| Investor Presentation June 13, 2025 |

| Disclaimer This presentation (the “presentation”) is being provided on a strictly confidential and non-reliance basis for informational purposes only. It shall not constitute (i) a solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Merger (as defined below) or (ii) an offer to sell, or the solicitation of an offer to buy, or a recommendation to purchase any securities, equity, debt or other financial instruments, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation or sale or recommendation would be unlawful. This presentation has been prepared to assist interested parties in making their own evaluation with respect to a proposed business combination pursuant to the Agreement and Plan of Merger (the “Merger Agreement”), dated as of September 11, 2024, by and among Southport Acquisition Corporation, a Delaware corporation (“Southport”), Sigma Merger Sub, Inc., a Delaware corporation and a direct wholly owned subsidiary of Southport (“Merger Sub”), and Angel, Inc., a Delaware corporation (“Angel”). The Merger Agreement provides for, among other things, the merger of Merger Sub with and into Angel (the “Merger”), with Angel surviving the Merger as a wholly owned subsidiary of Southport after the Merger, to be renamed “Angel, Inc.”, in accordance with the terms and subject to the conditions of the Merger Agreement. Neither the Securities and Exchange Commission (“SEC”) nor any securities commission of any other U.S. or non-U.S. jurisdiction has approved or disapproved of the proposed transaction, or determined that this presentation is truthful or complete. Any representation to the contrary is a criminal offense. This presentation and any related oral commentary are confidential and proprietary and are to be maintained in strict confidence and must not be replicated, copied, reproduced or disclosed, directly or indirectly, in whole or in part, to any other party. Each recipient agrees to maintain the confidentiality of the information contained in this presentation and communicated during any related oral commentary and use any such information in accordance with any contractual obligations to which it is subject, and applicable law, including U.S. federal and state securities laws. By receiving this presentation, each recipient also acknowledges that some or all of the information relating to it may be, or may become, material non-public information regarding Southport or Angel, or any of their respective affiliates, including any respective future affiliates, and that the securities laws of the U.S. and other relevant jurisdictions generally prohibit any persons who have material, non-public information in relation to a company from purchasing or selling securities of that company on the basis of such information or from communicating such information to any person under circumstances in which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information. In addition, this presentation is intended solely for investors that are, and by receiving this presentation, the recipient expressly confirms that they are, qualified institutional buyers or institutions, entities or persons that are accredited investors (as such terms are defined under the rules of the SEC). This presentation does not constitute a commitment on the part of Southport or Angel to provide the recipient with access to any additional information or to execute the proposed transaction. This presentation is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident of, or located in, any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or applicable regulations or which would require any authorization, registration, notification or licensing within such jurisdiction. Persons into whose possession this presentation, any part of it or other information referred to herein comes should inform themselves about and observe any such restrictions. Any failure to comply with these restrictions may constitute a violation of the securities laws of any such jurisdiction. No representations or warranties, express or implied, are given in, or in respect of, this presentation. To the fullest extent permitted by law, in no circumstances will Southport, Angel or any of their respective subsidiaries, stockholders, equityholders, affiliates, representatives, directors, officers, employees, advisers, or agents be responsible or liable for a direct, indirect, or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this presentation have been obtained from third-party industry publications and sources as well as from research reports prepared for other purposes. Neither Southport nor Angel’s has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to corrections and/or changes, with or without notice, and any such corrections and/or changes may be material. Southport and Angel, and their respective representatives disclaim any duty to update, revise, correct or confirm the information contained in this presentation. In addition, this presentation does not purport to be all-inclusive or to contain all of the information that may be required to evaluate a possible investment decisions or to make a full analysis of Southport, Angel, the proposed transaction or otherwise. Viewers of this presentation should each make their own evaluation of Southport and Angel and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. The information contained herein is as of June 13, 2025, and does not reflect any subsequent events. |

| FORWARD-LOOKING STATEMENTS This presentation may contain certain forward-looking statements within the meaning of the federal securities laws with respect to the proposed transaction between Angel and Southport. These forward-looking statements generally are identified by the words “believe,”“project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this communication, including but not limited to: (i) the risk that the proposed transaction may not be completed in a timely manner or at all, which may adversely affect the price of the combined company’s securities, (ii) the risk that the proposed transaction may not be completed by Southport’s business combination deadline and the potential failure to obtain an extension of the business combination deadline, (iii) the failure to satisfy the conditions to the consummation of the proposed transaction, including the adoption of the Merger Agreement by the stockholders of Southport and Angel, (iv) the lack of a third party valuation in determining whether or not to pursue the proposed transaction, (v) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger Agreement, (vi) the effect of the announcement or pendency of the transaction on Angel’s business relationships, operating results, and business generally, (vii) risks that the proposed transaction disrupts current plans and operations of Angel or diverts management’s attention from Angel’s ongoing business operations and potential difficulties in Angel’s employee retention as a result of the announcement and consummation of the proposed transaction, (viii) the outcome of any legal proceedings that may be instituted against Angel or against Southport related to the Merger Agreement or the proposed transaction, (ix) the ability to list the combined company’s securities on a national securities exchange in connection with the transaction, (x) the price of Southport’s securities may be volatile due to a variety of factors, including changes in the competitive and highly regulated industries in which Southport plans to operate or Angel operates, variations in operating performance across competitors, changes in laws and regulations affecting Southport’s or Angel’s business, and changes in the combined capital structure, (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed transaction, and identify and realize additional opportunities, (xii) the ability to recognize the anticipated benefits of the proposed transaction, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably, maintain relationships with customers and suppliers and retain its management and key employees, (xiii) the evolution of the markets in which Angel competes, (xiv) the costs related to the proposed transaction, (xv) Angel’s expectations regarding its market opportunities, (xvi) risks related to domestic and international political and macroeconomic uncertainty, including the Russia-Ukraine conflict and the war in the Middle East, and (xvii) the risk of downturns and a changing regulatory landscape in the highly competitive industry in which Angel operates. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of Southport’s and Angel’s annual reports on Form 10-K, and quarterly reports on Form 10-Q, the Registration Statement on Form S-4, including those under “Risk Factors” therein, and other documents filed by Southport and Angel from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Angel and Southport assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither Angel nor Southport gives any assurance that either Angel or Southport, or the combined company, will achieve its expectations. ADDITIONAL INFORMATION AND WHERE TO FIND IT In connection with the proposed transaction, Southport filed a registration statement on Form S-4 (as it may be amended, the “Registration Statement”) with the SEC on November 12, 2024, which includes a preliminary prospectus and joint proxy statement of Southport and Angel, referred to as a joint proxy statement/prospectus. The Registration Statement has not yet become effective. When available, a final joint proxy statement/prospectus will be sent to all Southport and Angel stockholders. Southport and Angel will also file other documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ, THE REGISTRATION STATEMENT, THE JOINT PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders will be able to obtain free copies of the Registration Statement, the joint proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC by Southport and Angel (when available) through the website maintained by the SEC at http://www.sec.gov. The documents filed by Southport with the SEC also may be obtained free of charge upon written request to 268 Post Road, Suite 200, Fairfield, CT 06824. The documents filed by Angel with the SEC also may be obtained free of charge on Angel’s website at https://www.angel.com/legal/sec-filings or upon written request to 295 W Center Street, Provo, UT 84601. PARTICIPANTS IN SOLICITATION Southport, Angel and certain of their respective directors and executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. A list of the names of such directors and executive officers and information regarding their interests in the proposed transaction between Southport and Angel are contained in the joint proxy statement/prospectus. You may obtain free copies of these documents as described in the preceding paragraph. TRADEMARKS This presentation contains trademarks, service marks, trade names and copyrights of Southport, Angel and other companies which are the property of their respective owners. |

| SECTION I COMPANY OVERVIEW |

| Angel is a community of 1.2M+ people who are replacing the Hollywood gatekeeper system. Stories that Amplify Light The Angel Guild votes on films and TV shows The Angel Guild shows up to movie theaters to support films The Angel Guild funds future films and TV shows with their membership THIS COMMUNITY IS CALLED OUR ANGEL GUILD. |

| The Angel Guild Pledges to Amplify Light “When I vote, I pledge to help choose excellent entertainment that is true, honest, noble, just, authentic, lovely, or admirable.” GUILD |

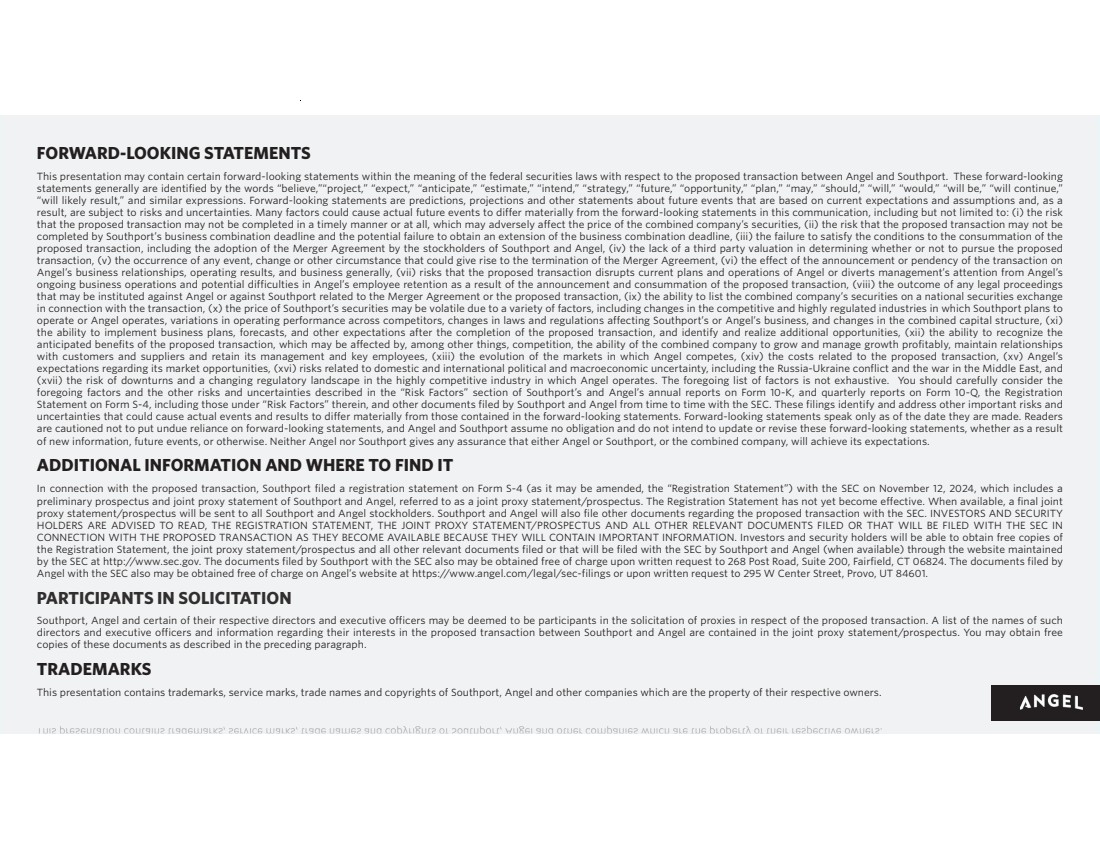

| Angel Snapshot $115M+ TTM Revenue** 1.2M+ Paying Angel 2013 Founded Guild Members* *As of June 2 , 2025. View latest count: angel.com/impact **Trailing Twelve Months Revenue as of March 31, 2025. ***As of March 31, 2025. 65M+ App Installs (Mobile + TV All-time)*** 5M+ MAUs on Angel (App + Web) MAUs on 9B+ Views (All-time, All Platforms) “leaves you better” Nick Roberts Review: https://appfigures.com/reviews/281586272819LX4Zds8Ptu97dysBuD8YlOQ |

