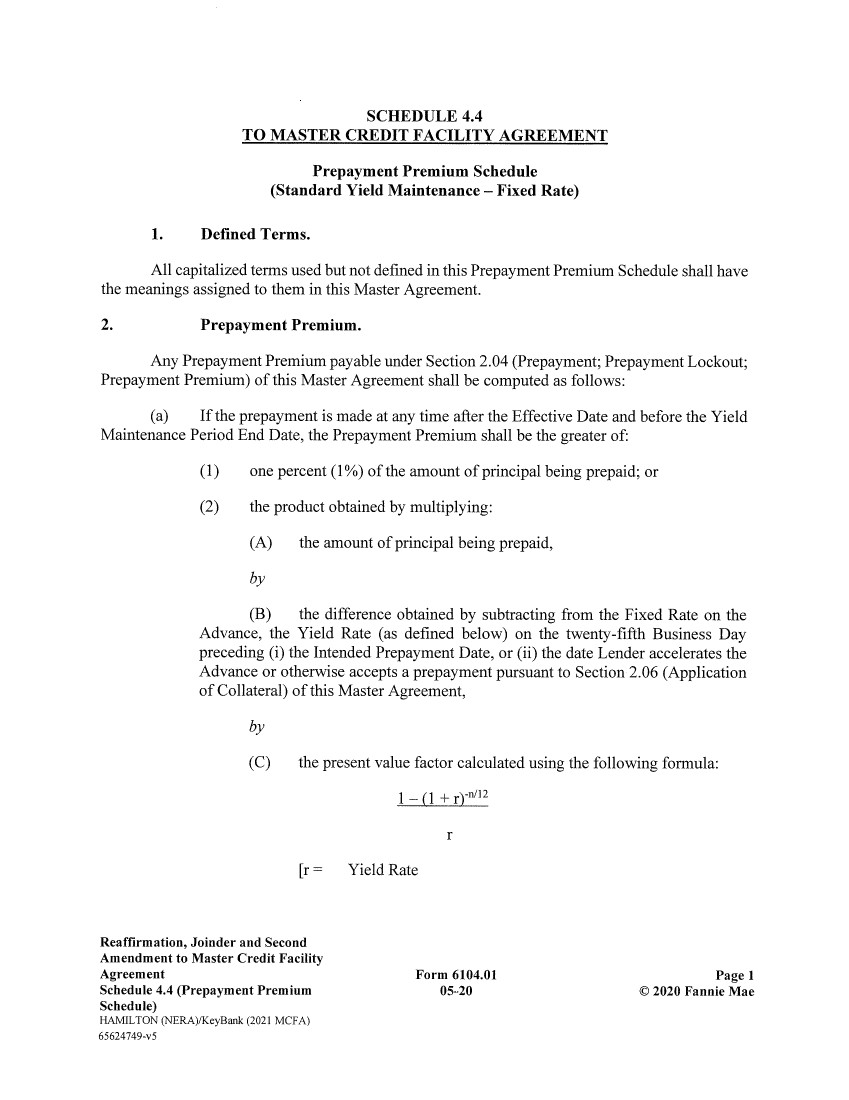

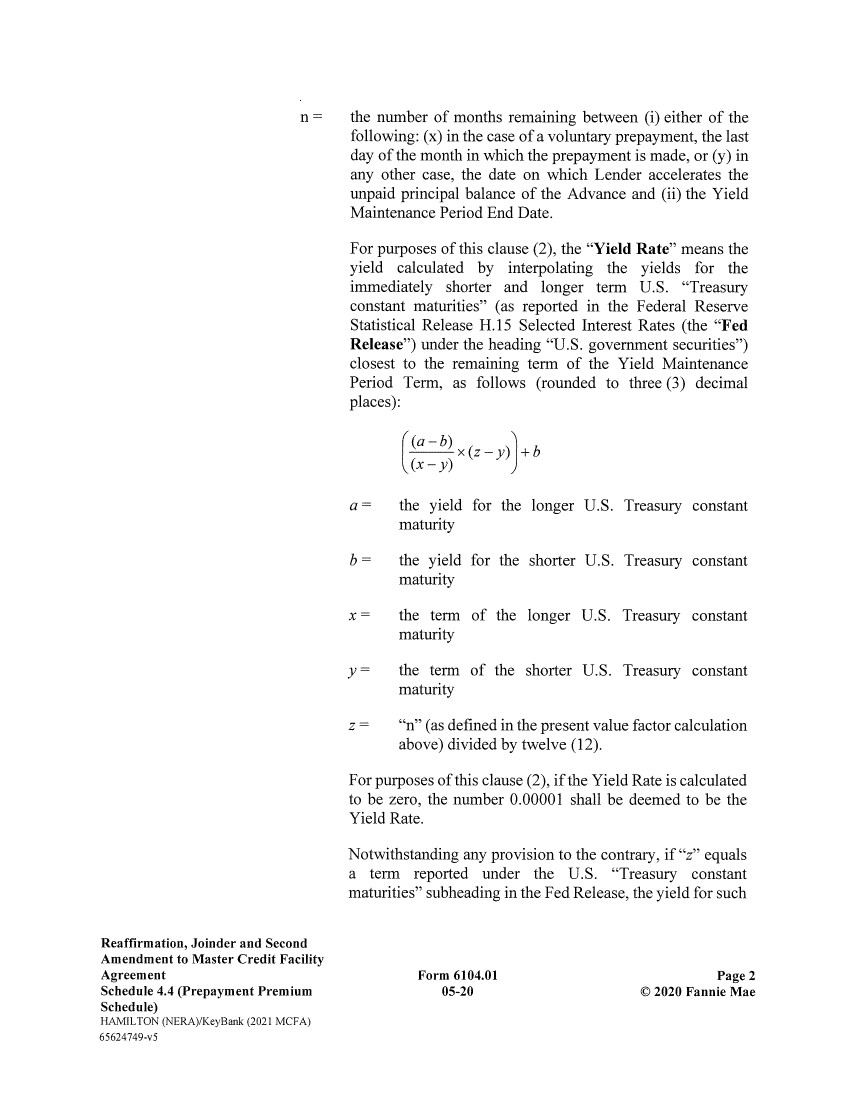

| SCHEDULE 4.4 TO MASTER CREDIT FACILITY AGREEMENT Prepayment Premium Schedule (Standard Yield Maintenance — Fixed Rate) 1. Defined Terms. All capitalized terms used but not defined in this Prepayment Premium Schedule shall have the meanings assigned to them in this Master Agreement. 2. Prepayment Premium. Any Prepayment Premium payable under Section 2.04 (Prepayment; Prepayment Lockout; Prepayment Premium) of this Master Agreement shall be computed as follows: (a) If the prepayment is made at any time after the Effective Date and before the Yield Maintenance Period End Date, the Prepayment Premium shall be the greater of: (1) one percent (1%) of the amount of principal being prepaid; or (2) the product obtained by multiplying: (A) the amount of principal being prepaid, by (B) the difference obtained by subtracting from the Fixed Rate on the Advance, the Yield Rate (as defined below) on the twenty-fifth Business Day preceding (i) the Intended Prepayment Date, or (ii) the date Lender accelerates the Advance or otherwise accepts a prepayment pursuant to Section 2.06 (Application of Collateral) of this Master Agreement, by (C) the present value factor calculated using the following formula: r) 112 [r = Yield Rate Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 4.4 (Prepayment Premium Schedule) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6104.01 05-20 Page 1 © 2020 Fannie Mae |

| n = the number of months remaining between (i) either of the following: (x) in the case of a voluntary prepayment, the last day of the month in which the prepayment is made, or (y) in any other case, the date on which Lender accelerates the unpaid principal balance of the Advance and (ii) the Yield Maintenance Period End Date. For purposes of this clause (2), the "Yield Rate" means the yield calculated by interpolating the yields for the immediately shorter and longer term U.S. "Treasury constant maturities" (as reported in the Federal Reserve Statistical Release H.15 Selected Interest Rates (the "Fed Release") under the heading "U.S. government securities") closest to the remaining term of the Yield Maintenance Period Term, as follows (rounded to three (3) decimal places): (a b) x(z—y) +b x— a = the yield for the longer U.S. Treasury constant maturity b = the yield for the shorter U.S. Treasury constant maturity x = the term of the longer U.S. Treasury constant maturity y = the term of the shorter U.S. Treasury constant maturity z = "n" (as defined in the present value factor calculation above) divided by twelve (12). For purposes of this clause (2), if the Yield Rate is calculated to be zero, the number 0.00001 shall be deemed to be the Yield Rate. Notwithstanding any provision to the contrary, if "z" equals a term reported under the U.S. "Treasury constant maturities" subheading in the Fed Release, the yield for such Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6104.01 Page 2 Schedule 4.4 (Prepayment Premium 05-20 © 2020 Fannie Mae Schedule) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 |

| term shall be used, and interpolation shall not be necessary. If publication of the Fed Release is discontinued by the Federal Reserve Board, Lender shall determine the Yield Rate from another source selected by Lender. Any determination of the Yield Rate by Lender will be binding absent manifest error.] (b) If the prepayment is made on or after the Yield Maintenance Period End Date but before the last calendar day of the fourth month prior to the month in which the Maturity Date occurs, the Prepayment Premium shall be one percent (1%) of the amount of principal being prepaid. (c) Notwithstanding the provisions of Section 2.04 (Prepayment; Prepayment Lockout; Prepayment Premium) of this Master Agreement, no Prepayment Premium shall be payable with respect to any prepayment made on or after the last calendar day of the fourth month prior to the month in which the Maturity Date occurs. [Remainder of Page Intentionally Blank] Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 4.4 (Prepayment Premium Schedule) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6104.01 05-20 Page 3 © 2020 Fannie Mae |

