Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

SEI INSTITUTIONAL INTERNATIONAL TRUST

|

|

| Entity Central Index Key |

0000835597

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Mar. 31, 2025

|

|

| C000017607 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equity Fund

|

|

| Class Name |

Class F

|

|

| Trading Symbol |

SEITX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the International Equity Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

International Equity Fund, Class F Shares | $55 | 1.09%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 1.07%. |

|

|

| Expenses Paid, Amount |

$ 55

|

|

| Expense Ratio, Percent |

1.09%

|

[1] |

| AssetsNet |

$ 3,445,653,000

|

|

| Holdings Count | Holding |

744

|

|

| Advisory Fees Paid, Amount |

$ 8,828

|

|

| InvestmentCompanyPortfolioTurnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $3,445,653 | 744 | $8,828 | 45% |

|---|

|

|

| Holdings [Text Block] |

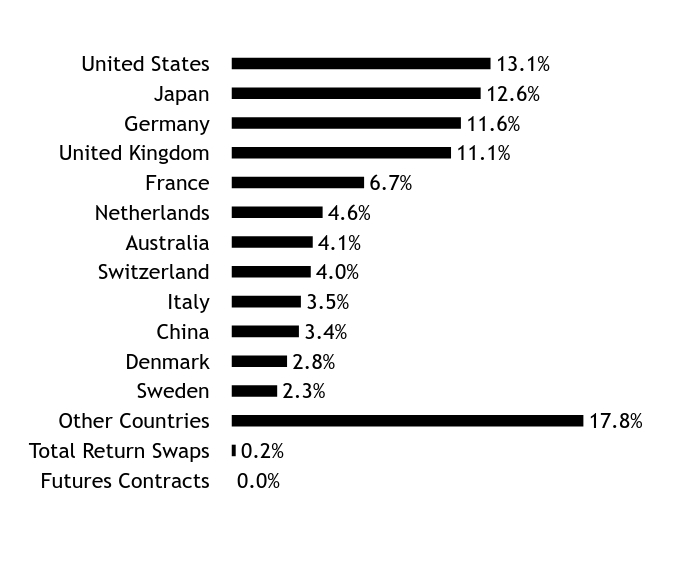

Country WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.0% | Total Return Swaps | 0.2% | Other Countries | 17.8% | Sweden | 2.3% | Denmark | 2.8% | China | 3.4% | Italy | 3.5% | Switzerland | 4.0% | Australia | 4.1% | Netherlands | 4.6% | France | 6.7% | United Kingdom | 11.1% | Germany | 11.6% | Japan | 12.6% | United States | 13.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Bill, 4.26%, 8/28/2025 | | | 3.0% | Roche Holding AG | | | 2.4% | SAP SE | | | 1.8% | Alibaba Group Holding Ltd | | | 0.9% | Equinor ASA | | | 0.9% | ING Groep NV | | | 0.9% | Sea Ltd ADR | | | 0.9% | Daimler Truck Holding AG | | | 0.9% | Novartis AG | | | 0.9% | GSK PLC | | | 0.9% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

|

| C000017606 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equity Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

SEEIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class I Shares of the International Equity Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

International Equity Fund, Class I Shares | $67 | 1.34%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 1.32%. |

|

|

| Expenses Paid, Amount |

$ 67

|

|

| Expense Ratio, Percent |

1.34%

|

[2] |

| AssetsNet |

$ 3,445,653,000

|

|

| Holdings Count | Holding |

744

|

|

| Advisory Fees Paid, Amount |

$ 8,828

|

|

| InvestmentCompanyPortfolioTurnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $3,445,653 | 744 | $8,828 | 45% |

|---|

|

|

| Holdings [Text Block] |

Country WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.0% | Total Return Swaps | 0.2% | Other Countries | 17.8% | Sweden | 2.3% | Denmark | 2.8% | China | 3.4% | Italy | 3.5% | Switzerland | 4.0% | Australia | 4.1% | Netherlands | 4.6% | France | 6.7% | United Kingdom | 11.1% | Germany | 11.6% | Japan | 12.6% | United States | 13.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Bill, 4.26%, 8/28/2025 | | | 3.0% | Roche Holding AG | | | 2.4% | SAP SE | | | 1.8% | Alibaba Group Holding Ltd | | | 0.9% | Equinor ASA | | | 0.9% | ING Groep NV | | | 0.9% | Sea Ltd ADR | | | 0.9% | Daimler Truck Holding AG | | | 0.9% | Novartis AG | | | 0.9% | GSK PLC | | | 0.9% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

|

| C000147407 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Equity Fund

|

|

| Class Name |

Class Y

|

|

| Trading Symbol |

SEFCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class Y Shares of the International Equity Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

