The Fund seeks to match, at the end of the current Outcome Period, the share price returns of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”), up to a specified upside Cap, while providing a Buffer against the first 15% of Underlying ETF losses. The Cap and the Buffer will be reduced after taking into account management fees and other Fund fees and expenses.

This table describes the fees and expenses that you may pay if you buy, hold and sell shares of the Fund (“Shares”). Investors may pay other fees, such as brokerage commissions and other fees to financial intermediaries, which are not reflected in the table or the example below.

Annual Fund Operating Expenses |

AllianzIM U.S. Equity Buffer15 ETF

(AllianzIM U.S. Equity Buffer15 ETF)

|

|

|---|---|---|

| Management Fees | 0.64% | |

| Distribution and/or Service (12b-1) Fees | none | |

| Other Expenses | none | [1] |

| Total Annual Fund Operating Expenses | 0.64% | |

| [1] | Other Expenses are estimated for the current fiscal year. |

This example is intended to help you compare the cost of investing in the Fund with the cost of investing in other funds.

This example assumes that you invest $10,000 in the Fund for the time periods indicated and then sell all of your Shares at the end of those periods. The example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses remain at current levels. This example does not include the brokerage commissions that investors may pay to buy and sell Shares. Although your actual costs may be higher or lower, your costs, based on these assumptions, would be:

Expense Example |

1 Year |

3 Years |

|---|---|---|

| AllianzIM U.S. Equity Buffer15 ETF | (AllianzIM U.S. Equity Buffer15 ETF) | USD ($) | 65 | 205 |

The Fund pays transaction costs, such as commissions, when it purchases and sells securities (or “turns over” its portfolio). A higher portfolio turnover will cause the Fund to incur additional transaction costs and may result in higher taxes when Shares are held in a taxable account. These costs, which are not reflected in Total Annual Fund Operating Expenses or in the example, may affect the Fund’s performance. Because the Fund has not yet commenced investment operations, no portfolio turnover information is available at this time.

The Fund pursues a buffered strategy that seeks to match the share price returns of the SPDR® S&P 500® ETF Trust (the “Underlying ETF”) (i.e., the market price returns of the Underlying ETF), at the end of a three-month calendar quarter (i.e., from January 1 to March 31, April 1 to June 30, July 1 to September 30, or October 1 to December 31), as described below (the “Outcome Period”), subject to an upside maximum percentage return (the “Cap”) and downside protection with a buffer against the first 15.00% of Underlying ETF losses (the “Buffer”). The Fund’s intended return measured across different market conditions (e.g., rising or declining markets) is referred to as “outcomes” in this prospectus. The Underlying ETF’s share price returns reflect the price at which the Underlying ETF’s shares trade on the secondary market (not the Underlying ETF’s net asset value).

Under normal market conditions, the Fund invests at least 80% of its net assets in instruments with economic characteristics similar to U.S. equity securities. Specifically, the Fund intends to invest substantially all of its assets in FLexible EXchange Options (“FLEX Options”) that reference the Underlying ETF. FLEX Options are customized equity or index options contracts that trade on an exchange, but provide investors with the ability to customize key contract terms like exercise prices, styles and expiration dates. The Fund may purchase and sell a combination of call option contracts and put option

contracts. A call option contract is an agreement between a buyer and seller that gives the purchaser of the call option contract the right, but not the obligation, to buy, and the seller of the call option contract (or the “writer”) the obligation to sell, a particular asset at a specified future date at an agreed upon price (commonly known as the “strike price”). A put option contract gives the purchaser of the put option contract the right, but not the obligation, to sell, and the writer of the put option contract the obligation to buy, a particular asset at a specified future date at the strike price.

The Cap is set at or near the close of the market on the business day prior to the first day of the Outcome Period, based on market conditions. Specifically, the Cap is based on the market costs associated with a series of FLEX Options that are purchased and sold in order to seek to obtain the relevant market exposure and to provide downside protection via the Buffer. The market conditions and other factors that influence the Cap can include market volatility, risk free rates, and time to expiration of the FLEX Options. The Cap for the current Outcome Period is [ ]% prior to taking into account any fees or expenses charged to the Fund. When the Fund’s annualized management fee of 0.64% of the Fund’s average daily net assets is taken into account, the Cap is reduced to [ ]%. The Buffer is 15.00% prior to taking into account any fees or expenses charged to the Fund. When the Fund’s annualized management fee of 0.64% of the Fund’s average daily net assets is taken into account, the Buffer is reduced to 14.36%.

