Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

AMG Funds I

|

| Entity Central Index Key |

0000882443

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| C000130199 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Boston Common Global Impact Fund

|

| Class Name |

Class I

|

| Trading Symbol |

BRWIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Boston Common Global Impact Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Boston Common Global Impact Fund

(Class I/BRWIX) |

$44 |

0.93% |

|

| Expenses Paid, Amount |

$ 44

|

| Expense Ratio, Percent |

0.93%

|

| Net Assets |

$ 488,979,342

|

| Holdings Count | Holding |

71

|

| Advisory Fees Paid, Amount |

$ 1,911,161

|

| Investment Company Portfolio Turnover |

40.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| Fund net assets |

$488,979,342 |

| Total number of portfolio holdings |

71 |

| Net advisory fees paid |

$1,911,161 |

| Portfolio turnover rate as of the end of the reporting period |

40% |

|

| Holdings [Text Block] |

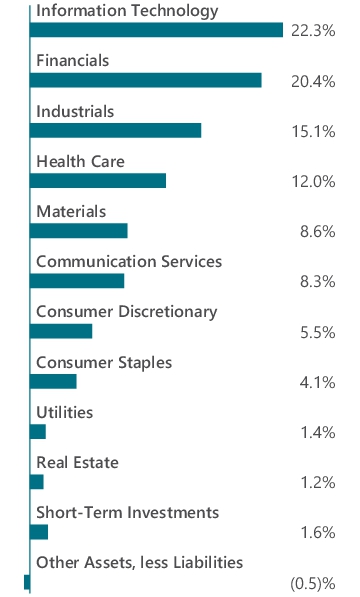

Graphical Representation of Holdings (as of March 31, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Microsoft Corp. (United States) |

3.6% |

| Apple, Inc. (United States) |

3.1% |

| Alphabet, Inc., Class A (United States) |

2.9% |

| NVIDIA Corp. (United States) |

2.7% |

| BYD Co., Ltd., Class H (China) |

2.6% |

| Netflix, Inc. (United States) |

2.5% |

| Visa, Inc., Class A (United States) |

2.5% |

| Taiwan Semiconductor Manufacturing Co., Ltd., Sponsored ADR (Taiwan) |

2.4% |

| Smurfit WestRock PLC (Ireland) |

2.4% |

| Chubb, Ltd. (Switzerland) |

2.3% |

| Top Ten as a Group |

27.0% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. (United States) |

3.6% |

| Apple, Inc. (United States) |

3.1% |

| Alphabet, Inc., Class A (United States) |

2.9% |

| NVIDIA Corp. (United States) |

2.7% |

| BYD Co., Ltd., Class H (China) |

2.6% |

| Netflix, Inc. (United States) |

2.5% |

| Visa, Inc., Class A (United States) |

2.5% |

| Taiwan Semiconductor Manufacturing Co., Ltd., Sponsored ADR (Taiwan) |

2.4% |

| Smurfit WestRock PLC (Ireland) |

2.4% |

| Chubb, Ltd. (Switzerland) |

2.3% |

| Top Ten as a Group |

27.0% |

|

| C000130200 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Veritas Global Real Return Fund

|

| Class Name |

Class I

|

| Trading Symbol |

BLUEX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Veritas Global Real Return Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Veritas Global Real Return Fund

