Exhibit 99.2

CANADA MORTGAGE AND HOUSING CORPORATION 2024 Annual Report To request an alternate format, please contact us at: 1-800-668-2642 700 Montreal Road, contactcentre@cmhc.ca Ottawa, ON K1A 0P7 CMHC.ca

Exhibit 99.2

CANADA MORTGAGE AND HOUSING CORPORATION 2024 Annual Report To request an alternate format, please contact us at: 1-800-668-2642 700 Montreal Road, contactcentre@cmhc.ca Ottawa, ON K1A 0P7 CMHC.ca

Canada Mortgage and Housing Corporation contributes to the well-being of Canada’s housing system. We deliver housing finance solutions and provide lenders reliable access to mortgage funding. We also provide crucial research and data to inform decisions for better housing sector outcomes, and deliver housing programs for the Government of Canada. 2024 Annual Report 2

Table of Contents Message From the Chair 4 Message From the President and CEO 6 Our Strategy 8 Our Performance 10 Management Discussion and Analysis 12 2024 Overview 13 Business and Financial Highlights 16 Consolidated Financial Highlights 16 Deliver commercial solutions 19 Deliver government programs and priorities 26 Build for the future 31 Capital Management 34 Risk Management 36 2024 Climate-Related Financial Risk Disclosures 39 Consolidated Financial Statements 55 Corporate Governance 140 Appendix: Enhanced Financial Reporting by Crown Corporations 144 Glossary 150 Historical Information 153 2024 Annual Report 3

Message From the Chair “CMHC is entering the new year in excellent shape and ready to support the housing needs of Canadians in even more focused and innovative ways. We are ready to be there again for Canadians.” The year 2024 was a momentous one for housing in Canada. It was a year that asked Canadians to become experts in monetary policy and macroeconomics. It asked developers to do more with less to make their numbers work. And the latest housing projections became as hotly anticipated as hockey scores. Through it all, CMHC was there for Canada. It was there with help for Canadians making housing decisions, with programs and products for private and not-for-profit builders, and with trustworthy data to make sense of it all. Read on to learn how CMHC fared in delivering these services in a challenging year – its successes, the obstacles we faced, and how we’ve tried to overcome them. Read on to see how we’re working hard to maintain the trust of Canadians. 2024 Annual Report 4

2024 is also the year that I joined CMHC as Board chair, She also inherited an organization in good shape thanks and it’s been an honour to help oversee all this crucial to the leadership of acting CEO Michel Tremblay. Michel work. I’d like to thank my predecessor, Derek Ballantyne, has now returned to his post as Chief Financial Officer for his contributions in leading us to where we are today and Senior Vice-President, Corporate Services, and we as an organization. are fortunate to still be able to call upon his experience and knowledge, along with that of the rest of the Executive I’m pleased to lead a strong board, anchored by Committee. The Board is truly grateful to all the leaders longstanding members and revitalized by new ones who who’ve worked to smooth out all this transition. joined with us this year. Our backgrounds vary, giving us the broad outlook that good stewardship requires, This is a time of change and opportunity for CMHC, and we share a commitment to the organization and as you will see in this report, it is entering the new and to the well-being of Canada’s housing system. year in excellent shape and ready to support the housing needs of Canadians in even more focused and innovative CMHC also welcomed a new CEO this past year. ways. We are ready to be there again for Canadians. Coleen Volk did an amazing job getting up to speed and making a positive impact right away – supported, of course, by a strong team. Don Iveson Chair, CMHC Board of Directors 2024 Annual Report 5

Message From the President and CEO “As the country faced ongoing housing challenges in 2024, Canada Mortgage and Housing Corporation continued to deliver strong results for Canadians.” Headwinds were strong as many homeowners renewed their mortgage at higher interest rates, renters faced higher rents in most markets, and far too many vulnerable people struggled to keep a roof over their heads. Yet throughout the year, CMHC remained focused on the three areas where it has the greatest impact. Deliver commercial solutions In 2024, we met major boosts in demand for our commercial products. Our MLI Select product incentivized multi-unit developers to build more affordable rental housing. Federal mortgage reforms to help new homebuyers created extra demand for our Homeowners MLI and our securitization products. More on page 19. Deliver government programs and priorities Last year, the federal government announced Budget 2024 and the new Canada Housing Plan, and tasked CMHC with delivering on several of its initiatives. 2024 Annual Report 6

We stood up new programs like the Co-op Housing I began my mandate along with several new members of Development Program, and launched a second round our Board of Directors, including the Chair, Don Iveson. of the Housing Accelerator Fund so that more local It’s a pleasure to work with such an engaged, community- governments can cut red tape and fast track home connected Board and we’ll benefit from its sage guidance construction. We also enhanced existing programs such and stewardship in the years to come. as the Affordable Housing Fund and the Apartment Finally, I’m grateful for the engagement of our many Construction Loan Program, helping more developers industry and government partners. In the months and get the financing they need to build more rental homes. years ahead, we’re committed to strengthening these More on page 26. relationships which are more important than ever in these uncertain times. Because together we’re stronger, Build for the future and together we’ll reach our shared goal – a healthier In 2024, we produced more timely, unbiased research housing system for all Canadians. and insights to help housing partners make sound decisions. Notably, we drilled further into our study of Canada’s housing supply challenges, gaining a clearer picture of supply gaps at the local level. In March 2024 we also hosted a national housing conference on behalf of the federal government, bringing together thought leaders from across the country to discuss innovative Coleen Volk solutions. More on page 31. President and Chief Executive Officer Strong team, mission that matters I joined CMHC as President and CEO mid-way through 2024, returning to the company after several years in the federal and Alberta governments. The housing context has definitely changed since I first worked at CMHC. But as you’ll read in this report, the company is as high-performing as ever. None of our achievements would be possible without our dedicated CMHC employees. They are fully invested in our mission, and guided by a strong, forward-looking leadership team. 2024 Annual Report 7

Our Strategy CMHC’s strategy is guided by the National Housing Act. The Act, in relation to financing for housing, promotes housing affordability and choice, facilitates access to, and competition and efficiency in the provision of, housing finance, protects the availability of adequate funding for housing at low cost, and generally contributes to the well-being of the housing sector in the national economy. As the housing landscape shifts, with changes in the environment and clearer roles within the system, our strategy evolves to address these changes. Providing access to adequate and affordable housing remains a major challenge, and our strategic choices are shaped to address these shifts. We focus our efforts on delivering commercial solutions, supporting government priorities and programs, and building for the future to maximize our impact on a well-functioning housing system. Three key outcomes To address the challenges of providing adequate and affordable housing, our strategic choices focused on three key outcomes. These outcomes, aligned with our strategy and mandate, define the changes needed across the housing system and guided our efforts: • People in core housing need have equitable and reliable access to housing that is secure and affordable. • Canada has the number of homes and the mix of housing options to serve diverse needs. • Canada’s housing system supports sustainability and stability. 2024 Annual Report 8

Three core activities Our efforts to contribute to these critical outcomes are driven by three core activities, each directly supporting our strategy: Deliver CMHC supports the sustainability and stability of Canada’s housing system through the delivery of public Commercial mortgage insurance and mortgage funding solutions. Solutions We contribute to the well-being of the housing sector by preserving the availability of capital, maintaining our ability to respond to disruptive events, and ensuring that we remain competitive and financially viable, with due regard for exposure to loss. Deliver CMHC helps the federal government deliver on its commitment to increase housing supply and make Government housing more affordable. This includes leading the Programs and delivery of housing programs, such as those included in the National Housing Strategy (NHS). The ongoing Priorities delivery of our programs also reflects our commitment to broader government-wide priorities, including climate compatibility, equity, and reconciliation. Build for the CMHC continues to act as a thought leader, given our deep knowledge of the housing system. We work closely Future with all orders of government and housing system participants, providing expert advice to fill knowledge gaps and support the creation of a stable and sustainable housing system. Meanwhile, this contributes to enhanced delivery of our own programs and development of new solutions as we build for the future. We endeavour to reflect the complexity and intersectionality of housing issues in the research, data and insights we deliver. To drive our strategy, our performance measures (see page 10) assess whether our products, programs and activities are achieving the desired impact in alignment with broader goals. 2024 Annual Report 9

Our Performance Our performance measures help us assess progress on our strategy and inform our decision making through evidence-based data. The performance highlights below show our contribution to addressing Canada’s housing shortfalls in 2024. 504,531 units 2024 TARGET 536,000 units new, repaired and assisted by CMHC programs* 118,541 units 2024 TARGET new, repaired and assisted, affordable 177,000 units to those in Core Housing Need* $77.3M 2024 TARGET ** $100M Incremental affordable housing funding 79% 2024 TARGET of units supported located in markets with greatest 75% need of new and/or improved rental supply*** 48% 2024 TARGET Ratio of climate compatible dwelling units/total dwelling 25% units (including retrofits) supported by CMHC * Includes commitments to all new and existing units facilitated through CMHC’s activities, including National Housing Strategy, Mortgage Loan Insurance, Legacy programs as well as Partnerships (units facilitated through Incremental Affordable Housing Funding) and Innovation. Some units may be double-counted in cases where projects receive funding from multiple programs. ** Funding secured through partnerships with private entities and that is committed to supporting or creating units affordable to people in core housing need. *** This measure captures approved rental units in markets identified as in high rental need based on their vacancy rates and affordability levels, as well as units in Northern and on-reserve communities. 2024 Annual Report 10

