Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holdings

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Artisan

Partners Funds, Inc.

|

| Entity Central Index Key |

0000935015

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| Artisan Developing World Fund - Advisor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Developing World Fund

|

| Class Name |

Advisor

Shares

|

| Trading Symbol |

APDYX

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Developing World Fund for the period of October 1,

2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual

Shareholder Report

|

| Additional Information [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Developing World Fund for the period of October 1,

2024 to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus. You can also

request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Advisor |

$57 |

1.13% |

| |

|

|

|

| Expenses Paid, Amount |

$ 57

|

| Expense Ratio, Percent |

1.13%

|

| Net Assets |

$ 3,615,730,000

|

| Holdings Count | Holdings |

35

|

| Advisory Fees Paid, Amount |

$ 18,770,000

|

| Investment Company, Portfolio Turnover |

36.45%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$3,615,730 |

| Number

of Portfolio Holdings |

35 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$18,770 |

| Portfolio

Turnover Rate |

36.45% |

|

| Holdings [Text Block] |

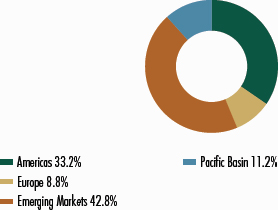

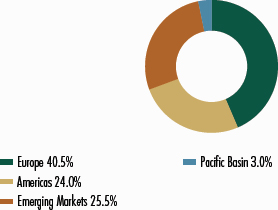

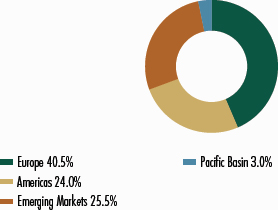

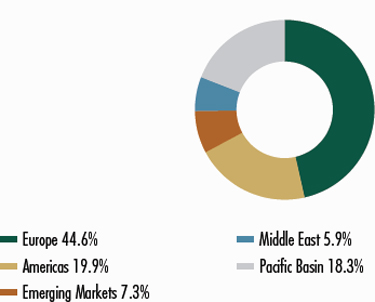

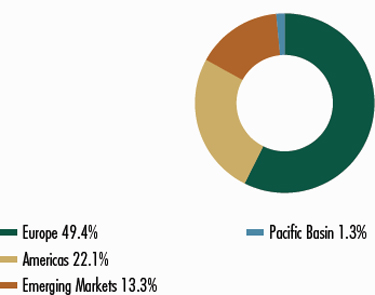

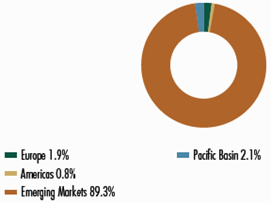

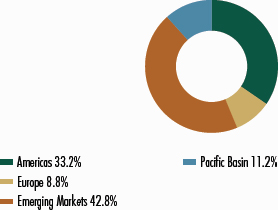

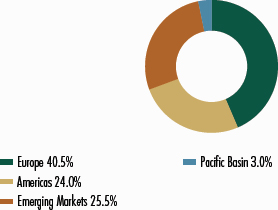

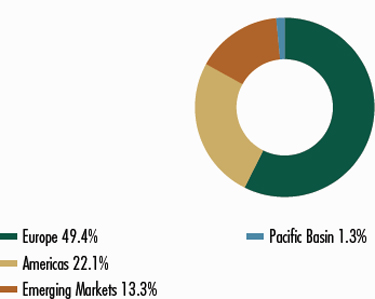

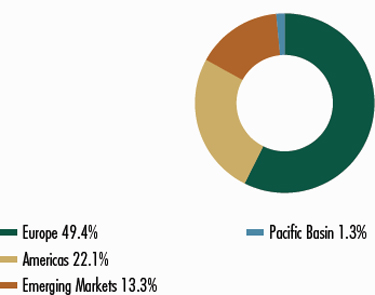

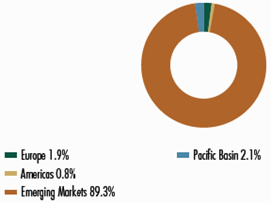

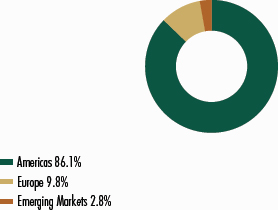

REGION

ALLOCATION

(As

a Percentage of Total Net Assets)

| Region |

|

| Americas |

33.2% |

| Europe |

8.8% |

| Emerging Markets |

42.8% |

| Pacific Basin |

11.2% |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| Australian

dollar | |

| 1.6 | % |

| Chinese

yuan renminbi offshore | |

| 3.4 | |

| Euro | |

| 7.7 | |

| Hong

Kong dollar | |

| 8.8 | |

| Indian

rupee | |

| 6.7 | |

| U.S.

dollar | |

| 71.8 | |

| Total

investments | |

| 100.0 | % |

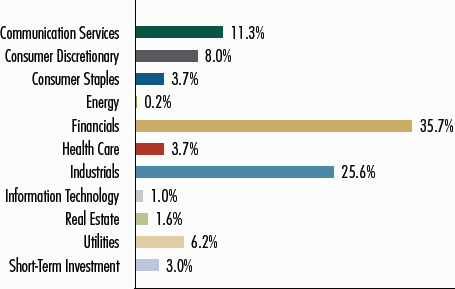

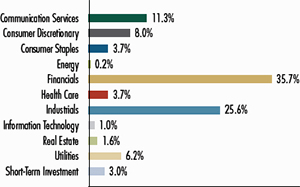

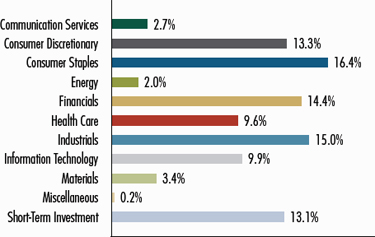

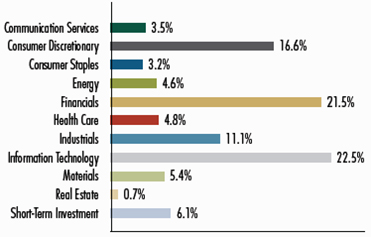

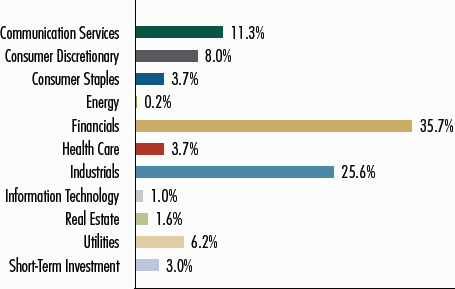

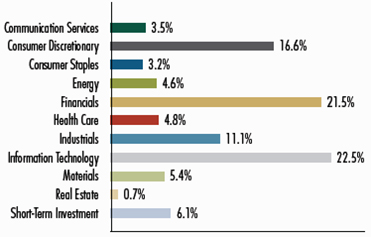

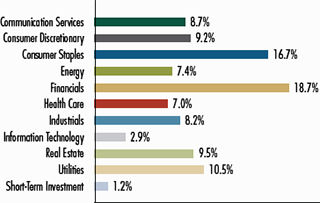

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

15.5% |

| Consumer Discretionary |

27.3% |

| Consumer Staples |

5.2% |

| Financials |

20.3% |

| Health Care |

5.9% |

| Industrials |

3.9% |

| Information Technology |

16.4% |

| Real Estate |

2.1% |

| Short-Term Investment |

3.4% |

|

| Largest Holdings [Text Block] |

| TOP

TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company

Name | |

Country |

Percentage of

Total Net Assets |

| Sea

Ltd. | |

Singapore |

5.7 | % |

| MercadoLibre,

Inc. | |

Brazil |

5.3 | |

| Visa,

Inc. | |

United

States |

4.7 | |

| Meituan | |

China |

4.5 | |

| MakeMyTrip

Ltd. | |

India |

4.4 | |

| Adyen

NV | |

Netherlands |

4.4 | |

| Tencent

Holdings Ltd. | |

China |

4.3 | |

| NU

Holdings Ltd. | |

Brazil |

4.0 | |

| Crowdstrike

Holdings, Inc. | |

United

States |

3.9 | |

| Grab

Holdings Ltd. | |

Singapore |

3.8 | |

| Total | |

|

45.0 | % |

| * | Excludes

short-term investments. |

|

| Artisan Developing World Fund - Institutional Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Developing World Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

APHYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Developing World Fund for the period of October

1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Developing World Fund for the period of October

1, 2024 to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus. You can

also request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Institutional |

$53 |

1.04% |

| |

|

|

|

| Expenses Paid, Amount |

$ 53

|

| Expense Ratio, Percent |

1.04%

|

| Net Assets |

$ 3,615,730,000

|

| Holdings Count | Holdings |

35

|

| Advisory Fees Paid, Amount |

$ 18,770,000

|

| Investment Company, Portfolio Turnover |

36.45%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$3,615,730 |

| Number

of Portfolio Holdings |

35 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$18,770 |

| Portfolio

Turnover Rate |

36.45% |

|

| Holdings [Text Block] |

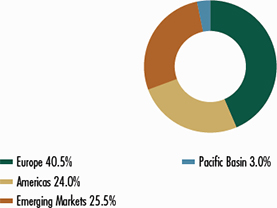

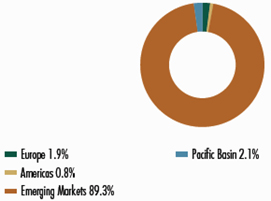

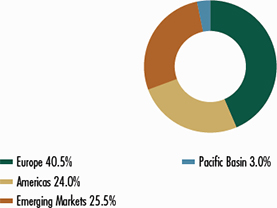

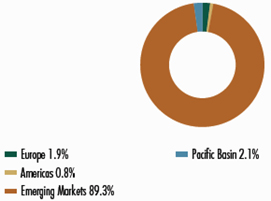

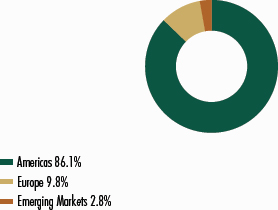

REGION

ALLOCATION

(As

a Percentage of Total Net Assets)

| Region |

|

| Americas |

33.2% |

| Europe |

8.8% |

| Emerging Markets |

42.8% |

| Pacific Basin |

11.2% |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| Australian

dollar | |

| 1.6 | % |

| Chinese

yuan renminbi offshore | |

| 3.4 | |

| Euro | |

| 7.7 | |

| Hong

Kong dollar | |

| 8.8 | |

| Indian

rupee | |

| 6.7 | |

| U.S.

dollar | |

| 71.8 | |

| Total

investments | |

| 100.0 | % |

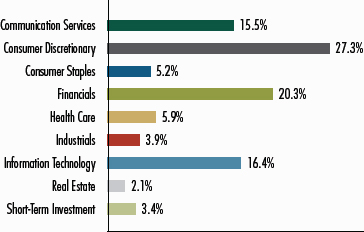

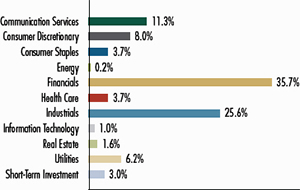

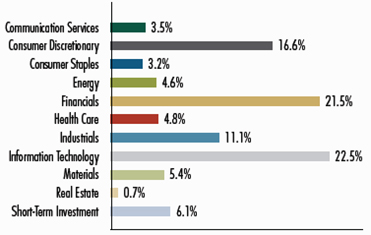

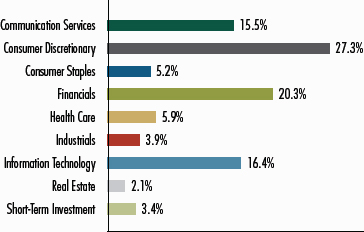

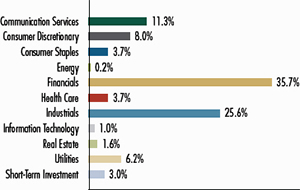

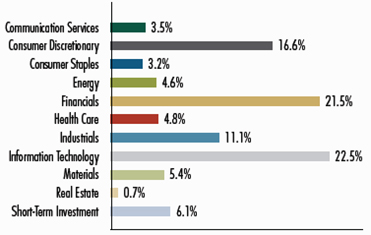

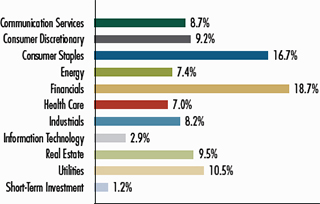

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

15.5% |

| Consumer Discretionary |

27.3% |

| Consumer Staples |

5.2% |

| Financials |

20.3% |

| Health Care |

5.9% |

| Industrials |

3.9% |

| Information Technology |

16.4% |

| Real Estate |

2.1% |

| Short-Term Investment |

3.4% |

|

| Largest Holdings [Text Block] |

| TOP

TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company

Name | |

Country |

Percentage of

Total Net Assets |

| Sea

Ltd. | |

Singapore |

5.7 | % |

| MercadoLibre,

Inc. | |

Brazil |

5.3 | |

| Visa,

Inc. | |

United

States |

4.7 | |

| Meituan | |

China |

4.5 | |

| MakeMyTrip

Ltd. | |

India |

4.4 | |

| Adyen

NV | |

Netherlands |

4.4 | |

| Tencent

Holdings Ltd. | |

China |

4.3 | |

| NU

Holdings Ltd. | |

Brazil |

4.0 | |

| Crowdstrike

Holdings, Inc. | |

United

States |

3.9 | |

| Grab

Holdings Ltd. | |

Singapore |

3.8 | |

| Total | |

|

45.0 | % |

| * | Excludes

short-term investments. |

|

| Artisan Developing World Fund - Investor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Developing World Fund

|

| Class Name |

Investor Shares

|

| Trading Symbol |

ARTYX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Developing World Fund for the period of October

1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Developing World Fund for the period of October

