|

D. Scott Carlton (SB#239151)

scottcarlton@paulhastings.com

Timothy D. Reynolds (SB#274589)

timothyreynolds@paulhastings.com

Stephanie Balitzer (SB#316133)

stephaniebalitzer@paulhastings.com

Joseph Montoya (SB#322279)

josephmontoya@paulhastings.com

Will Ostrander (SB#333340)

willostrander@paulhastings.com

PAUL HASTINGS LLP

515 South Flower Street, 25th Floor

Los Angeles, CA 90071

Telephone: (213) 683-6000

Facsimile: (213) 996-3153

Attorneys for Plaintiff,

Allied Gaming & Entertainment, Inc.

|

UNITED STATES DISTRICT COURT

CENTRAL DISTRICT OF CALIFORNIA

|

ALLIED GAMING & ENTERTAINMENT, INC.,

Plaintiff,

v.

KNIGHTED PASTURES, LLC, ROY CHOI, YIU-TING SO, NAOMI CHOI, ET AL.,

Defendants.

|

Civil Action No. 2:25-CV-05312

COMPLAINT FOR VIOLATIONS OF SECTION 13 OF THE SECURITIES EXCHANGE ACT OF 1934

|

Plaintiff Allied Gaming & Entertainment, Inc. (“Allied” or “the Company”) alleges against Defendants Knighted Pastures, LLC

(“Knighted”), Roy Choi, Yiu-Ting So, and Naomi Choi (all together, “Defendants”) as follows:

INTRODUCTION

1. This lawsuit

is the unfortunate but necessary action by Allied to protect its stockholders’ collective interest. Defendants have conducted a year-long scheme to amass large quantities of Allied’s stock without disclosing the same to Allied or its stockholders.

This has been a coordinated effort by Defendants to secure Knighted and Roy Choi’s control over Allied’s board of directors at the fast-approaching Annual Meeting in August 2025. Accordingly, Plaintiff is forced to bring this action pursuant to 15

U.S.C. §78m(d)(1) and Rule 13d-1(a) of the Securities Exchange Act of 1934 (“Section 13(d)”), seeking appropriate injunctive and related declaratory relief.

2. Adequate

disclosures are designed to provide shareholders with a clear picture of who owns a company and how they acquired that ownership. Accurate disclosures are particularly relevant in the context of a board election, as questions about “who owns the

company” and “how much do they own” naturally inform shareholders who are weighing which slate of candidates to vote for. Defendants’ violations of the federal securities laws critically undermine that policy in advance of the shareholder vote at

Allied’s Annual Meeting.

3. Allied is a

leading provider of esports entertainment. The Company owns one of the world’s largest esports arenas—the HyperX Arena—in Las Vegas and regularly hosts tournaments viewed by a massive fan base of video game enthusiasts. Beyond that, the Company

develops episodic, video game-related content that it offers on a multiplatform basis. Allied is a publicly traded company on the Nasdaq Stock Exchange.

4. Defendants

Knighted and Roy Choi, together, are Allied’s second largest stockholder. For over a year, through multiple litigations, Knighted and Mr.

Choi have pursued an activist campaign to remove Allied’s sitting directors in favor of their own preferred slate of hand-picked individuals to obtain

control of Allied and its considerable assets without paying a control premium.

5. Knighted and

Roy Choi have consistently disclosed through Schedule 13D filings with the U.S. Securities & Exchange Commission (the “SEC”) that they are the only beneficial owners of 11,986,423 shares, or approximately 31.5%, of Allied common stock.1

But those disclosures are a ruse. They omit the coordinated, long-standing effort by Mr. Choi, his family members, and his close business associates to buy up Allied’s stock and vote it in favor of Knighted’s slate of board candidates.

6. Defendant

Naomi Choi is Roy Choi’s mother. She was not a stockholder prior to January 1, 2024, but secretly and in coordination with Roy Choi’s activist efforts throughout 2024, acquired more than 1.4 million shares, making her Allied’s third-largest stockholder. She and Mr. Choi undertook the covert effort jointly and together with Knighted in order to secure control for Roy Choi

by voting in favor of Knighted’s slate of directors at the Company’s Annual Meeting.

7. Defendant

Yiu-Ting “Rebecca” So is similarly affiliated and acting in cooperation with Knighted and Roy Choi. Ms. So has a long history with Roy Choi and Knighted, serving as Knighted’s outside accountant, and later as Roy Choi’s business partner. Between

late 2023 and June 2025—concurrent with Knighted’s litigation and proxy challenges—she quietly increased her holdings in Allied by more than a quarter-million shares, an increase of approximately 35%, to become the fourth largest stockholder after she was appointed as the Chief

Financial Officer of a company for which Mr. Choi serves on the board and in which he is an investor. Ms.

1 Unless otherwise indicated, the percentage of a shareholder’s ownership presented in this Complaint is calculated based on Allied’s estimated

outstanding shares as of June 11, 2025.

So acquired these shares to vote them in favor of Knighted’s preferred slate of directors.

8. To date,

Defendants have never identified themselves as a group pursuant to Section 13(d) of the Securities Exchange Act of 1934, and never publicly filed any Schedule 13D filing disclosing any such affiliation. Indeed, on June 4, 2025, Knighted filed its

latest Schedule 13D, listing only itself and Mr. Choi as the relevant shareholders. It failed to mention Ms. Choi or Ms. So, the existence of their holdings, or their status as group members—all in violation of Section 13(d). Ms. Choi and Ms. So

have also never publicly disclosed their holdings in Allied through any relevant filings with the SEC.

