Report Prepared for

Silvercorp Metals Inc.

Report Prepared by

SRK Consulting (Canada) Inc.

Exhibit 99.1

Independent Technical Report for the

Condor Project,

Ecuador

Report Prepared for Silvercorp Metals Inc.

Report Prepared by SRK Consulting (Canada) Inc.

|

|

CAPR003605 ■ May 12, 2025

Independent Technical Report for the Condor Project, Ecuador

Silvercorp Metals Inc. Suite 1750-1066 W. Hastings Street Vancouver, BC V6E 3X1 Canada |

SRK Consulting (Canada) Inc. 155 University Avenue, Suite 1500 Toronto, ON M5H 3B7 Canada | |

+1 416 504 2024 https://silvercorpmetals.com/ |

+1 416 601 1445 www.srk.com | |

SRK Project Number: CAPR003605 |

||

Effective Date: February 28, 2025 |

||

Signature Date: May 12, 2025 |

||

Qualified Persons / Authored by: |

||

[“Original signed”] |

[“Original signed”] | |

Mark

Wanless, Pr.Sci.Nat |

Falong

Hu, MBA, BEng, FAusIMM, PMP | |

[“Original signed”] |

[“Original signed”] | |

| Yanfang

Zhao (Bonnie), MEng, MAusIMM Principal Consultant |

Lanliang

Niu, Beng, MAusIMM Principal Consultant |

Peer Reviewed by:

Glen Cole, PGeo, Practice Leader and Principal Consultant (Resource Geology)

Cover Image(s):

Image of the Condor Project property sourced from https://silvercorpmetal.com

IMPORTANT NOTICE

This report was prepared as a National Instrument 43-101 Standards of Disclosure for Mineral Projects Technical Report for Silvercorp Metals Inc. (Silvercorp) by SRK Consulting (Canada) Inc. (SRK). The quality of information, conclusions, and estimates contained herein are consistent with the quality of effort involved in SRK’s services. The information, conclusions, and estimates contained herein are based on i) information available at the time of preparation, ii) data supplied by outside sources, and iii) the assumptions, conditions, and qualifications set forth in this report. This report is intended for use by Silvercorp subject to the terms and conditions of its contract with SRK and relevant securities legislation. The contract permits Silvercorp to file this report as a Technical Report with Canadian securities regulatory authorities pursuant to National Instrument 43-101. Except for the purposes legislated under provincial securities law, any other uses of this report by any third party is at that party’s sole risk. The responsibility for this disclosure remains with Silvercorp. The user of this document should ensure that this is the most recent Technical Report for the property as it is not valid if a new Technical Report has been issued.

CAPR003605 ■ Silvercorp Metals Inc.

Independent Technical Report for the Condor Project, Ecuador

Contents

| Executive Summary | ix |

| Property Description and Ownership | ix |

| Accessibility, Climate, Physiography, Local Resources and Infrastructure | x |

| History | x |

| Geology and Mineralization | xi |

| Deposit Types | xii |

| Exploration, Quality Assurance and Quality Control | xiii |

| Data Verification | xiv |

| Mineral Processing and Metallurgical Testing | xiv |

| Mineral Resource Estimates | xvii |

| Interpretation and Conclusions | xix |

| Recommendations | xx |

| 1 | Introduction and Terms of Reference | 1 |

| 1.1 | Scope of Work | 1 |

| 1.2 | Work Program | 2 |

| 1.3 | Basis of Technical Report | 2 |

| 1.4 | Qualifications of SRK and SRK Team | 3 |

| 1.5 | Site Visit | 3 |

| 1.6 | Acknowledgement | 3 |

| 1.7 | Declaration | 3 |

| 2 | Reliance on Other Experts | 5 |

| 3 | Property Description and Location | 6 |

| 3.1 | Property Location | 6 |

| 3.2 | Mineral Tenure | 7 |

| 3.3 | Underlying Agreements | 8 |

| 3.4 | Environmental Regulations and Permitting | 8 |

| 3.5 | Mining Rights in Condor Project | 9 |

| 4 | Climate, Local Resources, Infrastructure, and Physiography | 11 |

| 4.1 | Accessibility | 11 |

| 4.2 | Climate | 11 |

| 4.3 | Local Resources and Infrastructure | 12 |

| 4.4 | Physiography | 12 |

| 5 | History | 14 |

| 5.1 | Ownership History | 14 |

| 5.2 | Exploration History | 14 |

| 5.3 | Production | 16 |

| 5.4 | Previous Mineral Resource Estimates | 16 |

| 6 | Geological Setting and Mineralization | 18 |

| 6.1 | Regional Geology | 18 |

| 6.2 | Property Geology | 20 |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | i |

CAPR003605 ■ Silvercorp Metals Inc.

Independent Technical Report for the Condor Project, Ecuador

| 6.3 | Mineralization | 23 |

| 7 | Deposit Types | 26 |

| 8 | Exploration | 27 |

| 9 | Drilling | 28 |

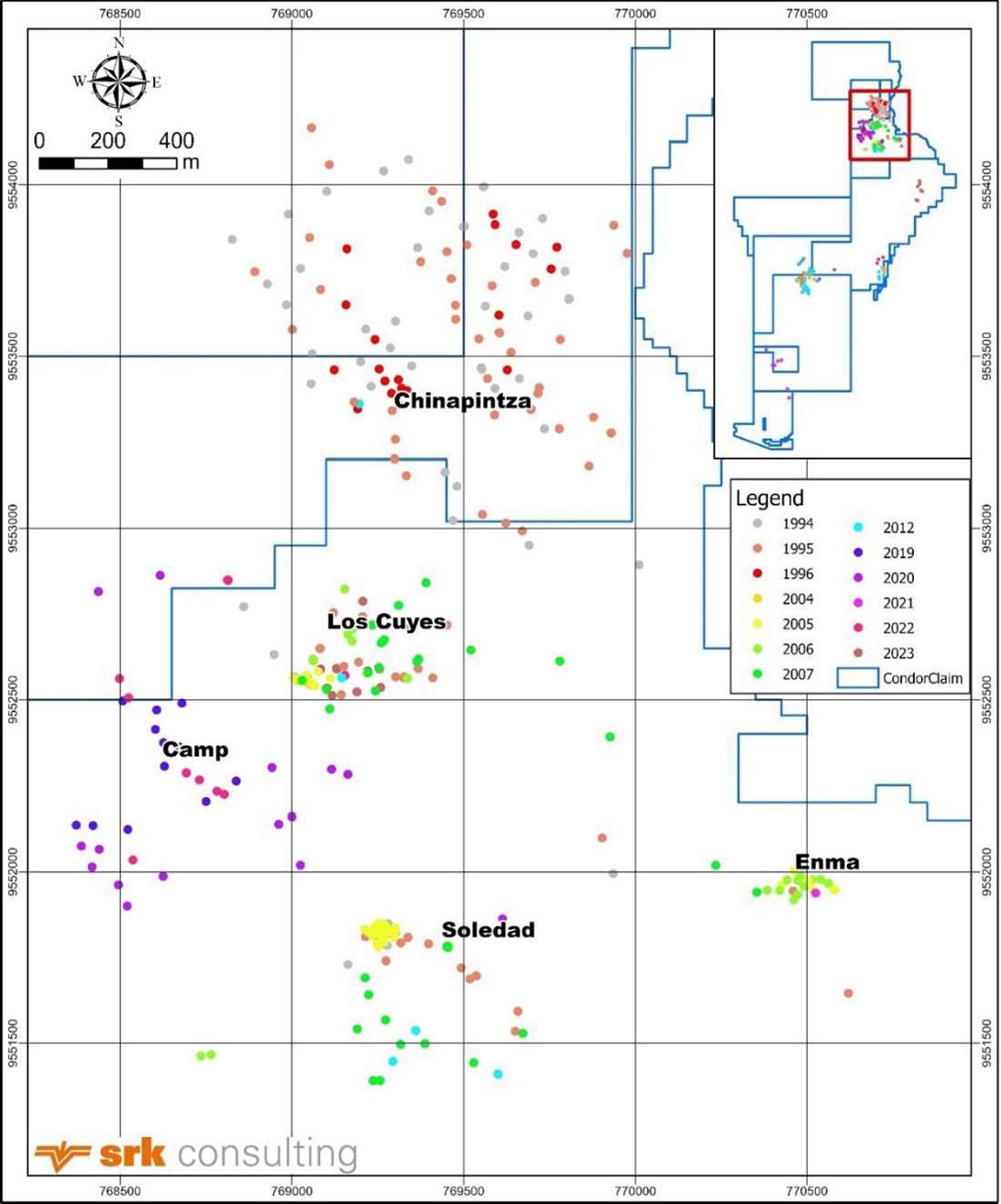

| 9.1 | Historical Drilling (Pre-2019) | 29 |

| 9.2 | Luminex Drilling (2019 – 2021) | 30 |

| 9.3 | Luminex Drilling (2022 – 2023) | 31 |

| 9.4 | Luminex Drilling Procedures | 31 |

| 9.5 | Recommendations | 32 |

| 10 | Sample Preparation, Analyses, and Security | 33 |

| 10.1 | Sampling | 33 |

| 10.2 | Sample Preparation and Analysis | 34 |

| 10.3 | Sample Shipment and Security | 35 |

| 10.4 | Bulk Density | 36 |

| 10.5 | QAQC | 36 |

| 10.6 | Recommendations | 39 |

| 11 | Data Verification | 40 |

| 11.1 | Site Visit | 40 |

| 11.2 | Historical Data Validation | 41 |

| 11.3 | Analytical Quality Control Data Validation | 42 |

| 11.4 | Recommendations and Conclusions | 58 |

| 12 | Mineral Processing and Metallurgical Testing | 60 |

| 12.1 | Introduction | 60 | |

| 12.2 | Los Cuyes West | 60 | |

| 12.2.1 | Head Assay and Mineral Composition | 60 | |

| 12.2.2 | Gravity Concentration | 61 | |

| 12.2.3 | Cyanidation | 62 | |

| 12.2.4 | Bulk Flotation | 64 | |

| 12.2.5 | Concentrate Cyanidation | 64 | |

| 12.2.6 | Flotation of Cyanide Leached Bulk Concentrate for Recovery of Silver, Lead and Zinc | 66 | |

| 12.2.7 | Flotation of Whole Ore Cyanidation Residue | 68 | |

| 12.3 | Camp | 68 | |

| 12.3.1 | Head Assay and Mineral Composition | 68 | |

| 12.3.2 | Gravity Concentration | 70 | |

| 12.3.3 | Cyanidation | 70 | |

| 12.3.4 | Bulk Flotation | 72 | |

| 12.3.5 | Concentrate Cyanidation | 73 | |

| 12.3.6 | Lead and Zinc Flotation of the Cyanide Leached Bulk Concentrate | 73 | |

| 12.3.7 | Sequential Selective Flotation of the Whole Ore Cyanide Leach Residue | 74 | |

| 12.4 | Soledad | 75 | |

| 12.4.1 | Direct Cyanidation | 75 | |

| 12.4.2 | Bulk Flotation Followed By Gravity Concentration And Cyanidation Process Options | 75 | |

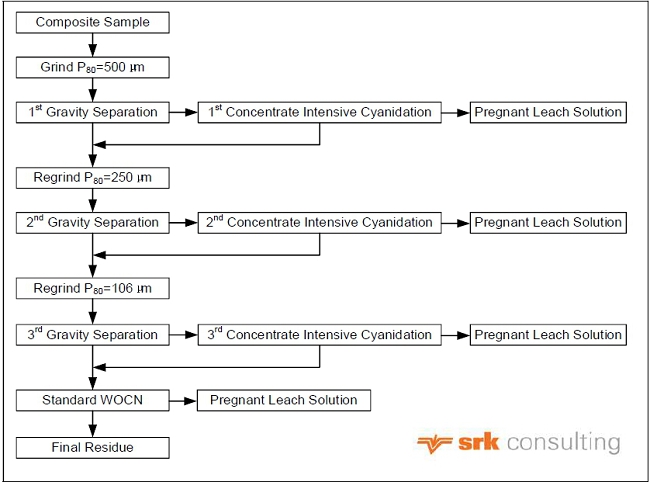

| 12.4.3 | Multi-Stage Gravity Concentration Followed By Cyanidation Options | 77 | |

| 12.5 | Enma | 79 | |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | ii |

CAPR003605 ■ Silvercorp Metals Inc.

Independent Technical Report for the Condor Project, Ecuador

| 12.5.1 | Sample and Head Assay | 79 | |

| 12.5.2 | Whole Ore Cyanidation | 79 | |

| 12.5.3 | Gravity Concentration and Cyanide Leach of Gravity Concentrate | 80 | |

| 12.5.4 | Grindability | 80 | |

| 12.6 | Conclusion and Recommendation | 81 | |

| 13 | Mineral Resource Estimates | 83 | |

| 13.1 | Introduction | 83 | |

| 13.2 | Estimation Procedures | 83 | |

| 13.3 | Resource Database | 84 | |

| 13.4 | Domain Modelling | 84 | |

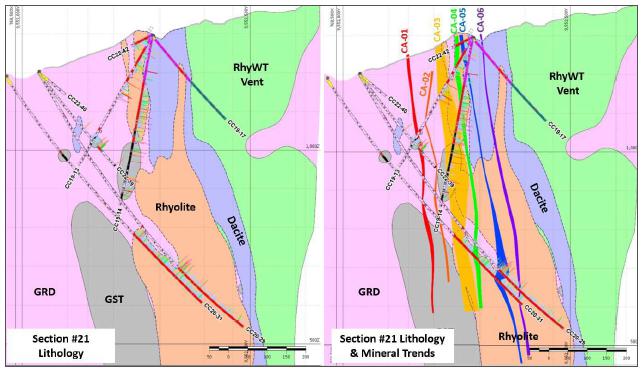

| 13.4.1 | Camp | 84 | |

| 13.4.2 | Los Cuyes | 86 | |

| 13.4.3 | Soledad | 88 | |

| 13.4.4 | Enma | 89 | |

| 13.5 | Specific Gravity | 90 | |

| 13.6 | Compositing | 91 | |

| 13.6.1 | Camp | 91 | |

| 13.6.2 | Los Cuyes | 93 | |

| 13.6.3 | Soledad | 95 | |

| 13.6.4 | Enma | 96 | |

| 13.7 | Evaluation of Outliers | 98 | |

| 13.7.1 | Camp | 98 | |

| 13.7.2 | Los Cuyes | 98 | |

| 13.7.3 | Soledad | 100 | |

| 13.7.4 | Enma | 100 | |

| 13.8 | Spatial Continuity Assessment | 101 | |

| 13.8.1 | Camp | 101 | |

| 13.8.2 | Los Cuyes | 102 | |

| 13.8.3 | Soledad | 104 | |

| 13.8.4 | Enma | 106 | |

| 13.9 | Block Model and Grade Estimation | 107 | |

| 13.9.1 | Camp | 107 | |

| 13.9.2 | Los Cuyes | 109 | |

| 13.9.3 | Soledad | 111 | |

| 13.9.4 | Enma | 111 | |

| 13.10 | Model Validation | 113 | |

| 13.10.1 | Camp | 113 | |

| 13.10.2 | Los Cuyes | 116 | |

| 13.10.3 | Soledad | 120 | |

| 13.10.4 | Enma | 122 | |

| 13.11 | Mineral Resource Classification | 124 | |

| 13.11.1 | Camp | 124 | |

| 13.11.2 | Los Cuyes | 126 | |

| 13.11.3 | Soledad | 129 | |

| 13.11.4 | Enma | 130 | |

| 13.12 | Mineral Resource Statement | 131 | |

| 13.13 | Grade Sensitivity Analysis | 136 | |

| 13.14 | Previous Mineral Resource Estimate | 143 | |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | iii |

CAPR003605 ■ Silvercorp Metals Inc.

Independent Technical Report for the Condor Project, Ecuador

| 14 | Adjacent Properties | 145 |

| 15 | Other Relevant Data and Information | 147 |

| 16 | Interpretation and Conclusions | 148 |

| 17 | Recommendations | 149 |

| References | 150 | |

| Appendix | 151 | |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | iv |

CAPR003605 ■ Silvercorp Metals Inc.

Independent Technical Report for the Condor Project, Ecuador

Tables

| Table i: | Cyanidation Test Results Summary - Gold and Silver Extractions | xv |

| Table ii: | Overall Recovery of Bulk Flotation – Concentrate Cyanidation – Residue Flotation | xvi |

| Table iii: | Overall Recovery of Cyanidation - Residue Flotation | xvi |

| Table iv: | Underground Extraction Mineral Resource Statement for Condor Project, as of 28 February 2025 | xviii |

| Table v: | Open Pit Mineral Resource Statement for Condor Project, as of 28 February 2025 | xix |

| Table 3.1: | Condormining Concessions | 9 |

| Table 5.1: | Geochemical Surveys of Condor Project | 15 |

| Table 5.2: | Geophysical Surveys of Condor Project | 16 |

| Table 9.1: | Drilling Programs of Condor Project (Pre-2019) | 30 |

| Table 9.2: | Drilling hole Summary of Condor Project (2022-2023) | 31 |

| Table 10.1: | Condor QAQC Samples During the Period 1994 to 2023 | 37 |

| Table 11.1: | Standards from Inspectorate Services Summary for the Condor Project | 42 |

