Shareholder Report

|

12 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Victory Portfolios IV

|

|

| Entity Central Index Key |

0002042316

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Mar. 31, 2025

|

|

| C000256497 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Fundamental Growth Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

PIGFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Fundamental Growth Fund (the “Fund”) (successor to Pioneer Fundamental Growth Fund) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class A* |

$99 |

0.99% |

|

|

| Expenses Paid, Amount |

$ 99

|

|

| Expense Ratio, Percent |

0.99%

|

|

| Factors Affecting Performance [Text Block] |

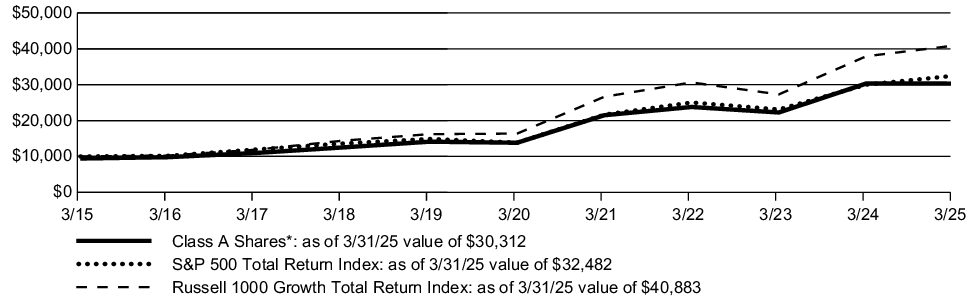

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class A shares at NAV returned (0.08)%. For the same period, the Fund’s broad-based benchmark, the S&P 500 Total Return Index, returned 8.25%. The performance benchmark, the Russell 1000 Growth Total Return Index, returned 7.76% over the period. -

Sector allocation was a slight detractor with the Fund’s underweight to communication services and consumer staples detracting from performance while being mostly offset by positive contributions from an overweight in the consumer discretionary and financial sector. -

Stock selection detracted from performance with underweight positions in the outperforming stocks of Apple and NVIDIA detracting from performance over the period. An underweight position in the underperforming Microsoft and a position in outperforming out of benchmark stock Intercontinental Exchange contributed positively to performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $10,000 investment made in Class A shares of the Fund at public offering price during the periods shown, compared to that of the S&P 500 Total Return Index and the Russell 1000 Growth Total Return Index. GROWTH OF $10,000

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class A shares of Victory Pioneer Fundamental Growth Fund is the performance of Class A shares of the Predecessor Fund, and has been restated to reflect differences in any applicable sales charges, but not differences in expenses. |

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class A* (with sales charge) |

-5.83% |

15.64% |

11.73% |

| Class A* (without sales charge) |

-0.08% |

17.01% |

12.39% |

| S&P 500 Total Return Index |

8.25% |

18.59% |

12.50% |

| Russell 1000 Growth Total Return Index |

7.76% |

20.09% |

15.12% |

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class A shares of Victory Pioneer Fundamental Growth Fund is the performance of Class A shares of the Predecessor Fund, and has been restated to reflect differences in any applicable sales charges, but not differences in expenses. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 6,728,910,320

|

|

| Holdings Count | Holding |

38

|

[1] |

| Advisory Fees Paid, Amount |

$ 45,664,694

|

|

| Investment Company Portfolio Turnover |

26.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$6,728,910,320% |

| Total number of portfolio holdings |

38^^ |

| Total advisory fee paid |

$45,664,694 |

| Portfolio turnover rate |

26% |

| ^^ |

Excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

SECTOR DISTRIBUTION

(as of March 31, 2025 )*

| Information Technology |

38.7% |

| Consumer Discretionary |

18.9% |

| Financials |

13.3% |

| Health Care |

12.8% |

| Industrials |

9.7% |

| Communication Services |

6.6% |

| * |

As a percentage of total investments excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. In the Reorganization, shareholders holding Class A shares of the Predecessor Fund received Class A shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| C000256499 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Fundamental Growth Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

FUNCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Fundamental Growth Fund (the “Fund”) (successor to Pioneer Fundamental Growth Fund) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class C* |

