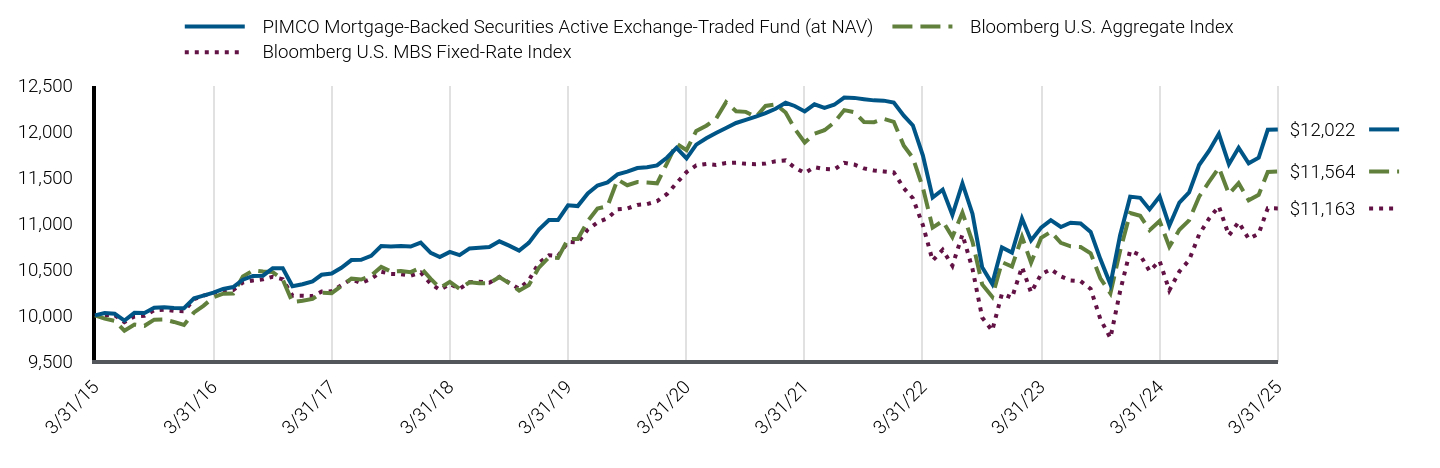

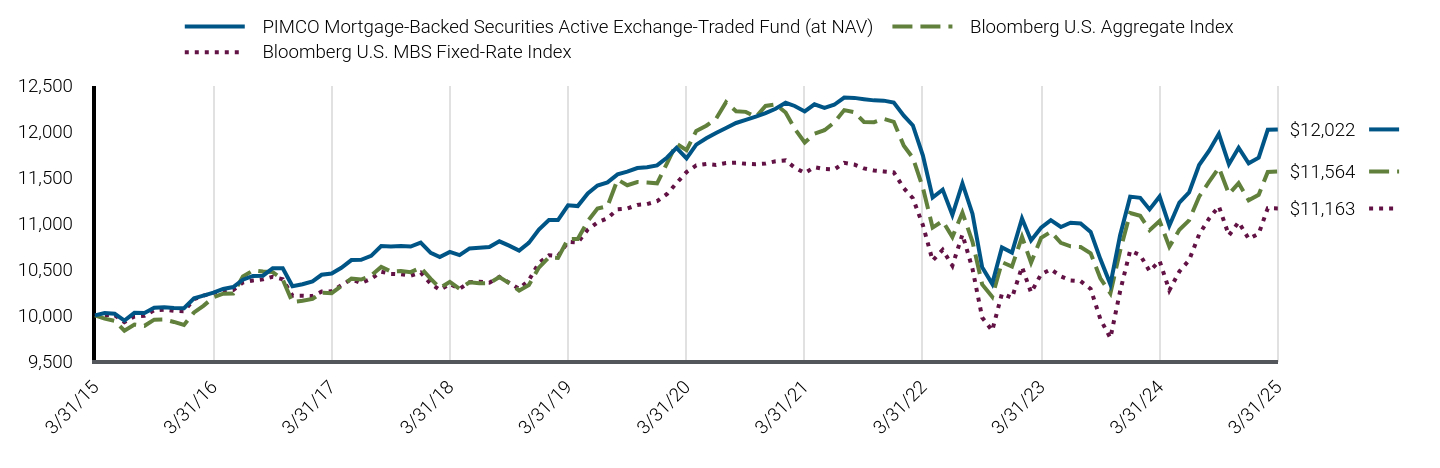

| Line Graph [Table Text Block] |

|

PIMCO Mortgage-Backed Securities Active Exchange-Traded Fund (at NAV) |

Bloomberg U.S. Aggregate Index |

Bloomberg U.S. MBS Fixed-Rate Index |

3/31/15 |

$10,000 |

$10,000 |

$10,000 |

4/30/15 |

$10,026 |

$9,964 |

$10,004 |

5/31/15 |

$10,017 |

$9,940 |

$10,002 |

6/30/15 |

$9,943 |

$9,832 |

$9,925 |

7/31/15 |

$10,027 |

$9,900 |

$9,988 |

8/31/15 |

$10,026 |

$9,886 |

$9,996 |

9/30/15 |

$10,082 |

$9,953 |

$10,055 |

10/31/15 |

$10,089 |

$9,954 |

$10,062 |

11/30/15 |

$10,081 |

$9,928 |

$10,048 |

12/31/15 |

$10,077 |

$9,896 |

$10,045 |

1/31/16 |

$10,185 |

$10,032 |

$10,176 |

2/29/16 |

$10,215 |

$10,103 |

$10,214 |

3/31/16 |

$10,246 |

$10,196 |

$10,244 |

4/30/16 |

$10,287 |

$10,235 |

$10,261 |

5/31/16 |

$10,308 |

$10,238 |

$10,274 |

6/30/16 |

$10,388 |

$10,422 |

$10,357 |

7/31/16 |

$10,429 |

$10,488 |

$10,379 |

8/31/16 |

$10,431 |

$10,476 |

$10,391 |

9/30/16 |

$10,513 |

$10,470 |

$10,420 |

10/31/16 |

$10,512 |

$10,389 |

$10,392 |

11/30/16 |

$10,316 |

$10,144 |

$10,213 |

12/31/16 |

$10,338 |

$10,158 |

$10,213 |

1/31/17 |

$10,369 |

$10,178 |

$10,209 |

2/28/17 |

$10,441 |

$10,246 |

$10,258 |

3/31/17 |

$10,455 |

$10,241 |

$10,261 |

4/30/17 |

$10,517 |

$10,320 |

$10,328 |

5/31/17 |

$10,601 |

$10,399 |

$10,393 |

6/30/17 |

$10,604 |

$10,389 |

$10,351 |

7/31/17 |

$10,647 |

$10,434 |

$10,398 |

8/31/17 |

$10,753 |

$10,527 |

$10,474 |

9/30/17 |

$10,749 |

$10,477 |

$10,450 |

10/31/17 |

$10,753 |

$10,483 |

$10,447 |

11/30/17 |

$10,748 |

$10,470 |

$10,432 |

12/31/17 |

$10,790 |

$10,518 |

$10,466 |

1/31/18 |

$10,680 |

$10,397 |

$10,343 |

2/28/18 |

$10,633 |

$10,298 |

$10,276 |

3/31/18 |

$10,690 |

