Exhibit 10.1

OFFICE LEASE

By and Between

99 HIGH STREET OWNER LLC, a Massachusetts limited liability company

(“Landlord”)

and

ENGENE USA, INC.

a Delaware corporation

(“Tenant”)

dated as of

June 4, 2025

Exhibit 10.1

OFFICE LEASE

By and Between

99 HIGH STREET OWNER LLC, a Massachusetts limited liability company

(“Landlord”)

and

ENGENE USA, INC.

a Delaware corporation

(“Tenant”)

dated as of

June 4, 2025

TABLE OF CONTENTS

LEASE OF PREMISES |

1 |

|

BASIC LEASE PROVISIONS |

1 |

|

STANDARD LEASE PROVISIONS |

4 |

|

|

|

|

1. |

TERM |

4 |

2. |

BASE RENT |

4 |

3. |

ADDITIONAL RENT |

5 |

4. |

IMPROVEMENTS AND ALTERATIONS |

12 |

5. |

REPAIRS |

16 |

6. |

USE OF PREMISES |

18 |

7. |

UTILITIES AND SERVICES |

22 |

8. |

INDEMNIFICATION; INSURANCE |

26 |

9. |

FIRE OR CASUALTY |

30 |

10. |

EMINENT DOMAIN |

31 |

11. |

ASSIGNMENT AND SUBLETTING |

32 |

12. |

DEFAULT |

38 |

13. |

ACCESS; CONSTRUCTION |

44 |

14. |

BANKRUPTCY |

45 |

15. |

LANDLORD DEFAULTS |

45 |

16. |

SUBORDINATION; ATTORNMENT; ESTOPPEL CERTIFICATES |

46 |

17. |

SALE BY LANDLORD; TENANT’S REMEDIES; NONRECOURSE LIABILITY |

47 |

18. |

PARKING; COMMON AREAS |

48 |

19. |

MISCELLANEOUS |

50 |

20. |

[INTENTIONALLY DELETED] |

58 |

21. |

RIGHT OF FIRST OFFER |

58 |

LIST OF EXHIBITS

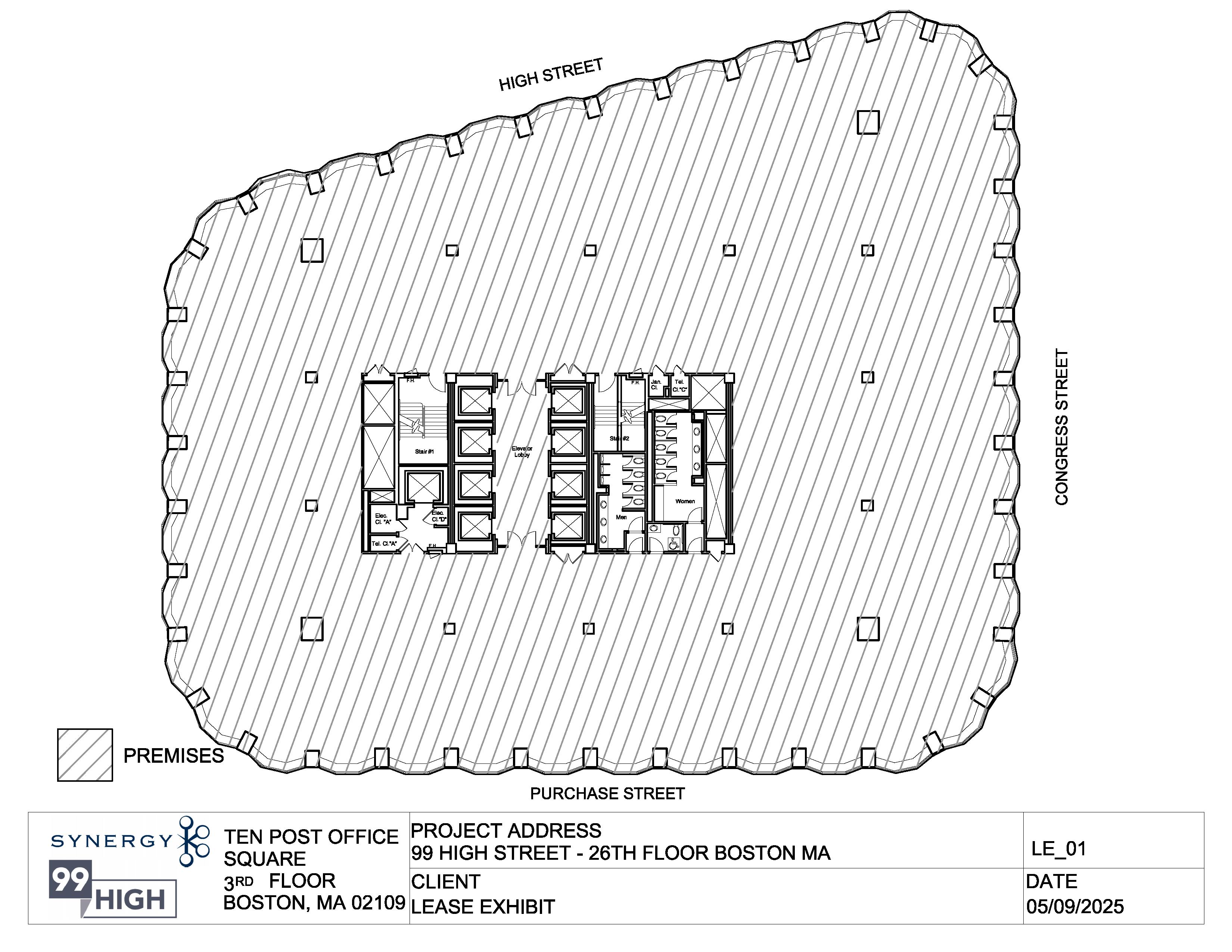

Exhibit A-1 |

Floor Plan |

|

|

Exhibit A-2 |

Legal Description of the Land |

|

|

Exhibit B |

Building Rules and Regulations |

|

|

Exhibit C |

Form of Tenant Estoppel Certificate |

|

|

Exhibit D |

Form of Commencement Letter |

|

|

Exhibit E |

[Intentionally Deleted] |

|

|

Exhibit F |

Tenant Insurance Requirements |

|

|

Exhibit G |

Cleaning Specifications |

|

|

Exhibit H |

Form of Guaranty |

-i-

OFFICE LEASE

THIS OFFICE LEASE (this “Lease”) is made between 99 HIGH STREET OWNER LLC, a Massachusetts limited liability company (“Landlord”), and the Tenant described in Item 1 of the Basic Lease Provisions.

LEASE OF PREMISES

Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, subject to all of the terms and conditions set forth herein, those certain premises (the “Premises”) described in Item 3 of the Basic Lease Provisions and as shown in the drawing attached hereto as Exhibit A-1. The Premises are located in the Building described in Item 2 of the Basic Lease Provisions. The Building is located on that certain land (the “Land”) more particularly described on Exhibit A-2 attached hereto, which is also improved with landscaping and other improvements, fixtures and common areas and appurtenances now or hereafter placed, constructed or erected on the Land.

BASIC LEASE PROVISIONS

1. |

Tenant: |

enGene USA, Inc., a Delaware corporation (“Tenant”) |

||

|

|

|

|

|

2. |

Building: |

99 High Street Boston, Massachusetts 02110 |

||

|

|

|

|

|

3. |

Description of Premises: |

26,335 rentable square feet, consisting of all of the rentable area on the twenty-sixth (26th) floor of the Building. The Premises do not include the area above dropped ceilings, below the upper surface of floor slabs or the areas outside of the inner surface of walls and plate glass (the areas above dropped ceilings and outside the inner surface of interior walls are referred to in this Lease as “Installation Areas”). |

||

|

|

|

|

|

|

Rentable Area of the Premises: |

26,335 rentable square feet |

||

|

|

|

|

|

|

Rentable Area of Building: |

731,204 rentable square feet |

||

|

|

|

|

|

4. |

Tenant’s Proportionate Share: |

3.60% (26,335 rsf/731,204 rsf) (See Section 3) |

||

|

|

|

|

|

5. |

Base Rent: |

Lease Year |

Per Annum |

Per Month |

|

(See Section 2) |

1 |

$2,027,795.00 |

$168,982.91 |

|

|

2 |

$2,068,350.90 |

$172,362.57 |

|

|

3 |

$2,109,717.91 |

$175,809.82 |

|

|

4 |

$2,151,912.27 |

$179,326.02 |

|

|

5 |

$2,194,950.52 |

$182,912.54 |

-1-

|

|

|

|

|

6. |

First Month's Base Rent Payable Upon Execution: |

$168,982.91 |

||

|

|

|

||

7. |

Letter of Credit Amount: |

[Intentionally Deleted] |

||

|

|

|

||

8. |

Base Year for Operating Expenses: Base Year for Real Estate Taxes: |

Calendar Year 2026 (See Section 3) Fiscal Year 2026 (i.e., July 1, 2025- June 30, 2026) (See Section 3) |

