Maximum Repurchase Fee |

None |

Sales Load |

None |

Annual Fund Operating Expenses

(as a percentage of net assets attributable to the shares)

Management Fee |

1.50% |

Shareholder Servicing Fee |

0.25% |

Other Expenses |

0.33% |

Total Annual Fund Operating Expenses |

2.08% |

Fee Waivers and/or Expense Reimbursements(1) |

(0.13)% |

Total Annual Fund Operating Expenses after Fee Waivers and/or Expense Reimbursements |

1.95% |

|

(1) |

The Adviser has contractually agreed to waive its management fee and/or reimburse expenses to the extent necessary to ensure that the Fund’s total annual operating expenses will not exceed 1.95% (after fee waivers and/or expense reimbursements, and exclusive of front-end or contingent deferred loads, taxes, interest, brokerage commissions, acquired fund fees or expenses, extraordinary expenses such as litigation expenses, and other expenses not incurred in the ordinary course of the Fund’s business). These arrangements will continue until October 1, 2025, and shall automatically renew for an additional one-year period unless sooner terminated by the Fund or by the Board upon 60 days’ written notice to the Adviser or termination of the advisory agreement between the Fund and the Adviser. The Adviser may recoup fees waived and expenses reimbursed for a period of three years following the date such reimbursement or reduction was made if such recoupment does not cause current expenses to exceed the expense limit for the Fund in effect at the time the expenses were paid/waived or any expense limit in effect at the time of recoupment. |

Example

The following Example is intended to help you understand the various costs and expenses that you, as a holder of shares, would bear directly or indirectly. The Example assumes that you invest $10,000 in shares of the Fund for the time periods indicated. Because there are no costs to you associated with repurchases of your shares, your costs would be the same whether you hold your shares or tender your shares for repurchase at the end of the time periods indicated. The example also assumes that your investment has a 5% return each year, that all dividends and distributions are reinvested at NAV, and that the Fund’s operating expenses (as described above) remain the same. The example should not be considered a representation of the Fund’s future expenses. Although your actual costs may be higher or lower, based on these assumptions your costs would be:

1 Year |

3 Years |

5 Years |

10 Years |

$198 |

$639 |

$1,107 |

$2,400 |

The Example should not be considered a representation of future expenses. Actual expenses may be greater or lesser than those assumed for purposes of the Example. The Fund’s actual rate of return may be greater or less than the hypothetical 5% return shown in the Example.

INVESTMENT OBJECTIVES AND PRINCIPAL INVESTMENT STRATEGIES

When used in this Prospectus, the term “invest” includes both direct investing and indirect investing and the term “investments” includes both direct investments and indirect investments. The Fund may be exposed to the different types of investments described below through such “indirect” investments.

INVESTMENT OBJECTIVES

The Fund’s primary objective is to generate current income; its secondary objective is long-term capital appreciation. There can be no assurance that the Fund will achieve its investment objectives.

The Fund’s investment objectives may be changed without shareholder approval. The Fund will provide notice prior to implementing any change to its investment objectives.

PRINCIPAL INVESTMENT STRATEGIES

The Fund pursues its investment objectives by investing, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in debt securities and other credit-related investments. For purposes of the Fund’s 80% policy, “credit-related investments” include equity tranches of collateralized loan obligations (“CLOs”), mezzanine tranches of CLOs, equity interests in CLO warehouses, funds that invest primarily in debt securities, and derivatives that have similar economic characteristics to debt securities. The Fund normally focuses on investments in equity and mezzanine tranches of CLOs. Investments in equity tranches of CLOs are considered to be credit-related investments and will count towards compliance with the Fund’s 80% policy. The Fund also may invest in other types of debt securities and credit-related investments, including, without limitation, more senior debt tranches of CLOs, mortgage-backed and other asset-backed securities, other forms of structured credit, high yield and investment grade bonds, notes and debentures of U.S. and non-U.S. issuers, securities issued or guaranteed by the U.S. Government, its agencies, instrumentalities or sponsored entities, senior secured or second lien or other subordinated or unsecured floating rate and fixed rate loans or debt, and other fixed, floating, or variable interest rate securities.

The Fund may invest in debt securities and credit-related investments of any maturity and credit quality, including securities rated below investment grade (such as certain mezzanine tranches of CLOs) and unrated securities. Investment grade securities are those rated in the Baa3 or higher categories by Moody’s Investors Service, Inc. (“Moody’s”), or in the BBB- or higher categories by Standard & Poor’s, a division of McGraw Hill Companies Inc. (“S&P”), or Fitch Ratings Ltd. (“Fitch”) or, if unrated by S&P, Moody’s, Fitch or another Nationally Recognized Statistical Rating Organization (“NRSRO”), determined by the Sub-Adviser to be of comparable credit quality. Below investment grade securities, commonly referred to as “junk” or “high yield” securities, have predominately speculative characteristics with respect to the issuer’s capacity to pay interest and repay principal and may be difficult to value and illiquid. The Fund may invest in securities and other instruments for which the issuer is not current in its payment obligations, including securities of stressed, distressed and bankrupt issuers and debt obligations that are in default.

The Fund also may invest up to 20% of its net assets in equity securities of companies of any market capitalization throughout the world.

The Fund may invest in both U.S. dollar denominated and non-U.S. dollar denominated loans and securities, as well as securities of foreign issuers.

In addition to the above, the Fund may invest in a broad range of other types of debt securities, including certificates of deposit, money market securities, funds that invest primarily in debt securities, and cash, cash equivalents and other short term holdings and may enter into repurchase agreements and reverse repurchase agreements.

To the extent consistent with the repurchase liquidity requirement for an interval fund under Rule 23c-3 of the 1940 Act, the Fund may invest without limit in illiquid securities.

The Fund’s investment strategies and policies may be changed from time to time without shareholder approval, unless specifically stated otherwise in this Prospectus or in the SAI.

Investment process

In selecting debt and credit-related investments for, and in sub-advising, the Fund’s portfolio, the Sub-Adviser combines bottom-up fundamental analysis with top-down portfolio allocation and risk management. In particular, the Sub-Adviser seeks to leverage its long-standing relationships with major CLO participants and its in-depth knowledge of underlying collateral portfolios and CLO structures to source CLO investments from either (i) the primary market, as dealers bring new issue, refinanced or reset CLOs to market, or (ii) in the secondary market through dealer secondary offering sheets, bids wanted in competition and other privately negotiated transactions. The Sub-Adviser utilizes a tiered screening process to identify investment opportunities, with a focus on relative value. The process typically entails analyzing four distinct layers to evaluate potential investments: the collateral manager (review of experience, depth and stability of the credit and portfolio management teams, investment strategy and process and historical performance, among other factors), the underlying collateral portfolio (overlap analysis of the portfolio collateral versus the Sub-Adviser’s existing portfolios, a review of portfolio-wide key metrics and review of individual assets, among other factors), the transaction structure (analyzing hypothetical deal performance and the structure’s sensitivity to factors such as differing default rates, reinvestment yields, prepayment rates, interest rates and other macro/market variables, among other factors, and comparing key terms to past and present deals in the market), and CLO documents (as these documents are not standardized). During the screening process, the Sub-Adviser utilizes a technology suite which includes third party analytics software and its own proprietary dashboard to screen and identify investment opportunities and attendant risks. Opportunities that have passed the screening process are submitted to the Sub-Adviser’s investment committee, which then analyzes and, once it has approved an investment decision, sets appropriate risk limits. In sub-advising the Fund’s portfolio, the Sub-Adviser focuses on monitoring relative value and achieving maximum risk-adjusted returns on both new and existing investments.

