Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holdings

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSRS

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

World Funds Trust

|

|

| Entity Central Index Key |

0001396092

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Mar. 31, 2025

|

|

| Curasset Capital Management Core Bond Fund Founders Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Curasset Capital Management Core Bond Fund

|

|

| Class Name |

Founders Class Shares

|

|

| Trading Symbol |

CMBEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Curasset Capital Management Core Bond Fund for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.curassetfunds.com/core-bond-fund. You can also contact us at (800) 673-0550.

|

|

| Additional Information Phone Number |

(800) 673-0550

|

|

| Additional Information Website |

www.curassetfunds.com/core-bond-fund

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Curasset Capital Management Core Bond Fund | $18 | 0.36%¹ |

|

|

| Expenses Paid, Amount |

$ 18

|

|

| Expense Ratio, Percent |

0.36%

|

[1] |

| Net Assets |

$ 270,917,893

|

|

| Holdings Count | Holdings |

266

|

|

| Advisory Fees Paid, Amount |

$ 299,122

|

|

| Investment Company, Portfolio Turnover |

8.89%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| |

|---|

Fund Net Assets | $270,917,893 | Number of Holdings | 266 | Total Advisory Fee Paid | $299,122 | Portfolio Turnover Rate | 8.89% |

|

|

| Holdings [Text Block] |

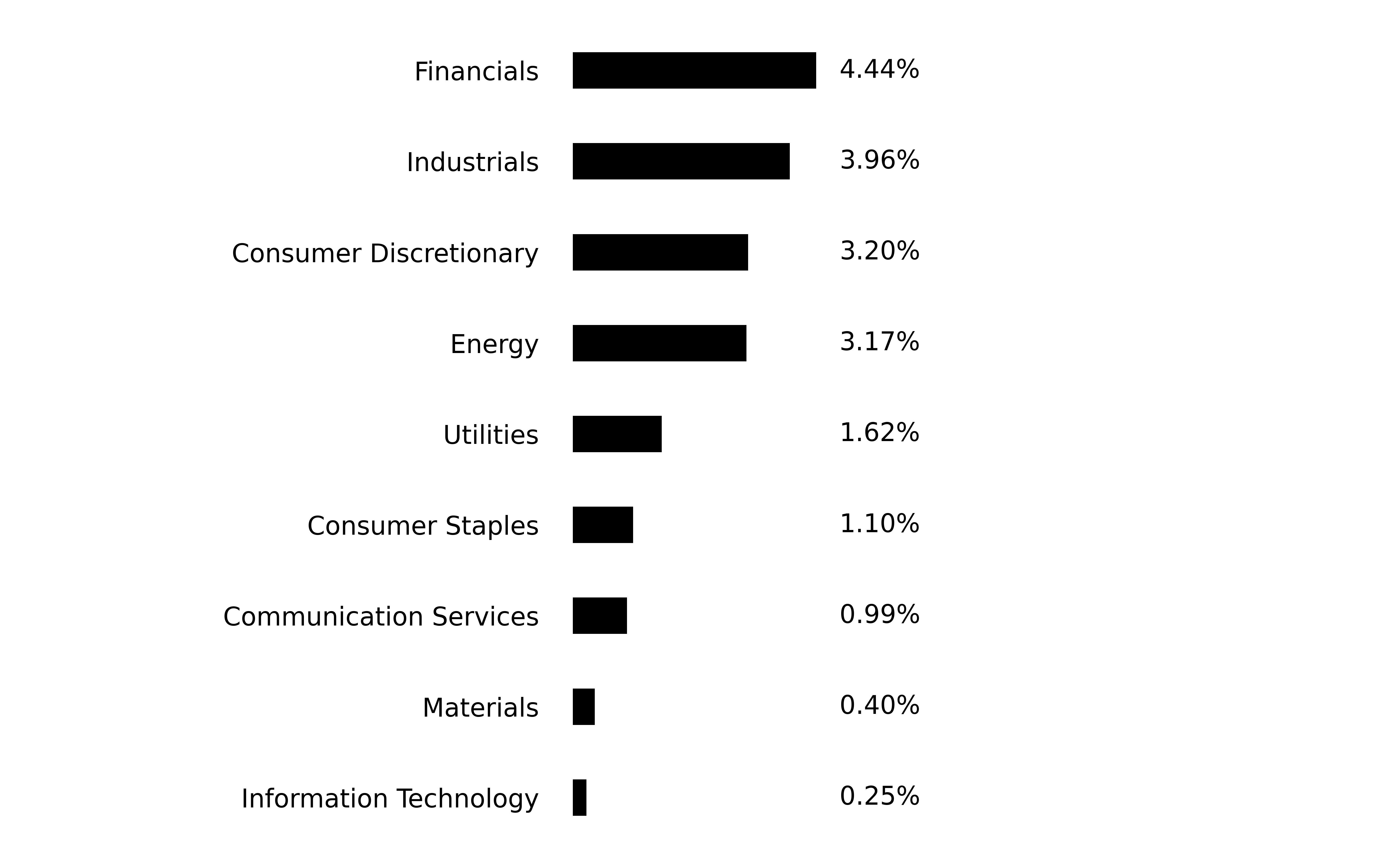

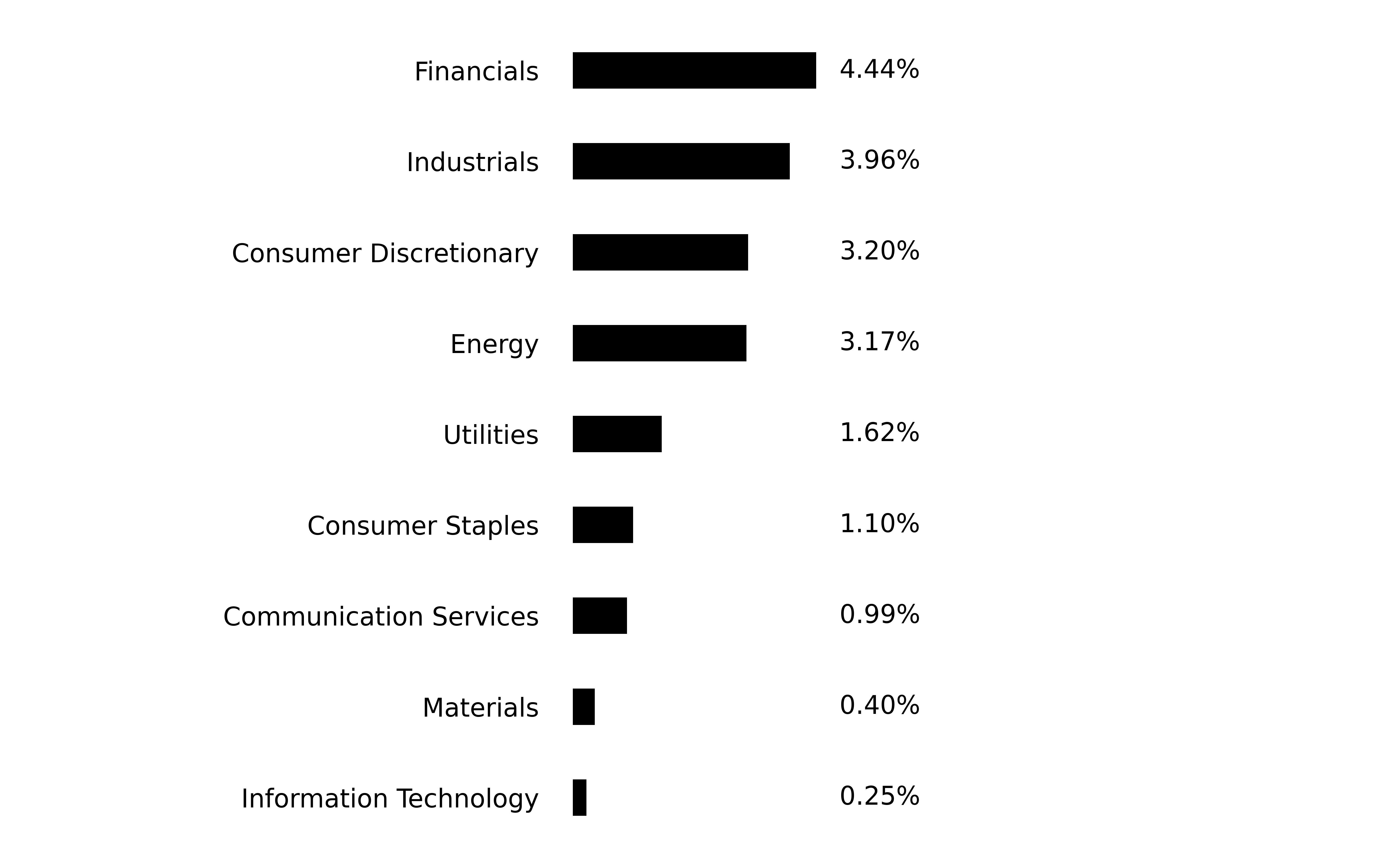

Sector Breakdown Asset Backed Bonds  Corporate Bonds

|

|

| Largest Holdings [Text Block] |

Portfolio Composition

Treasury Notes 42.38% Asset Backed Bonds 32.26% Corprorate Bonds 19.13% Money Market Fund 5.56% Futures Contracts 0.06% Exchange Traded Funds 0%²

|

|

| Curasset Capital Management Limited Term Income Fund Founders Class |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