Notes: Numbers of units created and repaired in 2024 exceeded those in 2023 with most programs achieving their 2024 targets. The discrepancy between actuals and targets is primarily due to a significant increase in the Affordable Housing Fund new construction target in 2024 resulting from the pull-forward of program funding from future years. If the units target had not been changed or accelerated, the AHF would have met its targets. Also, a higher number of loans was approved in 2024 compared to 2023, however, the units per loan size deviated significantly compared to the historical norm resulting in fewer new and existing units than expected in 2024. The lower-than-expected number of units addressing core housing need was attributed to a recent trend in a diminished share of existing units that typically have rents closer to or below market rents. In 2024, $77.3 million in incremental affordable housing funding was secured, nearly doubling the amount committed in 2023. Although this result did not meet the target, significant investments were achieved through important partnerships with private entities, including Habitat for Humanity, contributing to additional housing units for those in need. Approximately 299,000 units (79%) were placed in markets facing the greatest rental supply shortages, reflecting a 40,000-unit increase over 2023. Nearly 50% of the units facilitated in 2024 were climate-compatible, surpassing our 25% target. This achievement underscores our commitment to housing finance solutions that support the transition to a low-carbon future, where homes and communities are resilient to climate change. 2024 Annual Report 11

Management Discussion and Analysis The following management discussion and analysis of the financial condition and results of operations was prepared for the year ended 31 December 2024 and approved by the Board of Directors on 19 March 2025. This section should be read in conjunction with the audited consolidated financial statements. Unless otherwise indicated, all financial information in this report has been prepared in accordance with International Financial Reporting Standards (IFRS) and all amounts are expressed in Canadian dollars. Forward-looking statements Our annual report contains forward-looking statements that include, but are not limited to: • the statements with respect to our outlook for the regulatory environment in which we operate; • the outlook and priorities for each activity; and the risk environment. By their nature, forward-looking statements require us to make assumptions. They are subject to inherent risks and uncertainties that may cause actual results to differ materially from expectations expressed in the forward-looking statements. Non-IFRS measures We use a number of financial measures to assess our performance. Some of these measures are not calculated in accordance with IFRS and are not defined by IFRS, and do not have standardized meanings that would ensure consistency and comparability with other institutions. These non-IFRS measures are presented to supplement the information disclosed. They may be useful in analyzing performance and understanding the measures used by management in its financial and operational decision making. Where non-IFRS measures are used throughout the annual report, a definition of the term will be disclosed in the glossary for non-IFRS financial measures. 2024 Annual Report 12

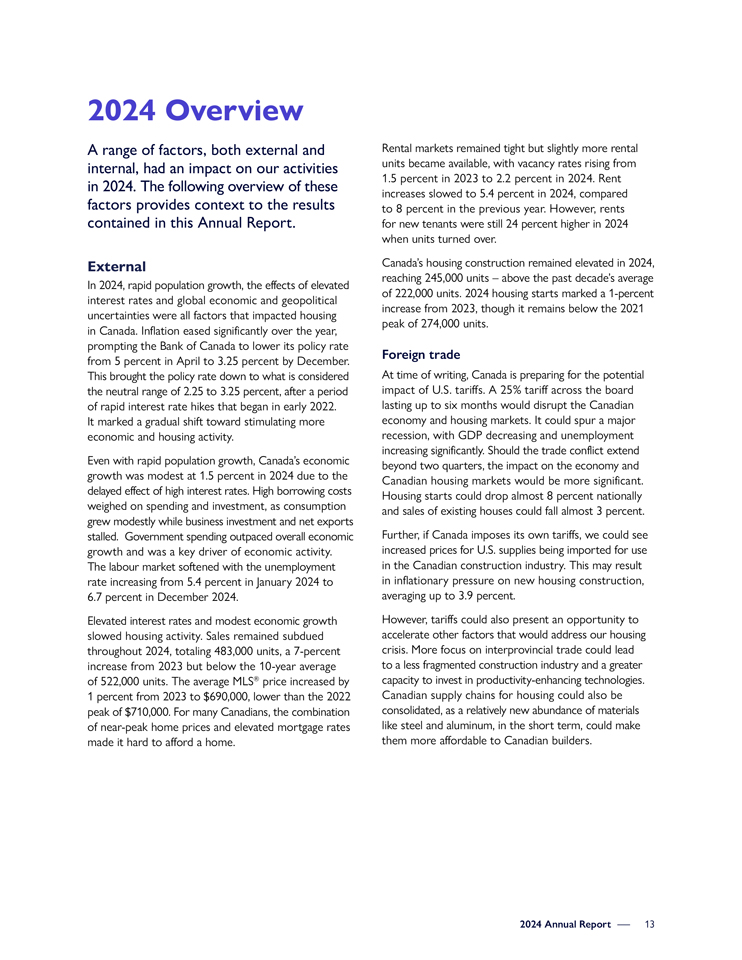

2024 Overview A range of factors, both external and Rental markets remained tight but slightly more rental internal, had an impact on our activities units became available, with vacancy rates rising from in 2024. The following overview of these 1.5 percent in 2023 to 2.2 percent in 2024. Rent increases slowed to 5.4 percent in 2024, compared factors provides context to the results to 8 percent in the previous year. However, rents contained in this Annual Report. for new tenants were still 24 percent higher in 2024 when units turned over. External Canada’s housing construction remained elevated in 2024, reaching 245,000 units – above the past decade’s average In 2024, rapid population growth, the effects of elevated of 222,000 units. 2024 housing starts marked a 1-percent interest rates and global economic and geopolitical increase from 2023, though it remains below the 2021 uncertainties were all factors that impacted housing peak of 274,000 units. in Canada. Inflation eased significantly over the year, prompting the Bank of Canada to lower its policy rate Foreign trade from 5 percent in April to 3.25 percent by December. This brought the policy rate down to what is considered At time of writing, Canada is preparing for the potential the neutral range of 2.25 to 3.25 percent, after a period impact of U.S. tariffs. A 25% tariff across the board of rapid interest rate hikes that began in early 2022. lasting up to six months would disrupt the Canadian It marked a gradual shift toward stimulating more economy and housing markets. It could spur a major economic and housing activity. recession, with GDP decreasing and unemployment increasing significantly. Should the trade conflict extend Even with rapid population growth, Canada’s economic beyond two quarters, the impact on the economy and growth was modest at 1.5 percent in 2024 due to the Canadian housing markets would be more significant. delayed effect of high interest rates. High borrowing costs Housing starts could drop almost 8 percent nationally weighed on spending and investment, as consumption and sales of existing houses could fall almost 3 percent. grew modestly while business investment and net exports stalled. Government spending outpaced overall economic Further, if Canada imposes its own tariffs, we could see growth and was a key driver of economic activity. increased prices for U.S. supplies being imported for use The labour market softened with the unemployment in the Canadian construction industry. This may result rate increasing from 5.4 percent in January 2024 to in inflationary pressure on new housing construction, 6.7 percent in December 2024. averaging up to 3.9 percent. Elevated interest rates and modest economic growth However, tariffs could also present an opportunity to slowed housing activity. Sales remained subdued accelerate other factors that would address our housing throughout 2024, totaling 483,000 units, a 7-percent crisis. More focus on interprovincial trade could lead increase from 2023 but below the 10-year average to a less fragmented construction industry and a greater of 522,000 units. The average MLS® price increased by capacity to invest in productivity-enhancing technologies. 1 percent from 2023 to $690,000, lower than the 2022 Canadian supply chains for housing could also be peak of $710,000. For many Canadians, the combination consolidated, as a relatively new abundance of materials of near-peak home prices and elevated mortgage rates like steel and aluminum, in the short term, could make made it hard to afford a home. them more affordable to Canadian builders. 2024 Annual Report 13

Internal Lastly, all MAP action items from the OAG performance audit on Chronic Homelessness in 2022, whose objectives Recalibration with Housing, Infrastructure included examining whether CMHC contributed to the and Communities Canada prevention and reduction of chronic homelessness, were In 2024, CMHC continued recalibrating roles and completed in Q2 2024. responsibilities with the newly formed department of Housing Infrastructure and Communities Canada Reconciliation Action Plan (HICC). This change sees HICC assume the primary On 20 June 2024, the eve of National Indigenous lead on strategic housing policy, supporting the Minister Peoples Day, CMHC launched an internal Reconciliation of Housing, Infrastructure and Communities. CMHC Action Plan (RAP). As an internal guiding document, it remains focused on delivering housing finance solutions, provides a roadmap for the organization’s reconciliation building and sharing our housing knowledge and journey over the next two years by committing to expertise, and delivering housing programs. near-term actions, longer term actions and key measures that we will track our reconciliation progress against. Refocusing government spending It is built upon four overarching pillars: Budget 2023 announced federal government-wide spending • Culture and inclusion reductions of $15.4 billion over the next five years, which included spending by Crown corporations. As both an • Talent development Enterprise and Appropriated Crown corporation, CMHC • Renewed relationships received direction and guidance from both the Minister • Improved Indigenous housing outcomes. of Finance and President of Treasury Board to reduce administrative expenses by 3 percent by 2026 and to Our hybrid workplace reduce professional services and travel by 15 percent beginning in 2024. These reductions were reflected In 2024, we announced increased requirements for in CMHC’s 2024-2028 Corporate Plan1. in-office presence for employees and executives at three and four days per week, respectively, starting as early as CMHC’s actual spending during the year was in line with January 2025. The decision was made to reinforce our the spending reduction target, as reflected in the Corporate commitment to community as a core value, and to be Plan. To respect the target, we found efficiencies in more in line with the ecosystem in which we operate, operations, in conjunction with reducing discretionary such as with our financial and public sector peers. spending, all while ensuring no impact to Canadians. A plan was put in place to address current space Special examinations/audits constraints across our six offices. In Q2 2024, the Office of the Auditor General of Pay Equity Plan Canada (OAG) began a performance audit of Federal In 2024, CMHC established a Pay Equity Committee Real Property. The scope of the audit includes a review and completed a full review of compensation elements of the Federal Lands Initiative led by CMHC, as well as as required under the Pay Equity Act2. The Pay Equity initiatives under other federal departments. This report Committee posted the Pay Equity Plan in time to meet is expected to be completed in Spring 2025. the legislative requirements, including the results of the pay equity analysis. Target salaries for female and male The OAG Audit on Housing in First Nations Communities job classes were compared and it was determined that was completed and tabled in Parliament in Q1 2024. The there is no pay equity gap between female and male objective of this audit was to examine the extent that gendered jobs. The Pay Equity Plan outlines activities CMHC and Indigenous Services Canada supported First that will allow CMHC to continue to move toward Nations in closing the housing gap on-reserve by improving the elimination of female- and male- stereotyped jobs. housing conditions and increasing First Nations’ capacity to manage housing. Action items identified in the Management Action Plan (MAP) from this audit are expected to be completed by Q1 2027. 1 https://www.cmhc-schl.gc.ca/about-us/corporate-reporting/summary-of-the-corporate-plan 2 https://laws-lois.justice.gc.ca/eng/acts/P-4.2 2024 Annual Report 14