International Equity Fund, Class Y Shares | $42 | 0.84%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.82%. |

|

|

| Expenses Paid, Amount |

$ 42

|

|

| Expense Ratio, Percent |

0.84%

|

[3] |

| AssetsNet |

$ 3,445,653,000

|

|

| Holdings Count | Holding |

744

|

|

| Advisory Fees Paid, Amount |

$ 8,828

|

|

| InvestmentCompanyPortfolioTurnover |

45.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $3,445,653 | 744 | $8,828 | 45% |

|---|

|

|

| Holdings [Text Block] |

Country WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.0% | Total Return Swaps | 0.2% | Other Countries | 17.8% | Sweden | 2.3% | Denmark | 2.8% | China | 3.4% | Italy | 3.5% | Switzerland | 4.0% | Australia | 4.1% | Netherlands | 4.6% | France | 6.7% | United Kingdom | 11.1% | Germany | 11.6% | Japan | 12.6% | United States | 13.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Bill, 4.26%, 8/28/2025 | | | 3.0% | Roche Holding AG | | | 2.4% | SAP SE | | | 1.8% | Alibaba Group Holding Ltd | | | 0.9% | Equinor ASA | | | 0.9% | ING Groep NV | | | 0.9% | Sea Ltd ADR | | | 0.9% | Daimler Truck Holding AG | | | 0.9% | Novartis AG | | | 0.9% | GSK PLC | | | 0.9% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

|

| C000017609 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Emerging Markets Equity Fund

|

|

| Class Name |

Class F

|

|

| Trading Symbol |

SIEMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the Emerging Markets Equity Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Emerging Markets Equity Fund, Class F Shares | $62 | 1.28%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 1.26%. |

|

|

| Expenses Paid, Amount |

$ 62

|

|

| Expense Ratio, Percent |

1.28%

|

[4] |

| AssetsNet |

$ 1,399,874,000

|

|

| Holdings Count | Holding |

479

|

|

| Advisory Fees Paid, Amount |

$ 5,043

|

|

| InvestmentCompanyPortfolioTurnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,399,874 | 479 | $5,043 | 30% |

|---|

|

|

| Holdings [Text Block] |

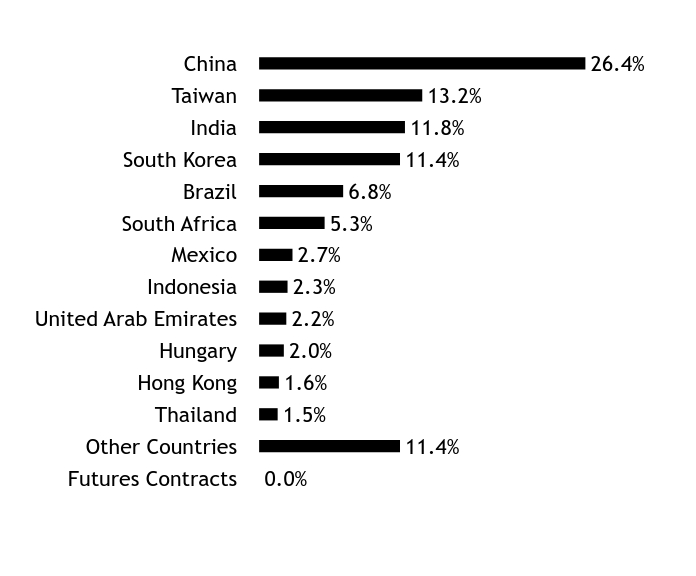

Country WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.0% | Other Countries | 11.4% | Thailand | 1.5% | Hong Kong | 1.6% | Hungary | 2.0% | United Arab Emirates | 2.2% | Indonesia | 2.3% | Mexico | 2.7% | South Africa | 5.3% | Brazil | 6.8% | South Korea | 11.4% | India | 11.8% | Taiwan | 13.2% | China | 26.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Taiwan Semiconductor Manufacturing Co Ltd | | | 6.3% | Alibaba Group Holding Ltd | | | 3.8% | Tencent Holdings Ltd | | | 2.9% | Samsung Electronics Co Ltd | | | 2.0% | Naspers Ltd, Cl N | | | 2.0% | Meituan, Cl B | | | 1.5% | HDFC Bank Ltd ADR | | | 1.5% | Emaar Properties PJSC | | | 1.4% | Kia Corp | | | 1.3% | Itau Unibanco Holding SA ADR | | | 1.3% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| C000147409 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Emerging Markets Equity Fund

