Shareholder Report

|

12 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

Krane Shares Trust

|

| Entity Central Index Key |

0001547576

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| C000247858 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

KraneShares 90% KWEB Defined Outcome January 2027 ETF

|

| Class Name |

KraneShares 90% KWEB Defined Outcome January 2027 ETF

|

| Trading Symbol |

KBUF

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the KraneShares 90% KWEB Defined Outcome January 2027 ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://kraneshares.com/kbuf/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

1-855-857-2638

|

| Additional Information Website |

https://kraneshares.com/kbuf/

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares 90% KWEB Defined Outcome January 2027 ETF | $29 | 0.26% |

|---|

|

| Expenses Paid, Amount |

$ 29

|

| Expense Ratio, Percent |

0.26%

|

| Factors Affecting Performance [Text Block] |

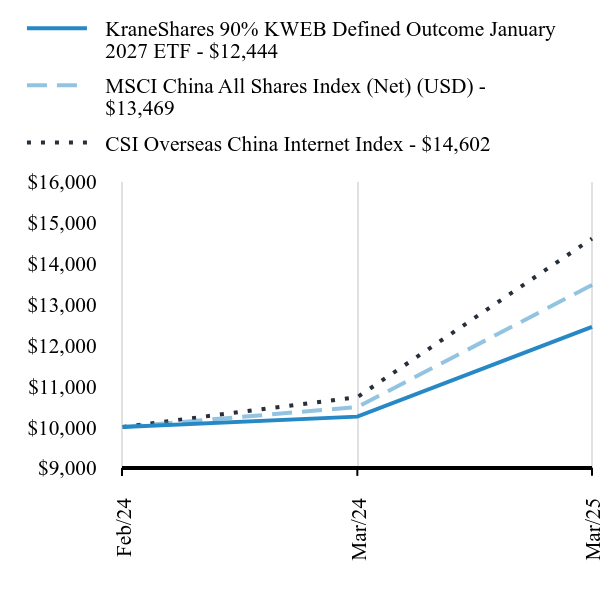

(a) KraneShares CSI Overseas China Internet ETF (KWEB) (1) The Fund is in the Morningstar U.S. ETF Defined Outcome Category. The Fund aims to provide, before fees and expenses, the total return of KWEB up to a 20.01% Cap while providing a 100% buffer against losses over the Outcome Period of January 27, 2025, to January 15, 2027. The Fund extended its Outcome Period by one year on January 24, 2025 (“Reset Date”) to January 15, 2027. From Fund inception to January 23, 2025, the call options, held short by the Fund, contributed the most to the Fund’s return. After the Reset Date to the end of the Period, the KWEB shares held by the Fund contributed the most to the Fund’s return. KWEB outperformed China's broad equity market, as measured by the MSCI China All Shares Index. There were several positive catalysts for China's internet companies during the Period, including stimulus measures announced by China's government, advancements in AI technology that benefited internet firms, and strong earnings reports. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

| KraneShares 90% KWEB Defined Outcome January 2027 ETF - $12444 | MSCI China All Shares Index (Net) (USD) - $13469 | CSI Overseas China Internet Index - $14602 |

|---|

Feb/24 | $10000 | $10000 | $10000 |

|---|

Mar/24 | $10252 | $10485 | $10728 |

|---|

Mar/25 | $12444 | $13469 | $14602 |

|---|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year |

Since

Inception |

|---|

KraneShares 90% KWEB Defined Outcome January 2027 ETF | 21.38% | 21.03% |

|---|

MSCI China All Shares Index (Net) (USD) | 28.47% | 29.70% |

|---|

CSI Overseas China Internet Index | 36.11% | 39.18% |

|---|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 3,755,286

|

| Holdings Count | Holding |

3

|

| Advisory Fees Paid, Amount |

$ 7,168

|

| InvestmentCompanyPortfolioTurnover |

3.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $3,755,286 | 3 | $7,168 | 3% |

