| WELLS FARGO CONFERENCE JUNE 11, 2025 |

| SAFE HARBOR COMMENTS AND FORWARD-LOOKING STATEMENTS This presentation contains “forward-looking” statements related to O-I Glass, Inc. (“O-I Glass” or the “Company”) within the meaning of Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and Section 27A of the Securities Act of 1933, as amended. Forward-looking statements reflect the Company’s current expectations and projections about future events at the time, and thus involve uncertainty and risk. The words “believe,” “expect,” “anticipate,” “will,” “could,” “would,” “should,” “may,” “plan,” “estimate,” “intend,” “predict,” “potential,” “continue,” "target," “commit” and the negatives of these words and other similar expressions generally identify forward-looking statements. It is possible that the Company’s future financial performance may differ from expectations due to a variety of factors including, but not limited to the following: (1) the Company’s ability to achieve expected benefits from cost management, efficiency improvements, and profitability initiatives, such as its Fit to Win program, including expected impacts from production curtailments, reduction in force and furnace closures, (2) the general political, economic, legal and competitive conditions in markets and countries where the Company has operations, including uncertainties related to economic and social conditions, trade policies and disputes, financial market conditions, disruptions in the supply chain, competitive pricing pressures, inflation or deflation, changes in tax rates, changes in laws or policies, legal proceedings involving the Company, war, civil disturbance or acts of terrorism, natural disasters, public health issues and weather, (3) cost and availability of raw materials, labor, energy and transportation (including impacts related to the current Ukraine-Russia and Israel-Hamas conflicts and disruptions in supply of raw materials caused by transportation delays), (4) competitive pressures from other glass container producers and alternative forms of packaging or consolidation among competitors and customers, (5) changes in consumer preferences or customer inventory management practices, (6) the continuing consolidation of the Company’s customer base, (7) the Company’s ability to improve its glass melting technology, known as the MAGMA program, and implement it in a manner to deliver economic profit within the timeframe expected in addition to successfully achieving key production and commercial milestones, (8) unanticipated supply chain and operational disruptions, including higher capital spending, (9) seasonality of customer demand, (10) the failure of the Company’s joint venture partners to meet their obligations or commit additional capital to the joint venture, (11) labor shortages, labor cost increases or strikes, (12) the Company’s ability to acquire or divest businesses, acquire and expand plants, integrate operations of acquired businesses and achieve expected benefits from acquisitions, divestitures or expansions, (13) the Company’s ability to generate sufficient future cash flows to ensure the Company’s goodwill is not impaired, (14) any increases in the underfunded status of the Company’s pension plans, (15) any failure or disruption of the Company’s information technology, or those of third parties on which the Company relies, or any cybersecurity or data privacy incidents affecting the Company or its third-party service providers, (16) risks related to the Company’s indebtedness or changes in capital availability or cost, including interest rate fluctuations and the ability of the Company to generate cash to service indebtedness and refinance debt on favorable terms, (17) risks associated with operating in foreign countries, (18) foreign currency fluctuations relative to the U.S. dollar, (19) changes in tax laws or global trade policies, (20) the Company’s ability to comply with various environmental legal requirements, (21) risks related to recycling and recycled content laws and regulations, (22) risks related to climate-change and air emissions, including related laws or regulations and increased ESG scrutiny and changing expectations from stakeholders, and the other risk factors discussed in the Company's filings with the Securities and Exchange Commission. It is not possible to foresee or identify all such factors. Any forward-looking statements in this document are based on certain assumptions and analyses made by the Company in light of its experience and perception of historical trends, current conditions, expected future developments, and other factors it believes are appropriate in the circumstances. Forward-looking statements are not a guarantee of future performance, and actual results or developments may differ materially from expectations. While the Company continually reviews trends and uncertainties affecting the Company’s results of operations and financial condition, the Company does not assume any obligation to update or supplement any particular forward-looking statements contained in this document. Additionally, certain forward-looking and other statements in this presentation or other locations, such as the Company’s corporate website, regarding ESG matters are informed by various ESG standards and frameworks (which may include standards for the measurement of underlying data) and the interests of various stakeholders. Accordingly, such information may not be, and should not be interpreted as necessarily being “material” under the federal securities laws for SEC reporting purposes, even if the Company uses the word “material” or “materiality” in such discussions. In particular, certain standards and frameworks use definitions of “materiality” in the ESG context that differ from, and are often more expansive than, the definition under U.S. federal securities laws. ESG information is also often reliant on third-party information or methodologies that are subject to evolving expectations and best practices. The Company’s disclosures may change due to revisions in framework requirements, availability of information, changes in its business or applicable governmental policies, or other factors, some of which may be beyond its control. 2 |

