|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Institutional Class

|

$99

|

0.97%

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

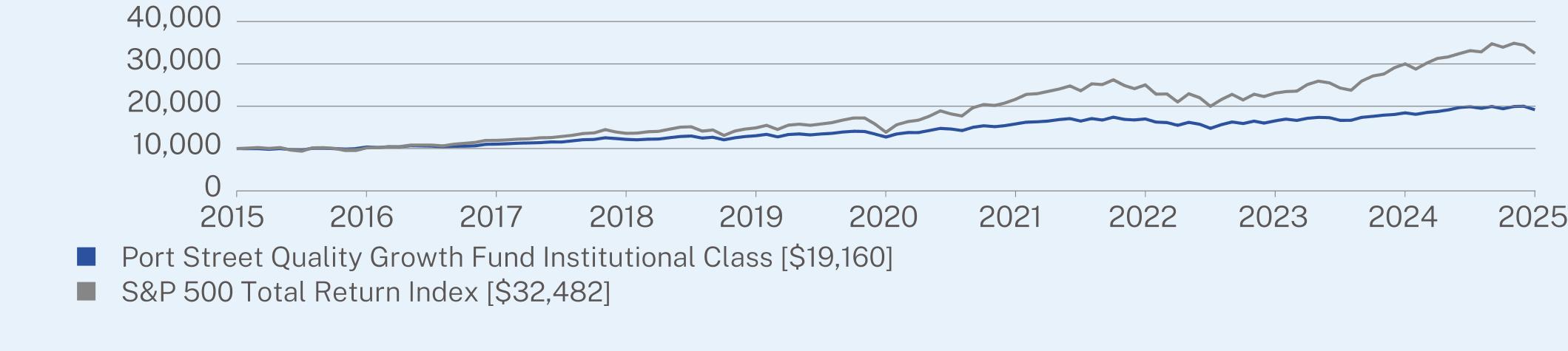

Institutional Class (without sales charge)

|

3.85

|

8.53

|

6.72

|

|

S&P 500 Total Return Index

|

8.25

|

18.59

|

12.50

|

|

Net Assets

|

$185,511,640

|

|

Number of Holdings

|

29

|

|

Net Advisory Fee

|

$1,474,831

|

|

Portfolio Turnover

|

7%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Bill

|

26.8%

|

|

Berkshire Hathaway, Inc.

|

5.7%

|

|

Unilever plc

|

5.2%

|

|

Alphabet, Inc.

|

5.1%

|

|

Walt Disney Co.

|

4.8%

|

|

Microsoft Corp.

|

4.5%

|

|

Medtronic plc

|

4.0%

|

|

Novo Nordisk

|

3.3%

|

|

RTX Corp.

|

3.0%

|

|

Roche Holding AG

|

2.9%

|

|

Top Sectors

|

(%)

|

|

Health Care

|

14.1%

|

|

Information Technology

|

14.0%

|

|

Consumer Staples

|

10.7%

|

|

Communication Services

|

9.9%

|

|

Financials

|

8.5%

|

|

Industrials

|

8.0%

|

|

Consumer Discretionary

|

5.3%

|

|

Cash & Other

|

29.5%

|