EXHIBIT 99.2

FINANCIAL RESULTS THIRD QUARTER FISCAL 2025

2 FORWARD - LOOKING STATEMENTS This presentation includes certain statements that are “forward - looking” statements within the meaning of the U . S . Private Securities Litigation Reform Act of 1995 , Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Securities Exchange Act of 1934 , as amended . These forward - looking statements are made based on management’s current expectations and beliefs regarding future and anticipated developments and their effects upon THOR, and inherently involve uncertainties and risks . These forward - looking statements are not a guarantee of future performance . We cannot assure you that actual results will not differ materially from our expectations . Factors which could cause materially different results include, among others : the impact of inflation on the cost of our products as well as on general consumer demand ; the effect of raw material and commodity price fluctuations, including the impact of tariffs, and/or raw material, commodity or chassis supply constraints ; the impact of war, military conflict, terrorism and/or cyber - attacks, including state - sponsored or ransom attacks ; the impact of sudden or significant adverse changes in the cost and/or availability of energy or fuel, including those caused by geopolitical events, on our costs of operation, on raw material prices, on our suppliers, on our independent dealers or on retail customers ; the dependence on a small group of suppliers for certain components used in production, including chassis ; interest rates and interest rate fluctuations and their potential impact on the general economy and, specifically, on our independent dealers and consumers and our profitability ; the ability to ramp production up or down quickly in response to rapid changes in demand or market share while also managing associated costs, including labor - related costs and production capacity costs ; the level and magnitude of warranty and recall claims incurred ; the ability of our suppliers to financially support any defects in their products ; the financial health of our independent dealers and their ability to successfully manage through various economic conditions ; legislative, regulatory and tax law and/or policy developments including their potential impact on our independent dealers, retail customers or on our suppliers ; the costs of compliance with governmental regulation ; the impact of an adverse outcome or conclusion related to current or future litigation or regulatory audits or investigations ; public perception of and the costs related to environmental, social and governance matters ; legal and compliance issues including those that may arise in conjunction with recently completed transactions ; the level of consumer confidence and the level of discretionary consumer spending ; the impact of exchange rate fluctuations ; restrictive lending practices which could negatively impact our independent dealers and/or retail consumers ; management changes ; the success of new and existing products and services ; the ability to maintain strong brands and develop innovative products that meet consumer demands ; changes in consumer preferences ; the risks associated with acquisitions, including : the pace and successful closing of an acquisition, the integration and financial impact thereof, the level of achievement of anticipated operating synergies from acquisitions, the potential for unknown or understated liabilities related to acquisitions, the potential loss of existing customers of acquisitions and our ability to retain key management personnel of acquired companies ; a shortage of necessary personnel for production and increasing labor costs and related employee benefits to attract and retain production personnel in times of high demand ; the loss or reduction of sales to key independent dealers, and stocking level decisions of our independent dealers ; disruption of the delivery of units to independent dealers or the disruption of delivery of raw materials, including chassis, to our facilities ; increasing costs for freight and transportation ; the ability to protect our information technology systems from data breaches, cyber - attacks and/or network disruptions ; asset impairment charges ; competition ; the impact of losses under repurchase agreements ; the impact of the strength of the U . S . dollar on international demand for products priced in U . S . dollars ; general economic, market, public health and political conditions in the various countries in which our products are produced and/or sold ; the impact of changing emissions and other related climate change regulations in the various jurisdictions in which our products are produced, used and/or sold ; changes to our investment and capital allocation strategies or other facets of our strategic plan ; and changes in market liquidity conditions, credit ratings and other factors that may impact our access to future funding and the cost of debt . These and other risks and uncertainties are discussed more fully in our Quarterly Report on Form 10 - Q for the quarter ended April 30 , 2025 and in Item 1 A of our Annual Report on Form 10 - K for the year ended July 31 , 2024 . We disclaim any obligation or undertaking to disseminate any updates or revisions to any forward - looking statements contained in this presentation or to reflect any change in our expectations after the date hereof or any change in events, conditions or circumstances on which any statement is based, except as required by law .