1, 2024 to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus. You can

also request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Investor |

$66 |

1.30% |

| |

|

|

|

| Expenses Paid, Amount |

$ 66

|

| Expense Ratio, Percent |

1.30%

|

| Net Assets |

$ 3,615,730,000

|

| Holdings Count | Holdings |

35

|

| Advisory Fees Paid, Amount |

$ 18,770,000

|

| Investment Company, Portfolio Turnover |

36.45%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$3,615,730 |

| Number

of Portfolio Holdings |

35 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$18,770 |

| Portfolio

Turnover Rate |

36.45% |

|

| Holdings [Text Block] |

REGION

ALLOCATION

(As

a Percentage of Total Net Assets)

| Region |

|

| Americas |

33.2% |

| Europe |

8.8% |

| Emerging Markets |

42.8% |

| Pacific Basin |

11.2% |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| Australian

dollar | |

| 1.6 | % |

| Chinese

yuan renminbi offshore | |

| 3.4 | |

| Euro | |

| 7.7 | |

| Hong

Kong dollar | |

| 8.8 | |

| Indian

rupee | |

| 6.7 | |

| U.S.

dollar | |

| 71.8 | |

| Total

investments | |

| 100.0 | % |

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

15.5% |

| Consumer Discretionary |

27.3% |

| Consumer Staples |

5.2% |

| Financials |

20.3% |

| Health Care |

5.9% |

| Industrials |

3.9% |

| Information Technology |

16.4% |

| Real Estate |

2.1% |

| Short-Term Investment |

3.4% |

|

| Largest Holdings [Text Block] |

| TOP

TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company

Name | |

Country |

Percentage of

Total Net Assets |

| Sea

Ltd. | |

Singapore |

5.7 | % |

| MercadoLibre,

Inc. | |

Brazil |

5.3 | |

| Visa,

Inc. | |

United

States |

4.7 | |

| Meituan | |

China |

4.5 | |

| MakeMyTrip

Ltd. | |

India |

4.4 | |

| Adyen

NV | |

Netherlands |

4.4 | |

| Tencent

Holdings Ltd. | |

China |

4.3 | |

| NU

Holdings Ltd. | |

Brazil |

4.0 | |

| Crowdstrike

Holdings, Inc. | |

United

States |

3.9 | |

| Grab

Holdings Ltd. | |

Singapore |

3.8 | |

| Total | |

|

45.0 | % |

| * | Excludes

short-term investments. |

|

| Artisan Emerging Markets Debt Opportunities Fund - Advisor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Emerging Markets Debt Opportunities Fund

|

| Class Name |

Advisor Shares

|

| Trading Symbol |

APDOX

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Emerging

Markets Debt Opportunities Fund for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Emerging

Markets Debt Opportunities Fund for the period of October 1, 2024 to March 31, 2025.

You can find additional information about the Fund at www.artisanpartners.com/prospectus.

You can also request this information by contacting us at 800.344.1770. This report

describes changes to the Fund that occurred during the reporting period.

|

| Material Fund Change Notice [Text Block] |

This report

describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Advisor |

$59 |

1.16% |

| |

|

|

|

| Expenses Paid, Amount |

$ 59

|

| Expense Ratio, Percent |

1.16%

|

| Net Assets |

$ 94,057,000

|

| Holdings Count | Holdings |

221

|

| Advisory Fees Paid, Amount |

$ 164,000

|

| Investment Company, Portfolio Turnover |

37.53%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$94,057 |

| Number

of Portfolio Holdings |

221 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$164 |

| Portfolio

Turnover Rate |

37.53% |

|

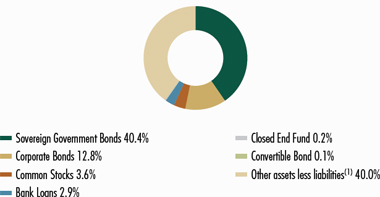

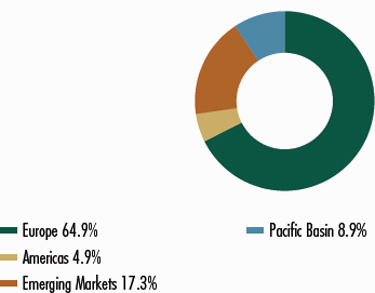

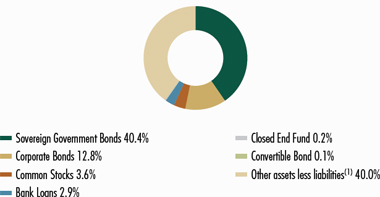

| Holdings [Text Block] |

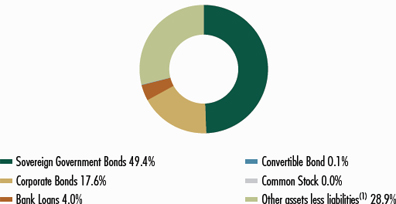

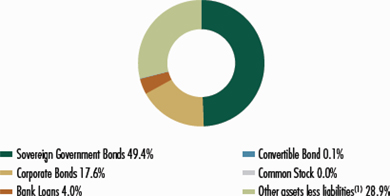

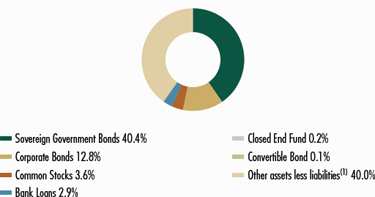

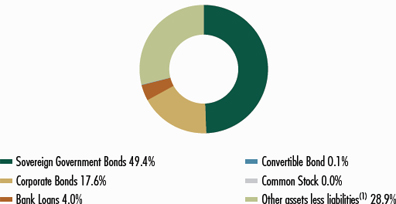

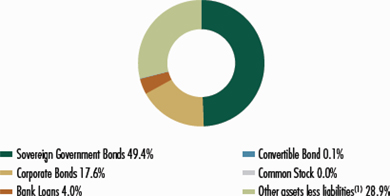

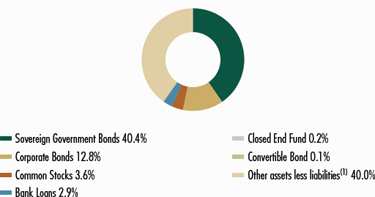

PORTFOLIO

COMPOSITION

(As

a Percentage of Total Net Assets)

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Sovereign Government Bonds |

49.4% |

| Corporate Bonds |

17.6% |

| Bank Loans |

4.0% |

| Convertible Bond |

0.1% |

| Common Stock |

0.0% |

| Other assets less liabilities |

28.9% |

| (1) | Includes any short-term

investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| Albanian

lek | |

| 2.5 | % |

| Dominican

peso | |

| 3.8 | |

| Egyptian

pound | |

| 6.1 | |

| Euro | |

| 9.4 | |

| Indonesian

rupiah | |

| 4.5 | |

| Nigerian

naira | |

| 5.9 | |

| Peruvian

nuevo sol | |

| 6.2 | |

| U.S.

dollar | |

| 57.2 | |

| Uruguayan

peso | |

| 1.5 | |

| Uzbekistani

som | |

| 1.8 | |

| Other | |

| 1.1 | |

| Total

investments | |

| 100.0 | % |

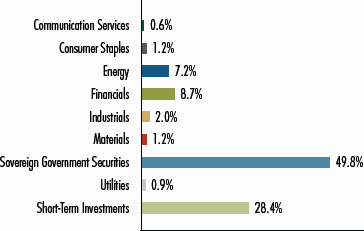

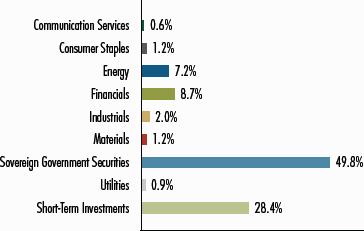

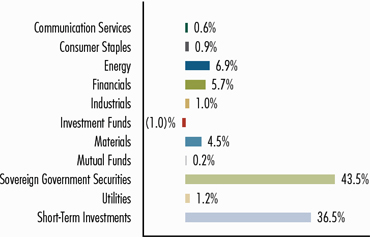

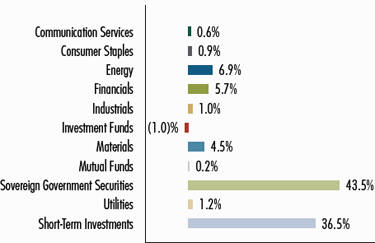

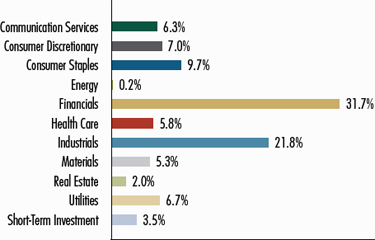

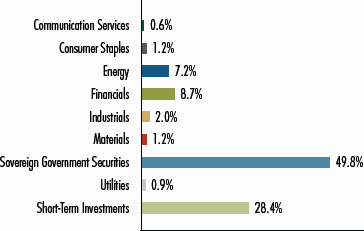

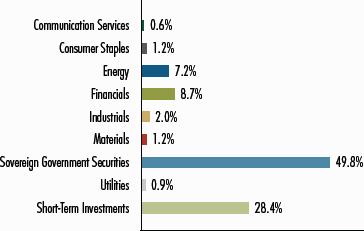

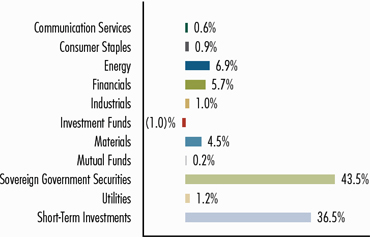

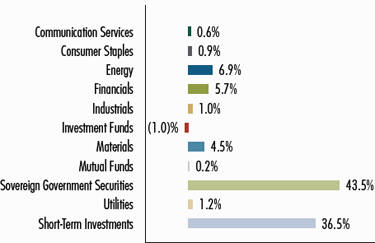

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

0.6% |

| Consumer Staples |

1.2% |

| Energy |

7.2% |

| Financials |

8.7% |

| Industrials |

2.0% |

| Materials |

1.2% |

| Sovereign Government Securities |

49.8% |

| Utilities |

0.9% |

| Short-Term Investments |

28.4% |

|

| Largest Holdings [Text Block] |

| TOP TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company Name | |

Country |

Percentage of

Total Net Assets |

| Commonwealth of the Bahamas | |

Bahamas |

6.5 | % |

| Bonos de la Tesoreria | |

Peru |

6.1 | |

| Republic of Indonesia | |

Indonesia |

4.5 | |

| Benin Government Bond | |

Benin |

3.8 | |

| Republic of Iraq | |

Iraq |

3.7 | |

| Banco Central de la Republica Dominicana, GDN | |

Dominican Republic |

3.7 | |

| Argentine Republic | |

Argentina |

2.7 | |

| Ukraine Government Bond | |

Ukraine |

2.4 | |

| Republic of Zambia | |

Zambia |

2.1 | |

| Federal Republic of Nigeria | |

Nigeria |

1.7 | |

| Total | |

|

37.2 | % |

| * | Excludes

short-term investments. |

|

| Material Fund Change [Text Block] |

This

is a summary of certain changes of the Fund since September 30, 2024. On January 2, 2025,

the fair value methodology used to value emerging markets debt, as determined by a third

party vendor, held by the Fund was changed from using bid pricing to using the midpoint

between the bid and ask price. The change resulted in a one-time increase of less than

0.40% in the net asset value for the Fund. Effective March 14, 2025, the Fund’s 2% redemption

fee was eliminated. For more information, you may review the Fund’s current prospectus,

which is available at www.artisanpartners.com/prospectus or upon request by calling 800.344.1770.

|

| Summary of Change Legend [Text Block] |

This

is a summary of certain changes of the Fund since September 30, 2024. On January 2, 2025,

the fair value methodology used to value emerging markets debt, as determined by a third

party vendor, held by the Fund was changed from using bid pricing to using the midpoint

between the bid and ask price. The change resulted in a one-time increase of less than

0.40% in the net asset value for the Fund. Effective March 14, 2025, the Fund’s 2% redemption

fee was eliminated.

|

| Updated Prospectus Phone Number |

800.344.1770

|

| Updated Prospectus Web Address |

www.artisanpartners.com/prospectus

|

| Artisan Emerging Markets Debt Opportunities Fund - Institutional Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Emerging Markets Debt Opportunities Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

APHOX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Emerging Markets Debt Opportunities Fund

for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Emerging Markets Debt Opportunities Fund

for the period of October 1, 2024 to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus.