| GLOBAL LEADER in glass packaging refocused on transforming COMPETITIVENESS, increasing ECONOMIC PROFIT and growing the VALUE of the company 3 WHO WE ARE TODAY Glass is the preferred choice for premium and health-oriented products ~21,000 employees, 70+ nationalities, 30+ languages customers across a broad product portfolio Sell into 74 countries through network of 69 plants in 19 countries Serve 6,000 TOP global beer and spirits brands Customer Excellence Top Quartile Net Promoter Score (NPS) Global Leader in both MAINSTREAM and PREMIUM Glass Packaging $6,531 $1,100 Net Sales aEBITDA FINANCIAL SCALE* ($M) #1 Global Glass Supplier Net sales 1.6x next largest glass competitor *2024 Results |

| 1,100 1,450 1,650 2024 2025E 2027 Target 2029 Objective 4 RESHAPING O-I TO BECOME THE ‘BEST VALUE’ PACKAGING OPTION Optimizing how we work across the value chain with suppliers and customers Transforming O-I’s cost base to become highly competitive Building a higher value, more premium business portfolio Focusing the business on driving Economic Profit Growing in clearly targeted geographies, categories and segments EARNINGS IMPROVEMENT (aEBITDA, $M) 1,150-1,200 ≥ ≥ > 8% 5YR CAGR ROBUST INVESTMENT THESIS TO CREATE SHAREHOLDER VALUE Note: 2027 target and 2029 objective were from our March 2025 I-Day and not subsequently updated |

| 5 OUR RIGHT TO WIN Consumers & Customers PREFER GLASS Privileged Footprint With GROWTH Opportunities GLOBAL Reach With LOCAL Touch Privileged CUSTOMER RELATIONSHIPS Refocus On COMPETITIVENESS From Scale |

| 6 LEVERAGING RIGHT TO WIN WILL CREATE VALUE DRIVE PROFITABLE GROWTH LEVERAGING OPTIMIZED NETWORK INVEST IN TARGETED GROWTH RETURN CAPITAL TO SHAREHOLDERS DELIVER HIGHER EARNINGS, FCF AND ECONOMIC PROFIT TRANSFORM COST COMPETITIVENESS STRENGTHEN BALANCE SHEET (Financial Leverage Ratio ≤ 2.5X) INCREASE SHAREHOLDER VALUE Note: Long-term target was from our March 2025 I-Day and not subsequently updated |