| Table 11.2: | CRM Reference Value Summary for the Condor Project | 43 |

| Table 11.3: | CRM Usage at the Condor Project | 44 |

| Table 11.4: | Selected CRM Results Summary for the Camp deposit | 45 |

| Table 11.5: | Selected CRM Results Summary for the Los Cuyes deposit | 48 |

| Table 11.6: | Selected CRM Results Summary for the Soledad Deposit | 50 |

| Table 11.7: | Selected CRM Results Summary for the Enma Deposit | 52 |

| Table 11.8: | Blanks Summary for the Condor Project | 53 |

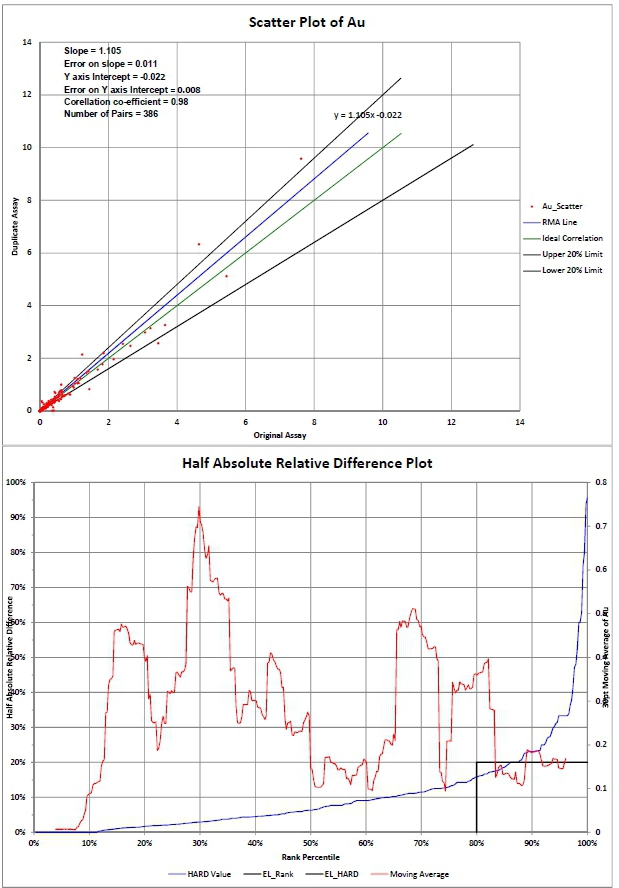

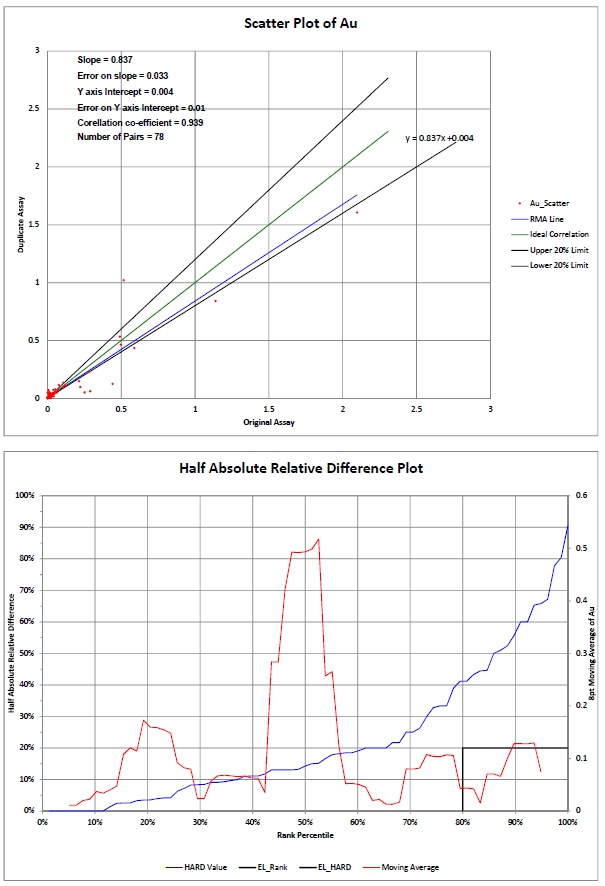

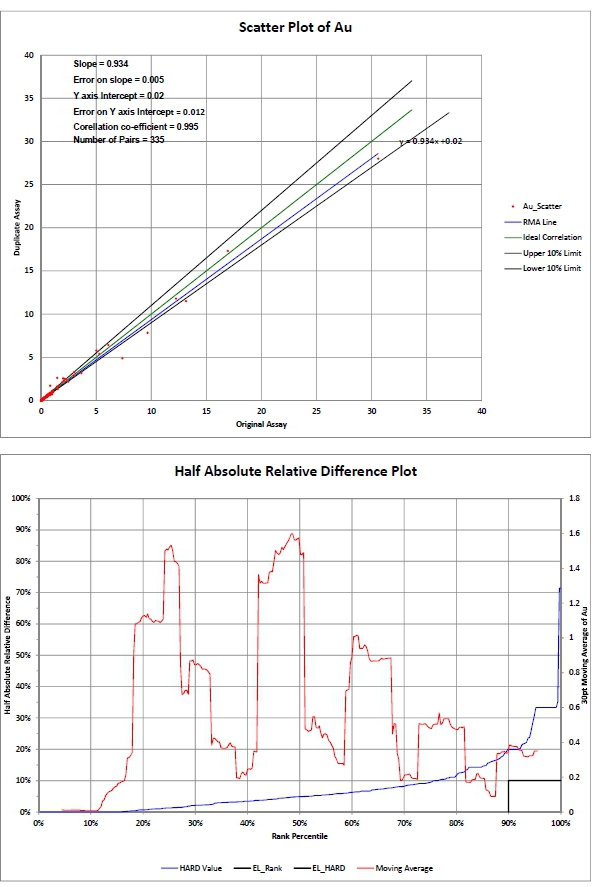

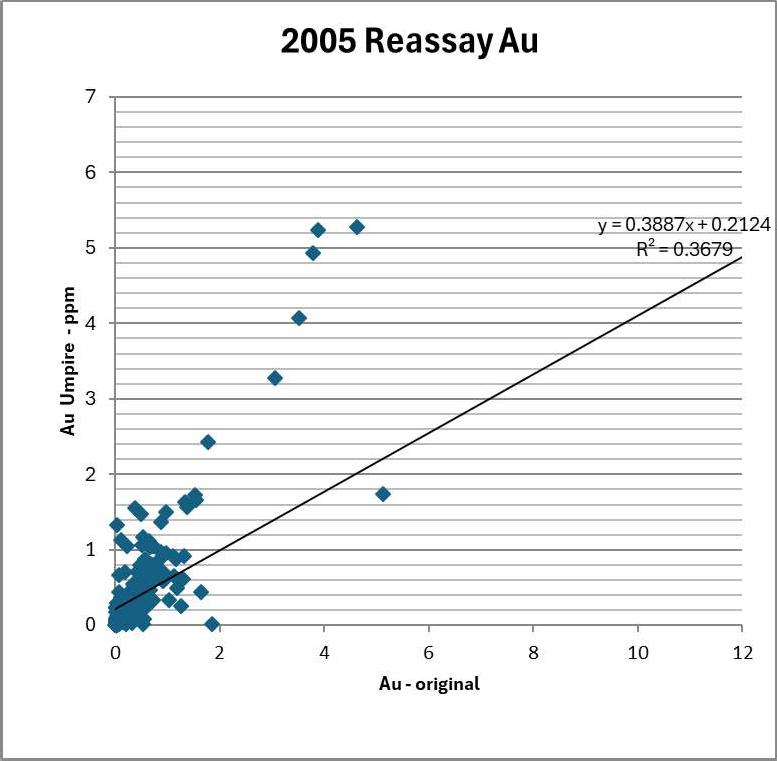

| Table 11.9: | Duplicates Summary for the Condor Project | 54 |

| Table 12.1: | Head Assays for Los Cuyes West and Breccia Pipe Samples | 61 |

| Table 12.2: | Bulk Mineralogy by XRD for Los Cuyes West and Breccia Pipe Samples | 61 |

| Table 12.3: | Gravity Concentration for Master Composite of Los Cuyes and Breccia Pipe | 62 |

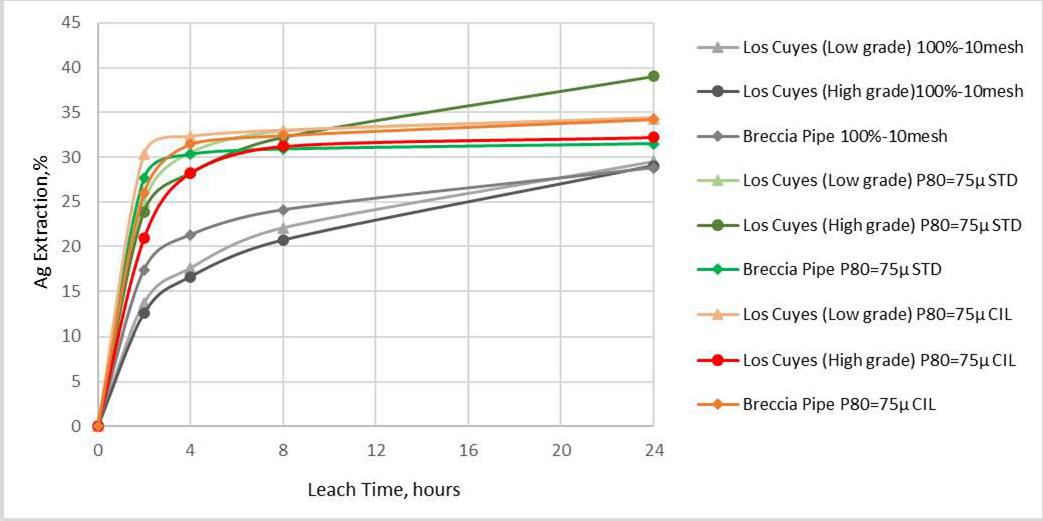

| Table 12.4: | Whole Ore Cyanidation Results for Los Cuyes West and Breccia Pipe | 62 |

| Table 12.5: | Bulk Flotation Results for Los Cuyes West and Breccia Pipe | 64 |

| Table 12.6: | Intensive CIL Cyanide Leach of Flotation Concentrate for Los Cuyes West and Breccia Pipe | 65 |

| Table 12.7: | Standard CIL Cyanide Leach of Flotation Concentrate for Los Cuyes West and Breccia Pipe | 65 |

| Table 12.8: | Overall Recovery of Bulk Flotation and Concentrate Cyanidation for Los Cuyes West and Breccia Pipe | 66 |

| Table 12.9: | Results of Bulk Flotation-Cyanidation-Pb Flotation-Zn Flotation | 67 |

| Table 12.10: | Results of Whole Ore Cyanidation and Bulk Flotation of Cyanide Leached Residue of Los Cuyes Master Composite | 68 |

| Table 12.11: | Head Assay Results of the Samples from the Camp Deposit | 69 |

| Table 12.12: | Bulk Mineralogy by XRD for the Samples from the Camp Deposit | 69 |

| Table 12.13: | Gravity Concentration Result for the Master Composite of the Camp Deposit | 70 |

| Table 12.14: | Results of Gravity Tails Cyanidation for the Camp Deposit | 71 |

| Table 12.15: | Test Results of the Whole Ore Cyanide Leach (WOCN) and CIL Cyanide Leach for the Camp Composite samples | 71 |

| Table 12.16: | Bulk Flotation of the Gravity Tails and the Feed Sample for the Camp Deposit | 72 |

| Table 12.17: | Bulk Flotation of the Design of Experiment for the Camp Deposit | 72 |

| Table 12.18: | Cyanidation of the Bulk Flotation Concentrate for the Base Camp | 73 |

| Table 12.19: | Lead and Zinc Flotation of the Cyanide Leached Bulk Concentrate for the Camp Deposit | 74 |

| Table 12.20: | Results of the Whole Ore Cyanidation and Flotation of the Cyanide Leach Residue for the Camp Master Composite | 74 |

| Table 12.21: | WOCN Test Results of San Jose Sample | 75 |

| Table 12.22: | Cyanidation Results of the San Jose Composite Sample | 75 |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | v |

CAPR003605 ■ Silvercorp Metals Inc.

Independent Technical Report for the Condor Project, Ecuador

| Table 12.23: | Bulk Flotation Test Result of a San Jose Composite Sample | 76 |

| Table 12.24: | Summary Results of Bulk Flotation and Cyanide Leach of the Bulk Concentrate | 76 |

| Table 12.25: | Summary Results of Bulk Flotation, and Gravity Concentration and Cyanidation | 77 |

| Table 12.26: | Results of Multi-Stage Gravity Concentration and Cyanidation Tests | 77 |

| Table 12.27: | Overall Results of Multi-stage Gravity Concentration and Cyanidation | 79 |

| Table 12.28: | Head Assay Result of Enma Master Composite | 79 |

| Table 12.29: | Whole Ore Cyanidation Results of the Enma MC Sample | 80 |

| Table 12.30: | Results of Gravity Concentration of the Enma MC Sample | 80 |

| Table 12.31: | Results of Gravity Concentration-Cyanidation of the Enma MC Sample | 80 |

| Table 12.32: | Summary of Ore Grindability | 81 |

| Table 13.1: | Resource Database Summary for the Condor Project | 84 |

| Table 13.2: | Density Data for Camp and Los Cuyes per Lithology Code | 91 |

| Table 13.3: | Camp Composites For Each Domain | 92 |

| Table 13.4: | Los Cuyes Domain Sample and Composite Au g/t Grades with Residual Sample Grades | 94 |

| Table 13.5: | Los Cuyes Deculstered Average Values for Estimated Variables in Each Domain | 94 |

| Table 13.6: | Soledad Sample and Composite Grades with Residual Sample Grades | 96 |

| Table 13.7: | Soledad Declustered Average Values for Estimated Variables | 96 |

| Table 13.8: | Enma Average Values for Estimated Varaibles | 98 |

| Table 13.9: | Summary of Grade Capping Applied to Camp | 98 |

| Table 13.10: | Summary of Grade Capping Applied to Los Cuyes | 99 |

| Table 13.11: | Summary of Grade Capping Applied to Soledad | 100 |

| Table 13.12: | Summary of Grade Capping Applied to Enma | 100 |

| Table 13.13: | Camp Semi-Variogram Model Parameters | 101 |

| Table 13.14: | Los Cuyes Semi-variogram Model Parameters | 103 |

| Table 13.15: | Soledad semi-variogram model parameters | 105 |

| Table 13.16: | Enma Semi-Variogram Model Parameters | 106 |

| Table 13.17: | Block Model Summary | 107 |

| Table 13.18: | Camp Search Parameters | 108 |

| Table 13.19: | Los Cuyes Search Parameters | 110 |

| Table 13.20: | Soledad Search Parameters | 111 |

| Table 13.21: | Enma Search Parameters | 112 |

| Table 13.22: | Camp per Domain Comparison Between Composites and Estimates | 113 |

| Table 13.23: | Los Cuyes Per Domain Comparison Between Composites and Estimates | 116 |

| Table 13.24: | Soledad Global Comparison Between Composites and Estimates | 121 |

| Table 13.25: | Enma global comparison between composites and estimates | 123 |

| Table 13.26: | Pit Shell Optimization Inputs for RPEEE | 132 |

| Table 13.27: | Cut-off Grade Estimates for the Condor Project | 133 |

| Table 13.28: | Payable Assumption Inputs | 134 |

| Table 13.29: | Weighted Payable Estimates to Los Cuyes and Camp | 134 |

| Table 13.30: | Underground Extraction Mineral Resource Statement for Condor Project, as of 28 February 2025 | 135 |

| Table 13.31: | Open Pit Mineral Resource Statement for Condor Project, as of 28 February 2025 | 135 |

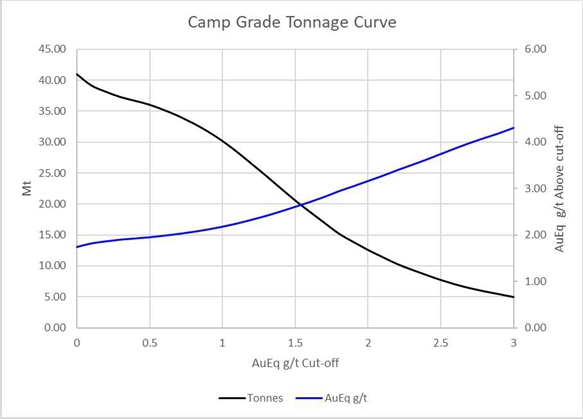

| Table 13.32: | Global Block Model Quantities and Grade Estimates for Indicated and Inferred Category, Camp at Various cut-off Grades | 136 |

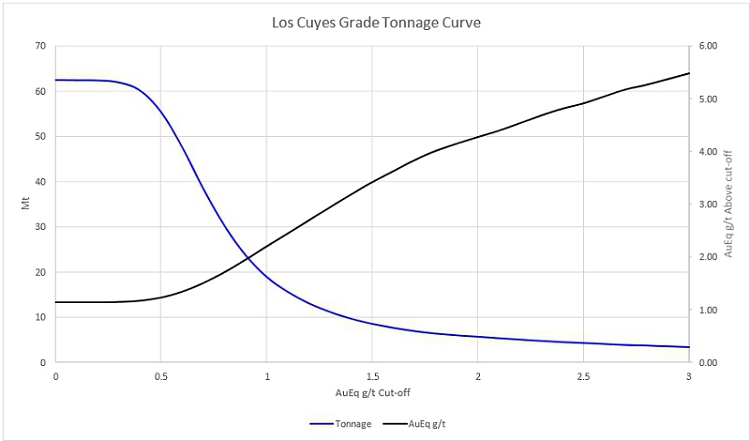

| Table 13.33: | Global Block Model Quantities and Grade Estimates for Indicated and Inferred Category, Los Cuyes at Various cut-off Grades | 138 |

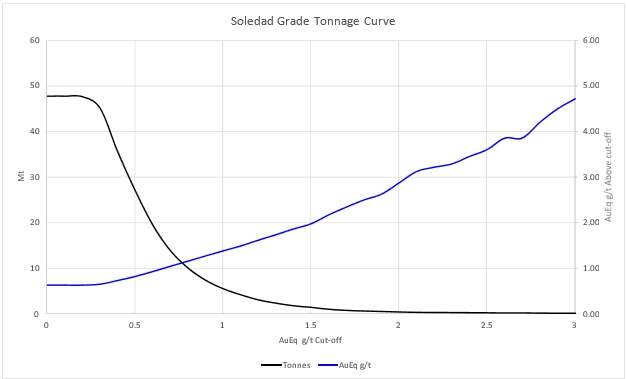

| Table 13.34: | Global Block Model Quantities and Grade Estimates for Indicated and Inferred Category, Soledad at Various cut-off Grades | 140 |

| Table 13.35: | Global Block Model Quantities and Grade Estimates for Indicated and Inferred Category, Enma at Various cut-off Grades | 142 |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | vi |

CAPR003605 ■ Silvercorp Metals Inc.

