Shareholder Report

|

12 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

|

| Document Type |

N-CSR

|

|

| Amendment Flag |

false

|

|

| Registrant Name |

BlackRock Allocation Target Shares

|

|

| Entity Central Index Key |

0001221845

|

|

| Entity Investment Company Type |

N-1A

|

|

| Document Period End Date |

Mar. 31, 2025

|

|

| C000003891 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BATS: Series C Portfolio

|

|

| Class Name |

BATS: Series C Portfolio

|

|

| Trading Symbol |

BRACX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BATS: Series C Portfolio (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

|

| Additional Information Phone Number |

(800) 441‑7762

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| BATS: Series C Portfolio |

$0(a) |

0.00%(b) |

| (a) |

Rounds to less than $1. |

| (b) |

Rounds to less than 0.01%. |

|

|

| Expenses Paid, Amount |

$ 0

|

[1] |

| Expense Ratio, Percent |

0.00%

|

[2] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund returned 4.73%. -

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 4.88% and the Bloomberg U.S. Credit Index returned 4.87%. What contributed to performance? The Fund’s allocations to the banking, utilities and technology sectors were the leading contributors. What detracted from performance? The Fund’s duration and yield curve positioning was the largest detractor, followed by allocations to the consumer services sector and non-U.S. government debt. (Duration is a measure of interest rate sensitivity). The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

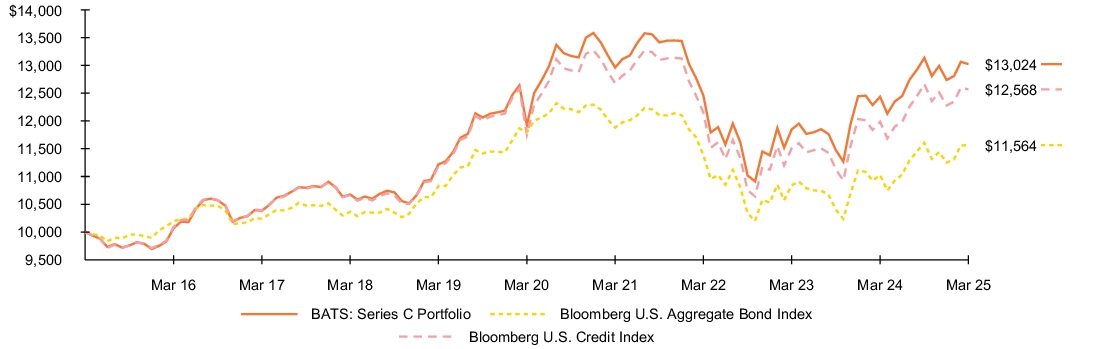

Fund performance Cumulative performance: April 1, 2015 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| BATS: Series C Portfolio |

4.73 |

% |

1.78 |

% |

2.68 |

% |

| Bloomberg U.S. Aggregate Bond Index |

4.88 |

|

(0.40 |

) |

1.46 |

|

| Bloomberg U.S. Credit Index |

4.87 |

|

1.35 |

|

2.31 |

|

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

|

| Net Assets |

$ 439,499,546

|

|

| Holdings Count | Holding |

837

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

446.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$439,499,546 |

| Number of Portfolio Holdings |

837 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

446% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments(a) |

|

| Corporate Bonds |

88.9 |

% |

| Preferred Securities |

3.3 |

% |

| U.S. Treasury Obligations |

3.0 |

% |

| Foreign Government Obligations |

3.0 |

% |

| Foreign Agency Obligations |

0.9 |

% |

| Municipal Bonds |

0.9 |

% | Credit quality allocation

| Credit Rating(b) |

Percent of Total

Investments(a) |

|

| AAA/Aaa(c) |

3.0 |

% |

| AA/Aa |

5.4 |

% |

| A |

27.0 |

% |

| BBB/Baa |

61.1 |

% |

| BB/Ba |

2.3 |

% |

| N/R |

1.2 |

% |

| (a) |

Excludes short-term securities, short investments and options, if any. |

| (b) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (c) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

|

|

| Credit Quality Explanation [Text Block] |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| C000003892 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BATS: Series M Portfolio

|

|

| Class Name |

BATS: Series M Portfolio

|

|

| Trading Symbol |

BRAMX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BATS: Series M Portfolio (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

|

| Additional Information Phone Number |

(800) 441‑7762

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| BATS: Series M Portfolio |

