EFMT DEPOSITOR

LLC ABS-15G

Exhibit 99.15

| Clayton Contact Information |

2 |

| Overview |

2 |

| Originators |

2 |

| Clayton’s Third Party Review (“TPR”)

Scope of Work |

3 |

| Review scope |

3 |

| # of Files Reviewed |

3 |

| Loan Grading |

3 |

| TPR Component Review Scope |

4 |

| Credit Review |

4 |

| Property Valuation Review |

4 |

| Regulatory Compliance Review |

5 |

| Data Integrity |

7 |

| Data Capture |

7 |

| Data Compare Results |

7 |

| Clayton Due Diligence Results |

8 |

| Clayton Third Party Reports Delivered |

9 |

| Appendix A: Credit Review Scope |

9 |

| Appendix B: Origination Appraisal Assessment |

12 |

| Appendix C: Regulatory Compliance Review

Scope |

14 |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 1 | May 20, 2025 |

Clayton

Contact Information

Client Service Management:

| · | Michael

Santarsiere Client Service

Director |

Phone:

(813) 371-0280/E-mail: msantarsiere@clayton.com

· Joe

Ozment Vice President – Client Services & Securitization

Phone:

(813) 261-0733/E-mail: jozment@clayton.com

Overview

On behalf of the originator, Clayton

conducted an independent third-party pre-securitization due diligence review of 1 residential loan. Ellington Management Group, LLC subsequently purchased

these loans via reliance letter and selected these loans for the EFMT 2025-NQM2 transaction.

The loan referenced in this narrative

report was reviewed on a flow loan basis in September of 2024. This narrative report provides information about the scope of work performed

by Clayton, and the results of Clayton’s review.

Originators

Origination channels for the loans in this review:

| Origination

Channel |

Loan

Count |

Percentage |

| Broker |

1 |

100.00% |

| Total |

1 |

100.00% |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 2 | May 20, 2025 |

Clayton’s

Third Party Review (“TPR”) Scope of Work

The scope of work for this transaction

consisted of a credit review, property valuation review, regulatory compliance review, and data integrity check.

Review

scope |

#

of Files Reviewed |

| Credit Review |

1 |

|

| Property Valuation Review |

1 |

|

| Regulatory Compliance Review |

1 |

|

| Data Integrity Check |

1 |

|

| |

|

|

| |

|

|

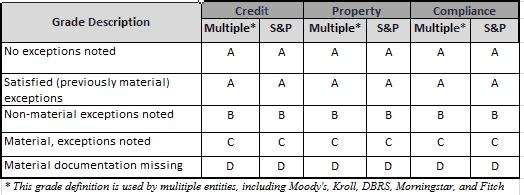

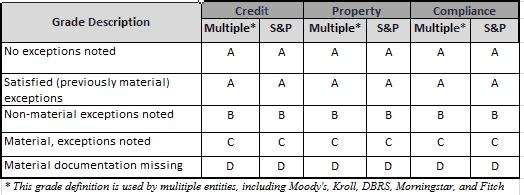

Loan

Grading

Each loan received an “initial”

and a “final” grade. The “initial” grade was assigned during the initial loan review. The “final”

grade takes into account additional information and supporting documentation that may have been provided by the originators to clear

outstanding conditions. Clayton’s loan grading is solely based on Clayton’s independent assessment of all guideline exceptions

and compensating factors for each of the component reviews. Clayton is providing a comprehensive loan-level analysis as part of this

pre-securitization reporting package that includes initial grades, final grades and detailed commentary on the rationale for any changes

in grades and sets forth compensating factors and waivers.

Clayton’s loan grading complied

with rating agency grading definitions published by Moody’s, Standard and Poor’s, Fitch, Morningstar, Kroll and DBRS.

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 3 | May 20, 2025 |

TPR

Component Review Scope

Clayton examined the selected

loan files with respect to the presence or absence of relevant documents, enforceability of mortgage loan documents, and accuracy and

completeness of data fields. Clayton relied on the accuracy of information contained in the loan documentation provided to Clayton.

Credit

Review

Clayton’s Credit scope of

review conducted on 1 loan on this transaction included the following elements (for more detail, please refer to Appendix A):

| § | Compared

the loan documentation found in the loan file to the origination guidelines; |

| § | Re-calculated

LTV, CLTV, income, liabilities, and debt-to-income ratios (DTI) and compared these against

the stated seller origination guidelines; |

| § | Analyzed

asset statements in order to determine that funds to close and reserves were within origination

guidelines; |

| § | Confirmed

that credit scores (FICO) and credit histories were within origination guidelines; |

| § | Evaluated

for evidence of borrower’s willingness and ability to repay the obligation; |

| § | Examined

income, employment, assets, and occupancy status for reasonability; |

| § | Reviewed

the occupancy, VOE and self/employed business documents within the loan file, as applicable; |

| § | Listed

the property type as Coop, as applicable; |

| § | Reviewed

for condo warranty documentation, as applicable; |

Property

Valuation Review

Clayton’s Property Valuation

scope of review conducted included the following elements:

| § | Original

Appraisal Assessment (1 loan) |

| - | Clayton

reviewed the original appraisal provided to determine whether the original appraisal was

complete, thorough and the original appraised value was reasonably supported. |

| - | For

more detail on the original appraisal review, please refer to Appendix B and to the guidelines

cited above. |

| § | Value

Supported Analysis (1 loan) |

Clayton applied a cascade methodology

to determine if the original appraised value was supported when compared to an independent third party valuation product. Loans were

held to a -10% tolerance utilizing the following waterfall;

For further detail please refer

to the EFMT 2025-NQM2 Valuations Summary Report

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 4 | May 20, 2025 |

Regulatory

Compliance Review

Clayton’s regulatory compliance

scope of review conducted on 1 loan on this transaction included the elements summarized below. (For more detail, please refer to Appendix

C.)

