Shareholder Report

|

6 Months Ended |

12 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

Mar. 31, 2025

USD ($)

Holding

|

| Shareholder Report [Line Items] |

|

|

| Document Type |

|

N-CSR

|

| Amendment Flag |

|

false

|

| Registrant Name |

|

Krane Shares Trust

|

| Entity Central Index Key |

|

0001547576

|

| Entity Investment Company Type |

|

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

Mar. 31, 2025

|

| C000129136 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares CSI China Internet ETF

|

| Class Name |

|

KraneShares CSI China Internet ETF

|

| Trading Symbol |

|

KWEB

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares CSI China Internet ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kweb/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kweb/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares CSI China Internet ETF | $83 | 0.70% |

|---|

|

| Expenses Paid, Amount |

|

$ 83

|

| Expense Ratio, Percent |

|

0.70%

|

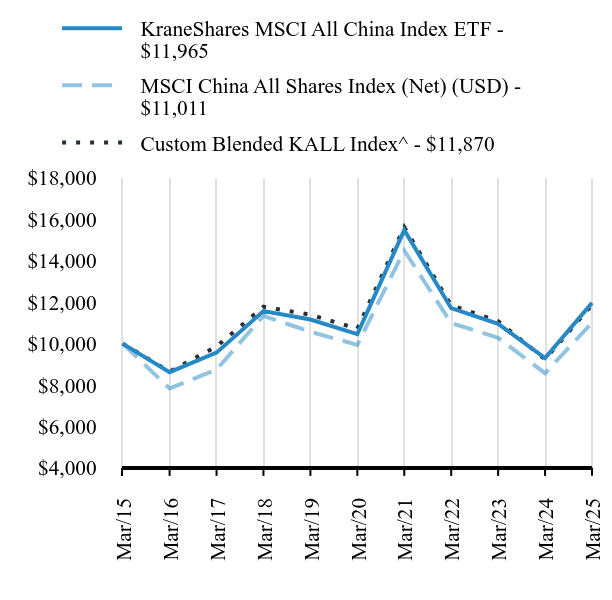

| Factors Affecting Performance [Text Block] |

|

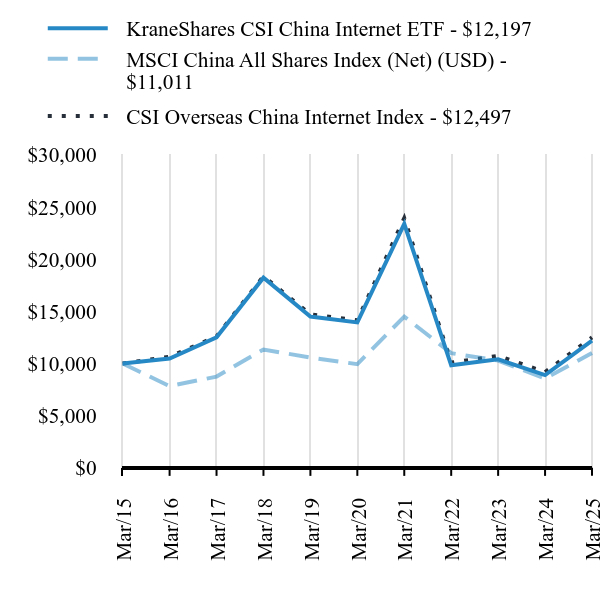

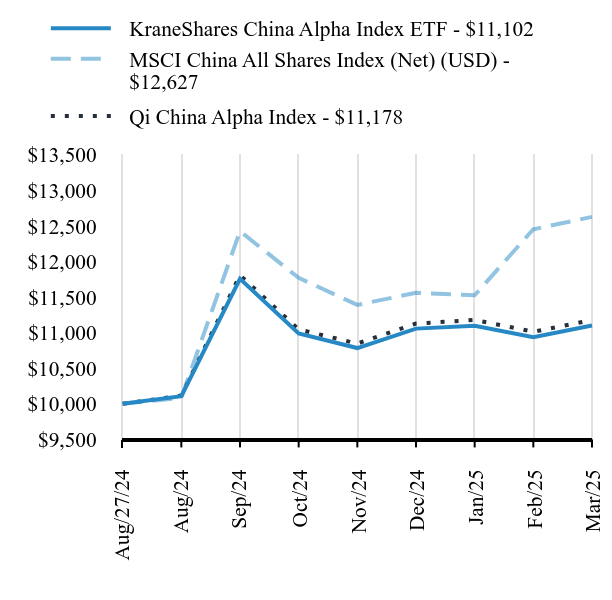

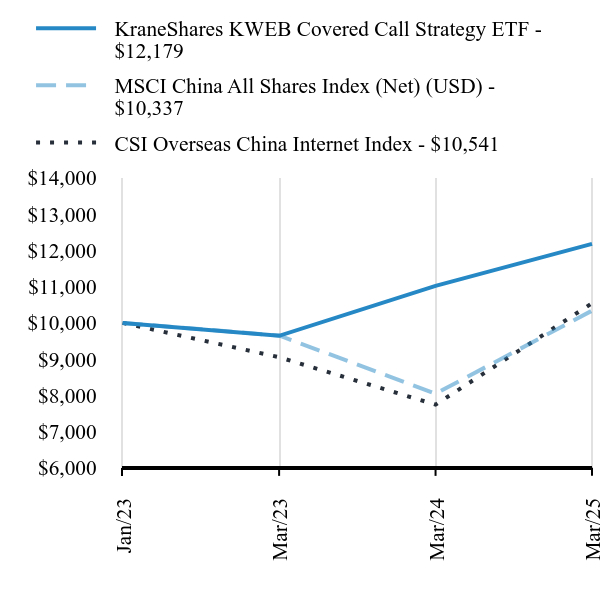

(a) CSI Overseas China Internet Index (b) The Fund is in the Morningstar U.S. ETF China Region Category The KraneShares CSI China Internet ETF seeks to provide investment results that, before expenses and fees, correspond generally to the price and yield performance of the CSI Overseas China Internet Index (the "Underlying Index"), which is designed to measure the performance of the investable universe of publicly traded China-based companies whose primary business or businesses are in the Internet and Internet-related sectors, as defined by the index sponsor, China Securities Index Co., Ltd. China's internet equities outperformed China's equity market more broadly and global equities, broadly defined, due to several positive catalysts for China's internet equities during the Period, including stimulus measures announced by China's government in September, which included a stock market stabilization fund, consumer subsidies, and rate cuts. In addition, DeepSeek, China's answer to OpenAI's ChatGPT, was reported to operate at a higher level of efficiency and demand fewer chips to train than expected, potentially eliminating concerns over chip shortages for China's internet giants. Earnings reported by China internet companies were also strong during the Period. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares CSI China Internet ETF - $12197 | MSCI China All Shares Index (Net) (USD) - $11011 | CSI Overseas China Internet Index - $12497 |

|---|

Mar/15 | $10000 | $10000 | $10000 |

|---|

Mar/16 | $10471 | $7833 | $10645 |

|---|

Mar/17 | $12514 | $8746 | $12588 |

|---|

Mar/18 | $18223 | $11342 | $18353 |

|---|

Mar/19 | $14498 | $10569 | $14704 |

|---|

Mar/20 | $13940 | $9941 | $14139 |

|---|

Mar/21 | $23387 | $14496 | $23932 |

|---|

Mar/22 | $9824 | $10988 | $10090 |

|---|

Mar/23 | $10400 | $10281 | $10731 |

|---|

Mar/24 | $8894 | $8571 | $9181 |

|---|

Mar/25 | $12197 | $11011 | $12497 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

KraneShares CSI China Internet ETF | 37.13% | -2.64% | 2.01% |

|---|

MSCI China All Shares Index (Net) (USD) | 28.47% | 2.07% | 0.97% |

|---|

CSI Overseas China Internet Index | 36.11% | -2.44% | 2.25% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 8,047,217,081

|

$ 8,047,217,081

|

| Holdings Count | Holding |

30

|

30

|

| Advisory Fees Paid, Amount |

|

$ 40,786,079

|

| InvestmentCompanyPortfolioTurnover |

|

54.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $8,047,217,081 | 30 | $40,786,079 | 54% |

|---|

|

| Holdings [Text Block] |

|

Sector WeightingsFootnote Reference*Value | Value |

|---|

Short-Term InvestmentFootnote Reference† | 2.1% | Real Estate | 3.5% | Industrials | 3.9% | Financials | 4.3% | Consumer Staples | 5.3% | Communication Services | 40.7% | Consumer Discretionary | 42.3% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. | Footnote† | This security, or a portion thereof, was purchased with cash collateral held from securities on loan. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Alibaba Group Holding | | | 12.2% | Tencent Holdings | | | 10.8% | PDD Holdings ADR | | | 6.9% | Meituan, Cl B | | | 6.6% | Trip.com Group | | | 4.7% | Kanzhun ADR | | | 4.5% | Kuaishou Technology, Cl B | | | 4.1% | Tencent Music Entertainment Group ADR | | | 4.0% | JD.com, Cl A | | | 3.9% | Full Truck Alliance ADR | | | 3.9% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

| Material Fund Change [Text Block] |

|

There were no material changes during the reporting period. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kweb/

|

| C000129571 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares Bosera MSCI China A 50 Connect Index ETF

|

| Class Name |

|

KraneShares Bosera MSCI China A 50 Connect Index ETF

|

| Trading Symbol |

|

KBA

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares Bosera MSCI China A 50 Connect Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kba/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kba/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares Bosera MSCI China A 50 Connect Index ETF | $60 | 0.56% |

