Shareholder Report

|

12 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

JOHN HANCOCK INVESTMENT TRUST

|

| Entity Central Index Key |

0000022370

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| C000251889 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Disciplined Value Global Long/Short Fund

|

| Class Name |

Class A

|

| Trading Symbol |

JAKRX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Disciplined Value Global Long/Short Fund (the fund) for the period of September 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last period ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Disciplined Value Global Long/Short Fund

(Class A/JAKRX) |

$113 |

1.95% |

|

| Expenses Paid, Amount |

$ 113

|

| Expense Ratio, Percent |

1.95%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Disciplined Value Global Long/Short Fund (Class A/JAKRX) returned 0.09% (excluding sales charges) for the period ended March 31, 2025. Global equities produced flat returns in the fund’s abbreviated reporting period. After initial strength, stocks experienced elevated volatility and weak returns from the beginning of December onward amid mounting concerns about the impact of U.S. trade policy on the world economic outlook.

TOP PERFORMANCE CONTRIBUTORS

Short positions and covered calls | These elements of the fund’s strategy, which entail the use of derivatives, combined for positive total returns on an absolute basis. Short positions in the information technology sector helped performance, with the largest contributions coming from ON Semiconductor Corp., Melexis NV, and Comet Holding AG. Short positions in industrials and healthcare contributed, as well.

Certain long positions | Specific areas of the long portfolio contributed positively to absolute performance. Most notably, the fund’s stock picks in the financials, industrials, and consumer discretionary sectors added value. Alibaba Group Holding Company, Ltd., BAE Systems PLC, and Iveco Group NV were leading contributors at the individual stock level.

TOP PERFORMANCE DETRACTORS

The long portfolio | The fund’s long positions experienced negative returns on an absolute basis as a group, offsetting some of the gains from its short positions. The weakest results occurred in the information technology, healthcare, and energy sectors.

Certain short positions | Although the short portfolio logged a gain in the aggregate, the fund lost some ground through its positioning in the financials and communication services sectors. Playa Hotels & Resorts NV was the largest detractor among individual short positions.

The views expressed in this report are exclusively those of the portfolio management team at Boston Partners Global Investors, Inc., and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

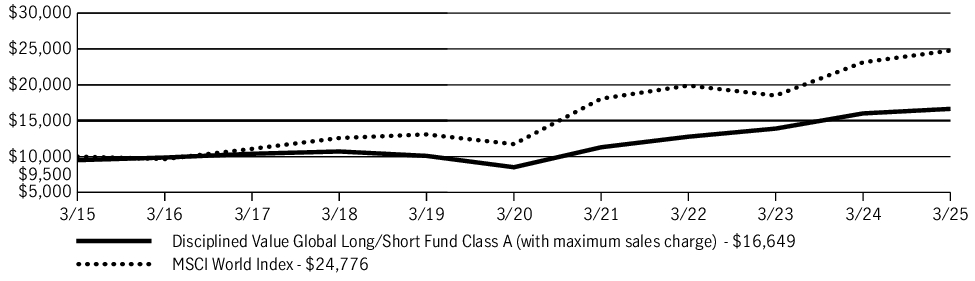

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Disciplined Value Global Long/Short Fund (Class A/JAKRX) |

(1.27)% |

13.18% |

5.23% |

| Disciplined Value Global Long/Short Fund (Class A/JAKRX)—excluding sales charge |

3.94% |

14.36% |

5.77% |

| MSCI World Index |

7.04% |

16.13% |

9.50% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Dec. 12, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 126,167,698

