Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

INVESTMENT MANAGERS SERIES TRUST II

|

|

| Entity Central Index Key |

0001587982

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Mar. 31, 2025

|

|

| C000214735 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSChesapeake Strategy Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

EQCHX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS Chesapeake Strategy Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/eqchx/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/eqchx/#fundliterature

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS Chesapeake Strategy Fund

(Class I/EQCHX) |

|

|

$88 |

1.85%1 |

|

|

| Expenses Paid, Amount |

$ 88

|

|

| Expense Ratio, Percent |

1.85%

|

[1] |

| Net Assets |

$ 25,448,940

|

|

| Holdings Count | Holding |

73

|

|

| Investment Company Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$25,448,940 |

| Total number of portfolio holdings |

73 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund.

Asset Allocation

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000222491 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSFTSE Venture CapitalReturn Tracker Fund

|

|

| Class Name |

Class A

|

|

| Trading Symbol |

LDVAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS FTSE Venture Capital Return Tracker Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/ldvix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/ldvix/#fundliterature

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS FTSE Venture Capital Return Tracker Fund

(Class A/LDVAX) |

|

|

$87 |

1.77%1 |

|

|

| Expenses Paid, Amount |

$ 87

|

|

| Expense Ratio, Percent |

1.77%

|

[2] |

| Net Assets |

$ 85,951,608

|

|

| Holdings Count | Holding |

145

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$85,951,608 |

| Total number of portfolio holdings |

145 |

| Portfolio turnover rate as of the end of the reporting period |

13% |

|

|

| Holdings [Text Block] |

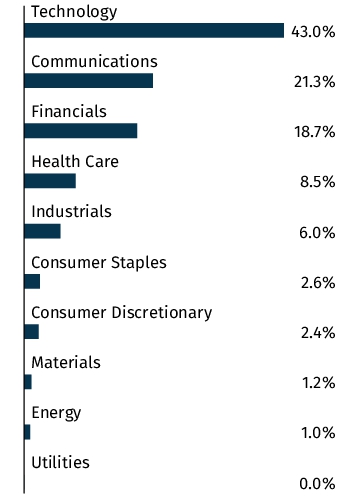

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any. The Sector Allocation chart represents Common Stocks of the Fund.

Top Ten Holdings

| Visa, Inc. - Class A |

4.9% |

| Netflix, Inc. |

4.8% |

| Mastercard, Inc. - Class A |

4.8% |

| Microsoft Corp. |

4.8% |

| Alphabet, Inc. - Class A |

4.6% |

| Meta Platforms, Inc. - Class A |

4.3% |

| Salesforce, Inc. |

3.8% |

| Berkshire Hathaway, Inc. - Class B |

3.8% |

| Oracle Corp. |

3.6% |

| International Business Machines Corp. |

3.4% |

Asset Allocation

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Visa, Inc. - Class A |

4.9% |

| Netflix, Inc. |

4.8% |

| Mastercard, Inc. - Class A |

4.8% |

| Microsoft Corp. |

4.8% |

| Alphabet, Inc. - Class A |

4.6% |

| Meta Platforms, Inc. - Class A |

4.3% |

| Salesforce, Inc. |

3.8% |

| Berkshire Hathaway, Inc. - Class B |

3.8% |

| Oracle Corp. |

3.6% |

| International Business Machines Corp. |

3.4% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000222489 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSFTSE Venture CapitalReturn Tracker Fund

|

|

| Class Name |

Class C

|

|

| Trading Symbol |

LDVCX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS FTSE Venture Capital Return Tracker Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/ldvix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/ldvix/#fundliterature

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS FTSE Venture Capital Return Tracker Fund

(Class C/LDVCX) |

|

|

$123 |

2.52%1 |

|

|

| Expenses Paid, Amount |

$ 123

|

|

| Expense Ratio, Percent |

2.52%

|

[3] |

| Net Assets |

$ 85,951,608

|

|

| Holdings Count | Holding |

145

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$85,951,608 |

| Total number of portfolio holdings |

145 |

| Portfolio turnover rate as of the end of the reporting period |

13% |

|

|

| Holdings [Text Block] |

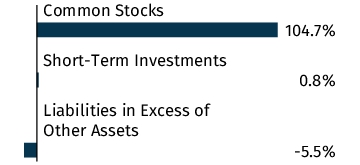

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any. The Sector Allocation chart represents Common Stocks of the Fund.

