| | |

Weatherford International plc 70 Sir John Rogerson’s Quay Dublin 2, D02R296 Ireland |

| | | | | | | | |

| Our ref | | 13 June 2025 |

| 661725/63 | | |

Dear Addressee

Registration Statement on Form S-3 of Weatherford International plc

Introduction

We act as legal advisers to Weatherford International plc, a public limited company incorporated under the laws of Ireland with company number 540406 (the “Company”), which has asked us to give this Opinion as to certain matters of Irish law in connection with the filing by the Company (together with Weatherford International Ltd., an exempted company incorporated under the laws of Bermuda (“Weatherford Bermuda”) and Weatherford International, LLC, a limited liability company incorporated under the laws of Delaware (“Weatherford Delaware”, and together with the Company and Weatherford Bermuda, the “Registrants”)) on the date hereof of a registration statement on Form S-3 (the “Registration Statement”) under the U.S. Securities Act of 1933, as amended (the “Securities Act”) with the U.S. Securities and Exchange Commission (the “Commission”).

Pursuant to the Registration Statement, the Registrants will register an indeterminate number of the following securities that may be allotted and issued, offered and/or sold together, separately or in any combination by the Registrants, or any of them:

(a)ordinary shares of $0.001 each (nominal value) in the capital of the Company (“Ordinary Shares”);

(b)options and warrants to purchase Ordinary Shares (“Options and Warrants”);

(c)share purchase contracts representing obligations on the holders to purchase from the Company and on the Company to sell to the holders a specific number of Ordinary Shares at a future date or dates (“Share Purchase Contracts”);

(d)share purchase units consisting of a Share Purchase Contract and either Debt Securities (as defined below) or debt obligations of third parties, including U.S. Treasury securities, securing the holder's obligations to purchase new Ordinary Shares under a Share Purchase Contract (“Share Purchase Units”);

(e)debt securities, either separately or together, of Weatherford Bermuda and Weatherford Delaware (“Debt Securities”); and

(f)the related guarantees by the Company, Weatherford Bermuda and/or Weatherford Delaware, as the case may be, of Debt Securities (“Guarantees”, and together with Ordinary Shares, Options and Warrants, Share Purchase Contracts, Share Purchase Units and Debt Securities, the “Securities”).

Debt Securities will be issued and Guarantees will be provided under a form of indenture to be governed by the laws of the State of New York filed with the Commission as an exhibit to the Registration Statement, which is to be entered into among the Company, Weatherford Bermuda, Weatherford Delaware and Deutsche Bank Trust Company Americas (the “Indenture”), as supplemented, from time to time, by one or more duly authorised, executed and lawful supplemental indenture(s) to the Indenture.

Basis of Opinion

For the purpose of giving this Opinion, we have examined the documents (including the corporate certificate), and have conducted the searches, listed in Schedule 1 (Documents and Searches) to this Opinion, together with such other materials as we have considered necessary or relevant as a basis for the opinions contained herein.

This Opinion is strictly limited to the matters expressly stated under the heading “Opinions”, below, and is not to be read as extending, by implication or otherwise, to any other matter. In particular, this Opinion does not deal with any tax matter, or the tax consequences of any matter referred to in this Opinion, in the documents or other materials examined by us for the purpose of giving this Opinion, or otherwise. We express no opinion and make no representation or warranty as to any matter of fact.

We have not investigated or verified any of the facts or assumptions, or the reasonableness of any assumptions, statements or opinions contained or represented by any person in the documents or other materials examined by us for the purposes of giving this Opinion, nor have we attempted to determine if any relevant facts have been omitted from such documents or materials.

This Opinion is given with respect to the laws of Ireland in effect on the date hereof and is based on legislation published and cases fully reported before that date and our knowledge of the facts relevant to the opinions contained herein. For the avoidance of doubt, Ireland does not include Northern Ireland (which is a separate jurisdiction), and references to the laws of Ireland do not include the laws in force in Northern Ireland.

We have made no investigations of, and we express no opinion on, the laws of any jurisdiction other than Ireland, or the effect thereof. In particular, we have made no investigations of any reference to non-Irish laws in any document or other materials examined by us or the meaning of effect thereof, and any phrases used in any non-Irish law governed document examined by us have been construed by us as having the meaning and effect they would have if such document was governed by Irish law. We have assumed, without enquiry, that there is nothing in the laws of any jurisdiction other than Ireland which would, or might, affect the opinions contained herein, and that, insofar as the laws of any jurisdiction other than Ireland are relevant, such laws have been, or will be, complied with.