The Fund’s return will be reduced by the Fund’s unitary management fee and further reduced by brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses not included in the Fund’s unitary management fee. For the purpose of this prospectus, “non-routine or extraordinary expenses” are non-recurring expenses that may be incurred by the Fund outside of the ordinary course of its business, including, without limitation, costs incurred in connection with any claim, litigation, arbitration, mediation, government investigation or similar proceedings, indemnification expenses and expenses in connection with holding or soliciting proxies for a meeting of Fund shareholders. The returns that the Fund seeks to provide also do not include the costs associated with purchasing Shares of the Fund. The Fund will not receive or benefit from any dividend payments made by the Underlying ETF. It is expected that the Cap will change from one Outcome Period to the next. There is no guarantee, and it is unlikely, that the Cap will remain the same after the end of the Outcome Period. The Cap may increase or decrease, and it may change significantly, depending upon the market conditions at that time.

The Fund is classified as “non-diversified” under the Investment Company Act of 1940, as amended (the “1940 Act”), which means it generally may invest a greater proportion of its assets in the securities of one or more issuers and may invest overall in a smaller number of issuers than a diversified fund.

The Underlying ETF is an exchange-traded unit investment trust that seeks to provide investment results that, before expenses, correspond generally to the price and yield performance of the S&P 500® Index (the “Underlying Index”). The Underlying Index is a large-cap, market-weighted, U.S. equities index. The Underlying ETF seeks to achieve its investment objective by holding a portfolio of the common stocks that are included in the Underlying Index, with the weight of each stock in the Underlying ETF’s portfolio substantially corresponding to the weight of such stock in the Underlying Index. Although the Underlying ETF seeks to track the performance of the Underlying Index, the Underlying ETF’s return may not match or achieve a high degree of correlation with the return of the Underlying Index due to fees, expenses and transaction costs incurred by the Underlying ETF, among other factors. In addition, it is possible that the Underlying ETF may not always fully replicate the Underlying Index, including due to the unavailability of certain Underlying Index securities in the secondary market or due to other extraordinary circumstances (e.g., if trading in a security has been halted). As of April 30, 2025, the Underlying Index was comprised of 503 constituent securities, representing 500 companies, with a market capitalization range of between $5.7 billion and $3.2 trillion, and had significant exposure to the information technology sector. Accordingly, through its investments in FLEX Options that reference the Underlying ETF, the Fund had significant exposure to the information technology sector as of April 30, 2025.

The Fund seeks to achieve its objective by buying and selling call and put FLEX Options that reference the Underlying ETF. Generally, the Fund will enter into the FLEX Options for an Outcome Period on the business day immediately prior to the first day of the Outcome Period, and the FLEX Options of an Outcome Period will expire on the last business day of the Outcome Period, at which time the Fund will invest in a new set of FLEX Options for the next Outcome Period.

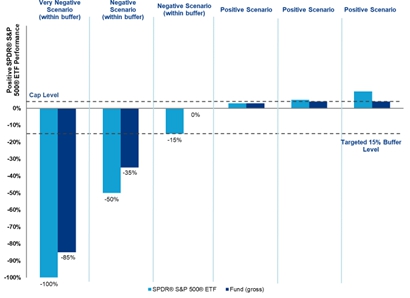

In general, the Fund seeks to achieve the following outcomes for each Outcome Period, although there can be no guarantee these results will be achieved:

| • | If the Underlying ETF’s share price has increased as of the end of the Outcome Period, the combination of FLEX Options held by the Fund is designed to provide positive returns that match the return of the Underlying ETF’s share price, up to the Cap. |

| • | If the Underlying ETF’s share price has decreased as of the end of the Outcome Period, the combination of FLEX Options held by the Fund is designed to compensate for the first 15.00% of losses experienced by the Underlying ETF’s share price. |

| • | If the Underlying ETF’s share price has decreased by more than 15.00% as of the end of the Outcome Period, the Fund is expected to experience all subsequent losses experienced by the Underlying ETF’s share price beyond 15.00% on a one-to-one basis, meaning that the Fund will decrease 1% for every 1% decrease in the Underlying ETF’s share price (i.e., if the Underlying ETF loses 20%, the Fund is designed to lose 5%). |

The outcomes described here are before taking into account Fund fees and expenses, brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses not included in the Fund’s unitary management fee. An investor that purchases Shares after the Outcome Period has begun or sells Shares prior to the end of the Outcome Period may experience results that are very different from the investment objective sought by the Fund for that Outcome Period.

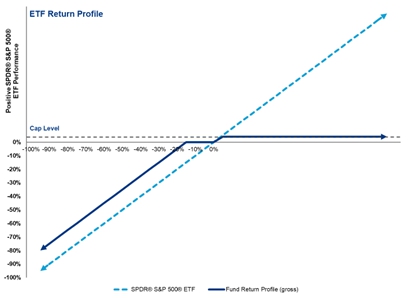

The following charts illustrate the hypothetical returns that the Fund seeks to provide where a shareholder holds Shares for the entire Outcome Period. The Cap Level illustrated in these charts is for illustration only and the actual Cap may be different and will change each Outcome Period.

The returns shown in the charts are based on hypothetical performance of the Underlying ETF’s share price in certain illustrative scenarios and do not take into account payment by the Fund of fees and expenses, brokerage commissions, trading fees, taxes and non-routine or extraordinary expenses not included in the Fund’s unitary management fee. There is no guarantee that the Fund will be successful in providing these investment outcomes for any Outcome Period.

In the first graph below, the dotted line represents the Underlying ETF’s share price performance, and the solid line represents the gross returns that the Fund seeks to provide relative to the Underlying ETF’s share price performance.

Despite the intended Buffer, a shareholder who holds Shares for the entire Outcome Period could lose their entire investment. An investment in the Fund is only appropriate for shareholders willing to bear the loss of their entire investment.

The outcomes may only be achieved if Shares are held over a complete Outcome Period. An investor that purchases or sells Shares during an Outcome Period may experience results that are very different from the outcomes sought by the Fund for that Outcome Period. For example, if an investor purchases Shares during an Outcome Period at a time when the Underlying ETF’s share price has decreased from its price at the beginning of the Outcome Period, that investor’s buffer will essentially be decreased by the amount of the decrease in the Underlying ETF’s share price. Conversely, if an investor purchases Shares during an Outcome Period at a time when the Underlying ETF’s share price has increased from its price at the beginning of the Outcome Period, that investor’s cap will essentially be decreased by the amount of the increase in the Underlying ETF’s share price. The strategy is designed to realize the outcomes only on the final day of the Outcome Period. To achieve the target outcomes sought by the Fund for an Outcome Period, an investor must hold Shares for that entire Outcome Period. This means investors should purchase the Shares immediately prior to the beginning of the Outcome Period and hold the Shares until the end of the Outcome Period to achieve the intended results.

Both the Cap and Buffer are fixed at levels calculated in relation to the Outcome NAV and the Underlying ETF’s share price. The Outcome NAV is the Fund’s net asset value (or “NAV”, which is the per share value of the Fund’s assets) calculated at the close of the market on the business day prior to the first day of the Outcome Period. An investor purchasing Shares on the secondary market on the first day of the Outcome Period may pay a price that is different from the Fund’s Outcome NAV. As a result, the investor may not experience the same investment results as the Fund, even if the Fund is successful in achieving the outcomes. Furthermore, an investor cannot expect to purchase Shares precisely at the beginning of the Outcome Period or precisely at the price of the Outcome NAV, or sell Shares precisely at the end of the Outcome Period or precisely at the price of the last calculated NAV of the Outcome Period, and thereby experience precisely the investment returns sought by the Fund for the Outcome Period.

The Outcome Period will be a three-month calendar quarter from January 1 to March 31, April 1 to June 30, July 1 to September 30, or October 1 to December 31. The Fund is designed to seek to achieve the outcomes at the end of each successive calendar quarter Outcome Period. The outcomes that the Fund achieves over multiple calendar quarter Outcome Periods likely will be different than the outcomes achieved by a comparable fund with a longer outcome period, and an investor holding Shares over multiple calendar quarter Outcome Periods likely will experience different investment results than if the investor held shares in a comparable fund with a longer outcome period. For example, during a single twelve-month period, the outcomes achieved by the Fund over four successive three-month Outcome Periods likely would be different than the outcomes achieved by a comparable fund over a one-year outcome period. The Fund resets at the beginning

of each Outcome Period by investing in a new set of FLEX Options that will provide a new Cap for the new Outcome Period. This means that the Cap is expected to change for each Outcome Period and is determined by market conditions on the business day immediately prior to the first day of each Outcome Period. The Cap may increase or decrease for each Outcome Period. The Buffer is not expected to change for each Outcome Period. The Cap and Buffer, and the Fund’s position relative to each, should be considered before investing in the Fund. The Fund will be indefinitely offered with a new Outcome Period tied to the same Underlying ETF beginning after the end of each Outcome Period; the Fund is not intended to terminate after the current or any subsequent Outcome Period.

Approximately one week prior to the end of each Outcome Period, the Fund will file a prospectus supplement that discloses the anticipated ranges for the Cap for the next Outcome Period. Following the close of business on the last day of the Outcome Period, the Fund will file a prospectus supplement that discloses the Fund’s final Cap (both before and after taking into account the Fund’s annualized management fee) for the next Outcome Period. There is no guarantee the final Cap will be within the anticipated range. This information also will be available on the Fund’s website, www.AllianzIMetfs.com/QBSF.

An investor that purchases Shares after the Outcome Period has begun or sells Shares prior to the end of the Outcome Period may experience investment returns very different from those sought by the Fund for that Outcome Period. The Fund’s website, www.AllianzIMetfs.com/QBSF, provides, on a daily basis, important Fund information, including the Fund’s position relative to the Cap and Buffer, as well as information relating to the potential return scenarios as a result of an investment in the Fund. Before purchasing Shares, an investor should visit the website to review this information and understand the possible outcomes of an investment in Shares on a particular day and held through the end of the Outcome Period.

As of the date of this prospectus, the Fund has not commenced operations and therefore does not have a performance history. Once available, the Fund’s performance information will be available on the Fund’s website at www.AllianzIMetfs.com and will provide some indication of the risks of investing in the Fund. The Fund’s past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Non-Diversification Risk. The Fund is classified as “non-diversified” under the 1940 Act. As a result, the Fund is only limited as to the percentage of its assets which may be invested in the securities of any one issuer by the diversification requirements imposed by the Internal Revenue Code of 1986, as amended (the “Code”). The Fund may invest a relatively high percentage of its assets in a limited number of issuers. As a result, the Fund may be more susceptible to a single adverse economic or regulatory occurrence affecting one or more of these issuers, experience increased volatility and be highly invested in certain issuers.

FLEX Options Risk. The Fund utilizes FLEX Options issued and guaranteed for settlement by the Options Clearing Corporation (“OCC”). The Fund bears the risk that the OCC will be unable or unwilling to perform its obligations under the FLEX Options contracts. In the unlikely event that the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the Fund could suffer significant losses. Additionally, FLEX Options may be less liquid than certain other securities such as standardized options. In a less liquid market for the FLEX Options, the Fund may have difficulty closing out certain FLEX Options positions at desired times and prices. The Fund may experience substantial downside from specific FLEX Option positions and certain FLEX Option positions may expire worthless. The value of the underlying FLEX Options will be affected by, among other things, changes in the Underlying ETF’s share price, changes in interest rates, changes in the actual and implied volatility of the Underlying ETF’s share price and the remaining time until the FLEX Options expire. The value of the FLEX Options does not increase or decrease at the same rate as the Underlying ETF’s share price; although they generally move in the same direction, it is possible they may move in different directions.

Buffered Loss Risk. There can be no guarantee that the Fund will be successful in its strategy to buffer the first 15.00% of losses experienced by the Underlying ETF in an Outcome Period. A shareholder may lose their entire investment. If an investor purchases or sells Shares during an Outcome Period after the Underlying ETF’s share price has decreased, the investor may receive less, or none, of the intended benefit of the Buffer. The Fund does not provide principal protection or protection of gains and shareholders could experience significant losses including loss of their entire investment.

Capped Upside Return Risk. The Fund’s strategy seeks to provide returns that match the share price returns of the Underlying ETF at the end of the Outcome Period, subject to the Cap. In the event that the Underlying ETF has gains in excess of the Cap for the Outcome Period, the Fund will not participate in those gains beyond the Cap. If an investor purchases or sells Shares during an Outcome Period after the Underlying ETF’s share price has increased relative to its price at the close of the market the business day prior to the first day of the Outcome Period the investor may have less or no investment gain on their Shares for that Outcome Period. The Cap represents the absolute maximum percentage return an investor can achieve from an investment in the Fund held for the entire Outcome Period.

Upside Participation Risk. There can be no guarantee that the Fund will be successful in its strategy to provide shareholders with a return that matches the share price returns of the Underlying ETF at the end of an Outcome Period, subject to the Cap.

If an investor purchases or sells Shares during an Outcome Period, the returns realized by the investor may not match those that the Fund seeks to achieve.

Correlation Risk. The FLEX Options held by the Fund will be exercisable at the strike price only on their expiration date. Prior to the expiration date, the value of the FLEX Options will be determined based upon market quotations or using other recognized pricing methods, consistent with the Fund’s valuation policy. Because a component of the FLEX Option’s value will be affected by, among other things, changes in the Underlying ETF’s share price, changes in interest rates, changes in the actual and implied volatility of the Underlying ETF’s share price and the remaining time until the FLEX Options expire, the value of the Fund’s FLEX Options positions is not anticipated to increase or decrease at the same rate as, and it is possible the value may move in different directions from, the Underlying ETF’s share price, and as a result, the Fund’s NAV may not increase or decrease at the same rate as the Underlying ETF’s share price. Similarly, the components of the FLEX Option’s value are anticipated to impact the effect of the Buffer on the Fund’s NAV, which may not be in full effect prior to the end of the Outcome Period. The Fund’s strategy is designed to produce the outcomes upon the expiration of the FLEX Options on the last business day of the Outcome Period, and it should not be expected that the outcomes will be provided at any point other than the end of the Outcome Period.

Cap Change Risk. A new Cap is established at the beginning of each Outcome Period and is dependent on market conditions generally on the business day immediately prior to the beginning of the Outcome Period. As such, the Cap will change from one Outcome Period to the next and is unlikely to remain the same for consecutive Outcome Periods and could change significantly from one Outcome Period to another.

Investment Objective Risk. Certain circumstances under which the Fund might not achieve its objective include, but are not limited, to (i) if the Fund disposes of FLEX Options during an Outcome Period or otherwise for reasons not related to the Fund’s investment strategy, (ii) if the Fund is unable to maintain the proportional relationship based on the number of FLEX Options in the Fund’s portfolio, (iii) significant accrual of Fund expenses in connection with effecting the Fund’s principal investment strategy or (iv) adverse tax law changes affecting the treatment of FLEX Options.

Outcome Period Risk. The Fund’s investment strategy is designed to deliver returns that match the share price returns of the Underlying ETF at the end of each Outcome Period, subject to the Cap and the Buffer. If an investor purchases or sells Shares during an Outcome Period, the returns realized by the investor will not match those that the Fund seeks to achieve for the Outcome Period. In particular, an investor who does not hold Shares for the entire Outcome Period may not receive the full intended benefit of the Buffer, may experience little or no upside gain due to the Cap, and may not experience investment returns equal to the investment returns sought by the Fund for the Outcome Period. Each Outcome Period is a three-month calendar quarter from January 1 to March 31, April 1 to June 30, July 1 to September 30, or October 1 to December 31. The Fund is designed to seek to achieve the outcomes at the end of each successive three-month calendar quarter Outcome Period. The outcomes that the Fund achieves over multiple calendar quarter Outcome Periods likely will be different than the outcomes achieved by a comparable fund with a longer outcome period, and an investor holding Shares over multiple calendar quarter Outcome Periods likely will experience different investment results than if the investor held shares in a comparable fund with a longer outcome period. For example, during a single twelve-month period, the outcomes achieved by the Fund over four successive three-month Outcome Periods likely would be different than the outcomes achieved by a comparable fund over a one-year outcome period. Generally, the Fund will enter into the FLEX Options for an Outcome Period on the business day immediately prior to the first day of the Outcome Period, and the FLEX Options of an Outcome Period will expire on the last business day of the Outcome Period. The Cap for each Outcome Period is also determined based on market conditions on the business day prior to the beginning of the Outcome Period. The outcomes are based on the Outcome NAV. As a result, investors should purchase the Shares immediately prior to the beginning of the Outcome Period and hold the Shares until the end of the Outcome Period. In addition, an investor cannot expect to purchase Shares precisely at the beginning of the Outcome Period or precisely at the price of the Outcome NAV, or sell Shares precisely at the end of the Outcome Period or precisely at the price of the last calculated NAV of the Outcome Period, and thereby experience precisely the investment returns sought by the Fund for the Outcome Period.

Downside Risk. The Fund’s strategy seeks to provide returns that match the share price returns of the Underlying ETF at the end of an entire Outcome Period, subject to the Cap, while limiting, or providing a buffer against, downside losses. Despite the intended Buffer, a shareholder could lose their entire investment. If an investor purchases Shares during an Outcome Period after the Underlying ETF’s share price has decreased during an Outcome Period, the investor may receive less, or none, of the intended benefit of the Buffer. The Fund might not achieve its objective in certain circumstances. The Fund does not provide principal protection or protection of gains and an investor may experience significant losses on their investment, including loss of their entire investment.

Counterparty Risk. Counterparty risk is the risk an issuer, guarantor or counterparty of a security in the Fund is unable or unwilling to meet its obligation on the security. The OCC acts as guarantor and central counterparty with respect to the FLEX Options. As a result, the ability of the Fund to meet its objective depends on the OCC being able to meet its obligations. In the unlikely event that the OCC becomes insolvent or is otherwise unable to meet its settlement obligations, the Fund could suffer significant losses.

Valuation Risk. During periods of reduced market liquidity or in the absence of readily available market quotations for the holdings of the Fund, the ability to value the FLEX Options becomes more difficult and the judgment of Allianz Investment Management LLC (the “Adviser”) or a fair value pricing vendor (in accordance with the fair value procedures approved by the Board of Trustees of the Trust (the “Board”)) may play a greater role in the valuation of the Fund’s holdings due to reduced availability of reliable objective pricing data. Consequently, while such determinations will be made in good faith, it may nevertheless be more difficult to accurately assign a daily value.

Liquidity Risk. In the event that trading in the FLEX Options is limited or absent, the value of the Fund’s FLEX Options may decrease. There is no guarantee that a liquid secondary trading market will exist for the FLEX Options. The trading in FLEX Options may be less deep and liquid than the market for certain other securities. FLEX Options may be less liquid than certain non-customized options. In a less liquid market for the FLEX Options, terminating the FLEX Options may require the payment of a premium or acceptance of a discounted price and may take longer to complete. In a less liquid market for the FLEX Options, the liquidation of a large number of options may significantly impact the price of the options. A less liquid trading market may adversely impact the value of the FLEX Options and the value of your investment.

Tax Risk. The Fund has elected and will continue to qualify each year to be treated as a regulated investment company (“RIC”) under Subchapter M of the Code. As a RIC, the Fund will not be subject to U.S. federal income tax on the portion of its net investment income and net capital gain that it distributes to shareholders, provided that it satisfies certain requirements of the Code. However, the federal income tax treatment of certain aspects of the proposed operations of the Fund are not entirely clear. This includes the tax aspects of the Fund’s options strategy, its hedging strategy, the possible application of the “straddle” rules, and various loss limitation provisions of the Code. Certain options on an ETF may not qualify as “Section 1256 contracts” under Section 1256 of the Code, and disposition of such options will likely result in short-term capital gains or losses. The Fund intends to treat any income it may derive from the FLEX Options as “qualifying income” under the provisions of the Code applicable to RICs. To maintain its status as a RIC, the Fund must meet certain income, diversification and distributions tests. For purposes of the diversification test, the identification of the issuer (or, in some cases, issuers) of a particular Fund investment can depend on the terms and conditions of that investment. In particular, there is no published IRS guidance or case law on how to determine the “issuer” of certain derivatives that the Fund will enter into. Based upon the language in the legislative history, the Fund intends to treat the issuer of the FLEX Options as the referenced asset, which, assuming the referenced asset qualifies as a RIC, would allow the Fund to qualify for special rules in the RIC diversification requirements. If the income is not qualifying income or the issuer of the FLEX Options is not appropriately the referenced asset, the Fund may not qualify, or may be disqualified, as a RIC. If the Fund does not qualify as a RIC for any taxable year and certain relief provisions are not available, the Fund’s taxable income will be subject to tax at the Fund level and to a further tax at the shareholder level when such income is distributed.

Additionally, buying securities shortly before the record date for a taxable dividend or capital gain distribution is commonly known as “buying a dividend.” If a shareholder purchases Shares after the Outcome Period has begun and shortly thereafter the Fund issues a dividend, the entire distribution may be taxable to the shareholder even though a portion of the distribution effectively represents a return of the purchase price.

Underlying ETF Risk. The Fund invests in FLEX Options that derive their value from the Underlying ETF, and therefore the Fund’s investment performance largely depends on the investment performance of the Underlying ETF. The value of the Underlying ETF will fluctuate over time based on fluctuations in the values of the securities held by the Underlying ETF, which may be affected by changes in general economic conditions, expectations for future growth and profits, interest rates and the supply and demand for those securities. In addition, ETFs are subject to absence of an active market risk, premium/discount risk, tracking error risk and trading issues risk. Brokerage, tax and other expenses may negatively impact

the performance of the Underlying ETF and, in turn, the value of the Fund’s investments. The Underlying ETF seeks to track the Underlying Index but may not exactly match the performance of the Underlying Index due to differences between the portfolio of the Underlying ETF and the components of the Underlying Index, fees and expenses, transaction costs, and other factors.

Equity Securities Risk. The Fund invests in FLEX Options that derive their value from the Underlying ETF. Because the Underlying ETF has exposure to the equity securities markets, the Fund has exposure to the equity securities markets. Equity securities prices fluctuate for several reasons, including economic and political developments, changes in interest rates, war, acts of terrorism, public health issues, or other events. Equity securities are susceptible to general stock market fluctuations and to volatile increases and decreases in value as investors’ perceptions of and confidence in their issuers change. These investor perceptions are based on various and unpredictable factors, including many of the same factors already mentioned.