Independent Technical Report for the Condor Project, Ecuador

| Table 13.36: | Previous Condor Project Mineral Resources for selected projects Effective 28 July 2021 | 144 |

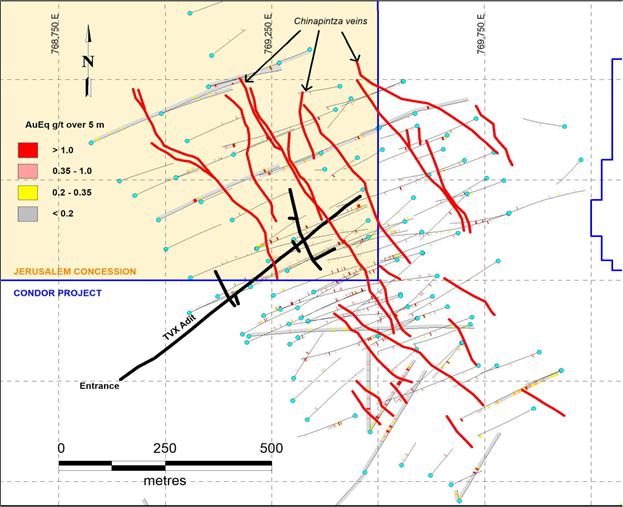

| Table 14.1: | Maynard (2004) Jeruslem Concession Mineral Resources | 146 |

| Table 14.2: | Luminex (2021) Mineral Resource estimate for the Santa Barbara Deposit | 146 |

| Table 17.1: | Proposed Initial Exploration Program for the Condor Project | 149 |

Figures

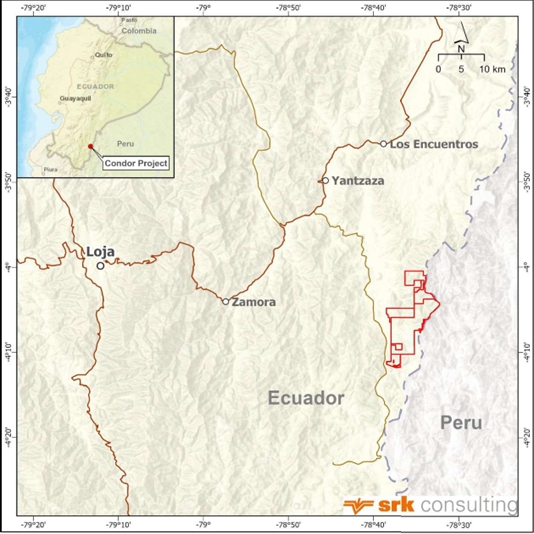

| Figure 3.1: | Location of the Condor Project | 6 |

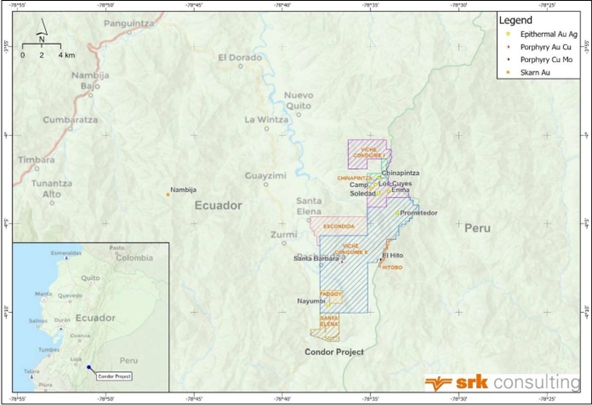

| Figure 3.2: | Condor Concessions | 7 |

| Figure 4.1: | Access to Condor Project | 11 |

| Figure 4.2: | Typical Landscape in the Condor Project | 13 |

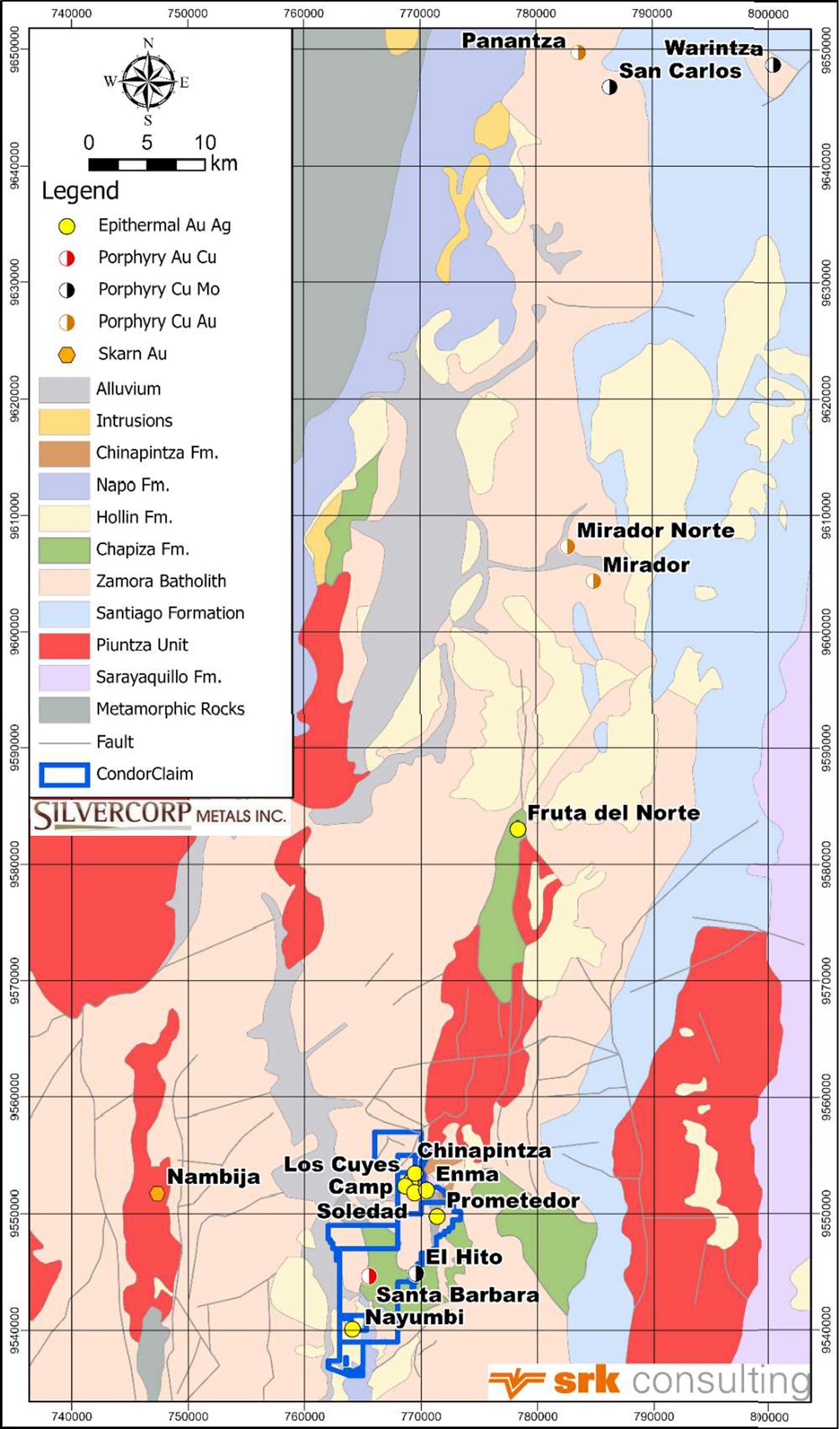

| Figure 6.1: | Regional Geological Map of Condor Project | 19 |

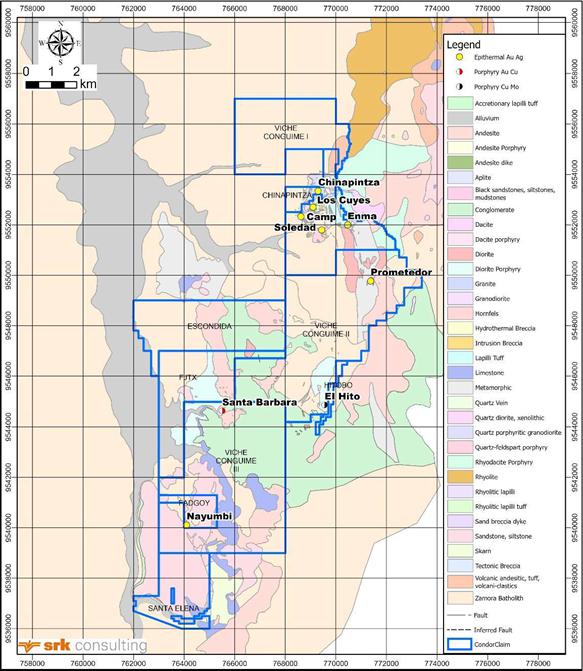

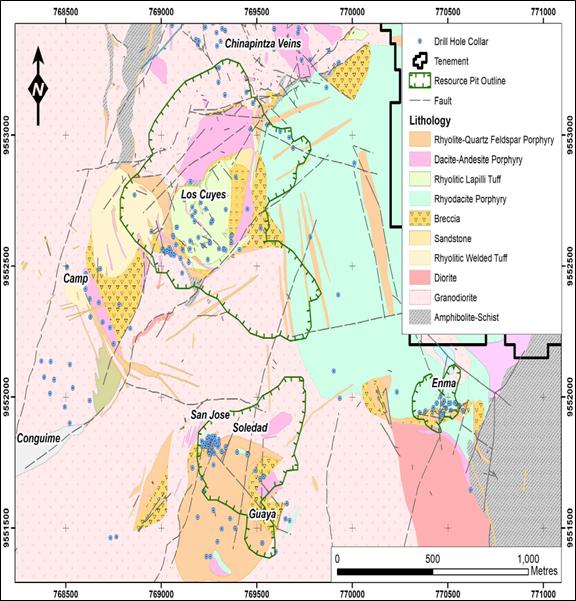

| Figure 6.2: | Property Geology Map of Condor Project | 21 |

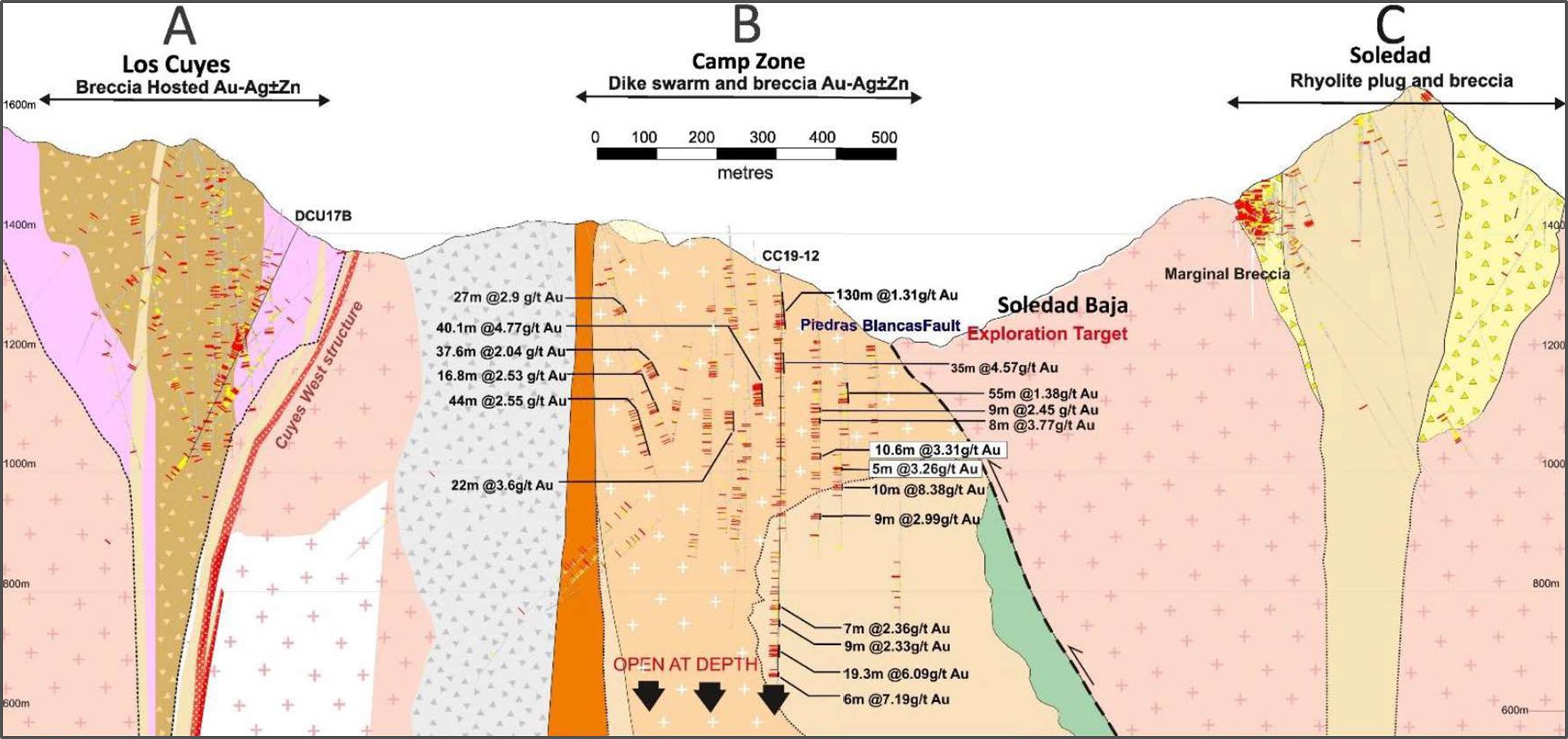

| Figure 6.3: | Diagrammatic Cross-section of Los Cuyes, Soledad, and Camp | 22 |

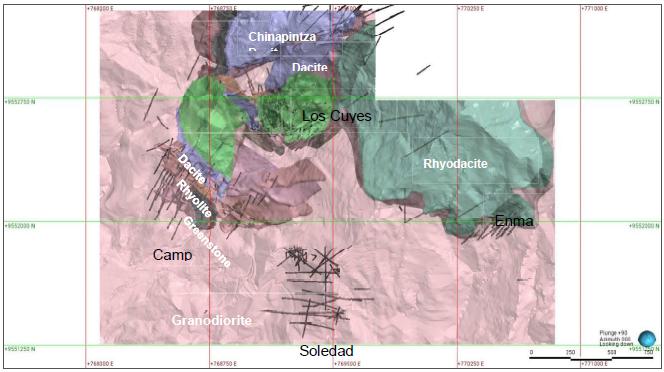

| Figure 6.4: | Condor Volcanogenic Breccia and Dome Complex | 25 |

| Figure 8.1: | 2024 SVM Relogging Program | 27 |

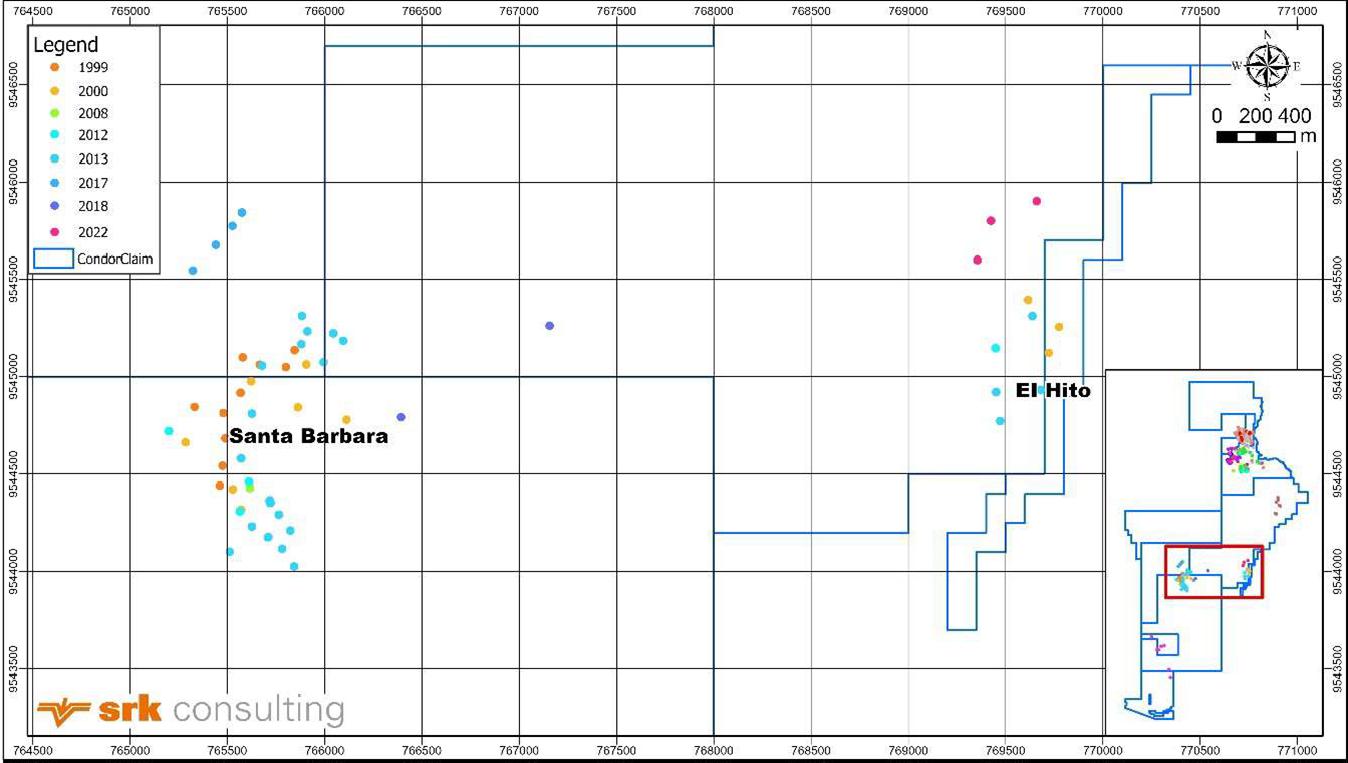

| Figure 9.1: | Condor North Area Drilling Location Map | 28 |

| Figure 9.2: | Condor Central Area Drilling Location Map | 29 |

| Figure 10.1: | Drill Core Photograph and Logging Areas of Condor Project | 34 |