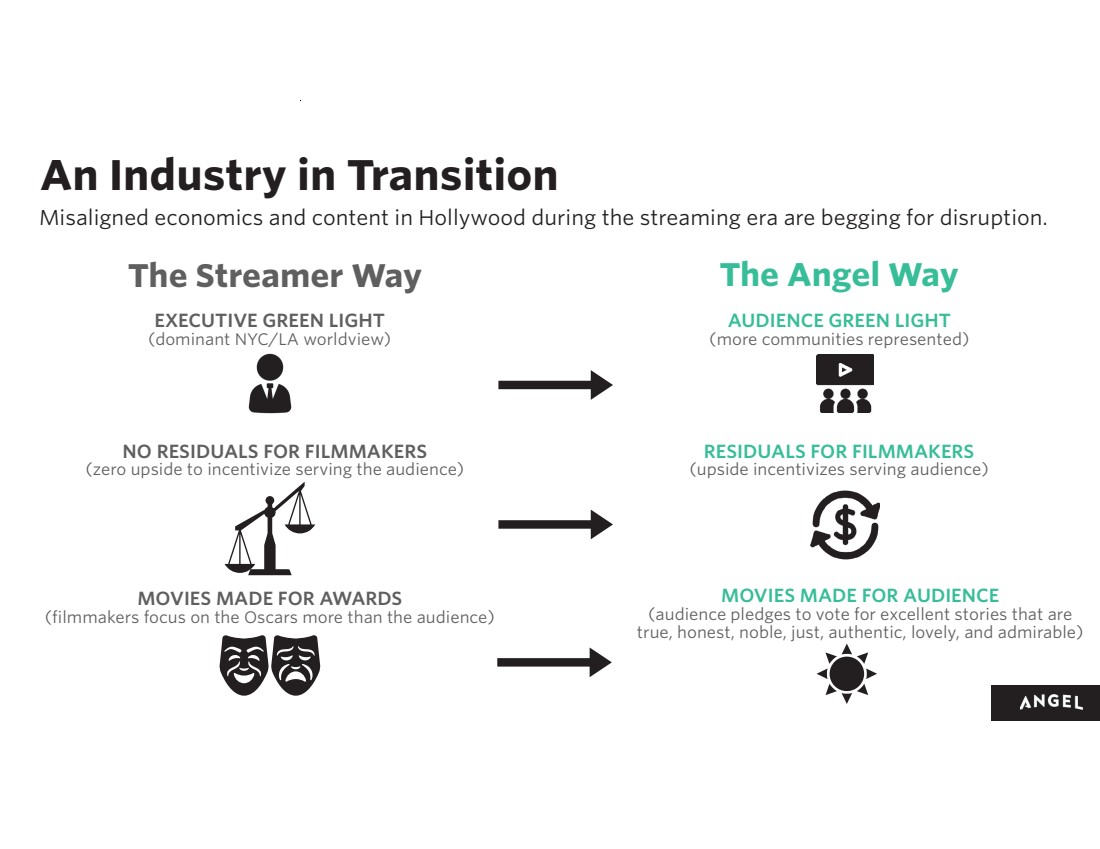

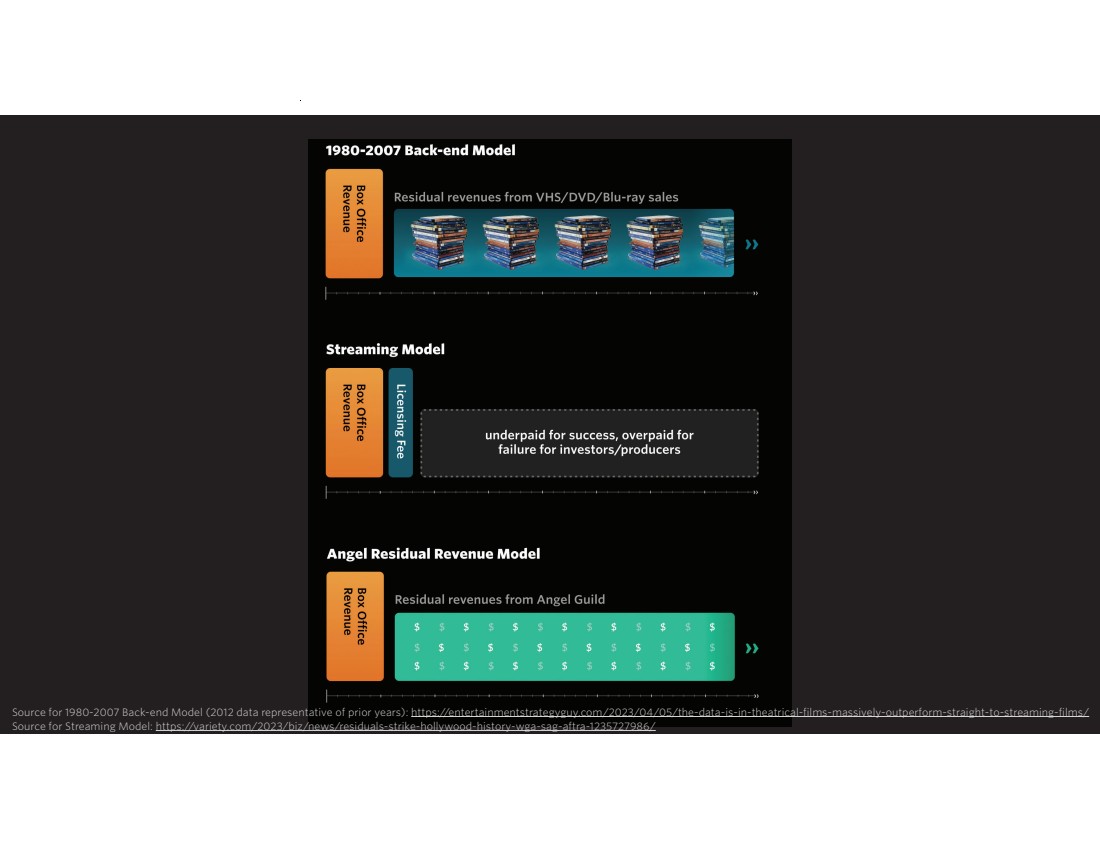

| An Industry in Transition Misaligned economics and content in Hollywood during the streaming era are begging for disruption. RESIDUALS FOR FILMMAKERS (upside incentivizes serving audience) NO RESIDUALS FOR FILMMAKERS (zero upside to incentivize serving the audience) The Streamer Way The Angel Way MOVIES MADE FOR AWARDS (filmmakers focus on the Oscars more than the audience) MOVIES MADE FOR AUDIENCE (audience pledges to vote for excellent stories that are true, honest, noble, just, authentic, lovely, and admirable) EXECUTIVE GREEN LIGHT (dominant NYC/LA worldview) AUDIENCE GREEN LIGHT (more communities represented) |

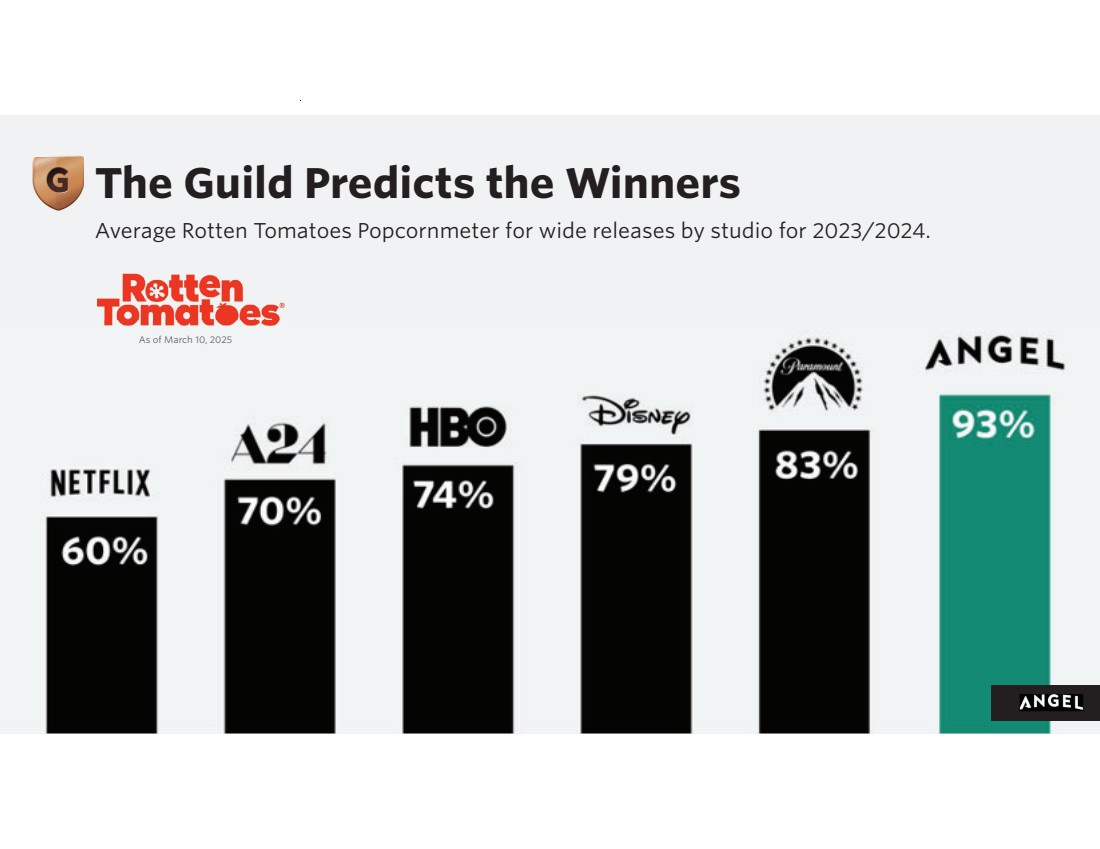

| The Guild Predicts the Winners Average Rotten Tomatoes Popcornmeter for wide releases by studio for 2023/2024. As of March 10, 2025 |