|---|

|

| Expenses Paid, Amount |

|

$ 60

|

| Expense Ratio, Percent |

|

0.56%

|

| Factors Affecting Performance [Text Block] |

|

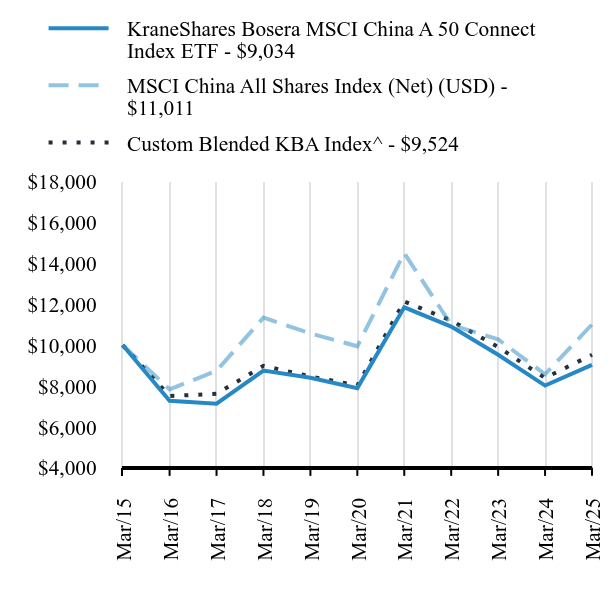

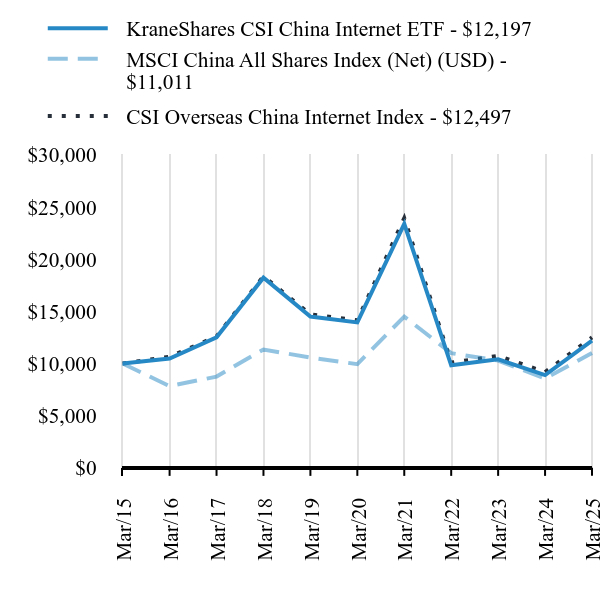

(a) MSCI China A 50 Connect Index (b) The Fund is in the Morningstar U.S. ETF China Region Category The KraneShares Bosera MSCI China A 50 Connect Index ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI China A 50 Connect Index (the "Underlying Index"). The Underlying Index is constructed from the MSCI China A Index (the "Parent Index"), a broad-based benchmark index, which captures large and mid-capitalization China A-shares listed on the Shanghai Stock Exchange and/or the Shenzhen Stock Exchange and accessible through the Northbound Stock Connect program. The Underlying Index is designed to reflect the performance of the 50 largest securities representing each Global Industry Classification Standard (GICS) sector at the sector weight allocation of the Parent Index. China's A-share market outpaced global equity markets during the Period, as measured by the MSCI All Country World Index (ACWI). China's A-share market benefited from the stimulus measures announced by China's government in September, which included a stock market stabilization fund, consumer subsidies, and rate cuts. Within the Fund, the best-performing sectors were Consumer Discretionary and Financials, while the worst-performing sectors were Real Estate and Energy. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares Bosera MSCI China A 50 Connect Index ETF - $9034 | MSCI China All Shares Index (Net) (USD) - $11011 | Custom Blended KBA Index^ - $9524 |

|---|

Mar/15 | $10000 | $10000 | $10000 |

|---|

Mar/16 | $7282 | $7833 | $7512 |

|---|

Mar/17 | $7133 | $8746 | $7617 |

|---|

Mar/18 | $8751 | $11342 | $8987 |

|---|

Mar/19 | $8400 | $10569 | $8469 |

|---|

Mar/20 | $7897 | $9941 | $8030 |

|---|

Mar/21 | $11846 | $14496 | $12133 |

|---|

Mar/22 | $10903 | $10988 | $11201 |

|---|

Mar/23 | $9526 | $10281 | $9905 |

|---|

Mar/24 | $8022 | $8571 | $8396 |

|---|

Mar/25 | $9034 | $11011 | $9524 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

KraneShares Bosera MSCI China A 50 Connect Index ETF | 12.61% | 2.73% | -1.01% |

|---|

MSCI China All Shares Index (Net) (USD) | 28.47% | 2.07% | 0.97% |

|---|

Custom Blended KBA Index^ | 13.44% | 3.47% | -0.49% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 189,121,002

|

$ 189,121,002

|

| Holdings Count | Holding |

85

|

85

|

| Advisory Fees Paid, Amount |

|

$ 1,004,622

|

| InvestmentCompanyPortfolioTurnover |

|

77.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $189,121,002 | 85 | $1,004,622 | 77% |

|---|

|

| Holdings [Text Block] |

|

Sector WeightingsFootnote Reference*Value | Value |

|---|

Real Estate | 0.9% | Communication Services | 1.1% | Energy | 3.1% | Utilities | 4.4% | Health Care | 5.9% | Consumer Discretionary | 7.9% | Materials | 9.3% | Consumer Staples | 11.6% | Industrials | 14.6% | Information Technology | 17.3% | Financials | 23.4% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net Assets |

|---|

Contemporary Amperex Technology, Cl A | | | 6.6% | Kweichow Moutai, Cl A | | | 6.3% | Zijin Mining Group, Cl A | | | 5.8% | BYD, Cl A | | | 5.4% | China Merchants Bank, Cl A | | | 4.0% | Hygon Information Technology, Cl A | | | 3.7% | China Yangtze Power, Cl A | | | 3.4% | Wanhua Chemical Group, Cl A | | | 3.4% | Luxshare Precision Industry, Cl A | | | 3.3% | Jiangsu Hengrui Pharmaceuticals, Cl A | | | 3.1% |

|

| Material Fund Change [Text Block] |

|

There were no material changes during the reporting period. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kba/

|

| C000141213 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares MSCI All China Index ETF

|

| Class Name |

|

KraneShares MSCI All China Index ETF

|

| Trading Symbol |

|

KALL

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares MSCI All China Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kall/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kall/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares MSCI All China Index ETF | $56 | 0.49% |

|---|

|

| Expenses Paid, Amount |

|

$ 56

|

| Expense Ratio, Percent |

|

0.49%

|

| Factors Affecting Performance [Text Block] |

|

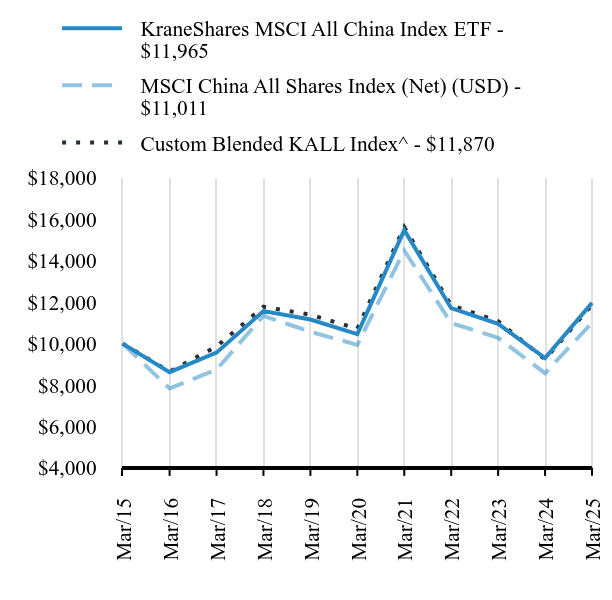

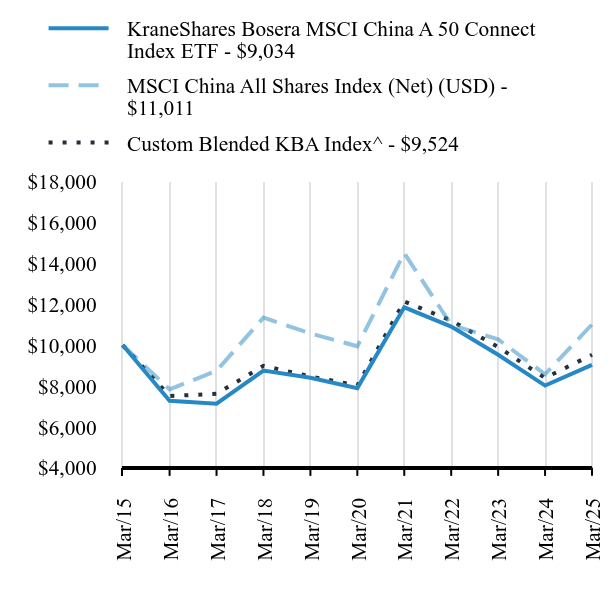

(a) MSCI China All Shares Index (b) The Fund is in the Morningstar U.S. ETF China Region Category. The KraneShares MSCI All China Index ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI China All Shares Index (the "Underlying Index"). The Underlying Index seeks to track the equity market performance of companies based in China and listed in Mainland China, Hong Kong and the United States. Companies available for inclusion must be headquartered in China and meet the market capitalization minimums required by the MSCI Global Investable Market Indexes Methodology. The Fund outperformed global equities, as measured by the MSCI ACWI, significantly during the Period. Offshore listings in Hong Kong and the United States contributed the most to performance. Unprecedented stimulus measures announced by China's government in September, which included a stock market stabilization fund, consumer subsidies, and rate cuts, were a key catalyst for the Fund during the Period. Offshore-listed internet and technology stocks were top performers within the Fund during the Period, as DeepSeek, China's answer to OpenAI's ChatGPT, was reported to operate at a higher level of efficiency and demand fewer chips to train, potentially eliminating concerns over chip shortages for many of China's internet and technology companies. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares MSCI All China Index ETF - $11965 | MSCI China All Shares Index (Net) (USD) - $11011 | Custom Blended KALL Index^ - $11870 |

