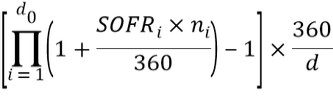

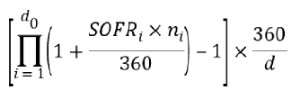

“d0”, for any Observation Period, is the number of U.S. Government Securities Business Days in the relevant Observation Period.

“i” is a series of whole numbers from one to d0, each representing the relevant U.S. Government Securities Business Days in chronological order from, and including, the first U.S. Government Securities Business Day in the relevant Observation Period.

“SOFRi”, for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is equal to SOFR in respect of that day “i”.

“ni”, for any U.S. Government Securities Business Day “i” in the relevant Observation Period, is the number of calendar days from, and including, such U.S. Government Securities Business Day “i” to, but excluding, the following U.S. Government Securities Business Day (“i+1”).

“d” is the number of calendar days in the relevant Observation Period.

In determining the Base Rate for a U.S. Government Securities Business Day, the Base Rate generally will be the rate in respect of such day that is provided on the following U.S. Government Securities Business Day. In determining the Base Rate for any other day, such as a Saturday, Sunday or holiday, the Base Rate generally will be the rate in respect of the immediately preceding U.S. Government Securities Business Day that is provided on the following U.S. Government Securities Business Day.

“SOFR” means, with respect to any U.S. Government Securities Business Day:

| (1) | the Secured Overnight Financing Rate in respect of such U.S. Government Securities Business Day as provided by the New York Federal Reserve, as the administrator of such rate (or a successor administrator) on the New York Federal Reserve’s Website on or about 3:00 p.m. (New York time) on the U.S. Government Securities Business Day immediately following such U.S. Government Securities Business Day; or |

| (2) | if the Secured Overnight Financing Rate in respect of such U.S. Government Securities Business Day does not appear as specified in paragraph (1), unless both a Benchmark Transition Event and its |

12