What were the Fund costs for the past six months?

(based on a hypothetical $10,000 investment)

Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|---|---|

Ned Davis Research 360° Dynamic Allocation ETF | $22 | 0.50% |

Key Fund Statistics

(as of March 31, 2025)

Fund Size (Thousands) | $2,717 |

Number of Holdings | 12 |

Total Advisory Fee Paid | $4,686 |

Portfolio Turnover | 101% |

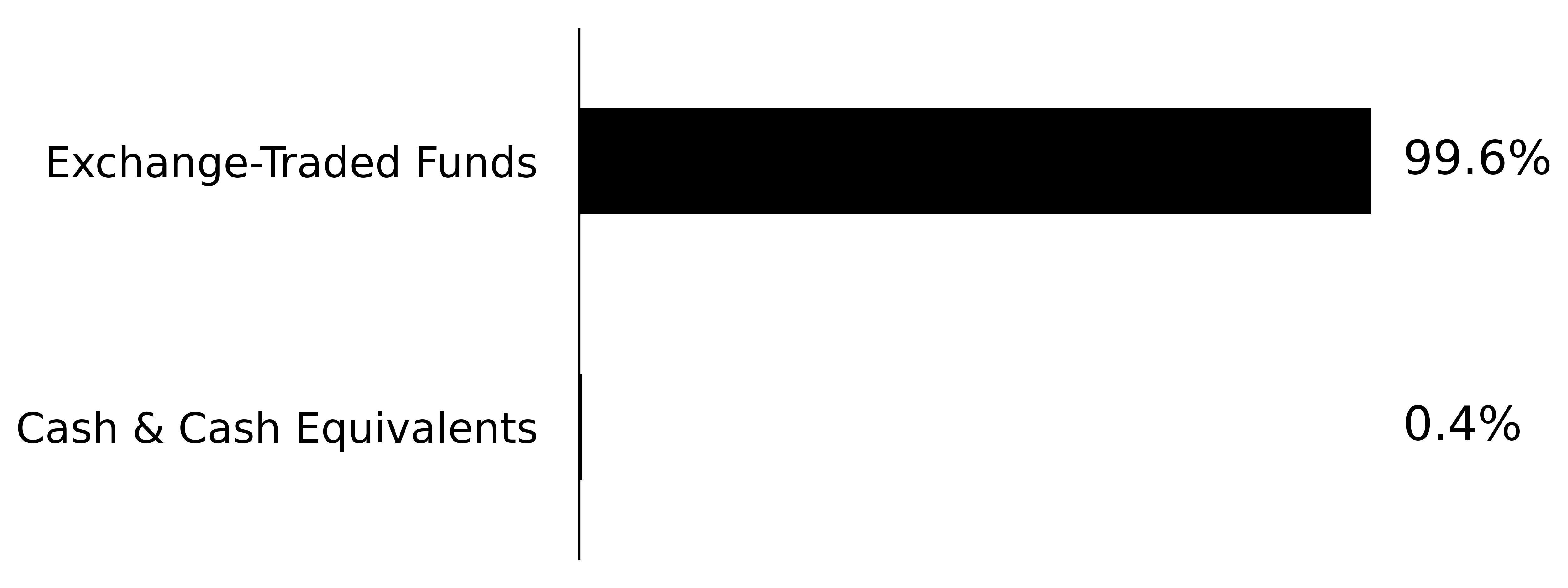

Sector Breakdown

(% of Total Net Assets)

Percentages are based on total net assets. Cash & Cash Equivalents represents short-term investments and assets in excess of other liabilities.

What did the Fund invest in?

(as of March 31, 2025)

Top Ten Holdings | (% of Total Net Assets) |

|---|---|

iShares Core MSCI EAFE ETF | |

abrdn Bloomberg All Commodity Strategy K-1 Free ETF | |

Vanguard S&P 500 ETF | |

iShares Core U.S. Value ETF | |

iShares Core MSCI Emerging Markets ETF | |

Vanguard Growth ETF | |

Vanguard Total International Bond ETF | |

iShares J.P. Morgan USD Emerging Markets Bond ETF | |

iShares 20+ Year Treasury Bond ETF | |

Vanguard Short-Term Treasury ETF |