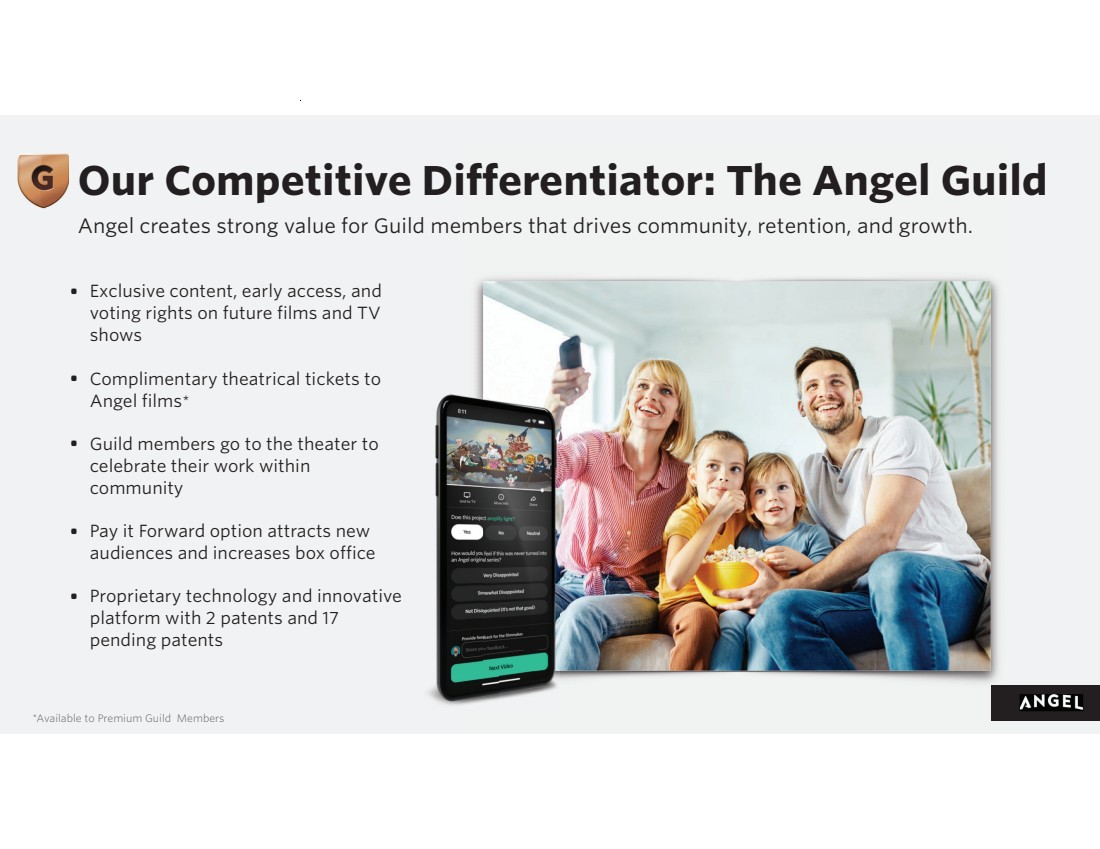

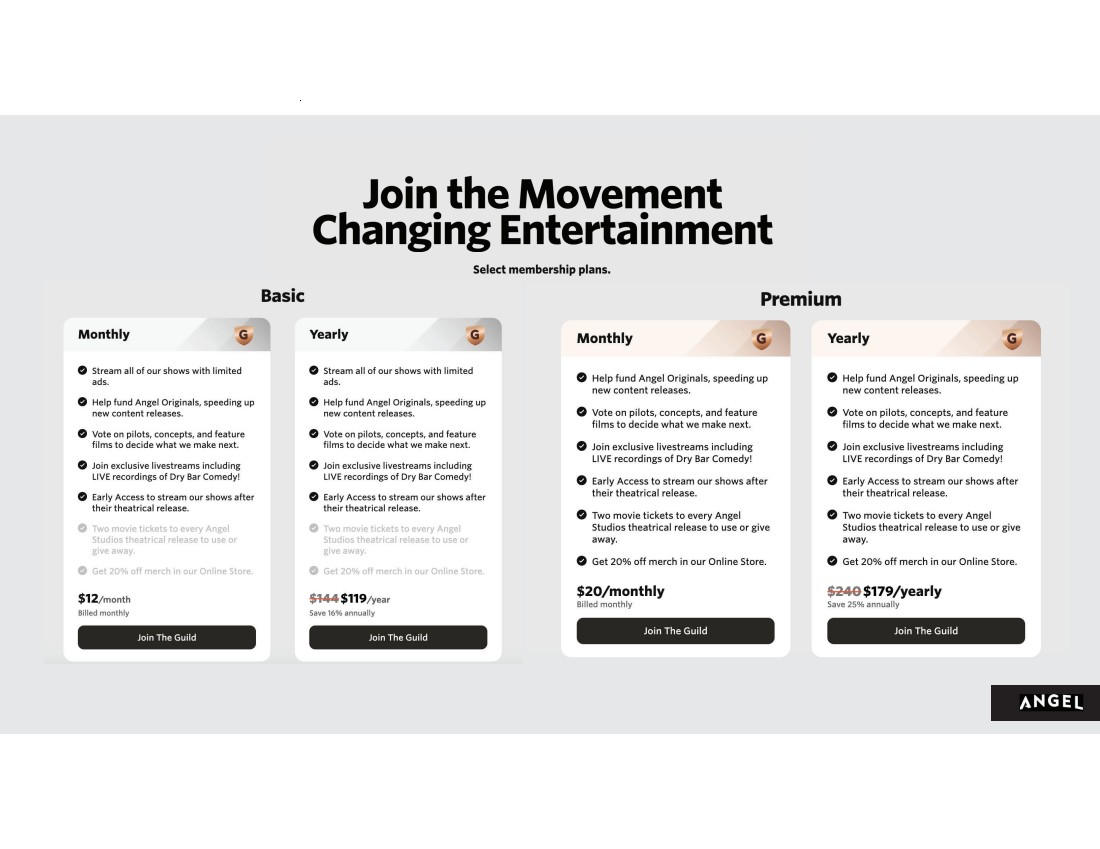

| Our Competitive Differentiator: The Angel Guild Angel creates strong value for Guild members that drives community, retention, and growth. *Available to Premium Guild Members • Exclusive content, early access, and voting rights on future films and TV shows • Complimentary theatrical tickets to Angel films* • Guild members go to the theater to celebrate their work within community • Pay it Forward option attracts new audiences and increases box office • Proprietary technology and innovative platform with 2 patents and 17 pending patents |

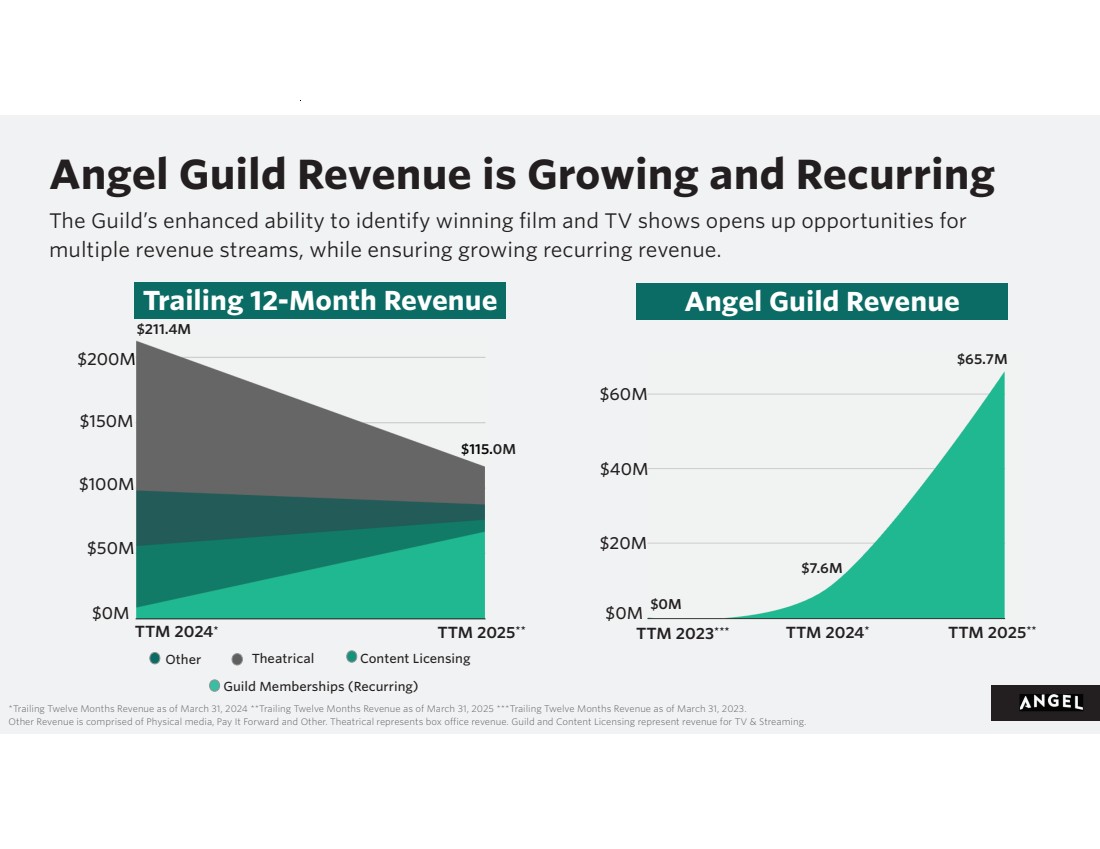

| *Trailing Twelve Months Revenue as of March 31, 2024 **Trailing Twelve Months Revenue as of March 31, 2025 ***Trailing Twelve Months Revenue as of March 31, 2023. Other Revenue is comprised of Physical media, Pay It Forward and Other. Theatrical represents box office revenue. Guild and Content Licensing represent revenue for TV & Streaming. $20M $0M $40M $60M TTM 2023*** TTM 2024* TTM 2025** $0M $7.6M Angel Guild Revenue $65.7M Theatrical Trailing 12-Month Revenue Guild Memberships (Recurring) Other Content Licensing TTM 2024* TTM 2025** $50M $0M $100M $150M $115.0M $211.4M Angel Guild Revenue is Growing and Recurring The Guild’s enhanced ability to identify winning film and TV shows opens up opportunities for multiple revenue streams, while ensuring growing recurring revenue. $200M M M $115. $ M |