This Opinion is expressed as of the date hereof and we assume no obligation to update the opinions contained herein.

Opinions

Based upon, and subject to, the foregoing and the assumptions, qualifications and limitations set out in Schedule 2 (Assumptions), Schedule 3 (Qualifications) and elsewhere in this Opinion, we are of the following opinions:

1.The Company is a public limited company, duly incorporated and validly existing under the laws of Ireland.

2.The Ordinary Shares (including any Ordinary Shares which may be issued pursuant to Options and Warrants, Share Purchase Contracts or Share Purchase Units), when allotted and issued in accordance with all necessary corporate action of the Company to authorise same (including a valid resolution of its board of directors or a duly constituted committee thereof) against receipt by the Company of the full consideration payable therefor, will, upon the entry of the name(s) of the relevant allottee(s) in the register of members of the Company as the registered holder(s) thereof (in each case credited as fully paid-up) be validly issued, fully paid-up and non-assessable. “Non-assessable” is a phrase which has no defined meaning under Irish law, but, for the purposes of this Opinion, shall mean the registered holders of such Ordinary Shares are not subject, solely by virtue of their shareholdings, to calls for additional payments of capital on such shares). As a matter of Irish law, a share in an Irish incorporated company is only issued when it has been entered in the register of members of the relevant company.

3.The Company has the requisite power under its constitution, subject to it taking all necessary corporate action to authorise same (including a valid resolution of its board of directors or a duly constituted committee thereof), to enter into Share Purchase Contracts and Share Purchase Units, provided that any Debt Securities issued as part of any Share Purchase Units are issued in accordance with the terms of the Indenture, as supplemented, from time to time, by one or more duly authorised, executed and lawful supplemental indenture(s) to the Indenture.

4.The Company has the requisite power under its constitution, subject to it taking all necessary corporate action to authorise same (including a valid resolution of its board of directors or a duly constituted committee thereof), to enter into the Indenture and to perform its obligations thereunder, including to give Guarantees on the terms contained in the Indenture, as

supplemented, from time to time, by one or more duly authorised, executed and lawful supplemental indenture(s) to the Indenture.

Reliance

This Opinion is furnished to you and the persons entitled to rely upon it pursuant to the applicable provisions of the Securities Act strictly for use in connection with the Registration Statement and may not be relied upon by any other person without our prior written consent.

Consent

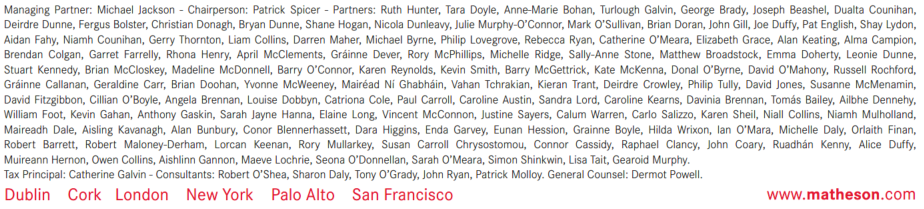

We hereby consent to the filing of this Opinion as Exhibit 5.2 to the Registration Statement and to the references to Matheson LLP under the caption “Legal Matters” in the prospectus constituting a part of the Registration Statement. In giving such consent, we do not admit that we are included in the category of persons whose consent is required under section 7 of the Securities Act, or the rules and regulations of the Commission promulgated thereunder.

Governing Law

This Opinion and the opinions contained herein are governed by, and construed in accordance with, the laws of Ireland.

Yours sincerely

/s/ Matheson LLP

MATHESON LLP

Schedule 1

Documents and Searches

For the purposes of giving this Opinion, we have examined the documents (including the corporate certificate) and have conducted the searches listed below.

1.The final form of the Registration Statement to which this Opinion is to be filed as an exhibit.

2.The final form of Indenture to be filed with the Commission as an exhibit to the Registration Statement.