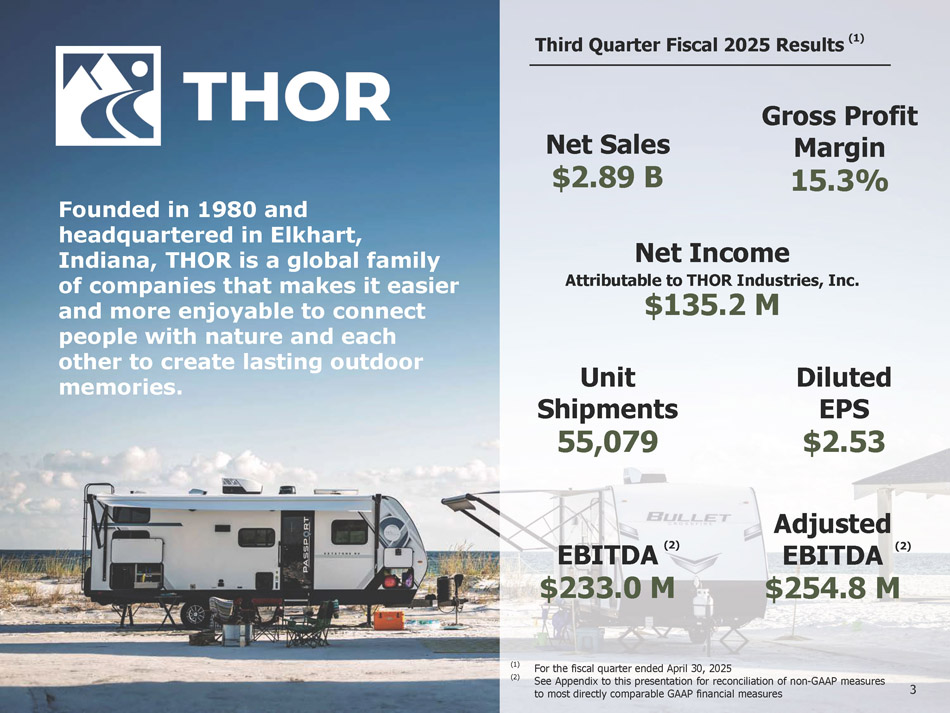

3 Founded in 1980 and headquartered in Elkhart, Indiana, THOR is a global family of companies that makes it easier and more enjoyable to connect people with nature and each other to create lasting outdoor memories. Unit Shipments 55,079 Net Sales $2.89 B Adjusted EBITDA $254.8 M Gross Profit Margin 15.3% Diluted EPS $2.53 (1) (2) For the fiscal quarter ended April 30, 2025 See Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures Third Quarter Fiscal 2025 Results (1) (2) Net Income Attributable to THOR Industries, Inc. $135.2 M EBITDA (2) $233.0 M

EUROPEAN SEGMENT NORTH AMERICAN MOTORIZED SEGMENT NORTH AMERICAN TOWABLE SEGMENT 4 We consist of a trusted family of brands that are loved by RV consumers