|---|

Mar/15 | $10000 | $10000 | $10000 |

|---|

Mar/16 | $8619 | $7833 | $8647 |

|---|

Mar/17 | $9564 | $8746 | $9860 |

|---|

Mar/18 | $11571 | $11342 | $11779 |

|---|

Mar/19 | $11164 | $10569 | $11394 |

|---|

Mar/20 | $10461 | $9941 | $10717 |

|---|

Mar/21 | $15479 | $14496 | $15628 |

|---|

Mar/22 | $11711 | $10988 | $11846 |

|---|

Mar/23 | $10957 | $10281 | $11083 |

|---|

Mar/24 | $9303 | $8571 | $9240 |

|---|

Mar/25 | $11965 | $11011 | $11870 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years | 10 Years |

|---|

KraneShares MSCI All China Index ETF | 28.62% | 2.72% | 1.81% |

|---|

MSCI China All Shares Index (Net) (USD) | 28.47% | 2.07% | 0.97% |

|---|

Custom Blended KALL Index^ | 28.47% | 2.07% | 1.73% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 10,209,728

|

$ 10,209,728

|

| Holdings Count | Holding |

201

|

201

|

| Advisory Fees Paid, Amount |

|

$ 39,611

|

| InvestmentCompanyPortfolioTurnover |

|

17.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $10,209,728 | 201 | $39,611 | 17% |

|---|

|

| Holdings [Text Block] |

|

Sector WeightingsFootnote Reference*Value | Value |

|---|

Real Estate | 2.1% | Utilities | 3.2% | Energy | 3.4% | Materials | 3.8% | Health Care | 4.0% | Industrials | 6.2% | Information Technology | 6.4% | Consumer Staples | 7.5% | Communication Services | 14.8% | Consumer Discretionary | 24.0% | Financials | 24.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net Assets |

|---|

Tencent Holdings | | | 10.2% | Alibaba Group Holding | | | 6.9% | Xiaomi, Cl B | | | 3.0% | Meituan, Cl B | | | 2.8% | China Construction Bank, Cl H | | | 2.3% | Kweichow Moutai, Cl A | | | 2.1% | PDD Holdings ADR | | | 2.0% | BYD, Cl H | | | 1.7% | JD.com, Cl A | | | 1.5% | Bank of China, Cl H | | | 1.4% |

|

| Material Fund Change [Text Block] |

|

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus, which is available at https://kraneshares.com/kall/#documents or upon request at 1-855-857-2638. Upon the recommendation of Krane Funds Advisors, LLC, the adviser to the Fund, the Board of Trustees of KraneShares Trust has approved the liquidation and termination of the Fund. Accordingly the Fund ceased operations and liquidated on May 27, 2025. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kall/

|

| C000180685 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares MSCI One Belt One Road Index ETF

|

| Class Name |

|

KraneShares MSCI One Belt One Road Index ETF

|

| Trading Symbol |

|

OBOR

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares MSCI One Belt One Road Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/obor/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/obor/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares MSCI One Belt One Road Index ETF | $82 | 0.79% |

|---|

|

| Expenses Paid, Amount |

|

$ 82

|

| Expense Ratio, Percent |

|

0.79%

|

| Factors Affecting Performance [Text Block] |

|

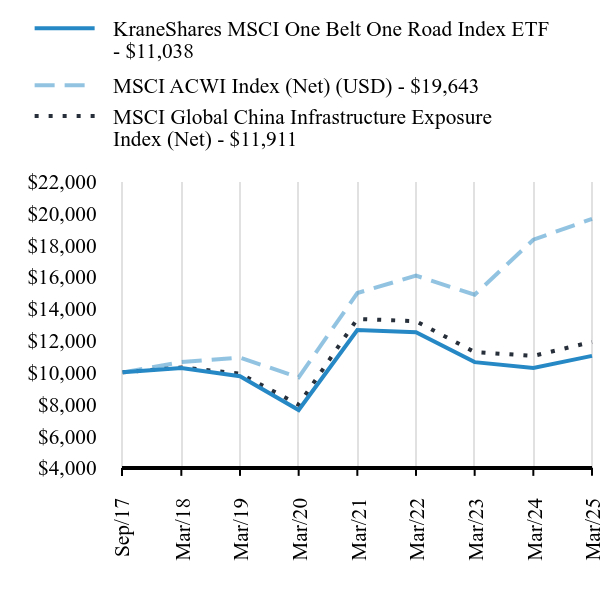

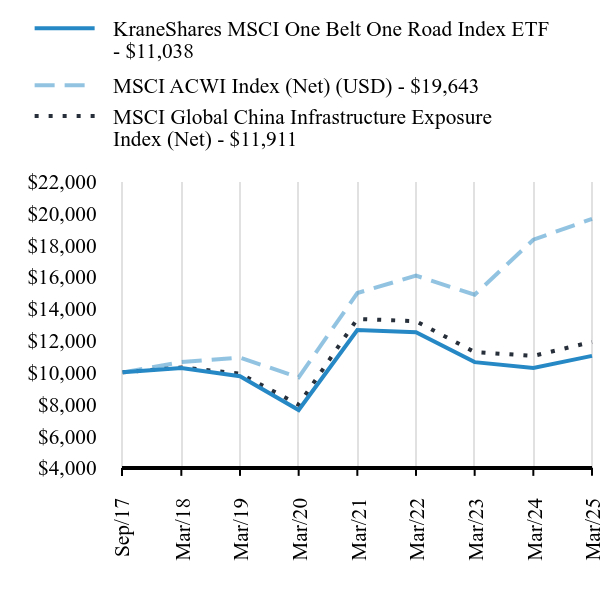

(a) MSCI Global China Infrastructure Exposure Index (b) The Fund is in the Morningstar U.S. ETF Infrastructure Category The KraneShares MSCI One Belt One Road Index ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI Global China Infrastructure Exposure Index (the Underlying Index). The Underlying Index aims to identify potential beneficiaries of the "Belt & Road" or "One Belt One Road" initiative by the central government in China based on how their geography, revenue, and sector attributes align with the broad theme. The Fund seeks to capture potential upside for the companies involved in China's Belt & Road Initiative. The shares in the companies involved in or related to China's outbound infrastructure investment initiatives slightly underperformed Emerging Markets equities, as measured by the MSCI Emerging Markets Index, and global equities, as measured by the MSCI ACWI. These companies tend to be concentrated in the Industrial and Financial sectors, which underperformed more growth-oriented sectors, such as Communication Services and Consumer Discretionary, across Emerging Markets, leading the Fund to underperform. Within the Fund, the top-performing countries were South Africa and Israel, while the worst-performing countries were the Philippines and Malaysia. Within the Fund, the top-performing sectors were Financials and Utilities, while the worst-performing sectors were Communication Services and Industrials. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares MSCI One Belt One Road Index ETF - $11038 | MSCI ACWI Index (Net) (USD) - $19643 | MSCI Global China Infrastructure Exposure Index (Net) - $11911 |

|---|

Sep/17 | $10000 | $10000 | $10000 |

|---|

Mar/18 | $10267 | $10644 | $10309 |

|---|

Mar/19 | $9759 | $10921 | $9922 |

|---|

Mar/20 | $7634 | $9692 | $7971 |

|---|

Mar/21 | $12659 | $14983 | $13358 |

|---|

Mar/22 | $12519 | $16074 | $13216 |

|---|

Mar/23 | $10643 | $14878 | $11274 |

|---|

Mar/24 | $10281 | $18333 | $11035 |

|---|

Mar/25 | $11038 | $19643 | $11911 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years |

Since

Inception |

|---|

KraneShares MSCI One Belt One Road Index ETF | 7.37% | 7.65% | 1.31% |

|---|

MSCI ACWI Index (Net) (USD) | 7.15% | 15.18% | 9.33% |

|---|

MSCI Global China Infrastructure Exposure Index (Net) | 7.93% | 8.36% | 2.34% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 3,249,166

|

$ 3,249,166

|

| Holdings Count | Holding |

118

|

118

|

| Advisory Fees Paid, Amount |

|

$ 27,280

|

| InvestmentCompanyPortfolioTurnover |

|

19.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $3,249,166 | 118 | $27,280 | 19% |

|---|

|

| Holdings [Text Block] |

|

Country WeightingsFootnote Reference*Value | Value |

|---|

Other Countries | 1.3% | Kazakhstan | 0.9% | Malaysia | 1.7% | Poland | 2.1% | Turkey | 2.2% | Thailand | 4.3% | South Africa | 4.5% | Indonesia | 4.6% | India | 5.0% | Israel | 7.9% | Singapore | 10.1% | Kuwait | 10.5% | China | 44.6% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net Assets |

|---|

Kuwait Finance House | | | 10.3% | Oversea-Chinese Banking | | | 7.4% | China Yangtze Power, Cl A | | | 4.9% | Elbit Systems | | | 4.7% | PTT | | | 4.3% | Impala Platinum Holdings | | | 2.8% | China Petroleum & Chemical, Cl H | | | 2.2% | KGHM Polska Miedz | | | 2.1% | Beijing-Shanghai High Speed Railway, Cl A | | | 2.0% | Turk Hava Yollari AO | | | 2.0% |

|

| Material Fund Change [Text Block] |

|

There were no material changes during the reporting period. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/obor/

|

| C000176655 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares Emerging Markets Consumer Technology Index ETF

|

| Class Name |

|

KraneShares Emerging Markets Consumer Technology Index ETF

|

| Trading Symbol |

|

KEMQ

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares Emerging Markets Consumer Technology Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kemq/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kemq/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares Emerging Markets Consumer Technology Index ETF | $62 | 0.55% |

