http://fasb.org/srt/2024#ChiefExecutiveOfficerMember

EXHIBIT 99.1

EXPLANATORY NOTE

Starwood Real Estate Income Trust, Inc. is filing this exhibit (this “Exhibit”) to the Current Report on Form 8-K solely to recast reportable segment financial information and related disclosures included in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, originally filed with the Securities and Exchange Commission on March 21, 2025 (the “2024 Form 10-K”), to reflect changes implemented during the first quarter of 2025, as described in the Company's Quarterly Report on Form 10-Q for the period ended March 31, 2025. The information in this Exhibit is not an amendment to or restatement of the 2024 Form 10-K.

ITEM 1. BUSINESS

References herein to “Starwood Real Estate Income Trust,” “Company,” “we,” “us,” or “our” refer to Starwood Real Estate Income Trust, Inc., a Maryland corporation, and its subsidiaries unless the context specifically requires otherwise.

General Description of Business and Operations

We were formed on June 22, 2017 as a Maryland corporation and elected to be taxed as a real estate investment trust (“REIT”) for U.S. federal income tax purposes commencing with our taxable year ended December 31, 2019. We are organized to invest primarily in stabilized, income-oriented commercial real estate and debt secured by commercial real estate. Our portfolio is principally comprised of properties located in the United States and is diversified on a global basis through investments in properties outside of the United States, with a focus on Europe. To a lesser extent, we also invest in real estate debt, which could include loans secured by real estate and real estate-related securities. We are the sole general partner of Starwood REIT Operating Partnership, L.P., a Delaware limited partnership (the “Operating Partnership”). Starwood REIT Special Limited Partner, L.L.C. (the “Special Limited Partner”), a wholly owned subsidiary of Starwood Capital Group Holdings, L.P. (the “Sponsor”), owns a special limited partner interest in the Operating Partnership. Substantially all of our business is conducted through the Operating Partnership. We and the Operating Partnership are externally managed by the Advisor, an affiliate of the Sponsor.

Our board of directors has at all times had oversight and policy-making authority over us, including responsibility for governance, financial controls, compliance and disclosure with respect to the Operating Partnership. Pursuant to an advisory agreement among the Advisor, the Operating Partnership and us (the “Advisory Agreement”), we have delegated to the Advisor the authority to source, evaluate and monitor our investment opportunities and make decisions related to the acquisition, management, financing and disposition of our assets, in accordance with our investment objectives, guidelines, policies and limitations, subject to oversight by our board of directors.

As of December 31, 2024, we owned 461 consolidated real estate properties, 933 single-family rental units, two investments in unconsolidated real-estate ventures and one real estate debt investment. As of January 1, 2025, we operate in five reportable segments: Multifamily, Industrial, Office, Other and Investments in Real Estate Debt. Effective January 1, 2022, the Hospitality and Medical Office segments were combined within the Other segment and previous amounts have been recasted to conform with current period presentation. Effective January 1, 2025, the Single-Family Rental properties and Self-Storage properties segments were combined within the Other properties segment and previous amounts have been recasted to conform with current period presentation.

On December 27, 2017, we commenced our initial public offering of up to $5.0 billion in shares of common stock. On June 2, 2021, our initial public offering terminated and we commenced a follow-on public offering of up to $10.0 billion in shares of common stock. On August 10, 2022, our follow-on public offering terminated and we commenced our third public offering of up to $18.0 billion in shares of common stock, consisting of up to $16.0 billion in shares in our primary offering and up to $2.0 billion in shares pursuant to our distribution reinvestment plan. We intend to continue selling shares in our third public offering on a monthly basis.

As of March 21, 2025, we had received net proceeds of $14.1 billion from the sale of our common stock through our public offerings. We have contributed the net proceeds from our public offerings to the Operating Partnership in exchange for a corresponding number of Class T, Class S, Class D and Class I units. The Operating Partnership has primarily used the net proceeds to make investments in real estate, real estate debt and real estate-related securities.

In April 2024, we launched a program (the “DST Program”) to raise capital, through the Operating Partnership, through private placement offerings exempt from registration under the Securities Act of 1933, as amended (the “Securities Act”), by selling beneficial interests (the “DST Interests”) in specific Delaware statutory trusts (“DSTs”) holding real properties (the “DST Properties”). We expect that the DST Program will give us the opportunity to expand and diversify our capital-raising strategies by offering what we believe to be an attractive investment product for investors that may be seeking like-kind replacement properties to complete tax-deferred exchange transactions under Section 1031 of the Internal Revenue Code (the “Code”). Affiliates of the Advisor will receive fees in connection with the sale of the DST Interests and the management of the DSTs. We intend to use the net offering proceeds from the DST Program to make investments in accordance with our investment strategy and policies, reduce our borrowings,

repay indebtedness, fund the repurchase of shares under our share repurchase plan and for other corporate purposes. As of March 21, 2025, we have raised approximately $37.0 million in gross offering proceeds through the DST Program.

Investment Objectives

Our investment objectives are to invest in assets that will enable us to:

•provide current income in the form of regular, stable cash distributions to achieve an attractive distribution yield;

•preserve and protect invested capital;

•realize appreciation in NAV from proactive investment management and asset management; and

•provide an investment alternative for stockholders seeking to allocate a portion of their long-term investment portfolios to commercial real estate with lower volatility than public real estate companies.

We cannot assure you that we will achieve our investment objectives. See Item 1A. — “Risk Factors” section of this Annual Report on Form 10-K.

Review of our Policies

Our independent directors have reviewed our policies and determined that they are in the best interests of our stockholders. Set forth below is a discussion of the basis for such determination. In addition, our board of directors, including our independent directors, has examined the material terms, factors and circumstances surrounding any related party transactions or arrangements described herein. On the basis of such examination, our board of directors, including our independent directors, has determined that such transactions occurring in the year ended December 31, 2024 are fair and reasonable to us and on terms and conditions not less favorable to us than those available from unaffiliated third parties.

Investment Strategy

Our investment strategy seeks to capitalize on Starwood Capital’s scale and the real-time information provided by its real estate holdings to identify and acquire our target investments at attractive pricing. We also seek to benefit from Starwood Capital’s reputation and ability to transact in scale with speed and certainty, and its long-standing and extensive relationships in the real estate industry. Starwood Capital is a private investment firm with a primary focus on global real estate. Since its inception in 1991, Starwood Capital has raised over $80 billion of capital and currently has approximately $115 billion of assets under management. Our objective is to bring Starwood Capital’s leading real estate investment platform to income-focused investors.

Our investment strategy is primarily to acquire stabilized, income-oriented commercial real estate. Our portfolio is principally comprised of properties located in the United States and is diversified on a global basis through investments in properties outside of the United States, with a focus on Europe. To a lesser extent, and subject to the investment limitations described herein, we may also invest in real estate debt, including loans secured by real estate and real estate-related debt securities, and real estate-related equity securities. Our investments in real estate-related debt and equity securities provide us with current income, a source of liquidity for our share repurchase plan, cash management and other purposes.

We believe that our structure as a perpetual-life REIT will allow us to acquire and manage our investment portfolio in a more active and flexible manner. We do not have a pre-determined operational period or the need to provide a “liquidity” event, potentially in an unfavorable market, at the end of that period.