|---|

|

| Holdings [Text Block] |

(KWEB) Industry WeightingsFootnote Reference*Value | Value |

|---|

Insurance | 0.7% | Media | 0.8% | Short-Term InvestmentFootnote Reference† | 2.1% | Diversified Consumer Services | 3.2% | Real Estate Management & Development | 3.5% | Consumer Finance | 3.6% | Ground Transportation | 3.9% | Consumer Staples Distribution & Retail | 5.3% | Internet & Catalog Retail | 6.6% | Hotels, Restaurants & Leisure | 6.6% | Entertainment | 11.5% | Broadline Retail | 25.9% | Interactive Media & Services | 28.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. | Footnote† | This security, or a portion thereof, was purchased with cash collateral held from KWEB securities on loan. |

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net Assets |

|---|

KraneShares CSI China Internet ETFFootnote Reference** | | | 106.8% | Purchased Option - KWEB US, $27.49, 01/15/27Footnote Reference(1) | | | 6.9% | Written Option - KWEB US, $42.76, 01/15/27Footnote Reference(1) | | | -14.8% |

| Footnote | Description | Footnote** | Affiliated Investment | Footnote(1) | At market value. |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://kraneshares.com/kbuf/#documents or upon request at 1-855-857-2638. Effective January 24, 2025, the Fund's initial Outcome Period was reset and extended by a year due to market conditions in the first year of the Fund's initial Outcome Period, and a new Cap and Buffer were established. The new Outcome Period is from January 27, 2025 through January 15, 2027. The name of the Fund changed from the "KraneShares 90% KWEB Defined Outcome January 2026 ETF" to the "KraneShares 90% KWEB Defined Outcome January 2027 ETF". |

| Updated Prospectus Web Address |

https://kraneshares.com/kbuf/

|

| C000247859 |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

KraneShares 100% KWEB Defined Outcome January 2027 ETF

|

| Class Name |

KraneShares 100% KWEB Defined Outcome January 2027 ETF

|

| Trading Symbol |

KPRO

|

| Security Exchange Name |

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about the KraneShares 100% KWEB Defined Outcome January 2027 ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

Annual Shareholder Report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at https://kraneshares.com/kpro/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

1-855-857-2638

|

| Additional Information Website |

https://kraneshares.com/kpro/

|

| Expenses [Text Block] |

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares 100% KWEB Defined Outcome January 2027 ETF | $28 | 0.26% |