3.A certificate issued by the secretary of the Company dated the date of this Opinion:

(a)attaching a copy of each of the following documents certified as being true, complete and correct by the secretary:

(i)the Company’s certificate of incorporation dated 3 March 2014, certificate of incorporation on change of name dated 20 March 2014 and certificate of incorporation on re-registration as a public limited company dated 29 May 2014 (the “Certificates of Incorporation”);

(ii)the memorandum of association of the Company adopted on 10 December 2019 (the “Memorandum of Association”) and the articles of association of the Company adopted on 10 December 2019 (the “Articles of Association”, and together with the Certificates of Incorporation and the Memorandum of Association, the “Constitutional Documents”); and

(iii)an extract from the minutes of meetings of the board of directors of the Company held on 11 June 2025 (the “Board Minutes”); and

(b)certifying certain other matters, as set out therein, on which we have relied for the purpose of this Opinion.

5.Searches carried out by independent law researchers on our behalf against the Company on 12 June 2025: (a) in the Register of Winding-up Petitions maintained at the Central Office of the High Court of Ireland; (b) in the Judgments’ Office of the High Court of Ireland; and (c) on the file of the Company maintained by the Registrar of Companies at the Irish Companies Registration Office (the “Companies Registration Office”) (the “Searches”).

Schedule 2

Assumptions

The opinions contained herein are given on the basis of the assumptions set out in this Schedule.

1.All signatures (including, for the avoidance of doubt, electronic signatures), initials, seals and stamps contained in, or on, any document examined by us are genuine.

2.All documents provided to us as originals are authentic and complete and all documents provided to us as copies (including, without limitation, any document provided to us as a .pdf (or any other format) attachment to an email) are complete and conform to the originals of such documents, and the originals of such documents are authentic and complete with all requisite seals and stamps affixed.

3.The contents of the documents (including the corporate certificate), the Searches and any other materials examined by us for the purposes of this Opinion are true and accurate as to factual matters, but we have made no independent investigation regarding such factual matters.

4.The Indenture will be duly authorised, executed and delivered by all parties thereto in the final form we have examined for the purposes of this Opinion.

5.Any supplemental indenture to the Indenture will be duly authorised, executed and delivered by all parties thereto, and no such supplemental indenture will contain a term or other provision that would render the Indenture or the offer, sale, issue, admission to trading and / or listing of Debt Securities (including Debt Securities the subject of Share Purchase Units) or the giving of Guarantees thereunder unlawful under the constitution of the Company or the laws of any jurisdiction, including Ireland.

6.All Guarantees and other Securities will conform to the description thereof in the prospectus or any supplemental prospectus forming part of the Registration Statement.

7.All other documents dated on, or prior to, the date hereof which we have examined for the purposes of this Opinion have not been revoked or amended and remain accurate.

8.There have been no amendments to the Constitutional Documents,

9.The resolutions documented in the extract from the Board Minutes were passed at a properly convened, constituted and quorate meeting of the board of directors of the Company, and such resolutions have not, since their date of adoption, been amended, superseded or rescinded and are in full force and effect.

10.The Company will derive a commercial benefit from entering into the Indenture, any supplemental indenture to the Indenture and any other document referred to in, or contemplated by, the Registration Statement (including the prospectus and any supplemental prospectus forming part thereof), giving Guarantees and/or allotting and issuing, offering and/

or selling any other Securities, in each case commensurate with the obligations undertaken by it.

11.The Indenture, any supplemental indenture to the Indenture and any other document referred to in, or contemplated by, the Registration Statement (including the prospectus and any supplemental prospectus forming part thereof) will be entered into, all Guarantees will be given and all other Securities will be allotted and issued, offered and/or sold, in each case in good faith in the interests of the Company for the benefit of its members as a whole and for its legitimate business purposes.

12.No Ordinary Shares will be allotted and issued and no rights to subscribe for, to receive or to convert any securities into, Ordinary Shares (“Rights”, which shall include rights granted pursuant to Options and Warrants, Share Purchase Contracts and Share Purchase Units) will be granted other than pursuant to a valid resolution of the board of directors of the Company or a duly constituted committee thereof.

13.The Company will have received the full consideration payable for any Ordinary Shares prior to, or simultaneous with, their allotment and issue, and no Ordinary Share will be allotted and issued for consideration that is less than its nominal value.

14.No Ordinary Share will be allotted and issued for consideration that: (a) consists of an undertaking given by any person that he, she or another should do work or perform services for the Company or any other person; (b) includes an undertaking which is to be or may be performed more than five years after the date of the allotment; or (c) is not considered good or adequate at law.