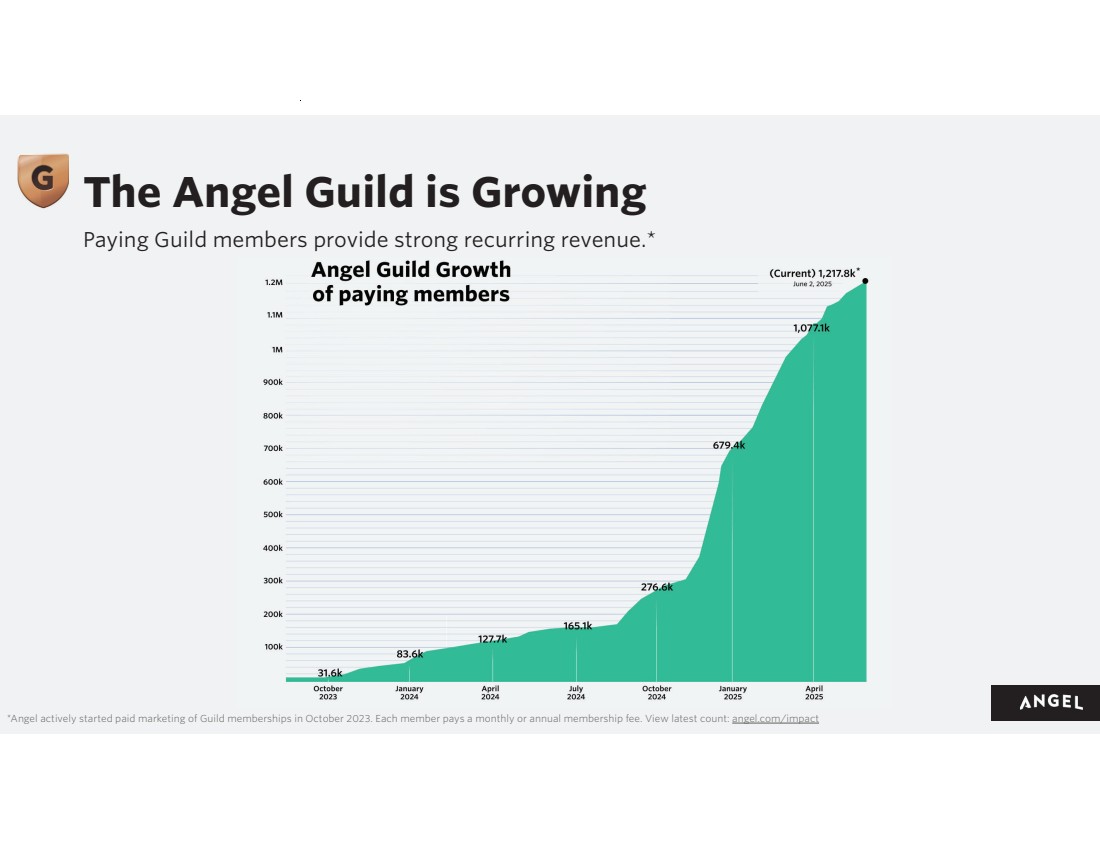

| *Angel actively started paid marketing of Guild memberships in October 2023. Each member pays a monthly or annual membership fee. View latest count: angel.com/impact The Angel Guild is Growing Paying Guild members provide strong recurring revenue.* * |

| Angel Guild Growth Drivers Multiple ways to drive growth of paying Angel Guild members. Large App User Base Guild-curated content expected to add ~100 new movies and 250+ individual episodes/specials in 2025 Marketing Optimization Attracting Filmmakers New & Exclusive Content Better economics and theatrical release offered to filmmakers increase desire to work with Angel driving more quality content 65M+ Lifetime App Installs (Across IOS, Android, TV)* Growing Angel App user base creates an ideal audience for upselling to Angel Guild Continual efforts to A/B test and improve user flow and conversion rates help drive ongoing growth *As of March 31, 2025. |

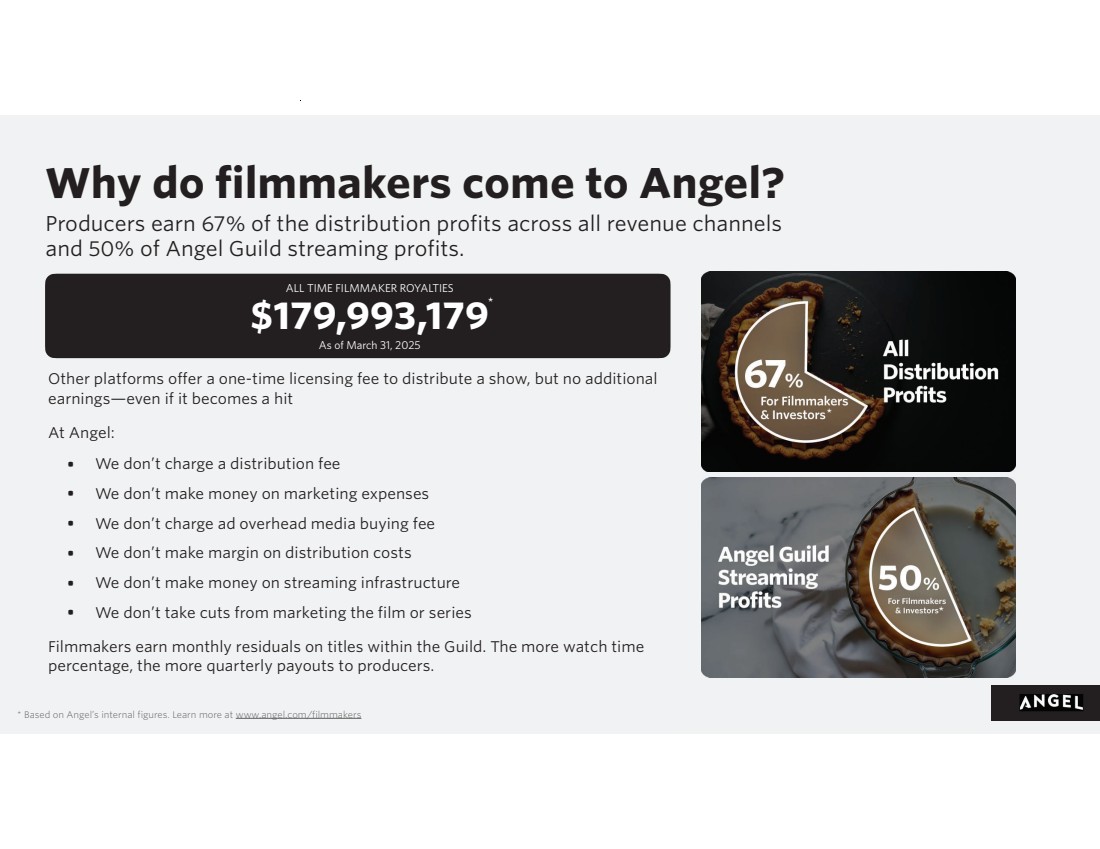

| Why do filmmakers come to Angel? Producers earn 67% of the distribution profits across all revenue channels and 50% of Angel Guild streaming profits. Other platforms offer a one-time licensing fee to distribute a show, but no additional earnings—even if it becomes a hit At Angel: • We don’t charge a distribution fee • We don’t make money on marketing expenses • We don’t charge ad overhead media buying fee • We don’t make margin on distribution costs • We don’t make money on streaming infrastructure • We don’t take cuts from marketing the film or series Filmmakers earn monthly residuals on titles within the Guild. The more watch time percentage, the more quarterly payouts to producers. * Based on Angel’s internal figures. Learn more at www.angel.com/filmmakers ALL TIME FILMMAKER ROYALTIES $179,993,179 As of March 31, 2025 * * * |