(Class I/BLUEX) |

$58 |

1.16% |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

1.16%

|

| Net Assets |

$ 99,204,866

|

| Holdings Count | Holding |

33

|

| Advisory Fees Paid, Amount |

$ 392,523

|

| Investment Company Portfolio Turnover |

11.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| Fund net assets |

$99,204,866 |

| Total number of portfolio holdings |

33 |

| Net advisory fees paid |

$392,523 |

| Portfolio turnover rate as of the end of the reporting period |

11% |

|

| Holdings [Text Block] |

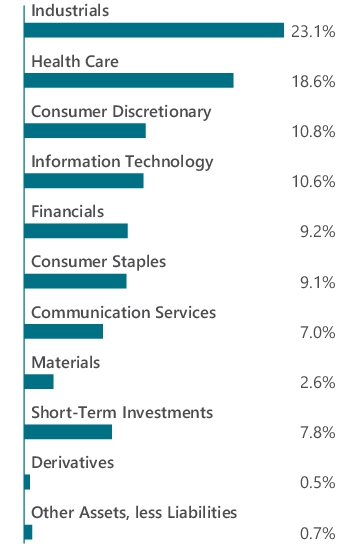

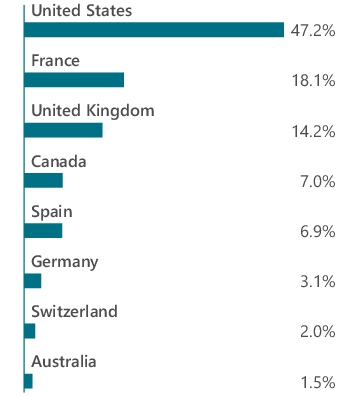

Graphical Representation of Holdings (as of March 31, 2025) Top ten holdings and portfolio breakdown are shown as a percentage of net assets of the Fund and country allocation is shown as a percentage of total long-term investments of the Fund. Top Ten Holdings

| Microsoft Corp. (United States) |

5.5% |

| Unilever PLC (United Kingdom) |

5.2% |

| Safran, S.A. (France) |

5.1% |

| Amazon.com, Inc. (United States) |

5.0% |

| Airbus SE (France) |

4.8% |

| Vinci, S.A. (France) |

4.3% |

| UnitedHealth Group, Inc. (United States) |

4.2% |

| Alphabet, Inc., Class A (United States) |

4.0% |

| Amadeus IT Group, S.A. (Spain) |

4.0% |

| Diageo PLC (United Kingdom) |

3.9% |

| Top Ten as a Group |

46.0% | Portfolio Breakdown Country Allocation

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Microsoft Corp. (United States) |

5.5% |

| Unilever PLC (United Kingdom) |

5.2% |

| Safran, S.A. (France) |

5.1% |

| Amazon.com, Inc. (United States) |

5.0% |

| Airbus SE (France) |

4.8% |

| Vinci, S.A. (France) |

4.3% |

| UnitedHealth Group, Inc. (United States) |

4.2% |

| Alphabet, Inc., Class A (United States) |

4.0% |

| Amadeus IT Group, S.A. (Spain) |

4.0% |

| Diageo PLC (United Kingdom) |

3.9% |

| Top Ten as a Group |

46.0% |

|

| C000248366 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Systematica Managed Futures Strategy Fund

|

| Class Name |

Class N

|

| Trading Symbol |

SMFNX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Systematica Managed Futures Strategy Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Systematica Managed Futures Strategy Fund

(Class N/SMFNX) |

$58 |

1.21% |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

1.21%

|

| Material Change Date |

Dec. 06, 2024

|

| Net Assets |

$ 5,596,734

|

| Holdings Count | Holding |

240

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

0.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| Fund net assets |

$5,596,734 |

| Total number of portfolio holdings |

240 |

| Net advisory fees paid |

$0 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

|

| Holdings [Text Block] |

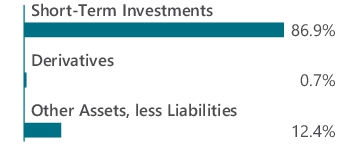

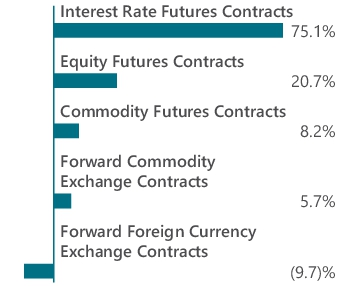

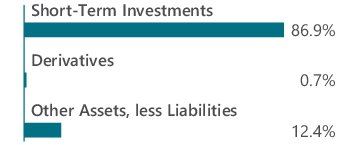

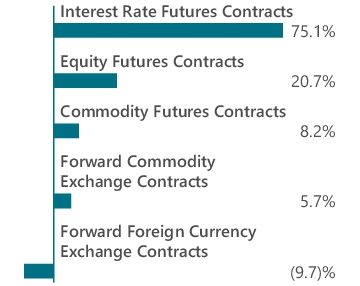

Graphical Representation of Holdings (as of March 31, 2025) The portfolio breakdown is shown as a percentage of net assets of the Fund and notional allocation is shown as a percentage of total notional value of the Fund's derivatives holdings. The portfolio breakdown and notional allocation are inclusive of the Fund's wholly-owned subsidiary. Portfolio Breakdown NOTIONAL ALLOCATION

|

| Material Fund Change [Text Block] |

Recent Fund Changes This is a summary of certain changes to the Fund since October 1, 2024. For more information, you may review the Fund's prospectus at https://wealth.amg.com/literature. The Fund's prospectus is also available without charge by calling 800.548.4539 or by sending an e-mail request to shareholderservices@amg.com. Effective December 6, 2024, AMG Funds LLC has contractually agreed, through February 1, 2026, to waive the management fee payable by the Fund by 0.30%, from 1.20% to 0.90%.