| Figure 10.2: | Core Tray and Sample Storage of Condor Project | 36 |

| Figure 11.1: | Rock Outcrops at the Condor Project | 40 |

| Figure 11.2: | Condor Project Drillhole Sealing Mark | 41 |

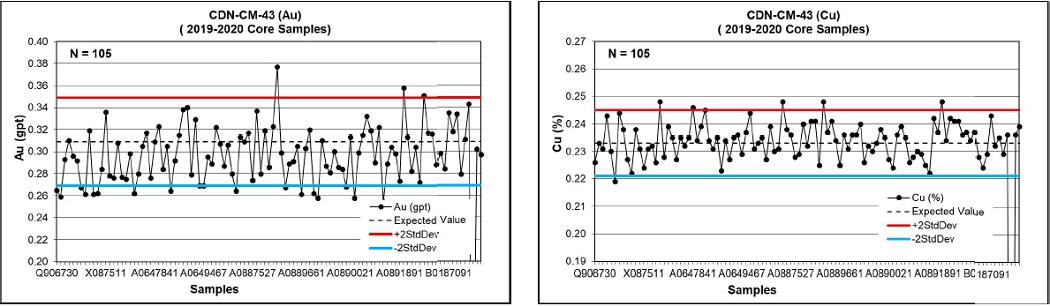

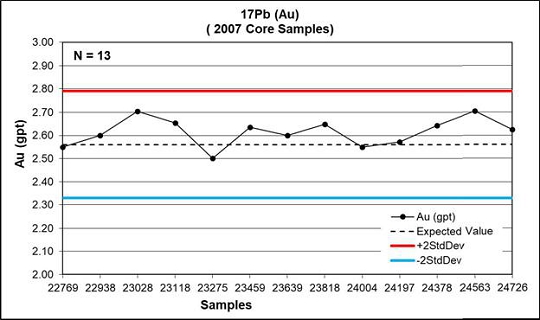

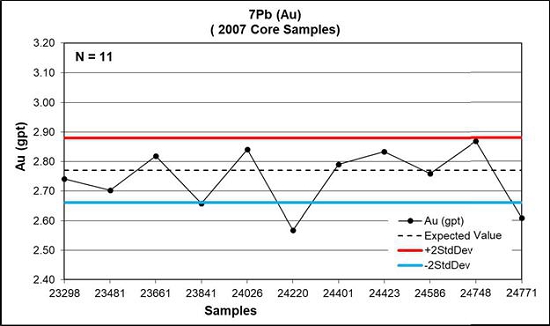

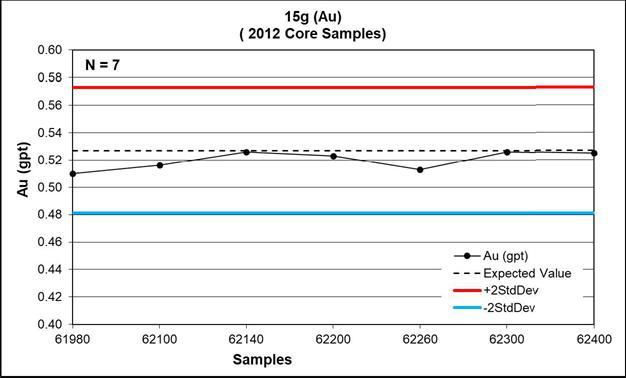

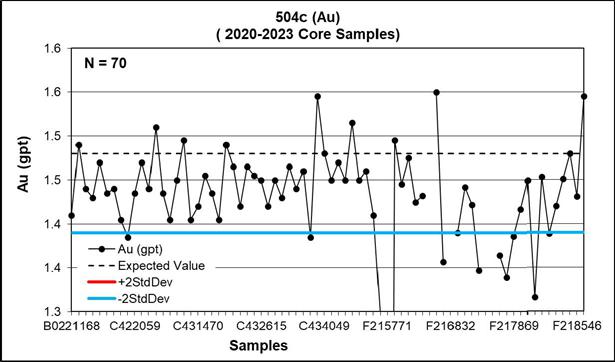

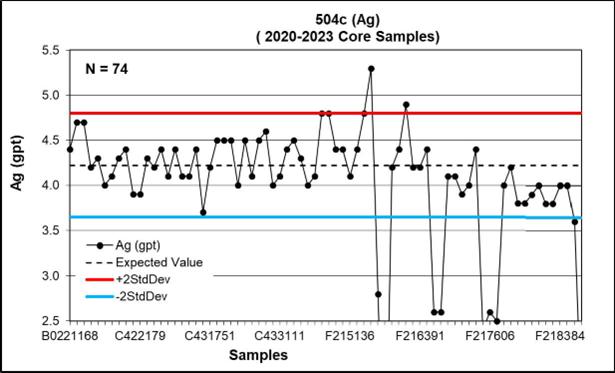

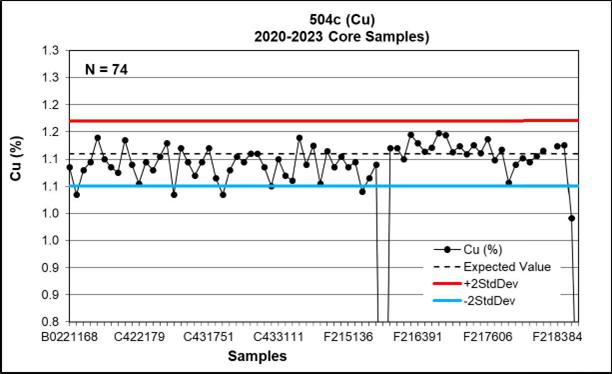

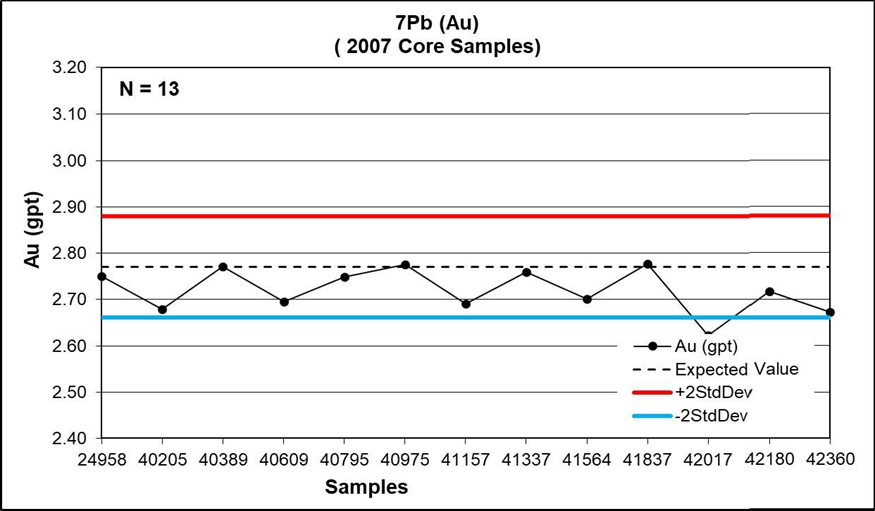

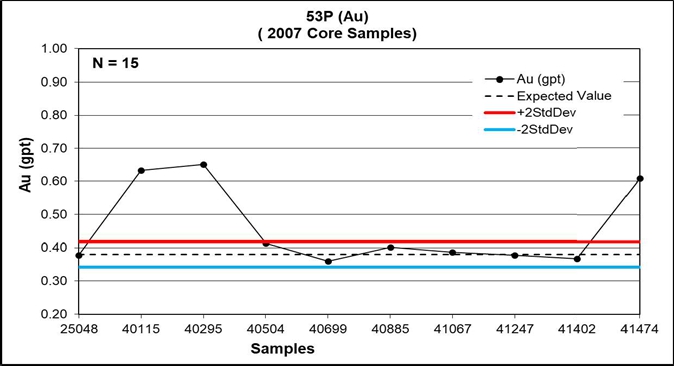

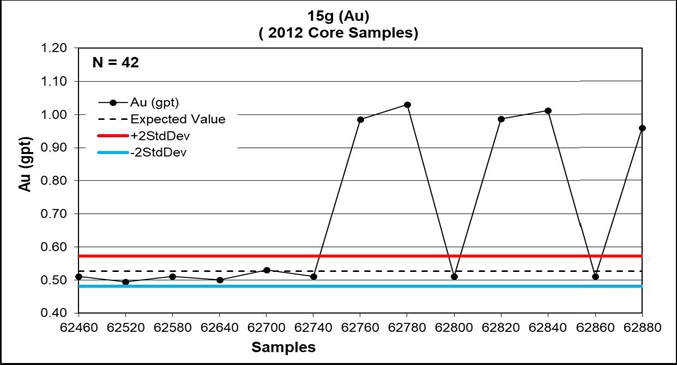

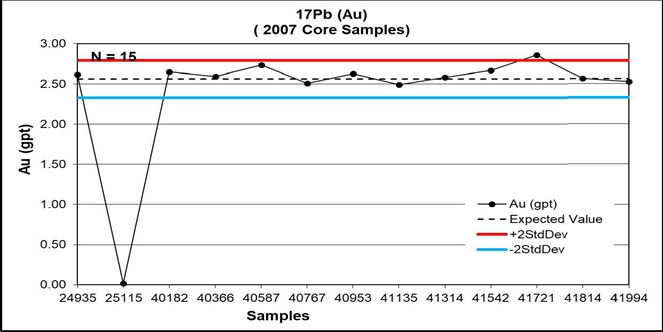

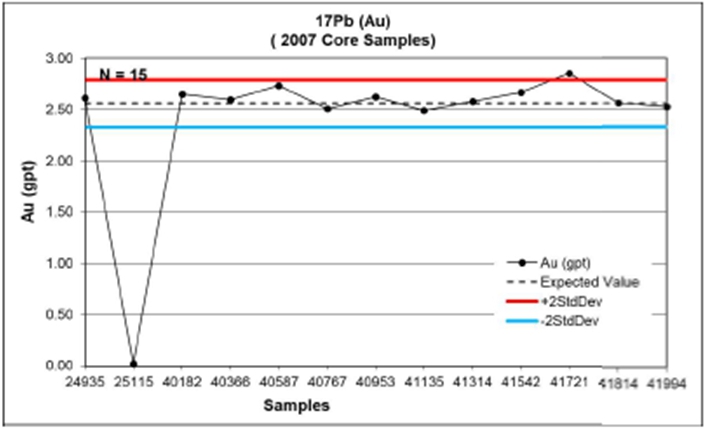

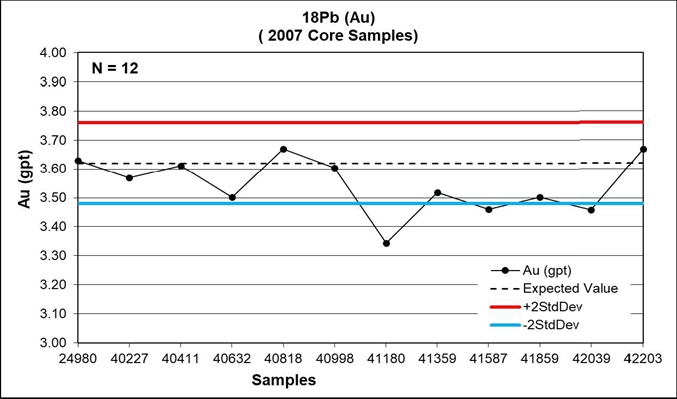

| Figure 11.3: | Selected CRMs Performances for the Camp Deposit | 47 |

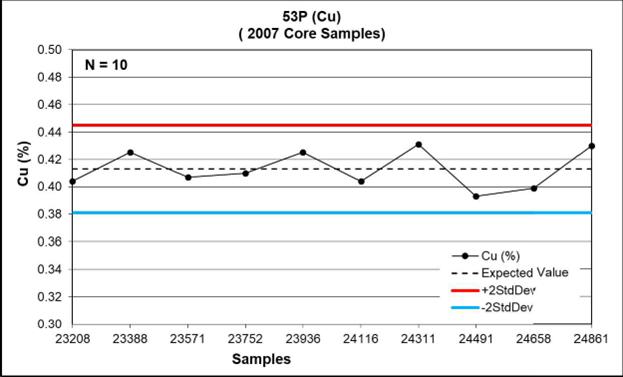

| Figure 11.4: | Selected CRMs Performances for the Los Cuyes Deposit | 49 |

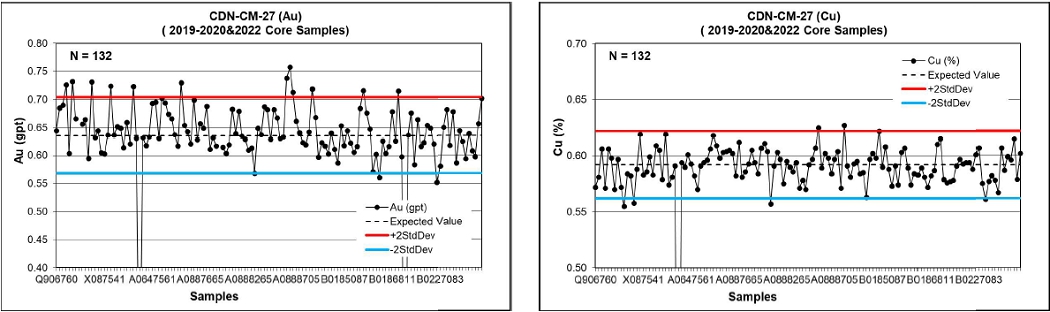

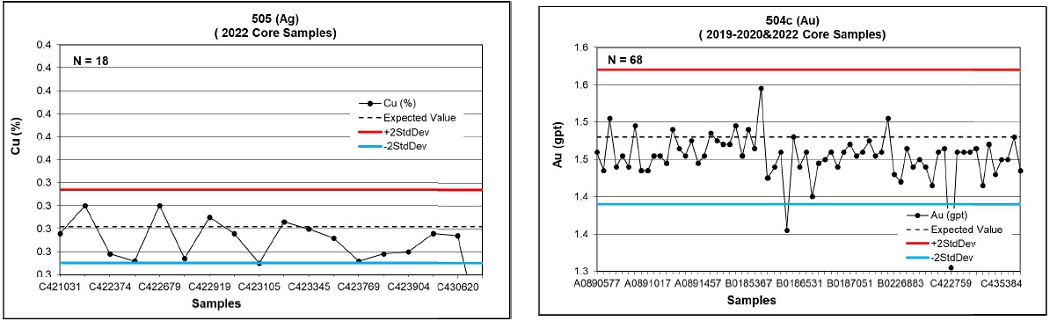

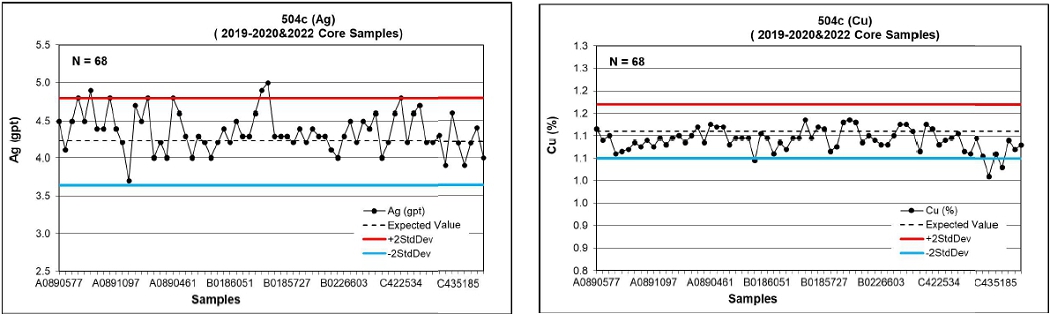

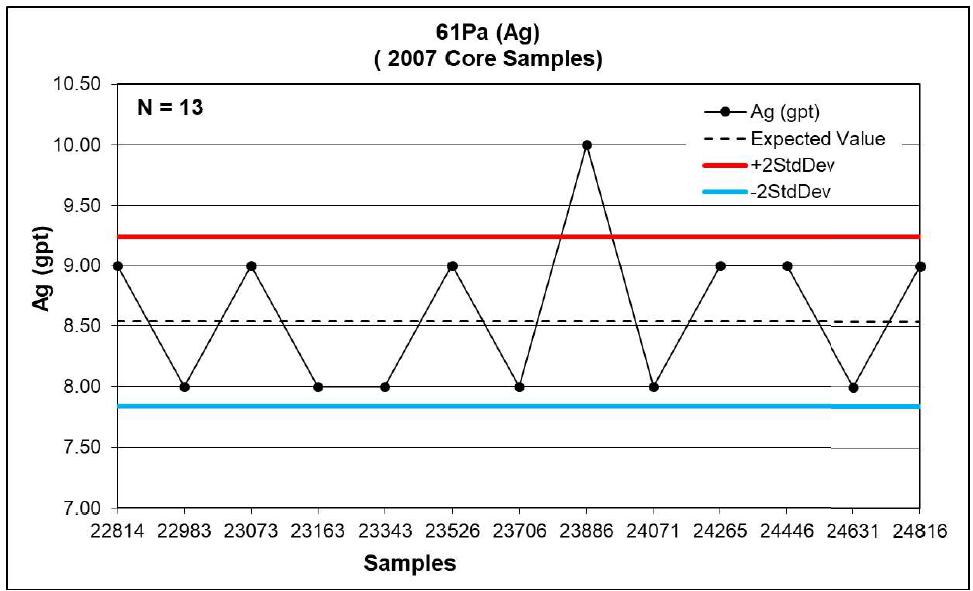

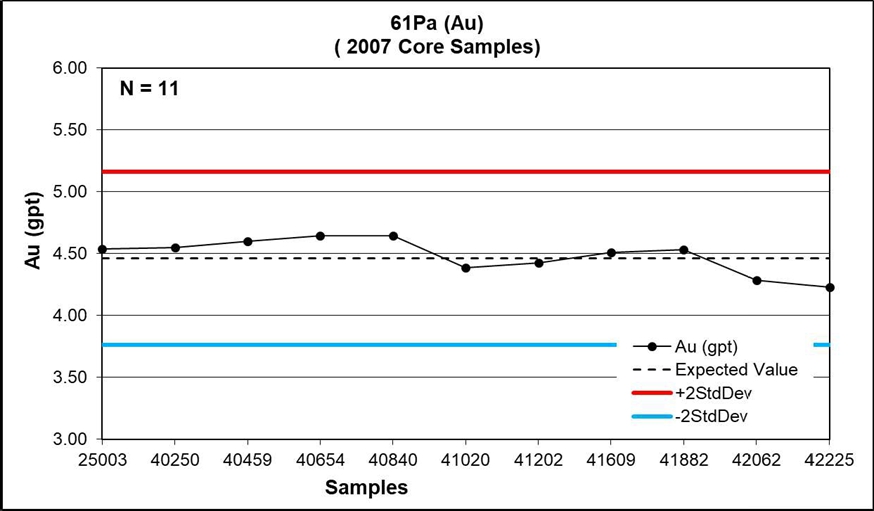

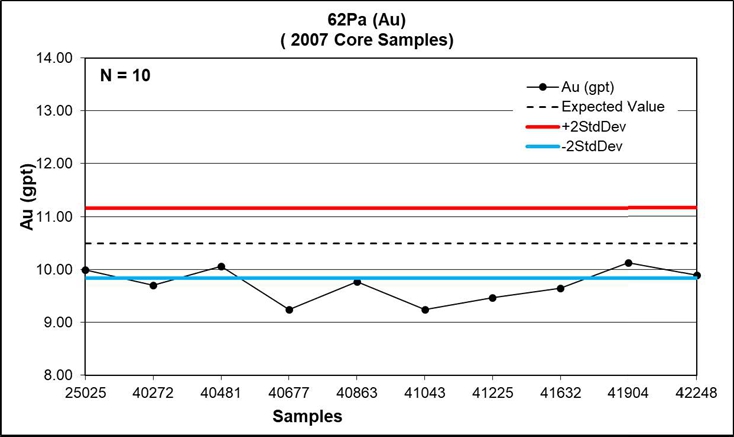

| Figure 11.5: | Selected CRMs Performances for the Soledad Deposit | 51 |

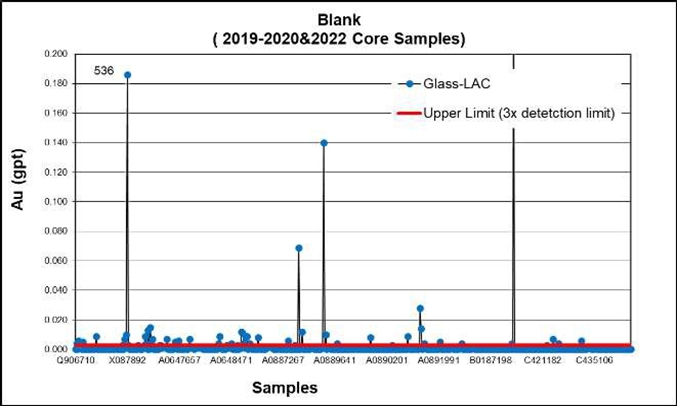

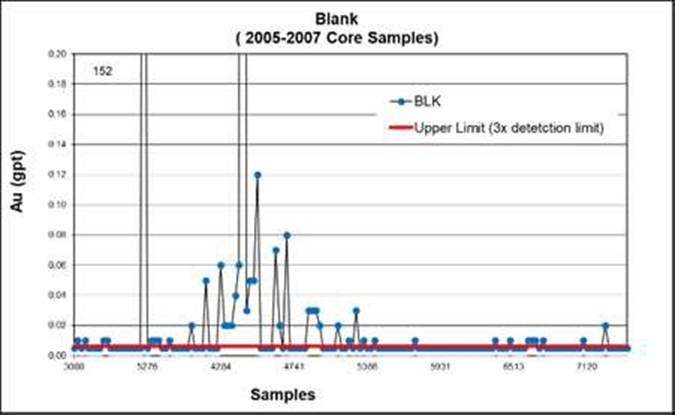

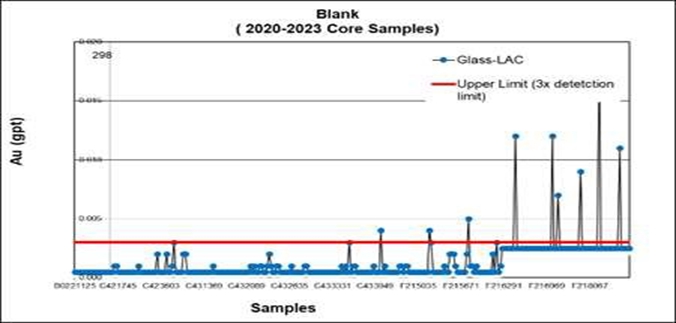

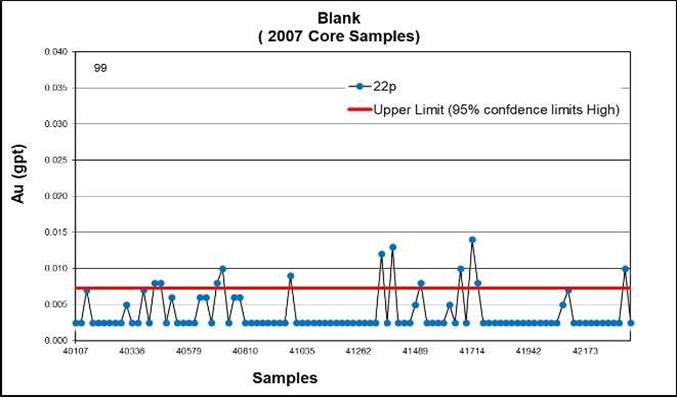

| Figure 11.6: | Selected Blanks Performances Charts for Au | 53 |

| Figure 11.7: | Coarse Duplicates Scatter and HARD Plot for Gold | 55 |

| Figure 11.8: | Field Duplicates Scatter and HARD Plot for Gold | 56 |

| Figure 11.9: | Pulp Duplicates Scatter and HARD Plot for the gold | 57 |

| Figure 11.10: | Umpire samples Scatter for the Los Cuyes deposit | 58 |

| Figure 12.1: | Gold Leach Curves of WOCN for Los Cuyes West and Breccia Pipe | 63 |

| Figure 12.2: | Silver Leach Curves of WOCN for Los Cuyes West and Breccia Pipe | 63 |

| Figure 12.3: | Flow Diagram for the Bulk Flotation-Cyanidation-Pb Flotation-Zn Flotation | 67 |

| Figure 12.4: | Flowsheet of Bulk Flotation at Coarse Grind Size and Cyanide leach of Bulk Concentrate | 76 |

| Figure 12.5: | Multi-Stage Gravity Concentration and Cyanidation Test Flowsheet | 78 |

| Figure 13.1: | Plan View of Condor Project Geology at Surface | 85 |

| Figure 13.2: | Cross Sections of the Veins CA-01 to CA-06 looking Northwest | 86 |