$0(a) |

0.00%(b) |

| (a) |

Rounds to less than $1. |

| (b) |

Rounds to less than 0.01%. |

|

|

| Expenses Paid, Amount |

$ 0

|

[3] |

| Expense Ratio, Percent |

0.00%

|

[4] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund returned 5.96%. -

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 4.88% and the Bloomberg MBS Index returned 5.39%. What contributed to performance? Out-of-benchmark allocations to commercial mortgage-backed securities were a leading contributor to performance. Agency mortgage derivatives and fixed rate collateralized mortgage obligations also contributed positively. Within residential mortgage-backed securities, the Fund’s active benchmark strategy, which implements relative value decisions between specified pools and to-be-announced securities (“TBAs”) contributed positively to performance. What detracted from performance? The Fund’s active management of duration and corresponding sensitivity to changes in interest rates detracted modestly from performance over the period. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

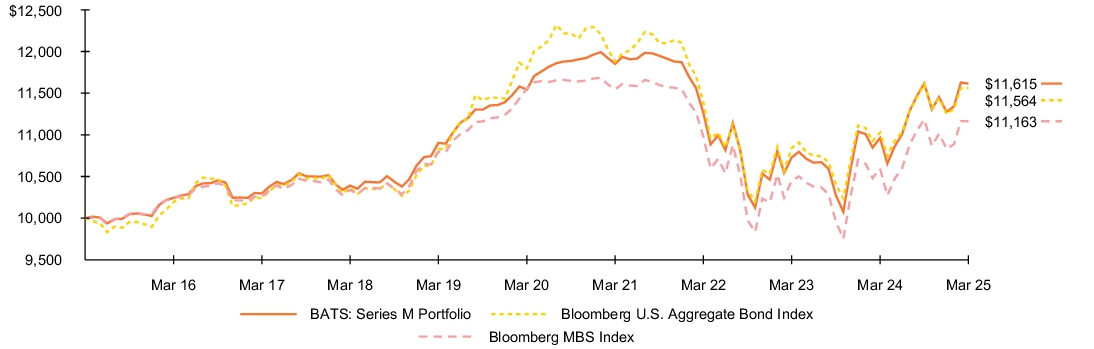

Fund performance Cumulative performance: April 1, 2015 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| BATS: Series M Portfolio |

5.96 |

% |

0.13 |

% |

1.51 |

% |

| Bloomberg U.S. Aggregate Bond Index |

4.88 |

|

(0.40 |

) |

1.46 |

|

| Bloomberg MBS Index |

5.39 |

|

(0.69 |

) |

1.11 |

|

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

|

| Net Assets |

$ 1,295,016,533

|

|

| Holdings Count | Holding |

1,145

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

892.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$1,295,016,533 |

| Number of Portfolio Holdings |

1,145 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

892% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments(a) |

|

| U.S. Government Sponsored Agency Securities |

93.1 |

% |

| Non-Agency Mortgage-Backed Securities |

5.4 |

% |

| Asset-Backed Securities |

1.5 |

% | Credit quality allocation

| Credit Rating(b) |

Percent of Total

Investments(a) |

|

| AAA/Aaa(c) |

97.3 |

% |

| AA/Aa |

0.2 |

% |

| A |

0.2 |

% |

| BBB/Baa |

0.1 |

% |

| N/R |

2.2 |

% |

| (a) |

Excludes short-term securities, short investments and options, if any. |

| (b) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (c) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

|

|

| Credit Quality Explanation [Text Block] |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| C000003893 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BATS: Series S Portfolio

|

|

| Class Name |

BATS: Series S Portfolio

|

|

| Trading Symbol |

BRASX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BATS: Series S Portfolio (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

|

| Additional Information Phone Number |

(800) 441‑7762

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| BATS: Series S Portfolio |