Large-Capitalization Companies Risk. The Fund invests in FLEX Options that derive their value from the Underlying ETF, which tracks the Underlying Index. Because the Underlying ETF has exposure to large-capitalization companies, the Fund has exposure to large-capitalization companies. Such large-capitalization companies may be less able than smaller capitalization companies to adapt to changing market conditions. Large-capitalization companies may be more mature and subject to more limited growth potential compared with smaller capitalization companies. During different market cycles, the performance of large capitalization companies has trailed the overall performance of the broader securities markets or other part of the securities markets, such as smaller- or mid-capitalization companies.

Information Technology Sector Risk. The Fund invests in FLEX Options that derive their value from the Underlying ETF, which tracks the Underlying Index. Because the Underlying ETF, as of April 30, 2025, has significant exposure to the information technology sector, the Fund has significant exposure to the information technology sector. Information technology companies may have limited product lines, markets, financial resources or personnel. Information technology companies typically face intense competition and potentially rapid product obsolescence. They are also heavily dependent on intellectual property rights and may be adversely affected by the loss or impairment of those rights.

Market Risk. The Fund could lose money over short periods due to short-term market movements and over longer periods during more prolonged market downturns. Assets may decline in value due to factors affecting financial markets generally or particular asset classes or industries represented in the markets. The value of a FLEX Option or other asset may also decline due to general market conditions, inflation, recessions, changes in interest rates, economic trends or events that are not specifically related to the issuer of the security or other asset, or due to factors that affect a particular issuer or issuers, country, group of countries, region, market, industry, group of industries, sector or asset class. Additionally, certain changes in the U.S. economy, such as a decrease in imports or exports, changes in trade regulations, inflation and/or economic recession, may have an adverse effect on the value of a FLEX Option or other assets. During a general market downturn, multiple asset classes may be negatively affected. Changes in market conditions and interest rates will not have the same impact on all types of securities. In addition, unexpected events and their aftermaths, such as pandemics, epidemics or other public health issues; natural, environmental or man-made disasters; financial, political or social disruptions; military conflict; terrorism and war; and other tragedies or catastrophes, can cause investor fear and panic, which can adversely affect the economies of many companies, sectors, nations, regions and the market in general, in ways that cannot necessarily be foreseen. Any such circumstances could have a materially negative impact on the value of the Shares and could result in increased market volatility. During any such events, the Shares may trade at increased premiums or discounts to their NAV.

Premium/Discount Risk. The market price of the Shares will generally fluctuate in accordance with changes in the Fund’s NAV as well as the relative supply of and demand for Shares on the exchange on which the Shares are listed and traded (the “Exchange”). The Adviser cannot predict whether Shares will trade below, at or above their NAV because the Shares trade on the Exchange at market prices and not at NAV. Price differences may be due, in large part, to the fact that supply and demand forces at work in the secondary trading market for Shares will be closely related, but not identical, to the same forces influencing the prices of the holdings of the Fund trading individually or in the aggregate at any point in time. These differences can be especially pronounced during times of market volatility or stress. During these periods, the demand for Shares may decrease considerably and cause the market price of Shares to deviate significantly from the Fund’s NAV. Thus, you may pay more (or less) than NAV when you buy Shares of the Fund in the secondary market, and you may receive less (or more) than NAV when you sell those Shares in the secondary market.

Management Risk. The Fund is subject to management risk because it is an actively managed portfolio. The Adviser will apply investment techniques and risk analyses in making investment decisions for the Fund, but there can be no guarantee that the Fund will meet its investment objective.

Large Shareholder Risk. Certain shareholders, including an authorized participant, the Adviser or an affiliate of the Adviser, or other funds or accounts advised by the Adviser or an affiliate of the Adviser, may own a substantial amount of Shares. Additionally, from time to time an authorized participant, a third-party investor, the Adviser, or an affiliate of the Adviser may invest in the Fund and hold its investment for a specific period of time in order to facilitate commencement of the Fund’s operations or to allow the Fund to achieve size or scale. Redemptions by large shareholders could have a significant negative impact on the Fund. If a large shareholder were to redeem all, or a large portion, of its Shares, there is no guarantee that the Fund will be able to maintain sufficient assets to continue operations in which case the Fund may be liquidated. In addition, transactions by large shareholders may account for a large percentage of the trading volume on the Exchange and may, therefore, have a material upward or downward effect on the market price of the Shares. In addition, the Fund may be a constituent of one or more adviser asset allocation models. Being a component of such a model may greatly affect the trading activity of the Fund, the size of the Fund, and the market volatility of the Fund’s shares. Inclusion in a model could increase demand for the Fund and removal from a model could result in outsized selling activity in a relatively short period of time. As a result, the Fund’s net asset value could be negatively impacted, and the Fund’s market price may be below the Fund’s net asset value during certain periods. In addition, model rebalances may potentially result in increased trading activity. To the extent buying or selling activity increases, the Fund can be exposed to increased brokerage costs and adverse tax consequences and the market price of the Fund can be negatively affected.