Workplace Diversity, Equity and Inclusion • We strengthened the measurement of our Inclusion CMHC advanced many commitments under its Workplace Index by broadening the dimensions we assess and Diversity, Equity and Inclusion Strategy to meet legislative introducing an inclusion risk management framework. requirements and, more importantly, reduce employment We achieved a stable and favourable corporate equity barriers for employees. Notable highlights include: Inclusion Index at 81% in 2024. • We met all minimum workforce representation goals • We completed 24 of 35 actions from our Accessibility except for Indigenous representation, which we are Plan 2023-20253. For example, we incorporated addressing through various talent attraction accessibility considerations into procurement and retention strategies. We remain committed processes, launched a pilot program designed to to sustaining a workforce that is representative develop leadership skills among employees with of the Canadian population. disabilities and strengthen our leadership pipeline, and published our Annual Accessibility Progress Report4. CMHC Total CMHC People Leaders Group 2024 Actual 2024 Minimum Goal 2024 Actual 2024 Minimum Goal Women 60.4% 50.9% 54.0% 50.9% Indigenous people 3.2% 5.0% 1.7% 5.0% People with disabilities 12.0% 12.0% 12.0% 12.0% Racialized people 46.1% 28.0% 29.0% 28.0% 2SLGBTQI+ people 6.6% 4.0% 6.8% 4.0% Note: People Leaders are individuals in a permanent or temporary position, with at least one reporting employee or who are Advisors or higher. Representation rates are based on the finite population (survey participants). Goals are based on Statistics Canada sources on the current and projected population of Canada. 3 https://www.cmhc-schl.gc.ca/about-us/corporate-reporting/transparency/accessibility-at-cmhc/2023-2025-accessibility-plan 4 https://www.cmhc-schl.gc.ca/about-us/corporate-reporting/transparency/accessibility-at-cmhc 2024 Annual Report 15

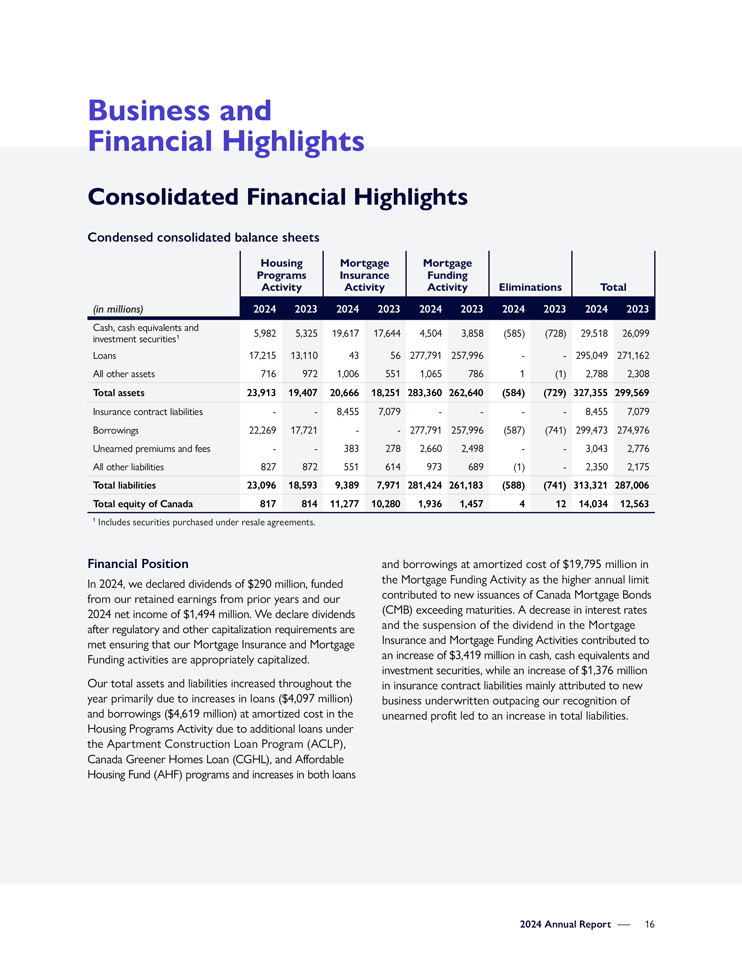

Business and Financial Highlights Consolidated Financial Highlights Condensed consolidated balance sheets Housing Mortgage Mortgage Programs Insurance Funding Activity Activity Activity Eliminations Total (in millions) 2024 2023 2024 2023 2024 2023 2024 2023 2024 2023 Cash, cash equivalents and 1 5,982 5,325 19,617 17,644 4,504 3,858 (585) (728) 29,518 26,099 investment securities Loans 17,215 13,110 43 56 277,791 257,996 — 295,049 271,162 All other assets 716 972 1,006 551 1,065 786 1 (1) 2,788 2,308 Total assets 23,913 19,407 20,666 18,251 283,360 262,640 (584) (729) 327,355 299,569 Insurance contract liabilities — 8,455 7,079 — — 8,455 7,079 Borrowings 22,269 17,721 — 277,791 257,996 (587) (741) 299,473 274,976 Unearned premiums and fees — 383 278 2,660 2,498 — 3,043 2,776 All other liabilities 827 872 551 614 973 689 (1)—2,350 2,175 Total liabilities 23,096 18,593 9,389 7,971 281,424 261,183 (588) (741) 313,321 287,006 Total equity of Canada 817 814 11,277 10,280 1,936 1,457 4 12 14,034 12,563 1 Includes securities purchased under resale agreements. Financial Position and borrowings at amortized cost of $19,795 million in In 2024, we declared dividends of $290 million, funded the Mortgage Funding Activity as the higher annual limit from our retained earnings from prior years and our contributed to new issuances of Canada Mortgage Bonds 2024 net income of $1,494 million. We declare dividends (CMB) exceeding maturities. A decrease in interest rates after regulatory and other capitalization requirements are and the suspension of the dividend in the Mortgage met ensuring that our Mortgage Insurance and Mortgage Insurance and Mortgage Funding Activities contributed to Funding activities are appropriately capitalized. an increase of $3,419 million in cash, cash equivalents and investment securities, while an increase of $1,376 million Our total assets and liabilities increased throughout the in insurance contract liabilities mainly attributed to new year primarily due to increases in loans ($4,097 million) business underwritten outpacing our recognition of and borrowings ($4,619 million) at amortized cost in the unearned profit led to an increase in total liabilities. Housing Programs Activity due to additional loans under the Apartment Construction Loan Program (ACLP), Canada Greener Homes Loan (CGHL), and Affordable Housing Fund (AHF) programs and increases in both loans 2024 Annual Report 16