$0(a) |

0.00%(b) |

| (a) |

Rounds to less than $1. |

| (b) |

Rounds to less than 0.01%. |

|

|

| Expenses Paid, Amount |

$ 0

|

[5] |

| Expense Ratio, Percent |

0.00%

|

[6] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund returned 6.31%. -

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 4.88% and the ICE BofA 1-3 Year U.S. Treasury Index returned 5.43%. What contributed to performance? The Fund’s allocation to investment-grade corporate bonds made the largest contribution to absolute performance. Allocations to asset-backed securities, U.S. Treasuries, agency residential mortgage-backed securities, and commercial mortgage-backed securities positively impacted returns, as well. What detracted from performance? At a time of positive performance for the Fund, no aspects of its positioning stood out as meaningful detractors. However, certain individual securities posted negative absolute returns in the period. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

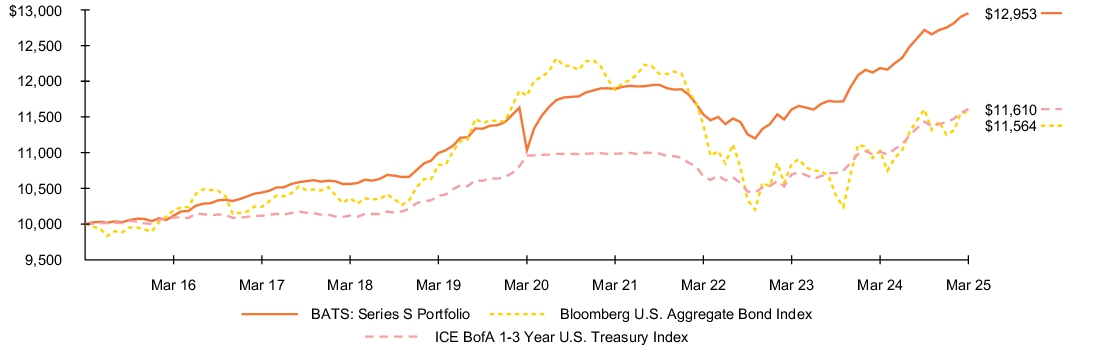

Fund performance Cumulative performance: April 1, 2015 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| BATS: Series S Portfolio |

6.31 |

% |

3.26 |

% |

2.62 |

% |

| Bloomberg U.S. Aggregate Bond Index |

4.88 |

|

(0.40 |

) |

1.46 |

|

| ICE BofA 1-3 Year U.S. Treasury Index |

5.43 |

|

1.16 |

|

1.50 |

|

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Prior Market Index Comparison [Text Block] |

An index that is a subset of ICE BofA US Treasury Index including all securities with a remaining term to final maturity less than 3 years. On December 1, 2023, the Fund began to compare its performance to the standard pricing time of the ICE BofA 1-3 Year U.S. Treasury Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for a custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023.

|

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

|

| Net Assets |

$ 364,929,043

|

|

| Holdings Count | Holding |

666

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

162.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$364,929,043 |

| Number of Portfolio Holdings |

666 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

162% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments(a) |

|

| Corporate Bonds |

33.5 |

% |

| Asset-Backed Securities |

24.0 |

% |

| U.S. Treasury Obligations |

16.9 |

% |

| Non-Agency Mortgage-Backed Securities |

14.2 |

% |

| U.S. Government Sponsored Agency Securities |

11.0 |

% |

| Foreign Government Obligations |

0.4 |

% | Credit quality allocation

| Credit Rating(b) |

Percent of Total

Investments |

|

| AAA/Aaa(c) |

61.4 |

% |

| AA/Aa |

1.7 |

% |

| A |

12.9 |

% |

| BBB/Baa |

19.0 |

% |

| N/R |

5.0 |

% |

| (a) |

Excludes short-term securities, short investments and options, if any. |

| (b) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (c) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