Investments in Properties

To execute our investment strategy, we invest primarily in stabilized, income-oriented commercial real estate. Our portfolio is principally comprised of properties located in the United States and is diversified on a global basis through investments in properties outside of the United States, with a focus on Europe. These may include multifamily, industrial, and office assets, as well as other property types, including, without limitation, single-family rental, self-storage, retail, medical office, student housing, senior living, data centers, and manufactured housing properties. We may also acquire assets that require some amount of capital investment in order to be renovated or repositioned. We generally will limit investment in new developments on a standalone basis, but we may consider development that is ancillary to an overall investment.

We do not designate specific sector allocations for the portfolio; rather we invest in markets or asset classes where we see the best opportunities that support our investment objectives.

Investments in Real Estate Debt

While our portfolio is principally comprised of properties, to a lesser extent, we may also invest in real estate debt, including loans secured by real estate and real estate-related debt securities. An allocation of our overall portfolio to real estate debt may allow us to add sources of income and further diversify our portfolio.

Our investments in loans secured by real estate may include first mortgages, subordinated mortgages and mezzanine loans, participations in such loans and other debt secured by or relating to the types of commercial real estate that are the focus of our real estate strategy. The type of real estate debt investments we seek to acquire are obligations backed principally by real estate of the type that generally meets our criteria for direct investment. Mortgage loans are typically secured by multifamily or commercial property and are subject to risks of delinquency and foreclosure. The ability of a borrower to repay a loan secured by an income-producing property typically is dependent primarily upon the successful operation of such property rather than upon the existence of independent income or assets of the borrower. Mezzanine loans may take the form of subordinated loans secured by a pledge of the ownership interests of either the entity owning the real property or an entity that owns (directly or indirectly) the interest in the entity owning the real property. These types of investments may involve a higher degree of risk than mortgage lending because the investment may become unsecured because of foreclosure by the senior lender. We do not intend to make loans to other persons or to engage in the purchase and sale of any types of investments other than those related to real estate.

We may also invest in real estate-related debt securities to provide us with current income and an additional source of liquidity for cash management, satisfying any stock repurchases we chose to make in any particular month and for other purposes. Our real estate-related debt securities investments may focus on investments in commercial mortgage-backed securities (“CMBS”) and, to a lesser extent, agency and non-agency residential mortgage-backed securities (“RMBS”) and collateralized loan obligations (“CLOs”).

Investments in Real Estate-Related Equity Securities

We also may invest in real estate-related equity securities investments, with a focus on non-controlling equity positions of public real estate-related companies, including preferred equity. We believe that investments in real estate-related equity securities may also provide an additional source of liquidity for cash management, satisfying any stock repurchases we chose to make in any particular month and for other purposes.

We do not intend that our investments in real estate-related debt and equity securities will require us to register as an investment company under the Investment Company Act, and we intend to generally divest appropriate securities before any such registration would be required. We may also invest, without limitation, in securities that are unregistered (but are eligible for purchase and sale by certain qualified institutional buyers) or are held by control persons of the issuer and securities that are subject to contractual restrictions on their resale.

Borrowing Policies

We use financial leverage to provide additional funds to support our investment activities. This allows us to make more investments than would otherwise be possible, resulting in a broader portfolio of investments. Subject to the limitation on indebtedness for money borrowed in our charter described below, our target leverage ratio is 50% to 65%. Our leverage ratio is measured by dividing (i) property-level and entity-level debt net of cash and loan-related restricted cash, by (ii) our gross real estate assets (measured using the greater of fair market value or cost) plus the equity in our real estate debt and real estate-related equity securities portfolios. For purposes of determining our gross real estate assets, we will include the asset values of the DST Properties due to the master lease structure, including the Operating Partnership’s fair market value option (the “FMV Option”). Our leverage ratio calculation does not include (i) indebtedness incurred in connection with funding a deposit in advance of the closing of an investment, (ii) indebtedness incurred as other working capital advances or (iii) the financing liability resulting from the sale of DST Properties included in our NAV calculation. Furthermore, the refinancing of any amount of existing indebtedness is not deemed to constitute incurrence of new indebtedness so long as no additional amount of net indebtedness is incurred in connection therewith (excluding the amount of transaction expenses associated with such refinancing).

Our real estate-related debt portfolio may have embedded leverage through the use of repurchase agreements. We may also have embedded leverage through the use of derivatives, including, but not limited to, total return swaps, securities lending arrangements and credit default swaps.

During times of increased investment and capital market activity, but subject to the limitation on indebtedness for money borrowed in our charter described below, we may employ greater leverage in order to quickly build a broader portfolio of assets. We may leverage our portfolio by assuming or incurring secured or unsecured property-level or entity-level debt. An example of property-level debt is a mortgage loan secured by an individual property or portfolio of properties incurred or assumed in connection with our acquisition of such property or portfolio of properties. An example of entity-level debt is a line of credit obtained by us or our Operating Partnership. We may decide to seek to obtain additional lines of credit under which we would reserve borrowing capacity. Borrowings under our

current lines of credit or any future lines of credit may be used not only to repurchase shares, but also to fund acquisitions or for any other corporate purpose.

Our actual leverage level is affected by a number of factors, some of which are outside our control. Significant inflows of proceeds from the sale of shares of our common stock generally cause our leverage as a percentage of our net assets, or our leverage ratio, to decrease, at least temporarily. Significant outflows of equity as a result of repurchases of shares of our common stock generally cause our leverage ratio to increase, at least temporarily. Our leverage ratio also increases or decreases with decreases or increases, respectively, in the value of our portfolio. If we borrow under a line of credit to fund repurchases of shares of our common stock or for other purposes, our leverage would increase and may exceed our target leverage. In such cases, our leverage may remain at the higher level until we receive additional net proceeds from our continuous offering or sell some of our assets to repay outstanding indebtedness.

Our board of directors reviews our aggregate borrowings at least quarterly. In connection with such review, our board of directors may determine to modify our target leverage ratio in light of then-current economic conditions, relative costs of debt and equity capital, fair values of our properties, general conditions in the market for debt and equity securities, growth and investment opportunities or other factors. We may exceed our targeted leverage ratio at times if the Advisor deems it advisable for us. For example, if we fund a repurchase under a line of credit, we will consider actual borrowings when determining whether we are at our leverage target, but not unused borrowing capacity. If, therefore, we are at a leverage ratio in the range of 50% to 65% of our gross real estate assets and we borrow additional amounts under a line of credit, or if the value of our portfolio decreases, our leverage could exceed the range of 50% to 65%. In the event that our leverage ratio exceeds our target, regardless of the reason, we will thereafter endeavor to manage our leverage back down to our target.

There is no limit on the amount we may borrow with respect to any individual property or portfolio. However, under our charter we may not incur indebtedness for money borrowed in an amount exceeding 300% of the cost of our net assets, which approximates borrowing 75% of the cost of our investments. “Net assets” is defined as our total assets other than intangibles valued at cost (prior to deducting depreciation, reserves for bad debts and other non-cash reserves) less total liabilities. However, we may borrow in excess of this amount if such excess is approved by a majority of our independent directors, and disclosed to stockholders in our next quarterly report, along with justification for such excess.

Our charter prohibits us from obtaining loans from any of our directors, Starwood Capital or any of their affiliates, unless approved by a majority of our board of directors (including a majority of our independent directors) not otherwise interested in the transaction as fair, competitive and commercially reasonable and on terms and conditions not less favorable than comparable loans between unaffiliated parties under the same circumstances.