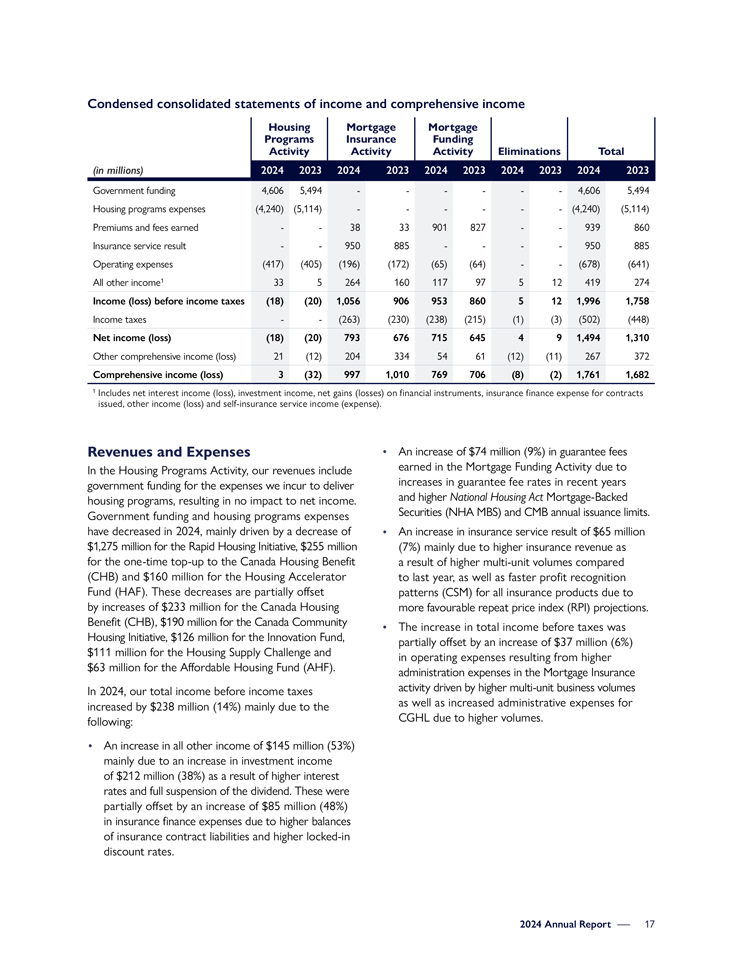

Condensed consolidated statements of income and comprehensive income Housing Mortgage Mortgage Programs Insurance Funding Activity Activity Activity Eliminations Total (in millions) 2024 2023 2024 2023 2024 2023 2024 2023 2024 2023 Government funding 4,606 5,494 — — — 4,606 5,494 Housing programs expenses (4,240) (5,114) — — — (4,240) (5,114) Premiums and fees earned — 38 33 901 827 — 939 860 Insurance service result — 950 885 — — 950 885 Operating expenses (417) (405) (196) (172) (65) (64) — (678) (641) All other income1 33 5 264 160 117 97 5 12 419 274 Income (loss) before income taxes (18) (20) 1,056 906 953 860 5 12 1,996 1,758 Income taxes — (263) (230) (238) (215) (1) (3) (502) (448) Net income (loss) (18) (20) 793 676 715 645 4 9 1,494 1,310 Other comprehensive income (loss) 21 (12) 204 334 54 61 (12) (11) 267 372 Comprehensive income (loss) 3 (32) 997 1,010 769 706 (8) (2) 1,761 1,682 1 Includes net interest income (loss), investment income, net gains (losses) on financial instruments, insurance finance expense for contracts issued, other income (loss) and self-insurance service income (expense). Revenues and Expenses In the Housing Programs Activity, our revenues include government funding for the expenses we incur to deliver housing programs, resulting in no impact to net income. Government funding and housing programs expenses have decreased in 2024, mainly driven by a decrease of $1,275 million for the Rapid Housing Initiative, $255 million for the one-time top-up to the Canada Housing Benefit (CHB) and $160 million for the Housing Accelerator Fund (HAF). These decreases are partially offset by increases of $233 million for the Canada Housing Benefit (CHB), $190 million for the Canada Community Housing Initiative, $126 million for the Innovation Fund, $111 million for the Housing Supply Challenge and $63 million for the Affordable Housing Fund (AHF). In 2024, our total income before income taxes increased by $238 million (14%) mainly due to the following: • An increase in all other income of $145 million (53%) mainly due to an increase in investment income of $212 million (38%) as a result of higher interest rates and full suspension of the dividend. These were partially offset by an increase of $85 million (48%) in insurance finance expenses due to higher balances of insurance contract liabilities and higher locked-in discount rates. An increase of $74 million (9%) in guarantee fees earned in the Mortgage Funding Activity due to increases in guarantee fee rates in recent years and higher National Housing Act Mortgage-Backed Securities (NHA MBS) and CMB annual issuance limits. An increase in insurance service result of $65 million (7%) mainly due to higher insurance revenue as a result of higher multi-unit volumes compared to last year, as well as faster profit recognition patterns (CSM) for all insurance products due to more favourable repeat price index (RPI) projections. The increase in total income before taxes was partially offset by an increase of $37 million (6%) in operating expenses resulting from higher administration expenses in the Mortgage Insurance activity driven by higher multi-unit business volumes as well as increased administrative expenses for CGHL due to higher volumes. 2024 Annual Report 17

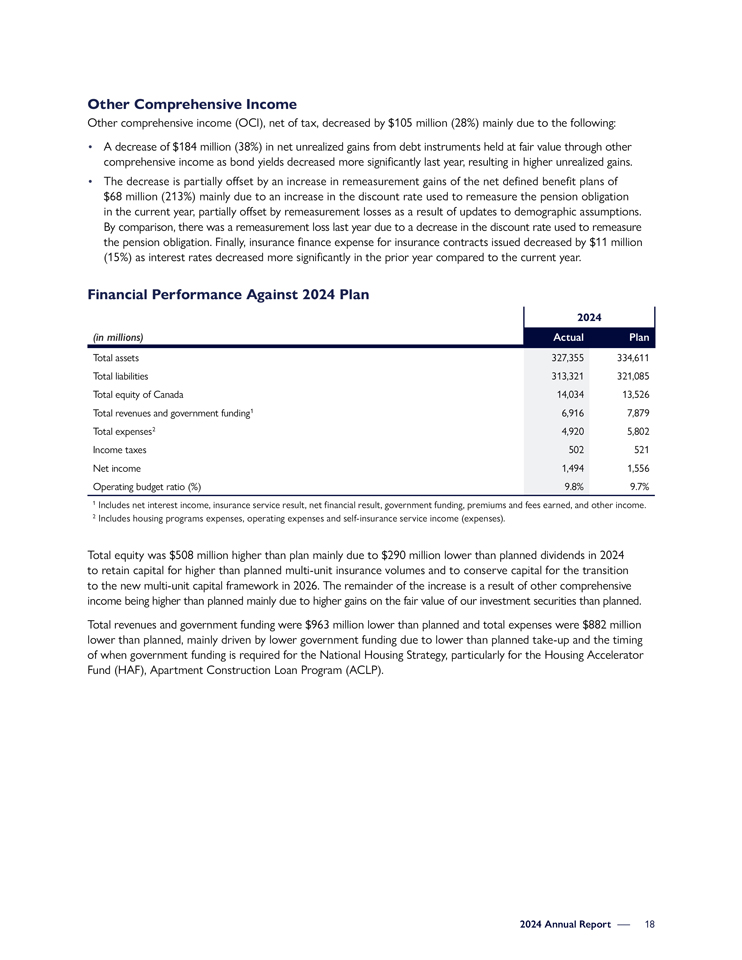

Other Comprehensive Income Other comprehensive income (OCI), net of tax, decreased by $105 million (28%) mainly due to the following: • A decrease of $184 million (38%) in net unrealized gains from debt instruments held at fair value through other comprehensive income as bond yields decreased more significantly last year, resulting in higher unrealized gains. • The decrease is partially offset by an increase in remeasurement gains of the net defined benefit plans of $68 million (213%) mainly due to an increase in the discount rate used to remeasure the pension obligation in the current year, partially offset by remeasurement losses as a result of updates to demographic assumptions. By comparison, there was a remeasurement loss last year due to a decrease in the discount rate used to remeasure the pension obligation. Finally, insurance finance expense for insurance contracts issued decreased by $11 million (15%) as interest rates decreased more significantly in the prior year compared to the current year. Financial Performance Against 2024 Plan 2024 (in millions) Actual Plan Total assets 327,355 334,611 Total liabilities 313,321 321,085 Total equity of Canada 14,034 13,526 Total revenues and government funding1 6,916 7,879 Total expenses2 4,920 5,802 Income taxes 502 521 Net income 1,494 1,556 Operating budget ratio (%) 9.8% 9.7% 1 Includes net interest income, insurance service result, net financial result, government funding, premiums and fees earned, and other income. 2 Includes housing programs expenses, operating expenses and self-insurance service income (expenses). Total equity was $508 million higher than plan mainly due to $290 million lower than planned dividends in 2024 to retain capital for higher than planned multi-unit insurance volumes and to conserve capital for the transition to the new multi-unit capital framework in 2026. The remainder of the increase is a result of other comprehensive income being higher than planned mainly due to higher gains on the fair value of our investment securities than planned. Total revenues and government funding were $963 million lower than planned and total expenses were $882 million lower than planned, mainly driven by lower government funding due to lower than planned take-up and the timing of when government funding is required for the National Housing Strategy, particularly for the Housing Accelerator Fund (HAF), Apartment Construction Loan Program (ACLP). 2024 Annual Report 18

Deliver commercial solutions We deliver mortgage loan insurance and mortgage funding solutions on a commercial basis to approved lenders and issuers. In doing this, we play a key role in maintaining a well-functioning housing finance system through all economic cycles. Our activities support the stability of the Canadian financial system while operating on a commercial basis with due regard for loss and without the need for government funding. Mortgage Loan Insurance What we do We offer competitive mortgage loan insurance (MLI) products to facilitate access to homeownership. We also offer effective multi-unit mortgage loan insurance (MU MLI) products that enable the financing of new construction of multi-unit residential properties, as well as purchase and refinancing to preserve the existing stock of multi-unit residential properties, including affordable rental housing. How we do it We work with lenders to offer both high- and low-ratio transactional and portfolio homeowner MLI products in all parts of Canada. We also offer a range of MU MLI products that reduce risks for lending institutions, which gives borrowers greater access to financing and allows lenders to offer them more favourable interest rates. 2024 Annual Report 19

Our 2024 results Objectives Activities Evolve our MLI • Updated MLI Select MU MLI product, which uses a points system to encourage products and business affordability, accessibility and energy efficiency. We updated the allocation processes to increase of points for energy-efficiency outcomes to encourage more affordability our agility and better commitments while ensuring access to higher tiers of MLI Select. serve Canadian lenders. • Increased the maximum amortization period for new construction loans for the MU MLI Market product. These changes encourage housing affordability, diverse housing options and align with the strategic objective to sustainably address rental housing supply gaps. • Continued modernization of our homeowner insurance business systems (CMHC Connect) (to 2026). • Continued major enhancements in multi-unit insurance systems for data ingestion, and arrears and default process (to 2026). Facilitate access to reliable • Delivered expansion to the Government Guarantee Parameters for first-time mortgage financing to meet homebuyers purchasing new builds. housing needs. • More than 49,000 housing units were purchased across Canada with the help of our homeowner insurance products in 2024, with over 14% insured in rural areas. (2023: 48,000 units, 15% in rural areas.) • Of the 283,000-plus rental units insured in 2024, close to 43% were for new construction, adding new units to the marketplace. (2023: 220,000-plus units, 40% for new construction.) • Over 179,000 rental units insured in 2024 were for MLI Select, a mortgage loan insurance product that advances affordability and climate compatibility. (2023: 127,000.) Financial Metrics and Ratios (in percentages) 2024 2023 Insurance service expense ratio1 12.6 11.9 Operating expense ratio 18.0 17.1 Combined ratio 30.6 29.0 Initial contractual service margin ratio2 62.8 65.1 Severity ratio 27.9 29.8 Return on equity 7.4 6.7 Return on required equity 8.2 7.3 1 Insurance service expense ratio on transactional homeowner and portfolio products excluding multi-unit residential was 4.9% for the year ended 31 December 2024 (11.9% for the year ended 31 December 2023). 2 The Initial contractual service margin ratio has been updated from previously published reports, resulting in an increase of 7.7% for the year ended 31 December 2023. 2024 Annual Report 20