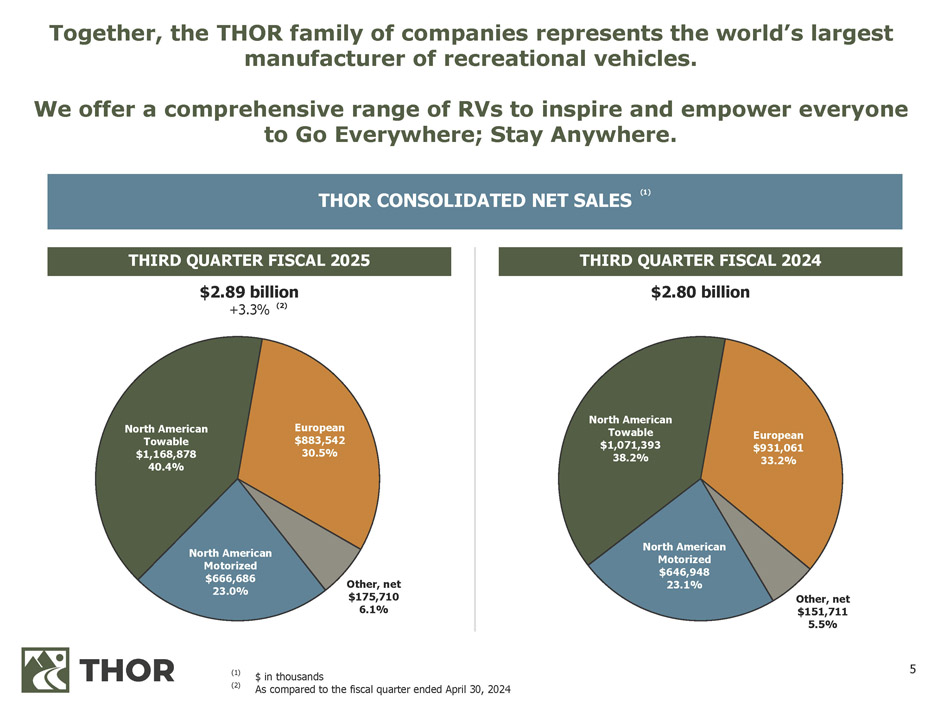

5 Together, the THOR family of companies represents the world’s largest manufacturer of recreational vehicles. We offer a comprehensive range of RVs to inspire and empower everyone to Go Everywhere; Stay Anywhere. Other, net $175,710 6.1% North American Motorized $666,686 23.0% (1) (2) $ in thousands As compared to the fiscal quarter ended April 30, 2024 THOR CONSOLIDATED NET SALES (1) North American Towable $1,168,878 40.4% European $883,542 30.5% Other, net $151,711 5.5% North American Motorized $646,948 23.1% North American Towable $1,071,393 38.2% European $931,061 33.2% THIRD QUARTER FISCAL 2025 THIRD QUARTER FISCAL 2024 $2.80 billion $2.89 billion +3.3% (2)

