Shareholder Report

|

12 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

PIMCO FUNDS

|

| Entity Central Index Key |

0000810893

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| C000088650 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PIMCO CommoditiesPLUS<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 15px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; white-space-collapse: preserve-breaks;">®</sup> Strategy Fund

|

| Class Name |

Class A

|

| Trading Symbol |

PCLAX

|

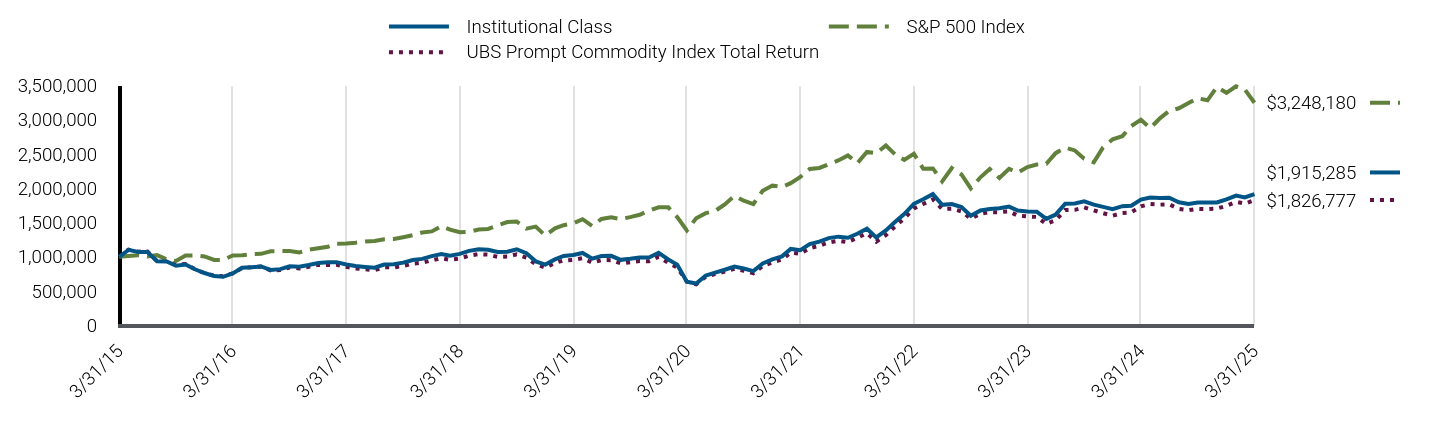

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO CommoditiesPLUS® Strategy Fund (the "Fund") for the period of April 1, 2024 to March 31, 2025 (the "reporting period").

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

| Additional Information Phone Number |

888.87.PIMCO (888.877.4626)

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$130 |

1.27% | |

| Expenses Paid, Amount |

$ 130

|

| Expense Ratio, Percent |

1.27%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Active commodity strategies within the agriculture sector, including underweight exposure to corn, as well as overweight exposure to coffee, contributed to relative performance versus the UBS Prompt Commodity Index Total Return ("Index"), as corn posted negative returns, while coffee posted positive returns. Overweight exposure to silver contributed to relative performance versus the Index, as silver posted positive returns. Exposure to securitized assets, including collateralized loan obligations, contributed to relative performance versus the Index, as spreads broadly tightened. Duration strategies in the U.S., including overweight exposure to the front-end of the curve, contributed to relative performance versus the Index, as front-end U.S. interest rates fell. Exposure to California Carbon Allowances ("CCAs") detracted from relative performance versus the Index, as CCAs posted negative returns. Overweight exposure to base metals detracted from relative performance versus the Index, as base metals posted positive returns. Underweight exposure to natural gas detracted from relative performance versus the Index, as natural gas posted positive returns.

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

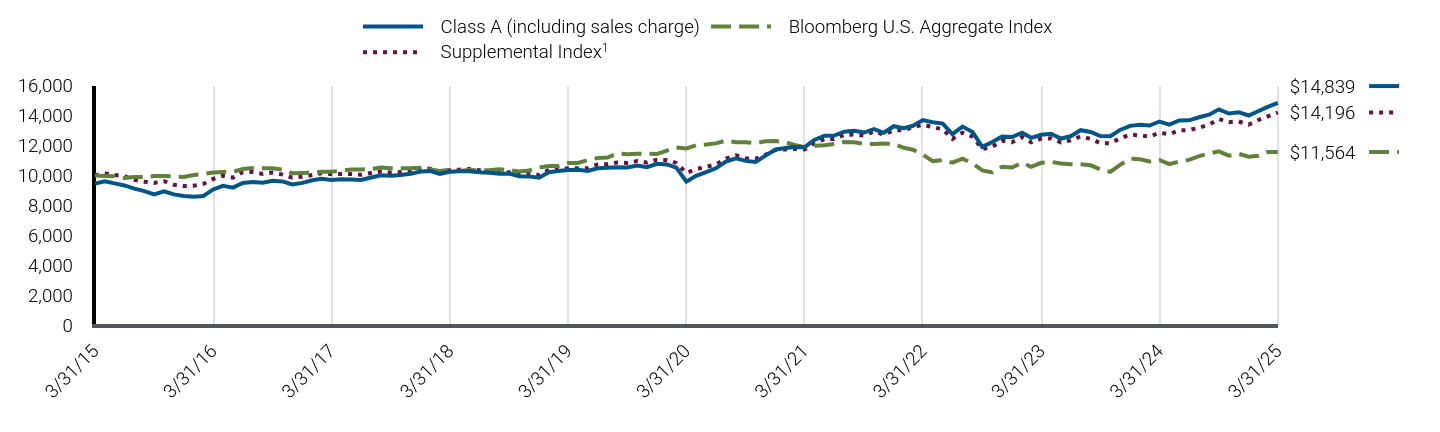

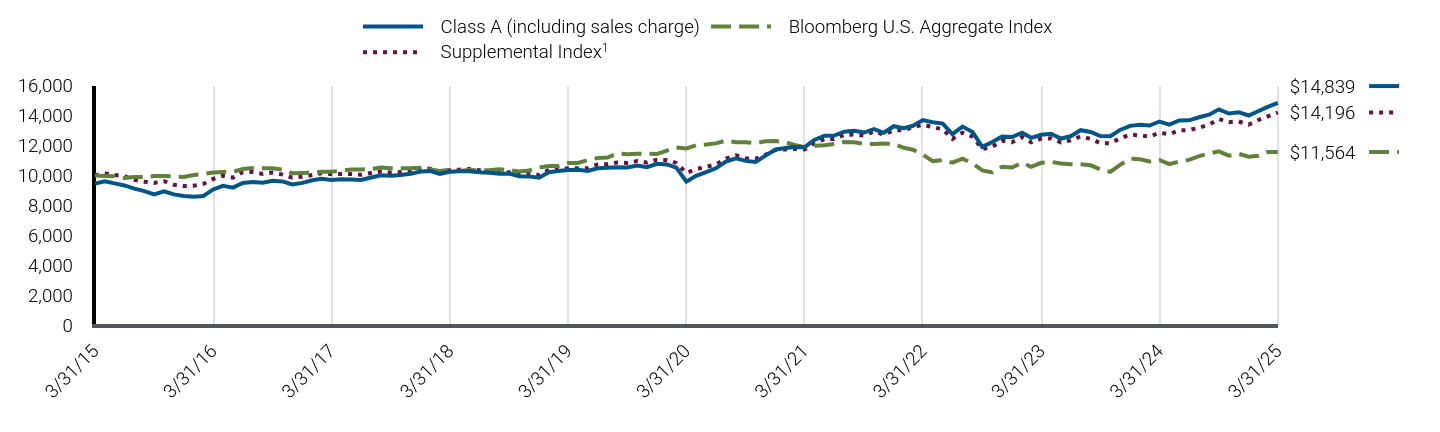

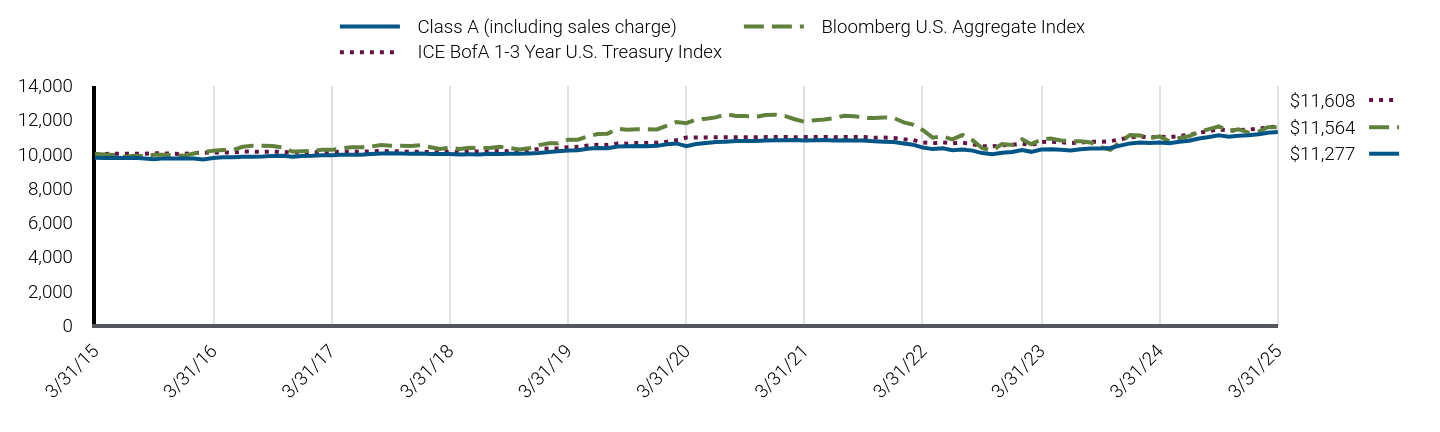

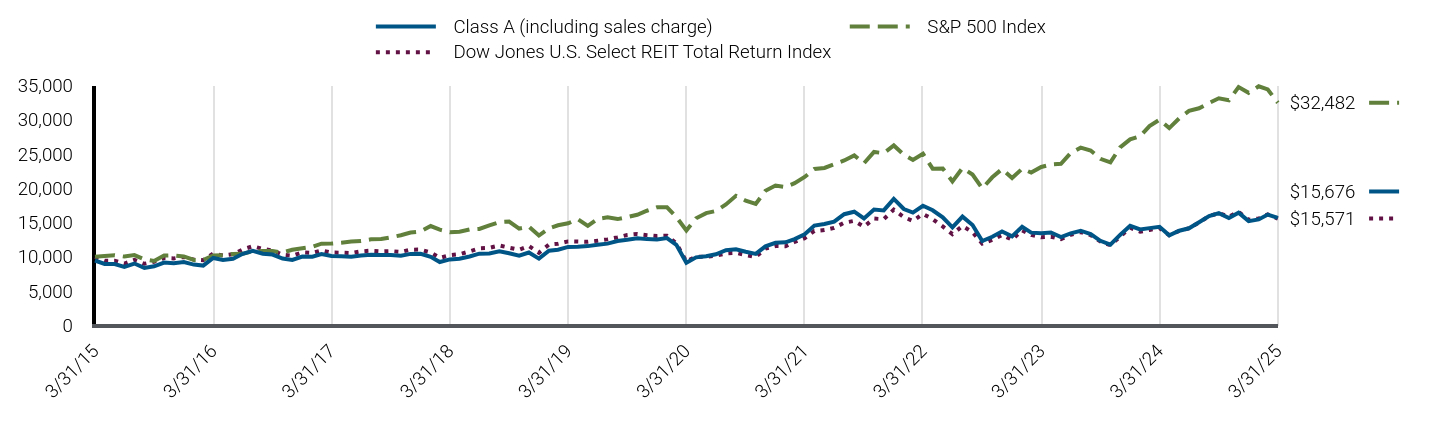

| Line Graph [Table Text Block] |

|

Class A (including sales charge) |

S&P 500 Index |

UBS Prompt Commodity Index Total Return |

3/31/15 |

$9,444 |

$10,000 |

$10,000 |

4/30/15 |

$10,410 |

$10,096 |

$11,039 |

5/31/15 |

$10,106 |

$10,226 |

$10,748 |

6/30/15 |

$10,094 |

$10,028 |

$10,778 |

7/31/15 |

$8,832 |

$10,238 |

$9,366 |

8/31/15 |

$8,805 |

$9,620 |

$9,398 |

9/30/15 |

$8,205 |

$9,382 |

$8,859 |

10/31/15 |

$8,379 |

$10,174 |

$8,944 |

11/30/15 |

$7,696 |

$10,204 |

$8,186 |

12/31/15 |

$7,195 |

$10,043 |

$7,630 |

1/31/16 |

$6,765 |

$9,545 |

$7,250 |

2/29/16 |

$6,658 |

$9,532 |

$7,175 |

3/31/16 |

$7,127 |

$10,178 |

$7,575 |

4/30/16 |

$7,893 |

$10,218 |

$8,366 |

5/31/16 |

$7,960 |

$10,401 |

$8,468 |

6/30/16 |

$8,075 |

$10,428 |

$8,586 |

7/31/16 |

$7,577 |

$10,813 |

$7,996 |

8/31/16 |

$7,698 |

$10,828 |

$8,077 |

9/30/16 |

$8,075 |

$10,830 |

$8,435 |

10/31/16 |

$8,021 |

$10,632 |

$8,309 |

11/30/16 |

$8,263 |

$11,026 |

$8,527 |

12/31/16 |

$8,531 |

$11,244 |

$8,813 |

1/31/17 |

$8,612 |

$11,457 |

$8,808 |

2/28/17 |

$8,639 |

$11,912 |

$8,842 |

3/31/17 |

$8,297 |

$11,926 |

$8,522 |

4/30/17 |

$8,095 |

$12,049 |

$8,291 |

5/31/17 |

$7,961 |

$12,218 |

$8,173 |

6/30/17 |

$7,856 |

$12,294 |

$8,054 |

7/31/17 |

$8,280 |

$12,547 |

$8,454 |

8/31/17 |

$8,308 |

$12,586 |

$8,454 |

9/30/17 |

$8,544 |

$12,845 |

$8,672 |

10/31/17 |

$8,898 |

$13,145 |

$8,997 |

11/30/17 |

$9,045 |

$13,548 |

$9,123 |

12/31/17 |

$9,408 |

$13,699 |

$9,487 |

1/31/18 |

$9,714 |

$14,483 |

$9,795 |

2/28/18 |

$9,485 |

$13,949 |

$9,556 |

3/31/18 |

$9,714 |

$13,595 |

$9,749 |

4/30/18 |

$10,111 |

$13,647 |

$10,177 |

5/31/18 |

$10,325 |

$13,976 |

$10,383 |

6/30/18 |

$10,249 |

$14,062 |

$10,311 |

7/31/18 |

$9,946 |

$14,585 |

$9,986 |

8/31/18 |

$9,994 |

$15,060 |

$10,026 |

9/30/18 |

$10,332 |

$15,146 |

$10,350 |

10/31/18 |

$9,781 |

$14,111 |

$9,871 |

11/30/18 |

$8,680 |

$14,398 |

$8,933 |

12/31/18 |

$8,224 |

$13,098 |

$8,401 |

1/31/19 |

$8,933 |

$14,148 |

$9,103 |

2/28/19 |

$9,394 |

$14,602 |

$9,463 |

3/31/19 |

$9,506 |

$14,886 |

$9,557 |

4/30/19 |

$9,790 |

$15,489 |

$9,788 |

5/31/19 |

$9,007 |

$14,504 |

$9,132 |

6/30/19 |

$9,376 |

$15,526 |

$9,519 |

7/31/19 |

$9,394 |

$15,750 |

$9,505 |

8/31/19 |

$8,838 |

$15,500 |

$9,031 |

9/30/19 |

$8,984 |

$15,790 |

$9,208 |

10/31/19 |

$9,147 |

$16,132 |

$9,372 |

11/30/19 |

$9,147 |

$16,718 |

$9,359 |

12/31/19 |

$9,801 |

$17,222 |

$9,989 |

1/31/20 |

$8,896 |

$17,216 |

$9,119 |

2/29/20 |

$8,171 |

$15,798 |

$8,429 |

3/31/20 |

$5,891 |

$13,847 |

$6,380 |

4/30/20 |

$5,618 |

$15,622 |

$5,971 |

5/31/20 |

$6,709 |

$16,366 |

$7,088 |

6/30/20 |

$7,084 |

$16,692 |

$7,477 |

7/31/20 |

$7,484 |

$17,633 |

$7,824 |

8/31/20 |

$7,903 |

$18,900 |

$8,247 |

9/30/20 |

$7,635 |

$18,182 |

$7,962 |

10/31/20 |

$7,307 |

$17,699 |

$7,603 |

11/30/20 |

$8,309 |

$19,636 |

$8,647 |

12/31/20 |

$8,856 |

$20,391 |

$9,181 |

1/31/21 |

$9,275 |

$20,185 |

$9,597 |

2/28/21 |

$10,259 |

$20,742 |

$10,622 |

3/31/21 |

$10,077 |

$21,650 |

$10,429 |

4/30/21 |

$10,879 |

$22,806 |

$11,273 |

5/31/21 |

$11,207 |

$22,965 |

$11,593 |

6/30/21 |

$11,688 |

$23,501 |

$12,099 |

7/31/21 |

$11,887 |

$24,059 |

$12,337 |

8/31/21 |

$11,738 |

$24,791 |

$12,153 |

9/30/21 |

$12,263 |

$23,638 |

$12,767 |

10/31/21 |

$12,933 |

$25,294 |

$13,454 |

11/30/21 |

$11,745 |

$25,119 |

$12,215 |

12/31/21 |

$12,699 |

$26,244 |

$13,159 |

1/31/22 |

$13,870 |

$24,886 |

$14,482 |

2/28/22 |

$14,857 |

$24,141 |

$15,600 |

3/31/22 |

$16,221 |

$25,038 |

$17,043 |

4/30/22 |

$16,840 |

$22,854 |

$17,695 |

5/31/22 |

$17,512 |

$22,896 |

$18,383 |

6/30/22 |

$16,086 |

$21,006 |

$16,986 |

7/31/22 |

$16,165 |

$22,943 |

$17,018 |

8/31/22 |

$15,749 |

$22,007 |

$16,623 |

9/30/22 |

$14,607 |

$19,981 |

$15,568 |

10/31/22 |

$15,300 |

$21,598 |

$16,275 |

11/30/22 |

$15,516 |

$22,805 |

$16,511 |

12/31/22 |

$15,582 |

$21,491 |

$16,511 |

1/31/23 |

$15,796 |

$22,842 |

$16,637 |

2/28/23 |

$15,273 |

$22,284 |

$15,999 |

3/31/23 |

$15,148 |

$23,103 |

$15,881 |

4/30/23 |

$15,124 |

$23,463 |

$15,818 |

5/31/23 |

$14,135 |

$23,565 |

$14,791 |

6/30/23 |

$14,690 |

$25,122 |

$15,335 |

7/31/23 |

$16,137 |

$25,929 |

$16,832 |

8/31/23 |

$16,185 |

$25,516 |

$16,850 |

9/30/23 |

$16,435 |

$24,300 |

$17,217 |

10/31/23 |

$16,000 |

$23,789 |

$16,775 |

11/30/23 |

$15,710 |

$25,961 |

$16,365 |

12/31/23 |

$15,371 |

$27,141 |

$15,992 |

1/31/24 |

$15,789 |

$27,597 |

$16,398 |

2/29/24 |

$15,838 |

$29,070 |

$16,486 |

3/31/24 |

$16,639 |

$30,006 |

$17,356 |

4/30/24 |

$16,910 |

$28,780 |

$17,720 |

5/31/24 |

$16,836 |

$30,207 |

$17,608 |

6/30/24 |

$16,860 |

$31,291 |

$17,648 |

7/31/24 |

$16,256 |

$31,672 |

$16,996 |

8/31/24 |

$16,054 |

$32,440 |

$16,794 |

9/30/24 |

$16,222 |

$33,133 |

$16,979 |

10/31/24 |

$16,196 |

$32,833 |

$16,960 |

11/30/24 |

$16,222 |

$34,760 |

$17,023 |

12/31/24 |

$16,627 |

$33,931 |

$17,438 |

1/31/25 |

$17,104 |

$34,876 |

$18,005 |

2/28/25 |

$16,865 |

$34,421 |

$17,759 |

3/31/25 |

$17,299 |

$32,482 |

$18,268 |

|

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

Class A (excluding sales charge) |

3.96% |

24.04% |

6.24% |

Class A (including sales charge) |

(1.71%) |

22.64% |

5.63% |

S&P 500 Index |

8.25% |

18.59% |

12.50% |

UBS Prompt Commodity Index Total Return |

5.26% |

23.42% |

6.21% | |

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

| AssetsNet |

$ 4,684,149,000

|

| Holdings Count | Holding |

1,079

|

| Advisory Fees Paid, Amount |

$ 22,011,000

|

| InvestmentCompanyPortfolioTurnover |

201.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$4,684,149 |

# of Portfolio Holdings |

1,079 |

Portfolio Turnover Rate |

201% |

Total Net Advisory Fees Paid During the Reporting Period |

$22,011 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Asset-Backed Securities |

17.0% |

Commodities |

14.8% |

Corporate Bonds & Notes |

11.5% |

U.S. Government Agencies |

11.0% |

U.S. Treasury Obligations |

3.2% |

Sovereign Issues |

2.3% |

Non-Agency Mortgage-Backed Securities |

2.2% |

Other Investments |

0.0%Footnote Reference^ |

Short-Term Instruments |

51.4% |

Affiliated Investments |

5.3% |

Financial Derivative Instruments |

1.5% |

Other Assets and Liabilities, Net |

(20.2%) |

Total |

100.0% |

| Footnote |

Description |

Footnote^ |

Rounded value of investments is less than 0.1% of net assets. |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

| Material Fund Change [Text Block] |

|

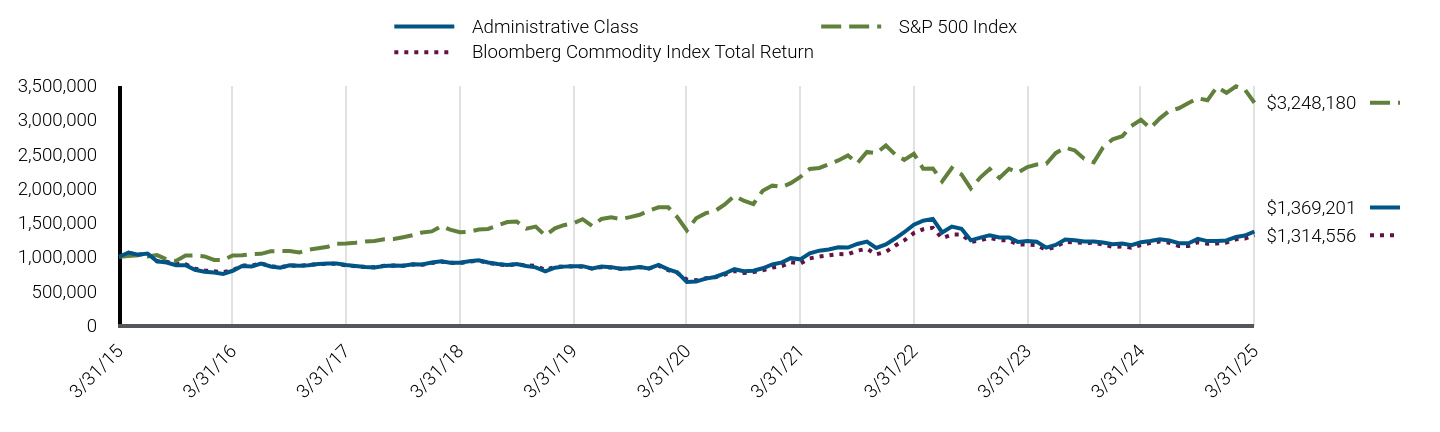

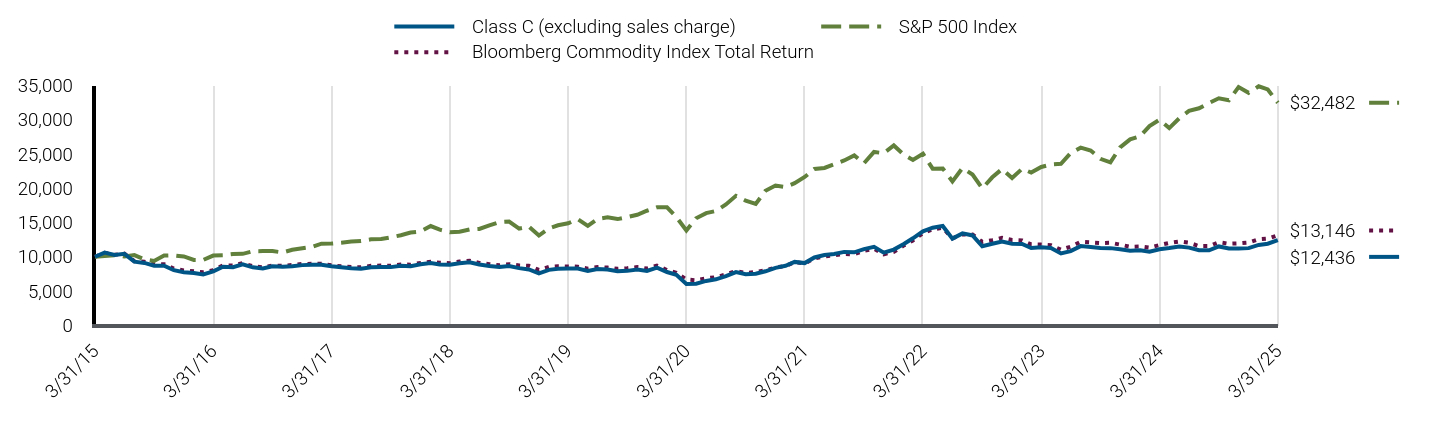

| C000088651 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PIMCO CommoditiesPLUS<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 15px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; white-space-collapse: preserve-breaks;">®</sup> Strategy Fund

|

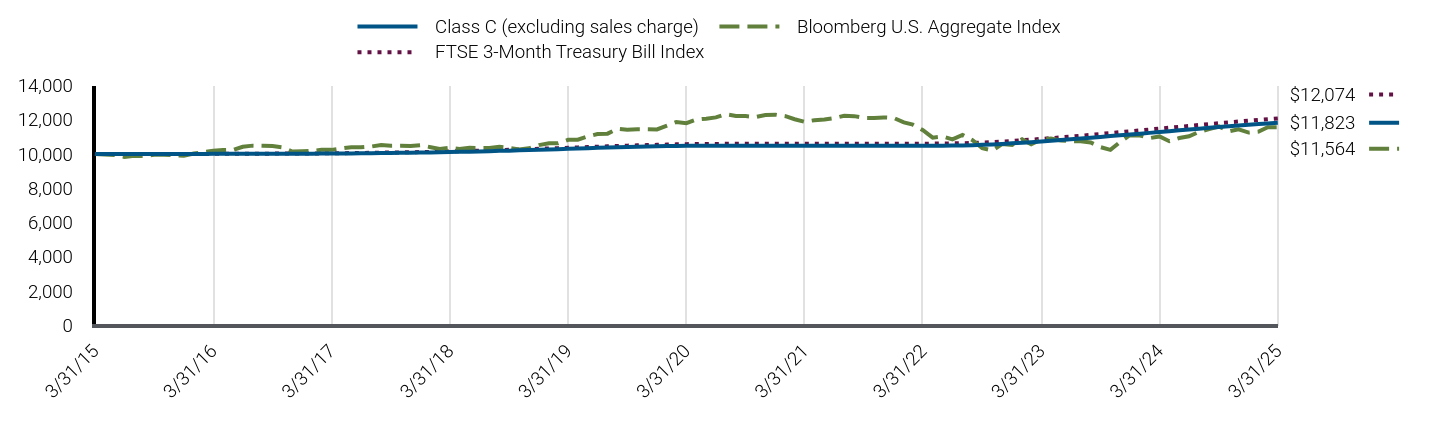

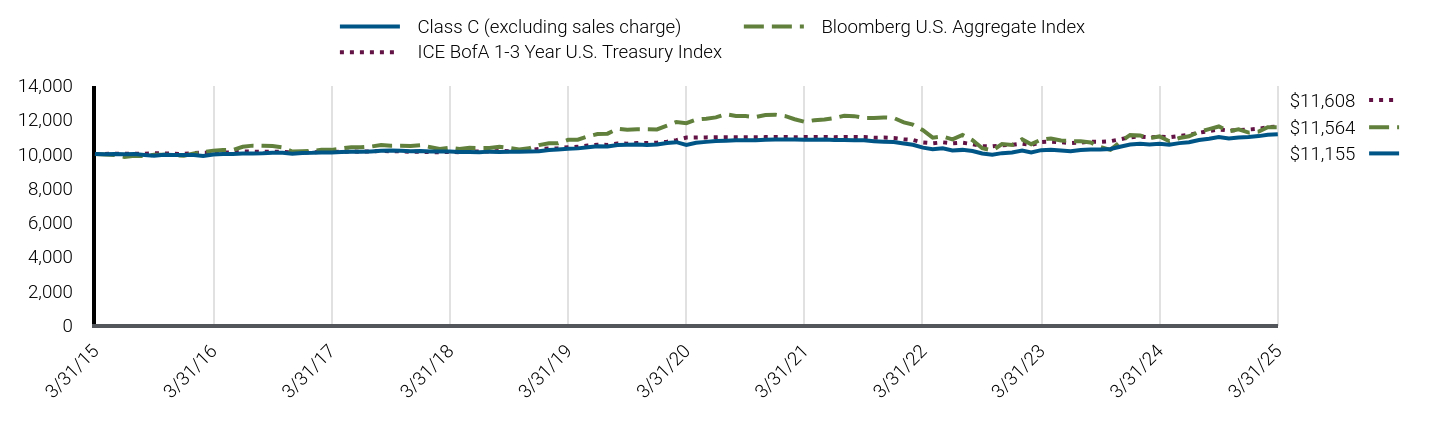

| Class Name |

Class C

|

| Trading Symbol |

PCPCX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO CommoditiesPLUS® Strategy Fund (the "Fund") for the period of April 1, 2024 to March 31, 2025 (the "reporting period").