The insurance service expense ratio increased primarily due to increasing multi-unit arrears volumes particularly in Quebec. The operating expense ratio increased mainly due to higher allocated corporate costs commensurate with the increased size of the multi-unit business and the resources required to support it. The initial contractual service margin ratio decreased mainly due to a higher risk adjustment assumption implemented in the fourth quarter of 2023, to cover the cost of capital for the transactional homeowner products. The severity ratio decreased compared to prior year due to reduced property sale costs. The return on equity and return on required equity ratio increased mainly due to higher insurance service result and higher investment income as described previously. The increases in these ratios are partially offset by higher average equity and higher required capital respectively as we continue to retain capital to support multi-unit insurance business growth. Insurance-in-force ($B)1 Contractual Service Margin (CSM) (in millions, unless otherwise indicated) 2024 2023 2024 2023 Transactional homeowner 162 169 2,059 1,960 Portfolio 65 77 65 78 Multi-unit residential 213 168 3,395 2,792 Total 440 414 5,519 4,830 1 Insurance-in-force figures are as reported by the mortgage lenders/servicers. CMHC’s total insurance-in-force is $440 billion which is compliant with the legislated limit of $800 billion set by the Government of Canada. This year, insurance-in-force increased by $26 billion due to new volumes insured exceeding the run-off of existing policies-in-force. New loans insured were $85 billion, while estimated loan amortization and pay-downs were $59 billion. CSM increased by $689 million (14%) as our new business underwritten continues to outpace the recognition of earned profit, primarily due to price increases and continued high demand for our multi-unit products. Insured volumes Insured Premiums and (units) volumes ($) fees received1 Claims paid2 (in millions, unless otherwise indicated) 2024 2023 2024 2023 2024 2023 2024 2023 Transactional homeowner 49,569 48,056 17,227 16,030 606 561 35 45 Portfolio 10,614 26,935 2,766 7,185 10 28 3 5 Multi-unit residential 283,711 220,925 65,167 43,257 1,673 968 7 2 Total 343,894 295,916 85,160 66,472 2,289 1,557 45 52 1 Premiums and fees received may not equal premiums received on insurance contracts written in the period and premiums and fees deferred on self-insured contracts written during the period, due to timing of receipts. 2 Claims paid refers to the net cash amounts paid out on settlement of the claims, excluding claims administration expenses. Transactional homeowner unit volumes increased largely due to declining interest rates, which boosted the housing market. Portfolio unit volumes decreased due to fewer large pools insured, as well as smaller lenders submitting smaller sized pools compared to prior year. The increase in multi-unit residential unit volumes is driven by an increase in new construction units insured, especially in the MLI Select product, which focuses on affordability, accessibility, and climate compatibility. 2024 Annual Report 21

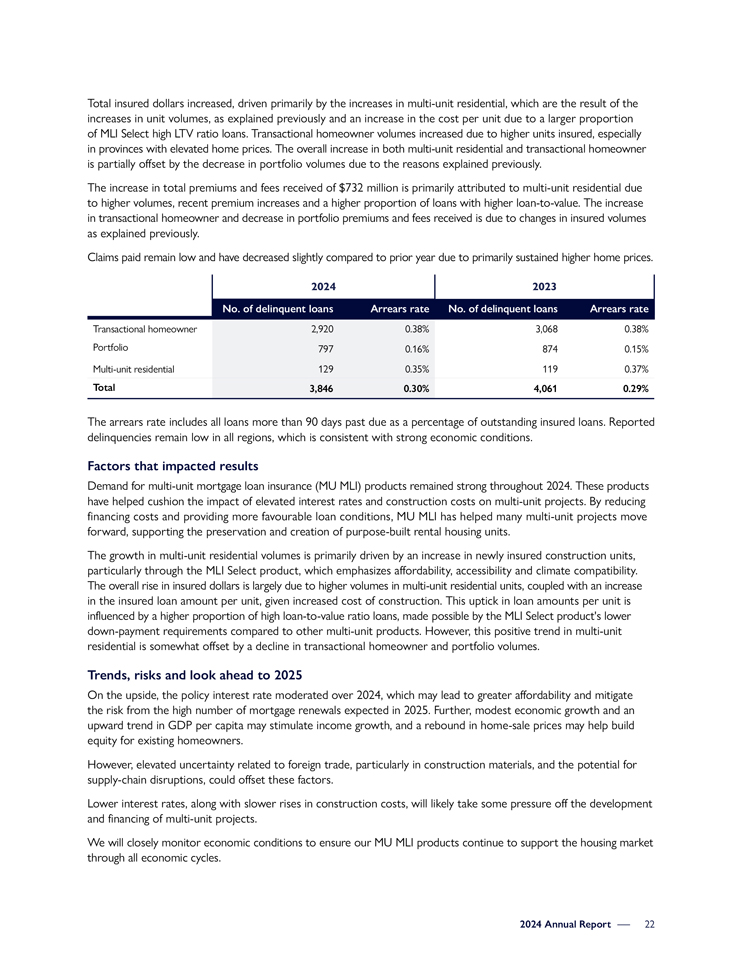

Total insured dollars increased, driven primarily by the increases in multi-unit residential, which are the result of the increases in unit volumes, as explained previously and an increase in the cost per unit due to a larger proportion of MLI Select high LTV ratio loans. Transactional homeowner volumes increased due to higher units insured, especially in provinces with elevated home prices. The overall increase in both multi-unit residential and transactional homeowner is partially offset by the decrease in portfolio volumes due to the reasons explained previously. The increase in total premiums and fees received of $732 million is primarily attributed to multi-unit residential due to higher volumes, recent premium increases and a higher proportion of loans with higher loan-to-value. The increase in transactional homeowner and decrease in portfolio premiums and fees received is due to changes in insured volumes as explained previously. Claims paid remain low and have decreased slightly compared to prior year due to primarily sustained higher home prices. 2024 2023 No. of delinquent loans Arrears rate No. of delinquent loans Arrears rate Transactional homeowner 2,920 0.38% 3,068 0.38% Portfolio 797 0.16% 874 0.15% Multi-unit residential 129 0.35% 119 0.37% Total 3,846 0.30% 4,061 0.29% The arrears rate includes all loans more than 90 days past due as a percentage of outstanding insured loans. Reported delinquencies remain low in all regions, which is consistent with strong economic conditions. Factors that impacted results Demand for multi-unit mortgage loan insurance (MU MLI) products remained strong throughout 2024. These products have helped cushion the impact of elevated interest rates and construction costs on multi-unit projects. By reducing financing costs and providing more favourable loan conditions, MU MLI has helped many multi-unit projects move forward, supporting the preservation and creation of purpose-built rental housing units. The growth in multi-unit residential volumes is primarily driven by an increase in newly insured construction units, particularly through the MLI Select product, which emphasizes affordability, accessibility and climate compatibility. The overall rise in insured dollars is largely due to higher volumes in multi-unit residential units, coupled with an increase in the insured loan amount per unit, given increased cost of construction. This uptick in loan amounts per unit is influenced by a higher proportion of high loan-to-value ratio loans, made possible by the MLI Select product’s lower down-payment requirements compared to other multi-unit products. However, this positive trend in multi-unit residential is somewhat offset by a decline in transactional homeowner and portfolio volumes. Trends, risks and look ahead to 2025 On the upside, the policy interest rate moderated over 2024, which may lead to greater affordability and mitigate the risk from the high number of mortgage renewals expected in 2025. Further, modest economic growth and an upward trend in GDP per capita may stimulate income growth, and a rebound in home-sale prices may help build equity for existing homeowners. However, elevated uncertainty related to foreign trade, particularly in construction materials, and the potential for supply-chain disruptions, could offset these factors. Lower interest rates, along with slower rises in construction costs, will likely take some pressure off the development and financing of multi-unit projects. We will closely monitor economic conditions to ensure our MU MLI products continue to support the housing market through all economic cycles. 2024 Annual Report 22

