Exhibit 99.2

1 Equity Raising Presentation B Li INVESTOR PRESENTATION June 2025 :

IONR www.ioneer.com ASX : INR NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4 IMPORTANT: You must read the following before continuing. This presentation has been prepared by ioneer Ltd (ABN 76 098 564 606) (and / or its subsidiaries, as the context

requires, “Company”, “ioneer” or “INR”) in relation to an institutional placement(“Placement”, “Offer” or “Institutional Placement”) of new ordinary shares in the Company (“New Shares”). The Placement will be made to certain eligible

institutional and sophisticated investors. The Placement is managed by the lead manager, Canaccord Genuity (Australia) Limited ("Lead Manager"). Summary Information This presentation contains summary information about the Company and its

activities and is current as at 13 June 2025. The information in this presentation is of a general background and does not purport to be complete or provide all information that an investor should consider when making an investment decision,

nor does it contain all the information which would be required in a prospectus, product disclosure statement or other disclosure document prepared in accordance with the requirements of the Corporations Act 2001 (Cth) (“Corporations Act”).

No representation or warranty, express or implied, is provided in relation to the accuracy or completeness of the information. Statements in this presentation are made only as of the date of this presentation unless otherwise stated and the

information in this presentation remains subject to change without notice. The Company is not responsible for updating, and does not undertake to update, this presentation. It should be read in conjunction with the Company’s other periodic

and continuous disclosure announcements lodged with the Australian Securities Exchange (“ASX”), which are available at www.asx.com.au Not financial product advice This presentation is for information purposes only and is not a prospectus,

product disclosure statement or other offer document under Australian law or the law of any other jurisdiction. This presentation is not financial product or investment advice, a recommendation to acquire New Shares or accounting, legal or

tax advice. It has been prepared without taking into account the objectives, financial or tax situation or needs of individuals. Any references to, or explanations of, legislation, regulatory issues or any other legal commentary (if any) are

indicative only, do not summarise all relevant issues and are not intended to be a full explanation of a particular matter. You are solely responsible for forming your own opinions and conclusions on such matters and the market and for making

your own independent assessment of the information in this presentation. The securities issued by ioneer are considered speculative and there is no guarantee that they will make a return on the capital invested, that dividends will be paid

on the shares or that there will be an increase in the value of the shares in the future. Before making an investment decision, prospective investors should consider the appropriateness of the information having regard to their own

objectives, financial and tax situation and needs, and seek legal and taxation advice appropriate to their jurisdiction. The Company is not licensed to provide financial product advice in respect of its securities. Cooling off rights do not

apply to the acquisition of New Shares. Competent Persons Statement In respect of Mineral Resources and Ore Reserves referred to in this presentation and previously reported by the Company in accordance with JORC Code 2012, the Company

confirms that it is not aware of any new information or data that materially affects the information included in the public reports titled “February 2025 Mineral Resource Estimate” dated 5 March 2025 and “Ore Reserve Quadruples; Reaffirms

Robust Project Economics” dated 2 June 2025, released on ASX. Further information regarding the Mineral Resource estimate and Ore Reserve can be found in those reports. All material assumptions and technical parameters underpinning the

estimates in the reports continue to apply and have not materially changed. In respect of production targets referred to in this presentation, the Company confirms that it is not aware of any new information or data that materially affects

the information included in the public report titled “Ore Reserve Quadruples; Reaffirms Robust Project Economics” dated 2 June 2025. Further information regarding the production estimates can be found in that report. All material assumptions

and technical parameters underpinning the estimates in the report continue to apply and have not materially changed. Past performance Past performance information given in this presentation is given for illustrative purposes only and should

not be relied upon as (and is not) an indication of the Company's views on its future performance or condition. Investors should note that past performance, including past share price performance, of ioneer cannot be relied upon as an

indicator of (and provides no guidance as to) future performance including future share price performance. The historical information included in this presentation is, or is based on, information that has previously been released to the

market. Diagrams, charts, graphs and tables Any diagrams, charts, graphs and tables appearing in this presentation are illustrative only and may not be drawn to scale. Non-IFRS Financial Measures Investors should also be aware that

certain financial data included in this presentation, such as EBITDA and all in sustaining cash cost, are "non‐IFRS financial information" under Regulatory Guide 230 Disclosing non‐IFRS financial information published by the Australian

Securities and Investments Commission (“ASIC”) or "non‐GAAP financial measures" under Regulation G of the U.S. Securities Exchange Act of 1934. The disclosure of such non‐GAAP financial measures in the manner included in this presentation

would not be permissible in a registration statement under the U.S. Securities Act of 1933 (“U.S. Securities Act”). Important Notices and Disclaimers

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4 Important Notices and Disclaimers Such information and financial measures (including EBITDA) do not have a standardised meaning prescribed by Australian Accounting Standards

(“AAS”) or International Financial Reporting Standards (“IFRS”) and, therefore, may not be comparable to similarly titled measures presented by other entities, nor should they be construed as an alternative to other financial measures

determined in accordance with AAS or IFRS. Investors are cautioned, therefore, not to place undue reliance on any non‐IFRS financial information or non‐GAAP financial measures and ratios included in this presentation. The Company believes

this non‐IFRS financial information, and these non‐GAAP financial measures, provide useful information to users in measuring the financial performance and conditions of ioneer. Pro forma financial information This presentation also contains

pro-forma historical financial information to show the impact of the Placement. The pro-forma information has not been audited or reviewed by the Company’s auditors. The pro-forma financial information provided in this presentation is for

illustrative purposes only and is not represented as being indicative of the Company’s (nor anyone else’s) views on its future financial condition and/or performance. The pro-forma financial information has been prepared on the basis set out

in this presentation. Investors should note that the pro-forma financial information has not been prepared in accordance with, and does not purport to comply with, Article 11 of Regulation S-X under the U.S. Securities Act. Forward looking

statements This presentation contains certain forward‐looking statements. The words "expect", "anticipate", "estimate", "intend", "believe", "guidance", "should", "could", "may", "will", "predict", "plan" and other similar expressions are

intended to identify forward‐looking statements. Forward‐looking statements in this presentation include statements regarding: the timetable and outcome of the Offer and the use of the proceeds thereof; the capital and operating costs,

timetable and operating metrics for the Rhyolite Ridge Project; the permitting process and timeline; the potential, timing and cost of other ioneer projects and opportunities; any impacts on and the future of the environment and

sustainability; future market supply and demand; and future commodity prices. Any indications of or guidance or outlook on, future earnings and financial position and performance are also forward‐looking statements. Forward‐looking

statements, opinions and estimates provided in this presentation are based on assumptions and contingencies which are subject to change without notice, as are statements about market and industry trends, which are based on interpretations of

current market conditions. Forward‐looking statements, including projections, guidance on future earnings and estimates are provided as a general guide only and should not be relied upon as an indication or guarantee of future performance.

This presentation contains such statements that are subject to risk factors associated with the mineral and resources exploration, development and production industry. It is believed that the expectations reflected in these statements are

reasonable, but they may be affected by a range of variables which could cause actual results or trends to differ materially, including but not limited to the risks set out in this presentation and the following risks: dependence on

commodity prices, availability of funding, impact of inflation on costs, exploration risks (including the risks of obtaining necessary licences and diminishing quantities or grades of reserves), risks associated with remoteness, environmental

regulation risk, currency and exchange rate risk, political risk, war and terrorism and global economic conditions, as well as earnings, capital expenditure, cash flow and capital structure risks and general business risks. Such risks may be

outside the control of and/or may be unknown to the Company. Refer to Appendix B: Key Risks of this Presentation for a non-exhaustive summary of certain key business, offer and general risk factors that may affect ioneer. All the material

assumptions underpinning forecast financial information derived from a production target continue to apply and have not materially changed. No representation, warranty or assurance (express or implied) is given or made in relation to any

forward‐looking statement by any person (including the Company). In particular, no representation, warranty or assurance (express or implied) is given that the occurrence of the events expressed or implied in any forward‐looking statements in

this presentation will actually occur. Actual results, performance or achievement may vary materially from any projections and forward‐looking statements in this presentation and the assumptions on which those statements are based. The

forward‐looking statements in this presentation speak only as of the date of this presentation. Subject to any continuing obligations under applicable law or any relevant ASX listing rules, the Company disclaims any obligation or undertaking

to provide any updates or revisions to any forward‐looking statements in this presentation to reflect any change in expectations in relation to any forward‐looking statements or any change in events, conditions or circumstances on which any

such statement is based. Nothing in this presentation will under any circumstances create an implication that there has been no change in the affairs of ioneer since the date of this presentation. Investors should consider the

forward-looking statements contained in this presentation in light of these disclosures and not place reliance on such statements. Any forward-looking statements in this presentation are not guarantees or predictions of future performance and

are based on information available to ioneer as at the date of this presentation. You are strongly cautioned not to place undue reliance on any forward-looking statements, particularly in light of the current economic climate and significant

volatility, uncertainty and disruption caused in relation to the Company. Effect of rounding A number of figures, amounts, percentages, estimates, calculations of value and fractions in this presentation are subject to the effect of

rounding. Accordingly, the actual calculation of these figures may differ from the figures set out in this presentation. Financial data All dollar values are in United States dollars ($ or US$) unless stated otherwise.

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4 Important Notices and Disclaimers Reliance on third party information The views expressed in this presentation contain information that has been derived from publicly available

sources that have not been independently verified. No representation or warranty is made as to the accuracy, completeness or reliability of the information. This presentation should not be relied upon as a recommendation or forecast by the

Company. Investment risk An investment in New Shares is subject to known and unknown risks, some of which are beyond the control of ioneer, including possible delays in repayment and loss of income and principal invested. The Company does

not guarantee any particular rate of return or the performance of ioneer, nor does it guarantee the repayment of capital from the Company or any particular tax treatment. Investors should have regard to the risks outlined in the "Key Risks"

section of this presentation. Not an offer This presentation is not and should not be considered an offer or an invitation to acquire ioneer securities or any other financial products and does not and will not form any part of any contract

for the acquisition of New Shares. This presentation is for information purposes only and is not a prospectus, product disclosure statement or other disclosure or offering document under Australian law or any other law. This presentation has

not been, and will not be, lodged with or approved by ASIC or any regulatory authority in any jurisdiction. The distribution of this presentation (including an electronic copy) in jurisdictions outside Australia may also be restricted by

law. Any recipient who is outside Australia must seek advice on and observe any such restrictions. Any failure to comply with such restrictions may constitute a violation of applicable securities laws. By accepting this presentation, you

represent and warrant that you are entitled to receive such presentation in accordance with the above restrictions and agree to be bound by the limitations contained herein. This presentation is not for distribution or release in the United

States. This presentation is not, and does not constitute, an invitation or offer to sell, or the solicitation of an offer to buy, any securities in any jurisdiction, including the United States, in which it would be unlawful to make such an

offer. The New Shares have not been, and will not be, registered under the U.S. Securities Act. Accordingly, the New Shares to be offered and sold in the Offer may not be offered or sold to any person in the United States unless they have

been registered under the U.S. Securities Act (which none of ioneer and the Lead Manager has any obligation to procure) or are offered or sold pursuant to an exemption from, or in a transaction not subject to, the registration requirements of

the U.S. Securities Act and applicable securities laws of any state or other jurisdiction of the United States. Lead Manager and advisor Neither the Lead Manager nor any of their or the Company’s respective advisers or any of their

respective affiliates, related bodies corporate, directors, officers, partners, employees and agents, (each a “Limited Party”) have authorised, permitted or caused the issue, submission, dispatch or provision of this presentation and, except

to the extent referred to in this presentation, none of them makes or purports to make any statement in this presentation and there is no statement in this presentation which is based on any statement by any of them. The Limited Parties

expressly disclaim, to the maximum extent permitted by law, all liabilities (however caused, including negligence) in respect of, make no representations regarding, and take no responsibility for, any part of this presentation and make no

representation or warranty as to the currency, accuracy, reliability or completeness of any information, statements, opinions, conclusions or representations contained in this presentation. The Limited Parties have not made or purported to

make any statement in this presentation and there is no statement in this presentation which is based on any statement by any of them. In particular, this presentation does not constitute, and shall not be relied upon as, a promise,

representation, warranty or guarantee as to the past, present or the future performance of ioneer. No Limited Party makes any recommendation as to whether any potential investors should participate in the offer of New Shares referred to in

this presentation and the statements in this presentation which are based on any statement by ioneer are made only as of the date of this presentation unless otherwise stated and the information in this presentation remains subject to change

without notice. To the maximum extent permitted by law, the Limited Parties exclude and disclaim all liability for any expenses, losses, damages or costs incurred by you as a result of your participation in the Offer and the information in

this presentation being inaccurate or incomplete in any way for any reason, whether by negligence or otherwise. To the maximum extent permitted by law, the Limited Parties make no representation or warranty, express or implied, as to the

currency, accuracy, reliability or completeness of information in this presentation and the Limited Parties take no responsibility for any part of this presentation or the Offer. The Limited Parties make no recommendations as to whether you

or your related parties should participate in the Offer nor do they make any representations or warranties to you concerning the Offer, and you represent, warrant and agree that you have not relied on any statements made by any of the Limited

Parties in relation to the Offer and you further expressly disclaim that you are in a fiduciary relationship with any of them. Statements made in this presentation are made only as at the date of this presentation. The information in this

presentation remains subject to change without notice. The Company reserves the right to withdraw the Offer or vary the timetable for the Offer without notice. Conflicts Disclosure The Lead Manager is, together with their respective

affiliates, a full service financial institution engaged in various activities, which may include trading, financial advisory, investment management, investment research, principal investment, hedging, market making, brokerage and other

financial and non-financial activities and services including for which they have received or may receive customary fees and expenses. The Lead Manager is acting as lead manager and underwriter to the offer for which they have received or

expect to receive fees and expenses.