||

|

|

|

||

9. |

Term: |

The period of time commencing on the Commencement Date and expiring on the last day of the calendar month in which the day immediately preceding the fifth (5th) anniversary of the Rent Commencement Date occurs (the “Expiration Date”), unless earlier terminated in accordance with the provisions of this Lease. |

||

|

|

|

||

10. |

Commencement Date: |

The date on which the Premises are delivered to Tenant in the Delivery Condition. |

||

|

|

|

||

|

Rent Commencement Date:

|

The date which is five (5) months after the Commencement Date. |

||

|

Scheduled Commencement Date: |

The day which is fifteen (15) days after the Effective Date. |

||

|

|

|

||

11. |

Broker(s) (See Section 19(k)) |

|

||

|

|

|

||

|

Landlord’s Broker: |

CBRE, Inc. |

||

|

|

|

||

|

Tenant’s Broker: |

Colliers |

||

|

|

|

||

12. |

Number of Parking Spaces: |

Seven (7) Parking Spaces, on the terms and conditions set forth in Section 18 |

||

|

|

|

||

13. |

Address for Notices: |

|

||

|

|

|

||

|

To: TENANT: |

To: LANDLORD: |

||

|

|

|

||

|

Prior to the Commencement Date: |

|

||

|

|

|

||

|

enGene USA, Inc. 200 Fifth Avenue, Suite 4020 Waltham, MA 02451 Attn: Lee Giguere Email: lgiguere@engene.com |

99 High Street Owner LLC c/o Synergy 10 Post Office Square, Suite 300 Boston, Massachusetts 02109 Attn: Asset Management |

||

-2-

|

|

|

|

With a copy to: |

With copies to: |

|

|

|

|

Morgan, Lewis & Bockius LLP One Federal Street Boston, MA 02110 Attn: James L. Black, Esq. Email: james.black@morganlewis.com

After the Commencement Date, to the Premises.

|

legalnotices@synergyboston.com -and- Goulston & Storrs PC One Post Office Square, 25th floor Boston, Massachusetts 02109 Attn: Frank E. Litwin, Esq. flitwin@goulstonstorrs.com |

|

With a copy to: |

|

|

|

|

|

Morgan, Lewis & Bockius LLP One Federal Street Boston, MA 02110 Attn: James L. Black, Esq. Email: james.black@morganlewis.com |

|

|

|

|

14. |

Address for Payment of Rent: |

All payments payable under this Lease shall be sent to Landlord at: 99 High Street Owner LLC c/o Synergy 10 Post Office Square, Suite 300 Boston, Massachusetts 02109 Attn: Asset Management Or to such other address as Landlord may designate to Tenant from time to time in writing. |

|

|

|

15. |

Effective Date: |

June 4, 2025 |

|

|

|

16. |

The “State” |

The Commonwealth of Massachusetts. |

|

|

|

17. |

Landlord’s Contribution: |

$658,375.00, subject to the provisions of Section 4. |

|

|

|

18. |

Guarantor |

enGene Holdings Inc., a Delaware corporation |

This Lease consists of the foregoing introductory sections and Basic Lease Provisions, the provisions of the Standard Lease Provisions (the “Standard Lease Provisions”) (consisting of Section 1 through Section 21 which follow) and Exhibit A through Exhibit H, all of which are incorporated herein by this reference. In the event of any conflict between the provisions of the Basic Lease Provisions and the provisions of the Standard Lease Provisions, the Standard Lease Provisions shall control.

-3-

STANDARD LEASE PROVISIONS

(a) Upon the Effective Date, the terms and provisions of this Lease shall be fully binding on Landlord and Tenant. From and after the delivery of the Premises to Tenant, the parties shall be bound by and shall perform all of their respective obligations under this Lease, in accordance with and subject to the terms and conditions hereof, notwithstanding that the Commencement Date has not occurred. The Term of this Lease shall commence on the Commencement Date (as defined in Item 10 of the Basic Lease Provisions. Unless earlier terminated in accordance with the provisions hereof, the Term of this Lease shall be the period shown in Item 9 of the Basic Lease Provisions. As used herein, “Lease Term” or “Term” shall mean the Term referred to in Item 9 of the Basic Lease Provisions, subject to any early termination thereof. The first “Lease Year” shall commence on the Rent Commencement Date and shall end on the last day of the calendar month preceding the month in which the first anniversary of the Rent Commencement Date occurs. Each succeeding Lease Year shall commence on the day following the end of the preceding Lease Year and shall extend for twelve (12) consecutive months; provided, however, the last Lease Year shall expire on the Expiration Date. Unless Landlord terminates this Lease prior to the Expiration Date in accordance with the provisions hereof, Landlord shall not be required to provide notice to Tenant of the Expiration Date. This Lease shall be a binding contractual obligation effective upon execution hereof by Landlord and Tenant, notwithstanding the later commencement of the Term of this Lease.

(b) Upon delivery of the Premises to Tenant in the Delivery Condition, Landlord shall prepare and deliver to Tenant, Tenant’s Commencement Letter substantially in the form of Exhibit D attached hereto (the “Commencement Letter”) which Tenant shall acknowledge by executing a copy and returning it to Landlord. If Tenant fails to sign and return the Commencement Letter to Landlord or to provide any objection to Landlord as to any of the matters set forth in the Commencement Letter within ten (10) Business Days of its receipt from Landlord, the Commencement Letter as sent by Landlord shall be deemed to have correctly set forth the Commencement Date, the Rent Commencement Date, and the other matters addressed in the Commencement Letter. Failure of Landlord to send the Commencement Letter shall have no effect on the Commencement Date, the Rent Commencement Date, and the other matters addressed in the Commencement Letter.

(c) Concurrent with the execution of this Lease, the Guarantor has executed and delivered to Landlord the Guaranty (the “Guaranty”) in the form attached hereto as Exhibit H. The Guaranty shall remain in full force and effect throughout the Term of this Lease.

(a) Tenant agrees to pay with respect to each calendar month (and proportionately on a per diem basis for any partial calendar month of the Lease Term) from and after the Rent Commencement Date as Base Rent for the Premises the sums shown for such periods in Item 5 of the Basic Lease Provisions. The Term “Base Rent” when used in this Lease shall mean the Base Rent payable during the given period.

-4-

(b) Base Rent shall be payable in consecutive monthly installments, in advance, without demand, deduction or offset, commencing on the Rent Commencement Date and continuing on the first (1st) Business Day of each calendar month thereafter until the Expiration Date. The first full monthly installment of Base Rent shall be payable upon Tenant’s execution of this Lease and shall be credited against the Rent next coming due. The obligation of Tenant to pay Rent and other sums to Landlord and the obligations of Landlord under this Lease are independent obligations.

(c) The parties agree that for all purposes hereunder the Premises and the Building shall be stipulated to contain the number of square feet of Rentable Area respectively described in Item 3 of the Basic Lease Provisions.

(d) Base Rent shall be paid to Landlord absolutely net of all costs and expenses. The provisions for payment of Operating Expenses by means of periodic payment of Tenant’s Proportionate Share of estimated Operating Expenses Excess (as defined in Section 3 of this Lease) and the year end adjustment of such payments are intended to pass on to Tenant and reimburse Landlord for Tenant’s Proportionate Share of the Operating Expenses Excess described in Section 3 of this Lease.

(a) If Operating Expenses (defined below) for any calendar year during the Lease Term exceed Base Operating Expenses (defined below), Tenant shall pay to Landlord, concurrent with each installment of Base Rent, as additional rent (“Operating Expenses Additional Rent”) an amount equal to Tenant’s Proportionate Share (defined below) of such excess (“Operating Expenses Excess”). If Real Estate Taxes (defined below) for any tax fiscal year during the Lease Term exceed Base Real Estate Taxes (defined below), Tenant shall pay to Landlord concurrent with each installment of Base Rent, as additional rent (“Taxes Additional Rent”) an amount equal to Tenant’s Proportionate Share of such excess (“Taxes Excess”). The term “Additional Rent” shall mean, collectively, the Operating Expenses Additional Rent, the Taxes Additional Rent, and all other amounts (excepting only Base Rent) payable by Tenant under this Lease.