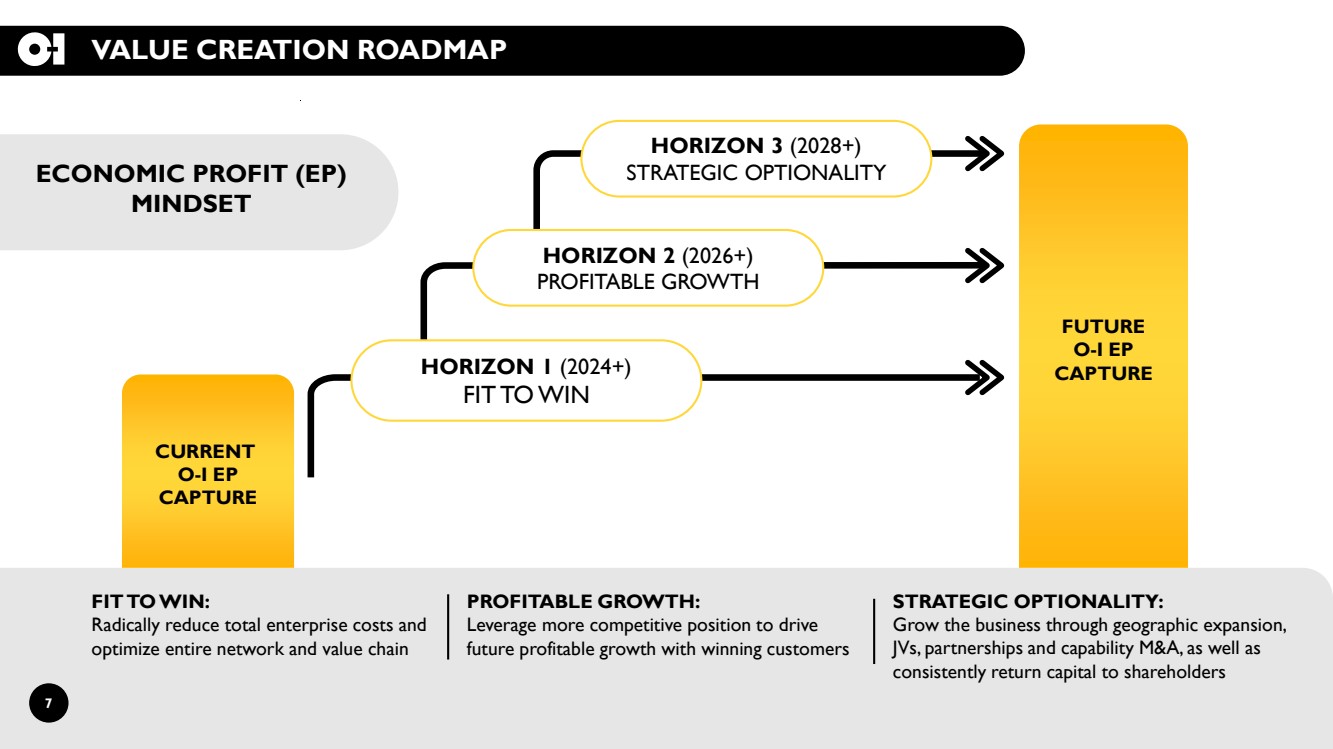

| 7 VALUE CREATION ROADMAP CURRENT O-I EP CAPTURE FUTURE O-I EP CAPTURE FIT TO WIN: Radically reduce total enterprise costs and optimize entire network and value chain PROFITABLE GROWTH: Leverage more competitive position to drive future profitable growth with winning customers HORIZON 1 (2024+) FIT TO WIN STRATEGIC OPTIONALITY: Grow the business through geographic expansion, JVs, partnerships and capability M&A, as well as consistently return capital to shareholders ECONOMIC PROFIT (EP) MINDSET HORIZON 2 (2026+) PROFITABLE GROWTH HORIZON 3 (2028+) STRATEGIC OPTIONALITY |

| 8 REFRAMING SUCCESS LONG-TERM OBJECTIVES (Post 2027) 2027 Target 2029 Objective aEBITDA Margin % Low 20s Mid 20s FCF % of Sales ≥ 5% ≥ 7% Economic Spread* ≥ 2% ≥ 4% ≥ $1,450M ≥ $1,650M Sustainable aEBITDA Organic growth ≥ 1.5%/yr Increase premium portfolio from 27% to ~ 40% 20%+ reduction in unit cost in relevant mainstream categories and markets Net Promoter Score (NPS) ≥ 60 Return more capital to shareholders * Economic Spread assumes 2024 WACC Achieve new 2030 Sustainability Goals Note: 2027 targets, 2029 objectives and long-term objectives (post 2027) were from our March 2025 I-Day and not subsequently updated |