The Sub-Adviser will consider selling an investment when a negative development impacts the investment or when the Sub-Adviser believes other investment opportunities may better optimize the relative value, risk and performance of the Fund’s strategy.

Principal portfolio composition

Under normal circumstances, the Fund invests at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in debt securities and other credit-related investments. For purposes of the Fund’s 80% policy, “credit-related investments” include equity tranches of CLOs, equity interests in CLO warehouses, funds that invest primarily in debt securities, and derivatives that have similar economic characteristics to debt securities. The Fund currently focuses on investments in equity and mezzanine tranches of CLOs. The Fund may also invest in a broad range of other debt securities and credit-related investments.

Debt securities

The Fund invests in debt securities, including debt securities that are rated below investment grade or are unrated. Debt securities represent obligations of corporations, governments and other entities to repay money borrowed, usually at the maturity of the security. These securities may pay fixed, variable or floating rates of interest. However, some fixed income securities, such as zero coupon bonds, do not pay current interest but are issued at a discount from their face values. Other debt instruments, such as certain mortgage-backed and other asset-backed securities, make periodic payments of interest and/or principal. Some debt instruments are partially or fully secured by collateral supporting the payment of interest and principal. Debt securities of corporate and governmental issuers in which the Fund may invest are subject to the risk of an issuer’s inability to meet principal and interest payments on the obligations (credit risk) and also may be subject to price volatility due to such factors as interest rate sensitivity, market perception of the creditworthiness of the issuer and general market liquidity (market risk).

Collateralized loan obligations

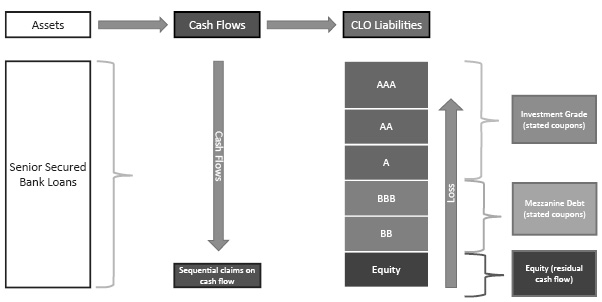

A CLO is typically collateralized by a pool of loans which may include, among other things, domestic and foreign senior secured loans, senior secured corporate bonds, unsecured corporate bonds, senior unsecured loans and subordinate corporate loans, including loans that may be rated below investment grade or equivalent unrated loans. While the vast majority of the portfolio of most CLOs consists of senior secured loans, many CLOs enable the CLO collateral manager to invest up to approximately 10% of the portfolio in assets that are not first lien senior secured loans, including second lien loans, unsecured loans, debtor-in-possession (DIP) loans and fixed rate loans. As illustrated in the diagram below, the cash flows from the trust are split into two or more portions, called tranches, with different priority claims, which represent different risk/return profiles. CLO debt tranches typically are rated “AAA” (or its equivalent) at the most senior level down to “BB” or “B” (or their equivalent), which is below investment grade, by Moody’s, S&P and/or Fitch. Holders of interests in the senior tranches are entitled to the lowest interest rate payments but those interests generally represent safer investments than more junior tranches because

senior tranches are paid from the cash flows from the underlying assets before the more junior tranches. Since they are partially protected from defaults, the senior CLO debt tranches typically have higher ratings and lower potential yields than the underlying securities, and can be rated investment grade. Despite the protection from the more junior and equity tranches, more senior CLO debt tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default and disappearance of protecting tranches, market anticipation of defaults and aversion to CLO securities as a class.

Sub-investment grade rated debt tranches of CLOs (CLO mezzanine tranches) are the most junior of the debt tranches. The equity tranches of CLOs are unrated and subordinated to the debt tranches in the CLO capital structure. The equity tranche receives excess cash flow after the payment of interest and principal on the more senior tranches, and other excess cash flow after the more senior tranches, are repaid, at the bottom of the payment waterfall. Economically, the equity tranche of a CLO benefits from the difference between the interest received from the senior secured loans and the interest paid to the holders of debt tranches of the CLO structure. A CLO’s equity tranche, while entitled to be paid the highest interest rate payments, is the riskiest portion of the CLO, representing the first loss position in the CLO (i.e., losses are first borne by the equity tranche, next by the junior tranches and finally by the senior tranches) and bearing the bulk of defaults from the bonds or loans in the trust. As a practical matter, the equity tranche covers a particular percent of the collateral’s principal and absorbs the first default losses accounting for such percent of the total pool of loans. For instance, if the equity tranche of a CLO covers 10% of the collateral’s principal, should a default or decrease in expected payments to the CLO occur, that deficiency typically will first affect the equity tranche in that holders of that position generally will be the first to have their payments decreased by the deficiency and would bear all of up to 10% of the collateral’s losses. Next in line to absorb losses is the mezzanine tranche of the CLO. If the second tranche (the mezzanine tranche) of the CLO covers the next 20% of collateral principal, it is protected by the equity tranche against 10% of losses and absorbs the next 20% of default losses on the portfolio of loans. The losses incurred by the equity and mezzanine tranches assume no excess spread benefit. If the next more senior tranche covers the next 60% of collateral principal, it is protected by equity and the mezzanine tranches against 30% (10% + 20%) of losses and absorbs the next 60% default losses on the portfolio of loans, and so on. Consequently, CLO equity and mezzanine tranches entail generally higher risk (albeit different risks because the mezzanine tranches are structurally superior to the equity tranche), with the potential for higher returns, than other tranches of CLO debt that are more senior. The percentages included in the above example are merely illustrative, but do generally fall in the typical ranges for the CLOs in which the Fund will invest. The percent covered by each tranche may differ from CLO to CLO and from issuance to issuance and, therefore, the percentages included in the above example may differ in and among the CLOs in which the Fund actually invests. Below investment grade securities are commonly referred to as “junk” or “high yield” securities and involve substantial risk of loss.

CLO equity and mezzanine tranches are considered speculative with respect to timely payment of distributions or investment and reinvestment or repayment of principal.

Each tranche within a CLO normally has voting rights on any amendments that would have a material effect on such tranche. Neither the debt tranches nor equity tranche of CLOs have voting rights on the management of the underlying loan portfolio. The holders of the equity tranches of CLOs typically have the right to approve and/or replace the CLO collateral manager after such CLO manager has triggered a default. CLO equity tranche holders typically have the ability to call or refinance the debt tranches following a non-call period. Debt tranches of CLOs do not have the right to call the other CLO security tranches. Debt tranches of CLOs typically have a stated coupon. Equity tranches of CLOs do not have a stated coupon.

Depending on the Sub-Adviser’s assessment of market conditions, the Fund’s focus may vary from time to time between CLO equity and debt tranches. In the market environment existing as of the date of this Prospectus, the Sub-Adviser expects investment opportunities in CLO equity to present more attractive risk-adjusted returns and higher risk levels than CLO debt, although the Sub-Adviser expects to make investments in CLO debt and related investments, in certain cases, to complement the CLO equity investments that the Fund makes.

CLO securities are subject to a number of risks as discussed elsewhere in more detail beginning on page 31 of this Prospectus under “Risk Factors.” Among the Fund’s primary targeted investments, the risks associated with CLO mezzanine tranches and CLO equity tranches are generally greater than those associated with more senior tranches of CLO debt.