|

| Material Fund Change Expenses [Text Block] |

Effective December 6, 2024, AMG Funds LLC has contractually agreed, through February 1, 2026, to waive the management fee payable by the Fund by 0.30%, from 1.20% to 0.90%.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more information, you may review the Fund's prospectus at https://wealth.amg.com/literature. The Fund's prospectus is also available without charge by calling 800.548.4539 or by sending an e-mail request to shareholderservices@amg.com.

|

| Updated Prospectus Phone Number |

800.548.4539

|

| Updated Prospectus Email Address |

shareholderservices@amg.com

|

| Updated Prospectus Web Address |

https://wealth.amg.com/literature

|

| C000248367 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Systematica Managed Futures Strategy Fund

|

| Class Name |

Class I

|

| Trading Symbol |

SMFIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Systematica Managed Futures Strategy Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Systematica Managed Futures Strategy Fund

(Class I/SMFIX) |

$58 |

1.21% |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

1.21%

|

| Material Change Date |

Dec. 06, 2024

|

| Net Assets |

$ 5,596,734

|

| Holdings Count | Holding |

240

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

0.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| Fund net assets |

$5,596,734 |

| Total number of portfolio holdings |

240 |

| Net advisory fees paid |

$0 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

|

| Holdings [Text Block] |

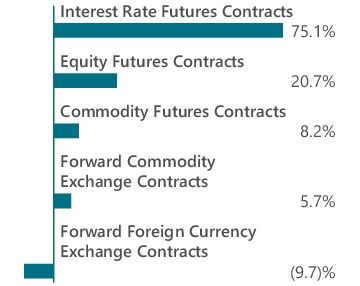

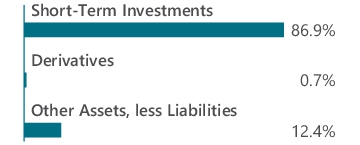

Graphical Representation of Holdings (as of March 31, 2025) The portfolio breakdown is shown as a percentage of net assets of the Fund and notional allocation is shown as a percentage of total notional value of the Fund's derivatives holdings. The portfolio breakdown and notional allocation are inclusive of the Fund's wholly-owned subsidiary. Portfolio Breakdown NOTIONAL ALLOCATION

|

| Material Fund Change [Text Block] |

Recent Fund Changes This is a summary of certain changes to the Fund since October 1, 2024. For more information, you may review the Fund's prospectus at https://wealth.amg.com/literature. The Fund's prospectus is also available without charge by calling 800.548.4539 or by sending an e-mail request to shareholderservices@amg.com. Effective December 6, 2024, AMG Funds LLC has contractually agreed, through February 1, 2026, to waive the management fee payable by the Fund by 0.30%, from 1.20% to 0.90%.

|

| Material Fund Change Expenses [Text Block] |

Effective December 6, 2024, AMG Funds LLC has contractually agreed, through February 1, 2026, to waive the management fee payable by the Fund by 0.30%, from 1.20% to 0.90%.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more information, you may review the Fund's prospectus at https://wealth.amg.com/literature. The Fund's prospectus is also available without charge by calling 800.548.4539 or by sending an e-mail request to shareholderservices@amg.com.

|

| Updated Prospectus Phone Number |

800.548.4539

|

| Updated Prospectus Email Address |

shareholderservices@amg.com

|

| Updated Prospectus Web Address |

https://wealth.amg.com/literature

|

| C000248365 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Systematica Managed Futures Strategy Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

SMFZX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Systematica Managed Futures Strategy Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Systematica Managed Futures Strategy Fund