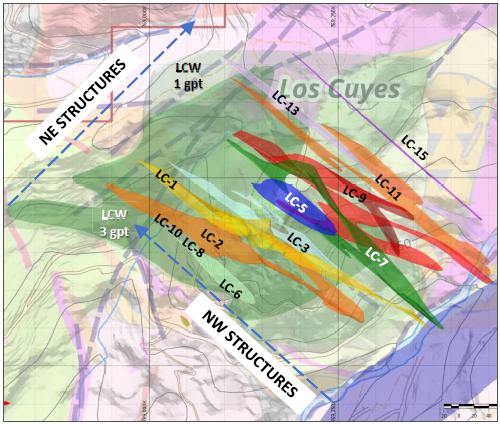

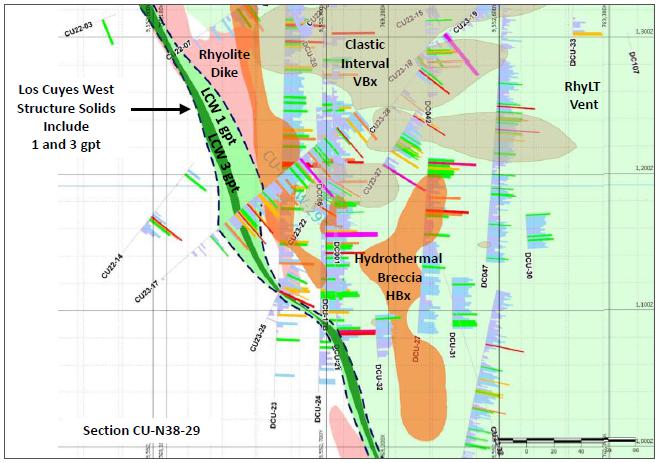

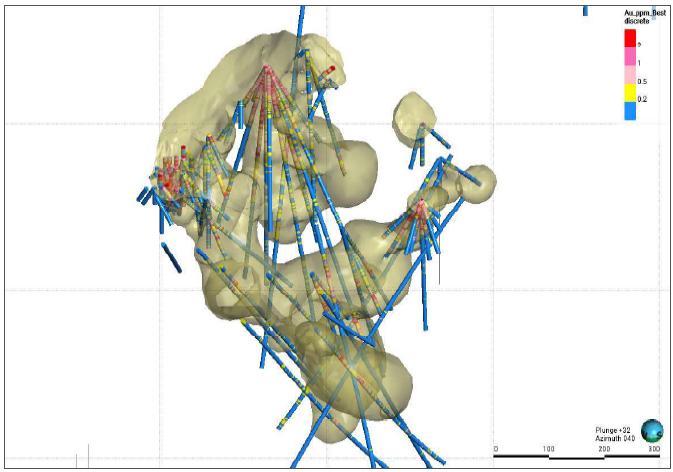

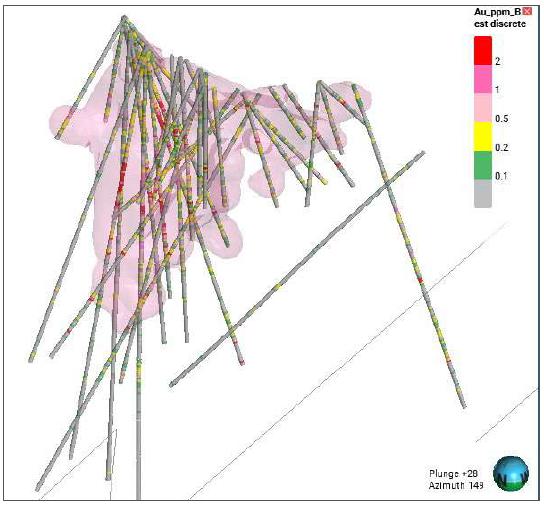

| Figure 13.3: | Plan View of the Los Cuyes Shear Hosted Mineralization Models | 87 |

| Figure 13.4: | Los Cuyes Vertical Cross Section looking North West | 88 |

| Figure 13.5: | Soledad Deposit 0.2 g/t Constraining Gold Grade Shell | 89 |

| Figure 13.6: | Enma Deposit 0.1 g/t Constraining Gold Grade Shell | 90 |

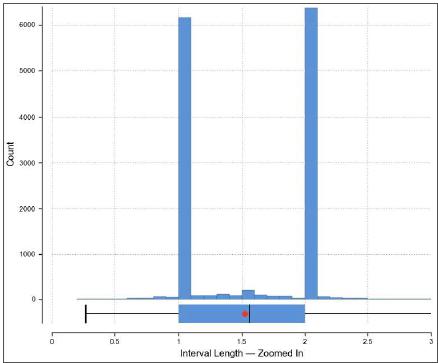

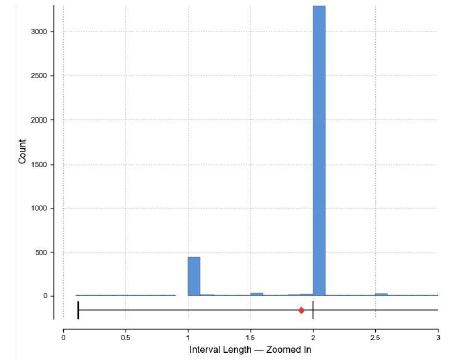

| Figure 13.7: | Interval Length Histogram for the Camp Deposit | 91 |

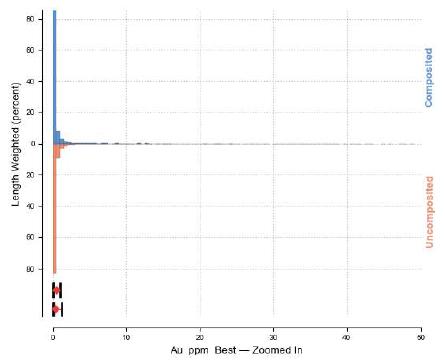

| Figure 13.8: | Gold Grades Before and After Compositing (Camp) | 92 |

| Figure 13.9: | Interval Length Histogram of Los Cuyes | 93 |

| Figure 13.10: | Interval Length Histogram of Soledad | 95 |

| Figure 13.11: | Interval Length Histogram for Enma | 97 |

| Figure 13.12: | Before and After Compositing (Enma) | 97 |

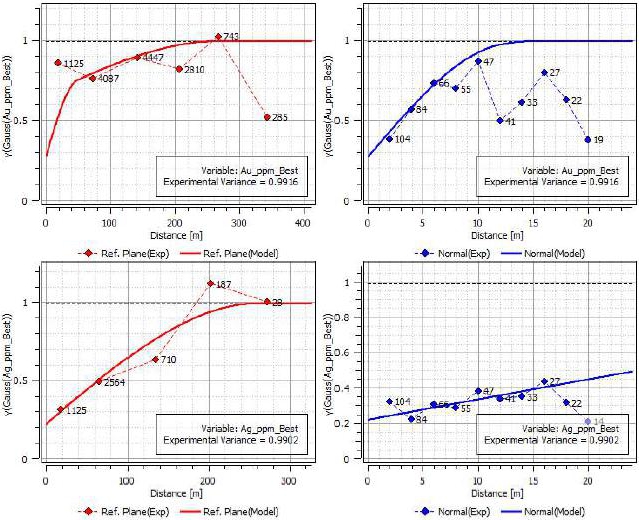

| Figure 13.13: | Camp CA-03 Domain Gaussian Space Semi-Variogram Models | 102 |

| Figure 13.14: | Los Cuyes LCW Domain Gaussian Space Semi-variogram Models | 104 |

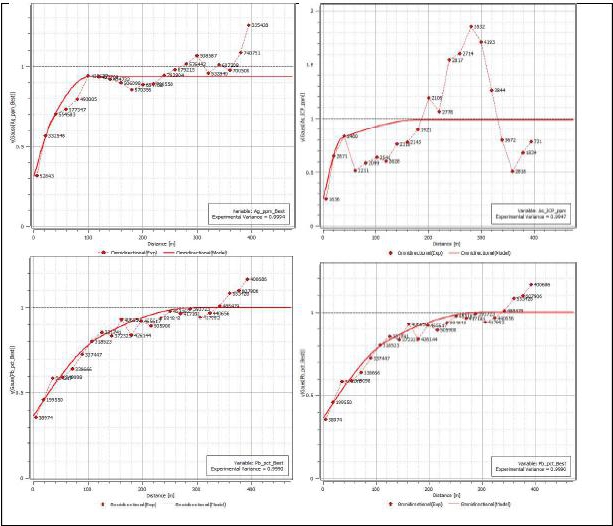

| Figure 13.15: | Soledad Gaussian Space Semi-variogram Models | 105 |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | vii |

CAPR003605 ■ Silvercorp Metals Inc.

Independent Technical Report for the Condor Project, Ecuador

| Figure 13.16: | Enma Semi-Variogram Models | 106 |

| Figure 13.17: | Vertical Section of The Camp Ca-03 Domain Gold Distribution Looking North | 114 |

| Figure 13.18: | Camp X Swath Plots for Gold, Silver, Lead and Zinc | 115 |

| Figure 13.19: | Camp Z Swath Plots for Gold, Silver, Lead and Zinc | 115 |

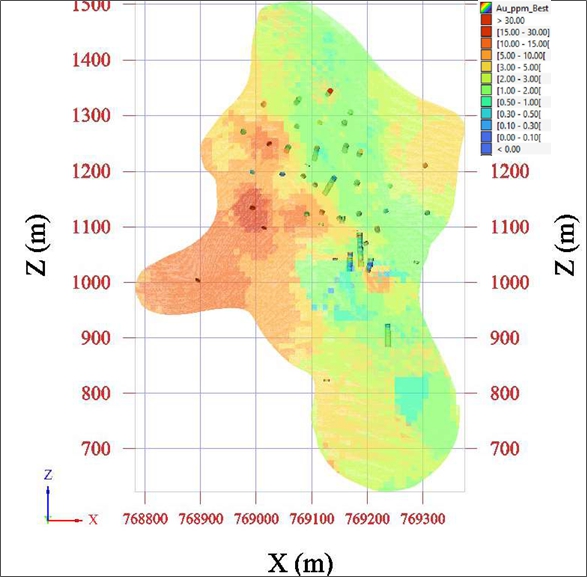

| Figure 13.20: | Vertical Section of the Los Cuyes LCW Domain Gold Distribution Looking North | 117 |

| Figure 13.21: | Los Cuyes X Swath Plots for Gold, Silver and Zinc in the LCW Domain | 118 |

| Figure 13.22: | Los Cuyes Z Swath Plots for Gold, Silver and Zinc in the Halo Domain | 119 |

| Figure 13.23: | Soledad Vertical Cross Section Looking West Showing Gold Grade | 120 |

| Figure 13.24: | Soledad Y and Z Swath Plots for Gold | 121 |

| Figure 13.25: | Enma vertical Cross Section Looking South Showing Gold Grade | 122 |

| Figure 13.26: | Enma X and Z Swath Plots for Gold | 123 |

| Figure 13.27: | Plan Showing Camp Domain CA-03 Classification | 125 |

| Figure 13.28: | Plan Showing Camp Domain CA-05 Classification | 126 |

| Figure 13.29: | Section Showing Los Cuyes Domain NW5 Classification | 127 |

| Figure 13.30: | Section Showing Los Cuyes Domain NW1 Classification | 128 |

| Figure 13.31: | Section Showing Los Cuyes Domain LCW Classification | 129 |

| Figure 13.32: | Section Showing Soledad Indicated Mineral Resource classification | 130 |

| Figure 13.33: | Section Showing Enma Indicated Mineral Resource Classification | 131 |

| Figure 13.34: | Camp Deposit Global Grade Tonnage Curve | 137 |

| Figure 13.35: | Los Cuyes Deposit Global Grade Tonnage Curve | 139 |

| Figure 13.36: | Soledad Deposit Global Grade Tonnage Curve | 141 |

| Figure 13.37: | Enma Deposit Global Grade Tonnage Curve | 143 |

| Figure 14.1: | Plan Map – Chinapintza Veins – Jerusalem Concession | 145 |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | viii |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Executive Summary

Introduction

Silvercorp Metals Inc. (Silvercorp, SVM, the Company or the Client) commissioned SRK Consulting (Canada) Inc (SRK) to undertake an independent technical review of the Condor project (the Condor Project or the Project) located in Ecuador. The deliverable of this Project is a National Instrument 43- 101 compliant Independent Technical Report with an independent and unbiased view of the Project which will enable potential equity investors and possible future shareholders to review the Project’s operations.

The Condor Project consists of the Condor North area, the Condor Central area and the Condor South area. The Condor North area consists of the deposits at Los Cuyes, Soledad, Enma, Camp, and the Prometedor Prospect. The Condor Central area consists of the copper-gold and copper-molybdenum porphyries at Santa Barbara and El Hito. The Condor South area consists of the newly identified Nayumbi Prospect.

The Condor Project in this report refers to the Los Cuyes, Soledad, Enma and Camp deposits in the Condor North area.

The Report documents an updated Mineral Resource estimate for the Los Cuyes, Soledad, Enma and Camp Deposits following the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 and Form 43-101 F1 (the “NI 43-101 Standard”) and in conformity with the generally accepted Canadian Institute of Mining, Metallurgy and Petroleum (the CIM)’s Definition Standards and the “Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines” (2019).

Property Description and Ownership

The Condor Project is located in the Province of Zamora-Chinchipe, near the Ecuador-Peru border and the southern end of the Cordillera del Condor. The Project is approximately 400 km south-southeast of Quito, 149 km east of the city of Loja, and 76 km east of the town of Zamora.

The ownership history of the Condor Project began with artisanal and small-scale miners operating in the area pre-1988. In 1988, modern exploration commenced through a joint venture between ISSFA and Prominex UK. This partnership lasted until 1991 when Prominex UK withdrew, and in 1993, TVX Gold, Inc. (TVX) and Chalupas Mining joined the venture. They remained involved until 2000, after which Goldmarca (formerly Hydromet Technologies Ltd.) formed a new joint venture with ISSFA in 2002. Goldmarca was rebranded to Ecometals Ltd. in 2007 and continued operations until the Ecuadorian government imposed a moratorium on mineral exploration from April 2008 to November 2009. In 2010, Ecometals sold its interest to Ecuador Capital, which was later renamed Ecuador Gold and Copper Corp. (EGX). Lumina Gold Corp (Lumina) acquired EGX in 2016, and in 2018, Lumina spun out Luminex Resources Corp. (Luminex), leading to the Condor Project being 90% owned by Condormining, a Luminex subsidiary, with ISSFA retaining a 10% stake. However, ISSFA has made no funding contribution to the continuing operation of the project; consequently, its share has been diluted

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | ix |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

to 1.3% to date. In January 2024, Adventus Mining Corporation (Adventus) merged with Luminex. In July 2024, Silvercorp acquired Adventus and assumed the ownership of the Condor Project.

Accessibility, Climate, Physiography, Local Resources and Infrastructure

Access to the project is provided by paved and gravel roads. The climate in the Project area is highland tropical, with an average daily temperature ranging from 21°C to 24°C, and an average annual rainfall of approximately 2,000 mm to 3,000 mm. There is a distinct annual rainy season that typically occurs between January and June.

The city of Loja (population ~181,000) is the largest regional centre in the area of the Project and will be a major source of basic goods and services for advanced phases of exploration as well as mine construction and operation. Initial estimates indicate that the national electric grid is capable of providing all necessary power to the Project. Current infrastructure at the Condor Project consists of a fully equipped 70-man exploration camp, located at 1,456 masl directly above the Camp deposit. The camp consists of dormitories, canteen, medical clinic, administrative offices, warehouse, emergency generator, water treatment plant, septic system, diesel storage tanks and fuelling station, a meteorological station, various security installations, and a large core logging and storage facility.

Ancillary core storage, warehousing, and waste segregation/accumulation facilities are also located near the camp. The camp is connected to the national grid and has full internet and cellular telephone access. The Congüime River and numerous smaller streams and springs within the Project concessions can serve as sources of water for all anticipated mining, mineral processing, potable usage, and other Project requirements.

The Project is located in steep, high-relief terrain, near the southern end of the Cordillera del Condor. Elevations range between 960 m and 1,830 m above sea level. The Condor Project area is subject to frequent landslides and mudflows, due to the steepness of terrain, underlying geology, periodically extreme precipitation events, and the accumulated exacerbating impacts of illegal mining clearances.