(b) “Tenant’s Proportionate Share” is the percentage number set forth in Item 4 of the Basic Lease Provisions. Tenant’s Proportionate Share represents a fraction, the numerator of which is the number of square feet of Rentable Area in the Premises and the denominator of which is the number of square feet of Rentable Area in the Building, expressed as a percentage.

(c) “Base Operating Expenses” means all Operating Expenses incurred or payable by Landlord during the calendar year specified as Tenant’s Base Year for Operating Expenses in Item 8 of the Basic Lease Provisions. “Base Real Estate Taxes” means all Real Estate Taxes incurred or payable by Landlord during the tax fiscal year specified as Tenant’s Base Year for Real Estate Taxes in Item 8 of the Basic Lease Provisions.

(d) “Operating Expenses” means all costs, expenses and obligations incurred or payable by Landlord in connection with the operation, ownership, management, repair or maintenance of the Land and Building during or allocable to the Lease Term, including without limitation, the cost of services and utilities (including taxes and other charges incurred in

-5-

connection therewith) provided to the Premises (other than separately metered utilities for which Tenant is responsible), the Building or the Land, including, without limitation, water, power, gas, sewer, waste disposal, telephone and cable television facilities, fuel, supplies, equipment, tools, materials, service contracts, janitorial service, waste and refuse disposal, window cleaning, maintenance and repair of sidewalks and Building exterior and services areas, gardening and landscaping; insurance, including, but not limited to, public liability, fire, property damage, wind, hurricane, earthquake, terrorism, flood, rental loss, rent continuation, boiler machinery, business interruption, contractual indemnification and property/casualty coverage insurance for the Land and/or Building and such other insurance as is carried by Landlord in its discretion, and any deductible portion of any insured loss otherwise covered by such insurance; the cost of compensation, including employment, welfare and social security taxes, paid vacation days, disability, pension, medical and other fringe benefits of all persons (including independent contractors) who perform services connected with the operation, maintenance, repair or replacement of the Land and/or Building; any personal property taxes on and maintenance and repair of equipment and other personal property used in connection with the operation, maintenance or repair of the Land and/or Building; repair and replacement of window coverings provided by Landlord to the tenants in the Building; such reasonable auditors’ fees and legal fees as are incurred in connection with the operation, maintenance or repair of the Land and/or Building; a property management fee (which fee may be imputed if Landlord has internalized management or otherwise acts as its own property manager); the maintenance of any easements or areas subject to ground leases benefiting the Land and/or Building, whether by Landlord or by an independent contractor; a reasonable allowance for depreciation of personal property used in the operation, maintenance or repair of the Land and/or Building; license, permit and inspection fees; all costs and expenses required by any governmental or quasi-governmental authority or by applicable Law not in effect as of the Effective Date, for any reason, including capital improvements, whether capitalized or not, and the cost of any capital improvements made to the Land or Building by Landlord that are intended to comply with BERDO and/or any other Laws not in effect as of the Effective Date, or are intended to reduce environmental impacts, or are intended to reduce Operating Expenses (such capital costs to be amortized over the useful life thereof, as Landlord may reasonably determine in accordance with customary practices in the commercial real estate industry, together with interest thereon at the rate of eight percent (8%) per annum); the cost of maintenance, operation and repair of air conditioning, heating, ventilating, plumbing, and elevator systems and equipment (to include the replacement of components which are in the nature of repairs as hereinafter described) and other mechanical and electrical systems repair and maintenance (including the replacement of components of the systems which are in the nature of repairs and are not required to be considered capital expenses under first class office building accounting standards even if such item might be classified as a capital expenditure under generally accepted accounting principles (by way of example, a fan motor in an HVAC distribution box might be a capital expense under generally accepted accounting principles but would be considered as a repair under the accounting standards as in use by the Building); sign maintenance; and Common Area (defined below) repair, resurfacing, operation and maintenance; the reasonable cost for temporary lobby displays and events commensurate with the operation of a similar class building, and the cost of providing security services, if any, deemed appropriate by Landlord from time to time. The term “BERDO Compliance Costs” shall mean the costs and expenses incurred by Landlord in order to comply with BERDO, including reporting, compliance and alternative compliance requirements, charges, costs, fines or penalties paid by Landlord as a result of the greenhouse gas and/or carbon emissions from the Building exceeding the limits applicable to the

-6-

Building for the respective calendar year, and if and to the extent applicable, costs incurred by Landlord to purchase renewable energy credits, offsets or other similar credits in lieu (in whole or in part) of charges, fines, or penalties that would otherwise be imposed on the Building and/or Landlord pursuant BERDO. Without limitation, the BERDO Compliance Costs shall be included in Operating Expenses under this Lease. Subject to the terms and conditions of this Lease, Operating Expenses shall not include expenses which are not charged as Operating Expenses to other office tenants of the Building.

Notwithstanding the foregoing, the following items shall be excluded from Operating Expenses:

(A) leasing commissions, attorneys’ fees, costs and disbursements and other costs and expenses incurred in connection with leasing, renovating or improving vacant space in the Building for tenants or prospective tenants of the Building or selling the Land or the Building;

(B) costs (including permit, license and inspection fees) incurred in renovating or otherwise improving, decorating, painting or redecorating space for tenants or vacant space;

(C) Landlord’s costs of any services provided to tenants to the extent Landlord is entitled to be reimbursed by such tenants as an additional charge or rental over and above the base rent and operating expenses payable under the lease with such tenant or other occupant;

(D) any depreciation or amortization of the Building except as expressly permitted herein;

(E) financing costs on any mortgage or other instrument encumbering the Land or Building including interest, charges, fees and principal amortization of debts and the costs of providing the same and rental on ground leases or other underlying leases and the costs of providing the same;

(F) repairs or other work occasioned by fire, windstorm or other work to the extent paid for through insurance or condemnation proceeds (excluding any deductible);

(G) legal fees and expenses or other professional or consulting fees and expenses incurred for (i) negotiating lease terms for prospective tenants, (ii) negotiating termination or extension of leases with existing tenants, or (iii) enforcing obligations of other tenants in the Building under their respective leases, or incurred in connection with disputes with other occupants of the Building, or in connection with the defense of Landlord’s title to or interest in the Property or any part thereof;

(H) charitable or political contributions;

-7-

(I) income and franchise taxes of Landlord;

(J) Real Estate Taxes;

(K) any liabilities, costs or expenses associated with or incurred in connection with the remediation, removal, enclosure, encapsulation or other handling of Hazardous Materials (as defined in Section 6(g) below) and the cost of defending against claims in regard to the existence, emission, or release of Hazardous Materials at the Building (except with respect to those costs for which Tenant is responsible pursuant to the express terms of this Lease);

(L) insurance premiums expressly and specifically payable by any other tenant of the Building to the extent Landlord is reimbursed from such other tenant;

(M) all other items to the extent that another party compensates or pays Landlord so that Landlord shall not recover any item of cost more than once;

(N) lease payments for equipment rented directly by Landlord (excluding both (i) equipment for which depreciation is properly charged as an expense, and (ii) equipment leased by contractors) that would constitute a capital expenditure if the equipment were purchased rather than leased, other than equipment the amortized cost of which is permitted to be included as a capital expenditure pursuant to the express provisions of this Lease;

(O) late fees or charges incurred by Landlord due to late payment of expenses, except to the extent attributable to Tenant’s actions or inactions;

(P) cost of acquiring or securing sculptures, paintings and other works of art;

(Q) reserve funds for future improvements, repairs, and additions;

(R) costs and expenses incurred in connection with contesting or settlement of any claimed violation of the Building with applicable Laws that are in effect as of the Effective Date;

(S) costs of mitigation or impact fees or subsidies (however characterized), imposed by public authorities prior to the Effective Date, or imposed by public authorities solely as a result of another tenant’s use of their respective premises;

(T) Landlord’s general overhead and any other expenses not directly attributable to the operation and management of the Building and the Land (e.g., the activities of Landlord’s officers and executives or professional development expenditures) expenses, except to the extent included in the management fee permitted hereby; and

(U) property management fees to the extent in excess of five percent (5%) of the gross revenues of the Building.