(Class Z/SMFZX) |

$58 |

1.21% |

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

1.21%

|

| Material Change Date |

Dec. 06, 2024

|

| Net Assets |

$ 5,596,734

|

| Holdings Count | Holding |

240

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

0.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| Fund net assets |

$5,596,734 |

| Total number of portfolio holdings |

240 |

| Net advisory fees paid |

$0 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of March 31, 2025) The portfolio breakdown is shown as a percentage of net assets of the Fund and notional allocation is shown as a percentage of total notional value of the Fund's derivatives holdings. The portfolio breakdown and notional allocation are inclusive of the Fund's wholly-owned subsidiary. Portfolio Breakdown NOTIONAL ALLOCATION

|

| Material Fund Change [Text Block] |

Recent Fund Changes This is a summary of certain changes to the Fund since October 1, 2024. For more information, you may review the Fund's prospectus at https://wealth.amg.com/literature. The Fund's prospectus is also available without charge by calling 800.548.4539 or by sending an e-mail request to shareholderservices@amg.com. Effective December 6, 2024, AMG Funds LLC has contractually agreed, through February 1, 2026, to waive the management fee payable by the Fund by 0.30%, from 1.20% to 0.90%.

|

| Material Fund Change Expenses [Text Block] |

Effective December 6, 2024, AMG Funds LLC has contractually agreed, through February 1, 2026, to waive the management fee payable by the Fund by 0.30%, from 1.20% to 0.90%.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since October 1, 2024. For more information, you may review the Fund's prospectus at https://wealth.amg.com/literature. The Fund's prospectus is also available without charge by calling 800.548.4539 or by sending an e-mail request to shareholderservices@amg.com.

|

| Updated Prospectus Phone Number |

800.548.4539

|

| Updated Prospectus Email Address |

shareholderservices@amg.com

|

| Updated Prospectus Web Address |

https://wealth.amg.com/literature

|

| C000257775 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Systematica Trend-Enhanced Markets Fund

|

| Class Name |

Class N

|

| Trading Symbol |

STMBX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Systematica Trend-Enhanced Markets Fund (the “Fund”) for March 31, 2025 (inception date).

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Systematica Trend-Enhanced Markets Fund

(Class N/STMBX) |

$0 |

0.00% |

|

| Expenses Paid, Amount |

$ 0

|

| Expense Ratio, Percent |

0.00%

|

| Net Assets |

$ 6,000,000

|

| Holdings Count | Holding |

0

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

0.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| Fund net assets |

$6,000,000 |

| Total number of portfolio holdings |

0 |

| Net advisory fees paid |

$0 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of March 31, 2025) The Fund's inception date was March 31, 2025, and the Fund held a 100% cash position only.

|

| C000257776 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Systematica Trend-Enhanced Markets Fund

|

| Class Name |

Class I

|

| Trading Symbol |

STMIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Systematica Trend-Enhanced Markets Fund (the “Fund”) for March 31, 2025 (inception date).

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Systematica Trend-Enhanced Markets Fund

(Class I/STMIX) |

$0 |

0.00% |

|

| Expenses Paid, Amount |

$ 0

|

| Expense Ratio, Percent |

0.00%

|

| Net Assets |

$ 6,000,000

|

| Holdings Count | Holding |

0

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

0.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| Fund net assets |

$6,000,000 |

| Total number of portfolio holdings |

0 |

| Net advisory fees paid |

$0 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of March 31, 2025) The Fund's inception date was March 31, 2025, and the Fund held a 100% cash position only.

|

| C000257774 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

AMG Systematica Trend-Enhanced Markets Fund

|

| Class Name |

Class Z

|

| Trading Symbol |

STMZX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about AMG Systematica Trend-Enhanced Markets Fund (the “Fund”) for March 31, 2025 (inception date).

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://wealth.amg.com/literature. You can also request this information by contacting us at 800.548.4539.

|

| Additional Information Phone Number |

800.548.4539

|

| Additional Information Website |

https://wealth.amg.com/literature

|

| Expenses [Text Block] |

Fund Expenses What were the Fund costs for the last six months? (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

AMG Systematica Trend-Enhanced Markets Fund

(Class Z/STMZX) |

$0 |

0.00% |

|

| Expenses Paid, Amount |

$ 0

|

| Expense Ratio, Percent |

0.00%

|

| Net Assets |

$ 6,000,000

|

| Holdings Count | Holding |

0

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

0.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| Fund net assets |

$6,000,000 |

| Total number of portfolio holdings |

0 |

| Net advisory fees paid |

$0 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings (as of March 31, 2025) The Fund's inception date was March 31, 2025, and the Fund held a 100% cash position only.

|