|

|

| Class Name |

Class Y

|

|

| Trading Symbol |

SEQFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class Y Shares of the Emerging Markets Equity Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Emerging Markets Equity Fund, Class Y Shares | $50 | 1.03%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 1.01%. |

|

|

| Expenses Paid, Amount |

$ 50

|

|

| Expense Ratio, Percent |

1.03%

|

[5] |

| AssetsNet |

$ 1,399,874,000

|

|

| Holdings Count | Holding |

479

|

|

| Advisory Fees Paid, Amount |

$ 5,043

|

|

| InvestmentCompanyPortfolioTurnover |

30.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $1,399,874 | 479 | $5,043 | 30% |

|---|

|

|

| Holdings [Text Block] |

Country WeightingsFootnote Reference*Value | Value |

|---|

Futures Contracts | 0.0% | Other Countries | 11.4% | Thailand | 1.5% | Hong Kong | 1.6% | Hungary | 2.0% | United Arab Emirates | 2.2% | Indonesia | 2.3% | Mexico | 2.7% | South Africa | 5.3% | Brazil | 6.8% | South Korea | 11.4% | India | 11.8% | Taiwan | 13.2% | China | 26.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Taiwan Semiconductor Manufacturing Co Ltd | | | 6.3% | Alibaba Group Holding Ltd | | | 3.8% | Tencent Holdings Ltd | | | 2.9% | Samsung Electronics Co Ltd | | | 2.0% | Naspers Ltd, Cl N | | | 2.0% | Meituan, Cl B | | | 1.5% | HDFC Bank Ltd ADR | | | 1.5% | Emaar Properties PJSC | | | 1.4% | Kia Corp | | | 1.3% | Itau Unibanco Holding SA ADR | | | 1.3% |

| Footnote | Description | Footnote(A) | Cash Equivalents are not shown in the top ten chart. |

|

|

| C000017608 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Fixed Income Fund

|

|

| Class Name |

Class F

|

|

| Trading Symbol |

SEFIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the International Fixed Income Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

International Fixed Income Fund, Class F Shares | $51 | 0.98%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.96%. |

|

|

| Expenses Paid, Amount |

$ 51

|

|

| Expense Ratio, Percent |

0.98%

|

[6] |

| AssetsNet |

$ 357,360,000

|

|

| Holdings Count | Holding |

1,237

|

|

| Advisory Fees Paid, Amount |

$ 552

|

|

| InvestmentCompanyPortfolioTurnover |

50.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $357,360 | 1,237 | $552 | 50% |