|

|

| Credit Quality Explanation [Text Block] |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| C000032703 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BATS: Series P Portfolio

|

|

| Class Name |

BATS: Series P Portfolio

|

|

| Trading Symbol |

BATPX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BATS: Series P Portfolio (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

|

| Additional Information Phone Number |

(800) 441‑7762

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| BATS: Series P Portfolio |

$0(a) |

0.00%(b) |

| (a) |

Rounds to less than $1. |

| (b) |

Rounds to less than 0.01%. |

|

|

| Expenses Paid, Amount |

$ 0

|

[7] |

| Expense Ratio, Percent |

0.00%

|

[8] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund returned 6.75%. -

For the same period, the Bloomberg U.S. Aggregate Bond Index returned 4.88% and the Bloomberg U.S. Treasury 7-10 Year Bond Index returned 4.65%. What contributed to performance? Allocations to cash and cash-like securities made the largest contribution to Fund performance. The Fund held cash as collateral in conjunction with its investments in U.S. Treasury futures and interest rate swaps. The use and cost of derivatives will result in a negative contribution to returns when interest rates fall; however, the Fund’s strategy is designed to offset these costs by holding shares of BlackRock Allocation Target Shares: Series S Portfolio (“Series S Portfolio”), a short-term proprietary fund. The use of derivatives is necessary to achieve the Fund’s objective and should therefore be evaluated in a portfolio context and not as a standalone strategy. The Fund’s use of derivatives contributed to results. The Fund’s position in the Series S Portfolio also contributed positively. What detracted from performance? At a time of positive performance for the Fund, no aspects of its positioning stood out as meaningful detractors. However, certain individual securities in BlackRock Allocation Target Shares Series S posted negative absolute returns during the reporting period. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

| Line Graph [Table Text Block] |

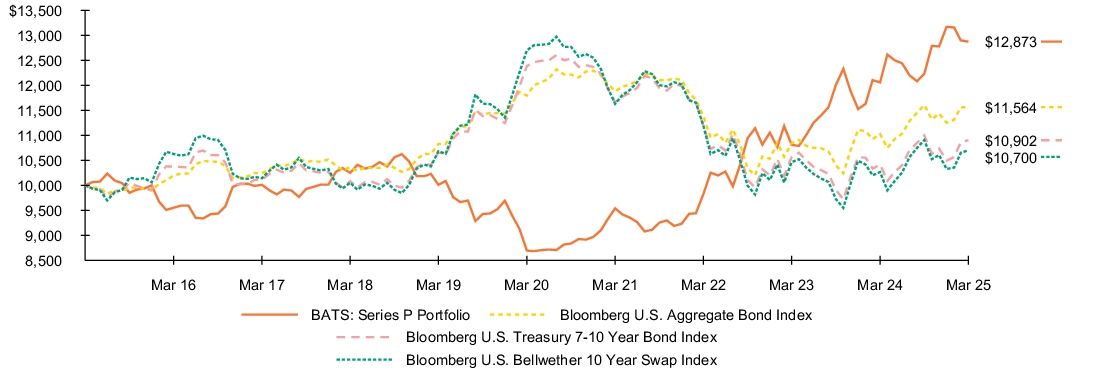

Fund performance Cumulative performance: April 1, 2015 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| BATS: Series P Portfolio |