$10,364 |

$10,341 |

4/30/18 |

$10,655 |

$10,287 |

$10,289 |

5/31/18 |

$10,728 |

$10,360 |

$10,361 |

6/30/18 |

$10,736 |

$10,348 |

$10,366 |

7/31/18 |

$10,742 |

$10,350 |

$10,355 |

8/31/18 |

$10,805 |

$10,417 |

$10,418 |

9/30/18 |

$10,758 |

$10,350 |

$10,354 |

10/31/18 |

$10,704 |

$10,268 |

$10,289 |

11/30/18 |

$10,788 |

$10,329 |

$10,381 |

12/31/18 |

$10,932 |

$10,519 |

$10,570 |

1/31/19 |

$11,036 |

$10,631 |

$10,653 |

2/28/19 |

$11,036 |

$10,625 |

$10,644 |

3/31/19 |

$11,197 |

$10,829 |

$10,799 |

4/30/19 |

$11,188 |

$10,831 |

$10,792 |

5/31/19 |

$11,326 |

$11,024 |

$10,932 |

6/30/19 |

$11,412 |

$11,162 |

$11,010 |

7/31/19 |

$11,446 |

$11,187 |

$11,055 |

8/31/19 |

$11,533 |

$11,476 |

$11,154 |

9/30/19 |

$11,562 |

$11,415 |

$11,162 |

10/31/19 |

$11,602 |

$11,450 |

$11,201 |

11/30/19 |

$11,611 |

$11,444 |

$11,210 |

12/31/19 |

$11,631 |

$11,436 |

$11,241 |

1/31/20 |

$11,717 |

$11,656 |

$11,320 |

2/29/20 |

$11,822 |

$11,866 |

$11,437 |

3/31/20 |

$11,707 |

$11,796 |

$11,558 |

4/30/20 |

$11,856 |

$12,006 |

$11,631 |

5/31/20 |

$11,926 |

$12,062 |

$11,646 |

6/30/20 |

$11,983 |

$12,137 |

$11,635 |

7/31/20 |

$12,038 |

$12,319 |

$11,656 |

8/31/20 |

$12,092 |

$12,219 |

$11,660 |

9/30/20 |

$12,126 |

$12,213 |

$11,648 |

10/31/20 |

$12,162 |

$12,158 |

$11,643 |

11/30/20 |

$12,199 |

$12,277 |

$11,651 |

12/31/20 |

$12,247 |

$12,294 |

$11,676 |

1/31/21 |

$12,312 |

$12,206 |

$11,685 |

2/28/21 |

$12,277 |

$12,030 |

$11,607 |

3/31/21 |

$12,218 |

$11,880 |

$11,548 |

4/30/21 |

$12,295 |

$11,974 |

$11,612 |

5/31/21 |

$12,257 |

$12,013 |

$11,591 |

6/30/21 |

$12,290 |

$12,097 |

$11,586 |

7/31/21 |

$12,368 |

$12,232 |

$11,659 |

8/31/21 |

$12,365 |

$12,209 |

$11,640 |

9/30/21 |

$12,351 |

$12,103 |