Senior Secured Obligations

It is currently expected that the underlying investments held by CLOs in which the Fund invests will primarily be senior secured loans and senior secured corporate bonds (“Senior Secured Obligations” or “SSOs”). These SSOs are senior secured loans made by banks or other institutions to leveraged, non-investment grade firms (or, in the case of European CLOs, senior secured bonds issued by non-investment grade firms), in each case, to finance mergers and acquisitions, recapitalizations, capital expenditures and general corporate purposes. These loans (or bonds) are syndicated, or sold, to institutional investors.

Typically, SSOs will be floating rate in nature and will benefit from collateral protection, as well as, in some cases, financial maintenance covenants. Financial maintenance covenants are intended to warn investors of weakening performance and, when breached, may permit lenders to re-price the obligation or take further action to protect their interests, a benefit generally unavailable to holders of high yield bonds (which instead are protected by incurrence covenants).

SSOs are secured and typically hold the senior most position in the capital structure. Because SSOs often are secured by a lien (which may be a first priority lien or a second priority lien) on substantially all of the assets of the borrower and other relevant obligors and/or guarantors, including receivables, inventory and property, plant and equipment, they must be repaid, to the extent the relevant obligor is otherwise unable to do so, from the proceeds of such assets before unsecured debt obligations (i.e., before the holders of most high yield bonds and equity).

Warehouse Investments

Prior to a CLO closing and issuing CLO securities to CLO investors, in anticipation of such CLO closing, a vehicle (often the future CLO issuer) will purchase and “warehouse” a portion of the underlying loans that will be held by such CLO (the “Warehouse”). To finance the accumulation of these assets, a financing facility (a “Warehouse Facility”) is opened, equitized either by the entity or affiliates of the entity that will become the collateral manager of the CLO upon its closing and/or by third-party investors that may or may not invest in the CLO. The period from the date such Warehouse is opened and asset accumulation begins to the date the CLO closes is referred to as the “warehousing period.” The Fund may participate in SSOs during warehousing periods by providing equity capital in support of Warehouses. In practice, a Warehouse investment (“Warehouse Investment”) may be structured in a variety of legal forms (typically determined by the bank engaged to underwrite the associated CLO which will also typically be the provider of senior financing to the Warehouse), including by subscribing for equity interests or a subordinated debt investment in a special purpose vehicle that obtains a Warehouse Facility secured by the assets (primarily SSOs) that are accumulated in anticipation of the related CLO.

Risk Retention Vehicles

The Fund may invest in CLO debt and equity tranches and Warehouse Investments directly or indirectly through an investment in U.S. and/or European vehicles, certain of which were established for the purpose of satisfying E.U. regulations that require eligible risk retainers to purchase and retain specified amounts of the credit risk associated with certain CLOs, which vehicles themselves are invested in CLO securities, Warehouse Investments, and/or Senior Secured Obligations (“Risk Retention Vehicles”). Risk Retention Vehicles will be structured to satisfy the retention requirements by purchasing and retaining the percentage of CLO notes prescribed under the applicable retention requirements (the “Retention Notes”) and will include Risk Retention Vehicles with respect to CLOs managed by other collateral managers, but will not include Risk Retention Vehicles with respect to CLOs for which the Sub-Adviser acts as collateral manager.

Indirect investments in CLO equity securities (and in some instances more senior CLO securities) and Warehouse Investments through entities that have been established to satisfy the European retention requirements may allow for better economics for the Fund (including through fee rebate arrangements) by creating stronger negotiating positions with CLO managers and underwriting banks who are incentivized to issue CLOs and who require the participation of a Risk Retention Vehicle to enable the CLO securities to be issued. However, Retention Notes differ from other securities of the same ranking since the retention requirements prescribe that such Retention Notes must be held by the relevant risk retainer for a specified period. Under E.U. regulations governing these Risk Retention Vehicles, the prescribed holding period is the lifetime of the CLO. In addition, Retention Notes are subject to other restrictions not imposed on other securities of the same ranking; for example, Retention Notes may not be subject to credit risk mitigation, and breach of the retention requirements may result in the imposition of regulatory sanctions or in claims being brought against the retaining party.

Structured credit

The Fund may invest in various types of structured instruments, including securities that have demand, tender or put features, or interest rate reset features. These may include instruments issued by structured investment or special purpose vehicles or conduits, and may be asset-backed or mortgage-backed securities. Structured instruments may take the form of participation interests or receipts in underlying securities or other assets, and in some cases are backed by a financial institution serving as a liquidity provider. The interest rate or principal amount payable at maturity on a structured instrument may vary based on changes in one or more specified reference factors, such as currencies, interest rates, commodities, indices or other financial indicators. Changes in the underlying reference factors may result in disproportionate changes in amounts payable under a structured instrument. Some of these instruments may have an interest rate swap feature which substitutes a floating or variable interest rate for the fixed interest rate on an underlying security. Structured instruments are a type of derivative instrument and the payment and credit qualities of these instruments derive from the assets embedded in the structure. For structured securities that have embedded leverage features, small changes in interest or prepayment rates may cause large and sudden price movements. Structured instruments are often subject to heightened liquidity risk.

Loans

The Fund may invest in loans to finance highly leveraged borrowers which may make such loans especially vulnerable to adverse changes in economic or market conditions. Loans in which the Fund may invest may be either collateralized or uncollateralized and senior or subordinate. Investments in uncollateralized and/or subordinate loans entail a greater risk of nonpayment than do investments in loans that hold a more senior position in the borrower’s capital structure and/or are secured with collateral. In addition, loans are generally subject to liquidity risk.

Floating rate loans

Floating rate loans are provided by banks and other financial institutions to large corporate customers. These loans are normally rated below investment grade, but typically are secured with specific collateral and have a senior position in the capital structure of the borrower. These loans typically have rates of interest that are reset periodically by reference to a base lending rate, such as Secured Overnight Financing Rate (“SOFR”), plus a premium.

Floating rate investments

Floating rate investments are securities and other instruments with interest rates that adjust or “float” periodically based on a specified interest rate or other reference and include repurchase agreements, money market securities and shares of money market and short-term bond funds. For purposes of the Fund’s investment policies, the Fund considers as floating rate instruments adjustable rate securities, fixed rate securities with durations of less than or equal to one year and funds that invest primarily in floating rate instruments.

Below investment grade debt securities

The Fund may invest in debt securities rated below investment grade or, if unrated, of equivalent quality as determined by the Sub-Adviser. Below investment grade securities, which are commonly referred to as “junk” or “high yield” securities, have high risk, speculative characteristics. A debt security is below investment grade if it is rated Ba/BB or lower or the equivalent rating by at least one NRSRO or determined to be of equivalent credit quality by the Sub-Adviser. Below investment grade debt securities involve greater risk of loss, are subject to greater price volatility and are less liquid, especially during periods of economic uncertainty or change, than higher quality debt securities. Below investment grade securities also may be more difficult to value.

For purposes of the Fund’s credit quality policies, if a security receives different ratings from two or more NRSROs, the Fund will use the rating chosen by the Portfolio Managers as most representative of the security’s credit quality. The ratings of NRSROs represent their opinions as to the quality of the securities that they undertake to rate and may not accurately describe the risks of the securities. An NRSRO may have a conflict of interest with respect to a security for which it assigns a quality rating. In addition, there may be a delay between a change in the credit quality of a security or other asset and a change in the quality rating assigned to the security or other asset by an NRSRO. If an NRSRO changes the quality rating assigned to one or more of the Fund’s portfolio securities, the Sub-Adviser will consider if any action is appropriate in light of the Fund’s investment objectives and strategies. An investor can still lose significant amounts when investing in investment grade securities.