Clayton utilized

its proprietary eCLAS engine for regulatory compliance testing.

The scope of the compliance review

performed is summarized below:

| § | Tested

for certain applicable federal, state and local high cost and/or anti-predatory laws; |

| § | Tested

for state-specific consumer protection laws including late charge and prepayment penalty

provisions; |

| § | Truth-in-lending/regulation

Z (TILA) testing included the following: |

| - | Notice

of Right to Cancel (Right of Rescission) adherence if applicable; |

| - | TIL

Disclosure Timing (3/7/3) and disclosure content; |

| - | TIL

APR and Finance charge tolerances; |

| - | Timeliness

of ARM Disclosures (if applicable); |

| - | Section

32 APR and Points and Fees Thresholds and prohibited practices; |

| - | Section

35 Higher Priced Mortgage Loans thresholds and applicable escrow and appraisal requirements; |

| - | Prohibited

Acts or Practices including Loan Originator compensation rules, NMLSR ID on documents, financing

credit Insurance, mandatory arbitration clauses, and NegAm Counseling; |

| - | Prepayment

Penalty restrictions; and |

| - | QM/ATR

Review: On applicable loans;, test compliance with applicable Qualified Mortgage (QM) and

Ability to Repay (ATR) requirements defined under the Dodd-Frank Wall Street Reform and Consumer

Protection Act as promulgated by the Consumer Financial Protection Bureau any loan subject

to that regulation, as further described on Appendix C attached hereto. |

| - | TILA/RESPA

Integrated Disclosure Scope (‘Covered Loans’ with an Application Date => 10/3/2015);

SFIG RMBS 3.0 TRID Compliance Review Scope as further described on Appendix C attached hereto. |

| § | Real Estate Settlement

Procedures Act (RESPA) laws and regulations testing included the following, for loans other

than ‘Covered Loans’ and loans with an Application Date prior to 10/3/2015: |

| - | GFE

initial disclosure timing and content; |

| - | Confirmed

the file contains the final HUD1 Settlement Statement; |

| - | GFE

to HUD1 evaluation for 0% and 10% fee tolerances; |

| - | Homeownership

Counseling Notice; |

| - | Affiliated

Business Disclosure if applicable. |

OF NOTE: As of October 3, 2015 (“TRID Effective

Date”), Clayton commenced testing applicable loans subject to the TRID Effective date against a TRID scope of review that was based

on outside counsel’s interpretations of the published regulations as of the TRID Effective Date. Clayton’s scope was commercially

reasonable as it relates to a Third Party Review (“TPR”) firm’s role as TPR conducting an independent third-party pre-securitization

due diligence review (“Initial TRID Scope”). The Initial TRID Scope was created with guidance from outside counsel.

On, June 15th, 2016 SFIG published its RMBS 3.0

TRID Compliance Review Scope © documentation, developed under the leadership of members from Third Party Review (“TPR”)

firms across the industry and SFIG’s RMBS 3.0 Due Diligence, Data and Disclosure Working Group. The RMBS 3.0 TRID Compliance Review

Scope was created with an aim to facilitate a uniform testing and risk identification standard as it would apply to an assignee, as a

result of a consistent Truth-In-Lending Act liability interpretation according to the understanding of prevailing legal precedent and

informal written guidance and webinars offered by the CFPB, as it applies to the Know Before You Owe / Truth In Lending Act (“TILA)

– Real Estate Settlement Procedures Act (“RESPA”) Integrated Disclosure (“TRID”) Rule (78 FR 79730, as

amended). RMBS 3.0 TRID Compliance Review Scope may be formally amended by the SFIG RMBS 3.0 Due Diligence, Data and Disclosure Working

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 5 | May 20, 2025 |

Group as clarifying regulations may be promulgated

on a go forward basis, as well as any binding judicial interpretations of the underlying law.

Following the June 15th formal publication

of the RMBS 3.0 TRID Compliance Review Scope ©, Clayton reviewed prior testing results dating back to the TRID Effective Date, and

applied the enhanced RMBS 3.0 TRID Compliance Review Scope to such loans upon the affirmative election by EF Mortgage LLC.

Compliance Review (Business

Purpose, Non-Owner Occupied)

Non-Owner Occupied Scope: Most

consumer protection laws are designed to afford protection to borrowers who are entering into a loan that will be secured by their residence.

For most high cost and higher-priced laws, as well as rescission, the only loans covered by the law are loans secured by the borrower’s

(or in the case of rescission a title holder’s) principal residence. Most other consumer protection laws extend to

a borrower’s secondary residence, which under TILA and RESPA is a residence that they occupy at least 2 weeks during the year.