-8-

(e) “Real Estate Taxes” means any form of assessment, license fee, license tax, business license fee, levy, charge, improvement bond, tax, water and sewer rents and charges, utilities and communications taxes and charges or similar or dissimilar imposition imposed by any authority having the direct power to tax, including any city, county, state or federal government, or any school, agricultural, lighting, drainage or other improvement or special assessment district thereof, or any other governmental charge, general and special, ordinary and extraordinary, foreseen and unforeseen, which may be assessed against any legal or equitable interest of Landlord in the Premises, Building or the Land. Real Estate Taxes shall also include, without limitation:

(i) any hereafter adopted assessment, tax, fee, levy or charge in substitution, partially or totally, of any assessment, tax, fee, levy or charge previously included within the ad valorem real property taxes. It is the intention of Tenant and Landlord that all such new and increased assessments, taxes, fees, levies and charges be included within the definition of “Real Estate Taxes” for the purposes of this Lease;

(ii) any assessment, tax, fee, levy or charge allocable to or measured by the area of the Premises or other premises in the Building or the rent payable by Tenant hereunder or other tenants of the Building, including, without limitation, any gross receipts tax or excise tax levied by state, city or federal government, or any political subdivision thereof, with respect to the receipt of such rent, or upon or with respect to the possession, leasing, operation, management, maintenance, alteration, repair, use or occupancy by Tenant of the Premises, or any portion thereof but not on Landlord’s other operations;

(iii) any assessment, tax, fee, levy or charge upon this transaction or any document to which Tenant is a party, creating or transferring an interest or an estate in the Premises, and any business improvement district assessments or charges, or PILOT (i.e., payments in lieu of taxes payments);

(iv) any assessment, tax, fee, levy or charge by any governmental agency related to any transportation plan, fund or system (including assessment districts) instituted within the geographic area of which the Land is a part; and/or

(v) any costs and expenses (including, without limitation, reasonable attorneys’ fees) incurred in attempting to protest, reduce or minimize Real Estate Taxes.

Notwithstanding any provision to the contrary set forth in this Lease, “Real Estate Taxes” shall not include (x) interest or penalties incurred by Landlord as a result of Landlord’s late payment of Real Estate Taxes, or (y) income, estate, succession, gift, inheritance, corporate excise, and transfer taxes.

(f) For any calendar year during which actual occupancy of the Building is less than ninety five percent (95%) of the Rentable Area of the Building, those Operating Expenses for services which vary based on the level of occupancy of the Building (such as cleaning services) shall be appropriately adjusted to reflect ninety five percent (95%) occupancy of the existing Rentable Area of the Building during such period. In determining Operating Expenses, if any services or utilities are separately charged to tenants of the Building or others, Operating Expenses shall be adjusted by Landlord to reflect the amount of expense which would have been incurred for such services or utilities on a full-time basis for normal Building operating hours. Operating

-9-

Expenses for the Tenant’s Base Year for Operating Expenses shall not include Operating Expenses attributable to temporary market-wide labor-rate increases and/or utility rate increases due to extraordinary circumstances, including, but not limited to Force Majeure, conservation surcharges, boycotts, embargoes, or other shortages. In the event (i) the Commencement Date shall be a date other than January 1, (ii) the date fixed for the expiration of the Lease Term shall be a date other than December 31, (iii) of any early termination of this Lease, or (iv) of any increase or decrease in the size of the Premises, then in each such event, an appropriate adjustment in the application of this Section 3 shall, subject to the provisions of this Lease, be made to reflect such event on a basis determined by Landlord to be consistent with the principles underlying the provisions of this Section 3. Landlord shall also have the right, in its sole discretion, to allocate and prorate any portion or portions of the Operating Expenses in any reasonable manner, provided that said allocation or proration is consistent from year-to-year. Without limiting the generality of the foregoing, Landlord shall have the right, from time to time, to equitably allocate and prorate some or all of the Operating Expenses among different tenants (the “Cost Pools”), adjusting Tenant’s Proportionate Share as to each of the separately allocated costs based on the ratio of the Rentable Area of the Premises to the Rentable Area of all of the premises to which such costs are allocated, provided that said allocation or proration is consistent from year-to-year. Such Cost Pools may include, without limitation, differentiation of the office space tenants and retail space tenants of the Building.

(g) In connection with each calendar year and/or fiscal year (as applicable) of the Lease Term following the Commencement Date, Landlord shall have the right to give to Tenant a written estimate of Tenant’s Proportionate Share of Operating Expenses Excess and/or Taxes Excess, if any, for the Building and/or Land for the ensuing year. Tenant shall pay such estimated amount to Landlord in equal monthly installments, in advance on the first day of each month, concurrent with each payment of Base Rent. Within ninety (90) days after the end of each calendar year and/or tax fiscal year (as applicable), Landlord shall furnish Tenant a statement (each, a “Statement”) indicating in reasonable detail the excess or shortfall of (i) Operating Expenses over Base Operating Expenses for such period, and (ii) Real Estate Taxes over Base Real Estate Taxes for such period, and the parties shall, within thirty (30) days thereafter, make any payment or allowance necessary to adjust Tenant’s estimated payments to Tenant’s actual share of such excess or shortfall as indicated by such annual Statement. Each such Statement shall constitute an account stated, subject to the provisions of Section 3(i) below. Any payment due Landlord shall be payable by Tenant within thirty (30) days after demand from Landlord. Any amount due Tenant as a result of such overpayments shall be credited against installments of Rent next becoming due under this Section 3(g) or promptly refunded to Tenant, if requested by Tenant. The provisions of this Section 3(g) shall survive the expiration or earlier termination of this Lease.

(h) Tenant shall pay, within thirty (30) days after receipt of a bill or invoice therefor, all taxes and assessments levied against any personal property, fixtures, tenant improvements or trade fixtures of Tenant in or about the Premises. If any such taxes or assessments are levied against Landlord or Landlord’s property or if the assessed value of the Land and Building is increased as a result of the inclusion therein of a value placed upon the personal property or trade fixtures of Tenant, then Tenant shall upon demand reimburse Landlord for the taxes and assessments so levied against Landlord, or such taxes, levies and assessments resulting from such increase in assessed value. To the extent that any such taxes are not separately assessed or billed

-10-

to Tenant, Tenant shall pay, within thirty (30) days after receipt of a bill or invoice therefor, the amount thereof.

(i) Any delay or failure of Landlord in (i) delivering any estimate or Statement described in this Section 3, or (ii) computing or billing Tenant’s Proportionate Share of Operating Expenses Excess and/or Taxes Excess shall not constitute a waiver of its right to require an increase in Additional Rent, or in any way impair the continuing obligations of Tenant under this Section 3. In the event of any dispute as to any Additional Rent due under this Section 3, Tenant, an officer of Tenant, or Tenant’s independent certified public accounting firm (but in no event shall Tenant hire or employ an accounting firm or any other person to audit Landlord as set forth under this Section 3 who is compensated or paid for such audit on a contingency basis) shall have the right after reasonable notice and at reasonable times to audit Landlord’s accounting records for the respective calendar year or tax fiscal year at Landlord’s accounting office. If the parties are unable to resolve any dispute as to the correctness of such Statement within thirty (30) days following delivery to Landlord of the results of such audit performed by Tenant, then either party may refer the issues raised to a nationally recognized public accounting firm selected by Landlord and reasonably acceptable to Tenant, and the decision of such accountants shall be conclusively binding upon Landlord and Tenant. If Landlord and Tenant cannot mutually agree to an independent certified public accountant, then the parties agree that Landlord shall choose an independent certified public accountant to conduct the certification as to the proper amount of Tenant’s Proportionate Share of Operating Expenses and/or Real Estate Taxes due by Tenant for the period in question; provided, however, such certified public accountant shall not be the accountant who conducted Landlord’s initial calculation of Operating Expenses and/or Real Estate Taxes to which Tenant is now objecting. If the independent accounting firm determines that Tenant has overpaid Tenant’s Proportionate Share of Operating Expenses and/or Real Estate Taxes for the period in question, then Landlord shall credit such excess to Tenant’s next payment of Operating Expenses and/or Real Estate Taxes or, at the request of Tenant, promptly refund such excess to Tenant and conversely, if the independent accounting firm determines that Tenant has underpaid Tenant’s Proportionate Share of Operating Expenses and/or Real Estate Taxes, Tenant shall promptly pay such additional Operating Expenses and/or Real Estate Taxes to Landlord. Tenant agrees to pay the cost of such audit and the fees and charges payable to said independent accounting firm. Tenant waives the right to audit the books and records of Landlord or to dispute any matter relating to the calculation of Operating Expenses and/or Real Estate Taxes or Additional Rent under this Section 3, if any claim or dispute with respect thereto is not asserted in writing to Landlord within ninety (90) days after delivery to Tenant of the original billing Statement with respect thereto. Notwithstanding the foregoing, Tenant shall maintain strict confidentiality of all of Landlord’s accounting records and shall not disclose the same to any other person or entity except for Tenant’s professional advisory representatives (such as Tenant’s employees, accountants, advisors, attorneys and consultants) with a need to know such accounting information, who agree to similarly maintain the confidentiality of such financial information.