Our Taxation as a REIT

We believe we have operated in a manner that has allowed us to be taxed as a REIT under Sections 856 through 860 of the Code, for federal income tax purposes, beginning with our taxable year ended December 31, 2019 and intend to continue to operate in a manner that will allow us to continue to qualify as a REIT. As long as we qualify for taxation as a REIT, we generally will not be subject to U.S. federal corporate income tax on our net taxable income (determined without regard to our net capital gain and dividends paid deduction) that we timely distribute to our stockholders. Even if we qualify for taxation as a REIT, we may be subject to certain state and local taxes, taxes imposed by foreign jurisdictions attributed to certain non-U.S. investments, taxes on our income and property, and federal income and excise taxes in certain circumstances, including on our undistributed taxable income.

We have formed certain subsidiaries to function as taxable REIT subsidiaries (“TRSs”). In general, a TRS may perform additional services for our tenants and generally may engage in any real estate or non-real estate-related business other than management or operation of a lodging facility or a health care facility. The TRSs are subject to taxation at the federal, state, local and foreign levels, as applicable. We will account for applicable income taxes by utilizing the asset and liability method. As such, we will record deferred tax assets and liabilities for the future tax consequences resulting from the difference between the carrying value of existing assets and liabilities and their respective tax basis. A valuation allowance for deferred tax assets is provided if we believe it is more likely than not that some or all of the deferred tax asset may not be realized.

Governmental Regulations

As an owner of real estate, our operations are subject, in certain instances, to supervision and regulation by U.S. and other governmental authorities, and may be subject to various laws and judicial and administrative decisions imposing various requirements and restrictions, which, include among other things: (i) federal and state securities laws and regulations; (ii) federal, state and local tax laws and regulations; (iii) state and local laws relating to real property; (iv) federal, state and local environmental laws, ordinances,

and regulations; and (v) various laws relating to housing, including permanent and temporary rent control and stabilization laws, the Americans with Disabilities Act of 1990 and the Fair Housing Amendment Act of 1988, among others.

Compliance with the federal, state and local laws described above has not had a material, adverse effect on our business, assets, results of operations, financial condition and ability to pay distributions, and we do not believe that our existing portfolio will require us to incur material expenditures to comply with these laws and regulations.

Competition

We face competition from various entities for investment opportunities in properties, including other REITs, pension funds, insurance companies, investment funds and companies, partnerships and developers. In addition to third-party competitors, other programs sponsored by the Advisor and its affiliates, particularly those with investment strategies that overlap with ours, may seek investment opportunities under Starwood Capital’s prevailing policies and procedures. Many of these entities may have greater access to capital to acquire properties than we have.

In the face of this competition, we have access to our Advisor’s and Sponsor’s professionals and their industry expertise and relationships, which we believe provide us with a competitive advantage and help us source, evaluate and compete for potential investments. We believe these relationships will enable us to compete more effectively for attractive investment opportunities. However, we may not be able to achieve our business goals or expectations due to the competitive risks that we face. For additional information concerning these competitive risks, see Item 1A. “Risk Factors—General Risks Related to Investments in Real Estate.”

Human Capital

We have no employees. Our operations are conducted by the Advisor. Our executive officers serve as officers of the Advisor, and are employed by an affiliate of the Advisor. See Item 13. “Certain Relationships and Related Transactions, and Director Independence—Our Relationship with Our Advisor and Starwood Capital.”

Conflicts of Interest

We are subject to conflicts of interest arising out of our relationship with Starwood Capital, including the Advisor and its affiliates. See Item 1A “Risk Factors—Risks Related to Conflicts of Interest.”

Available Information

Stockholders may obtain copies of our filings with the U.S. Securities and Exchange Commission (the “SEC”), free of charge from the website maintained by the SEC at www.sec.gov or from our website at www.starwoodnav.reit.

We are providing the address to our website solely for the information of investors. The information on our website is not a part of, nor is it incorporated by reference into this report. From time to time, we may use our website as a distribution channel for information about our Company. The information we post through this channel may be deemed material. Accordingly, investors should monitor this channel, in addition to following our press releases and SEC filings.

ITEM 7. MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

References herein to “Starwood Real Estate Income Trust, Inc.,” “Company,” “we,” “us,” or “our” refer to Starwood Real Estate Income Trust, Inc. and its subsidiaries unless the context specifically requires otherwise.

The following discussion should be read in conjunction with the consolidated financial statements and notes thereto appearing elsewhere in this Annual Report on Form 10-K. In addition to historical data, this discussion contains forward-looking statements about our business, operations and financial performance based on current expectations that involve risks, uncertainties and assumptions. Our actual results may differ materially from those in this discussion as a result of various factors, including but not limited to those discussed under Item 1A. “Risk Factors” in this Annual Report on Form 10-K.

Overview

We were formed on June 22, 2017 as a Maryland corporation to invest primarily in stabilized, income-oriented commercial real estate and debt secured by commercial real estate. Our portfolio is principally comprised of properties located in the United States and is diversified on a global basis through investments in properties outside of the United States, with a focus on Europe. To a lesser extent, we also invest in real estate debt, including loans secured by real estate and real estate-related securities. We are an externally advised, perpetual-life REIT. We own all or substantially all of our assets through the Operating Partnership, of which we are the sole general partner. We and the Operating Partnership are externally managed by the Advisor.

Our board of directors has at all times oversight and policy-making authority over us, including responsibility for governance, financial controls, compliance and disclosure. Pursuant to an advisory agreement among the Advisor, the Operating Partnership and us (the “Advisory Agreement”), we have delegated to the Advisor the authority to source, evaluate and monitor our investment opportunities and make decisions related to the acquisition, management, financing and disposition of our assets, in accordance with our investment objectives, guidelines, policies and limitations, subject to oversight by our board of directors.

We have elected to be taxed as a REIT under the Code for U.S. federal income tax purposes, commencing with our taxable year ended December 31, 2019. We generally will not be subject to U.S. federal income taxes on our taxable income to the extent we annually distribute all of our net taxable income (determined without regard to our net capital gain and dividends-paid deduction) to stockholders and maintain our qualification as a REIT.

Public Offerings

On December 27, 2017, we commenced our initial public offering of up to $5.0 billion in shares of our common stock. On June 2, 2021, our initial public offering terminated and we commenced our follow-on public offering of up to $10.0 billion in shares of common stock. On August 10, 2022, the follow-on public offering terminated and we commenced our third public offering of up to $18.0 billion in shares of common stock, consisting of up to $16.0 billion in shares in our primary offering and up to $2.0 billion in shares pursuant to our distribution reinvestment plan. We intend to continue selling shares in our third public offering on a monthly basis.

As of March 21, 2025, we had received net proceeds of $14.1 billion from the sale of our common stock through our public offerings. We have contributed the net proceeds from our public offerings to the Operating Partnership in exchange for a corresponding number of Class T, Class S, Class D and Class I units. The Operating Partnership has primarily used the net proceeds to make investments in real estate and real estate debt as further described below under “Portfolio”.

DST Program

In April 2024, we, through the Operating Partnership, commenced the DST Program to issue and sell up to a maximum aggregate offering amount of $1.0 billion of DST Interests in specific DSTs holding one or more DST Properties. These DST Interests will be issued and sold to “accredited investors,” as that term is defined under Regulation D promulgated by the SEC under the Securities Act, in private placements exempt from registration pursuant to Section 4(a)(2) of the Securities Act (the “DST Offerings”).