9. Together,

Ms. Choi and Ms. So own nearly 6.5% of Allied. Much of this stock was acquired while Knighted maxed out its own holdings and pursued two sequential lawsuits against Allied’s board of directors in 2024 and early 2025. Ms. Choi and Ms. So’s holdings

have never been disclosed, but the holdings add to Knighted and Roy Choi’s approximately 31.5% ownership interest and were required to be disclosed pursuant to Section 13(d) of the Exchange Act.

10. At the same

time that Ms. Choi and Ms. So were acquiring significant positions in Allied throughout 2024 and the first six months of 2025, Knighted and Mr. Choi were pursuing very public lawsuits against Allied and its board of directors in an unequivocal

campaign to distort the facts, make bald accusations against Allied’s directors for alleged self-interested transactions, and accuse the board of breaching its fiduciary duties. The first lawsuit was brought on March 7, 2024. Allied’s board of

directors mooted the substantive claims in June 2024, and the lawsuit was subsequently dismissed. The second lawsuit was filed in November 2024 and was stayed on April 29, 2025 following Allied’s actions to moot Knighted’s claims again. Each

lawsuit resulted in Allied agreeing to continue its Annual Meeting until after the lawsuits were resolved. Pursuant to an order of the Court of Chancery of the State of Delaware, a combined 2024/2025 Annual Meeting is set for August 4,

2025 (“Combined 2024/2025 Annual Meeting”), with the record date presently set for June 25, 2025.

11. The buying

history of Ms. Choi and Ms. So illustrates the coordinated group effort with Mr. Choi and Knighted. Ms. Choi did not own a single Allied share before January 2024, yet by July 5, 2024—during the course of Knighted’s first activist litigation—she

acquired more than 310,000 shares. She then acquired more than 1.1 million more shares from July 2024 through March 6, 2025, during the pendency of Knighted’s second lawsuit against Allied. By May 15, 2025, she held 1,441,466 shares.

12. Similarly,

Ms. So accumulated significant Allied stock concurrent with Knighted’s large acquisitions between December 2023 and January 2024, evidently in coordination with Mr. Choi and Knighted; indeed, Ms. So acquired as much as 574,000 shares from September

through December 2023—the same time Mr. Choi and Knighted were increasing their own ownership in advance of their proxy challenge.

13. Then,

during Knighted’s second litigation, on information and belief, Ms. So apparently engaged in a quid pro quo with Mr. Choi that benefited both her and Mr. Choi. In fact, in the very same month—March 2025—that she became the CFO of PM Studios, under

the direction of Mr. Choi who was a board member of the company, she began acquiring nearly 117,000 more shares of Allied, making her Allied’s 4th largest stockholder. As of May 15, 2025, Ms. So held 966,737 shares. She then purchased even more shares

over the following weeks, increasing her holdings to 971,737 shares by June 2, 2025.

14. Further,

based on public records and information and belief, Ms. So did not (and does not) have the substantial capital necessary to make such large acquisitions—requiring close to $1 million in capital. And as such, on information and belief, Mr. Choi and

Knighted assisted and directed these purchases by Ms. So by supplying the requisite capital.

15. Knighted

and Roy Choi cannot hide behind their partial disclosure that they beneficially hold 11,986,423 shares, when the record plainly demonstrates that they are acting as a coordinated group with Ms. Choi and Ms. So to vote shares with two additional

stockholders and collectively, Defendants own 14,394,626 shares, or 37.8%, of Allied’s outstanding stock.

16. Knighted’s

non-disclosures were purposefully orchestrated to strategically evade Section 13(d) obligations, the Company’s Bylaws and its Stockholder Rights Plan which would necessarily be triggered as a result of this group coordinated buying spree. Knighted

therefore purchased shares up to the Stockholder Rights Plan’s threshold and then coordinated with the Knighted Group to surreptitiously buy up shares in order to gain an advantage over other large shareholders in its proxy contest.

17. On June 2,

2025, Knighted formally notified Allied of its intent to nominate six candidates at the Combined 2024/2025 Annual Meeting (“Knighted’s Second Advance Notice”). Despite having an opportunity and requirement to do so, Knighted’s Second Advance Notice

failed to identify the group with Ms. Choi and/or Ms. So.

18. Now, Allied

seeks injunctive relief, including an order requiring Defendants to (i) file an amended Schedule 13D, properly disclosing the existence of their group, (ii) abstain from acquiring additional shares pending completion of Defendants Schedule 13D

filings and a reasonable “cooling off” period following such filings, and (iii) vote any shares acquired in violation of Section 13(d) according to a proportional scheme at Allied’s Combined 2024/2025 Annual Meeting on August 5, 2025. Additionally,

Allied requests declaratory relief providing that Knighted’s Second Advance Notice—purporting to nominate three individuals for election to the Board and proposing that one current director be removed—is invalid.

PARTIES

A. Plaintiff Allied Gaming & Entertainment, Inc.

19. Plaintiff

Allied is an esports entertainment company that hosts gaming tournaments, develops mobile games, and produces original programming related to video games.

20. Allied is

publicly traded on the Nasdaq Stock Exchange (ticker symbol “AGAE”), is incorporated in Delaware, and has its principal place of business in New York, New York.

B. Defendant Knighted Pastures, LLC

21. Defendant

Knighted Pastures, LLC is a California limited liability company with a business address in Los Angeles, California. SEC filings identify Knighted’s address as 1933 S. Broadway Suite 1146, Los Angeles, CA 90007.

