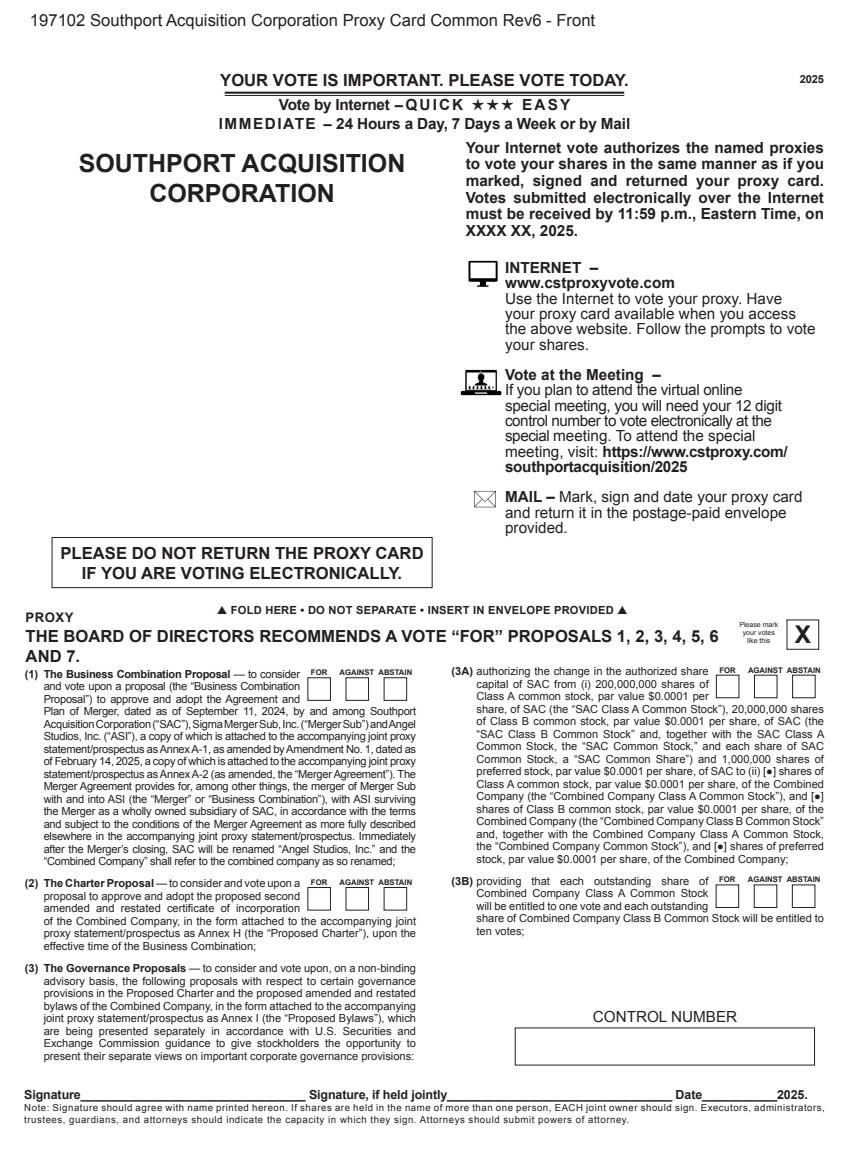

| 2025 (3A) authorizing the change in the authorized share capital of SAC from (i) 200,000,000 shares of Class A common stock, par value $0.0001 per share, of SAC (the “SAC Class A Common Stock”), 20,000,000 shares of Class B common stock, par value $0.0001 per share, of SAC (the “SAC Class B Common Stock” and, together with the SAC Class A Common Stock, the “SAC Common Stock,” and each share of SAC Common Stock, a “SAC Common Share”) and 1,000,000 shares of preferred stock, par value $0.0001 per share, of SAC to (ii) [●] shares of Class A common stock, par value $0.0001 per share, of the Combined Company (the “Combined Company Class A Common Stock”), and [●] shares of Class B common stock, par value $0.0001 per share, of the Combined Company (the “Combined Company Class B Common Stock” and, together with the Combined Company Class A Common Stock, the “Combined Company Common Stock”), and [●] shares of preferred stock, par value $0.0001 per share, of the Combined Company; (3B) providing that each outstanding share of Combined Company Class A Common Stock will be entitled to one vote and each outstanding share of Combined Company Class B Common Stock will be entitled to ten votes; (1) The Business Combination Proposal — to consider and vote upon a proposal (the “Business Combination Proposal”) to approve and adopt the Agreement and Plan of Merger, dated as of September 11, 2024, by and among Southport Acquisition Corporation (“SAC”), Sigma Merger Sub, Inc. (“Merger Sub”) and Angel Studios, Inc. (“ASI”), a copy of which is attached to the accompanying joint proxy statement/prospectus as Annex A-1, as amended by Amendment No. 1, dated as of February 14, 2025, a copy of which is attached to the accompanying joint proxy statement/prospectus as Annex A-2 (as amended, the “Merger Agreement”). The Merger Agreement provides for, among other things, the merger of Merger Sub with and into ASI (the “Merger” or “Business Combination”), with ASI surviving the Merger as a wholly owned subsidiary of SAC, in accordance with the terms and subject to the conditions of the Merger Agreement as more fully described elsewhere in the accompanying joint proxy statement/prospectus. Immediately after the Merger’s closing, SAC will be renamed “Angel Studios, Inc.” and the “Combined Company” shall refer to the combined company as so renamed; (2) The Charter Proposal — to consider and vote upon a proposal to approve and adopt the proposed second amended and restated certificate of incorporation of the Combined Company, in the form attached to the accompanying joint proxy statement/prospectus as Annex H (the “Proposed Charter”), upon the effective time of the Business Combination; (3) The Governance Proposals — to consider and vote upon, on a non-binding advisory basis, the following proposals with respect to certain governance provisions in the Proposed Charter and the proposed amended and restated bylaws of the Combined Company, in the form attached to the