Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

Investment Managers Series Trust III

|

|

| Entity Central Index Key |

0000924727

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Mar. 31, 2025

|

|

| C000243216 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

FPA New Income Fund

|

|

| Class Name |

Institutional Class

|

|

| Trading Symbol |

FPNIX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the FPA New Income Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://fpa.com/funds/overview/new-income. You can also request this information by contacting us at (800) 638-3060.

|

|

| Additional Information Phone Number |

(800) 638-3060

|

|

| Additional Information Website |

https://fpa.com/funds/overview/new-income

|

|

| Expenses [Text Block] |

Fund Expenses (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

FPA New Income Fund

(Institutional Class/FPNIX) |

$23 |

0.45%1 |

|

|

| Expenses Paid, Amount |

$ 23

|

|

| Expense Ratio, Percent |

0.45%

|

[1] |

| Net Assets |

$ 8,888,294,054

|

|

| Holdings Count | Holding |

336

|

|

| Investment Company Portfolio Turnover |

22.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$8,888,294,054 |

| Total number of portfolio holdings |

336 |

| Portfolio turnover rate as of the end of the reporting period |

22% |

|

|

| Holdings [Text Block] |

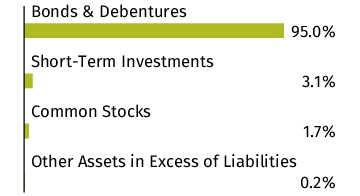

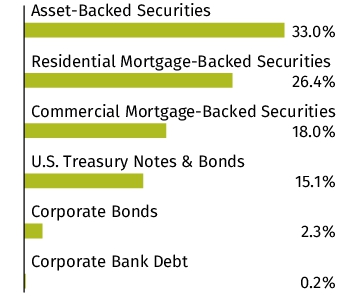

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. Interest rates presented in the Top Ten Holdings are as of the reporting period end. The Sector Allocation chart represents Bonds & Debentures of the Fund. Top Ten Holdings

| U.S. Treasury Note, 4.375%, 12/31/2029 |

7.6% |

| U.S. Treasury Note, 4.125%, 11/30/2029 |

2.1% |

| U.S. Treasury Note, 4.250%, 1/31/2030 |

1.4% |

| Fortress Credit Opportunities Ltd., Series 2017-9A, Class A1TR, 6.114%, 10/15/2033 |

1.3% |

| Fannie Mae Pool, 1.000%, 3/1/2037 |

1.3% |

| U.S. Treasury Note, 4.125%, 10/31/2029 |

1.3% |

| U.S. Treasury Note, 3.500%, 9/30/2029 |

1.3% |

| U.S. Treasury Note, 4.625%, 9/30/2030 |

1.2% |

| PHI Group, Inc. |

1.0% |

| Verizon Master Trust, Series 2024-2, Class A, 4.830%, 12/22/2031 |

1.0% | Asset Allocation Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| U.S. Treasury Note, 4.375%, 12/31/2029 |

7.6% |

| U.S. Treasury Note, 4.125%, 11/30/2029 |

2.1% |

| U.S. Treasury Note, 4.250%, 1/31/2030 |

1.4% |

| Fortress Credit Opportunities Ltd., Series 2017-9A, Class A1TR, 6.114%, 10/15/2033 |

1.3% |

| Fannie Mae Pool, 1.000%, 3/1/2037 |

1.3% |

| U.S. Treasury Note, 4.125%, 10/31/2029 |

1.3% |

| U.S. Treasury Note, 3.500%, 9/30/2029 |

1.3% |

| U.S. Treasury Note, 4.625%, 9/30/2030 |

1.2% |

| PHI Group, Inc. |

1.0% |

| Verizon Master Trust, Series 2024-2, Class A, 4.830%, 12/22/2031 |

1.0% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

| C000249814 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

FPA New Income Fund

|

|

| Class Name |

Investor Class

|

|

| Trading Symbol |

FPNRX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the FPA New Income Fund (“Fund”) for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://fpa.com/funds/overview/new-income. You can also request this information by contacting us at (800) 638-3060.