-11-

(a) Landlord shall deliver the Premises to Tenant, and Tenant agrees to accept the Premises from Landlord in the Delivery Condition, and in all other respects in its then-existing “AS-IS,” “WHERE-IS,” and “WITH ALL FAULTS” conditions, and Landlord shall have no obligation to perform any improvements or alterations or to refurbish or otherwise improve the Premises in connection with the initial occupancy thereof. The “Delivery Condition” shall mean that (i) the Premises are broom-clean and free and clear of other tenants and occupants, (ii) in all other respects the Premises are in “as is”, “where is” condition, and (iii) the base building mechanical, electrical, plumbing, sanitary, sprinkler, heating, ventilation and air conditioning, security, life-safety, and other service systems or facilities of the Building up to the point of connection of localized distribution to the Premises (collectively, the “Building Systems”) are in good working order.

Landlord will exercise commercially reasonable efforts to cause the Commencement Date to occur by the Scheduled Commencement Date. Without limiting the foregoing, if the Commencement Date has not occurred by the date that is ten (10) days after the Scheduled Commencement Date (as such date may be extended on a day-for-day basis for events of Force Majeure, the “Outside Delivery Date”), then as liquidated damages and the sole and exclusive remedy of Tenant on account thereof, for and with respect to each day between the Outside Delivery Date and the date on which the Commencement Date actually occurs, Tenant shall receive a credit against the Base Rent payable under this Lease in an amount equal to the per diem Base Rent payable for the Premises for Lease Year 1.

(b) Landlord has no obligation to perform any work, supply any materials, incur any expense or make any alterations, additions or improvements to the Premises to prepare the Premises for Tenant’s initial occupancy. Promptly after the Commencement Date, Tenant shall, at its own cost and expense, in accordance with and subject to the terms and provisions of this Lease, perform or cause to be performed any and all other work necessary to prepare the Premises for Tenant’s initial occupancy (collectively, the “Initial Installations”), and shall equip the Premises with such trade fixtures and personal property necessary or proper for the conduct of Tenant’s business. In connection with the performance of the Initial Installations, Tenant shall pay to Landlord, as Additional Rent, a construction supervision fee in an amount equal to 2.5% of the total project costs of the Initial Installations. In addition, Tenant shall reimburse Landlord for all third-party out-of-pocket commercially reasonable costs and expenses actually incurred by

-12-

Landlord in connection with the performance of the Initial Installations. Upon request by Tenant, Landlord will provide Tenant with reasonable and customary back-up for said costs and expenses.

(c) Landlord shall provide to Tenant a tenant improvement allowance in an amount equal to Landlord’s Contribution, subject to the terms and conditions of this Section 4. The Landlord’s Contribution shall be applied toward the costs and expenses incurred by Tenant in connection with the Initial Installations, provided that as of the date on which Landlord is required to make payment thereof pursuant to this Section 4, (i) this Lease is in full force and effect, and (ii) no Event of Default then exists. Tenant shall pay all costs of the Initial Installations in excess of Landlord’s Contribution. The Landlord’s Contribution shall be payable solely on account of hard construction costs and labor directly related to the Initial Installations and materials delivered to the Premises in connection with the Initial Installations; provided, however, Tenant may apply up to but not more than twenty percent (20%) of the Landlord’s Contribution against either (i) “soft costs” incurred by Tenant in connection with the performance of the Initial Installations, including architectural, engineering and project management fees incurred by Tenant, or (ii) the Base Rent payable by Tenant under this Lease. Upon the occurrence of the date which is twelve (12) months after the Commencement Date, any amount of Landlord’s Contribution which has not been previously disbursed or applied shall be retained by Landlord and Tenant shall have no further right or claim thereto.

(d) Landlord shall make progress payments on account of Landlord’s Contribution to Tenant on a monthly basis, for the work performed during the previous month less retainage (“Retainage”) of five percent (5%) of each progress payment. Each of Landlord’s progress payments shall be limited to an amount equal to the aggregate amounts theretofore paid by Tenant (as certified by the chief financial officer of Tenant and by Tenant’s independent architect) to Tenant’s contractors, subcontractors, material suppliers, architects, engineers, and other consultants which have not been subject to previous disbursements from Landlord’s Contribution multiplied by a fraction, the numerator of which is the amount of Landlord’s Contribution, and the denominator of which is the total contract price for the performance of all of the Initial Installations shown on all plans and specifications approved by Landlord, provided that in no event shall such fraction be greater than one. Such progress payments shall be made not later than thirty (30) days following the delivery to Landlord of requisitions therefor. Each requisition shall be executed by the chief financial officer of Tenant, and shall be accompanied by (i) with the exception of the first requisition, copies of partial waivers of lien from all contractors, subcontractors, and material suppliers covering all work and materials which were the subject of previous progress payments by Landlord and Tenant, (ii) a certification from Tenant’s architect that the work for which the requisition is being made has been performed substantially in accordance with the plans and specifications approved by Landlord, and (iii) such other documents and information as Landlord may reasonably request. Landlord shall disburse the Retainage upon submission by Tenant to Landlord of Tenant’s requisition therefor accompanied by all documentation required under the foregoing provisions of this Section 4, together with (A) proof of the satisfactory completion of all required inspections and issuance of any required approvals, permits and sign-offs for the Initial Installations by governmental authorities having jurisdiction thereover (including issuance of a certificate of occupancy for the Premises, if and to the extent required by applicable Laws), (B) final “as-built” plans and specifications for the Initial Installations, and (C) issuance of final lien waivers by all contractors, subcontractors and material suppliers for the Initial Installations. The right to receive Landlord’s Contribution is for the exclusive benefit of Tenant and in no event shall

-13-

such right be assigned to or be enforceable by or for the benefit of any third party, including any contractor, subcontractor, materialman, laborer, architect, engineer, attorney or other person or entity.

(e) In addition to Landlord’s Contribution, Landlord shall provide an allowance (the “Space Planning Allowance”) of up to $3,950.25, to reimburse Tenant for the architectural and engineering fees incurred by Tenant in preparing an initial space plan for the Premises. Said Space Planning Allowance shall be provided to Tenant not later than thirty (30) days after delivery to Landlord of the initial space plan, along with a copy of the invoice for said architectural and engineering fees.

(f) Tenant shall not make any alterations, additions, improvements or other physical changes in or about the Premises (collectively, “Alterations”), other than Decorative Alterations (as hereinafter defined) and Permitted Non-Structural Alterations (as hereinafter defined), without Landlord’s prior consent in each instance. “Decorative Alterations” shall mean decorative Alterations such as painting, wall coverings and floor coverings. “Permitted Non-Structural Alterations” shall mean Alterations costing less than $100,000.00 in the aggregate performed by Tenant in any consecutive twelve (12) month period during the Term of this Lease, that (i) are non-structural and do not affect any Building Systems, (ii) affect only the Premises and are not visible from outside of the Premises or the Building, (iii) do not require a conditional use permit, variance, waiver or other relief from any applicable Law, and (iv) in all respects, comply with all applicable Laws. “Specialty Alterations” shall mean Alterations which are not standard office installations such as kitchens, executive bathrooms, raised computer floors, computer room installations, supplemental HVAC equipment, safe deposit boxes, vaults, libraries or file rooms requiring reinforcement of floors, internal staircases, slab penetrations, conveyors, dumbwaiters, print rooms and model shops, and other Alterations of a similar character. Prior to making any Alterations, Tenant, at its expense, shall (i) excepting only for Decorative Alterations and Permitted Non-Structural Alterations, submit to Landlord for its approval, detailed plans and specifications for such proposed Alteration, and with respect to any proposed Alteration affecting any Building System or the structural support, roof, or exterior walls of the Building, evidence that the proposed Alteration has been designed by, or reviewed and approved by, Landlord’s designated engineer for the affected Building System or the structural support, roof, or exterior walls of the Building, (ii) obtain all permits, approvals and certificates required by any governmental authorities for the proposed Alteration, and furnish copies thereof to Landlord, and (iii) provide not less than five (5) Business Days’ prior notice to Landlord before commencing the performance of the proposed Alteration. Landlord’s consent shall not be unreasonably withheld with respect to proposed Alterations that (i) comply with all applicable Laws; (ii) are compatible with the Building and its mechanical, electrical, HVAC and life safety systems; (iii) will not interfere with the use and occupancy of any other portion of the Building by any other tenant or their invitees; (iv) do not affect the structural portions of the Building; and, (v) do not and will not, whether alone or taken together with other improvements, require the construction of any other improvements or alterations within the Building. All Alterations shall be performed in accordance with the construction rules, regulations, specifications and requirements adopted by Landlord from time to time. Tenant shall cause, at its sole cost and expense, all Alterations to comply with insurance requirements and with Laws and shall construct, at its sole cost and expense, any alteration or modification required by Laws as a result of any Alterations. All Alterations shall be constructed at Tenant’s sole cost and expense, in a first class and good and workmanlike manner by contractors