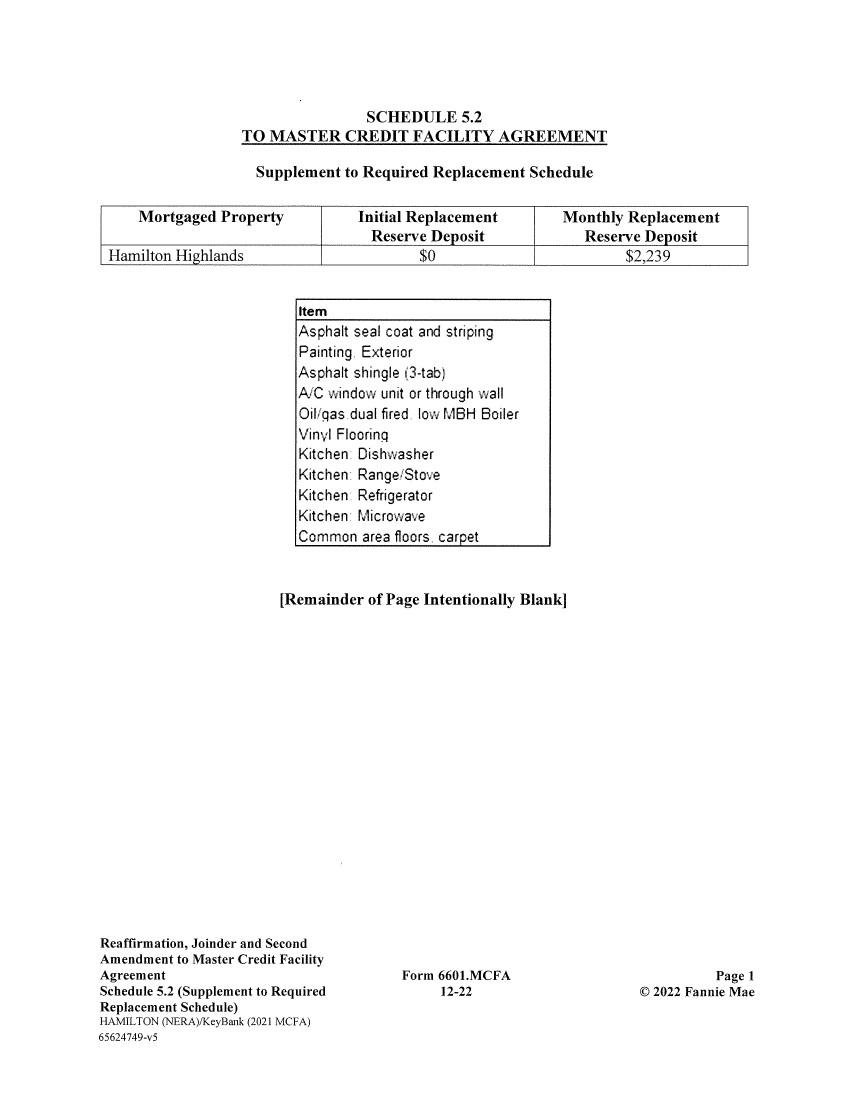

| SCHEDULE 5.2 TO MASTER CREDIT FACILITY AGREEMENT Supplement to Required Replacement Schedule Mortgaged Property Initial Replacement Reserve Deposit Monthly Replacement Reserve Deposit Hamilton Highlands $0 $2,239 Item Asphalt seal coat and striping Painting. Exterior Asphalt shingle (3-tab) NC window unit or through wall Oil/"gas dual fired, low MBH Boiler Vinyl Floorinq Kitchen: Dishwasher Kitchen Range/Stove Kitchen Refrigerator Kitchen Microwave Common area floors. ca [Remainder of Page Intentionally Blank] Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 5.2 (Supplement to Required Replacement Schedule) HAMILTON (NERA)/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 1 © 2022 Fannie Mae |

| SCHEDULE 6.2 TO MASTER CREDIT FACILITY AGREEMENT Supplement to Required Repair Schedule Mortgaged Property Name: Hamilton Highlands Mortgaged Property Address: 757 Highland Ave, Needham, Norfolk County, Massachusetts 02494 Fannie Mae Collateral Reference Number: 9999121228-001 Repairs Escrow Deposit: $0 Hamilton Highlands Immediate Repairs Table: Escrow: Completion: Cost: Escrow Amount Life Safety: Elevator Cabs - Certificate of operation is expired 1 both North & South Building - Per correspondance saved in the deal folder this item has been cleared by the vendor. Yes X No 0 fvlos. S1.500 50 Fire Suppression - According to the provided fire inspection reports the fire sprinkler system was last inspected February 1 2023 Inspection and testing of the fire sprinkler system is recommended - Per correspondance saved in the deal folder this item has been cleared by the vendor Yes X No 0 Mon S1.500 50 Critical: ADA - Provide Van Accessible Parking Space Yes X No 3 Moo 5250 50 ADA - Modify Public Toilet Room for ADA Accessibility Yes X No 3 Mos_ 5250 SO Totals: $3,500 $0 [Remainder of Page Intentionally Blank] Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 6.2 (Supplement to Required Repair Schedule) HAMILTON/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 1 © 2022 Fannie Mae |