22. Knighted is

solely controlled by Mr. Choi and, on information and belief, does not have active day-to-day operations. Knighted has several corporate affiliates, including Knighted Ventures, LLC, which claim involvement in the casino and gaming industries.

23. According

to Knighted’s amended Schedule 13D, filed on June 4, 2025, Knighted held 8,906,270 shares in Allied, or approximately 23.4% of the Company’s common stock.

C. Defendant Roy Choi

24. Defendant

Roy Choi, a resident of Dallas, Texas, is the sole member (and managing member) of Knighted.

25. On June 2,

2025, Knighted reiterated to Allied that it intends to nominate Mr. Choi for a position on Allied’s board of directors at the Company’s next annual shareholder meeting.

26. According

to Knighted’s amended Schedule 13D, filed on June 4, 2025, Mr. Choi and Knighted together own 11,986,423 shares, or approximately 31.5%, of Allied common stock.

D. Defendant Naomi Choi

27. Defendant

Naomi Choi is Roy Choi’s mother and a resident of Los Angeles, California.

28. In addition

to their mother-son relationship, Ms. Choi and Mr. Choi have a history of pursuing joint business ventures. For example, Ms. Choi is an authorized member of Elevated, LLC f/k/a Vantage Systems, LLC (“Elevated”), a gaming services business for which

Mr. Choi is a manager. On information and belief, Ms. Choi’s membership in Elevated and her ownership of Allied stock are her only business connections to the video game industry.

29. Ms. Choi

and Mr. Choi engage in other commercial endeavors together, including real estate investments. Indeed, they have purchased, co-owned, and sold numerous Los Angeles properties over the years. For instance, public records show that Ms. Choi and Mr.

Choi purchased a condominium at 5057 Maplewood Avenue in Los Angeles in January 2014 for $736,000, and sold the same property in August 2015 for $780,000. Public records also show that Ms. Choi and Mr. Choi purchased a house at 1219 S. Wilton Place

in Los Angeles for $1.1 million in March 2015 before selling it for $1.87 million in October 2020.

30. Ms. Choi

started purchasing shares in Allied stock starting in early 2024.

31. As of June

2025, Allied’s non-objecting beneficial owners (“NOBO”) list shows that Ms. Choi beneficially owns 1,441,466 shares of Allied common stock.

E. Defendant Yiu-Ting So

32. Defendant

Yiu-Ting “Rebecca” So is a resident of Ventura County, California.

33. Ms. So and

Mr. Choi are longtime business associates. Ms. So was a CPA at Knighted’s accounting firm, Meloni Hribal Tratner LLP between 2005 and 2020. Subsequently, Ms. So and Mr. Choi have both held executive level positions at Human Ingenuity, Inc. (“Human

Ingenuity”) since at least May 2024, with Ms. So

serving as the CFO and Mr. Choi as the CEO. Mr. Choi has also invested in Human Ingenuity.

34. In March

2025, Ms. So became the CFO of PM-Studios, Inc. (“PM-Studios”). Mr. Choi has served on the board of PM-Studios since 2021 and is an investor in that company as well.

35. As of June

2, 2025, Allied’s NOBO list shows that Ms. So beneficially owns 971,737 shares of Allied common stock.

F. The Knighted Group

36. As detailed

below, Knighted, Roy Choi, Naomi Choi, and Yiu-Ting So acted together to acquire approximately 37.8% of Allied’s shares as a “group” under Section 13(d).

37. On

information and belief, Defendants coordinated these efforts and evaded their disclosure requirements in order to aggregate shares of Allied’s stock without alerting the Company or its shareholders to the existence of their group.

38. Specifically,

Defendants coordinated their purchases of Allied stock in an effort to conceal Knighted’s holdings to facilitate Knighted’s assumption of control of the Board at the Company’s upcoming annual shareholders’ meeting.

39. Defendants’

failure to timely disclose the existence of their group, as required under Section 13(d), has harmed Allied and its shareholders by, among other things, depriving shareholders of material information required to be disclosed pursuant to the Williams

Act and compromising the integrity of the proxy process.

JURISDICTION AND VENUE

40. Federal

subject matter jurisdiction exists in this action pursuant to 28 U.S.C. §§ 1331 and 1337 and § 27 of the Exchange Act, 15 U.S.C. § 78aa, because the claims asserted herein arise under § 13(d) of the Securities and Exchange Act of 1934, and

regulations promulgated thereunder by the SEC.

41. Venue is

proper in the Central District of California pursuant to 15 U.S.C. § 78aa and 28 U.S.C. § 1391(b). That is, various acts or transactions

constituting the offenses herein occurred within the Central District of California, and Defendants Knighted, Ms. So, and Ms. Choi are subject to personal

jurisdiction in this district for claims under the Securities Exchange Act.

42. That is,

among other things, Knighted has its principal place of business in Los Angeles, California, while Ms. So and Ms. Choi are residents of Ventura County and Los Angeles County, and many of the acts alleged herein, including preparation and

dissemination of the misleading statements to the investing public, occurred in substantial part in this District.

43. The

Defendants, directly and/or indirectly, used the means and instrumentalities of interstate commerce, the United States mails, and the facilities of the national securities markets in connection with the acts, conduct, and other wrongs complained of

herein.

44. This Court

has personal jurisdiction over each Defendant, among other reasons, pursuant to 15 U.S.C. § 78aa, which provides for nationwide service of process, as the claims asserted against Defendants arise under the Securities Exchange Act of 1934 and each

have sufficient contacts with the United States for purposes of appropriate service of process pursuant thereto.