$171 |

1.72% |

|

|

| Expenses Paid, Amount |

$ 171

|

|

| Expense Ratio, Percent |

1.72%

|

|

| Factors Affecting Performance [Text Block] |

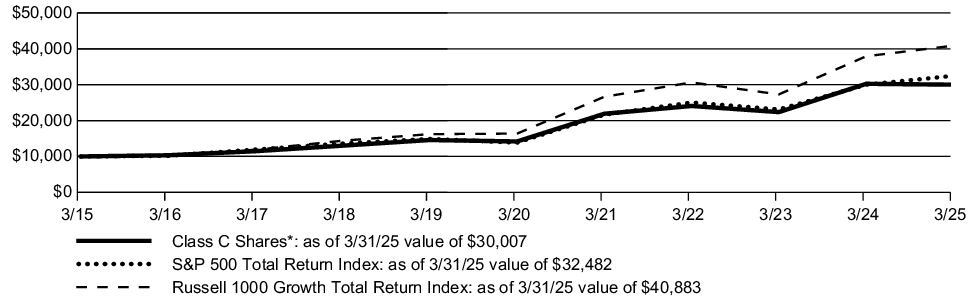

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class C shares at NAV returned (0.82)%. For the same period, the Fund’s broad-based benchmark, the S&P 500 Total Return Index, returned 8.25%. The performance benchmark, the Russell 1000 Growth Total Return Index, returned 7.76% over the period. -

Sector allocation was a slight detractor with the Fund’s underweight to communication services and consumer staples detracting from performance while being mostly offset by positive contributions from an overweight in the consumer discretionary and financial sector. -

Stock selection detracted from performance with underweight positions in the outperforming stocks of Apple and NVIDIA detracting from performance over the period. An underweight position in the underperforming Microsoft and a position in outperforming out of benchmark stock Intercontinental Exchange contributed positively to performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $10,000 investment made in Class C shares of the Fund during the periods shown, compared to that of the S&P 500 Total Return Index and the Russell 1000 Growth Total Return Index. GROWTH OF $10,000

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class C shares of Victory Pioneer Fundamental Growth Fund is the performance of Class C shares of the Predecessor Fund, and has been restated to reflect differences in any applicable sales charges, but not differences in expenses. |

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class C* (with contingent deferred sales charge) |

-1.75% |

16.17% |

11.61% |

| Class C* (without contingent deferred sales charge) |

-0.82% |

16.17% |

11.61% |

| S&P 500 Total Return Index |

8.25% |

18.59% |

12.50% |

| Russell 1000 Growth Total Return Index |

7.76% |

20.09% |

15.12% |

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class C shares of Victory Pioneer Fundamental Growth Fund is the performance of Class C shares of the Predecessor Fund, and has been restated to reflect differences in any applicable sales charges, but not differences in expenses. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 6,728,910,320

|

|

| Holdings Count | Holding |

38

|

[2] |

| Advisory Fees Paid, Amount |

$ 45,664,694

|

|

| Investment Company Portfolio Turnover |

26.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$6,728,910,320% |

| Total number of portfolio holdings |

38^^ |

| Total advisory fee paid |

$45,664,694 |

| Portfolio turnover rate |

26% |

| ^^ |

Excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

SECTOR DISTRIBUTION

(as of March 31, 2025 )*

| Information Technology |

38.7% |

| Consumer Discretionary |

18.9% |

| Financials |

13.3% |

| Health Care |

12.8% |

| Industrials |

9.7% |

| Communication Services |

6.6% |

| * |

As a percentage of total investments excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. In the Reorganization, shareholders holding Class C shares of the Predecessor Fund received Class C shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| C000256495 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Fundamental Growth Fund

|

|

| Class Name |

Class R

|

|

| Trading Symbol |

PFGRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Fundamental Growth Fund (the “Fund”) (successor to Pioneer Fundamental Growth Fund) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R* |

$139 |

1.39% |

|

|

| Expenses Paid, Amount |

$ 139

|

|

| Expense Ratio, Percent |

1.39%

|

|

| Factors Affecting Performance [Text Block] |

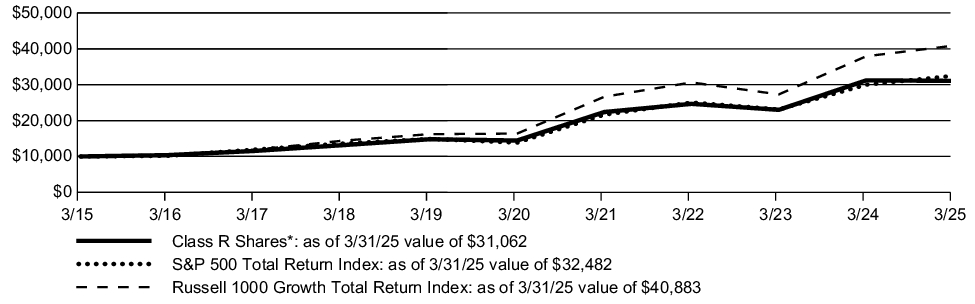

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class R shares at NAV returned (0.49)%. For the same period, the Fund’s broad-based benchmark, the S&P 500 Total Return Index, returned 8.25%. The performance benchmark, the Russell 1000 Growth Total Return Index, returned 7.76% over the period. -

