Pay Versus Performance

In accordance with rules adopted by the SEC pursuant to the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, we provide the following disclosure regarding executive compensation for our principal executive officer (“PEO”) and Non-PEO NEOs and Company performance for the fiscal years listed below. The Compensation Committee did not consider the pay versus performance disclosure below in making its pay decisions for any of the years shown.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

|

|

|

|

|

|

|

|

|

|

Value of Initial Fixed $100 Investment based on: (4) |

|

|

|

|

|

|

|

|

||||||||||||||||||||||

Year |

|

Summary Compensation Table Total for |

|

Compensation Actually Paid to PEO (1)(2)(3) |

|

Average Summary Compensation Table Total for Non-PEO NEOs (1) |

|

Average |

|

TSR |

|

Peer Group |

|

Net Income |

|

Adjusted |

||||||||||||||||||||||||

2024 |

|

|

3,973,485 |

|

|

|

|

3,876,710 |

|

|

|

|

774,375 |

|

|

|

|

861,970 |

|

|

|

|

92.62 |

|

|

|

|

123.93 |

|

|

|

|

(441.0 |

) |

|

|

|

3.2 |

|

|

2023 |

|

|

5,847,661 |

|

|

|

|

(3,434,422 |

) |

|

|

|

1,291,473 |

|

|

|

|

(349,239 |

) |

|

|

|

81.62 |

|

|

|

|

114.43 |

|

|

|

|

(259.3 |

) |

|

|

|

(9.9 |

) |

|

2022 |

|

|

10,467,712 |

|

|

|

|

9,153,853 |

|

|

|

|

1,110,338 |

|

|

|

|

1,053,973 |

|

|

|

|

203.51 |

|

|

|

|

100.08 |

|

|

|

|

(8.9 |

) |

|

|

|

52.2 |

|

|

2021 |

|

|

4,515,356 |

|

|

|

|

6,565,639 |

|

|

|

|

1,155,022 |

|

|

|

|

1,381,134 |

|

|

|

|

243.02 |

|

|

|

|

131.83 |

|

|

|

|

(8.6 |

) |

|

|

|

11.3 |

|

|

2020 |

|

|

2,898,033 |

|

|

|

|

4,106,999 |

|

|

|

|

900,561 |

|

|

|

|

1,059,643 |

|

|

|

|

154.37 |

|

|

|

|

124.19 |

|

|

|

|

2.4 |

|

|

|

|

10.8 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||

2024 |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

Ulrich Dopfer |

|

Ulrich Dopfer |

|

Michael K. Foliano |

|

Michael K. Foliano |

|

Michael K. Foliano |

James D. Wilson, Jr. |

|

James D. Wilson, Jr. |

|

James D. Wilson, Jr. |

|

James D. Wilson, Jr. |

|

James D. Wilson, Jr. |

Christoph Glingener |

|

Christoph Glingener |

|

Ronald D. Centis |

|

Ronald D. Centis |

|

Ronald D. Centis |

|

|

Michael K. Foliano |

|

Raymond Harris |

|

Raymond Harris |

|

Eduard Scheiterer |

|

|

|

|

Christoph Glingener |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Year |

|

Summary Compensation |

|

Exclusion of |

|

Inclusion of |

|

Compensation |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2024 |

|

|

3,973,485 |

|

|

|

|

(2,130,975 |

) |

|

|

|

2,034,200 |

|

|

|

|

3,876,710 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Year |

|

Average Summary |

|

Average Exclusion of |

|

Average Inclusion of |

|

Average Compensation |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2024 |

|

|

774,375 |

|

|

|

|

(187,356 |

) |

|

|

|

274,951 |

|

|

|

|

861,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

The amounts in the Inclusion of Equity Values in the tables above are derived from the amounts set forth in the following tables:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Year |

|

Year-End Fair Value |

|

Change in Fair Value |

|

Vesting-Date Fair |

|

Change in Fair Value |

Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Thomas R. Stanton |

|

Total - Inclusion of |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2024 |