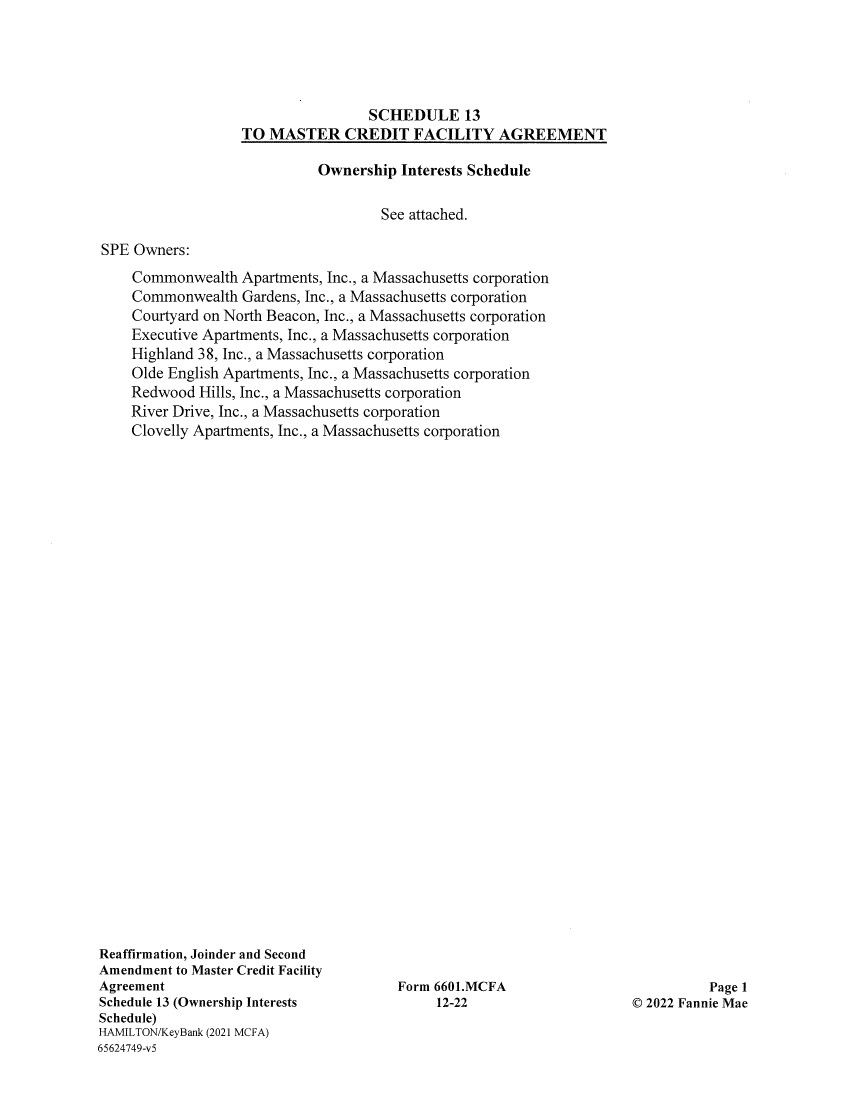

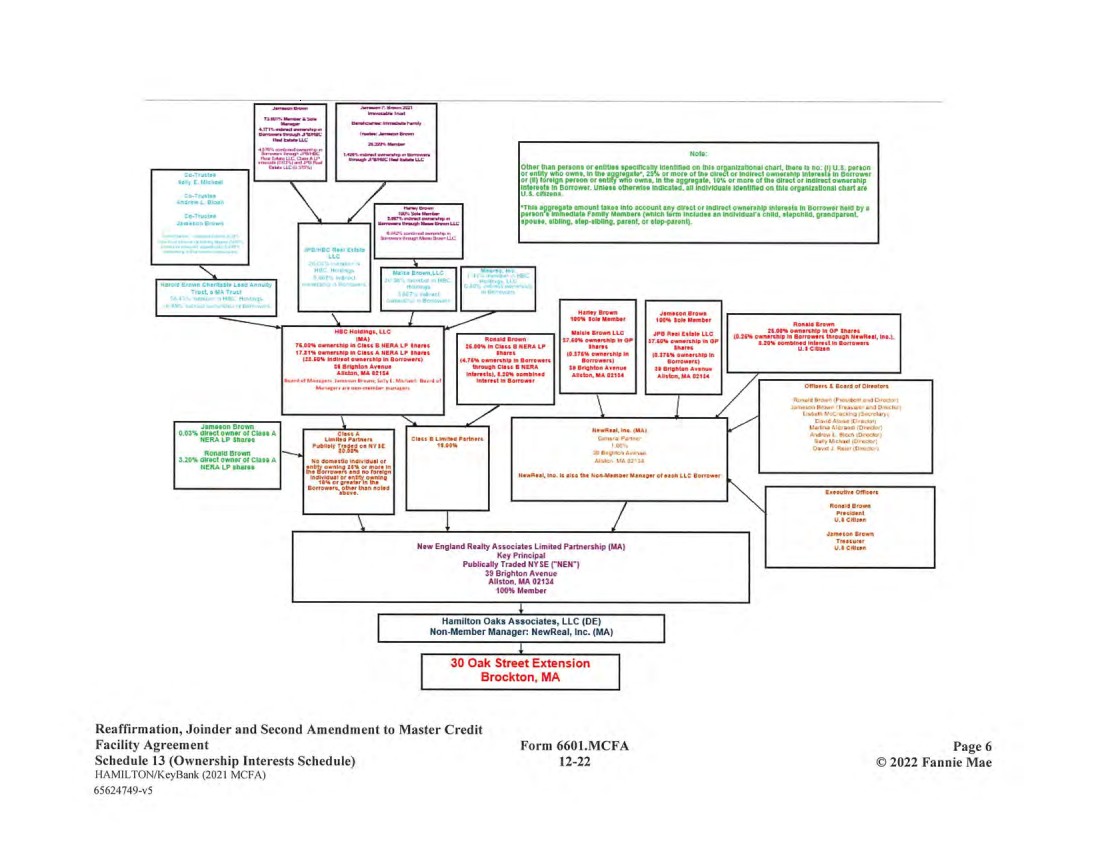

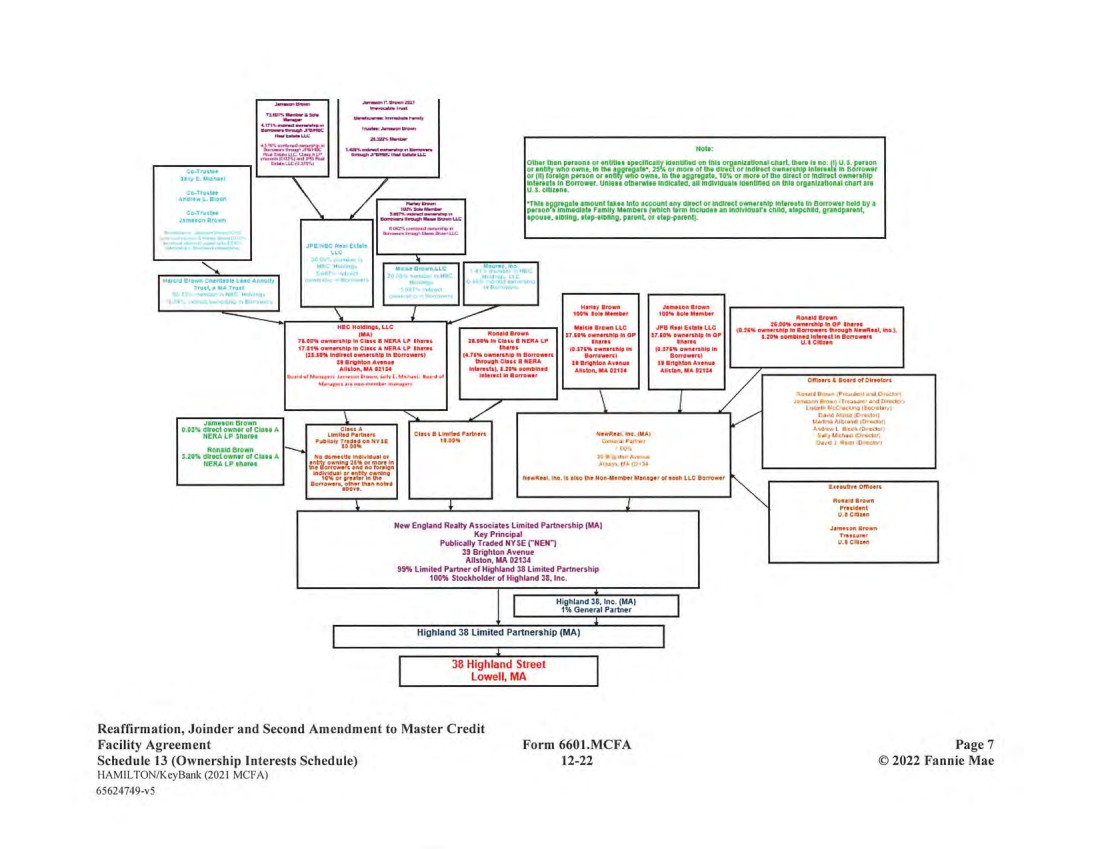

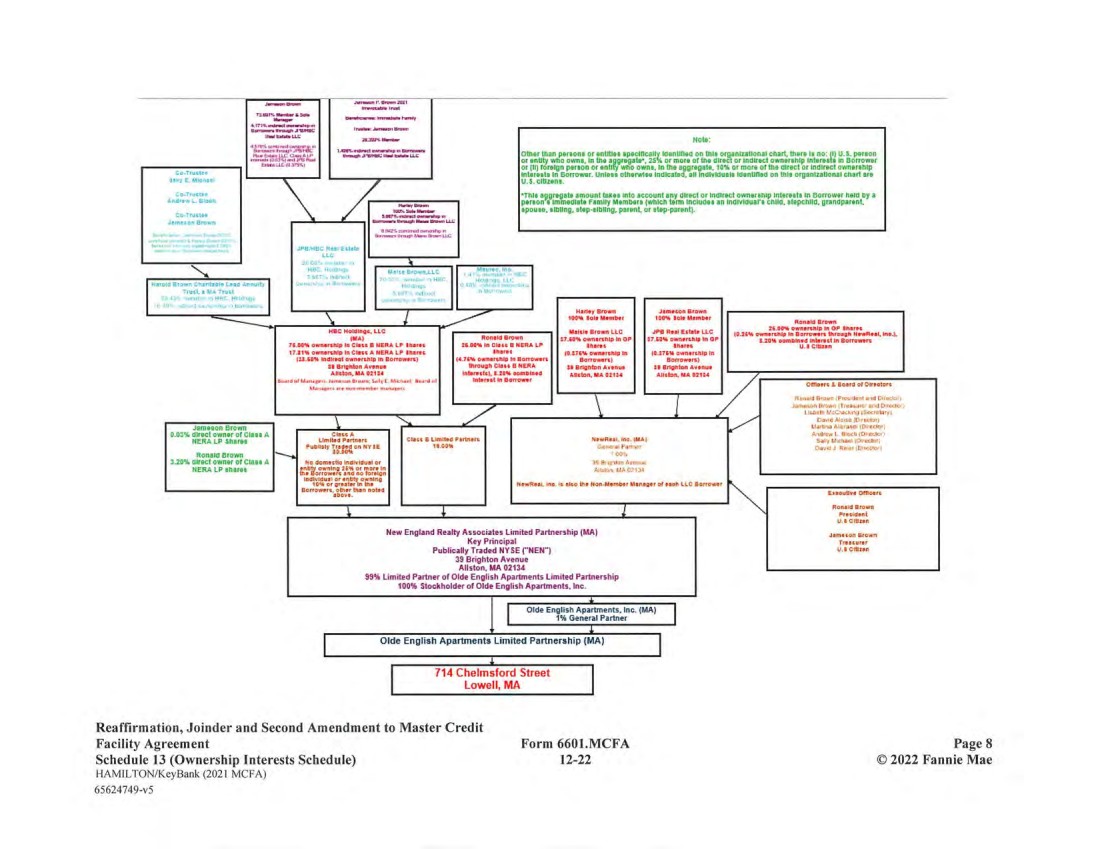

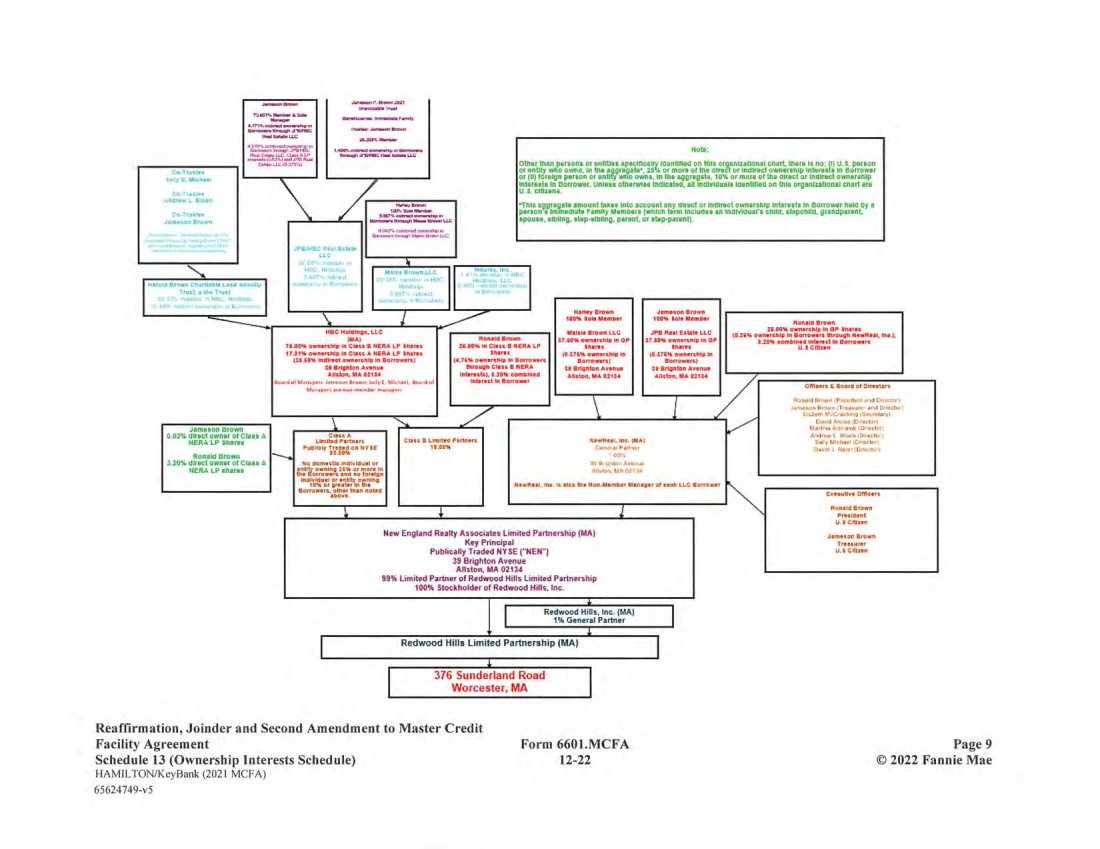

| SCHEDULE 13 TO MASTER CREDIT FACILITY AGREEMENT Ownership Interests Schedule See attached. SPE Owners: Commonwealth Apartments, Inc., a Massachusetts corporation Commonwealth Gardens, Inc., a Massachusetts corporation Courtyard on North Beacon, Inc., a Massachusetts corporation Executive Apartments, Inc., a Massachusetts corporation Highland 38, Inc., a Massachusetts corporation Olde English Apartments, Inc., a Massachusetts corporation Redwood Hills, Inc., a Massachusetts corporation River Drive, Inc., a Massachusetts corporation Clovelly Apartments, Inc., a Massachusetts corporation Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Schedule 13 (Ownership Interests Schedule) HAMILTON/KeyBank (2021 MCFA) 65624749-v5 Form 6601.MCFA 12-22 Page 1 © 2022 Fannie Mae |

| s Rl .w~N. w..~.r.""ir=rarrli_r' avn ae..r~ ~~ w:.u~.Au• ~n.•aorwwvc d. e m ru . 1~'ervl red Ira N+r bY+.L: iu a,TI co-Trait.. later E. Mloneel co-rn.t.. Anorr. L. Er0.h o-rra.e.. Jam.ann Brown Note: an persons or entfllee ,pe0lnce11Y Identlfled on into organizational chart there Is no: II U.S. peroan Wno own.. In the aggregate'. 25,4 or more of the direct or Indirect owoershlp Internals In Borrower sign person or entity who own., In the aggregate, 10% or more or the direct or Indirect ownership In Borrower Unto is otherwi.e Indicated, ail InoNi0uell hientmed on this organizational chart are aggregate amount lake. into account any direct or mmrect ownerenlp Internet, lIt Borrower Laid Dy a n a Immediate Family Members iwhlch term Inciude0 an Individuate ohhd. stepchild. grandparent. .a. Boiling. ritep-omdng, parent or step-parsntl JPB:HBC Rea Elle:r .L_ I H.-, Bro win Jerr.e[*n Brown 100% W. l Der 100% 6.1. 0 0,00.1 HBC Holdlno., LLC YM.I. Brown LLC JPB R.el E[tab LLC IMA1 Ransld Brown 117.60%.—Irchli, OP 37.60% d'.ner.m. In OP 16.00% own.r.nlp In Clr.c B NERA LP than[ 26.00% In CM.. B NERA LP Inan. .hrn[ 17..1%owns r.hlp In Clee[ ♦ HERO LP Inan[ Ihrn. 10.176% ownerchlO In 10.176% own.r.hlo In 1".60% Indlreat.... r[hlp In aarnWer.I 76% owner. h 1p In Bpnawar. Borrdwenl so alrit 2e Brighton Avenue ihnaph Cle[[ B NERA 16 Brghton A..... 10 Bdpht.. A .nu. AII&Wh, MA 021.1 Inters.l[I. 6.20% oomeineo Allston, YA 01111 Allston, MA 0211. C•.erdul lJen.e+.. l+rnrwr eru. r, S+IvrM.ve+l. Yu. dot Lr+ e.+ . err lion in+inhr nrr•rar+r. Int....t In Bo,ro..f C Ill.. A LIm IYtl Partn.r. Cla.. B Llmlte0 Prrb.rrc NrwRarl Ino. IYAI P- JD u my Tnd.d on N Y I E 1t 00% Go..., P.n'cr 10.00% . 03.E Nn dam.tll. 1-1duei ar 30 Brp-rlon A,.n anbfi• ownlnr0.26 d no fMarr~lOn MI—i. IAA 0:131 NInd6/0Xpw,of arlDtlln gnIn0 pne .r N.wasal, Inr. Ic Mco O.r Non-MemMr Menap.r of crow LLC BortowOr Borrower., olnsr torn nat.0 New England Realty Associates Limited Partnership (MA) Key Principal Pubtically Traded NYSE ("NEW') 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of Commonwealth 1144 Limited Partnership 100% Stockholder of Commonwealth Apartments, Inc. Herod Brown CiraritOlr 1.10 Annu11 Trur:1, a MA Trust 1111 1111 1111 . i . I. Jameson Brown direct ownor or Class S HERA LP Shares Ronald Brown 11",11 ~0% dIfect owner of CIao o I: NERA LP sere. 000.10 Brown 26.00% owncnnlp in OP 1Mnc i20%own.rrrriorrnorrow.nhllrouarr N.wn..l, reo.l. 1.20% 0001010.0 Intan.t In Borrower. U1 Cltuen Ow,.I, B Bore or nlr.ptan Ro,luid Bmxn :President aid Clrccto•l Jane.on err/.n Gila and mrecia_ 1100.111 N:Ga. II lip laccrclerrl Da.ld Alol.a IOror.»rl ManIlna AICnnel In,'.clor, AldIC. L Bloch 1Dlecicrj SaI I MI1111el iol'eciorl C•avdJ Crier;m,0cm-i E...uar. omnorc Ronald Brown Prs.Ioent U.1 C mten J.me.on Ire-we Ili... U.. C m... . Commonwealth Apartments. Inc. 1% General Partner 1144 Limited Partnership (MA) 1144 Commonwealth Avenue Boston, MA Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 2 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 |