Further, if the loan is for a business purpose it is often excluded from consumer protection laws regardless of occupancy, including

TILA (whereas if it is secured by non-owner occupied but for a personal, family or household purpose it is more likely to be covered).

Therefore, the list of laws

that Clayton tests that apply to a loan secured by non-owner occupied property for a business purpose is limited. Regulatory Compliance

testing of Business Purpose Loans consists of the following:

State and Federal High Cost

and Higher-Priced:

| · | Cook

County High Cost Ordinance |

| · | Chicago

High Cost Ordinance |

Clayton currently tests the

Chicago and Cook County ordinances due to vague language around loans for a business purpose not related to the property. While

the state of Illinois has similar language, Clayton’s audit law firm determined that only principal residences should be tested

for IL high cost.

Anti-predatory lending laws

| · | Virginia

Lender and Broker Act after 6/1/2008 |

| · | Minnesota

§58 on or after 8/1/2008 |

Prepayment Penalties and Late

Charges in certain states

National Flood Insurance Program

for 1-4 unit residential properties (Transaction Date on or after 1/1/2016 for regulated lenders)

| · | Escrow

of insurance payments |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 6 | May 20, 2025 |

Data

Integrity

Clayton utilized its proprietary

eCLAS tool to determine tape-to-file accuracy of 1 reviewed loan, by completing the following steps:

| § | Tape

data received from seller/client is stored in eCLAS; |

| § | Loan

reviewer collects validated loan data in eCLAS; |

| § | Each

received data point is compared to its counterpart collected data point; |

| § | Discrepancies

found during comparison are stored; |

| § | Each

discrepancy is reported in a Loan Level Tape Compare Upload. |

Data

Capture

Clayton collected data fields

required to create American Securitization Forum (“ASF”) and Standard and Poor’s LEVELS 7.4.3 data disclosure requirements.

Both of these file formats are provided as part of the pre-securitization reporting package. Additionally, Clayton captured rating agency

required data points relating to ATR/QM determination, which is provided in the reporting package.

data

Compare Results

Clayton provided EF Mortgage LLC, with

a copy of the Loan Level Tape Compare Upload which shows the differences between the data received from the sellers versus the data captured

by Clayton during the loan review in relation to the 1 loan reviewed.

| Field

Name |

#

of Loans |

Accuracy

% |

| Disbursement

Date |

1 |

0.00% |

| Total

Cash Out |

1 |

0.00% |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 7 | May 20, 2025 |

Clayton

Due Diligence Results

Below are the initial and final overall loan grades for this

review, as well as the credit, property valuation, and regulatory compliance component review grades.

Initial and Final Overall Loan Grade Results

| |

Overall

Grade Migration |

| |

Initial |

| Final |

|

A |

B |

C |

D |

Total |

| A |

1 |

|

|

|

1 |

| B |

|

|

|

|

0 |

| C |

|

|

|

|

0

|

| D |

|

|

|

|

0

|

| Total |

1

|

0 |

0 |

0 |

1 |

The overall grade summary reflects the combination of the credit, property

valuation and regulatory compliance component reviews into one overall grade. The overall grade assigned is the most severe grade from

each of the component reviews.

Initial and Final Credit Component Grade Results

| |

Credit

Grade Migration |

| |

Initial |

| Final |

|

A |

B |

C |

D |

Total |

| A |

1

|

|

|

|

1 |

| B |

|

|

|

|

0 |

| C |

|

|

|

|

0

|

| D |

|

|

|

|

0

|

| Total |

1 |

0 |

0 |

0 |

1 |

Initial and Final Property Valuation Grade Results

| |

Property

Valuation Grade Migration |

| |

Initial |

| Final |

|

A |

B |

C |

D |

Total |

| A |

1 |

|

|

|

1 |

| B |

|

|

|

|

0 |

| C |

|

|

|

|

0

|

| D |

|

|

|

|

0

|

| Total |

1 |

0 |

0 |

0 |

1 |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 8 | May 20, 2025 |

Initial and Final Regulatory Compliance Grade

Results

| |

Compliance

Grade Migration |

| |

Initial |

| Final |

|

A |

B |

C |

D |

Total |

| A |

1 |

|

|

|

1 |

| B |

|

|

|

|

0 |

| C |

|

|

|

|

0

|

| D |

|

|

|

|

0

|

| Total |

1 |

0 |

0 |

0 |

1 |

*Compliance results may not tie to total loan count based on business entity

loans not being subject to a regulatory compliance review (0 loans in pool)

Clayton

Third Party Reports Delivered

Clayton furnished the following reports on this transaction:

| 6. | Loan Level

Tape Compare |

| 7. | Waived Conditions

Summary |

Appendix

A: Credit Review Scope

For each mortgage loan, Clayton performed a guideline review

utilizing specific guidelines furnished at the time of the review.