6.75 |

% |

8.17 |

% |

2.56 |

% |

| Bloomberg U.S. Aggregate Bond Index |

4.88 |

|

(0.40 |

) |

1.46 |

|

| Bloomberg U.S. Treasury 7-10 Year Bond Index |

4.65 |

|

(2.52 |

) |

0.87 |

|

| Bloomberg U.S. Bellwether 10 Year Swap Index |

4.24 |

|

(3.37 |

) |

0.68 |

|

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

|

| Net Assets |

$ 3,481,645

|

|

| Holdings Count | Holding |

16

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

134.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$3,481,645 |

| Number of Portfolio Holdings |

16 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

134% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments |

|

| Fixed-Income Funds |

21.0 |

% |

| Short-Term Securities |

79.0 |

% |

|

|

| C000144517 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BATS: Series E Portfolio

|

|

| Class Name |

BATS: Series E Portfolio

|

|

| Trading Symbol |

BATEX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BATS: Series E Portfolio (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

|

| Additional Information Phone Number |

(800) 441‑7762

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| BATS: Series E Portfolio |

$0(a) |

0.05% |

| (a) |

Rounds to less than $1. |

|

|

| Expenses Paid, Amount |

$ 0

|

[9] |

| Expense Ratio, Percent |

0.05%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund returned 5.05%. -

For the same period, the Bloomberg Municipal Bond Index returned 1.22% and the Bloomberg Municipal High Yield Bond Index returned 5.59%. What contributed to performance? On a sector basis, other industries, utilities and healthcare were the largest contributors to absolute performance. In terms of ratings categories, non-rated bonds—which had a 41% portfolio weighting at the close of the period—were the largest contributors by a wide margin. More generally, high yield bonds outperformed investment-grade securities. Bonds with maturities of 25 years and longer were also significant contributors. At the individual holding level, the Fund benefitted from strong total returns for Puerto Rico Electric Power Authority bonds, Puerto Rico contingent value securities, and the bonds of Brightline East and Brightline West (which were issued to finance a high-speed rail project between Las Vegas and Southern California). What detracted from performance? At a time of positive performance for the Fund, no sector, rating, maturity, or coupon category experienced a negative total return. A few individual tobacco bonds posted losses due to declining consumption figures, but the Fund’s overall position in the sector nonetheless delivered a gain. Short-duration, high-grade securities, while producing gains in absolute terms, made the smallest contribution. The Fund’s cash weighting was slightly elevated as of March 31, 2025. Cash yields remained attractive, and the securities provided stability to the Fund in periods of volatility. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

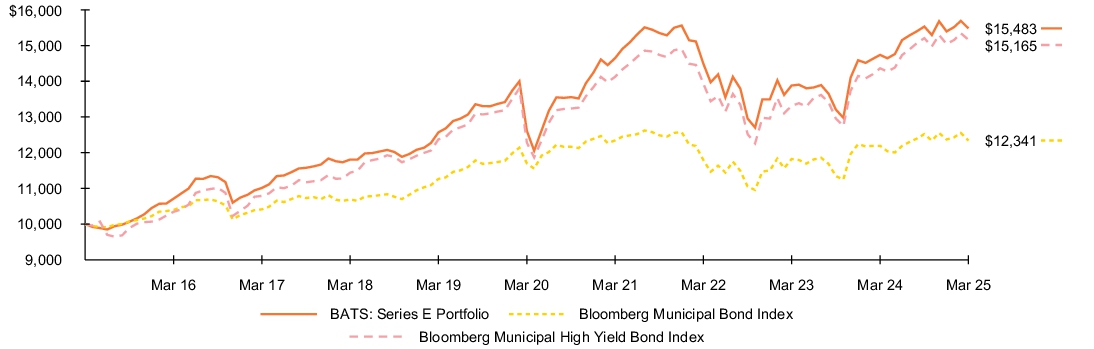

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: April 1, 2015 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