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

| Additional Information Phone Number |

888.87.PIMCO (888.877.4626)

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class C |

$205 |

2.02% | |

| Expenses Paid, Amount |

$ 205

|

| Expense Ratio, Percent |

2.02%

|

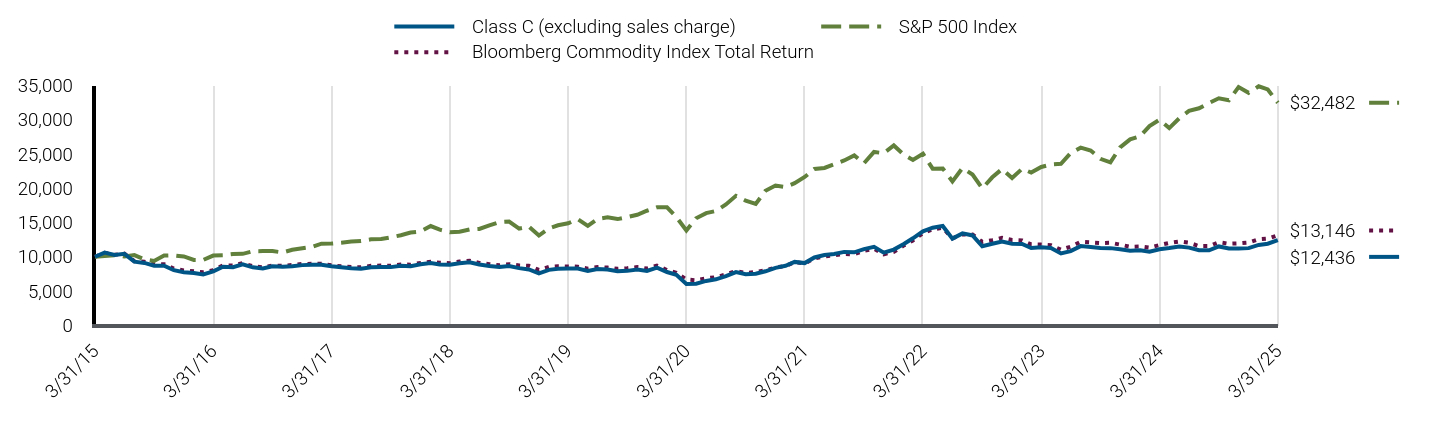

| Factors Affecting Performance [Text Block] |

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Active commodity strategies within the agriculture sector, including underweight exposure to corn, as well as overweight exposure to coffee, contributed to relative performance versus the UBS Prompt Commodity Index Total Return ("Index"), as corn posted negative returns, while coffee posted positive returns. Overweight exposure to silver contributed to relative performance versus the Index, as silver posted positive returns. Exposure to securitized assets, including collateralized loan obligations, contributed to relative performance versus the Index, as spreads broadly tightened. Duration strategies in the U.S., including overweight exposure to the front-end of the curve, contributed to relative performance versus the Index, as front-end U.S. interest rates fell. Exposure to California Carbon Allowances ("CCAs") detracted from relative performance versus the Index, as CCAs posted negative returns. Overweight exposure to base metals detracted from relative performance versus the Index, as base metals posted positive returns. Underweight exposure to natural gas detracted from relative performance versus the Index, as natural gas posted positive returns.

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

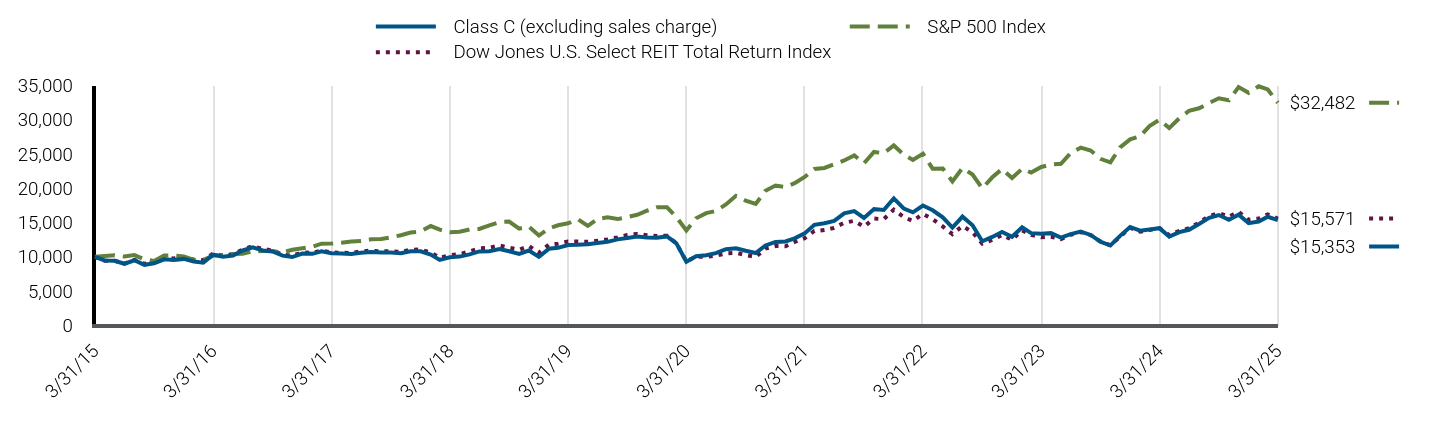

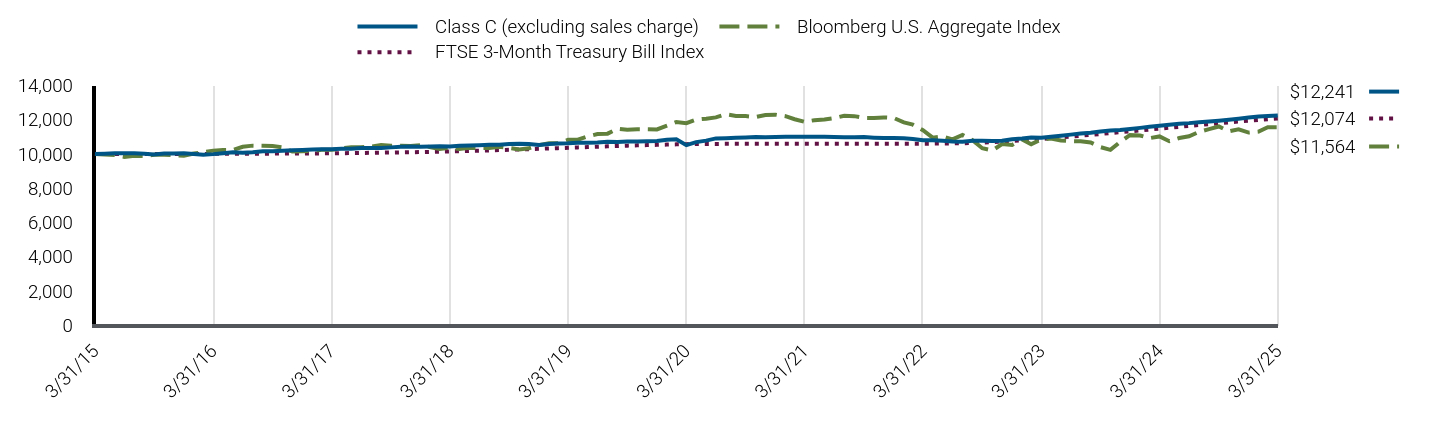

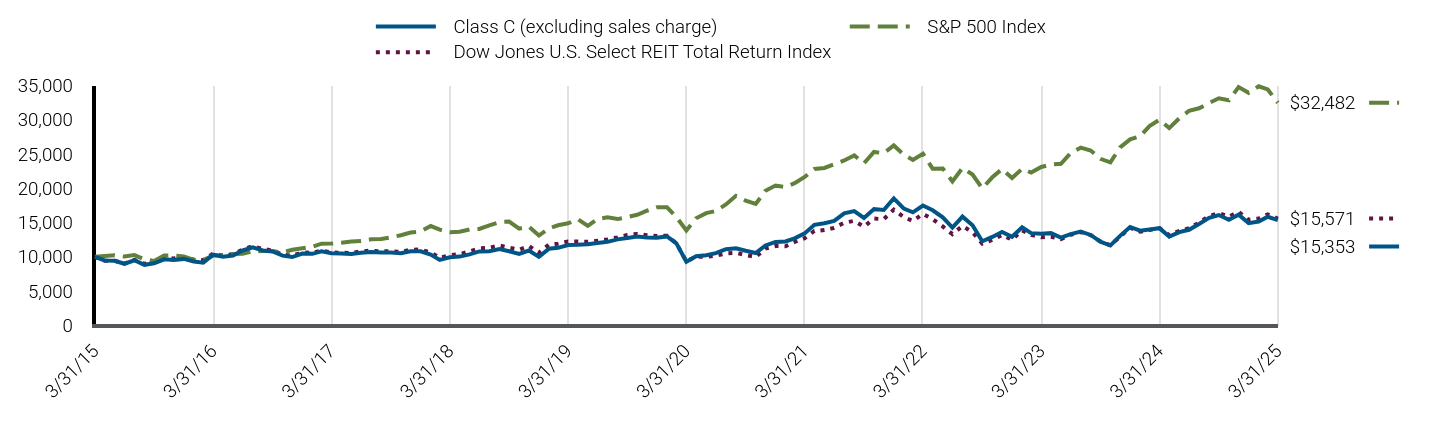

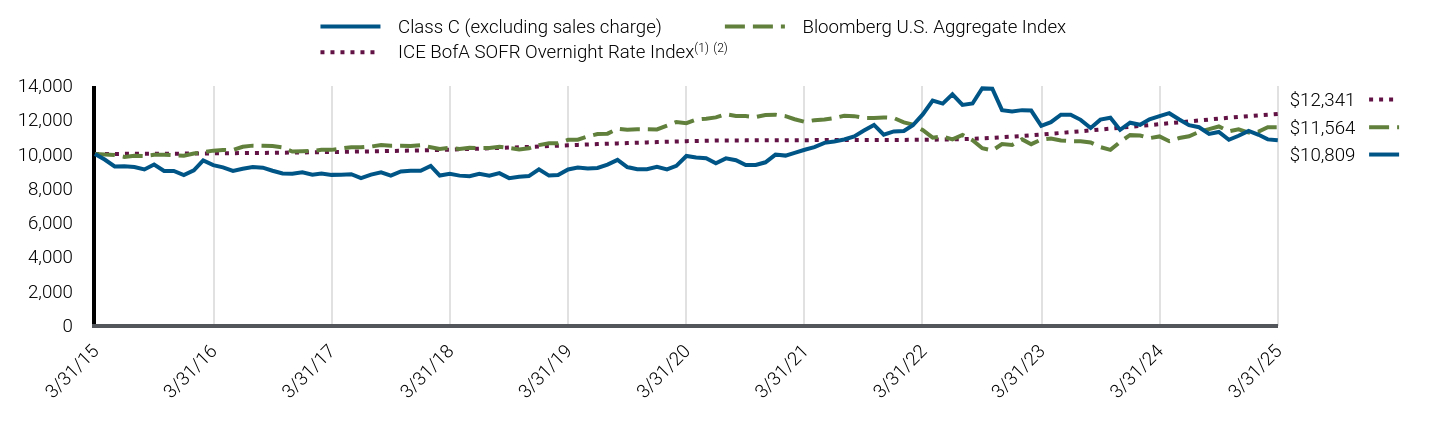

| Line Graph [Table Text Block] |

|

Class C (excluding sales charge) |

S&P 500 Index |

UBS Prompt Commodity Index Total Return |

3/31/15 |

$10,000 |

$10,000 |

$10,000 |

4/30/15 |

$11,019 |

$10,096 |

$11,039 |

5/31/15 |

$10,689 |

$10,226 |

$10,748 |

6/30/15 |

$10,660 |

$10,028 |

$10,778 |

7/31/15 |

$9,337 |

$10,238 |

$9,366 |

8/31/15 |

$9,293 |

$9,620 |

$9,398 |

9/30/15 |

$8,655 |

$9,382 |

$8,859 |

10/31/15 |

$8,829 |

$10,174 |

$8,944 |

11/30/15 |

$8,105 |

$10,204 |

$8,186 |

12/31/15 |

$7,562 |

$10,043 |

$7,630 |

1/31/16 |

$7,113 |

$9,545 |

$7,250 |

2/29/16 |

$6,997 |

$9,532 |

$7,175 |

3/31/16 |

$7,489 |

$10,178 |

$7,575 |

4/30/16 |

$8,286 |

$10,218 |

$8,366 |

5/31/16 |

$8,358 |

$10,401 |

$8,468 |

6/30/16 |

$8,460 |

$10,428 |

$8,586 |

7/31/16 |

$7,953 |

$10,813 |

$7,996 |

8/31/16 |

$8,069 |

$10,828 |

$8,077 |

9/30/16 |

$8,445 |

$10,830 |

$8,435 |

10/31/16 |

$8,387 |

$10,632 |

$8,309 |

11/30/16 |

$8,634 |

$11,026 |

$8,527 |

12/31/16 |

$8,923 |

$11,244 |

$8,813 |

1/31/17 |

$8,981 |

$11,457 |

$8,808 |

2/28/17 |

$9,010 |

$11,912 |

$8,842 |

3/31/17 |

$8,663 |

$11,926 |

$8,522 |

4/30/17 |

$8,445 |

$12,049 |

$8,291 |

5/31/17 |

$8,301 |

$12,218 |

$8,173 |

6/30/17 |

$8,175 |

$12,294 |

$8,054 |

7/31/17 |

$8,615 |

$12,547 |

$8,454 |

8/31/17 |

$8,646 |

$12,586 |

$8,454 |

9/30/17 |

$8,874 |

$12,845 |

$8,672 |

10/31/17 |

$9,239 |

$13,145 |

$8,997 |

11/30/17 |

$9,382 |

$13,548 |

$9,123 |

12/31/17 |

$9,756 |

$13,699 |

$9,487 |

1/31/18 |

$10,068 |

$14,483 |

$9,795 |

2/28/18 |

$9,822 |

$13,949 |

$9,556 |

3/31/18 |

$10,052 |

$13,595 |

$9,749 |

4/30/18 |

$10,463 |

$13,647 |

$10,177 |

5/31/18 |

$10,677 |

$13,976 |

$10,383 |

6/30/18 |

$10,586 |

$14,062 |

$10,311 |

7/31/18 |

$10,275 |

$14,585 |

$9,986 |

8/31/18 |

$10,310 |

$15,060 |

$10,026 |

9/30/18 |

$10,656 |

$15,146 |

$10,350 |

10/31/18 |

$10,080 |

$14,111 |

$9,871 |

11/30/18 |

$8,946 |

$14,398 |

$8,933 |

12/31/18 |

$8,473 |

$13,098 |

$8,401 |

1/31/19 |

$9,199 |

$14,148 |

$9,103 |

2/28/19 |

$9,658 |

$14,602 |

$9,463 |

3/31/19 |

$9,762 |

$14,886 |

$9,557 |

4/30/19 |

$10,050 |

$15,489 |

$9,788 |

5/31/19 |

$9,244 |

$14,504 |

$9,132 |

6/30/19 |

$9,608 |

$15,526 |

$9,519 |

7/31/19 |

$9,627 |

$15,750 |

$9,505 |

8/31/19 |

$9,048 |

$15,500 |

$9,031 |

9/30/19 |

$9,187 |

$15,790 |

$9,208 |

10/31/19 |

$9,362 |

$16,132 |

$9,372 |

11/30/19 |

$9,362 |

$16,718 |

$9,359 |

12/31/19 |

$10,006 |

$17,222 |

$9,989 |

1/31/20 |

$9,073 |

$17,216 |

$9,119 |

2/29/20 |

$8,335 |

$15,798 |

$8,429 |

3/31/20 |

$5,993 |

$13,847 |

$6,380 |

4/30/20 |

$5,740 |

$15,622 |

$5,971 |

5/31/20 |

$6,830 |

$16,366 |

$7,088 |

6/30/20 |

$7,223 |

$16,692 |

$7,477 |

7/31/20 |

$7,612 |

$17,633 |

$7,824 |

8/31/20 |

$8,041 |

$18,900 |

$8,247 |

9/30/20 |

$7,749 |

$18,182 |

$7,962 |

10/31/20 |

$7,418 |

$17,699 |

$7,603 |

11/30/20 |

$8,430 |

$19,636 |

$8,647 |

12/31/20 |

$8,975 |

$20,391 |

$9,181 |

1/31/21 |

$9,384 |

$20,185 |

$9,597 |

2/28/21 |

$10,397 |

$20,742 |

$10,622 |

3/31/21 |

$10,202 |

$21,650 |

$10,429 |

4/30/21 |

$11,010 |

$22,806 |

$11,273 |

5/31/21 |

$11,331 |

$22,965 |

$11,593 |

6/30/21 |

$11,808 |

$23,501 |

$12,099 |

7/31/21 |

$11,994 |

$24,059 |

$12,337 |

8/31/21 |

$11,845 |

$24,791 |

$12,153 |

9/30/21 |

$12,368 |

$23,638 |

$12,767 |

10/31/21 |

$13,024 |

$25,294 |

$13,454 |

11/30/21 |

$11,844 |

$25,119 |

$12,215 |

12/31/21 |

$12,781 |

$26,244 |

$13,159 |

1/31/22 |

$13,961 |

$24,886 |

$14,482 |

2/28/22 |

$14,936 |

$24,141 |

$15,600 |

3/31/22 |

$16,303 |

$25,038 |

$17,043 |

4/30/22 |

$16,899 |

$22,854 |

$17,695 |

5/31/22 |

$17,578 |

$22,896 |

$18,383 |

6/30/22 |

$16,134 |

$21,006 |

$16,986 |

7/31/22 |

$16,224 |

$22,943 |

$17,018 |

8/31/22 |

$15,771 |

$22,007 |

$16,623 |

9/30/22 |

$14,623 |

$19,981 |

$15,568 |

10/31/22 |

$15,298 |

$21,598 |

$16,275 |

11/30/22 |

$15,498 |

$22,805 |

$16,511 |

12/31/22 |

$15,563 |

$21,491 |

$16,511 |

1/31/23 |

$15,758 |

$22,842 |

$16,637 |

2/28/23 |

$15,229 |

$22,284 |

$15,999 |

3/31/23 |

$15,090 |

$23,103 |

$15,881 |

4/30/23 |

$15,062 |

$23,463 |

$15,818 |

5/31/23 |

$14,073 |

$23,565 |

$14,791 |

6/30/23 |

$14,638 |

$25,122 |

$15,335 |

7/31/23 |

$16,051 |

$25,929 |

$16,832 |

8/31/23 |

$16,080 |

$25,516 |

$16,850 |

9/30/23 |

$16,334 |

$24,300 |

$17,217 |

10/31/23 |

$15,882 |

$23,789 |

$16,775 |

11/30/23 |

$15,571 |

$25,961 |

$16,365 |

12/31/23 |

$15,256 |

$27,141 |

$15,992 |

1/31/24 |

$15,630 |

$27,597 |

$16,398 |

2/29/24 |

$15,688 |

$29,070 |

$16,486 |

3/31/24 |

$16,486 |

$30,006 |

$17,356 |

4/30/24 |

$16,716 |

$28,780 |

$17,720 |

5/31/24 |

$16,659 |

$30,207 |

$17,608 |

6/30/24 |

$16,665 |

$31,291 |

$17,648 |

7/31/24 |

$16,074 |

$31,672 |

$16,996 |

8/31/24 |

$15,837 |

$32,440 |

$16,794 |

9/30/24 |

$16,008 |

$33,133 |

$16,979 |

10/31/24 |

$15,977 |

$32,833 |

$16,960 |

11/30/24 |

$15,977 |

$34,760 |

$17,023 |

12/31/24 |

$16,361 |

$33,931 |

$17,438 |

1/31/25 |

$16,829 |

$34,876 |

$18,005 |

2/28/25 |

$16,580 |

$34,421 |

$17,759 |

3/31/25 |

$17,003 |

$32,482 |

$18,268 |

|

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

Class C (excluding sales charge) |

3.14% |

23.19% |

5.45% |

Class C (including sales charge) |

2.20% |

23.19% |

5.45% |

S&P 500 Index |

8.25% |

18.59% |

12.50% |

UBS Prompt Commodity Index Total Return |

5.26% |

23.42% |

6.21% | |

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

| AssetsNet |

$ 4,684,149,000

|

| Holdings Count | Holding |

1,079

|

| Advisory Fees Paid, Amount |

$ 22,011,000

|

| InvestmentCompanyPortfolioTurnover |

201.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$4,684,149 |

# of Portfolio Holdings |

1,079 |

Portfolio Turnover Rate |

201% |

Total Net Advisory Fees Paid During the Reporting Period |

$22,011 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Asset-Backed Securities |

17.0% |

Commodities |

14.8% |

Corporate Bonds & Notes |

11.5% |

U.S. Government Agencies |

11.0% |

U.S. Treasury Obligations |

3.2% |

Sovereign Issues |

2.3% |

Non-Agency Mortgage-Backed Securities |

2.2% |

Other Investments |

0.0%Footnote Reference^ |

Short-Term Instruments |

51.4% |

Affiliated Investments |

5.3% |

Financial Derivative Instruments |

1.5% |

Other Assets and Liabilities, Net |

(20.2%) |

Total |

100.0% |

| Footnote |

Description |

Footnote^ |

Rounded value of investments is less than 0.1% of net assets. |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

| Material Fund Change [Text Block] |

|

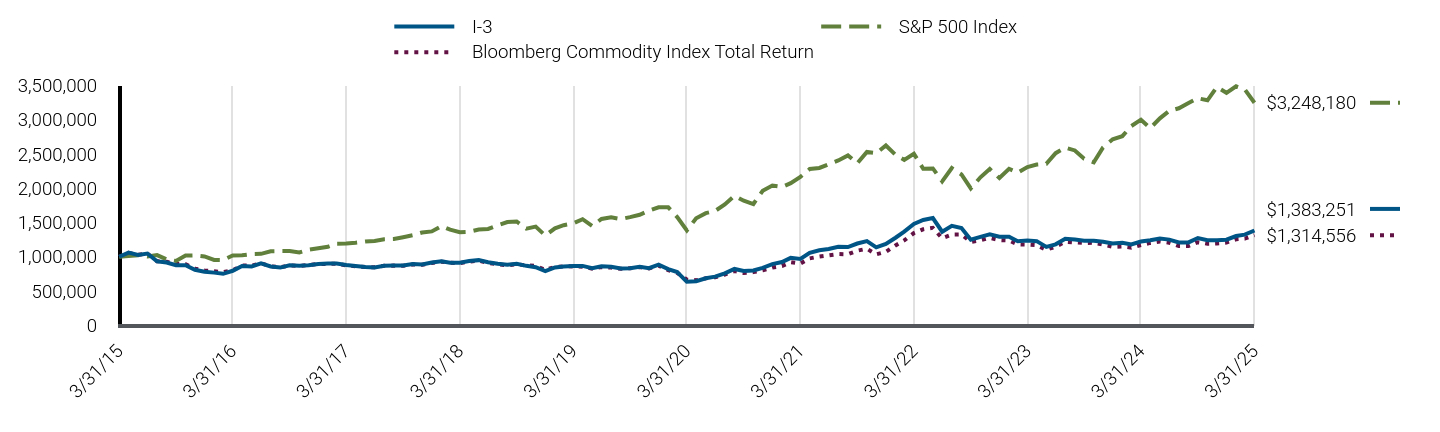

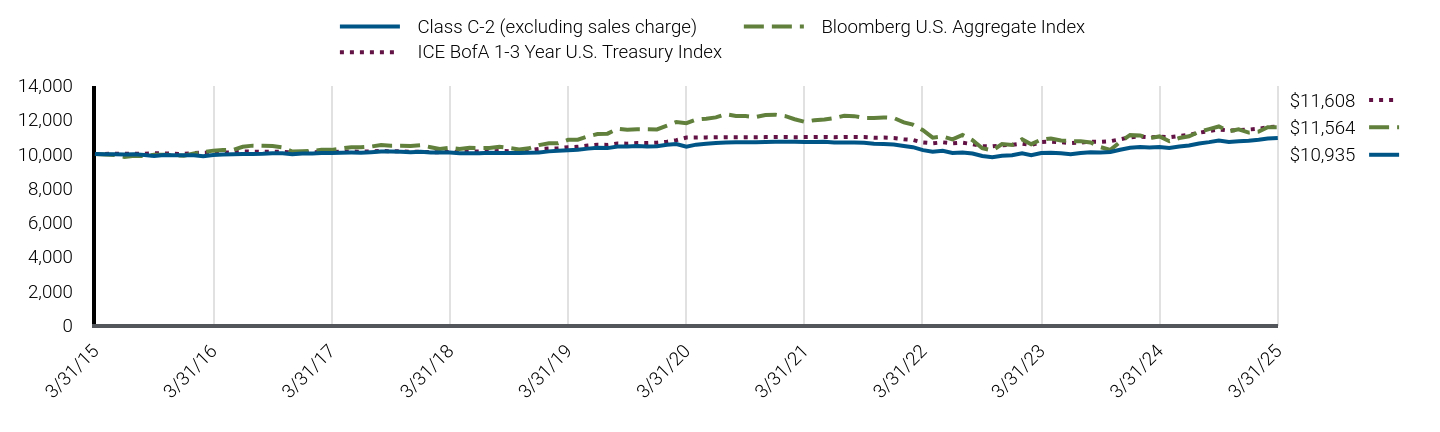

| C000200462 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

PIMCO CommoditiesPLUS<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 15px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; white-space-collapse: preserve-breaks;">®</sup> Strategy Fund

|

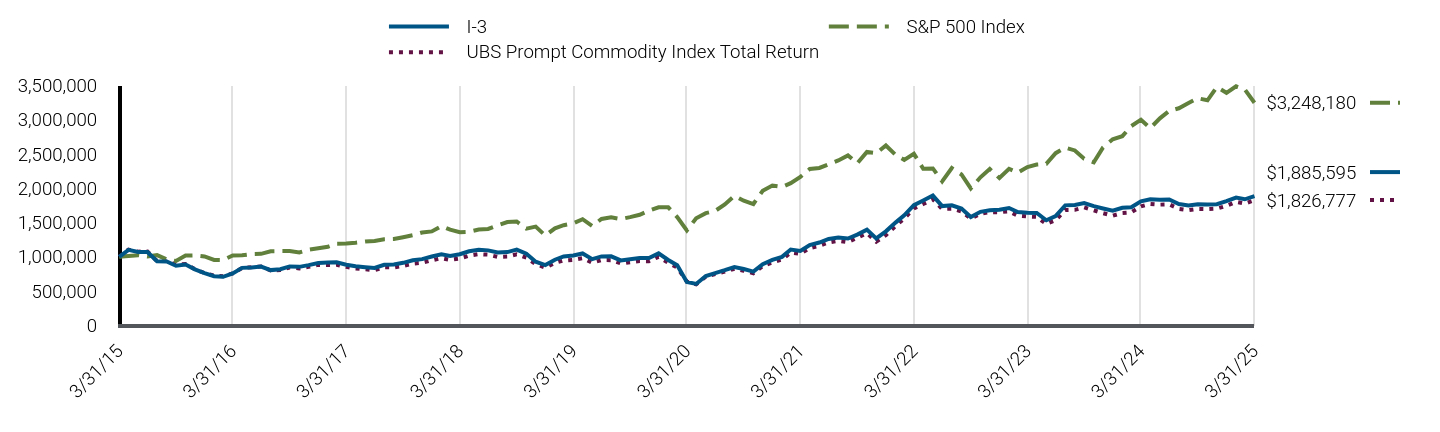

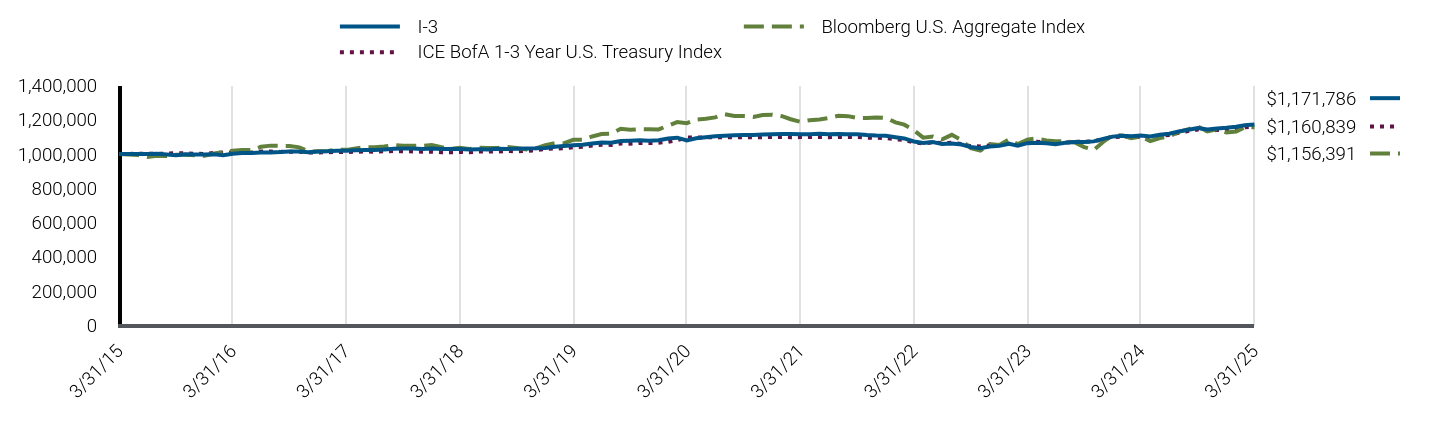

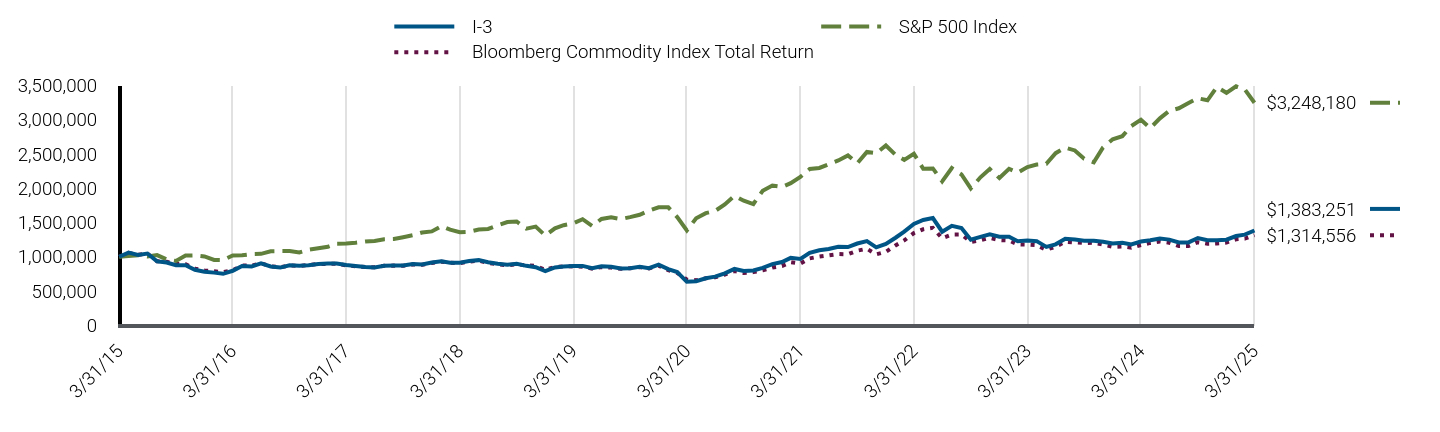

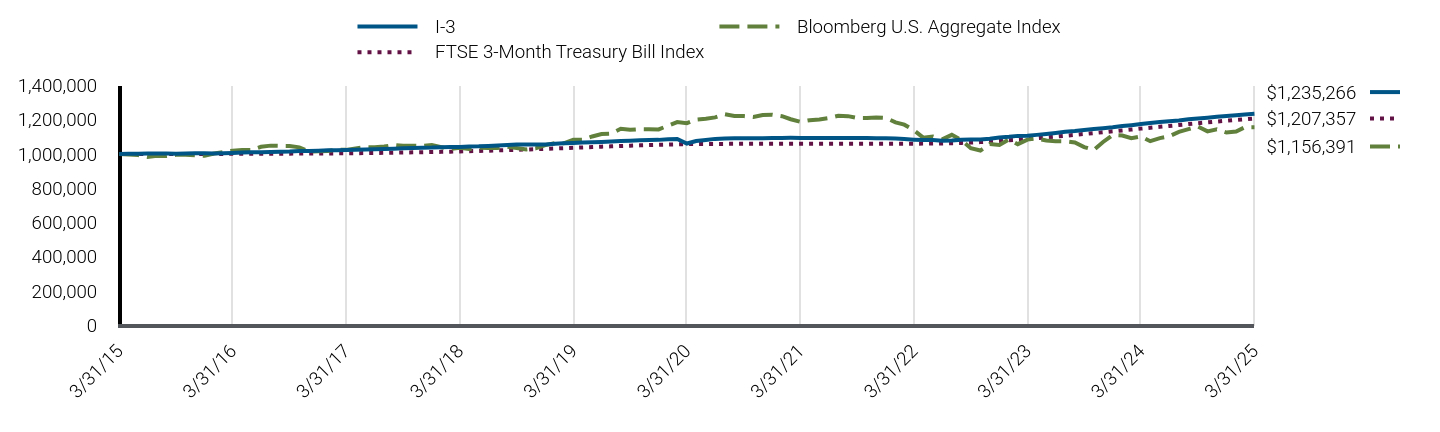

| Class Name |

I-3

|

| Trading Symbol |

PCLNX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO CommoditiesPLUS® Strategy Fund (the "Fund") for the period of April 1, 2024 to March 31, 2025 (the "reporting period").