Under the DST Program, each DST Property may be sourced from our real properties or from third parties, which will be held in a DST are leased-back to a wholly owned subsidiary of the Operating Partnership on a long-term basis through January 2, 2031, unless sooner terminated pursuant to master lease agreements. Each master lease agreement will be guaranteed by the Operating Partnership, which will retain a FMV Option, giving it the right, but not the obligation, to acquire the DST Interests in the applicable DST from the investors in exchange for Operating Partnership units or cash, at the Operating Partnership’s discretion. Such FMV Option shall be exercisable any time after two years from the closing of the applicable DST Offering. The Operating Partnership, in its sole and absolute discretion, may assign its rights in the FMV Option to a subsidiary, an affiliate, a successor entity to the Operating Partnership or the acquiror of a majority of the Operating Partnership’s assets. After a one-year holding period, investors who acquire

Operating Partnership units pursuant to the FMV Option generally have the right to cause the Operating Partnership to redeem all or a portion of their Operating Partnership units for, at our sole discretion, shares of our common stock, cash, or a combination of both.

We expect that the DST Program will give us the opportunity to expand and diversify our capital-raising strategies by offering what we believe to be an attractive investment product for investors that may be seeking like-kind replacement properties to complete tax-deferred exchange transactions under Section 1031 of the Code. Affiliates of the Advisor are expected to receive fees in connection with the sale of the DST Interests and the management of the DSTs. We intend to use the net offering proceeds from the DST Program to make investments in accordance with our investment strategy and policies, reduce our borrowings, repay indebtedness, fund the repurchase of shares of all classes of our common stock under our share repurchase plan and for other corporate purposes.

As of December 31, 2024, we have raised approximately $25.8 million in gross offering proceeds through the DST Program.

Investment Objectives

Our investment objectives are to invest in assets that will enable us to:

•provide current income in the form of regular, stable cash distributions to achieve an attractive distribution yield;

•preserve and protect invested capital;

•realize appreciation in NAV from proactive investment management and asset management; and

•provide an investment alternative for stockholders seeking to allocate a portion of their long-term investment portfolios to commercial real estate with lower volatility than publicly traded real estate companies.

We cannot assure you that we will achieve our investment objectives. See Item 1A.“Risk Factors” section of this Annual Report on Form 10-K.

Recent Developments

2024 Performance

Through year-end 2024, our Class I shares delivered an inception-to-date annualized return of +6.8%. For the year ended December 31, 2024, performance for the Class I shares was +0.2%. For the fifth consecutive year, 100% of our distributions during the year ended December 31, 2024 were characterized as a Return of Capital (“ROC”) for federal income tax purposes. Our annualized distribution rate is 5.7% and equates to approximately 9.7% on a tax-equivalent basis for investors in the highest income tax bracket.

Performance for the year was impacted by interest rates, both positively and negatively. Short-term interest rates declined with the Federal Reserve’s three rate cuts beginning in September 2024. Lower rates, combined with a sense that the worst is behind us, led to lower credit spreads and overall borrowing costs. This helped to stabilize asset values. The offset to lower short-term rates was a negative impact to the mark-to-market value of our interest rate hedges, which are in-place to protect distributable cash flow. Excluding these hedges, our total net return for the year ended December 31, 2024, would have been +2.4%, underscoring the positive direction of real estate values.

Portfolio Update

While rent growth slowed throughout the year due to elevated supply deliveries, fundamentals in our portfolio remained solid. Revenue growth in our two largest reporting segments (rental housing and industrial) outperformed the top 50 markets average by nearly 3% on a combined basis. This outperformance was primarily driven by our unique affordable housing portfolio within rental residential (which benefits from inflation and wage indexed rents) and allocation to in-fill, last mile and infrastructure centric industrial investments (which experienced lower levels of new supply growth). Bigger picture, supply and demand fundamentals for rental housing continue to benefit from an estimated four to five million unit shortfall and industrial continues to benefit from the growth in e-commerce and the need to deliver products to consumers faster.

We believe our portfolio is strategically positioned, with 92% allocated to asset classes with strong long-term fundamentals, including rental housing, industrial, and a floating-rate real estate term loan. In addition, our assets are approximately 80% located in the sunbelt markets, which benefit from outsized long-term demand drivers including population growth, job growth, and superior affordability. Another 8% is invested internationally for diversification and high barriers to new supply.

Across our Consolidated Balance Sheet, we have emphasized downside protection with approximately 88% of our secured property debt currently being fixed-rate or hedged, and having three-and-a-half years of duration remaining. Due to an improving capital

markets environment, we are looking to be opportunistic in extending loan maturities and, in several cases, reducing credit spreads. For example, we recently successfully refinanced the $1.2 billion loan on our Extended Stay portfolio with a spread that is 110 bps inside previous levels, generating meaningful interest savings and increasing cash-on-cash yields. At present, our portfolio has an average cost of debt of approximately 3.8% with limited near-term loan maturities. The major challenge for most investors in this environment has maturing debt or unhedged interest rates, and we are well positioned from this perspective.

Outlook

As we look to 2025 and beyond, we expect to see continued cash flow growth due to several factors. Supply and demand fundamentals should continue to improve as new supply starts have declined 60-70% in multifamily and industrial. The realization of lower deliveries should begin to take hold in late 2025 and into early 2026. In the meantime, demand for multifamily apartments remains robust with national absorption levels near 20-year highs. Affordability continues to play a key factor in driving demand. Our average multifamily rent is nearly half that of the median U.S. mortgage payment. Wage growth has also outpaced rent growth, which has improved the rent-to-income of our portfolio and now stands at a very healthy 21%, providing room for future rent increases. Since affordable housing rents are formulaic (tied to inflation and wage growth) and a portion of our historical allowable rent increases have been deferred into the future, we have good visibility into continued mid-single-digit rent growth in 2025. Similarly, within our industrial portfolio, our releasing spreads were a positive 50% throughout 2024 and rents remain approximately 20% below market, which should also allow for continued cash flow growth as leases roll over the next several years.

Liquidity

We continue to prioritize generating liquidity for stockholders submitting share repurchase requests, while also staying focused on protecting and maximizing value for our stockholders who remain fully invested. This requires picking the right spots to generate liquidity as the markets continue to improve.

Our current liquidity stands at approximately $0.6 billion, representing approximately 6.8% of NAV. Through the end of February 2025, we have successfully executed select asset sales totaling approximately $0.8 billion on a gross basis. From a timing standpoint, our decision to wait for the first Fed rate cuts proved to be the right one. The capital markets between September 2024 and November 2024 provided an optimal three-month window for asset sales, as short-term rates declined and investor demand was strong. Fortunately, nearly all of our asset sales were either closed or were under contract before interest rate volatility and before the uncertainty of the new administration’s fiscal and trade policy took shape. Once these asset sales are finalized, we expect total liquidity to increase to approximately $0.9 billion, or approximately 10% of our NAV. We will continue to evaluate additional select asset sales and other strategic initiatives to strengthen liquidity throughout the year.

Please refer to Item 1A. “Risk Factors” in this Annual Report on Form 10-K for additional disclosure relating to material trends or uncertainties that may impact our business.

2024 Highlights

Operating Results:

•Declared monthly net distributions totaling $494.3 million for the year ended December 31, 2024. The details of the average annualized distribution rates and total returns are shown in the following table:

|

|

|

|

|

|

Class T |

Class S |

Class D |

Class I |

|

Shares |

Shares |

Shares |

Shares |

Average Annualized Distribution Rate |

4.8% |

4.8% |

5.6% |

5.7% |

Year-to-Date Total Return, without upfront selling commissions and dealer manager fees |

(0.6%) |

(0.7%) |

(0.1%) |

0.2% |

Annualized Inception-to-Date Total Return, without upfront selling commissions and dealer manager fees |

6.1% |

6.0% |

6.4% |

6.8% |

Annualized Inception-to-Date Total Return, assuming full upfront selling commissions and dealer manager fees |

5.5% |

5.4% |

6.1% |

N/A |

Disposition Activity:

•Sold seven industrial properties, two hotel properties, one net-lease property, and 83 single-family rental units for total net proceeds of $204.9 million during the year ended December 31, 2024.