|---|

|

| Expenses Paid, Amount |

|

$ 62

|

| Expense Ratio, Percent |

|

0.55%

|

| Factors Affecting Performance [Text Block] |

|

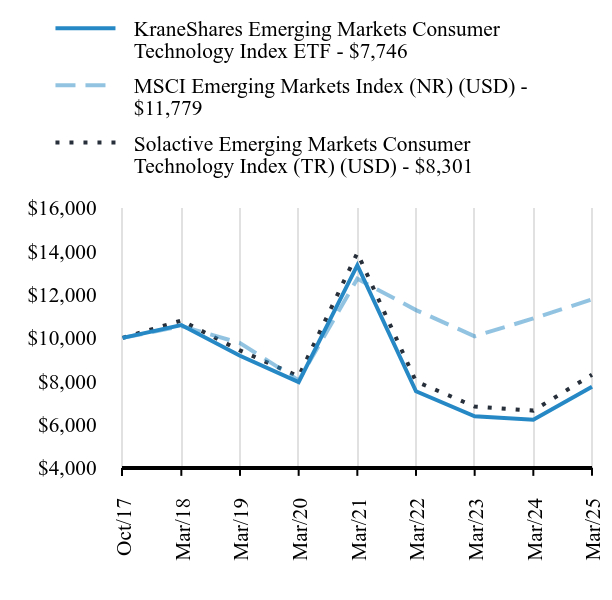

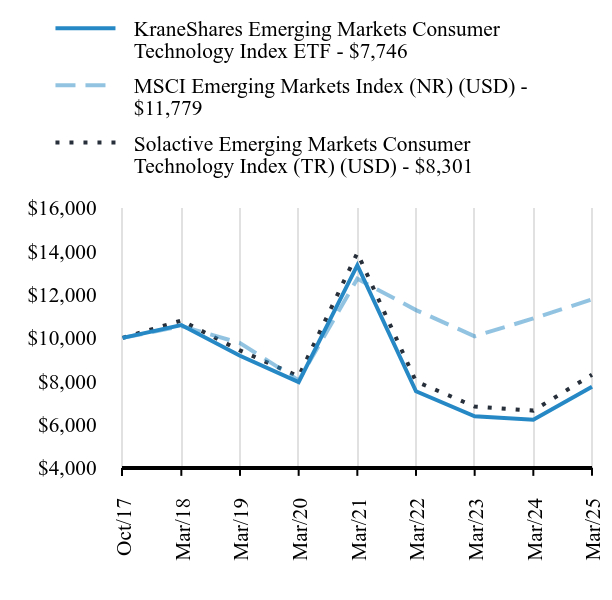

(a) Solactive Emerging Markets Consumer Technology Index (b) The Fund is in the Morningstar U.S. ETF Diversified Emerging Markets Category The KraneShares Emerging Markets Consumer Technology Index ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Solactive Emerging Markets Consumer Technology Index (the "Underlying Index"). The Underlying Index selects companies from 26 eligible countries within emerging markets whose primary business or businesses are internet retail, internet software/services, purchase, payment processing, semiconductor production, or software for internet and e-commerce transactions. Emerging Markets consumer technology equities outperformed global equities, as measured by the MSCI ACWI, during the Period. These stocks benefited from stimulus and AI innovation in China, and strong economic growth in Latin America and Southeast Asia. Within the Fund, the best-performing stocks included financial technology companies and online health care platforms. In contrast, the worst-performing stocks included chipmakers, which came off record-high valuations, and payments processors. Within the Fund, the best-performing countries were Singapore and China, while the worst-performing countries were Taiwan and Brazil. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares Emerging Markets Consumer Technology Index ETF - $7746 | MSCI Emerging Markets Index (NR) (USD) - $11779 | Solactive Emerging Markets Consumer Technology Index (TR) (USD) - $8301 |

|---|

Oct/17 | $10000 | $10000 | $10000 |

|---|

Mar/18 | $10592 | $10546 | $10802 |

|---|

Mar/19 | $9176 | $9765 | $9421 |

|---|

Mar/20 | $7957 | $8038 | $8225 |

|---|

Mar/21 | $13355 | $12731 | $13922 |

|---|

Mar/22 | $7537 | $11284 | $7987 |

|---|

Mar/23 | $6384 | $10076 | $6831 |

|---|

Mar/24 | $6226 | $10898 | $6643 |

|---|

Mar/25 | $7746 | $11779 | $8301 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years |

Since

Inception |

|---|

KraneShares Emerging Markets Consumer Technology Index ETF | 24.41% | -0.54% | -3.36% |

|---|

MSCI Emerging Markets Index (NR) (USD) | 8.09% | 7.94% | 2.22% |

|---|

Solactive Emerging Markets Consumer Technology Index (TR) (USD) | 24.96% | 0.18% | -2.46% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 20,197,851

|

$ 20,197,851

|

| Holdings Count | Holding |

53

|

53

|

| Advisory Fees Paid, Amount |

|

$ 89,103

|

| InvestmentCompanyPortfolioTurnover |

|

63.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $20,197,851 | 53 | $89,103 | 63% |

|---|

|

| Holdings [Text Block] |

|

Country/Asset WeightingsFootnote Reference*Value | Value |

|---|

Other Countries | 1.7% | Greece | 0.9% | Short-Term InvestmentFootnote Reference† | 2.0% | Netherlands | 2.0% | Japan | 2.7% | Finland | 2.7% | India | 3.6% | South Africa | 3.7% | Singapore | 3.9% | Brazil | 4.3% | Taiwan | 13.0% | South Korea | 17.7% | China | 44.2% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. | Footnote† | This security, or a portion thereof, was purchased with cash collateral held from securities on loan. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

Sea ADR | | | 3.9% | JD.com, Cl A | | | 3.8% | PDD Holdings ADR | | | 3.8% | NetEase | | | 3.7% | SK Hynix | | | 3.7% | Naspers, Cl N | | | 3.7% | Alibaba Group Holding | | | 3.6% | Tencent Holdings | | | 3.6% | Meituan, Cl B | | | 3.5% | Taiwan Semiconductor Manufacturing | | | 3.4% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

| Material Fund Change [Text Block] |

|

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus, which is available at https://kraneshares.com/kemq/#documents or upon request at 1-855-857-2638. Effective November 1, 2024, Krane has contractually agreed to waive its management fee by 0.30% of the average daily net assets of the Fund. This contractual fee waiver will continue until August 1, 2025, and may only be terminated prior thereto by the Board. Prior to November 1, 2024, Krane had contractually agreed to waive its management fee by 0.20% of the average daily net assets of the Fund. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kemq/

|

| C000157444 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares MSCI China Clean Technology Index ETF

|

| Class Name |

|

KraneShares MSCI China Clean Technology Index ETF

|

| Trading Symbol |

|

KGRN

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares MSCI China Clean Technology Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kgrn/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kgrn/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares MSCI China Clean Technology Index ETF | $90 | 0.79% |

|---|

|

| Expenses Paid, Amount |

|

$ 90

|

| Expense Ratio, Percent |

|

0.79%

|

| Factors Affecting Performance [Text Block] |

|

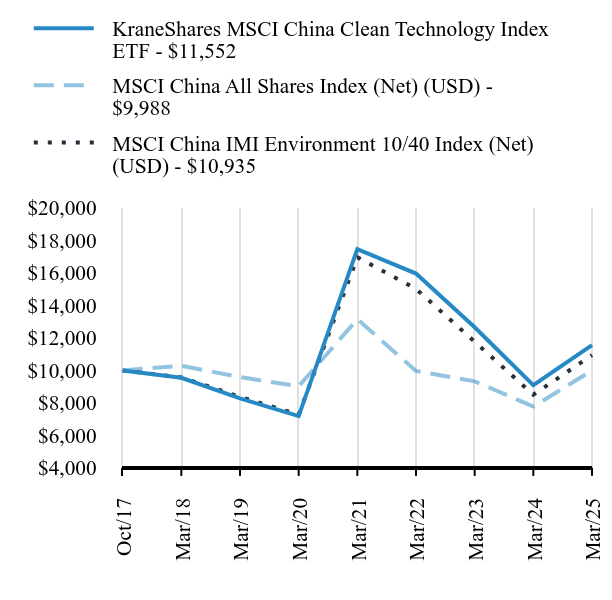

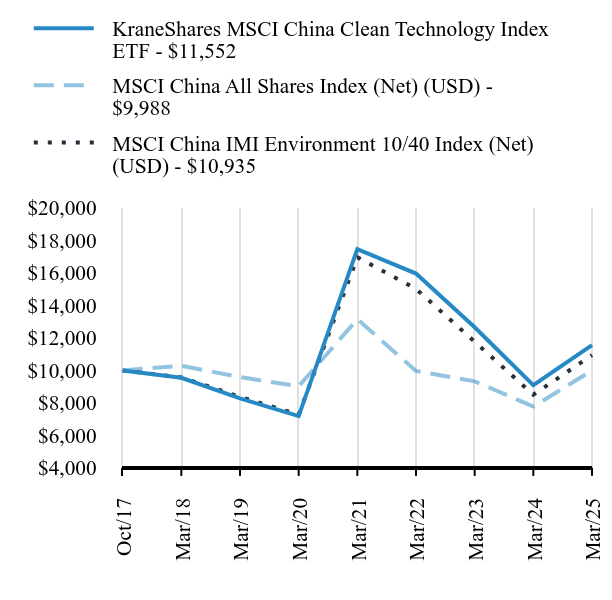

(a) MSCI China IMI Environment 10/40 Index (b) The Fund is in the Morningstar U.S. ETF China Region Category The KraneShares MSCI China Clean Technology Index ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI China IMI Environment 10/40 Index (the "Underlying Index"). The Underlying Index comprises securities that derive at least 50% of their revenues from environmentally beneficial products and services. The Underlying Index is based on four key clean technology themes: (1) Alternative Energy, (2) Sustainable Water, (3) Pollution Prevention and (4) Energy Efficiency. The Underlying Index is designed to measure the performance of Chinese companies that focus on contributing to a more environmentally sustainable economy by making efficient use of scarce natural resources or by mitigating the impact of environmental degradation. China's clean technology equities outperformed global equities, as represented by the MSCI ACWI, and China equities more broadly, as represented by the MSCI China All Shares Index, during the Period. Within the Fund, electric vehicle (EV) manufacturers, supported by consumer subsidies targeting the automotive industry, outperformed new energy system component suppliers, which were challenged by the potential for increased trade protectionism abroad, including in the U.S., among other factors. Xpeng, an EV manufacturer and top Fund holding, beat earnings per share (EPS) estimates for the fourth quarter of 2024. Meanwhile, Xinyi Solar, a manufacturer of solar panels and equipment, fell short of expectations for its EPS for the second half of 2024, posting a loss for the year after three years of net profits. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares MSCI China Clean Technology Index ETF - $11552 | MSCI China All Shares Index (Net) (USD) - $9988 | MSCI China IMI Environment 10/40 Index (Net) (USD) - $10935 |

|---|

Oct/17 | $10000 | $10000 | $10000 |

|---|

Mar/18 | $9544 | $10289 | $9569 |

|---|

Mar/19 | $8277 | $9588 | $8373 |

|---|

Mar/20 | $7187 | $9018 | $7274 |

|---|

Mar/21 | $17466 | $13150 | $16965 |

|---|

Mar/22 | $15962 | $9968 | $15018 |

|---|

Mar/23 | $12656 | $9326 | $11762 |

|---|

Mar/24 | $9091 | $7775 | $8505 |

|---|

Mar/25 | $11552 | $9988 | $10935 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years |