|---|

|

|

| Holdings [Text Block] |

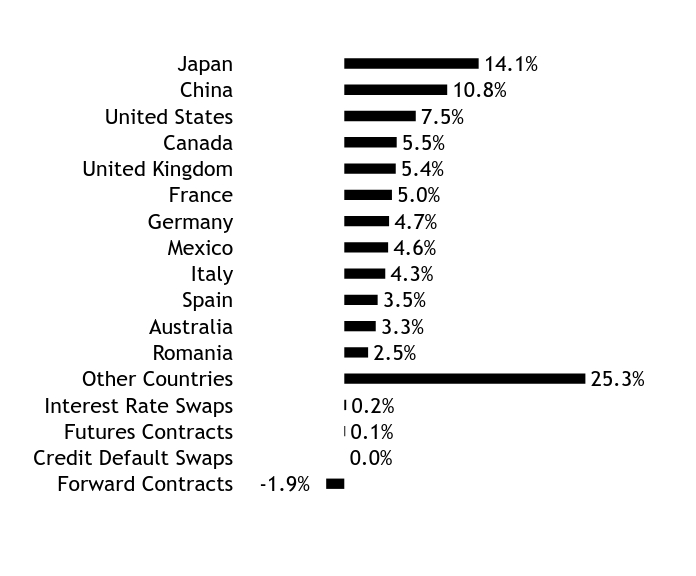

Country WeightingsFootnote Reference*Value | Value |

|---|

Forward Contracts | -1.9% | Credit Default Swaps | 0.0% | Futures Contracts | 0.1% | Interest Rate Swaps | 0.2% | Other Countries | 25.3% | Romania | 2.5% | Australia | 3.3% | Spain | 3.5% | Italy | 4.3% | Mexico | 4.6% | Germany | 4.7% | France | 5.0% | United Kingdom | 5.4% | Canada | 5.5% | United States | 7.5% | China | 10.8% | Japan | 14.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Bill | 4.236%

| 06/26/25

| 2.1% | Bank of China | 3.200%

| 10/18/25

| 1.7% | Japan Government Thirty Year Bond | 2.300%

| 03/20/40

| 1.5% | Kingdom of Belgium Government Bond | 3.100%

| 06/22/35

| 1.4% | Colombian TES | 6.000%

| 04/28/28

| 1.4% | China Government Bond | 2.550%

| 10/15/28

| 1.4% | Industrial & Commercial Bank of China | 3.200%

| 10/25/25

| 1.3% | European Union Bill | 0.000%

| 05/09/25

| 1.2% | Italy Buoni Poliennali Del Tesoro | 3.350%

| 07/01/29

| 1.2% | Japan Treasury Discount Bill | 0.000%

| 05/12/25

| 1.2% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

|

| C000147408 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

International Fixed Income Fund

|

|

| Class Name |

Class Y

|

|

| Trading Symbol |

SIFIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class Y Shares of the International Fixed Income Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

International Fixed Income Fund, Class Y Shares | $38 | 0.73%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.71%. |

|

|

| Expenses Paid, Amount |

$ 38

|

|

| Expense Ratio, Percent |

0.73%

|

[7] |

| AssetsNet |

$ 357,360,000

|

|

| Holdings Count | Holding |

1,237

|

|

| Advisory Fees Paid, Amount |

$ 552

|

|

| InvestmentCompanyPortfolioTurnover |

50.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $357,360 | 1,237 | $552 | 50% |

|---|

|

|

| Holdings [Text Block] |

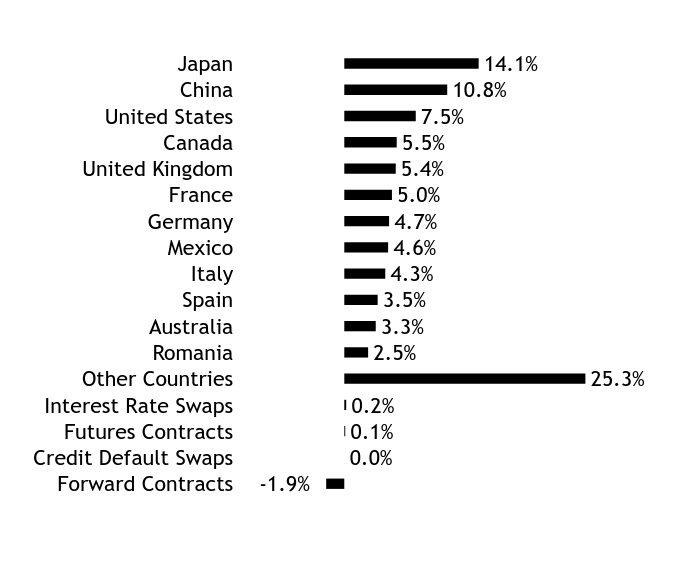

Country WeightingsFootnote Reference*Value | Value |

|---|

Forward Contracts | -1.9% | Credit Default Swaps | 0.0% | Futures Contracts | 0.1% | Interest Rate Swaps | 0.2% | Other Countries | 25.3% | Romania | 2.5% | Australia | 3.3% | Spain | 3.5% | Italy | 4.3% | Mexico | 4.6% | Germany | 4.7% | France | 5.0% | United Kingdom | 5.4% | Canada | 5.5% | United States | 7.5% | China | 10.8% | Japan | 14.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

