Shareholder Report

|

12 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSR

|

| Amendment Flag |

false

|

| Registrant Name |

BlackRock Funds

|

| Entity Central Index Key |

0000844779

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| C000232954 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Global Equity Absolute Return Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

BABSX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Global Equity Absolute Return Fund (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Institutional Shares |

$189 |

1.85% |

|

| Expenses Paid, Amount |

$ 189

|

| Expense Ratio, Percent |

1.85%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund's Institutional Shares returned 3.91%. -

For the same period, the MSCI All Country World Index returned 7.15% and the ICE BofA 3-Month U.S. Treasury Bill Index returned 4.97%. What contributed to performance? On a sector level, allocations to financials and industrials were the primary contributors to absolute performance. In regional terms, exposure to Asia was the top contributor, followed by the United Kingdom. Individual securities held within mid- and large-cap stocks drove positive performance. The Fund used derivatives as part of its investment strategy, including the establishment of both long and synthetic short positions and the use of leverage for the purpose of increasing the economic exposure of the Fund beyond the value of its net assets, contributing to the Fund’s positive return for the period. The Fund’s cash position had no material impact on performance. What detracted from performance? On a sector level, allocations to communication services and index derivatives were the primary detractors from absolute performance. In regional terms, exposure to the U.S. was the only detractor as all other regions generated positive returns. Performance was impacted negatively by the Fund’s holdings of smaller cap stocks. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

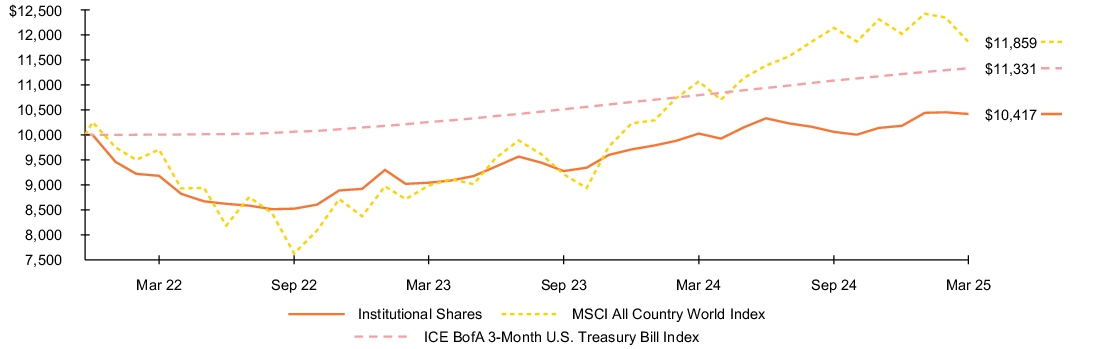

Fund performance Cumulative performance: December 21, 2021 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

Since Fund

Inception |

|

| Institutional Shares |

3.91 |

% |

1.26 |

% |

| MSCI All Country World Index |

7.15 |

|

5.35 |

|

| ICE BofA 3-Month U.S. Treasury Bill Index |

4.97 |

|

3.89 |

|

|

| Performance Inception Date |

Dec. 21, 2021

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Prior Market Index Comparison [Text Block] |

On December 1, 2023, the Fund began to compare its performance to the standard pricing time of the ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for a custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 10,479,130

|

| Holdings Count | Holding |

1

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

48.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$10,479,130 |

| Number of Portfolio Holdings |

1 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

48% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments |

|

| Short-Term Securities |

100.0 |

% |

|

| Material Fund Change [Text Block] |

Material fund changes This is a summary of certain changes and planned changes to the Fund since March 31, 2024. On February 20, 2025, the Fund’s Board approved a proposal to liquidate the Fund. Accordingly, effective April 4, 2025, the Fund no longer accepted purchase orders and the Fund was terminated on April 11, 2025.

|

| C000232953 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Global Equity Absolute Return Fund

|

| Class Name |

Investor A Shares

|

| Trading Symbol |

BGRAX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Global Equity Absolute Return Fund (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Investor A Shares |

$214 |

2.10% |

|

| Expenses Paid, Amount |

$ 214

|

| Expense Ratio, Percent |

2.10%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund's Investor A Shares returned 3.73%. -