| A. | Verified that the characteristics of the mortgage loan and borrower conformed

to the Sponsor Acquisition Criteria requirements including: |

| o | Property

type and use eligibility; and if the property type was a condominium or cooperative, assessed

project adherence |

| o | Borrower

eligibility, including: |

- Citizenship

status

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 9 | May 20, 2025 |

- Non-

occupant co-borrower

| o | Transaction

eligibility, including: |

- Maximum

loan amount

- Loan

purpose

- Occupancy

| o | Noted

any approved exceptions or waivers by the originator and/or aggregator to guidelines; verified

that approved exceptions included required, documented compensating factors |

| B. | As part of the guideline review, Clayton performed a credit analysis during

which various documents were examined, including: |

| o | Uniform

Residential Loan Application reviewed to determine: |

| - | Initial

loan application was in the loan file and was signed by all borrowers |

| - | Final

loan application was in the loan file and was complete |

| - | Information

and debts disclosed on loan application aligned with related documentation in the loan file |

| o | Employment

analyzed and verified through use of various documents, including: |

| - | Verbal

and/or written verifications of employments (VVOE, VOE) |

| - | Tax

transcripts (IRS Form 4506-T) |

| - | Other

documentation in loan file |

| - | Required

income documentation for all borrowers was present and within required time period |

| - | Documents

did not appear to have been altered or inconsistent |

| § | Signed by all borrowers

and processed by the originator |

| § | Compared IRS tax transcripts

to income documentation and noted any inconsistencies |

| - | Income

was recalculated and was documented with applicable documentation, including: |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 10 | May 20, 2025 |

| § | Other documentation in

loan file |

| - | Asset

documentation required to verify down payment, closing costs, prepaid items and reserves

was present and within required timeframe, including: |

| § | Verification of deposits

(VOD) |

| § | Depository account statements |

| § | Stock or security account

statements |

| § | Other evidence of conveyance

and transfer of funds, if a sale of assets was involved |

| § | Other documentation in

loan file |

| - | Asset

documents were reviewed to determine any large deposits and appropriate sourcing of funds |

| o | Credit

Report review included: |

| - | Complete

copy of report was in loan file |

| - | Report

was dated within required timeframe |

| - | All

borrowers were included in the report |

| - | Checked

any fraud alerts against related loan file documentation |

| - | Verified

all disclosed mortgage debt on credit report against the loan application (under the schedule

of real estate owned) for accurate debt ratio calculation |

| - | Compared

liabilities listed on the credit report against the loan application for accurate debt ratio

calculation |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 11 | May 20, 2025 |

| - | Captured

and utilized appropriate credit score for guideline review |

| o | Title

policy review included: |

| - | Title

interest – determined if |

| - | Appropriate

vestee(s) were listed on title policy |

| - | Amount

of coverage was greater than or equal to the original principal amount of the mortgage |

| - | Applicable

title endorsements were present |

| - | Checked

for any encumbrances, encroachments and other title exceptions affecting the lien identified

through the title search; verified that each issues was addressed in the transaction |

| - | Reviewed

the chain of title and duration of ownership by seller or borrower (whichever was applicable) |

| - | Captured

monthly tax payments in debt ratio calculation |

| o | HUD1

(Settlement Statement) review included: |

| - | Funds

to close identified and analyzed against borrower’s assets |

| - | Seller

contributions did not exceed maximum allowed |

| - | Subject

property, seller and borrower aligned with other loan documentation |

| - | Disbursements

and pay-offs included in debt ratio calculations |

| o | Hazard/Flood

insurance review included: |

| - | Verified

presence of required hazard insurance and flood insurance (if required) |

| - | Confirmed

that any required insurance was for the: |

| § | Life of loan, if flood

insurance required |

| - | Confirmed

that any required insurance minimum coverage amount and policy period |

| - | Reviewed

for evidence that any required insurance policy premium was paid |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 12 | May 20, 2025 |

| - | Confirmed

that the mortgagee clause listed the lender’s name and “it’s successors

and assigns” |

| - | Confirmed

that the payment amount on any required insurance was included in the debt ratio calculation |

| o | Mortgage

Insurance review included: |

| - | Determined

if mortgage insurance is required |

| - | Captured

mortgage insurance name, certificate # and percentage guarantee (when required) |

| C. | For each mortgage loan, Clayton examined the mortgage or deed of trust

for evidence of recordation. In lieu of a copy of the mortgage or deed of trust with recording

information, a copy of the mortgage or deed of trust that is stamped “true and certified

copy” by the escrow/settlement agent plus recording directions on closing instruction

documentation was utilized as evidence for recording. |

| D. | For each mortgage loan, Clayton utilized the results from an independent,

third-party fraud tool along with information in the loan file to identify and address any

potential misrepresentations including: |

| - | Social

Security inconsistencies |

| - | Borrower

name variations |

| - | Borrower

address history |

| - | Subject

property ownership history |

| o | Licensing

– reviewed NMLS data for: |

| - | Mortgage

lender/originator |

Appendix

B: Origination Appraisal Assessment

For each Mortgage Loan, Clayton performed

the following origination appraisal analysis:

| A. | Verified that the mortgage loan file contained

an appraisal report and that it met the following criteria: |

| o | Appraisal

report used standard GSE forms, appropriate to the property type: |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 13 | May 20, 2025 |

| - | FNMA

1004/FHLMC 70 – Uniform Residential Appraisal Report. Used for 1-unit properties, units

in planned unit developments (detached PUDs) and condominium projects that consist solely