| ea„0 ,ni'na rr,_..A._o,h.a•r, ;,J ILLi` sum , west. uU C C~TrL,toe r'N'..LL in .rh.i 1a~1 E. Ml.nael Antlnw L BJDOh A sti. n~r,t~ Ca-Tr-uciee •y~y owEP w Jsmecon Brown m"~. e•uNr r. b•er"' JPB,'HBC Res: Estd:a LLC U 440 Hole: Other than potion. or entities apaUncetly tdenthed on this orgganlzaticnaI chart mere a no: I) U.S. person or entity wile owns. In the agpgregata', 256 or more ottne olrsct or inalreet ownership intereele In Borrower or ill] Toreign person or entity who owns, in the aggregate, 10% or more of the aired or Inalreet ownerehlp interests In Borrower. Unlest otherwise Indicated, all Inoivlauale Identlned on this organizallonal chart are U.S. citizens- 'This aggregate amount taxes Into account any infect or Indirect omlerahlp Interest. In Borrower heirs 1.y a pen on a Immediate Family Members iwhlch term Inctltdot an individuals child, atepchnd, grandparent, spouse, .1Oling. step-alonng, parent of step-parent'_ He", Brown Brown 100% isle Mam Der 100% Bale taNMgmhar Ron ld Brown 76.06% ownanhlp in Class B HERA LP Inaroc 11.11% ewnnnhlp in Class A HERA LP Ih.nc HOC Holdings. LLC "'Al 26.00% in 011155 N ERA LP U.S CIt4.n Ronald Brown 17.60% ownership In OP 17.60% pwnerchip in OP 10.2'.% o . —hip 1. in.-d i Bnrro. e n through N,nRe.1, Ino.i, Iharec 10.176% ewn,rahip in 10.076% Uwnarhhln In M.1.1. Brown LLC JPB Reel Estate LLC 26.00% owmenhlp In OP then, Inure. 1.70% nom Dinars Intonct In Borrower, 123.60% Indinat owrverchlp In Borrowers) 14.76% ownership in Barrows, Borrltwenl sortowersi through Cla1e 8 NERA Se Brighton Avenue be Brighton Aeenue 41 Brighton Ao.nu. AIIEIOh, MA 02134 inlereelc),320% aalnDllleu ASston, MA 0211. Aortoe, MA 02174 W:aidul Marr.rn, IA,,,L.w. 0:u.•e; 5.11'E.M„I. Ho. 'I,I Into rest In Barrow., 61 •~.1:•r, .rr rrua.n....Lr rn.rr~..r, 0.03% tlhect Owner of Class HERA LP Shane I cleslA I umltad Farman Claus B Llmnes Partners NawMu4 in.. IMAI Puolloly Tndad on NY IE le 10% Goncr01 Paver Manila Brown 10.00% , W' 3.20% dNect owner of Close A Hoodomeetle lne:rltual or 35 Bro-llon AY. '_.. HERA LP shares gins 1v Boimning2AC or wore In on',cn. arts r:._ Ia: maividual er errt1ttfy Irvv Ind 10% _ 051c r Borrower; , than noted bo NerReel, 1.a cello the Martagar oreeo h ice eorrowsr aoav4. New England Realty Associates Limited Partnership (MA) Key Principal Publically Traded NYSE ("NEN") 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of Commonwealth 1137 Limited Partnership 100% Stockholder of Commonwealth Gardens, Inc. CommonwealthGardens, Inc. (MA) 1% General Partner Commonwealth 1137 Limited Partnership (MA) I 1137 Commonwealth Avenue Boston, MA Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Schedule 13 (Ownership Interests Schedule) 12-22 HAMILTON/KeyBank (2021 MCFA) 65624749-v5 Page 3 © 2022 Fannie Mae Draws & Board of olnoton 0011010 Brawn 1Prcsldallr 0,4 LIneaL'I Jalisian Brawn ltreusum mro olrccrcr, Lllbaln Vcc'ackeq ISScuctaril Luau 01011.2 ;enders MaN,5, Al CronW iDPaclm; 0110(0 L Bitch 10100106 5a1', Michaul IDI'aclor; Davtll Rokr{Olrc.ro- : EeaoBve om<-r1 Ronald grown Preldent 0.1 cmzen J, meson Brow, Tna,unr 0.0 ,mien |