|

|

| Additional Information Phone Number |

(800) 638-3060

|

|

| Additional Information Website |

https://fpa.com/funds/overview/new-income

|

|

| Expenses [Text Block] |

Fund Expenses (Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

FPA New Income Fund

(Investor Class/FPNRX) |

$28 |

0.55%1 |

|

|

| Expenses Paid, Amount |

$ 28

|

|

| Expense Ratio, Percent |

0.55%

|

[2] |

| Net Assets |

$ 8,888,294,054

|

|

| Holdings Count | Holding |

336

|

|

| Investment Company Portfolio Turnover |

22.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$8,888,294,054 |

| Total number of portfolio holdings |

336 |

| Portfolio turnover rate as of the end of the reporting period |

22% |

|

|

| Holdings [Text Block] |

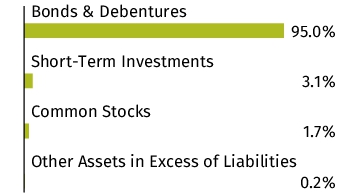

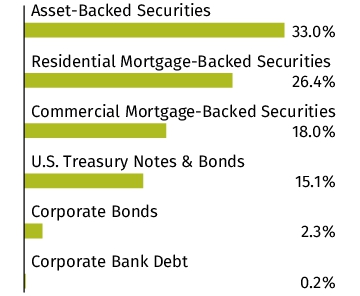

Graphical Representation of Holdings The tables below show the investment makeup of the Fund, representing percentage of the total net assets of the Fund. The Top Ten Holdings and Sector Allocation exclude short-term holdings, if any. The Top Ten Holdings table may not reflect the total exposure to an issuer. Interest rates presented in the Top Ten Holdings are as of the reporting period end. The Sector Allocation chart represents Bonds & Debentures of the Fund. Top Ten Holdings

| U.S. Treasury Note, 4.375%, 12/31/2029 |

7.6% |

| U.S. Treasury Note, 4.125%, 11/30/2029 |

2.1% |

| U.S. Treasury Note, 4.250%, 1/31/2030 |

1.4% |

| Fortress Credit Opportunities Ltd., Series 2017-9A, Class A1TR, 6.114%, 10/15/2033 |

1.3% |

| Fannie Mae Pool, 1.000%, 3/1/2037 |

1.3% |

| U.S. Treasury Note, 4.125%, 10/31/2029 |

1.3% |

| U.S. Treasury Note, 3.500%, 9/30/2029 |

1.3% |

| U.S. Treasury Note, 4.625%, 9/30/2030 |

1.2% |

| PHI Group, Inc. |

1.0% |

| Verizon Master Trust, Series 2024-2, Class A, 4.830%, 12/22/2031 |

1.0% | Asset Allocation Sector Allocation

|

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| U.S. Treasury Note, 4.375%, 12/31/2029 |

7.6% |

| U.S. Treasury Note, 4.125%, 11/30/2029 |

2.1% |

| U.S. Treasury Note, 4.250%, 1/31/2030 |

1.4% |

| Fortress Credit Opportunities Ltd., Series 2017-9A, Class A1TR, 6.114%, 10/15/2033 |

1.3% |

| Fannie Mae Pool, 1.000%, 3/1/2037 |

1.3% |

| U.S. Treasury Note, 4.125%, 10/31/2029 |

1.3% |

| U.S. Treasury Note, 3.500%, 9/30/2029 |

1.3% |

| U.S. Treasury Note, 4.625%, 9/30/2030 |

1.2% |

| PHI Group, Inc. |

1.0% |

| Verizon Master Trust, Series 2024-2, Class A, 4.830%, 12/22/2031 |

1.0% |

|

|

| Accountant Change Disagreements [Text Block] |

Changes in and Disagreements with Accountants There were no changes in or disagreements with the Fund's accountants during the reporting period.

|

|

|

|