15.No Ordinary Shares will be allotted or issued fully or partly paid-up otherwise than in cash unless the provisions of sections 1028 to 1030 of the Companies Act 2014 of Ireland, as amended (the “Companies Act”) (which require an independent valuation of the non-cash consideration to be prepared by an expert and circulated to the proposed allottee(s)), are complied with in full.

16.At the time of the allotment and issue of any Ordinary Shares, the Company will have a sufficient number of unissued ordinary shares in its authorised share capital, being at least equal to the number of Ordinary Shares to be allotted and issued.

17.At the time of the allotment and issue of any Ordinary Shares or, if earlier, the granting of any Rights, to the extent required: (a) the directors of the Company will, in accordance with section 1021 of the Companies Act, have been either specifically or generally authorised by the members of the Company to allot a sufficient number of “relevant securities” (within the meaning of that section), being at least equal to the number of Ordinary Shares the subject of such allotment and issuance or Rights; and (b) the directors of the Company will, in accordance with section 1023 of the Companies Act, have been either specifically or generally empowered by the members of the Company to allot and issue such Ordinary Shares or grant such Rights in respect thereof as if section 1022(1) of the Companies Act did not apply to such allotment and issuance or the granting of such Rights.

18.To the extent any Ordinary Shares are being re-allotted off-market from treasury, the maximum and minimum prices of re-issue shall have been determined in advance at a general meeting of the Company in accordance with the requirements of section 1078 of the Companies Act.

19.The Company will not give any financial assistance, as contemplated by sections 82 and 1043 of the Companies Act for the purpose of the acquisition of any Ordinary Shares, save as permitted by, or pursuant to an exemption from the application of, the said sections 82 and 1043.

20.Each person to whom Ordinary Shares are allotted and issued will have the due and requisite capacity (and, if relevant, will have taken all necessary corporate action to be authorised) to be allotted and issued Ordinary Shares (including upon the exercise or vesting of Rights) and to be registered in the register of members of the Company as the holder thereof.

21.To the extent any Ordinary Shares to be allotted and issued are proposed to be issued directly to Cede & Co., as the nominee of The Depository Trust Company (“DTC”), the Company will have satisfied all requirements of DTC for acceptance of the Ordinary Shares as eligible for its depository and book entry transfer services.

22.The Company together with any other entity whose obligations are guaranteed by it under the Indenture or any supplemental indenture to the Indenture together comprise a “group” for the purposes of section 243 of the Companies Act and any person that subsequently becomes an issuer or a guarantor under the Indenture or any such supplemental indenture will also be a member of such group.

23.The obligations expressed to be assumed by each party to the Indenture, will upon the Indenture being authorised, executed and delivered, constitute legal, valid, binding and enforceable obligations under all applicable laws and in all applicable jurisdictions (other than, in the case of the Company, the laws of Ireland and the jurisdiction of Ireland) and any obligations expressed to be assumed by each party to any supplemental indenture to the Indenture and any other document referred to in, or contemplated by, the Registration Statement (including the prospectus and any supplemental prospectus forming part thereof) will, upon such supplemental indenture being authorised, executed and delivered, constitute legal, valid, binding and enforceable obligations under all applicable laws and in all applicable jurisdictions (including the laws of Ireland and the jurisdiction of Ireland).

24.If any obligation of any of the parties under the Indenture, any supplemental indenture to the Indenture or any other document referred to in, or contemplated by, the Registration Statement (including the prospectus and any supplemental prospectus forming part thereof) is to be performed in any jurisdiction other than Ireland, its performance will not be illegal or ineffective by virtue of the law of that jurisdiction.

25.There are no provisions of the laws or public policy of any jurisdiction outside Ireland which would be contravened by the execution or performance of the Indenture, any supplemental indenture to the Indenture or any other document referred to in, or contemplated by, the Registration Statement (including the prospectus and any supplemental prospectus forming

part thereof) or which would render their performance ineffective by virtue of the laws of that jurisdiction.

26.All authorisations, approvals, licences, exemptions or consents of governmental or regulatory authorities, including Ireland, with respect to the transactions contemplated by the Registration Statement (including the prospectus and any supplemental prospectus forming part thereof), the giving of Guarantees and/or the allotment and issue, offer and/or sale of any other Securities have been, or will be, obtained and are, or will be, in full force and effect, and the selling restrictions contained in the Registration Statement (including the prospectus and any supplemental prospectus forming part thereof) have been and will, at all times, be observed.