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 4 Important Notices and Disclaimers Swap Agreements In connection with the Placement, one or more investors may elect to acquire an economic interest in the New Shares (“Economic

Interest”), instead of subscribing for or acquiring the legal or beneficial interest in those shares. The Lead Manager (or their affiliates) may, for their own account, write derivative transactions with those investors relating to the New

Shares to provide the Economic Interest, or otherwise acquire shares in ioneer in connection with the writing of such derivative transactions in the Placement and/or the secondary market. As a result of such transactions, the Lead Manager

(or their affiliates) may be allocated, subscribe for or acquire New Shares or shares of ioneer in the Placement and/or the secondary market, including to hedge those derivative transactions, as well as hold long or short positions in such

shares. These transactions may, together with other shares in ioneer acquired by the Lead Manager or their affiliates in connection with their ordinary course sales and trading, principal investing and other activities, result in the Lead

Manager or their affiliates disclosing a substantial holding and earning fees. Acceptance By attending an investor presentation or briefing, or accepting, accessing or reviewing this presentation you acknowledge and agree to the terms set

out in the important notice and disclaimer.

Equity Raising Summary 6

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

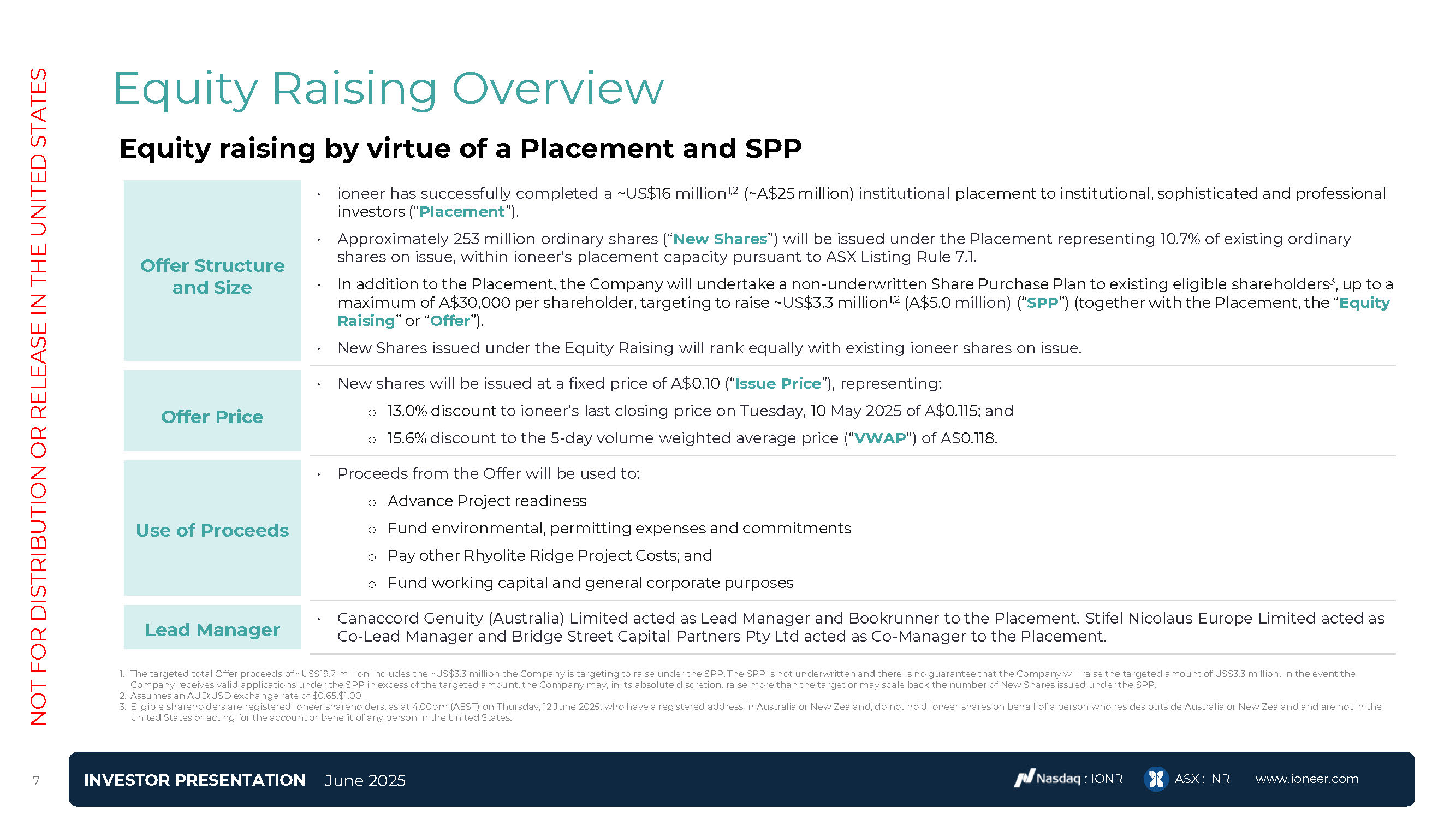

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 7 Equity Raising Overview Offer Structure and Size ioneer has successfully completed a ~US$16 million1,2 (~A$25 million) institutional placement to institutional, sophisticated

and professional investors (“Placement”). Approximately 253 million ordinary shares (“New Shares”) will be issued under the Placement representing 10.7% of existing ordinary shares on issue, within ioneer's placement capacity pursuant to

ASX Listing Rule 7.1. In addition to the Placement, the Company will undertake a non-underwritten Share Purchase Plan to existing eligible shareholders3, up to a maximum of A$30,000 per shareholder, targeting to raise ~US$3.3 million1,2

(A$5.0 million) (“SPP”) (together with the Placement, the “Equity Raising” or “Offer”). New Shares issued under the Equity Raising will rank equally with existing ioneer shares on issue. Offer Price New shares will be issued at a fixed

price of A$0.10 (“Issue Price”), representing: 13.0% discount to ioneer’s last closing price on Tuesday, 10 May 2025 of A$0.115; and 15.6% discount to the 5-day volume weighted average price (“VWAP”) of A$0.118. Use of Proceeds Proceeds

from the Offer will be used to: Advance Project readiness Fund environmental, permitting expenses and commitments Pay other Rhyolite Ridge Project Costs; and Fund working capital and general corporate purposes Lead Manager Canaccord

Genuity (Australia) Limited acted as Lead Manager and Bookrunner to the Placement. Stifel Nicolaus Europe Limited acted as Co-Lead Manager and Bridge Street Capital Partners Pty Ltd acted as Co-Manager to the Placement. Equity raising by

virtue of a Placement and SPP The targeted total Offer proceeds of ~US$19.7 million includes the ~US$3.3 million the Company is targeting to raise under the SPP. The SPP is not underwritten and there is no guarantee that the Company will

raise the targeted amount of US$3.3 million. In the event the Company receives valid applications under the SPP in excess of the targeted amount, the Company may, in its absolute discretion, raise more than the target or may scale back the

number of New Shares issued under the SPP. Assumes an AUD:USD exchange rate of $0.65:$1:00 Eligible shareholders are registered Ioneer shareholders, as at 4.00pm (AEST) on Thursday, 12 June 2025, who have a registered address in Australia

or New Zealand, do not hold ioneer shares on behalf of a person who resides outside Australia or New Zealand and are not in the United States or acting for the account or benefit of any person in the United States.

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

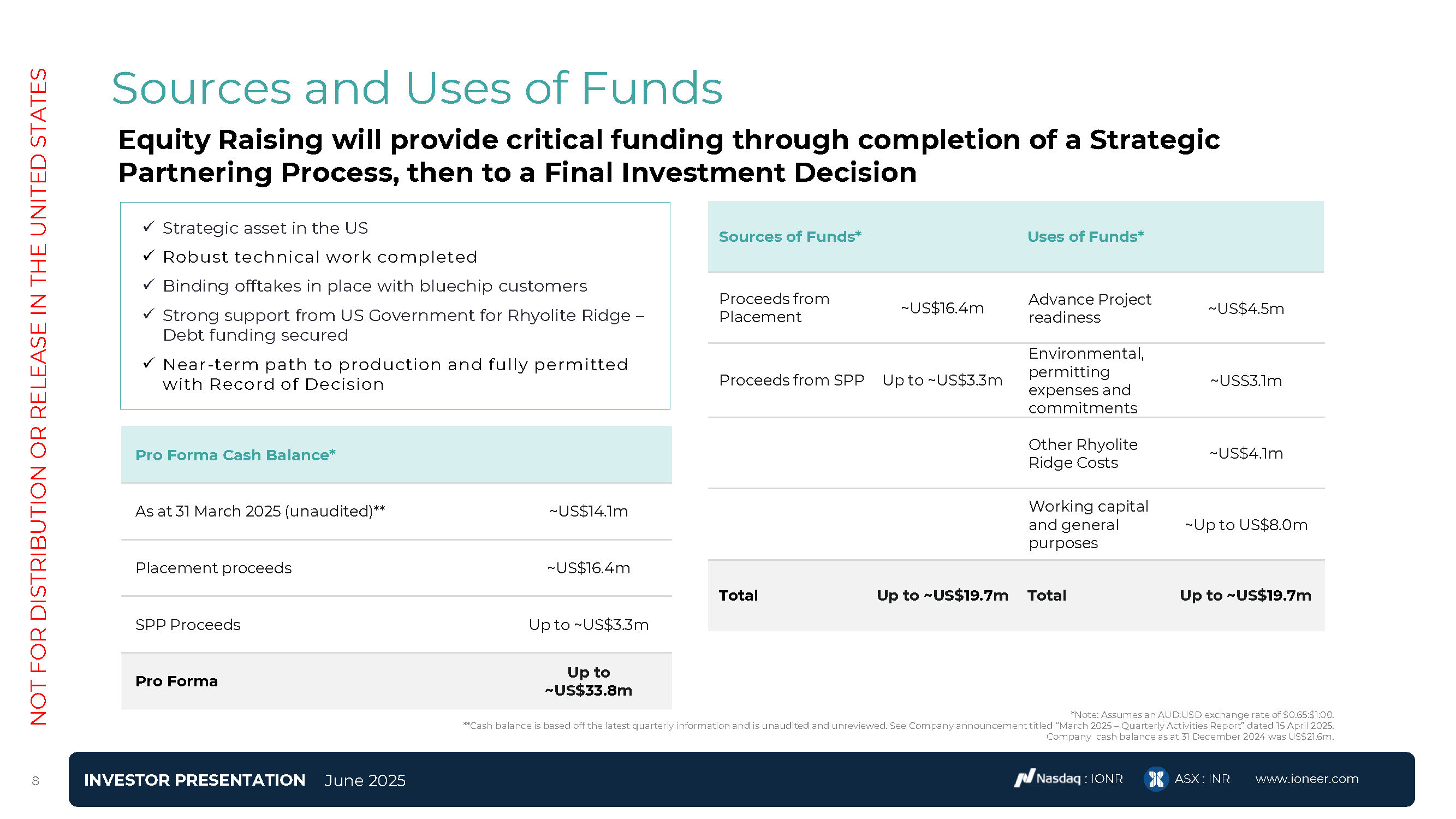

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 7 Sources and Uses of Funds Sources of Funds* Uses of Funds* Proceeds from Placement ~US$16.4m Advance Project readiness ~US$4.5m Proceeds from SPP Up to

~US$3.3m Environmental, permitting expenses and commitments ~US$3.1m Other Rhyolite Ridge Costs ~US$4.1m Working capital and general purposes ~Up to US$8.0m Total Up to ~US$19.7m Total Up to ~US$19.7m *Note: Assumes an AUD:USD

exchange rate of $0.65:$1:00. **Cash balance is based off the latest quarterly information and is unaudited and unreviewed. See Company announcement titled “March 2025 – Quarterly Activities Report” dated 15 April 2025. Company cash balance

as at 31 December 2024 was US$21.6m. Equity Raising will provide critical funding through completion of a Strategic Partnering Process, then to a Final Investment Decision Pro Forma Cash Balance* As at 31 March 2025

(unaudited)** ~US$14.1m Placement proceeds ~US$16.4m SPP Proceeds Up to ~US$3.3m Pro Forma Up to ~US$33.8m Strategic asset in the US Robust technical work completed Binding offtakes in place with bluechip customers Strong support

from US Government for Rhyolite Ridge – Debt funding secured Near-term path to production and fully permitted with Record of Decision

