What were the Fund costs for the past year?

(based on a hypothetical $10,000 investment)

| Fund Name | Costs of a $10,000 | Costs paid as a |

| OTG Latin America Fund | $258 | 2.69% |

How did the Fund Perform last year?

The OTG Latin America Fund (the “Fund”) returned -8.15%, excluding the impact of the maximum sales charge for the period April 1, 2024 through March 31, 2025, compared to its benchmark the MSCI EM Latin America Index which performed -18.55%.

The Fund was launched to provide an investment vehicle focused on opportunities in the Latin America region. The investment strategy is supported by a research team located within the region, allowing for a localized approach to identifying portfolio companies.

Latin America has historically exhibited characteristics such as a relatively young workforce, ongoing population growth, an expanding middle class, and unmet needs in sectors like infrastructure, housing, telecommunications, and financial services. These factors have contributed to increased internal demand for goods and services within and across the region. Regional companies have responded by addressing a more integrated market and seeking efficiencies that support greater scale and competitiveness.

Factors which influenced performance

Latin America markets have sharply underperformed broader Emerging and Developed markets during this period, with losses not only in stocks but in currency indexes as well.

Thanks to our flexible investment approach in asset allocation and a more diversified country investment within the Region, The Fund was able to outperform its benchmark by nearly 500 points. Additionally, maintaining a cash position between 20% to 30% during these turbulent times allowed us to effectively manage volatility.

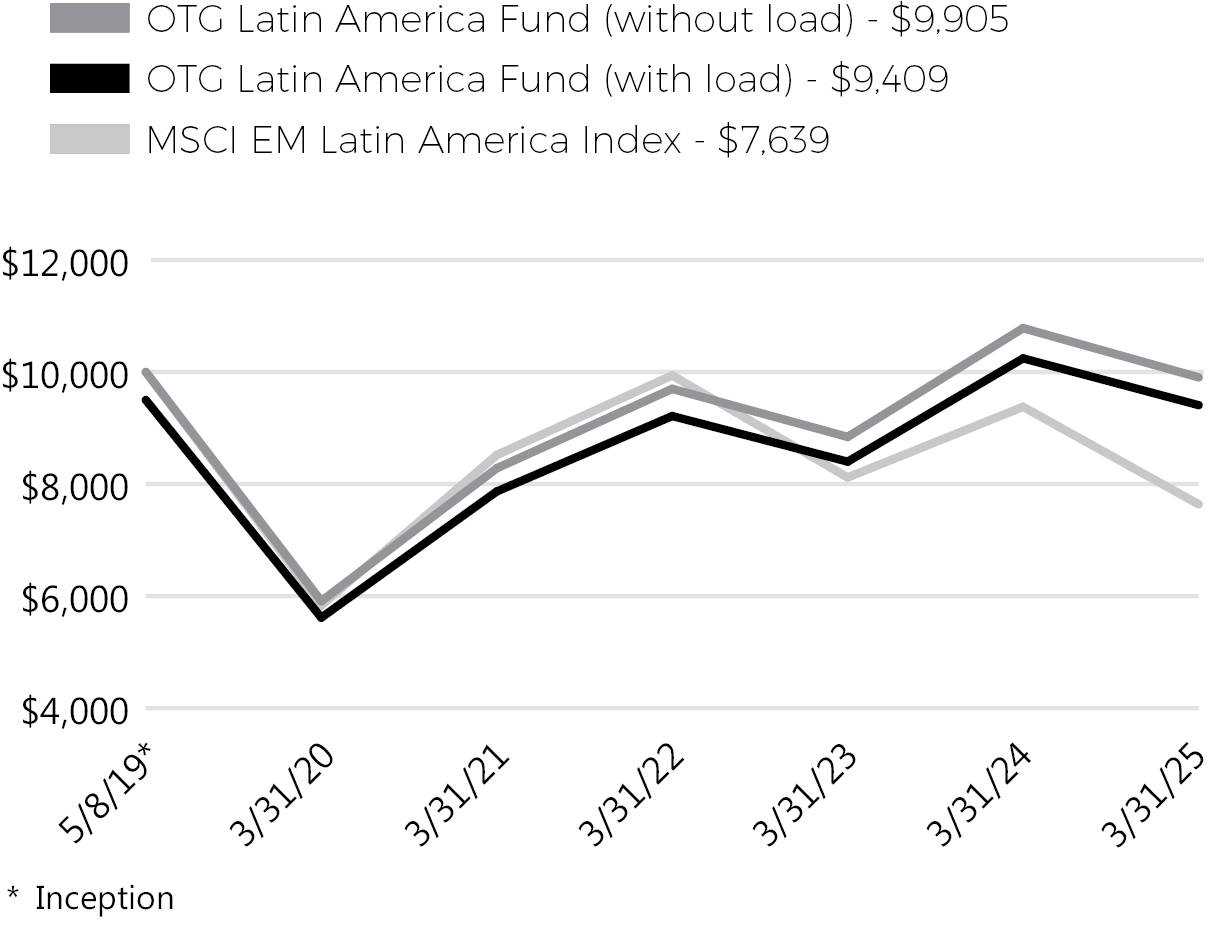

Cumulative Performance

(based on a hypothetical $10,000 investment)

Annual Performance

| 1 Year | 5 Year | Since | |

| OTG Latin America Fund (without load) | -8.15% | 10.88% | -0.16% |

| OTG Latin America Fund (with load) | -12.74% | 9.75% | -1.03% |

| MSCI EM Latin America Index | -18.55% | 5.54% | -4.46% |

The MSCI Emerging Markets Latin America Index captures large and mid cap representation across 6 Emerging Markets (EM) countries in Latin America. With 112 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Visit https://otgam.net/products/mutual-fund/latin-america-fund-otgax for more recent performance information.

The Fund’s past performance is not a good predictor of how the Fund will perform in the future. The graph and table do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or redemption of Fund shares.

The MSCI Emerging Markets Latin America Index captures large and mid cap representation across 6 Emerging Markets (EM) countries in Latin America. With 112 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

Key Fund Statistics

(as of March 31, 2025)

| Fund Net Assets | $16,797,715 |

| Number of Holdings | 44 |

| Total Advisory Fee Paid | $49,869 |

| Portfolio Turnover Rate | 47.80% |

Sector Breakdown

Top 10 Holdings

| Morgan Stanley Institutional Liquid Government Fund - Institutional Class | 7.52% |

| Cencosud SA | 4.14% |

| Vale SA | 3.76% |

| Intercorp Financial Services, Inc. | 3.58% |

| Wal Mart de Mexico S.A.B. de C.V. | 3.54% |

| Cemex S.A.B. de C.V. | 3.53% |

| Ambev SA | 3.50% |

| Banco Bradesco SA | 3.31% |

| Banco Itaú Chile | 3.24% |

| SMU SA | 3.20% |