U.S. Treasury Bill | 4.236%

| 06/26/25

| 2.1% | Bank of China | 3.200%

| 10/18/25

| 1.7% | Japan Government Thirty Year Bond | 2.300%

| 03/20/40

| 1.5% | Kingdom of Belgium Government Bond | 3.100%

| 06/22/35

| 1.4% | Colombian TES | 6.000%

| 04/28/28

| 1.4% | China Government Bond | 2.550%

| 10/15/28

| 1.4% | Industrial & Commercial Bank of China | 3.200%

| 10/25/25

| 1.3% | European Union Bill | 0.000%

| 05/09/25

| 1.2% | Italy Buoni Poliennali Del Tesoro | 3.350%

| 07/01/29

| 1.2% | Japan Treasury Discount Bill | 0.000%

| 05/12/25

| 1.2% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

|

| C000017610 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Emerging Markets Debt Fund

|

|

| Class Name |

Class F

|

|

| Trading Symbol |

SITEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class F Shares of the Emerging Markets Debt Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Emerging Markets Debt Fund, Class F Shares | $54 | 1.08%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 1.06%. |

|

|

| Expenses Paid, Amount |

$ 54

|

|

| Expense Ratio, Percent |

1.08%

|

[8] |

| AssetsNet |

$ 901,293,000

|

|

| Holdings Count | Holding |

893

|

|

| Advisory Fees Paid, Amount |

$ 1,736

|

|

| InvestmentCompanyPortfolioTurnover |

101.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $901,293 | 893 | $1,736 | 101% |

|---|

|

|

| Holdings [Text Block] |

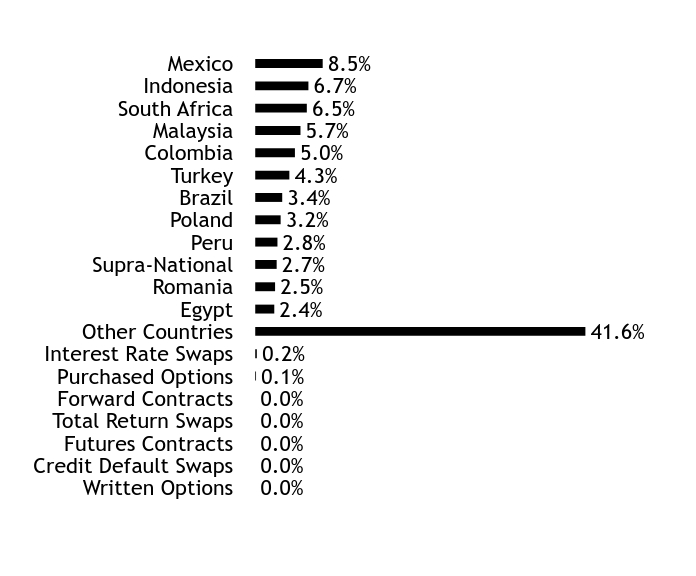

Country WeightingsFootnote Reference*Value | Value |

|---|

Written Options | 0.0% | Credit Default Swaps | 0.0% | Futures Contracts | 0.0% | Total Return Swaps | 0.0% | Forward Contracts | 0.0% | Purchased Options | 0.1% | Interest Rate Swaps | 0.2% | Other Countries | 41.6% | Egypt | 2.4% | Romania | 2.5% | Supra-National | 2.7% | Peru | 2.8% | Poland | 3.2% | Brazil | 3.4% | Turkey | 4.3% | Colombia | 5.0% | Malaysia | 5.7% | South Africa | 6.5% | Indonesia | 6.7% | Mexico | 8.5% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

Indonesia Treasury Bond | 6.750%

| 07/15/35

| 1.0% | Mexican Bonos | 8.500%

| 03/02/28

| 0.9% | Republic of South Africa Government Bond, ZAR | 8.750%

| 01/31/44

| 0.9% | Malaysia Government Bond, MYR | 3.955%

| 09/15/25

| 0.9% | Peru Government Bond | 5.400%

| 08/12/34

| 0.8% | Petroleos Mexicanos | 7.690%

| 01/23/50

| 0.8% | Mexican Bonos, MXN | 7.750%

| 11/13/42

| 0.8% | Republic of South Africa Government Bond, ZAR | 8.000%

| 01/31/30

| 0.8% | Republic of South Africa Government Bond, ZAR | 8.750%

| 02/28/48

| 0.8% | Petroleos Mexicanos | 6.750%

| 09/21/47

| 0.8% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

|

| C000147410 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Emerging Markets Debt Fund

|

|

| Class Name |

Class Y

|

|

| Trading Symbol |

SIEDX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Class Y Shares of the Emerging Markets Debt Fund (the "Fund") for the period from October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports. You can also request this information by contacting us at 610-676-1000.