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

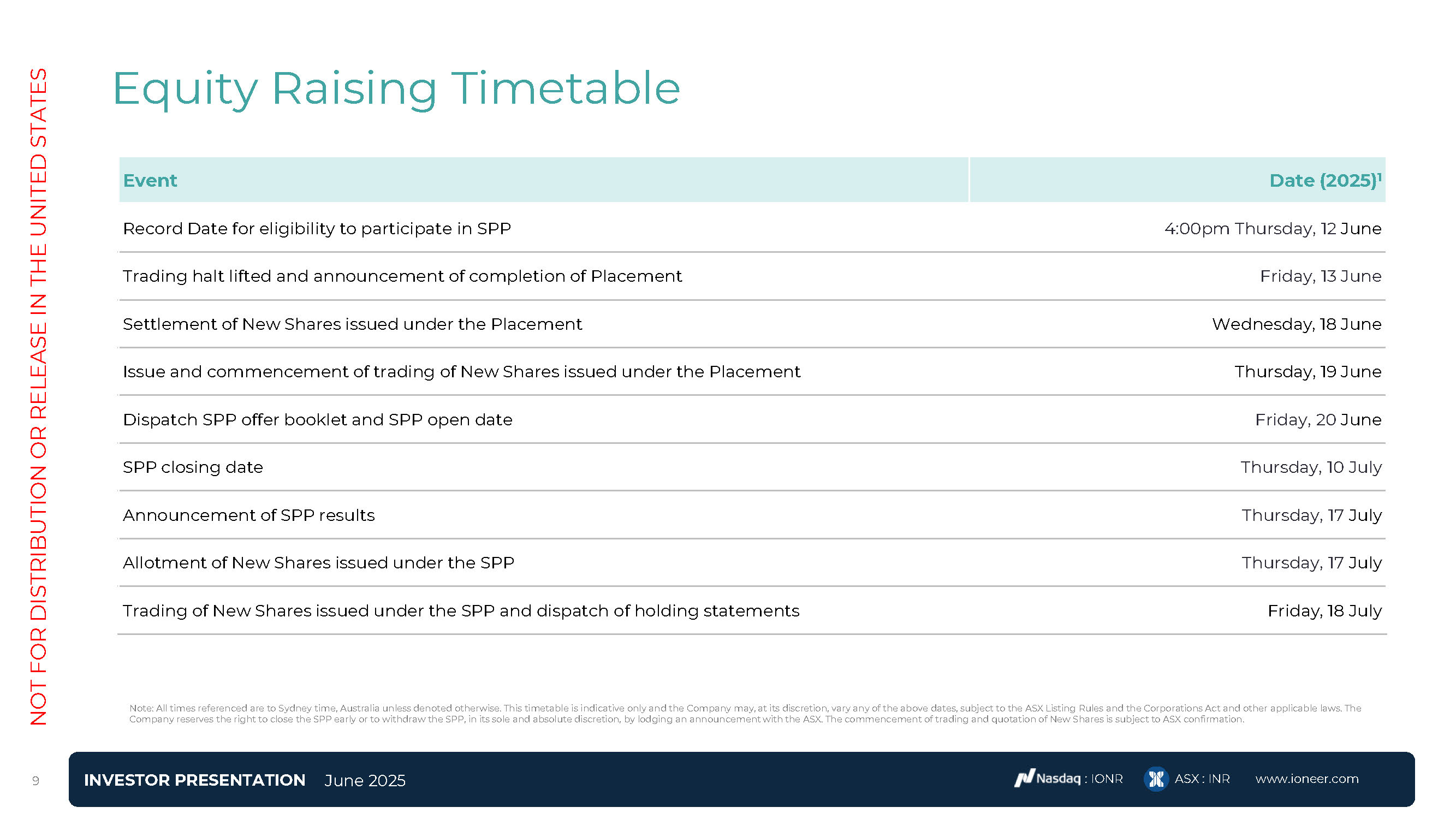

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 7 Equity Raising Timetable Event Date (2025)1 Record Date for eligibility to participate in SPP 4:00pm Thursday, 12 June Trading halt lifted and announcement of completion of

Placement Friday, 13 June Settlement of New Shares issued under the Placement Wednesday, 18 June Issue and commencement of trading of New Shares issued under the Placement Thursday, 19 June Dispatch SPP offer booklet and SPP open

date Friday, 20 June SPP closing date Thursday, 10 July Announcement of SPP results Thursday, 17 July Allotment of New Shares issued under the SPP Thursday, 17 July Trading of New Shares issued under the SPP and dispatch of holding

statements Friday, 18 July Note: All times referenced are to Sydney time, Australia unless denoted otherwise. This timetable is indicative only and the Company may, at its discretion, vary any of the above dates, subject to the ASX Listing

Rules and the Corporations Act and other applicable laws. The Company reserves the right to close the SPP early or to withdraw the SPP, in its sole and absolute discretion, by lodging an announcement with the ASX. The commencement of trading

and quotation of New Shares is subject to ASX confirmation.

10 Rhyolite Ridge Project Overview

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Corporate

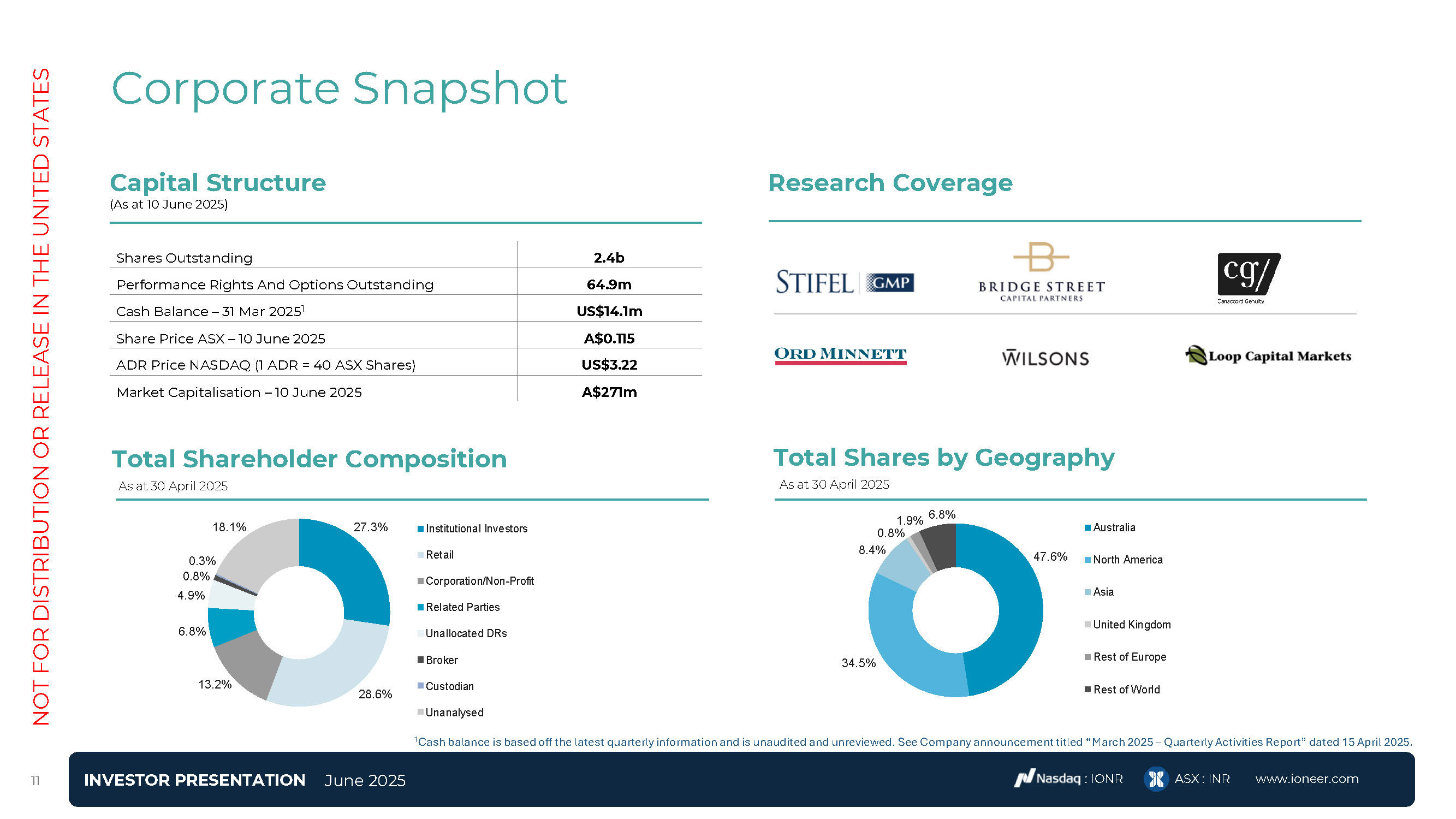

Snapshot Capital Structure (As at 10 June 2025) Shares Outstanding 2.4b Performance Rights And Options Outstanding 64.9m Cash Balance – 31 Mar 20251 US$14.1m Share Price ASX – 10 June 2025 A$0.115 ADR Price NASDAQ (1 ADR = 40 ASX

Shares) US$3.22 Market Capitalisation – 10 June 2025 A$271m Research Coverage Total Shareholder Composition As at 30 April 2025 Total Shares by Geography As at 30 April

2025 27.3% 28.6% 13.2% 6.8% 0.3% 0.8% 4.9% 18.1% Institutional Investors Retail Corporation/Non-Profit Related Parties Unallocated DRs Broker Custodian Unanalysed 1Cash balance is based off the latest quarterly information

and is unaudited and unreviewed. See Company announcement titled “March 2025 – Quarterly Activities Report” dated 15 April 2025. 47.6% 34.5% 1.9% 6.8% 0.8% 8.4% Australia North America Asia United Kingdom Rest of Europe Rest of

World INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 14

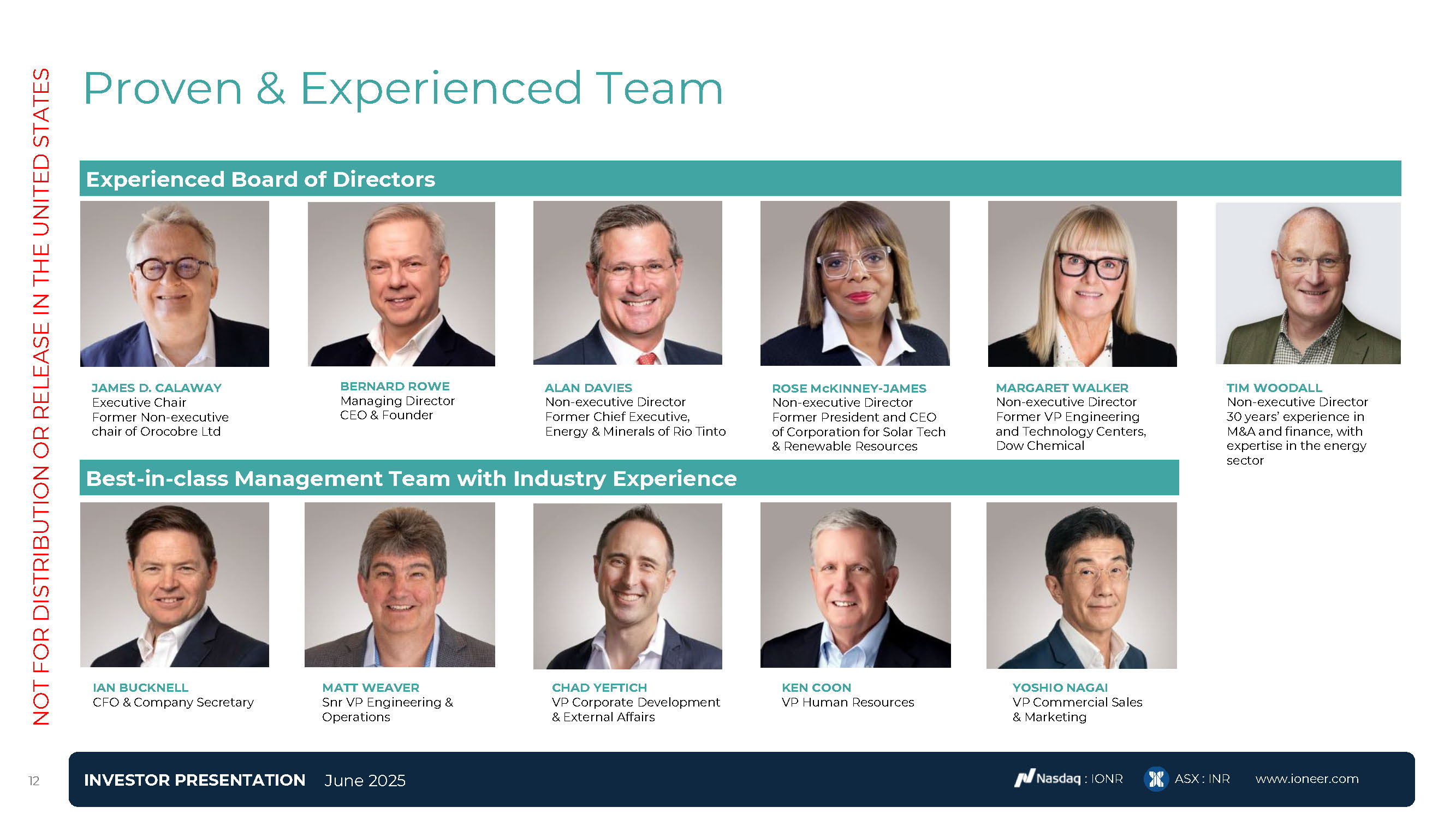

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Proven & Experienced

Team Experienced Board of Directors ALAN DAVIES Non-executive Director Former Chief Executive, Energy & Minerals of Rio Tinto ROSE McKINNEY-JAMES Non-executive Director Former President and CEO of Corporation for Solar Tech &

Renewable Resources JAMES D. CALAWAY Executive Chair Former Non-executive chair of Orocobre Ltd MARGARET WALKER Non-executive Director Former VP Engineering and Technology Centers, Dow Chemical TIM WOODALL Non-executive Director 30

years’ experience in M&A and finance, with expertise in the energy sector BERNARD ROWE Managing Director CEO & Founder Best-in-class Management Team with Industry Experience IAN BUCKNELL CFO & Company Secretary MATT

WEAVER Snr VP Engineering & Operations CHAD YEFTICH VP Corporate Development & External Affairs KEN COON VP Human Resources YOSHIO NAGAI VP Commercial Sales & Marketing INVESTOR PRESENTATION June 2025 : IONR ASX :