| la~ Rir.YW wr~M.pa, ar.dlJwex: ~,.rw.. J.,~„tLvwr IOU adeLLt. nJlri law,rr ab,~uv.in+9:wry~,i ill, •ip~.all' e,rowJ,JnleeICIY r+•,rl.IpaaalrJ eti n:.I ddlLL ~a.TrJatee du., ll nr s•s~4i ..11 E. MI. nest Ca-Traatan Andrew L. B»oh Co-Troatee ter. x.O rR Jameson Brown ems. n.o.y, r w.., I1. LL-Note: 3r' pare one or entitles apeclncally Identined on thin organ lzatlonaI chart. (flare!. no: (I) U.S. person iEO owns, in the aggregat6', 25,4 or more Of the direct or Indirect ownership Interests in Borrower alga person or entity who owns, ra the aggregate, 10% or more of the direct or indirect ovmsrship in Borrower. Unleaa otherwise indicated. all Individuals Identified on this organizational chart are ens. gregete amount tales into account any direct or indirect ownership Interests In Borrower held by a Immddlat. Family Members Iwhich tern includes an Individual's child. stepchild. grandparent, sibling. step-sibing, parent, or step-parantl. Harold Brawn CMrllable Land Ar n _ If. Lract, a MA Trust HeneT Brown Jerwscon Brown 100% leis Maminr 100% Isle Mem Oar Hall Holdings, LLC Msisle Brown LLC JPS Real Estate LLC IMA] Ronald Brown :7.66% ownenhlp In OP 57.60% a•Anarchlp In OP T6n0% awns nelp In Clec. B HERA LP Ihenc 26.00% In Class B NERA IF Inen• Is,n. 17.:1%o.nenhlp in Class A NERA LP Inenc leer', 10.:76% ownership in 10.476% ownership In 12:.60% Intllreat owlserchip in Borrower.! (4.76% erm,nhiY In eonrofen Borrvwenl Borrowers] Os Brighton A..nue through or... B HERA :1 Brghton Avenue CM Bn.ht.n Avenue Allston, MA 021:4 Inlarmtit, 1.20% 00mbineo Alston, MA 021:4 Allston, MA 02114 Iw,4 er/J1r..o,l lamrv.,n e,uwl,; said E. Miv.I. Iliad .I ll+vr..r..r. r,un.rnrrnhr ,r..n+e.r. lntantt In Borrewar J6il.SOn Brotttl 0.03% affect owner of Class A olec6A NERA LP Shame 1-1.1ted P.nn.,, 01155 S Limned Partners N6wfle,L lra.1MAt Pab]]DIV mated on NYIE 10.00% Gonaal Pon-, Ronald Brown 10.00% . c3,,_ 3.20% OBact owner of Claus A No domeatla lndvlduel or 30 ery'dpn Avon— NERA LP neared ~ rtrwl~n anU no fanlQn 0111.011. IJA a 13a Indlu I4ual orerrlIbty Prv' lnp 10% or Onater Iliare borrowers, diner men -too .bare. NawResl, end. liaise the Nan-Member Menage, or..or LLC a oRGAar New England Realty Associates Limited Partnership (MA) Key Principal Publically Traded NYSE ("NEN") 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of North Beacon 140 Limited Partnership 100% Stockholder of Courtyard on North Beacon, Inc. Courtyard on North Beacon, Inc. (MA) 1% General Partner North Beacon 140 Limited Partnership (MA) 140 North Beacon Street Boston, MA Manila Brown :..Oa,. ownenhlp In OF IMnc 0.25% owlrenhip to Burrawan foraug" NeaR..!, Ine.i, 1.20% oomblna41n6nctln Borrawen a.6 CHOIR Dirle.rc S Board or DlreotoIs Ronald Brown .;Prwldanr aid 0,racto'i lanann Brawn (Tnaeum• and olrecioa, Ll sbala h'z=vckr1a laecralarrl Curd Malta ;D vaned Marll'u Al Crun41 i 01001cC Aldrea1 BlcshlDrsCiai, Sal', Michael iDlmotor: Dao01 ecierr,Dlrocrc.- E.eoulo. Dre-1. Ronald Brown President u. e O illzen Jamecon Brown Tr' slum JA Chile Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 4 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 |

| CO.Traetee to ! E. 01001.0 c_T Jct And— L. ee C• Jamey Jrworww~. Amon I'. tl,wn nml~ 4ry m..4o.0 „w.t ev.r_.e,.a~,xwuc I-- 400 Isra.dr"• aavn ern6a• m'l~uii ti ' Bn w~au..a:le.: e..e. w: eu..U: ru an~cl Note: other than persona or entitles epaclocall~( laant[naa on this organizational chart. [here Is no: (I) U.S. person or entity who owns. In the aggregate'. 25.' or more 01 1100 direct or Indirect ownership Intenseta In harrower or {B) foreign person or entity who owns. In the aggregate. 10% or more of the direct or Indirect ownership Interests in Borrower. U61aaB atria Wlee Inaicated, all IMlvmuala I0001Uh00 an thin organizational chart are U_S. citizen,. •This aggregate amounttakel Into account any direct or Indirect ownership Interests in harrower hold by a person a Immedlet. Family Members (which tern) knefur101 an Individual's child, atwpchlld, grandparent, spouse, aibllng, step-siding, parent, or step-parent,. Harold Brown Cho tlabl Lead Annuli'/ roll, a MO Trail ((ICC HOC HcIIC,.4 JPe~--e. P e e Eclz VOL 7 7 7 r Harty Bros- Jemecon Brown 10011 lots Marraer 100% Bore Member HOC Hal0Inol, LLC Ml1sle Brown LLC JPB Real Ectete LLC "'Al Rone0 Brown 37.60% onnarahlp In OP 37.60% ewnrchlp In OP 76.00% ownenhlp In Cl B NERA It fine-. :6.00% In cle cc B NERA LP 400-. ear- s 17.31% ownaranlp In Class A 001001 10 lo.n. 1he-S 10.376% oln.rshly M 10.076% own.rclIO In 123.604 Indlreat 0wr-rclM In Bortawlni 14.70% c1O0rch Is In aarrowarc Borrawiral Borrowers) is BNghton Avenue lhrougr. Clacc B NERA 10 enlahton Anna. 0e Brighton Avenue Allctan, 06 02104 Inten.lcl, 1.20% nombina0 A01tcn. MA 02114 A11a10.n, MA 02134 .rJ of fA.I . •mrw, l,,,,, C.II1.M, r 6. Jl 'nfe-cl In Berrawa AI•~a ..,r uuu n,•nrbr•moue•,. C111, A J&mmoton Brown 6.03% a Heal owne of dons A NERA LP Shares LImIM7 Partner. CI.;; B l lnrle001 11.00% Partner. PJblloly Tra00d on NY SE 11404 INW 00101 Ina. tRIAl Gpncral Pannc, dal ROneIO Brown Rood% 3.20% dtract owner of Class A Noo 1~ dcrosatlo lntll".10uel or 00 Bryllon Avan•s NERA LP 000140 ~ 6orttivteri one no fori lfl ivn Apra-,, MA. 07104 Indlclduar or arrtIily dewr' In, lOX or p-dray In Ms Borrawerc, other then not00 above. NewR4el, M.A. 1110 111. Non-Mem W r Menage r ar aeon LLC BorrowNr New England Realty Associates Limited Partnership (MA) Key Principal Publically Traded NYSE ("NEN") 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of Executive Apartments Limited Partnership 10(1% Stockholder of Executive Apartments. Inc. Executive Apartments, Inc. (MA) 1% General Partner I Executive Apartments Limited Partnership (MA) 545 Worcester Road Framingham, MA Rona10 Brown 26.00% ownenhlp In OP Ihar.s (0.20%ownarihlp In Barron- thrau.h 54100.1, 1001. 0.20% 00nbinnd inter, at In Bornowlmt U.I CI0ren Omo.re & Board of 01re0t0rs Ronald Brown (Pnecld1nt 2010 Grace I J.anacon drawn /Treaeurn- On] Dlrec1CC 01.0010 MCC'acl:r4 I0 0rclaryi 00.10 No110:Droclonl Madlna Al Cran01 10100101. A0drrw L Bloch (Dl'lCIcr) Sal v MAlchael IDl'acIoll DAVUJ RnM,(DlrhbCi E.touily, 0mca, Ron. 4 Brown Prea ldenl 11.0 c rll:en Jene.on Brown Tnalum U.1 chine Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 5 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 |