Top Ten Holdings

| Visa, Inc. - Class A |

4.9% |

| Netflix, Inc. |

4.8% |

| Mastercard, Inc. - Class A |

4.8% |

| Microsoft Corp. |

4.8% |

| Alphabet, Inc. - Class A |

4.6% |

| Meta Platforms, Inc. - Class A |

4.3% |

| Salesforce, Inc. |

3.8% |

| Berkshire Hathaway, Inc. - Class B |

3.8% |

| Oracle Corp. |

3.6% |

| International Business Machines Corp. |

3.4% |

Asset Allocation

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Visa, Inc. - Class A |

4.9% |

| Netflix, Inc. |

4.8% |

| Mastercard, Inc. - Class A |

4.8% |

| Microsoft Corp. |

4.8% |

| Alphabet, Inc. - Class A |

4.6% |

| Meta Platforms, Inc. - Class A |

4.3% |

| Salesforce, Inc. |

3.8% |

| Berkshire Hathaway, Inc. - Class B |

3.8% |

| Oracle Corp. |

3.6% |

| International Business Machines Corp. |

3.4% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000222490 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSFTSE Venture CapitalReturn Tracker Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

LDVIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS FTSE Venture Capital Return Tracker Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/ldvix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/ldvix/#fundliterature

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS FTSE Venture Capital Return Tracker Fund

(Class I/LDVIX) |

|

|

$74 |

1.52%1 |

|

|

| Expenses Paid, Amount |

$ 74

|

|

| Expense Ratio, Percent |

1.52%

|

[4] |

| Net Assets |

$ 85,951,608

|

|

| Holdings Count | Holding |

145

|

|

| Investment Company Portfolio Turnover |

13.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$85,951,608 |

| Total number of portfolio holdings |

145 |

| Portfolio turnover rate as of the end of the reporting period |

13% |

|

|

| Holdings [Text Block] |

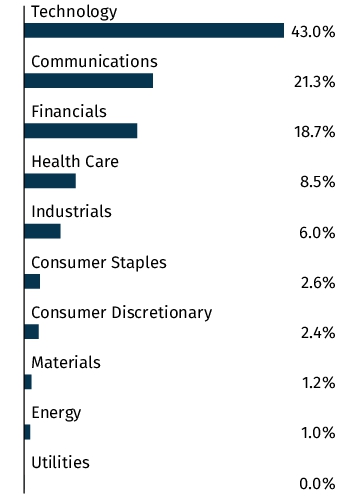

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any. The Sector Allocation chart represents Common Stocks of the Fund.

Top Ten Holdings

| Visa, Inc. - Class A |

4.9% |

| Netflix, Inc. |

4.8% |

| Mastercard, Inc. - Class A |

4.8% |

| Microsoft Corp. |

4.8% |

| Alphabet, Inc. - Class A |

4.6% |

| Meta Platforms, Inc. - Class A |

4.3% |

| Salesforce, Inc. |

3.8% |

| Berkshire Hathaway, Inc. - Class B |

3.8% |

| Oracle Corp. |

3.6% |

| International Business Machines Corp. |

3.4% |

Asset Allocation

Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Visa, Inc. - Class A |

4.9% |

| Netflix, Inc. |

4.8% |

| Mastercard, Inc. - Class A |

4.8% |

| Microsoft Corp. |

4.8% |

| Alphabet, Inc. - Class A |

4.6% |

| Meta Platforms, Inc. - Class A |

4.3% |

| Salesforce, Inc. |

3.8% |

| Berkshire Hathaway, Inc. - Class B |

3.8% |

| Oracle Corp. |

3.6% |

| International Business Machines Corp. |

3.4% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000234280 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSIncome Opportunities Fund

|

|

| Class Name |

Class D

|

|

| Trading Symbol |

OIODX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS Income Opportunities Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/oioix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/oioix/#fundliterature