-14-

reasonably acceptable to Landlord and only good grades of materials shall be used. Without limiting the generality of the foregoing, Tenant shall pay to Landlord, within ten (10) Business Days after completion of any Alterations, as Additional Rent, a construction fee (in the amount set forth in Section 4(b)) in connection with Alterations, together with customary commercially reasonable costs incurred by Landlord for services rendered by Landlord’s management personnel and engineers to coordinate and/or supervise such Alterations. Landlord’s right to review plans and specifications and to monitor construction shall be solely for its own benefit, and Landlord shall have no duty to see that such plans and specifications or construction comply with applicable Laws. Without limiting the other grounds upon which Landlord may refuse to approve any contractor or subcontractor, Landlord may take into account the desirability of maintaining harmonious labor relations at the Building. Landlord may also require that all life safety related work and all mechanical, electrical, plumbing and roof related work be performed by contractors designated by Landlord. Landlord shall have the right, in its sole discretion, to instruct Tenant to remove those improvements or Alterations from the Premises and the Installation Areas which (i) were not approved in advance by Landlord, (ii) were not built in conformance with the plans and specifications approved by Landlord, or (iii) which are identified as Specialty Alterations by Landlord at the time of review of the plans and specifications therefor. Without limiting the foregoing, concurrent with the review of the applicable the plans and specifications (including, without limitation, the proposed plans for the Initial Installations), Landlord will notify Tenant as to which of the proposed Alterations constitute Specialty Alterations which Tenant will be required to remove at the expiration of the Term provided that Tenant shall include the following legend in capitalized and bold type displayed prominently on the top of the first page of Tenant’s notice delivered concurrently with such plans and specifications: “LANDLORD SHALL NOTIFY TENANT AT THE TIME LANDLORD APPROVES THESE PLANS AND SPECIFICATIONS AS TO WHICH ALTERATIONS SHOWN THEREON ARE SPECIALTY ALTERATIONS WHICH MAY BE REQUIRED TO BE REMOVED AT THE END OF THE TERM OF THE LEASE.” If upon the expiration or termination of this Lease Landlord requires Tenant to remove any or all of such Alterations from the Premises and the Installation Areas, then Tenant, at Tenant’s sole cost and expense, shall promptly remove such Alterations and improvements and Tenant shall repair and restore the Premises to their original condition as of the Commencement Date, reasonable wear and tear excepted. Without limiting the foregoing, any Alterations remaining in the Premises following the expiration of the Lease Term or following the surrender of the Premises from Tenant to Landlord, shall become the property of Landlord and may be disposed of or used by Landlord, with no obligations or liabilities therefore to Tenant. Tenant shall provide Landlord with the identities and mailing addresses of all persons performing work or supplying materials, prior to beginning such construction, and Landlord may post on and about the Premises notices of non-responsibility pursuant to applicable Laws. Tenant shall assure payment for the completion of all work free and clear of liens and shall provide certificates of insurance for worker’s compensation and other coverage in amounts and from an insurance company reasonably satisfactory to Landlord protecting Landlord against liability for bodily injury or property damage during construction. Upon completion of any Alteration and upon Landlord’s reasonable request, Tenant shall deliver to Landlord sworn statements setting forth the names of all contractors and subcontractors who did work on the Alterations and final lien waivers from all such contractors and subcontractors. Additionally, upon completion of any Alteration, Tenant shall provide Landlord, at Tenant’s expense, with a complete set of “as built” plans in reproducible form and specifications reflecting the actual conditions of the Alterations, together with a copy of such plans

-15-

on diskette in the AutoCAD format or such other format as may then be required by Landlord. Tenant shall pay to Landlord, as Additional Rent, the reasonable out-of-pocket fees and costs of all architects, engineers and other consultants retained by Landlord to review all plans, specifications and working drawings for Alterations (including the Initial Installations) performed by Tenant during the Lease Term, within thirty (30) days after Tenant’s receipt of invoices from Landlord.

(g) Tenant shall keep the Premises, the Building and the Land free from any and all liens and other encumbrances arising out of any Alterations, work performed, materials furnished, or obligations incurred by or for Tenant. In the event that Tenant shall not, within twenty (20) days following the imposition of any such lien, cause the same to be released of record by payment or posting of a bond in a form and issued by a surety acceptable to Landlord, Landlord shall have the right, but not the obligation, to cause such lien to be released by such means as it shall deem proper (including payment of or defense against the claim giving rise to such lien); in such case, Tenant shall reimburse Landlord for all actual out-of-pocket costs and expenses paid by Landlord in connection therewith, together with interest thereon at the Default Rate (defined below) and Tenant shall indemnify and defend each and all of the Landlord Indemnitees (defined below) against any damages, losses or costs arising out of any such claim. Tenant’s indemnification of Landlord contained in this Section 4(g) shall survive the expiration or earlier termination of this Lease. Such rights of Landlord shall be in addition to all other remedies provided herein or by applicable Laws.

(h) NOTICE IS HEREBY GIVEN THAT LANDLORD SHALL NOT BE LIABLE FOR ANY LABOR, SERVICES OR MATERIALS FURNISHED OR TO BE FURNISHED TO TENANT, OR TO ANYONE HOLDING THE PREMISES THROUGH OR UNDER TENANT, AND THAT NO MECHANICS’ OR OTHER LIENS FOR ANY SUCH LABOR, SERVICES OR MATERIALS SHALL ATTACH TO OR AFFECT THE INTEREST OF LANDLORD IN THE PREMISES.

(a) Landlord shall maintain, in good order, condition and repair, reasonable wear and tear and damage by casualty or eminent domain excepted, as part of Basic Services, the following: (i) the structural portions of the Building, (ii) the exterior walls of the Building, including, without limitation, glass and glazing, (iii) the roof foundation and facades of the Building, (iv) all Building Systems, (v) the base building lavatories, (vi) the Common Areas, and (vii) all base building fire and life safety systems, sprinklers and smoke detectors. Landlord shall not be deemed to have breached any obligation with respect to the condition of any part of the Land or Building unless Tenant has given to Landlord written notice of any required repair and Landlord has not made such repair within a reasonable time following the receipt by Landlord of such notice. The foregoing notwithstanding, (i) Tenant shall pay for the cost of any repairs as a result of damage to any of the foregoing to the extent caused by the acts or omissions of Tenant or it agents, employees or contractors, except to the extent such repairs are covered by insurance carried by Landlord pursuant to the provisions of Section 8(e) below; and (ii) the obligations of Landlord pertaining to damage or destruction by casualty shall be governed by the provisions of Section 9. Landlord shall have the right but not the obligation to undertake work of repair that Tenant is required to perform under this Lease and that Tenant fails or refuses to perform in a timely and efficient manner, and

-16-

such repair is not completed within thirty (30) Business Days after delivery of notice thereof by Landlord to Tenant. All costs incurred by Landlord in performing any such repair for the account of Tenant shall be repaid by Tenant to Landlord upon demand, together with an administration fee equal to fifteen percent (15%) of such costs. There shall be no abatement of Rent, no liability of Landlord by reason of any injury to or interference with Tenant’s business arising from the making of any repairs, alterations or improvements in or to any portion of the Premises, the Building or the Land, excepting only to the extent caused by the negligence or willful misconduct of Landlord. Tenant waives the right to make repairs at Landlord’s expense under any Law now or hereafter in effect.

(b) Tenant, at its expense, (i) shall maintain the Premises, in good order, condition and repair, reasonable wear and tear and damage by casualty or eminent domain excepted, and (ii) shall bear the cost of maintenance and repair, by contractors approved by Landlord in its reasonable discretion, of all facilities which are not expressly required to be maintained or repaired by Landlord and which exclusively serve the Premises, including, without limitation, lavatory, shower, toilet, wash basin and kitchen facilities, and supplemental heating and air conditioning systems (including all plumbing connected to said facilities or systems installed by or on behalf of Tenant or existing in the Premises at the time of Landlord’s delivery of the Premises to Tenant). Tenant shall make all repairs to the Premises with replacements of any materials to be made by use of materials of equal or better quality. Tenant shall pay for the cost of any repairs to the Premises, the Building and/or the Land made necessary by any negligence or willful misconduct of Tenant or any of its assignees, subtenants, employees or their respective agents, representatives, contractors, or other persons permitted in or invited to the Premises, the Building or the Land by Tenant, except to the extent such repairs are covered by insurance carried by Landlord or Tenant pursuant to the provisions of Section 8(e) below. If Tenant fails to commence such repairs or replacements within fifteen (15) days after written notice from Landlord, or thereafter to prosecute diligently such repairs to completion, then Landlord may at its option make such repairs or replacements, and Tenant shall upon demand pay Landlord for the cost thereof, together with an administration fee equal to fifteen percent (15%) of such costs.