| a~.:.w,w,a,M~e2 rr.wwA._wrGewn co-Trust.e leieY E. Oboes) Co-Trucl.. xndre'w L. Bloch — r.wwn C a~Tra6ne I.R YU. Jam{ can Brown tivra~. e.oM laver u .,E.r-r,, Ell::,' note: Otter than persona or entities specdically Identifed on this Organizational Chart, there Ii no: 1] U.S. person orentity who owns, in the aggregate', 250. or more of the director Indirect ownership interests in Borrower or (p) foreign person or entity who owns. in the aggregate, 10% or more of the director indirect ownerailip Intornete In Borrower. Unless otherwise indicated. all Indlvlduals Identified on this organizational chart are U.S. CItlz.n a. aihis aggregate amount takes into account any direct or Indirect ownership inter.ile In Borrower held Dye persons Immediate Family Member (which term Includes an IndboIdual"e child, stepchild, grendparanL spouse, sibling, atop-sibing. parent, or step-psrentl. T Haney Brown Jemecon Brown 1100% Bole Me— 100% ION 8=1 gon.ld Brown 11.151. Brown LLC JPH Real Estate LLC 26.00% of on o ' p In oP 015140 HBC 10101,101, LLC Ronald Brown 57.60% own.renlp In OP 57.60% ownership In OP (0.26% e' 4.20% oe In Burro' leew ilia Bel w . ,. R Inp.), IMA) 6.20%oomalnetriertit In Hortowerc 76.00% ownership In Class B NEPA LP Inane 25.00% In Cl- B HERA LP Inens $her.. U.S Cihian 17.61% ownerthlp In Class A NERA LP Incas Usenet 10.176% o'merchlp In 10.376% ownership In 121.60% 10411.05 ewnirchp In Bortowene) {.71% ownerahlp le Berr.w.rc Borrowers] Borrower.) Be Brighton A..... through Clatt B HERA 1B arght n Arenue is Bnghlon Arenue Allston, MA 02114 lntensicl. 6.20% uomhln. d Ae cton, MA 02114 Allston. MA 02124 .4.(VA.ruarrr. I..n oo O.eo,. 0.IY E.Mcarl. au. ,1.1 rntenct In Berton, Ma~.s.r..rr nurrnrern6r rrunwlrr. Jemeeen Brown Na'rit..l, pa. (MA, 0.03% direct anther of Class A CladsA HERA LP Shares I Limited P.rtn0 rt Slots B Limned Pertn... Aches P1MO, 700110117701000 on NY II 10.00% 1 CCU'. Rdnaid Brown 15.00% ee enton, 4,0,40 3.2a% tired l owner of Closed No dcmeelle IntlnlOual or Al c1i', %IA 02' 0 t HERA LP 5110105 bt • ownln0 26% or more 1n Otis ~Or(Ow and no d lanlpn Naw R.al Ind. Is also the Non-alt—or Manager a1 assn LLt Borrower Indt Osd60er or e~~bn MM Ire otne, t Inhie eortoWerc, diner then notstl New England Realty Associates Limited Partnership (MA) Key Principal Publically Traded NYSE ("NEN") 39 Brighton Avenue Allston, MA 02134 100% Member Hamilton Oaks Associates, LLC (DE) Non-Member Manager. NewReal, Inc. (MA) 30 Oak Street Extension Brockton, MA Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 6 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 Ole... A. BOMB or Olreolprs Ronald Brown rouldenr old Clr1O10l Jameson Brown 0 D04000-and 000010,. 11,00111 w<C'acon, Iattrolar,I Dead 410110 ;170540,11 5.1001,1 Al Lr an., Droeler; A1drwwL 01000) oracIC,, Halt' 01011001 10100100 01004 RaO, (blro<to'l _a...the Umoerc Rona :I - Brown President 41.5 C titan Jam.sen erowrl Tna..... U.s Closer |

| ua.l~rl)n1 rJ J,K Fr.i Lo-rr.Istss E.N,,.aA~u)ml ray:) E. Mlahael Ca-ha&tee Andna L. elpor, r&r.ss. rrrr Jamacon Bruwm n'~+e'~b'~~w`" L -EC El,'., Er le • II Nola: r then pore one or entitle, apecihceii i identlned on tole org anIzational chart, there Ia no: 1II U.S. person j hty who O1ma, In the arrlIgregata•, 2516 or more or the direct or Indirect ownership Interesta in Borrower foreign person or ,ntl@y who owns, In the aggregate, lo% or more of the direct or Indirect ownership sets In Borrower. Unless otherwise indicated, all Individuals Identttled on this organizational chart are cihtena. I aggregate amount takes Into account any direct or Indirect owTieronlp Interests In Borrower held try a on B Immediate Family Members (which term Includes an Individual's child, elopcnlld, grandparent. as, soling. step-elbung, parent or step-parenq. __________ H Haney Brom Jamacon Brown 1p0% bola Nemper 100% IoM Memptr NBC Holdlndc, LLC MMcle Brawn LLC JPB Real Ectate LLC IMAI ald Brown 37.60% ownarchlp In OF 17.50% e'wnarchtp M OP 76.0O%owner&nip in Clac, B NERA LP Ihera1 inCali B NERA CF Ihanc ahem& n.1114 ewnannlp in Clacc A NERA LP Inch 1 Ihanc rF 7 I 10.176% ownerchlp in 10.171% ewnerchlo In 125.60% Indlreot ewne lchlo in BOrteweraj r&hII In Bortoaerc Bon=aarei Borrowerdi Se Briohten Avenue Chic B NERA Si Brionton Avenue 35 Briaeion Avenue Allston. MA 02154 1.20% combined Aecton. ILA 02114 Alicia,, MA 02134 b.,. ,I .I l In aertOawr JBmsIdin Brown 8.03% dlrec( owner or Clare A Clan&A NERA LP Sharer Limited Partner& clots a Limned c,b'aly Trade•] on w", to OD% Forerensic NawRaaL Ins. INAI General Formby Ronald Brown SD.DO% c,~,.~ 3.20% dirwto'Mner or Clals A J~J era'ilen Avenue NERA LP shares Noo 1a demeelto In O:.luuel or Bo~ wnln,26 Mi o or !•npn,. MA L: — rnarreisn Ind ri 10%~Mep~aater .Ina In New Real.:no. 1 Oleo Me Non.Mombtr Manager or ouch LLC B-0— Bortowar&, other then tla n Oted New England Realty Associates Limited Partnership (MA) Key Principal Publically Traded NYSE ("NEN") 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of Highland 38 Limited Partnership 100% Stockholder of Highland 38, Inc. Highland 38, Inc. (MA) 1% General Partner I Highland 38 Limited Partnership (MA) I 38 Highland Street Lowell, MA Ronald Brown 26.00% ownanhlp in OP share& (0.26% ownarchlp in Barroaerc MroneN NawReel, Ino). 5.20% combined plan it In Borrower. U.1 Chuun Omcerc A Board of Dlreatarc Ronald Brown (President aid Cvrocao' I Ja•newn Brown jTraoawe• end Dlnctorj 1110.15 MCC•ack6p Iaacrtirj I Da.ld Alma,e IDrerOori Martha Altrondi (DI•eclerl Andrea L Bloch IDI•oclor,i 5a1 y Mlchiel IDI•aclor; 0.004 Roar(OlrccwCl Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 7 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 |