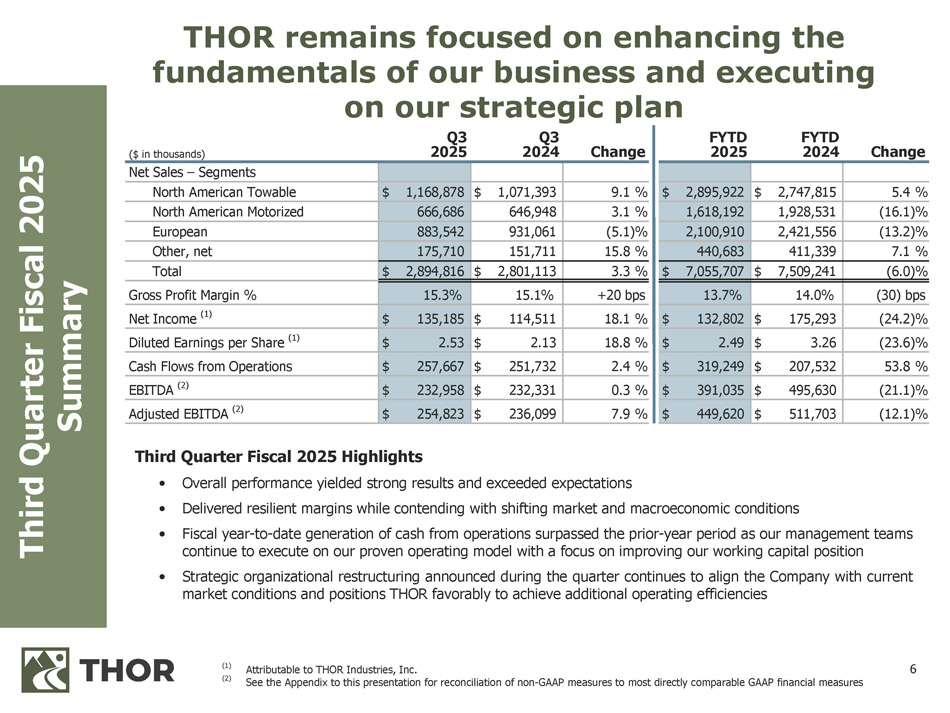

6 ($ in thousands) Q3 2025 Q3 2024 Change Net Sales – Segments 9.1 % $ 1,071,393 $ 1,168,878 North American Towable 3.1 % 646,948 666,686 North American Motorized (5.1)% 931,061 883,542 European 15.8 % 151,711 175,710 Other, net 3.3 % $ 2,801,113 $ 2,894,816 Total +20 bps 15.1% 15.3% Gross Profit Margin % 18.1 % $ 114,511 $ 135,185 Net Income (1) 18.8 % $ 2.13 $ 2.53 Diluted Earnings per Share (1) 2.4 % $ 251,732 $ 257,667 Cash Flows from Operations 0.3 % $ 232,331 $ 232,958 EBITDA (2) 7.9 % $ 236,099 $ 254,823 Adjusted EBITDA (2) FYTD 2025 FYTD 2024 Change 5.4 % $ 2,747,815 $ 2,895,922 (16.1)% 1,928,531 1,618,192 (13.2)% 2,421,556 2,100,910 7.1 % 411,339 440,683 (6.0)% $ 7,509,241 $ 7,055,707 (30) bps 14.0% 13.7% (24.2)% $ 175,293 $ 132,802 (23.6)% $ 3.26 $ 2.49 53.8 % $ 207,532 $ 319,249 (21.1)% $ 495,630 $ 391,035 (12.1)% $ 511,703 $ 449,620 THOR remains focused on enhancing the fundamentals of our business and executing on our strategic plan (1) (2) Attributable to THOR Industries, Inc. See the Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures Third Quarter Fiscal 2025 Summary Third Quarter Fiscal 2025 Highlights • Overall performance yielded strong results and exceeded expectations • Delivered resilient margins while contending with shifting market and macroeconomic conditions • Fiscal year - to - date generation of cash from operations surpassed the prior - year period as our management teams continue to execute on our proven operating model with a focus on improving our working capital position • Strategic organizational restructuring announced during the quarter continues to align the Company with current market conditions and positions THOR favorably to achieve additional operating efficiencies

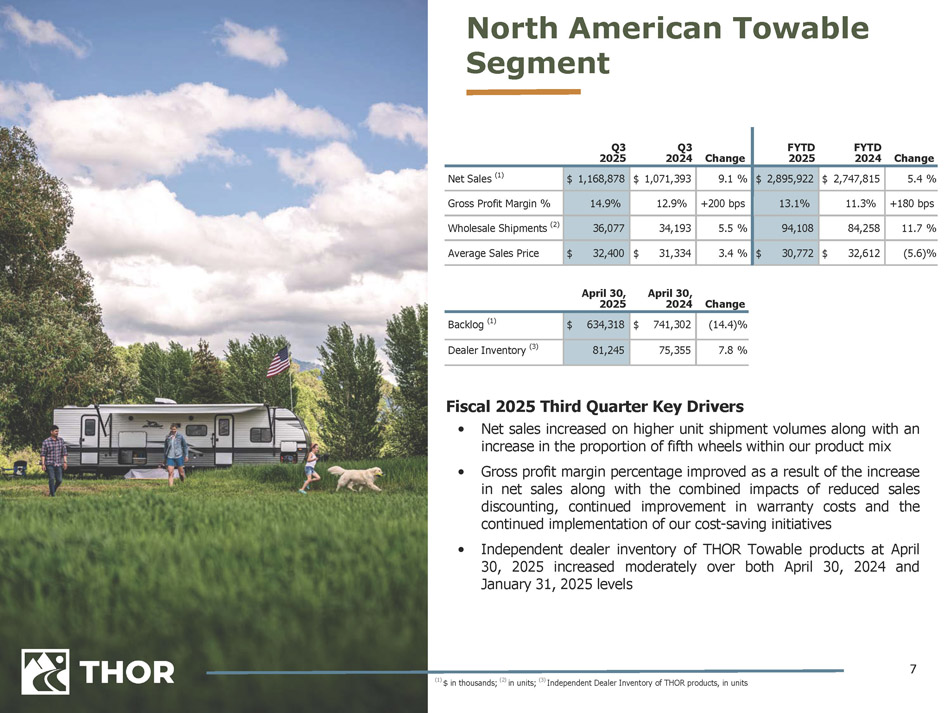

7 Fiscal 2025 Third Quarter Key Drivers • Net sales increased on higher unit shipment volumes along with an increase in the proportion of fifth wheels within our product mix • Gross profit margin percentage improved as a result of the increase in net sales along with the combined impacts of reduced sales discounting, continued improvement in warranty costs and the continued implementation of our cost - saving initiatives • Independent dealer inventory of THOR Towable products at April 30 , 2025 increased moderately over both April 30 , 2024 and January 31 , 2025 levels North American Towable Segment FYTD FYTD Q3 Q3 Change 2024 2025 Change 2024 2025 5.4 % $ 2,747,815 $ 2,895,922 9.1 % $ 1,071,393 $ 1,168,878 Net Sales (1) +180 bps 11.3% 13.1% +200 bps 12.9% 14.9% Gross Profit Margin % 11.7 % 84,258 94,108 5.5 % 34,193 36,077 Wholesale Shipments (2) (5.6)% $ 32,612 $ 30,772 3.4 % $ 31,334 $ 32,400 Average Sales Price April 30, 2025 April 30, 2024 Change (14.4)% $ 741,302 $ 634,318 Backlog (1) 7.8 % 75,355 81,245 Dealer Inventory (3) (1) $ in thousands; (2) in units; (3) Independent Dealer Inventory of THOR products, in units