Since

Inception |

|---|

KraneShares MSCI China Clean Technology Index ETF | 27.07% | 9.96% | 1.95% |

|---|

MSCI China All Shares Index (Net) (USD) | 28.47% | 2.07% | -0.02% |

|---|

MSCI China IMI Environment 10/40 Index (Net) (USD) | 28.58% | 8.50% | 1.20% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 48,392,215

|

$ 48,392,215

|

| Holdings Count | Holding |

47

|

47

|

| Advisory Fees Paid, Amount |

|

$ 404,836

|

| InvestmentCompanyPortfolioTurnover |

|

36.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $48,392,215 | 47 | $404,836 | 36% |

|---|

|

| Holdings [Text Block] |

|

Sector WeightingsFootnote Reference*Value | Value |

|---|

Information Technology | 17.0% | Industrials | 18.7% | Utilities | 20.6% | Consumer Discretionary | 43.7% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net Assets |

|---|

XPeng, Cl A | | | 10.6% | BYD, Cl H | | | 9.6% | Li Auto, Cl A | | | 8.7% | Contemporary Amperex Technology, Cl A | | | 8.4% | China Yangtze Power, Cl A | | | 4.5% | Kingdee International Software Group | | | 4.1% | Zhejiang Leapmotor Technology | | | 4.0% | CGN Power, Cl H | | | 3.8% | NIO, Cl A | | | 3.7% | China Longyuan Power Group, Cl H | | | 3.0% |

|

| Material Fund Change [Text Block] |

|

There were no material changes during the reporting period. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kgrn/

|

| C000198139 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares Electric Vehicles and Future Mobility Index ETF

|

| Class Name |

|

KraneShares Electric Vehicles and Future Mobility Index ETF

|

| Trading Symbol |

|

KARS

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares Electric Vehicles and Future Mobility Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kars/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kars/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares Electric Vehicles and Future Mobility Index ETF | $70 | 0.72% |

|---|

|

| Expenses Paid, Amount |

|

$ 70

|

| Expense Ratio, Percent |

|

0.72%

|

| Factors Affecting Performance [Text Block] |

|

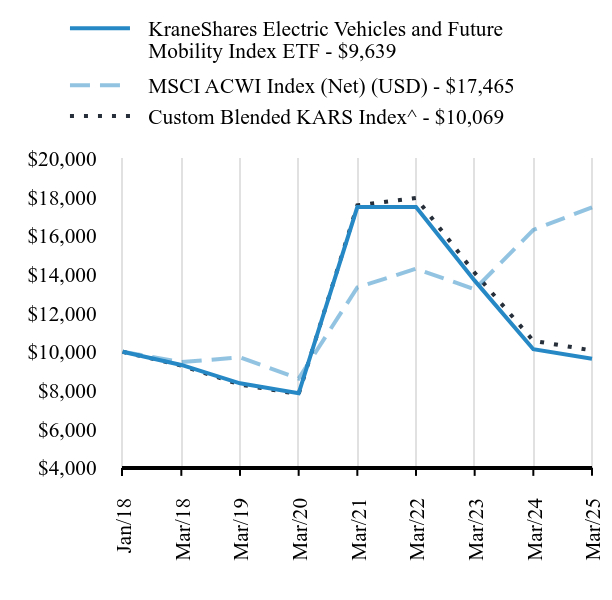

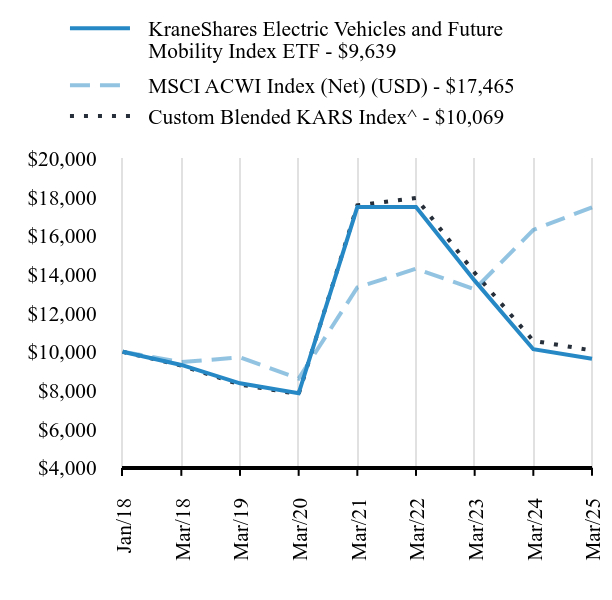

(a) Bloomberg Electric Vehicles Index (b) The Fund is in the Morningstar U.S. ETF Industrials Category The KraneShares Electric Vehicle & Future Mobility Index ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Bloomberg Electric Vehicles Index (the "Underlying Index"). The Underlying Index seeks to measure the performance of companies that are engaged in the production of electric vehicles, their components, or other initiatives that may change the future of mobility. This includes electric vehicles, autonomous driving, lithium and/or copper production, lithium-ion/lead acid battery production, hydrogen fuel cell manufacturing, and/or electric infrastructure businesses. The global electric vehicle (“EV”) and future mobility ecosystem was challenged by waning support for the electrification of transport from the U.S. government following a surge in support with the Biden Administration's 2023 Inflation Reduction Act. Nonetheless, global electric vehicle sales reached another record high of over 17 million units in 2024. Electric vehicle manufacturers in China outperformed those in other regions. Within the Fund, the best-performing industries were vehicle manufacturers and EV components, while the worst-performing industries were hydrogen engines, fuel cells, and EV charging infrastructure. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares Electric Vehicles and Future Mobility Index ETF - $9639 | MSCI ACWI Index (Net) (USD) - $17465 | Custom Blended KARS Index^ - $10069 |

|---|

Jan/18 | $10000 | $10000 | $10000 |

|---|

Mar/18 | $9320 | $9464 | $9287 |

|---|

Mar/19 | $8370 | $9710 | $8307 |

|---|

Mar/20 | $7856 | $8617 | $7812 |

|---|

Mar/21 | $17476 | $13322 | $17567 |

|---|

Mar/22 | $17484 | $14291 | $17951 |

|---|

Mar/23 | $13676 | $13228 | $14081 |

|---|

Mar/24 | $10132 | $16299 | $10567 |

|---|

Mar/25 | $9639 | $17465 | $10069 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years |

Since

Inception |

|---|

KraneShares Electric Vehicles and Future Mobility Index ETF | -4.86% | 4.18% | -0.51% |

|---|

MSCI ACWI Index (Net) (USD) | 7.15% | 15.18% | 8.05% |

|---|

Custom Blended KARS Index^ | -4.71% | 5.21% | 0.10% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 63,659,698

|

$ 63,659,698

|

| Holdings Count | Holding |

53

|

53

|

| Advisory Fees Paid, Amount |

|

$ 544,206

|

| InvestmentCompanyPortfolioTurnover |

|

39.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $63,659,698 | 53 | $544,206 | 39% |

|---|

|

| Holdings [Text Block] |

|

Country/Asset WeightingsFootnote Reference*Value | Value |

|---|

Sweden | 0.9% | Belgium | 1.5% | Germany | 2.3% | Chile | 2.8% | Japan | 5.2% | Short-Term InvestmentFootnote Reference† | 6.0% | Australia | 7.4% | South Korea | 9.1% | United States | 14.5% | China | 55.6% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. | Footnote† | This security, or a portion thereof, was purchased with cash collateral held from securities on loan. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net AssetsFootnote Reference(A) |

|---|

BYD, Cl A | | | 4.6% | XPeng, Cl A | | | 4.4% | Panasonic Holdings | | | 4.2% | Li Auto, Cl A | | | 4.1% | Contemporary Amperex Technology, Cl A | | | 4.0% | Geely Automobile Holdings | | | 4.0% | Rivian Automotive, Cl A | | | 4.0% | Zhejiang Leapmotor Technology | | | 3.5% | CMOC Group, Cl A | | | 3.0% | Tesla | | | 3.0% |

| Footnote | Description | Footnote(A) | Short-Term Investments are not shown in the top ten chart. |

|

| Material Fund Change [Text Block] |

|

There were no material changes during the reporting period. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kars/

|

| C000195635 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares MSCI All China Health Care Index ETF

|

| Class Name |

|

KraneShares MSCI All China Health Care Index ETF

|

| Trading Symbol |

|

KURE

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares MSCI All China Health Care Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kure/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kure/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares MSCI All China Health Care Index ETF | $68 | 0.65% |