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

| Additional Information Phone Number |

888.87.PIMCO (888.877.4626)

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

I-3 |

$99 |

0.97% | |

| Expenses Paid, Amount |

$ 99

|

| Expense Ratio, Percent |

0.97%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Active commodity strategies within the agriculture sector, including underweight exposure to corn, as well as overweight exposure to coffee, contributed to relative performance versus the UBS Prompt Commodity Index Total Return ("Index"), as corn posted negative returns, while coffee posted positive returns. Overweight exposure to silver contributed to relative performance versus the Index, as silver posted positive returns. Exposure to securitized assets, including collateralized loan obligations, contributed to relative performance versus the Index, as spreads broadly tightened. Duration strategies in the U.S., including overweight exposure to the front-end of the curve, contributed to relative performance versus the Index, as front-end U.S. interest rates fell. Exposure to California Carbon Allowances ("CCAs") detracted from relative performance versus the Index, as CCAs posted negative returns. Overweight exposure to base metals detracted from relative performance versus the Index, as base metals posted positive returns. Underweight exposure to natural gas detracted from relative performance versus the Index, as natural gas posted positive returns.

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

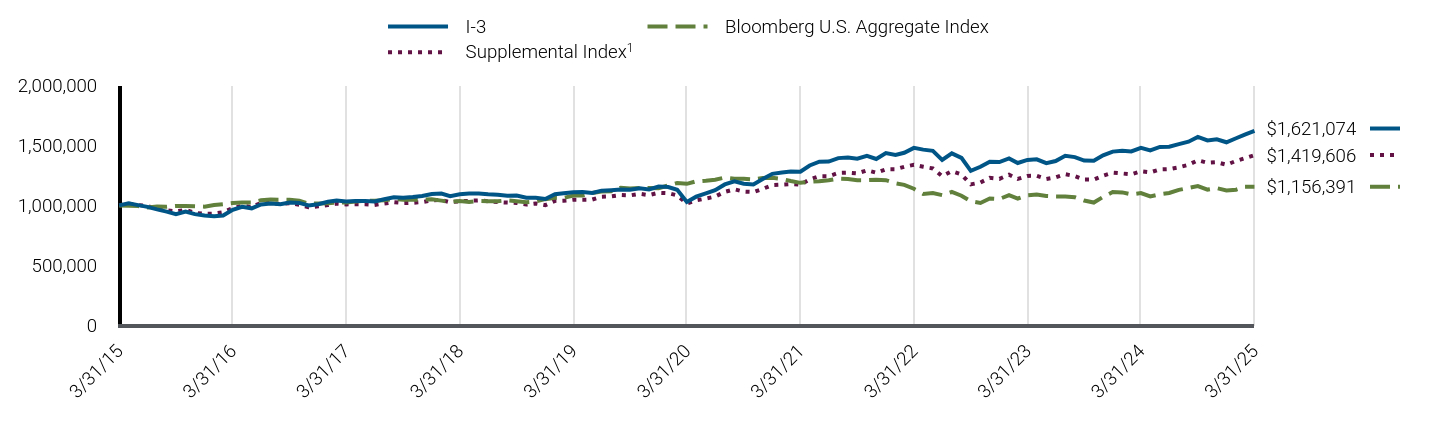

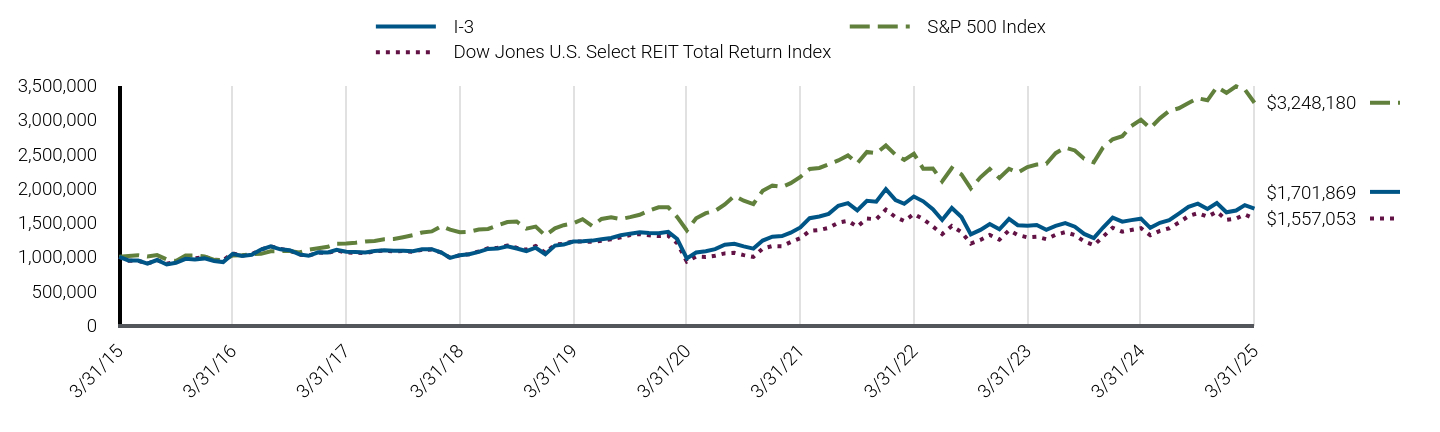

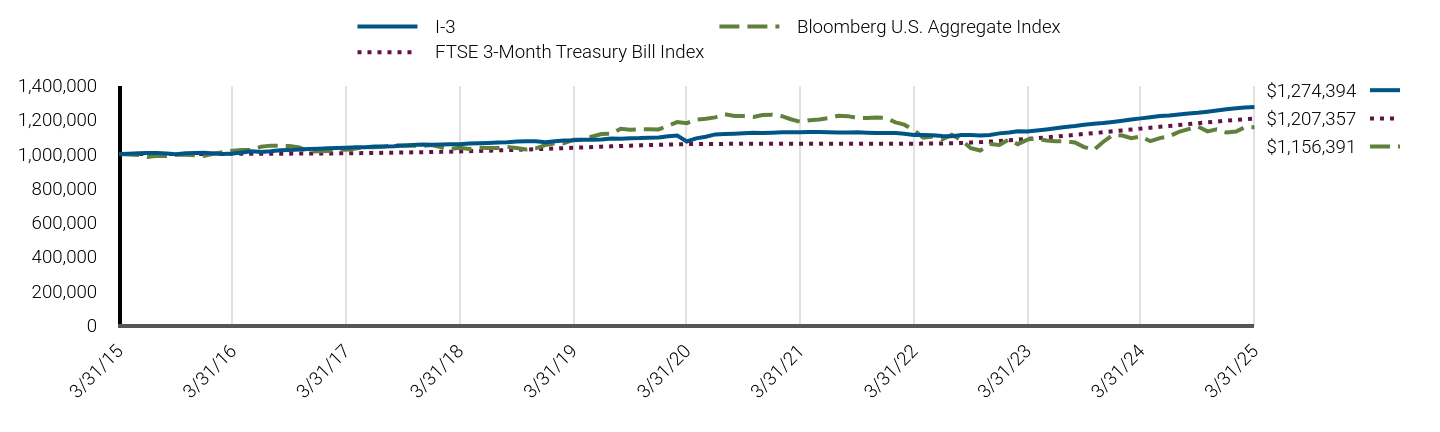

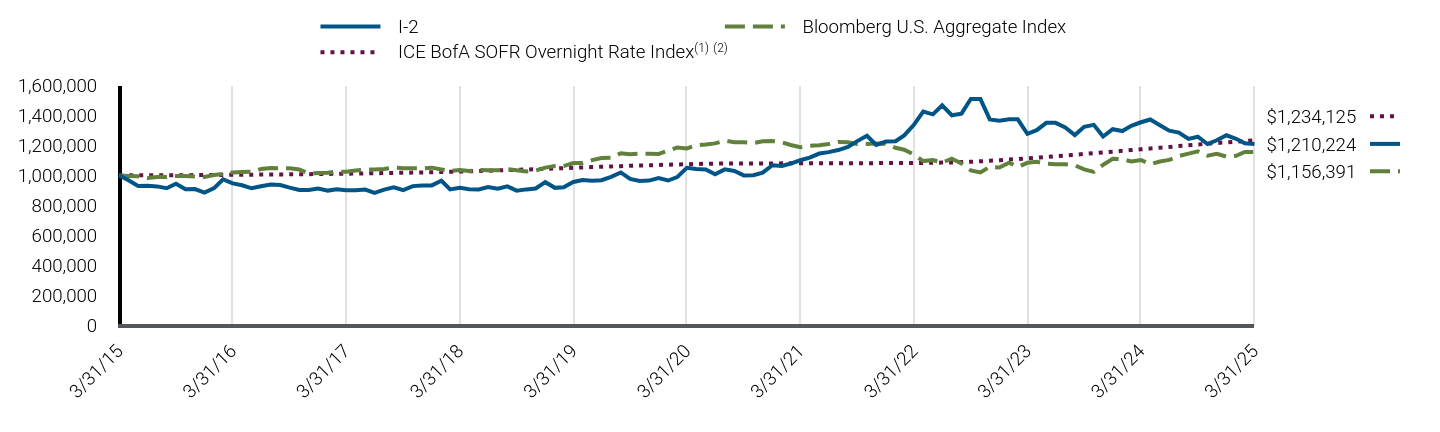

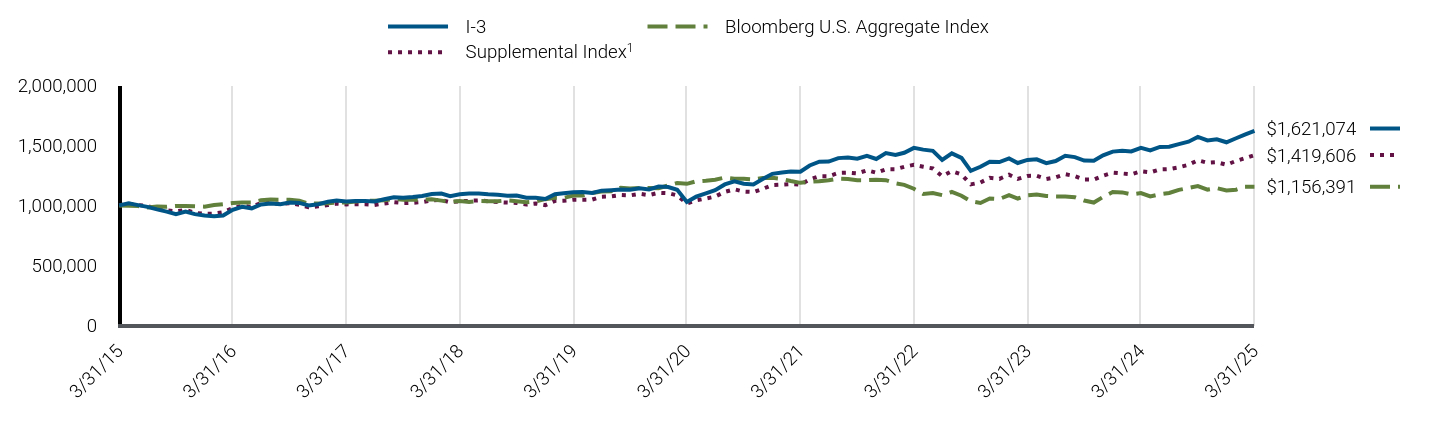

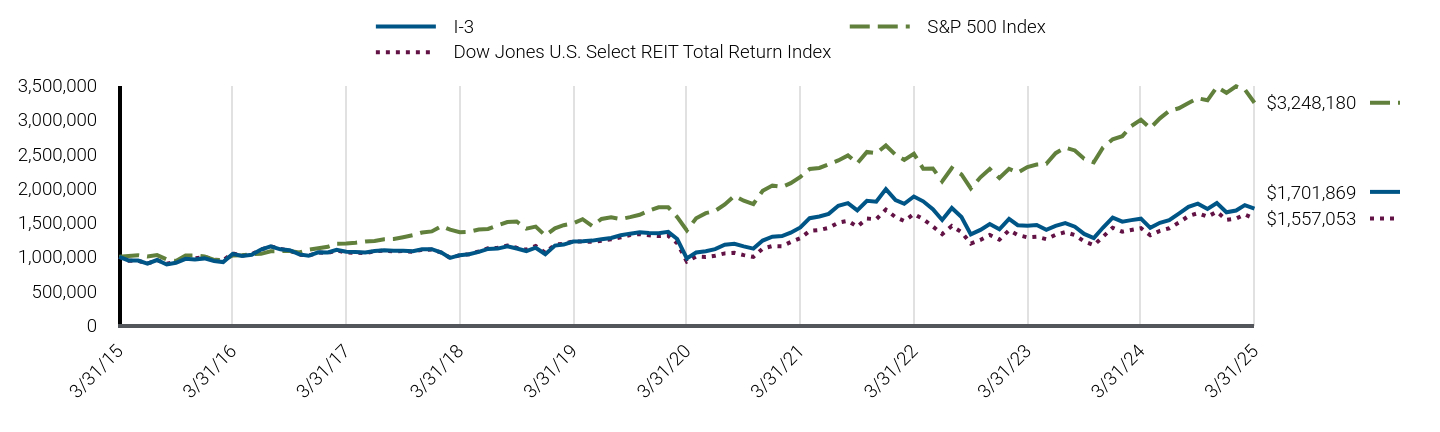

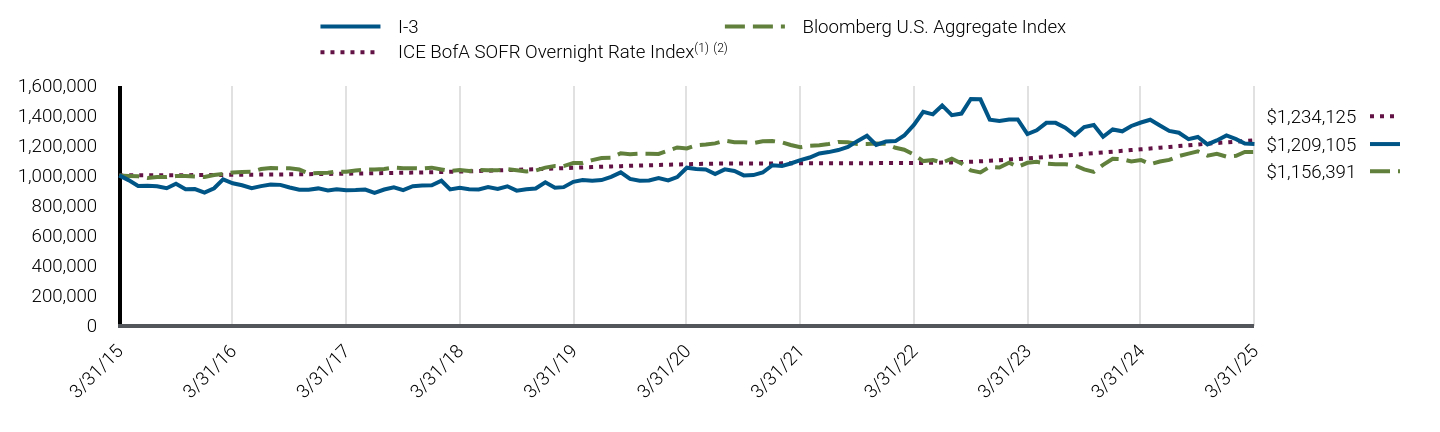

| Line Graph [Table Text Block] |

|

I-3 |

S&P 500 Index |

UBS Prompt Commodity Index Total Return |

3/31/15 |

$1,000,000 |

$1,000,000 |

$1,000,000 |

4/30/15 |

$1,100,978 |

$1,009,593 |

$1,103,873 |

5/31/15 |

$1,070,372 |

$1,022,576 |

$1,074,822 |

6/30/15 |

$1,068,583 |

$1,002,781 |

$1,077,753 |

7/31/15 |

$934,884 |

$1,023,790 |

$936,551 |

8/31/15 |

$931,988 |

$962,021 |

$939,768 |

9/30/15 |

$868,761 |

$938,217 |

$885,889 |

10/31/15 |

$886,893 |

$1,017,360 |

$894,412 |

11/30/15 |

$816,624 |

$1,020,385 |

$818,552 |

12/31/15 |

$762,415 |

$1,004,292 |

$762,979 |

1/31/16 |

$717,229 |

$954,455 |

$725,002 |

2/29/16 |

$707,284 |

$953,167 |

$717,486 |

3/31/16 |

$756,500 |

$1,017,828 |

$757,514 |

4/30/16 |

$838,112 |

$1,021,774 |

$836,616 |

5/31/16 |

$845,049 |

$1,040,123 |

$846,843 |

6/30/16 |

$857,722 |

$1,042,818 |

$858,601 |

7/31/16 |

$805,419 |

$1,081,265 |

$799,584 |

8/31/16 |

$818,008 |

$1,082,784 |

$807,729 |

9/30/16 |

$858,806 |

$1,082,988 |

$843,465 |

10/31/16 |

$853,055 |

$1,063,233 |

$830,904 |

11/30/16 |

$878,331 |

$1,102,610 |

$852,719 |

12/31/16 |

$907,824 |

$1,124,405 |

$881,252 |

1/31/17 |

$916,165 |

$1,145,730 |

$880,773 |

2/28/17 |

$918,878 |

$1,191,223 |

$884,185 |

3/31/17 |

$884,202 |

$1,192,612 |

$852,160 |

4/30/17 |

$862,872 |

$1,204,860 |

$829,127 |

5/31/17 |

$848,617 |

$1,221,816 |

$817,310 |

6/30/17 |

$836,859 |

$1,229,442 |

$805,369 |

7/31/17 |

$882,749 |

$1,254,723 |

$845,391 |

8/31/17 |

$887,089 |

$1,258,564 |

$845,403 |

9/30/17 |

$911,461 |

$1,284,525 |

$867,222 |

10/31/17 |

$948,546 |

$1,314,500 |

$899,693 |

11/30/17 |

$965,476 |

$1,354,816 |

$912,263 |

12/31/17 |

$1,004,724 |

$1,369,880 |

$948,717 |

1/31/18 |

$1,036,744 |

$1,448,311 |

$979,501 |

2/28/18 |

$1,012,517 |

$1,394,930 |

$955,592 |

3/31/18 |

$1,037,461 |

$1,359,480 |

$974,890 |

4/30/18 |

$1,080,793 |

$1,364,697 |

$1,017,724 |

5/31/18 |

$1,103,411 |

$1,397,561 |

$1,038,345 |

6/30/18 |

$1,093,540 |

$1,406,163 |

$1,031,075 |

7/31/18 |

$1,063,070 |

$1,458,492 |

$998,642 |

8/31/18 |

$1,068,148 |

$1,506,017 |

$1,002,617 |

9/30/18 |

$1,103,679 |

$1,514,589 |

$1,035,015 |

10/31/18 |

$1,045,312 |

$1,411,067 |

$987,111 |

11/30/18 |

$928,576 |

$1,439,822 |

$893,278 |

12/31/18 |

$879,587 |

$1,309,819 |

$840,103 |

1/31/19 |

$956,645 |

$1,414,783 |

$910,333 |

2/28/19 |

$1,005,511 |

$1,460,209 |

$946,295 |

3/31/19 |

$1,017,817 |

$1,488,583 |

$955,689 |

4/30/19 |

$1,048,031 |

$1,548,856 |

$978,843 |

5/31/19 |

$964,944 |

$1,450,428 |

$913,193 |

6/30/19 |

$1,004,680 |

$1,552,649 |

$951,876 |

7/31/19 |

$1,006,583 |

$1,574,964 |

$950,481 |

8/31/19 |

$947,596 |

$1,550,016 |

$903,112 |

9/30/19 |

$963,897 |

$1,579,018 |

$920,803 |

10/31/19 |

$981,178 |

$1,613,219 |

$937,221 |

11/30/19 |

$981,178 |

$1,671,777 |

$935,942 |

12/31/19 |

$1,049,776 |

$1,722,235 |

$998,876 |

1/31/20 |

$953,467 |

$1,721,559 |

$911,889 |

2/29/20 |

$876,419 |

$1,579,842 |

$842,933 |

3/31/20 |

$632,573 |

$1,384,711 |

$637,991 |

4/30/20 |

$603,556 |

$1,562,223 |

$597,074 |

5/31/20 |

$719,624 |

$1,636,628 |

$708,827 |

6/30/20 |

$761,758 |

$1,669,176 |

$747,675 |

7/31/20 |

$804,401 |

$1,763,293 |

$782,429 |

8/31/20 |

$850,921 |

$1,890,039 |

$824,720 |

9/30/20 |

$821,063 |

$1,818,224 |

$796,199 |

10/31/20 |

$784,183 |

$1,769,870 |

$760,320 |

11/30/20 |

$892,882 |

$1,963,607 |

$864,721 |

12/31/20 |

$953,555 |

$2,039,105 |

$918,095 |

1/31/21 |

$998,222 |

$2,018,518 |

$959,685 |

2/28/21 |

$1,105,036 |

$2,074,179 |

$1,062,177 |

3/31/21 |

$1,084,644 |

$2,165,019 |

$1,042,880 |

4/30/21 |

$1,172,037 |

$2,280,563 |

$1,127,329 |

5/31/21 |

$1,207,966 |

$2,296,491 |

$1,159,290 |

6/30/21 |

$1,260,807 |

$2,350,103 |

$1,209,899 |

7/31/21 |

$1,281,849 |

$2,405,929 |

$1,233,749 |

8/31/21 |

$1,266,067 |

$2,479,083 |

$1,215,251 |

9/30/21 |

$1,323,144 |

$2,363,781 |

$1,276,744 |

10/31/21 |

$1,395,669 |

$2,529,392 |

$1,345,440 |

11/30/21 |

$1,268,308 |

$2,511,866 |

$1,221,538 |

12/31/21 |

$1,371,030 |

$2,624,438 |

$1,315,853 |

1/31/22 |

$1,498,403 |

$2,488,631 |

$1,448,176 |

2/28/22 |

$1,604,547 |

$2,414,118 |

$1,560,016 |

3/31/22 |

$1,753,188 |

$2,503,753 |

$1,704,321 |

4/30/22 |

$1,820,397 |

$2,285,421 |

$1,769,459 |

5/31/22 |

$1,893,366 |

$2,289,614 |

$1,838,298 |

6/30/22 |

$1,739,648 |

$2,100,621 |

$1,698,572 |

7/31/22 |

$1,750,102 |

$2,294,307 |

$1,701,820 |

8/31/22 |

$1,704,102 |

$2,200,741 |

$1,662,348 |

9/30/22 |

$1,580,630 |

$1,998,056 |

$1,556,755 |

10/31/22 |

$1,655,789 |

$2,159,821 |

$1,627,524 |

11/30/22 |

$1,678,565 |

$2,280,521 |

$1,651,058 |

12/31/22 |

$1,686,253 |

$2,149,130 |

$1,651,124 |

1/31/23 |

$1,711,234 |

$2,284,168 |

$1,663,664 |

2/28/23 |

$1,653,777 |

$2,228,437 |

$1,599,917 |

3/31/23 |

$1,641,493 |

$2,310,252 |

$1,588,110 |

4/30/23 |

$1,638,960 |

$2,346,311 |

$1,581,811 |

5/31/23 |

$1,532,567 |

$2,356,510 |

$1,479,141 |

6/30/23 |

$1,593,363 |

$2,512,217 |

$1,533,521 |

7/31/23 |

$1,750,420 |

$2,592,922 |

$1,683,176 |

8/31/23 |

$1,755,486 |

$2,551,639 |

$1,684,968 |

9/30/23 |

$1,784,089 |

$2,429,982 |

$1,721,668 |

10/31/23 |

$1,738,343 |

$2,378,888 |

$1,677,506 |

11/30/23 |

$1,705,304 |

$2,596,140 |

$1,636,490 |

12/31/23 |

$1,671,462 |

$2,714,085 |

$1,599,203 |

1/31/24 |

$1,715,447 |

$2,759,693 |

$1,639,802 |

2/29/24 |

$1,723,210 |

$2,907,048 |

$1,648,587 |

3/31/24 |

$1,808,274 |

$3,000,582 |

$1,735,565 |

4/30/24 |

$1,839,406 |

$2,878,024 |

$1,771,963 |

5/31/24 |

$1,831,623 |

$3,020,730 |

$1,760,799 |

6/30/24 |

$1,835,284 |

$3,129,120 |

$1,764,777 |

7/31/24 |

$1,768,980 |

$3,167,209 |

$1,699,553 |

8/31/24 |

$1,747,763 |

$3,244,035 |

$1,679,375 |

9/30/24 |

$1,766,682 |

$3,313,318 |

$1,697,916 |

10/31/24 |

$1,763,960 |

$3,283,271 |

$1,696,007 |

11/30/24 |

$1,766,682 |

$3,476,003 |

$1,702,287 |

12/31/24 |

$1,811,133 |

$3,393,141 |

$1,743,837 |

1/31/25 |

$1,864,073 |

$3,487,632 |

$1,800,531 |

2/28/25 |

$1,838,996 |

$3,442,124 |

$1,775,866 |

3/31/25 |

$1,885,595 |

$3,248,180 |

$1,826,777 |

|

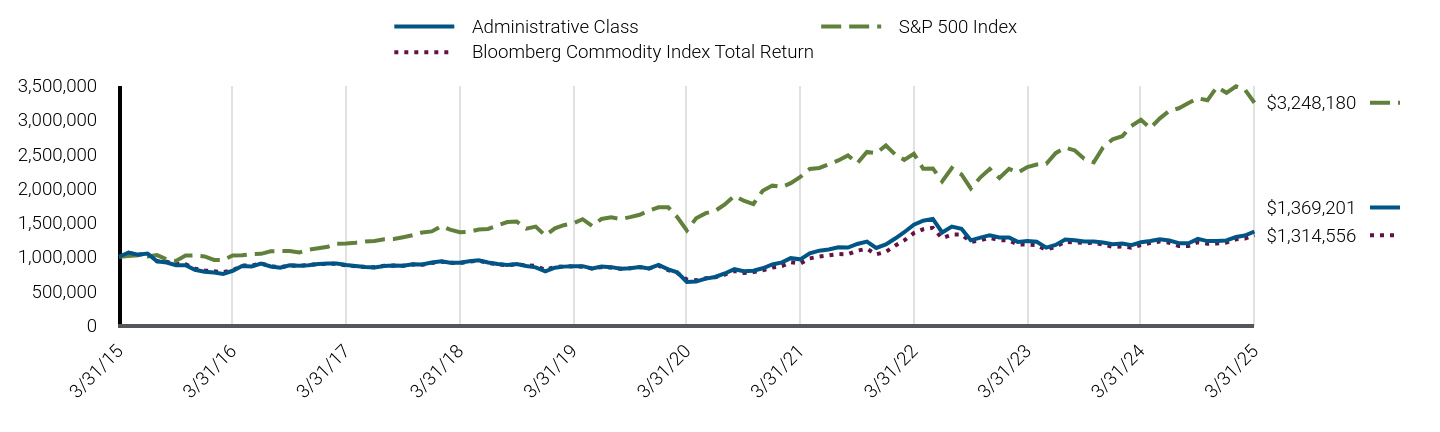

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

I-3 |

4.28% |

24.41% |

6.55% |

S&P 500 Index |

8.25% |

18.59% |

12.50% |

UBS Prompt Commodity Index Total Return |

5.26% |

23.42% |

6.21% | |

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

| AssetsNet |

$ 4,684,149,000

|

| Holdings Count | Holding |

1,079

|

| Advisory Fees Paid, Amount |

$ 22,011,000

|

| InvestmentCompanyPortfolioTurnover |

201.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$4,684,149 |

# of Portfolio Holdings |

1,079 |

Portfolio Turnover Rate |

201% |

Total Net Advisory Fees Paid During the Reporting Period |

$22,011 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Asset-Backed Securities |