History

The exploration of the Condor Project area has been extensive and spans several decades.

| ■ | From 1988 to 1991, ISSFA and Prominex UK conducted regional stream sediment sampling and geological mapping. |

| ■ | After TVX Gold, Inc. (TVX) and Chalupas withdrew in 2000, Goldmarca / Ecometals took over and continued with reconnaissance mapping, IP and magnetic surveys, and drilling 154 holes totaling 33,323m from 2002 to 2008. |

| ■ | The exploration halted due to a moratorium imposed from April 2008 to November 2009. Resuming in 2012, EGX focused on geological mapping, rock sampling, and diamond drilling 37 holes totaling 22,052m until 2016. |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | x |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| ■ | Under Lumina Gold Corp from 2016 to 2018, the Project saw additional mapping, sampling, and geophysical surveys, leading to the drilling of nine holes totaling 1,907m. |

| ■ | Since 2018, Luminex Resources Corp. has continued these efforts, conducting a property-wide airborne ZTEM geophysical survey and drilling 46 holes totaling 23,211m at the Camp deposit. |

Despite extensive exploration efforts, the Condor Project has not yet achieved commercial mineral production. However, artisanal mining has been a significant activity in the area since the 1980s.

Geology and Mineralization

The Condor Project is located in the Cordillera del Condor in the Zamora copper-gold metallogenic belt. The Project area comprises epithermal gold-silver, porphyry copper-gold ±molybdenum, and numerous alluvial gold deposits.

The Condor Project's geology is both diverse and complex, particularly in the Condor North area. This region is characterized by distinctive low- to intermediate-sulphidation epithermal vein swarms located in the northern part. These vein swarms form a series of north-northwest-striking, narrow, high-grade gold and electrum-bearing manganoan carbonate veins, often accompanied by base metals and hosted in dacite porphyry. The Condor breccia, dyke, and dome complex is further divided into four main zones: Camp, Los Cuyes, Soledad and Enma. Gold-silver mineralization in these zones is linked with sphalerite-pyrite/marcasite veins, which typically occur within breccias, along the contacts of rhyolite dykes, and as replacements and disseminations. These veins are often disrupted by post- mineral extensional faults.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xi |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Camp: The Camp deposit features gold and silver mineralization linked to a swarm of northwest- striking rhyolite-dacite dykes, likely originating from a larger buried rhyolite intrusion. These dykes are concentrated at the contact between a volcanic/intrusive complex and a major granodiorite intrusion. The mineralized zone, dipping steeply at 85° to the northeast, extends over 700 m along strike and is 200 m wide. Gold occurs within veins containing pyrite, marcasite, iron-rich sphalerite (marmatite), galena, ± chalcopyrite, pyrrhotite, quartz, and rhodochrosite gangue. Host rocks include altered granodiorites, breccias, flow-banded rhyolite, and phreatomagmatic breccia. The area is capped by 30 to 80 m of trachyte to rhyolitic welded tuff, with the Camp ridge bounded by the Camp Fault and Piedras Blancas Fault.

Los Cuyes: Los Cuyes is hosted within an oval-shaped diatreme measuring 450 m northeast- southwest, 300 m northwest-southeast, and extending to at least 350 m in depth. This diatreme, resembling an inverted cone plunging approximately 50° to the southeast, consists of an outer shell of polymictic phreatomagmatic breccia and an internal fill of well-sorted rhyolitic lapilli tuffs, breccias, and volcanic sandstones. Amphibolite and quartz arenite fragments occur around its periphery, with dacite and rhyolite ring dykes intruding the steep margins. Lithological contacts, such as dykes cutting through the diatreme and its outer breccia shell, favoured vein development. The mineralization and alteration at Los Cuyes post-date all local rock types, including blocks of the Hollín Formation, indicating that the mineralization is post-Early Cretaceous.

Soledad: The Soledad Zone features a 700-meter diameter oval-shaped rhyolite intrusion within the Zamora Batholith, surrounded by discontinuous pyritic breccias. The overall mineralization at Soledad is described as a north-south elongated wine glass-shaped body, tapering between 200 to 300 m below the surface and extending approximately 110 m northwest by 50 m northeast. Sphalerite transitions to pyrite as the dominant sulphide at around 100 m below the surface, leading to diminished gold and silver grades similar to Los Cuyes.

Enma: Gold and silver mineralization at Enma is hosted in a west-northwest-trending rhyolitic breccia that occurs at the contact between andesite lapilli tuffs and the Zamora batholith. The deposit has dimensions of 280 m east-northeast, is approximately 20 to 75 m wide, and has a vertical extent of 350 m. Alteration mineralogy is primarily chlorite with minor quartz-sericite ± alunite-kaolinite. Gold is associated with pyrite-sphalerite-quartz and locally rhodochrosite veins. At depths greater than 200 m, gold-poor, pyrite-pyrrhotite ± chalcopyrite veins are more dominant.

Deposit Types

Camp, Los Cuyes, Soledad and Enma Deposits are consistent with low- to intermediate sulphidation epithermal mineralization. Characteristics of such deposits are:

| ■ | Occur at convergent plate settings, typically in calc-alkaline volcanic arcs. |

| ■ | Form at shallow depths (<2 km) from near-neutral pH, sulfur-poor hydrothermal fluids, often of meteoric origin, with metals derived from underlying porphyry intrusions. |

| ■ | Structural permeability created by hydrothermal fluid over-pressuring allows for mineralized fluids to permeate, with gold precipitated by boiling. |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xii |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| ■ | Sub-types include sulphide-poor deposits with rhyolites, sulphide-rich deposits with andesites/rhyodacites, and sulphide-poor deposits with alkali rocks. |

| ■ | Hydrothermal alteration is zoned and subtle, characterized by sericite, illite, smectite, and carbonate. |

| ■ | Features quartz, quartz-carbonate, and carbonate veins with various textures. |

| ■ | Sulphide content varies (1-20%), typically <5%, with pyrite, sphalerite, galena, and low copper (chalcopyrite). |

| ■ | High gold, silver, arsenic, antimony, mercury, zinc, lead, selenium, and low copper, tellurium. |

Exploration, Quality Assurance and Quality Control

Since 1994, the Condor Project has undergone extensive drilling by various operators. The drilling campaigns of Condor Project from 1994 to 2023, totalling 538 holes with 157,312 meters, focused primarily on the Condor North Area and Condor Central Area.

No QAQC data are available for the TVX Gold, Inc. (TVX) drilling programme.

From 2004 to August 2007, the Certified Reference Materials (CRMs or standards Standards), blanks and quarter core duplicate samples were used on the Project. The QAQC procedure from July 2007 to 2011 involved inserting a blank every 6 samples, a standard after 7 samples, a duplicate after 6 samples, followed by another blank. Checks by SRK indicate that this methodology was not strictly adhered to in terms of the number of blanks and standards. From July 2007, OREAS standards and blanks were used, mine waste material was no longer used.

During the Goldmarca / Ecuador Gold and Copper Corp. (EGX) drill programs from 2012 to 2014, CRMS, blanks and quarter core duplicate sample were inserted after every 20 samples as part of the QAQC procedure.

Quality control failures for programs from 2012–2015 were addressed with programs of remedial assay analysis.

During the 2017–2018 drill program, QAQC samples are inserted after every six core samples. These include three certified standards (high, medium and low gold grades), a blank, and a coarse duplicate.

During the 2019–2021 drill program, QAQC samples are inserted with the insert rate about 2% - 4% for each type, including the certified standards, blank, coarse duplicate and fine duplicates.

The author considers that quality control measures adopted for assaying of the Condor Mineral Resource drilling have established that the assaying is representative and free of any biases or other factors that may materially impact the reliability of the analytical results. The author considers that the sample preparation, security and analytical procedures adopted for Condor drilling provide an adequate basis for the current Mineral Resource estimates.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xiii |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Data Verification

SRK conducted a site inspection of the Condor Project from June 19 to 20, 2024. The inspection was led by Principal Geologist Mark Wanless (QP) from SRK Canada, Falong, Hu (Principal Mining Consultant) and Yanfang Zhao (Principal Geologist) from SRK China, who carried out a series of verification steps. These included a thorough examination of the Project area, meetings with company representatives, and discussions with geologists regarding sample collection, preparation, storage, and QAQC procedures. The team also reviewed geological interpretations, inspected outcrops, mineralization, and fault structures, and verified drillhole sealing marks. Additionally, they visually checked stratigraphy against interpreted drilling sections and visited the drill core storage facility and core catalog room to assess the company’s core storage protocols and procedures.

The QP was provided the database named CN_DH_Export_Database_8Sept2023.xlsx which covers the QAQC data for several deposits from 1994 to 2023. A review of historical QAQC data was conducted by SRK.

Based on SRK’s site visit, review of the previous and ongoing exploration datasets, communication with the Condor’s technical personnel and consideration of the mineralization characteristics of the deposit, SRK is satisfied with the quality and result of the sample preparation and assay conducted by related analytical laboratories. The analytical procedures are consistent with generally accepted industry practices and the primary sample results are therefore suitably reliable for use in Mineral Resource estimation.

Mineral Processing and Metallurgical Testing

Mineralization of Los Cuyes, Camp, Soledad (San Jose) and Enma deposits comprise gold and silver with low-level base metal sulphides of copper, lead and zinc. The recovery target metals are gold and silver as dore by gravity concentration and cyanide leach, as well as copper, lead and zinc as flotation concentrates when their contents are high enough for economic recovery.

Cyanide leaching tests were conducted on all four deposit samples, including standard whole ore cyanidation (WOCN), carbon in leach (CIL) and gravity plus concentrate intensive cyanidation and tails WOCN. The results are summarised in Table i. All the samples from four deposits are amenable to WOCN, and there is no preg-robbing effect. For a San Jose sample with 2.72 g/t gold and 26.7 g/t, grind size of 90% passing 75 µm, and leaching for 72 hours, the gold and silver extractions reached 91.6% and 82.0%, respectively. For an Enma ore sample with 0.97 g/t gold and 36.8 g/t silver, grind size of 80% passing 75 µm, and leaching for 24 hours, the gold and silver extractions reached 74.2% and 67.9%, respectively.

The bulk rougher flotation was also investigated with the bulk concentrate being cyanide leached samples of Los Cuyes, Camp and San Jose. The cyanide leached bulk concentrate was floated again to produce the silver/lead concentrate and silver/zinc concentrate. The results are shown in Table ii. Overall gold recoveries of flotation and concentrate cyanide leach were 90.2% to 91.5% for Los Cuyes and 92.6% for Camp. The flotation of the concentrate cyanide leach residues likely produced saleable lead concentrate and zinc concentrate in some cases, depending on the feed grade and flotation operating conditions. The tests obtained a saleable zinc concentrate and a silver/lead concentrate for

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xiv |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

the Los Cuyes samples, only a saleable lead/silver concentrate for the Camp sample. The San Jose sample at Soledad has not obtained a satisfied bulk flotation result likely due to overly coarse grind size. Enma has not been tested yet on bulk flotation. The bulk flotation and then concentrate cyanide leach followed by selective flotation to produce the silver/lead concentrate and zinc concentrate is a capital cost effective flowsheet, it can comprehensively recover the residual gold and silver from the cyanide residue. However, the overall gold recovery may be somewhat compromised, and the management of process waters will be complicated, because any residual cyanide in the process water will reduce gold recovery during flotation. Optimization test work of this flowsheet should be carried out on all the deposits.

Since gold and silver in the mineralized materials are easily cyanide leachable, in order to obtain a higher gold and silver recovery, the process flowsheet of cyanidation followed by flotation of the cyanide residue has also been preliminarily tested. The overall results are summarized in Table iii. This process flowsheet can achieve higher gold and silver recoveries than the process of bulk flotation – bulk concentrate cyanidation – cyanide residue separate flotation and does not have the issue of residual cyanide in the process water on gold recovery. Although the capital cost is higher, it is recommended that the detailed cyanide residue flotation tests be carried out on all of the master composite samples (MC) from the four deposits to demonstrate whether the marketable lead and zinc concentrates can be produced and to determine overall recoveries for gold, silver, lead, zinc and copper. A trade-off study between the two process flowsheets should be conducted during the next technical study phase.

Table i: Cyanidation Test Results Summary - Gold and Silver Extractions

| Composite | WOCN | CIL | Gravity+WOCN | |||

| Au | Ag | Au | Ag | Au | Ag | |

| Camp-Low Grade1 | 91.8 | 49.5 | 92.1 | 41.5 | 92.9 | 45.6 |

| Camp-Med Grade1 | 96.5 | 43.3 | 98.0 | 39.7 | 96.9 | 43.9 |

| Camp-High Grade1 | 96.0 | 43.3 | 97.0 | 48.5 | 96.0 | 43.3 |

| Los Cuyes-Low Grade1 | 87.5 | 27.2 | ||||

| Los Cuyes-Med Grade1 | 90.8 | 37.5 | ||||

| Los Cuyes-High Grade1 | 87.9 | 57.4 | ||||

| Los Cuyes-Master1 | 87.1 | 49.4 | 89.1 | 47.7 | 85.9 | 54.5 |

| Enma-Master1 | 74.2 | 67.9 | 71.5 | 67.0 | ||

| San Jose2 | 91.6 | 82.0 | ||||

| San Jose Master3 | 72.6 | 43.3 | 63.4 | 40.3 | ||

| Note: | 1 grind size P80=75µm, leaching time 24 hours |

| 2 grind size P90=75µm, leaching time 72 hours | |

| 3 grind size P80=106µm, leaching time 48 hours |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xv |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Table ii: Overall Recovery of Bulk Flotation – Concentrate Cyanidation – Residue Flotation

| Grade | Recovery (%) | ||||||||||

| Parameter | Weight % |

Au g/t |

Au g/t |

Cu % |

Pb % |

Zn % |

Au | Ag | Cu | Pb | Zn |

| Los Cuyes - Low Grade | |||||||||||

| Bulk Conc | 10.2 | 8.40 | 104.8 | 0.39 | 2.57 | 95.2 | 85.7 | 81.6 | 58.5 | ||

| Bullion | 90.2 | 54.4 | |||||||||

| Ag/Pb Conc. | 0.08 | 1 ,748 | 23.19 | 10.69 | 10.3 | 38.8 | 2.1 | ||||

| Zn Conc | 0.31 | 127.8 | 0.90 | 49.00 | 2.9 | 5.8 | 36.7 | ||||

| Overall Recovery - bullion plus saleable concentrate | 90.2 | 64.7 | 36.7 | ||||||||

| Los Cuyes - High Grade | |||||||||||

| Bulk Conc | 13.9 | 28.67 | 256.1 | 1.25 | 4.77 | 95.0 | 87.4 | 83.9 | 71 .9 | ||

| Bullion | 91.5 | 46.1 | |||||||||

| Ag/Pb Conc | 0.21 | 2,653 | 32.33 | 9.66 | 12.7 | 38.6 | 2.2 | ||||

| Zn Conc | 0.67 | 161.3 | 0.94 | 45.18 | 2.5 | 3.6 | 32.6 | ||||

| Overall Recovery - bullion plus saleable concentrate | 91.5 | 58.8 | 32.6 | ||||||||

| Base Camp | |||||||||||

| Bulk Conc | 14.4 | 32.1 | 187 | 1.0 | 5.6 | 98.5 | 96.3 | 94.5 | 78.8 | ||

| Bullion | 92.6 | 50.3 | |||||||||

| Ag/Pb Conc | 0.04 | 1.01 | 3,324 | 52.4 | 3.86 | 0.01 | 6.45 | 23.4 | 0.16 | ||

| Zn Conc | 0.14 | 0.83 | 316.7 | 4.28 | 2.32 | 0.05 | 2.31 | 7.28 | 0.39 | ||

| Overall Recovery - bullion plus saleable concentrate | 92.6 | 56.7 | 23.4 | ||||||||

Table iii: Overall Recovery of Cyanidation - Residue Flotation

Grade |

Recovery (%) | ||||||||||

Parameter |

Weight % |

Au |

Ag |

Cu % |

Pb % |

Zn % |

Au |

Ag |

Cu | Pb | Zn |

| Los Cuyes - Low Grade | |||||||||||

|

Bullion |

|

|

87.1 | 49.4 | |||||||

| Cu/Pb Conc | 0.1 | 3.81 | 650 | 5.88 | 16.2 | 0.49 | 0.78 | 18.6 | 34.9 | 61.9 | 0.6 |

| Overall Recovery - bullion plus saleable concentrate | 87.1 | 49.4 | |||||||||

| Camp | |||||||||||

|

Bullion |

95.7 | 44.6 | |||||||||

| Ag/Pb Conc | 0.1 | 3.28 | 3,348 | 0.8 | 44.2 | 20 | 0.08 | 12.3 | 2.6 | 38.1 | 2.4 |

| Zn Conc | 1.3 | 2.52 | 218.7 | 1.37 | 1 | 45.3 | 0.68 | 8.7 | 47.7 | 9.3 | 59.7 |

| Overall Recovery - bullion plus saleable concentrate | 96.5 | 65.6 | |||||||||

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xvi |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Mineral Resource Estimates

Condor Project comprises several deposits, however this section only focuses on the Camp, Los Cuyes, Soledad and Enma deposits in the Condor North area, which are included in the Mineral Resources estimation.

The Mineral Resource estimation work of Condor Project was completed by SRK in 2025. The estimates are based on drilling samples information available up to 2023. The QP believes the drilling information is sufficiently reliable to interpret with confidence the boundaries for the deposits and that the assay data are sufficiently reliable to support Mineral Resource estimation. Mr Mark Wanless (Pr.Sci.Nat, FGSSA), and Ms Yanfang Zhao (MAusIMM), who are Principal Geologists from SRK have reviewed the drillhole database, geological model and the mineralisation domains generated by SVM, made some adjustment, performed the grade estimation, classified the Mineral Resources and prepared the Mineral Resource estimate using Datamine, Isatis.Neo and Leapfrog Geo and Edge.

The Qualified Person responsible for the Mineral Resources is Mr Mark Wanless, who is a full time employee of SRK Consulting (Canada) Inc. (SRK Canada) and registered with the South African Council for Natural Scientific Professionals as Pr.Sci.Nat, 400178/05, Fellow of the Geological Society of South Africa, Member of the Geostatistical Association of South Africa and a Member of the South African Institute for Mining and Metallurgy (SAIMM). Mr. Mark Wanless visited the Condor Project between the 19th and 20th of June 2024.

The Mineral Resources have been estimated in accordance with generally accepted CIM Definition Standards and are reported in accordance with the Stock Exchange listing requirements.

The Company considered future operation on Soledad and Enma using surface mining. However at Camp and Los Cuyes the Company plans underground mining due to the steep terrain conditions, relative complexity, high grade tabular mineralization, and that the surface infrastructure might best be located in Camp and/or Los Cuyes area.

The optimization parameters reflect a conventional open pit operation although the cost and revenue assumptions on Soledad and Enma used are not related to any mine plan or financial analysis, they were used only to define the reasonable prospects for eventual economic extraction (RPEEE) envelope, and the figures were derived from the current information.