| S.w.e.d.-, taw]iI r%. •-...SILL e,~aw~a~~md uc co-rm.e.. rwr..u..,.,•, .~ an. E. Mldne.: p-r uatee 4nCrew ~. B;aoh rr.N areww C.-Truata. 3.ri:~`.seaYrn.~~r.P., J. m.a on Bry W n 4 F,t.t~ •e~+urreM w evwr u JPB:HB Note: Other than persons or entitles apecInca17 Idantllted on tine organIzatlonaI chart, mare IS no: III) U.S. person or entity who owns, In the agggregate', 25w or more or the direct or Indirect ownership Interests In Borrower or (it) foreign person or entity who owns, In the aggregate, 10% or more or the direct or Indirect ownership Interests In Borrower. Unless otherAi le Indicated. all Individuals Identinetl on into organlzatlonsl chart are U.S. citizens •Thls eBgregete amount lakes Into account any direct or Indirect ownership Interests in Borrower held by a person a Immediate Family Members {which term Includes an Individual's child. stepchild, grandparent, spouse. aibbng, step-slhang, parent- or step-parent). A Harold Brawn Churnable Len, -[ Vst, a M4 Trpt' Han.. Brown Jama1on Brown 100% solo M.m D.1 100% svl. Me,110.r Rvh.l. Brvwn HBC Holdings, LLC Yell. arvwn LLC JPB Real Ester. LLC r ows 26.00% In OP sh.nc B orrower s IY4) Rnnerd Blown 37.60% oWR.nhlp In OP 37.60% cwn.rchlp In OP (0.26% o-1 hip In r e tu rn ugh N w e rs , Ind.;. 20% l .d mt., ks .In Borrowers 76.00% oen.rshlp In Class B NERA LP than. 26.00% in Class B NERA LP aharec shares {-20% avm Dlnu e d lo os. 17.31% ownership In Class A HERA LP Ihanc mares 10.376%o'wnerchlp In 10.376% awn.r.hlp In 111.60% lndlraot own.rch10 In 9ortpwan) (..76% o.rerchlp In Borrowers Borrowers Borrowers, SB Brighton Avenue through Class B NERA 36 Brighton A.enu. is Brighton Avenue Allston. MA elite Int.realcl. 1.20% Ovrnbln.d Anton, MA 0213. 4111101. MA 0213! .:.rd ul M.n.A•r. 1.0r'0, ,r 01u IYi M.,',e al bu.•J , I Interest In Borrower Omosrc & Board or Dlreotpn Ronald Brvwn; Pros Iddnt Ald Elro:ta'r LAermrvn Bnswn ,,rr...ure• Ara fliodcr) 11100th W:C'11:rv31sucrelur,I Dared 4100.0 ;D renvrl Jameson Brawn h1aril-a Altrandl lDI'.dor: 0.03% direct owner of Close A "loss A Aidtrw L Blcch IDI'eclvj NERA Lp Shares Umltad Partners Class B Limned Perth— N.WRerL Ida. IMAI PUDnoh• Tn dad on NY SE 1..00% G.ncl Al Part7vr S1IY rAlc hdel IDrec Cyvld 1 R.MriDur_orl hv' Ronald Brown 35.00% . C2-. 3.20% direct owner of Clues A He dpmeatle Ivan Iduel or 3s arynIir Av0,l NERA LP orioles i ownln~2i C no 1arsl0n 0111.01. MA ; I1' Individual ors qrimy lha 1D%pr oreat In lt+: N. WRea41no. Ic also One Non-Number Manager or reel, LLCeironer Borrowers , other then noted EnoWve Omo.rc Dor.. Ronald Brown President U.S Clp:an New England Realty Associates Limited Partnership (MA) J.ma do erevr Key Principal rnacunr Publically Traded NYSE ("KEN") U.S sheen 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of Olde English Apartments Limited Partnership 100% Stockholder of Olde English Apartments. Inc. Olde English Apartments. Inc. (MA) 1% General Partner Olde English Apartments Limited Partnership (MA) I 714 Chelmsford Street Lowell, MA Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 8 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 |

| T1~1X IYb a]a. rrr~.votlu lrwn a..e.wSn Aveae: 1r.or.. A.,ra.r Iw... ' w s:so ra..rr re.. e.~rl, r.,~.Au• 1 e.orn~" irwe~ie.. era~l.lpul~l N 1,6 rrr bW.L1 ru ]ry.;l Co-Tru,tet tsar E. short., Ce-Tr,rstee Callow 1. eloeb ur —m C o-T.ru[tee aer7?.~ae.ed wt~.lyw Jame con Bro An mgr aesah err ~aml !PB~HB~ Raa robin Note: roar than persons or entitle, apeclhcoliy Identified on (ells organizational chart, mere I6 no: li U.S. perso0 entity who own a, in the aggregate, 256 or more of the direct or Indirect ownership In to re sirs In Borrower Ill) foreign person or silky who owns. in the aggregate. 10% or more of me direct or indirect ownership erests In Borrower, Unla Be otherwise indicated. all individuals Identified on into organizational [hart are gregde amount lakes Into account any direct or Indirect ownership Interests In Borrower held by a 1 lmmetllate Family Member, lwhiCh term Includes an Individual'. child, stepchild, grandparent, albling, step-ilbang. parent, or step-parentl - r• C aro10 Brown Cluaribbl Lad Anne il, I I I LJ "root, Truor Hader Brorm JMaecon Brown 100% iota Member 100% a.N LlsmtN1 HBC Holdings, LLC Makle Brown LLC Joe Reel Estate LLC INC) Ronald Brown 57.60% ownership In OP 37.60% ovmershlp M OP J 6OC% ownership Inclass a NERA LP I hang 26.00% In Clacc B NERA LP Inure, share, 17.31% ownership in 01.60 A NERA LP Inane Ihenf 10,376% awnsrehla 10 10.476% ewnerehls In 123.60% Indlreot ewnerenlp in Bortpwalo) (4.76% oMer[hlp In Borrower. Bornol..rs BOrtdweee) 86 Brighton Avenue (1610195 Clati B NERA is Brl hton Avenue is Brighton Avenue Alicton. MA 02134 In(alotts), 6.20% oombined Alton, MA 02134 Allston, MA 02134 .ra ul M,,.Aar. r,o,,., r l,,.., a 11- E. ML+eai au.'J 1 Intere,t In Borrower Ma..6.r..r r rruu-nrarriLr ni.rr.pr. Jameson Brown 0.09% dlrscl owner of Ciao B 4 aA NERA LP Shares 1ed Paners rt Cla,t B Limned Paers rtn hewRea..Inc. IMAI P.100011 pIY Traded cn NYSE 16.00% 1.,. seal Pani_r Ronald Brown 30.00% 1 . 5.20% abed owner Of Class a 560 doenat110 rndrddael or ]e 8,ATIon Avon... NERA LP shares hie ltorrnlna 26% lop 111—,. IAA02130 rfrorelOn Ind 10%uo l r ore 0loa 1 In MRIOg NerRaal, me. R also hie Non-Member Manager of eeoh LLC Borrcevr Borrowers, other then noted abl're. New England Realty Associates Limited Partnership (MA) Key Principal Puhlically Traded NYSE ("NEN") 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of Redwood Hills Limited Partnership 100% Stockholder of Redwood Hills, Inc. I Redwood Hills, Inc. (MA) 1% General Partner I Redwood Hills Limited Partnership (MA) I 376 Sunderland Road Worcester, MA Ronal) Brown 26.00% ornalh is In OP therac 10.26% 00110151110 in Borrow." through Na'aaeel, Inn.!. 130% oombined inlet. ct In Borrowers u t cittlon Dmoer. L Board of Directors Ronald Bruhn lPrcldenr eve I: ' _ JaTlp64n Brorn irossurc' ar4 D~ra_Icr 1160510 NCC•4ckl'q lattrdlirrl Da:10 A10lse Draccorl Llaaina Altrandl iDuaclorl Andrer L Bloch IDI•tclC4I 5al, Mioh,al iol•aclor: 01043 Roher(olrMi•I E.eoutive omoerc Ronald Brown Pretldent u. t C lb.en Jsrnewn Brorn Tloacurer u.t Citizen Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 9 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 |

| n n:Y~YS~ Yrrneor6 lnof ~ y ear tlw.ly~ n.r~l.b r s.r111.wrY.d ewrralgn bv~rarewe, J'1Nae: rnofw. Jr,rmervo i llnuurl.wed'.1~nMtl'.n A1.Yfn kbw~ ~Car~I LLl; Aa' 1 tlAd,J1MalC larr Oss ll.l. 151In .u_11. a7c'<I ca-T—tee 3eCy E. Mlanael '.0-Tr=JLtee w Yar~~ aYna1 ~4~ Jameson BT.', a~•.~+aaa111w wwrllu K acrd arvJ1, ., fr,.rr I.~,hw. ,r• :C:"4 Pea Er-b:, LLB Nate: n persons or enldtea speclncany 4oenlNfed on this organizational chart Inato Is no: f) U.S. perean wh o owns, in th e aggregate•, 25% or more of the direct or Indirect ownership Inlereela In Borrower sign person or entity who owns. In the aggregate, 10% or more or the direct or Icollect ownership In Borrower. Unless otherwise Indicated, all individuals ldenitlied on this organizational mart are )regate amount lakes into account any direct or Indirect ownership Interests in Borrower nail by a Immodest. Family Members (which term Includes an IndIvduai'. child, slepehlld, grandparent, albdng, step-eibhng, parent or step-parent). Harty Braan Jameson Brawn 100% bole Member 100% Se. Mere W r HOC Ha1dingc, LLC Melal. Brown LLC JPB Reel Eliot. LLC I MAI Ronald Brown 37.60% ormer.hlp In OP 37.60% a'wnerchlp In OP 76.0011 ownarhlp In Class 51108.0110 the ns 26.00%In Class B NERA LP Ihanc Lhenc 17.11% ovnarthlp In Class A NERA LP lhfns ohms 0.3)6% o'nn.rchlp In 10.376% awn.rshlp In 121.60% Inatreat 0,11.011110 In Borrower) (4.76% ornenhlp M Borrower Borr0wersl Borrowerni 36 BhIDlhon A.enu. (lupuoh class B NERA Si Brlollton Avenue 30 Brighton Avenue Allston- MA 02014 Intenitci. 3.22% a0mbinad Aeston. MA 02134 Allston, MA D2134 lw11 ul /Aanraxn tan, .u, I, ux i.I,E. M-1: Cod 1nt. nct In Barroear M.+.e•r. s,r numm.n,Lr m.rua+r. Jameson Brawn 0.03% direct awn or of Class A "Mss A NERA LOIama Llmlbdr CMGs B Partnsr6 Mewne21 Ina-INA1 11,011101171. 0.208 NY IE 19.00%0-D General PaRwr Ronald Brown 10.00% . ao,. 3.20% direct owner of Class A Na dnmedla lnernduel or 300,0-dpn /--.0 NERA LP shares entlly oxnm~ ~6% n or mare In B Allsul. GA. CO 134 Ib d no rorslDn IndiVIdual er girrl1 Nfyorrrr Inp 10% or areater In m~ Borrowers, other than noted abcr.. NewReal, 180.11.11011.. Nan-Mear"r Manage! of.eall LLC Barrows New England Realty Associates Limited Partnership (MA) Key Principal Publically Traded NYSE ("NEN') 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of River Drive Limited Partnership 100% Stockholder of River Drive. Inc. River Drive, Inc. (MA) 1% General Partner River Drive Limited Partnership (MA) 3 River Drive Danvers, MA Ronald Brown 25.00% awner rip In OP .hires (0.26% owmerhip In Barrwnn throagI 51*8.1l, Inn.), 1.20% o0mbin.d Inters 6t In Borrower aJ cltllan Others & Board of olnolor Ronald Bruin (Presldont 11d Limns-I !- — Brawn Irraasure' and 01151107, 10100111 NCC'acknq l5acralarrl Cvnd M.I. ;C reclorl Mane',, Alorandl ID1•ec10q A'Idreo L Bloch 1017:1511 5210 Wch201 IDl'ocloC 020004 ROMr(oerocw'I EaeoLuva 01110.15 Ronald Brawn Precedent 0. a c mien Jameson Brn'wn Tnacurar Ill cmien Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 10 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 |