17.0% |

Commodities |

14.8% |

Corporate Bonds & Notes |

11.5% |

U.S. Government Agencies |

11.0% |

U.S. Treasury Obligations |

3.2% |

Sovereign Issues |

2.3% |

Non-Agency Mortgage-Backed Securities |

2.2% |

Other Investments |

0.0%Footnote Reference^ |

Short-Term Instruments |

51.4% |

Affiliated Investments |

5.3% |

Financial Derivative Instruments |

1.5% |

Other Assets and Liabilities, Net |

(20.2%) |

Total |

100.0% |

| Footnote |

Description |

Footnote^ |

Rounded value of investments is less than 0.1% of net assets. |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

| Material Fund Change [Text Block] |

|

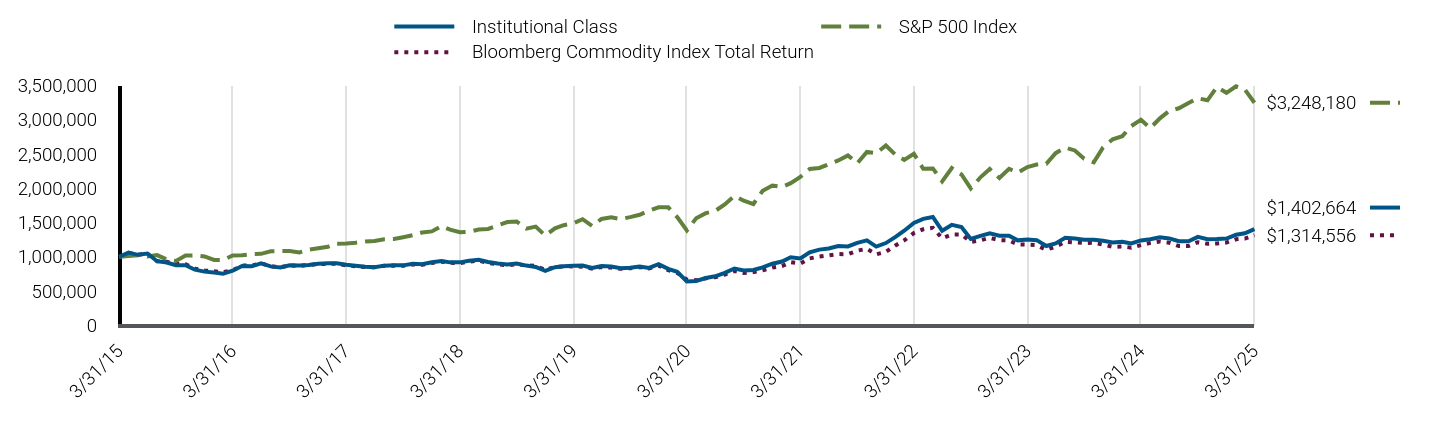

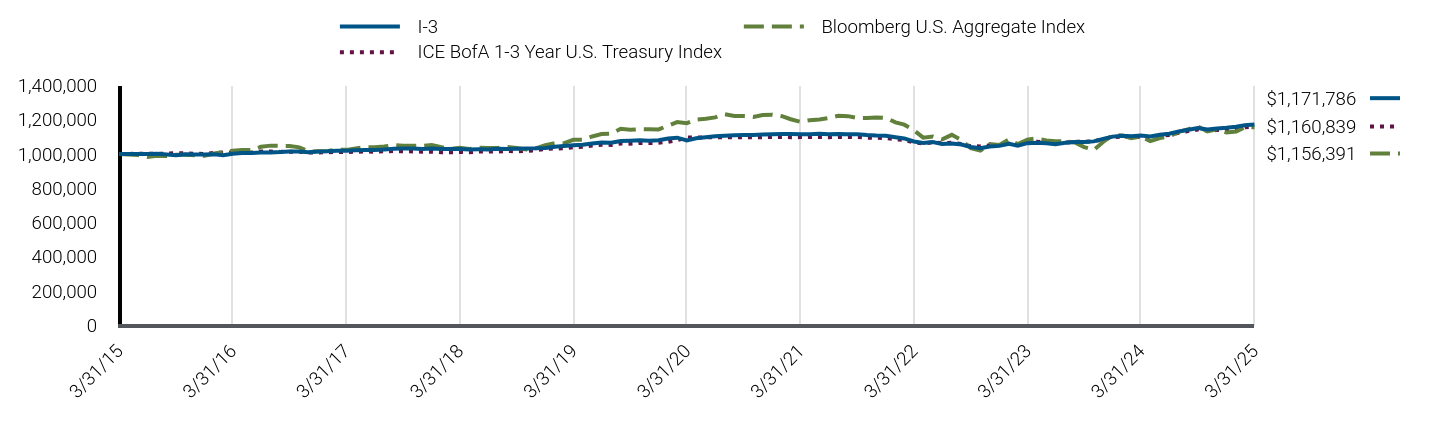

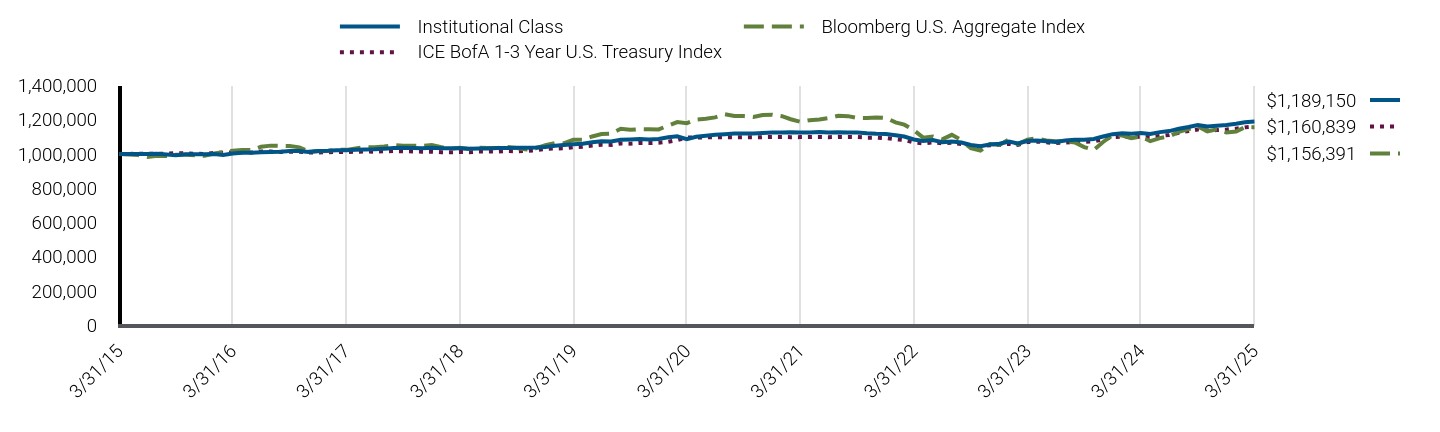

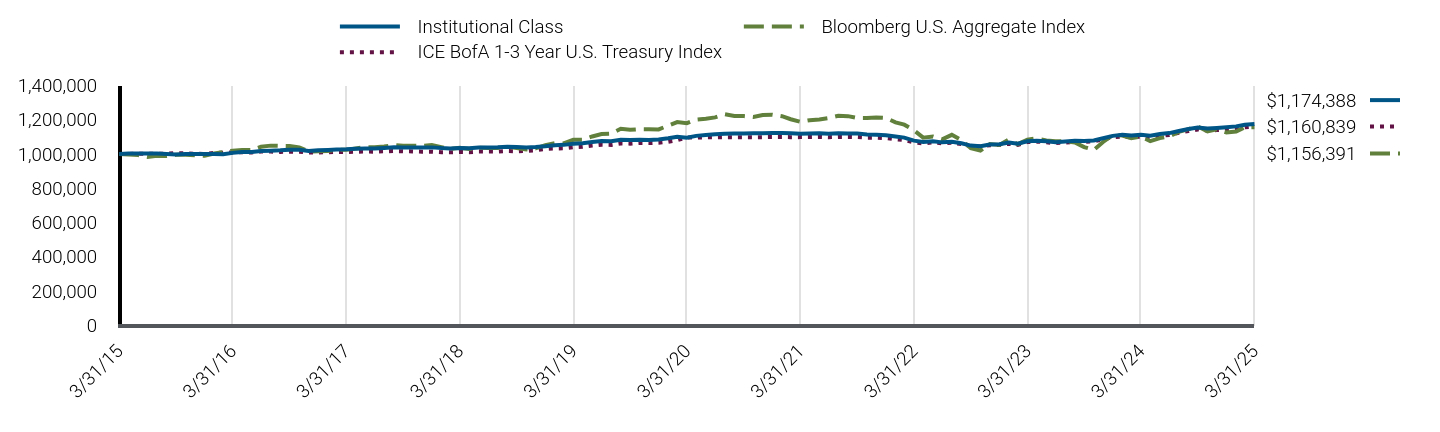

| C000088655 |

|

| Shareholder Report [Line Items] |

|

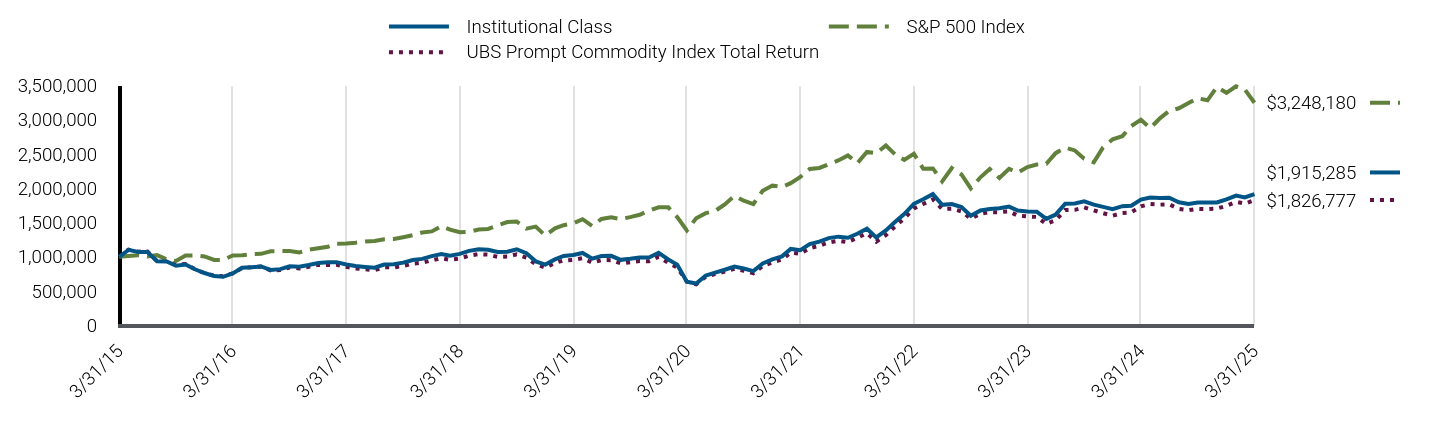

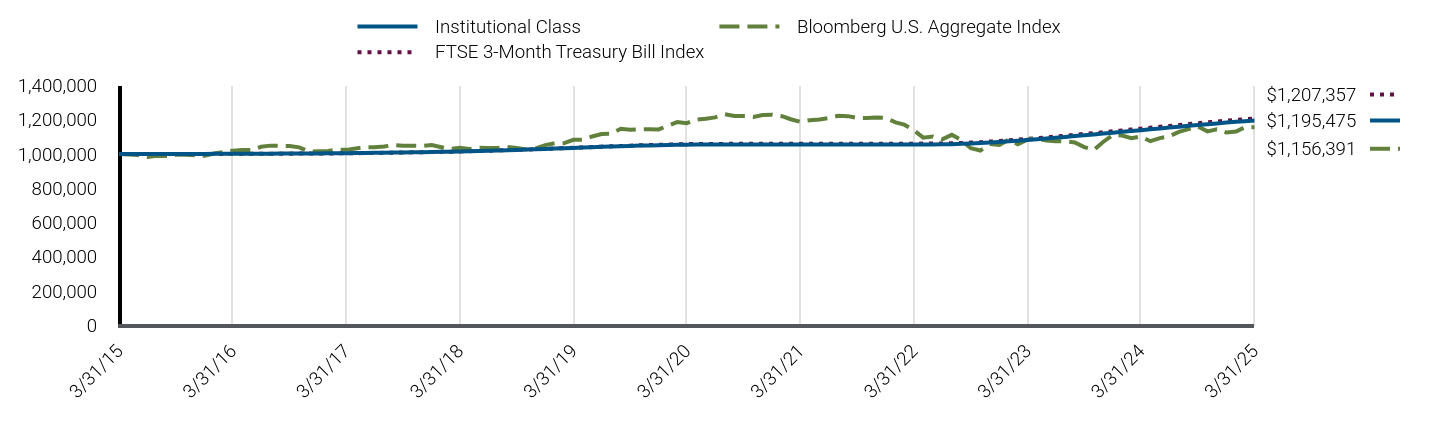

| Fund Name |

PIMCO CommoditiesPLUS<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 15px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; white-space-collapse: preserve-breaks;">®</sup> Strategy Fund

|

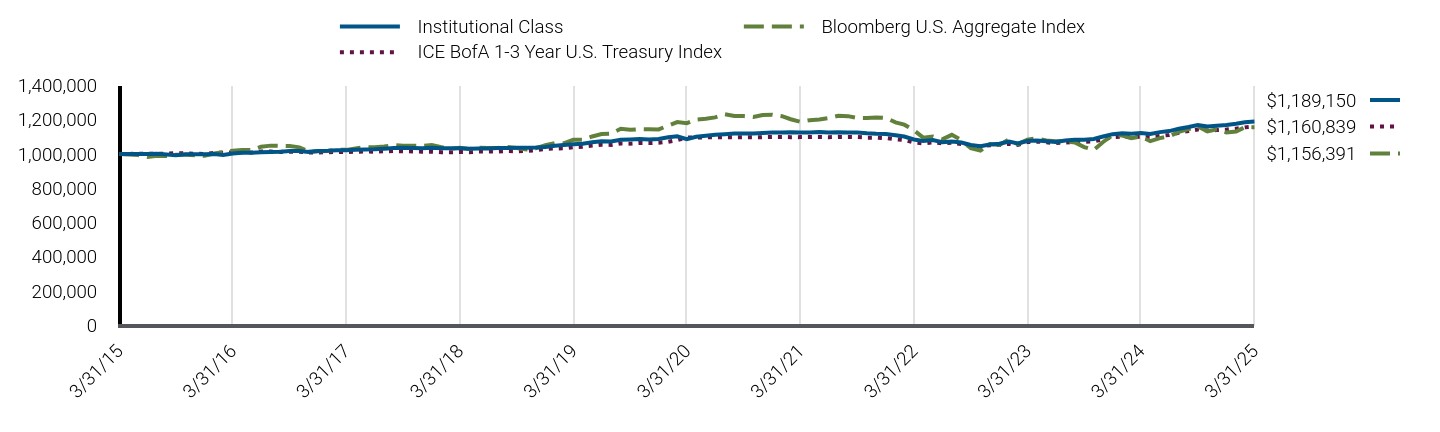

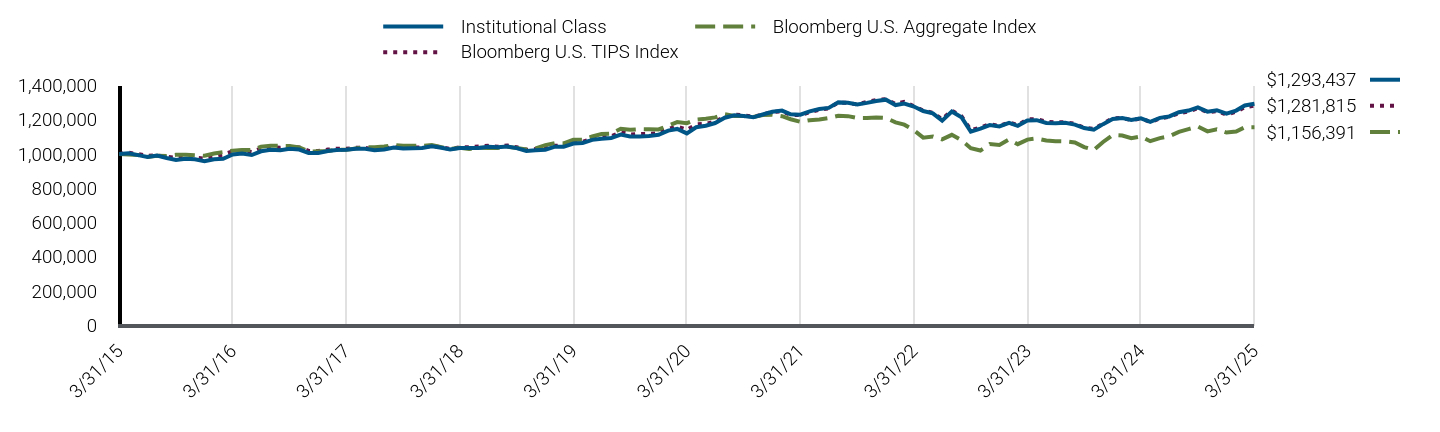

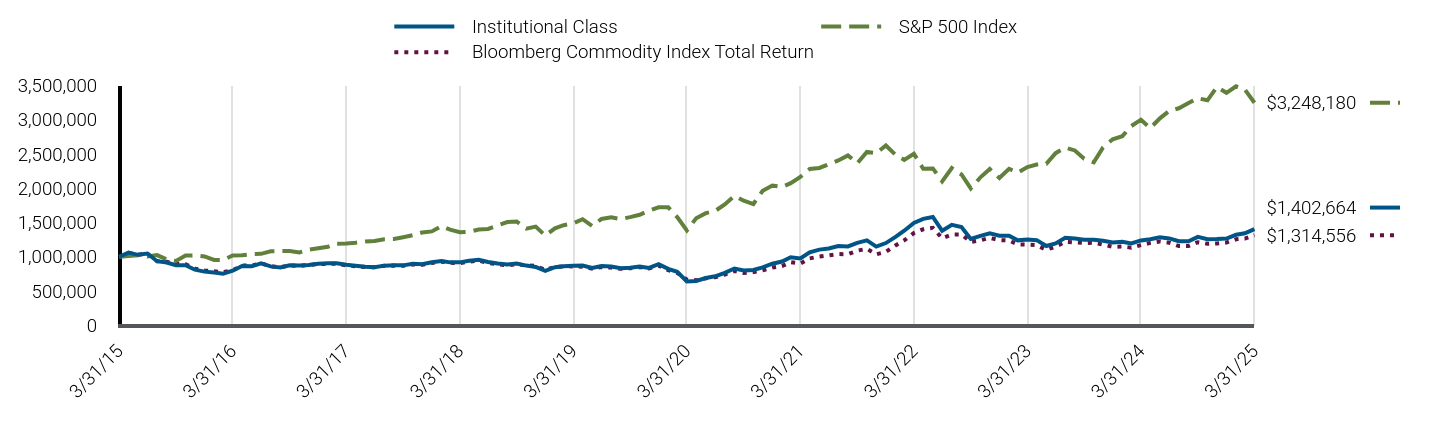

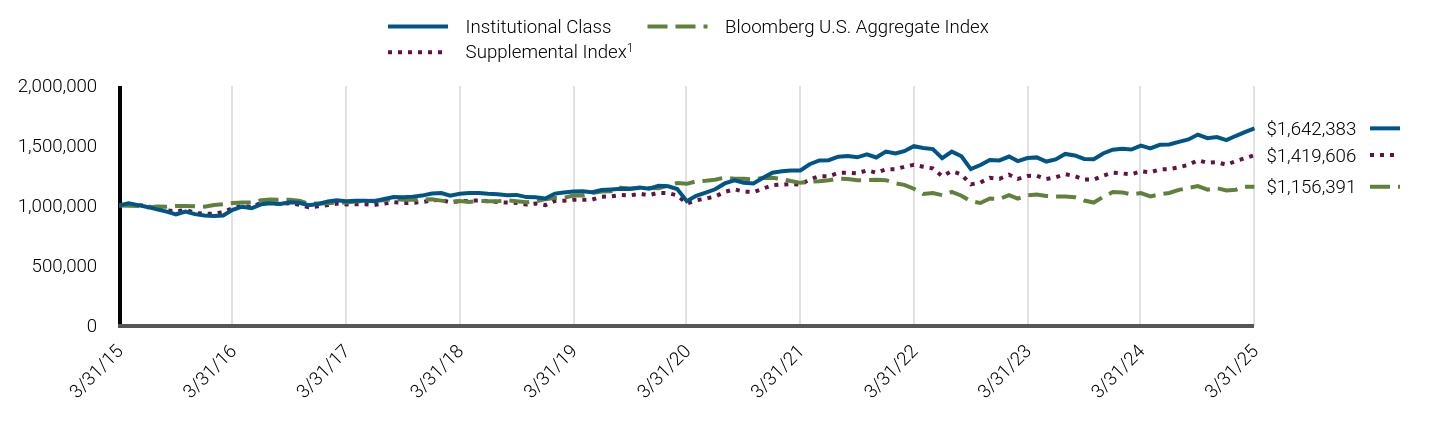

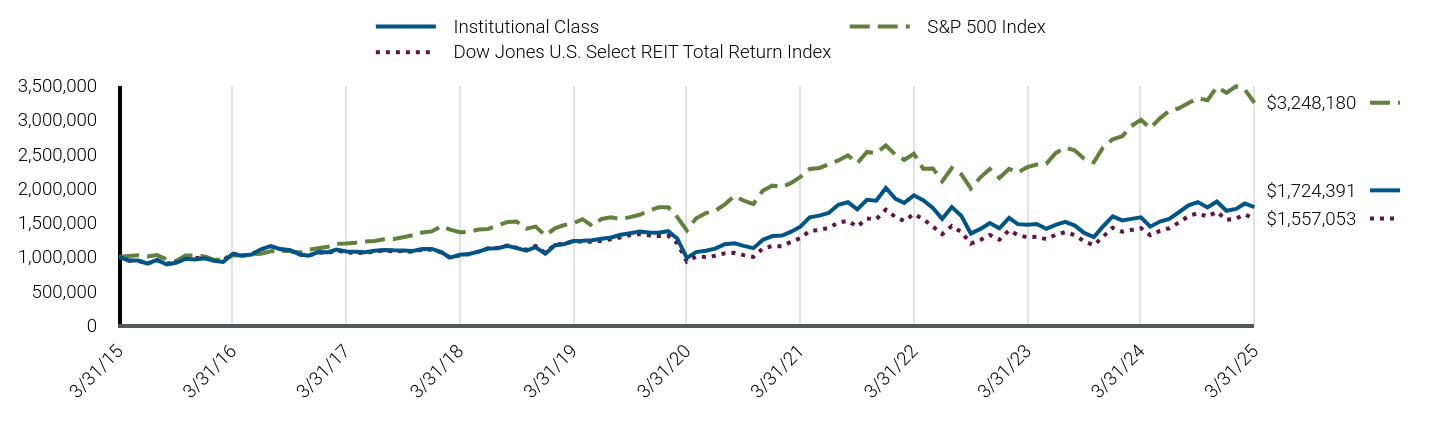

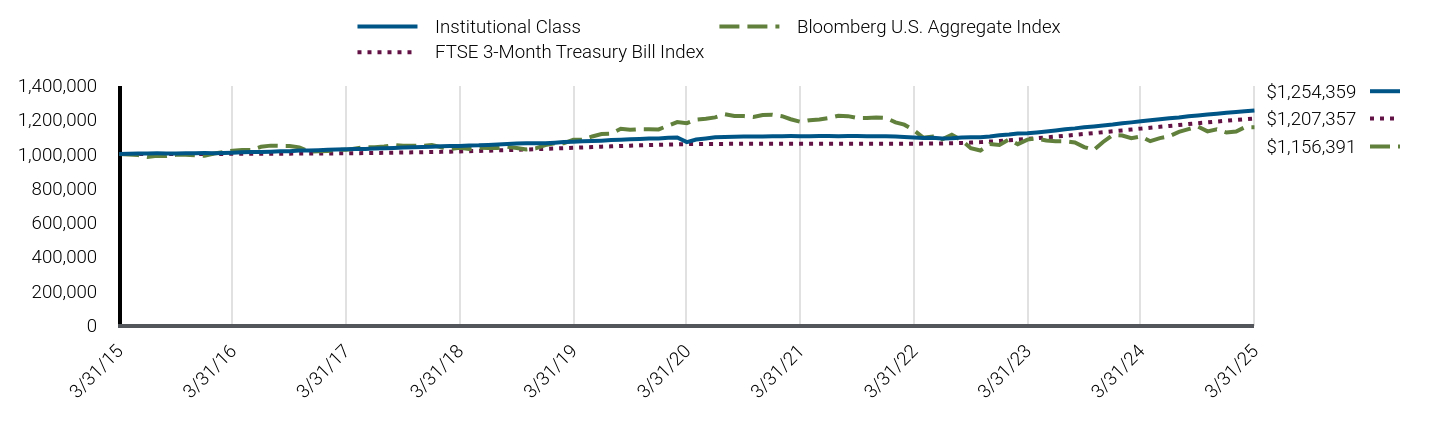

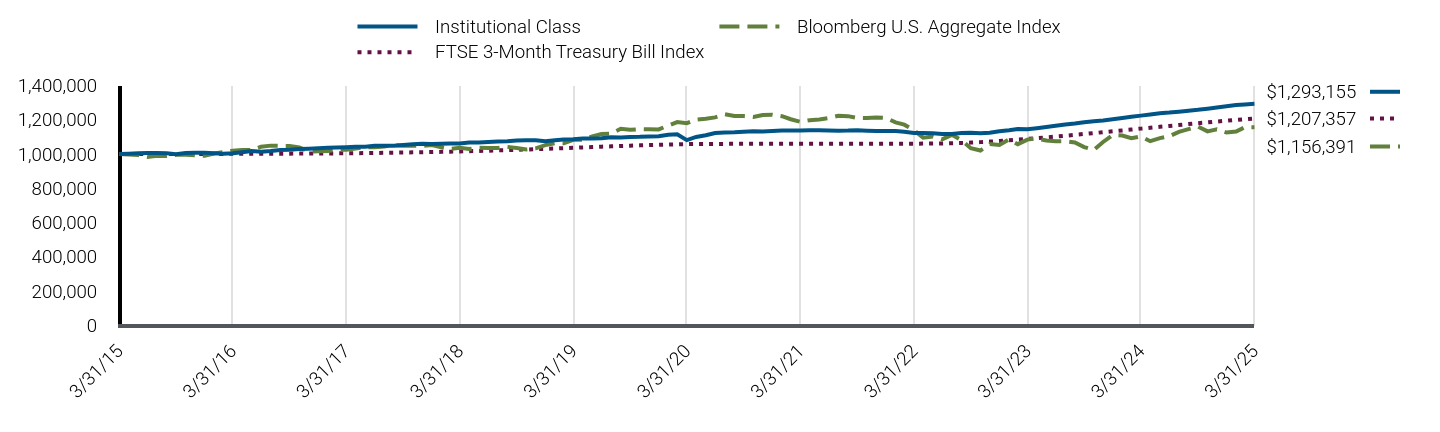

| Class Name |

Institutional Class

|

| Trading Symbol |

PCLIX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO CommoditiesPLUS® Strategy Fund (the "Fund") for the period of April 1, 2024 to March 31, 2025 (the "reporting period").

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

| Additional Information Phone Number |

888.87.PIMCO (888.877.4626)

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Institutional Class |

$84 |

0.82% | |

| Expenses Paid, Amount |

$ 84

|

| Expense Ratio, Percent |

0.82%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Active commodity strategies within the agriculture sector, including underweight exposure to corn, as well as overweight exposure to coffee, contributed to relative performance versus the UBS Prompt Commodity Index Total Return ("Index"), as corn posted negative returns, while coffee posted positive returns. Overweight exposure to silver contributed to relative performance versus the Index, as silver posted positive returns. Exposure to securitized assets, including collateralized loan obligations, contributed to relative performance versus the Index, as spreads broadly tightened. Duration strategies in the U.S., including overweight exposure to the front-end of the curve, contributed to relative performance versus the Index, as front-end U.S. interest rates fell. Exposure to California Carbon Allowances ("CCAs") detracted from relative performance versus the Index, as CCAs posted negative returns. Overweight exposure to base metals detracted from relative performance versus the Index, as base metals posted positive returns. Underweight exposure to natural gas detracted from relative performance versus the Index, as natural gas posted positive returns.