For the higher-grade and thicker tabular domains at Camp and Los Cuyes, there is the opportunity of using a bulk mining method such as long hole open stoping for underground extraction. The thinner tabular domains at Camp and Los Cuyes require using more selective mining methods such as short hole shrinkage and/or cut and fill methods. The Company has extensive experience on selective mining methods and advised that they would like to consider a selective method as the primary approach. Therefore, a breakeven cut-off grade was calculated to determine the subset of the estimated blocks that can be economically exploited using shrinkage or cut and fill mining.

The commodity prices are sourced from an independent analyst, Consensus Market Forecast (CMF) for gold, silver, lead, and zinc. The projected outlook (in real USD) was issued by CMF in February 2025. The long-term prices were used for the consideration of the Reasonable Prospect for Eventual Economic Extraction (RPEEE).

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xvii |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Within the current mining license area, as of 31 December 2024, Mineral Resources are reported for the Condor Project, above a COG of 2.2 g/t gold equivalent for Camp and Los Cuyes which are amenable to underground extraction, and 0.6 g/t and 0.5 g/t gold equivalent for Enma and Soledad respectively which are amenable for open pit extraction.

For the open pit deposits, the Mineral Resource is constrained by a conceptual pit, designed using Whittle software. For the underground mineral Resources, SRK used a Mineable Shapes Optimiser (MSO) to outline areas of the mineralization domain that have suitable continuity and grade to sustain underground mining operations. SVM intend using a highly selective mining method (shrinkage or cut and fill) for which the MSO process is not well suited. Therefore, SRK reported the underground Mineral Resources using only a cut off value and excluding small and isolated areas which are unlikely to be practically extractable. The summary of the estimated Mineral Resources is shown in Table iv for Mineral Resources with underground mining potential, and in in Table v for Mineral Resources with open pit mining potential.

Table iv: Underground Extraction Mineral Resource Statement for Condor Project, as of 28 February 2025

| Average Grade | Contained Metal | ||||||||||

| Deposit | Tonnes | AuEq | Au | Ag | Pb | Zn | AuEq | Au | Ag | Pb | Zn |

| (Mt) | (g/t) | (g/t) | (g/t) | (%) | (%) | (koz) | (koz) | (koz) | (lb’000) | (lb’000) | |

| Indicated | |||||||||||

| Camp | 2.45 | 3.44 | 3.17 | 18.68 | 0.08 | 0.73 | 271 | 250 | 1,471 | 4,355 | 39,454 |

Los Cuyes |

0.72 | 4.04 | 3.82 | 22.9 | 0.09 | 0.63 | 93 | 88 | 528 | 1,366 | 9,966 |

| Total | 3.17 | 3.58 | 3.32 | 19.63 | 0.08 | 0.71 | 365 | 338 | 1,999 | 5,721 | 49,420 |

| Inferred | |||||||||||

| Camp | 7.9 | 3.38 | 3.07 | 20.59 | 0.08 | 0.89 | 859 | 780 | 5,229 | 13,271 | 154,944 |

| Los

Cuyes |

4.2 | 4.71 | 4.47 | 24.64 | 0.12 | 0.53 | 636 | 603 | 3,327 | 10,741 | 49,278 |

| Total | 12.1 | 3.84 | 3.55 | 22.00 | 0.09 | 0.77 | 1,495 | 1,383 | 8,556 | 24,012 | 204,222 |

Sources: SRK 2025

Notes: Mineral resources are reported above an underground extraction economic cut off value for Camp and Los Cuyes. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate.

The resource statement does not include mineralization in the Halo domain of the Los Cuyes, and its economic potential remains to be further investigated in future studies.

Underground Mineral Resources are reported at a cut-off grade of 2.2 g/t AuEq at Camp and Los Cuyes. Underground cut off grades have been determined using a gold price of USD/oz 2,200, silver price of USD/oz 27, zinc price of USD/t 2,650 and lead price of USD/t 1,950.

1 troy ounce = 31.1034768 metric grams.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xviii |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Table v: Open Pit Mineral Resource Statement for Condor Project, as of 28 February 2025

| Average Grade | Contained Metal | ||||||||||

| Deposit | Tonnes | AuEq | Au | Ag | Pb | Zn | AuEq | Au | Ag | Pb | Zn |

| (Mt) | (g/t) | (g/t) | (g/t) | (%) | (%) | (koz) | (koz) | (koz) | (lb’000) | (lb’000) | |

| Indicated | |||||||||||

| Soledad | 4.03 | 1.14 | 1.06 | 7.05 | 0.05 | 0.56 | 148 | 138 | 912 | 4,365 | 49,882 |

| Enma | 0.03 | 1.05 | 0.97 | 7.11 | 0.07 | 0.30 | 1 | 1 | 7 | 46 | 214 |

| Total | 4.06 | 1.14 | 1.06 | 7.05 | 0.05 | 0.56 | 149 | 139 | 920 | 4,411 | 50,097 |

| Inferred | |||||||||||

| Soledad | 14.15 | 0.83 | 0.76 | 5.86 | 0.04 | 0.51 | 375 | 346 | 2,664 | 12,819 | 158,009 |

| Enma | 0.02 | 0.74 | 0.56 | 16.07 | 0.06 | 0.20 | 1 | 0 | 12 | 33 | 103 |

| Total | 14.17 | 0.82 | 0.76 | 5.87 | 0.04 | 0.51 | 376 | 347 | 2,676 | 12,851 | 158,112 |

Sources: SRK 2025

Notes: Mineral resources are reported in relation to a conceptual pit shell for Soledad and Enma. Mineral Resources are not Mineral Reserves and do not have demonstrated economic viability. All figures are rounded to reflect the relative accuracy of the estimate.

Open pit Mineral Resources are reported at a cut-off grade of 0.6 g/t AuEq for Enma and 0.5 g/t AuEq for Soledad. Open pit optimizations have been determined using a gold price of USD/oz 2,200, silver price of USD/oz 27, zinc price of USD/t 2,650 and lead price of USD/t 1,950.

1 troy ounce = 31.1034768 metric grams.

Interpretation and Conclusions

SVM has reviewed, re-logged, and remodelled the mineralization at the Condor Project. At the Los Cuyes and Camp deposits the updated model of mineralization has included identification of several high-grade tabular domains which are potentially amenable to extraction using underground mining methods. At Soledad, Enma and outside of the high-grade domains at Los Cuyes SVM have modelled a lower grade disseminated mineralization which has the potential for extraction using an open pit mining method.

This mineralization interpretation at Los Cuyes is a change from the previous model which only considered a disseminated mineralization style, and did not isolate the high-grade zones separately. For some domains at Los Cuyes (such as the LCW domain) the data strongly support the revised interpretation, with good continuity in the mineralization observed over the project area. While for other domains, the continuity is less clear, and the quantity of data supporting these is less, resulting in lower confidence in these interpretations. The lateral extents of some of the domains are based on wider spaced drilling which naturally carries some additional risk to the confidence in the interpretation of the domain continuity.

At Camp, the previous models relied on interpolated domain definition using indicators, and the current interpretation is supported by a more geologically rigorous interpretation using a combination of the grade and geological logs to link up intersections between drill holes into more coherent and continuous domains.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xix |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

The geological interpretation at Soledad and Enma is not as well developed as that of Los Cuyes and Camp, relying on grade shells to constrain the mineralization. At Soledad, there is sufficient dense sampling in several locations to confirm the continuity of the mineralization despite the lower understanding of the mineralization controls, and SRK considers this sufficient to support an Indicated Mineral Resource classification.

For all the deposits, the metallurgical test work indicated that there are reasonable prospects for achieving the recoveries applied to the economic assessment. However, further work is required to be able to confirm the optimal processing configuration for each style of mineralization. As such, there is a risk that these recovery factors may change with additional test work and depending on the ultimate processing flow sheet that is selected if the project is developed.

Recommendations

In order to confirm the interpretation of the high-grade domains at Camp and Los Cuyes, SRK recommends that a phased exploration program should be undertaken. SVM has planned an initial two-phase exploration program of surface drilling. The initial phase plans for drilling six holes at Los Cuyes with an average length of approximately 400 m for a total of 2,470 m, and a second phase plans for drilling four holes split between Los Cuyes and Camp totalling 1,030 m.

Pending the approval of an environmental permit which is in progress at present, SVM plans to develop underground access drives to intersect the mineralization, and to provide platforms for drilling which will allow for better targeted drilling of shorter holes from the underground development. SVM has not yet developed a detailed development and drilling plant, as this is contingent on the outcomes of the initial surface drilling results and the approval of the environmental permit applications.

SRK recommends that the two mineral processes of "bulk flotation – bulk concentrate cyanidation - cyaniding residue separation flotation " and "cyanidation - cyaniding residue flotation" should be tested in detail, and the trade-off study between the two processes should be conducted according to the final test results.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | xx |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| 1 | Introduction and Terms of Reference |

The Condor Project is located in the Province of Zamora-Chinchipe, near the Ecuador-Peru border and the southern end of the Cordillera del Condor. Silvercorp took ownership of the Condor Project during 2024 through the acquisition of Adventus Mining Corporation.

As part of the advancement of the project, Silvercorp aims to update the Mineral Resource estimates, with underground mining of the Camp and Los Cuyes deposits being the primary focus, and open pit mining of the Soledad and Enma deposits.

SRK Consulting (China) (SRK CN) was previously engaged in May 2024 by Silvercorp to undertake a due diligence audit of the Adventus Mining Corporation's assets in Ecuador in relation to a possible stock exchange listing. A team of consultants from SRK CN and SRK Consulting (North America) undertook an audit including a site visit to the Condor Project during June 2024.

This technical report summarizes the technical information available on the Condor Project and demonstrates that the Condor Project clearly qualifies as an “Advanced Exploration Property”. In the opinion of the QP, this property has merit warranting additional exploration expenditures. An exploration work program is recommended comprising diamond core drilling, open pit and underground development to facilitate exploration drilling, and geological and Mineral Resource modelling.

The sources of information and data contained in the technical report include a review of all relevant information and documents provided by Silvercorp as of December 2024.

This technical report was prepared following the guidelines of the Canadian Securities Administrators’ National Instrument 43-101 (NI 43-101) and Form 43-101F1. The Mineral Resource Statement reported herein was prepared in conformity with generally accepted CIM Estimation of Mineral Resources and Mineral Reserves Best Practice Guidelines.

| 1.1 | Scope of Work |

The scope of work is focused on an update of the Mineral Resource estimates for the Camp and Cuyes deposits for which there is additional data subsequent to the June 2024 review, but to also include updates on the Soledad and Enma deposits for which there is no additional data, except for a revised geological model generated by Silvercorp. During the site visit in June 2024, it was apparent that the understanding of the geology and the controls on the mineralization has evolved since the previous Mineral Resource estimates were undertaken. SRK and Silvercorp agreed that the estimates for these deposits needed to be updated to reflect this understanding.

The detailed items for which the consultants from SRK are responsible include:

| ■ | Update the drilling, QAQC review and reporting for the additional data generated subsequent to the 2024 review. |

| ■ | Update the Los Cuyes Mineral Resource model, using the updated Silvercorp geological model, to include the latest drilling and the high-grade target of Los Cuyes. |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 1 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| ■ | Review and update the Camp, Soledad and Enma Mineral Resource models using geological models generated by Silvercorp. |

| ■ | Establish a potential underground Mineral Resource at Los Cuyes using the same parameters as Camp. Update the reporting constraints for the Enma and Soledad deposits using agreed commodity price estimates and mining costs. |

| ■ | Determine with Silvercorp the preferred mining approach for the declaration of Mineral Resources on each deposit. |

| ■ | Deliver an independent Technical Report (the Technical Report) with an updated Mineral Resource estimate prepared in accordance with National instrument 43-101 - Standards of Disclosure for Mineral Projects (NI 43-101) for filing with applicable securities commissions with sign off by the SRK team as Qualified Persons. |

| 1.2 | Work Program |

The Mineral Resource statement reported herein is a collaborative effort between Silvercorp and SRK personnel. The exploration database was compiled and maintained by Silvercorp and was audited by SRK. The geological model and outlines for the gold mineralization were constructed by Silvercorp and reviewed and in the case of Enma, modified by SRK. In the opinion of SRK, the geological model is a reasonable representation of the distribution of the targeted mineralization at the current level of sampling. The geostatistical analysis, variography, and grade models were completed by SRK during the months of January 2025 to March 2025.

The Mineral Resource Statement reported herein was prepared in conformity with the generally accepted CIM Exploration Best Practices Guidelines and CIM Estimation of Mineral Resource and Mineral Reserves Best Practices Guidelines. This technical report was prepared following the guidelines of the Canadian Securities Administrators’ NI 43-101 and Form 43-101 F1.

| 1.3 | Basis of Technical Report |

This report is based on information collected by SRK consultants during a site visit in June 2024, and on additional information provided by Silvercorp throughout the course of SRK’s investigations. SRK has no reason to doubt the reliability of the information provided by Silvercorp. This technical report is based on the following sources of information:

| ■ | Discussions with Silvercorp personnel. |

| ■ | Inspection of the Condor project area, including outcrop and drill core. |

| ■ | Review of exploration data collected by Silvercorp. |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 2 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| 1.4 | Qualifications of SRK and SRK Team |

The SRK Group comprises more than 1,700 professionals, offering expertise in a wide range of resource engineering disciplines. The independence of the SRK Group is ensured by the fact that it holds no equity in any project it investigates and that its ownership rests solely with its staff. These facts permit SRK to provide its clients with conflict-free and objective recommendations. SRK has a proven track record in undertaking independent assessments of Mineral Resources and mineral reserves, project evaluations and audits, technical reports and independent feasibility evaluations to bankable standards on behalf of exploration and mining companies, and financial institutions worldwide. Through its work with a large number of major international mining companies, the SRK Group has established a reputation for providing valuable consultancy services to the global mining industry.

To complete the scope of work detailed above, SRK appointed a team of professionals sourced from the SRK Toronto and SRK China offices under the supervision of Mr. Mark Wanless, Pr.Sci.Nat, a Principal Consultant based out of the SRK Toronto office. Ms. Bonnie Zhao is responsible for the data review, QAQC validation and descriptive sections of the technical report. Mr. Falong Hu is responsible for the mining related activities and for the calculation of the required reporting constraints such as open pit shells, and cut-off grades. Mr. Wanless takes the role as the Qualified Person for the reporting on Mineral Resources with support from Mrs. Zhao.

| 1.5 | Site Visit |

In accordance with NI 43-101 guidelines, Mr. Wanless, Ms. Zhao, and Mr. Hu travelled to the Condor Project in June 2024 to undertake an inspection of the project, the drill core available at the Camp site for these projects, and to review the exploration procedures, data capture and geological interpretation with the Silvercorp exploration team.

The SRK team was given full access to relevant data and conducted interviews with exploration staff to obtain the information required for technical reporting.

| 1.6 | Acknowledgement |

SRK would like to acknowledge the support and collaboration provided by Silvercorp personnel for this assignment. Their collaboration was greatly appreciated and instrumental to the success of this project.

| 1.7 | Declaration |

SRK’s opinion contained herein and effective 28 February 2025 is based on information collected by SRK throughout the course of SRK’s investigations. The information in turn reflects various technical and economic conditions at the time of writing this report. Given the nature of the mining business, these conditions can change significantly over relatively short periods of time. Consequently, actual results may be significantly more or less favourable.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 3 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

This report may include technical information that requires subsequent calculations to derive subtotals, totals, and weighted averages. Such calculations inherently involve a degree of rounding and consequently introduce a margin of error. Where these occur, SRK does not consider them to be material.

SRK is not an insider, associate or an affiliate of Silvercorp, and neither SRK nor any affiliate has acted as advisor to Silvercorp, its subsidiaries or its affiliates in connection with this project. The results of the technical review by SRK are not dependent on any prior agreements concerning the conclusions to be reached, nor are there any undisclosed understandings concerning any future business dealings.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 4 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| 2 | Reliance on Other Experts |

SRK has not performed an independent verification of land title and tenure information as summarized in Section 3 of this report. SRK did not verify the legality of any underlying agreement(s) that may exist concerning the permits or other agreement(s) between third parties, but have relied on Flor, Bustamante, Pizarro, Hurtado Abogados, as expressed in a legal opinion provided to SVM on 26 August 2024. A copy of the title opinions is provided in Appendix A. The reliance applies solely to the legal status of the rights disclosed in Section 3.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 5 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| 3 | Property Description and Location |

| 3.1 | Property Location |

The Condor Project is located in the Province of Zamora-Chinchipe, near the Ecuador-Peru border and the southern end of the Cordillera del Condor (Figure 3.1). The Project is approximately 400 km south- southeast of Quito, 149 km east of the city of Loja, and 76 km east of the town of Zamora. The approximate centre of the Project properties is located at 95523500 m North and 768000 m East (geographic projection: Provisional South American Datum 1956, UTM Zone 17M).

Figure 3.1: Location of the Condor Project

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 6 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| 3.2 | Mineral Tenure |

The Condor Project consists of nine concessions in alphabetical order: Chinapintza, Escondida, FADGOY, FJTX, Hitobo, Santa Barbara, Viche Congüime I, Viche Congüime II, Viche Congüime III (Figure 3.2).

Figure 3.2: Condor Concessions

The mining concessions are held under Condormining S.A, Corporación FJTX S.A, and Bestminers S.A., subsidiaries of Adventus Mining Corporation which was acquired by SVM in 2024. Adventus Mining Corporation owns 100% of Ecuador Gold Holdings Ltd., which owns 98.73% of Condormining S.A through its 100% owned subsidiary EMH S.A.. Corporación FJTX is owned by Adventus Mining Corporation through EMH S.A., which holds 99.974% of the common shares of Corporación FJTX. Bestminers S.A. is 98.73% owned by Adventus Mining Corporation through EMH S.A.

Condormining S.A. holds four mining concessions that are part of the Condor Project, namely:

| ■ | Viche Congüime Cuerpo 1 (registered May 20, 2010, valid for ~21 years). |

| ■ | Viche Congüime Cuerpo 2 (registered May 21, 2010, renewed in 2021 for 25 years). |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 7 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| ■ | Viche Congüime Cuerpo 3 (registered May 20, 2010, valid for ~22 years). |

| ■ | Hitobo (registered May 25, 2010, valid for ~21 years). |

Corporación FJTX S.A. holds four mining concessions also included in the Condor Project, namely:

| ■ | Escondida (registered February 17, 2017, valid for 25 years). |

| ■ | Santa Elena (registered February 17, 2017, valid for 25 years). |

| ■ | FJTX (registered May 25, 2010, valid for ~21 years). |

| ■ | Fadgoy (registered May 20, 2010, valid for ~21 years) Silvercorp Legal Opinion. |

Bestminers S.A. holds the Chinapintza concession, which was created from a division of Viche Congüime Cuerpo I in 2014. The concession is valid for ~17 years (since February 6, 2014).

| 3.3 | Underlying Agreements |

Condormining previously held a joint venture agreement with Minera Guangsho Ecuador and JV Chinapintza Mining S.A. (signed November 2, 2012). This agreement was terminated on April 29, 2016, but Condormining still owns 30% of JV Chinapintza Mining S.A., which is undergoing liquidation.

| 3.4 | Environmental Regulations and Permitting |

Currently, the Condor Mining Project holds an active Environmental License for advanced exploration activities, formalized by the Ministry of the Environment, Water, and Ecological Transition (MAATE) through Resolution No. 267 dated April 22, 2013.