|

| Holdings Count | Holding |

205

|

| Advisory Fees Paid, Amount |

$ 818,419

|

| Investment Company Portfolio Turnover |

125.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$126,167,698 |

| Total number of portfolio holdings |

205 |

| Total advisory fees paid (net) |

$818,419 |

| Portfolio turnover rate |

125% |

|

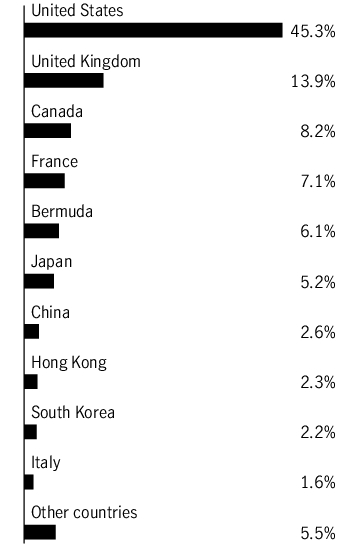

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Hiscox, Ltd. |

3.6% |

| The Weir Group PLC |

3.0% |

| AstraZeneca PLC, ADR |

2.8% |

| Nomad Foods, Ltd. |

2.6% |

| BAE Systems PLC |

2.3% |

| KT Corp., ADR |

2.2% |

| Norfolk Southern Corp. |

2.2% |

| Vallourec SACA |

2.1% |

| Schlumberger, Ltd. |

2.0% |

| Prudential PLC |

1.9% |

|

|

Sector Composition

| Industrials |

13.5% |

| Energy |

12.5% |

| Materials |

10.4% |

| Financials |

9.5% |

| Health care |

7.4% |

| Information technology |

6.2% |

| Consumer discretionary |

5.9% |

| Communication services |

5.2% |

| Consumer staples |

5.0% |

| Utilities |

0.5% |

| Real estate |

0.1% |

| Short-term investments and other |

23.8% |

Country Composition

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Hiscox, Ltd. |

3.6% |

| The Weir Group PLC |

3.0% |

| AstraZeneca PLC, ADR |

2.8% |

| Nomad Foods, Ltd. |

2.6% |

| BAE Systems PLC |

2.3% |

| KT Corp., ADR |

2.2% |

| Norfolk Southern Corp. |

2.2% |

| Vallourec SACA |

2.1% |

| Schlumberger, Ltd. |

2.0% |

| Prudential PLC |

1.9% |

|

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

After the close of business on October 18, 2024, the fund acquired the assets and liabilities of the Boston Partners Global Long/Short Fund, a series of The RBB Fund, Inc. (the predecessor fund), and as a result of the transaction, adopted the accounting and performance history of the predecessor fund. The predecessor fund was advised by Boston Partners Global Investors, Inc., and Boston Partners Global Investors, Inc. is the subadvisor to this fund.

The Board of Trustees of the fund approved a change to the fund's fiscal year end from October 31 to March 31, effective October 21, 2024. The predecessor fund had a fiscal year end of August 31.

On December 12, 2024, the Board of Trustees of the fund approved the change in the fund’s diversification status from “non-diversified” to “diversified”, effective on that date.

This is a summary of certain changes to the fund since 9-1-24. For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Risks Change [Text Block] |

On December 12, 2024, the Board of Trustees of the fund approved the change in the fund’s diversification status from “non-diversified” to “diversified”, effective on that date.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 9-1-24. For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000251890 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Disciplined Value Global Long/Short Fund

|

| Class Name |

Class C

|

| Trading Symbol |

JAKTX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Disciplined Value Global Long/Short Fund (the fund) for the period of September 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last period ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Disciplined Value Global Long/Short Fund

(Class C/JAKTX) |

$119 |

2.70% |

|

| Expenses Paid, Amount |

$ 119

|

| Expense Ratio, Percent |

2.70%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Disciplined Value Global Long/Short Fund (Class C/JAKTX) declined 0.15% (excluding sales charges) for the period ended March 31, 2025. Global equities produced flat returns in the fund’s abbreviated reporting period. After initial strength, stocks experienced elevated volatility and weak returns from the beginning of December onward amid mounting concerns about the impact of U.S. trade policy on the world economic outlook.

TOP PERFORMANCE CONTRIBUTORS

Short positions and covered calls | These elements of the fund’s strategy, which entail the use of derivatives, combined for positive total returns on an absolute basis. Short positions in the information technology sector helped performance, with the largest contributions coming from ON Semiconductor Corp., Melexis NV, and Comet Holding AG. Short positions in industrials and healthcare contributed, as well.

Certain long positions | Specific areas of the long portfolio contributed positively to absolute performance. Most notably, the fund’s stock picks in the financials, industrials, and consumer discretionary sectors added value. Alibaba Group Holding Company, Ltd., BAE Systems PLC, and Iveco Group NV were leading contributors at the individual stock level.