10 Years |

|

| BATS: Series E Portfolio |

5.05 |

% |

4.19 |

% |

4.47 |

% |

| Bloomberg Municipal Bond Index |

1.22 |

|

1.07 |

|

2.13 |

|

| Bloomberg Municipal High Yield Bond Index |

5.59 |

|

4.31 |

|

4.25 |

|

| Customized Reference Benchmark |

4.05 |

|

3.31 |

|

N/A |

|

| Customized Reference Benchmark (prior) |

2.73 |

|

2.21 |

|

N/A |

|

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Prior Market Index Comparison [Text Block] |

Beginning July 29, 2024, the Fund started to compare its performance to that of the Customized Reference Benchmark comprised of 60% Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index, 20% Bloomberg Municipal Bond Rated Baa Index, and 20% Bloomberg Municipal Investment Grade ex BBB. Fund management believes that the new benchmark is more representative of the types of investments held within the Fund. The Customized Reference Benchmark commenced on September 30, 2016. Prior to July 29, 2024, the Fund compared its performance to that of the prior Customized Reference Benchmark, which is comprised of the Bloomberg Municipal Bond Index Total Return Index Value Unhedged (65%) and the Bloomberg Municipal Bond: High Yield (non-Investment Grade) Total Return Index (35%). The prior Customized Reference Benchmark commenced on September 30, 2016.

|

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

|

| Net Assets |

$ 527,280,263

|

|

| Holdings Count | Holding |

655

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

23.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$527,280,263 |

| Number of Portfolio Holdings |

655 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

23% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Sector allocation

| Sector |

Percent of Total

Investments |

|

| County/City/Special District/School District |

35.9 |

% |

| Transportation |

17.0 |

% |

| Utilities |

14.7 |

% |

| Health Care |

11.3 |

% |

| Education |

10.6 |

% |

| Housing |

5.9 |

% |

| Tobacco |

4.6 |

% | Credit quality allocation

| Credit Rating(a) |

Percent of Total

Investments |

|

| AAA/Aaa |

2.8 |

% |

| AA/Aa |

16.7 |

% |

| A |

11.8 |

% |

| BBB/Baa |

10.5 |

% |

| BB/Ba |

7.9 |

% |

| B |

1.5 |

% |

| CCC/Caa |

0.3 |

% |

| N/R |

48.5 |

% |

| (a) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| C000146955 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BATS: Series A Portfolio

|

|

| Class Name |

BATS: Series A Portfolio

|

|

| Trading Symbol |

BATAX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BATS: Series A Portfolio (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

|

| Additional Information Phone Number |

(800) 441‑7762

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| BATS: Series A Portfolio |

$0(a) |

0.01% |

| (a) |

Rounds to less than $1. |

|

|

| Expenses Paid, Amount |

$ 0

|

[10] |

| Expense Ratio, Percent |

0.01%

|

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund returned 8.11%. -

For the same period, the Bloomberg U.S. Universal Index returned 5.24% and the Reference Benchmark returned 6.51%. What contributed to performance? All securitized asset classes contributed positively to the Fund’s performance. Contributions were led by exposure to non-agency residential mortgage-backed securities, particularly those backed by near prime, non-performing/re-performing and subprime loans. This was followed by holdings of single asset/single borrower senior tranches within commercial mortgage-backed securities and AAA-rated collateralized loan obligations (“CLOs”), as those categories posted the largest gains over the period. Allocations to AA-rated CLOs, private student loan asset-backed securities (“ABS”) and unsecured consumer ABS also showed positive returns. The Fund held some private whole loan securities including commercial mortgage loans and consumer whole loans. These private holdings also produced positive returns. What detracted from performance? There were no material detractors from the Fund’s performance during the reporting period. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