|---|

|

| Expenses Paid, Amount |

$ 28

|

| Expense Ratio, Percent |

0.26%

|

| Factors Affecting Performance [Text Block] |

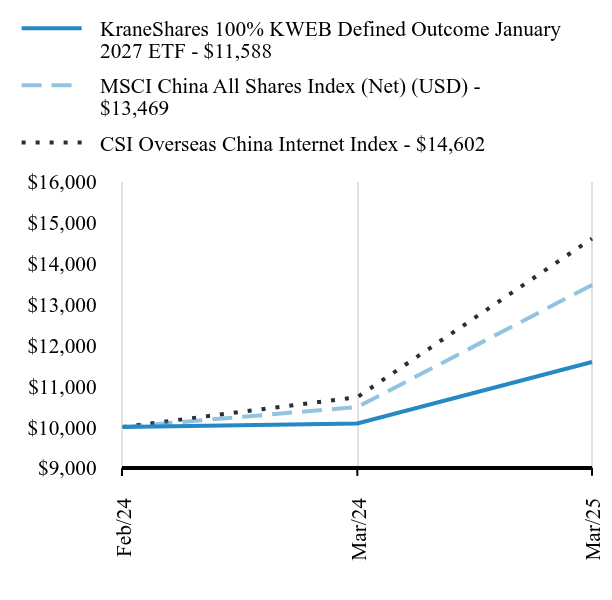

(a) KraneShares CSI Overseas China Internet ETF (KWEB) (1) The Fund is in the Morningstar U.S. ETF Defined Outcome Category. The Fund aims to provide, before fees and expenses, the total return of KWEB up to a 20.01% Cap while providing a 100% buffer against losses over the Outcome Period of January 27, 2025, to January 15, 2027. The Fund extended its Outcome Period by one year on January 24, 2025 (“Reset Date”) to January 15, 2027. From Fund inception to January 23, 2025, the call options, held short by the Fund, contributed the most to the Fund’s return. After the Reset Date to the end of the Period, the KWEB shares held by the Fund contributed the most to the Fund’s return. KWEB outperformed China's broad equity market, as measured by the MSCI China All Shares Index. There were several positive catalysts for China's internet companies during the Period, including stimulus measures announced by China's government, advancements in AI technology that benefited internet firms, and strong earnings reports. |

| Performance Past Does Not Indicate Future [Text] |

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

| KraneShares 100% KWEB Defined Outcome January 2027 ETF - $11588 | MSCI China All Shares Index (Net) (USD) - $13469 | CSI Overseas China Internet Index - $14602 |

|---|

Feb/24 | $10000 | $10000 | $10000 |

|---|

Mar/24 | $10084 | $10485 | $10728 |

|---|

Mar/25 | $11588 | $13469 | $14602 |

|---|

|

| Average Annual Return [Table Text Block] |

Fund/Index Name | 1 Year |

Since

Inception |

|---|

KraneShares 100% KWEB Defined Outcome January 2027 ETF | 14.92% | 13.74% |

|---|

MSCI China All Shares Index (Net) (USD) | 28.47% | 29.70% |

|---|

CSI Overseas China Internet Index | 36.11% | 39.18% |

|---|

|

| No Deduction of Taxes [Text Block] |

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 2,793,272

|

| Holdings Count | Holding |

3

|

| Advisory Fees Paid, Amount |

$ 6,650

|

| InvestmentCompanyPortfolioTurnover |

4.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $2,793,272 | 3 | $6,650 | 4% |

|---|

|

| Holdings [Text Block] |

(KWEB) Industry WeightingsFootnote Reference*Value | Value |

|---|

Insurance | 0.7% | Media | 0.8% | Short-Term InvestmentFootnote Reference† | 2.1% | Diversified Consumer Services | 3.2% | Real Estate Management & Development | 3.5% | Consumer Finance | 3.6% | Ground Transportation | 3.9% | Consumer Staples Distribution & Retail | 5.3% | Internet & Catalog Retail | 6.6% | Hotels, Restaurants & Leisure | 6.6% | Entertainment | 11.5% | Broadline Retail | 25.9% | Interactive Media & Services | 28.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. | Footnote† | This security, or a portion thereof, was purchased with cash collateral held from KWEB securities on loan. |

|

| Largest Holdings [Text Block] |

Holding Name | | | Percentage of

Total Net Assets |

|---|

KraneShares CSI China Internet ETFFootnote Reference** | | | 111.0% | Purchased Option - KWEB US, $30.54, 01/15/27Footnote Reference(1) | | | 10.6% | Written Option - KWEB US, $36.65, 01/15/27Footnote Reference(1) | | | -21.7% |

| Footnote | Description | Footnote** | Affiliated Investment | Footnote(1) | At market value. |

|

| Material Fund Change [Text Block] |

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund's prospectus, which is available at https://kraneshares.com/kpro/#documents or upon request at 1-855-857-2638. Effective January 24, 2025, the Fund's initial Outcome Period was reset and extended by a year due to market conditions in the first year of the Fund's initial Outcome Period, and a new Cap and Buffer were established. The new Outcome Period is from January 27, 2025 through January 15, 2027. The name of the Fund changed from the "KraneShares 100% KWEB Defined Outcome January 2026 ETF" to the "KraneShares 100% KWEB Defined Outcome January 2027 ETF". |

| Updated Prospectus Web Address |

https://kraneshares.com/kpro/

|