You can also request this information by contacting us at 800.344.1770. This report

describes changes to the Fund that occurred during the reporting period.

|

| Material Fund Change Notice [Text Block] |

This report

describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Institutional |

$56 |

1.11% |

| |

|

|

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

1.11%

|

| Net Assets |

$ 94,057,000

|

| Holdings Count | Holdings |

221

|

| Advisory Fees Paid, Amount |

$ 164,000

|

| Investment Company, Portfolio Turnover |

37.53%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$94,057 |

| Number

of Portfolio Holdings |

221 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$164 |

| Portfolio

Turnover Rate |

37.53% |

|

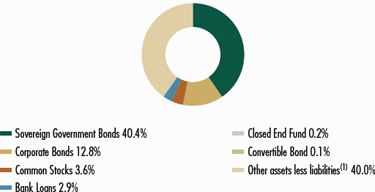

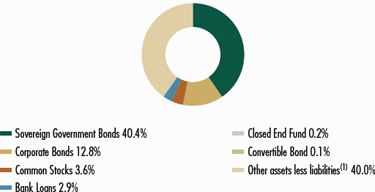

| Holdings [Text Block] |

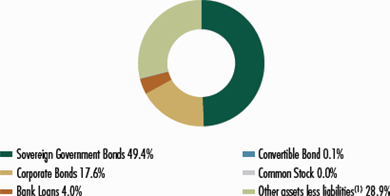

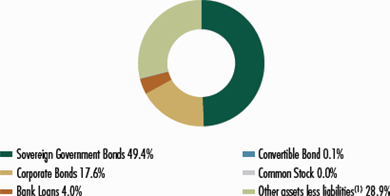

PORTFOLIO

COMPOSITION

(As

a Percentage of Total Net Assets)

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Sovereign Government Bonds |

49.4% |

| Corporate Bonds |

17.6% |

| Bank Loans |

4.0% |

| Convertible Bond |

0.1% |

| Common Stock |

0.0% |

| Other assets less liabilities |

28.9% |

| (1) | Includes any short-term

investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| Albanian

lek | |

| 2.5 | % |

| Dominican

peso | |

| 3.8 | |

| Egyptian

pound | |

| 6.1 | |

| Euro | |

| 9.4 | |

| Indonesian

rupiah | |

| 4.5 | |

| Nigerian

naira | |

| 5.9 | |

| Peruvian

nuevo sol | |

| 6.2 | |

| U.S.

dollar | |

| 57.2 | |

| Uruguayan

peso | |

| 1.5 | |

| Uzbekistani

som | |

| 1.8 | |

| Other | |

| 1.1 | |

| Total

investments | |

| 100.0 | % |

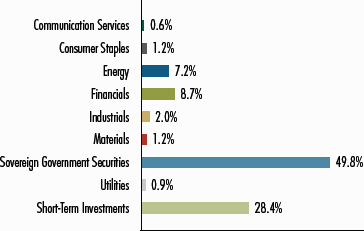

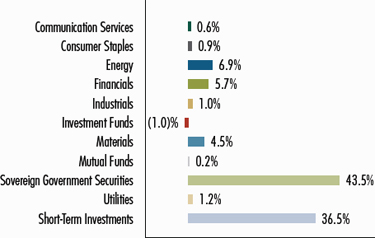

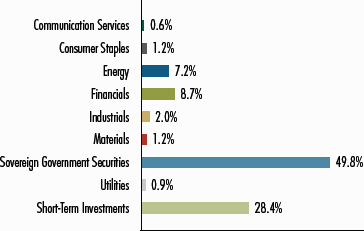

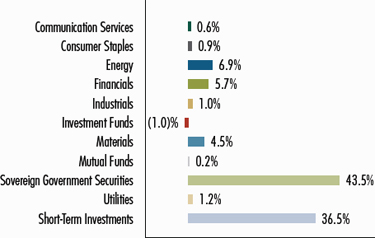

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

0.6% |

| Consumer Staples |

1.2% |

| Energy |

7.2% |

| Financials |

8.7% |

| Industrials |

2.0% |

| Materials |

1.2% |

| Sovereign Government Securities |

49.8% |

| Utilities |

0.9% |

| Short-Term Investments |

28.4% |

|

| Largest Holdings [Text Block] |

| TOP TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company Name | |

Country |

Percentage of

Total Net Assets |

| Commonwealth of the Bahamas | |

Bahamas |

6.5 | % |

| Bonos de la Tesoreria | |

Peru |

6.1 | |

| Republic of Indonesia | |

Indonesia |

4.5 | |

| Benin Government Bond | |

Benin |

3.8 | |

| Republic of Iraq | |

Iraq |

3.7 | |

| Banco Central de la Republica Dominicana, GDN | |

Dominican Republic |

3.7 | |

| Argentine Republic | |

Argentina |

2.7 | |

| Ukraine Government Bond | |

Ukraine |

2.4 | |

| Republic of Zambia | |

Zambia |

2.1 | |

| Federal Republic of Nigeria | |

Nigeria |

1.7 | |

| Total | |

|

37.2 | % |

| * | Excludes

short-term investments. |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes of the Fund since September 30, 2024. On January 2, 2025, the fair value methodology

used to value emerging markets debt, as determined by a third party vendor, held by the Fund was changed from using bid pricing

to using the midpoint between the bid and ask price. The change resulted in a one-time increase of less than 0.40% in the

net asset value for the Fund. Effective March 14, 2025, the Fund’s 2% redemption fee was eliminated. For more information,

you may review the Fund’s current prospectus, which is available at www.artisanpartners.com/prospectus or upon request by

calling 800.344.1770.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes of the Fund since September 30, 2024. On January 2, 2025, the fair value methodology

used to value emerging markets debt, as determined by a third party vendor, held by the Fund was changed from using bid pricing

to using the midpoint between the bid and ask price. The change resulted in a one-time increase of less than 0.40% in the

net asset value for the Fund. Effective March 14, 2025, the Fund’s 2% redemption fee was eliminated.

|

| Updated Prospectus Phone Number |

800.344.1770

|

| Updated Prospectus Web Address |

www.artisanpartners.com/prospectus

|

| Artisan Emerging Markets Debt Opportunities Fund - Investor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Emerging Markets Debt Opportunities Fund

|

| Class Name |

Investor Shares

|

| Trading Symbol |

APFOX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Emerging Markets Debt Opportunities Fund

for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Emerging Markets Debt Opportunities Fund

for the period of October 1, 2024 to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus.

You can also request this information by contacting us at 800.344.1770. This report

describes changes to the Fund that occurred during the reporting period.

|

| Material Fund Change Notice [Text Block] |

This report

describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Investor |

$64 |

1.26% |

| |

|

|

|

| Expenses Paid, Amount |

$ 64

|

| Expense Ratio, Percent |

1.26%

|

| Net Assets |

$ 94,057,000

|

| Holdings Count | Holdings |

221

|

| Advisory Fees Paid, Amount |

$ 164,000

|

| Investment Company, Portfolio Turnover |

37.53%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$94,057 |

| Number

of Portfolio Holdings |

221 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$164 |

| Portfolio

Turnover Rate |

37.53% |

|

| Holdings [Text Block] |

PORTFOLIO

COMPOSITION

(As

a Percentage of Total Net Assets)

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Sovereign Government Bonds |

49.4% |

| Corporate Bonds |

17.6% |

| Bank Loans |

4.0% |

| Convertible Bond |

0.1% |

| Common Stock |

0.0% |

| Other assets less liabilities |

28.9% |

| (1) | Includes any short-term

investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| Albanian

lek | |

| 2.5 | % |

| Dominican

peso | |

| 3.8 | |

| Egyptian

pound | |

| 6.1 | |

| Euro | |

| 9.4 | |

| Indonesian

rupiah | |

| 4.5 | |

| Nigerian

naira | |

| 5.9 | |

| Peruvian

nuevo sol | |

| 6.2 | |

| U.S.

dollar | |

| 57.2 | |

| Uruguayan

peso | |

| 1.5 | |

| Uzbekistani

som | |

| 1.8 | |

| Other | |

| 1.1 | |

| Total

investments | |

| 100.0 | % |

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

0.6% |

| Consumer Staples |

1.2% |

| Energy |

7.2% |

| Financials |

8.7% |

| Industrials |

2.0% |

| Materials |

1.2% |

| Sovereign Government Securities |

49.8% |

| Utilities |

0.9% |

| Short-Term Investments |

28.4% |

|

| Largest Holdings [Text Block] |

| TOP TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company Name | |

Country |

Percentage of

Total Net Assets |

| Commonwealth of the Bahamas | |

Bahamas |

6.5 | % |

| Bonos de la Tesoreria | |

Peru |

6.1 | |

| Republic of Indonesia | |

Indonesia |

4.5 | |

| Benin Government Bond | |

Benin |

3.8 | |

| Republic of Iraq | |

Iraq |

3.7 | |

| Banco Central de la Republica Dominicana, GDN | |

Dominican Republic |

3.7 | |

| Argentine Republic | |

Argentina |

2.7 | |

| Ukraine Government Bond | |

Ukraine |

2.4 | |

| Republic of Zambia | |

Zambia |

2.1 | |

| Federal Republic of Nigeria | |

Nigeria |

1.7 | |

| Total | |

|

37.2 | % |

| * | Excludes

short-term investments. |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes of the Fund since September 30, 2024. On January 2, 2025, the fair value methodology

used to value emerging markets debt, as determined by a third party vendor, held by the Fund was changed from using bid pricing

to using the midpoint between the bid and ask price. The change resulted in a one-time increase of less than 0.40% in the

net asset value for the Fund. Effective March 14, 2025, the Fund’s 2% redemption fee was eliminated. For more information,

you may review the Fund’s current prospectus, which is available at www.artisanpartners.com/prospectus or upon request by

calling 800.344.1770.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes of the Fund since September 30, 2024. On January 2, 2025, the fair value methodology

used to value emerging markets debt, as determined by a third party vendor, held by the Fund was changed from using bid pricing

to using the midpoint between the bid and ask price. The change resulted in a one-time increase of less than 0.40% in the

net asset value for the Fund. Effective March 14, 2025, the Fund’s 2% redemption fee was eliminated.

|

| Updated Prospectus Phone Number |

800.344.1770

|

| Updated Prospectus Web Address |

www.artisanpartners.com/prospectus

|

| Artisan Floating Rate Fund - Advisor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Floating Rate Fund

|

| Class Name |

Advisor Shares

|

| Trading Symbol |

APDUX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Floating Rate Fund for the period of October

1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Floating Rate Fund for the period of October

1, 2024 to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus. You can

also request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Advisor |

$56 |

1.10% |

| |

|

|

|

| Expenses Paid, Amount |

$ 56

|

| Expense Ratio, Percent |

1.10%

|

| Net Assets |

$ 85,081,000

|

| Holdings Count | Holdings |

102

|

| Advisory Fees Paid, Amount |

$ 149,000

|

| Investment Company, Portfolio Turnover |

44.52%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$85,081 |

| Number

of Portfolio Holdings |

102 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$149 |

| Portfolio

Turnover Rate |

44.52% |

|

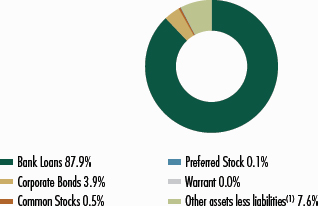

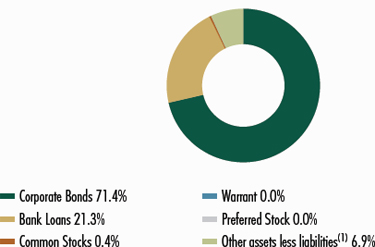

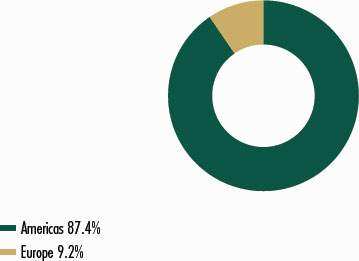

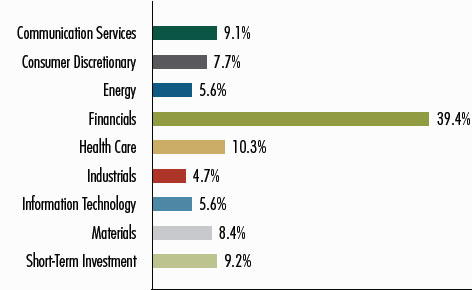

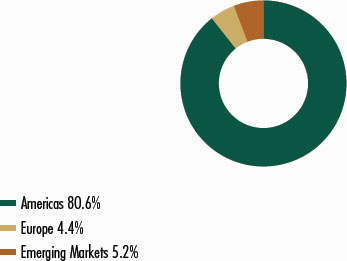

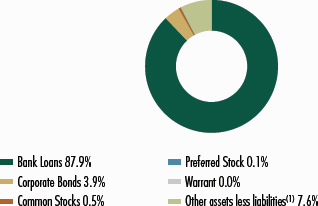

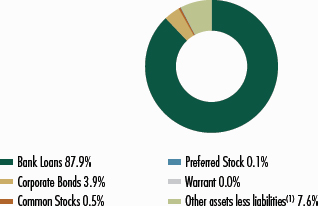

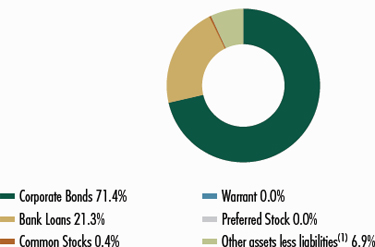

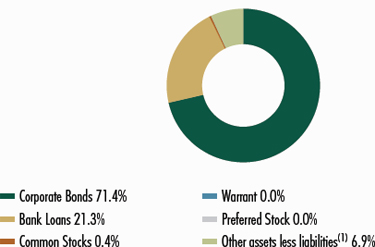

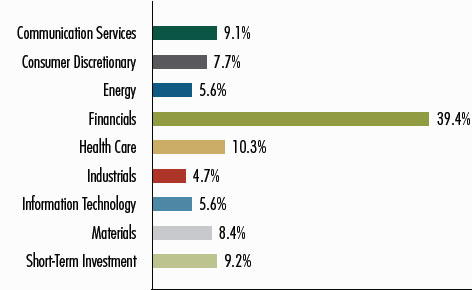

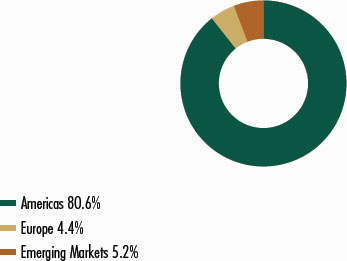

| Holdings [Text Block] |

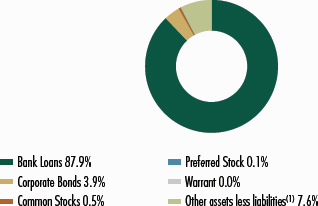

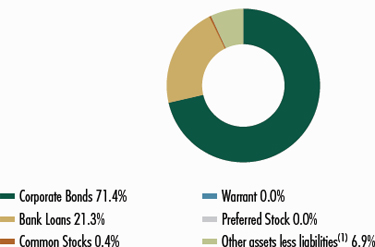

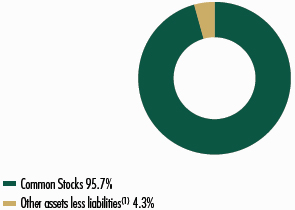

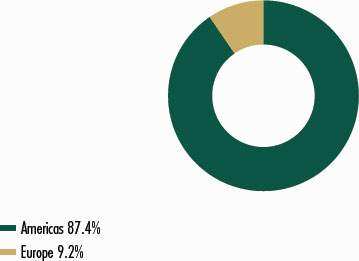

PORTFOLIO

COMPOSITION

(As

a Percentage of Total Net Assets)