|

|

2,128,124 |

|

|

|

|

110,113 |

|

|

|

— |

|

|

|

(204,037 |

) |

|

— |

|

|

2,034,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

Average Year-End |

|

Average Change in |

|

Average Vesting- |

|

Average Change in |

Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs |

|

Total - Average |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

($) |

|

|

|

2024 |

|

234,284 |

|

|

40,823 |

|

|

— |

|

|

(156) |

|

— |

|

274,951 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

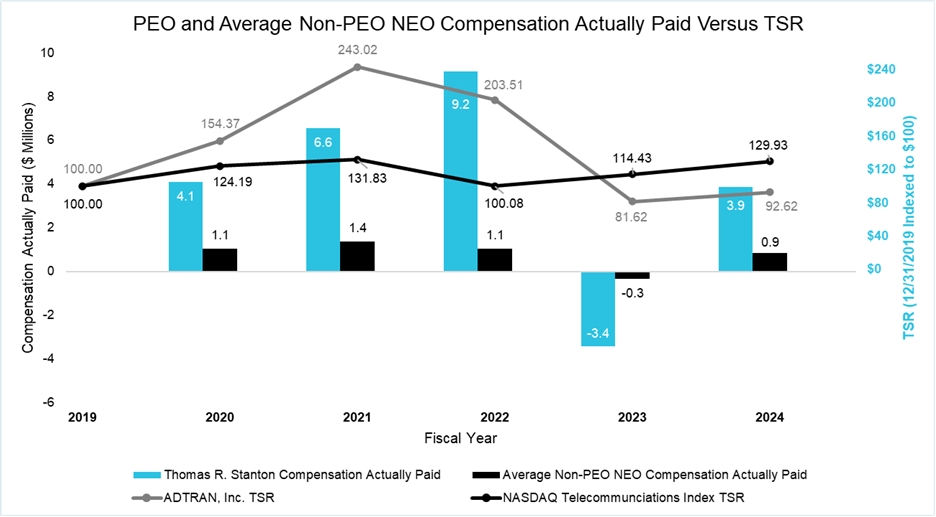

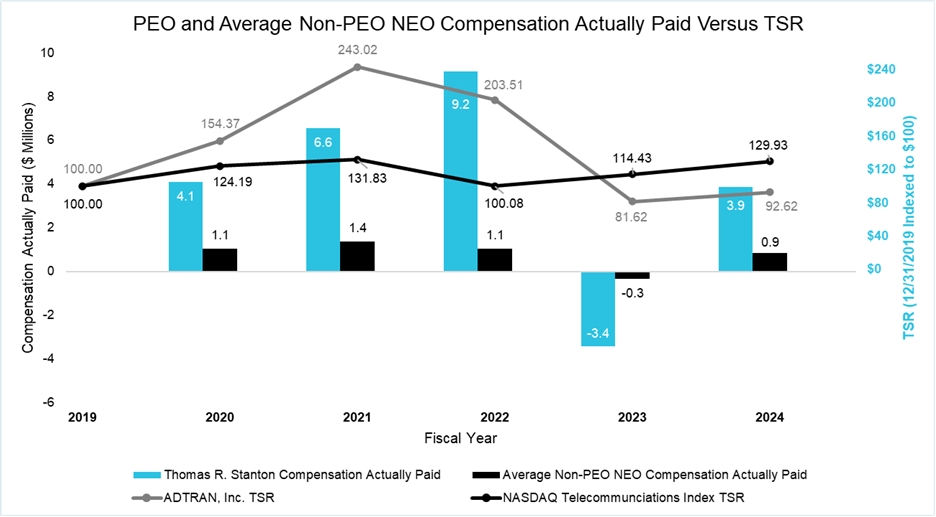

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Total Shareholder Return (“TSR”)

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, the cumulative TSR of the Company over the five most recently completed fiscal years, and the NASDAQ Telecommunications Index TSR over the same period.