accompanying joint proxy statement/prospectus as Annex I (the “Proposed Bylaws”), which are being presented separately in accordance with U.S. Securities and Exchange Commission guidance to give stockholders the opportunity to present their separate views on important corporate governance provisions: SOUTHPORT ACQUISITION CORPORATION FOLD HERE • DO NOT SEPARATE • INSERT IN ENVELOPE PROVIDED Signature_________________________________ Signature, if held jointly_________________________________ Date___________2025. Note: Signature should agree with name printed hereon. If shares are held in the name of more than one person, EACH joint owner should sign. Executors, administrators, trustees, guardians, and attorneys should indicate the capacity in which they sign. Attorneys should submit powers of attorney. Please mark your votes like this X 197102 Southport Acquisition Corporation Proxy Card Common Rev6 - Front CONTROL NUMBER PROXY THE BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” PROPOSALS 1, 2, 3, 4, 5, 6 AND 7. PLEASE DO NOT RETURN THE PROXY CARD IF YOU ARE VOTING ELECTRONICALLY. INTERNET – www.cstproxyvote.com Use the Internet to vote your proxy. Have your proxy card available when you access the above website. Follow the prompts to vote your shares. Vote at the Meeting – If you plan to attend the virtual online special meeting, you will need your 12 digit control number to vote electronically at the special meeting. To attend the special meeting, visit: https://www.cstproxy.com/ southportacquisition/2025 MAIL – Mark, sign and date your proxy card and return it in the postage-paid envelope provided. Your Internet vote authorizes the named proxies to vote your shares in the same manner as if you marked, signed and returned your proxy card. Votes submitted electronically over the Internet must be received by 11:59 p.m., Eastern Time, on XXXX XX, 2025. YOUR VOTE IS IMPORTANT. PLEASE VOTE TODAY. IMMEDIATE - 24 Hours a Day, 7 Days a Week or by Mail Vote by Internet - QUICK EASY FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN |

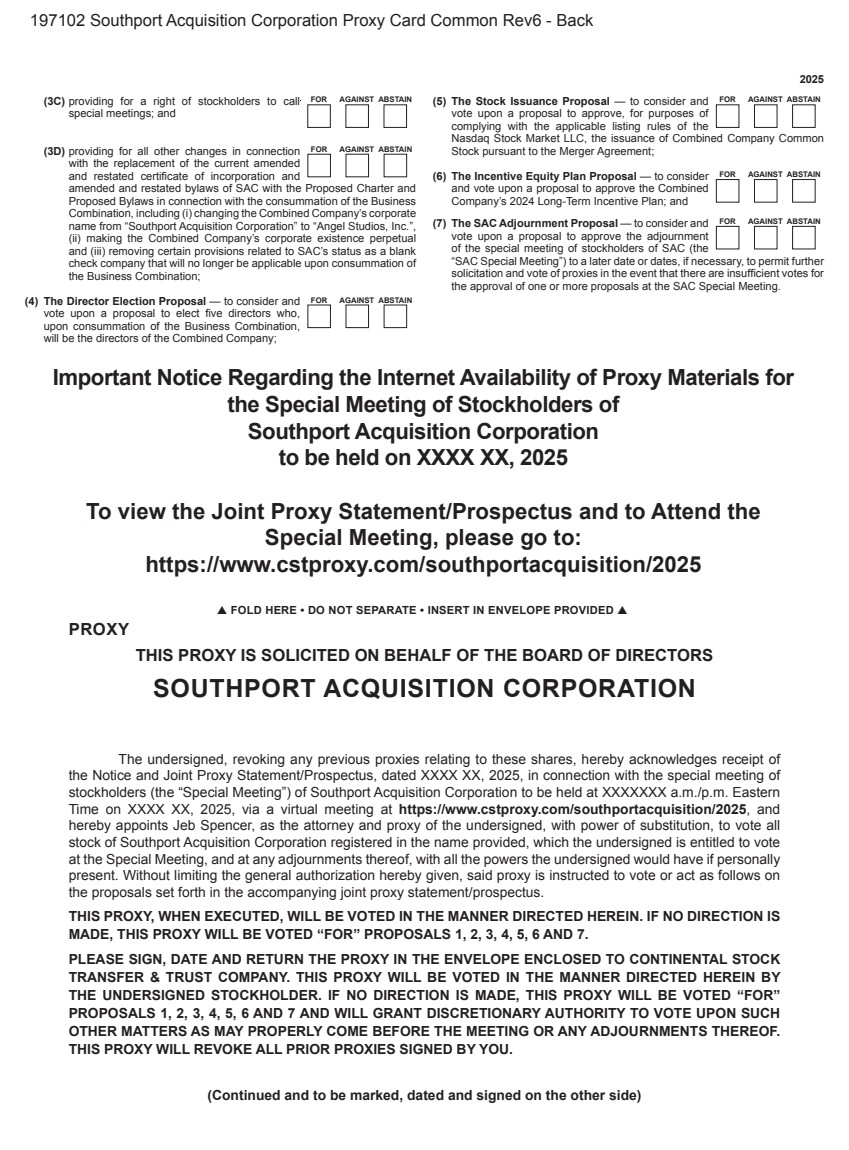

| 2025 FOLD HERE • DO NOT SEPARATE • INSERT IN ENVELOPE PROVIDED PROXY THIS PROXY IS SOLICITED ON BEHALF OF THE BOARD OF DIRECTORS SOUTHPORT ACQUISITION CORPORATION The undersigned, revoking any previous proxies relating to these shares, hereby acknowledges receipt of the Notice and Joint Proxy Statement/Prospectus, dated XXXX XX, 2025, in connection with the special meeting of stockholders (the “Special Meeting”) of Southport Acquisition Corporation to be held at XXXXXXX a.m./p.m. Eastern Time on XXXX XX, 2025, via a virtual meeting at https://www.cstproxy.com/southportacquisition/2025, and hereby appoints Jeb Spencer, as the attorney and proxy of the undersigned, with power of substitution, to vote all stock of Southport Acquisition Corporation registered in the name provided, which the undersigned is entitled to vote at the Special Meeting, and at any adjournments thereof, with all the powers the undersigned would have if personally present. Without limiting the general authorization hereby given, said proxy is instructed to vote or act as follows on the proposals set forth in the accompanying joint proxy statement/prospectus. THIS PROXY, WHEN EXECUTED, WILL BE VOTED IN THE MANNER DIRECTED HEREIN. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED “FOR” PROPOSALS 1, 2, 3, 4, 5, 6 AND 7. PLEASE SIGN, DATE AND RETURN THE PROXY IN THE ENVELOPE ENCLOSED TO CONTINENTAL STOCK TRANSFER & TRUST COMPANY. THIS PROXY WILL BE VOTED IN THE MANNER DIRECTED HEREIN BY THE UNDERSIGNED STOCKHOLDER. IF NO DIRECTION IS MADE, THIS PROXY WILL BE VOTED “FOR” PROPOSALS 1, 2, 3, 4, 5, 6 AND 7 AND WILL GRANT DISCRETIONARY AUTHORITY TO VOTE UPON SUCH OTHER MATTERS AS MAY PROPERLY COME BEFORE THE MEETING OR ANY ADJOURNMENTS THEREOF. THIS PROXY WILL REVOKE ALL PRIOR PROXIES SIGNED BY YOU. (Continued and to be marked, dated and signed on the other side) Important Notice Regarding the Internet Availability of Proxy Materials for the Special Meeting of Stockholders of Southport Acquisition Corporation to be held on XXXX XX, 2025 To view the Joint Proxy Statement/Prospectus and to Attend the Special Meeting, please go to: https://www.cstproxy.com/southportacquisition/2025 197102 Southport Acquisition Corporation Proxy Card Common Rev6 - Back (3C) providing for a right of stockholders to call special meetings; and (3D) providing for all other changes in connection with the replacement of the current amended and restated certificate of incorporation and amended and restated bylaws of SAC with the Proposed Charter and Proposed Bylaws in connection with the consummation of the Business Combination, including (i) changing the Combined Company’s corporate name from “Southport Acquisition Corporation” to “Angel Studios, Inc.”, (ii) making the Combined Company’s corporate existence perpetual and (iii) removing certain provisions related to SAC’s status as a blank check company that will no longer be applicable upon consummation of the Business Combination; (4) The Director Election Proposal — to consider and vote upon a proposal to elect five directors who, upon consummation of the Business Combination, will be the directors of the Combined Company; (5) The Stock Issuance Proposal — to consider and vote upon a proposal to approve, for purposes of complying with the applicable listing rules of the Nasdaq Stock Market LLC, the issuance of Combined Company Common Stock pursuant to the Merger Agreement; (6) The Incentive Equity Plan Proposal — to consider and vote upon a proposal to approve the Combined Company’s 2024 Long-Term Incentive Plan; and (7) The SAC Adjournment Proposal — to consider and vote upon a proposal to approve the adjournment of the special meeting of stockholders of SAC (the “SAC Special Meeting”) to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for the approval of one or more proposals at the SAC Special Meeting. FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN |