The following tables describe the fees and expenses you may pay if you buy and hold shares of the funds, the annual operating expenses for each fund, and the pro forma expenses of Putnam Sustainable Retirement Maturity Fund, assuming consummation of the merger and based on pro forma combined assets as of January 31, 2025 . Please see “Information about the Merger – Trustees’ Considerations Relating to the Merger” for information about the expenses of the merger. The shareholder fees (fees paid directly from your investment) are the same for all classes of each fund except for Class A shares and will not change as a result of the merger, except for Class A shares. Annual fund operating expenses (expenses that are deducted from fund assets) are described in the table below.

Shareholder Fees - Putnam Sustainable Retirement Maturity Fund |

Class A Maturity |

Class C Maturity |

Class R Maturity |

Class R3 Maturity |

Class R4 Maturity |

Class R5 Maturity |

Class R6 Maturity |

Class Y Maturity |

||

|---|---|---|---|---|---|---|---|---|---|---|

| Maximum Sales Charge Imposed on Purchases (as a percentage of Offering Price) | 4.00% | none | none | none | none | none | none | none | ||

| Maximum Deferred Sales Charge (as a percentage) | 1.00% | [1] | 1.00% | [2] | none | none | none | none | none | none |

| [1] | Applies only to certain redemptions of shares bought with no initial sales charge. |

| [2] | This charge is eliminated after one year. |

Annual Fund Operating Expenses - Putnam Sustainable Retirement Maturity Fund |

Class A Maturity |

Class C Maturity |

Class R Maturity |

Class R3 Maturity |

Class R4 Maturity |

Class R5 Maturity |

Class R6 Maturity |

Class Y Maturity |

|

|---|---|---|---|---|---|---|---|---|---|

| Management Fees (as a percentage of Assets) | 0.46% | 0.46% | 0.46% | 0.46% | 0.46% | 0.46% | 0.46% | 0.46% | |

| Distribution and Service (12b-1) Fees | 0.25% | 1.00% | 0.50% | 0.25% | none | none | none | none | |

| Other Expenses (as a percentage of Assets): | 0.19% | 0.19% | 0.34% | 0.34% | 0.34% | 0.19% | 0.09% | 0.19% | |

| Acquired Fund Fees and Expenses | 0.43% | 0.43% | 0.43% | 0.43% | 0.43% | 0.43% | 0.43% | 0.43% | |

| Expenses (as a percentage of Assets) | 1.33% | 2.08% | 1.73% | 1.48% | 1.23% | 1.08% | 0.98% | 1.08% | |

| Fee Waiver or Reimbursement | [1] | 0.48% | 0.48% | 0.48% | 0.48% | 0.48% | 0.48% | 0.48% | 0.48% |

| Net Expenses (as a percentage of Assets) | 0.85% | 1.60% | 1.25% | 1.00% | 0.75% | 0.60% | 0.50% | 0.60% | |

| [1] | Reflects a contractual obligation of the Investment Manager to limit certain fund expenses and acquired fund fees through November 30, 2027. This obligation may be modified or discontinued only with approval of the Board of Trustees. |

The following hypothetical examples are intended to help you compare the cost of investing in either fund with the cost of investing in other funds. It assumes that you invest $10,000 in a fund for the time periods indicated and then, except as indicated, redeem all your shares at the end of those periods. It assumes a 5% return on your investment each year and that each fund’s operating expenses remain the same. Your actual costs may be higher or lower.

Expense Example - Putnam Sustainable Retirement Maturity Fund - USD ($) |

Expense Example, with Redemption, 1 Year |

Expense Example, with Redemption, 3 Years |

Expense Example, with Redemption, 5 Years |

Expense Example, with Redemption, 10 Years |

Expense Example, No Redemption, 1 Year |

Expense Example, No Redemption, 3 Years |

Expense Example, No Redemption, 5 Years |

Expense Example, No Redemption, 10 Years |

|---|---|---|---|---|---|---|---|---|

| Class A Maturity | 483 | 660 | 959 | 1,809 | ||||

| Class C Maturity | 263 | 505 | 978 | 2,093 | 163 | 505 | 978 | 2,093 |

| Class R Maturity | 127 | 396 | 795 | 1,912 | ||||

| Class R3 Maturity | 102 | 318 | 662 | 1,636 | ||||

| Class R4 Maturity | 77 | 240 | 529 | 1,354 | ||||

| Class R5 Maturity | 61 | 192 | 447 | 1,179 | ||||

| Class R6 Maturity | 51 | 160 | 393 | 1,062 | ||||

| Class Y Maturity | 61 | 192 | 447 | 1,179 |

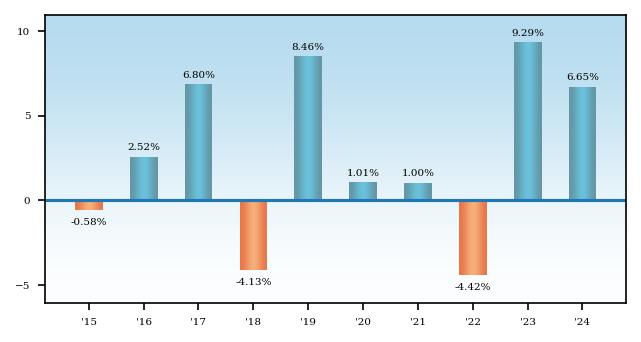

Average Annual Total Returns - Putnam Sustainable Retirement Maturity Fund |

1 Year |

5 Years |

10 Years |

|

|---|---|---|---|---|

| Class A Maturity | 2.38% | 1.76% | 2.13% | |

| Class A Maturity | After Taxes on Distributions | 0.95% | 0.27% | 0.90% | |

| Class A Maturity | After Taxes on Distributions and Sales | 1.40% | 0.72% | 1.12% | |

| Class C Maturity | 4.88% | 1.83% | 1.94% | |

| Class R Maturity | 6.25% | 2.21% | 2.23% | |

| Class R3 Maturity | [1] | 6.47% | 2.43% | 2.39% |

| Class R4 Maturity | [2] | 6.76% | 2.69% | 2.65% |

| Class R5 Maturity | [3] | 6.95% | 2.86% | 2.80% |

| Class R6 Maturity | [4] | 7.00% | 2.95% | 2.88% |

| Class Y Maturity | 6.88% | 2.85% | 2.80% | |

| Bloomberg U.S. Aggregate Index (no deduction for fees, expenses or taxes) | 1.25% | (0.33%) | 1.35% | |

| Russell 3000® Index (no deduction for fees, expenses or taxes) | 23.81% | 13.86% | 12.55% | |

| S&P Target Date To Retirement Income Index (no deduction for fees, expenses or taxes) | 6.00% | 3.68% | 4.00% | |

| [1] | Performance for class R3 shares prior to their inception (1/4/21) is derived from the historical performance of class Y shares, adjusted for the higher 12b-1 fees and investor servicing fees applicable to class R3 shares (relative to the comparable fees applicable to class Y shares prior to the inception of class R3 shares). |

| [2] | Performance for class R4 shares prior to their inception (1/4/21) is derived from the historical performance of class Y shares, adjusted for the higher investor servicing fees applicable to class R4 shares (relative to the comparable fees applicable to class Y shares prior to the inception of class R4 shares). |

| [3] | Performance for class R5 shares prior to their inception (1/4/21) is derived from the historical performance of class R6 shares, adjusted for the higher investor servicing fees applicable to class R5 shares (relative to the comparable fees applicable to R6 shares prior to the inception of class R5 shares). |

| [4] | Performance for class R6 shares prior to their inception (9/1/16) is derived from the historical performance of class Y shares and has not been adjusted for the lower investor servicing fees applicable to class R6 shares (relative to the comparable fees applicable to class Y shares prior to the inception of class R6 shares); had it been adjusted, returns would have been higher. |