27.The allotment and issue, offer and/or sale (including the marketing) of any Securities will be made, effected and conducted in accordance with and will not otherwise violate: (a) any applicable securities laws and regulations of any jurisdiction (including the jurisdiction of Ireland) which impose any restrictions or mandatory requirements in relation to the offering or sale of any Securities to the public, including the obligation to prepare a prospectus or registration document relating to any Securities; and (b) any requirement or restriction imposed by any court, governmental body or regulatory authority having jurisdiction over the Company or the members of its group.

28.The allotment and issue, offer and sale of any Securities and any transfers and payments to be made thereunder or in connection therewith (including pursuant to the Indenture and/or any supplemental indenture to the Indenture) are not, and will not be, affected or prohibited by any financial restrictions or sanctions imposed by the United Nations, the European Union or Ireland or which arise under any human rights, anti-terrorism, anti-corruption, anti-money laundering or exchange control laws and regulations of the European Union or Ireland, including, without limitation, any arising from orders made under the Financial Transfers Act 1992 of Ireland, the Criminal Justice (Terrorist Offences) Acts 2005 and 2015 of Ireland or the Criminal Justice (Money Laundering and Terrorist Financing) Acts 2010 to 2021 of Ireland.

29.The information disclosed by the Searches was accurate and complete as of the date the Searches were made and has not been altered, the Searches did not fail to disclose any information which had been delivered for registration but which did not appear from the information available at the time the Searches were made or which ought to have been delivered for registration at that time but had not been so delivered and no additional matters would have been disclosed by additional searches being carried out since that time.

30.The Company is at the date hereof, and will be at the time of and immediately following: (a) the execution and delivery of the Indenture or any supplemental indenture to the Indenture; (b) the giving of any Guarantee; and (c) the allotment and issue, offer or sale of any other Securities, solvent.

31.The Company will not be insolvent as a consequence of: (a) executing and delivering the Indenture or any supplemental indenture to the Indenture; (b) giving any Guarantee; (c) allotting and issuing, offering and/or selling any other Securities; and/or (d) doing any other act or thing referred to in, or contemplated by, the Registration Statement (including the prospectus and any supplemental prospectus forming part thereof).

32.The Company has not at the date hereof, and will not have at the time of and immediately prior to: (a) the execution and delivery of the Indenture or any supplemental indenture to the Indenture; (b) the giving of any Guarantee; and (c) the allotment and issue, offer or sale of any other Securities, passed a voluntary winding-up resolution or a resolution to place the Company under court protection or to appoint a process adviser, and no petition has or will have been presented to, or order has or will have been made by, a court for the winding-up of the Company or to place the Company under court protection or for the appointment of a process adviser.

33.In approving the giving of any Guarantee or the allotment and issue, offer or sale of any other Securities, there shall be no intent by the Company to give a creditor a preference which could be deemed an unfair preference in accordance with section 604 of the Companies Act.

34.The absence of fraud and the presence of good faith on the part of all parties to any document we have examined for the purposes of this Opinion and their respective officers, employees, agents and advisors.

Schedule 3

Qualifications

The opinions contained herein are given subject to the qualifications set out in this Schedule.

1.A search in the Companies Registration Office will not reveal whether a petition has been presented to the Irish courts for the appointment of a liquidator or an examiner.

2.A search of the Register of Winding-up Petitions should reveal the existence of a petition for the appointment of a liquidator or an examiner but there may be a time lag between presentation and entry of particulars of the petition on the Register of Winding-up Petitions and accordingly a search of the Register of Winding-up Petitions may fail to reveal that any such petition has been presented. Furthermore in the case of certain smaller companies a petition for the appointment of an examiner may be presented to the Circuit Court and a search of the Register of Winding-up Petitions will not reveal the existence of such a petition.

3.A search in the Companies Registration Office should reveal the appointment of a liquidator, examiner, process adviser or receiver (whether by the Irish courts or, in the case of a liquidator, process adviser or a receiver, out of court). However, similarly there may be a time lag between the appointment and the filing of particulars of the appointment and accordingly a search in the Companies Registration Office may fail to reveal any such appointment.