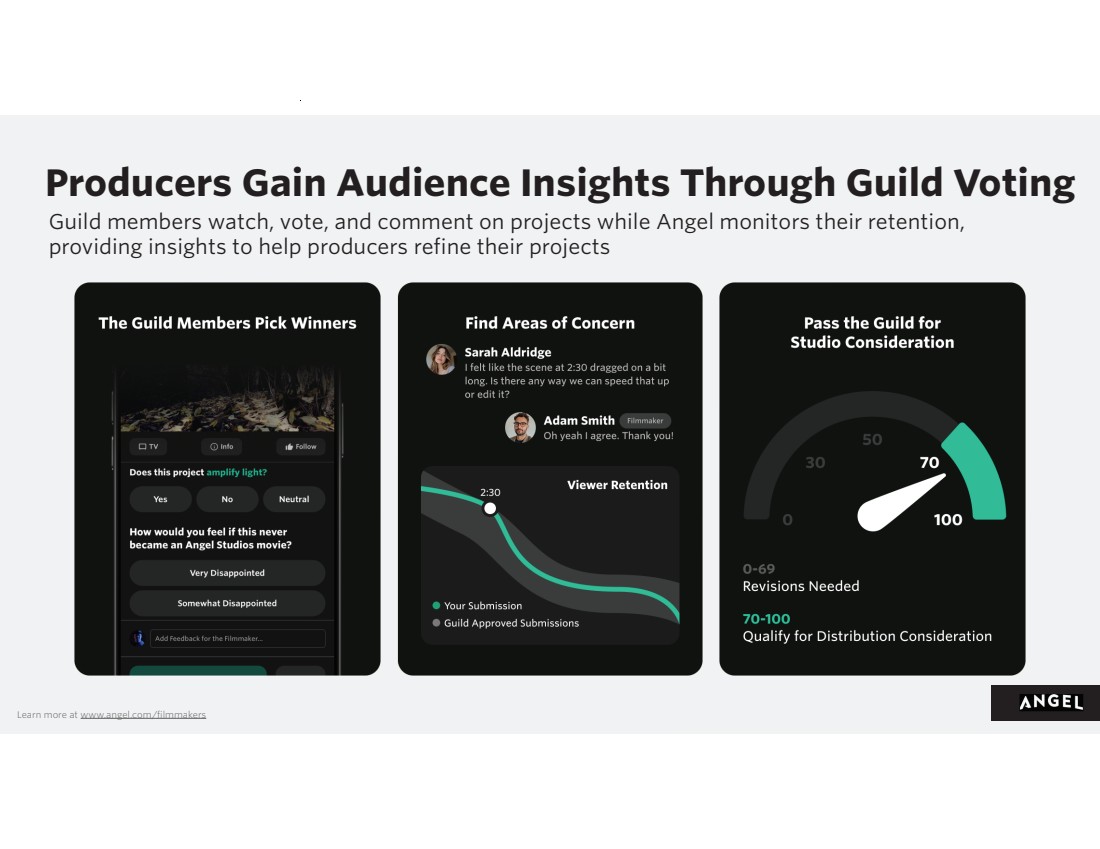

| Producers Gain Audience Insights Through Guild Voting Guild members watch, vote, and comment on projects while Angel monitors their retention, providing insights to help producers refine their projects Learn more at www.angel.com/filmmakers |

| SECTION II MARKET OPPORTUNITY |

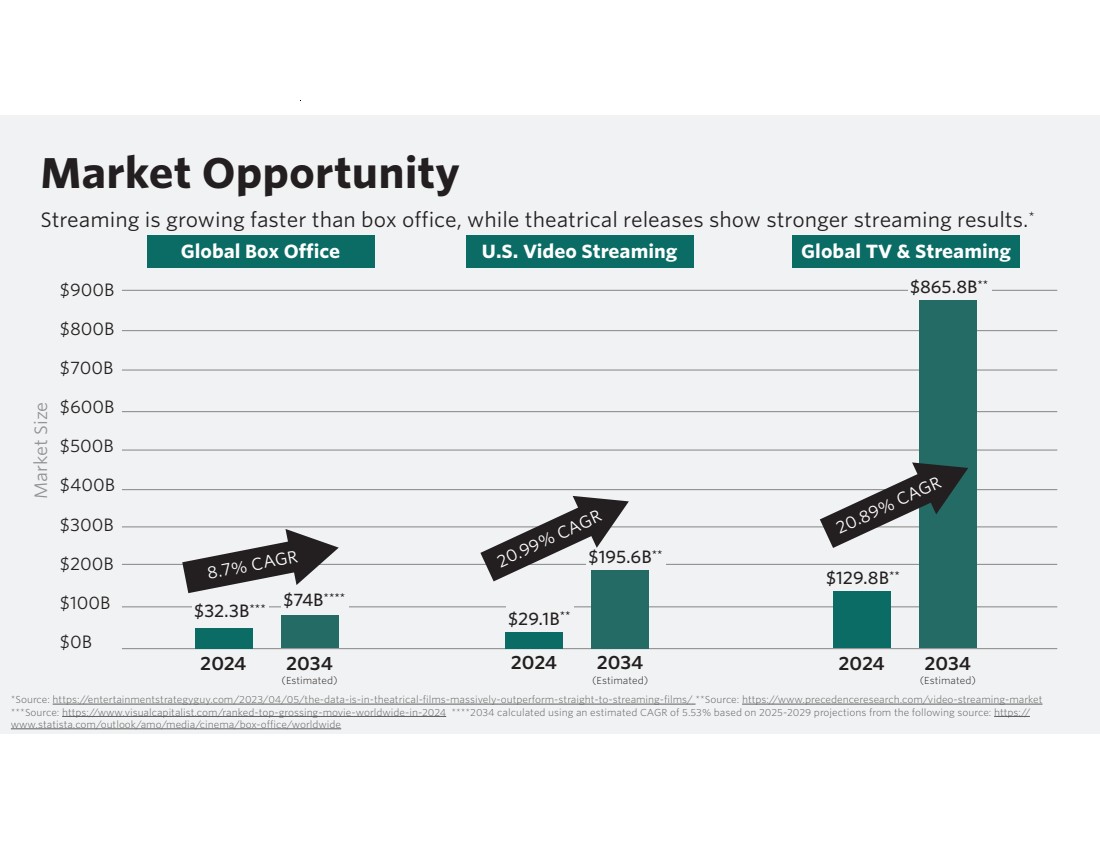

| Market Opportunity Streaming is growing faster than box office, while theatrical releases show stronger streaming results.* *Source: https://entertainmentstrategyguy.com/2023/04/05/the-data-is-in-theatrical-films-massively-outperform-straight-to-streaming-films/ **Source: https://www.precedenceresearch.com/video-streaming-market ***Source: https://www.visualcapitalist.com/ranked-top-grossing-movie-worldwide-in-2024 ****2034 calculated using an estimated CAGR of 5.53% based on 2025-2029 projections from the following source: https:// www.statista.com/outlook/amo/media/cinema/box-office/worldwide $900B $800B $700B $600B $500B $400B $300B $200B $100B $0B 2024 2034 $32.3B*** $74B**** 2024 2034 $29.1B** $195.6B** 20.99% CAGR 8.7% CAGR (Estimated) 2024 2034 $129.8B** $865.8B** 20.89% CAGR Global Box Office U.S. Video Streaming Global TV & Streaming (Estimated) (Estimated) Market Size |

| Whether as an investor, customer, or team member, thank you for joining us! Investor Relations https://ir.angel.com |

| SECTION III APPENDIX |

| Management Team Neal Harmon • Co-Founder of Angel, Orabrush, Harmon Brothers • Holds a BA and MS from Brigham Young University Chief Executive Officer Jeffrey Harmon • Co-Founder of Angel, Orabrush, Harmon Brothers • Holds a BA from Brigham Young University and Fundação Getúlio Vargas in São Paulo, Brazil Chief Content Officer Scott Klossner • Over 35 years experience in finance leadership and growth strategy • Public company experience includes NASDAQ: MPRA, NASDAQ: NVNI, NASDAQ: LVNTA, and NYSE: HBI • Holds a BS from University of Utah and MBA from University of Southern California Chief Financial Officer Jordan Harmon • Co-Founder of Angel, Cove • Marketing with VidAngel and Harmon Brothers • Holds a BS from Brigham Young University-Idaho President Glen Nickle • Over 30 years of legal and executive experience across both public and private companies • Previous CLO for Beyond, Inc. and held senior legal roles at iFIT Health and Fitness, Inc. • Holds a JD, MAcc, and BS from Brigham Young University and is a member of the Utah State Bar Chief Legal Officer & Corporate Secretary Robert C. Gay • Over 30 years in private equity and global finance • Founder and Chairman at Kensington Capital Holdings and Exec Director, Co-Founder, and past CEO of HGGC • Formerly Managaging Director at Bain Capital • Holds an A.B. from University of Utah, and Ph.D from Harvard Board Member Experienced leadership team across entertainment, technology, and public markets. |