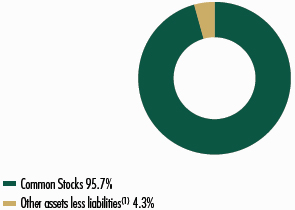

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Bank Loans |

87.9% |

| Corporate Bonds |

3.9% |

| Common Stocks |

0.5% |

| Preferred Stock |

0.1% |

| Warrant |

0.0% |

| Other assets less liabilities |

7.6% |

| (1) | Includes any short-term

investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| U.S. dollar | |

| 100.0 | % |

| Total

investments | |

| 100.0 | % |

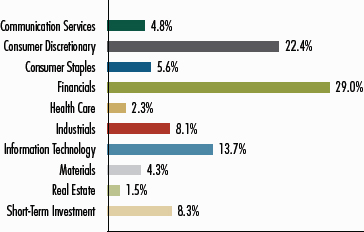

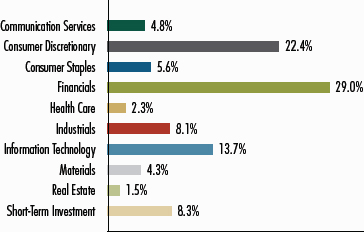

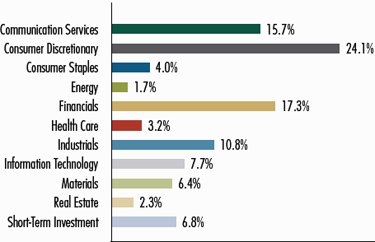

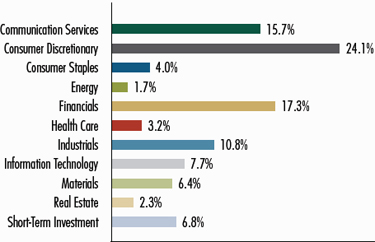

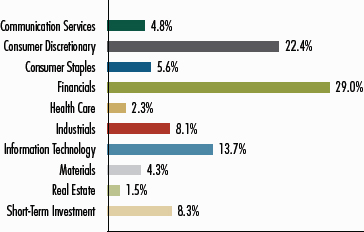

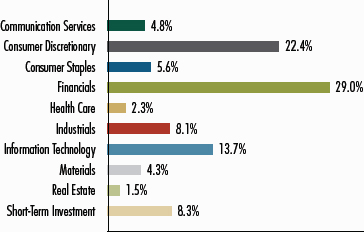

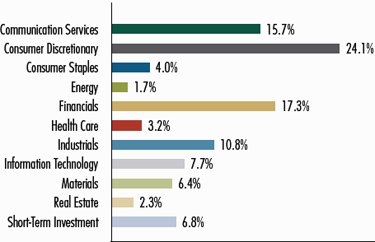

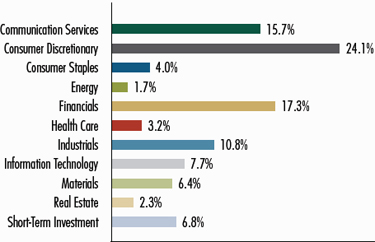

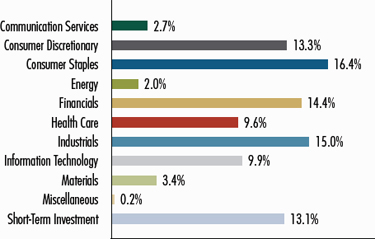

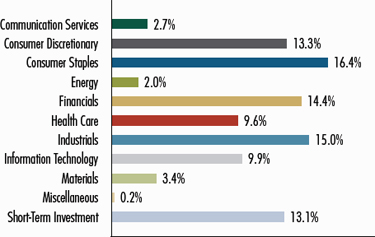

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

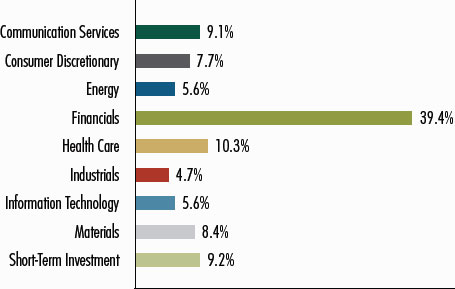

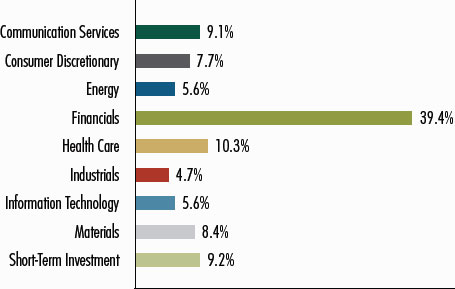

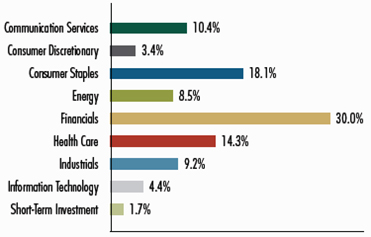

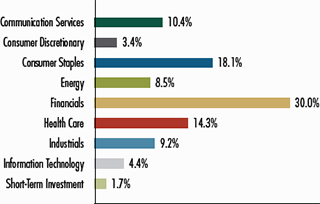

| Sector |

|

| Communication Services |

4.8% |

| Consumer Discretionary |

22.4% |

| Consumer Staples |

5.6% |

| Financials |

29.0% |

| Health Care |

2.3% |

| Industrials |

8.1% |

| Information Technology |

13.7% |

| Materials |

4.3% |

| Real Estate |

1.5% |

| Short-Term Investment |

8.3% |

|

| Largest Holdings [Text Block] |

| TOP TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company Name | |

Country |

Percentage of

Total Net Assets |

| GSM Holdings, Inc. First Lien Term Loan | |

United States |

2.9 | % |

| Nexus Buyer LLC First Lien Term Loan | |

United States |

2.8 | |

| Delta Topco, Inc. First Lien Term Loan | |

United States |

2.8 | |

| UKG, Inc. First Lien Term Loan | |

United States |

2.3 | |

| Nexus Buyer LLC Second Lien Term Loan | |

United States |

2.2 | |

| Arches Buyer, Inc. First Lien Term Loan | |

United States |

2.2 | |

| TKC Holdings, Inc. | |

United States |

2.0 | |

| CCI Buyer, Inc. First Lien Term Loan | |

United States |

1.9 | |

| Acrisure LLC First Lien Term Loan B1 | |

United States |

1.9 | |

| BCPE Grill Parent, Inc. First Lien Term Loan | |

United States |

1.9 | |

| Total | |

|

22.9 | % |

| * | Excludes

short-term investments. |

|

| Artisan Floating Rate Fund - Institutional Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Floating Rate Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

APHUX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Floating Rate Fund for the period of October

1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Floating Rate Fund for the period of October

1, 2024 to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus. You can

also request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Institutional |

$53 |

1.05% |

| |

|

|

|

| Expenses Paid, Amount |

$ 53

|

| Expense Ratio, Percent |

1.05%

|

| Net Assets |

$ 85,081,000

|

| Holdings Count | Holdings |

102

|

| Advisory Fees Paid, Amount |

$ 149,000

|

| Investment Company, Portfolio Turnover |

44.52%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$85,081 |

| Number

of Portfolio Holdings |

102 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$149 |

| Portfolio

Turnover Rate |

44.52% |

|

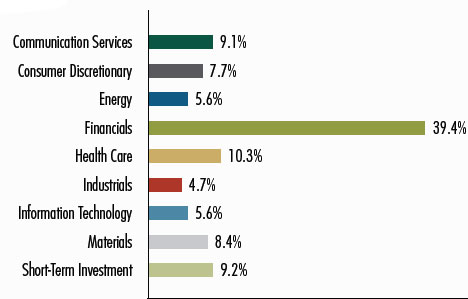

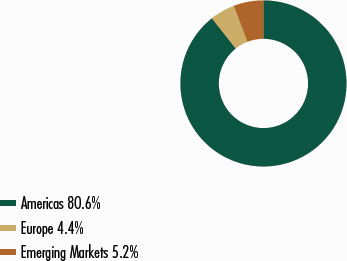

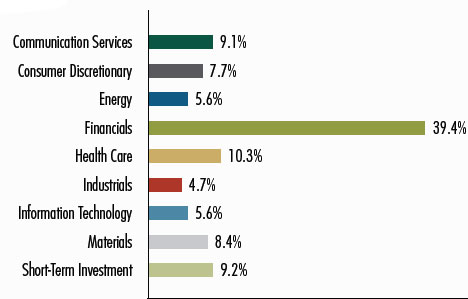

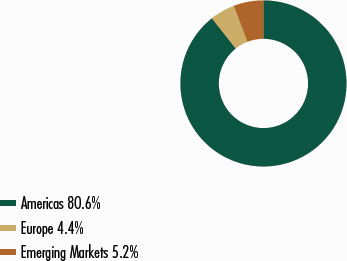

| Holdings [Text Block] |

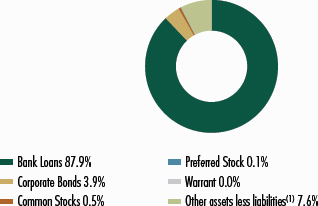

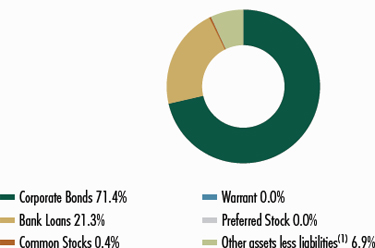

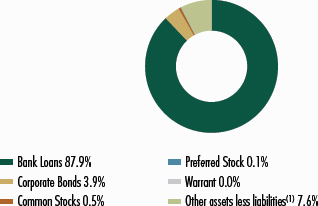

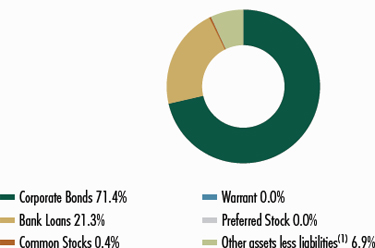

PORTFOLIO

COMPOSITION

(As

a Percentage of Total Net Assets)

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Bank Loans |

87.9% |

| Corporate Bonds |

3.9% |

| Common Stocks |

0.5% |

| Preferred Stock |

0.1% |

| Warrant |

0.0% |

| Other assets less liabilities |

7.6% |

| (1) | Includes any short-term

investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| U.S. dollar | |

| 100.0 | % |

| Total

investments | |

| 100.0 | % |

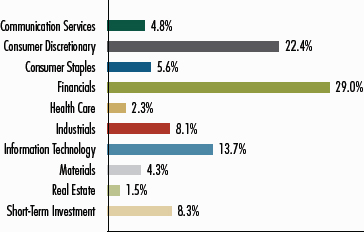

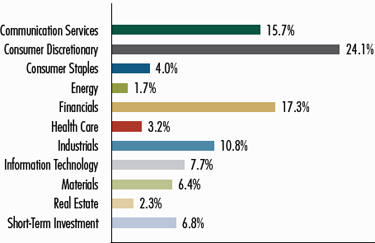

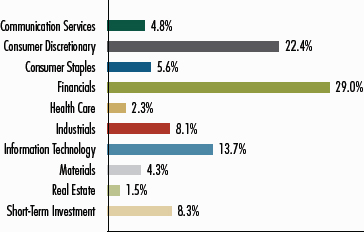

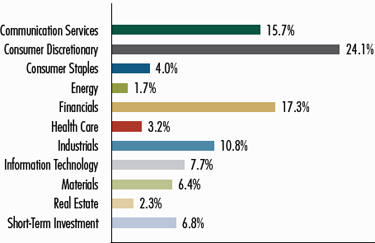

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

4.8% |

| Consumer Discretionary |

22.4% |

| Consumer Staples |

5.6% |

| Financials |

29.0% |

| Health Care |

2.3% |

| Industrials |

8.1% |

| Information Technology |

13.7% |

| Materials |

4.3% |

| Real Estate |

1.5% |

| Short-Term Investment |

8.3% |

|

| Largest Holdings [Text Block] |

| TOP TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company Name | |

Country |

Percentage of

Total Net Assets |

| GSM Holdings, Inc. First Lien Term Loan | |

United States |

2.9 | % |

| Nexus Buyer LLC First Lien Term Loan | |

United States |

2.8 | |

| Delta Topco, Inc. First Lien Term Loan | |

United States |

2.8 | |

| UKG, Inc. First Lien Term Loan | |

United States |

2.3 | |

| Nexus Buyer LLC Second Lien Term Loan | |

United States |

2.2 | |

| Arches Buyer, Inc. First Lien Term Loan | |

United States |

2.2 | |

| TKC Holdings, Inc. | |

United States |

2.0 | |

| CCI Buyer, Inc. First Lien Term Loan | |

United States |

1.9 | |

| Acrisure LLC First Lien Term Loan B1 | |

United States |

1.9 | |

| BCPE Grill Parent, Inc. First Lien Term Loan | |

United States |

1.9 | |

| Total | |

|

22.9 | % |

| * | Excludes

short-term investments. |

|

| Artisan Floating Rate Fund - Investor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Floating Rate Fund

|

| Class Name |

Investor Shares

|

| Trading Symbol |

ARTUX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Floating Rate Fund for the period of October

1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Floating Rate Fund for the period of October