Sector allocation was a slight detractor with the Fund’s underweight to communication services and consumer staples detracting from performance while being mostly offset by positive contributions from an overweight in the consumer discretionary and financial sector. -

Stock selection detracted from performance with underweight positions in the outperforming stocks of Apple and NVIDIA detracting from performance over the period. An underweight position in the underperforming Microsoft and a position in outperforming out of benchmark stock Intercontinental Exchange contributed positively to performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $10,000 investment made in Class R shares of the Fund during the periods shown, compared to that of the S&P 500 Total Return Index and the Russell 1000 Growth Total Return Index. GROWTH OF $10,000

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class R shares of Victory Pioneer Fundamental Growth Fund is the performance of Class R shares of the Predecessor Fund, and has not been restated to reflect differences in expenses. |

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class R* |

-0.49% |

16.56% |

12.00% |

| S&P 500 Total Return Index |

8.25% |

18.59% |

12.50% |

| Russell 1000 Growth Total Return Index |

7.76% |

20.09% |

15.12% |

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class R shares of Victory Pioneer Fundamental Growth Fund is the performance of Class R shares of the Predecessor Fund, and has not been restated to reflect differences in expenses. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 6,728,910,320

|

|

| Holdings Count | Holding |

38

|

[3] |

| Advisory Fees Paid, Amount |

$ 45,664,694

|

|

| Investment Company Portfolio Turnover |

26.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$6,728,910,320% |

| Total number of portfolio holdings |

38^^ |

| Total advisory fee paid |

$45,664,694 |

| Portfolio turnover rate |

26% |

| ^^ |

Excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

SECTOR DISTRIBUTION

(as of March 31, 2025 )*

| Information Technology |

38.7% |

| Consumer Discretionary |

18.9% |

| Financials |

13.3% |

| Health Care |

12.8% |

| Industrials |

9.7% |

| Communication Services |

6.6% |

| * |

As a percentage of total investments excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. In the Reorganization, shareholders holding Class R shares of the Predecessor Fund received Class R shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| C000256496 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Fundamental Growth Fund

|

|

| Class Name |

Class R6

|

|

| Trading Symbol |

PFGKX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Fundamental Growth Fund (the “Fund”) (successor to Pioneer Fundamental Growth Fund) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R6* |

$65 |

0.65% |

|

|

| Expenses Paid, Amount |

$ 65

|

|

| Expense Ratio, Percent |

0.65%

|

|

| Factors Affecting Performance [Text Block] |

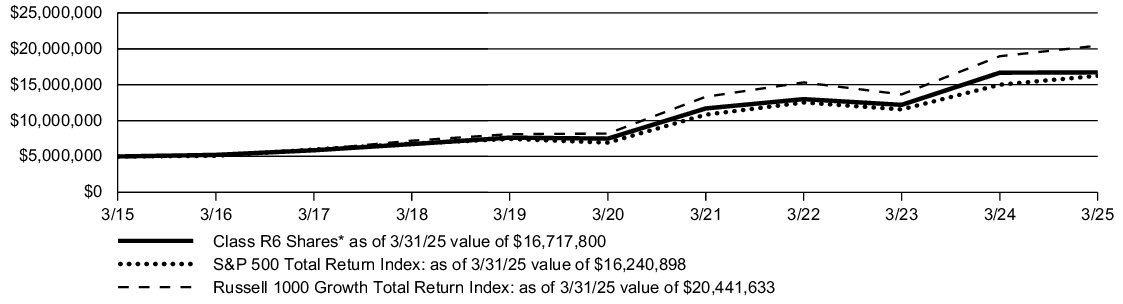

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class R6 shares* at NAV returned 0.27%. For the same period, the Fund’s broad-based benchmark, the S&P 500 Total Return Index, returned 8.25%. The performance benchmark, the Russell 1000 Growth Total Return Index, returned 7.76% over the period. -

Sector allocation was a slight detractor with the Fund’s underweight to communication services and consumer staples detracting from performance while being mostly offset by positive contributions from an overweight in the consumer discretionary and financial sector. -