TOP PERFORMANCE DETRACTORS

The long portfolio | The fund’s long positions experienced negative returns on an absolute basis as a group, offsetting some of the gains from its short positions. The weakest results occurred in the information technology, healthcare, and energy sectors.

Certain short positions | Although the short portfolio logged a gain in the aggregate, the fund lost some ground through its positioning in the financials and communication services sectors. Playa Hotels & Resorts NV was the largest detractor among individual short positions.

The views expressed in this report are exclusively those of the portfolio management team at Boston Partners Global Investors, Inc., and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

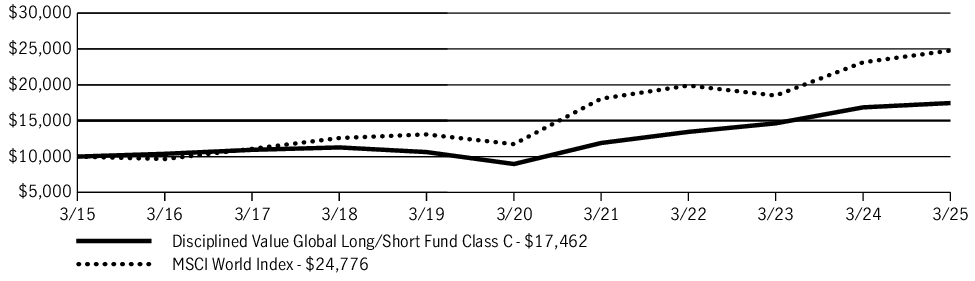

| Line Graph [Table Text Block] |

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $10,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $10,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Disciplined Value Global Long/Short Fund (Class C/JAKTX) |

2.67% |

14.27% |

5.73% |

| Disciplined Value Global Long/Short Fund (Class C/JAKTX)—excluding sales charge |

3.57% |

14.27% |

5.73% |

| MSCI World Index |

7.04% |

16.13% |

9.50% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Dec. 12, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 126,167,698

|

| Holdings Count | Holding |

205

|

| Advisory Fees Paid, Amount |

$ 818,419

|

| Investment Company Portfolio Turnover |

125.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$126,167,698 |

| Total number of portfolio holdings |

205 |

| Total advisory fees paid (net) |

$818,419 |

| Portfolio turnover rate |

125% |

|

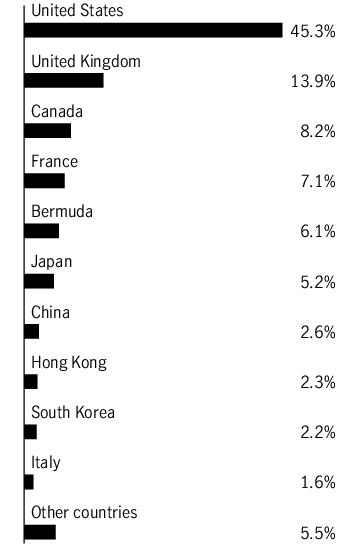

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Hiscox, Ltd. |

3.6% |

| The Weir Group PLC |

3.0% |

| AstraZeneca PLC, ADR |

2.8% |

| Nomad Foods, Ltd. |

2.6% |

| BAE Systems PLC |

2.3% |

| KT Corp., ADR |

2.2% |

| Norfolk Southern Corp. |

2.2% |

| Vallourec SACA |

2.1% |

| Schlumberger, Ltd. |

2.0% |

| Prudential PLC |

1.9% |

|

|

Sector Composition

| Industrials |

13.5% |

| Energy |

12.5% |

| Materials |

10.4% |

| Financials |

9.5% |

| Health care |

7.4% |

| Information technology |

6.2% |

| Consumer discretionary |

5.9% |

| Communication services |

5.2% |

| Consumer staples |

5.0% |

| Utilities |

0.5% |

| Real estate |

0.1% |

| Short-term investments and other |

23.8% |

Country Composition

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Hiscox, Ltd. |

3.6% |

| The Weir Group PLC |

3.0% |

| AstraZeneca PLC, ADR |

2.8% |

| Nomad Foods, Ltd. |

2.6% |

| BAE Systems PLC |

2.3% |

| KT Corp., ADR |

2.2% |

| Norfolk Southern Corp. |

2.2% |

| Vallourec SACA |

2.1% |

| Schlumberger, Ltd. |

2.0% |

| Prudential PLC |

1.9% |

|

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

After the close of business on October 18, 2024, the fund acquired the assets and liabilities of the Boston Partners Global Long/Short Fund, a series of The RBB Fund, Inc. (the predecessor fund), and as a result of the transaction, adopted the accounting and performance history of the predecessor fund. The predecessor fund was advised by Boston Partners Global Investors, Inc., and Boston Partners Global Investors, Inc. is the subadvisor to this fund.