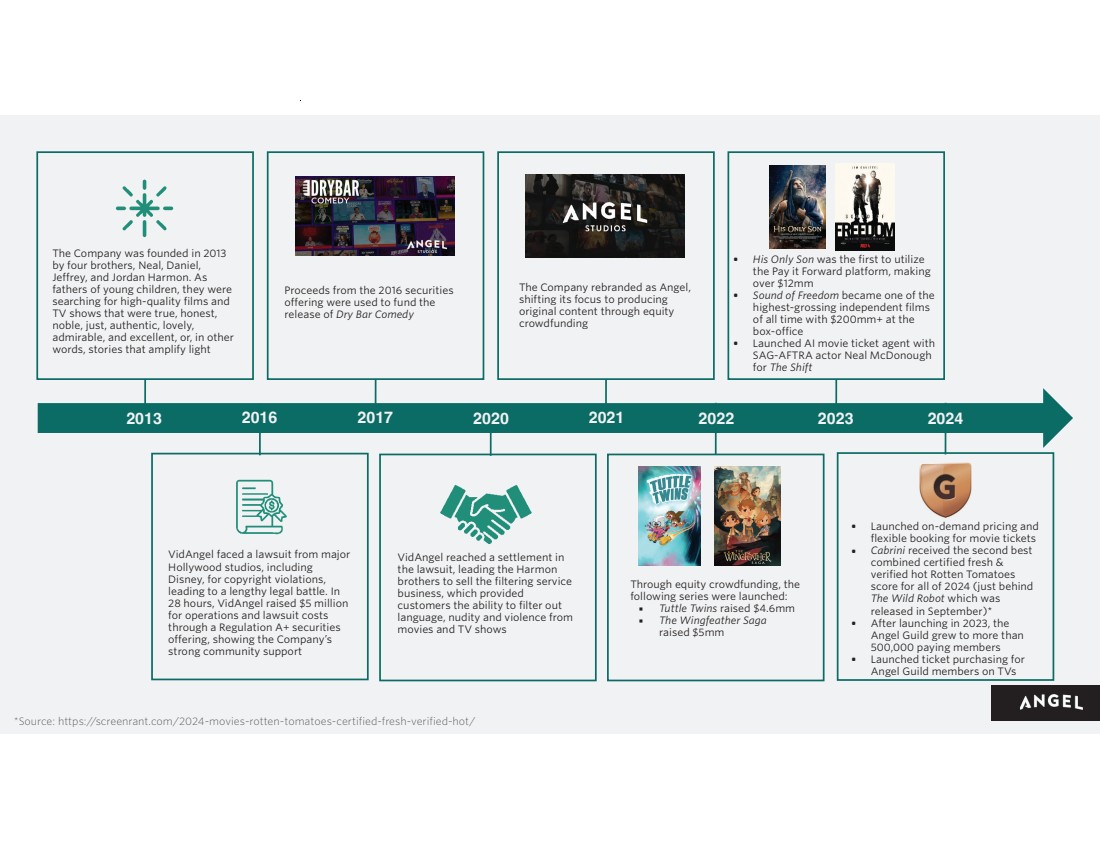

| *Source: https://screenrant.com/2024-movies-rotten-tomatoes-certified-fresh-verified-hot/ VidAngel faced a lawsuit from major Hollywood studios, including Disney, for copyright violations, leading to a lengthy legal battle. In 28 hours, VidAngel raised $5 million for operations and lawsuit costs through a Regulation A+ securities offering, showing the Company’s strong community support VidAngel reached a settlement in the lawsuit, leading the Harmon brothers to sell the filtering service business, which provided customers the ability to filter out language, nudity and violence from movies and TV shows The Company rebranded as Angel, shifting its focus to producing original content through equity crowdfunding Through equity crowdfunding, the following series were launched: ▪ Tuttle Twins raised $4.6mm ▪ The Wingfeather Saga raised $5mm Proceeds from the 2016 securities offering were used to fund the release of Dry Bar Comedy The Company was founded in 2013 by four brothers, Neal, Daniel, Jeffrey, and Jordan Harmon. As fathers of young children, they were searching for high-quality films and TV shows that were true, honest, noble, just, authentic, lovely, admirable, and excellent, or, in other words, stories that amplify light 2013 2016 2017 2020 2021 2022 2023 2024 • Launched on-demand pricing and flexible booking for movie tickets • Cabrini received the second best combined certified fresh & verified hot Rotten Tomatoes score for all of 2024 (just behind The Wild Robot which was released in September)* • After launching in 2023, the Angel Guild grew to more than 500,000 paying members • Launched ticket purchasing for Angel Guild members on TVs • His Only Son was the first to utilize the Pay it Forward platform, making over $12mm • Sound of Freedom became one of the highest-grossing independent films of all time with $200mm+ at the box-office • Launched AI movie ticket agent with SAG-AFTRA actor Neal McDonough for The Shift |

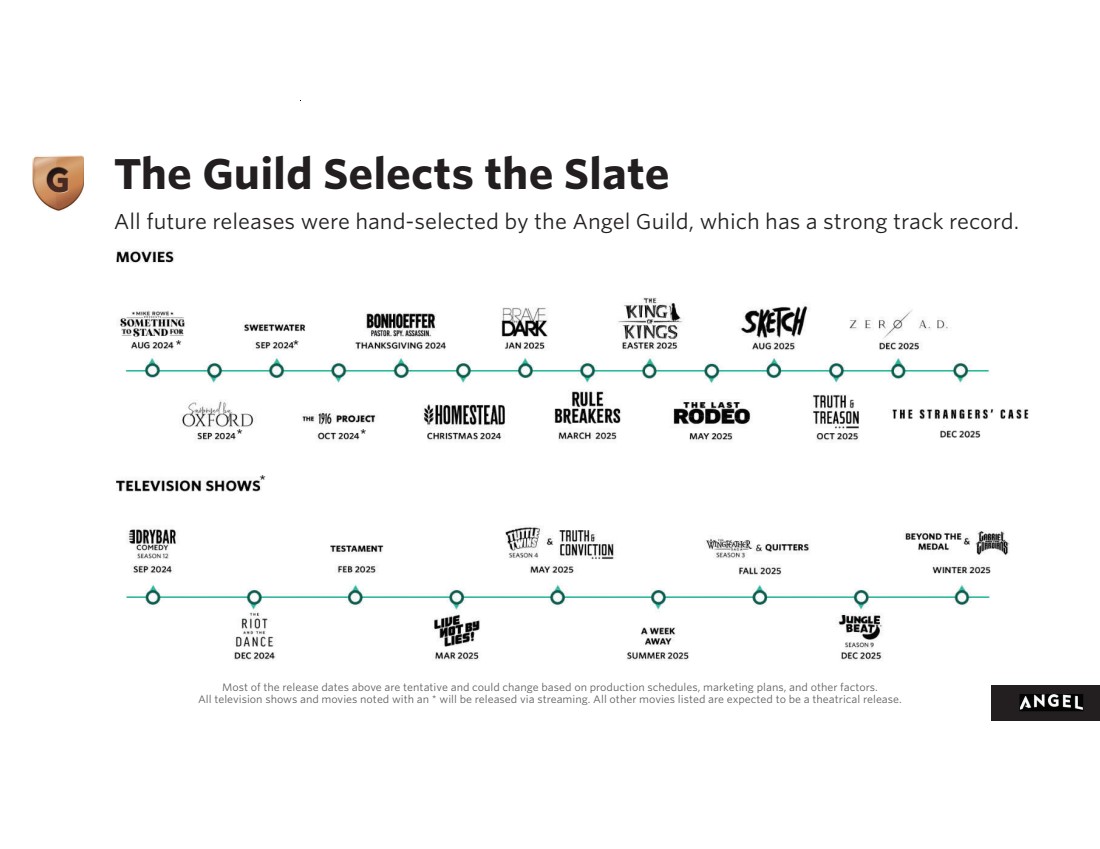

| The Guild Selects the Slate All future releases were hand-selected by the Angel Guild, which has a strong track record. Most of the release dates above are tentative and could change based on production schedules, marketing plans, and other factors. All television shows and movies noted with an * will be released via streaming. All other movies listed are expected to be a theatrical release. * * * * * |

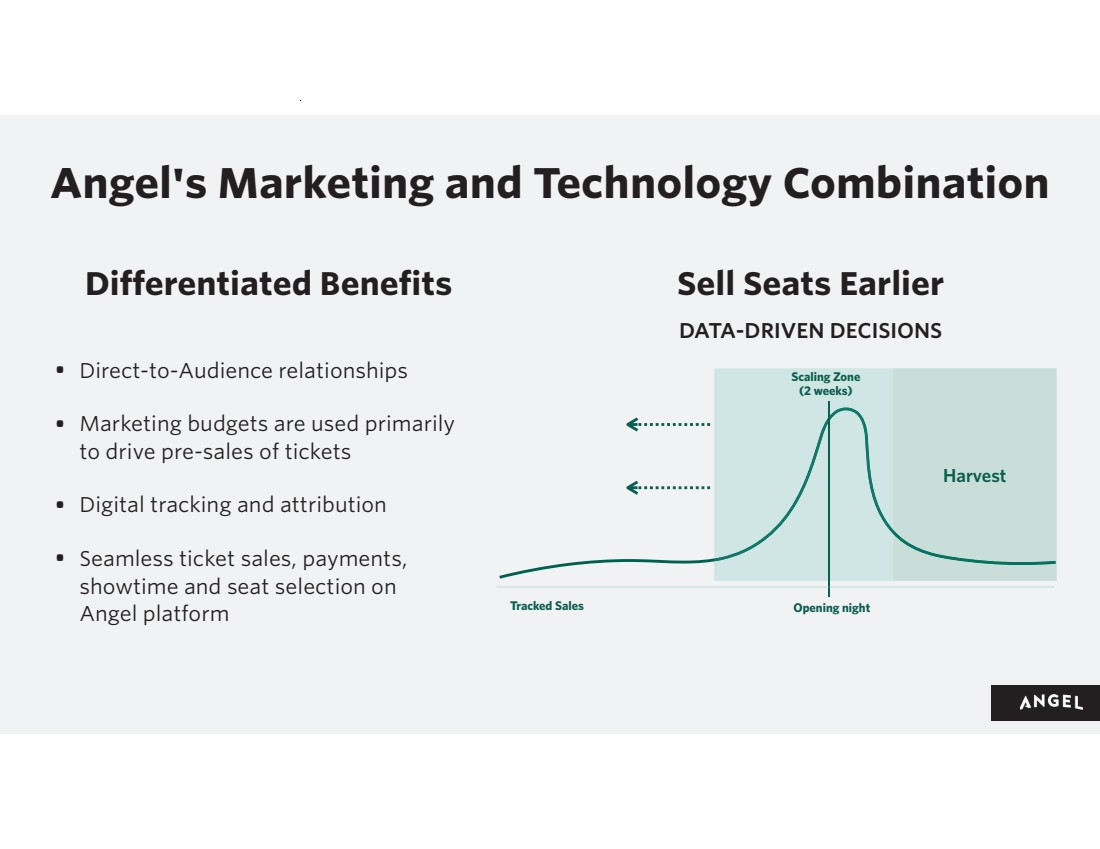

| Sell Seats Earlier Scaling Zone (2 weeks) Opening night Harvest Tracked Sales • Direct-to-Audience relationships • Marketing budgets are used primarily to drive pre-sales of tickets • Digital tracking and attribution • Seamless ticket sales, payments, showtime and seat selection on Angel platform Differentiated Benefits DATA-DRIVEN DECISIONS Angel's Marketing and Technology Combination |

|

| Source for 1980-2007 Back-end Model (2012 data representative of prior years): https://entertainmentstrategyguy.com/2023/04/05/the-data-is-in-theatrical-films-massively-outperform-straight-to-streaming-films/ Source for Streaming Model: https://variety.com/2023/biz/news/residuals-strike-hollywood-history-wga-sag-aftra-1235727986/ |