1, 2024 to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus. You can

also request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Investor |

$61 |

1.20% |

| |

|

|

|

| Expenses Paid, Amount |

$ 61

|

| Expense Ratio, Percent |

1.20%

|

| Net Assets |

$ 85,081,000

|

| Holdings Count | Holdings |

102

|

| Advisory Fees Paid, Amount |

$ 149,000

|

| Investment Company, Portfolio Turnover |

44.52%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$85,081 |

| Number

of Portfolio Holdings |

102 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$149 |

| Portfolio

Turnover Rate |

44.52% |

|

| Holdings [Text Block] |

PORTFOLIO

COMPOSITION

(As

a Percentage of Total Net Assets)

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Bank Loans |

87.9% |

| Corporate Bonds |

3.9% |

| Common Stocks |

0.5% |

| Preferred Stock |

0.1% |

| Warrant |

0.0% |

| Other assets less liabilities |

7.6% |

| (1) | Includes any short-term

investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| U.S. dollar | |

| 100.0 | % |

| Total

investments | |

| 100.0 | % |

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

4.8% |

| Consumer Discretionary |

22.4% |

| Consumer Staples |

5.6% |

| Financials |

29.0% |

| Health Care |

2.3% |

| Industrials |

8.1% |

| Information Technology |

13.7% |

| Materials |

4.3% |

| Real Estate |

1.5% |

| Short-Term Investment |

8.3% |

|

| Largest Holdings [Text Block] |

| TOP TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company Name | |

Country |

Percentage of

Total Net Assets |

| GSM Holdings, Inc. First Lien Term Loan | |

United States |

2.9 | % |

| Nexus Buyer LLC First Lien Term Loan | |

United States |

2.8 | |

| Delta Topco, Inc. First Lien Term Loan | |

United States |

2.8 | |

| UKG, Inc. First Lien Term Loan | |

United States |

2.3 | |

| Nexus Buyer LLC Second Lien Term Loan | |

United States |

2.2 | |

| Arches Buyer, Inc. First Lien Term Loan | |

United States |

2.2 | |

| TKC Holdings, Inc. | |

United States |

2.0 | |

| CCI Buyer, Inc. First Lien Term Loan | |

United States |

1.9 | |

| Acrisure LLC First Lien Term Loan B1 | |

United States |

1.9 | |

| BCPE Grill Parent, Inc. First Lien Term Loan | |

United States |

1.9 | |

| Total | |

|

22.9 | % |

| * | Excludes

short-term investments. |

|

| Artisan Focus Fund - Advisor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Focus Fund

|

| Class Name |

Advisor Shares

|

| Trading Symbol |

APDTX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Focus Fund for the period of October 1, 2024

to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Focus Fund for the period of October 1, 2024

to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus. You can also

request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Advisor |

$58 |

1.16% |

| |

|

|

|

| Expenses Paid, Amount |

$ 58

|

| Expense Ratio, Percent |

1.16%

|

| Net Assets |

$ 989,311,000

|

| Holdings Count | Holdings |

39

|

| Advisory Fees Paid, Amount |

$ 5,437,000

|

| Investment Company, Portfolio Turnover |

131.24%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$989,311 |

| Number

of Portfolio Holdings |

39 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$5,437 |

| Portfolio

Turnover Rate |

131.24% |

|

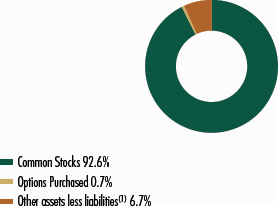

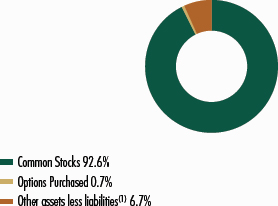

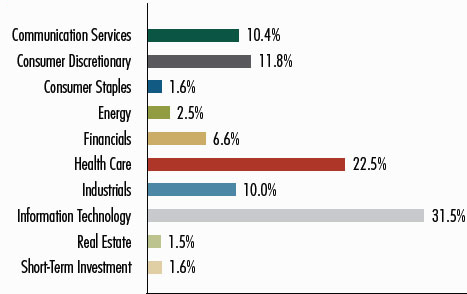

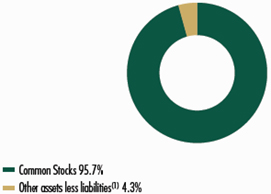

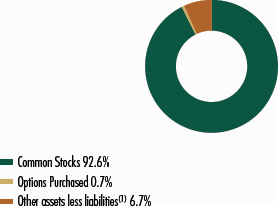

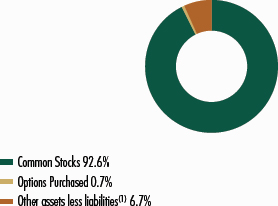

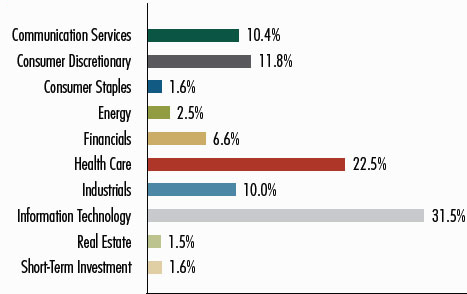

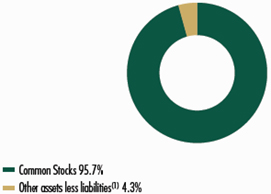

| Holdings [Text Block] |

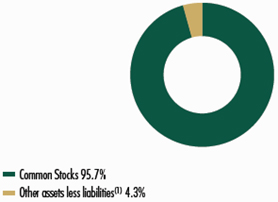

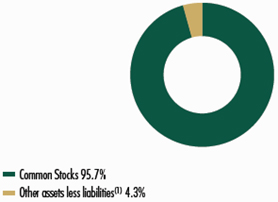

PORTFOLIO COMPOSITION

(As

a Percentage of Total Net Assets)

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Common Stocks |

92.6% |

| Options Purchased |

0.7% |

| Other assets less liabilities |

6.7% |

| (1) | Includes any short-term

investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| British

pound | |

| 4.3 | % |

| Euro | |

| 4.7 | |

| U.S.

dollar | |

| 91.0 | |

| Total

investments | |

| 100.0 | % |

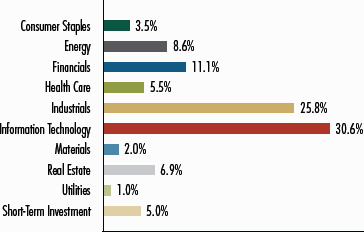

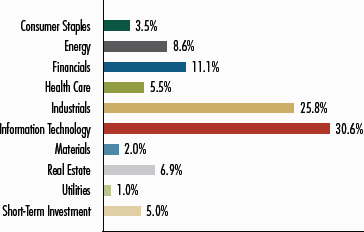

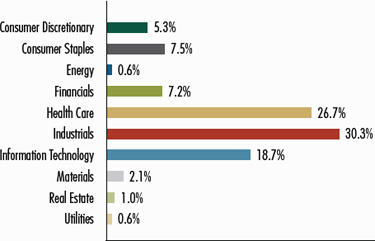

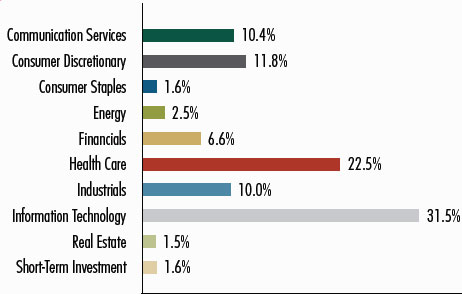

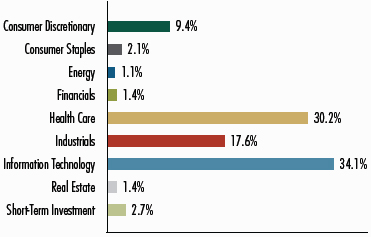

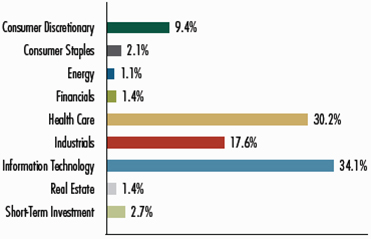

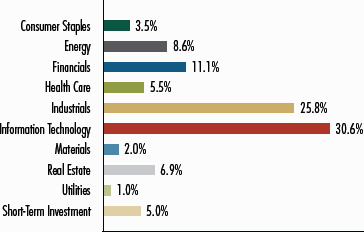

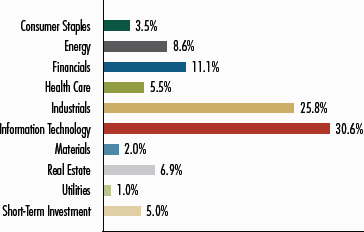

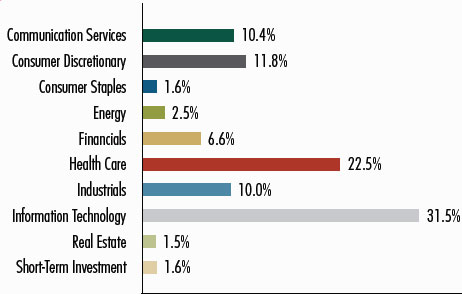

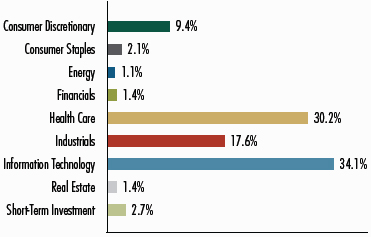

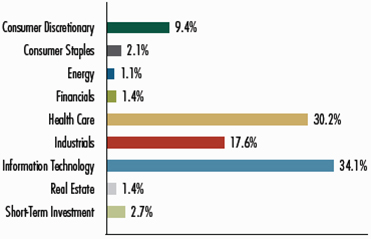

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Consumer Staples |

3.5% |

| Energy |

8.6% |

| Financials |

11.1% |

| Health Care |

5.5% |

| Industrials |

25.8% |

| Information Technology |

30.6% |

| Materials |

2.0% |

| Real Estate |

6.9% |

| Utilities |

1.0% |

| Short-Term Investment |

5.0% |

|

| Largest Holdings [Text Block] |

| TOP TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company

Name | |

Country |

Percentage of

Total Net Assets |

| Microsoft

Corp. | |

United States |

9.3 | % |

| NVIDIA Corp. | |

United States |

8.1 | |

| Taiwan Semiconductor

Manufacturing Co. Ltd. | |

Taiwan |

7.4 | |

| GE Aerospace | |

United States |

6.8 | |

| Williams Cos., Inc. (The) | |

United States |

4.4 | |

| Rolls-Royce Holdings

plc | |

United Kingdom |

4.2 | |

| Howmet Aerospace, Inc. | |

United States |

4.1 | |

| Kinder Morgan, Inc. | |

United States |

4.0 | |

| Intuitive Surgical, Inc. | |

United States |

3.9 | |

| Crown

Castle, Inc. | |

United

States |

3.6 | |

| Total | |

|

55.8 | % |

| * | Excludes

short-term investments. |

|

| Artisan Focus Fund - Institutional Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Focus Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

APHTX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about Artisan Focus Fund for the period of October 1, 2024

to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information about Artisan Focus Fund for the period of October 1, 2024

to March 31, 2025. You can find additional information about the Fund at www.artisanpartners.com/prospectus. You can also

request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Institutional |

$54 |

1.08% |

| |

|

|

|

| Expenses Paid, Amount |

$ 54

|

| Expense Ratio, Percent |

1.08%

|

| Net Assets |

$ 989,311,000

|

| Holdings Count | Holdings |

39

|

| Advisory Fees Paid, Amount |

$ 5,437,000

|

| Investment Company, Portfolio Turnover |

131.24%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$989,311 |

| Number

of Portfolio Holdings |

39 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$5,437 |

| Portfolio

Turnover Rate |

131.24% |

|

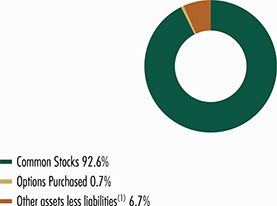

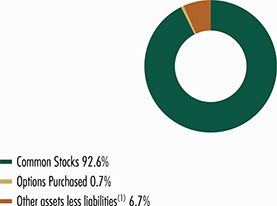

| Holdings [Text Block] |

PORTFOLIO COMPOSITION

(As

a Percentage of Total Net Assets)

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Common Stocks |

92.6% |

| Options Purchased |

0.7% |

| Other assets less liabilities |

6.7% |

| (1) | Includes any short-term

investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| British

pound | |

| 4.3 | % |

| Euro | |

| 4.7 | |

| U.S.

dollar | |

| 91.0 | |

| Total

investments | |

| 100.0 | % |

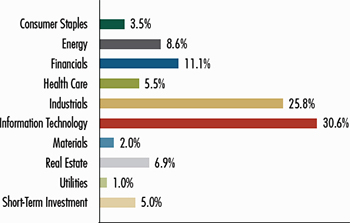

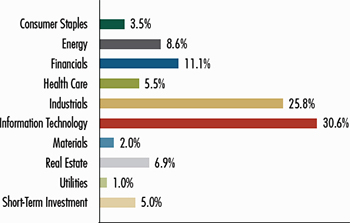

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Consumer Staples |

3.5% |

| Energy |

8.6% |

| Financials |

11.1% |

| Health Care |

5.5% |

| Industrials |

25.8% |

| Information Technology |

30.6% |

| Materials |

2.0% |

| Real Estate |

6.9% |

| Utilities |

1.0% |

| Short-Term Investment |

5.0% |

|

| Largest Holdings [Text Block] |

| TOP TEN HOLDINGS* | |

|

| |

| | |

|

| |

| Company

Name | |

Country |

Percentage of

Total Net Assets |

| Microsoft

Corp. | |

United States |

9.3 | % |

| NVIDIA Corp. | |

United States |

8.1 | |

| Taiwan Semiconductor

Manufacturing Co. Ltd. | |

Taiwan |

7.4 | |

| GE Aerospace | |

United States |

6.8 | |

| Williams Cos., Inc. (The) | |

United States |

4.4 | |

| Rolls-Royce Holdings

plc | |

United Kingdom |

4.2 | |

| Howmet Aerospace, Inc. | |

United States |

4.1 | |

| Kinder Morgan, Inc. | |

United States |

4.0 | |

| Intuitive Surgical, Inc. | |

United States |

3.9 | |

| Crown

Castle, Inc. | |

United

States |

3.6 | |

| Total | |

|

55.8 | % |

| * | Excludes

short-term investments. |

|

| Artisan Focus Fund - Investor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Focus Fund

|

| Class Name |

Investor Shares

|

| Trading Symbol |

ARTTX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information

about Artisan Focus Fund for the period of October 1, 2024 to March

31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual

Shareholder Report

|

| Additional Information [Text Block] |

This semi-annual shareholder report contains important information

about Artisan Focus Fund for the period of October 1, 2024 to March

31, 2025. You can find additional information about the Fund at

www.artisanpartners.com/prospectus. You can also request this information by contacting us at 800.344.1770.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Investor |