$11,598 |

10/31/21 |

$12,338 |

$12,100 |

$11,576 |

11/30/21 |

$12,335 |

$12,136 |

$11,565 |

12/31/21 |

$12,314 |

$12,105 |

$11,555 |

1/31/22 |

$12,171 |

$11,844 |

$11,383 |

2/28/22 |

$12,065 |

$11,712 |

$11,273 |

3/31/22 |

$11,737 |

$11,386 |

$10,980 |

4/30/22 |

$11,282 |

$10,954 |

$10,595 |

5/31/22 |

$11,367 |

$11,025 |

$10,712 |

6/30/22 |

$11,091 |

$10,852 |

$10,540 |

7/31/22 |

$11,434 |

$11,117 |

$10,879 |

8/31/22 |

$11,106 |

$10,803 |

$10,507 |

9/30/22 |

$10,523 |

$10,336 |

$9,976 |

10/31/22 |

$10,342 |

$10,202 |

$9,834 |

11/30/22 |

$10,738 |

$10,578 |

$10,235 |

12/31/22 |

$10,683 |

$10,530 |

$10,190 |

1/31/23 |

$11,054 |

$10,854 |

$10,526 |

2/28/23 |

$10,815 |

$10,573 |

$10,248 |

3/31/23 |

$10,953 |

$10,842 |

$10,447 |

4/30/23 |

$11,035 |

$10,908 |

$10,501 |

5/31/23 |

$10,961 |

$10,789 |

$10,424 |

6/30/23 |

$11,007 |

$10,750 |

$10,380 |

7/31/23 |

$10,999 |

$10,743 |

$10,372 |

8/31/23 |

$10,907 |

$10,674 |

$10,287 |

9/30/23 |

$10,612 |

$10,403 |

$9,959 |

10/31/23 |

$10,337 |

$10,239 |

$9,753 |

11/30/23 |

$10,871 |

$10,702 |

$10,262 |

12/31/23 |

$11,291 |

$11,112 |

$10,704 |

1/31/24 |

$11,278 |

$11,082 |

$10,655 |

2/29/24 |

$11,152 |

$10,925 |

$10,481 |

3/31/24 |

$11,292 |

$11,026 |

$10,592 |

4/30/24 |

$10,975 |

$10,747 |

$10,272 |

5/31/24 |

$11,227 |

$10,930 |

$10,477 |

6/30/24 |

$11,337 |

$11,033 |

$10,600 |

7/31/24 |

$11,635 |

$11,291 |

$10,879 |

8/31/24 |

$11,790 |

$11,453 |

$11,054 |

9/30/24 |

$11,974 |

$11,606 |

$11,186 |

10/31/24 |

$11,644 |

$11,319 |

$10,869 |

11/30/24 |

$11,823 |

$11,438 |

$11,014 |

12/31/24 |

$11,654 |

$11,251 |

$10,832 |

1/31/25 |

$11,715 |

$11,311 |

$10,888 |

2/28/25 |

$12,018 |

$11,560 |

$11,165 |

3/31/25 |

$12,022 |

$11,564 |

$11,163 |

|