Stock selection detracted from performance with underweight positions in the outperforming stocks of Apple and NVIDIA detracting from performance over the period. An underweight position in the underperforming Microsoft and a position in outperforming out of benchmark stock Intercontinental Exchange contributed positively to performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $5 million investment made in Class R6 shares* of the Fund during the periods shown, compared to that of the S&P 500 Total Return Index and the Russell 1000 Growth Total Return Index. GROWTH OF $5 million

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class R6 shares of Victory Pioneer Fundamental Growth Fund is the performance of Class K shares of the Predecessor Fund, and has not been restated to reflect differences in expenses. |

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class R6* |

0.27% |

17.43% |

12.83% |

| S&P 500 Total Return Index |

8.25% |

18.59% |

12.50% |

| Russell 1000 Growth Total Return Index |

7.76% |

20.09% |

15.12% |

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class R6 shares of Victory Pioneer Fundamental Growth Fund is the performance of Class K shares of the Predecessor Fund, and has not been restated to reflect differences in expenses. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 6,728,910,320

|

|

| Holdings Count | Holding |

38

|

[4] |

| Advisory Fees Paid, Amount |

$ 45,664,694

|

|

| Investment Company Portfolio Turnover |

26.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$6,728,910,320% |

| Total number of portfolio holdings |

38^^ |

| Total advisory fee paid |

$45,664,694 |

| Portfolio turnover rate |

26% |

| ^^ |

Excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

SECTOR DISTRIBUTION

(as of March 31, 2025 )*

| Information Technology |

38.7% |

| Consumer Discretionary |

18.9% |

| Financials |

13.3% |

| Health Care |

12.8% |

| Industrials |

9.7% |

| Communication Services |

6.6% |

| * |

As a percentage of total investments excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. In the Reorganization, shareholders holding Class K shares of the Predecessor Fund received Class R6 shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| C000256498 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Fundamental Growth Fund

|

|

| Class Name |

Class Y

|

|

| Trading Symbol |

FUNYX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Fundamental Growth Fund (the “Fund”) (successor to Pioneer Fundamental Growth Fund) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class Y* |

$76 |

0.76% |

|

|

| Expenses Paid, Amount |

$ 76

|

|

| Expense Ratio, Percent |

0.76%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class Y shares at NAV returned 0.15%. For the same period, the Fund’s broad-based benchmark, the S&P 500 Total Return Index, returned 8.25%. The performance benchmark, the Russell 1000 Growth Total Return Index, returned 7.76% over the period. -

Sector allocation was a slight detractor with the Fund’s underweight to communication services and consumer staples detracting from performance while being mostly offset by positive contributions from an overweight in the consumer discretionary and financial sector. -

Stock selection detracted from performance with underweight positions in the outperforming stocks of Apple and NVIDIA detracting from performance over the period. An underweight position in the underperforming Microsoft and a position in outperforming out of benchmark stock Intercontinental Exchange contributed positively to performance.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

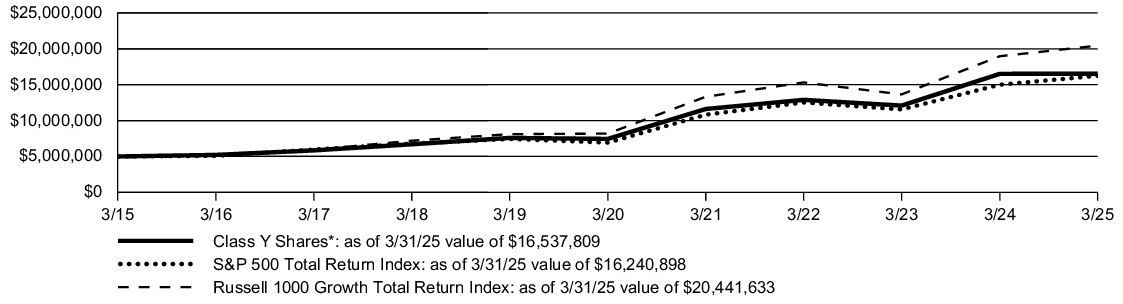

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $5 million investment made in Class Y shares of the Fund during the periods shown, compared to that of the S&P 500 Total Return Index and the Russell 1000 Growth Total Return Index. GROWTH OF $5 million

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class Y shares of Victory Pioneer Fundamental Growth Fund is the performance of Class Y shares of the Predecessor Fund, and has not been restated to reflect differences in expenses. |