| CONSISTENT IMPROVEMENT in Sustainable aEBITDA 9 IMPROVE EARNINGS 2027 aEBITDATarget of $1.45B Through Fit To Win Benefits Despite Cautious Commercial Outlook Expect Continued Performance Improvement Through 2029 Supported by Cost and Growth/Expansion Initiatives ADJUSTED EBITDA ($M) 2024 Net Price Sales Volume Production Normalization Fit to Win 2027 Target Fit To Win Profitable Growth Strategic Optionality Prelim. 2029 Objective ≥ $1,450M (Low 20s) ≥ $1,650M (Mid 20s) $1,100M (17%) Includes potential impact of fav. Energy contract resets in 2026/2027 TBD Note: Long-term targets were from our March 2025 I-Day and not subsequently updated |

| STRONG FIT TO WIN BENEFITS and solid progress towards ≥ $650M savings target by 2027 1Q25: DELIVERING ON OUR FIT TO WIN SAVINGS OBJECTIVE ($M) COMMENTS TOTAL FIT TO WIN SAVINGS 2024 ACTUAL 25 3 YEAR 1 TARGET 650 1Q25 61 TARGET All actions completed to secure 2025 benefits Expect all actions to achieve 2027 target will be done by early 2026 Reshape SG&A 14 22 100 200 All actions to secure 2025 benefits will be completed by mid-2025 Expect all actions to achieve 2027 target will be done by mid-2026 Initial Network Optimization 11 17 100 150 Total Phase A Savings 25 39 200 350 - Successfully completed Toano, VA TOE pilot; initiate broad rollout in May Strong initial benefits as many plants already leveraging TOE principles Total Organization Effectiveness 25 150 Total Phase B Savings - 50 300 250 2025 1 PHASE B PHASE A Cost Transformation Initiated procurement, efficiency and energy programs for 2025 - 25 150 10 1 Savings are cumulative compared to 2024 baseline year 10 22 12 ≥ ≥ Note: Long-term targets were from our March 2025 I-Day and not subsequently updated |

| Maintenance CapEx Productivity CapEx Restructuring Debt Reduction Share Repurchase / Dividend 11 CAPITAL ALLOCATION DRIVING ECONOMIC PROFIT FIT TO WIN INVESTMENTS • SG&A Restructuring • Network Optimization / Restructuring • Capacity / Productivity Investments RETURN CAPITAL TO SHAREHOLDERS • Anti-dilutive Share Repurchases • Evaluate Additional Share Repurchases • Evaluate Dividend IMPROVE PRICE, MIX, COST & PRODUCTIVITY TO DRIVE +2% ECONOMIC SPREAD PROFITABLE GROWTH • Capacity / Productivity Investments • Line Extension Investments • Selective Brownfield / Green Investments IMPROVE CAPITAL STRUCTURE • Prioritize ≤ 2.5x Financial Leverage • Long-term Target range of 2.0x - 2.5x Financial Leverage Ratio STRATEGIC OPTIONALITY • Geographic Expansion • M&A, JVs • Enter Glass Adjacencies ALLOCATION OF CASH FROM OPERATIONS (2025-2027) Note: Long-term targets were from our March 2025 I-Day and not subsequently updated |

| REAFFIRMING 2025 GUIDANCE 2025 EARNINGS EXPECTEDTO IMPROVE 50% TO 85% FROM 2024 2024 2025E Adjusted EPS $0.81 $1.20 - $1.50 Free Cash Flow ($M) ($128) $150 - $200 1st Qtr 2nd Qtr 3rd Qtr 4th Qtr EST. QUARTERLY ALLOCATION OF aEPS 27%-33% 28%-35% 27%-33% 10%-12% Strong start to 2025 and successfully managing elements within O-I’s control. Outlook may not fully reflect the potential impact of elevated uncertainty related to changing global trade policies. 2025 Guidance 12 Estimated quarter allocation of aEPS has been updated to reflect YTD performance through 1Q25 |