INR www.ioneer.com 14

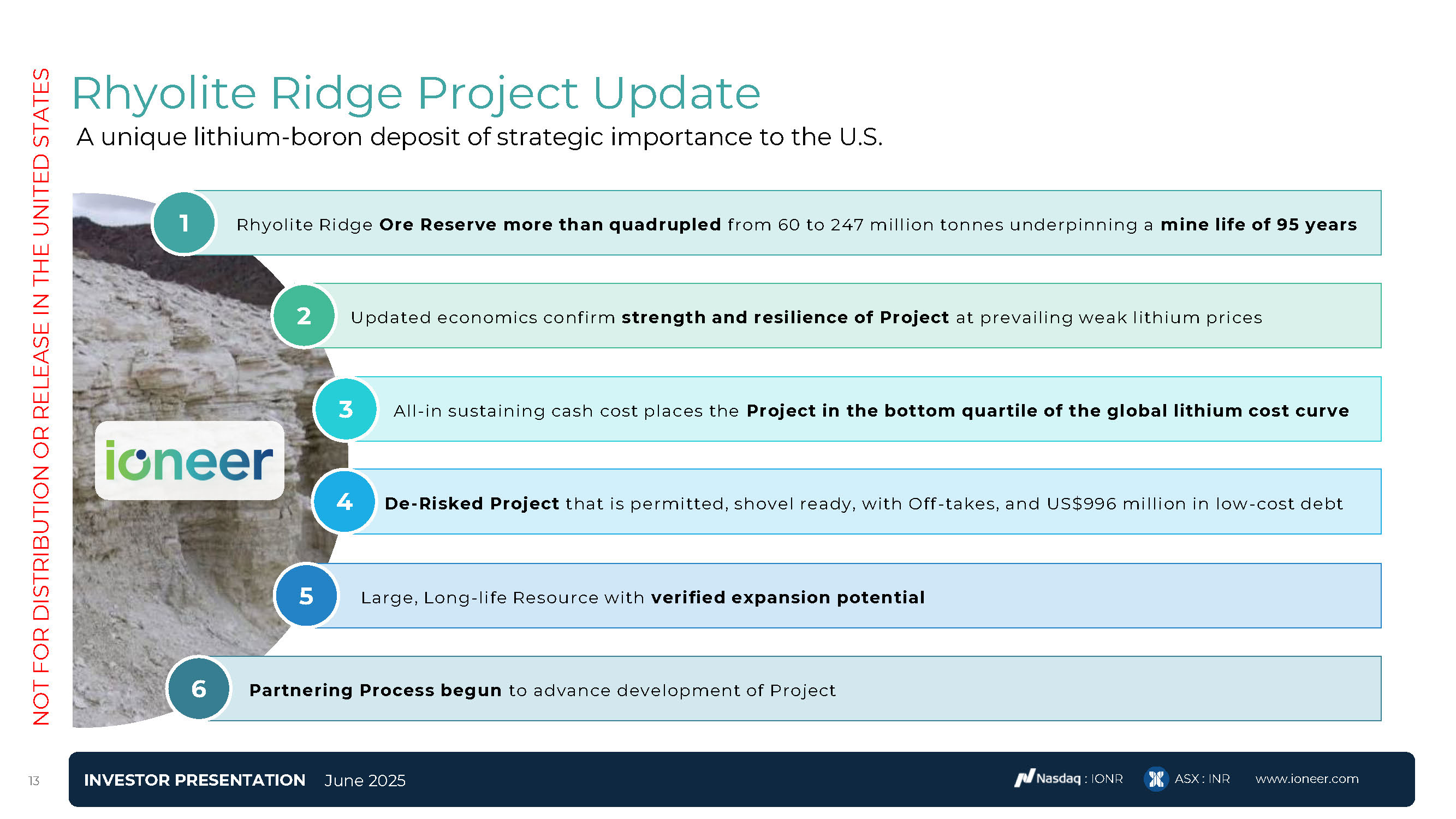

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Rhyolite Ridge Project

Update A unique lithium-boron deposit of strategic importance to the U.S. Rhyolite Ridge Ore Reserve more than quadrupled from 60 to 247 million tonnes underpinning a mine life of 95 years All-in sustaining cash cost places the Project in

the bottom quartile of the global lithium cost curve Large, Long-life Resource with verified expansion potential De-Risked Project that is permitted, shovel ready, with Off-takes, and US$996 million in low-cost debt 2 Updated economics

confirm strength and resilience of Project at prevailing weak lithium prices 3 4 5 6 Partnering Process begun to advance development of Project 1 INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 14

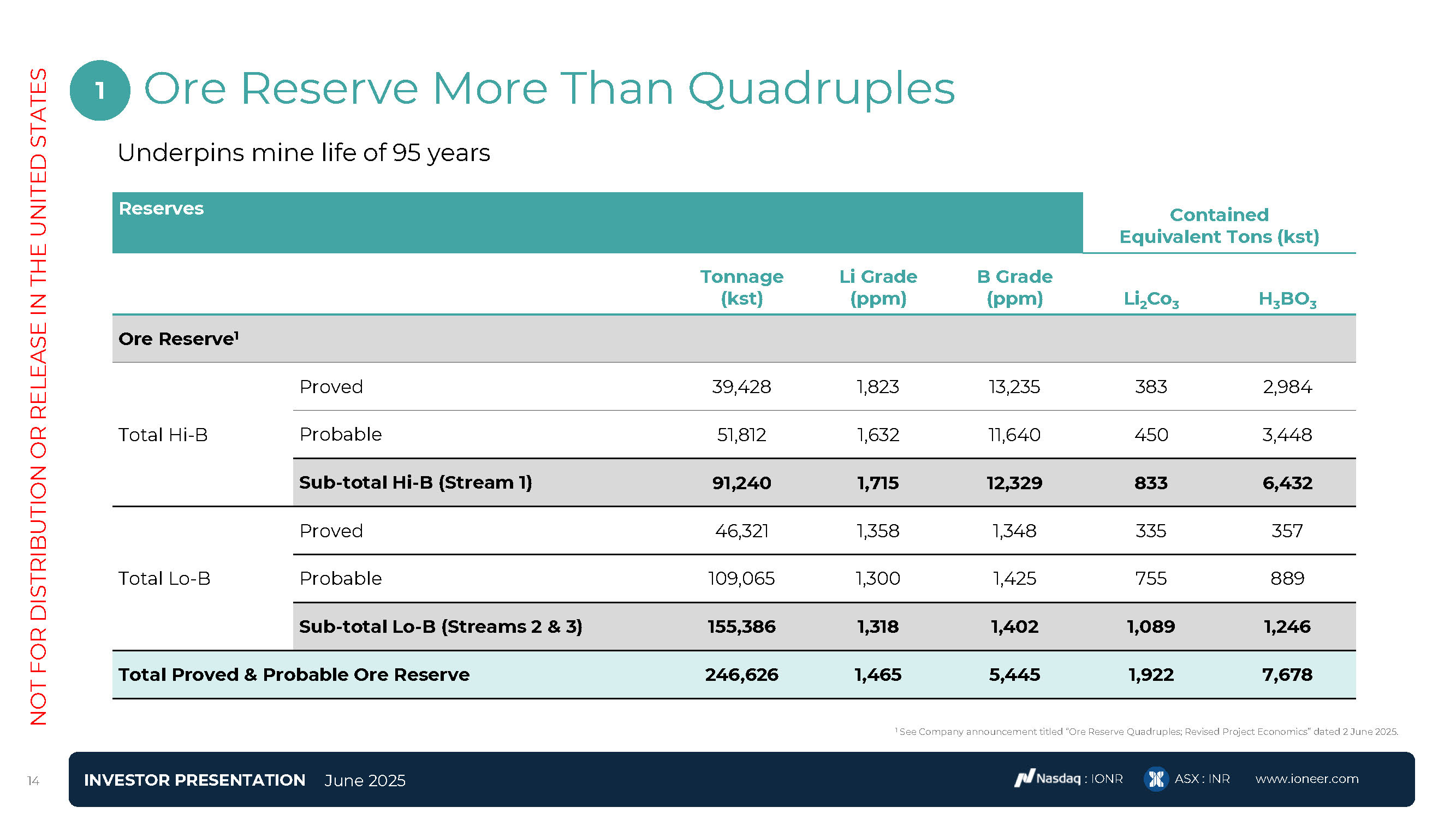

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Ore Reserve More Than

Quadruples 1 See Company announcement titled “Ore Reserve Quadruples; Revised Project Economics” dated 2 June 2025. Reserves Contained Equivalent Tons (kst) Tonnage (kst) Li Grade (ppm) B Grade (ppm) Li2Co3 H3BO3 Ore

Reserve1 Proved 39,428 1,823 13,235 383 2,984 Total Hi-B Probable 51,812 1,632 11,640 450 3,448 Sub-total Hi-B (Stream 1) 91,240 1,715 12,329 833 6,432 Proved 46,321 1,358 1,348 335 357 Total

Lo-B Probable 109,065 1,300 1,425 755 889 Sub-total Lo-B (Streams 2 & 3) 155,386 1,318 1,402 1,089 1,246 Total Proved & Probable Ore Reserve 246,626 1,465 5,445 1,922 7,678 1 INVESTOR PRESENTATION June 2025 :

IONR ASX : INR www.ioneer.com 14 Underpins mine life of 95 years

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Compelling Updated

Economics 2 INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 14 Key metrics of Current Update Current LOM Estimate Years 1-25 Unlevered NPV8 $1,367 million Levered NPV8 $1,469 million Avg. LOM Annual

Revenue $497 million $619 million Avg. Annual Lithium Production 18,800 tpa 21,200 tpa Avg. Annual Boric Acid Production 60,400 tpa 116,400 tpa Ore Reserves 246.6 Mt Life of Mine 95 years Average Annual EBITDA $319 million $406

million Capital Costs (AACE Class 2 estimate) $1,667.9 million Unlevered IRR 14.5% Levered IRR 18.3% Payback Period (from operations) 8.0 years Confidence Level P65 See Company announcement titled “Ore Reserve Quadruples; Reaffirms

Robust Project Economics” dated 2 June 2025.

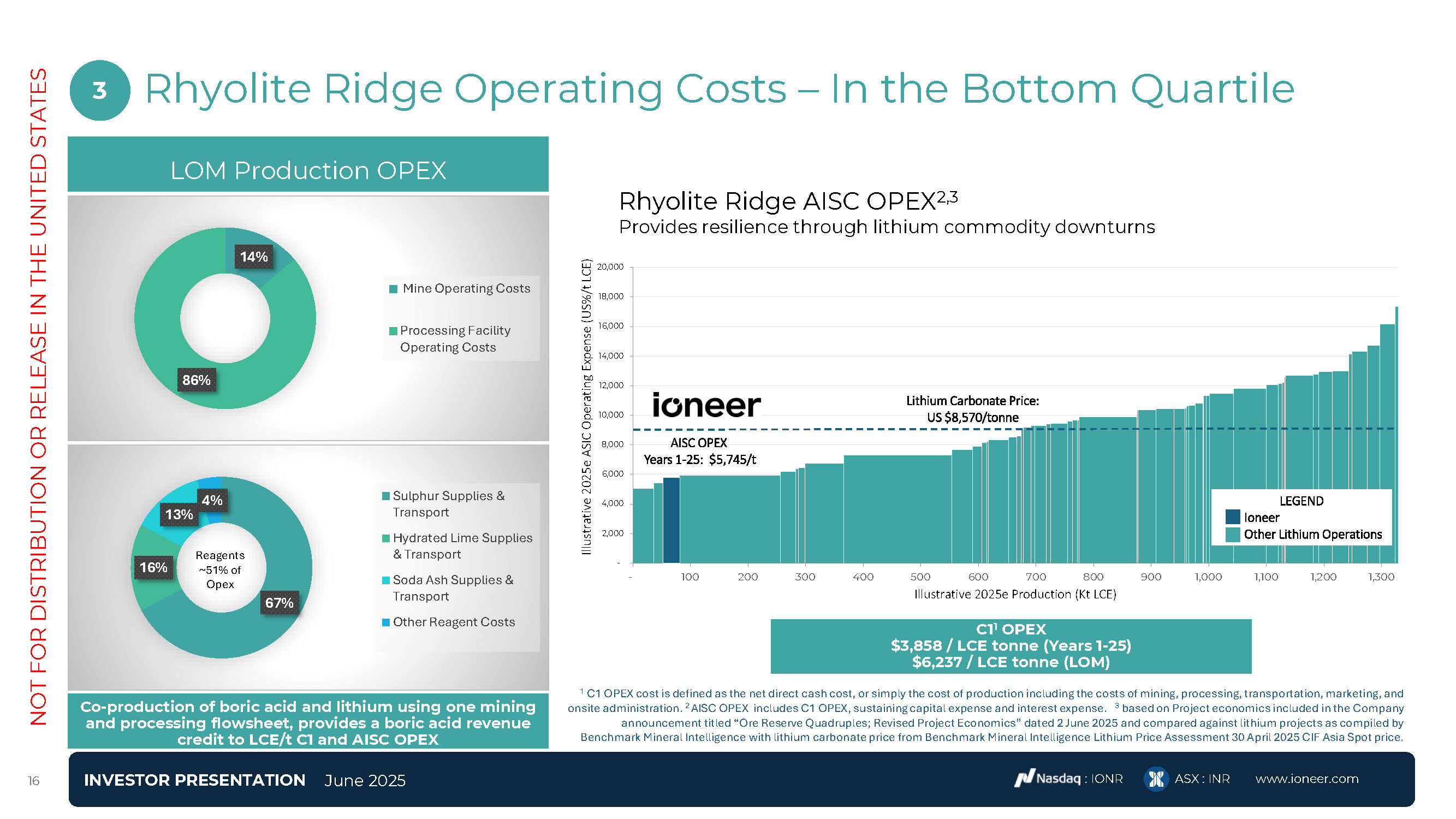

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Rhyolite Ridge Operating

Costs – In the Bottom Quartile 3 LOM Production OPEX 14% Mine Operating Costs Processing Facility Operating Costs 86% 4% Sulphur Supplies & 13% Transport Hydrated Lime Supplies Reagents & Transport 16% ~51% of Opex Soda