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

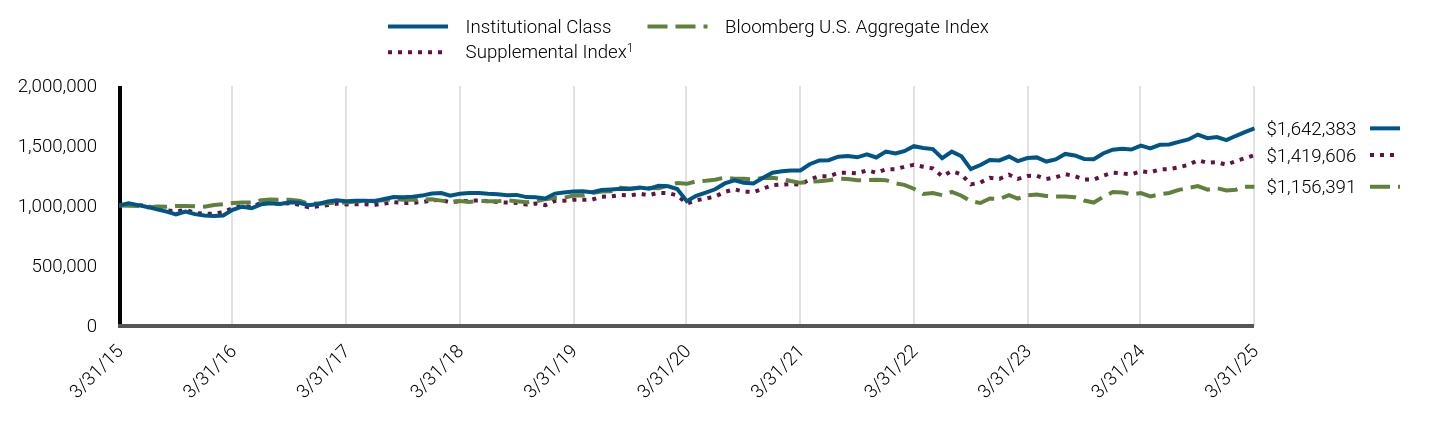

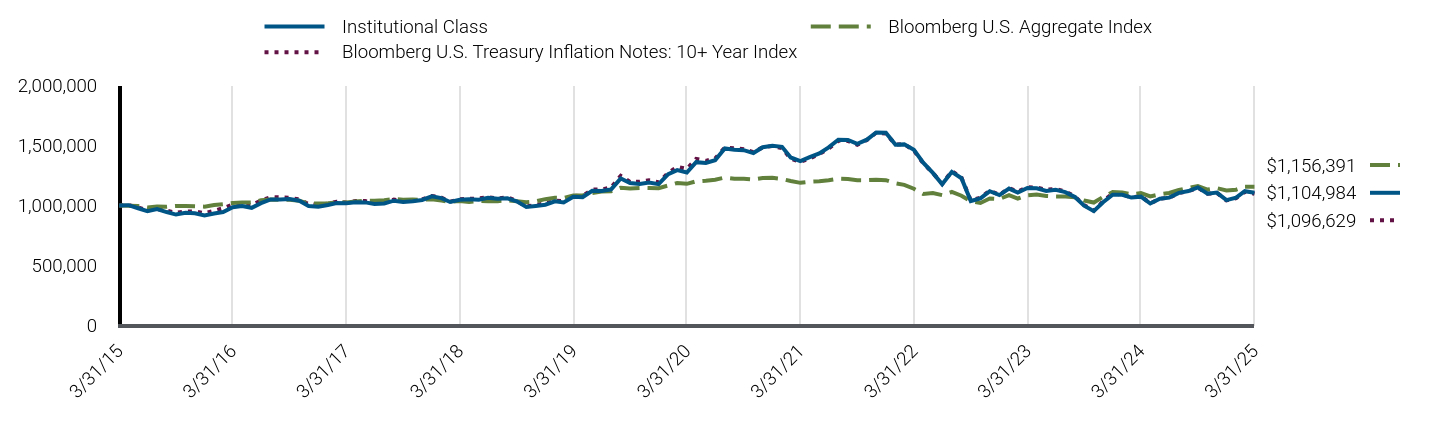

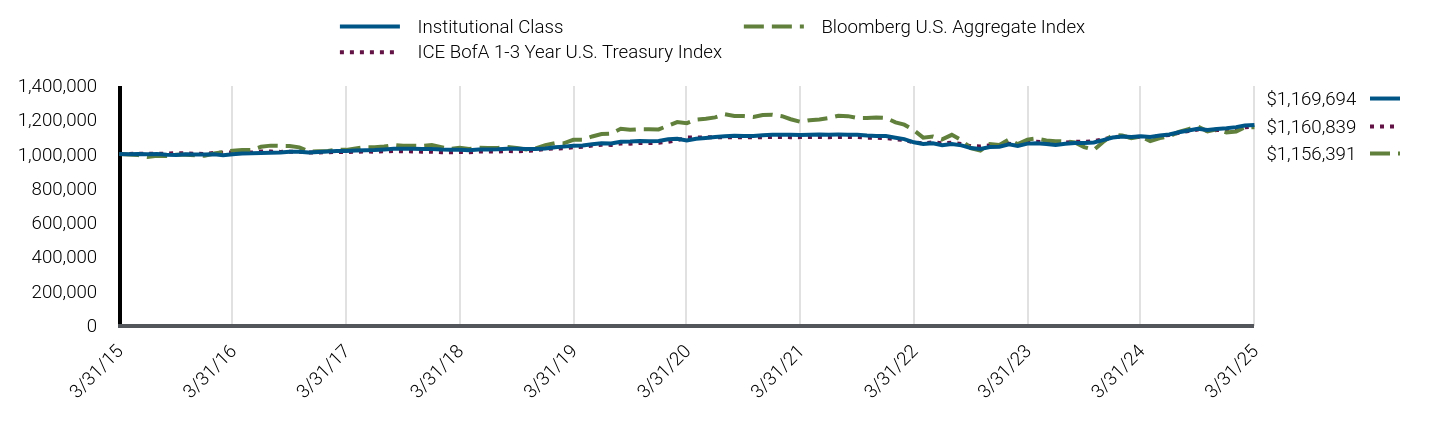

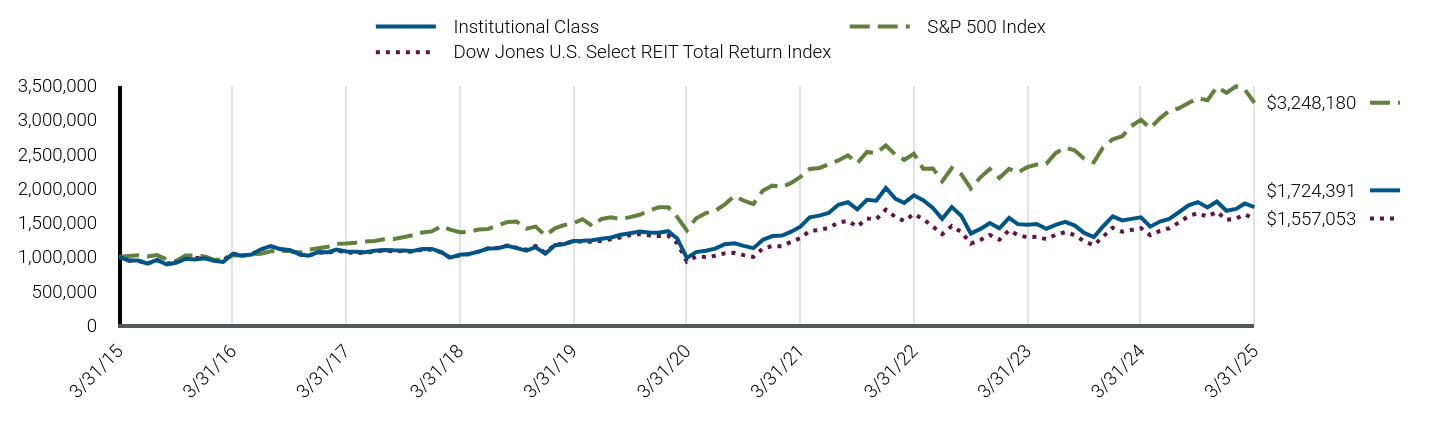

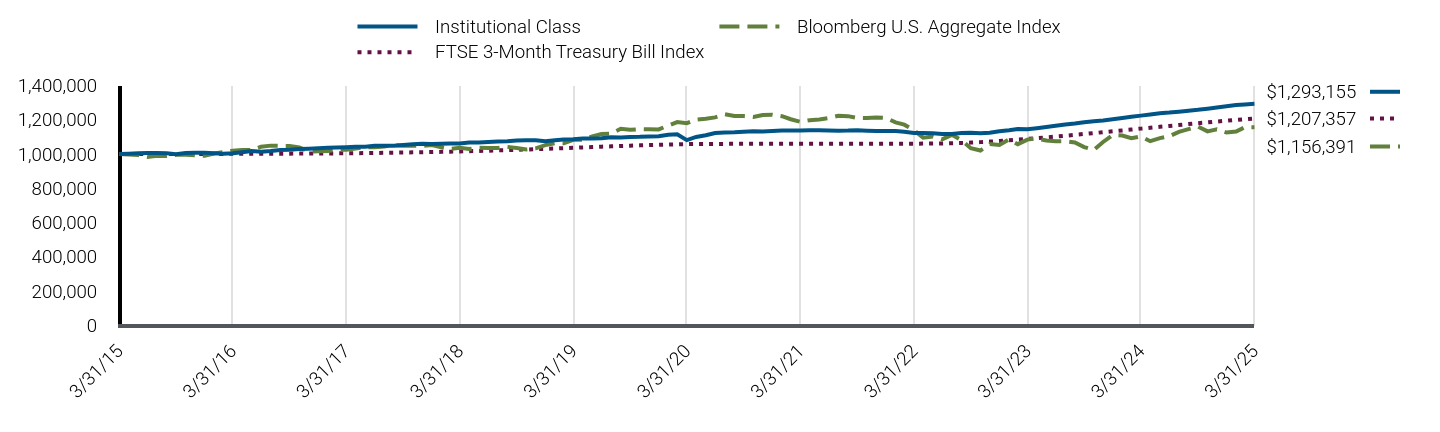

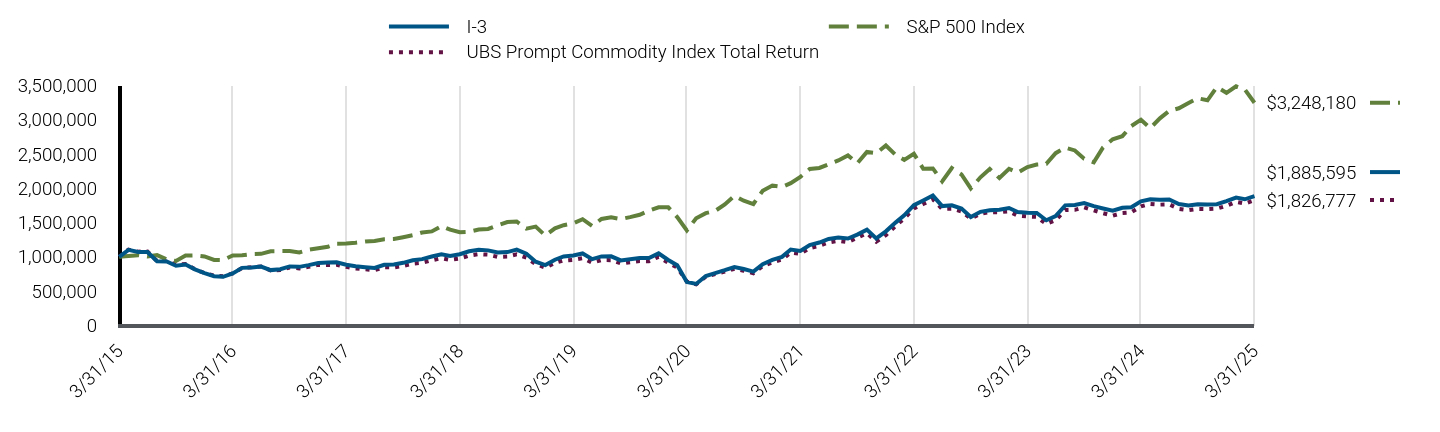

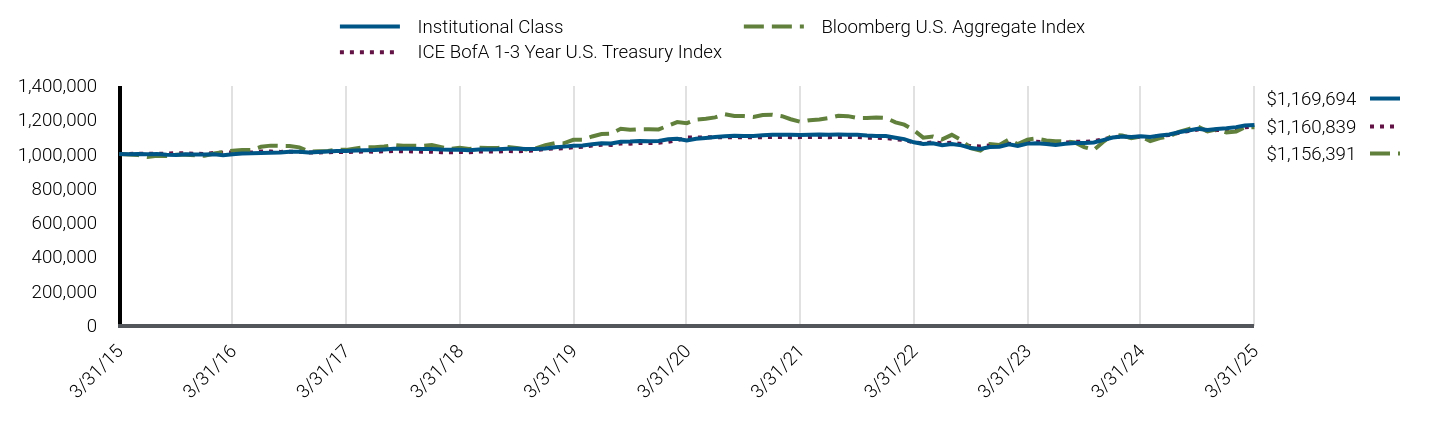

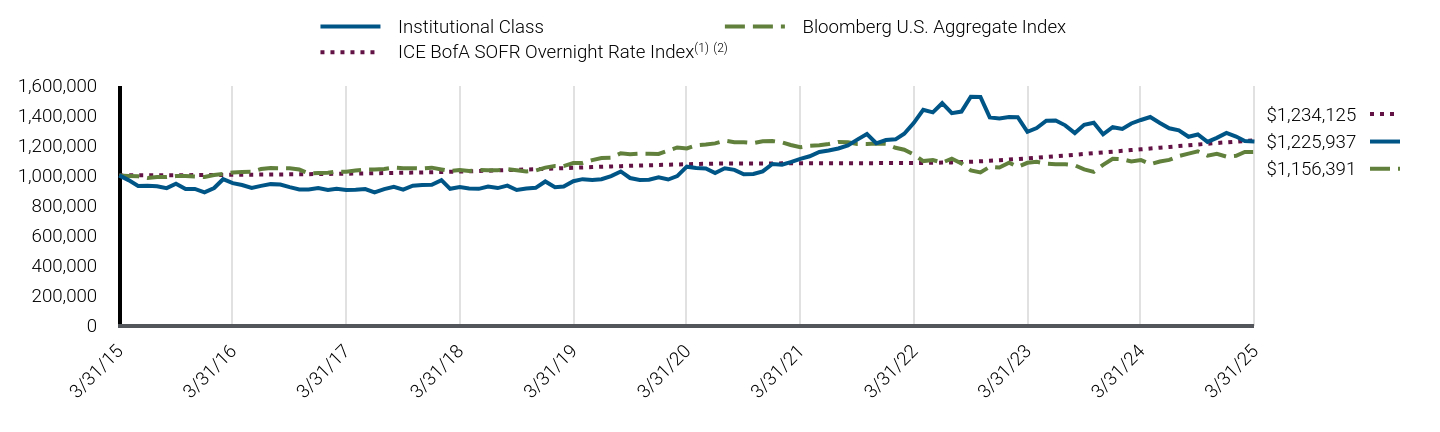

| Line Graph [Table Text Block] |

|

Institutional Class |

S&P 500 Index |

UBS Prompt Commodity Index Total Return |

3/31/15 |

$1,000,000 |

$1,000,000 |

$1,000,000 |

4/30/15 |

$1,101,108 |

$1,009,593 |

$1,103,873 |

5/31/15 |

$1,070,637 |

$1,022,576 |

$1,074,822 |

6/30/15 |

$1,068,979 |

$1,002,781 |

$1,077,753 |

7/31/15 |

$935,357 |

$1,023,790 |

$936,551 |

8/31/15 |

$932,573 |

$962,021 |

$939,768 |

9/30/15 |

$869,415 |

$938,217 |

$885,889 |

10/31/15 |

$887,674 |

$1,017,360 |

$894,412 |

11/30/15 |

$817,447 |

$1,020,385 |

$818,552 |

12/31/15 |

$763,282 |

$1,004,292 |

$762,979 |

1/31/16 |

$718,134 |

$954,455 |

$725,002 |

2/29/16 |

$708,258 |

$953,167 |

$717,486 |

3/31/16 |

$757,638 |

$1,017,828 |

$757,514 |

4/30/16 |

$839,469 |

$1,021,774 |

$836,616 |

5/31/16 |

$846,523 |

$1,040,123 |

$846,843 |

6/30/16 |

$859,324 |

$1,042,818 |

$858,601 |

7/31/16 |

$807,029 |

$1,081,265 |

$799,584 |

8/31/16 |

$819,749 |

$1,082,784 |

$807,729 |

9/30/16 |

$860,737 |

$1,082,988 |

$843,465 |

10/31/16 |

$855,083 |

$1,063,233 |

$830,904 |

11/30/16 |

$880,524 |

$1,102,610 |

$852,719 |

12/31/16 |

$910,205 |

$1,124,405 |

$881,252 |

1/31/17 |

$918,685 |

$1,145,730 |

$880,773 |

2/28/17 |

$921,511 |

$1,191,223 |

$884,185 |

3/31/17 |

$886,848 |

$1,192,612 |

$852,160 |

4/30/17 |

$865,564 |

$1,204,860 |

$829,127 |

5/31/17 |

$851,374 |

$1,221,816 |

$817,310 |

6/30/17 |

$839,680 |

$1,229,442 |

$805,369 |

7/31/17 |

$885,832 |

$1,254,723 |

$845,391 |

8/31/17 |

$890,299 |

$1,258,564 |

$845,403 |

9/30/17 |

$914,870 |

$1,284,525 |

$867,222 |

10/31/17 |

$952,212 |

$1,314,500 |

$899,693 |

11/30/17 |

$969,327 |

$1,354,816 |

$912,263 |

12/31/17 |

$1,008,856 |

$1,369,880 |

$948,717 |

1/31/18 |

$1,041,139 |

$1,448,311 |

$979,501 |

2/28/18 |

$1,016,926 |

$1,394,930 |

$955,592 |

3/31/18 |

$1,042,109 |

$1,359,480 |

$974,890 |

4/30/18 |

$1,085,732 |

$1,364,697 |

$1,017,724 |

5/31/18 |

$1,108,351 |

$1,397,561 |

$1,038,345 |

6/30/18 |

$1,101,304 |

$1,406,163 |

$1,031,075 |

7/31/18 |

$1,069,162 |

$1,458,492 |

$998,642 |

8/31/18 |

$1,074,237 |

$1,506,017 |

$1,002,617 |

9/30/18 |

$1,109,761 |

$1,514,589 |

$1,035,015 |

10/31/18 |

$1,051,446 |

$1,411,067 |

$987,111 |

11/30/18 |

$933,048 |

$1,439,822 |

$893,278 |

12/31/18 |

$886,423 |

$1,309,819 |

$840,103 |

1/31/19 |

$961,544 |

$1,414,783 |

$910,333 |

2/28/19 |

$1,012,250 |

$1,460,209 |

$946,295 |

3/31/19 |

$1,024,910 |

$1,488,583 |

$955,689 |

4/30/19 |

$1,055,110 |

$1,548,856 |

$978,843 |

5/31/19 |

$972,060 |

$1,450,428 |

$913,193 |

6/30/19 |

$1,010,197 |

$1,552,649 |

$951,876 |

7/31/19 |

$1,014,002 |

$1,574,964 |

$950,481 |

8/31/19 |

$955,026 |

$1,550,016 |

$903,112 |

9/30/19 |

$969,797 |

$1,579,018 |

$920,803 |

10/31/19 |

$989,001 |

$1,613,219 |

$937,221 |

11/30/19 |

$989,001 |

$1,671,777 |

$935,942 |

12/31/19 |

$1,058,010 |

$1,722,235 |

$998,876 |

1/31/20 |

$961,652 |

$1,721,559 |

$911,889 |

2/29/20 |

$884,566 |

$1,579,842 |

$842,933 |

3/31/20 |

$637,023 |

$1,384,711 |

$637,991 |

4/30/20 |

$609,916 |

$1,562,223 |

$597,074 |

5/31/20 |

$726,090 |

$1,636,628 |

$708,827 |

6/30/20 |

$768,395 |

$1,669,176 |

$747,675 |

7/31/20 |

$811,084 |

$1,763,293 |

$782,429 |

8/31/20 |

$857,653 |

$1,890,039 |

$824,720 |

9/30/20 |

$828,139 |

$1,818,224 |

$796,199 |

10/31/20 |

$791,203 |

$1,769,870 |

$760,320 |

11/30/20 |

$902,010 |

$1,963,607 |

$864,721 |

12/31/20 |

$961,233 |

$2,039,105 |

$918,095 |

1/31/21 |

$1,005,987 |

$2,018,518 |

$959,685 |

2/28/21 |

$1,114,952 |

$2,074,179 |

$1,062,177 |

3/31/21 |

$1,095,494 |

$2,165,019 |

$1,042,880 |

4/30/21 |

$1,184,029 |

$2,280,563 |

$1,127,329 |

5/31/21 |

$1,220,027 |

$2,296,491 |

$1,159,290 |

6/30/21 |

$1,272,827 |

$2,350,103 |

$1,209,899 |

7/31/21 |

$1,293,779 |

$2,405,929 |

$1,233,749 |

8/31/21 |

$1,278,065 |

$2,479,083 |

$1,215,251 |

9/30/21 |

$1,336,146 |

$2,363,781 |

$1,276,744 |

10/31/21 |

$1,408,417 |

$2,529,392 |

$1,345,440 |

11/30/21 |

$1,281,501 |

$2,511,866 |

$1,221,538 |

12/31/21 |

$1,384,497 |

$2,624,438 |

$1,315,853 |

1/31/22 |

$1,515,010 |

$2,488,631 |

$1,448,176 |

2/28/22 |

$1,622,595 |

$2,414,118 |

$1,560,016 |

3/31/22 |

$1,772,878 |

$2,503,753 |

$1,704,321 |

4/30/22 |

$1,839,815 |

$2,285,421 |

$1,769,459 |

5/31/22 |

$1,914,402 |

$2,289,614 |

$1,838,298 |

6/30/22 |

$1,757,821 |

$2,100,621 |

$1,698,572 |

7/31/22 |

$1,770,303 |

$2,294,307 |

$1,701,820 |

8/31/22 |

$1,724,537 |

$2,200,741 |

$1,662,348 |

9/30/22 |

$1,598,506 |

$1,998,056 |

$1,556,755 |

10/31/22 |

$1,675,488 |

$2,159,821 |

$1,627,524 |

11/30/22 |

$1,698,130 |

$2,280,521 |

$1,651,058 |

12/31/22 |

$1,707,196 |

$2,149,130 |

$1,651,124 |

1/31/23 |

$1,732,010 |

$2,284,168 |

$1,663,664 |

2/28/23 |

$1,674,938 |

$2,228,437 |

$1,599,917 |

3/31/23 |

$1,660,818 |

$2,310,252 |

$1,588,110 |

4/30/23 |

$1,658,301 |

$2,346,311 |

$1,581,811 |

5/31/23 |

$1,552,613 |

$2,356,510 |

$1,479,141 |

6/30/23 |

$1,615,523 |

$2,512,217 |

$1,533,521 |

7/31/23 |

$1,774,055 |

$2,592,922 |

$1,683,176 |

8/31/23 |

$1,779,088 |

$2,551,639 |

$1,684,968 |

9/30/23 |

$1,808,498 |

$2,429,982 |

$1,721,668 |

10/31/23 |

$1,760,507 |

$2,378,888 |

$1,677,506 |

11/30/23 |

$1,727,672 |

$2,596,140 |

$1,636,490 |

12/31/23 |

$1,694,359 |

$2,714,085 |

$1,599,203 |

1/31/24 |

$1,738,068 |

$2,759,693 |

$1,639,802 |

2/29/24 |

$1,745,781 |

$2,907,048 |

$1,648,587 |

3/31/24 |

$1,833,352 |

$3,000,582 |

$1,735,565 |

4/30/24 |

$1,864,295 |

$2,878,024 |

$1,771,963 |

5/31/24 |

$1,856,559 |

$3,020,730 |

$1,760,799 |

6/30/24 |

$1,860,705 |

$3,129,120 |

$1,764,777 |

7/31/24 |

$1,794,816 |

$3,167,209 |

$1,699,553 |

8/31/24 |

$1,771,096 |

$3,244,035 |

$1,679,375 |

9/30/24 |

$1,793,261 |

$3,313,318 |

$1,697,916 |

10/31/24 |

$1,790,556 |

$3,283,271 |

$1,696,007 |

11/30/24 |

$1,793,261 |

$3,476,003 |

$1,702,287 |

12/31/24 |

$1,838,027 |

$3,393,141 |

$1,743,837 |

1/31/25 |

$1,893,389 |

$3,487,632 |

$1,800,531 |

2/28/25 |

$1,865,708 |

$3,442,124 |

$1,775,866 |

3/31/25 |

$1,915,285 |

$3,248,180 |

$1,826,777 |

|

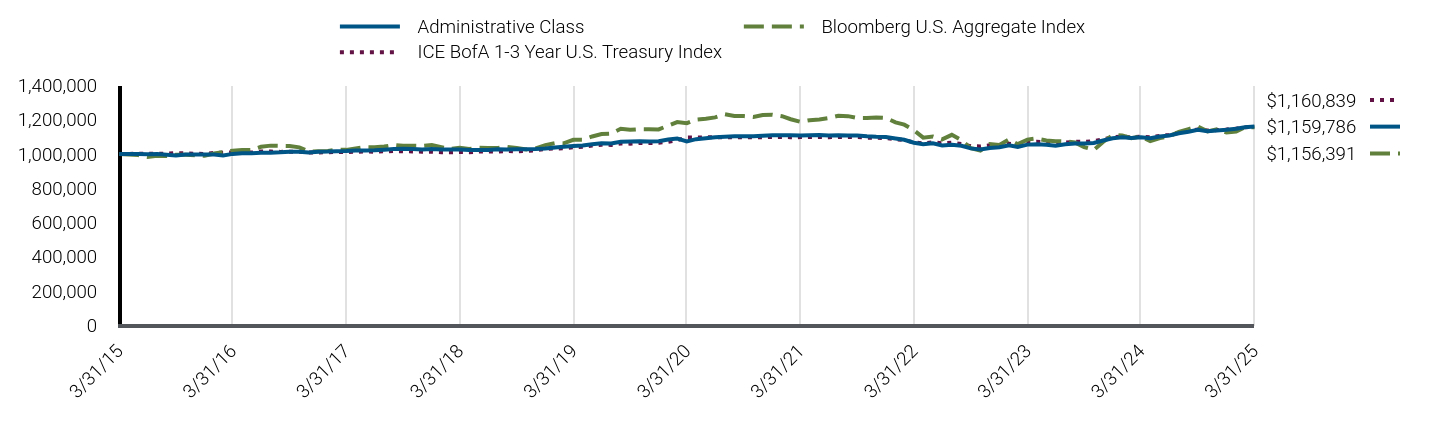

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

Institutional Class |

4.47% |

24.63% |

6.71% |

S&P 500 Index |

8.25% |

18.59% |

12.50% |

UBS Prompt Commodity Index Total Return |

5.26% |

23.42% |

6.21% | |

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

| AssetsNet |

$ 4,684,149,000

|

| Holdings Count | Holding |

1,079

|

| Advisory Fees Paid, Amount |

$ 22,011,000

|

| InvestmentCompanyPortfolioTurnover |

201.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$4,684,149 |

# of Portfolio Holdings |

1,079 |

Portfolio Turnover Rate |

201% |

Total Net Advisory Fees Paid During the Reporting Period |

$22,011 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Asset-Backed Securities |

17.0% |

Commodities |

14.8% |

Corporate Bonds & Notes |

11.5% |

U.S. Government Agencies |

11.0% |

U.S. Treasury Obligations |

3.2% |

Sovereign Issues |

2.3% |

Non-Agency Mortgage-Backed Securities |

2.2% |

Other Investments |

0.0%Footnote Reference^ |

Short-Term Instruments |

51.4% |

Affiliated Investments |

5.3% |

Financial Derivative Instruments |

1.5% |

Other Assets and Liabilities, Net |

(20.2%) |

Total |

100.0% |

| Footnote |

Description |

Footnote^ |

Rounded value of investments is less than 0.1% of net assets. |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

| Material Fund Change [Text Block] |

|

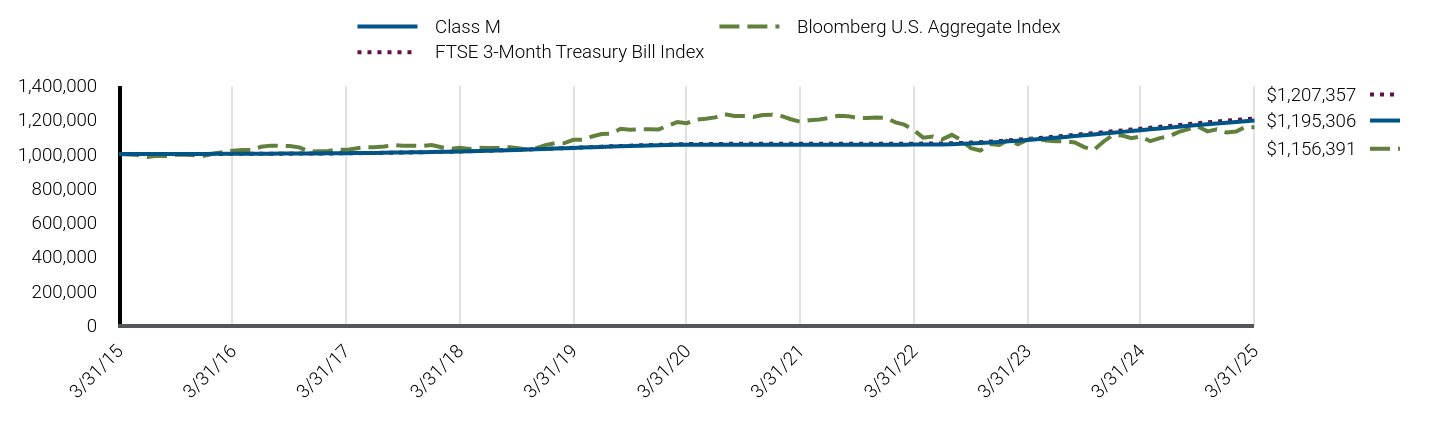

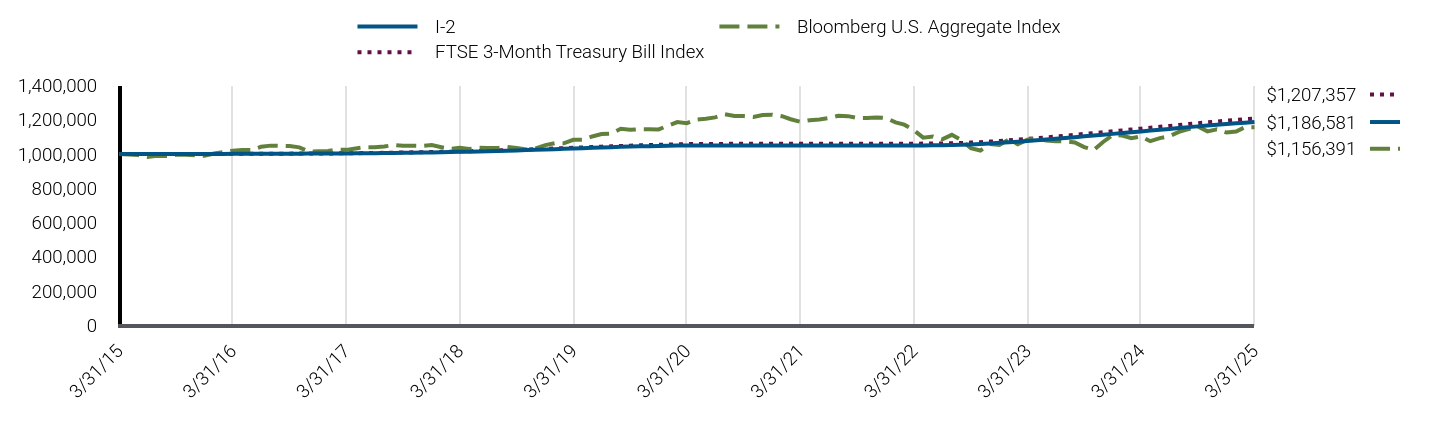

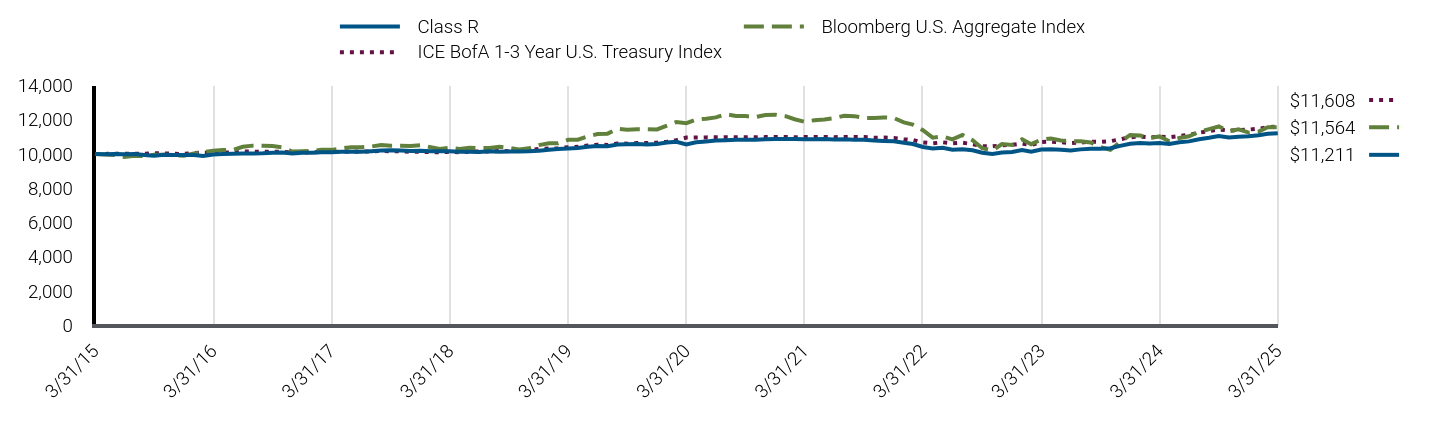

| C000088654 |

|

| Shareholder Report [Line Items] |

|

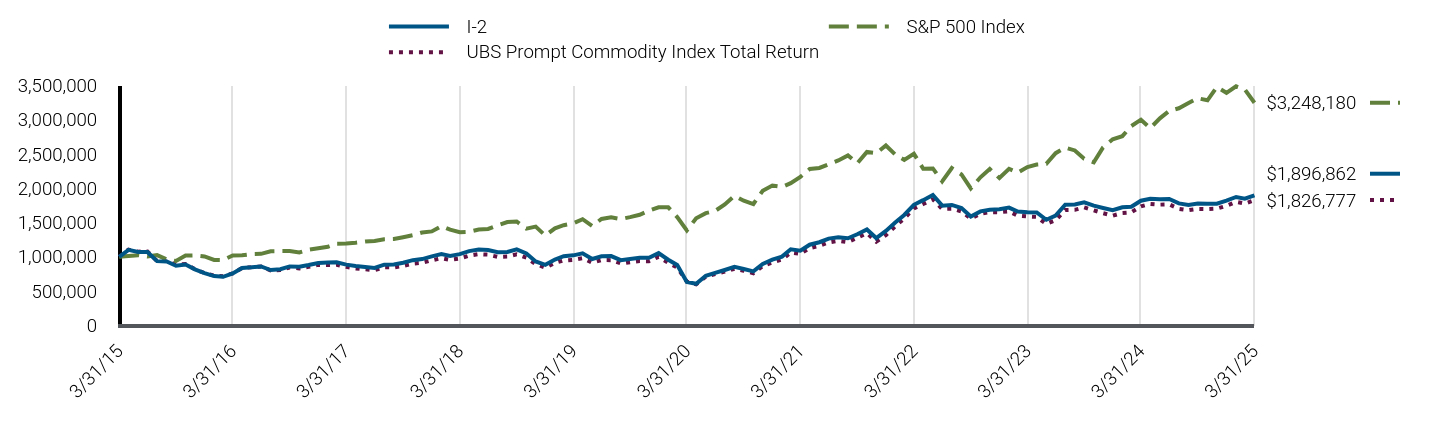

| Fund Name |

PIMCO CommoditiesPLUS<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 15px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; white-space-collapse: preserve-breaks;">®</sup> Strategy Fund