FACTUAL BACKGROUND

|

A. |

The Knighted Group Begins Its Undisclosed Purchase of Allied Stock

|

45. Since May

2020, Knighted has held at least 7% of Allied stock. For several years, Knighted was a significant shareholder but was not active in the Company’s governance.

46. Although

Knighted did not participate in the Company’s 2022 or 2023 Annual Meetings, shortly after the June 2023 Annual Meeting (and following Allied’s announcement that it would restructure its existing esports business and expand the Company’s focus through

acquisitions, joint ventures, and related opportunities), Defendants rapidly increased their holdings in Allied shares.

47. In December

2023, Mr. Choi and Knighted rapidly amassed significant quantities of stock. For instance, in a single week between December 12 and 19, 2023, Knighted and its affiliates purchased at least 1,953,200 shares of Allied stock. A large number of shares

were purchased by Knighted in an off-market transaction with a former member of Allied’s board, Lyle Berman. By mid-December 2023, Knighted and Roy Choi’s ownership grew to approximately 27.6% of Allied’s outstanding shares. Not long after that, on

January 8, 2024, Knighted and Mr. Choi sent a Section 220 books and records demand to Allied.

48. At that

very same time, between December 2023 and January 2024, Ms. So suddenly bought up large numbers of the Company’s shares too. Though she held a de minimis number of shares in the fall of 2023, she significantly grew her holdings from 141,460 shares

in September 2023 to 715,941 shares by December 29, 2023.

49. Knighted

and Roy Choi, for their part, continued their buying spree as well. On February 6, 2024, Knighted and Roy Choi filed an amended Schedule 13D with the SEC reporting purchases by Knighted of additional shares of Allied common stock, totaling

10,945,030 shares. The Schedule 13D/A reported Knighted and Roy Choi’s aggregate beneficial ownership interest as 29.6%. That ownership consisted of 8,851,208 Common Shares and 190,000 warrants to purchase Common Shares at $11.50 per share owned by

Knighted, and 1,903,822 Common Shares owned by Mr. Choi. That Schedule 13D did not disclose affiliations with any other parties.

50. Following

Knighted’s significant share acquisitions, Allied’s board of directors enacted certain measures to protect stockholder interests in early 2024 including adopting a shareholder rights plan that would trigger in the event of coordinated buying by

stockholders above certain thresholds.

51. Allied’s

February 2024 Shareholders’ Rights Plan (the “Rights Plan”) applies equally to all Allied stockholders and serves to significantly dilute any shareholder or group of shareholders that acquires at least 10% of Allied’s common stock. Both Knighted and

Ourgame International Holdings Ltd. (“Ourgame”) (the

other largest shareholder in Allied) were grandfathered into the Rights Plan and were permitted to retain their greater than 10% ownership in the Company

without triggering the Rights Plan. However, if a grandfathered stockholder or its affiliates or associates (a defined in the Rights Plan) purchased additional shares, the grandfathered person and its affiliates and associates would trigger the Rights

Plan and experience significant economic and voting dilution. Moreover, if a grandfathered stockholder or any other person with which such grandfathered stockholder has any agreement, arrangement or understanding, written or otherwise, for the purpose

of acquiring, holding, voting or disposing of any securities of the Company, acquires additional shares, the grandfathered stockholder and such persons would trigger the Rights Plan and experience significant economic and voting dilution.

52. Knighted

and Mr. Choi coordinated purchases with the Knighted Group and knowingly disregarded their Section 13(d) obligations as part of their plan, arrangement, or agreement to avoid the economic and voting consequences of the Rights Plan that would result

if Knighted or Choi purchased additional shares themselves or disclosed the Knighted Group. By doing so, Knighted and Choi would all-but ensure a victory in their proxy contest where they seek to unseat the majority of the Board.

|

B. |

Knighted Launches Challenges to the Company’s Board In Its Proxy Contest and In Litigation, While the Undisclosed Group Members Buy Up More Shares

|

53. In March

2024, Knighted delivered its first notice of nomination nominating three candidates for election as class B directors (including Mr. Choi) to Allied’s Board and bylaw amendment proposals for shareholder consideration at the upcoming 2024 Annual

Meeting.

54. Just before

and continuing after Knighted announced its proxy contest, Ms. So and Ms. Choi began to acquire significant numbers of Allied shares. Ms.

Choi—who never owned any shares of Allied previously—amassed hundreds of thousands of shares between January 2024 and July 2024. By July 5, 2024, Ms. Choi

owned 310,063 shares in Allied. Ms. So, who was also a relatively new shareholder, also increased her holdings from 715,941 shares as of December 29, 2023 to 816,837 shares on July 5, 2024—an increase of nearly 15%. This rapid accumulation of shares

by the Knighted Group coincided with the implementation of the Shareholder Rights Plan and (as noted) Knighted’s delivery of its amended Nomination Notice and a proposal to remove three Board members.

55. Simultaneous

with Ms. So and Ms. Choi’s purchases, Knighted had been expanding its challenges to the Board’s business decisions to the courtroom, as another tactic to take control of the Company.

56. Knighted

filed its first lawsuit against Allied in the Court of Chancery of the State of Delaware on March 7, 2024. Therein, Knighted challenged Allied’s December 2023 transaction with Elite Fun Entertainment Co. Ltd., a significant player in the Macau

cultural and entertainment industry, which would help Allied expand its live events business in Asia (the “Elite Litigation”). Knighted also claimed that the Rights Plan—while it applied equally to all shareholders—was in fact, adopted for the

benefit of Allied’s shareholder, Ourgame. Notably, in the course of that litigation, Knighted and its affiliates were privy to sensitive and confidential financial details about the Company that were obtained in discovery.