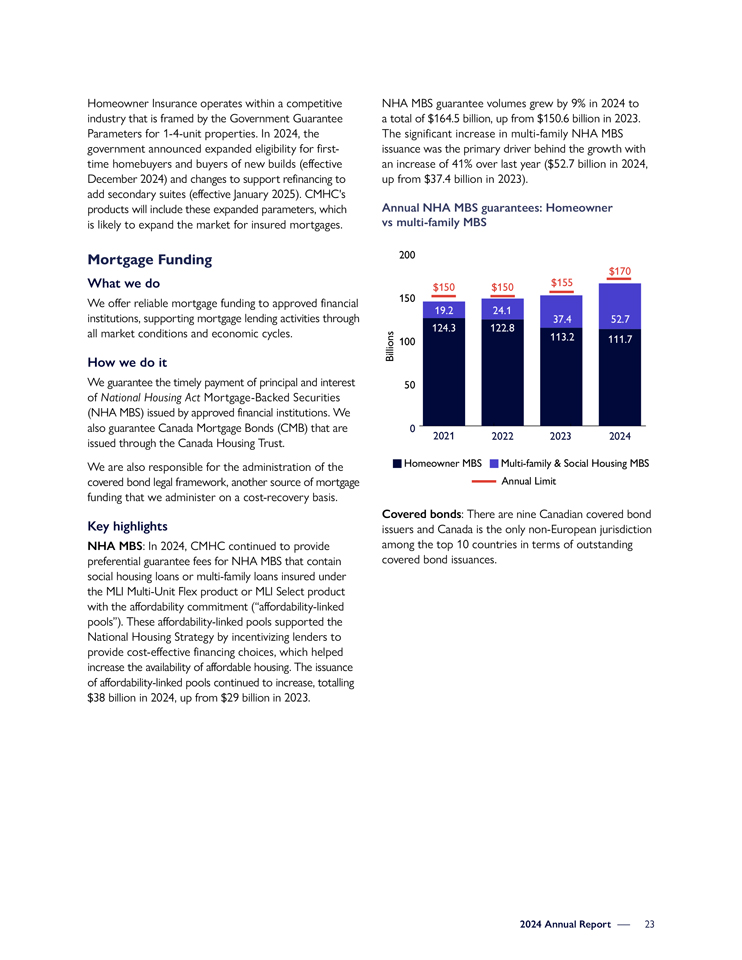

Homeowner Insurance operates within a competitive industry that is framed by the Government Guarantee Parameters for 1-4-unit properties. In 2024, the government announced expanded eligibility for first-time homebuyers and buyers of new builds (effective December 2024) and changes to support refinancing to add secondary suites (effective January 2025). CMHC’s products will include these expanded parameters, which is likely to expand the market for insured mortgages. Mortgage Funding What we do We offer reliable mortgage funding to approved financial institutions, supporting mortgage lending activities through all market conditions and economic cycles. How we do it We guarantee the timely payment of principal and interest of National Housing Act Mortgage-Backed Securities (NHA MBS) issued by approved financial institutions. We also guarantee Canada Mortgage Bonds (CMB) that are issued through the Canada Housing Trust. We are also responsible for the administration of the covered bond legal framework, another source of mortgage funding that we administer on a cost-recovery basis. Key highlights NHA MBS: In 2024, CMHC continued to provide preferential guarantee fees for NHA MBS that contain social housing loans or multi-family loans insured under the MLI Multi-Unit Flex product or MLI Select product with the affordability commitment (“affordability-linked pools”). These affordability-linked pools supported the National Housing Strategy by incentivizing lenders to provide cost-effective financing choices, which helped increase the availability of affordable housing. The issuance of affordability-linked pools continued to increase, totalling $38 billion in 2024, up from $29 billion in 2023. NHA MBS guarantee volumes grew by 9% in 2024 to a total of $164.5 billion, up from $150.6 billion in 2023. The significant increase in multi-family NHA MBS issuance was the primary driver behind the growth with an increase of 41% over last year ($52.7 billion in 2024, up from $37.4 billion in 2023). Annual NHA MBS guarantees: Homeowner vs multi-family MBS 200 $170 $150 $150 $155 150 19.2 24.1 37.4 52.7 124.3 122.8 Billions 100 113.2 111.7 50 0 2021 2022 2023 2024 Homeowner MBS Multi-family & Social Housing MBS Annual Limit Covered bonds: There are nine Canadian covered bond issuers and Canada is the only non-European jurisdiction among the top 10 countries in terms of outstanding covered bond issuances. 2024 Annual Report 23

Our 2024 results Objectives Activities Offer lenders • Guaranteed $60 billion of Canada Mortgage Bond (CMB), helping provide an increase reliable access to of $20 billion in CMB funding to multi-family Mortgage-Backed Securities (MBS). mortgage funding. • Continued to provide affordability-linked pools with priority access to 10-year CMB funding. $17.5 billion of affordability-linked pools received priority access to CMB funding. • $38.8 billion of Affordability-Linked NHA Mortgage-Backed Securities were issued by Approved Issuers in 2024. (2023: $29 billion.) • Played a key leadership role in the industry’s transition from the Canadian Dollar Offered Rate (CDOR) to the Canadian Overnight Repo Rate Average (CORRA). On 1 July 2024, CMHC transitioned all outstanding floating-rate CDOR-based securities guaranteed under its securitization program to CORRA ($28 billion in NHA MBS and $13.5 billion in CMB). Financial Metrics and Ratios (in percentages) 2024 2023 Operating expense ratio 5.9 6.7 Return on equity 42.1 46.3 The operating expense ratio is lower than last year, mainly due to an increase in guarantee and application fees earned, as older pools with lower fees are gradually replaced with new pools with higher associated fees. The return on equity decreased compared to prior year, due to the higher average equity, as a result of the temporary suspension of the dividend effective August 2024. Total guarantees-in- New securities Guarantee and force ($B) guaranteed ($B) application fees received1 2024 2023 2024 2023 2024 2023 National Housing Act Mortgage- 277 254 164 151 801 740 Backed Securities (NHA MBS) Canada Mortgage Bonds (CMB) 276 254 60 45 262 195 Total 553 508 224 196 1,063 935 1 Guarantee and application fees received for NHA MBS; guarantee fees received for CMB. Total guarantees-in-force represents the maximum principal obligation related to the timely payment guarantee. Guarantees-in-force increased by $45 billion (9%) in 2024, due to a lower prepayment rate as well as a higher annual issuance limit effective since Q4 2023. High interest rates have slowed down the housing market leading to lower prepayment rates. Our total guarantees-in-force is compliant with the $800 billion limit set by the Government of Canada. Guarantee and application fees received increased by $128 million (14%), whilst new securities guaranteed increased by $28 billion (14%) compared to last year. Guarantee fees are higher due to the higher guarantee volumes compared to last year, which is the result of the higher annual issuance limits on both NHA MBS and CMB. Factors that impacted results In 2024, the Government of Canada authorized CMHC to provide up to $60 billion of new guarantees of CMB and $170 billion of new guarantees of NHA MBS. This includes a $20 billion increase in annual CMB funding capacity, as well as an increase of $20 billion in NHA MBS funding capacity, which has been fully implemented and has provided incremental funding for the multi-unit market. The National Housing Act was amended to raise the legislative limit for guarantees issued by CMHC in respect of NHA MBS and CMB to $800 billion to accommodate the increased funding capacity. 2024 Annual Report 24

Fairfax Homes5 Westphal, Nova Scotia, an Akoma Holdings project made possible through CMHC’s Rapid Housing Initiative. 5 https://www.cmhc-schl.gc.ca/media-newsroom/news-releases/2022/canada-supports-rapid-housing-halifax 2024 Annual Report 25

Deliver government programs and priorities What we do We deliver housing programs for the Government of Canada by providing financial solutions that increase supply and preserve housing. How we do it Through parliamentary appropriations and low-cost funding from the government, we deliver housing programs by: • Building and maintaining functions and capabilities that allow scalable delivery of housing programs; and • Focusing the delivery and administration of housing programs to achieve Government of Canada targets. 2024 Annual Report 26

Our 2024 results Objectives Activities Deliver government • Federal Community Housing Initiative-Phase 2 (FCHI): $162.74 million initiatives to help in rent assistance provided to 10,631 low-income units with operating people living in Canada agreements, which supports the continued availability of 44,543 community gain access to housing. housing units. Overall, 48,027 community housing units have been supported through Phases 1 and 2. • NHS Bilateral Agreements with all 13 Provinces and Territories represent over $15.7 billion in joint funding over 10 years to protect, renew and expand community housing repair, construction and affordability. Deliver funding for • The Apartment Construction Loan Program has committed $21.76 billion the construction and in loans to support the construction of 56,439 new purpose-built rental units. modernization of Canada’s • The Affordable Housing Fund has committed $10.87 billion to support housing supply to provide the creation of 41,858 new affordable units and the repair of 168,139 units access to affordable and of community housing stock. market housing. • Through the lease of federal lands and buildings, the Federal Lands Initiative has committed $120.44 million to support the creation of 3,702 new units and the repair/renewal of 244 units. • Delivered other NHS initiatives on behalf of the federal government, including: – Rapid Housing Initiative – Community Housing Transformation Centre and its Sector Transformation Fund projects – Co-op Housing Development Program – Affordable Housing Innovation Fund – Phase 2 • Continued to deliver the following legacy programs: – On-Reserve Non-Profit Housing Program (Section 95): As of 31 December 2024, $1.27 billion has been invested to support the creation of 6,591 new units and the subsidization of 22,440 units on reserve. – Residential Rehabilitation Assistance Program (enhanced): Delivered $186.62 million to support the repair of 6,807 units on reserve as of Q4 2024. This represents eight times the regular budget funding delivered over a three- month period. – Community Housing—Preservation Funding 2024 Annual Report 27

Objectives Activities Collaborate with new • Incentivized local governments to implement initiatives that remove barriers and existing partners to accelerate the pace of housing development through the Housing Accelerator on solutions that lead Fund. As of 31 December 2024, completed 215 agreements committing to greater investment nearly $4.19 billion over four years to incentivize over 114,545 additional and impact in the housing permitted units. ecosystem. • Continued to develop, showcase, and stimulate the growth of innovative housing solutions through the Demonstrations Initiative, Solutions Labs, Housing Supply Challenge, and Affordable Housing Innovation Fund. • Launched the Frequent Builder framework, which is accelerating the construction of affordable rental homes by expediting the application process for established housing providers. who access funding through the AHF and the ACLP. Review our role in • Indigenous governments and housing providers have received and contribution to the a commitment of $4.11 billion in loans and $4.15 billion in contributions, Indigenous housing system to build and repair 50,897 housing units. to advance purposeful • $337 million has been conditionally or financially committed under the transformation. Indigenous Shelter and Transitional Housing Initiative toward the construction of 37 shelters and 34 transitional homes, new safe spaces for Indigenous women, 2SLGBTQQIA+ people, and their children. • Urban, Rural and Northern Indigenous Housing Strategy: Continued to collaborate with Indigenous Services Canada and Crown-Indigenous Relations and Northern Affairs Canada on this strategy. Deliver climate objectives in • Canada Greener Homes Loan, in partnership with Natural Resources our programs to align with Canada: has committed more than $2.37 billion for 99,757 loans. the federal government’s Approximately 77 percent of applicants have completed their retrofits and broader commitments on received final loan funding. The program will be fully committed in 2025. climate change mitigation • Canada Greener Affordable Housing program: has committed over and adaptation. $155 million to support over 16,000 units for pre-retrofit activities and over 1,160 units for deep energy-retrofit projects. Of this, over $1 million has been committed to support pre-retrofit activities on approximately 500 units of housing for Indigenous people. To learn more in-depth information about the programs we deliver through the NHS, visit the Housing, Infrastructure and Communities Canada (HICC) website6, which houses NHS program results. 6 https://housing-infrastructure.canada.ca/housing-logement/ptch-csd/index-eng.html 2024 Annual Report 28