The Board of Trustees of the fund approved a change to the fund's fiscal year end from October 31 to March 31, effective October 21, 2024. The predecessor fund had a fiscal year end of August 31.

On December 12, 2024, the Board of Trustees of the fund approved the change in the fund’s diversification status from “non-diversified” to “diversified”, effective on that date.

This is a summary of certain changes to the fund since 9-1-24. For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Risks Change [Text Block] |

On December 12, 2024, the Board of Trustees of the fund approved the change in the fund’s diversification status from “non-diversified” to “diversified”, effective on that date.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 9-1-24. For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000251891 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Disciplined Value Global Long/Short Fund

|

| Class Name |

Class I

|

| Trading Symbol |

JAKUX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Disciplined Value Global Long/Short Fund (the fund) for the period of September 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last period ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Disciplined Value Global Long/Short Fund

(Class I/JAKUX) |

$99 |

1.70% |

|

| Expenses Paid, Amount |

$ 99

|

| Expense Ratio, Percent |

1.70%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Disciplined Value Global Long/Short Fund (Class I/JAKUX) returned 0.18% for the period ended March 31, 2025. Global equities produced flat returns in the fund’s abbreviated reporting period. After initial strength, stocks experienced elevated volatility and weak returns from the beginning of December onward amid mounting concerns about the impact of U.S. trade policy on the world economic outlook.

TOP PERFORMANCE CONTRIBUTORS

Short positions and covered calls | These elements of the fund’s strategy, which entail the use of derivatives, combined for positive total returns on an absolute basis. Short positions in the information technology sector helped performance, with the largest contributions coming from ON Semiconductor Corp., Melexis NV, and Comet Holding AG. Short positions in industrials and healthcare contributed, as well.

Certain long positions | Specific areas of the long portfolio contributed positively to absolute performance. Most notably, the fund’s stock picks in the financials, industrials, and consumer discretionary sectors added value. Alibaba Group Holding Company, Ltd., BAE Systems PLC, and Iveco Group NV were leading contributors at the individual stock level.

TOP PERFORMANCE DETRACTORS

The long portfolio | The fund’s long positions experienced negative returns on an absolute basis as a group, offsetting some of the gains from its short positions. The weakest results occurred in the information technology, healthcare, and energy sectors.

Certain short positions | Although the short portfolio logged a gain in the aggregate, the fund lost some ground through its positioning in the financials and communication services sectors. Playa Hotels & Resorts NV was the largest detractor among individual short positions.

The views expressed in this report are exclusively those of the portfolio management team at Boston Partners Global Investors, Inc., and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

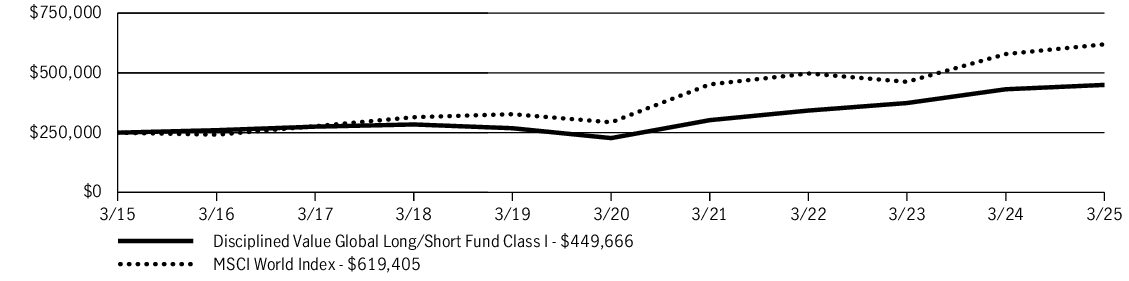

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $250,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $250,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Disciplined Value Global Long/Short Fund (Class I/JAKUX) |