Financing Activity:

•Received net borrowings of $454.5 million from our unsecured line of credit during the year ended December 31, 2024.

•Entered into a senior secured revolving credit facility agreement with a total borrowing capacity of $150.0 million during the year ended December 31, 2024. The senior secured revolving credit facility agreement matures in January 2026, at which time we may request an additional one-year extension thereafter. Interest under the senior secured revolving credit facility is determined based on one-month U.S. dollar denominated Secured Overnight Financing Rate (“SOFR”) plus 2.5%. During the year ended December 31, 2024, no amounts were borrowed under this senior secured revolving credit facility.

Portfolio

Summary of Portfolio

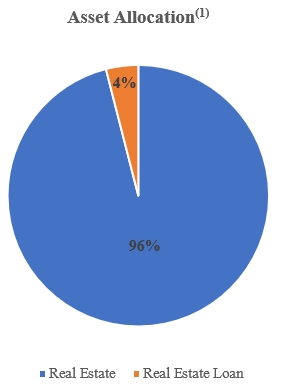

The following chart outlines the percentage of our assets across investments in real estate and our investment in a real estate loan based on fair value as of December 31, 2024:

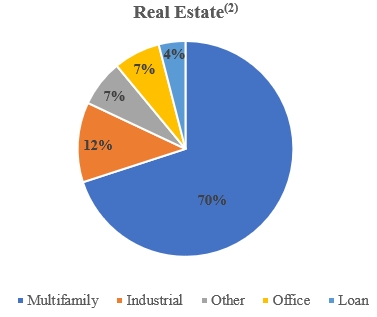

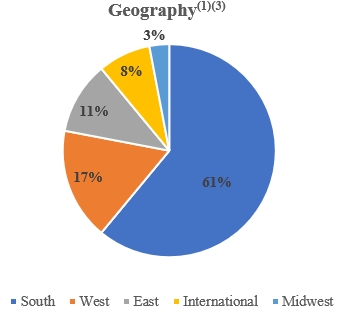

The following charts further describe the composition of our investments in real estate and our investment in a real estate loan based on fair value as of December 31, 2024:

(1)Investments in real estate includes our direct property investments and our unconsolidated investments. Our investment in a real estate loan includes our term loan.

(2)Includes our direct property investments, our unconsolidated investments and our investment in a term loan.

(3)Geography weighting includes our term loan. Geography weighting is measured as the asset value of real estate properties, unconsolidated real estate ventures, and our investment in a real estate loan for each geographical category against the total value of all (i) real estate properties, (ii) unconsolidated real estate ventures, and (iii) our investment in a real estate loan.

Investments in Real Estate

The following table provides a summary of our portfolio as of December 31, 2024 ($ in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment |

|

Number of

Consolidated

Properties |

|

Sq. Feet

(in millions)

/ Number of

Units/Keys |

|

Occupancy

Rate (1) |

|

Gross Asset Value (2) |

|

|

Segment

Revenue for the year ended December 31, 2024 |

|

|

Percentage of

Segment

Revenue |

Multifamily |

|

284 |

|

66,919 units |

|

95% |

|

$ |

16,065,200 |

|

|

$ |

1,233,802 |

|

|

73% |

Industrial |

|

124 |

|

17.18 sq. ft. |

|

96% |

|

|

2,833,370 |

|

|

|

183,907 |

|

|

11% |

Office |

|

20 |

|

3.90 sq. ft. |

|

90% |

|

|

1,530,364 |

|

|

|

166,798 |

|

|

10% |

Other Properties(3) (4) |

|

33 |

|

N/A (5) |

|

N/A |

|

|

1,121,867 |

|

|

|

103,278 |

|

|

6% |

Total |

|

461 |

|

|

|

|

|

$ |

21,550,801 |

|

|

$ |

1,687,785 |

|

|

100% |

(1)The occupancy rate for our multifamily investments is defined as the number of leased units divided by the total unit count as of December 31, 2024. The occupancy rate for our industrial and office investments is defined as all leased square footage divided by the total available square footage as of December 31, 2024.

(2)Based on fair value as of December 31, 2024.

(3)Includes a 100% interest in a subsidiary with 24 single-family rental units and a 95% interest in a consolidated joint venture with 909 single-family rental units.

(4)Excludes our investments in unconsolidated real estate ventures.

(5)Includes approximately 2.6 million sq. ft. across our self-storage, medical office and retail properties, 431 keys at our consolidated hospitality properties and 933 single-family rental units.

Average Effective Annual Base Rents

The following table provides a summary of the average effective annual base rents across our portfolio as of December 31, 2024:

|

|

|

|

|

|

Property Type |

|

Average Effective Annual

Base Rent per Leased

Square Foot / Units |

|

Multifamily(1) |

|

$ |

|

18,082 |

|

Industrial(2) |

|

$ |

|

7.42 |

|

Office(2) |

|

$ |

|

34.20 |

|

(1)For multifamily properties, average effective annual base rent per leased unit represents the annualized base rent for the year ended December 31, 2024. The average effective annual base rent includes the effects of rent concessions and abatements and excludes tenant recoveries, straight-line rent, and above-market and below-market lease amortization.

(2)For industrial and office properties, average effective annual base rent represents the annualized base rent per leased square foot for the year ended December 31, 2024. The average effective annual base rent includes the effects of rent concessions and abatements and excludes tenant recoveries, straight-line rent, and above-market and below-market lease amortization.

The following table provides information regarding our portfolio of real estate properties as of December 31, 2024:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment and Investment |

|

Number of

Properties |

|

Location |

|

Acquisition

Date |

|

Ownership

Interest (1) |

|

Sq. Feet

(in millions)

/ Number of

Units/Keys |

|

|

Occupancy(2) |

Multifamily: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida Multifamily Portfolio |