8 North American Motorized Segment Fiscal 2025 Third Quarter Key Drivers • While unit shipments increased 10 . 9 % , net sales increased moderately by 3 . 1 % compared to the prior - year period due to a shift in product mix towards our lower - priced Class C, Class B and Class A gas product lines and an increase in sales discounting • Gross profit margin percentage decreased due to the combined impact of higher sales discounting and the change in product mix • While independent dealer inventory of THOR Motorized products at April 30 , 2025 decreased in comparison to the prior year, levels did increase modestly compared to the second quarter of our fiscal 2025 as independent dealers prepared for their 2025 selling season FYTD FYTD Q3 Q3 Change 2024 2025 Change 2024 2025 (16.1)% $ 1,928,531 $ 1,618,192 3.1 % $ 646,948 $ 666,686 Net Sales (1) (190) bps 11.0% 9.1% (60) bps 11.1% 10.5% Gross Profit Margin % (14.7)% 14,984 12,774 10.9 % 4,964 5,507 Wholesale Shipments (2) (1.6)% $ 128,706 $ 126,679 (7.1)% $ 130,328 $ 121,062 Average Sales Price April 30, 2025 April 30, 2024 Change (4.5)% $ 925,829 $ 883,739 Backlog (1) (15.4)% 12,539 10,602 Dealer Inventory (3) (1) $ in thousands; (2) in units; (3) Independent Dealer Inventory of THOR products, in units