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class Y* |

0.15% |

17.30% |

12.71% |

| S&P 500 Total Return Index |

8.25% |

18.59% |

12.50% |

| Russell 1000 Growth Total Return Index |

7.76% |

20.09% |

15.12% |

| * |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the "Predecessor Fund") reorganized with Victory Pioneer Fundamental Growth Fund (the "Reorganization") pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund's performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. The performance of Class Y shares of Victory Pioneer Fundamental Growth Fund is the performance of Class Y shares of the Predecessor Fund, and has not been restated to reflect differences in expenses. |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 6,728,910,320

|

|

| Holdings Count | Holding |

38

|

[5] |

| Advisory Fees Paid, Amount |

$ 45,664,694

|

|

| Investment Company Portfolio Turnover |

26.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$6,728,910,320% |

| Total number of portfolio holdings |

38^^ |

| Total advisory fee paid |

$45,664,694 |

| Portfolio turnover rate |

26% |

| ^^ |

Excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

SECTOR DISTRIBUTION

(as of March 31, 2025 )*

| Information Technology |

38.7% |

| Consumer Discretionary |

18.9% |

| Financials |

13.3% |

| Health Care |

12.8% |

| Industrials |

9.7% |

| Communication Services |

6.6% |

| * |

As a percentage of total investments excluding short-term investments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund. In the Reorganization, shareholders holding Class Y shares of the Predecessor Fund received Class Y shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective May 2, 2025, after the end of the annual reporting period covered by this report, Pioneer Fundamental Growth Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Fundamental Growth Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization which was approved by the shareholders of the Predecessor Fund on April 29, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of Victory Pioneer Fundamental Growth Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser (the “Transaction”). All portfolio managers of Amundi US became employees of the Adviser.

|

|

| C000256539 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Multi-Asset Ultrashort Income Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

MAFRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class A |

$60 |

0.58% |

|

|

| Expenses Paid, Amount |

$ 60

|

|

| Expense Ratio, Percent |

0.58%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class A shares at NAV returned 5.85%. For the same period, the Fund’s broad-based benchmark, the Bloomberg U.S. Aggregate Bond Total Return Index, returned 4.88%. The performance benchmark, the ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index, returned 4.97% over the period. -

The Fund’s credit positioning contributed to returns. Credit spreads compressed across the majority of the sectors where the portfolio invests. -

The Fund’s securitized credit allocations were strong performers, with the allocation to Asset-Backed Securities (ABS) experiencing the largest gain. Within Investment Grade (IG) Corporate exposures, financials and industrials relatively outperformed utilities, benefitting the portfolio’s overweight position. Bank Loans and catastrophe bonds also contributed to relative returns. -

Cash allocations detracted from returns as most non-cash assets outperformed. There were no other major detractors for the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $10,000 investment made in Class A shares of the Fund during the periods shown, compared to that of the Bloomberg U.S. Aggregate Bond Total Return Index and the ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index. GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class A |

5.85% |

4.46% |

2.46% |

| Bloomberg U.S. Aggregate Bond Total Return Index |

4.88% |

-0.40% |

1.46% |

| ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index |

4.97% |

2.56% |

1.87% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 7,798,048,490

|

|

| Holdings Count | Holding |

1,165

|

[6] |

| Advisory Fees Paid, Amount |

$ 18,848,079

|

|

| Investment Company Portfolio Turnover |

53.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$7,798,048,490% |

| Total number of portfolio holdings |

1,165^^ |

| Total advisory fee paid |

$18,848,079 |

| Portfolio turnover rate |

53% |

| ^^ |

Excluding short-term investments, TBA sales commitments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

PORTFOLIO DIVERSIFICATION

(as of March 31, 2025 ) *

| Corporate Bonds |

39.5% |

| Asset Backed Securities |

29.9% |

| Collateralized Mortgage Obligations |

11.6% |

| Commercial Mortgage-Backed Securities |

11.1% |

| U.S. Government and Agency Obligations |

5.1% |

| Senior Secured Floating Rate Loan Interests |

2.4% |

| Insurance-Linked Securities |

0.4% |

| * |

As a percentage of total investments excluding short-term investments, TBA sales commitments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective April 1, 2025, after the end of the annual reporting period covered by this report, Pioneer Multi-Asset Ultrashort Income Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization approved by the shareholders of the Predecessor Fund on March 27, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of the Fund. In the Reorganization, shareholders holding Class A shares of the Predecessor Fund received Class A shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser. All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective April 1, 2025, after the end of the annual reporting period covered by this report, Pioneer Multi-Asset Ultrashort Income Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization approved by the shareholders of the Predecessor Fund on March 27, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of the Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser. All portfolio managers of Amundi US became employees of the Adviser.