Curasset Capital Management Limited Term Income Fund

|

|

| Class Name |

Founders Class Shares

|

|

| Trading Symbol |

CMIFX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Curasset Capital Management Limited Term Income Fund for the period of October 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at www.curassetfunds.com/limited-term-income. You can also contact us at (800) 673-0550.

|

|

| Additional Information Phone Number |

(800) 673-0550

|

|

| Additional Information Website |

www.curassetfunds.com/limited-term-income

|

|

| Expenses [Text Block] |

What were the Fund costs for the period? (based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

Curasset Capital Management Limited Term Income Fund | $22 | 0.44%¹ |

|

|

| Expenses Paid, Amount |

$ 22

|

|

| Expense Ratio, Percent |

0.44%

|

[2] |

| Net Assets |

$ 340,516,911

|

|

| Holdings Count | Holdings |

260

|

|

| Advisory Fees Paid, Amount |

$ 522,062

|

|

| Investment Company, Portfolio Turnover |

18.35%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics (as of March 31, 2025)

| |

|---|

Fund Net Assets | $340,516,911 | Number of Holdings | 260 | Total Advisory Fee Paid | $522,062 | Portfolio Turnover Rate | 18.35% |

|

|

| Holdings [Text Block] |

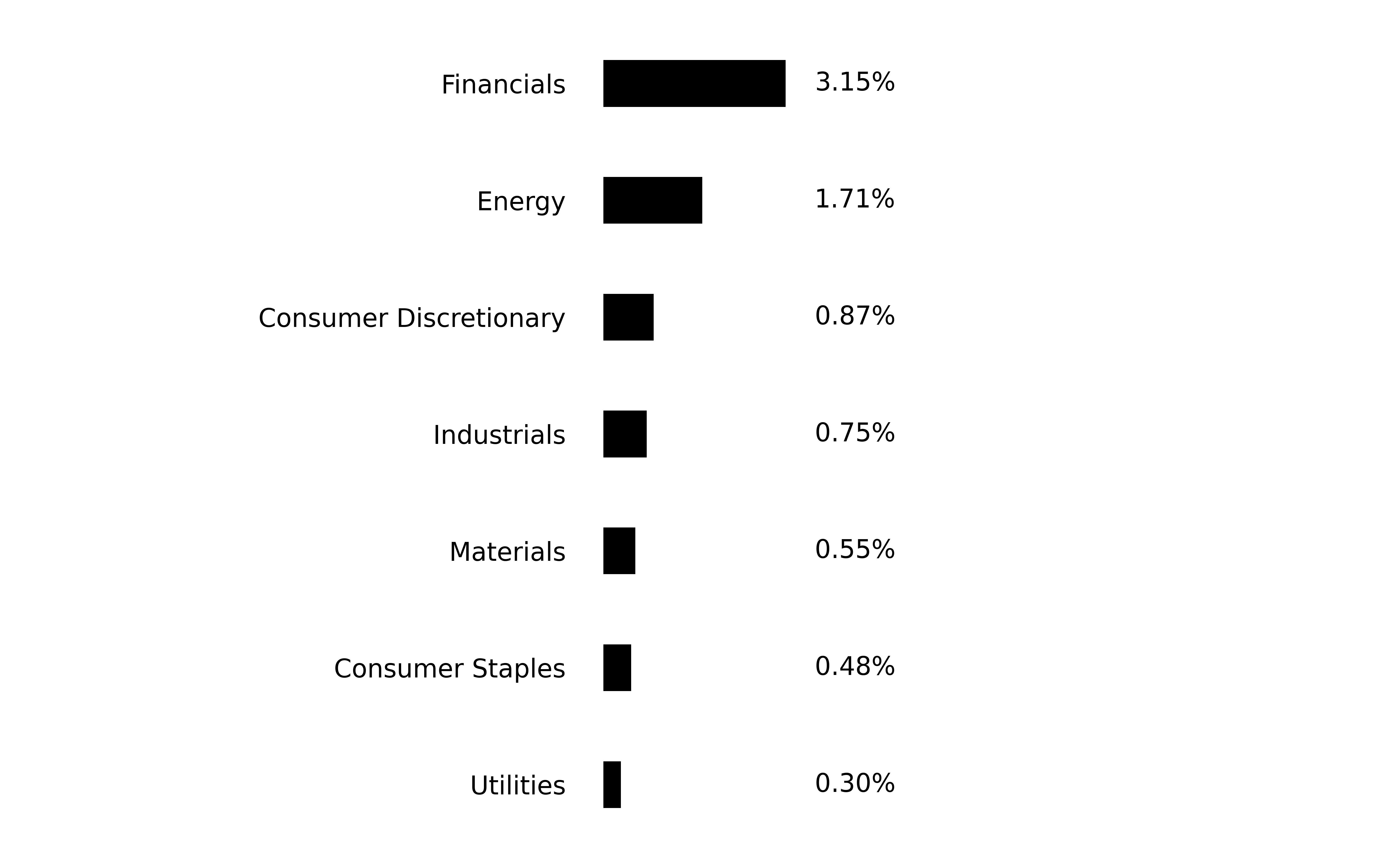

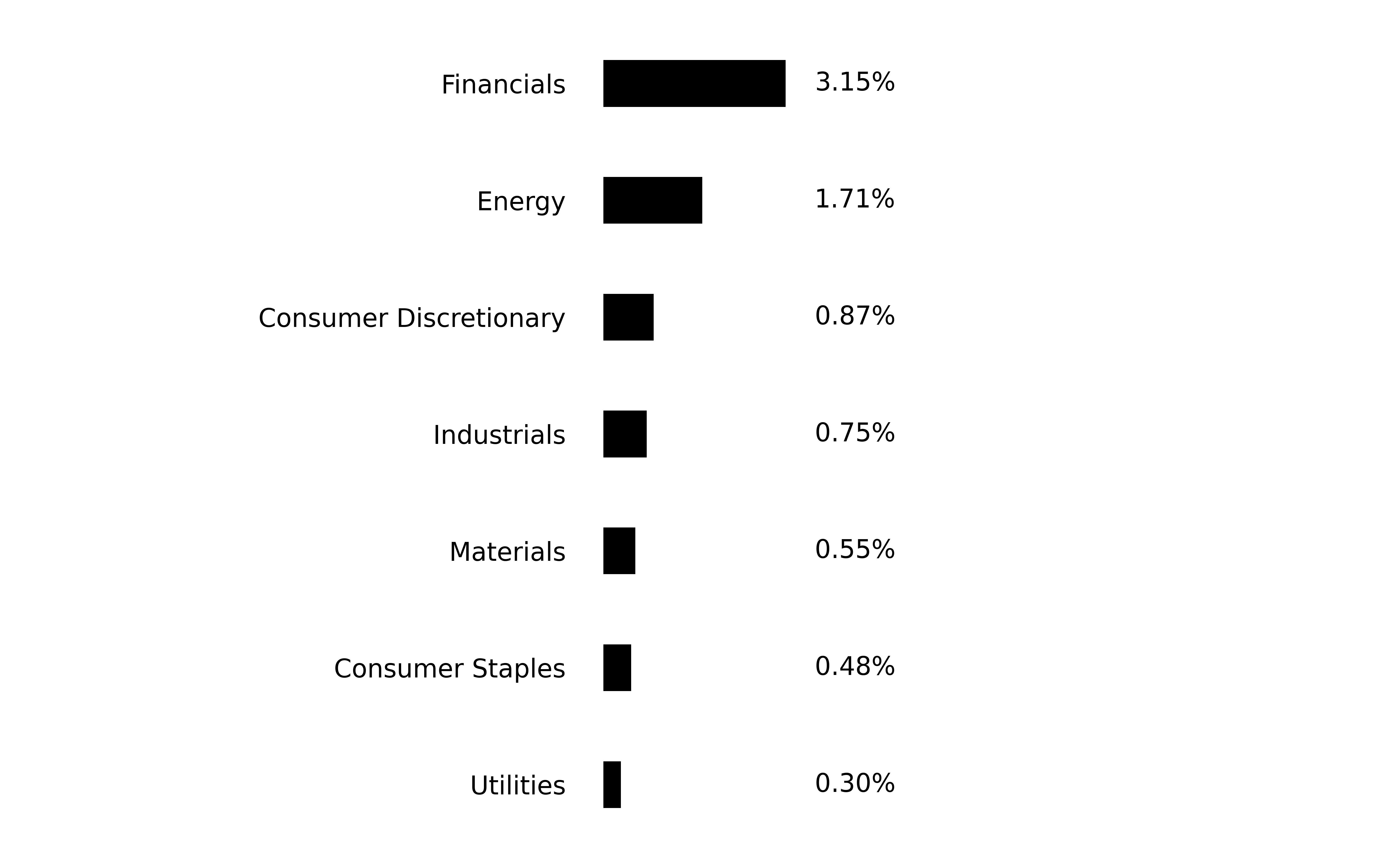

Sector Breakdown Asset Backed Bonds  Corporate Bonds

|

|

| Largest Holdings [Text Block] |

Portfolio Composition

Treasury Notes 52.18% Asset Backed Bonds 38.08% Corprorate Bonds 7.81% Money Market Fund 1.42% Futures Contracts 0.10% Exchange Traded Funds 0%²

|

|

|

|