| HORIZON 1 (2024+) FIT TO WIN HORIZON 2 (2026+) PROFITABLE GROWTH HORIZON 3 (2028+) STRATEGIC OPTIONALITY CURRENT O-I EP CAPTURE FUTURE O-I EP CAPTURE CONCLUSION – EXECUTING ON WHAT IS IN OUR CONTROL EXECUTING VALUE CREATION ROADMAP 2025 EARNINGS EXPECTED TO IMPROVE 50% - 85% FROM 2024 STRONG START TO 2025 EXECUTING FIT TO WIN MARKETS ARE IMPROVING 13 |

| APPENDIX 14 |

| 15 O-I operations Manufacturing In the Market for the Market PLANTS IN 19 COUNTRIES 69 SUBJECT TO ONGOING TARIFF UNCERTAINTY ~4.5% SALES/SUPPLY WITHIN 300 MILES OF O-I PLANTS 85% |

| 16 NEW TARIFFS REPRESENT BOTH CHALLENGES AND OPPORTUNITIES CHALLENGES: ▼ DIRECT TARIFF EXPOSURE LIMITED (SO FAR) • ~ 4.5 % of O-I’s global sales volume is currently exposed to new tariffs (mostly U.S. imports from EU) • US cross border sales with MX / CAN exempt as a result of USMCA compliance ▼ ELEVATED RISK TO TARIFF DRIVEN CONSUMER VOLATILITY OPPORTUNITIES: ▲ LOCAL SUPPLY CHAIN: ~ 85% sales/supply within 300 miles of O-I plants ▲ FAVORABLE SUBSTRATE DYNAMICS: Sector specific tariffs on Aluminum ▲ CHINA TARIFF BENEFIT: Elevated tariffs on glass imports to US from China ▲ LARGEST US GLASS SYSTEM: Supports higher consumption of domestic products ▲ FOREIGN EXCHANGE: Weaker U.S. dollar improving foreign earnings translation O-I CROSS BOARDER SHIPMENTS AND NEW TARIFF EXPOSURE 4.5% 4.5% 9.5% 0% 5% 10% 15% 20% % of O-I Global Sales Vol (KT) Imported to US % of O-I Global Sales Subject to New Tariffs US / EU / UK US / MX / CAN CROSS BORDER SHIPMENTS AND POTENTIAL TARIFF EXPOSURES (Includes empty and filled bottles) Changes in global trade policy may create both new challenges and opportunities which cannot be fully determined at this stage Fit To Win and Improving O-I’s Competitive Position is Key To Mitigating Macro Uncertainty and Creating Shareholder Value |

| 17 SUSTAINABILITY = PRODUCTIVITY + EFFICIENCY *2017 Baseline **2019 Baseline Prior 2030 Goals* As of 2024 GHG by 25% (2.0˚ Pathway) ~20% Renewable Electricity to 40% ~40% Cullet to 50% 40% on avg RECYCLED C O N T E N T MANUFACTURING E F F I C I E N C Y ENERGY E F F I C I E N C Y LOW CARBON E N E R G Y LIGHTER W E I G H T MANUFACTURING T E C H N O L O G Y Updated 2030** Goals GHG by 47% (1.5˚ Pathway) Renewable Electricity to 80% Cullet to 60% |

| PHASE A PHASE B $200 $170 $100 $150 $150 $100 $150 $100 $25 $150 $100 $25 ≥$650 $520 $250 2027 2026 2025 FIT TO WIN BENEFITS ($M) Reshape SG&A (A) Initial Network Optimization (A) Cost Transformation (B) Total Organization Effectiveness (B) Savings from 2024 Baseline FIT TO WIN Drives ≥ $650M BENEFITS through 2027 18 FIT TO WIN: RESHAPING O-I’S COMPETITIVE POSITION Note: Long-term targets were from our March 2025 I-Day and not subsequently updated |