Ash Supplies & 67% Transport Other Reagent Costs Co-production of boric acid and lithium using one mining and processing flowsheet, provides a boric acid revenue credit to LCE/t C1 and AISC OPEX Rhyolite Ridge AISC OPEX2,3 Provides

resilience through lithium commodity downturns 1 C1 OPEX cost is defined as the net direct cash cost, or simply the cost of production including the costs of mining, processing, transportation, marketing, and onsite administration. 2 AISC

OPEX includes C1 OPEX, sustaining capital expense and interest expense. 3 based on Project economics included in the Company announcement titled “Ore Reserve Quadruples; Revised Project Economics” dated 2 June 2025 and compared against

lithium projects as compiled by - 2,000 4,000 6,000 8,000 10,000 20,000 18,000 16,000 14,000 12,000 - 100 200 300 400 500 600 700 800 Illustrative 2025e Production (Kt LCE) 900 1,000 1,100 1,200 1,300 Lithium Carbonate

Price: US $8,570/tonne AISC OPEX Years 1-25: $5,745/t LEGEND Ioneer Other Lithium Operations Illustrative 2025e ASIC Operating Expense (US%/t LCE) C11 OPEX $3,858 / LCE tonne (Years 1-25) $6,237 / LCE tonne (LOM) Benchmark Mineral

Intelligence with lithium carbonate price from Benchmark Mineral Intelligence Lithium Price Assessment 30 April 2025 CIF Asia Spot price. INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 16

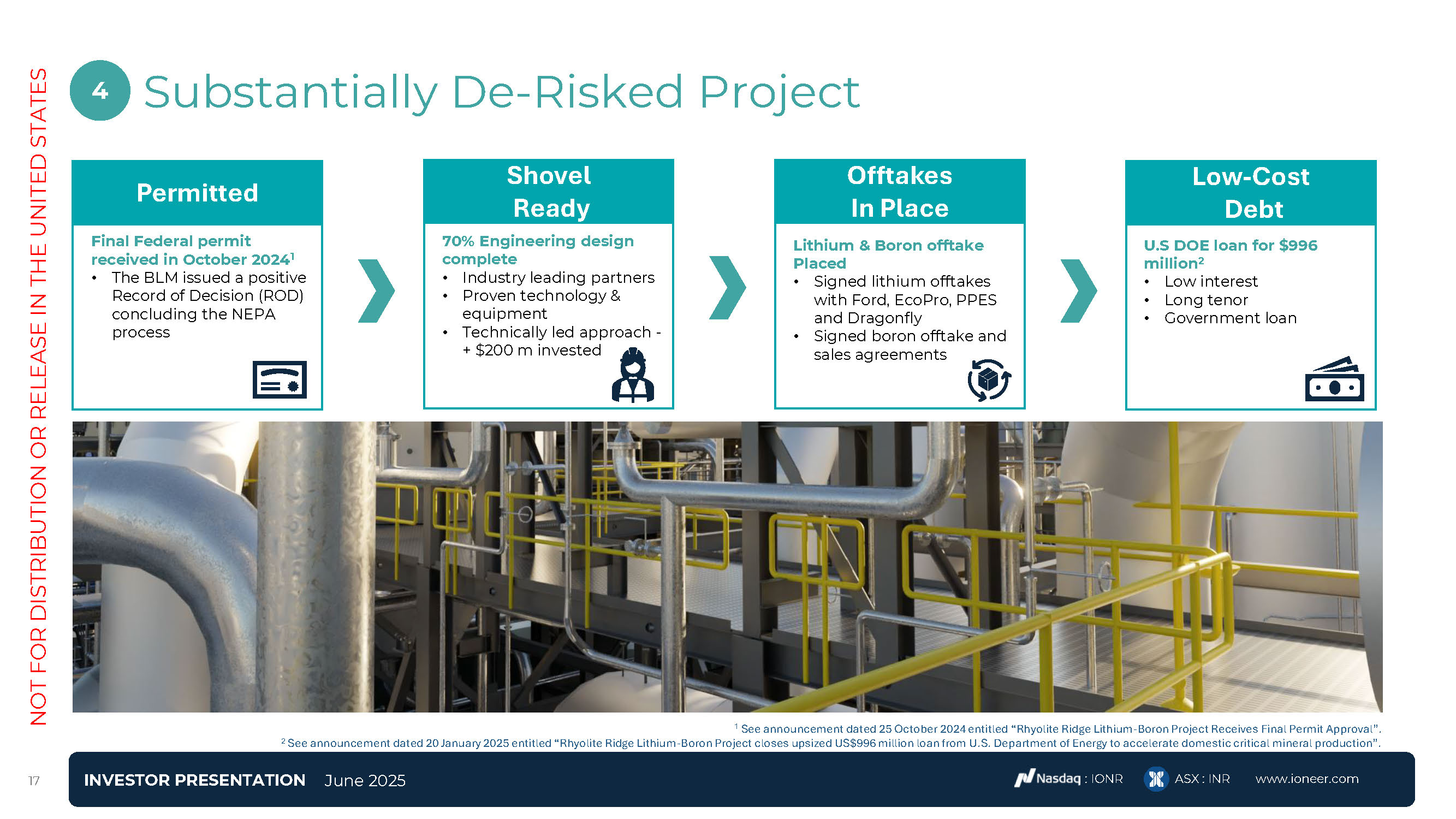

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Substantially De-Risked

Project 1 See announcement dated 25 October 2024 entitled “Rhyolite Ridge Lithium-Boron Project Receives Final Permit Approval”. 2 See announcement dated 20 January 2025 entitled “Rhyolite Ridge Lithium-Boron Project closes upsized US$996

million loan from U.S. Department of Energy to accelerate domestic critical mineral production”. Permitted Shovel Ready Offtakes In Place Low-Cost Debt 70% Engineering design complete Industry leading partners Proven technology

& equipment Technically led approach - + $200 m invested Lithium & Boron offtake Placed Signed lithium offtakes with Ford, EcoPro, PPES and Dragonfly Signed boron offtake and sales agreements U.S DOE loan for $996 million2 Low

interest Long tenor Government loan Final Federal permit received in October 20241 The BLM issued a positive Record of Decision (ROD) concluding the NEPA process 4 INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 17

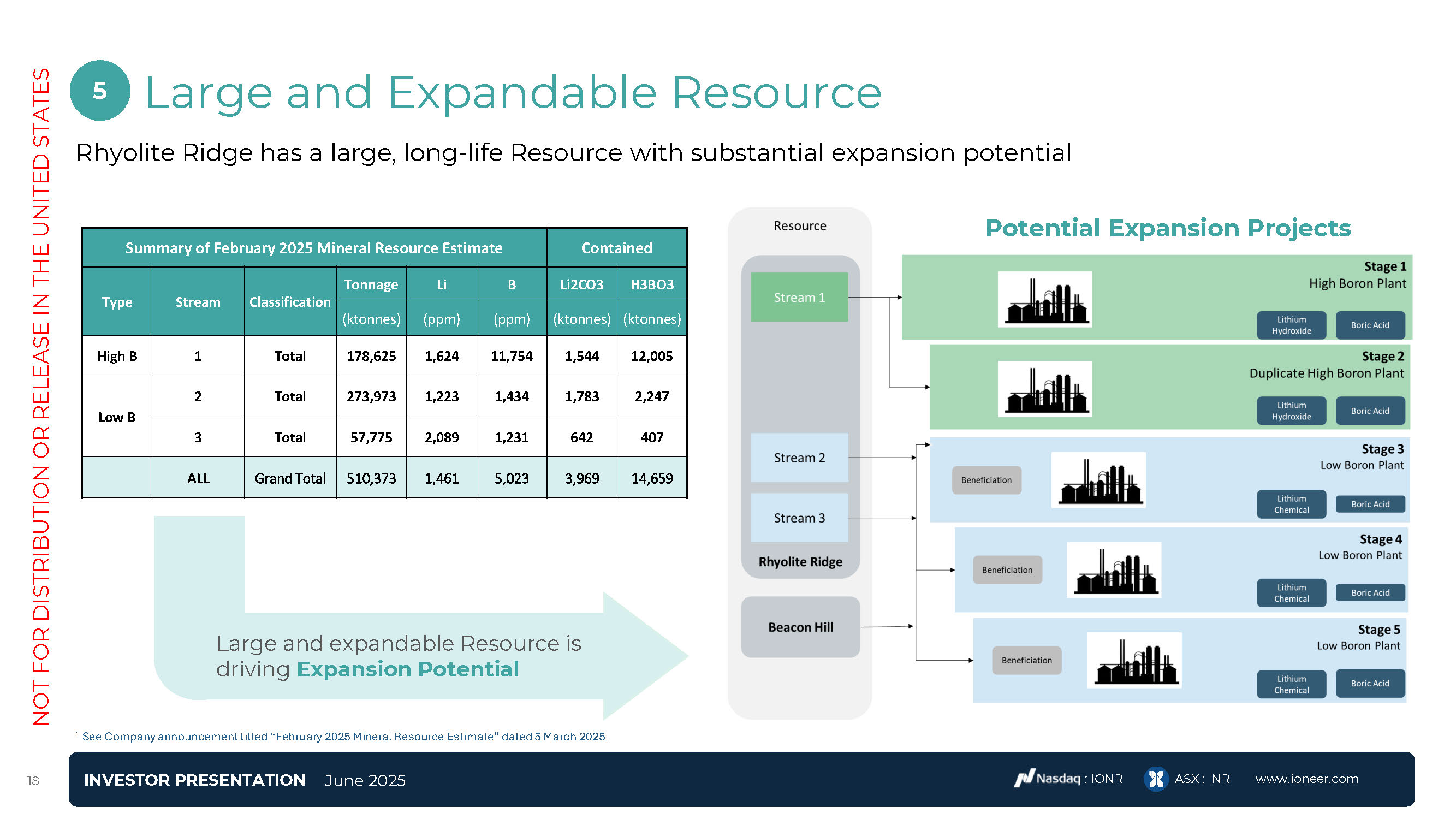

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Large and Expandable

Resource 1 See Company announcement titled “February 2025 Mineral Resource Estimate” dated 5 March 2025. Rhyolite Ridge has a large, long-life Resource with substantial expansion potential Potential Expansion Projects Large and expandable

Resource is driving Expansion Potential Summary of February 2025 Mineral Resource Estimate Contained Type Stream Classification Tonnage Li B Li2CO3 H3BO3 (ktonnes) (ppm) (ppm) (ktonnes) (ktonnes) High

B 1 Total 178,625 1,624 11,754 1,544 12,005 Low B 2 Total 273,973 1,223 1,434 1,783 2,247 3 Total 57,775 2,089 1,231 642 407 ALL Grand Total 510,373 1,461 5,023 3,969 14,659 5 INVESTOR PRESENTATION June 2025 :

IONR ASX : INR www.ioneer.com 20

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Status of Partnering

Process 6 Planning for a Strategic Partnering Process has begun INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 20 Goldman Sachs engaged to assist with the formal Strategic Partnering process We have relaunched a

strategic partnering process in search of a partner who can help accelerate the development of Rhyolite Ridge Activities to date have included updating a data room and preparing materials. Outreach is expected to commence in Q2 2025 The

process will be thorough and is expected to take a minimum of 4 months. Shareholders will be kept informed of progress on the process

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 20 1 All future dates subject to change without notice Secure equity financing to sit alongside U.S. Government debt ($996 M) Final Investment Decision once equity and debt are in

place Construction Phase. Expected to take approximately 36 months (including long lead items) First Production – 36 months from FID1 Pathway to future growth Rhyolite Ridge Next steps