of detached dwelling (site condominium) |

| - | FNMA

1073/FHLMC 465 – Individual Condominium Report. Used to appraise a unit in a condominium

project or a condominium unit in a PUD (attached PUD) |

| - | FNMA

1025/FHLMC 72 – Small Residential Income Property Appraisal Report. Used for all two-to-four

unit residential income properties, including two-to-four unit properties in a PUD |

| - | FNMA

2090 – Individual Cooperative Appraisal Report. Used for individual cooperative units |

| - | FNMA

2000/FHLMC 1032 – One Unit Residential Appraisal Field Review |

| - | FNMA

2000a/FHLMC 1072 – Two to Four Unit Residential Appraisal Field Review |

| o | Appraisal

report was reasonably complete and included: |

| - | Appraisal

report form, certification, statement of limiting conditions and scope of work |

| - | Accurate

identification of the subject property |

| - | Accurate

identification of the subject loan transaction |

| - | Accurate

identification of the property type, in both land and improvements |

| - | All

required attachments including: |

| § | Subject

front, rear and street photos and valued features |

| § | Subject

interior photos – kitchen, all baths, main living area, updates/upgrades, deferred maintenance |

| § | Photos

of all comparable sales and listings |

| § | Exterior

sketch of property with dimensions |

| § | 1004MC

Market Conditions Report |

| - | Evidence

that appraisal report was made “As Is” or provided satisfactory evidence of completion

for all material conditions |

| - | Appraisal

date met supplied Sponsor Acquisition Criteria |

| - | If

applicable to Sponsor Acquisition Criteria requirements, a second full appraisal was furnished

and met Sponsor Acquisition Criteria |

| B. | Performed a general credibility assessment

of the results of the appraisal per Title XI of FIRREA and USPAP based on the following criteria: |

| - | Determined

that either the appraiser or supervisory appraiser was appropriately licensed by verifying

the appraiser’s license included in the appraisal. |

| - | Reviewed

for the presence of any “red flags” related to the mortgaged property that may

have posed a risk to the property or occupants |

| - | Confirmed

that the appraiser’s certification is present and executed within the original appraisal. |

| C. | Reviewed and graded the appraisal valuation

to the following criteria: |

| o | Appraised

value was reasonably supported. Utilized the following review in making value supported determination: |

| - | Comps

used were located reasonably close to the subject property and if not the reason was satisfactorily

explained |

| - | Comps

used were reasonably recent in transaction date and if not the reason was furnished |

| - | Comps

used were reasonably similar to the subject property and if not an explanation was supplied |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 14 | May 20, 2025 |

| - | Appraised

value of the subject was bracketed by the sales prices of the comps and if not the reason

was furnished |

| - | Adjustments

were reviewed and appeared reasonable utilizing the 15% net/25% gross guideline. |

| o | Property

was complete. However, if the property was not 100% complete, then any unfinished portion

had no material impact to the value, safety, soundness, structural integrity, habitability

or marketability of the subject property |

| o | Appraisal

was reviewed for any indication of property or marketability issues. Utilized the following

key points in making determination: |

| - | Appraisal

was made on an “As Is” basis or provides satisfactory evidence of completion of

all material conditions |

| - | Property

usage was reviewed for zoning compliance |

| - | Property

utilization was reviewed to determine it was “highest and best use” |

| - | Neighborhood

values were reviewed to determine if declining |

| - | Market

conditions were reviewed to determine indication of possible marketability issues: |

| - | Physical

condition of the property was reviewed to determine that the property condition was average

or better |

| - | Style

of property was reviewed to determine if unique property |

| - | Any

health and safety issues were noted and/or remediated |

| - | Locational

and/or environmental concerns adequately addressed if present |

| D. | Property Eligibility Criteria – Clayton

reviewed the property to determine that the property met the client supplied eligibility

requirements. Examples of ineligible property types may include: |

| o | 3

to 4 unit owner occupied properties |

| o | 2

to 4 unit second homes |

| o | Unwarrantable

or limited review condominiums |

| o | Manufactured

or mobile homes |

| o | Working

farms, ranches or orchards |

| o | Properties

subject to existing oil or gas leases |

| o | Properties

located in Hawaii Lava Zones 1 and 2 |

| o | Properties

exceeding Sponsor Acquisition Criteria requirements for excess acreage |

| E. | Properties Affected by Disasters Criteria

– Clayton reviewed the appraisal date against any FEMA Declared Disaster Areas that

were designated for Individual and/or Public Assistance due to a federal government disaster

declaration. |

| o | If

the appraisal date is before the FEMA Effective Date for any of the disasters listed, Clayton

will specify whether or not there has been a property inspection since the date listed, the

latest inspection date, whether or not new damage has been indicated, and the amount of said

damage. |

| o | The

individuals performing the aforementioned original appraisal assessment are not persons providing

valuations for purposes of the Uniform Standards of Professional Appraisal Practice (“USPAP”)

or necessarily licensed as appraisers under Federal or State law, and the services

being performed by such persons do not constitute “appraisal reviews” for purposes of USPAP or Federal or State law. |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 15 | May 20, 2025 |

| o | Clayton

makes no representation or warranty as to the value of any mortgaged property, notwithstanding