Other investments

Mortgage-backed and other asset-backed securities

The Fund may invest in mortgage-backed and asset-backed securities in addition to CLOs. Mortgage-backed securities may be issued by private issuers, by government-sponsored entities such as Fannie Mae (formally known as the Federal National Mortgage Association) or Freddie Mac (formally known as the Federal Home Loan Mortgage Corporation) or by agencies of the U.S. Government, such as the Government National Mortgage Association (“Ginnie Mae”). Mortgage-backed securities represent direct or indirect participations in, or are collateralized by and payable from, mortgage loans secured by real property.

Unlike mortgage-backed securities issued or guaranteed by the U.S. Government or certain government-sponsored entities, mortgage-backed securities issued by private issuers do not have a government or government-sponsored entity guarantee (but may have other credit enhancement), and may, and frequently do, have less favorable collateral, credit risk or other underwriting characteristics.

Asset-backed securities represent participations in, or are secured by and payable from, assets such as installment sales or loan contracts, leases, credit card receivables and other categories of receivables.

Collateralized mortgage obligations (“CMOs”) are debt obligations collateralized by mortgage loans or mortgage pass-through securities. CMOs are a type of mortgage-backed security. Typically, CMOs are collateralized by Ginnie Mae, Fannie Mae or Freddie Mac Certificates, but may also be collateralized by whole loans or private pass-throughs (referred to as “Mortgage Assets”). Payments of principal and of interest on the Mortgage Assets, and any reinvestment income thereon, provide the Fund with income to pay debt service on the CMOs. In a CMO, a series of bonds or certificates is issued in multiple classes. Each class of CMOs, often referred to as a “tranche,” is issued at a specified fixed or floating coupon rate and has a stated maturity or final distribution date. Principal prepayments on the Mortgage Assets may cause the CMOs to be retired substantially earlier than their stated maturities or final distribution dates. Interest is paid or accrues on all classes of the CMOs on a monthly, quarterly or semi-annual basis. The principal of and interest on the Mortgage Assets may be allocated among the several classes of a series of a CMO in innumerable ways. As market conditions change, and particularly during periods of rapid or unanticipated changes in market interest rates, the attractiveness of the CMO classes and the ability of the structure to provide the anticipated investment characteristics may be significantly reduced. Such changes can result in volatility in the market value, and in some instances reduced liquidity, of the CMO class.

Collateralized debt obligations (“CDOs”) are a type of asset-backed security. CDOs include collateralized bond obligations (“CBOs”), CLOs and other similarly structured securities. A CBO is a trust or other special purpose entity which is typically backed by a diversified pool of fixed income securities (which may include high risk, below investment grade securities). CDOs generally issue separate series or “tranches” which vary with respect to risk and yield. These tranches can experience substantial losses due to actual defaults, increased sensitivity to defaults due to collateral default and disappearance of subordinate tranches, market anticipation of defaults, as well as investor aversion to CDO securities as a class. Interest on certain tranches of a CDO may be paid in kind (paid in the form of obligations of the same type rather than cash), which involves continued exposure to default risk with respect to such payments. The Fund expects to primarily invest in CDOs based on bank loans, including syndicated bank debt, senior secured loans, floating rate notes and leveraged loans.

Corporate debt

Corporate debt securities are fixed income securities usually issued by businesses to finance their operations. Various types of business entities may issue these securities, including corporations, trusts, limited partnerships, limited liability companies and other types of non-governmental legal entities. Notes, bonds, debentures and commercial paper are the most common types of corporate debt securities, with the primary difference being their maturities and secured or unsecured status. Commercial paper has the shortest term and is usually unsecured. The broad category of corporate debt securities includes debt issued by U.S. or foreign companies of all kinds, including those with small, mid and large capitalizations. Corporate debt may carry variable or floating rates of interest.

U.S. Government obligations

The Fund may invest in U.S. Government obligations. U.S. Government obligations include U.S. Treasury obligations and other obligations of, or guaranteed by, the U.S. Government, its agencies or government-sponsored entities. Although the U.S. Government guarantees principal and interest payments on securities issued by the U.S. Government and some of its agencies, such as securities issued by Ginnie Mae, this guarantee does not apply to losses resulting from declines in the market value of these securities. U.S. Government obligations include zero coupon securities that make payments of interest and principal only upon maturity and which therefore tend to be subject to greater volatility than interest bearing securities with comparable maturities.

Some of the U.S. Government securities that the Fund may hold are not guaranteed or backed by the full faith and credit of the U.S. Government, such as those issued by Fannie Mae and Freddie Mac. The maximum potential liability of the issuers of some U.S. Government obligations may greatly exceed their current resources, including any legal right to support from the U.S. Government.

Non-U.S. investments

The Fund may invest without limit in securities of non-U.S. issuers, including securities of emerging market issuers. Non-U.S. issuers are issuers that are organized and have their principal offices outside of the United States. Non- U.S. securities may be issued by non-U.S. governments, banks or corporations, or private issuers, and certain supranational organizations, such as the World Bank and the European Union. The Fund expects that a majority of its investments in CLOs will consist of securities of non-U.S. issuers.

Defaulted securities

The Fund may invest in defaulted securities. The risk of loss due to default may be considerably greater with lower-quality securities because they are generally unsecured and are often subordinated to other debt of the issuer. Investing in defaulted debt securities involves risks such as the possibility of complete loss of the investment where the issuer does not restructure to enable it to resume principal and interest payments. If the issuer of a security in the Fund’s portfolio defaults, the Fund may have unrealized losses on the security, which may lower the Fund’s NAV. Defaulted securities tend to lose much of their value before they default. Thus, the Fund’s NAV may be adversely affected before an issuer defaults. In addition, the Fund may incur additional expenses if it must try to recover principal or interest payments on a defaulted security.

Distressed securities

While the Fund does not intend to acquire distressed securities, the Fund may continue to hold leveraged loans and other debt instruments that were not distressed at the time of investment during periods of market dislocation or in instances where the issuers of such instruments experience some level of financial or business distress (including undergoing bankruptcy or other reorganization or liquidation proceedings) such that the instruments held by the Fund may be deemed distressed securities. Distressed securities may involve a substantial degree of risk. In certain periods, there may be little or no liquidity in the markets for these securities or instruments. In addition, the prices of such securities or instruments may be subject to periods of abrupt and erratic market movements and above-average price volatility. It may be more difficult to value such securities and the spread between the bid and ask prices of such securities may be greater than normally expected. If the Adviser’s evaluation of the risks and anticipated outcome of an investment in a distressed security should prove incorrect, the Fund may lose a substantial portion or all of its investment or the Fund may be required to accept cash or securities with a value less than its original investment.

Certificates of deposit, bankers’ acceptances and time deposits

The Fund may acquire certificates of deposit, bankers’ acceptances and time deposits. Certificates of deposit are negotiable certificates issued against funds deposited in a commercial bank for a definite period of time and earning a specified return. Bankers’ acceptances are negotiable drafts or bills of exchange, normally drawn by an importer or exporter to pay for specific merchandise, which are “accepted” by a bank, meaning in effect that the bank unconditionally agrees to pay the face value of the instrument on maturity. Certificates of deposit and bankers’ acceptances acquired by the Fund will be dollar-denominated obligations of domestic banks, savings and loan associations or financial institutions at the time of purchase, have capital, surplus and undivided profits in excess of $100 million (including assets of both domestic and foreign branches), based on latest published reports, or less than $100 million if the principal amount of such bank obligations are fully insured by the U.S. Government. In addition to purchasing certificates of deposit and bankers’ acceptances, to the extent permitted under the Fund’s investment objectives and policies, the Fund may make interest-bearing time or other interest-bearing deposits in commercial or savings banks. Time deposits are non-negotiable deposits maintained at a banking institution for a specified period of time at a specified interest rate.

