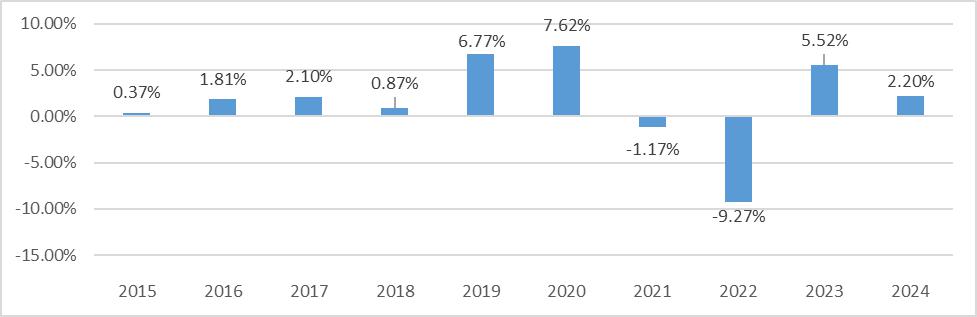

Performance: The following bar chart and table provide some indication of the risks of investing in the Fund. The Fund is adopting the performance of the Predecessor Mutual Fund as the result of the Reorganization. Prior to the Reorganization, the Fund had not yet commenced operations. The bar chart shows changes in the Predecessor Mutual Fund’s performance from year to year (represented by the performance of the Predecessor Mutual Fund’s Class I Shares). The table shows how the Predecessor Mutual Fund’s average annual returns (represented by the average annual returns of the Predecessor Mutual Fund’s Class I Shares) for 1 year, 5 years and 10 years compared with those of an appropriate broad-based securities market index and a secondary benchmark index. Per the Securities and Exchange Commission’s new Tailored Shareholder Reports rule, effective July 29, 2024, the Predecessor Mutual Fund’s primary benchmark is the Bloomberg U.S. Aggregate Bond Index. The Fund will continue to show performance of the Bloomberg Intermediate U.S. Government/Credit Index as a secondary benchmark. Had the Predecessor Mutual Fund been structured as an ETF, its performance may have differed. The Fund’s (and the Predecessor Mutual Fund’s) past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future. Updated performance information will be available at no cost by visiting https://tcw.com or by calling (866) 364-1383.

| * | For the period shown in the bar chart above: |

| Best Quarter | 12/31/23 | 5.13% | ||

| Worst Quarter | 3/31/22 | -4.52% |

| 1 Year | 5 Year | 10 Year | ||||||||||

| Return Before Taxes | 2.20 | % | 0.80 | % | 1.58 | % | ||||||

| Return After Taxes on Distributions | 0.47 | % | -0.53 | % | 0.41 | % | ||||||

| Return After Taxes on Distributions and Sale of Fund Shares | 1.30 | % | 0.07 | % | 0.72 | % | ||||||

| Bloomberg U.S. Aggregate Bond Index(1) | 1.25 | % | -0.33 | % | 1.35 | % | ||||||

| Bloomberg Intermediate U.S./Government Credit Index(2) | 3.00 | % | 0.85 | % | 1.71 | % | ||||||

| (1) | The Bloomberg U.S. Aggregate Bond Index is a broad-based benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. This includes Treasuries, government-related and corporate securities, mortgage-backed securities, asset-backed securities and collateralized mortgage-backed securities. |

| (2) | The Bloomberg Intermediate U.S. Government/Credit Index measures investment grade, US dollar-denominated, fixed-rate nominal Treasuries, government-related and corporate securities with 1-10 year maturities. |

The Predecessor Mutual Fund’s fiscal year end is March 31. The Fund’s fiscal year end is October 31. The Predecessor Mutual Fund’s most recent quarterly return (since the end of the last fiscal year) through the end of the most recent quarter (March 31, 2025) was 2.68%.