57. Allied and

its Board at the time felt it more prudent that the shareholders be able to pass judgment on the Board’s business decisions at the ballot box, and mooted Knighted’s claims by taking various actions to unwind decisions that Knighted had challenged.

Allied also provided a limited exemption to the Rights Plan to Knighted, to permit Knighted to purchase as many shares of Allied stock to make Knighted’s holdings even with Ourgame (which approximately held 11,986,523 shares). The Court of Chancery

therefore granted Allied’s Motion to Dismiss (in part) on June 20, 2024.

58. Following

the closure of the Elite Litigation, Knighted sent another 220 Demand to the Company (dated September 26, 2024), and then filed another Amended 13D with the SEC on October 1, 2024, reporting that Knighted and Mr. Choi collectively owned 11,986,423

shares of Allied, or 31.4% of the Company’s shares, and filed a preliminary proxy statement for its proxy contest. Again, there was no mention of Roy Choi’s mother and her significant stock purchases or Roy Choi’s accountant and business venture

partner, Rebecca So in Knighted’s filings.

59. After

Knighted filed its preliminary proxy statement, the Company responded on October 24, 2024, with a settlement proposal to Knighted’s counsel regarding its

willingness to enter into a cooperation agreement before a proxy contest. Specifically, Allied offered to expand the board by one director (from 8 to 9) and appoint a person of Knighted’s choice as a Class A director. On October 31, 2024,

Knighted responded refusing Allied’s generous offer and instead demanding that Knighted appoint four new independent directors selected by Knighted and that five incumbent directors step down from the Company’s seven-member Board, in addition to

requiring the Company’s dissolution of its recent strategic transaction with venture capital firm, Yellow River Global Capital (“Yellow River”). Knighted’s demand for a complete takeover of the Board showcases its unwavering desire to seize

control of the Company, whether through persistent demands, litigation, or the marketplace, and at any cost, even through coordinated and undisclosed Group share purchases.

60. Knighted’s

Amended 13D filing on November 14, 2024, maintained that Knighted and Choi beneficially held 11,986,423 total shares (just shy of the amount of shares held by Ourgame), and yet again did not disclose any other group members, including the more than 1

million shares collectively held by Ms. Choi and Ms. So.

61. In the

meantime, Knighted filed yet another lawsuit against Allied and its Board in November 2024. That complaint challenged Allied’s transaction with

Yellow River that the board had approved to facilitate the Company’s expansion into the esports market. Knighted’s suit contended that the transaction with

Yellow River was designed to benefit the Company’s largest shareholder, Ourgame, and entrench the Company’s directors. Before filing this suit, Knighted did not file a section 220 demand to seek facts regarding the Yellow River Transaction, and during

the suit, effectively conceded that it did not have facts to support its bald allegation that Ourgame and Yellow River were affiliated. No nexus between Yellow River and Ourgame was ever uncovered during the entirety of the litigation.

62. While

pushing expedited litigation to challenge Allied Board’s approval of the Yellow River Transaction, Roy Choi was simultaneously scheming with his mother and his business partner to amass an overwhelming number of shares of Allied in anticipation of a

future shareholder vote to put Roy Choi and his friends into power as directors of Allied.

63. Indeed,

during the pendency of Knighted’s second litigation against Allied (when Knighted received sensitive and confidential financial information about Allied through discovery), Ms. So, Knighted’s former accountant, and Mr. Choi’s business partner,

increased her ownership from 854,837 shares in March 2025 to 971,737 shares by early June 2025—acquiring nearly 117,000 shares of Allied’s stock in three months’ time.

64. Critically,

at nearly the exact same time that Ms. So began adding to her common stock holdings in Allied, she was also seeking employment with an entity that Mr. Choi was intimately involved with as a board member. In fact, in March of 2025, Ms. So was named

as the Chief Financial Officer of the company in which Mr. Choi served on the board (Studio-PM, Inc.).

65. Put

differently, after being appointed as the CFO of Studio-PM, Inc.—a business venture Mr. Choi is actively involved with and serves as a board

member—Ms. So began buying more shares of Allied, increasing her ownership by

nearly 15%. Therefore, based on information and belief, Mr. Choi has and continues to exercise influence over Ms. So and her purchases of Allied shares.

66. Roy Choi’s

mother was even more aggressive in buying up Allied’s stock. From July 5, 2024 through March 6, 2025, Roy Choi’s mother amassed more than 1.1 million shares.

During this time period, July 2024 through March 2025, the Company and its board of directors were actively litigating against her son and his controlled entity, Mr. Choi had publicly disclosed that he sought to be nominated and elected as a member

of the Company’s board and he sought to control Allied through the election of his friends and the removal of Allied’s present board of directors. At the same time, the Rights Plan prevented Mr. Choi and Knighted from purchasing more shares.

67. Meanwhile,

none of these buying efforts were publicly disclosed or made known to Allied or its shareholders. Roy Choi and Knighted continued their public refrain that they held slightly less common stock than Allied’s largest stockholder, but the concealed truth was that that through the coordinated efforts to buy stock with his mother and business partner, by May 15, 2025, Defendants had

amassed a 37.8% interest in the Company.