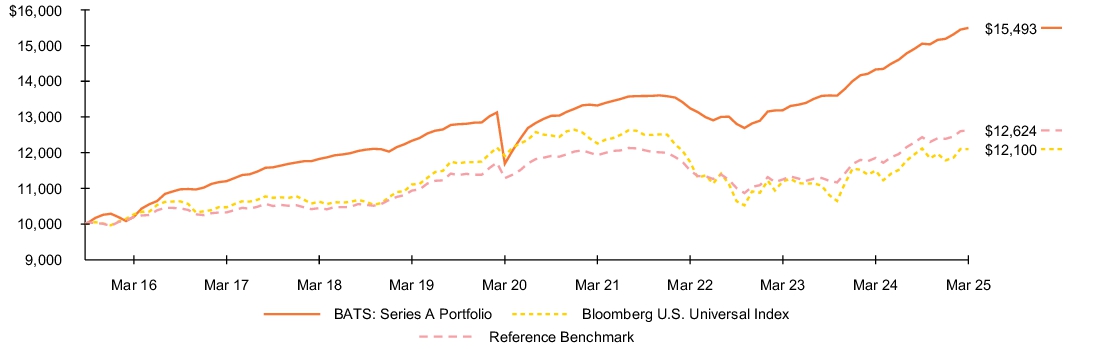

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: September 21, 2015 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

5 Years |

|

Since Fund

Inception |

|

| BATS: Series A Portfolio |

8.11 |

% |

5.79 |

% |

4.70 |

% |

| Bloomberg U.S. Universal Index |

5.24 |

|

0.32 |

|

2.02 |

|

| Reference Benchmark |

6.51 |

|

2.27 |

|

2.48 |

|

|

|

| Performance Inception Date |

Sep. 21, 2015

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

|

| Net Assets |

$ 3,576,385,769

|

|

| Holdings Count | Holding |

1,753

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

50.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$3,576,385,769 |

| Number of Portfolio Holdings |

1,753 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

50% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments(a) |

|

| Non-Agency Mortgage-Backed Securities |

50.0 |

% |

| Asset-Backed Securities |

49.3 |

% |

| U.S. Government Sponsored Agency Securities |

0.4 |

% |

| Floating Rate Loan Interests |

0.3 |

% |

| Corporate Bonds |

— |

%(b) | Credit quality allocation

| Credit Rating(c) |

Percent of Total

Investments(a) |

|

| AAA/Aaa(d) |

36.5 |

% |

| AA/Aa |

5.2 |

% |

| A |

2.8 |

% |

| BBB/Baa |

2.9 |

% |

| BB/Ba |

3.4 |

% |

| B |

0.8 |

% |

| CCC/Caa |

1.7 |

% |

| CC/Ca |

1.2 |

% |

| C |

0.9 |

% |

| D |

0.1 |

% |

| N/R |

44.5 |

% |

| (a) |

Excludes short-term securities, short investments and options, if any. |

| (b) |

Rounds to less than 0.1%. |

| (c) |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change. |

| (d) |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa. |

|

|

| Credit Quality Explanation [Text Block] |

The investment adviser evaluates the credit quality of unrated investments based upon certain factors including, but not limited to, credit ratings for similar investments and financial analysis of sectors, individual investments and/or issuers. Using this approach, the investment adviser has deemed unrated U.S. Government Sponsored Agency Securities and U.S. Treasury Obligations to be of similar credit quality as investments rated AAA/Aaa.

|

|

| Credit Ratings Selection [Text Block] |

For purposes of this report, credit quality ratings shown above reflect the highest rating assigned by either S&P Global Ratings or Moody’s Investors Service, Inc. if ratings differ. These rating agencies are independent, nationally recognized statistical rating organizations and are widely used. Investment grade ratings are credit ratings of BBB/Baa or higher. Below investment grade ratings are credit ratings of BB/Ba or lower. Investments designated N/R are not rated by either rating agency. Unrated investments do not necessarily indicate low credit quality. Credit quality ratings are subject to change.