$67 |

1.34% |

| |

|

|

|

| Expenses Paid, Amount |

$ 67

|

| Expense Ratio, Percent |

1.34%

|

| Net Assets |

$ 989,311,000

|

| Holdings Count | Holdings |

39

|

| Advisory Fees Paid, Amount |

$ 5,437,000

|

| Investment Company, Portfolio Turnover |

131.24%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$989,311 |

| Number

of Portfolio Holdings |

39 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$5,437 |

| Portfolio

Turnover Rate |

131.24% |

|

| Holdings [Text Block] |

PORTFOLIO

COMPOSITION

(As

a Percentage of Total Net Assets)

| PORTFOLIO COMPOSITION |

|

| Type |

|

| Common Stocks |

92.6% |

| Options Purchased |

0.7% |

| Other assets less liabilities |

6.7% |

| (1) | Includes

any short-term investments and net other assets (liabilities). |

| TRADING

CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments |

| British pound | |

| 4.3 | % |

| Euro | |

| 4.7 | |

| U.S.

dollar | |

| 91.0 | |

| Total

investments | |

| 100.0 | % |

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Consumer Staples |

3.5% |

| Energy |

8.6% |

| Financials |

11.1% |

| Health Care |

5.5% |

| Industrials |

25.8% |

| Information Technology |

30.6% |

| Materials |

2.0% |

| Real Estate |

6.9% |

| Utilities |

1.0% |

| Short-Term Investment |

5.0% |

|

| Largest Holdings [Text Block] |

| Company Name | |

Country |

Percentage

of

Total Net Assets |

| Microsoft

Corp. | |

United States |

9.3 | % |

| NVIDIA Corp. | |

United States |

8.1 | |

| Taiwan Semiconductor

Manufacturing Co. Ltd. | |

Taiwan |

7.4 | |

| GE Aerospace | |

United States |

6.8 | |

| Williams Cos., Inc. (The) | |

United States |

4.4 | |

| Rolls-Royce Holdings

plc | |

United Kingdom |

4.2 | |

| Howmet Aerospace, Inc. | |

United States |

4.1 | |

| Kinder Morgan, Inc. | |

United States |

4.0 | |

| Intuitive Surgical, Inc. | |

United States |

3.9 | |

| Crown Castle, Inc. | |

United States |

3.6 | |

| Total | |

|

55.8 | % |

| * | Excludes

short-term investments. |

|

| Artisan Global Discovery Fund - Advisor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Global Discovery Fund

|

| Class Name |

Advisor Shares

|

| Trading Symbol |

APDDX

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Global Discovery

Fund for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual

Shareholder Report

|

| Additional Information [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Global Discovery

Fund for the period of October 1, 2024 to March 31, 2025. You can find additional information

about the Fund at www.artisanpartners.com/prospectus. You can also request this information

by contacting us at 800.344.1770. This report describes changes to the Fund that occurred

during the reporting period.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred

during the reporting period.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Advisor |

$65 |

1.30% |

| |

|

|

|

| Expenses Paid, Amount |

$ 65

|

| Expense Ratio, Percent |

1.30%

|

| Net Assets |

$ 223,291,000

|

| Holdings Count | Holdings |

62

|

| Advisory Fees Paid, Amount |

$ 1,193,000

|

| Investment Company, Portfolio Turnover |

34.96%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$223,291 |

| Number

of Portfolio Holdings |

62 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$1,193 |

| Portfolio

Turnover Rate |

34.96% |

|

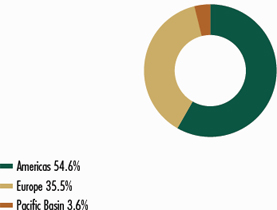

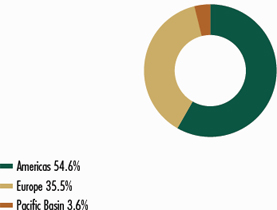

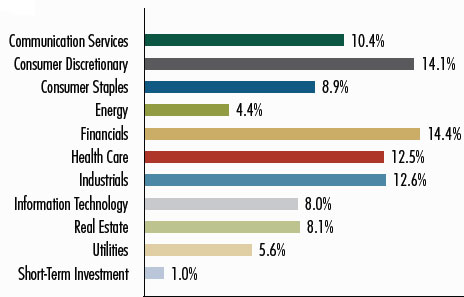

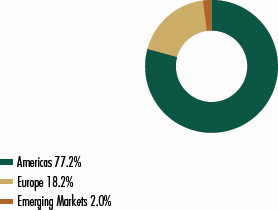

| Holdings [Text Block] |

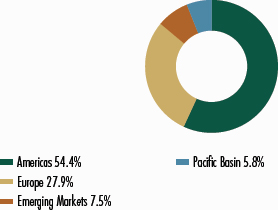

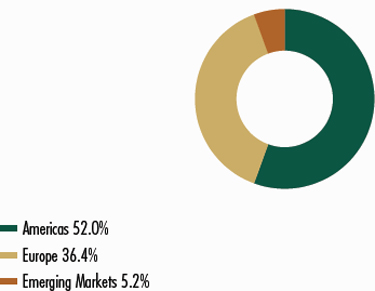

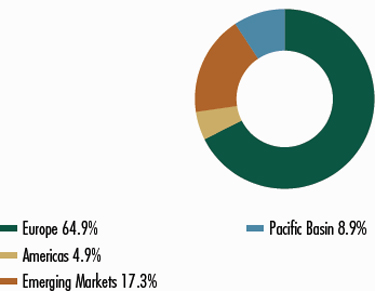

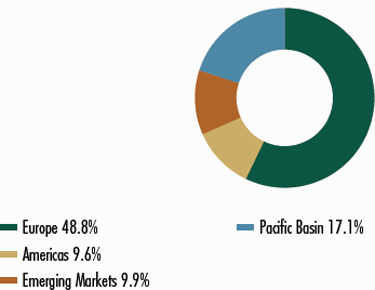

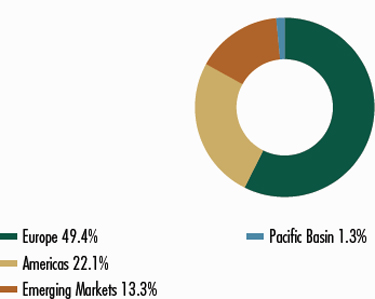

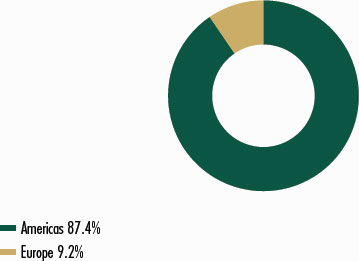

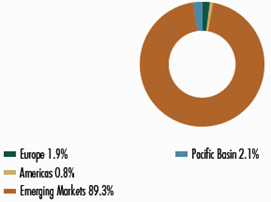

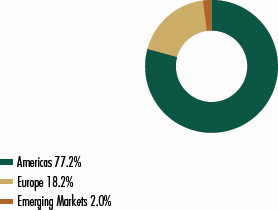

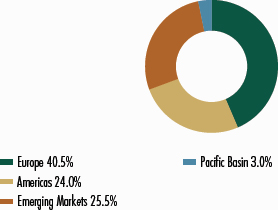

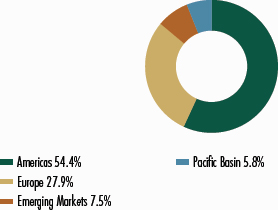

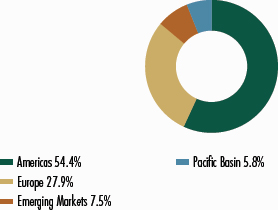

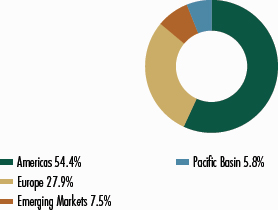

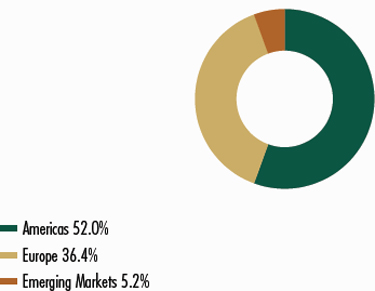

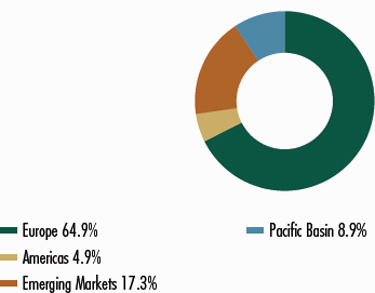

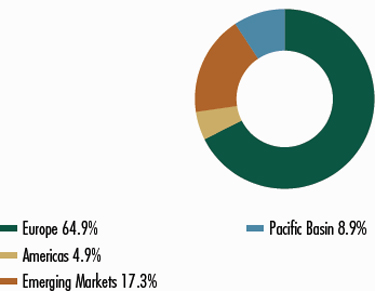

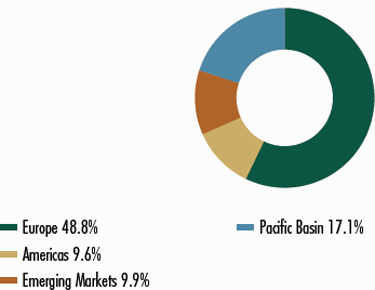

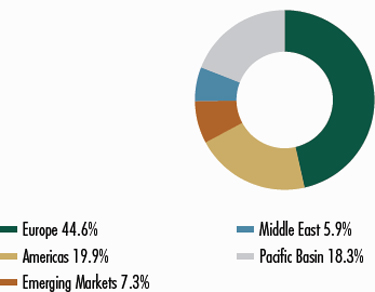

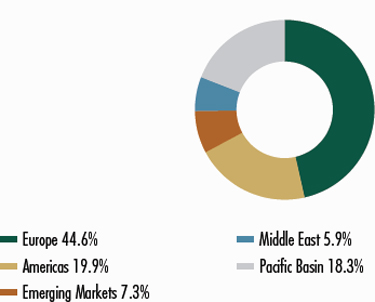

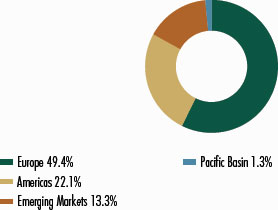

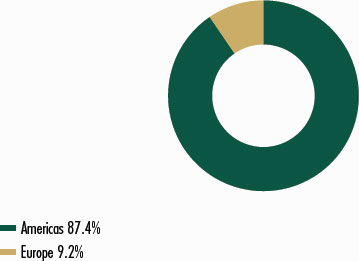

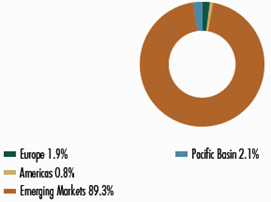

REGION

ALLOCATION

(As

a Percentage of Total Net Assets)