|

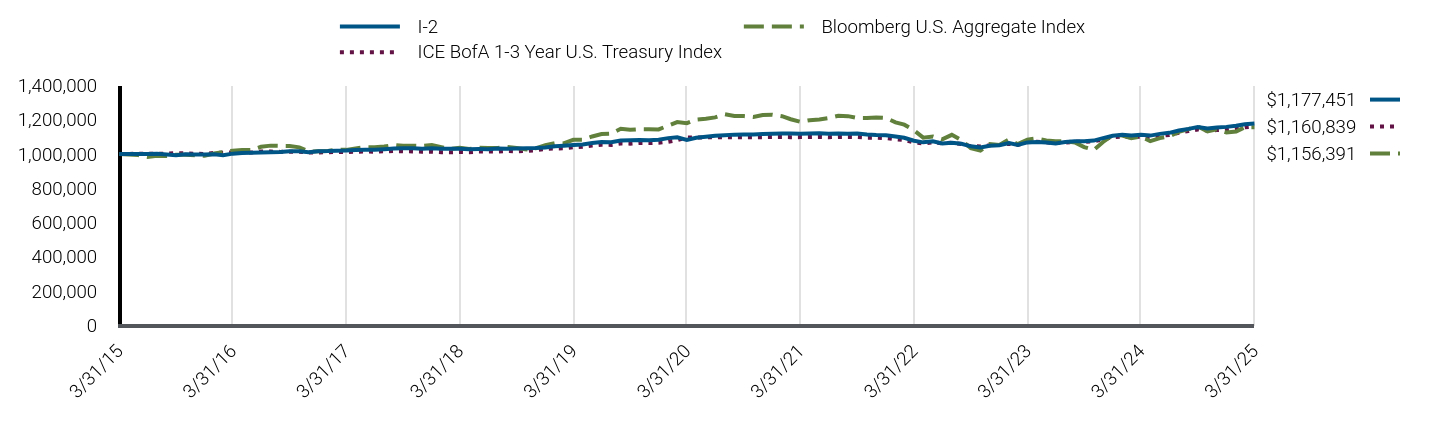

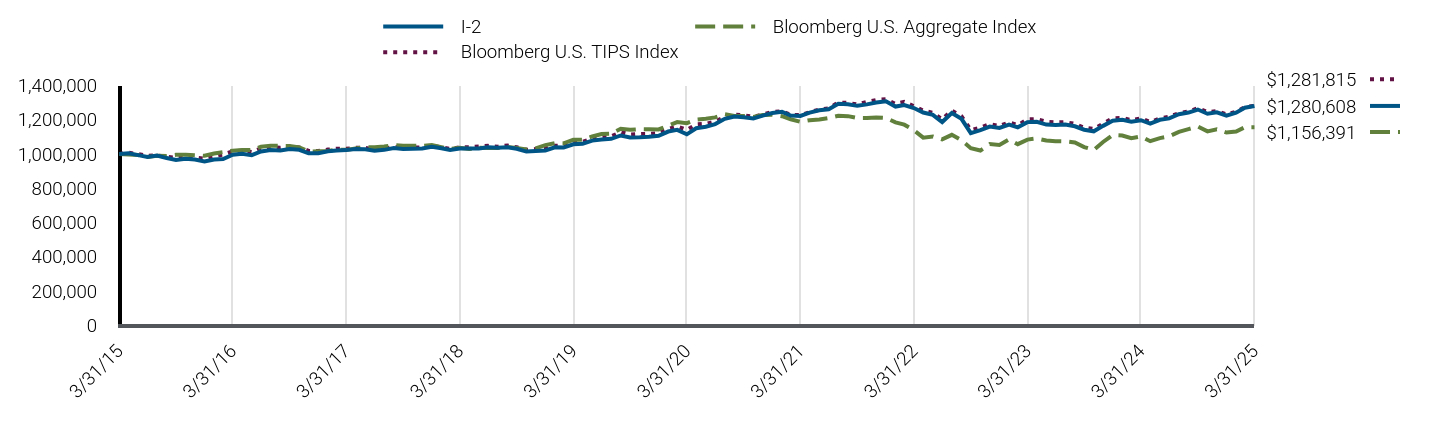

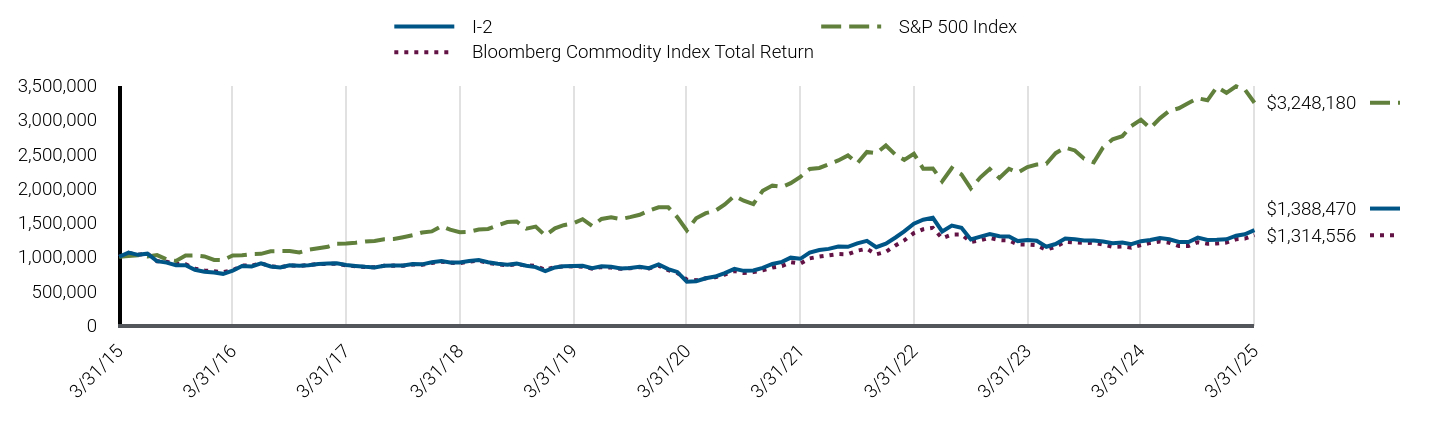

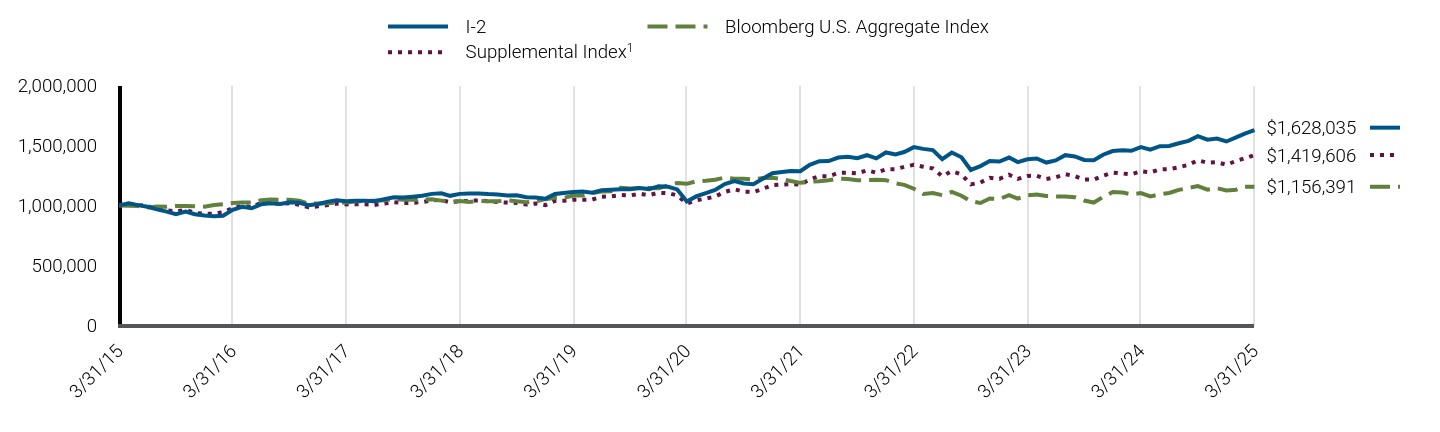

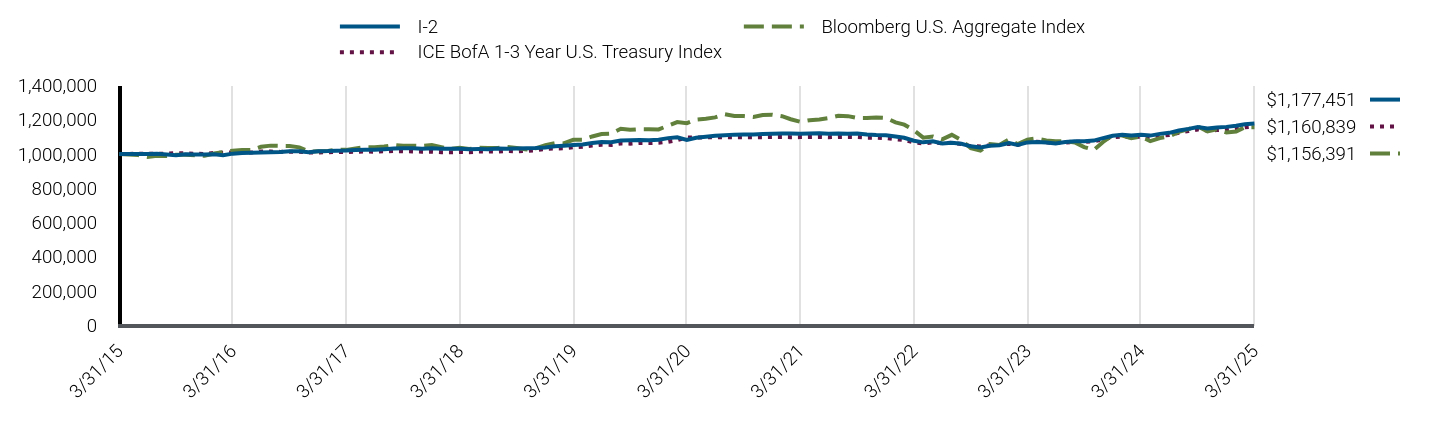

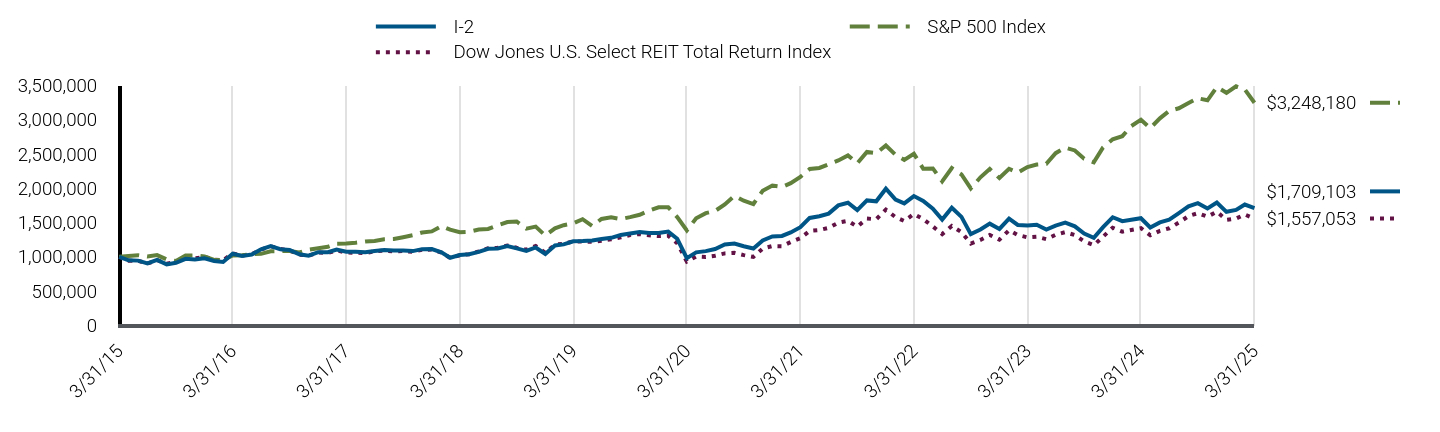

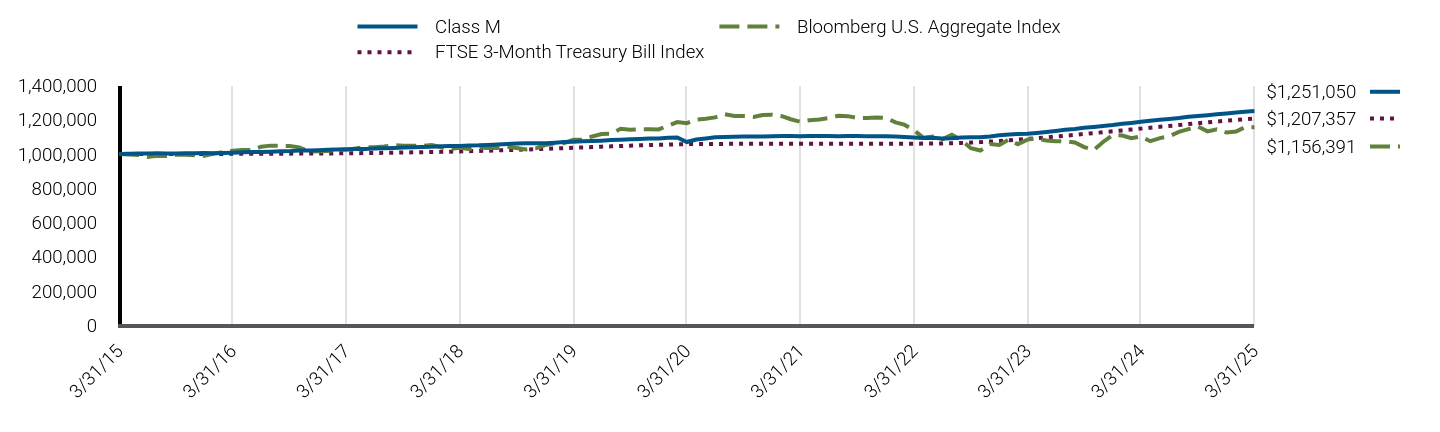

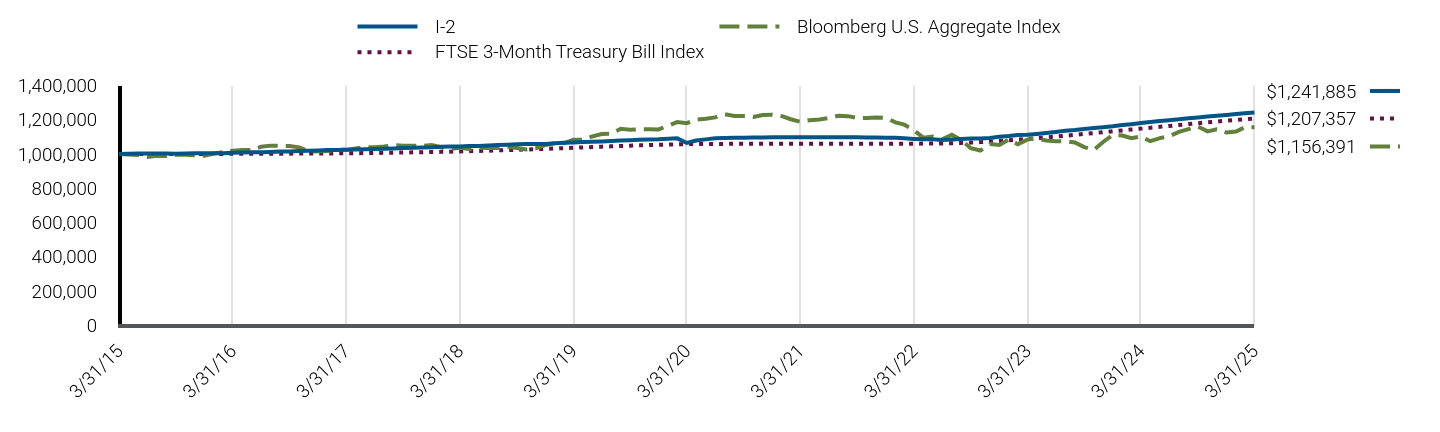

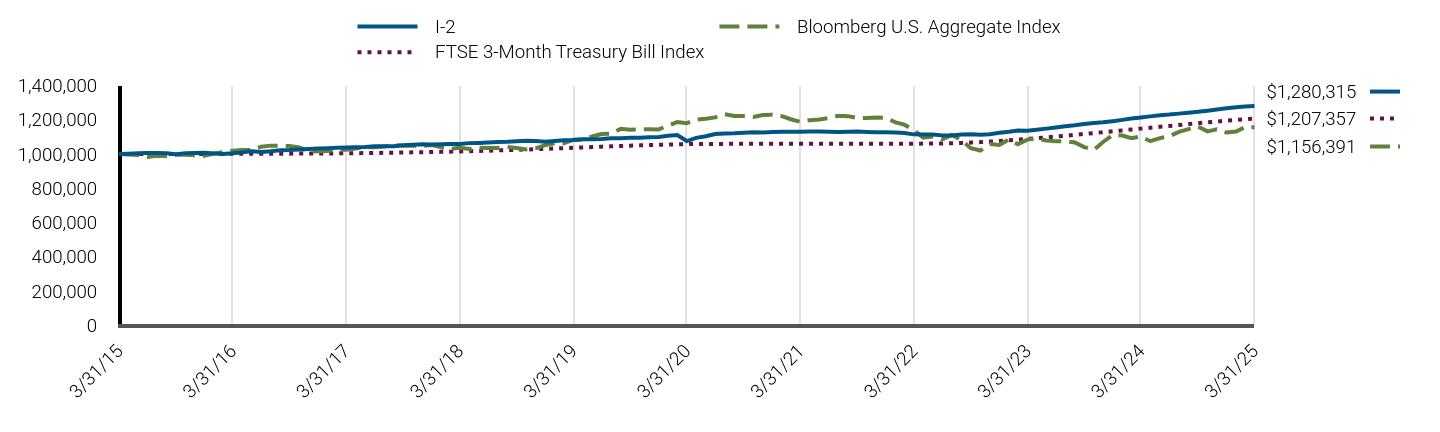

| Class Name |

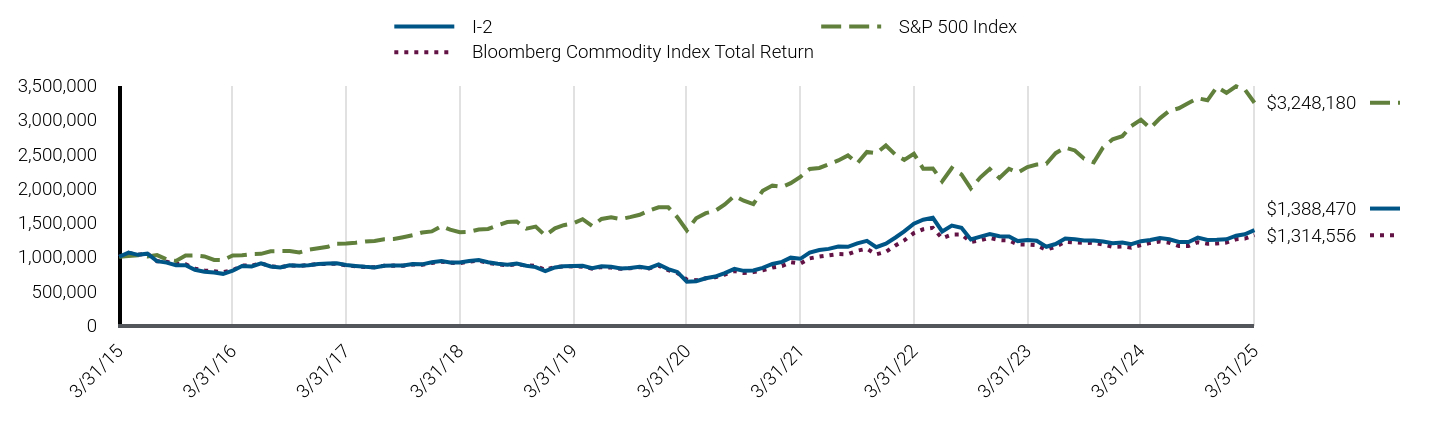

I-2

|

| Trading Symbol |

PCLPX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO CommoditiesPLUS® Strategy Fund (the "Fund") for the period of April 1, 2024 to March 31, 2025 (the "reporting period").

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

| Additional Information Phone Number |

888.87.PIMCO (888.877.4626)

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

I-2 |

$94 |

0.92% | |

| Expenses Paid, Amount |

$ 94

|

| Expense Ratio, Percent |

0.92%

|

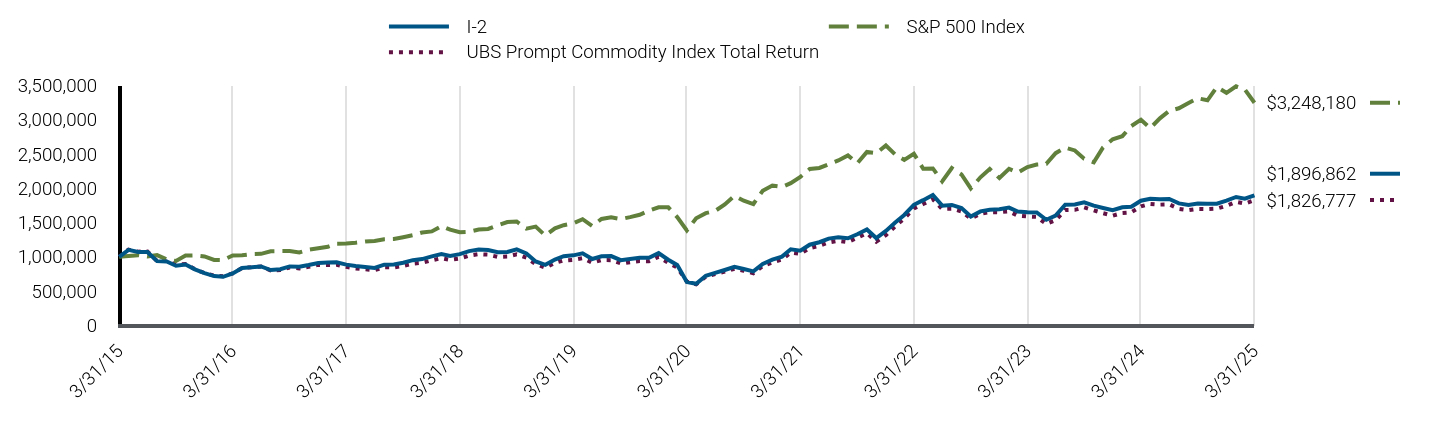

| Factors Affecting Performance [Text Block] |

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: Active commodity strategies within the agriculture sector, including underweight exposure to corn, as well as overweight exposure to coffee, contributed to relative performance versus the UBS Prompt Commodity Index Total Return ("Index"), as corn posted negative returns, while coffee posted positive returns. Overweight exposure to silver contributed to relative performance versus the Index, as silver posted positive returns. Exposure to securitized assets, including collateralized loan obligations, contributed to relative performance versus the Index, as spreads broadly tightened. Duration strategies in the U.S., including overweight exposure to the front-end of the curve, contributed to relative performance versus the Index, as front-end U.S. interest rates fell. Exposure to California Carbon Allowances ("CCAs") detracted from relative performance versus the Index, as CCAs posted negative returns. Overweight exposure to base metals detracted from relative performance versus the Index, as base metals posted positive returns. Underweight exposure to natural gas detracted from relative performance versus the Index, as natural gas posted positive returns.