| 19 NON-GAAP FINANCIAL MEASURES The company uses certain non-GAAP financial measures, which are measures of its historical or future financial performance that are not calculated and presented in accordance with GAAP, within the meaning of applicable SEC rules. Management believes that its presentation and use of certain non-GAAP financial measures, including adjusted earnings, adjusted earnings per share, free cash flow, free cash flow as a percentage of net sales, financial leverage ratio, EBITDA, adjusted EBITDA, adjusted EBITDA margin, Economic Profit and Economic spread provide relevant and useful supplemental financial information that is widely used by analysts and investors, as well as by management in assessing both consolidated and business unit performance. These non-GAAP measures are reconciled to the most directly comparable GAAP measures and should be considered supplemental in nature and should not be considered in isolation or be construed as being more important than comparable GAAP measures. Adjusted earnings relates to net earnings (loss) attributable to the company, exclusive of items management considers not representative of ongoing operations and other adjustments because such items are not reflective of the company’s principal business activity, which is glass container production. Adjusted earnings are divided by weighted average shares outstanding (diluted) to derive adjusted earnings per share. EBITDA refers to net earnings, excluding gains or losses from discontinued operations, interest expense, net, provision for income taxes, depreciation and amortization of intangibles. Adjusted EBITDA refers to EBITDA, exclusive of items management considers not representative of ongoing operations and other adjustments. Adjusted EBITDA margin refers to Adjusted EBITDA divided by net sales. Financial leverage ratio refers to the sum of total debt less cash and unfunded pension liability divided by Adjusted EBITDA. Economic Profit (EP) refers to net earnings (loss) attributable to the Company, excluding interest expense, net and non-cash goodwill impairment charges, minus the product of the Company’s average invested capital and its weighted average cost of capital. Economic spread percentage (ES%) refers to economic profit divided by the Company’s average invested capital. Management uses adjusted earnings, adjusted earnings per share, EBITDA, Adjusted EBITDA, economic profit, economic spread and financial leverage ratio to evaluate its period-over-period operating performance because it believes these provide useful supplemental measures of the results of operations of its principal business activity by excluding items that are not reflective of such operations. The above non-GAAP financial measures may be useful to investors in evaluating the underlying operating performance of the company’s business as these measures eliminate items that are not reflective of its principal business activity. Further, free cash flow relates to cash provided by operating activities less cash payments for property, plant and equipment. Free cash flow as a percentage of net sales relates to free cash flow divided by net sales. Management has historically used free cash flow and free cash flow as a percentage of net sales to evaluate its period-over-period cash generation performance because it believes these have provided useful supplemental measures related to its principal business activity. It should not be inferred that the entire free cash flow amount is available for discretionary expenditures, since the company has mandatory debt service requirements and other non-discretionary expenditures that are not deducted from these measures. Management uses non-GAAP information principally for internal reporting, forecasting, budgeting and calculating compensation payments. The company routinely posts important information on its website – www.o-i.com/investors. |

| RECONCILIATION TO ADJUSTED EARNINGS 20 The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measure, adjusted earnings and adjusted earnings per share, for the periods ending after December 31, 2024 to its most directly comparable GAAP financial measure, net earnings (loss) attributable to the Company, because management cannot reliably predict all of the necessary components of this GAAP financial measure without unreasonable efforts. Net earnings (loss) attributable to the Company includes several significant items, such as restructuring charges, asset impairment charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that typically lead to the recognition of these and other similar items are complex and inherently unpredictable, and the amount recognized for each item can vary significantly. Accordingly, the Company is unable to provide a reconciliation of adjusted earnings and adjusted earnings per share to net earnings (loss) attributable to the Company or address the probable significance of the unavailable information, which could be material to the Company's future financial results. |