|

|

| C000256540 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Multi-Asset Ultrashort Income Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

MAUCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class C |

$92 |

0.90% |

|

|

| Expenses Paid, Amount |

$ 92

|

|

| Expense Ratio, Percent |

0.90%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class C shares at NAV returned 5.51%. For the same period, the Fund’s broad-based benchmark, the Bloomberg U.S. Aggregate Bond Total Return Index, returned 4.88%. The performance benchmark, the ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index, returned 4.97% over the period. -

The Fund’s credit positioning contributed to returns. Credit spreads compressed across the majority of the sectors where the portfolio invests. -

The Fund’s securitized credit allocations were strong performers, with the allocation to Asset-Backed Securities (ABS) experiencing the largest gain. Within Investment Grade (IG) Corporate exposures, financials and industrials relatively outperformed utilities, benefitting the portfolio’s overweight position. Bank Loans and catastrophe bonds also contributed to relative returns. -

Cash allocations detracted from returns as most non-cash assets outperformed. There were no other major detractors for the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

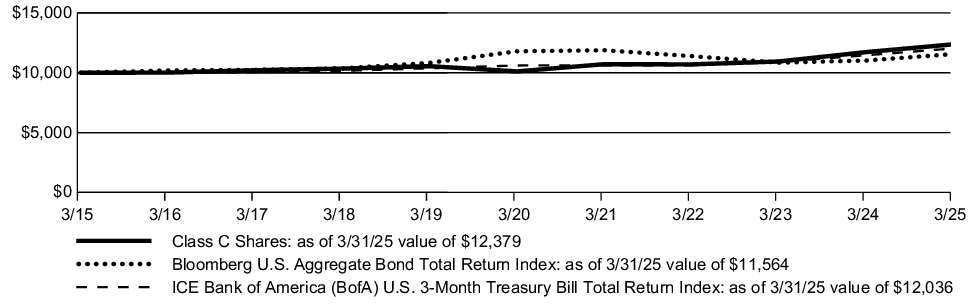

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $10,000 investment made in Class C shares of the Fund during the periods shown, compared to that of the Bloomberg U.S. Aggregate Bond Total Return Index and the ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index. GROWTH OF $10,000

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class C |

5.51% |

4.13% |

2.16% |

| Bloomberg U.S. Aggregate Bond Total Return Index |

4.88% |

-0.40% |

1.46% |

| ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index |

4.97% |

2.56% |

1.87% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 7,798,048,490

|

|

| Holdings Count | Holding |

1,165

|

[7] |

| Advisory Fees Paid, Amount |

$ 18,848,079

|

|

| Investment Company Portfolio Turnover |

53.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$7,798,048,490% |

| Total number of portfolio holdings |

1,165^^ |

| Total advisory fee paid |

$18,848,079 |

| Portfolio turnover rate |

53% |

| ^^ |

Excluding short-term investments, TBA sales commitments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

PORTFOLIO DIVERSIFICATION

(as of March 31, 2025 ) *

| Corporate Bonds |

39.5% |

| Asset Backed Securities |

29.9% |

| Collateralized Mortgage Obligations |

11.6% |

| Commercial Mortgage-Backed Securities |

11.1% |

| U.S. Government and Agency Obligations |

5.1% |

| Senior Secured Floating Rate Loan Interests |

2.4% |

| Insurance-Linked Securities |

0.4% |

| * |

As a percentage of total investments excluding short-term investments, TBA sales commitments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective April 1, 2025, after the end of the annual reporting period covered by this report, Pioneer Multi-Asset Ultrashort Income Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization approved by the shareholders of the Predecessor Fund on March 27, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of the Fund. In the Reorganization, shareholders holding Class C shares and Class C2 shares of the Predecessor Fund received Class C shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser. All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective April 1, 2025, after the end of the annual reporting period covered by this report, Pioneer Multi-Asset Ultrashort Income Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization approved by the shareholders of the Predecessor Fund on March 27, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of the Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser. All portfolio managers of Amundi US became employees of the Adviser.

|

|

| C000256541 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Multi-Asset Ultrashort Income Fund

|

|

| Class Name |

Class R6

|

|

| Trading Symbol |

MAUKX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class R6 |

$36 |

0.35% |

|

|

| Expenses Paid, Amount |

$ 36

|

|

| Expense Ratio, Percent |

0.35%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class R6 shares at NAV returned 6.09%. For the same period, the Fund’s broad-based benchmark, the Bloomberg U.S. Aggregate Bond Total Return Index, returned 4.88%. The performance benchmark, the ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index, returned 4.97% over the period. -