For the same period, the MSCI All Country World Index returned 7.15% and the ICE BofA 3-Month U.S. Treasury Bill Index returned 4.97%. What contributed to performance? On a sector level, allocations to financials and industrials were the primary contributors to absolute performance. In regional terms, exposure to Asia was the top contributor, followed by the United Kingdom. Individual securities held within mid- and large-cap stocks drove positive performance. The Fund used derivatives as part of its investment strategy, including the establishment of both long and synthetic short positions and the use of leverage for the purpose of increasing the economic exposure of the Fund beyond the value of its net assets, contributing to the Fund’s positive return for the period. The Fund’s cash position had no material impact on performance. What detracted from performance? On a sector level, allocations to communication services and index derivatives were the primary detractors from absolute performance. In regional terms, exposure to the U.S. was the only detractor as all other regions generated positive returns. Performance was impacted negatively by the Fund’s holdings of smaller cap stocks. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

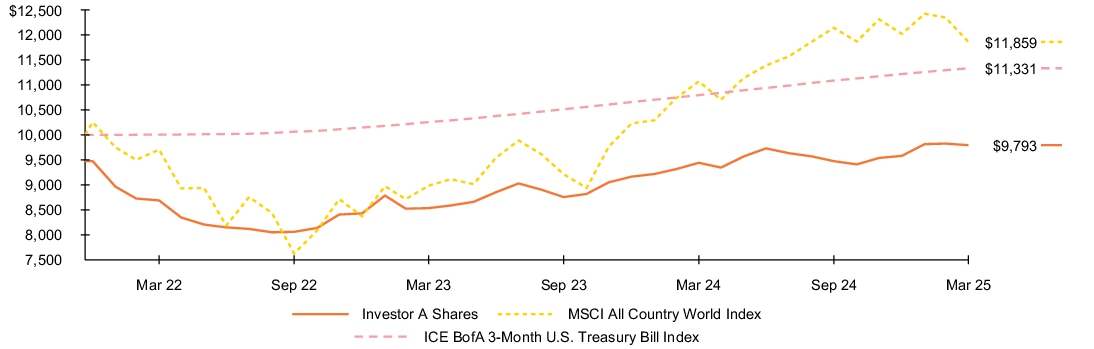

Fund performance Cumulative performance: December 21, 2021 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

Since Fund

Inception |

|

| Investor A Shares |

3.73 |

% |

1.01 |

% |

| Investor A Shares (with sales charge) |

(1.72 |

) |

(0.64 |

) |

| MSCI All Country World Index |

7.15 |

|

5.35 |

|

| ICE BofA 3-Month U.S. Treasury Bill Index |

4.97 |

|

3.89 |

|

|

| Performance Inception Date |

Dec. 21, 2021

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Prior Market Index Comparison [Text Block] |

On December 1, 2023, the Fund began to compare its performance to the standard pricing time of the ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for a custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 10,479,130

|

| Holdings Count | Holding |

1

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

48.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$10,479,130 |

| Number of Portfolio Holdings |

1 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

48% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments |

|

| Short-Term Securities |

100.0 |

% |

|

| Material Fund Change [Text Block] |

Material fund changes This is a summary of certain changes and planned changes to the Fund since March 31, 2024. On February 20, 2025, the Fund’s Board approved a proposal to liquidate the Fund. Accordingly, effective April 4, 2025, the Fund no longer accepted purchase orders and the Fund was terminated on April 11, 2025.

|

| C000232952 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

BlackRock Global Equity Absolute Return Fund

|

| Class Name |

Class K Shares

|

| Trading Symbol |

BGRKX

|

| Annual or Semi-Annual Statement [Text Block] |

This annual shareholder report contains important information about BlackRock Global Equity Absolute Return Fund (the “Fund”) for the period of April 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at blackrock.com/fundreports. You can also request this information by contacting us at (800) 441‑7762.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

(800) 441‑7762

|

| Additional Information Website |

blackrock.com/fundreports

|

| Expenses [Text Block] |

What were the Fund costs for the last year? (based on a hypothetical $10,000 investment)

| Class name |

Costs of a $10,000

investment |

Costs paid as a percentage of a

$10,000 investment |

| Class K Shares |

$184 |

1.80% |

|

| Expenses Paid, Amount |

$ 184

|

| Expense Ratio, Percent |

1.80%

|

| Factors Affecting Performance [Text Block] |

How did the Fund perform last year? -

For the reporting period ended March 31, 2025, the Fund's Class K Shares returned 4.05%. -