4.21% |

14.62% |

6.05% |

| MSCI World Index |

7.04% |

16.13% |

9.50% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Dec. 12, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 126,167,698

|

| Holdings Count | Holding |

205

|

| Advisory Fees Paid, Amount |

$ 818,419

|

| Investment Company Portfolio Turnover |

125.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$126,167,698 |

| Total number of portfolio holdings |

205 |

| Total advisory fees paid (net) |

$818,419 |

| Portfolio turnover rate |

125% |

|

| Holdings [Text Block] |

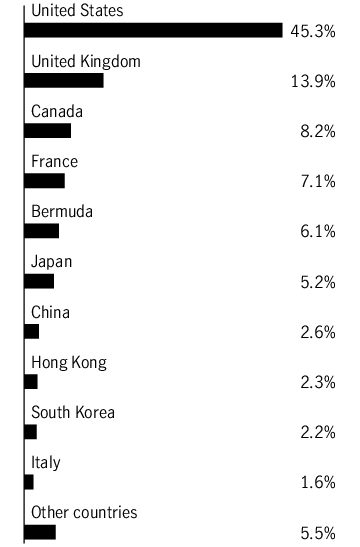

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Hiscox, Ltd. |

3.6% |

| The Weir Group PLC |

3.0% |

| AstraZeneca PLC, ADR |

2.8% |

| Nomad Foods, Ltd. |

2.6% |

| BAE Systems PLC |

2.3% |

| KT Corp., ADR |

2.2% |

| Norfolk Southern Corp. |

2.2% |

| Vallourec SACA |

2.1% |

| Schlumberger, Ltd. |

2.0% |

| Prudential PLC |

1.9% |

|

|

Sector Composition

| Industrials |

13.5% |

| Energy |

12.5% |

| Materials |

10.4% |

| Financials |

9.5% |

| Health care |

7.4% |

| Information technology |

6.2% |

| Consumer discretionary |

5.9% |

| Communication services |

5.2% |

| Consumer staples |

5.0% |

| Utilities |

0.5% |

| Real estate |

0.1% |

| Short-term investments and other |

23.8% |

Country Composition

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Hiscox, Ltd. |

3.6% |

| The Weir Group PLC |

3.0% |

| AstraZeneca PLC, ADR |

2.8% |

| Nomad Foods, Ltd. |

2.6% |

| BAE Systems PLC |

2.3% |

| KT Corp., ADR |

2.2% |

| Norfolk Southern Corp. |

2.2% |

| Vallourec SACA |

2.1% |

| Schlumberger, Ltd. |

2.0% |

| Prudential PLC |

1.9% |

|

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

After the close of business on October 18, 2024, the fund acquired the assets and liabilities of the Boston Partners Global Long/Short Fund, a series of The RBB Fund, Inc. (the predecessor fund), and as a result of the transaction, adopted the accounting and performance history of the predecessor fund. The predecessor fund was advised by Boston Partners Global Investors, Inc., and Boston Partners Global Investors, Inc. is the subadvisor to this fund.

The Board of Trustees of the fund approved a change to the fund's fiscal year end from October 31 to March 31, effective October 21, 2024. The predecessor fund had a fiscal year end of August 31.

On December 12, 2024, the Board of Trustees of the fund approved the change in the fund’s diversification status from “non-diversified” to “diversified”, effective on that date.

This is a summary of certain changes to the fund since 9-1-24. For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Risks Change [Text Block] |

On December 12, 2024, the Board of Trustees of the fund approved the change in the fund’s diversification status from “non-diversified” to “diversified”, effective on that date.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 9-1-24. For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|

| C000251888 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

John Hancock Disciplined Value Global Long/Short Fund

|

| Class Name |

Class R6

|

| Trading Symbol |

JAKVX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the John Hancock Disciplined Value Global Long/Short Fund (the fund) for the period of September 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the fund at jhinvestments.com/documents. You can also request this information by contacting us at 800-225-5291.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800-225-5291

|

| Additional Information Website |

jhinvestments.com/documents

|

| Expenses [Text Block] |

What were the fund costs during the last period ?