|---|

|

| Expenses Paid, Amount |

|

$ 68

|

| Expense Ratio, Percent |

|

0.65%

|

| Factors Affecting Performance [Text Block] |

|

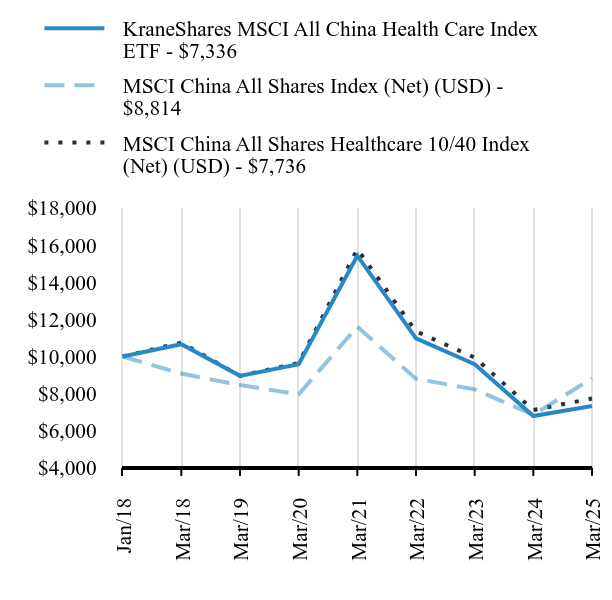

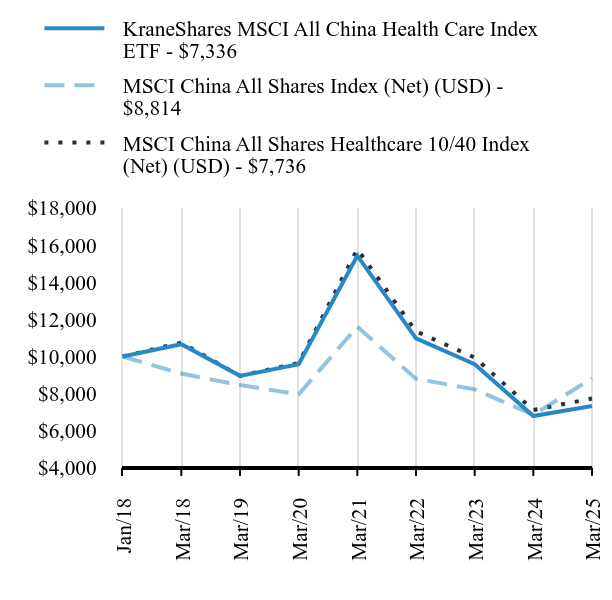

(a) MSCI China All Shares Health Care 10/40 Index (b) The Fund is in the Morningstar U.S. ETF China Region Category The KraneShares MSCI All China Health Care Index ETF seeks to provide investment results that, before fees and expenses, track the price and yield performance of the MSCI China All Shares Health Care 10/40 Index (the "Underlying Index"). The Underlying Index captures large and mid-cap representation across China A‐shares, B‐shares, H‐shares, Red‐chips, P‐chips, and foreign listings (e.g. American depositary receipts). The Underlying Index is designed to reflect the various China equity share classes, including those listed in Hong Kong, Shanghai, Shenzhen, and outside of China. China's health care equities outperformed global equities, as measured by the MSCI ACWI, during the Period. China's health care equities benefited from the stimulus measures announced by China's government in September, which included a stock market stabilization fund, consumer subsidies, and rate cuts. China's regulators also adopted a more supportive approach to the sector than in the past, releasing plans to induce more private investments in innovative medicine and expand insurance programs to cover the costs of new drug development. In addition, Fund holding Akeso developed a new lung cancer treatment during the Period that could be twice as effective as the current global best-in-class treatments, based on initial clinical trial data driving positive performance for the Fund. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares MSCI All China Health Care Index ETF - $7336 | MSCI China All Shares Index (Net) (USD) - $8814 | MSCI China All Shares Healthcare 10/40 Index (Net) (USD) - $7736 |

|---|

Jan/18 | $10000 | $10000 | $10000 |

|---|

Mar/18 | $10660 | $9079 | $10746 |

|---|

Mar/19 | $8955 | $8460 | $8951 |

|---|

Mar/20 | $9578 | $7958 | $9649 |

|---|

Mar/21 | $15426 | $11604 | $15776 |

|---|

Mar/22 | $10971 | $8796 | $11353 |

|---|

Mar/23 | $9583 | $8230 | $9942 |

|---|

Mar/24 | $6794 | $6861 | $7116 |

|---|

Mar/25 | $7336 | $8814 | $7736 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years |

Since

Inception |

|---|

KraneShares MSCI All China Health Care Index ETF | 7.98% | -5.19% | -4.23% |

|---|

MSCI China All Shares Index (Net) (USD) | 28.47% | 2.07% | -1.75% |

|---|

MSCI China All Shares Healthcare 10/40 Index (Net) (USD) | 8.72% | -4.32% | -3.52% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 86,599,232

|

$ 86,599,232

|

| Holdings Count | Holding |

51

|

51

|

| Advisory Fees Paid, Amount |

|

$ 301,369

|

| InvestmentCompanyPortfolioTurnover |

|

77.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $86,599,232 | 51 | $301,369 | 77% |

|---|

|

| Holdings [Text Block] |

|

Industry WeightingsFootnote Reference*Value | Value |

|---|

Health Care Providers & Services | 8.8% | Health Care Equipment & Supplies | 13.0% | Life Sciences Tools & Services | 16.1% | Biotechnology | 26.2% | Pharmaceuticals | 35.9% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net Assets |

|---|

BeiGene | | | 8.6% | Jiangsu Hengrui Pharmaceuticals, Cl A | | | 8.0% | Wuxi Biologics Cayman | | | 7.5% | Shenzhen Mindray Bio-Medical Electronics, Cl A | | | 7.2% | Innovent Biologics | | | 4.7% | WuXi AppTec, Cl A | | | 4.3% | Akeso | | | 3.9% | Aier Eye Hospital Group, Cl A | | | 3.2% | CSPC Pharmaceutical Group | | | 3.2% | Sino Biopharmaceutical | | | 3.2% |

|

| Material Fund Change [Text Block] |

|

There were no material changes during the reporting period. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kure/

|

| C000195632 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares Asia Pacific High Income USD Bond ETF

|

| Class Name |

|

KraneShares Asia Pacific High Income USD Bond ETF

|

| Trading Symbol |

|

KHYB

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares Asia Pacific High Income USD Bond ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/khyb/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/khyb/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares Asia Pacific High Income USD Bond ETF | $72 | 0.69% |

|---|

|

| Expenses Paid, Amount |

|

$ 72

|

| Expense Ratio, Percent |

|

0.69%

|

| Factors Affecting Performance [Text Block] |

|

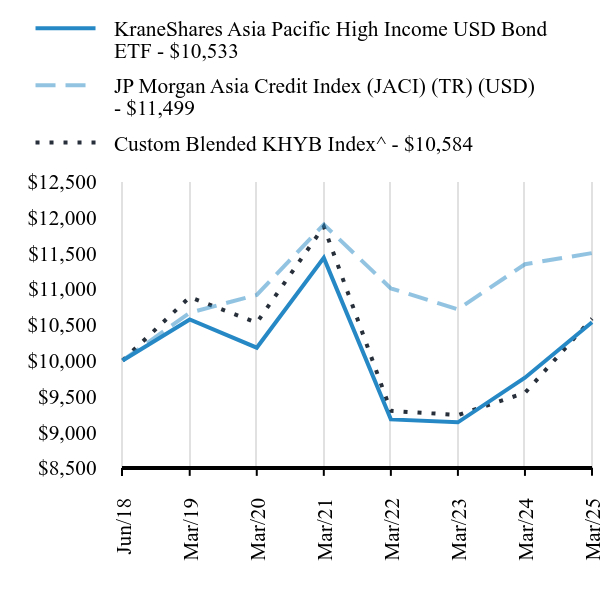

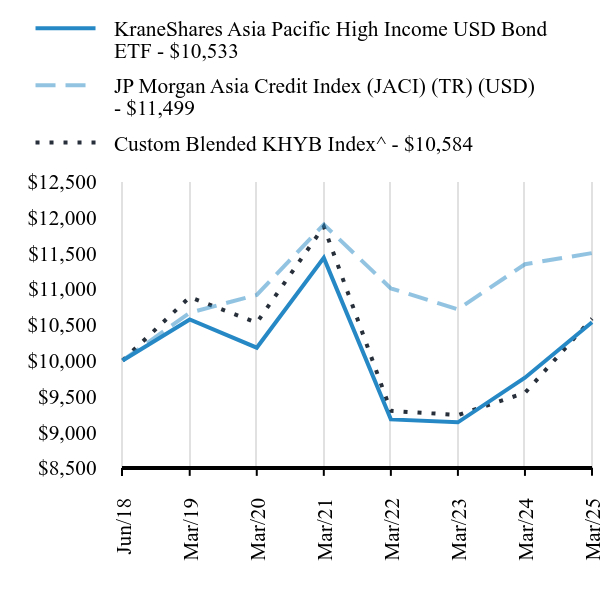

^ Fund is actively managed and does not track an Underlying Index (1) The Fund is in the Morningstar U.S. ETF Emerging Markets Bond Category The KraneShares Asia Pacific High Income U.S.D. Bond ETF seeks to provide a total return that, before fees and expenses, exceeds that of the JP Morgan Asia Credit Index (JACI) Non-Investment Grade Corporate (the "Benchmark Index") over a complete market cycle. The Benchmark Index is comprised of liquid U.S. dollar-denominated debt instruments issued out of Asia ex-Japan and is market capitalization weighted. The Underlying Index is limited to issuers classified as noninvestment grade based on the middle rating between Moody's, Fitch, and S&P. The Asia ex Japan high yield bond market slightly underperformed the global high yield bond market, as measured by the Bloomberg Global High Yield Index, during the Period. China real estate developers' bonds continued to recover on strong government support and backstop measures, contributing positively to the Fund's performance and resulting in real estate issuers doubling as a percentage of the total portfolio. Meanwhile, trade-related uncertainties led to a slight widening of high-yield spreads in Asia. However, relatively benign inflation in local economies and rate cut cycles initiated by multiple regional central banks during the Period supported bond prices, mitigating losses by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares Asia Pacific High Income USD Bond ETF - $10533 | JP Morgan Asia Credit Index (JACI) (TR) (USD) - $11499 | Custom Blended KHYB Index^ - $10584 |

|---|

Jun/18 | $10000 | $10000 | $10000 |

|---|

Mar/19 | $10572 | $10665 | $10884 |

|---|

Mar/20 | $10178 | $10915 | $10527 |

|---|

Mar/21 | $11432 | $11897 | $11869 |

|---|

Mar/22 | $9177 | $11006 | $9296 |

|---|

Mar/23 | $9136 | $10714 | $9238 |

|---|

Mar/24 | $9759 | $11343 | $9547 |

|---|

Mar/25 | $10533 | $11499 | $10584 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years |