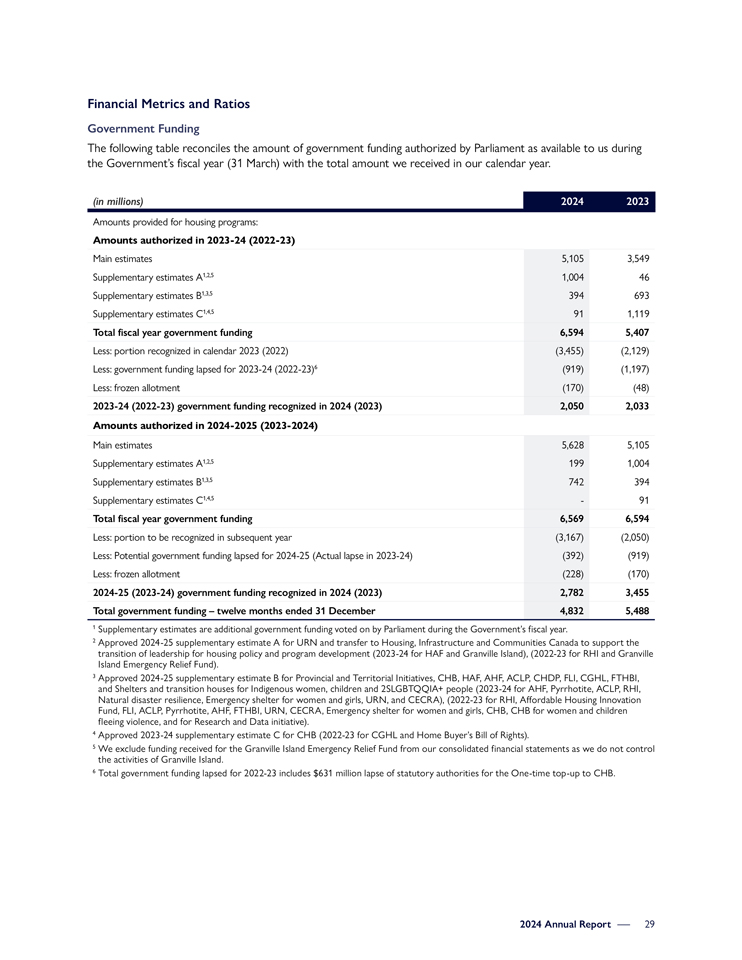

Financial Metrics and Ratios Government Funding The following table reconciles the amount of government funding authorized by Parliament as available to us during the Government’s fiscal year (31 March) with the total amount we received in our calendar year. (in millions) 2024 2023 Amounts provided for housing programs: Amounts authorized in 2023-24 (2022-23) Main estimates 5,105 3,549 Supplementary estimates A1,2,5 1,004 46 Supplementary estimates B1,3,5 394 693 Supplementary estimates C1,4,5 91 1,119 Total fiscal year government funding 6,594 5,407 Less: portion recognized in calendar 2023 (2022) (3,455) (2,129) Less: government funding lapsed for 2023-24 (2022-23)6 (919) (1,197) Less: frozen allotment (170) (48) 2023-24 (2022-23) government funding recognized in 2024 (2023) 2,050 2,033 Amounts authorized in 2024-2025 (2023-2024) Main estimates 5,628 5,105 Supplementary estimates A1,2,5 199 1,004 Supplementary estimates B1,3,5 742 394 Supplementary estimates C1,4,5—91 Total fiscal year government funding 6,569 6,594 Less: portion to be recognized in subsequent year (3,167) (2,050) Less: Potential government funding lapsed for 2024-25 (Actual lapse in 2023-24) (392) (919) Less: frozen allotment (228) (170) 2024-25 (2023-24) government funding recognized in 2024 (2023) 2,782 3,455 Total government funding – twelve months ended 31 December 4,832 5,488 1 Supplementary estimates are additional government funding voted on by Parliament during the Government’s fiscal year. 2 Approved 2024-25 supplementary estimate A for URN and transfer to Housing, Infrastructure and Communities Canada to support the transition of leadership for housing policy and program development (2023-24 for HAF and Granville Island), (2022-23 for RHI and Granville Island Emergency Relief Fund). 3 Approved 2024-25 supplementary estimate B for Provincial and Territorial Initiatives, CHB, HAF, AHF, ACLP, CHDP, FLI, CGHL, FTHBI, and Shelters and transition houses for Indigenous women, children and 2SLGBTQQIA+ people (2023-24 for AHF, Pyrrhotite, ACLP, RHI, Natural disaster resilience, Emergency shelter for women and girls, URN, and CECRA), (2022-23 for RHI, Affordable Housing Innovation Fund, FLI, ACLP, Pyrrhotite, AHF, FTHBI, URN, CECRA, Emergency shelter for women and girls, CHB, CHB for women and children fleeing violence, and for Research and Data initiative). 4 Approved 2023-24 supplementary estimate C for CHB (2022-23 for CGHL and Home Buyer’s Bill of Rights). 5 We exclude funding received for the Granville Island Emergency Relief Fund from our consolidated financial statements as we do not control the activities of Granville Island. 6 Total government funding lapsed for 2022-23 includes $631 million lapse of statutory authorities for the One-time top-up to CHB. 2024 Annual Report 29

Factors that impacted results Budget 2024 and Fall Economic Statement 2024 included significant investments for housing, expanding existing programs and creating new ones. CMHC was tasked with delivering the following: • Enhancements and new loan funding to ACLP; • Enhancements and new funding to AHF, including funds to create a new Rapid Housing Sub-Stream; • Enhancements and new funding to the Federal Lands Initiative (FLI); • A second round of the Housing Accelerator Fund (HAF). Trends, risks and look ahead to 2025 On the upside, new, lower immigration targets may slow increases in housing demand, especially in the rental market, since most immigrants rent when they arrive. Also, modest but positive economic growth, with an expected shift to increasing GDP per capita, shows potential for income growth. However, foreign trade risks remain elevated, which creates a risk of economic contraction that could be hard on both renters and homeowners. In the event of an economic contraction, more households may remain in rentals, or return to them, increasing demand and putting upward pressure on rents. We are closely monitoring the potential impact of the current economic and policy environment on our overall program outcomes for future years. Sagonaska Place7 Belleville, Ontario, a Summers & Co project made possible through CMHC’s Federal Lands Initiative, Affordable Housing Fund and Seed Funding. 7 https://www.cmhc-schl.gc.ca/media-newsroom/news-releases/2024/canada-convert-federal-building-into-affordable-homes-belleville 2024 Annual Report 30

Build for the future “By closely monitoring key trends, we remained agile in addressing challenges and providing evidence-based guidance on housing to stakeholders.” What we do We build and share our knowledge and expertise of the housing system to drive informed decision making, stimulate dialogue and improve outcomes in the housing sector. We address critical knowledge gaps in the housing market by providing timely, relevant and objective insights. How we do it We conduct and support surveys, research and analysis to better understand current and future housing system challenges and explore potential solutions. Our focus areas include: housing supply and demand, housing finance, housing needs, building science and construction innovation, and Indigenous and northern housing. 2024 Annual Report 31

Our 2024 results Objectives Activities Understand • Published flagship reports on housing market outlook8, housing supply current and future developments9 and analysis of the rental markets10. challenges of the • Released findings from the third cycle of the Canadian Housing Survey housing system, in partnership with Statistics Canada. barriers to housing • Completed the first phase of development of the Integrated Housing Model affordability and that will be used for estimating the supply gap and for forecasting housing households in core variables at provincial level and 6 largest Census Metropolitan Areas (CMAs). housing need, recognizing the • Published study on Indigenous insurance and risk11, and supported research unique needs of and initiatives addressing core housing needs12, and housing models13 to improve Indigenous people housing outcomes for Indigenous peoples, including women, 2SLGBTQQIA+14 and racialized individuals, and other underrepresented groups living in urban, rural, and Canadians. northern communities. Create solutions to • Published research on filtering15, and environmental, social and governance address current and performance measurement16 in the housing sector. future challenges in the • Reported on progress towards CMHC-led UNDA Action Plan17 measures. housing system with • Published Urban Rural and Northern Indigenous (URN) What We Heard a focus on economic, report, summarizing the views and perspectives informing the URN Strategy. environmental, and social vulnerabilities. Strengthen thought • Published impactful thought leadership articles exploring critical housing issues, leadership in the housing such as affordability, rental markets and Canada’s housing construction capacity. system by offering bold insights that influence others to act. 8 https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/market-reports/housing-market/housing-market-outlook 9 https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/market-reports/housing-market/housing-supply-report 10https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/market-reports/rental-market-reports-major-centres 11https://www.cmhc-schl.gc.ca/blog/2024/addressing-indigenous-insurance-challenges 12https://abo-peoples.org/wp-content/uploads/2024/05/May23Phase-3-Part-1-Housing-Costing-Study-Report_FINAL.docx.pdf 13https://www.cmhc-schl.gc.ca/blog/2024/developing-saaca-housing-model-indigenous-communities-across-canada 14https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/housing-research/research-reports/housing-needs/ exploring-metis-women-slgbtqia-peoples-housing-issues-canada 15https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/housing-research/research-reports/accelerate-supply/ understanding-filtering-long-term-strategy-new-supply-housing-affordability 16https://www.cmhc-schl.gc.ca/professionals/housing-markets-data-and-research/housing-research/research-reports/accelerate-supply/ exploring-environmental-social-governance-performance-measurement 17https://www.justice.gc.ca/eng/declaration/ap-pa/ah/pdf/unda-action-plan-digital-eng.pdf 2024 Annual Report 32