that Clayton may have reviewed valuation information for reasonableness |

| o | Clayton

is not an ‘AMC’ (appraisal management company) and therefore Clayton does not

opine on the actual value of the underlying property |

| o | Clayton

is not a ‘creditor’ within the meaning of ECOA or other lending laws and regulations,

and therefore Clayton will not have any communication with or responsibility to any individual

consumer concerning property valuation. |

| o | Clayton

does not check to see if the appraiser is on the Freddie Mac exclusionary list |

Appendix

C: Regulatory Compliance Review Scope

This appendix provides an overview of Clayton’s proprietary

compliance system for 1-4 family residential mortgage loans in the due diligence process to determine, to the extent possible and

subject to the caveats below, whether the loans comply with federal, state and local laws. The Disclaimer section explains limitations

that you should be aware of. Additional details on the items listed below as well as Clayton’s state, county and municipal testing

can be provided upon request. The compliance engine is fully integrated into Clayton’s proprietary due diligence platform, eCLAS.

Federal Law

| A. | RESPA and Regulation X: Loan level analysis on the following: |

| o | GFE/HUD1:

confirm the correct version of the GFE and HUD1 were properly completed under the Regulation

X Final Rule that became mandatory on January 1, 2010 |

| o | Initial

Good Faith Estimate, (GFE): timing and content of the initial disclosure |

| o | Final

GFE: Verification that increases to fees from the initial GFE were disclosed within 3 days

of valid changed circumstance documentation within the loan file |

| o | Final

HUD1 Settlement Statement: verify the loan file contains the final HUD1 and the loan terms

on the HUD1 correspond to the actual loan terms from the Note |

| o | Final

GFE to HUD1 tolerance fee evaluation: confirm the fees charged on the HUD1 do not exceed

the Final GFE in the 0% or 10% fee tolerance categories, including a review for a Settlement

Service Provider List if the lender excludes fees that the borrower can shop for. |

| o | Affiliated

Business Disclosure: if the loan file indicates the lender or broker referred the borrower

to a known affiliate, confirm the disclosure was provided to the borrower |

| o | Homeownership

Counseling Notice: for loan applications on or after 1/10/2014, confirm the notice was provided

to the borrower within 3 days of application |

| B. | Truth in Lending Act and Regulation Z - Loan level analysis

on the following: |

| o | TIL

Disclosure: Content of Disclosures – perform an independent recalculation of the finance

charges and APR to determine whether the amounts disclosed on the final TIL were within allowable

tolerances. Payment schedule accuracy, including under the Mortgage Disclosure Improvement

Act for loans applications on or after January 30, 2010. Additional disclosure content with

a focus on the consistency of the prepayment penalty disclosure and assumption policy with

the note and security instrument. |

| o | Mortgage

Disclosure Improvement Act, (3/7/3 rule): Confirm the timing of the initial TIL disclosure

within 3 days of application, 7 days prior to consummation, and corrected TIL disclosures

provided at least 3 days prior to consummation for applications received on or after July

30, 2009 (Section 19) |

| o | ARM

Disclosure: confirm these disclosures are in the file within 3 days of application, or 3

days of the borrower discussing ARM programs identified within the loan file |

| o | Right

of Rescission – Review the disclosure form type, disclosure timing, disclosed dates,

other material disclosures, and the loan disbursement (Section 23) |

| o | High

Cost mortgage thresholds for points and fees (Section 32) |

| o | High

Cost Prohibited Acts and Practices upon request (Section 33) |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 16 | May 20, 2025 |

| o | Higher

Priced Mortgage Loan thresholds for APR in relation to the APOR. Including Escrow and appraisal

requirements (Section 35) |

| o | Prohibited

Acts or Practices including testing the Loan Originator compensation rules, NMLSR ID on documents,

financing Credit Insurance, mandatory arbitration clauses, and NegAm Counseling (Section

36) |

| o | ATR/QM

Ability to Repay, aka Minimum Standards for Transactions: for applications on or after 1/10/2014,

confirm the loan file contains documentation to evidence the lender considered and verified

the borrower has the ability to repay in accordance with the ATR requirements This included

identifying whether QM loans met agency exemptions or were underwritten in accordance with

Appendix Q. Non QM loans will be reviewed to ensure the lender documented that they considered

and verified the 8 underwriting factors as required for ATR compliance. This review also

includes evaluating loans against the new TILA prepayment penalty restrictions (Section 43) |

| o | TILA/RESPA

Integrated Disclosures (“TRID”) |

| § | Test whether or not

the loan is subject to disclosure on TRID documents, the Loan Estimate (“LE”) and

Closing Disclosure (“CD”) |

| § | Pre-application Requirement

Testing: |

| · | Pre-application forms

cannot look similar to the LE |

| · | Pre-application forms

must contain the required disclaimer (“Your actual rate, payment, and costs could be

higher. Get an official Loan Estimate before choosing a loan”). |

| · | The LE was delivered

or placed in the mail within 3 business days of the broker or lender receiving an application. |

| · | The loan does not consummate

(Clayton looks to the later of the note date or notary date) until the later of seven business

days after the LE is delivered or placed in the mail and three business days after the CD