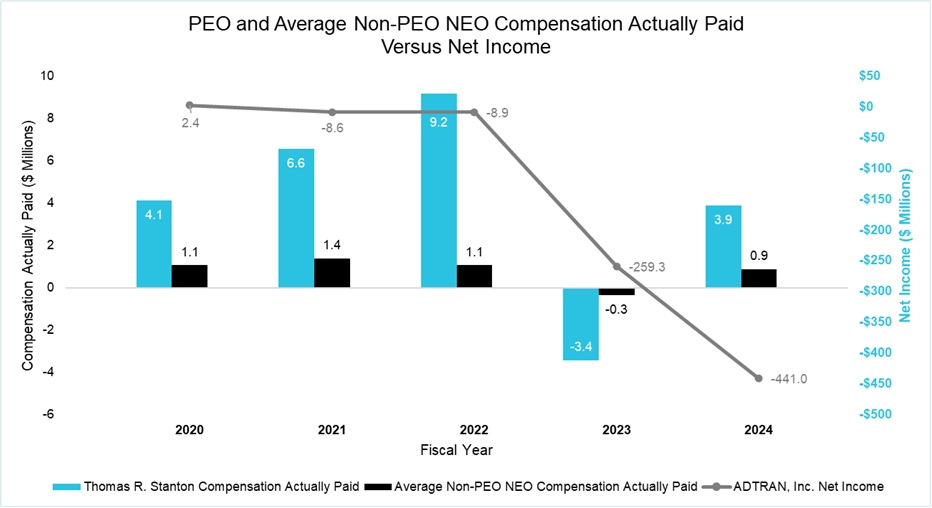

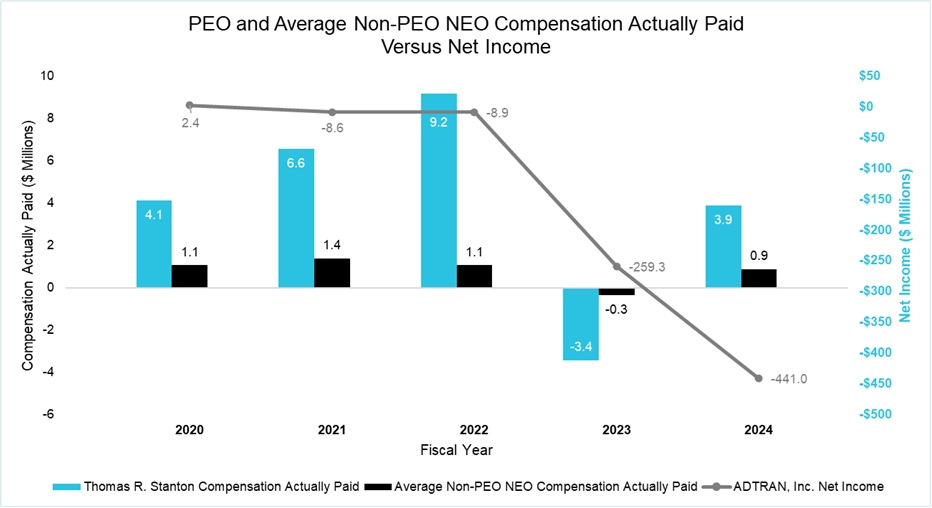

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Net Income

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and our net income during the five most recently completed fiscal years.