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS Income Opportunities Fund

(Class D/OIODX) |

|

|

$155 |

3.20%1 |

|

|

| Expenses Paid, Amount |

$ 155

|

|

| Expense Ratio, Percent |

3.20%

|

[5] |

| Net Assets |

$ 41,648,986

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company Portfolio Turnover |

116.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$41,648,986 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate as of the end of the reporting period |

116% |

|

|

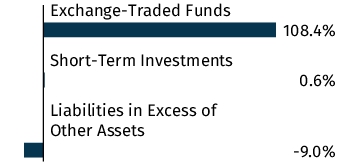

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

Top Ten Holdings

| iShares Residential and Multisector Real Estate ETF |

22.2% |

| iShares Core U.S. REIT ETF |

21.9% |

| Global X Variable Rate Preferred ETF |

15.5% |

| VanEck Mortgage REIT Income ETF |

15.2% |

| Principal Spectrum Preferred Securities Active ETF |

13.2% |

| Janus Henderson AAA CLO ETF |

13.1% |

| Virtus InfraCap U.S. Preferred Stock ETF |

7.3% |

Asset Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| iShares Residential and Multisector Real Estate ETF |

22.2% |

| iShares Core U.S. REIT ETF |

21.9% |

| Global X Variable Rate Preferred ETF |

15.5% |

| VanEck Mortgage REIT Income ETF |

15.2% |

| Principal Spectrum Preferred Securities Active ETF |

13.2% |

| Janus Henderson AAA CLO ETF |

13.1% |

| Virtus InfraCap U.S. Preferred Stock ETF |

7.3% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000234278 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSIncome Opportunities Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

OIOIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS Income Opportunities Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/oioix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/oioix/#fundliterature

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS Income Opportunities Fund

(Class I/OIOIX) |

|

|

$107 |

2.20%1 |

|

|

| Expenses Paid, Amount |

$ 107

|

|

| Expense Ratio, Percent |

2.20%

|

[6] |

| Net Assets |

$ 41,648,986

|

|

| Holdings Count | Holding |

8

|

|

| Investment Company Portfolio Turnover |

116.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$41,648,986 |

| Total number of portfolio holdings |

8 |

| Portfolio turnover rate as of the end of the reporting period |

116% |

|

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

Top Ten Holdings

| iShares Residential and Multisector Real Estate ETF |

22.2% |

| iShares Core U.S. REIT ETF |

21.9% |

| Global X Variable Rate Preferred ETF |

15.5% |

| VanEck Mortgage REIT Income ETF |

15.2% |

| Principal Spectrum Preferred Securities Active ETF |

13.2% |

| Janus Henderson AAA CLO ETF |

13.1% |

| Virtus InfraCap U.S. Preferred Stock ETF |

7.3% |

Asset Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| iShares Residential and Multisector Real Estate ETF |

22.2% |

| iShares Core U.S. REIT ETF |

21.9% |

| Global X Variable Rate Preferred ETF |

15.5% |

| VanEck Mortgage REIT Income ETF |

15.2% |

| Principal Spectrum Preferred Securities Active ETF |

13.2% |

| Janus Henderson AAA CLO ETF |

13.1% |

| Virtus InfraCap U.S. Preferred Stock ETF |

7.3% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000237932 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSAdaptive Plus Fund

|

|

| Class Name |

AXSAdaptive Plus Fund

|

|

| Trading Symbol |

AXSPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS Adaptive Plus Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/axspx/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/axspx/#fundliterature