|

|

| Additional Information Phone Number |

610-676-1000

|

|

| Additional Information Website |

https://www.seic.com/mutual-fund-documentation/prospectuses-and-reports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last six months?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Emerging Markets Debt Fund, Class Y Shares | $41 | 0.83%Footnote Reference(1) |

|---|

| Footnote | Description | Footnote(1) | The expense ratio includes a proxy fee expense. Had this expense been excluded the ratio would have been 0.81%. |

|

|

| Expenses Paid, Amount |

$ 41

|

|

| Expense Ratio, Percent |

0.83%

|

[9] |

| AssetsNet |

$ 901,293,000

|

|

| Holdings Count | Holding |

893

|

|

| Advisory Fees Paid, Amount |

$ 1,736

|

|

| InvestmentCompanyPortfolioTurnover |

101.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets (000's) | Number of Holdings | Total Advisory Fees Paid (000's) | Portfolio Turnover Rate |

|---|

| $901,293 | 893 | $1,736 | 101% |

|---|

|

|

| Holdings [Text Block] |

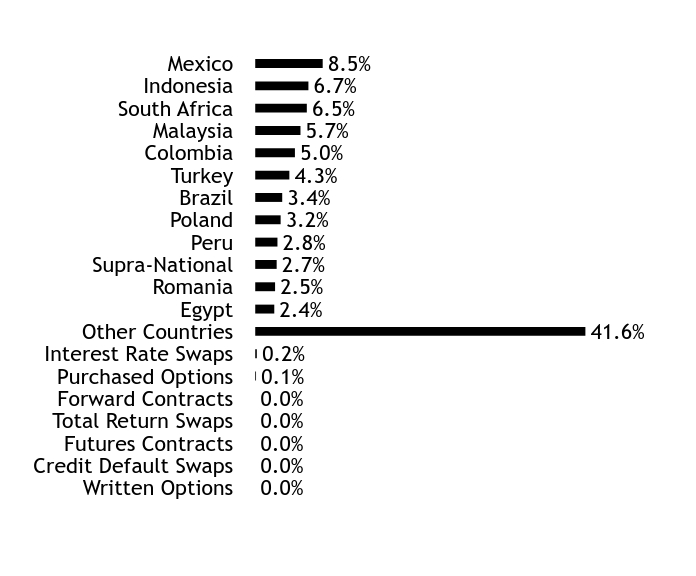

Country WeightingsFootnote Reference*Value | Value |

|---|

Written Options | 0.0% | Credit Default Swaps | 0.0% | Futures Contracts | 0.0% | Total Return Swaps | 0.0% | Forward Contracts | 0.0% | Purchased Options | 0.1% | Interest Rate Swaps | 0.2% | Other Countries | 41.6% | Egypt | 2.4% | Romania | 2.5% | Supra-National | 2.7% | Peru | 2.8% | Poland | 3.2% | Brazil | 3.4% | Turkey | 4.3% | Colombia | 5.0% | Malaysia | 5.7% | South Africa | 6.5% | Indonesia | 6.7% | Mexico | 8.5% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

|

| Largest Holdings [Text Block] |

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net AssetsFootnote Reference(A) |

|---|

Indonesia Treasury Bond | 6.750%

| 07/15/35

| 1.0% | Mexican Bonos | 8.500%

| 03/02/28

| 0.9% | Republic of South Africa Government Bond, ZAR | 8.750%

| 01/31/44

| 0.9% | Malaysia Government Bond, MYR | 3.955%

| 09/15/25

| 0.9% | Peru Government Bond | 5.400%

| 08/12/34

| 0.8% | Petroleos Mexicanos | 7.690%

| 01/23/50

| 0.8% | Mexican Bonos, MXN | 7.750%

| 11/13/42

| 0.8% | Republic of South Africa Government Bond, ZAR | 8.000%

| 01/31/30

| 0.8% | Republic of South Africa Government Bond, ZAR | 8.750%

| 02/28/48

| 0.8% | Petroleos Mexicanos | 6.750%

| 09/21/47

| 0.8% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

|

|

|