(c) Upon the expiration or earlier termination of this Lease, Tenant shall surrender the Premises in a safe, clean and neat condition, normal wear and tear excepted. Except as otherwise set forth in Section 4(b) of this Lease, Tenant shall remove from the Premises all Specialty Alterations (subject to the provisions of Section 4(f)), trade fixtures, furnishings and other personal property of Tenant and, (unless otherwise directed by Landlord) all computer and phone cabling and wiring installed by or on behalf of Tenant, shall repair all damage caused by such removal. In addition to all other rights Landlord may have, in the event Tenant does not so remove any such fixtures, furnishings or personal property by the expiration or earlier termination of the Term of this Lease, then Tenant shall be deemed to have abandoned the same, in which case Landlord may store or dispose of the same at Tenant’s expense, appropriate the same for itself, and/or sell the same in its discretion.

-17-

(a) Tenant shall use the Premises only for lawfully-permitted general business office uses, and shall not use the Premises or permit the Premises to be used for any other purpose. Landlord shall have the right to deny its consent to any change in the permitted use of the Premises in its sole and absolute discretion. In no event may the Premises be used for a Prohibited Use (as hereinafter defined). A “Prohibited Use” shall mean the following: (i) a restaurant or bar; (ii) the preparation, consumption, storage, manufacture or sale of food or beverages to persons other than the employees, agents, representatives, guests and contractors of Tenant ; (iii) the sale of alcohol or tobacco; (iv) a school or classroom (except in connection with Tenant’s business); (v) lodging or sleeping; (vi) the operation of retail facilities (meaning a business whose primary patronage arises from the generalized solicitation of the general public to visit Tenant’s offices in person without a prior appointment) or retail facilities of any financial, lending, securities brokerage or investment activity; (vii) offices of any Governmental Authority, any foreign government, or any agency or department of the foregoing; (viii) the manufacture, retail sale, storage of merchandise or auction of merchandise, goods or property of any kind to the general public which could reasonably be expected to create a volume of pedestrian traffic substantially in excess of that normally encountered in first-class multi-tenant office buildings; (ix) the rendering of medical, dental or other therapeutic or diagnostic services; or (x) any illegal purposes or any activity constituting a nuisance.

(b) Tenant shall not at any time use or occupy the Premises, or permit any act or omission in or about the Premises in violation of any applicable law, statute, ordinance, by-law, code, or any governmental rule, regulation or order (collectively, “Law” or “Laws”), and Tenant shall, upon written notice from Landlord, discontinue any use of the Premises which is a violation of Law. If any Law shall, by reason of the nature of Tenant’s use or occupancy of the Premises, impose any duty upon Tenant or Landlord with respect to (i) modification or other maintenance of the Premises, the Building or the Land, or (ii) the use, alteration or occupancy thereof, Tenant shall cause the Premises to comply with such Law at Tenant’s sole cost and expense. This Lease shall be subject to and Tenant shall comply with all Security Documents (as defined in Section 16(a) below) and all covenants, conditions and restrictions affecting the Premises, the Building or the Land, including, but not limited to, any subordination agreements described in Section 16(a) below.

(c) In the event that any governmental agency or department having jurisdiction shall at any time contend or declare that the Premises are used or occupied in violation of such applicable Law, then Tenant shall, upon five (5) days’ notice from Landlord or any such governmental agency or department, immediately discontinue such use of the Premises (and otherwise remedy such violation). The failure by Tenant to discontinue such use shall be considered a default under this Lease and Landlord shall have the right to exercise any and all rights and remedies provided herein or by Law. Any statement in this Lease of the nature of the business to be conducted by Tenant in the Premises shall not be deemed or construed to constitute a representation or guaranty by Landlord that such business will continue to be lawful or permissible under any applicable Law.

-18-

(d) Tenant shall not do or permit to be done anything which may invalidate any insurance coverage that is in place affording coverage at the Building, or that would increase the risk of loss at the Building, or that would cause an increase in the cost of any insurance policy covering the Building, the Land and/or property located therein. Tenant shall comply with all Laws that pertain to the Premises or the operations of Tenant in the Premises; provided, however, Tenant shall not be obligated to perform or be liable with respect to structural alterations, unless the application of such Laws arises out of or results from (i) the specific manner and nature of Tenant’s use or occupancy of the Premises, as distinct from general office use, (ii) Alterations made by Tenant, or (iii) a breach or default by Tenant under any provisions of this Lease. Without limitation, within the Premises, (which shall include any and all internal stairways between floors comprising parts of the Premises if the Premises contain more than one such floor), Tenant shall be responsible for compliance with the Americans with Disabilities Act (42 U.S.C. § 12101 et. seq.) and the regulations and Accessibility Guidelines for Buildings and Facilities issued pursuant thereto (collectively, the “ADA”). Landlord shall be responsible for the compliance of the common areas of the Building with the ADA. Tenant shall comply with all rules, orders, regulations and requirements as set forth in all applicable fire codes and ordinances issued by any federal, state or local governmental body, or by any other organization performing a similar function and issuing codes that pertain to the Premises. In addition to all other remedies of Landlord, Landlord may require Tenant, promptly upon demand, to reimburse Landlord for the full amount of any additional premiums charged for such policy or policies by reason of Tenant’s failure to comply with the provisions of this Section 6.

(e) Tenant shall not in any way interfere with the rights or quiet enjoyment of other tenants or occupants of the Building. Tenant shall not use or allow the Premises to be used for any improper, immoral, unlawful or objectionable purpose, nor shall Tenant cause, maintain, or permit any nuisance in, on or about the Premises, the Building or the Land by Tenant, or any person or entity claiming by, through, or under Tenant. Tenant shall not place weight upon any portion of the Premises exceeding the structural floor load (per square foot of area) which such area was designed (and is permitted by Law) to carry or otherwise use any Building System in excess of its capacity or in any other manner which may damage such system or the Building. Tenant shall not create within the Premises a working environment with a density of greater than the lesser of (i) six (6) persons per 1,000 square feet of Rentable Area, or (ii) the maximum density permitted by Law. Business machines and mechanical equipment shall be placed and maintained by Tenant, at Tenant’s expense, in locations and in settings sufficient in Landlord’s reasonable judgment to absorb and prevent vibration, noise and annoyance. Tenant shall not commit or suffer to be committed by Tenant, or any person or entity claiming by, through, or under Tenant, any waste in, on, upon or about the Premises, the Building or the Land.

(f) Tenant shall take all commercially reasonable steps necessary to adequately secure the Premises from unlawful intrusion, theft, fire and other hazards, and shall keep and maintain any and all security devices in or on the Premises in good working order, including, but not limited to, exterior door locks for the Premises, and smoke detectors located within the Premises and shall cooperate with Landlord and other tenants in the Building with respect to access control and other safety matters.

-19-

(g) Tenant shall comply with all mandatory energy, greenhouse gas emissions, water or other conservation controls or requirements of general applicability to Comparable Buildings issued or imposed from time-to-time by applicable governmental agencies or authorities, or applicable utilities or insurance carriers, which may include, without limitation, requirements, controls or limitations concerning the permitted range of temperature settings or the amount of energy consumption, greenhouse gas emissions, or water consumption. “BERDO” shall mean the Building Emissions Reduction and Disclosure Ordinance adopted by the City of Boston, as the same has been and may hereafter be amended, modified, or supplemented, together with all regulations adopted and directives issued thereunder. Tenant shall comply with, and shall cooperate with the customary and commercially reasonable efforts of Landlord to comply with, BERDO. Tenant covenants and agrees that it will (a) upon request, provide Landlord with information concerning greenhouse gas emission, carbon emission, water consumption, and utility and energy consumption in and at the Premises, together with such additional information in the possession of Tenant concerning its operations in the Premises as may be required for Landlord to satisfy the reporting requirements under BERDO, and (b) include energy and water consumption metering or sub-metering equipment as part of Tenant’s Work and integrate such equipment and meters with the data management system of Landlord for the Building. With respect to any equipment or components related to or affecting greenhouse gas emissions and/or carbon emissions from the Premises that are installed or replaced by Tenant during the Term of this Lease (“Tenant’s Emissions Equipment”), if the emissions standards established under BERDO become more restrictive or limiting (the “Applicable BERDO Standard”), then Tenant shall modify such Tenant’s Emissions Equipment and/or install or replace, as applicable, such equipment with updated Tenant’s Emissions Equipment so that the overall impact of the Tenant’s Emissions Equipment on the overall emissions of the Building complies with the more restrictive or limiting then-Applicable BERDO Standard applicable to the Building. If, at any time during the Lease Term, any of Tenant’s Emissions Equipment creates or results in a condition that is reasonably likely to result in a violation of BERDO, then Landlord may elect, at Landlord’s sole cost and expense, to replace such Tenant’s Emission Equipment by providing notice thereof to Tenant. Said replacement of Tenant’s Emissions Equipment shall be performed at such times, and in such manner, as to minimize interference with or disruption of the conduct of Tenant’s business in the Premises.