However, the Ministry of Energy and Mines (MEM), through an official administrative resolution, has categorized the mining concessions of the Cóndor project under the small-scale mining regime. This categorization provides full legal support for initiating processes related to regularization, monitoring, mining control, and environmental management based on the established mining rights.

The Mineral Resources in the Condor North area are located within the three northernmost contiguous concessions shown in Figure 3.2. According to MEM and MAATE, advanced exploration works have been conducted in these concessions since 2013 in compliance with an approved EIS (Ambienconsul, 2006), biennial environmental audits, and regularly updated PMAs.

From February 19, 2025, the environmental regularization process for a new EIS under the small-scale mining regime was initiated via the Single Environmental Information System (SUIA) for the simultaneous phases of exploration, exploitation, and beneficiation of metallic minerals within an operational area inside the concessions.

The Mining Law allows concessionaires to enter pre-negotiation agreements with the Government of Ecuador related to the development of exploitation contracts. Such discussions may commence following a formal request during the Economic Evaluation Period.

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 8 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Before the construction of the mine and the commencement of mineral production, the Condor Project will be subject to the guidelines and directives required by the current Ecuadorian laws and regulations on mining and environment. Considering previous experience with projects of a similar scale in Ecuador, it is estimated that the main permitting actions will take up to 24 months to complete. These actions are summarized in the following: Change of Mining Phase, Environmental Licensing Process, Water Permits, Safety and Health Planning Actions, Electricity-Related Permits, Fuel and Explosives Permits, among others.

| 3.5 | Mining Rights in Condor Project |

In Ecuador, mining concessions are granted by the Ministry of Energy and Mines (MEM) through a Mining Title. Condormining is the lawful title holder of four mining concessions. The Condormining and Corporación FJTX S.A. FJTX and Fadgoy concessions were originally granted in 2001. In 2009, the Mining Law was reformed and it provided that existing mining titles shall be substituted with new mining titles in accordance with the new provisions of the Mining Law. Therefore, in 2010, new/substituted mining titles were granted to Condormining and Corporación FJTX S.A. for these six concessions. The concession information is summarized in Table 3.1 to Table 3.3.

Table 3.1: Condormining Concessions

| Concession Name | Cadastral Code |

Surface Area (hectares) |

Registration date1 |

Term of the concession2 |

| Viche Congüime Cuerpo 1 | 2024 | 1,930 | May 20, 2010 | 21 years, 3 months, 11 days |

| Viche Congüime Cuerpo 2 | 2024A | 2,410 | May 21, 2010 | 25 years counted since February 4, 2021 because it was renewed for additional 25 years |

| Viche Congüime Cuerpo 3 | 500802 | 2,501 | May 20, 2010 | 22 years, 11 months, 5 days |

| Hitobo | 500115 | 5,850 | May 25, 2010 | 21 years, 4 months, 17 days |

| Sources: SVM provided Independent Legal Opinion – Flor, Bustamante, Pizarro, Hurtado | ||

| 1 | Date the Mining Title was registered in the Mining Register | |

| 2 | Term of the concession (counted since the date of registration in the Mining Registry) |

Table 3.2: Corporación FJTX S.A. Concessions

| Concession Name | Cadastral Code |

Surface

Area (hectares) |

Registration date1 |

Term of the concession2 |

| Escondida | 50000497 | 1000 | 17/02/2017 | 25 years |

| Santa Elena | 50000655 | 615 | 17/02/2017 | 25 years |

| FJTX | 500135 | 960 | 25/05/2010 | 21 years, 4 months, 17 days |

| Fadgoy | 500245 | 199 | 20/05/2010 | 21 years, 3 months, 25 days |

Sources: SVM provided Independent Legal Opinion – Flor, Bustamante, Pizarro, Hurtado

| 1 | Date the Mining Title was registered in the Mining Register |

| 2 | Term of the concession (counted since the date of registration in the Mining Registry) |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 9 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

Table 3.3: Bestminers S.A. Concessions

| Concession Name | Cadastral Code |

Surface Area (hectares) |

Registration date1 |

Term of the concession2 |

| Chinapintza | 2024.1 | 210.02 | 6/02/2014 | 17 years, 7 months, 2 days |

Sources: SVM provided Independent Legal Opinion – Chinapintza

| 1 | Date the Mining Title was registered in the Mining Register |

| 2 | Term of the concession (counted since the date of registration in the Mining Registry) |

| SRK CONSULTING (CANADA) INC. ■ MAY 12, 2025 | 10 |

| CAPR003605 ■ Silvercorp Metals Inc. |

| Independent Technical Report for the Condor Project, Ecuador |

| 4 | Climate, Local Resources, Infrastructure, and Physiography |

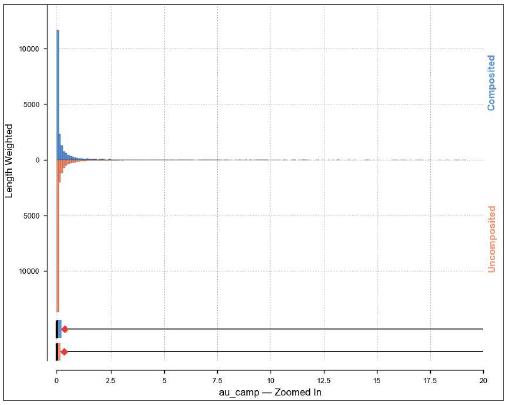

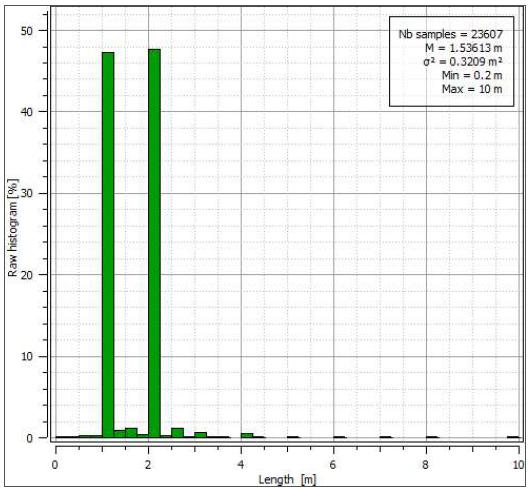

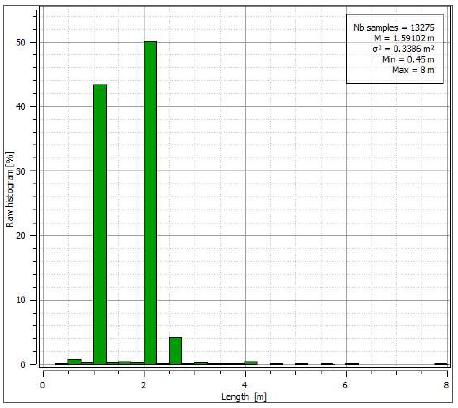

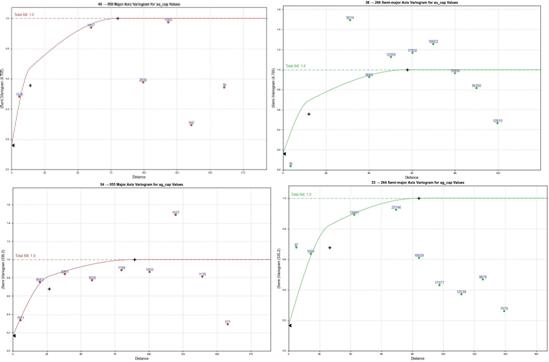

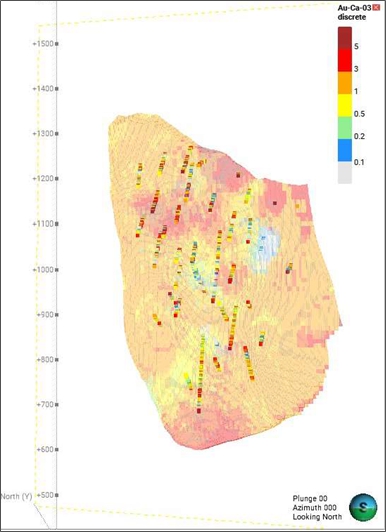

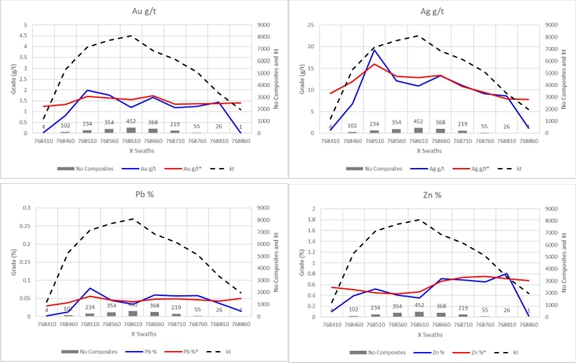

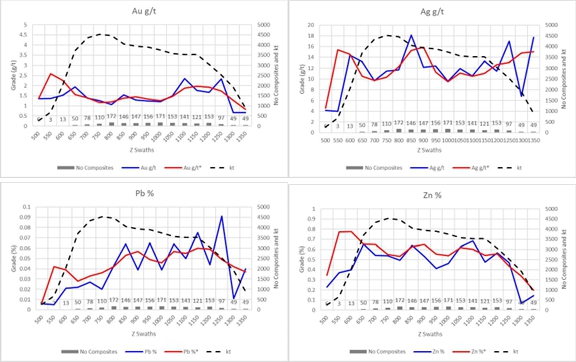

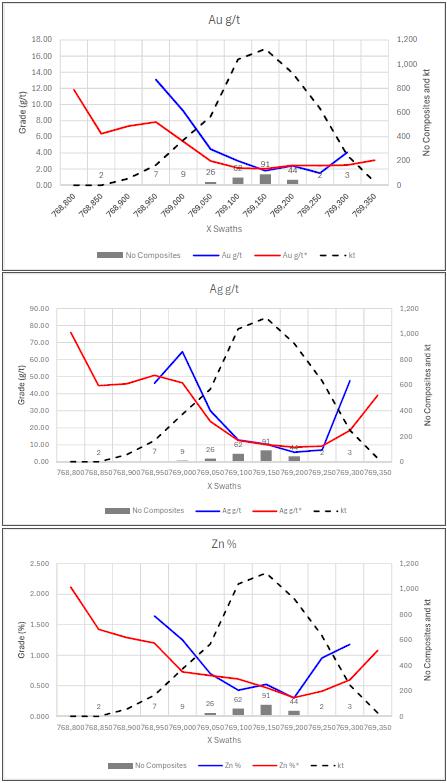

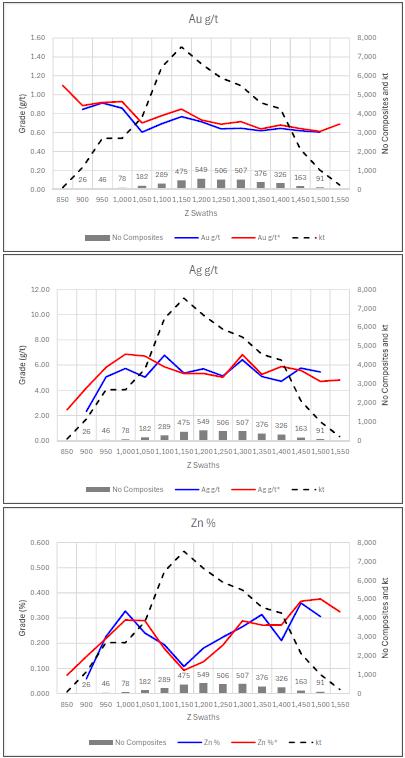

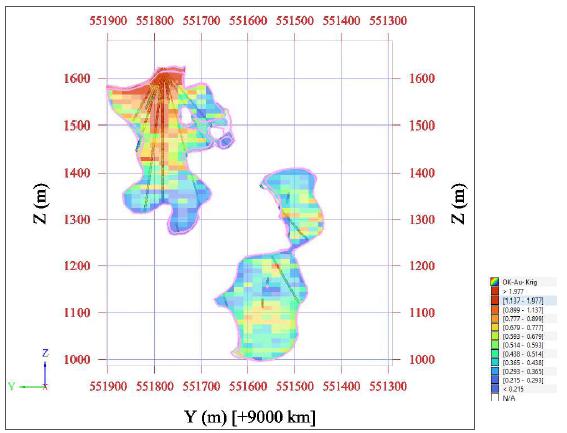

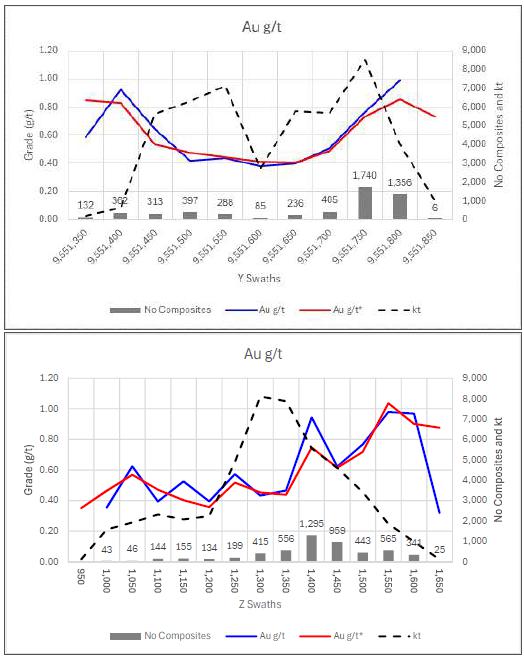

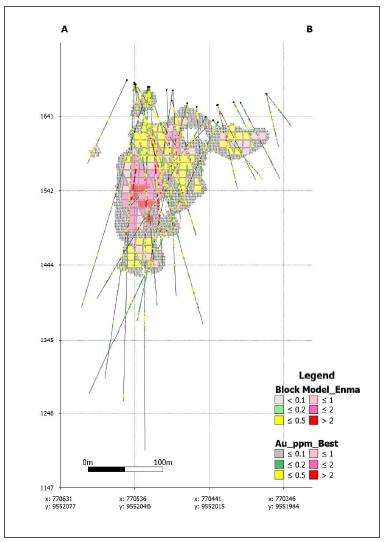

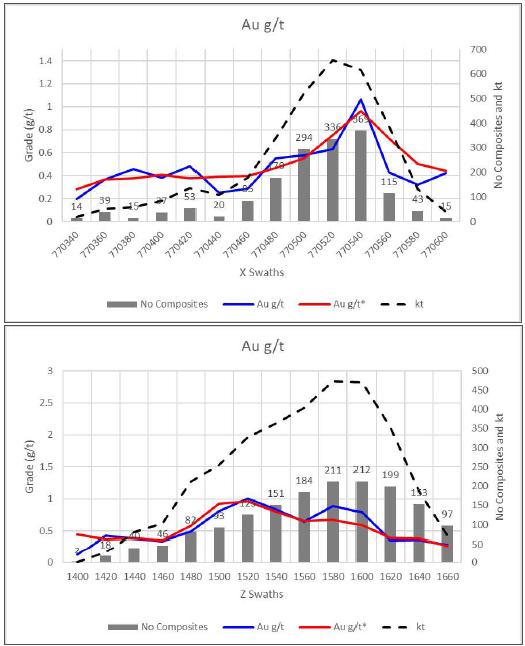

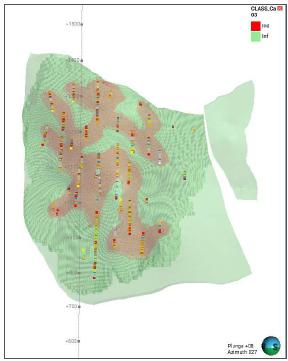

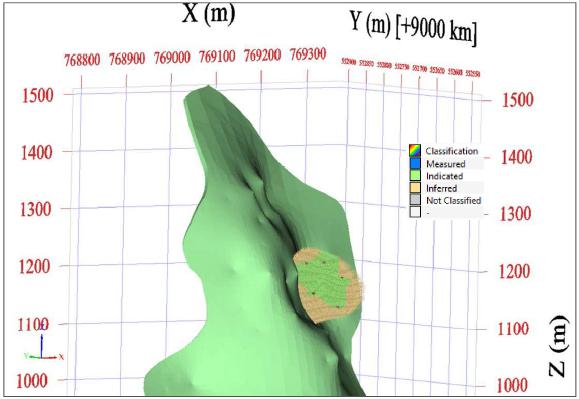

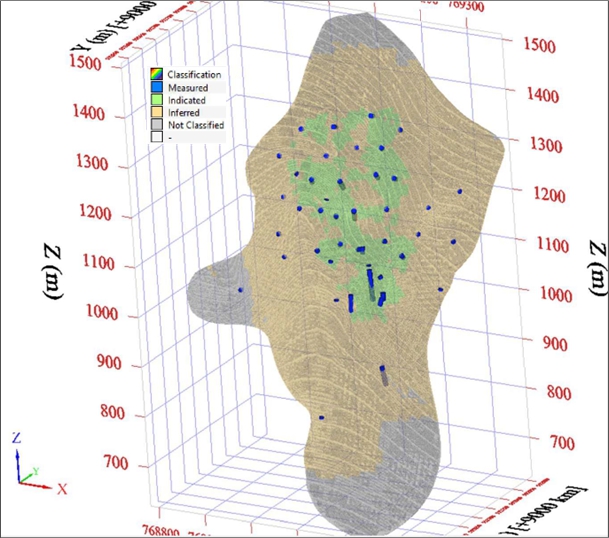

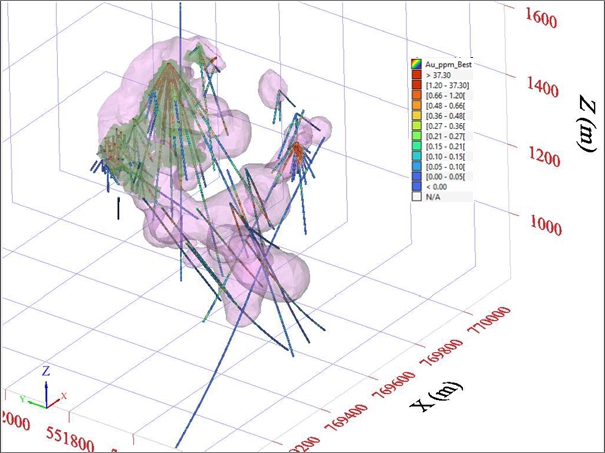

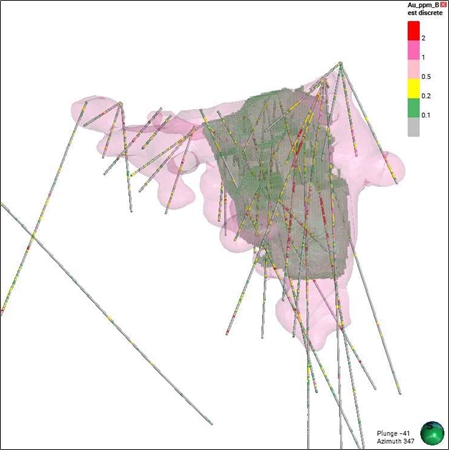

| 4.1 | Accessibility |