Since

Inception |

|---|

KraneShares Asia Pacific High Income USD Bond ETF | 7.93% | 0.69% | 0.77% |

|---|

JP Morgan Asia Credit Index (JACI) (TR) (USD) | 6.63% | 2.07% | 2.85% |

|---|

Custom Blended KHYB Index^ | 10.87% | 0.11% | 0.84% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 25,273,651

|

$ 25,273,651

|

| Holdings Count | Holding |

80

|

80

|

| Advisory Fees Paid, Amount |

|

$ 121,225

|

| InvestmentCompanyPortfolioTurnover |

|

158.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $25,273,651 | 80 | $121,225 | 158% |

|---|

|

| Holdings [Text Block] |

|

Maturity WeightingsFootnote Reference*Footnote Reference^Value | Value |

|---|

Perpetual MaturityFootnote Reference(A) | 23.6% | Greater than 10 Years | 1.1% | 5 to 10 Years | 6.3% | 3 to 5 Years | 14.8% | 1 to 3 Years | 37.5% | Less than 1 Year | 9.9% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. | Footnote^ | This chart does not include cash, and therefore, the investments as a percentage to total net assets (which includes cash) will not add up to 100%. | Footnote(A) | Perpetual security with no stated maturity date. |

|

| Largest Holdings [Text Block] |

|

Holding Name | Coupon Rate | Maturity Date | Percentage of Total

Net Assets |

|---|

Fuqing Investment Management | 3.250%

| 06/23/25

| 2.4% | Mong Duong Finance Holdings BV | 5.125%

| 05/07/29

| 2.2% | Standard Chartered, H15T5Y + 3.135% | 4.300%

| —Footnote Reference(A) | 2.1% | Greentown China Holdings | 8.450%

| 02/24/28

| 2.0% | Pingan Real Estate Capital | 3.450%

| 07/29/26

| 1.9% | Piramal Finance | 7.800%

| 01/29/28

| 1.8% | Yanlord Land HK | 5.125%

| 05/20/26

| 1.7% | VLL International | 7.250%

| 07/20/27

| 1.7% | Golomt Bank | 11.000%

| 05/20/27

| 1.6% | Vedanta Resources Finance II | 10.875%

| 09/17/29

| 1.6% |

| Footnote | Description | Footnote(A) | Perpetual security with no stated maturity date. |

|

| Material Fund Change [Text Block] |

|

This is a summary of certain changes to the Fund since April 1, 2024. For more complete information, you may review the Fund’s prospectus, which is available at https://kraneshares.com/khyb/#documents or upon request at 1-855-857-2638. Effective August 1, 2024, the name of the Fund changed from the “KraneShares Asia Pacific High Income Bond ETF” to the “KraneShares Asia Pacific High Income USD Bond ETF”. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/khyb/

|

| C000210156 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares MSCI Emerging Markets ex China Index ETF

|

| Class Name |

|

KraneShares MSCI Emerging Markets ex China Index ETF

|

| Trading Symbol |

|

KEMX

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares MSCI Emerging Markets ex China Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kemx/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kemx/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares MSCI Emerging Markets ex China Index ETF | $24 | 0.24% |

|---|

|

| Expenses Paid, Amount |

|

$ 24

|

| Expense Ratio, Percent |

|

0.24%

|

| Factors Affecting Performance [Text Block] |

|

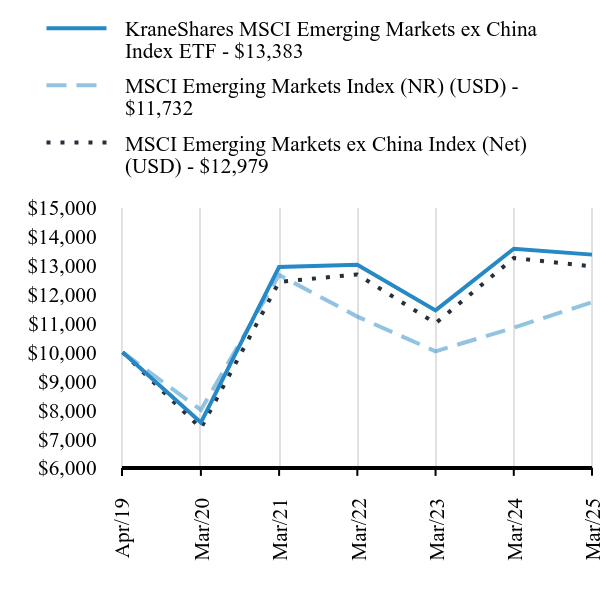

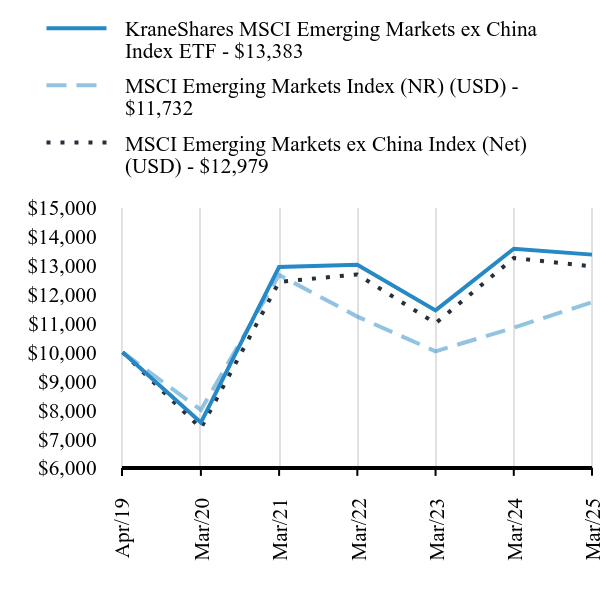

(a) MSCI Emerging Markets ex China Index (b) The Fund is in the Morningstar U.S. ETF Diversified Emerging Markets Category The KraneShares MSCI Emerging Markets ex China Index ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the MSCI Emerging Markets ex China Index (the "Underlying Index"). The Underlying Index is a free float-adjusted market capitalization-weighted index designed to track the equity market performance of mid- and large-cap companies of emerging market countries, excluding China. Emerging Markets equities, excluding China, underperformed both China, as measured by the MSCI China All Shares Index, and the global equity market, as measured by the MSCI ACWI. U.S. dollar strength and the anticipation of increased U.S. tariffs and protectionism weighed on Emerging Markets during the Period. Meanwhile, a re-rating of semiconductor manufacturers after their valuations reached all-time highs and DeepSeek's demonstration that large language models (LLMs) may require significantly fewer chips to train weighed on key semiconductor-producing countries, Taiwan and South Korea. Within the Fund, the best-performing countries were the Czech Republic and Colombia, while the worst-performing countries were Indonesia and Mexico. Within the Fund, the best-performing sectors were Utilities and Financials, while the worst-performing sectors were Materials and Industrials. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares MSCI Emerging Markets ex China Index ETF - $13383 | MSCI Emerging Markets Index (NR) (USD) - $11732 | MSCI Emerging Markets ex China Index (Net) (USD) - $12979 |

|---|

Apr/19 | $10000 | $10000 | $10000 |

|---|

Mar/20 | $7569 | $8005 | $7371 |

|---|

Mar/21 | $12957 | $12679 | $12440 |

|---|

Mar/22 | $13031 | $11238 | $12697 |

|---|

Mar/23 | $11451 | $10036 | $11006 |

|---|

Mar/24 | $13589 | $10854 | $13263 |

|---|

Mar/25 | $13383 | $11732 | $12979 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year | 5 Years |

Since

Inception |

|---|

KraneShares MSCI Emerging Markets ex China Index ETF | -1.51% | 12.07% | 5.00% |

|---|

MSCI Emerging Markets Index (NR) (USD) | 8.09% | 7.94% | 2.71% |

|---|

MSCI Emerging Markets ex China Index (Net) (USD) | -2.14% | 11.98% | 4.46% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 63,995,861

|

$ 63,995,861

|

| Holdings Count | Holding |

291

|

291

|

| Advisory Fees Paid, Amount |

|

$ 170,053

|

| InvestmentCompanyPortfolioTurnover |

|

3.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $63,995,861 | 291 | $170,053 | 3% |

|---|

|

| Holdings [Text Block] |

|

Country WeightingsFootnote Reference*Value | Value |

|---|

Other Countries | 5.4% | Qatar | 1.2% | United Arab Emirates | 1.3% | Thailand | 1.6% | Poland | 2.1% | Malaysia | 2.4% | Indonesia | 2.4% | Mexico | 3.7% | South Africa | 6.5% | Brazil | 7.0% | South Korea | 15.8% | India | 22.3% | Taiwan | 28.1% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net Assets |

|---|

Taiwan Semiconductor Manufacturing | | | 11.9% | Samsung Electronics | | | 3.7% | ICICI Bank | | | 1.8% | HDFC Bank | | | 1.7% | Infosys ADR | | | 1.7% | SK Hynix | | | 1.5% | MediaTek | | | 1.5% | Bharti Airtel | | | 1.4% | Hon Hai Precision Industry | | | 1.3% | Naspers, Cl N | | | 1.3% |

|

| Material Fund Change [Text Block] |

|

There were no material changes during the reporting period. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kemx/

|

| C000214065 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares Global Carbon Strategy ETF

|

| Class Name |

|

KraneShares Global Carbon Strategy ETF

|

| Trading Symbol |

|

KRBN

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares Global Carbon Strategy ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/krbn/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/krbn/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares Global Carbon Strategy ETF | $78 | 0.79% |