|

4 |

|

Jacksonville/Naples, FL |

|

January 2019 |

|

100% |

|

|

1,150 |

|

|

100% |

Phoenix Property |

|

1 |

|

Mesa, AZ |

|

January 2019 |

|

100% |

|

|

256 |

|

|

96% |

Columbus Multifamily |

|

3 |

|

Columbus, OH |

|

September/October 2019 |

|

96% |

|

|

690 |

|

|

96% |

Cascades Apartments(3) |

|

1 |

|

Charlotte, NC |

|

October 2019 |

|

79% |

|

|

570 |

|

|

87% |

Exchange on Erwin |

|

1 |

|

Durham, NC |

|

November 2019 |

|

100% |

|

|

265 |

|

|

87% |

Avida Apartments |

|

1 |

|

Salt Lake City, UT |

|

December 2019 |

|

100% |

|

|

400 |

|

|

94% |

Southeast Affordable Housing Portfolio |

|

22 |

|

Various |

|

Various 2020 |

|

100% |

|

|

4,384 |

|

|

95% |

Florida Affordable Housing Portfolio II |

|

4 |

|

Jacksonville, FL |

|

October 2020 |

|

100% |

|

|

958 |

|

|

93% |

Mid-Atlantic Affordable Housing Portfolio |

|

28 |

|

Various |

|

October 2020 |

|

100% |

|

|

3,660 |

|

|

96% |

Kalina Way(3) |

|

1 |

|

Salt Lake City, UT |

|

December 2020 |

|

79% |

|

|

264 |

|

|

98% |

Southeast Affordable Housing Portfolio II |

|

9 |

|

DC, FL, GA, MD, SC, VA |

|

May 2021 |

|

100% |

|

|

1,642 |

|

|

98% |

Azalea Multifamily Portfolio |

|

17 |

|

TX, FL, NC, MD, TN, GA |

|

June/July 2021 |

|

100% |

|

|

5,620 |

|

|

95% |

Keystone Castle Hills |

|

1 |

|

Dallas, TX |

|

July 2021 |

|

100% |

|

|

690 |

|

|

96% |

Greater Boston Affordable Portfolio |

|

5 |

|

Boston, MA |

|

August/September 2021 |

|

98% |

|

|

842 |

|

|

97% |

Columbus Preferred Portfolio |

|

2 |

|

Columbus, OH |

|

September 2021 |

|

96% |

|

|

400 |

|

|

96% |

The Palmer Dadeland |

|

1 |

|

Dadeland, FL |

|

September 2021 |

|

100% |

|

|

844 |

|

|

95% |

Seven Springs Apartments |

|

1 |

|

Burlington, MA |

|

September 2021 |

|

100% |

|

|

331 |

|

|

95% |

Maison’s Landing |

|

1 |

|

Taylorsville, UT |

|

September 2021 |

|

100% |

|

|

492 |

|

|

95% |

Sawyer Flats |

|

1 |

|

Gaithersburg, MD |

|

October 2021 |

|

100% |

|

|

648 |

|

|

95% |

Raleigh Multifamily Portfolio |

|

6 |

|

Raleigh, NC |

|

November 2021 |

|

95% |

|

|

2,291 |

|

|

93% |

SEG Multifamily Portfolio |

|

62 |

|

Various |

|

November 2021 |

|

100% |

|

|

15,461 |

|

|

93% |

South Florida Multifamily Portfolio |

|

3 |

|

Various |

|

November 2021 |

|

95% |

|

|

1,150 |

|

|

95% |

Florida Affordable Housing Portfolio III |

|

16 |

|

Various |

|

November 2021 |

|

100% |

|

|

2,660 |

|

|

96% |

Central Park Portfolio |

|

9 |

|

Denver, CO |

|

December 2021 |

|

100% |

|

|

1,445 |

|

|

93% |

National Affordable Housing Portfolio |

|

17 |

|

Various |

|

December 2021 |

|

100% |

|

|

3,264 |

|

|

95% |

Phoenix Affordable Housing Portfolio |

|

7 |

|

Phoenix, AZ |

|

April/May 2022 |

|

100% |

|

|

1,462 |

|

|

96% |

Mid-Atlantic Affordable Housing Portfolio II |

|

8 |

|

DC, GA |

|

April 2022 |

|

100% |

|

|

1,449 |

|

|

96% |

Texas and North Carolina Multifamily Portfolio |

|

5 |

|

TX, NC |

|

April/June 2022 |

|

95% |

|

|

1,601 |

|

|

94% |

Summit Multifamily Portfolio |

|

34 |

|

Various |

|

May/June 2022 |

|

100% |

|

|

8,812 |

|

|

94% |

Florida Affordable Housing Portfolio IV |

|

9 |

|

Various, FL |

|

June/July 2022 |

|

100% |

|

|

2,054 |

|

|

98% |

Blue Multifamily Portfolio |

|

4 |

|

Various |

|

August 2022 |

|

100% |

|

|

1,164 |

|

|

95% |

Total Multifamily |

|

284 |

|

|

|

|

|

|

|

|

66,919 |

|

|

|

Industrial: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Airport Logistics Park |

|

6 |

|

Nashville, TN |

|

September 2020 |

|

100% |

|

|

0.40 |

|

|

100% |

Marshfield Industrial Portfolio |

|

4 |

|

Baltimore, MD |

|

October 2020 |

|

100% |

|

|

1.33 |

|

|

100% |

Denver/Boulder Industrial Portfolio |

|

16 |

|

Denver, CO |

|

April 2021 |

|

100% |

|

|

1.68 |

|

|

92% |

Reno Logistics Portfolio |

|

18 |

|

Reno, NV |

|

May 2021 |

|

100% |

|

|

3.04 |

|

|

96% |

Northern Italy Industrial Portfolio |

|

4 |

|

Northern Italy |

|

August 2021 |

|

100% |

|

|

0.75 |

|

|

100% |

Southwest Light Industrial Portfolio |

|

15 |

|

AZ, NV |

|

September 2021 |

|

100% |

|

|

2.48 |

|

|

93% |

Norway Logistics Portfolio |

|

2 |

|

Oslo, Norway |

|

February 2022 |

|

100% |

|

|

0.37 |

|

|

100% |

American Industrial Center |

|

25 |

|

Orlando, FL |

|

April 2022 |

|

100% |

|

|

0.82 |

|

|

94% |

Middlebrook Crossroads |

|

18 |

|

Bridgewater, NJ |

|

May 2022 |

|

95% |

|

|

0.58 |

|

|

93% |

Verona Oppeano |

|

5 |

|

Verona, Italy |

|

June 2022 |

|

100% |

|

|

2.64 |

|

|

100% |

Denmark Logistics Portfolio |

|

10 |

|

Eastern Denmark |

|

June 2022 |

|

100% |

|

|

1.97 |

|

|

100% |

Belgioioso Logistics |

|

1 |

|

Greater Milan, Italy |

|

August 2022 |

|

100% |

|

|

1.12 |

|

|

100% |

Total Industrial |

|

124 |

|

|

|

|

|

|

|

|

17.18 |

|

|

|

Office: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Florida Office Portfolio |

|

11 |

|

Jacksonville, FL |

|

May 2019 |

|

97% |

|

|

1.27 |

|

|

76% |

Columbus Office Portfolio |

|

1 |

|

Columbus, OH |

|

October 2019 |

|

96% |

|

|

0.32 |

|

|

100% |

Nashville Office |

|

1 |

|

Nashville, TN |

|

February 2020 |

|

100% |

|

|

0.36 |

|

|

100% |

60 State Street |

|

1 |

|

Boston, MA |

|

March 2020 |

|

100% |

|

|

0.91 |

|

|

95% |

Stonebridge |

|

3 |

|

Atlanta, GA |

|

February 2021 |

|

100% |

|

|

0.46 |

|

|

100% |

M Campus |

|

2 |

|

Paris, France |

|

December 2021 |

|

100% |

|

|

0.24 |

|

|

99% |

Barcelona Mediacomplex |

|

1 |

|

Barcelona, Spain |

|

June 2022 |

|

100% |

|

|

0.34 |

|

|

100% |

Total Office |

|

20 |

|

|

|

|

|

|

|

|

3.90 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Segment and Investment |

|

Number of

Properties |

|

Location |

|

Acquisition

Date |

|

Ownership

Interest (1) |

|

Sq. Feet

(in millions)