| nolA—a —r abe„ aw,.e.eelalusN: ~,aB.LLp naaA.rrvrlYe.o Jasrn lw.rb. Nd19: + " t '~"r~ ' I1L Oa All' '~"""''"'~'"'Om""`• ~tl.arrab•tK:lewe Cab LLL Other than P ersona or entltlee a cmcelly lbentmed on this o anlzetional chart, there is no: I U.S. person pe Y ( t "r.Vni`i.n lint °x or entity ign p erso m the e app wise ter.25% or more of the direct or indirect direct m(e i ect m ne r al l ip or (n] foreign person or sniffy who owns, m the aggregate, 10% or more of the direct or indirect oEmerenlp Cu-Trnct.e Interests in Borrower. Unless otherwise Indicateil, all mdlvlduale Identified on this organizational chart are 6e':T E. Miarr..I U.S. citizens. cc-rr,,an• •This aggregate amount takes Into account any direct of Indirect ownarshlp interests In Borrower held by a 4nor.w L. B:oo.- person a Immediate Family Members (which term Includes an Individual's child. otepcevlld, grandparent .rr s spouse. among, step-sibling, parent or step-parent(_ eo-rrretee it ,_,.__e-_,__w Ja In eson Brcr: n er . euaxyr naa noun w: .narW arruHy u Harold Brown Charitable Lean Ann'. I' 4Tr Hadar Brb.nl Jem.fOn Brown 1001E Role Member led% tow Member Ronaltl Brown NBC Holdings, LLC Melcl. Br,.n LLC JPB Reel Eltat. LLC 26.00% Orne nhlp In OP shares Ronald arown 67.601E ownenhlp In OP 17.60% ownership In OP 10.26% ownenhlp in Borrow r, Ihro uon r . . RR.1, In..), 76.001f ownenhlp In 011112 NERA LP mono 26.00% In Clacc B NERA LP Are— eharec 1.20% ocmbin" Int.nct in Borrowwer; rs U.1 Clbnn 11.11% ownenhlp In Class A NERA LP Shorn men; 10.176% own•rcnlp In 10.376% own•rohlp In. 121.60% Indlnpl ,wmnlllp In Bortow.n) 14.76% ownenhlp In Barto'sar6 Borrowan) Borrows 36 Brighton Aran.. throboh cis[; a NERA la Brtohlon Afloat 30 Brldhton Av.nue All 9ban, e MA 02134 W.i4 ul N+n..un ,+nv.~r~~uw i.lv E.Miv.l. tlu. Jul Inl.nale l-6.20% pom Int.nct In B.rtowar Al MA A021St All [lon, MA 02134 M.+.pr. m nmr m.mLr muua.r, 6nlaerc i Board of Dlnp — Ro e Jamawn semen ;rraasu ,,I Dnacleri Llsbaln IV C c ckrq iS-.Iaryl Dodd Wol[c;Dr 11 Ja0B1ao11 BrOYIII N.wft.il, Ina.lMAl Llpnlna Al fund, IDi'-W: . direct own8ror Chl" A Cl...A .Andre. L NERA LP Shares Llmlhd Pertn.n Clacc E LImHeO F erfn arc Gen.,., F.— n 1 1 1'DI'acl IDI•aslbrl 1 0 03% Publicly Tnd•d on NY IE 19 i0k '.CGh Sal 0 I 1 R.1 al Davtl! ROMr (DlrccG'I ROdaID Brown 30.00% 30 Br gnbn Avanuc 5.20% DCect owner of Class A AIL•!o,. MA C213x NEAR LP shares No h dom.dlo luster,dual or or r. 1, {, 89orrpw.n a6 0 f Ineluleu+l o..nbh ovnlnn Ne'RR•el, Ind. 1..11. the Non-Memb.r Manage, or...h LLC sorrows' noted I Ex•punve omoerc i Ronaw arown P n sid.nl U.t Calxen Jam. wn ar— Tns6unr New England Realty Associates Limited Partnership (MA) U., ctux.n Key Principal Publically Traded NYSE ("NEN") 39 Brighton Avenue Allston, MA 02134 100% Member WCB Associates, LLC (DE) Non-Member Manager. NewReal, Inc. (MA) 10 Westland Street Brockton, MA Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Page 11 Schedule 13 (Ownership Interests Schedule) 12-22 © 2022 Fannie Mae HAMILTON/KeyBank (2021 MCFA) 65624749-v5 |

| CO-True LOB rely E. Mlahnol Co-TruclO. :<ndnw L. Bloat, Co-mud.. Jamewn Brown nail. 1* ~.w...I ' rte' ti Ida..w...rlawa,en.. W~ilr; ri~a, u' a.e,eranwaK lrh ear,,,. Isr.Lu'~ ~"rir roy Nola: en persons orentnses epaclncaU4 identified on this organlzallonalchart there to no: I) U.S. person wt10 owns, In the aggregate•, 25% or more of the direct or Indirect ownership Internal, in Borrower sign person or entity Ivho owns, In the aggregate. 10% or more of Inc direct or Indirect ownership I In Borrower- Unless otherwl,e indicated. all Individuals Identified on this Organizational catart are 'ene. gregate amount takes Into account any direct or Indirect ownership Interests In Borrower held by a Immediate Family Members {which term Includes an IndNNlual'* child, stepchild. grandparent, sibling. step-el➢ang, parent or atop-parontl. JPB/HBC Rea! Elbe LLC L'r _L- ~.06T". iriJ HBC Holding,, LLC I MA! 71.0ex ownennlp in Clas, B NERA LP Instil 17.11%ownennlp in CI.Cc A NERA LP than, 113.110% Indirect o,n.rcnlp in Borrowers) U Brighton Avenue Allston, MA 02114 ie of M1 r. .rn.ar ,,Iy E.Mivel. eee klw+.M,..i. irun.,ri.n,l.r n,.nwpr. 0a1c,J &rows Cl-nrllabla Lela AnOulty rur1, 1 Me. Truce H1Mr B Jameson Brown 000% t0 Sole Nempar M tOaX ION Member gpnal0 Brown Match Br0'a, LLC JPB Real Estate LLC 26.00% o.m.renlp In oP aharec Ronald Brown 17.60%ownennlp In OP 17.60% o.anarahlp In OP 0.26X o'an0rs nip In Borrowers ihroupn NwaReal, Ino.}, 1.20% o0mbined Inle—t In Borrowers 26.00% In 011118 NERA IF Ihln, Snares U4 olden inert. 10.176% pwnerlhlp In 10.376% ownennlp In (4.76% omenhlp M Borrowarc Borrower.) Borrowarcl through Clasl B NERA 16 Brighton Arena. 9r Brighton Avenue INlnelsi, 6.20% aomblned Heston, MA 01134 Allston, MA 02194 halenet In 11-ever Ohioerc L Boers or olrl010rs Ronald Brown IPnsldenl aid Clre00'I m 11 m Bros, (no. !rand Olncic; ,0110 MCCrackhy 19ecrabrvl 01.10 mouse ;o redorl Man— Albrand (OVacbc Aldrew L Bloch 0110100 Sal PA,,ha.' 101,010!1 021.01 R110r(Olrecarrr Limlbd Partners Class B Uml1ed PanU:nrc PubllelU Traded on NYIE te.OD% 50.00% No dpma,llo Ina Mllual or ; B ow.h nl and no foreign Ind 6B Nlduai or errlIHty ~err Ino tax or gnus! 3ortawan, other then noted NaIBRalI. Ino. IMAI 000 vat Partner ' 00% 0s erp1lon Avunu: mloicn, IAA 02130 NewReal, Ino. 11 .150 the Non-Member MullIgan of erbn LLC aurroes r New England Realty Associates Limited Partnership (MA) Key Principal Publically Traded NYSE (HEN') 39 Brighton Avenue Allston, MA 02134 99% Limited Partner of Clovelly Apartments Limited Partnership 100% Stockholder of Clovelly Apartments, Inc. Clovelly Apartments, Inc. (MA) 1% General Partner Clovelly Apartments Limited Partnership (MA) 0.03% direct owner of Clara A NERA LP Sharer Ronald Brown 3.20% direct owner or claaa A ItERA LP aherea Eaeaatve Omeerc Ronald Brown Preuldant U.i citizen Jameson Broan rn.cunr U. a Oluaen 160 Concord Street Nashua, NH Reaffirmation, Joinder and Second Amendment to Master Credit Facility Agreement Form 6601.MCFA Schedule 13 (Ownership Interests Schedule) 12-22 HAMILTON/KeyBank (2021 MCFA) 65624749-v5 Page 12 © 2022 Fannie Mae |