|---|

|

| Expenses Paid, Amount |

|

$ 78

|

| Expense Ratio, Percent |

|

0.79%

|

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 172,178,220

|

$ 172,178,220

|

| Holdings Count | Holding |

9

|

9

|

| Advisory Fees Paid, Amount |

|

$ 2,032,003

|

| InvestmentCompanyPortfolioTurnover |

|

45.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $172,178,220 | 9 | $2,032,003 | 45% |

|---|

|

| Holdings [Text Block] |

|

Market ExposureFootnote Reference*Futures Contracts: | |

|---|

Futures Contract | 103.4% |

|---|

Collateral and Currency Management: | |

|---|

Short-Term Investment, GVMXX | 0.1% |

|---|

Exchange-Traded FundFootnote Reference** | 68.3% |

|---|

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. All Investments are presented at market value with the exception of future contracts which are presented at the notional amount. | Footnote** | Affiliated Investment |

|

| Largest Holdings [Text Block] |

|

Futures BreakdownFootnote Reference^Value | Value |

|---|

CCA 2025 Future | 20.0% | REG 2025 Future | 5.0% | CCA 2026 Future | 5.0% | EUA 2025 Future | 54.9% | EUA 2026 Future | 5.0% | UKA 2025 Future | 5.0% | WSH 2025 Future | 5.1% |

| Footnote | Description | Footnote^ | Percentages are calculated based on total notional value. Future contracts are presented at the notional value. |

|

| Updated Prospectus Web Address |

|

https://kraneshares.com/krbn/

|

| C000222186 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares Value Line<sup style="box-sizing: border-box; color: rgb(38, 137, 197); display: inline; flex-wrap: nowrap; font-size: 16px; font-weight: 700; grid-area: auto; line-height: 0px; margin: 0px; overflow: visible; position: relative; text-align: left; white-space-collapse: preserve-breaks;">®</sup> Dynamic Dividend Equity Index ETF

|

| Trading Symbol |

|

KVLE

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares Value Line® Dynamic Dividend Equity Index ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kvle/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kvle/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|

KraneShares Value Line® Dynamic Dividend Equity Index ETF | $59 | 0.56% |

|---|

|

| Expenses Paid, Amount |

|

$ 59

|

| Expense Ratio, Percent |

|

0.56%

|

| Factors Affecting Performance [Text Block] |

|

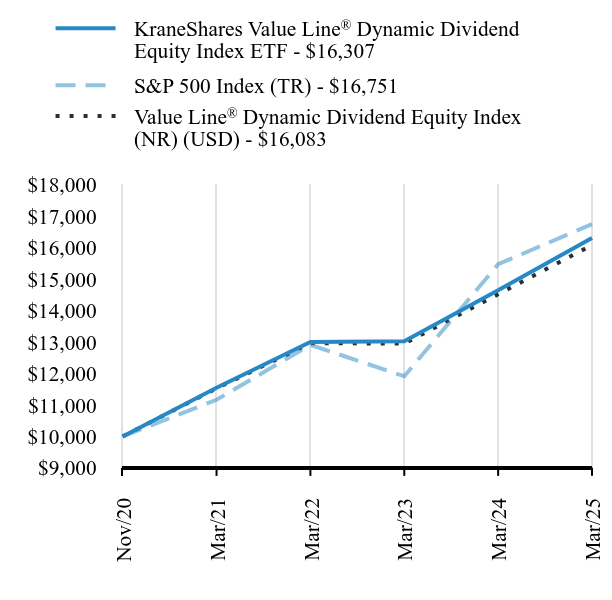

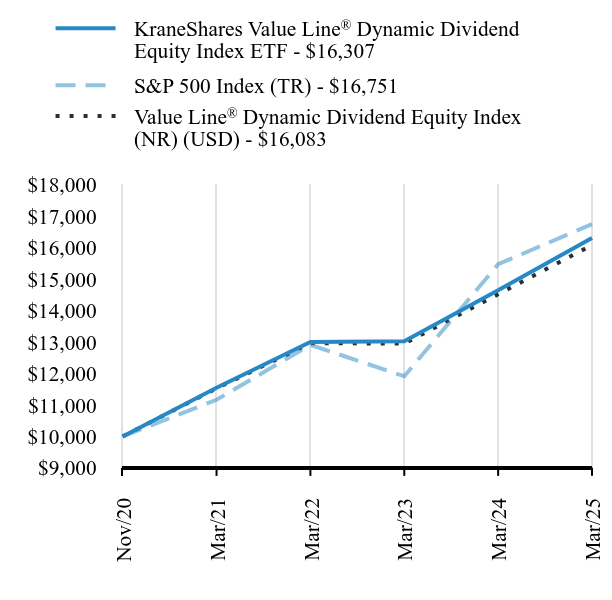

(a) Value Line® Dynamic Dividend Equity Index (b) The Fund is in the Morningstar U.S. ETF Large Value Category The KraneShares Value Line® Dynamic Dividend Equity Index ETF seeks to provide investment results that correspond generally to the price and yield performance of the Value Line® Dynamic Dividend Equity Index (the "Underlying Index"). The Underlying Index introduces a market-adaptive approach to investing in U.S. large-cap companies. The strategy seeks to identify U.S. companies whose equity securities pay a high dividend yield and are the highest rated by Value Line®'s Safety™ and Timeliness™ Ranking Systems. Careful quantitative modeling, which incorporates a unique set of risk management tools, adjusts the beta of the overall portfolio based on the market environment. The index is rebalanced monthly. During the Period, large-cap, high-dividend, diversified U.S. stocks outperformed global equities, as represented by the MSCI ACWI, and outperformed broad U.S. equities, as measured by the S&P 500 Index. The Fund's sector-neutral approach proved valuable when high concentrations in other U.S. indexes led them to underperform as uncertainties rose in the first quarter of 2025. Within the Fund, the best-performing sectors were Utilities and Energy, while the worst-performing sectors were Materials and Consumer Discretionary. The deviation between the Fund's performance and that of the Underlying Index can be mainly attributed to management fees paid by the Fund. |

| Performance Past Does Not Indicate Future [Text] |

|

Past performance is not indicative of future performance.

|

| Line Graph [Table Text Block] |

|

| KraneShares Value Line® Dynamic Dividend Equity Index ETF - $16307 | S&P 500 Index (TR) - $16751 | Value Line® Dynamic Dividend Equity Index (NR) (USD) - $16083 |

|---|

Nov/20 | $10000 | $10000 | $10000 |

|---|

Mar/21 | $11546 | $11165 | $11529 |

|---|

Mar/22 | $13003 | $12912 | $12966 |

|---|

Mar/23 | $13027 | $11914 | $12950 |

|---|

Mar/24 | $14650 | $15474 | $14522 |

|---|

Mar/25 | $16307 | $16751 | $16083 |

|---|

|

| Average Annual Return [Table Text Block] |

|

Fund/Index Name | 1 Year |

Since

Inception |

|---|

KraneShares Value Line® Dynamic Dividend Equity Index ETF | 11.31% | 11.89% |

|---|

S&P 500 Index (TR) | 8.25% | 12.58% |

|---|

Value Line® Dynamic Dividend Equity Index (NR) (USD) | 10.75% | 11.53% |

|---|

|

| No Deduction of Taxes [Text Block] |

|

The table and graph presented above do not reflect the deduction of taxes a shareholder would pay on Fund distributions or the redemption of Fund shares.

|

| AssetsNet |

$ 28,483,315

|

$ 28,483,315

|

| Holdings Count | Holding |

80

|

80

|

| Advisory Fees Paid, Amount |

|

$ 172,898

|

| InvestmentCompanyPortfolioTurnover |

|

80.00%

|

| Additional Fund Statistics [Text Block] |

|

Key Fund Statistics as of March 31, 2025 | Total Net Assets | Number of Holdings | Total Advisory Fees Paid | Portfolio Turnover Rate |

|---|

| $28,483,315 | 80 | $172,898 | 80% |

|---|

|

| Holdings [Text Block] |

|

Sector WeightingsFootnote Reference*Value | Value |

|---|

Real Estate | 2.2% | Materials | 2.4% | Utilities | 5.0% | Consumer Staples | 7.6% | Consumer Discretionary | 7.7% | Energy | 8.8% | Communication Services | 9.9% | Health Care | 10.4% | Financials | 10.6% | Industrials | 12.6% | Information Technology | 22.6% |

| Footnote | Description | Footnote* | Percentages are calculated based on total net assets. |

|

| Largest Holdings [Text Block] |

|

Holding Name | | | Percentage of

Total Net Assets |

|---|

Microsoft | | | 5.4% | NVIDIA | | | 5.4% | Apple | | | 5.0% | Alphabet, Cl C | | | 4.4% | Amazon.com | | | 2.4% | Home Depot | | | 2.3% | Visa, Cl A | | | 2.1% | Cisco Systems | | | 1.9% | Comcast, Cl A | | | 1.8% | Goldman Sachs Group | | | 1.8% |

|

| Material Fund Change [Text Block] |

|

There were no material changes during the reporting period. |

| Updated Prospectus Web Address |

|

https://kraneshares.com/kvle/

|

| C000223083 |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

|

KraneShares Mount Lucas Managed Futures Index Strategy ETF

|

| Class Name |

|

KraneShares Mount Lucas Managed Futures Index Strategy ETF

|

| Trading Symbol |

|

KMLM

|

| Security Exchange Name |

|

NYSEArca

|

| Annual or Semi-Annual Statement [Text Block] |

|

This annual shareholder report contains important information about the KraneShares Mount Lucas Managed Futures Index Strategy ETF (the "Fund") for the period from April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

|

Annual Shareholder Report

|

| Additional Information [Text Block] |

|

You can find additional information about the Fund at https://kraneshares.com/kmlm/. You can also request this information by contacting us at 1-855-857-2638.

|

| Additional Information Phone Number |

|

1-855-857-2638

|

| Additional Information Website |

|

https://kraneshares.com/kmlm/

|

| Expenses [Text Block] |

|

What were the Fund costs for the last year?(based on a hypothetical $10,000 investment) Fund Name | Costs of a $10,000 investment | Costs paid as a percentage of a $10,000 investment |

|---|