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS Adaptive Plus Fund

(AXSPX) |

|

|

$92 |

1.99%1 |

|

|

| Expenses Paid, Amount |

$ 92

|

|

| Expense Ratio, Percent |

1.99%

|

[7] |

| Net Assets |

$ 35,506,692

|

|

| Holdings Count | Holding |

5

|

|

| Investment Company Portfolio Turnover |

0.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$35,506,692 |

| Total number of portfolio holdings |

5 |

| Portfolio turnover rate as of the end of the reporting period |

0% |

|

|

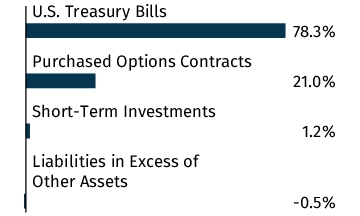

| Holdings [Text Block] |

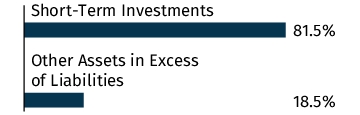

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

Top Ten Holdings

| United States Treasury Bill, 4/3/2025 |

28.2% |

| United States Treasury Bill, 6/12/2025 |

27.9% |

| United States Treasury Bill, 8/7/2025 |

22.2% |

| Nomura Galaxy Option -ProfitScore Regime-Adaptive Equity Index, 6/15/2025 |

21.0% |

Asset Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| United States Treasury Bill, 4/3/2025 |

28.2% |

| United States Treasury Bill, 6/12/2025 |

27.9% |

| United States Treasury Bill, 8/7/2025 |

22.2% |

| Nomura Galaxy Option -ProfitScore Regime-Adaptive Equity Index, 6/15/2025 |

21.0% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000241127 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSDynamic Opportunity Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

ADOIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS Dynamic Opportunity Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/adoix/#fundliteratureents. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/adoix/#fundliteratureents

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS Dynamic Opportunity Fund

(Class I/ADOIX) |

|

|

$72 |

1.50%1 |

|

|

| Expenses Paid, Amount |

$ 72

|

|

| Expense Ratio, Percent |

1.50%

|

[8] |

| Net Assets |

$ 49,237,975

|

|

| Holdings Count | Holding |

33

|

|

| Investment Company Portfolio Turnover |

7.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$49,237,975 |

| Total number of portfolio holdings |

33 |

| Portfolio turnover rate as of the end of the reporting period |

7% |

|

|

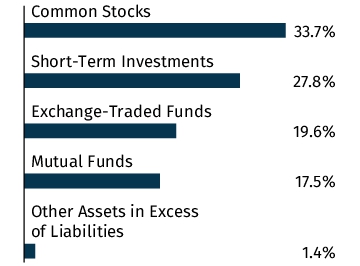

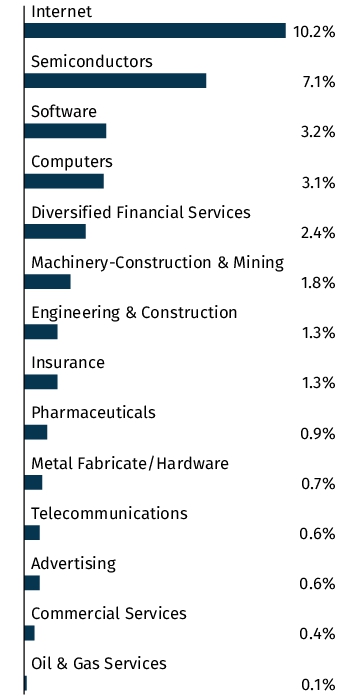

| Holdings [Text Block] |

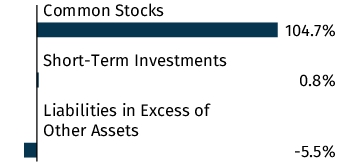

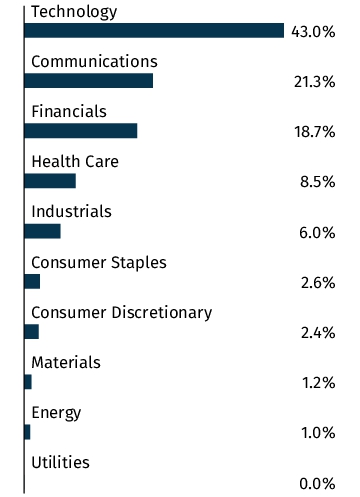

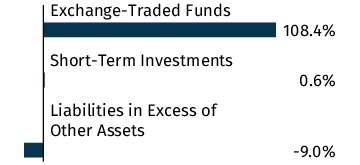

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Industry Allocation exclude short-term holdings, if any. The Industry Allocation chart represents Common Stocks of the Fund.