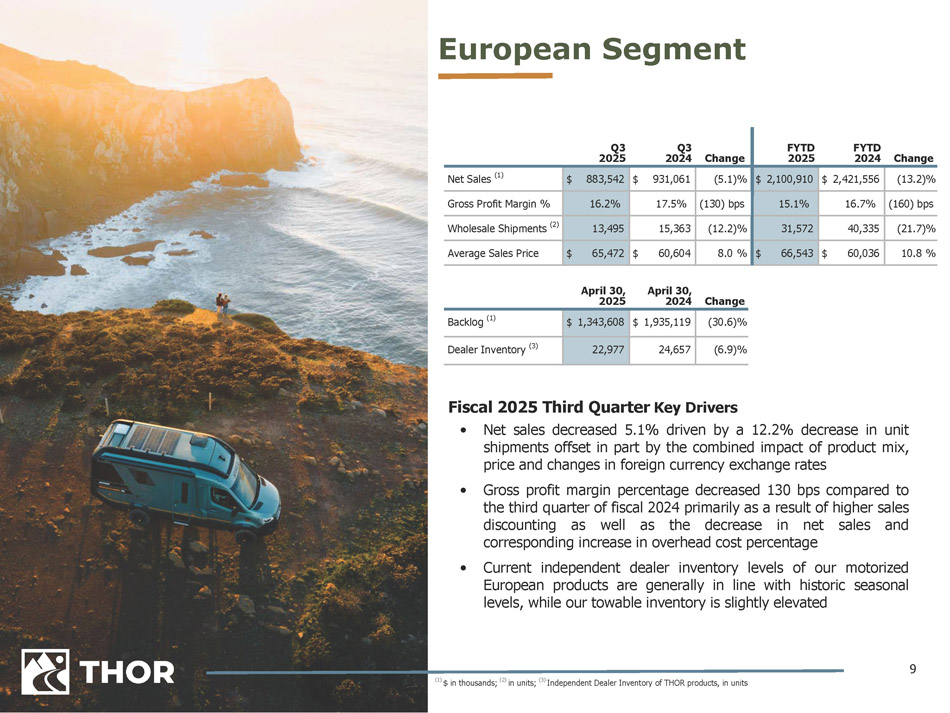

9 European Segment Fiscal 2025 Third Quarter Key Drivers • Net sales decreased 5 . 1 % driven by a 12 . 2 % decrease in unit shipments offset in part by the combined impact of product mix, price and changes in foreign currency exchange rates • Gross profit margin percentage decreased 130 bps compared to the third quarter of fiscal 2024 primarily as a result of higher sales discounting as well as the decrease in net sales and corresponding increase in overhead cost percentage • Current independent dealer inventory levels of our motorized European products are generally in line with historic seasonal levels, while our towable inventory is slightly elevated FYTD FYTD Q3 Q3 Change 2024 2025 Change 2024 2025 (13.2)% $ 2,421,556 $ 2,100,910 (5.1)% $ 931,061 $ 883,542 Net Sales (1) (160) bps 16.7% 15.1% (130) bps 17.5% 16.2% Gross Profit Margin % (21.7)% 40,335 31,572 (12.2)% 15,363 13,495 Wholesale Shipments (2) 10.8 % $ 60,036 $ 66,543 8.0 % $ 60,604 $ 65,472 Average Sales Price April 30, 2025 April 30, 2024 Change (30.6)% $ 1,935,119 $ 1,343,608 Backlog (1) (6.9)% 24,657 22,977 Dealer Inventory (3) (1) $ in thousands; (2) in units; (3) Independent Dealer Inventory of THOR products, in units

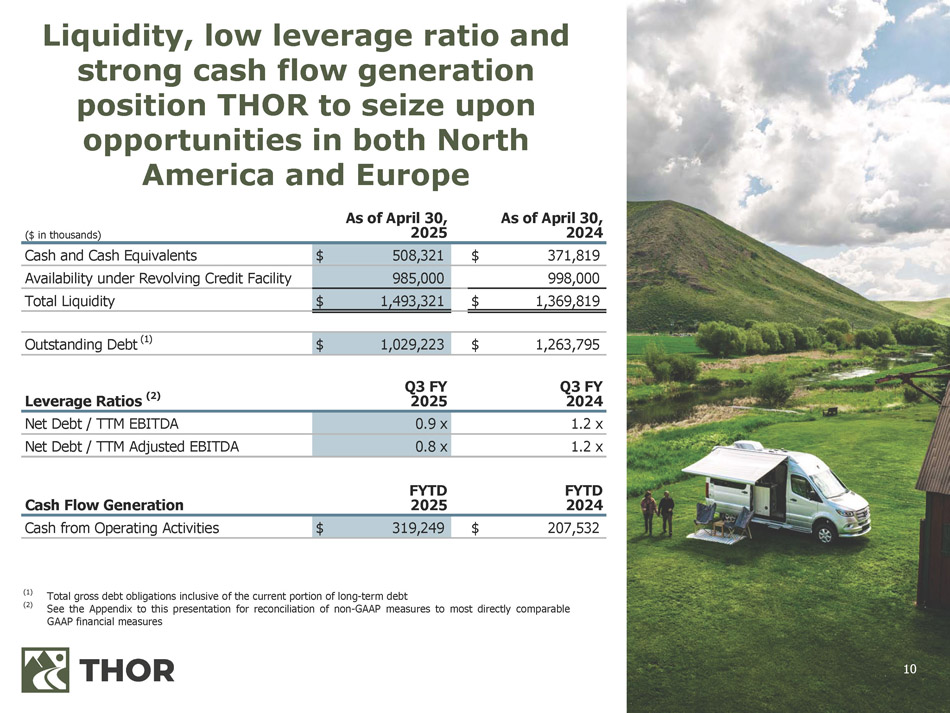

10 $ 1,263,795 $ 1,029,223 Outstanding Debt (1) ($ in thousands) As of April 30, 2025 As of April 30, 2024 $ 371,819 $ 508,321 Cash and Cash Equivalents 998,000 985,000 Availability under Revolving Credit Facility $ 1,369,819 $ 1,493,321 Total Liquidity Leverage Ratios (2) Q3 FY 2025 Q3 FY 2024 1.2 x 0.9 x Net Debt / TTM EBITDA 1.2 x 0.8 x Net Debt / TTM Adjusted EBITDA Cash Flow Generation FYTD 2025 FYTD 2024 $ 207,532 $ 319,249 Cash from Operating Activities (1) (2) Total gross debt obligations inclusive of the current portion of long - term debt See the Appendix to this presentation for reconciliation of non - GAAP measures to most directly comparable GAAP financial measures Liquidity, low leverage ratio and strong cash flow generation position THOR to seize upon opportunities in both North America and Europe