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

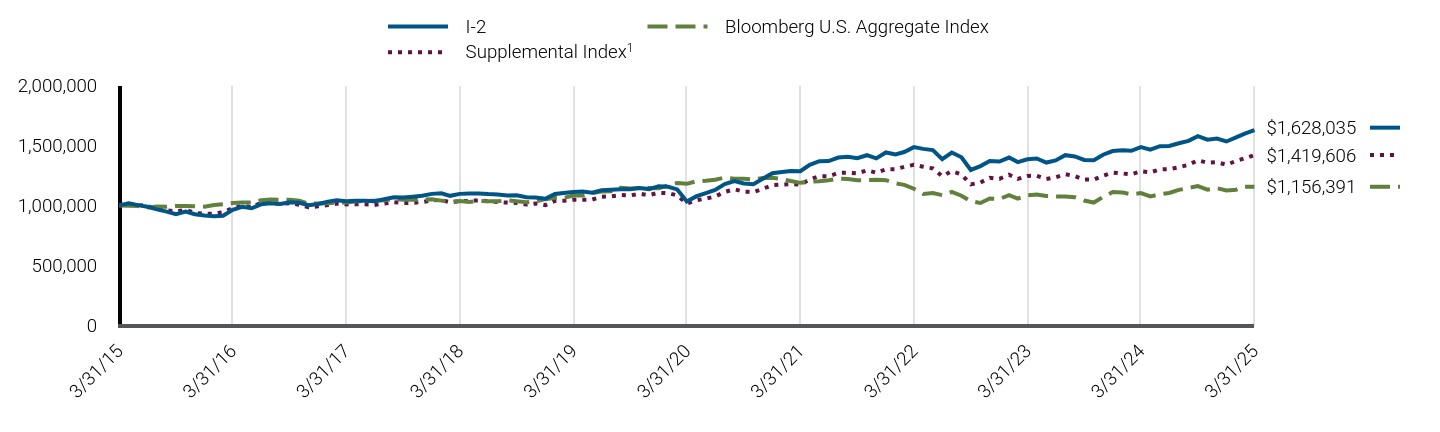

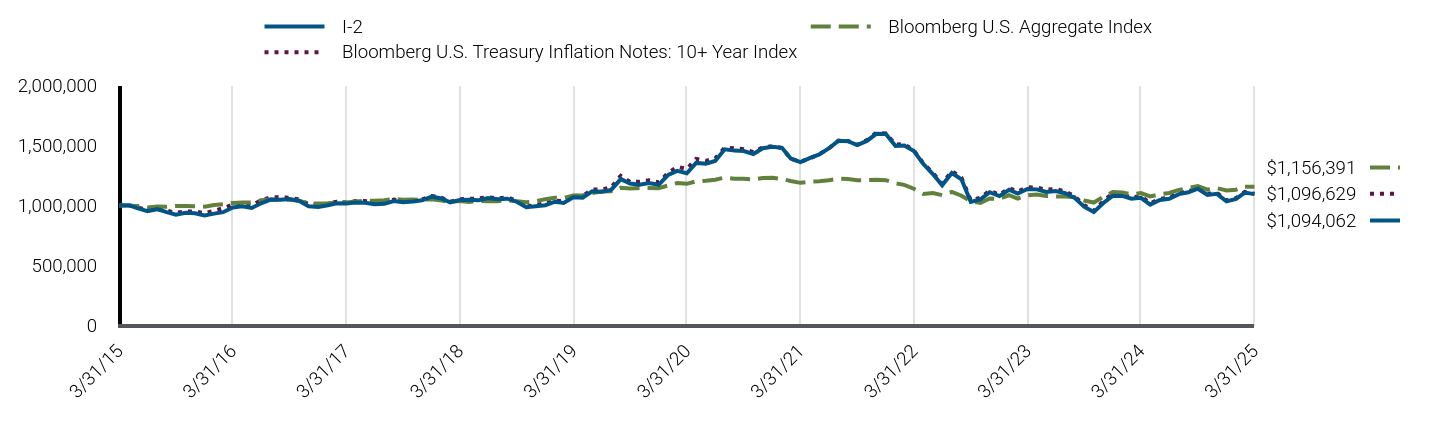

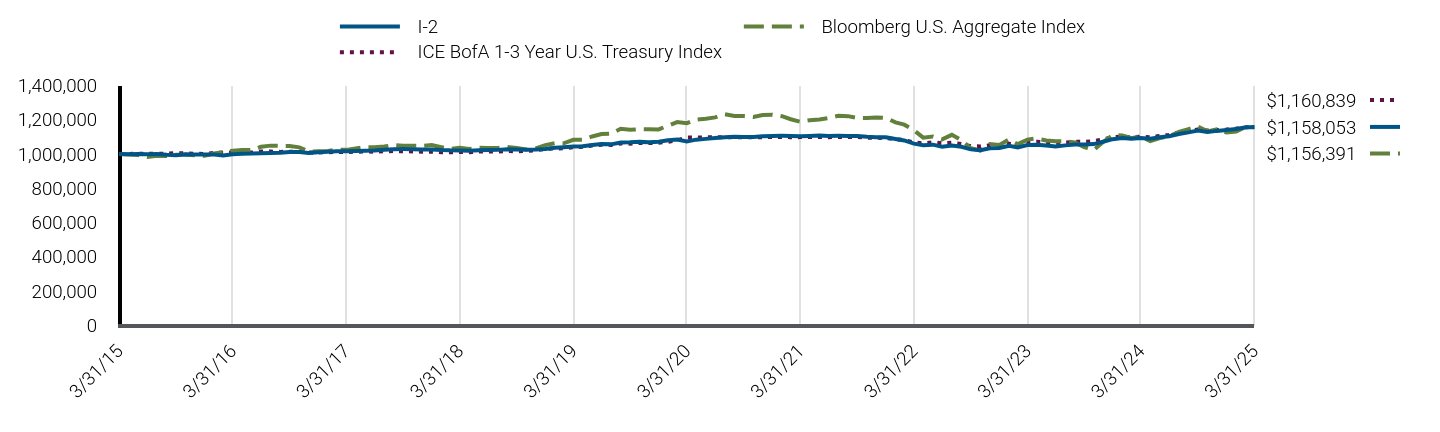

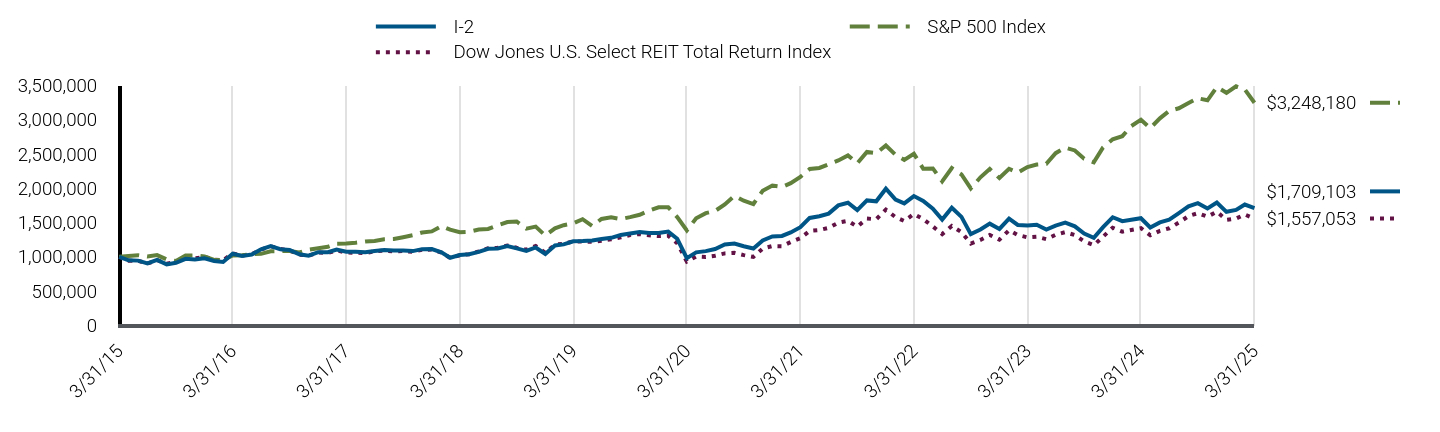

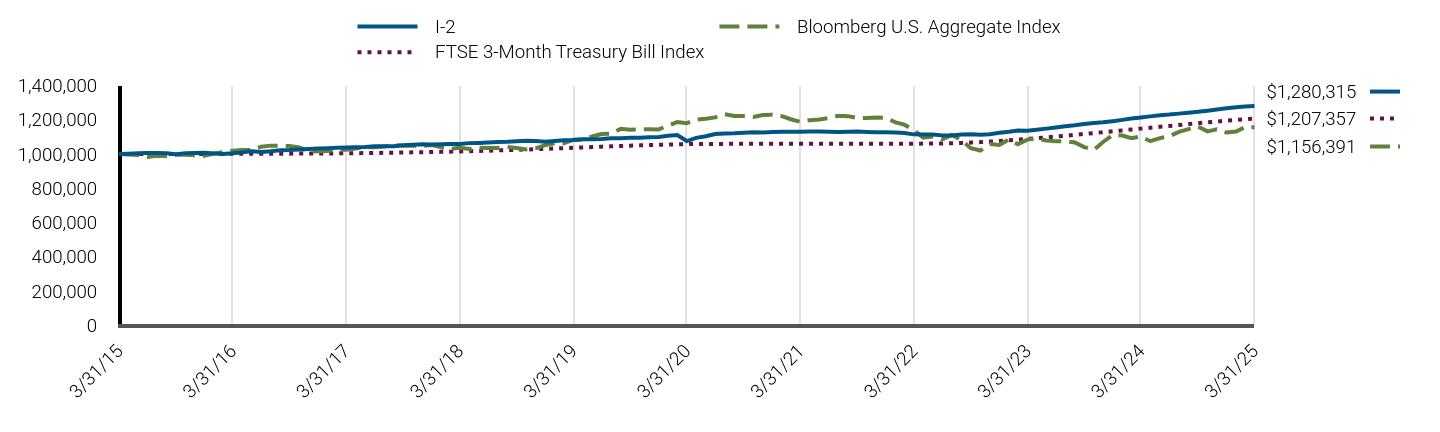

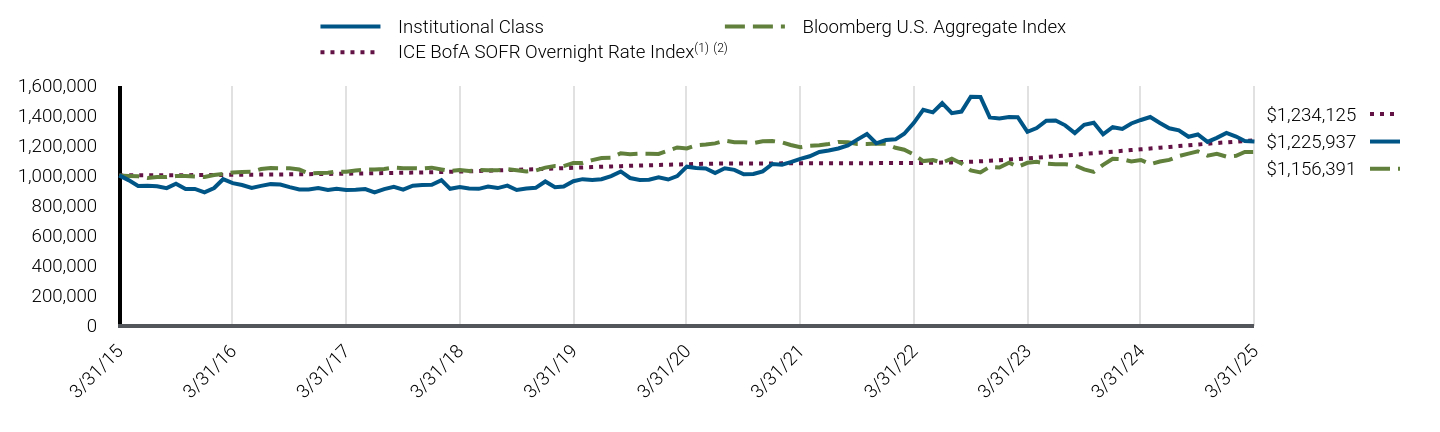

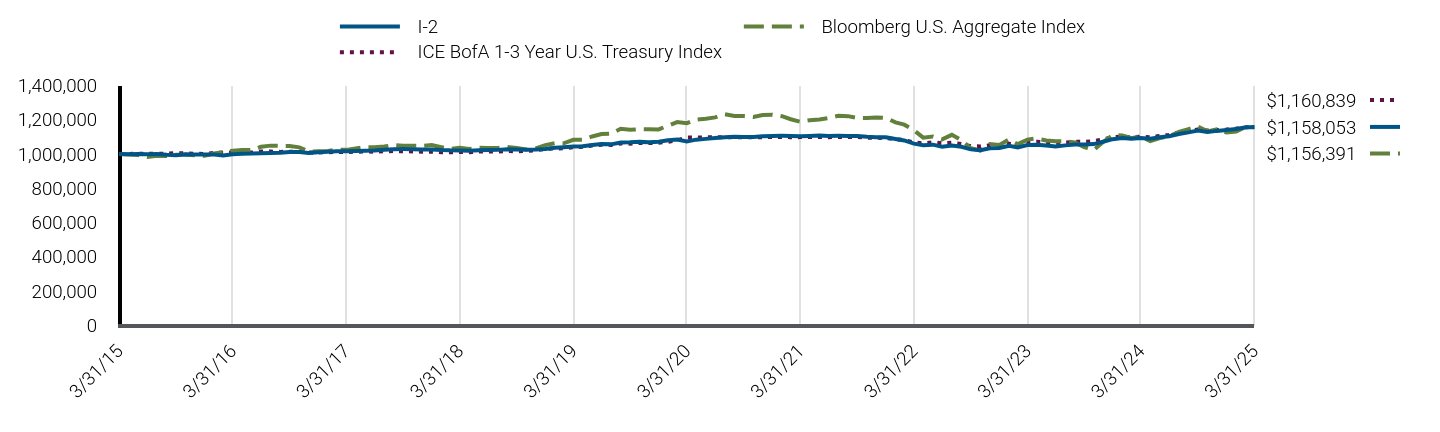

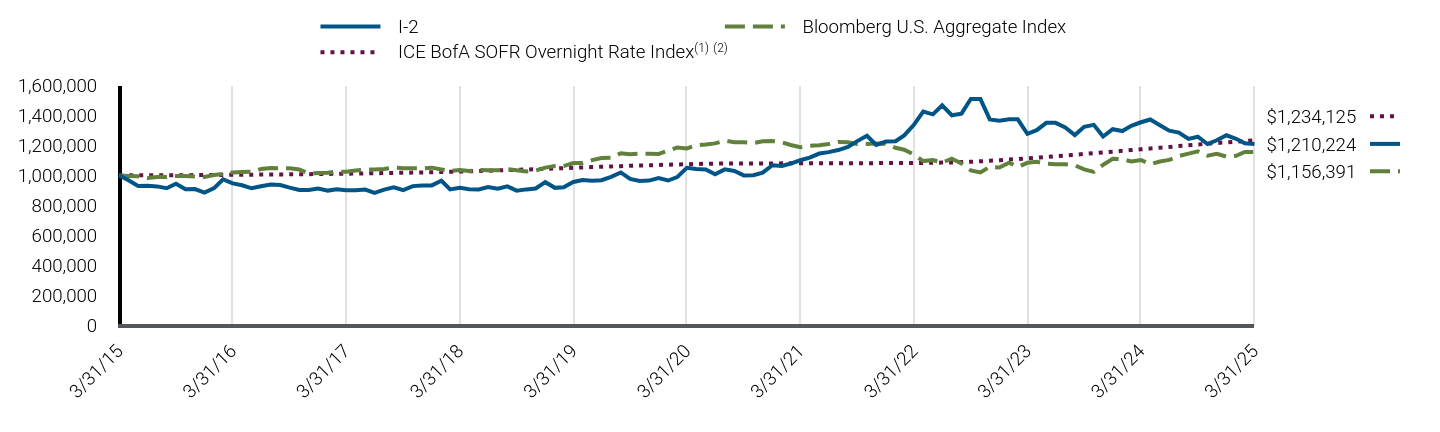

| Line Graph [Table Text Block] |

|

I-2 |

S&P 500 Index |

UBS Prompt Commodity Index Total Return |

3/31/15 |

$1,000,000 |

$1,000,000 |

$1,000,000 |

4/30/15 |

$1,101,671 |

$1,009,593 |

$1,103,873 |

5/31/15 |

$1,069,638 |

$1,022,576 |

$1,074,822 |

6/30/15 |

$1,069,184 |

$1,002,781 |

$1,077,753 |

7/31/15 |

$936,236 |

$1,023,790 |

$936,551 |

8/31/15 |

$932,037 |

$962,021 |

$939,768 |

9/30/15 |

$869,681 |

$938,217 |

$885,889 |

10/31/15 |

$888,035 |

$1,017,360 |

$894,412 |

11/30/15 |

$816,032 |

$1,020,385 |

$818,552 |

12/31/15 |

$762,559 |

$1,004,292 |

$762,979 |

1/31/16 |

$718,701 |

$954,455 |

$725,002 |

2/29/16 |

$707,383 |

$953,167 |

$717,486 |

3/31/16 |

$756,900 |

$1,017,828 |

$757,514 |

4/30/16 |

$837,541 |

$1,021,774 |

$836,616 |

5/31/16 |

$846,030 |

$1,040,123 |

$846,843 |

6/30/16 |

$858,726 |

$1,042,818 |

$858,601 |

7/31/16 |

$806,295 |

$1,081,265 |

$799,584 |

8/31/16 |

$819,049 |

$1,082,784 |

$807,729 |

9/30/16 |

$858,726 |

$1,082,988 |

$843,465 |

10/31/16 |

$854,475 |

$1,063,233 |

$830,904 |

11/30/16 |

$879,981 |

$1,102,610 |

$852,719 |

12/31/16 |

$909,739 |

$1,124,405 |

$881,252 |

1/31/17 |

$916,824 |

$1,145,730 |

$880,773 |

2/28/17 |

$919,659 |

$1,191,223 |

$884,185 |

3/31/17 |

$885,503 |

$1,192,612 |

$852,160 |

4/30/17 |

$864,182 |

$1,204,860 |

$829,127 |

5/31/17 |

$849,969 |

$1,221,816 |

$817,310 |

6/30/17 |

$838,071 |

$1,229,442 |

$805,369 |

7/31/17 |

$884,300 |

$1,254,723 |

$845,391 |

8/31/17 |

$887,282 |

$1,258,564 |

$845,403 |

9/30/17 |

$913,123 |

$1,284,525 |

$867,222 |

10/31/17 |

$950,521 |

$1,314,500 |

$899,693 |

11/30/17 |

$966,103 |

$1,354,816 |

$912,263 |

12/31/17 |

$1,005,449 |

$1,369,880 |

$948,717 |

1/31/18 |

$1,039,395 |

$1,448,311 |

$979,501 |

2/28/18 |

$1,013,531 |

$1,394,930 |

$955,592 |

3/31/18 |

$1,038,730 |

$1,359,480 |

$974,890 |

4/30/18 |

$1,082,415 |

$1,364,697 |

$1,017,724 |

5/31/18 |

$1,105,066 |

$1,397,561 |

$1,038,345 |

6/30/18 |

$1,097,910 |

$1,406,163 |

$1,031,075 |

7/31/18 |

$1,065,718 |

$1,458,492 |

$998,642 |

8/31/18 |

$1,070,801 |

$1,506,017 |

$1,002,617 |

9/30/18 |

$1,107,789 |

$1,514,589 |

$1,035,015 |

10/31/18 |

$1,049,392 |

$1,411,067 |

$987,111 |

11/30/18 |

$930,826 |

$1,439,822 |

$893,278 |

12/31/18 |

$882,059 |

$1,309,819 |

$840,103 |

1/31/19 |

$959,168 |

$1,414,783 |

$910,333 |

2/28/19 |

$1,008,067 |

$1,460,209 |

$946,295 |

3/31/19 |

$1,020,587 |

$1,488,583 |

$955,689 |

4/30/19 |

$1,050,826 |

$1,548,856 |

$978,843 |

5/31/19 |

$967,667 |

$1,450,428 |

$913,193 |

6/30/19 |

$1,007,560 |

$1,552,649 |

$951,876 |

7/31/19 |

$1,009,465 |

$1,574,964 |

$950,481 |

8/31/19 |

$950,420 |

$1,550,016 |

$903,112 |

9/30/19 |

$966,889 |

$1,579,018 |

$920,803 |

10/31/19 |

$984,190 |

$1,613,219 |

$937,221 |

11/30/19 |

$984,190 |

$1,671,777 |

$935,942 |

12/31/19 |

$1,053,021 |

$1,722,235 |

$998,876 |

1/31/20 |

$956,590 |

$1,721,559 |

$911,889 |

2/29/20 |

$879,446 |

$1,579,842 |

$842,933 |

3/31/20 |

$633,406 |

$1,384,711 |

$637,991 |

4/30/20 |

$606,287 |

$1,562,223 |

$597,074 |

5/31/20 |

$722,509 |

$1,636,628 |

$708,827 |

6/30/20 |

$764,776 |

$1,669,176 |

$747,675 |

7/31/20 |

$807,480 |

$1,763,293 |

$782,429 |

8/31/20 |

$852,124 |

$1,890,039 |

$824,720 |

9/30/20 |

$822,378 |

$1,818,224 |

$796,199 |

10/31/20 |

$787,383 |

$1,769,870 |

$760,320 |

11/30/20 |

$896,256 |

$1,963,607 |

$864,721 |

12/31/20 |

$957,323 |

$2,039,105 |

$918,095 |

1/31/21 |

$1,002,076 |

$2,018,518 |

$959,685 |

2/28/21 |

$1,109,094 |

$2,074,179 |

$1,062,177 |

3/31/21 |

$1,088,663 |

$2,165,019 |

$1,042,880 |

4/30/21 |

$1,176,223 |

$2,280,563 |

$1,127,329 |

5/31/21 |

$1,212,220 |

$2,296,491 |

$1,159,290 |

6/30/21 |

$1,265,133 |

$2,350,103 |

$1,209,899 |

7/31/21 |

$1,286,189 |

$2,405,929 |

$1,233,749 |

8/31/21 |

$1,270,397 |

$2,479,083 |

$1,215,251 |

9/30/21 |

$1,328,276 |

$2,363,781 |

$1,276,744 |

10/31/21 |

$1,399,118 |

$2,529,392 |

$1,345,440 |

11/30/21 |

$1,273,374 |

$2,511,866 |

$1,221,538 |

12/31/21 |

$1,376,507 |

$2,624,438 |

$1,315,853 |

1/31/22 |

$1,504,060 |

$2,488,631 |

$1,448,176 |

2/28/22 |

$1,610,354 |

$2,414,118 |

$1,560,016 |

3/31/22 |

$1,759,094 |

$2,503,753 |

$1,704,321 |

4/30/22 |

$1,826,382 |

$2,285,421 |

$1,769,459 |

5/31/22 |

$1,901,360 |

$2,289,614 |

$1,838,298 |

6/30/22 |

$1,745,748 |

$2,100,621 |

$1,698,572 |

7/31/22 |

$1,756,214 |

$2,294,307 |

$1,701,820 |

8/31/22 |

$1,710,163 |

$2,200,741 |

$1,662,348 |

9/30/22 |

$1,586,879 |

$1,998,056 |

$1,556,755 |

10/31/22 |

$1,662,119 |

$2,159,821 |

$1,627,524 |

11/30/22 |

$1,687,199 |

$2,280,521 |

$1,651,058 |

12/31/22 |

$1,693,165 |

$2,149,130 |

$1,651,124 |

1/31/23 |

$1,718,175 |

$2,284,168 |

$1,663,664 |

2/28/23 |

$1,660,653 |

$2,228,437 |

$1,599,917 |

3/31/23 |

$1,648,574 |

$2,310,252 |

$1,588,110 |

4/30/23 |

$1,646,038 |

$2,346,311 |

$1,581,811 |

5/31/23 |

$1,539,514 |

$2,356,510 |

$1,479,141 |

6/30/23 |

$1,600,385 |

$2,512,217 |

$1,533,521 |

7/31/23 |

$1,760,170 |

$2,592,922 |

$1,683,176 |

8/31/23 |

$1,762,706 |

$2,551,639 |

$1,684,968 |

9/30/23 |

$1,794,214 |

$2,429,982 |

$1,721,668 |

10/31/23 |

$1,745,859 |

$2,378,888 |

$1,677,506 |

11/30/23 |

$1,712,774 |

$2,596,140 |

$1,636,490 |

12/31/23 |

$1,678,737 |

$2,714,085 |

$1,599,203 |

1/31/24 |

$1,722,778 |

$2,759,693 |

$1,639,802 |

2/29/24 |

$1,730,550 |

$2,907,048 |

$1,648,587 |

3/31/24 |

$1,818,458 |

$3,000,582 |

$1,735,565 |

4/30/24 |

$1,847,034 |

$2,878,024 |

$1,771,963 |

5/31/24 |

$1,839,241 |

$3,020,730 |

$1,760,799 |

6/30/24 |

$1,843,059 |

$3,129,120 |

$1,764,777 |

7/31/24 |

$1,779,322 |

$3,167,209 |

$1,699,553 |

8/31/24 |

$1,755,421 |

$3,244,035 |

$1,679,375 |

9/30/24 |

$1,777,372 |

$3,313,318 |

$1,697,916 |

10/31/24 |

$1,774,646 |

$3,283,271 |

$1,696,007 |

11/30/24 |

$1,774,646 |

$3,476,003 |

$1,702,287 |

12/31/24 |

$1,819,324 |

$3,393,141 |

$1,743,837 |

1/31/25 |

$1,872,341 |

$3,487,632 |

$1,800,531 |

2/28/25 |

$1,847,228 |

$3,442,124 |

$1,775,866 |

3/31/25 |

$1,896,862 |

$3,248,180 |

$1,826,777 |

|

| Average Annual Return [Table Text Block] |

Class/Index Name |

1 Year |

5 Years |

10 Years |

I-2 |

4.31% |

24.53% |

6.61% |

S&P 500 Index |

8.25% |

18.59% |

12.50% |

UBS Prompt Commodity Index Total Return |

5.26% |

23.42% |

6.21% | |

| No Deduction of Taxes [Text Block] |

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| Performance Table Market Index Changed [Text Block] |

Differences in the Fund’s performance versus an index and related attribution information with respect to particular categories of securities or individual positions may be attributable, in part, to differences in the pricing methodologies used by the Fund and the index.

|

| Updated Performance Information Location [Text Block] |

For performance current to the most recent month-end, visit www.pimco.com/literature or via 888.87.PIMCO (888.877.4626).

|

| AssetsNet |

$ 4,684,149,000

|

| Holdings Count | Holding |

1,079

|

| Advisory Fees Paid, Amount |

$ 22,011,000

|

| InvestmentCompanyPortfolioTurnover |

201.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund StatisticsFootnote Reference† (as of the end of the reporting period)

Total Net Assets |

$4,684,149 |

# of Portfolio Holdings |

1,079 |

Portfolio Turnover Rate |

201% |

Total Net Advisory Fees Paid During the Reporting Period |

$22,011 |

| Footnote |

Description |

Footnote† |

Dollar amounts displayed in 000's | |

| Holdings [Text Block] |

Security Type Breakdown (% of Net Asset Value)Footnote Reference*

Asset-Backed Securities |

17.0% |

Commodities |

14.8% |

Corporate Bonds & Notes |

11.5% |

U.S. Government Agencies |

11.0% |

U.S. Treasury Obligations |

3.2% |

Sovereign Issues |

2.3% |

Non-Agency Mortgage-Backed Securities |

2.2% |

Other Investments |

0.0%Footnote Reference^ |

Short-Term Instruments |

51.4% |

Affiliated Investments |

5.3% |

Financial Derivative Instruments |

1.5% |

Other Assets and Liabilities, Net |

(20.2%) |

Total |

100.0% |

| Footnote |

Description |

Footnote^ |

Rounded value of investments is less than 0.1% of net assets. |

Footnote* |

% of Net Asset Value includes derivatives instruments, if any, valued at the value used for determining the Fund's net asset value. The notional exposure of such derivatives investments therefore may be greater than what is depicted. | |