The Fund’s credit positioning contributed to returns. Credit spreads compressed across the majority of the sectors where the portfolio invests. -

The Fund’s securitized credit allocations were strong performers, with the allocation to Asset-Backed Securities (ABS) experiencing the largest gain. Within Investment Grade (IG) Corporate exposures, financials and industrials relatively outperformed utilities, benefitting the portfolio’s overweight position. Bank Loans and catastrophe bonds also contributed to relative returns. -

Cash allocations detracted from returns as most non-cash assets outperformed. There were no other major detractors for the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $5 million investment made in Class R6 shares of the Fund during the periods shown, compared to that of the Bloomberg U.S. Aggregate Bond Total Return Index and the ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index. GROWTH OF $5 million

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class R6 |

6.09% |

4.70% |

2.71% |

| Bloomberg U.S. Aggregate Bond Total Return Index |

4.88% |

-0.40% |

1.46% |

| ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index |

4.97% |

2.56% |

1.87% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 7,798,048,490

|

|

| Holdings Count | Holding |

1,165

|

[8] |

| Advisory Fees Paid, Amount |

$ 18,848,079

|

|

| Investment Company Portfolio Turnover |

53.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$7,798,048,490% |

| Total number of portfolio holdings |

1,165^^ |

| Total advisory fee paid |

$18,848,079 |

| Portfolio turnover rate |

53% |

| ^^ |

Excluding short-term investments, TBA sales commitments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

PORTFOLIO DIVERSIFICATION

(as of March 31, 2025 ) *

| Corporate Bonds |

39.5% |

| Asset Backed Securities |

29.9% |

| Collateralized Mortgage Obligations |

11.6% |

| Commercial Mortgage-Backed Securities |

11.1% |

| U.S. Government and Agency Obligations |

5.1% |

| Senior Secured Floating Rate Loan Interests |

2.4% |

| Insurance-Linked Securities |

0.4% |

| * |

As a percentage of total investments excluding short-term investments, TBA sales commitments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective April 1, 2025, after the end of the annual reporting period covered by this report, Pioneer Multi-Asset Ultrashort Income Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization approved by the shareholders of the Predecessor Fund on March 27, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of the Fund. In the Reorganization, shareholders holding Class K shares of the Predecessor Fund received Class R6 shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser. All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective April 1, 2025, after the end of the annual reporting period covered by this report, Pioneer Multi-Asset Ultrashort Income Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization approved by the shareholders of the Predecessor Fund on March 27, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of the Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser. All portfolio managers of Amundi US became employees of the Adviser.

|

|

| C000256538 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Victory Pioneer Multi-Asset Ultrashort Income Fund

|

|

| Class Name |

Class Y

|

|

| Trading Symbol |

MYFRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at advisor.vcm.com/literature/mutual-fund-prospectuses. You may also request more information by calling 800-225-6292.

|

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

|

| Additional Information Phone Number |

800-225-6292

|

|

| Additional Information Website |

advisor.vcm.com/literature/mutual-fund-prospectuses

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (Based on a hypothetical $10,000 investment)

| Class Name |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

| Class Y |

$45 |

0.44% |

|

|

| Expenses Paid, Amount |

$ 45

|

|

| Expense Ratio, Percent |

0.44%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year and what affected the Fund performance? -

For the fiscal year ended March 31, 2025, the Fund’s Class Y shares at NAV returned 6.00%. For the same period, the Fund’s broad-based benchmark, the Bloomberg U.S. Aggregate Bond Total Return Index, returned 4.88%. The performance benchmark, the ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index, returned 4.97% over the period. -

The Fund’s credit positioning contributed to returns. Credit spreads compressed across the majority of the sectors where the portfolio invests. -

The Fund’s securitized credit allocations were strong performers, with the allocation to Asset-Backed Securities (ABS) experiencing the largest gain. Within Investment Grade (IG) Corporate exposures, financials and industrials relatively outperformed utilities, benefitting the portfolio’s overweight position. Bank Loans and catastrophe bonds also contributed to relative returns. -

Cash allocations detracted from returns as most non-cash assets outperformed. There were no other major detractors for the period.

|

|

| Performance Past Does Not Indicate Future [Text] |

The performance data quoted represents past performance, which is no guarantee of future results.