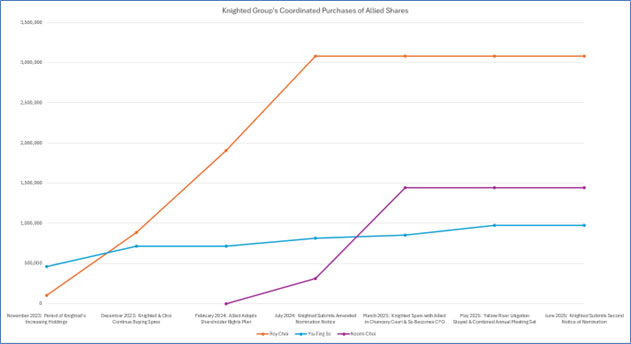

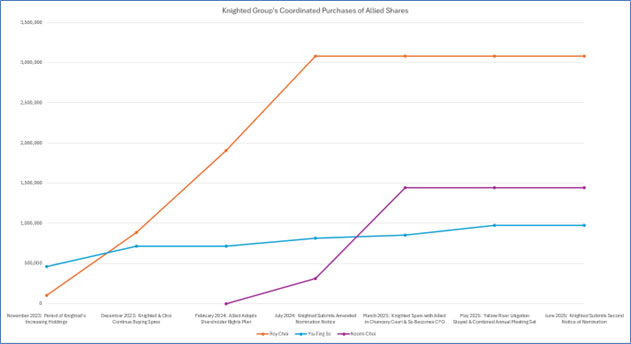

68. By June 2,

2025—three weeks before the Company’s June 25, 2025 annual meeting record date—Defendants undisclosed group had amassed a 37.8% interest in the Company, while only telling Allied and its stockholders that they held less than Allied’s largest

stockholder. Below is a chart showing the Knighted Group’s share purchases up to June 2, 2025.

69. To be

clear, Roy Choi and Knighted have never disclosed the purchases of Roy Choi’s mother or his accountant / business partner. Despite the

unquestionable familial and business ties between Ms. Choi and Mr. Choi, and the extensive business relationship between Ms. So and Mr. Choi, Defendants repeatedly filed Schedule 13Ds that purposefully and wrongfully excluded Ms. Choi and Ms. So.

70. The reason

for Knighted’s material omissions is simple: disclosing the Knighted Group would immediately trigger the provisions in the Rights Plan that is purposefully designed to protect Allied stockholders from precisely this conduct, namely, a stockholder or

group of stockholders acquiring creeping control of the Company without paying a control premium. Properly disclosing the information on its Schedule 13D would cause the Rights Plan to be triggered thus causing the group’s holdings to be diluted and

rendering unachievable its intended goal—to cause Roy Choi to win his proxy contest against Allied and gain control of Allied’s board of directors, and thus Allied’s considerable assets for personal gain.

71. Allied was

not aware of this scheme until it discovered the massive increase in Naomi Choi’s stock holdings. Specifically, Allied noticed that Ms. Choi had become the Company’s third largest stockholder in less than a year. In fact, she owned zero stock in

Allied prior to January 2024, and thereafter acquired approximately 310,000 shares before July 2024, and an additional 1.1 million shares between July 2024 and March 2025.

72. Allied

necessarily assumed that Ms. Choi would be disclosed as part of the 13D group in the June 2, 2025, Notice of Stockholder Intent to Nominate Individuals for Election as Directors (“Knighted’s Second Advance Notice”). A true and correct copy of

Knighted’s Second Advance Notice is included herewith as Exhibit 1. She was not mentioned at all in derogation of the Company’s Bylaws’ requirements.

73. At this

time Allied also inquired of Ms. So, who had quietly amassed the fourth largest position in Allied behind Knighted and Ms. Choi. Allied was surprised to learn of Ms. So’s considerable ties to Mr. Choi, including the coordinated buying of Allied

stock between late 2023 and early 2024 (when Knighted announced its first proxy contest) and again following Ms. So’s appointment to the CFO position at a company Mr. Choi is invested in and serves on the board. Ms. So’s coordinated buying was also

not disclosed in Knighted’s Second Advance Notice.

74. Instead,

Knighted submitted the Second Advance Notice (on the last day permitted under the Company’s Bylaws) purporting to nominate three new Class C directors to the Board and present a business proposal at the annual meeting and disclosing only Mr. Choi,

Knighted, and the proposed individuals Knighted sought to elect to Allied’s board in order to secure complete control of Allied and its considerable assets.

75. Notably,

the purpose of the advance notice requirement of the Company’s bylaws is to allow the Company sufficient time to evaluate and respond

to the material information relating to any director nominations and stockholder proposals presented at the Company’s annual meeting.

76. Surprised

that Knighted’s Second Advance Notice failed to disclose the existence of the group coordinated in the effort to elect Knighted’s preferred slate, Allied sent a letter to Knighted on June 5, 2025, seeking clarification on Knighted’s justification for

failing to disclose the group and thereby comply with all applicable requirements. A true and correct copy of the June 5, 2025 letter is included herewith as Exhibit 2.

77. On June 9,

2025, Roy Choi responded to Allied’s inquiry, defiantly asserting that his mother and his business partner he describes as a “fractional chief financial officer in a private company of which I am a stockholder” (failing to disclose PM Studios at all

or that he is also a board member of that entity and in charge of Ms. So’s oversight) are not a group. He asserted, without support, that he has not engaged in “discussions with either my mother or Ms. So regarding how they intend to vote.” A true

and correct copy of the June 9, 2025 response letter is included herewith as Exhibit 3. However, Mr. Choi’s response is tellingly silent as to

whether he ever entered into any agreement, arrangement or understanding with Ms. So or Ms. Choi regarding the purchase of Allied shares, including whether Mr. Choi or his affiliates directly or indirectly financially assisted with those purchases.