(or Corrected CD when a new three-day waiting period is triggered) is received. |

| · | That a revised LE or

CD is provided within three business days of the lender having knowledge of the information

that led to the change. |

| · | Zero and ten percent

tolerance fees are only reset with a valid and timely change of circumstance. |

| · | If a credit or refund

is made, that it is sufficient to cover Clayton’s calculated under-disclosure. |

| § | Payment Schedule Accuracy: |

| · | The number of columns

and timing of changes to payments as well as the mortgage insurance drop-off match Clayton’s

calculated payment schedule. |

| · | Interest-only periods

and final balloon payments are accurately completed. |

| · | The total of the principal

and interest payment, mortgage insurance and escrow amounts add up correctly. |

| · | When applicable, that

the AIR and AP tables are consistent with Clayton’s calculations. |

| § | Accuracy of the Loan

Calculations |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 17 | May 20, 2025 |

| · | Total interest percentage |

| · | Compliance with the TRID

rounding rules. |

| · | Compliance with specified

formatting requirements. |

| · | Compliance with date

entry requirements (such as when a field, if not applicable, must be present and left blank). |

| · | Alphabetization of fees. |

| · | Title fees preceded by

“Title –.” |

| · | Column or similar limits

such as four columns for Projected Payments and a maximum of thirteen Origination Charges

on the LE. |

| § | Consistency within and

across forms |

| · | Once a fee is disclosed

it must remain substantially the same name across disclosures. |

| · | Consistency between the

Costs at Closing and Calculating Cash to Close tables, for which there is a version for transactions

with a seller and an optional, but not required, version for transactions without a seller.

They should be consistent within and across disclosures. |

| · | Where amounts in a table

reference that they are derived from another section of the form, that the amounts match

the amount in the section referenced. |

| · | Escrow amounts disclosed

in the Projected Payments section tie out to the escrow amounts detailed in the Loan Disclosures

section. |

| § | Completion of the LE

and CD |

| · | All required fields not

specifically listed herein are completed or left blank in accordance with TRID rules; creditor

information, contact information, rate lock information, etc. |

| · | For areas where multiple

options are provided, such as Assumption, Negative Amortization and Liability after Foreclosure,

only one option is indicated. |

| · | That there is either

a signature or a Loan Acceptance statement on the form. |

| · | Clayton will capture

if the borrower waived their waiting period and the sufficiency of the waiver under TRID.

However, based on past experience with clients, Clayton will also issue an exception for

the loan closing early. |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 18 | May 20, 2025 |

| § | Corrected CD requiring

a new waiting period |

| · | Whether the APR increased

or decreased outside of tolerance requiring a new waiting period and whether that waiting

period was provided. For APR decreases Clayton will look to whether the APR decreased due

to a reduced finance charge, which will be considered to be within tolerance. |

| · | Whether the product or

a product feature changed which requires a new waiting period and whether that waiting period

was provided. |

| · | Whether a prepayment

penalty was added requiring a new waiting period and whether that waiting period was provided. |

| · | Corrected CD’s provided

with a post-close refund. |

| · | Post-close CD’s

to correct numerical errors based on events (such as recording) occurring within 30 days

of consummation. |

| · | Post-close CD’s

to correct non-numerical clerical errors required within 60 days of consummation. |

| · | Provision and timing

of Your Home Loan Toolkit (first lien, purchase-money loans) |

| · | Written List of Providers,

when there are items in in the Services You Can Shop For category (can impact fee tolerances) |

| · | Affiliated Business Disclosure

(can impact fee tolerances) |

| § | Outside of Clayton’s

default TRID scope: |

| · | Accuracy of the LE in

terms of whether fees are within the correct category and loan terms where we would need

a Note to verify. More detailed testing will occur by comparing the final CD to the Note

terms. |

| · | Whether the Liability

after Foreclosure selection is correct for the property state. |

| · | Accuracy of the Aggregate

Adjustment amount. |

| · | Presence and accuracy

of the Seller’s Transaction columns of the Summaries of Transactions section. |

| · | Accuracy of the Contact

Information for the lender, broker and settlement agent. Clayton will look for discrepancies

across forms, but is not independently verifying the information. |

| C. | FACTA - the Credit Score, Key Factors, and Notice to Home

Loan Applicant disclosures |

| D. | HMDA – Whether the loans is Rate Spread threshold

reportable. |

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 19 | May 20, 2025 |

STATE, COUNTY and MUNICIPAL LAW

Clayton test whether a loan meets the thresholds for a higher-priced,

rate spread, subprime or nonprime mortgage loan, and whether such loan meets regulatory requirements, in the following states:

| Higher-Priced |

| California |

Maryland |

New York |

| Connecticut |

Massachusetts (subprime ARMS to first

time homebuyers) |

North Carolina |

| Maine |

Minnesota |

|

Clayton test whether a loan meets the thresholds for a high cost

or covered loan in the following states, counties and municipalities, and also tests for compliance with provisions in such laws that

apply to all loans subject to high cost testing:

| State/Local High Cost |

| Arkansas |

Maine |

Pennsylvania |

| California |

Maryland |

Rhode Island, including the Providence

ordinance |

| Colorado |

Massachusetts |

South Carolina |

| Connecticut |

Nevada |

Tennessee |

| District

of Columbia |

New Jersey |

Texas |

| Florida |

New Mexico |

Utah |

| Georgia |

New York |

Vermont

(High Rate, High Point law) |

| Illinois,

including the Cook County and Chicago ordinances |

North Carolina |

Wisconsin |

| Indiana |

Ohio, including

Cleveland Heights ordinance |

|

| Kentucky |

Oklahoma |

|

Several states have laws that do not create a separate class of

high cost or higher-priced mortgage loans, but set APR or finance charge ceilings and may also set forth similar anti-predatory lending

restrictions as found in high cost laws. Clayton tests for compliance with such laws in the following states:

| · | Minnesota (Mortgage Originator

and Service Licensing Act) |

| · | Puerto Rico (Office Regulation

5722) |

| · | Texas (Texas Finance

Code) |

| · | West Virginia (Residential

Mortgage Lender, Broker and Servicer Act). |

Clayton uses a module that reports to the client the factors that

the client can weigh to determine whether or not the loan is in the borrower’s interest, and also makes a mathematical

determination as to whether or not there is at least one benefit. This module is only used in the following states, where the laws

or releases by the regulators provide an indication of some standards that can be applied.

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 20 | May 20, 2025 |

| Borrower’s Interest |

| Maine |

Ohio |

South Carolina |

| Massachusetts |

Rhode Island |

|

Several states have laws that neither create a separate class of

high cost or higher-priced mortgage loan, nor impose a ceiling on the overall fees or APR, but nonetheless contain requirements and restrictions

on mortgage loans that may impact the assignee or the lien. Clayton tests for compliance with such laws, including late charge and prepayment

penalty provisions, in the following states and municipalities:

| Consumer Protection |

| Alabama

(the “Mini-code”) |

Nebraska (Mortgage Bankers

Registration and Licensing Act and the Installment Loan Act) |

| Hawaii

(Financial Services Loan Company Act) |

Nevada (AB 440 |

| Idaho

(Residential Mortgage Practices Act) |

Ohio (Consumer Sales Practices Act;

whether the loan is in Summit County) |

| Illinois

(both versions of the Cook County Predatory Lending Database; Illinois Residential Mortgage Licensing Act) |

Texas (Article XVI, Section 50(a)(6)

of the Texas Constitution) |

| Iowa (Consumer

Credit Code) |

Utah (Consumer Credit Code) |

| Kansas

(Consumer Credit Code) |

Virginia (Mortgage Lender and Broker

Act) |

| Kentucky

(HB 552) |

Washington (Consumer Loan Act and Responsible

Mortgage Lending Act) |

| Maryland

(DLLR Regulations, Commercial Law) |

West Virginia (Consumer Credit Protection

Act) |

| Massachusetts

(Attorney General regulations) |

Wyoming (Residential Mortgage Practices

Act) |

| Michigan

(Consumer Mortgage Protection Act) |

|

See attached Exhibit A - Consumer Protection Laws for additional

details on the specific components of the aforementioned Consumer Protection laws that are evaluated as part of the Clayton Compliance

Review Scope:

In addition to identifying whether Texas refinances are cash out

transactions subject to the Texas Constitution Article 16 Section 50(a)(6) requirements, Clayton reviews the title report to confirm

prior loans being refinanced are continuous purchase money and not (a)(6) loans. In the event a loan is determined to be a Texas Home

Equity loan, the underwriter reviews the loan images to confirm the loan meets the Texas requirements including maximum LTV/CLTV, 3%

fee cap, product restrictions and the required disclosures were provided to the borrower in accordance with required timelines.

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 21 | May 20, 2025 |

GSE Testing

Clayton can review loans to determine whether they comply with Fannie

Mae’s and Freddie Mac’s Points and Fees threshold tests. These fee limitations of 5% for all loans with application dates

prior to 1/10/2014 were reduced to 3% on Primary and Second Homes for applications on or after 1/10/2014. If requested, loans can be

reviewed to determine whether the loan is a residential mortgage transaction ineligible for delivery due to its APR or fees exceeding

the HOEPA thresholds. Clayton offers Lender Letter and non-traditional mortgage testing for Fannie Mae. (Note: Fannie Mae requires a

non-disclosure agreement between the client and Fannie Mae for Clayton to report these results.)

Disclaimer

Please be advised that Clayton has not determined whether the Loans

comply with federal, state or local laws, constitutional provisions, regulations or ordinances, including, but not limited to, licensing

and general usury laws that set rate and/or fee limitations, unless listed above. Clayton’s review is focused on issues that raise

concerns for secondary market investors and other assignees, based on potential for assignee liability, an adverse impact on the lien,

and regulatory, litigation and headline risk. Clayton’s review is not designed to fully test a lender’s compliance with all

applicable disclosure and licensing requirements. Furthermore, the findings reached by Clayton are dependent upon its receiving complete

and accurate data regarding the Loans from loan originators and other third parties. Please be further advised that Clayton and its employees

do not engage in the practice of law, and the findings set forth in the reports prepared by Clayton do not constitute legal advice or

opinions.

© 2025 Clayton Services LLC. All rights reserved.

This material is confidential and may not be copied, used, or distributed

without the written permission of Clayton Services LLC

| EFMT 2025-NQM2 Due Diligence Narrative Report | Page | 22 | May 20, 2025 |