What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

CoreValues Alpha Greater China Growth ETF | $39 | 0.75% |

Key Fund Statistics

(as of March 31, 2025)

Fund Size (Thousands) | $8,525 |

Number of Holdings | 25 |

Total Advisory Fee Paid | $30,931 |

Portfolio Turnover | 59% |

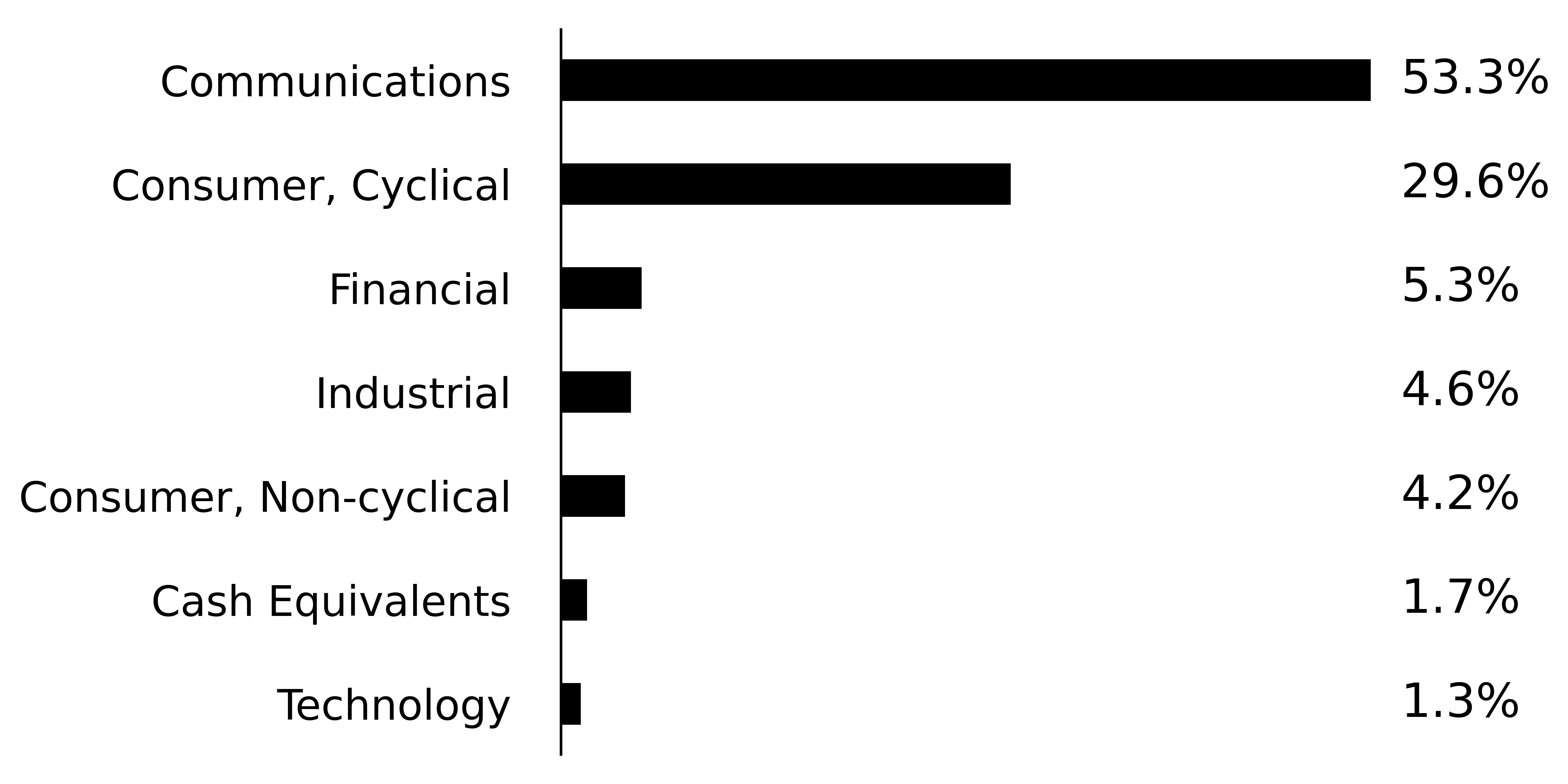

Sector Breakdown

(% of Total Net Assets)

Top Ten Holdings | (% of Total Net Assets) |

|---|---|

Xiaomi Corp. - Class B | |

Alibaba Group Holding Ltd. - ADR | |

BYD Co. Ltd. - Class H | |

Tencent Holdings Ltd. | |

PDD Holdings, Inc. - ADR | |

JD.com, Inc. - Class A | |

Pop Mart International Group Ltd. | |

Luckin Coffee, Inc. - ADR | |

Trip.com Group Ltd. - ADR | |

Full Truck Alliance Co. Ltd. - ADR |