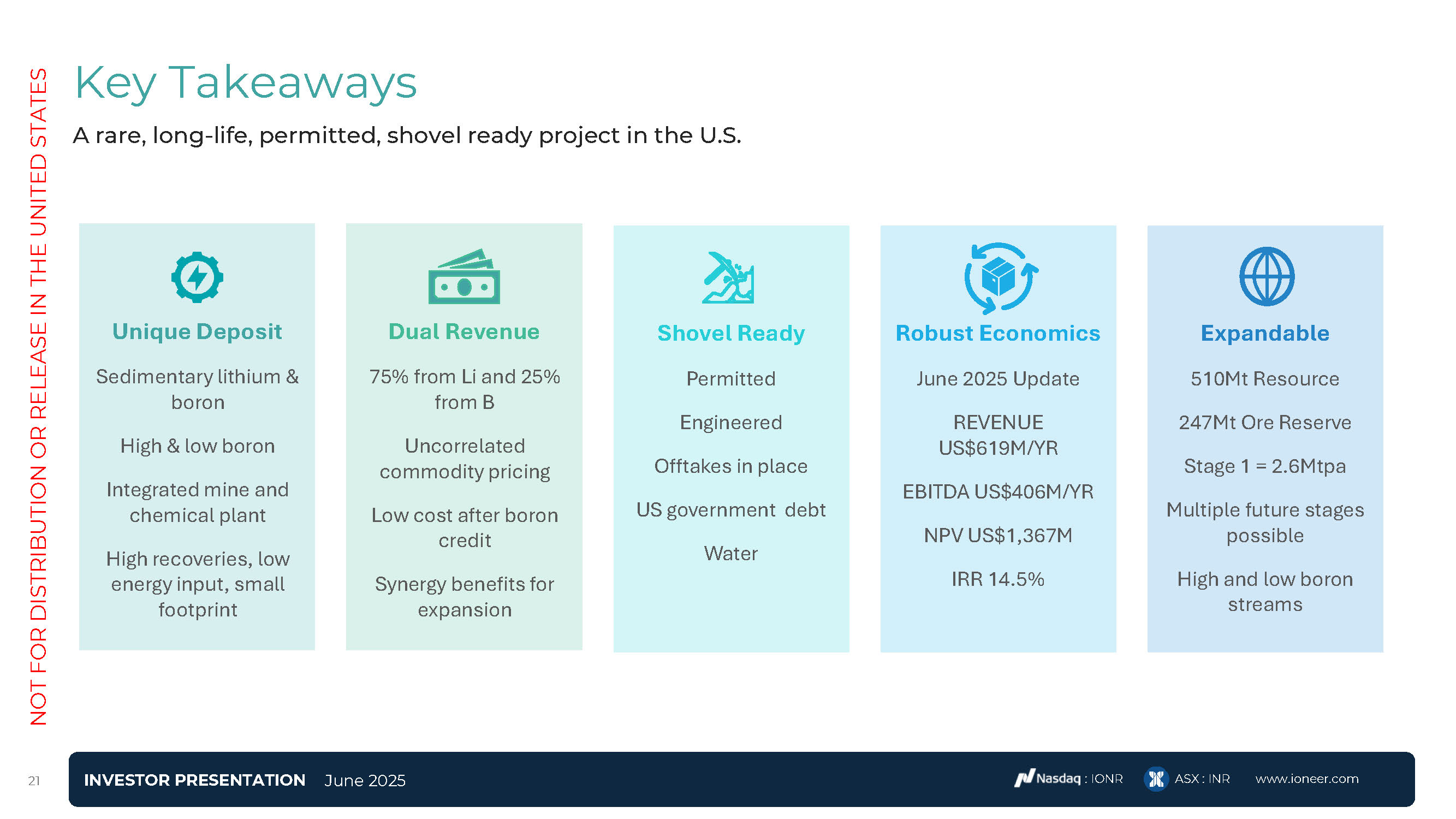

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Key Takeaways Shovel

Ready Permitted Engineered Offtakes in place US government debt Water Expandable 510Mt Resource 247Mt Ore Reserve Stage 1 = 2.6Mtpa Multiple future stages possible High and low boron streams Robust Economics June 2025 Update REVENUE

US$619M/YR EBITDA US$406M/YR NPV US$1,367M IRR 14.5% Dual Revenue 75% from Li and 25% from B Uncorrelated commodity pricing Low cost after boron credit Synergy benefits for expansion Unique Deposit Sedimentary lithium &

boron High & low boron Integrated mine and chemical plant High recoveries, low energy input, small footprint A rare, long-life, permitted, shovel ready project in the U.S. INVESTOR PRESENTATION June 2025 : IONR ASX :

INR www.ioneer.com 20

Appendix A: Supporting Materials 22

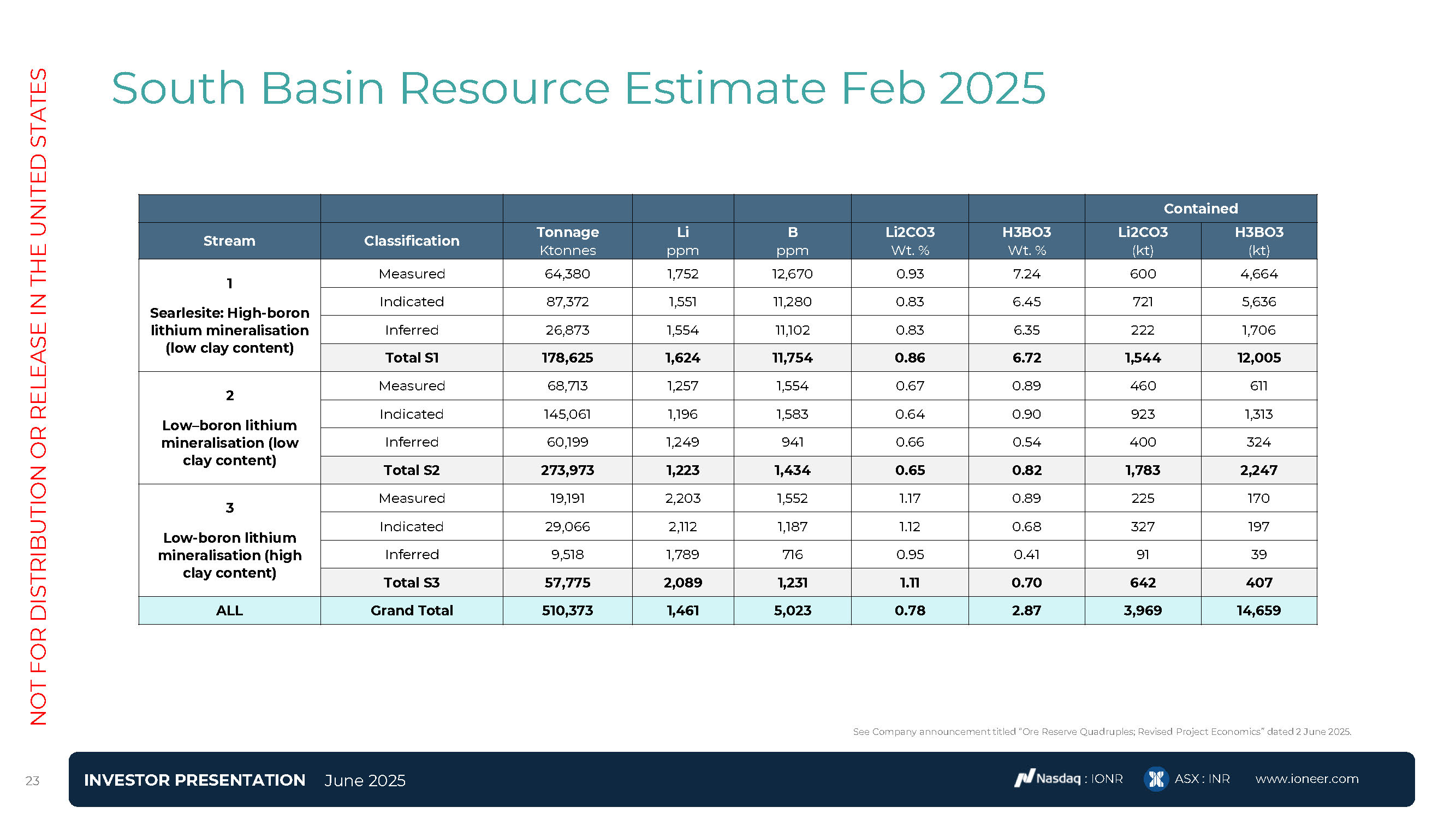

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 24 South Basin Resource Estimate Feb 2025 Contained Stream Classification Tonnage Ktonnes Li ppm B ppm Li2CO3 Wt. % H3BO3 Wt.

% Li2CO3 (kt) H3BO3 (kt) 1 Searlesite: High-boron lithium mineralisation (low clay

content) Measured 64,380 1,752 12,670 0.93 7.24 600 4,664 Indicated 87,372 1,551 11,280 0.83 6.45 721 5,636 Inferred 26,873 1,554 11,102 0.83 6.35 222 1,706 Total

S1 178,625 1,624 11,754 0.86 6.72 1,544 12,005 2 Low–boron lithium mineralisation (low clay

content) Measured 68,713 1,257 1,554 0.67 0.89 460 611 Indicated 145,061 1,196 1,583 0.64 0.90 923 1,313 Inferred 60,199 1,249 941 0.66 0.54 400 324 Total

S2 273,973 1,223 1,434 0.65 0.82 1,783 2,247 3 Low-boron lithium mineralisation (high clay

content) Measured 19,191 2,203 1,552 1.17 0.89 225 170 Indicated 29,066 2,112 1,187 1.12 0.68 327 197 Inferred 9,518 1,789 716 0.95 0.41 91 39 Total S3 57,775 2,089 1,231 1.11 0.70 642 407 ALL Grand

Total 510,373 1,461 5,023 0.78 2.87 3,969 14,659 See Company announcement titled “Ore Reserve Quadruples; Revised Project Economics” dated 2 June 2025.

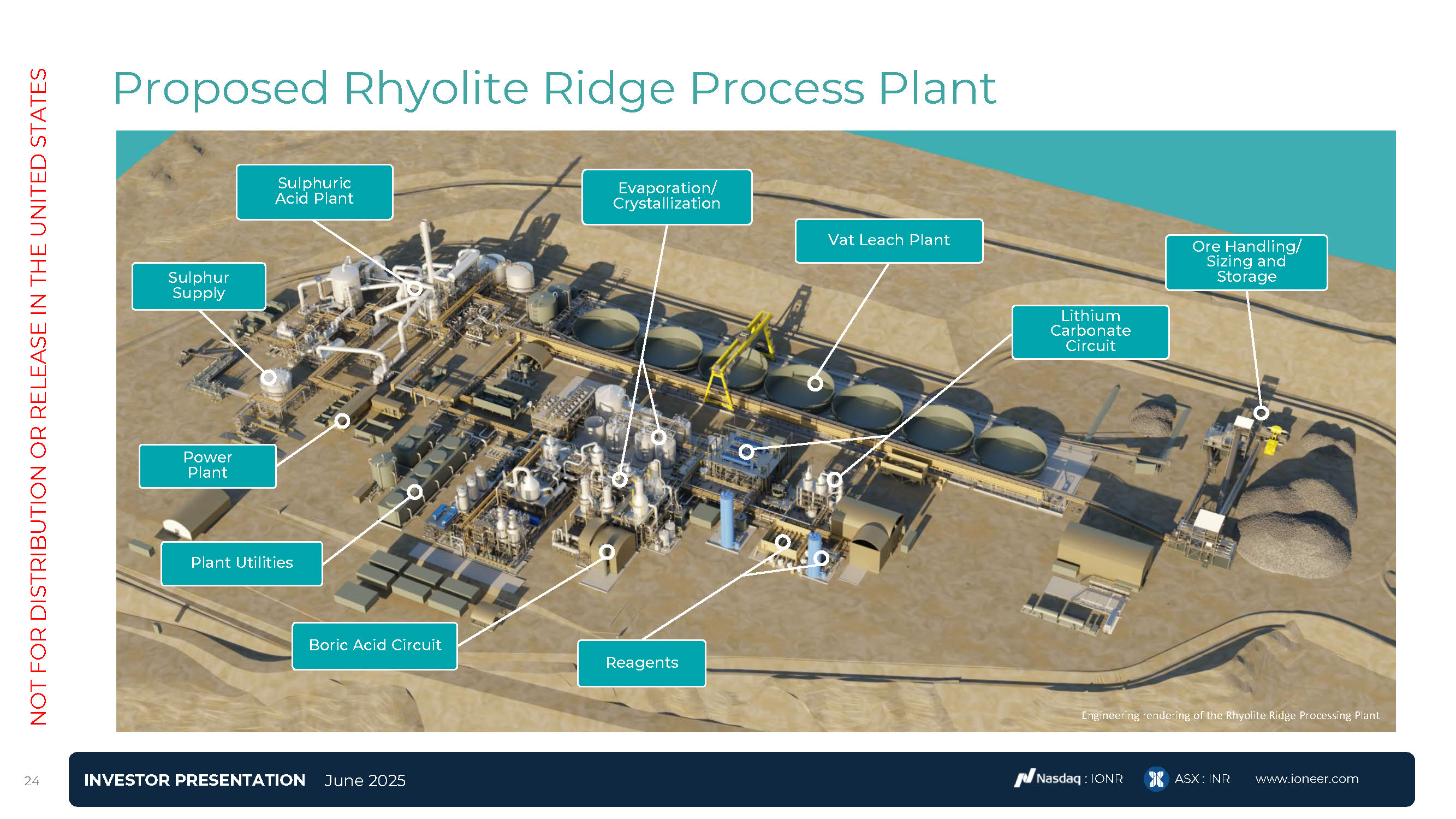

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Proposed Rhyolite Ridge

Process Plant Ore Handling/ Sizing and Storage Sulphuric Acid Plant Vat Leach Plant Sulphur Supply Power Plant Plant Utilities Boric Acid Circuit Reagents Lithium Carbonate Circuit Evaporation/ Crystallization Engineering rendering

of the Rhyolite Ridge Processing Plant INVESTOR PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 24

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES Commitment to

Sustainability Designed to minimise impact on the environment Majority of on-site power from CO2- free energy production, low greenhouse gas emissions. Mobile equipment meets Tier 4 EPA standards Project design implements best-in- class

water utilization while recycling the majority of water usage. Expected to use 30x less water per tonne than existing U.S. production No evaporation ponds or tailings dam Generating all power on-site. Automation of mine haulage

equipment All baseline studies for EIS completed over 2 years. Ongoing commitment to the environment and the protection and conservation of Tiehm’s buckwheat Implementation of TSM1 ESG program Low Emissions INVESTOR PRESENTATION June

2025 : IONR ASX : INR www.ioneer.com 24 Low Water Usage Small Mine Footprint Efficient Equipment Commitment to Sustainability 1. Towards sustainable mining