4.The expressions “valid”, “binding and “enforceable” when used in this Opinion mean that the obligations expressed to be assumed are of a type which the courts of Ireland will treat as valid and binding. It does not mean that these obligations will necessarily be enforced in all circumstances in accordance with their terms. In particular, enforcement of obligations may be:

(a)limited by general principles of equity, in particular, equitable remedies (such as an order for specific performance or an injunction) which are discretionary and are not available where damages are considered to be an adequate remedy;

(b)subject to any limitations arising from examinership, administration, bankruptcy, insolvency, moratoria, receivership, liquidation, reorganisation, court scheme of arrangement, arrangement and similar laws affecting the rights of creditors;

(c)limited by the provisions of the law of Ireland applicable to contracts held to have been frustrated by events happening after their execution;

(d)invalidated if and to the extent that performance or observance arising in a jurisdiction outside Ireland would be unlawful, unenforceable, or contrary to public policy or to the exchange control regulations under the law of such jurisdiction;

(e)invalidated by reason of fraud; and/or

(f)barred under the Statutes of Limitations of Ireland or may be or become subject to the defence of set-off or counterclaim.

5.The Companies Act prohibits certain steps being taken, except with the leave of the court, against a company after the presentation of a petition for the appointment of an examiner. This prohibition continues for so long as the examiner remains appointed. An examiner may remain appointed for a maximum period of one hundred days during which time the examiner must complete a report to formulate proposals for a compromise or scheme of arrangement in relation to the company concerned. Following the submission of this report to the court, the court may extend the period of appointment by such further period as the court considers necessary to enable it to take a decision as to whether it confirms the proposals set forth by the examiner. Prohibited steps include steps taken to withhold performance of, terminate or accelerate any executory contract solely by reason of the making of a petition to appoint, or the appointment of, an examiner or because the company is unable to pay its debts, steps taken to enforce any security over a company’s property, the commencement or continuation of proceedings or execution or other legal process or the levying of distress against the company or its property and the appointment of a receiver.

6.Under the provisions of the Companies Act, an examiner can be appointed on a petition to the Circuit Court if certain criteria are met. It is not possible for anyone other than a party to the relevant proceedings or the solicitors on record for such parties to inspect the Circuit Court files to ascertain whether a petition for the appointment of an examiner has been made in the Circuit Court, and we have made no searches or enquiries in this regard in respect of the Company.

7.A contractual provision conferring or imposing a remedy or an obligation consequent upon default may not be enforceable if it were construed by an Irish court as being a penalty, particularly if it involves enforcing an additional pecuniary remedy (such as a default or overdue interest) referable to such default and which does not constitute a genuine and reasonable pre-estimate of the damage likely to be suffered as a result of the default in payment of the amount in question or the termination in question; further, recovery may be limited by laws requiring mitigation of loss suffered.

8.An Irish court may not give effect to an indemnity given by any party to an agreement to the extent it is in respect of legal costs incurred by an unsuccessful litigant or to the extent that it is in respect of litigation costs which are not awarded by the court.

9.In the event of any proceedings being brought in an Irish court in respect of a monetary obligation expressed to be payable in a currency other than euro, an Irish court would have the power to give a judgment to pay a currency other than euro but may decline to do so in its discretion and an Irish court might not enforce the benefit of currency conversion or indemnity clauses and, with respect to a bankruptcy, liquidation, insolvency, reorganisation or similar proceeding, the laws of Ireland may require that all claims or debts be converted into euro at an exchange rate determined by the court as at a date related thereto, such as the date of commencement of a winding-up.

10.A determination or calculation of any party to an agreement or other document stated in the agreement or other document to be conclusive may be held by the courts of Ireland not to be final, conclusive or binding.

11.The effect of terms, if any, in an agreement or other document excusing a party from a liability or duty otherwise owed are limited by law.

12.Where a party is vested with a discretion or may determine a matter in its opinion, the laws of Ireland may require that such discretion is exercised reasonably or that such opinion is based upon reasonable grounds.

13.The courts of Ireland may interpret restrictively any provision purporting to allow the beneficiary of a guarantee or other suretyship to make a material amendment to the obligations to which the guarantee or suretyship relates without further reference to the guarantor or surety.

14.The enforceability of any provision as to severability may be determined by the courts of Ireland at its discretion.

15.An Irish court may not give effect to any provision of an agreement which: (a) provides for a matter to be determined by future agreement or negotiation; or (b) it considers to be devoid of any meaning, vague or uncertain.

16.A right of set-off provided for in an agreement or other document may not be enforceable in all circumstances.