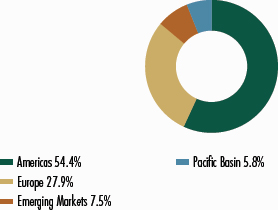

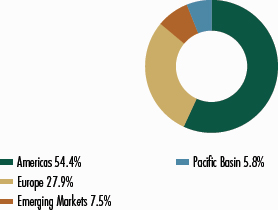

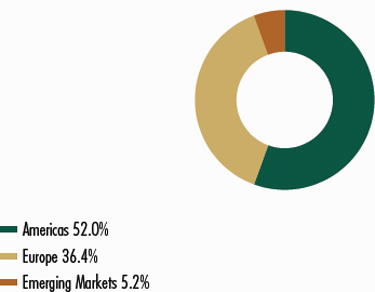

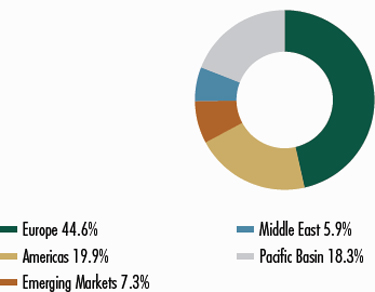

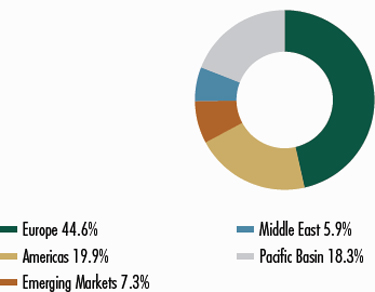

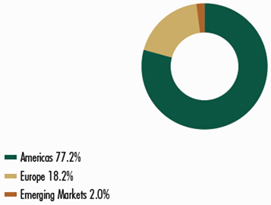

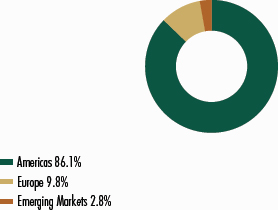

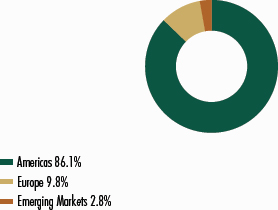

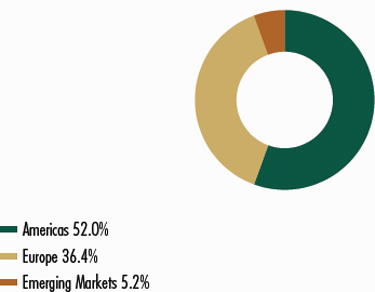

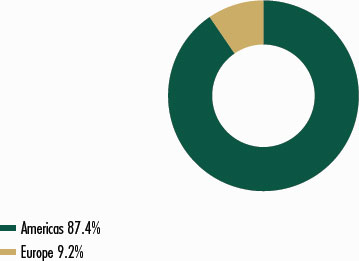

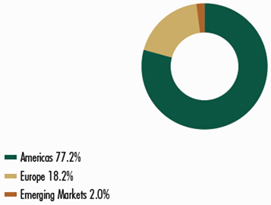

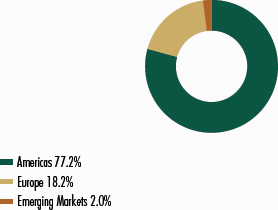

| REGION ALLOCATION |

|

| Region |

|

| Americas |

54.6% |

| Europe |

35.5% |

| Pacific Basin |

3.6% |

| TRADING CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments

|

| British pound | |

| 10.3 | % |

| Canadian dollar | |

| 1.1 | |

| Danish krone | |

| 1.8 | |

| Euro | |

| 9.6 | |

| Hong Kong dollar | |

| 1.4 | |

| Swedish krona | |

| 0.9 | |

| Swiss franc | |

| 5.0 | |

| U.S. dollar | |

| 69.9 | |

| Total

investments | |

| 100.0 | % |

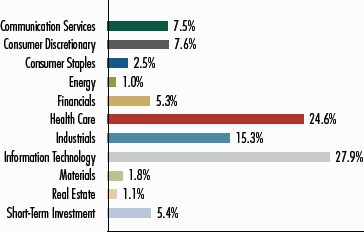

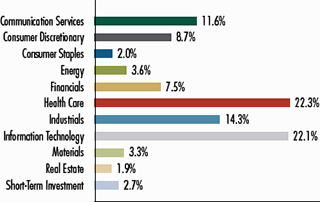

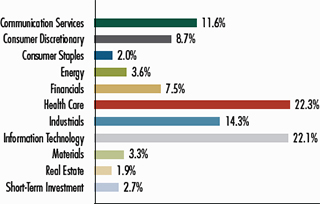

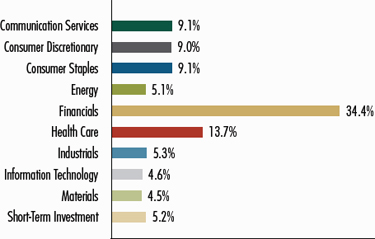

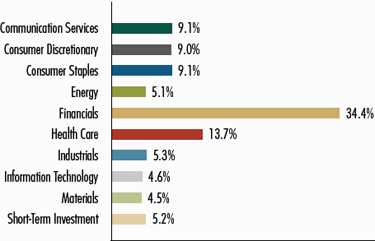

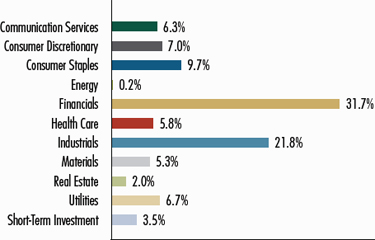

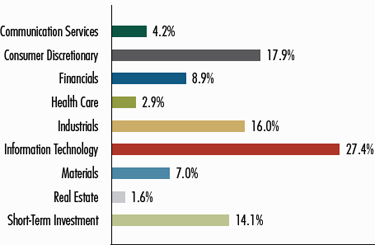

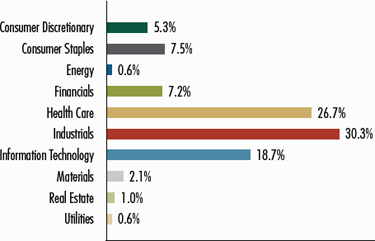

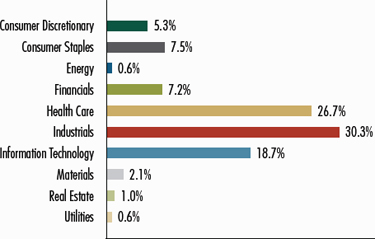

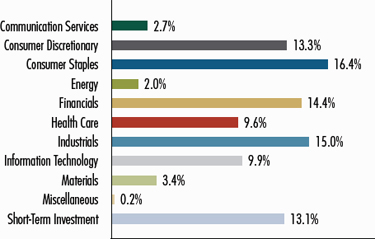

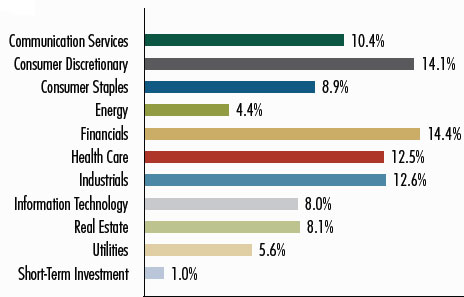

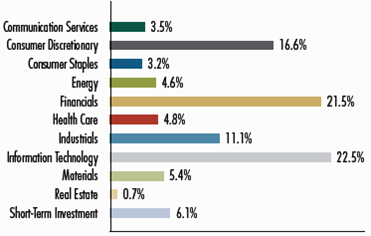

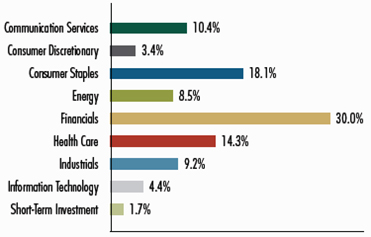

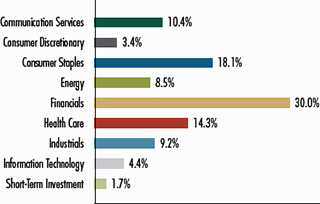

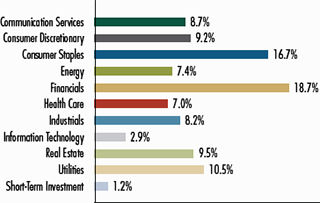

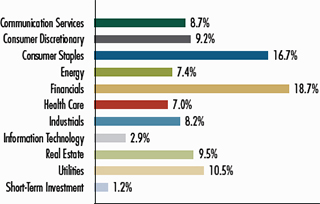

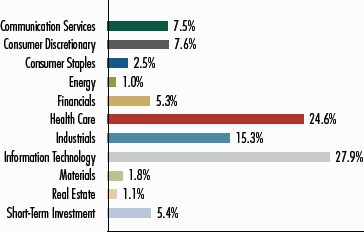

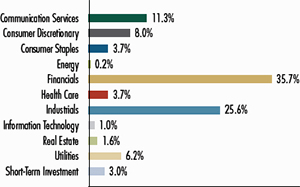

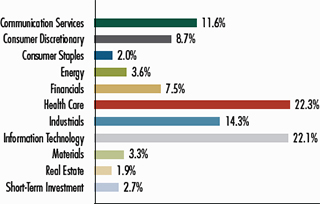

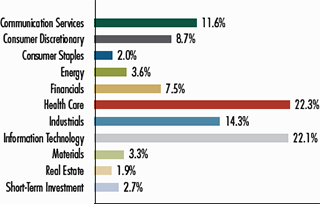

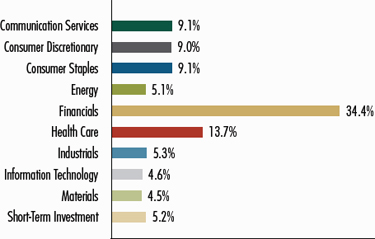

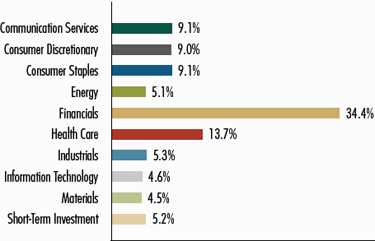

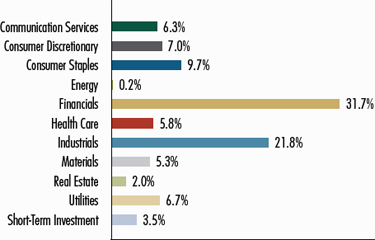

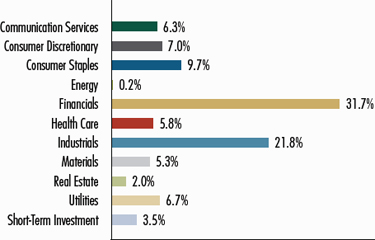

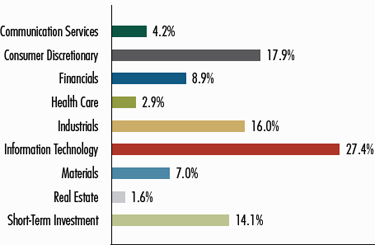

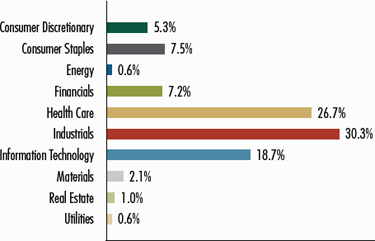

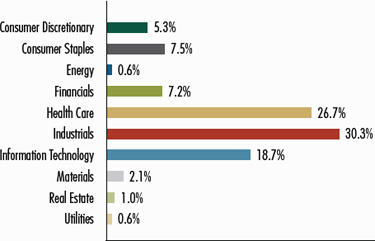

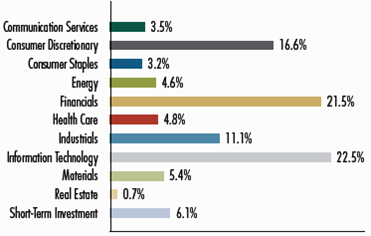

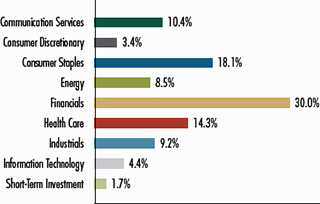

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

7.5% |

| Consumer Discretionary |

7.6% |

| Consumer Staples |

2.5% |

| Energy |

1.0% |

| Financials |

5.3% |

| Health Care |

24.6% |

| Industrials |

15.3% |

| Information Technology |

27.9% |

| Materials |

1.8% |

| Real Estate |

1.1% |

| Short-Term Investment |

5.4% |

|

| Largest Holdings [Text Block] |

| Company Name | |

Country |

Percentage of

Total Net Assets

|

| Argenx SE | |

Netherlands |

4.5 | % |

| Ascendis Pharma A/S | |

Denmark |

3.6 | |

| Babcock International

Group plc | |

United Kingdom |

3.4 | |

| London Stock Exchange

Group plc | |

United Kingdom |

3.4 | |

| Tyler Technologies, Inc. | |

United States |

2.9 | |

| Guidewire Software, Inc. | |

United States |

2.5 | |

| iRhythm Technologies,

Inc. | |

United States |

2.2 | |

| Sea Ltd. | |

Singapore |

2.2 | |

| Liberty Media Corp-Liberty

Formula One | |

United States |

2.1 | |

| adidas

AG | |

Germany |

2.0 | |

| Total | |

|

28.8 | % |

| * | Excludes

short-term investments. |

|

| Material Fund Change [Text Block] |

This

is a summary of certain changes of the Fund since September 30, 2024. Effective December

31, 2024, Craigh Cepukenas stepped down as portfolio manager of the Fund. Mr. Cepukenas

will remain an active member of the Artisan Partners Growth Team in an advisory capacity

as a managing director. For more information, you may review the Fund’s current prospectus,

which is available at www.artisanpartners.com/prospectus or upon request by calling 800.344.1770.

|

| Summary of Change Legend [Text Block] |

This

is a summary of certain changes of the Fund since September 30, 2024. Effective December

31, 2024, Craigh Cepukenas stepped down as portfolio manager of the Fund. Mr. Cepukenas

will remain an active member of the Artisan Partners Growth Team in an advisory capacity

as a managing director.

|

| Updated Prospectus Phone Number |

800.344.1770

|

| Updated Prospectus Web Address |

www.artisanpartners.com/prospectus

|

| Artisan Global Discovery Fund - Institutional Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Global Discovery Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

APHDX

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Global Discovery

Fund for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual

Shareholder Report

|

| Additional Information [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Global Discovery

Fund for the period of October 1, 2024 to March 31, 2025. You can find additional information

about the Fund at www.artisanpartners.com/prospectus. You can also request this information

by contacting us at 800.344.1770. This report describes changes to the Fund that occurred

during the reporting period.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred

during the reporting period.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Institutional |