| RECONCILIATION TO ADJUSTED EBITDA 21 For the periods ending after December 31, 2024, the Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measure, adjusted EBITDA, to its most directly comparable U.S. GAAP financial measure, net earnings (loss) attributable to the Company, because management cannot reliably predict all of the necessary components of this U.S. GAAP financial measure without unreasonable efforts. Net earnings (loss) attributable to the Company includes several significant items, such as restructuring, asset impairment and other charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that typically lead to the recognition of these and other similar non-GAAP adjustments are inherently unpredictable as to if and when they may occur. The inability to provide a reconciliation is due to that unpredictability and the related difficulties in assessing the potential financial impact of the non-GAAP adjustments. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to the Company’s future financial results. |

| ADDITIONAL TO FREE CASH FLOW 22 The Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measures, free cash flow and free cash flow as a percentage of net sales, for all periods after December 31, 2025 to its most directly comparable U.S. GAAP financial measure, cash provided by operating activities, without unreasonable effort. This is due to potentially high variability, complexity and low visibility, in the relevant future periods, of components of cash provided by operating activities and cash spent on property, plant and equipment, as well as items that would be excluded from cash provided by operating activities. The variability of these excluded items and other components of cash provided by operating activities may have a significant, and potentially unpredictable, impact on the Company's future financial results. |

| ADDITIONAL RECONCILIATIONS 23 RECONCILIATION TO FINANCIAL LEVERAGE RATIO For the periods ending after December 31, 2024, the Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measure, economic profit and economic spread percentage, to its most directly comparable U.S. GAAP financial measure, net earnings (loss) attributable to the Company, because management cannot reliably predict all of the necessary components of this U.S. GAAP financial measure without unreasonable efforts. Net earnings (loss) attributable to the Company includes several significant items, such as restructuring, asset impairment and other charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that typically lead to the recognition of these and other similar non-GAAP adjustments are inherently unpredictable as to if and when they may occur. The inability to provide a reconciliation is due to that unpredictability and the related difficulties in assessing the potential financial impact of the non-GAAP adjustments. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to the Company’s future financial results. RECONCILIATION TO ECONOMIC PROFIT AND ECONOMIC SPREAD PERCENTAGE RECONCILIATION TO ADJUSTED EBITDA MARGIN For the periods ending after December 31, 2024, the Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measure, total financial leverage ratio, which is defined as the sum of total debt less cash and unfunded pension liability divided by Adjusted EBITDA, to its most directly comparable U.S. GAAP financial measure, Net earnings (loss), because management cannot reliably predict all of the necessary components of this U.S. GAAP financial measure without unreasonable efforts. Net earnings (loss) includes several significant items, such as restructuring, asset impairment and other charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that typically lead to the recognition of these and other similar non-GAAP adjustments are inherently unpredictable as to if and when they may occur. The inability to provide a reconciliation is due to that unpredictability and the related difficulties in assessing the potential financial impact of the non-GAAP adjustments. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to the Company’s future financial results. For the periods ending after December 31, 2024, the Company is unable to present a quantitative reconciliation of its forward-looking non-GAAP measure adjusted EBITDA margin to its most directly comparable U.S. GAAP financial measure, net earnings (loss) attributable to the Company, because management cannot reliably predict all of the necessary components of this U.S. GAAP financial measure without unreasonable efforts. Net earnings (loss) attributable to the Company includes several significant items, such as restructuring, asset impairment and other charges, charges for the write-off of finance fees, and the income tax effect on such items. The decisions and events that typically lead to the recognition of these and other similar non-GAAP adjustments are inherently unpredictable as to if and when they may occur. The inability to provide a reconciliation is due to that unpredictability and the related difficulties in assessing the potential financial impact of the non-GAAP adjustments. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to the Company’s future financial results. |