Equity securities

Equity securities include common stocks, warrants and rights, as well as “equity equivalents” such as preferred stocks and securities convertible into common stock. The equity securities in which the Fund invests may be publicly or privately offered. Preferred stocks generally pay a dividend and rank ahead of common stocks and behind debt securities in claims for dividends and for assets of the issuer in a liquidation or bankruptcy. The dividend rate of preferred stocks may cause their prices to behave more like those of debt securities. A convertible security is one that can be converted into or exchanged for common stock of an issuer within a particular period of time at a specified price, upon the occurrence of certain events or according to a price formula.

Convertible securities offer the Fund the ability to participate in equity market movements while also seeking some current income. Convertible debt securities pay interest and convertible preferred stocks pay dividends until they mature or are converted, exchanged or redeemed. The Fund considers some convertible securities to be “equity equivalents” because they are convertible into common stock. The credit ratings of those convertible securities generally have less impact on the investment decision, although they may still be subject to credit and interest rate risk.

Small and medium capitalization companies

The Fund may invest in companies with small or medium capitalizations. Smaller and medium capitalization securities can be more volatile than, and perform differently from, larger capitalization securities. There may be less trading in a smaller or medium company’s securities, which means that buy and sell transactions in those securities could have a larger impact on the securities’ price than is the case with larger company securities. Smaller and medium company securities may be particularly sensitive to changes in interest rates, borrowing costs and earnings. Smaller and medium companies may have fewer business lines; changes in any one line of business, therefore, may have a greater impact on the price of a smaller and medium company’s securities than is the case for a larger company. As a result, the purchase or sale of more than a limited number of securities of a small and medium company may affect its market price. The Fund may need a considerable amount of time to purchase or sell its positions in these securities. In addition, smaller or medium company securities may not be well known to the investing public.

Reverse repurchase agreements and borrowing

The Fund may enter into reverse repurchase agreements pursuant to which the Fund transfers securities to a counterparty in return for cash, and the Fund agrees to repurchase the securities at a later date and generally for a higher price. Reverse repurchase agreements are treated as borrowings by the Fund, are a form of leverage and may make the value of an investment in the Fund more volatile and increase the risks of investing in the Fund. The Fund also may borrow money from banks or other lenders, including to finance repurchase requests. Entering into reverse repurchase agreements and other borrowing transactions may cause the Fund to liquidate positions when it may not be advantageous to do so in order to satisfy its obligations or to meet segregation or coverage requirements.

Repurchase agreements

The Fund may enter into repurchase agreements with broker-dealers, member banks of the Federal Reserve System and other financial institutions. Repurchase agreements are arrangements under which the Fund purchases securities and the seller agrees to repurchase the securities within a specific time and at a specific price. The repurchase price is generally higher than the Fund’s purchase price, with the difference being income to the Fund. A repurchase agreement may be considered a loan by the Fund collateralized by securities. Under the direction of the Board of Trustees (the “Board”), the Adviser reviews and monitors the creditworthiness of any institution which enters into a repurchase agreement with the Fund. All repurchase agreements entered into by the Fund shall be fully collateralized with U.S. Treasury and/or agency obligations at all times during the period of the agreement in that the value of the collateral shall be at least equal to an amount of the loan, including interest thereon. Collateral is held by the Fund’s custodian in a segregated safekeeping account for the benefit of the Fund. Repurchase agreements afford the Fund an opportunity to earn income on temporarily available cash. In the event of commencement of bankruptcy or insolvency proceedings with respect to the seller of the security before repurchase of the security under a repurchase agreement, the Fund may encounter delay and incur costs before being able to sell the security. Such a delay may involve loss of interest or a decline in price of the security. If the court characterizes the transaction as a loan and the Fund has not perfected a security interest in the collateral, the Fund may be required to return the collateral to the seller’s estate and be treated as an unsecured creditor of the seller. As an unsecured creditor, the Fund would be at risk of losing some or all of the principal and interest involved in the transaction.

Cash management and temporary investments

Normally, the Fund invests substantially all of its assets to meet its investment objectives. The Fund may invest the remainder of its assets in securities with remaining maturities of less than one year or cash equivalents, or may hold cash. For temporary defensive purposes, including during periods of unusual cash flows, the Fund may depart from its principal investment strategies and invest part or all of its assets in these securities or may hold cash. To the extent that the Fund has any uninvested cash, the Fund would also be subject to risk with respect to the depository institution holding the cash. During such periods, it may be more difficult for the Fund to achieve its investment objectives. The Fund may adopt a defensive strategy when the Sub-Adviser believes securities in which the Fund normally invests have special or unusual risks or are less attractive due to adverse market, economic, political or other conditions.

Short-term trading

The Fund usually does not trade for short-term profits. The Fund will sell an investment, however, even if it has only been held for a short time, if it no longer meets the Fund’s investment criteria. If the Fund does a lot of trading, it may incur additional operating expenses, which would reduce performance, and could cause shareowners to incur a higher level of taxable income or capital gains.

RISK FACTORS

Risk is inherent in all investing. Investing in any investment company security involves risk, including the risk that you may receive little or no return on your investment. Therefore, before purchasing shares of the Fund, you should consider carefully the risks that you assume when you invest in the Fund.

Some of the risks of investing in the Fund, including the principal risks of the Fund, are discussed below. The Fund may be subject to factors and risks other than those identified in this Prospectus, and these other factors and risks could adversely affect the Fund’s investment results. More information about risks appears in the Statement of Additional Information (“SAI”).

PRINCIPAL RISKS

General

The Fund is a non-diversified, closed-end management investment company designed primarily as a long-term investment and not as a trading tool. The Fund is not a complete investment program and should be considered only as an addition to an investor’s existing portfolio of investments. Due to uncertainty inherent in all investments, there can be no assurance that the Fund will achieve its investment objectives. In addition, even though the Fund makes periodic offers to repurchase a portion of its outstanding shares to provide some liquidity to shareholders, shareholders should consider the Fund to be an illiquid investment.

Non-diversification risk

The Fund is classified as “non-diversified,” which means that it may invest a larger percentage of its assets in the securities of a smaller number of issuers than a diversified fund. Being non-diversified may magnify the Fund’s losses from adverse events affecting a particular issuer, and the value of its shares may be more volatile than if it invested more widely. To the extent the Fund invests its assets in a smaller number of issuers, the Fund will be more susceptible to negative events affecting those issuers than a diversified fund.

Debt securities risks

The value of debt securities may go up or down, sometimes rapidly and unpredictably, due to general market conditions, such as real or perceived adverse economic or political conditions, inflation, changes in interest rates, governmental actions or intervention, market disruptions caused by trade disputes or other factors, lack of liquidity in the bond markets or adverse investor sentiment. In addition, the value of a debt security may decline if the issuer or other obligor of the security fails to pay principal and/or interest, otherwise defaults or has its credit rating downgraded or is perceived to be less creditworthy, or the credit quality or value of any underlying assets declines. If the value of debt securities owned by the Fund fall, the value of your investment will go down. Below investment grade, high-yield debt securities (commonly known as “junk bonds”) have a higher risk of default and are considered speculative. Subordinated securities are more likely to suffer a credit loss than non-subordinated securities of the same issuer and will be disproportionately affected by a default, downgrade or perceived decline in creditworthiness.