(h) As used herein, the term “Hazardous Material” means any (a) oil or any other petroleum-based substance, flammable substances, explosives, radioactive materials, hazardous wastes or substances, toxic wastes or substances, or any other wastes, materials or pollutants which (i) pose a hazard to the Building or to persons on or about the Land or (ii) cause the Building or the Land to be in violation of any Laws; (b) asbestos in any form, urea formaldehyde foam insulation, transformers or other equipment that contain dielectric fluid containing levels of polychlorinated biphenyls, or radon gas; (c) chemical, material or substance defined as or included in the definition of “hazardous substances”, “hazardous wastes”, “hazardous materials”, “extremely hazardous waste”, “restricted hazardous waste”, or “toxic substances” or words of similar import under any applicable local, state or federal law or under the regulations adopted or publications promulgated pursuant thereto, including, but not limited to, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended, 42 U.S.C. §9601, et seq.; the Hazardous Materials Transportation Act, as amended, 49 U.S.C. §1801, et seq.; the Federal Water Pollution Control Act, as amended, 33 U.S.C. §1251, et seq.; the Resource Conservation and Recovery Act, as amended, 42 U.S.C. §6901, et seq.; the Safe Drinking Water

-20-

Act, as amended, 42 U.S.C. §300, et seq.; the Toxic Substances Control Act, as amended, 15 U.S.C. §2601, et seq.; the Federal Hazardous Substances Control Act, as amended, 15 U.S.C. §1261, et seq.; the Occupational Safety and Health Act, as amended, 29 U.S.C. §651, et seq.; and Massachusetts General Laws, Chapters 21C and 21E; (d) other chemical, material or substance, exposure to which is prohibited, limited or regulated by any governmental authority or may or could pose a hazard to the health and safety of the occupants of the Building or the owners and/or occupants of property adjacent to or surrounding the Building, or any other Person coming upon the Building or the Land or adjacent property; and (e) other chemicals, materials or substances which may or could pose a hazard to the environment. The term “Permitted Hazardous Materials” shall mean Hazardous Materials which are contained in ordinary office supplies of a type and in quantities typically used in the ordinary course of business within first-class business offices of similar size in comparable office buildings, but only if and to the extent that such supplies are transported, stored and used in full compliance with all applicable Laws and otherwise in a safe and prudent manner. Hazardous Materials which are contained in ordinary office supplies but which are transported, stored and used in a manner which is not in full compliance with all applicable Laws, or which is not in any respect safe and prudent shall not be deemed to be “Permitted Hazardous Materials” for the purposes of this Lease.

(i) Tenant, its assignees, subtenants, and their respective agents, servants, employees, representatives and contractors (collectively referred to herein as “Tenant Affiliates”) shall not cause or permit any Hazardous Material to be brought upon, kept or used in or about the Premises by Tenant or by Tenant Affiliates without the prior written consent of Landlord (which may be granted, conditioned or withheld in the sole discretion of Landlord), save and except only for Permitted Hazardous Materials, which Tenant or Tenant Affiliates may bring, store and use in reasonable quantities for their intended use in the Premises, but only in full compliance with all applicable Laws. On or before the expiration or earlier termination of this Lease, Tenant shall remove from the Premises all Hazardous Materials (including, without limitation, Permitted Hazardous Materials), introduced, released, brought upon, transported or used by Tenant or any persons acting by, through or under Tenant, regardless of whether such Hazardous Materials are present in concentrations which require removal under applicable Laws, except to the extent that such Hazardous Materials were present in the Premises as of the Commencement Date and were not brought onto the Premises by Tenant or Tenant Affiliates.

(ii) Tenant agrees to indemnify, defend and hold Landlord and its Affiliates (defined below) harmless for, from and against any and all claims, actions, administrative proceedings (including informal proceedings), judgments, damages, penalties, fines, costs, liabilities, interest or losses, including reasonable attorneys’ fees and expenses, court costs, consultant fees, and expert fees, together with all other costs and expenses of any kind or nature that arise during or after the Lease Term directly or indirectly from or in connection with the release by Tenant or any Tenant Affiliates of any Hazardous Material in or into the air, soil, surface water or groundwater at, on, about, under or within the Premises and/or the Building and/or the Land, or any portion thereof.

-21-

(iii) In the event any investigation or monitoring of site conditions or any clean-up, containment, restoration, removal or other remedial work (collectively, the “Remedial Work”) is required under any applicable federal, state or local Law, by any judicial order, or by any governmental entity as the result of operations or activities upon, or any use or occupancy of any portion of the Premises by Tenant or Tenant Affiliates, Landlord shall perform or cause to be performed the Remedial Work in compliance with such Law or order at Tenant’s sole cost and expense. All Remedial Work shall be performed by one or more contractors, selected and approved by Landlord, and under the supervision of a consulting engineer, selected by Tenant and approved in advance in writing by Landlord. All costs and expenses of such Remedial Work shall be paid by Tenant, including, without limitation, the charges of such contractor(s), the consulting engineer, and Landlord’s reasonable attorneys’ fees and costs incurred in connection with monitoring or review of such Remedial Work.

(iv) Each of the covenants and agreements of Tenant set forth in this Section 6(g) shall survive the expiration or earlier termination of this Lease.

(a) During the Lease Term, Landlord shall furnish, or cause to be furnished to the Premises, the utilities and services described in this Section 7(a) (collectively the “Basic Services”):

(i) Tepid or cold water at those points of supply provided for general use of other tenants in the Building;

(ii) On Mondays through Fridays (excepting Holidays (as hereinafter defined)) from 8:00 A.M. to 6:00 P.M., and upon prior request of Tenant, on Saturdays from 8:00 A.M. to 1:00 P.M., central heat and air conditioning, but Landlord shall not be responsible for inadequate air-conditioning or ventilation (x) to the extent the same occurs because Tenant’s use of power exceeds five (5) watts per rentable square foot (connected load) (excluding electricity for the base building HVAC Equipment), without Tenant providing adequate air-conditioning and ventilation therefor, or if the number of individuals in the Premises exceeds one (1) per one hundred (100) rentable square feet, or (y) because of any rearrangement of partitioning or other Alterations made by or on behalf of Tenant or any person claiming through or under Tenant, or (z) because of any other reason beyond the reasonable control of Landlord;

(iii) Maintenance, repairs, structural and exterior maintenance (including, without limitation, exterior glass and glazing), painting and lighting service for all Building Systems and Common Areas in the manner and to the extent reasonably deemed by Landlord to be standard for the Building, subject to the limitation contained in Section 5(a) above;

(iv) Janitorial service on a five (5) day per week basis, excluding Holidays, substantially in accordance with the cleaning specifications set forth on the schedule attached hereto as Exhibit G;

-22-

(v) An electrical system to convey power delivered by public utility providers selected by Landlord in amounts sufficient for normal office operations as provided in similar office buildings, with a total allowance of five (5) watts per square foot of Rentable Area (which includes an allowance for lighting of the Premises at the maximum wattage per square foot of Rentable Area permitted under applicable Laws) (excluding electricity for the base building HVAC equipment), provided that no single item of electrical equipment consumes more than 0.5 kilowatts at rated capacity or requires a voltage other than one hundred twenty (120) volts, single phase; and

(vi) Passenger elevator service serving the floors on which the Premises are situated, during Business Hours. Subject to Force Majeure, reduced service, consisting of at least one passenger elevator accessing the Premises from the lobby area of the Building, will be provided at all other times.

(b) During the Lease Term, Landlord shall provide to Tenant at Tenant’s sole cost and expense (and subject to the limitations hereinafter set forth) the following extra services (collectively the “Extra Services”):

(i) Such extra cleaning and janitorial services requested by Tenant, and agreed to by Landlord, for special improvements or Alterations;

(ii) Subject to Section 7(d) below, additional HVAC capacity in excess of that typically provided by the Building;

(iii) Maintaining and replacing lamps, bulbs, and ballasts in the Premises;