/ Number of

Units/Keys |

|

|

Occupancy(2) |

Other Properties: |

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. Select Service Portfolio |

|

3 |

|

CO, OH, AR |

|

January 2019 |

|

100% |

|

|

431 |

|

|

74% |

Fort Lauderdale Hotel (5) |

|

1 |

|

Fort Lauderdale, FL |

|

March 2019 |

|

43% |

|

|

236 |

|

|

64% |

Exchange on Erwin - Commercial |

|

2 |

|

Durham, NC |

|

November 2019 |

|

100% |

|

|

0.10 |

|

|

93% |

Barlow |

|

1 |

|

Chevy Chase, MD |

|

March 2020 |

|

100% |

|

|

0.29 |

|

|

80% |

Marketplace at the Outlets |

|

1 |

|

West Palm Beach, FL |

|

December 2021 |

|

100% |

|

|

0.30 |

|

|

100% |

Single-Family Rental Joint Venture |

|

N/A |

|

Various |

|

Various |

|

95% |

|

|

909 |

|

|

88% |

Sun Belt Single-Family Rental Portfolio |

|

N/A |

|

Various |

|

December 2021 |

|

100% |

|

|

24 |

|

|

58% |

Morningstar Self-Storage Joint Venture |

|

26 |

|

Various |

|

December 2021/March 2022 |

|

95% |

|

|

1.90 |

|

|

84% |

Extended Stay Portfolio (5) |

|

196 |

|

Various |

|

July 2022 |

|

45% |

|

|

24,935 |

|

|

78% |

Total Other Properties |

|

230 |

|

|

|

|

|

|

|

N/A (4) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Investment Properties |

|

658 |

|

|

|

|

|

|

|

|

|

|

|

(1)Certain of the joint venture agreements entered into by us provide the other partner a profits interest based on certain internal rate of return hurdles being achieved. Such investments are consolidated by us and any profits interest due to the other partner will be reported within non-controlling interests in consolidated joint ventures on our Consolidated Balance Sheets. The table also includes two investments (197 total properties) owned by two unconsolidated real estate ventures.

(2) The occupancy rate for our multifamily and certain other properties, including single-family rental investments, is defined as the number of leased units divided by the total unit count as of December 31, 2024. The occupancy rate for our industrial and office properties is defined as all leased square footage divided by the total available square footage as of December 31, 2024. The occupancy rate for our other investments, including self-storage investments, is defined as all leased square footage divided by the total available square footage as well as the trailing 12 month average occupancy for hospitality and extended stay investments for the period ended December 31, 2024.

(3)Held through our DST Program as of December 31, 2024. These properties have been consolidated on our Consolidated Balance Sheets. Any profits interest due to the third-party investors in the DST Program are reported within non-controlling interests in consolidated joint ventures on our Consolidated Balance Sheets.

(4)Includes 2.6 million sq. ft. across our self-storage, medical office and retail properties and 25,602 keys at our hospitality and extended stay properties.

(5)Investment in unconsolidated real estate ventures.

Impairment of Investments in Real Estate

Management reviews its consolidated real estate properties for impairment each quarter or when there is an event or change in circumstances that indicates an impaired value. If the carrying amount of the real estate investment is no longer recoverable and exceeds the fair value of such investment, an impairment loss is recognized. The impairment loss is recognized based on the excess of the carrying amount of the asset over its fair value. The evaluation of anticipated future cash flows is highly subjective and is based in part on assumptions regarding future occupancy, rental rates and capital requirements that could differ materially from actual results. Since cash flows on real estate properties are considered on an undiscounted basis to determine whether an asset has been impaired, our strategy of holding properties over the long term directly decreases the likelihood of recording an impairment loss. If our strategy changes or market conditions otherwise dictate an earlier sale date, an impairment loss may be recognized, and such loss could be material to our results. If we determine that an impairment has occurred, the affected assets must be reduced to their fair value.

During the year ended December 31, 2024, we recognized an aggregate $150.4 million of impairment charges related predominantly to multifamily properties and, to a lesser extent, one hospitality property and one industrial property. During the year ended December 31, 2023, we recognized an aggregate of $188.8 million of impairment charges related predominantly to single-family rental properties and, to a lesser extent, two hospitality properties, in the Consolidated Statements of Operations and Comprehensive Loss. During the year ended December 31, 2022, we did not recognize any impairment charges on investments in real estate. The estimated fair values of the impaired properties held as of December 31, 2024, were primarily based on recently completed sales transactions, letters of intent, or non-binding purchase and sales contracts. These inputs are considered Level 2 inputs for purposes of the fair value hierarchy. There are inherent uncertainties in making these estimates such as current and future macroeconomic conditions.

Impairment of Investments in Unconsolidated Real Estate Ventures

Management reviews our investments in unconsolidated joint ventures for impairment each quarter and will record impairment charges when events or circumstances change indicating that a decline in the fair values below the carrying values has occurred and such decline is other-than-temporary. The ultimate realization of the investment in unconsolidated joint ventures is dependent on a number of factors, including the performance of each investment and market conditions.

During the years ended December 31, 2024, 2023, and 2022, we did not recognize any impairments on our investments in unconsolidated real estate ventures.

Investments in Real Estate Debt

The following table details our investment in real estate debt as of December 31, 2024 ($ in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

December 31, 2024 |

|

Type of Loan |

|

Number of Positions |

|

Coupon (1) |

|

Maturity Date |

|

Cost Basis |

|

|

Fair Value |

|

Term loan |

|

1 |

|

B + 4.75% |

|

June 2027 |

|

$ |

956,877 |

|

|

$ |

852,461 |

|

(1)The symbol “B” refers to the relevant benchmark rate, which is the three-month Bank Bill Swap Bid Rate (“BBSY”).

During June 2022, we provided financing in the form of a term loan to an unaffiliated entity in connection with its acquisition of Australia’s largest hotel and casino company. The loan is in the amount of AUD 1,377 million and has an initial term of five years, with a two-year extension option. The loan is pre-payable at the option of the borrower at any time.

Lease Expirations

The following table details the expiring leases at our industrial, office and other properties by annualized base rent as of December 31, 2024 ($ in thousands). The table below excludes our multifamily and certain other properties, including single-family rental and self-storage properties, as substantially all leases at such properties expire within 12 months:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Industrial |