Factors that impacted results Evolving economic and housing conditions influenced our research, insights and policy work. By closely monitoring key trends, we remained agile in addressing challenges and providing evidence-based guidance on housing to stakeholders. Trends, risks and look ahead to 2025 We remain focused on delivering the objectives outlined in CMHC’s Corporate Plan, while closely monitoring financial, reputational, operational and strategic risks. The broader macroeconomic environment will continue to shape our research priorities and insights. With the increasing political and economic volatility across the global landscape, we will need to be more agile and adaptive in our planning and forecasting. Maintaining a proactive approach will allow us to adapt and respond effectively to emerging challenges and opportunities in the housing system. La Maison des Papillons18 Montreal, Quebec, a Le Murier project made possible through the Canada-Québec Rapid Housing Initiative Agreement. 18https://www.cmhc-schl.gc.ca/media-newsroom/news-releases/2024/new-housing-units-people-living-mental-health-issues-montreal 2024 Annual Report 33

Capital Management Frameworks For our Housing Programs Activity, we maintain a reserve fund pursuant to Section 29 of the CMHC Act which includes profits of the Corporation, after providing for all matters, that in the opinion of the Board of Directors, are required to carry out the purposes of the Corporation. Aside from the reserve fund, we do not hold capital for our Housing Programs activities, as they do not present material financial risks that are not already otherwise mitigated. For our Mortgage Insurance Activity, our capital management framework follows OSFI regulations with respect to the use of the MICAT as our Own Risk and Solvency Assessment (ORSA) economic capital is lower than OSFI’s regulatory capital requirements. Due to the significant growth in multi-unit insurance business in recent years, OSFI is implementing a new capital framework to address multi-unit insurance risks. This new framework leverages the Capital Adequacy Requirements (CAR) for standardized banks, which is based on Basel III and differentiates required capital based on the type of exposure. As a result, different considerations will be given to properties with and without elevated risks, whether they are under development/construction, and second position mortgages. The target implementation date is 1 January 2026 and includes a 5 year transition plan for multi-unit insurance-in-force immediately prior to transition beginning in 2026 and ending in 2030. With respect to our Mortgage Funding Activity, our capital management framework follows industry best practices and incorporates regulatory principles from OSFI, including those set out in OSFI’s E19 – Own Risk and Solvency Assessment guideline, and those of the Basel Committee on Banking Supervision. Our capital adequacy assessment uses an integrated approach to evaluate our capital needs from both a regulatory and economic capital basis to establish capital targets that take into consideration our strategy and risk appetite. In August 2024, our Board of Directors approved maintaining the internal targets and operating levels of 155% and 165% respectively for Mortgage Insurance and 105% and 110% for Mortgage Funding for 2025. For Mortgage Funding, the Board approved an increase of the economic capital required at the operating level from $2.2 billion to $2.6 billion, effective 1 January 2025. However, this is not expected to have an impact on our economic capital available to economic capital required ratio for the next year, as our liquidity target is higher. Ratios The following table presents our capital management ratios as at 31 December. (in percentages) 2024 2023 Mortgage Insurance: Capital available to 188 185 minimum capital required (MICAT) Mortgage Funding: Economic capital 127 109 available to economic capital required The Mortgage Insurance capital available to minimum capital required ratio increased compared to last year mainly due to increases in our capital available that was generated from our comprehensive income. Mortgage Funding capital available to capital required ratio increased compared to last year, mainly due to a higher economic capital available. On 22 August 2024, the Board of Directors approved the temporary suspension of all remaining dividends to retain capital for multi-unit growth in the Mortgage Insurance Activity which contributed to the increase in the economic capital available during the year. Refer to the Consolidated Financial Statements Note 10 – Capital Management for further disclosure on capital management. 2024 Annual Report 34

Dividend Breakdown The following table presents dividends paid over the last 5 years. (in millions) 2024 2023 2022 2021 20201 Dividends Paid 290 1,080 2,180 5,080 -Dividends Declared 290 1,080 2,180 5,080—1 Dividend was temporarily suspended in 2020 due to the COVID-19 pandemic. As part of Budget 2024, the Government issued revisions to the Capital and Dividend Framework for Financial Crown Corporations. The nature of the revisions relate primarily to specific expectations of Financial Crown Corporations regarding the amount of capital to be retained and how excess capital should be deployed as well as specific disclosure requirements. The primary impact to CMHC related to additional disclosures regarding the types of scenarios that might lead to a recapitalization and the amount of notice that would be provided to the Government of Canada should a recapitalization be required. These additional disclosures were included in our 2025-2029 Corporate Plan Summary. There were no specific impacts to the preparation of our annual reports. 2024 Annual Report 35

Risk Management Our Enterprise Risk Management Framework (ERMF) is crucial to our proactive risk management practice. It helps us effectively identify and manage current and emerging risks in the financial system that affect housing and CMHC. It also helps ensure our risk management activities are comprehensive and play an integral part in strategy formulation as well as day-to-day business activities and decision-making. In these ways, it reinforces an effective risk culture across the organization and, ultimately, helps us to achieve our strategic and business objectives. Risk Environment and Profile In 2024, financial risks remained overall low and within risk tolerances. • Credit risk and liquidity risk remained low and stable supported by strong credit quality. • Market risk was within established risk limits and tolerances, as the diversification of our investment portfolios continued to provide resiliency and mitigate the impact of uncertain market and economic conditions. • Homeowner insurance risk was stable and arrears remained low. Interest rate and renewal risk remains low and exposure to variable rate mortgages continues to decrease. • Multi-unit insurance risk remained moderate due to product mix weighted towards higher risk loans. • Capital adequacy risk was moderate as CMHC suspended dividends to support increased multi-unit volumes and updated capital requirements for multi-unit exposures. Our strategic risks are being effectively managed within risk tolerances. CMHC continues to conduct stress-testing activities and monitor its mortgage insurance portfolio in consideration of the large number of borrowers who will renew mortgages at higher rates in 2025 and the political and economic uncertainty that exists in its operating environment (e.g., the impact on housing affordability of possible protectionist policies, such as trade tariffs). Within operational risk, cyber, third party, operational resilience, and data governance risks continue to be key risks for the corporation. Various transformative programs and initiatives are ongoing to strengthen our control environment in these areas while ensuring increased operational efficiency and optimized risk management practices and oversight. In addition, we have continued to update our risk management practices, policies, and tools to align with industry standards, legislative requirements, and regulatory guidelines. 2024 Annual Report 36

ORSA and Stress Testing CMHC conducts an Own Risk and Solvency Assessment (ORSA), which enables the company to better understand the interrelationships between our risk profile and our capital needs. Through this process, we assess risks quantitively and evaluate our capital needs and solvency position to set internal capital targets. We also conduct Corporate-Wide Stress Testing (CWST), a quantitative assessment of capital sufficiency under specific adverse economic and financial conditions. CWST evaluates the mortgage insurance, mortgage funding, and investment portfolios, based on selected adverse scenarios (such as a deep or severe economic recession). Through the CWST program, we can determine if actions need to be taken by management to maintain sufficient capital. The 2024 ORSA and Stress Testing exercise confirmed that, despite uncertainties in the Canadian economy, CMHC remains adequately capitalized to withstand financial stress, even under the extreme hypothetical market shocks assumed in the exercises. In addition, we confirm that the currently planned management actions ensure CMHC’s compliance with OSFI’s new supervisory framework for multi-unit mortgage insurance under the base projection. We continue to closely monitor current and emerging risks to safeguard CMHC’s financial resilience. OFSI Consultations and Guidelines The following announcements by the Office of the Superintendent of Financial Institutions (OFSI) took place in 2024, which affect CMHC: OSFI’s New Supervisory Framework On 8 February 2024, OSFI released its new supervisory framework for federally regulated financial institutions (FRFIs) and private pension plans. Officially implemented on 1 April 2024, the new framework is the most significant change to OSFI’s supervisory approach in 25 years and brings notable changes including: • expanding the 4-point risk rating scale to an 8-point scale which will provide an earlier indication of changes in OSFI’s risk assessment of their organizations; • including more information about the drivers of risk rating; and • introducing new risk assessment categories: business risk, financial resilience, operational resilience and risk governance, together with the integration of climate risk considerations. Guideline B-10 Third-Party Risk Management This guideline came into effect on 1 May 2024 and sets out associated risk expectations to manage third-party arrangements. Our Vendor Risk Management Program and related governance documents provide accountability, guidance and tools for effective third- party risk management practices by outlining the processes to identify, assess, treat (control), and monitor third-party risk exposure. Our third-party risk management practices have been aligned with the requirements of Guideline B-10 and will continue to enhance and embed in our operations. Guideline B-13 Technology and Cyber Risk Management In January 2024, this OFSI Guideline came into effect. It sets out expectations for the sound management of technology and cyber risk for FRFIs outlining expectations for financial institutions to compete effectively and take full advantage of digital innovation, while maintaining sound technology risk management. CMHC’s practices align to the principles of Guideline B-13. We continue to enhance processes to improve our maturity in this space. Consultation on draft Standardized Climate Scenario Exercise (SCSE) In December 2024, CMHC responded to a consultation on the draft SCSE — Phase 2 (Phase 1 was completed in December 2023). The SCSE aims to increase FRFIs’ understanding of their potential exposures to climate-related risks. It also aims to build their capacity to conduct climate scenario analysis and risk assessments. As a fully standardized exercise, the SCSE will also give OSFI a comparable quantitative assessment of climate-related risks across FRFIs. OSFI used feedback from the first phase of the SCSE consultation to update the draft methodology, create a draft workbook with a set of instructions, and produce a “What We Heard” report. Guideline for Assurance on Capital, Leverage and Liquidity Returns In July 2024, OSFI revised this Guideline, which seeks to inform external auditors and institutions on the work to be performed on their regulatory returns to enhance and align OSFI’s assurance expectations across all FRFIs. Regulatory returns are key contributors to the assessment of the soundness of a FRFI. Beginning in Q1 2024, reviews and senior management attestations will be provided on the accuracy and completeness of the MICAT Cover schedule on a quarterly basis. 2024 Annual Report 37