26 Appendix B: Key Risks

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 30 Key Risks There are a number of factors, specific to the Company and of a general nature, which may affect the future operating and financial performance of the Company, the

Rhyolite Ridge Lithium-Boron Project ("Project") and the industry in which the Company operates. This section discusses some of the key risks associated with an investment in shares in the Company. These risks may affect the future operating

and financial performance of the Company and/or the Project and the value of the Company's shares. The risks set out below are not listed in order of importance and do not necessarily constitute an exhaustive list of all risks involved with

an investment in the Company. Before investing in the Company, you should consider whether this investment is suitable for you. Potential investors should consider publicly available information on the Company (such as that available on the

websites of the Company and ASX at: https://www.asx.com.au/markets/company/inr), carefully consider their personal circumstances and consult their professional advisers before making an investment decision. Additional risks and uncertainties

that the Company is unaware of, or that it currently considers to be immaterial, may also become important factors that adversely affect the Company’s operating and financial performance and the value of the Company's shares. You should note

that the occurrence or consequences of many of the risks described in this section are partially or completely outside the control of the Company, its directors and senior management. Further, you should also note that this section does not

purport to list every risk that the Company may have now or in the future. It is also important to note that there can be no guarantee that the Company will achieve its stated objectives or that any forward-looking statements or forecasts

contained in this Presentation will be realised or otherwise evaluated. All potential investors should satisfy themselves that they have a sufficient understanding of these matters, including the risks described in this section, and have

regard to their own investment objectives, financial circumstances and taxation position. Cooling off rights do not apply to the acquisition of New Shares. Rhyolite Ridge Lithium-Boron Project The Company intends to continue developing the

Project into a commercially viable mine and production facility. The development of the Project will require establishment of a minesite, construction of a processing plant, haulage road, ancillary infrastructure including an accommodation

camp, securing and maintaining adequate water supply including bore field access and licensing, pump and pipeline infrastructure, as well as a number of operating contracts, among other things. Whether a mineral deposit will be commercially

viable depends on a number of factors, including the size and grade of the mineral deposit, its proximity to infrastructure, market conditions for the sale of its minerals, the economics of operating infrastructure, processing methods and

costs, and government regulation. Like typical greenfield mining project developments of this nature, there are risks and uncertainties that are associated with the development of the Project, such as unexpected technical, geographical,

metallurgical, meteorological, geological, third-party access, community issues, or inclement weather. If they were to eventuate, these risks and uncertainties could result in the Company not achieving its development plans, or such plans

generating less revenue than expected, costing more than expected or taking longer to realise than expected. Any of these outcomes could have an adverse effect on the commercial viability of the Project and on the Company’s expected financial

and operating performance. Future milestones As the Company progresses the development of the Project, there are risks and uncertainties involved which could result in the Company not delivering on its anticipated timing for future

milestones. As announced on 25 October 2024, the Company received the formal Record of Decision ("ROD") from the Bureau of Land Management ("BLM"), following the issuance of the final Environmental Impact Statement ("EIS") by the BLM on 21

October 2024. Construction at the Project will begin following a Final Investment Decision ("FID"), which is subject to the Company's ability to secure a equity partner to help see the Project into production via the strategic partnership

process expected to be recommenced in Q2 of 2025 ("Strategic Partnership Process"). There can be no assurance that the Project will be determined to be economically viable, nor any certainty that the Company will make the FID to commence

construction. While Ioneer remains committed to the timelines for the Project indicated, there can be no assurances that future delays will not arise. In addition, the ability to achieve construction of the Project and production outcomes

will continue to remain subject to uncertainty and risk, including in relation to the making of the FID. Any of these outcomes could have an adverse effect on the Company’s expected financial and operating performance. Construction

risk Upon construction commencing, which is subject to completion of the Strategic Partnership Process and the FID being made, the Company and the Project will be subject to risks associated with construction of Stage 1 of the Project until

such time as practical completion of construction is achieved, and first production is achieved. Expected capital costs are based on the interpretation of resource data, feasibility studies that are undertaken, anticipated revenues and

operating costs and other factors that may prove to be inaccurate. Feasibility reports are inherently subject to uncertainty and there can be no assurance that actual costs will not be higher than anticipated. The ability to achieve the

planned construction timeline is subject to the risk of delay. The risk of delay also exposes the Project to the increased risk of higher construction costs. There are a variety of reasons why the Project may be subject to the risk of delay

including the need to place orders for items of equipment and material that may be subject to long lead times for delivery, supply chain issues (including as a result of, or in response to, US tariffs) affecting the availability of necessary

construction materials and the availability of labour and construction trades in the areas in which the Project is located. Capital costs may be affected by unexpected modifications to plant design, changes to estimates of non- fixed

components, delays in commissioning and sourcing financing.

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 30 Key Risks Higher than expected inflation rates generally, or specific to the mining industry in particular, could be expected to increase development and operating costs and

potentially reduce the value of future project developments. While, in some cases, such cost increases might be offset by increased selling prices or reduced operating costs, there is no assurance that this would be possible. To the extent

that such offset is not possible, this could adversely impact the Company's and the Project's financial performance. Since the preparation of AACE Class 3 cost estimates in 2020 there has been a material increase in the cost estimates for

the Project. This has been a feature of many mining projects under development in the global mining industry over that period. The Company's current cost estimates for the Project (AACE Class 2 cost estimates) will be replaced with updated

estimates ahead of the first draw-down under the DOE LPO Loan (refer to the funding risk below). Competition is intense for mining equipment, supplies, service providers and personnel for the development of mining projects. If qualified

construction services cannot be obtained at cost effective rates when required, the Company may need to procure these services from other sources leading to further delays and cost increases. Increases in construction and capital expenditure

costs will have a negative impact on the overall economic performance of the Project and may have an adverse effect on the Company's expected financial and operating performance. Production and operating estimates The Company has prepared a

range of target cash costs for the Project's operations. No assurance can be given by the Company that such targets will be achieved. Failure to achieve operating cost targets or material increases in costs could have an adverse impact on the

Company's future cash flows, profitability, results of operations and financial condition. Funding risk The Company's continued ability to operate the Project and its business and to effectively implement its business plan over time will

depend in part on its ability to raise funds for operations and growth activities. As announced on 20 January 2025, the Company has closed a US$996 million loan from the U.S. Department of Energy Loan Programs Office ("DOE LPO") via the

Advanced Technology Vehicles Manufacturing program to support the development of an off-site processing facility at the Project. The $996 million loan ($968 million principal and $28 million in capitalised interest) ("DOE LPO Loan") is a

$268 million increase in loan principal from the DOE LPO conditional loan commitment previously announced on 16 January 2023. Draw-downs under the DOE LPO Loan are subject to a number of conditions precedent, many of which are outside the

control of the Company, including that: equity funding be available for the Project; and The Company prepares updated cost estimates and projected economics to support the commercial viability of the Project, to support any additional

funding, and to form the basis of the making of a FID on the Project ("Project Model"). The preparation and finalisation of the Project Model is subject to many variables, including changes to cost estimates and future revenue, any of which

may be subject to material change before finalisation of the Project Model. The unit purchase and subscription agreement pursuant to which Sibanye-Stillwater Ltd ("Sibanye") agreed to provide Ioneer equity funding to help see the Project

into production ("UPSA") has been terminated as announced on 26 February 2025. Sibanye was not a signatory to the DOE LPO Loan. As such, termination of the UPSA will have no impact on the Company's ability to draw on the DOE LPO Loan once

conditions precedent have been satisfied. To the extent that the conditions precedent under the DOE LPO Loan are unable to be satisfied or waived, such funding will become unavailable to the Company and would require the Company to find

alternative funding sources. There can be no guarantee that the Company will be able to raise sufficient funding on acceptable terms, or at all, to fund the Project. Funding terms may also place restrictions on the manner in which the Company

conducts its business and impose limitations on the Company’s ability to execute on its business plan and growth strategies. An inability to obtain finance on acceptable terms, or at all, may cause, among other things, substantial delays in,

or prevent, the funding of the Project to FID, and in turn the development or operation of the Project. Further, to the extent that the Company cannot raise funding for the Project within its corporate structure through the issue of shares

or corporate debt, it may be required to raise funding at the Project level. If the Company's economic interest in the Project is reduced to below 50% that may impact the Company's management rights in connection with the operation of the

Project and thereby could have an adverse impact on the Company's future cash flows, profitability, results of operations and financial condition. Water sources Any restrictions on the Company’s ability to access water may adversely impact

the costs, production levels and financial performance of it and the Project's operations. There is no guarantee that the source of water the Company intends to utilise will support the Project’s water demands in relation to its sites and

operations or that access to water will otherwise remain uninterrupted. Any interruption to water access could adversely affect production and the Company’s ability to develop or expand projects and operations in the future. In addition,

there can be no assurance that the Company will be able to obtain alternative water sources on commercially reasonable terms or at all in the event of prolonged drought conditions or other interruptions to existing water access arrangements.

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 30 Key Risks Reserves and Resources On 2 June 2025, ioneer announced a 308% increase in the Rhyolite Ridge Ore Reserve to 247Mt, relative to the Ore Reserve announced in support

of the Rhyolite Ridge Definitive Feasibility Study (“DFS”) completed in April 2020. On 5 March 2025, ioneer announced a 45% increase in the Rhyolite Ridge Mineral Resource estimate to 510Mt (relative to the 30 April 2024 Resource update noted

below). On 30 April 2024, ioneer announced a Mineral Resource estimate of 351Mt. The 2025 Ore Reserve estimate is based on information compiled by Joseph McNaughton, a Competent Person who is a certified Professional Engineer (‘PE’) in the

US and is a registered professional engineer in the State of Arizona. Mr. McNaughton is a full-time employee of Independent Mining Consultants, Inc. (IMC) and is independent of Ioneer and its affiliates. Mr. McNaughton has sufficient

experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of

Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code 2012). Mr. McNaughton consents to the inclusion in the report of the matters based on his information in the form and context in which it appears The February 2025 Mineral

Resource estimate was compiled by Herbert E. Welhener, a Competent Person who is a Registered Member of the SME (Society for Mining, Metallurgy, and Exploration), and is a QP Member of MMSA (the Mining and Metallurgical Society of America).

Mr. Welhener is a full-time employee of Independent Mining Consultants, Inc. (IMC) and is independent of Ioneer and its affiliates. Mr. Welhener has sufficient experience that is relevant to the style of mineralisation and type of deposit

under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’ (JORC Code 2012). Mr.

Welhener consents to the inclusion in the report of the matters based on his information in the form and context in which it appears. The determination of Ore Reserve includes estimates and assumptions about a range of geological, technical

and economic factors including quantities, grades, production techniques, recovery rates, commodity prices and exchange rates. Changes in Ore Reserve impact the assessment of recoverability of exploration and evaluation assets. Estimates of

Ore Reserve and Mineral Resources are necessarily imprecise and depend to some extent on interpretations which may prove inaccurate or incorrect. No assurance can be given that the estimated Ore Reserve and Mineral Resources are accurate or

that the indicated level of lithium refined materials, carbonate, boric acid or any other mineral products will be achieved. Such estimates are largely based on interpretations of geological data obtained from drill holes and other sampling

techniques. Actual mineralisation or geological conditions may be different from those predicted. No assurance can be given that any or all of the Company’s Mineral Resources constitute or will be converted into Ore Reserve. Actual Ore

Reserve and Mineral Resources may differ from those estimated, which could have a positive or negative effect on the Company's financial performance. The Company is exposed to future commodity price risk. This risk arises from the Company's

activities that are directed at exploration and development of mineral commodities and may be impacted by the prevailing market price of commodities. The Company does not hedge its commodity price exposure. Commodity price fluctuations, as

well as increased production and capital costs, may render the Company’s Ore Reserves unprofitable for periods of time or may render Ore Reserves containing relatively lower grade mineralisation uneconomic. Estimated Ore Reserves may have to

be recalculated based on actual production experience. Any of these factors may require the Company to reduce its Ore Reserves and Mineral Resources, which could have a negative impact on the Company’s financial results and the expected

operating life of the Project. Mining companies in other countries may be required to report their mineral reserves and/or resources in accordance with other guidelines including applicable United States Securities and Exchange Commission

(“SEC”) rules on disclosure of mining operations (“SEC Mining Disclosure Rules”) in the United States. While the Company's reserve and mineral resource estimates may comply with the JORC Code, they may not comply with the relevant guidelines

in other countries, including SEC Mining Disclosure Rules. Therefore, the estimates of reserves and resources included in the information that the Company is required to file under the ASX Listing Rules may differ from reserves and resources

estimated using SEC Mining Disclosure Rules and may not be comparable to other issuers that report reserves under SEC Mining Disclosure Rules. Community relations The Company’s mining activities may cause issues or concerns with the local

community in connection with, among other things, the potential effect on the environment, as well as other social impacts relating to employment, use of infrastructure and community development. A key risk to the Company's business and its

operations is the risk of losing the Company's social licence to operate through negative community, regulatory and other key stakeholder sentiment. Tiehm’s buckwheat (a plant growing on the land of the Project) is protected as an endangered

species under the Endangered Species Act and critical habitat has been designated in the Project area. The Project's Mine Plan of Operations ("Plan") has no direct impact on Tiehm's buckwheat and includes measures to minimise and mitigate for

indirect impacts within the designated critical habitat areas identified. The Plan was approved by BLM through the issue of the favourable ROD in October 2024 ("BLM Decision"). Later that same month, three non-governmental organisations, the

Center for Biological Diversity, Great Basic Resource Watch and the Western Shoshone Defense Project, filed a federal lawsuit against the BLM Decision. In November 2024, Ioneer filed a motion to intervene and join the US federal government in

its defence, which the court allowed in January 2025. Preliminary filings are expected to occur in late Q2 2025 (refer to the litigation risk below). Additional or new requirements for environmental protection of flora and fauna may have an

adverse effect on the Company's and the Project's expected financial and operating performance During Q1 of 2025, the Company completed a comprehensive development agreement with Esmerelda County ("Development Agreement"). Under the

Development Agreement, the Company will provide benefits to local residents, including road access, improvements and maintenance, public safety resources and local hiring and recruitment programs.