78. Despite Mr.

Choi’s non-responsive letter, the coordinated buying by Ms. Choi and Ms. So, in concert with Knighted’s aggressive litigation tactics and smear campaigns, speak volumes.

79. As

beneficial owners of greater than 5% of Allied’s outstanding shares, Defendants were required to report their total securities holdings and all material changes thereto on Schedule 13Ds filed with the SEC pursuant to Exchange Act Section 13(d).

These disclosure requirements are designed to provide the Company and its investors with adequate information regarding acquisitions that may result in a shift in corporate control.

80. Defendants

have never disclosed the existence of a group as between them and continue to deny the existence of their group although the facts plainly demonstrate they acted together to purchase shares to facilitate Knighted’s efforts to gain control of the

Company while evading the triggering of the Rights Plan. Indeed, as set forth above, the evidence strongly suggests that Defendants understood, planned, and/or agreed among themselves to work together toward a common goal including contemporaneous

rapid accumulation of Allied stock. On information and belief, Defendants assisted each other in accumulating stock, financially or otherwise, and in concealing their group status in order to advance Knighted’s efforts to take control of the

Company’s Board.

81. As a result

of the Defendants’ withholding of information regarding their coordination and purpose, Knighted and Choi’s Schedule 13Ds remain incomplete and misleading and violate Section 13(d) of the Exchange Act. Moreover, Mr. Choi’s June 9, 2025 letter

indicates that Defendants’ violations will continue absent an order compelling them to file accurate Schedules 13D.

82. Knighted’s

continued denial of a group, contrary to the evidence, continues to prejudice the ability of the Company and its stockholders to receive, evaluate, and respond in a timely manner to all material information concerning the nomination by Knighted of

its slate of directors, and therefore to conduct a fair proxy contest.

COUNT I

Violations of Section 13 of the Securities Exchange Act of 1934 (Against All Defendants)

83. Allied

incorporates the foregoing paragraphs by reference as if fully set forth herein.

84. Section

13(d) of the Exchange Act requires that any stockholder (or group of stockholders) that acquires more than 5% of a company’s registered stock

file with the SEC a Schedule 13D disclosing, among other things, their ownership interest in the company to the market.

85. Under

Section 13(d) and its implementing regulations, a group that acts together to acquire more than 5% of a company’s securities is required to disclose their combined ownership on Schedule 13D: “When two or more persons agree to act together for the

purpose of acquiring, holding, voting or disposing of equity securities of an issuer, the group formed thereby shall be deemed to have acquired beneficial ownership, for purposes of sections 13(d) and (g) of the Act, as of the date of such agreement,

of all equity securities of that issuer beneficially owned by any such persons.” 17 C.F.R. § 240.13d-5.

86. Under

Section 13(d) and its implementing regulations any person, or any group of persons, acting for the purpose of acquiring, holding, or voting a corporation’s securities must file a Schedule 13D statement with the SEC within 5 business days after

acquiring beneficial ownership of more than 5% of any class of the corporation’s voting securities. 15 U.S.C. § 78m(d); 17 C.F.R. § 240.13d-1.

87. The

Schedule 13D must set forth the reporting person’s background, identity, residence, citizenship, and the nature and amount of his or her beneficial ownership, as well as the source and amount of funds used to purchase the beneficially owned

securities. Further, if the purchasers’ purpose is to obtain control of the corporation, their Schedule 13D must set forth their plans or proposals for any major change in the corporation’s structure.

88. In

addition, a Schedule 13D must report the purchasers’ agreements, arrangements, or understandings concerning the corporation’s securities.

89. When an

investor fails to comply with Section 13(d), the issuer of the shares has standing to bring an action to compel compliance. Here, as the issuer, Allied has standing to bring an action against Defendants.

90. As detailed

above, the evidence suggests that Knighted, Roy Choi, Naomi Choi, and Yiu-Ting So have acted together, pursuant to an agreement,

arrangement or understanding, to acquire more than 5% of Allied’s common stock in beneficial ownership, requiring them to report as a group on Schedule 13D.

On information and belief, Defendants Knighted, Roy Choi, Naomi Choi, and Yiu-Ting So have, in fact, reached an agreement to acquire shares in Allied in a coordinated effort to influence the outcome of the shareholder vote at the Combined 2024/2025

Annual Meeting.

91.

Defendants’ group crossed the 5% ownership threshold before May 2025, requiring Defendants to file a Schedule 13D and make the required disclosures of their group’s beneficial ownership, agreements, arrangements, and understandings, financing,

background, and other information set forth on Schedule 13D.

92. Defendants

failed to file a Schedule 13D disclosing their group, and continue to disclaim their group status, including while they engage in ongoing purchases of Allied shares, in violation of Section 13(d) of the Exchange Act

93. Based on

the above violations, Allied has been, is now, and will be irreparably injured because Defendants’ failure to file complete Schedule 13Ds deprives Allied and its shareholders of material information to which they are lawfully entitled and which is

necessary to understand Defendants’ purposes, plans and proposals concerning Allied. Specifically, Defendants’ denials have impeded Allied’s ability to consider appropriate responses, and to prepare for its upcoming shareholder meeting and proxy

contest. Finally, the existence of Defendants’ group is important factual information that benefits Allied’s shareholders and the public, including with respect to the Company’s upcoming Combined 2024/2025 Annual Meeting on August 4, 2025. The

ongoing inaccuracies in Defendants’ Schedule 13Ds continue to harm Allied, the public, and Allied’s shareholders.

94. Allied has

no adequate remedy at law and seeks injunctive relief to cure existing violations of Section 13(d) and to prevent irreparable injury arising from such violations.