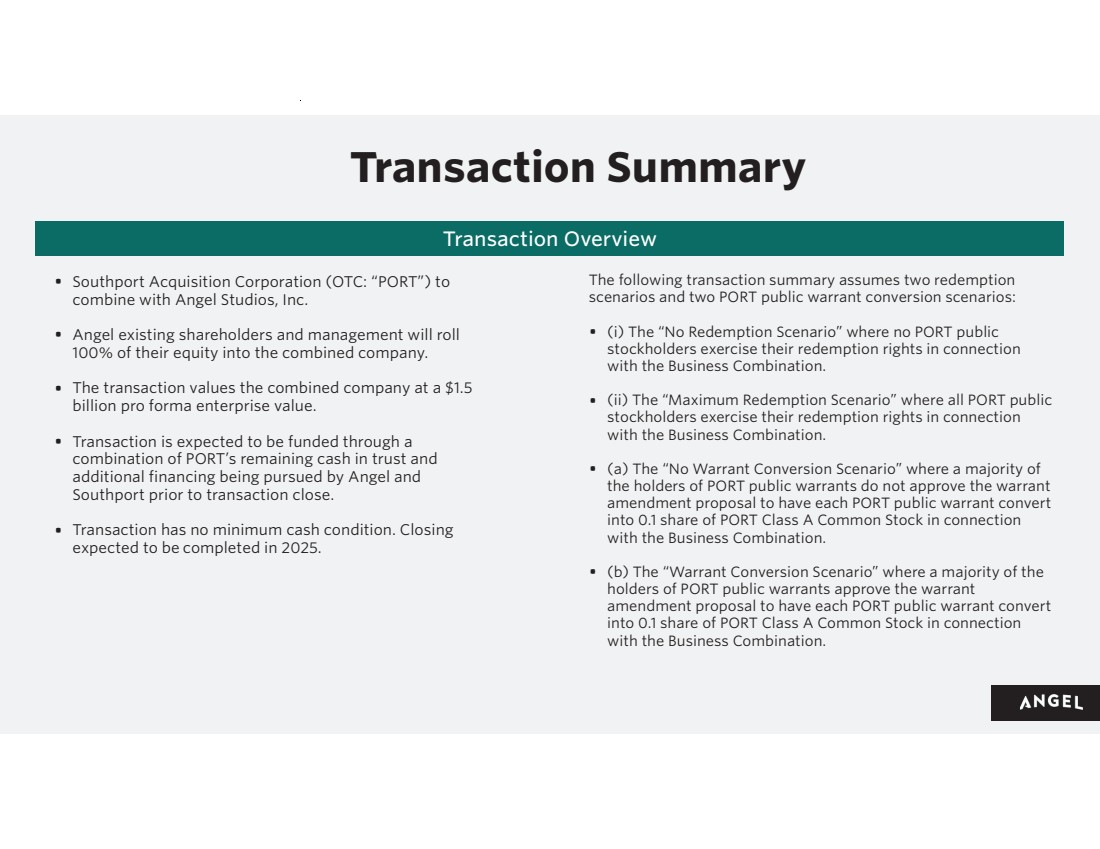

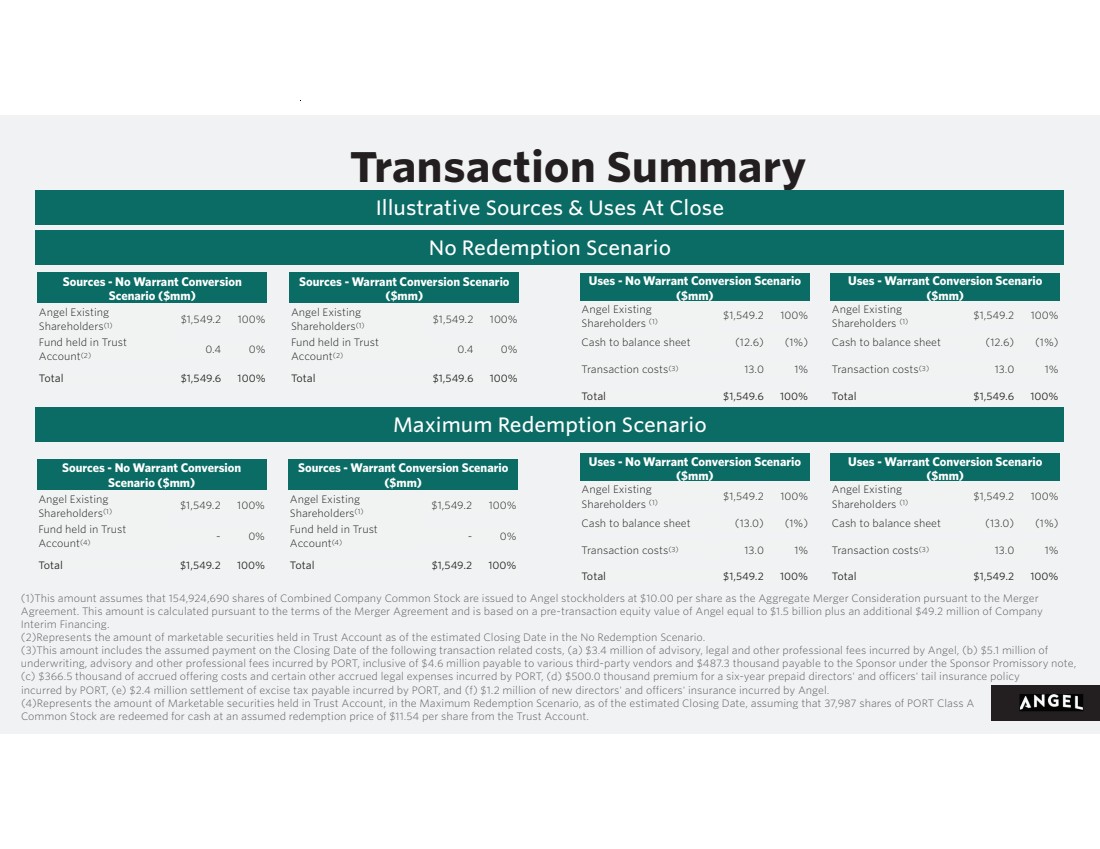

| Transaction Summary Transaction Overview • Southport Acquisition Corporation (OTC: “PORT”) to combine with Angel Studios, Inc. • Angel existing shareholders and management will roll 100% of their equity into the combined company. • The transaction values the combined company at a $1.5 billion pro forma enterprise value. • Transaction is expected to be funded through a combination of PORT’s remaining cash in trust and additional financing being pursued by Angel and Southport prior to transaction close. • Transaction has no minimum cash condition. Closing expected to be completed in 2025. The following transaction summary assumes two redemption scenarios and two PORT public warrant conversion scenarios: • (i) The “No Redemption Scenario” where no PORT public stockholders exercise their redemption rights in connection with the Business Combination. • (ii) The “Maximum Redemption Scenario” where all PORT public stockholders exercise their redemption rights in connection with the Business Combination. • (a) The “No Warrant Conversion Scenario” where a majority of the holders of PORT public warrants do not approve the warrant amendment proposal to have each PORT public warrant convert into 0.1 share of PORT Class A Common Stock in connection with the Business Combination. • (b) The “Warrant Conversion Scenario” where a majority of the holders of PORT public warrants approve the warrant amendment proposal to have each PORT public warrant convert into 0.1 share of PORT Class A Common Stock in connection with the Business Combination. |

| Transaction Summary Illustrative Sources & Uses At Close Sources - No Warrant Conversion Scenario ($mm) Angel Existing Shareholders(1) $1,549.2 100% Fund held in Trust Account(2) 0.4 0% Total $1,549.6 100% No Redemption Scenario Maximum Redemption Scenario Sources - Warrant Conversion Scenario ($mm) Angel Existing Shareholders(1) $1,549.2 100% Fund held in Trust Account(2) 0.4 0% Total $1,549.6 100% Uses - No Warrant Conversion Scenario ($mm) Angel Existing Shareholders (1) $1,549.2 100% Cash to balance sheet (12.6) (1%) Transaction costs(3) 13.0 1% Total $1,549.6 100% Uses - Warrant Conversion Scenario ($mm) Angel Existing Shareholders (1) $1,549.2 100% Cash to balance sheet (12.6) (1%) Transaction costs(3) 13.0 1% Total $1,549.6 100% Uses - No Warrant Conversion Scenario ($mm) Angel Existing Shareholders (1) $1,549.2 100% Cash to balance sheet (13.0) (1%) Transaction costs(3) 13.0 1% Total $1,549.2 100% Uses - Warrant Conversion Scenario ($mm) Angel Existing Shareholders (1) $1,549.2 100% Cash to balance sheet (13.0) (1%) Transaction costs(3) 13.0 1% Total $1,549.2 100% Sources - No Warrant Conversion Scenario ($mm) Angel Existing Shareholders(1) $1,549.2 100% Fund held in Trust Account(4) - 0% Total $1,549.2 100% Sources - Warrant Conversion Scenario ($mm) Angel Existing Shareholders(1) $1,549.2 100% Fund held in Trust Account(4) - 0% Total $1,549.2 100% (1)This amount assumes that 154,924,690 shares of Combined Company Common Stock are issued to Angel stockholders at $10.00 per share as the Aggregate Merger Consideration pursuant to the Merger Agreement. This amount is calculated pursuant to the terms of the Merger Agreement and is based on a pre-transaction equity value of Angel equal to $1.5 billion plus an additional $49.2 million of Company Interim Financing. (2)Represents the amount of marketable securities held in Trust Account as of the estimated Closing Date in the No Redemption Scenario. (3)This amount includes the assumed payment on the Closing Date of the following transaction related costs, (a) $3.4 million of advisory, legal and other professional fees incurred by Angel, (b) $5.1 million of underwriting, advisory and other professional fees incurred by PORT, inclusive of $4.6 million payable to various third-party vendors and $487.3 thousand payable to the Sponsor under the Sponsor Promissory note, (c) $366.5 thousand of accrued offering costs and certain other accrued legal expenses incurred by PORT, (d) $500.0 thousand premium for a six-year prepaid directors' and officers' tail insurance policy incurred by PORT, (e) $2.4 million settlement of excise tax payable incurred by PORT, and (f) $1.2 million of new directors' and officers' insurance incurred by Angel. (4)Represents the amount of Marketable securities held in Trust Account, in the Maximum Redemption Scenario, as of the estimated Closing Date, assuming that 37,987 shares of PORT Class A Common Stock are redeemed for cash at an assumed redemption price of $11.54 per share from the Trust Account. |