| Material Fund Change [Text Block] |

|

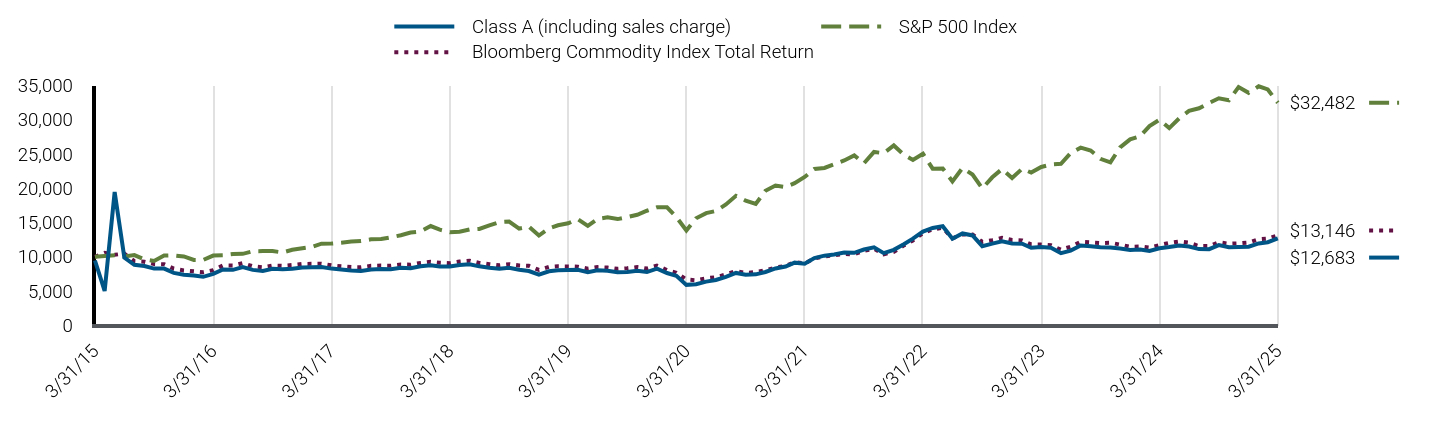

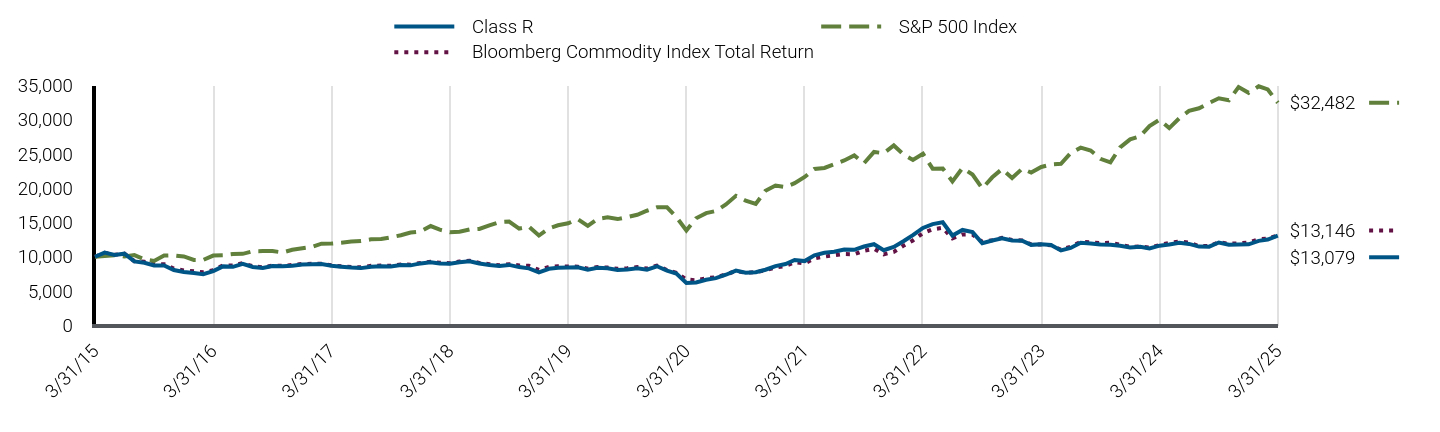

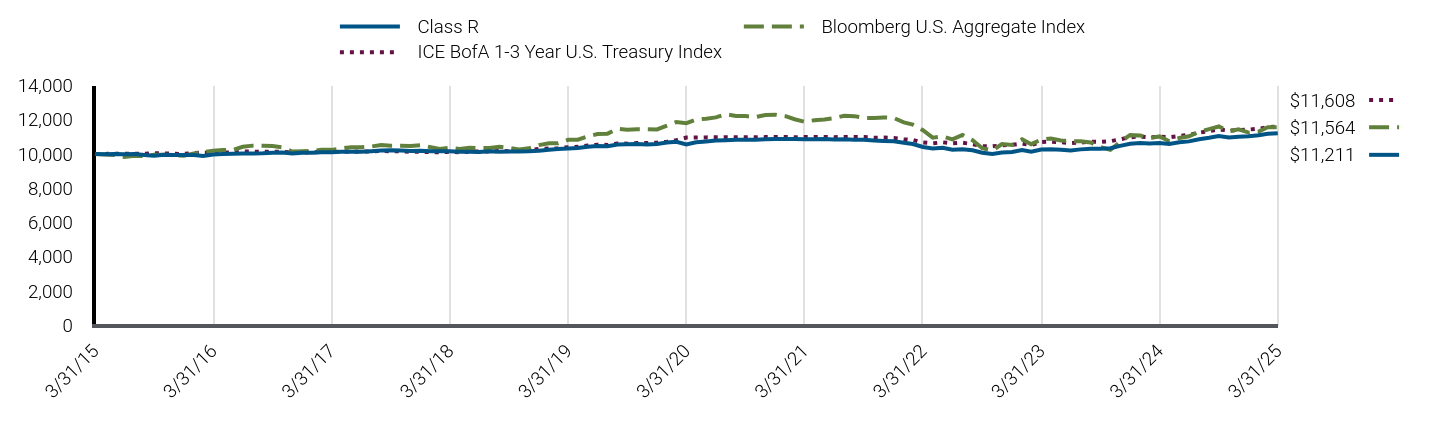

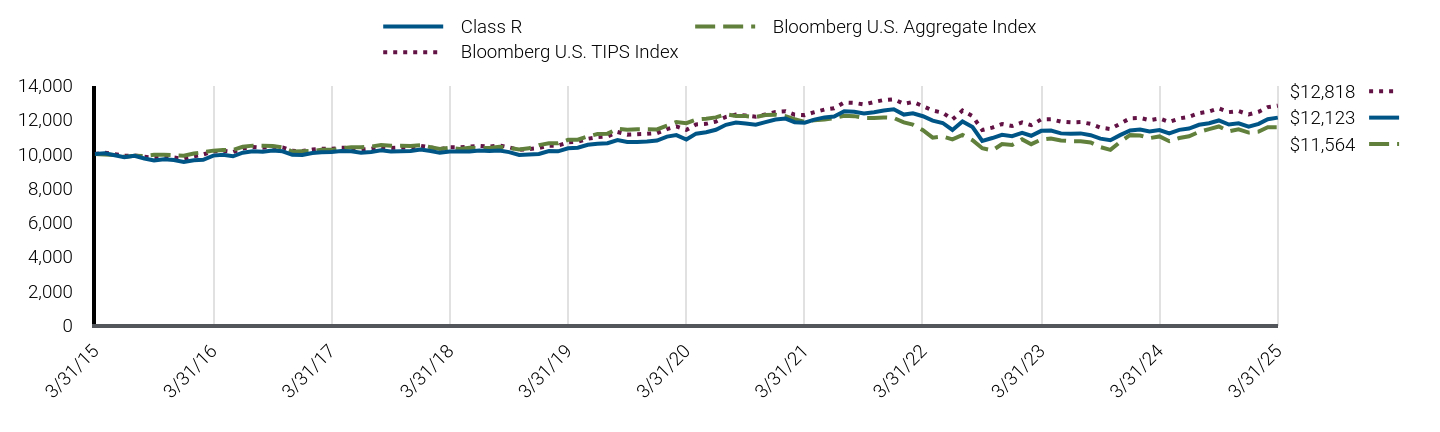

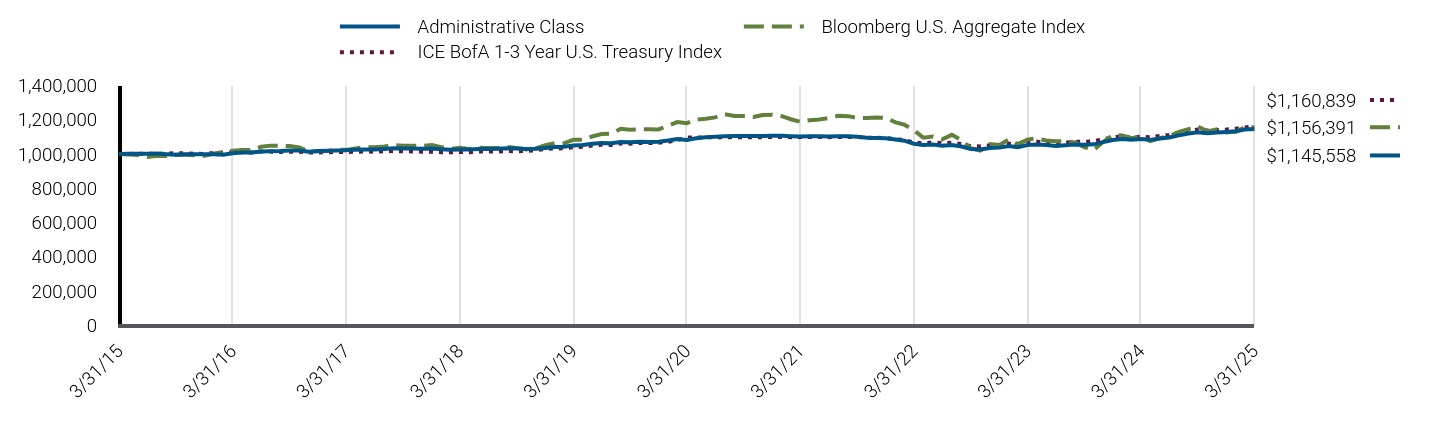

| C000026652 |

|

| Shareholder Report [Line Items] |

|

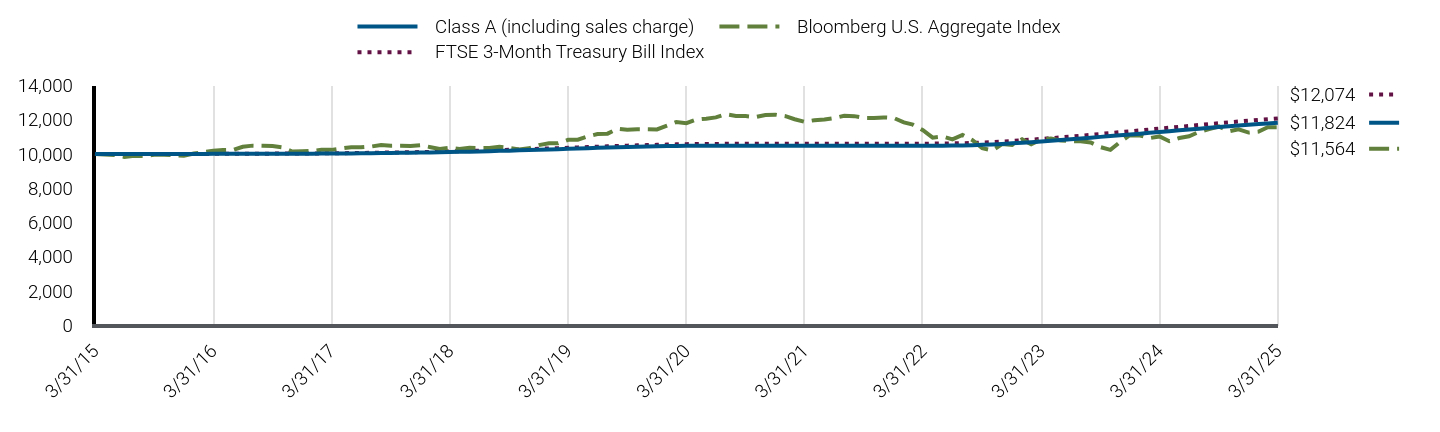

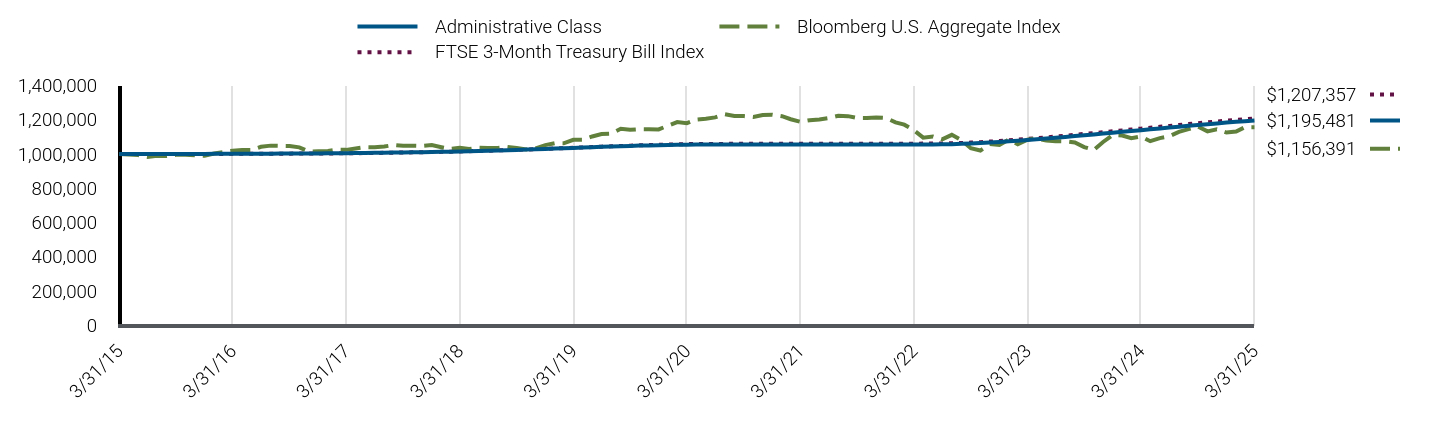

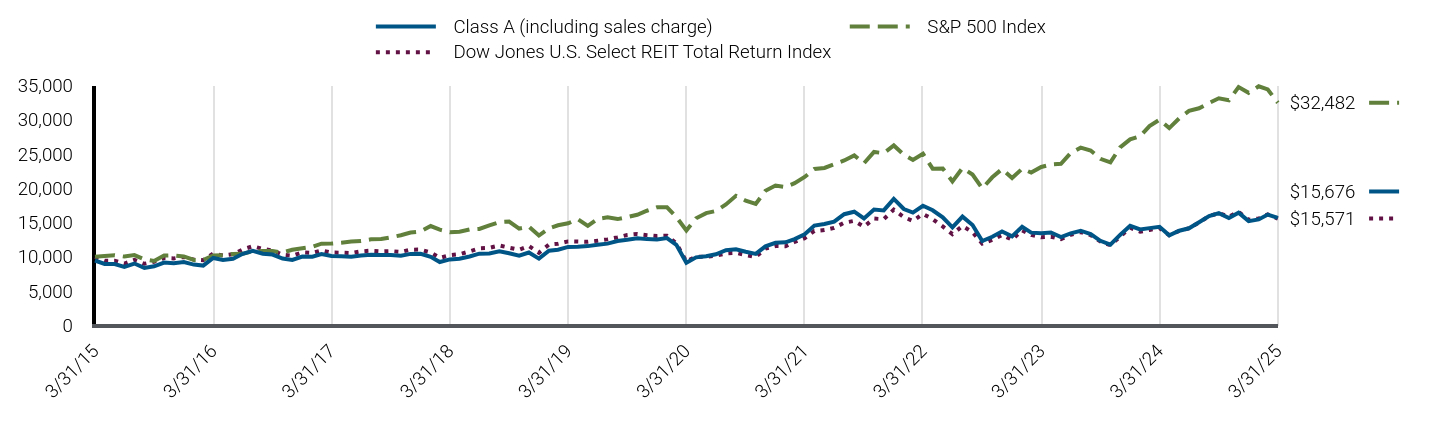

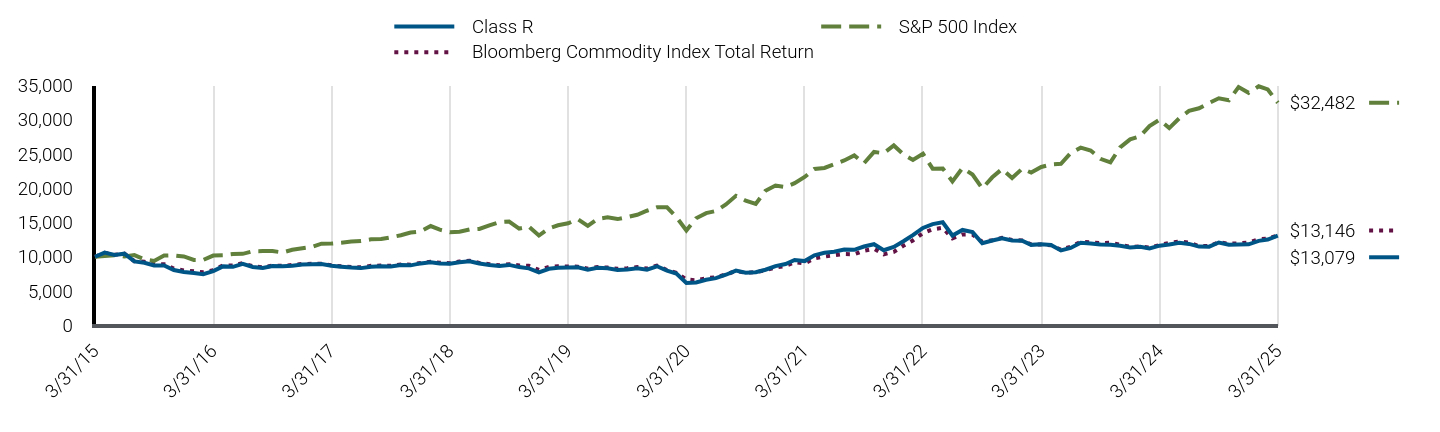

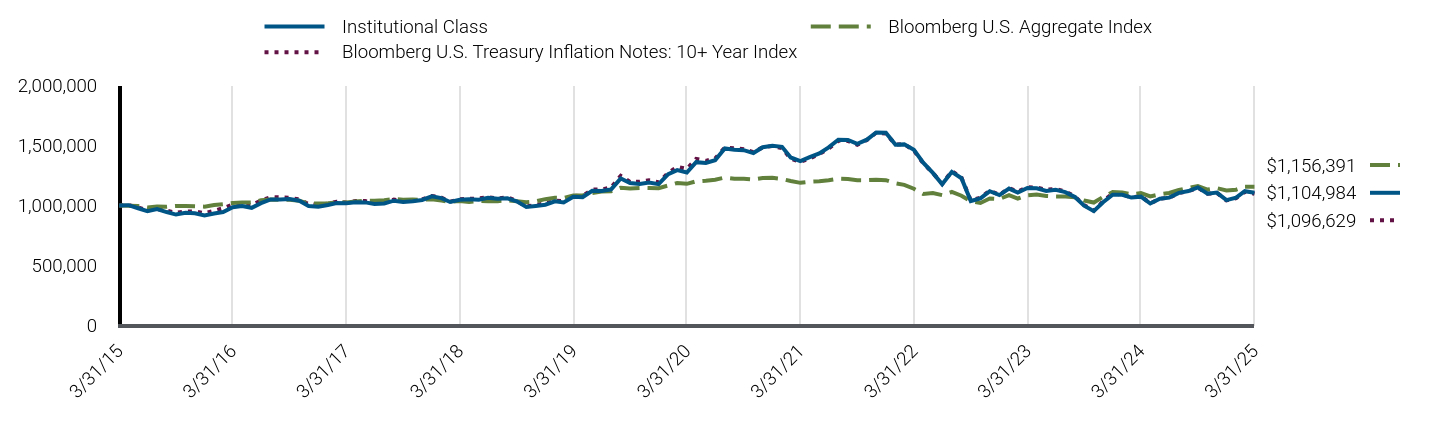

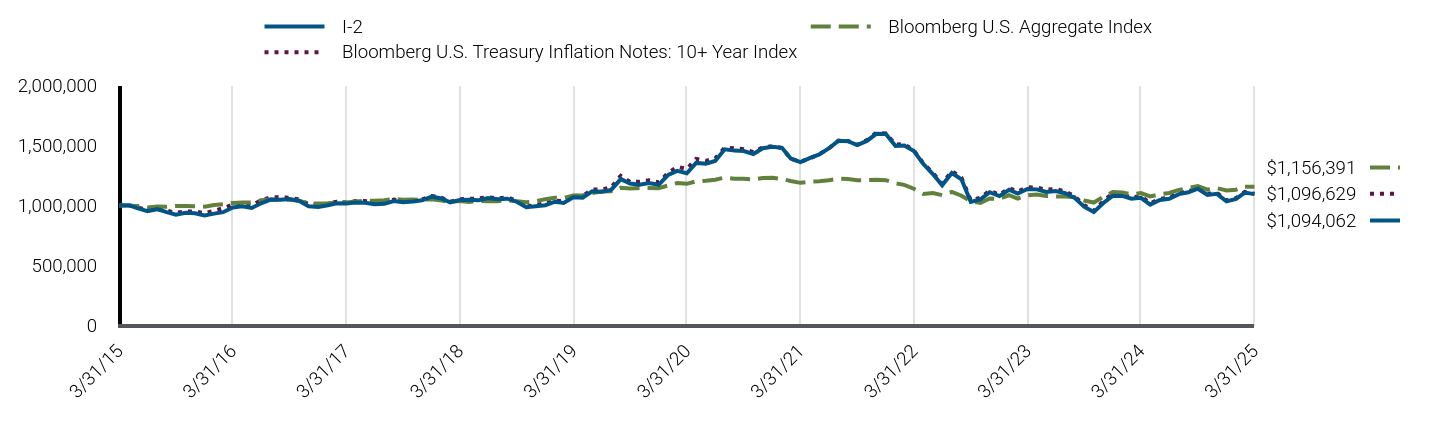

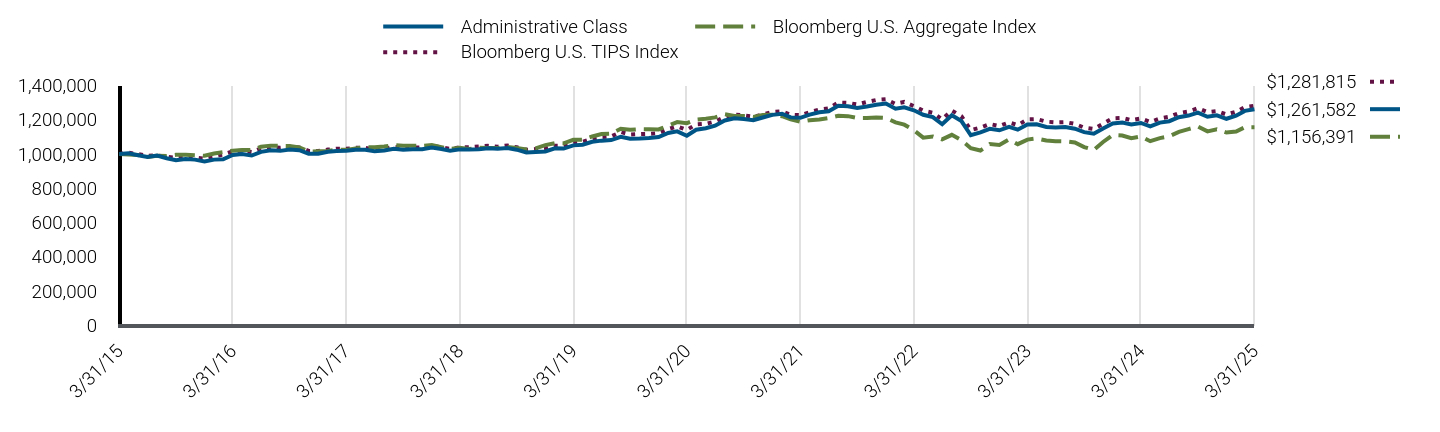

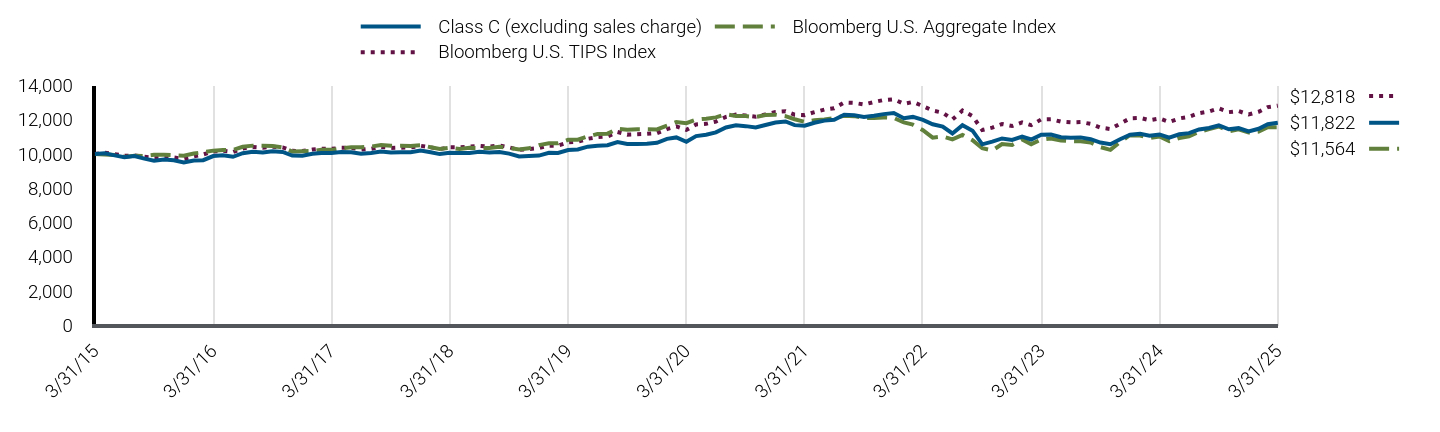

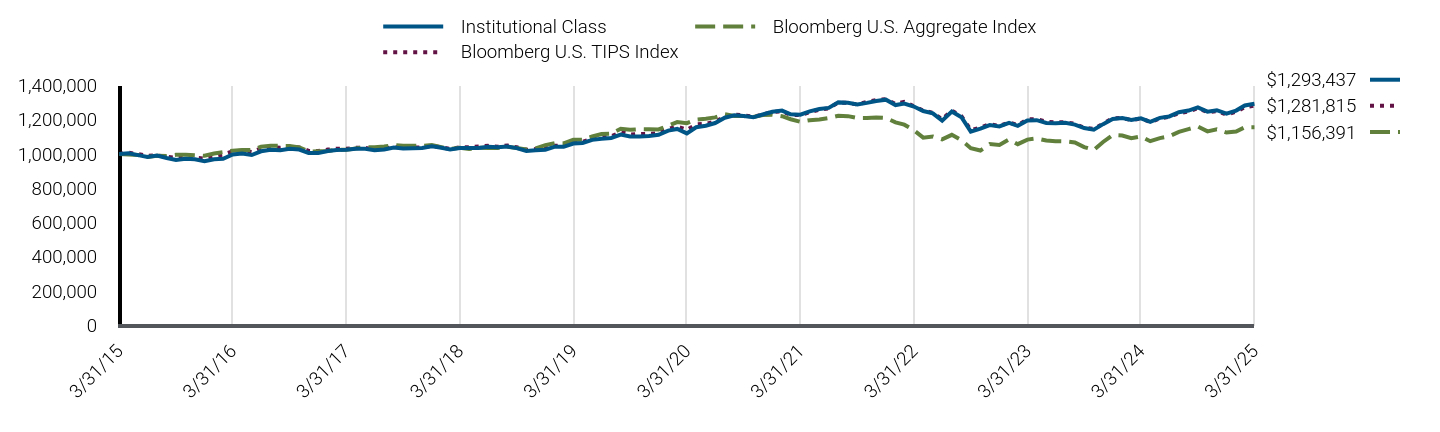

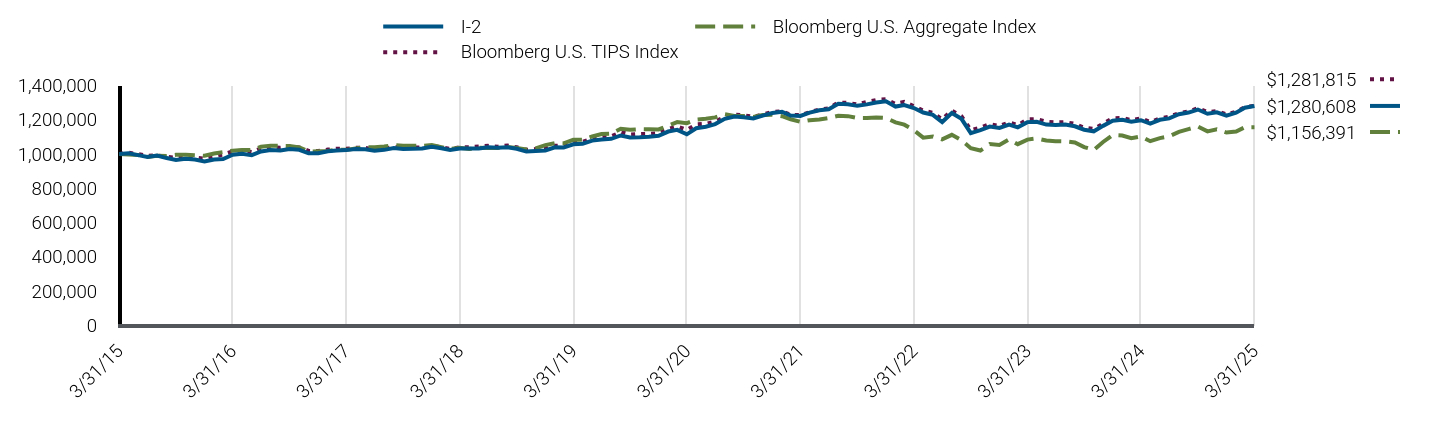

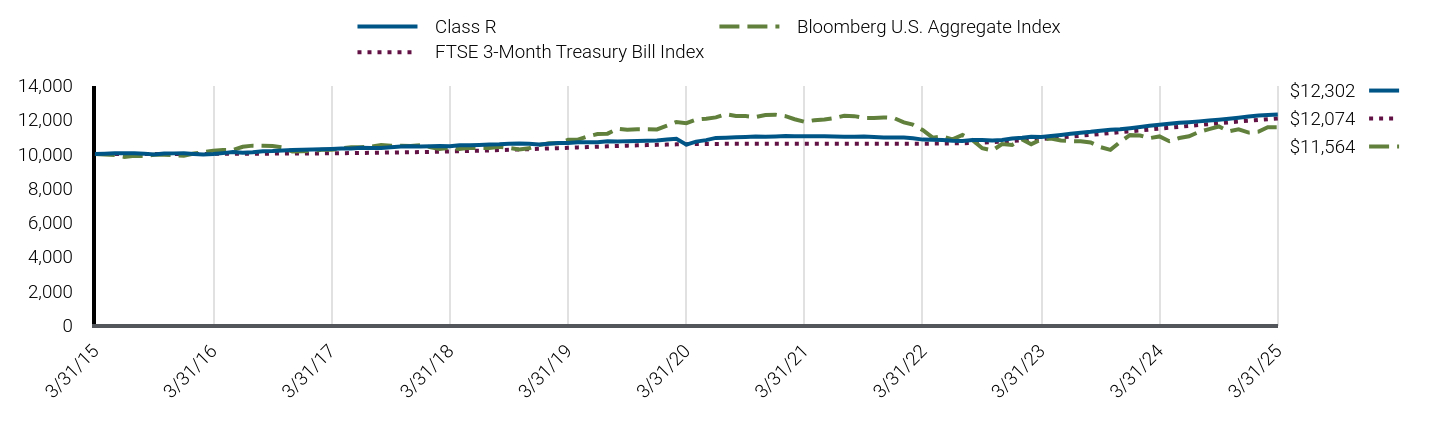

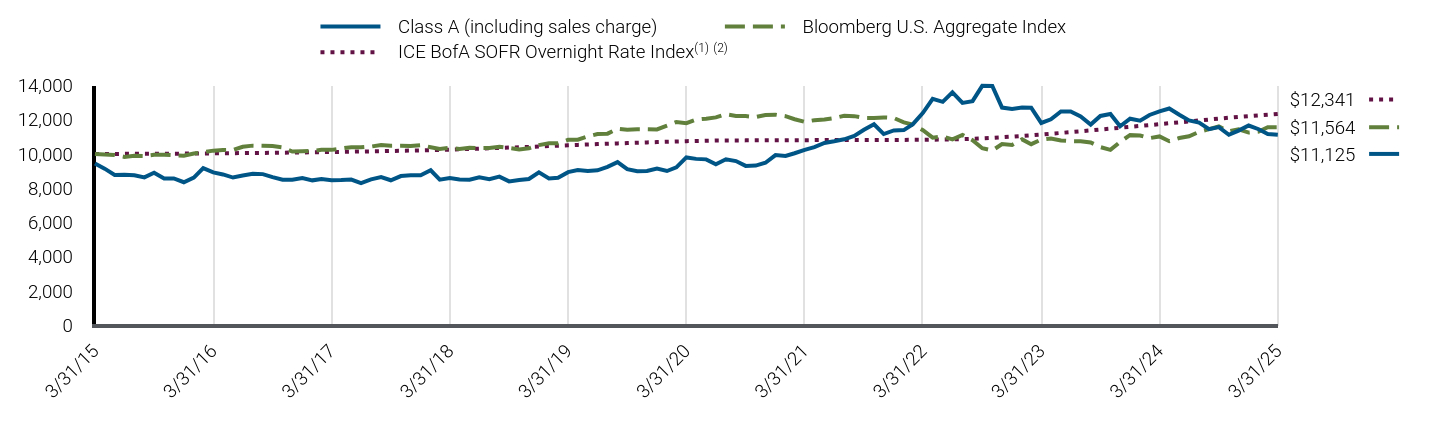

| Fund Name |

PIMCO CommodityRealReturn Strategy Fund<sup style="box-sizing: border-box; color: rgb(0, 0, 0); display: inline; flex-wrap: nowrap; font-size: 15px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; white-space-collapse: preserve-breaks;">®</sup>

|

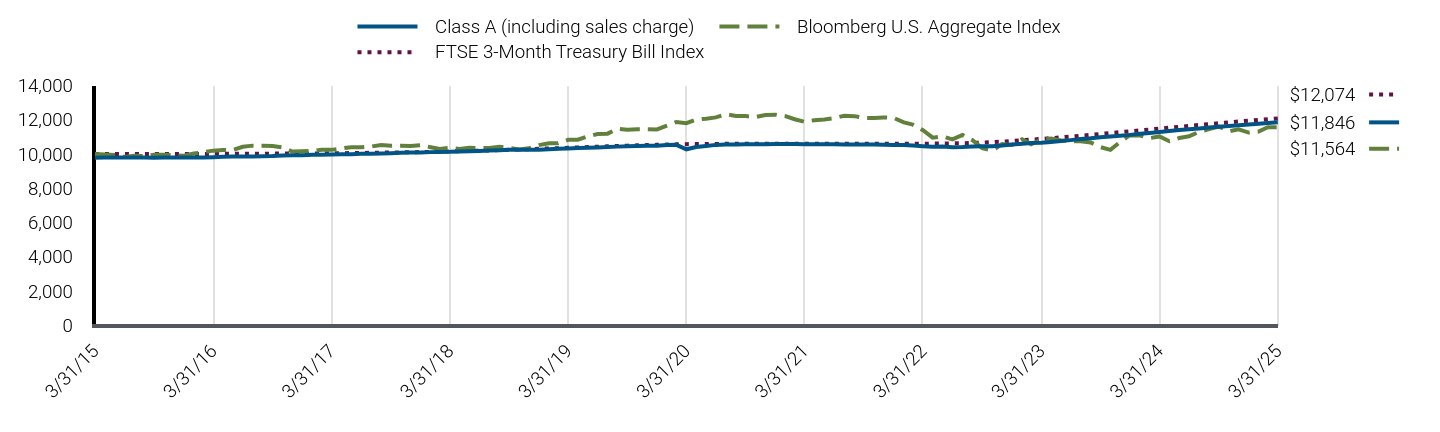

| Class Name |

Class A

|

| Trading Symbol |

PCRAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the PIMCO CommodityRealReturn Strategy Fund® (the "Fund") for the period of April 1, 2024 to March 31, 2025 (the "reporting period").

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.pimco.com/literature. You can also request this information by contacting us at 888.87.PIMCO (888.877.4626).

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

888.87.PIMCO (888.877.4626)

|

| Expenses [Text Block] |

What were the Fund costs for the reporting period?(based on a hypothetical $10,000 investment)

Class Name |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Class A |

$144 |

1.35% | |

| Expenses Paid, Amount |

$ 144

|

| Expense Ratio, Percent |

1.35%

|

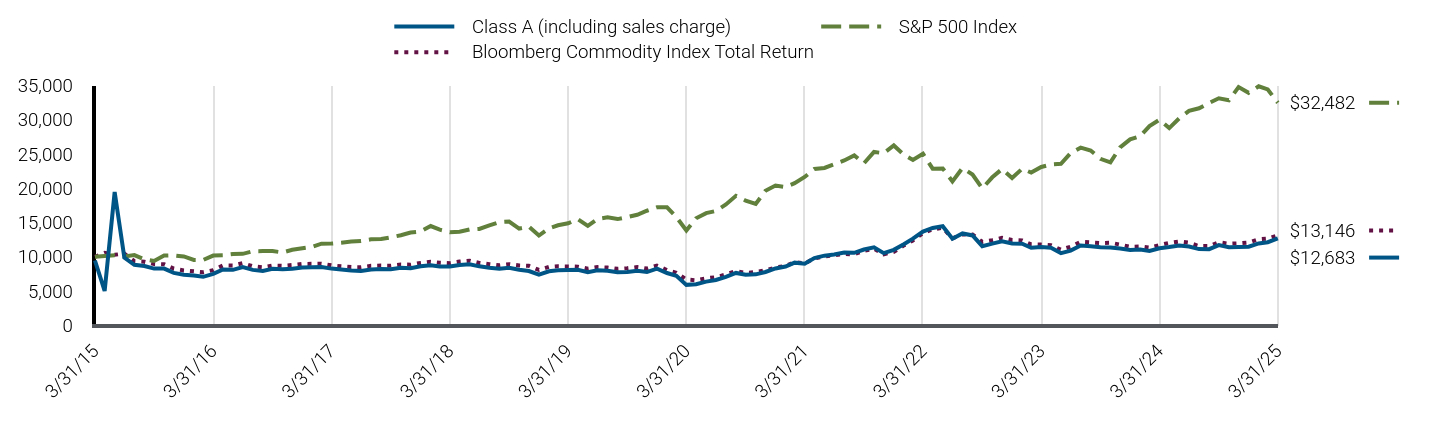

| Factors Affecting Performance [Text Block] |

How did the Fund perform during the reporting period and what affected its performance?The following affected performance (on a gross basis) during the reporting period: The structural allocation to short-term U.S. Treasury inflation-protected securities ("TIPS”), contributed to relative performance versus the Bloomberg Commodity Index Total Return ("Index"), as short-term TIPS underperformed 3-month Treasury Bills. Eurozone interest rate strategies, including short exposure to duration and exposure to swap spreads, contributed to relative performance versus the Index, as eurozone rates rose, while swaps spreads tightened. Positioning within the agriculture sector, including an underweight exposure to corn, contributed to relative performance versus the Index, as corn posted negative returns. Exposure to U.S. non-agency residential mortgage-backed securities and collateralized loan obligations contributed to relative performance versus the Index, as spreads broadly tightened across these sectors. Exposure to California Carbon Allowances ("CCAs") detracted from relative performance versus the Index, as CCAs posted negative returns. Positioning within the energy sector, including an underweight exposure to natural gas, detracted from relative performance versus the Index, as natural gas posted positive returns. There were no other material detractors for this Fund.

|

| Performance Past Does Not Indicate Future [Text] |

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results.

|

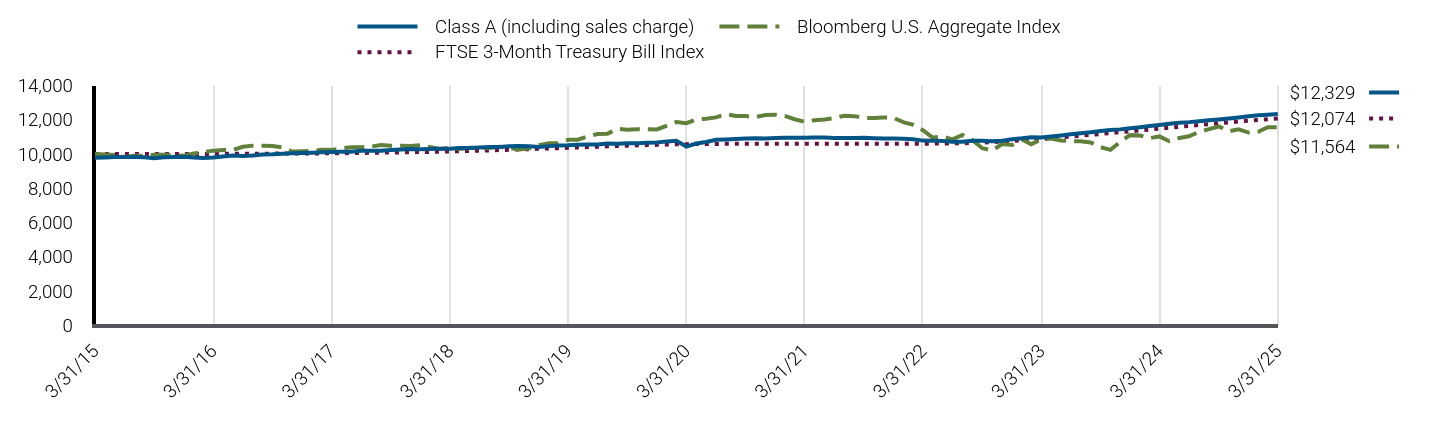

| Line Graph [Table Text Block] |

|

Class A (including sales charge) |

S&P 500 Index |

Bloomberg Commodity Index Total Return |

3/31/15 |

$9,456 |

$10,000 |

$10,000 |

4/30/15 |

$5,011 |

$10,096 |

$10,573 |

5/31/15 |

$19,456 |

$10,226 |

$10,288 |

6/30/15 |

$9,883 |

$10,028 |

$10,466 |

7/31/15 |

$8,826 |

$10,238 |

$9,354 |

8/31/15 |

$8,642 |

$9,620 |

$9,269 |

9/30/15 |

$8,276 |

$9,382 |

$8,952 |

10/31/15 |

$8,276 |

$10,174 |

$8,912 |

11/30/15 |

$7,643 |

$10,204 |

$8,265 |

12/31/15 |

$7,375 |

$10,043 |

$8,010 |

1/31/16 |

$7,256 |

$9,545 |

$7,876 |

2/29/16 |

$7,077 |

$9,532 |

$7,748 |

3/31/16 |

$7,495 |

$10,178 |

$8,044 |

4/30/16 |

$8,151 |

$10,218 |

$8,728 |

5/31/16 |

$8,092 |

$10,401 |

$8,712 |

6/30/16 |

$8,503 |

$10,428 |

$9,072 |