|

|

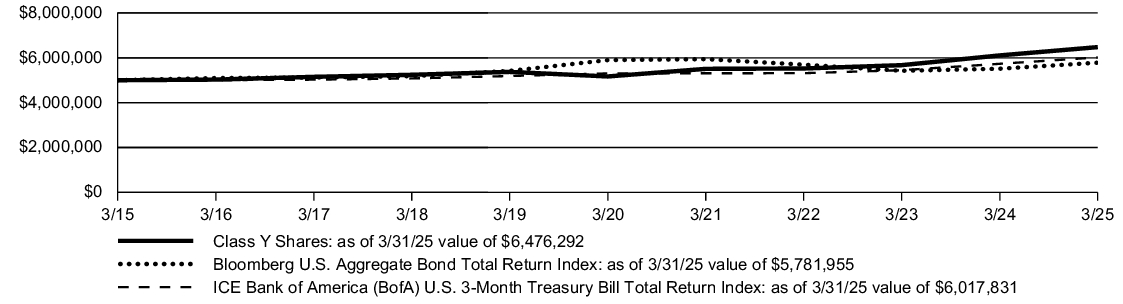

| Line Graph [Table Text Block] |

Fund Performance The line graph below shows the change in value of a $5 million investment made in Class Y shares of the Fund during the periods shown, compared to that of the Bloomberg U.S. Aggregate Bond Total Return Index and the ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index. GROWTH OF $5 million

|

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Class Y |

6.00% |

4.62% |

2.62% |

| Bloomberg U.S. Aggregate Bond Total Return Index |

4.88% |

-0.40% |

1.46% |

| ICE Bank of America (BofA) U.S. 3-Month Treasury Bill Total Return Index |

4.97% |

2.56% |

1.87% |

|

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Call 1-800-225-6292 or visit https://advisor.vcm.com/literature/mutual-fund-prospectuses for the most recent month-end performance results.

|

|

| Net Assets |

$ 7,798,048,490

|

|

| Holdings Count | Holding |

1,165

|

[9] |

| Advisory Fees Paid, Amount |

$ 18,848,079

|

|

| Investment Company Portfolio Turnover |

53.00%

|

|

| Additional Fund Statistics [Text Block] |

KEY FUND STATISTICS

(as of March 31, 2025)

| Fund net assets |

$7,798,048,490% |

| Total number of portfolio holdings |

1,165^^ |

| Total advisory fee paid |

$18,848,079 |

| Portfolio turnover rate |

53% |

| ^^ |

Excluding short-term investments, TBA sales commitments and all derivative contracts except for options purchased. |

|

|

| Holdings [Text Block] |

PORTFOLIO DIVERSIFICATION

(as of March 31, 2025 ) *

| Corporate Bonds |

39.5% |

| Asset Backed Securities |

29.9% |

| Collateralized Mortgage Obligations |

11.6% |

| Commercial Mortgage-Backed Securities |

11.1% |

| U.S. Government and Agency Obligations |

5.1% |

| Senior Secured Floating Rate Loan Interests |

2.4% |

| Insurance-Linked Securities |

0.4% |

| * |

As a percentage of total investments excluding short-term investments, TBA sales commitments and all derivative contracts except for options purchased. |

|

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective April 1, 2025, after the end of the annual reporting period covered by this report, Pioneer Multi-Asset Ultrashort Income Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization approved by the shareholders of the Predecessor Fund on March 27, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of the Fund. In the Reorganization, shareholders holding Class Y shares of the Predecessor Fund received Class Y shares of the Fund. Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser. All portfolio managers of Amundi US became employees of the Adviser.

|

|

| Material Fund Change Name [Text Block] |

Effective April 1, 2025, after the end of the annual reporting period covered by this report, Pioneer Multi-Asset Ultrashort Income Fund (the “Predecessor Fund”) reorganized with Victory Pioneer Multi-Asset Ultrashort Income Fund (the “Reorganization”) pursuant to an agreement and plan of reorganization approved by the shareholders of the Predecessor Fund on March 27, 2025. The Predecessor Fund is the accounting survivor of the Reorganization. Accordingly, the Predecessor Fund’s performance and financial history have become the performance and financial history of the Fund.

|

|

| Material Fund Change Adviser [Text Block] |

Victory Capital Management Inc. (the “Adviser”) is the Fund’s investment adviser. Effective April 1, 2025, Amundi Asset Management US, Inc. (“Amundi US”), the Predecessor Fund’s investment adviser, was combined with Victory Capital Holdings, Inc., the parent company of the Adviser. All portfolio managers of Amundi US became employees of the Adviser.

|

|

|

|