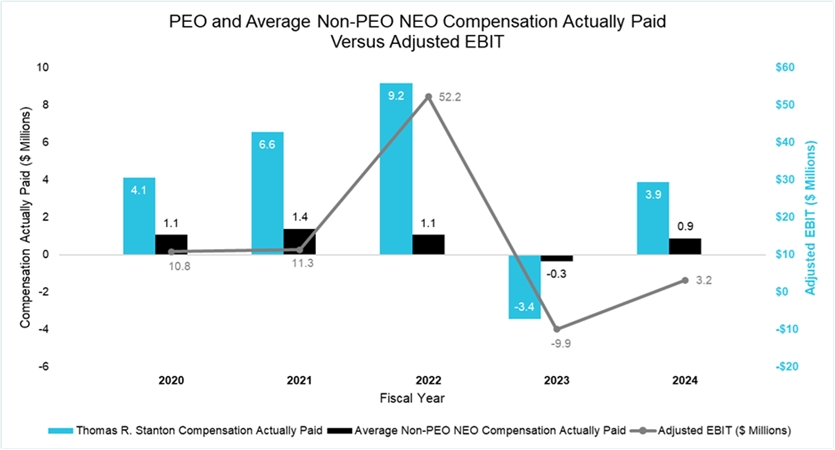

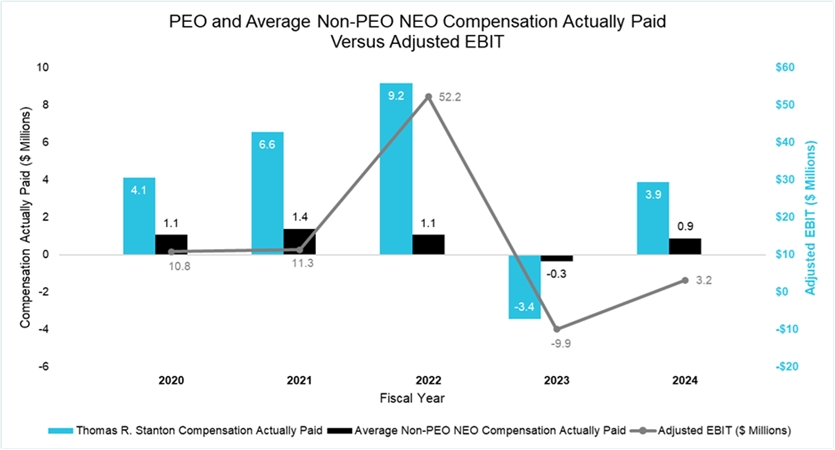

Description of Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Adjusted EBIT

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and Adjusted EBIT during the five most recently completed fiscal years.

Tabular List of Most Important Financial Performance Measures

The following table presents the financial performance measures that the Company considers to have been the most important in linking Compensation Actually Paid to our PEO and other NEOs for 2024 to Company performance. The measures in this table are not ranked.

Adjusted EBIT |

Gross Margin |

Relative TSR |

2024 |

|

2023 |

|

2022 |

|

2021 |

|

2020 |

Ulrich Dopfer |

|

Ulrich Dopfer |

|

Michael K. Foliano |

|

Michael K. Foliano |

|

Michael K. Foliano |

James D. Wilson, Jr. |

|

James D. Wilson, Jr. |

|

James D. Wilson, Jr. |

|

James D. Wilson, Jr. |

|

James D. Wilson, Jr. |

Christoph Glingener |

|

Christoph Glingener |

|

Ronald D. Centis |

|

Ronald D. Centis |

|

Ronald D. Centis |

|

|

Michael K. Foliano |

|

Raymond Harris |

|

Raymond Harris |

|

Eduard Scheiterer |

|

|

|

|

Christoph Glingener |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Year |

|

Summary Compensation |

|

Exclusion of |

|

Inclusion of |

|

Compensation |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2024 |

|

|

3,973,485 |

|

|

|

|

(2,130,975 |

) |

|

|

|

2,034,200 |

|

|

|

|

3,876,710 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

The amounts in the Inclusion of Equity Values in the tables above are derived from the amounts set forth in the following tables:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Year |

|

Year-End Fair Value |

|

Change in Fair Value |

|

Vesting-Date Fair |

|

Change in Fair Value |

Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Thomas R. Stanton |

|

Total - Inclusion of |

|||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2024 |

|

|

2,128,124 |

|

|

|

|

110,113 |

|

|

|

— |

|

|

|

(204,037 |

) |

|

— |

|

|

2,034,200 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

Year |

|

Average Summary |

|

Average Exclusion of |

|

Average Inclusion of |

|

Average Compensation |

||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

2024 |

|

|

774,375 |

|

|

|

|

(187,356 |

) |

|

|

|

274,951 |

|

|

|

|

861,970 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

The amounts in the Inclusion of Equity Values in the tables above are derived from the amounts set forth in the following tables:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year |

|

Average Year-End |

|

Average Change in |

|

Average Vesting- |

|

Average Change in |

Average Fair Value at Last Day of Prior Year of Equity Awards Forfeited During Year for Non-PEO NEOs |

|

Total - Average |

|||||

|

|

|

|

|

|

|

|

|

|

|

|

|

($) |

|

|

|

2024 |

|

234,284 |

|

|

40,823 |

|

|

— |

|

|

(156) |

|

— |

|

274,951 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Total Shareholder Return (“TSR”)

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, the cumulative TSR of the Company over the five most recently completed fiscal years, and the NASDAQ Telecommunications Index TSR over the same period.

Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Net Income

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and our net income during the five most recently completed fiscal years.

Description of Relationship Between PEO and Non-PEO NEO Compensation Actually Paid and Adjusted EBIT

The following chart sets forth the relationship between Compensation Actually Paid to our PEO, the average of Compensation Actually Paid to our Non-PEO NEOs, and Adjusted EBIT during the five most recently completed fiscal years.

Tabular List of Most Important Financial Performance Measures

The following table presents the financial performance measures that the Company considers to have been the most important in linking Compensation Actually Paid to our PEO and other NEOs for 2024 to Company performance. The measures in this table are not ranked.

Adjusted EBIT |

Gross Margin |

Relative TSR |