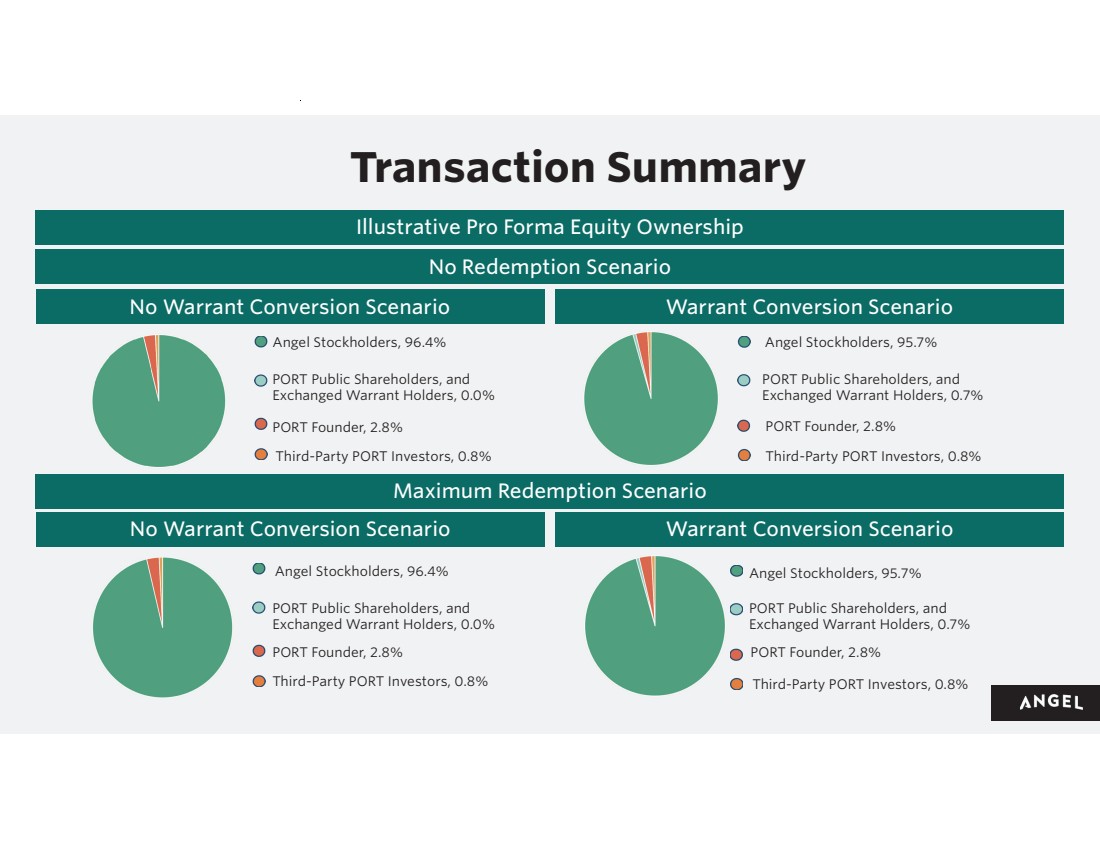

| Transaction Summary Illustrative Pro Forma Equity Ownership No Redemption Scenario Maximum Redemption Scenario No Warrant Conversion Scenario Warrant Conversion Scenario No Warrant Conversion Scenario Warrant Conversion Scenario Angel Stockholders, 96.4% PORT Founder, 2.8% Third-Party PORT Investors, 0.8% Angel Stockholders, 96.4% PORT Founder, 2.8% Third-Party PORT Investors, 0.8% Angel Stockholders, 95.7% PORT Founder, 2.8% Third-Party PORT Investors, 0.8% Angel Stockholders, 95.7% PORT Founder, 2.8% Third-Party PORT Investors, 0.8% PORT Public Shareholders, and Exchanged Warrant Holders, 0.0% PORT Public Shareholders, and Exchanged Warrant Holders, 0.0% PORT Public Shareholders, and Exchanged Warrant Holders, 0.7% PORT Public Shareholders, and Exchanged Warrant Holders, 0.7% |

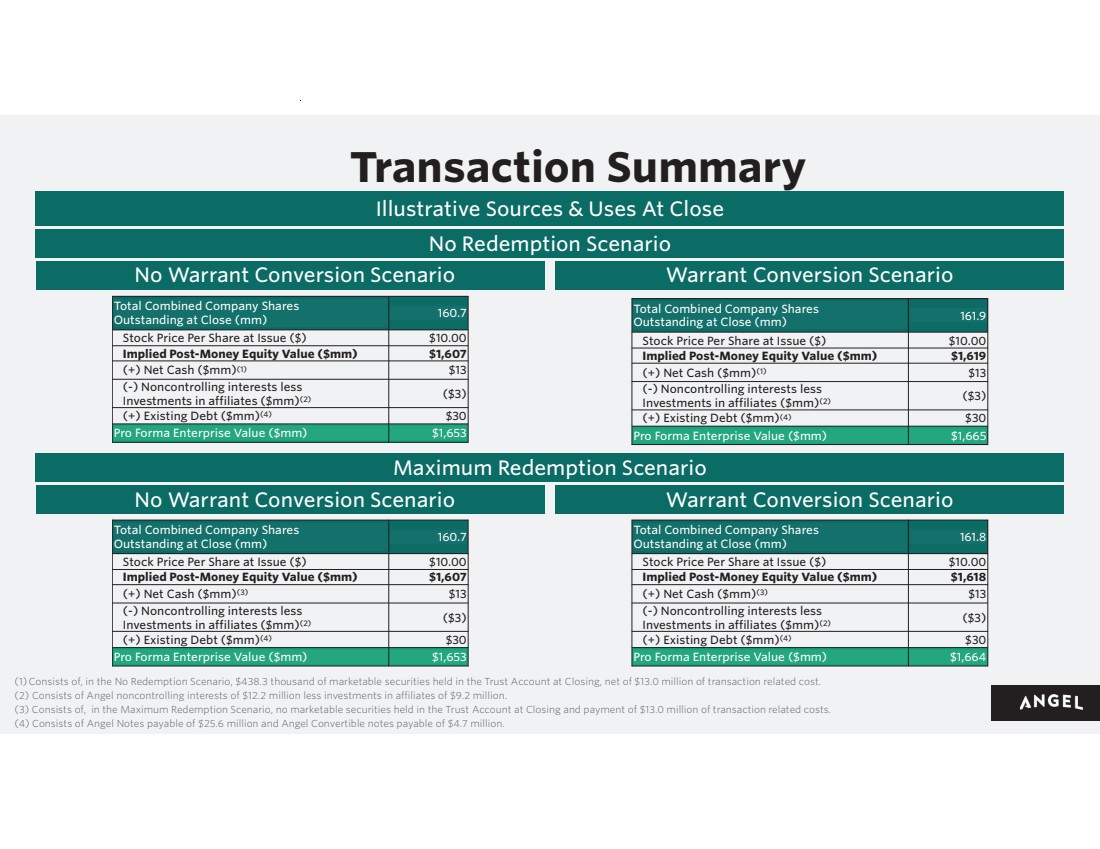

| Transaction Summary Illustrative Sources & Uses At Close (1)Consists of, in the No Redemption Scenario, $438.3 thousand of marketable securities held in the Trust Account at Closing, net of $13.0 million of transaction related cost. (2) Consists of Angel noncontrolling interests of $12.2 million less investments in affiliates of $9.2 million. (3) Consists of, in the Maximum Redemption Scenario, no marketable securities held in the Trust Account at Closing and payment of $13.0 million of transaction related costs. (4) Consists of Angel Notes payable of $25.6 million and Angel Convertible notes payable of $4.7 million. Total Combined Company Shares Outstanding at Close (mm) 160.7 Stock Price Per Share at Issue ($) $10.00 Implied Post-Money Equity Value ($mm) $1,607 (+) Net Cash ($mm)(1) $13 (-) Noncontrolling interests less Investments in affiliates ($mm)(2) ($3) (+) Existing Debt ($mm)(4) $30 Pro Forma Enterprise Value ($mm) $1,653 No Redemption Scenario No Warrant Conversion Scenario Warrant Conversion Scenario Maximum Redemption Scenario Maximum Redemption Scenario No Warrant Conversion Scenario Warrant Conversion Scenario Total Combined Company Shares Outstanding at Close (mm) 160.7 Stock Price Per Share at Issue ($) $10.00 Implied Post-Money Equity Value ($mm) $1,607 (+) Net Cash ($mm)(3) $13 (-) Noncontrolling interests less Investments in affiliates ($mm)(2) ($3) (+) Existing Debt ($mm)(4) $30 Pro Forma Enterprise Value ($mm) $1,653 Total Combined Company Shares Outstanding at Close (mm) 161.9 Stock Price Per Share at Issue ($) $10.00 Implied Post-Money Equity Value ($mm) $1,619 (+) Net Cash ($mm)(1) $13 (-) Noncontrolling interests less Investments in affiliates ($mm)(2) ($3) (+) Existing Debt ($mm)(4) $30 Pro Forma Enterprise Value ($mm) $1,665 Total Combined Company Shares Outstanding at Close (mm) 161.8 Stock Price Per Share at Issue ($) $10.00 Implied Post-Money Equity Value ($mm) $1,618 (+) Net Cash ($mm)(3) $13 (-) Noncontrolling interests less Investments in affiliates ($mm)(2) ($3) (+) Existing Debt ($mm)(4) $30 Pro Forma Enterprise Value ($mm) $1,664 |

| BITCOIN TREASURY STRATEGY |

| Seeking to Empower the Guild for Generations Angel plans to continue to acquire and hold Bitcoin as a strategic treasury asset as an adjunct to its core film and TV production and distribution business. The continued implementation of Angel’s Bitcoin treasury strategy aims to support its mission-driven approach to funding the world’s best filmmakers in producing stories that amplify light for generations to come. The overall strategy contemplates that Angel may (i) enter into capital raising transactions that are collateralized by its Bitcoin holdings, (ii) consider pursuing strategies to create income streams or otherwise generate funds using its Bitcoin holdings and (iii) periodically sell Bitcoin for general corporate purposes, including to generate cash to meet its operating requirements.* Seekin Angel Treasury Stories that Amplify Light BTC BALANCE**: 303+ *Angel has not currently set any official policies governing how or when it will exchange cash for Bitcoin, or sell Bitcoin for cash, with the exception that Bitcoin may be sold, if necessary, to meet the day-to-day financial obligations of the company. **Angel’s Bitcoin balance as of March 31, 2025 was 303.1 |

| Bitcoin Strategy - Strategy Case Study Strategy* (MSTR) adopted Bitcoin as its primary treasury reserve asset on August 10, 2020** Over the past four years, Strategy has grown faster than Nvidia. Four year time horizon On a time horizon of <4 years, Bitcoin makes MSTR volatile, but on a longer term horizon, Bitcoin has outperformed every asset for the past ten years. *Strategy was previously known as MicroStrategy. **While Strategy’s intent is to acquire and hold Bitcoin long-term, it has sold Bitcoin when needed. Source: https://www.kucoin.com/learn/crypto/microstrategy-s-bitcoin-holdings-and-purchase-history Similar to Strategy, Angel plans to continue to acquire and hold Bitcoin as a primary treasury asset. |

| Bitcoin Strategy - Rewarding Those Who Hold Historically, Bitcoin has risen in value against the dollar. Angel plans to continue to acquire and hold Bitcoin as a strategic treasury asset. Four year time horizon Four year time horizon |

| • Giving the green-light power to the Guild • Continuing financial performance of audience-first film and TV show choices • Funding filmmakers who serve the audience first • Shaping the future of the entertainment industry • Supporting Angel’s mission to tell stories that amplify light • Indirectly owning Bitcoin, Angel’s strategic treasury asset Buying and Holding Angel Long-Term Means: Guild audience-first film and TV show choices udience first ent industry ories that amplify light ategic treasury asset |