|

Office |

|

Other Properties |

|

Total |

Year |

|

Annualized

Base Rent (1) |

|

|

% of Total

Annualized

Base

Rent

Expiring |

|

Annualized

Base Rent (1) |

|

|

% of Total

Annualized

Base

Rent

Expiring |

|

Annualized

Base Rent (1) |

|

|

% of Total

Annualized

Base

Rent

Expiring |

|

Annualized

Base Rent (1) |

|

|

% of Total

Annualized

Base

Rent

Expiring |

2025 |

|

$ |

|

19,706 |

|

|

|

7% |

|

$ |

|

6,839 |

|

|

|

2% |

|

$ |

|

1,636 |

|

|

|

1% |

|

$ |

|

28,181 |

|

|

|

10% |

2026 |

|

|

|

22,884 |

|

|

|

8% |

|

|

|

13,125 |

|

|

|

4% |

|

|

|

2,978 |

|

|

|

1% |

|

|

|

38,987 |

|

|

|

13% |

2027 |

|

|

|

27,197 |

|

|

|

9% |

|

|

|

13,264 |

|

|

|

4% |

|

|

|

1,841 |

|

|

|

1% |

|

|

|

42,302 |

|

|

|

14% |

2028 |

|

|

|

14,982 |

|

|

|

5% |

|

|

|

11,619 |

|

|

|

4% |

|

|

|

4,757 |

|

|

|

1% |

|

|

|

31,358 |

|

|

|

10% |

2029 |

|

|

|

14,452 |

|

|

|

5% |

|

|

|

7,860 |

|

|

|

3% |

|

|

|

3,143 |

|

|

|

1% |

|

|

|

25,455 |

|

|

|

9% |

2030 |

|

|

|

12,690 |

|

|

|

4% |

|

|

|

18,129 |

|

|

|

6% |

|

|

|

2,159 |

|

|

|

1% |

|

|

|

32,978 |

|

|

|

11% |

2031 |

|

|

|

5,562 |

|

|

|

2% |

|

|

|

24,888 |

|

|

|

8% |

|

|

|

1,957 |

|

|

|

1% |

|

|

|

32,407 |

|

|

|

11% |

2032 |

|

|

|

2,924 |

|

|

|

1% |

|

|

|

9,115 |

|

|

|

3% |

|

|

|

1,234 |

|

|

|

0% |

|

|

|

13,273 |

|

|

|

4% |

2033 |

|

|

|

6,819 |

|

|

|

2% |

|

|

|

29,234 |

|

|

|

10% |

|

|

|

2,104 |

|

|

|

1% |

|

|

|

38,157 |

|

|

|

13% |

2034 |

|

|

|

1,305 |

|

|

|

0% |

|

|

|

6,017 |

|

|

|

2% |

|

|

|

1,259 |

|

|

|

0% |

|

|

|

8,581 |

|

|

|

2% |

Thereafter |

|

|

|

2,278 |

|

|

|

1% |

|

|

|

3,062 |

|

|

|

1% |

|

|

|

4,166 |

|

|

|

1% |

|

|

|

9,506 |

|

|

|

3% |

Total |

|

$ |

|

130,799 |

|

|

|

44% |

|

$ |

|

143,152 |

|

|

|

47% |

|

$ |

|

27,234 |

|

|

|

9% |

|

$ |

|

301,185 |

|

|

|

100% |

(1)Annualized base rent is determined from the annualized base rent per leased square foot of the applicable year and excludes tenant recoveries, straight-line rent and above-market and below-market lease amortization.

Certain operating leases contain early termination options that require advance notification and may include payment of penalty, which, in most cases, is substantial enough to be deemed economically disadvantageous by a tenant to exercise. As of December 31, 2024, approximately 1% of our industrial portfolio square footage and approximately 21% of our office portfolio square footage is subject to early termination provisions. Approximately 4% of our office portfolio that is subject to these early termination provisions have early termination dates prior to January 1, 2028.

During the year ended December 31, 2024, two tenants exercised early lease termination provisions, impacting 56,747 square feet across our industrial and office properties, which represents 0.3% of our combined square footage owned across our industrial and office properties. During the year ended December 31, 2023, two tenants exercised early lease termination provisions, impacting 64,122 square feet across our industrial and office properties, which represents 0.3% of our combined square footage owned across our industrial and office properties.

Results of Operations

The following table sets forth information regarding our consolidated results of operations ($ in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the Year Ended December 31, |

|

|

2024 vs. 2023 |

|

|

|

2024 |

|

|

2023 |

|

|

$ |

|

Revenues |

|

|

|

|

|

|

|

|

|

|

|

|

Rental revenue |

|

$ |

|

1,649,291 |

|

|

$ |

|

1,695,917 |

|

|

$ |

|

(46,626 |

) |

Other revenue |

|

|

|

38,494 |

|

|

|

|

58,401 |

|

|

|

|

(19,907 |

) |

Total revenues |

|

|

|

1,687,785 |

|

|

|

|

1,754,318 |

|

|

|

|

(66,533 |

) |

Expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Property operating |

|

|

|

714,991 |

|

|

|

|

748,522 |

|

|

|

|

(33,531 |

) |

General and administrative |

|

|

|

47,048 |

|

|

|

|

45,144 |

|

|

|

|

1,904 |

|

Management fees |

|

|

|

105,356 |

|

|

|

|

153,411 |

|

|

|

|

(48,055 |

) |

Performance participation allocation |

|

|

|

— |

|

|

|

|

— |

|

|

|

|

— |

|

Impairment of investments in real estate |

|

|

|

150,392 |

|

|

|

|

188,804 |

|

|

|

|

(38,412 |

) |

Depreciation and amortization |

|

|

|

742,220 |

|

|

|

|

811,788 |

|

|

|

|

(69,568 |

) |

Total expenses |

|

|

|

1,760,007 |

|

|

|

|

1,947,669 |

|

|

|

|

(187,662 |

) |

Other (expense) income |

|

|

|

|

|

|

|

|

|

|

|

|

Loss from unconsolidated real estate ventures |

|

|

|

(13,435 |

) |

|

|

|

(11,624 |

) |

|

|

|

(1,811 |

) |

Income from investments in real estate debt, net |

|

|

|

95,755 |

|

|

|

|

123,138 |

|

|

|

|

(27,383 |

) |

Net gain on dispositions of real estate |

|

|

|

87,108 |

|

|

|

|

289,818 |

|

|

|

|

(202,710 |

) |

Interest expense |

|

|

|

(641,420 |

) |

|

|

|

(583,476 |

) |

|

|

|

(57,944 |

) |

Loss on extinguishment of debt |

|

|

|

— |

|

|

|

|

(93 |

) |

|

|

|

93 |

|

Other expense, net |

|

|

|

(179,994 |

) |

|

|

|

(299,930 |

) |

|

|

|

119,936 |

|

Total other expense |

|

|

|

(651,986 |

) |

|

|

|

(482,167 |

) |

|

|

|

(169,819 |

) |

Net loss |

|

|

|

(724,208 |

) |

|

|

|

(675,518 |

) |

|

|

|

(48,690 |

) |

Net loss (income) attributable to non-controlling interests in consolidated joint ventures |

|

|

|

3,228 |

|

|

|

|

(3,350 |

) |

|

|

|

6,578 |

|

Net loss attributable to non-controlling

interests in Operating Partnership |

|

|

|

36,097 |

|

|

|

|

29,165 |

|

|

|

|

6,932 |

|

Net loss attributable to stockholders |

|

$ |

|

(684,883 |

) |

|

$ |

|

(649,703 |

) |

|

$ |

|

(35,180 |

) |

Revenues

Rental revenue primarily consists of base rent arising from tenant leases at our multifamily, industrial, office, and other properties. Rental revenue is recognized on a straight-line basis over the life of the lease, including any rent steps or abatement provisions. During the years ended December 31, 2024 and 2023, rental revenue was $1.6 billion and $1.7 billion, respectively. The decrease in rental revenue was driven by a lower average investment in real estate balance as a result of asset dispositions, slightly offset by an increase in average rental rates for multifamily and industrial assets for the year ended December 31, 2024 compared to the year ended December 31, 2023.

Other revenue primarily consists of revenue generated by our hospitality properties. Hospitality revenue consists primarily of room revenue. During the years ended December 31, 2024 and 2023, other revenue was $38.5 million and $58.4 million, respectively, resulting in a year over year decrease of $19.9 million as a result of dispositions of hospitality properties.

Expenses

Property operating expenses consist of the costs of ownership and operation of our real estate investments. Examples of property operating expenses include real estate taxes, insurance, utilities and repair and maintenance expenses. Property operating expenses also include general and administrative expenses unrelated to the operations of the properties. During the years ended December 31, 2024 and 2023, property operating expenses were $715.0 million and $748.5 million, respectively. The decrease was driven primarily by a lower average investment in real estate balance as a result of asset dispositions, offset by an increase in insurance and real estate tax expenses.