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 30 Key Risks The Development Agreement is divided into 3 phrases to coincide with the Project's planned construction and operations schedule and will become fully effective once

the County completes certain statutory procedures. While the Company understands these statutory procedures to be routine, there can be no assurance that the Development Agreement will become fully effective. Additionally, any delay in the

construction and operation of the Project may result in the Development Agreement being unable to be performed in accordance with its terms and/or terminated. The Project is located on BLM lands as well as private lands. No tribally-held

lands are located within the Project’s boundary. The Project’s region is within the ancestral territory of the Northern Paiute, who occupied an expansive area prior to Euro-American contact that spanned parts of Nevada, Oregon, and California

as well as the ancestral territory of the Western Shoshone, who historically resided in parts of Nevada, Utah, and Idaho. The Company has worked closely with several tribes in the region in a multi-year effort to better understand the tribes’

interests and to minimize, mitigate, and avoid impacts to any cultural resources and sites located within the Project’s boundaries. The Company undertook the voluntary measure of reaching an agreement with interested tribes on a

pre-construction tribal cultural resources monitoring plan. In addition, the Company worked closely with the BLM to ensure that all cultural resources consultation with the tribes was properly performed for purposes of Federal permitting.

While there can be no assurance that the tribes will agree with all permit requirements to address cultural resource impacts, there is no indication at present that the tribes will seek to legally challenge the Project. To date, only one

tribal advocacy organization called the Western Shoshone Defense Project has joined the federal litigation against the Project (refer to the litigation risk below), where no emergency injunctive relief has been sought. The Company continues

to engage with interested tribes and will abide by permit requirements protective of cultural resources as it proceeds to develop the Project. Operational risks Mining operations generally involve a high degree of inherent risk and

uncertainty. Such operations are subject to all the hazards and risks normally encountered in the exploration, development and production of lithium refined materials, boric acid and other mineral products, including unusual and unexpected

geologic formations, metallurgical recovery and other processing problems, industrial accidents, wall failure, seismic activity, rock bursts, cave-ins, flooding, fire, access restrictions, interruptions, inclement or hazardous weather

conditions and other conditions involved in the drilling, blasting and removal or processing of material, any of which could result in damage to, or destruction of, mines and other processing facilities, damage to life or property,

environmental damage and possible legal liability. The Company is further subject to all of the risks associated with establishing new mining, processing and haulage and transport operations including the timing and cost of the construction

of mining and processing facilities, the availability and costs of skilled labour and mining equipment, the need to obtain additional environmental and other governmental approvals and permits and the availability of additional funds if

required to further finance construction and development activities. Tax and customs risk The Company is subject to taxation and other import duties in Australia and the USA, as well as other jurisdictions in which the Company has

activities and investments. The entities established to undertake the Project will similarly be subject to taxation and other import duties, primarily in the US and the state of Nevada. Changes in taxation laws (including transfer pricings),

or changes in the interpretation or application of existing laws by courts or applicable revenue authorities (including as a result of, and in response to, US tariffs), may affect the taxation or customs treatment of the business activities

of the Company and the entities established to undertake the Project and adversely affect the Company’s financial condition. Further, there may be delays in processing tax or duty rebates or refunds for which the Company (or the Project

entities) has applied. Should it become unlikely that the Company (or the Project entities) will recover such rebates or refunds, this could also adversely affect the Company’s financial condition and require a reclassification of assets or

recognition of expenses in the Company’s accounts. Offtake agreements The Company has entered into binding offtake agreements and distribution and sales agreements for the supply of technical grade lithium carbonate and boric acid from the

Project. These agreements provide for variable pricing based on prevailing market prices and the performance of global benchmarks and period adjustments for pricing elements. The offtake agreements include conditions precedent relating to the

timing of the FID and first production. There can be no guarantee that the Company will be able to renegotiate these conditions precedent on acceptable terms should there be delays in the Project. There is a risk that the parties to the

agreements may not perform their respective obligations or may breach the agreements. Given the variable pricing mechanisms under the agreements, there is no guarantee that the Project will achieve its forecast rates of return under the

agreements. In addition, there is a risk that an offtake party may become insolvent or may not be able to meet its future buying or equity subscription obligations under the relevant agreement. Commodity prices and foreign exchange The

Project’s revenues will in time be exposed to fluctuations in the prices for the minerals it produces including the price of lithium refined materials and boric acid. Volatility in these prices creates revenue uncertainty and requires careful

management of business performance and cashflows. Lower prices can impact operations by requiring a reassessment of the feasibility of mine plans and certain projects and initiatives. Even if a project is ultimately determined to be

economically viable, the need to conduct such a reassessment could potentially cause substantial delays and/or may interrupt operations, which may have a material adverse effect on the Company’s results of operations and financial

condition. Lithium commodity prices have faced significant fluctuations in spot prices in recent years. Since the preparation of the DFS in April 2020, lithium carbonate prices have increased by approximately 13% from ~US$7,009/t lithium

carbonate to ~US$9,120/t lithium carbonate in April 2025. During the period, the price increased to $81,000/t in December 2022 during a supply deficit and decreased as supply outpaced demand. Similarly, boric acid prices have increased by

approximately 30% to an average of ~US$848/t or a price between US$750-$1,200/t in April 2025. . 1 Wood Mackenzie 2020 historic price. 2 Fastmarkets spot April average price (BG Li2CO3). 3 Based on INR internal study on trade statistics,

customer and distributor interviews, China Association data, etc. using CIF or DDP prices

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 30 Key Risks The factors which affect the price for refined lithium materials and boric acid (many of which are outside the control of the Company and its directors) include, among

many other factors, manufacturing activities; the quantity of global supply in lithium refined materials and boric acid as a result of the commissioning of new mines and the decommissioning of others; tariffs and trade policy in the US and

other jurisdictions in which the Company has activities and investments; political developments in countries which produce and consume material quantities of lithium refined materials and boric acid; the weather in these same countries;

stockpiling and the timing of release from stockpiles in some countries (particularly China); the price and availability of appropriate substitutes; advancements in technologies and the uses and potential uses of lithium refined materials and

boric acid, and the demand for the applications for which lithium refined materials and boric acid may be used; the grade and quality of lithium refined materials and boric acid produced; and sentiment or conditions in the countries and

sectors in which the Company and its business/commercial partners sell or intend to sell their products. Given the range of factors which contribute to the price of lithium refined materials and boric acid, and the fact that pricing is

subject to negotiation, it is particularly difficult for the Company to predict with any certainty the prices at which the Company will sell its product and accordingly, investors are cautioned not to place undue reliance on any price or

demand forecasts provided by the Company or by external analysts. Movements in currency exchange rates may affect the Company's cash flows, profitability, costs and revenue. It is not possible to accurately predict future movements in

exchange rates. As the Company moves into production it will consider hedging strategies to mitigate this risk. Contract and counterparty risk The ability of the Company to achieve its stated objectives will depend on the performance of

contractual counterparties. The Company and Project entities may enter into various agreements for the construction, development and operation of the Project (including the supply of equipment, construction services, diesel fuel supply,

contract mining and product handling and logistics). Should any of the risks associated with entering into these agreements materialise, this could have a material adverse impact on the Company’s profitability and financial performance. If

the Project counterparties default on the performance of their respective obligations, for example if an offtake counterparty defaults on payment or a supplier defaults on delivery, this may cause operational and financial detriment to the

Project and the Company and may require approaching a United States or other international court to seek enforcement or some other legal remedy, if no alternative settlement can be reached. Such legal action can be uncertain, lengthy and

costly. There is a risk that the Company or Project entities may not be able to seek the legal redress that it could expect under Australian law against a defaulting counterparty, or that a legal remedy will not be granted on satisfactory

terms. In addition, the sale of lithium refined materials and boric acid is subject to commercial verification and qualification processes to ensure any produced product meets the specifications for industrial supply required by customers

under any offtake and supply agreements. The qualification process may require approval from multiple parties in the supply chain and not just those parties with whom the Company or Project entities has contractual arrangements. Failure to

have the Project product qualified, or any unanticipated delay in qualifying the Project product, may adversely impact the Company’s financial performance and position (including by resulting in the Project generating less revenue or profit

than anticipated and/or incurring higher costs than anticipated). Competition The Company competes with other companies, including major mineral exploration and production companies. Some of these companies have greater financial and other

resources than the Company and, as a result, may be in a better position to compete for future business opportunities. Many of the Company’s competitors not only explore for and produce minerals but also carry out refining operations and

other products on a worldwide basis. There can be no assurance that the Company can compete effectively with these companies. Environmental risk The Project's operations and activities are subject to environmental laws and regulations. As

with all mining operations and exploration and development projects, the Project’s operations may substantially impact the environment or cause exposure to, or emission of, hazardous materials, which could result in substantial costs being

incurred for environmental risk management, rehabilitation and damage control. Further, environmental conditions may be attached to mining tenements and other permits and approvals, and a failure to comply with these conditions may lead to

their forfeiture. The Company is unable to predict the effect of additional or new environmental laws and regulations which may be adopted in the future, including whether any such laws or regulations would materially increase the Company’s

cost of doing business or affect its operations in any manner. In particular, tailings may be a potential environmental risk as (and if) the Project proceeds to production. Stockpiling of low-boron lithium is a key feature of Stage 1

development of the Project as processing options for this material are further evaluated. Management of tailings and low-grade stockpiled material involves a number of environmental risks that need to be managed as part of the

Project. Regulatory risk The Company’s and the Project's operations are dependent upon the grant, maintenance or renewal of appropriate licences, concessions, leases, permits and regulatory consents which may be withdrawn or made subject to

limitations or onerous conditions. Approvals, licences and permits required to comply with such rules may, in some instances, be subject to the discretion of the applicable government or government officials. No assurance can be given that

the Company will be successful in obtaining any or all of the various approvals, licences and permits required to conduct its business or that the Company will be able to maintain such authorisations in full force and effect without

modification or revocation. To the extent such approvals are required and not retained or obtained in a timely manner, or at all, the Company may be curtailed or prohibited from continuing or proceeding with production, development and

exploration activities.

NOT FOR DISTRIBUTION OR RELEASE IN THE UNITED STATES INVESTOR

PRESENTATION June 2025 : IONR ASX : INR www.ioneer.com 30 Key Risks The operations of the Company and the Project are subject to various laws and plans including those relating to mining, prospecting, development, permit and licence

requirements, industrial relations, environment, land use, royalties, water, native title and cultural heritage, land access, mine safety and occupational health. Amendments to current laws, regulations and permits, or a more stringent

implementation thereof, could have a material adverse impact on the Company and cause increases in exploration expenses, capital expenditures or production costs, reduction in levels of production at producing properties, or abandonment or

delays in development of new mining properties. Dependence on key management personnel The Company is dependent upon a number of key management personnel. The loss of the services of one or more of these personnel could have a material

adverse effect on the Company and there is no guarantee that the Company will be able to find an adequate replacement in a timely manner or at all. The Company’s ability to manage its operations, development and exploration activities, and

hence its success, will depend in large part on the efforts of these individuals. Government actions The Company’s and the Project's operations could be adversely affected by government actions in the United States or other countries or

jurisdictions in which it has operational exposures or investment or exploration interests. These actions include, but are not limited to, the introduction of or amendment to or changes in the interpretation of legislation, guidelines and

regulations in relation to mining and resources exploration and production, taxation, the environment, carbon emissions, competition policy and so on. Such actions could impact upon land access, the granting of licences and permits, the

approval of project developments and ancillary infrastructure requirements and the cost of compliance. The potential impact of the introduction of additional legislation, regulations, guidelines or amendments to existing legislation that

might affect the Company is difficult to predict. Any such government action may require increased capital commitments in order to ensure compliance or could delay or even prevent certain operations and/or activities of the Company and the

Project. Such actions could therefore have a material adverse effect on the Company’s financial condition. The Company’s and Project's business could be affected by new or evolving trade regulations and policy and international standards,

such as tariffs or controls on exports, prices and sanctions restricting or regulating trading with, or the sale or purchase of goods or products to or from, entities in the United States or other jurisdictions relevant to the business, any

of which could adversely impact the Company’s revenue and profitability. Labour risks The Company believes that all of it and the Project's operations have, in general, good relations with their employees. However, there can be no assurance

that the Company’s operations will not be affected by labour related problems in the future, such as disputes for pay raises, increased benefits, industrial actions or strikes etc. There are risks associated with staff, no matter where

located, acting out of their permitted authority and with contractors not acting in accordance with the Company’s policies. The Project will require a workforce of approximately 225 people to work across the mine and chemical processing

business. The local labour supply is limited in volume and skillset. The total population in the area is sparse with an older demographic and approximately 9,000 residents living within 1.5 hours of the Project. Labour assessments have

highlighted the small number of skilled craft workers residing in the area. Recruiting efforts will need to attract qualified candidates from the region and potentially beyond. The US labour market has been constrained for several years,

Unemployment for the US during 2024 was low at 4.1% and unemployment in mining extraction and chemical processing typically runs below the national average. Labour availability, particularly in heavy blue-collar industries such as mining and