The Fund has a broad mandate with respect to the type and nature of debt investments in which it may participate. While some of the debt securities in which the Fund invests may be secured, the Fund also may invest in debt securities that are either unsecured and subordinated to substantial amounts of senior indebtedness, or a significant portion of which may be unsecured. In such instances, the ability of the Fund to influence an issuer’s affairs, especially during periods of financial distress or following an insolvency is likely to be substantially less than that of senior creditors. For example, under terms of subordination agreements, senior creditors are typically able to block the acceleration of the debt or other exercises by the Fund of its rights as a creditor. Accordingly, the Fund may not be able to take the steps necessary to protect its investments in a timely manner or at all. In addition, the debt securities in which the Fund invests may not be protected by financial covenants or limitations upon additional indebtedness, may have limited liquidity and may not be rated by a credit rating agency.

Creditors of loans constituting the Fund’s assets may seek the protections afforded by bankruptcy, insolvency and other debtor relief laws. Bankruptcy proceedings are unpredictable. Additionally, the numerous risks inherent in the insolvency process create a potential risk of loss by the Fund of its entire investment in any particular investment.

Insolvency laws may, in certain jurisdictions, result in a restructuring of the debt without the Fund’s consent under the “cramdown” provisions of applicable insolvency laws and may also result in a discharge of all or part of the debt without payment to the Fund.

Debt securities are also subject to other risks, including (i) the possible invalidation of an investment transaction as a “fraudulent conveyance,” (ii) the recovery of liens perfected or payments made on account of a debt in the period before an insolvency filing as a “preference,” (iii) equitable subordination claims by other creditors, (iv) so called “lender liability” claims by the issuer of the obligations, and (v) environmental liabilities that may arise with respect to collateral securing the obligations. Additionally, adverse credit events with respect to any issuer, such as missed or delayed payment of interest and/or principal, bankruptcy, receivership, or distressed exchange, can significantly diminish the value of the Fund’s investment in any such company. The Fund’s investments in debt securities may be subject

to early redemption features, refinancing options, pre-payment options or similar provisions which, in each case, could result in the issuer repaying the principal on an obligation held by the Fund earlier than expected. Accordingly, there can be no assurance that the Fund’s investment objectives will be realized.

Interest rate risk

The market prices of securities may fluctuate significantly when interest rates change. When interest rates rise, the value of fixed income securities generally falls. A variety of factors can impact interest rates, including central bank monetary policies and inflation rates. Recently, inflation and interest rates have been volatile and may increase in the future. Any interest rate increases in the future could cause the value of the Fund’s holdings to decrease. A general rise in interest rates may cause investors to move out of fixed income securities on a large scale, which could adversely affect the price and liquidity of fixed income securities and could also result in increased redemptions from the Fund. A change in interest rates will not have the same impact on all fixed income securities. Generally, the longer the maturity (i.e., measure of time remaining until the final payment on a security) or duration (i.e., measure of the underlying portfolio’s price sensitivity to changes in prevailing interest rates) of a fixed income security, the greater the impact of a rise in interest rates on the security’s value. For example, if interest rates increase by 1%, the value of a fund’s portfolio with a portfolio duration of ten years would be expected to decrease by 10%, all other things being equal. In addition, different interest rate measures (such as short- and long-term interest rates and U.S. and foreign interest rates), or interest rates on different types of securities or securities of different issuers, may not necessarily change in the same amount or in the same direction.

Rising interest rates can lead to increased default rates, as issuers of floating rate securities find themselves faced with higher payments. Unlike fixed rate securities, floating rate securities generally will not increase in value if interest rates decline. Changes in interest rates also will affect the amount of interest income the Fund earns on its floating rate investments. Unlike fixed rate securities, when prevailing interest rates decrease, the interest rate payable on floating rate investments will decrease. Although CLOs are generally structured to mitigate the risk of interest rate mismatch, there may be some difference between the timing of interest rate resets on the assets and liabilities of a CLO. Such a mismatch in timing could have a negative effect on the amount of funds distributed to CLO investors. In addition, CLOs may not be able to enter into hedge agreements, even if it may otherwise be in the best interests of the CLO to hedge such interest rate risk.

As prevailing interest rates increase, some obligors may not be able to make the increased interest payments on loans or refinance their obligations, resulting in payment defaults and defaulted obligations. Many of the debt obligations underlying CLO or Warehouse Investments, and the debt issued by CLOs and Warehouses, bear interest at floating interest rates. Unlike fixed rate securities, floating rate securities generally will not increase in value if interest rates decline. Changes in interest rates also will affect the amount of interest income the Fund earns on its CLO and floating rate investments.

Credit risk

If an issuer or guarantor of a security held by the Fund or a counterparty to a financial contract with the Fund defaults on its obligation to pay principal and/ or interest, has its credit rating downgraded or is perceived to be less creditworthy, or the credit quality or value of any underlying assets declines, the value of your investment will decline. In addition, the Fund may incur expenses and may be hindered or delayed in enforcing its rights against an issuer, obligor or counterparty. A security may change in price for a variety of reasons. For example, floating rate securities may have final maturities of ten or more years, but their effective durations will tend to be very short. If there is an adverse credit event, or a perceived change in the issuer’s creditworthiness, these securities could experience a far greater negative price movement than would be predicted by the change in the security’s yield in relation to their effective duration. The Fund evaluates the credit quality of issuers and counterparties prior to investing in securities. Credit risk is broadly gauged by the credit ratings of the securities in which the Fund invests. However, ratings are only the opinions of the companies issuing them and are not guarantees as to quality. Securities rated in the lowest category of investment grade (Baa/BBB) may possess certain speculative characteristics. Credit risk is typically greatest for high yield debt securities (“junk” bonds), which are rated below the Baa/BBB categories or unrated securities of comparable credit quality.

Prepayment or call risk

Many issuers have a right to prepay their securities. If interest rates fall, an issuer may exercise this right. If this happens, the Fund would be forced to reinvest prepayment proceeds at a time when yields or securities available in the market are lower than the yield on the prepaid security. The Fund may also lose any premium it paid on the security.

Extension risk

When interest rates rise, repayments of debt securities, particularly asset- and mortgage-backed securities, may occur more slowly than anticipated, extending the effective duration of these debt securities at below market interest rates and causing their market prices to decline more than they would have declined due to the rise in interest rates alone. This may cause the Fund’s NAV to be more volatile.

City National Rochdale Strategic CREDIT Fund | PAGE 32

Risks relating to collateralized loan obligations

In the case of most CLOs, the structured finance securities are issued in multiple tranches, offering investors various maturity and credit risk characteristics, often categorized as senior, mezzanine and subordinated/equity according to their degree of risk. If there are defaults or the relevant collateral otherwise underperforms, scheduled payments to senior tranches of such securities take precedence over those of mezzanine tranches, and scheduled payments to mezzanine tranches have a priority in right of payment to subordinated/equity tranches. CLOs may therefore present risks similar to those of other types of debt obligations and, in fact, such risks may be of greater significance in the case of CLOs depending upon the ranking of the Fund’s investment in the capital structure. Investments in structured vehicles, including equity and junior debt tranches of CLOs, involve risks, including credit risk and market risk. Changes in interest rates and credit quality may cause significant price fluctuations.