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Costs of a $10,000 investment |

Costs paid as a percentage

of a $10,000 investment |

Disciplined Value Global Long/Short Fund

(Class R6/JAKVX) |

$70 |

1.58% |

|

| Expenses Paid, Amount |

$ 70

|

| Expense Ratio, Percent |

1.58%

|

| Factors Affecting Performance [Text Block] |

Management’s Discussion of Fund Performance

SUMMARY OF RESULTS

Disciplined Value Global Long/Short Fund (Class R6/JAKVX) returned 0.36% for the period ended March 31, 2025. Global equities produced flat returns in the fund’s abbreviated reporting period. After initial strength, stocks experienced elevated volatility and weak returns from the beginning of December onward amid mounting concerns about the impact of U.S. trade policy on the world economic outlook.

TOP PERFORMANCE CONTRIBUTORS

Short positions and covered calls | These elements of the fund’s strategy, which entail the use of derivatives, combined for positive total returns on an absolute basis. Short positions in the information technology sector helped performance, with the largest contributions coming from ON Semiconductor Corp., Melexis NV, and Comet Holding AG. Short positions in industrials and healthcare contributed, as well.

Certain long positions | Specific areas of the long portfolio contributed positively to absolute performance. Most notably, the fund’s stock picks in the financials, industrials, and consumer discretionary sectors added value. Alibaba Group Holding Company, Ltd., BAE Systems PLC, and Iveco Group NV were leading contributors at the individual stock level.

TOP PERFORMANCE DETRACTORS

The long portfolio | The fund’s long positions experienced negative returns on an absolute basis as a group, offsetting some of the gains from its short positions. The weakest results occurred in the information technology, healthcare, and energy sectors.

Certain short positions | Although the short portfolio logged a gain in the aggregate, the fund lost some ground through its positioning in the financials and communication services sectors. Playa Hotels & Resorts NV was the largest detractor among individual short positions.

The views expressed in this report are exclusively those of the portfolio management team at Boston Partners Global Investors, Inc., and are subject to change. They are not meant as investment advice.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance does not guarantee future results.

|

| Line Graph [Table Text Block] |

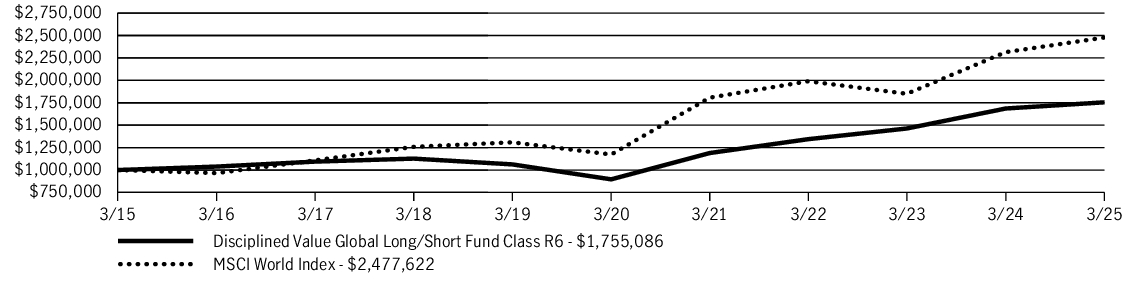

Fund Performance

The following graph compares the initial and subsequent account values at the end of each of the most recently completed 10 fiscal years of the fund (or for the life of the fund, if shorter). It assumes a $1,000,000 initial investment in the fund and in an appropriate, broad-based securities market index for the same period.

GROWTH OF $1,000,000

|

| Average Annual Return [Table Text Block] |

| AVERAGE ANNUAL TOTAL RETURN |

1 Year |

5 Years |

10 Years |

| Disciplined Value Global Long/Short Fund (Class R6/JAKVX) |

4.09% |

14.39% |

5.79% |

| MSCI World Index |

7.04% |

16.13% |

9.50% |

|

| No Deduction of Taxes [Text Block] |

The graph and table do not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares.

|

| Material Change Date |

Dec. 12, 2024

|

| Updated Performance Information Location [Text Block] |

Due to market volatility and other factors, the fund’s current performance may be higher or lower than the performance shown and can be found at jhinvestments.com/investments or by calling 800-225-5291.