|

|

| C000227189 [Member] |

|

|

| Shareholder Report [Line Items] |

|

|

| Fund Name |

BATS: Series V Portfolio

|

|

| Class Name |

BATS: Series V Portfolio

|

|

| Trading Symbol |

BATVX

|

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BATS: Series V Portfolio (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

|

| Additional Information Phone Number |

(800) 441‑7762

|

|

| Additional Information Website |

blackrock.com/fundreports

|

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Fund name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| BATS: Series V Portfolio |

$0(a) |

0.00%(b) |

| (a) |

Rounds to less than $1. |

| (b) |

Rounds to less than 0.01%. |

|

|

| Expenses Paid, Amount |

$ 0

|

[11] |

| Expense Ratio, Percent |

0.00%

|

[12] |

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund returned 3.23%. -

For the same period, the Bloomberg Municipal Bond Index returned 1.22% and the SIFMA Municipal Swap Index returned 3.21%. What contributed to performance? The Fund maintained high levels of liquidity while providing an attractive yield primarily through its holdings of variable rate demand notes (“VRDNs”). The Fund also opportunistically laddered maturities in holdings of attractive municipal commercial paper and select fixed-rate, tax-backed local credits, through both municipal notes and bonds. The Fund maintained its bias for daily and weekly reset VRDNs while also holding select longer-dated commercial paper and municipal notes. The Fund’s weighted average maturity (“WAM”) of 29 days remained longer than the benchmark WAM of 7 days, as the Fund took advantage of opportunities presented by interest rate volatility to purchase fixed-rate securities when their yields appeared attractive relative to expected VRDN yields. What detracted from performance? There were no material detractors from the Fund’s performance during the reporting period. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

|

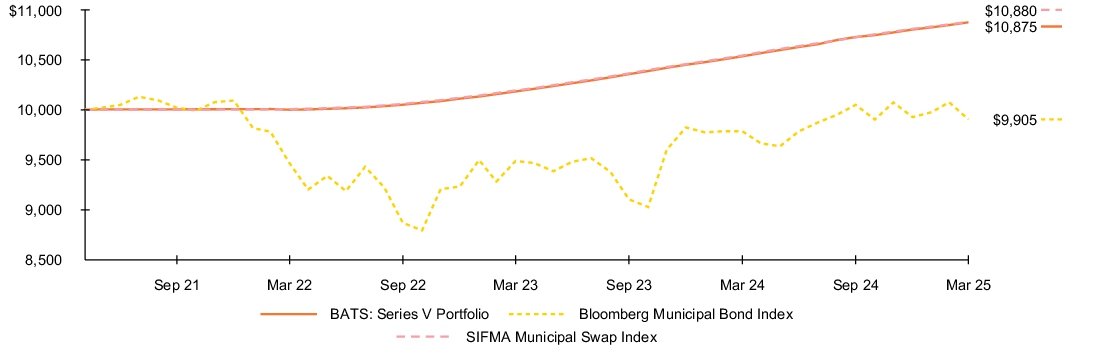

| Line Graph [Table Text Block] |

Fund performance Cumulative performance: May 5, 2021 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

Since Fund

Inception |

|

| BATS: Series V Portfolio |

3.23 |

% |

2.17 |

% |

| Bloomberg Municipal Bond Index |

1.22 |

|

(0.24 |

) |

| SIFMA Municipal Swap Index |

3.21 |

|

2.19 |

|

|

|

| Performance Inception Date |

May 05, 2021

|

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

|

| Net Assets |

$ 125,127,991

|

|

| Holdings Count | Holding |

81

|

|

| Advisory Fees Paid, Amount |

$ 0

|

|

| Investment Company Portfolio Turnover |

233.00%

|

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$125,127,991 |

| Number of Portfolio Holdings |

81 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

233% |

|

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Sector allocation

| Sector |

Percent of Total

Investments |

|

| Housing |

26.5 |

% |

| County/City/Special District/School District |

25.1 |

% |

| Health Care |

19.3 |

% |

| Education |

15.8 |

% |

| Utilities |

12.5 |

% |

| Transportation |

0.8 |

% |

|

|

|

|