95. Allied is

entitled to an Order directing Defendants to file amended Schedule 13Ds that comply with the statutory and regulatory requirements. Absent such corrective filings, Allied and its shareholders do not have the complete and accurate information to

which they are entitled. Moreover, Knighted will have impermissibly evaded the Rights Plan and injected unfairness into the Company’s upcoming proxy contest.

96. Allied is

further entitled to an Order enjoining Defendants from acquiring further shares or making any effort to vote any shares acquired in violation of Section 13(d) other than in accordance with a proportional scheme at Allied’s Combined 2024/2025 Annual

Meeting, set on August 4, 2025. For one, allowing Knighted and its group to acquire additional shares after they failed to comply with applicable law would unfairly and irreparably harm the fairness of the proxy contest. Further, Defendants should

have to vote any shares in accordance with a proportional scheme, or in other words, in each shareholder vote, Defendants should be required to vote their Allied shares “yes” and “no” in the same proportion by which the remaining Allied shareholders

vote “yes” or “no” on that issue. Absent such relief, Defendants could unfairly advantage Knighted’s slate of directors and board proposals.

COUNT II

Declaratory Relief that Knighted’s Second Advance Notice Failed to Comply with the Company’s Bylaws (Against Defendants Knighted and Mr.

Choi)

97. Allied

incorporates the foregoing paragraphs by reference as if fully set forth herein.

98. As provided

in 28 U.S.C. § 2201, in the case of actual controversy within its jurisdiction, any court of the United States may declare the rights and other legal relations of any interested party seeking such declaration.

99. An actual,

present, and justiciable controversy exists in connection with whether Knighted and Mr. Choi’s Second Advance Notice complies with Allied’s

bylaws, is valid, and is therefore acceptable for Knighted’s nominations and proposals at the upcoming annual shareholders’ meeting.

100. Section

109 of the Delaware General Corporation Law provides that a corporation’s bylaws may contain any provision, not inconsistent with law or with the certificate of incorporation, relating to the business of the corporation, the conduct of its affairs,

and its rights or powers or the rights or powers of its stockholders, directors, officers or employees.

101. Section

2.13 of the Company’s Bylaws concerning Advance Notice of Stockholder Nominations and Proposals, provides that at a meeting of the stockholders, only such nominations of persons for the election of directors and such other business shall be conducted

as shall have been properly brought before the meeting.

102. Subsection

2.13(b) of the Company’s Bylaws further states that a proper stockholder nomination must disclose (i) the name and address of the Proposing Stockholder as they appear on the Corporation’s books and of the beneficial owner, if any, on whose behalf the

nomination or other business proposal is being made and any control person, (ii) the class and number of shares of the Corporation which are owned as of the date of the Proposing Stockholder’s notice by the Proposing Stockholder (beneficially and of

record), the beneficial owner, if any, on whose behalf the nomination or other business proposal is being made, and (iii) a description of any agreement, arrangement, or understanding with respect to such nomination or other business proposal between

or among the Proposing Stockholder, the beneficial owner, if any, on whose behalf the nomination or other business proposal is being made, any control person, and any others (including their names) acting in concert with any of the foregoing;

including without limitation (1) any agreements that would be required to be disclosed pursuant to Item 5 or Item 6 of Schedule 13D under the Exchange Act and (2) any plans or proposals which relate to or would result in any action that would be

required to be disclosed pursuant to Item 4 of Schedule 13D

under the Exchange Act (in each case, regardless of whether the requirement to file a Schedule 13D under the Exchange Act is applicable).

103. Defendants

failed to disclose the Knighted Group in violation of Allied’s Bylaws. Specifically, Knighted’s Second Advance Notice fails to comply with subsection 2.14(b)(6) of Allied’s Bylaws, requiring shareholders to disclose, inter alia, “the beneficial owner, if any on whose behalf the nomination … is being made.”

104. By reason

of the foregoing, Knighted’s Second Advance Notice is invalid, and Allied seeks a declaration invalidating Knighted’s Second Advance Notice, rendering Knighted’s nominations of Class C directors and proposal to remove a Class A director therein void.

PRAYER FOR RELIEF

WHEREFORE, Allied prays that this Court enter judgment against Defendants and in favor of Allied, and issue the following relief:

(a) Order

Defendants to file an appropriate Schedule 13D for their entire group, as set forth herein;

(b) Enjoin

Defendants from acquiring additional shares pending completion of Defendants Schedule 13D filings and a reasonable “cooling off” period following such filings;

(c) Order

Defendants to vote their shares in proportion to the votes cast by all shareholders other than the Defendants at the Combined 2024/2025 Annual Meeting;

(d) Declare

Knighted’s Second Advance Notice invalid;

(e) Award

damages and equitable monetary relief according to proof;

(f) Award

Allied its attorneys’ fees and costs as provided by law;

(g) Grant

preliminary and permanent injunctive relief to prevent further irreparable harm to Allied; and

(h) Award all

such further relief as the Court deems appropriate.

DEMAND FOR JURY TRIAL

Allied hereby demands a jury trial of all claims and causes of action triable before a jury.

|

DATED: June 11, 2025

|

Respectfully submitted,

By: /s/ Timothy D. Reynolds

PAUL HASTINGS LLP

515 South Flower Street, 25th Floor

Los Angeles, CA 90071

timothyreynolds@paulhastings.com

Telephone: (213) 683-6000

Facsimile: (213) 996-3153

Attorneys for Plaintiff Allied Gaming &

Entertainment, Inc.

|

- 25 -