For the same period, the MSCI All Country World Index returned 7.15% and the ICE BofA 3-Month U.S. Treasury Bill Index returned 4.97%. What contributed to performance? On a sector level, allocations to financials and industrials were the primary contributors to absolute performance. In regional terms, exposure to Asia was the top contributor, followed by the United Kingdom. Individual securities held within mid- and large-cap stocks drove positive performance. The Fund used derivatives as part of its investment strategy, including the establishment of both long and synthetic short positions and the use of leverage for the purpose of increasing the economic exposure of the Fund beyond the value of its net assets, contributing to the Fund’s positive return for the period. The Fund’s cash position had no material impact on performance. What detracted from performance? On a sector level, allocations to communication services and index derivatives were the primary detractors from absolute performance. In regional terms, exposure to the U.S. was the only detractor as all other regions generated positive returns. Performance was impacted negatively by the Fund’s holdings of smaller cap stocks. The views expressed reflect the opinions of BlackRock as of the date of this report and are subject to change based on changes in market, economic or other conditions. These views are not intended to be a forecast of future events and are no guarantee of future results.

|

| Performance Past Does Not Indicate Future [Text] |

Past performance is not an indication of future results.

|

| Line Graph [Table Text Block] |

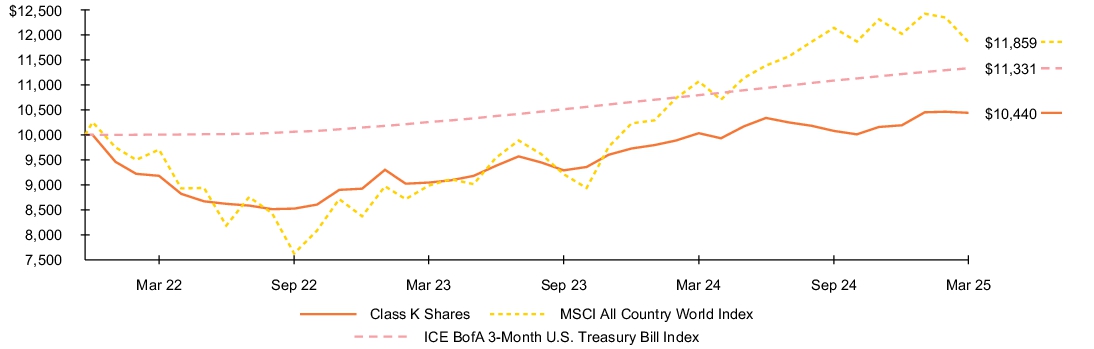

Fund performance Cumulative performance: December 21, 2021 through March 31, 2025 Initial investment of $10,000 See “Average annual total returns” for additional information on fund performance.

|

| Average Annual Return [Table Text Block] |

Average annual total returns

|

1 Year |

|

Since Fund

Inception |

|

| Class K Shares |

4.05 |

% |

1.32 |

% |

| MSCI All Country World Index |

7.15 |

|

5.35 |

|

| ICE BofA 3-Month U.S. Treasury Bill Index |

4.97 |

|

3.89 |

|

|

| Performance Inception Date |

Dec. 21, 2021

|

| No Deduction of Taxes [Text Block] |

Performance results do not reflect the deduction of taxes that a shareholder would pay on fund distributions or on the redemption or sale of fund shares.

|

| Prior Market Index Comparison [Text Block] |

On December 1, 2023, the Fund began to compare its performance to the standard pricing time of the ICE BofA 3-Month U.S. Treasury Bill Index (the “Index”). Index data prior to March 1, 2021 is for the Index’s standard pricing time of 3pm. Index data from March 1, 2021 through November 30, 2023 is for a custom 4pm pricing variant of the Index. Index returns beginning on December 1, 2023 reflect the Index’s new standard pricing time of 4pm. The change of the Index’s standard pricing time from 3pm to 4pm resulted in the discontinuation of the custom 4pm pricing variant used from March 1, 2021 through November 30, 2023.

|

| Updated Performance Information Location [Text Block] |

Visit blackrock.com for more recent performance information.

|

| Net Assets |

$ 10,479,130

|

| Holdings Count | Holding |

1

|

| Advisory Fees Paid, Amount |

$ 0

|

| Investment Company Portfolio Turnover |

48.00%

|

| Additional Fund Statistics [Text Block] |

Key Fund statistics

| Net Assets |

$10,479,130 |

| Number of Portfolio Holdings |

1 |

| Net Investment Advisory Fees |

$0 |

| Portfolio Turnover Rate |

48% |

|

| Holdings [Text Block] |

What did the Fund invest in? (as of March 31, 2025) Portfolio composition

| Investment Type |

Percent of Total

Investments |

|

| Short-Term Securities |

100.0 |

% |

|

| Material Fund Change [Text Block] |

Material fund changes This is a summary of certain changes and planned changes to the Fund since March 31, 2024. On February 20, 2025, the Fund’s Board approved a proposal to liquidate the Fund. Accordingly, effective April 4, 2025, the Fund no longer accepted purchase orders and the Fund was terminated on April 11, 2025.

|