In addition to the general risks associated with investing in debt securities, CLO securities carry additional risks, including: (i) the possibility that distributions from collateral assets will not be adequate to make interest or other payments; (ii) the quality of the collateral may decline in value or default; (iii) investments in CLO equity and junior debt tranches will likely be subordinate in right of payment to other senior classes of CLO debt; and (iv) the complex structure of a particular security may not be fully understood at the time of investment and may produce disputes with the issuer or unexpected investment results. Additionally, changes in the collateral held by a CLO may cause payments on the instruments held by the Fund to be reduced, either temporarily or permanently. CLOs also may be subject to prepayment risk. Further, the performance of a CLO may be adversely affected by a variety of factors, including the security’s priority in the capital structure of the issuer thereof, the availability of any credit enhancement, the level and timing of payments and recoveries on and the characteristics of the underlying receivables, loans or other assets that are being securitized, remoteness of those assets from the originator or transferor, the adequacy of and ability to realize upon any related collateral and the capability of the servicer of the securitized assets. There are also the risks that the trustee of a CLO does not properly carry out its duties to the CLO, potentially resulting in loss to the CLO.

The complex structure of CLO securities may produce unexpected investment results, especially during times of market stress or volatility. The complexity of CLOs and related investments gives rise to the risk that investors, parties involved in their creation and issuance, and other parties with an interest in them may not have the same understanding of how these investments behave, or the rights that the various interested parties have with respect to them. Furthermore, the documents governing these investments may contain some ambiguities that are subject to differing interpretations. Even in the absence of such ambiguities, if a dispute were to arise concerning these instruments, there is a risk that a court or other tribunal might not fully understand all aspects of these investments and might rule in a manner contrary to both the terms and the intent of the documents. Therefore, the Fund cannot be fully assured that it will be able to enjoy all of the rights that it expects to have when it invests in CLOs and related investments.

Investing in securities of CLOs involves the possibility of investments being subject to potential losses arising from material misrepresentation or omission on the part of borrowers whose loans make up the assets of such entities. Such inaccuracy or incompleteness may adversely affect the valuation of the receivables or may adversely affect the ability of the relevant entity to perfect or effectuate a lien on the collateral securing its assets. The CLOs in which the Fund invests will rely upon the accuracy and completeness of representations made by the underlying borrowers to the extent reasonable, but cannot guarantee such accuracy or completeness. The quality of the Fund’s investments in CLOs is subject to the accuracy of representations made by the underlying borrowers and issuers. In addition, the Fund is subject to the risk that the systems used by the originators of CLOs to control for accuracy are defective. Under certain circumstances, payments to the Fund may be reclaimed if any such payment or distribution is later determined to have been a fraudulent conveyance or a preferential payment.

CLOs typically will have no significant assets other than the assets underlying such CLOs, including, but not limited to, secured loans, leveraged loans, project finance loans, unsecured loans, cash collateralized letters of credit and other asset-backed obligations, and/or instruments (each of which may be listed or unlisted and in bearer or registered form) that serve as collateral. Payments on the CLO securities are and will be payable solely from the cash flows from the collateral, net of all management fees and other expenses.

The failure by a CLO in which the Fund invests to satisfy financial covenants, including with respect to adequate collateralization and/or interest coverage tests, could lead to a reduction in its payments to the Fund. In the event that a CLO fails certain tests, holders of CLO senior debt may be entitled to additional payments that would, in turn, reduce the payments the Fund would otherwise be entitled to receive. Separately, the Fund may incur expenses to the extent necessary to seek recovery upon default or to negotiate new terms, which may include the waiver of certain financial covenants, with a defaulting CLO or any other investment the Fund may make. If any of these occur, it could materially and adversely affect the Fund’s returns.

The leveraged nature of CLOs magnifies the adverse impact of loan defaults. CLO investments represent a leveraged investment with respect to the underlying loans. As a result, changes in the market value of the CLO investments could be greater than the change in the market value of the underlying loans (which are subject to credit, liquidity and interest rate risk) and any event that negatively impacts an underlying investment could result in a substantial loss that would not be as substantial if the investment were not leveraged. The leverage varies depending on the seniority of the tranche. Equity tranches typically have leverage in excess of ten times.

The loans or bonds underlying CLOs typically have floating interest rates. A rising interest rate environment may increase loan defaults, resulting in losses for the CLOs and the Fund. Further, a general rise in interest rates will increase the financing costs of the CLOs. However, since many of the senior secured loans within a CLO have a reference rate (lending base rate) floor, there may not be corresponding increases in investment income constraining distributions to investors in the CLO.

The CLO equity and junior debt tranches that the Fund acquires will be subordinated to, and will rank behind, more senior tranches of CLO debt. As such, CLO equity and junior debt tranches are subject to increased risks of default and greater risk of loss of all or a portion of their value relative to the holders of superior priority interests in the same CLO. In addition, at the time of issuance, CLO equity tranches are typically under-collateralized in that the liabilities of a CLO at inception frequently exceed its total assets. The Fund expects to often be in a first loss or subordinated position with respect to realized losses on the assets of the CLOs in which it is invested.

If an event of default occurs under an indenture, loan agreement or other document governing a fund investment, the holders of a majority of the most senior class of outstanding notes or loans issued by such investment generally will be entitled to determine the remedies to be exercised under the indenture, loan agreement or other governing document. These remedies, which may include the sale and liquidation of the assets underlying the investment, could be adverse to the interests of the Fund in CLO equity or junior debt tranches. As a holder of an investment in CLO equity or junior debt tranches, the Fund typically will have no rights under the indenture, loan agreement or other document governing an investment and will not be able to exercise any remedies following an event of default as long as any more senior notes or loans are outstanding, nor will the Fund receive any payments after an event of default until the more senior notes or loans and certain other amounts have been paid in full.

Between the closing date and the effective date of a CLO, the CLO collateral manager will generally expect to purchase additional collateral obligations for the CLO. During this period, the price and availability of these collateral obligations may be adversely affected by a number of market factors, including price volatility and availability of investments suitable for the CLO, which could hamper the ability of the collateral manager to acquire a portfolio of collateral obligations that will satisfy specified concentration limitations and allow the CLO to reach the target initial par amount of collateral prior to the effective date. An inability or delay in reaching the target initial par amount of collateral may adversely affect the timing and amount of interest or principal payments received by the holders of the CLO debt securities and distributions on the CLO equity securities and could result in early redemptions which may cause CLO debt and equity investors to receive less than face value of their investment.

LIBOR transition risk. The debt obligations underlying CLO or Warehouse Investments, and the debt issued by CLOs and Warehouses, typically bear interest at a floating rate which historically has been based on the London Inter-Bank Offer Rate, or “LIBOR”. The United Kingdom Financial Conduct Authority (the “FCA”) previously announced that all LIBOR settings would either cease to be provided by any loan administrator, or no longer be representative immediately after December 31, 2021 for all GBP, EUR, CHF and JPY LIBOR settings and one-week and two-month USD LIBOR settings, and immediately after June 30, 2023 for the remaining USD LIBOR settings, including one-month and three-month USD LIBOR. Now that those deadlines have passed, LIBOR has generally been eliminated as a benchmark rate with respect to collateral loan obligation securities as well as leverage loans generally. Accordingly, it is expected that the debt obligations underlying CLO or Warehouse Investments, and the debt issued by CLOs and Warehouses, will have migrated away from LIBOR (to the extent previously applicable) or otherwise rely on a benchmark rate other than LIBOR, such as the Secured Overnight Financing Rate (“SOFR”).

SOFR is intended to be a broad measure of the cost of borrowing funds overnight in transactions that are collateralized by U.S. Treasury securities. SOFR is calculated based on transaction-level repo data collected from various sources. For each trading day, SOFR is calculated as a volume-weighted median rate derived from such data. SOFR is calculated and published by the FRBNY. If data from a given source required by the FRBNY to calculate SOFR is unavailable for any day, then the most recently available data for that segment will be used, with certain adjustments. If errors are discovered in the transaction data or the calculations underlying SOFR after its initial publication on a given day, SOFR may be republished at a later time that day. Rate revisions will be effected only on the day of initial publication and will be republished only if the change in the rate exceeds one basis point.