Top Ten Holdings

| AXS Adaptive Plus Fund - Class I |

17.5% |

| ProShares Short S&P500 |

5.0% |

| Tradr 2X Long Triple Q Monthly ETF |

4.9% |

| Tradr 2X Long Triple Q Quarterly ETF |

4.9% |

| ProShares UltraShort S&P500 |

4.8% |

| NVIDIA Corp. |

4.4% |

| Amazon.com, Inc. |

3.3% |

| Meta Platforms, Inc. - Class A |

3.3% |

| Apple, Inc. |

2.8% |

| Microsoft Corp. |

2.7% |

Asset Allocation

Industry Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| AXS Adaptive Plus Fund - Class I |

17.5% |

| ProShares Short S&P500 |

5.0% |

| Tradr 2X Long Triple Q Monthly ETF |

4.9% |

| Tradr 2X Long Triple Q Quarterly ETF |

4.9% |

| ProShares UltraShort S&P500 |

4.8% |

| NVIDIA Corp. |

4.4% |

| Amazon.com, Inc. |

3.3% |

| Meta Platforms, Inc. - Class A |

3.3% |

| Apple, Inc. |

2.8% |

| Microsoft Corp. |

2.7% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000241130 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

AXSTactical Income Fund

|

|

| Class Name |

Class I

|

|

| Trading Symbol |

TINIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the AXS Tactical Income Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.axsinvestments.com/tinix/#fundliterature. You can also request this information by contacting us at (833) 297-2587.

|

|

| Additional Information Phone Number |

(833) 297-2587

|

|

| Additional Information Website |

www.axsinvestments.com/tinix/#fundliterature

|

|

| Expenses [Text Block] |

Fund Expenses

(Based on a hypothetical $10,000 investment)

| Fund (Ticker) |

|

|

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

AXS Tactical Income Fund

(Class I/TINIX) |

|

|

$84 |

1.68%1 |

|

|

| Expenses Paid, Amount |

$ 84

|

|

| Expense Ratio, Percent |

1.68%

|

[9] |

| Net Assets |

$ 30,775,559

|

|

| Holdings Count | Holding |

14

|

|

| Investment Company Portfolio Turnover |

116.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$30,775,559 |

| Total number of portfolio holdings |

14 |

| Portfolio turnover rate as of the end of the reporting period |

116% |

|

|

| Holdings [Text Block] |

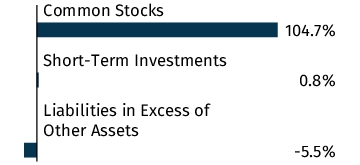

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings exclude short-term holdings, if any.

Top Ten Holdings

| iShares Short Treasury Bond ETF |

22.3% |

| SPDR Bloomberg 1-3 Month T-Bill ETF |

22.3% |

| Vanguard Long-Term Corporate Bond ETF |

5.0% |

| Vanguard Emerging Markets Government Bond ETF |

5.0% |

| Vanguard Intermediate-Term Treasury ETF |

5.0% |

| Janus Henderson AAA CLO ETF |

5.0% |

| Vanguard Intermediate-Term Corporate Bond ETF |

5.0% |

| Vanguard Short-Term Inflation-Protected Securities ETF |

5.0% |

| Vanguard Mortgage-Backed Securities ETF |

5.0% |

| Vanguard Short-Term Treasury ETF |

4.9% |

Asset Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| iShares Short Treasury Bond ETF |

22.3% |

| SPDR Bloomberg 1-3 Month T-Bill ETF |

22.3% |

| Vanguard Long-Term Corporate Bond ETF |

5.0% |

| Vanguard Emerging Markets Government Bond ETF |

5.0% |

| Vanguard Intermediate-Term Treasury ETF |

5.0% |

| Janus Henderson AAA CLO ETF |

5.0% |

| Vanguard Intermediate-Term Corporate Bond ETF |

5.0% |

| Vanguard Short-Term Inflation-Protected Securities ETF |

5.0% |

| Vanguard Mortgage-Backed Securities ETF |

5.0% |

| Vanguard Short-Term Treasury ETF |

4.9% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants

There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

|

|