|

| Net Assets |

$ 126,167,698

|

| Holdings Count | Holding |

205

|

| Advisory Fees Paid, Amount |

$ 818,419

|

| Investment Company Portfolio Turnover |

125.00%

|

| Additional Fund Statistics [Text Block] |

Fund Statistics

| Fund net assets |

$126,167,698 |

| Total number of portfolio holdings |

205 |

| Total advisory fees paid (net) |

$818,419 |

| Portfolio turnover rate |

125% |

|

| Holdings [Text Block] |

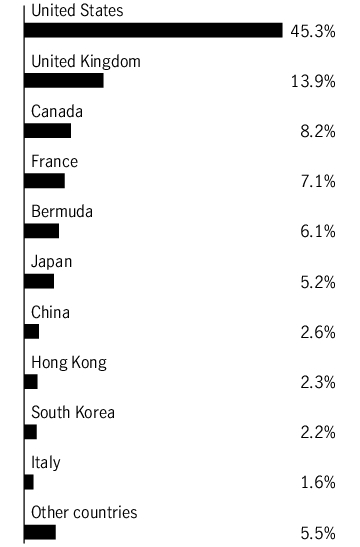

Graphical Representation of Holdings

The tables below show the investment makeup of the fund, representing a percentage of the total net assets of the fund.

Top Ten Holdings

| Hiscox, Ltd. |

3.6% |

| The Weir Group PLC |

3.0% |

| AstraZeneca PLC, ADR |

2.8% |

| Nomad Foods, Ltd. |

2.6% |

| BAE Systems PLC |

2.3% |

| KT Corp., ADR |

2.2% |

| Norfolk Southern Corp. |

2.2% |

| Vallourec SACA |

2.1% |

| Schlumberger, Ltd. |

2.0% |

| Prudential PLC |

1.9% |

|

|

Sector Composition

| Industrials |

13.5% |

| Energy |

12.5% |

| Materials |

10.4% |

| Financials |

9.5% |

| Health care |

7.4% |

| Information technology |

6.2% |

| Consumer discretionary |

5.9% |

| Communication services |

5.2% |

| Consumer staples |

5.0% |

| Utilities |

0.5% |

| Real estate |

0.1% |

| Short-term investments and other |

23.8% |

Country Composition

Holdings may not have been held by the fund for the entire period and are subject to change without notice. Portfolio composition is subject to review in accordance with the fund’s investment strategy and may vary in the future. Current and future portfolio holdings are subject to risk and may change at any time.

|

| Largest Holdings [Text Block] |

Top Ten Holdings

| Hiscox, Ltd. |

3.6% |

| The Weir Group PLC |

3.0% |

| AstraZeneca PLC, ADR |

2.8% |

| Nomad Foods, Ltd. |

2.6% |

| BAE Systems PLC |

2.3% |

| KT Corp., ADR |

2.2% |

| Norfolk Southern Corp. |

2.2% |

| Vallourec SACA |

2.1% |

| Schlumberger, Ltd. |

2.0% |

| Prudential PLC |

1.9% |

|

|

|

| Material Fund Change [Text Block] |

Material Fund Changes

After the close of business on October 18, 2024, the fund acquired the assets and liabilities of the Boston Partners Global Long/Short Fund, a series of The RBB Fund, Inc. (the predecessor fund), and as a result of the transaction, adopted the accounting and performance history of the predecessor fund. The predecessor fund was advised by Boston Partners Global Investors, Inc., and Boston Partners Global Investors, Inc. is the subadvisor to this fund.

The Board of Trustees of the fund approved a change to the fund's fiscal year end from October 31 to March 31, effective October 21, 2024. The predecessor fund had a fiscal year end of August 31.

On December 12, 2024, the Board of Trustees of the fund approved the change in the fund’s diversification status from “non-diversified” to “diversified”, effective on that date.

This is a summary of certain changes to the fund since 9-1-24. For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Material Fund Change Risks Change [Text Block] |

On December 12, 2024, the Board of Trustees of the fund approved the change in the fund’s diversification status from “non-diversified” to “diversified”, effective on that date.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the fund since 9-1-24. For more complete information, please refer to the fund’s prospectus. The currently effective prospectus is available at jhinvestments.com/documents or by calling 800-225-5291.

|

| Updated Prospectus Phone Number |

800-225-5291

|

| Updated Prospectus Web Address |

jhinvestments.com/documents

|