Active Markets Risk. Although the Shares are listed for trading on the Exchange, there can be no assurance that an active trading market for the Shares will develop or be maintained. Shares trade on the Exchange at market prices that may be below, at or above the Fund’s NAV. The Fund faces numerous market trading risks, including losses from trading in secondary markets, periods of high volatility and disruption in the creation/redemption process of the Fund. Securities, including the Shares, are subject to market fluctuations and liquidity constraints that may be caused by such factors as economic, political, or regulatory developments, changes in interest rates, or perceived trends in securities prices. In stressed market conditions, the market for Shares may become less liquid in response to deteriorating liquidity in the markets for the Fund’s portfolio holdings, which may cause a significant variance in the market price of Shares and their underlying value and wider bid-ask spreads. Shares of the Fund could decline in value or underperform other investments.

Operational Risk. The Fund is exposed to operational risks arising from a number of factors, including, but not limited to, human error in the calculation of the Cap, processing and communication errors, errors of the Fund’s service providers, counterparties or other third-parties, including errors relating to the operation and valuation of the Underlying ETF, failed or inadequate processes and technology or systems failures. The Fund and the Adviser seek to reduce these operational risks through controls and procedures. However, these measures do not address every possible risk and may be inadequate to address these risks.

Authorized Participant Concentration Risk. Only an authorized participant may engage in creation or redemption transactions directly with the Fund. The Fund has a limited number of institutions that may act as authorized participants on an agency basis (i.e., on behalf of other market participants). To the extent that authorized participants exit the business or are unable to proceed with creation or redemption orders with respect to the Fund and no other authorized participant is able to step forward to create or redeem “Creation Units” (defined in “Purchase and Sale of Shares”), Shares may be more likely to trade at a premium or discount to NAV and possibly face trading halts or delisting.

Cash Transactions Risk. The Fund may effectuate creations and redemptions solely or partially for cash, rather than in-kind. To the extent the Fund engages in full or partial cash creation and redemption transactions, an investment in the Fund may be less tax-efficient than an investment in an exchange-traded fund (“ETF”) that effects its creations and redemption for in-kind securities or instruments. To the extent the Fund effects redemptions for cash, it may be required to sell portfolio securities or close derivatives positions in order to obtain the cash needed to distribute redemption proceeds. A sale of portfolio securities may result in capital gains or losses and may also result in higher brokerage costs. Under such circumstances, an investment in the Fund may be less tax-efficient than investments in other ETFs. Moreover, cash transactions may have to be carried out over several days if the securities market is relatively illiquid and may involve considerable brokerage fees and taxes. These brokerage fees and taxes, which will be higher than if the Fund sold and redeemed its shares principally in-kind, generally will be passed on to purchasers and redeemers of Shares in the form of creation and redemption transaction fees. In addition, these factors may result in wider spreads between the bid and the offered prices of Shares than for other ETFs.

Trading Issues Risk. Although the Shares are listed for trading on the Exchange, there can be no assurance that an active trading market for such Shares will develop or be maintained. Trading in Shares on the Exchange may be halted due to market conditions or for reasons that, in the view of the Exchange, make trading in Shares inadvisable. In addition, trading

in Shares on the Exchange is subject to trading halts caused by extraordinary market volatility pursuant to the Exchange “circuit breaker” rules. There can be no assurance that the requirements of the Exchange necessary to maintain the listing of the Fund will continue to be met or will remain unchanged. Initially, due to the small asset size of the Fund, it may have difficulty maintaining its listing on the Exchange.

Market Maker Risk. If the Fund has lower average daily trading volumes, it may rely on a small number of third-party market makers to provide a market for the purchase and sale of Shares. Any problem relating to the trading activity of these market makers could result in a dramatic change in the spread between the Fund’s NAV and the price at which the Shares are trading on the Exchange, which could result in a decrease in value of the Shares. In addition, market makers are under no obligation to make a market in the Shares, and authorized participants are not obligated to submit purchase or redemption orders for Creation Units. Decisions by market makers or authorized participants to reduce their role or step away from these activities in times of market stress could inhibit the effectiveness of the arbitrage process in maintaining the relationship between the underlying values of the Fund’s portfolio securities and the Fund’s market price. This reduced effectiveness could result in Shares trading at a discount to NAV and also in greater than normal intraday bid-ask spreads for Shares.