$54 |

1.08% |

| |

|

|

|

| Expenses Paid, Amount |

$ 54

|

| Expense Ratio, Percent |

1.08%

|

| Net Assets |

$ 223,291,000

|

| Holdings Count | Holdings |

62

|

| Advisory Fees Paid, Amount |

$ 1,193,000

|

| Investment Company, Portfolio Turnover |

34.96%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$223,291 |

| Number

of Portfolio Holdings |

62 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$1,193 |

| Portfolio

Turnover Rate |

34.96% |

|

| Holdings [Text Block] |

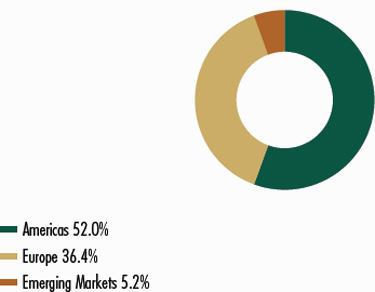

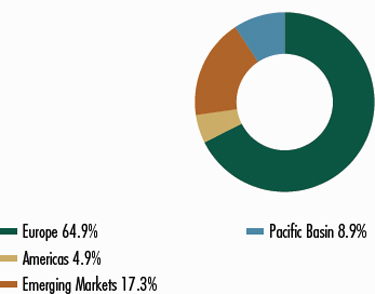

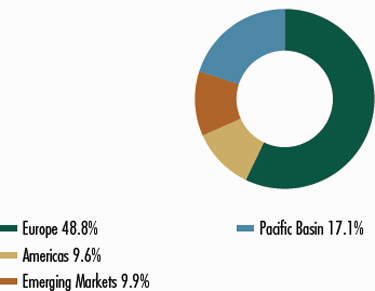

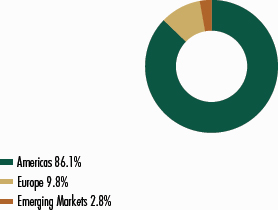

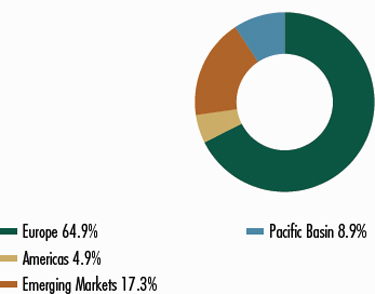

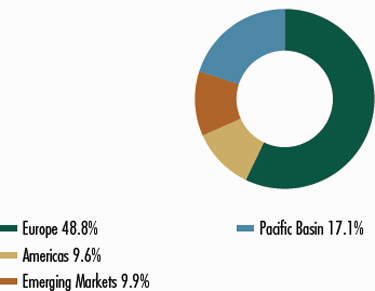

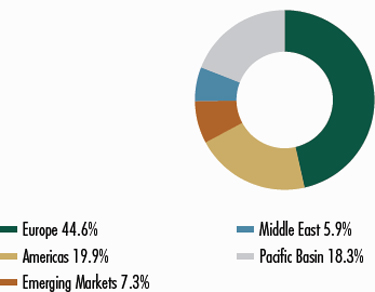

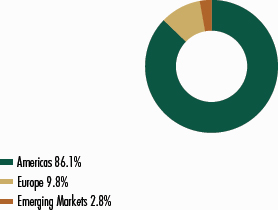

REGION

ALLOCATION

(As

a Percentage of Total Net Assets)

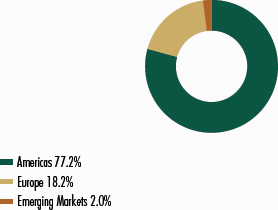

| REGION ALLOCATION |

|

| Region |

|

| Americas |

54.6% |

| Europe |

35.5% |

| Pacific Basin |

3.6% |

| TRADING CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments

|

| British pound | |

| 10.3 | % |

| Canadian dollar | |

| 1.1 | |

| Danish krone | |

| 1.8 | |

| Euro | |

| 9.6 | |

| Hong Kong dollar | |

| 1.4 | |

| Swedish krona | |

| 0.9 | |

| Swiss franc | |

| 5.0 | |

| U.S. dollar | |

| 69.9 | |

| Total

investments | |

| 100.0 | % |

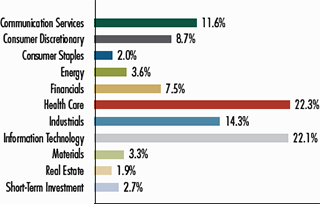

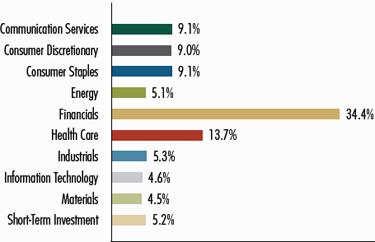

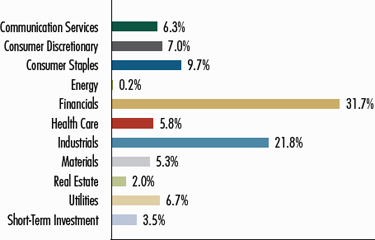

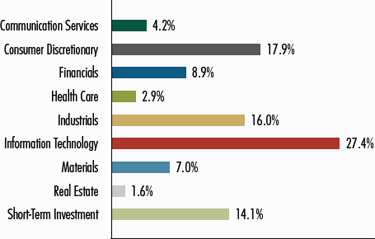

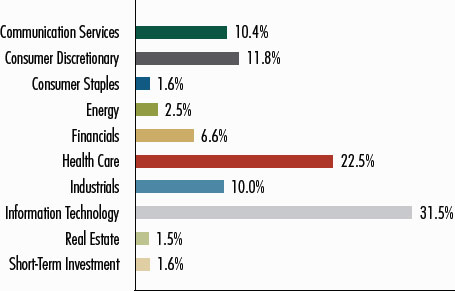

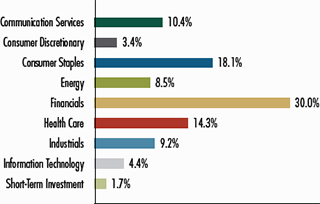

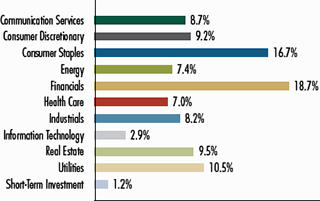

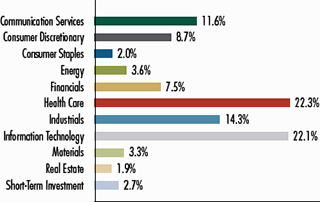

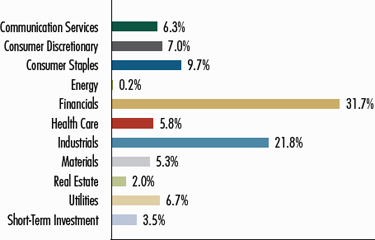

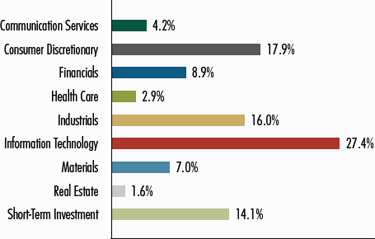

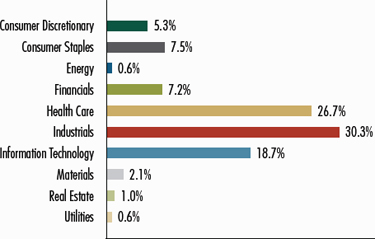

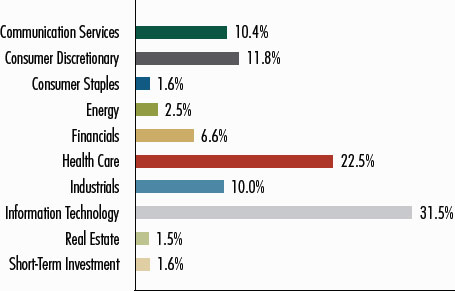

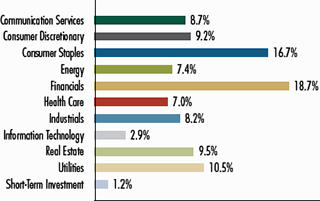

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

7.5% |

| Consumer Discretionary |

7.6% |

| Consumer Staples |

2.5% |

| Energy |

1.0% |

| Financials |

5.3% |

| Health Care |

24.6% |

| Industrials |

15.3% |

| Information Technology |

27.9% |

| Materials |

1.8% |

| Real Estate |

1.1% |

| Short-Term Investment |

5.4% |

|

| Largest Holdings [Text Block] |

| Company Name | |

Country |

Percentage of

Total Net Assets

|

| Argenx SE | |

Netherlands |

4.5 | % |

| Ascendis Pharma A/S | |

Denmark |

3.6 | |

| Babcock International

Group plc | |

United Kingdom |

3.4 | |

| London Stock Exchange

Group plc | |

United Kingdom |

3.4 | |

| Tyler Technologies, Inc. | |

United States |

2.9 | |

| Guidewire Software, Inc. | |

United States |

2.5 | |

| iRhythm Technologies,

Inc. | |

United States |

2.2 | |

| Sea Ltd. | |

Singapore |

2.2 | |

| Liberty Media Corp-Liberty

Formula One | |

United States |

2.1 | |

| adidas

AG | |

Germany |

2.0 | |

| Total | |

|

28.8 | % |

| * | Excludes

short-term investments. |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes of the Fund since September 30, 2024. Effective December 31, 2024,

Craigh Cepukenas stepped down as portfolio manager of the Fund. Mr. Cepukenas will remain an active

member of the Artisan Partners Growth Team in an advisory capacity as a managing director. For more

information, you may review the Fund’s current prospectus, which is available at

www.artisanpartners.com/prospectus or upon request by calling 800.344.1770.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes of the Fund since September 30, 2024. Effective December 31, 2024,

Craigh Cepukenas stepped down as portfolio manager of the Fund. Mr. Cepukenas will remain an active

member of the Artisan Partners Growth Team in an advisory capacity as a managing director.

|

| Updated Prospectus Phone Number |

800.344.1770

|

| Updated Prospectus Web Address |

www.artisanpartners.com/prospectus

|

| Artisan Global Discovery Fund - Investor Shares |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Artisan

Global Discovery Fund

|

| Class Name |

Investor Shares

|

| Trading Symbol |

APFDX

|

| Annual or Semi-Annual Statement [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Global Discovery

Fund for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Semi-Annual

Shareholder Report

|

| Additional Information [Text Block] |

This

semi-annual shareholder report contains important information about Artisan Global Discovery

Fund for the period of October 1, 2024 to March 31, 2025. You can find additional information

about the Fund at www.artisanpartners.com/prospectus. You can also request this information

by contacting us at 800.344.1770. This report describes changes to the Fund that occurred

during the reporting period.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred

during the reporting period.

|

| Additional Information Phone Number |

800.344.1770

|

| Additional Information Website |

www.artisanpartners.com/prospectus

|

| Expenses [Text Block] |

What

were the Fund costs for the last six months?

(based

on a hypothetical $10,000 investment)

| Class

Name |

Costs

of a $10,000 investment |

Costs

paid as a percentage of a $10,000 investment |

| Investor |

$69 |

1.39% |

| |

|

|

|

| Expenses Paid, Amount |

$ 69

|

| Expense Ratio, Percent |

1.39%

|

| Net Assets |

$ 223,291,000

|

| Holdings Count | Holdings |

62

|

| Advisory Fees Paid, Amount |

$ 1,193,000

|

| Investment Company, Portfolio Turnover |

34.96%

|

| Additional Fund Statistics [Text Block] |

| Key

Fund Statistics |

| Dollar

values in thousands |

| Net

Assets |

$223,291 |

| Number

of Portfolio Holdings |

62 |

| Total

Investment Advisory Fees (net of waivers and reimbursements) |

$1,193 |

| Portfolio

Turnover Rate |

34.96% |

|

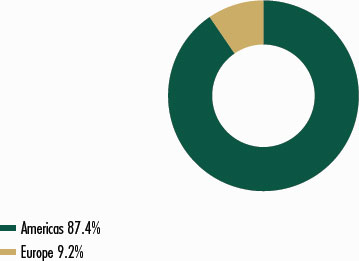

| Holdings [Text Block] |

REGION

ALLOCATION

(As

a Percentage of Total Net Assets)

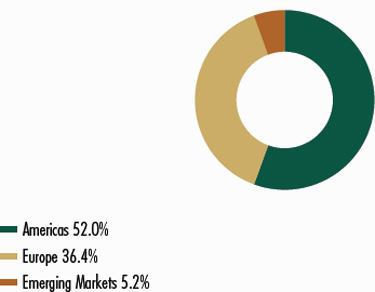

| REGION ALLOCATION |

|

| Region |

|

| Americas |

54.6% |

| Europe |

35.5% |

| Pacific Basin |

3.6% |

| TRADING CURRENCIES | |

| | |

| | |

| | |

| Currency | |

| Percentage of

Total Investments

|

| British pound | |

| 10.3 | % |

| Canadian dollar | |

| 1.1 | |

| Danish krone | |

| 1.8 | |

| Euro | |

| 9.6 | |

| Hong Kong dollar | |

| 1.4 | |

| Swedish krona | |

| 0.9 | |

| Swiss franc | |

| 5.0 | |

| U.S. dollar | |

| 69.9 | |

| Total

investments | |

| 100.0 | % |

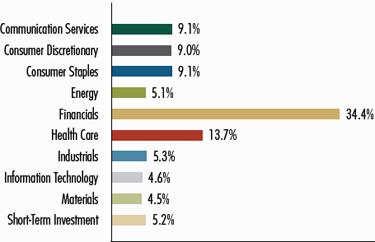

PORTFOLIO

DIVERSIFICATION

(As

a Percentage of Total Investments)

| Sector |

|

| Communication Services |

7.5% |

| Consumer Discretionary |

7.6% |

| Consumer Staples |

2.5% |

| Energy |

1.0% |

| Financials |

5.3% |

| Health Care |

24.6% |

| Industrials |

15.3% |

| Information Technology |

27.9% |

| Materials |

1.8% |

| Real Estate |

1.1% |

| Short-Term Investment |

5.4% |

|

| Largest Holdings [Text Block] |

| Company Name | |

Country |

Percentage of

Total Net Assets

|

| Argenx SE | |

Netherlands |

4.5 | % |

| Ascendis Pharma A/S | |

Denmark |

3.6 | |

| Babcock International

Group plc | |

United Kingdom |

3.4 | |

| London Stock Exchange

Group plc | |

United Kingdom |

3.4 | |