Because SOFR is a financing rate based on overnight secured funding transactions, it differs fundamentally from LIBOR. LIBOR is intended to be an unsecured rate that represents interbank funding costs for different short-term maturities or tenors. It is a forward-looking rate reflecting expectations regarding interest rates for the applicable tenor. Thus, LIBOR is intended to be sensitive, in certain respects, to bank credit risk and to term interest rate risk. In contrast, SOFR is a secured overnight rate reflecting the credit of U.S. Treasury securities as collateral. Thus, it is largely insensitive to credit-risk considerations and to short-term interest rate risks. SOFR is a transaction-based rate, and it has been more volatile than other benchmark or market rates, such as three-month LIBOR, during certain periods. For these reasons, among others, there is no assurance that SOFR, or rates derived from SOFR, will perform in the same or similar way as LIBOR would have performed at any time, and there is no assurance that SOFR-based rates will be a suitable substitute for LIBOR.

Notwithstanding the discontinuation of LIBOR generally, the transition away from LIBOR may cause pricing volatility within the market for the Fund’s assets. Such volatility may negatively impact the pricing and liquidity of the relevant debt obligations. The transition from LIBOR to SOFR (or another reference rate) may also introduce operational risks in the Fund’s accounting, financial reporting, loan servicing, liability management and other aspects of the Fund’s business. However, we cannot reasonably estimate the impact of the transition at this time.

Further to the foregoing, on April 3, 2023, the FCA announced that it would compel ICE Benchmark Administration Limited to publish a non-representative synthetic LIBOR for one-, three- and six-month USD LIBOR settings for use in certain legacy contracts through the end of September 2024. Therefore, certain loans that bear interest based on LIBOR may not have migrated away from LIBOR on June 30, 2023.

The adoption of SOFR reference rates as a benchmark for CLOs is very recent, and there is little actual historical data. Although the Federal Reserve Bank of New York (“FRBNY”) started publishing SOFR in 2018 and has started publishing historical indicative SOFR dating back to 2014, such historical data inherently involves assumptions, estimates and approximations. The future performance of SOFR, and SOFR-based reference rates, cannot be predicted based on SOFR’s history or otherwise. Since the initial publication of SOFR, daily changes in SOFR have, on occasion, been more volatile than daily changes in comparable benchmark or market rates, and SOFR over the term of the CLOs may bear little or no relation to historical actual or historical indicative data.

Risks related to warehousing

Prior to a CLO closing and issuing CLO securities to CLO investors, in anticipation of such CLO closing, a vehicle (often the future CLO issuer) will purchase and “warehouse” a portion of the underlying loans (and, in the case of European CLOs, bonds) that will be held by such CLO (the “Warehouse”). To finance the accumulation of these assets, a financing facility (a “Warehouse Facility”) is opened, equitized either by the entity or affiliates of the entity that will become the collateral manager of the CLO upon its closing and/or by third-party investors that may or may not invest in the CLO. The Fund may use a portion of the net proceeds from the offering to purchase Warehouse Investments. A Warehouse Investment generally bears the risk that (i) the warehoused assets (typically primarily senior secured corporate loans) will drop in value during the warehousing period, (ii) certain of the warehoused assets default or for another reason are not permitted to be included in a CLO and a loss is incurred upon their disposition, and (iii) the anticipated CLO is delayed past the maturity date of the related Warehouse Facility or does not close at all, and, in either case, losses are incurred upon disposition of all of the warehoused assets. In the case of (iii), a particular CLO may not close for many reasons, including as a result of a market-wide material adverse change, a manager-related material adverse change or the discretion of the manager or the underwriter.

There can be no assurance that a CLO related to each such Warehouse Investment will be consummated. In the event a planned CLO is not consummated, the Warehouse investors (which may include the Fund) may be responsible for either holding or disposing of the warehoused assets. Because leverage is typically utilized in Warehouses, the potential risk of loss will be increased for the Warehouse investors. This could expose the Fund to losses, including in some cases a complete loss of all capital invested in the Warehouse Investment.

The Fund may be an investor in Warehouse Investments, and also an investor in CLOs that acquire Warehouse assets, including from Warehouses in which any of the Fund, other clients of the Sub-Adviser or the Sub-Adviser has directly or indirectly invested. This involves certain conflicts and risks.

The Warehouse Investments represent leveraged investments in the underlying assets of a Warehouse. Therefore, the NAV of a Warehouse Investment is anticipated to be affected by, among other things, (i) changes in the market value of the underlying assets of the Warehouse; (ii) distributions, defaults, recoveries, capital gains, capital losses and prepayments on the underlying assets of the Warehouse; and (iii) the prices, interest rates and availability of eligible assets for reinvestment. Due to the leveraged nature of a Warehouse Investment, a significant portion (and in some circumstances all) of the Warehouse Investments made by the Fund may not be repaid.

Risk Retention Vehicle risks

The Fund may elect to invest in Risk Retention Vehicles. Given the adoption of the European retention requirements, there can be no guarantee that a liquid market in Risk Retention Vehicle interests will develop or be sustained or that such interests will trade at prices close to their NAVs, nor can there be any guarantee that such structures will satisfy the applicable European retention requirements. In addition, due to, inter alia, the evolving regulatory environment, there may be a limited number of holders of interests in any one Risk Retention Vehicle, which may mean that there is limited liquidity in such interests which may affect: (i) a holder’s (including the Fund’s) ability to realize some or all of their investment; (ii) the price at which a holder (including the Fund) can effect such realization; and/or (iii) the price at which such interests trade in the secondary market; accordingly, the Fund may be unable to realize its investment in Risk Retention Vehicles at such investment’s NAV or at all. Moreover, no indenture is likely to govern the Risk Retention Vehicles, and there are likely to be limited protections and no diversification requirements governing the investments held by the Risk Retention Vehicles.

In addition, Risk Retention Vehicles complying with the European retention requirements will, in addition to CLO equity and mezzanine tranches and Warehouse Investments, hold other investments directly, such as corporate loans and secured bonds, and will therefore be subject to the risks related to such investments.

Risks of holding a minority position

The Fund may hold a non-controlling interest in any CLO issuer, Warehouse Investment or Risk Retention Vehicle and, therefore, in such case, would have limited voting power with respect to such interest and the underlying assets and a limited ability to influence the management of any such investment. For example, one or more other holders of CLO equity may control the vote of the CLO equity in the underlying CLO, which typically includes the ability to cause the underlying CLO to optionally redeem (following the expiration of applicable noncall periods) its CLO securities, including its CLO equity and mezzanine tranches, to refinance certain tranches of its CLO securities and to make other material decisions that may affect the value of the CLO equity and mezzanine tranches, which could adversely impact returns to investors in the Fund.

Risk of limited transparency of investments

The Fund’s investments in CLO vehicles and other investments may be riskier and less transparent to the Adviser, the Sub-Adviser, the Fund and fund investors than direct investments in the underlying companies. There may be less information available to the Adviser and Sub-Adviser regarding the underlying debt investments held by certain CLO vehicles than if the Fund had invested directly in the debt of the underlying companies. In particular, the collateral manager may have no obligation to keep the Adviser, the Sub-Adviser or the Fund (or other holders of investments) informed as to matters relating to the collateral obligations, with limited exceptions. Particularly in the case of CLOs managed by parties other than CIFC, the Sub-Adviser is unlikely to know the details of the underlying assets of the CLO vehicles in which the Fund invests.