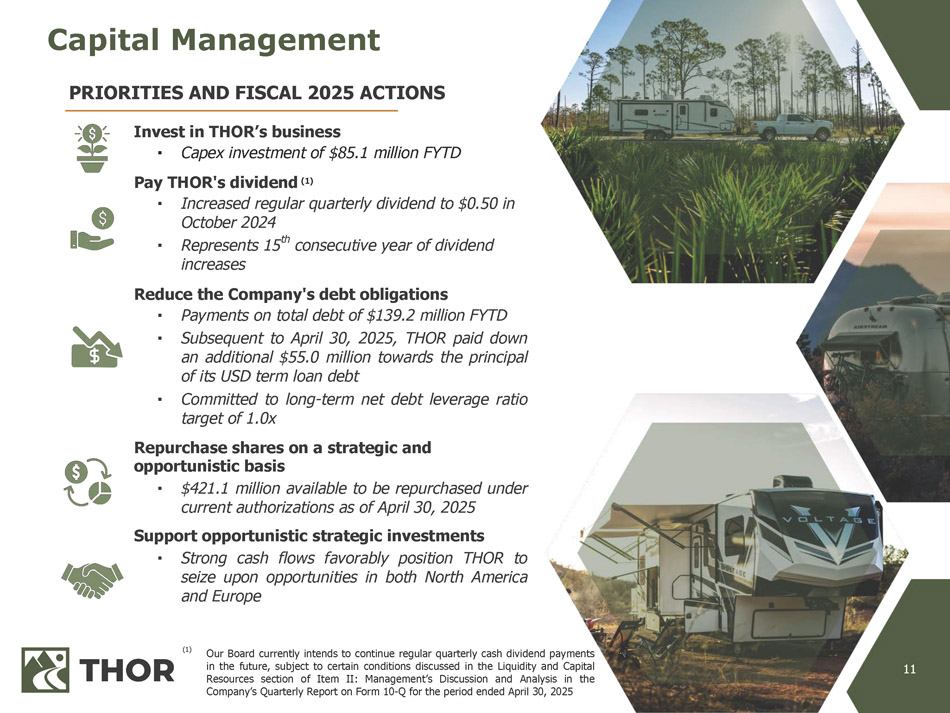

11 Capital Management PRIORITIES AND FISCAL 2025 ACTIONS Invest in THOR’s business ▪ Capex investment of $ 85 . 1 million FYTD Pay THOR's dividend (1) ▪ Increased regular quarterly dividend to $0.50 in October 2024 ▪ Represents 15 th consecutive year of dividend increases Reduce the Company's debt obligations ▪ Payments on total debt of $ 139 . 2 million FYTD ▪ Subsequent to April 30 , 2025 , THOR paid down an additional $ 55 . 0 million towards the principal of its USD term loan debt ▪ Committed to long - term net debt leverage ratio target of 1 . 0 x Repurchase shares on a strategic and opportunistic basis ▪ $ 421 . 1 million available to be repurchased under current authorizations as of April 30 , 2025 Support opportunistic strategic investments ▪ Strong cash flows favorably position THOR to seize upon opportunities in both North America and Europe (1) Our Board currently intends to continue regular quarterly cash dividend payments in the future, subject to certain conditions discussed in the Liquidity and Capital Resources section of Item II : Management’s Discussion and Analysis in the Company’s Quarterly Report on Form 10 - Q for the period ended April 30 , 2025

12 Financial performance for the third quarter yielded strong results and exceeded expectations Delivered resilient consolidated margin in the face of shifting market and macroeconomic conditions Improved fiscal year - to - date generation of cash from operations by over $ 100 . 0 million on a year - over - year basis, driven by management’s execution of our proven operating model and significantly reducing working capital Announced strategic organizational restructuring to continue to align operations with current market conditions and to favorably position THOR to achieve additional operating efficiencies Through the first nine months of fiscal 2025 , we have reduced our indebtedness by approximately $ 139 . 2 million and paid down an additional $ 55 . 0 million against the principal balance of our USD term loan subsequent to April 30 , 2025 Key takeaways from Q3 FY 2025

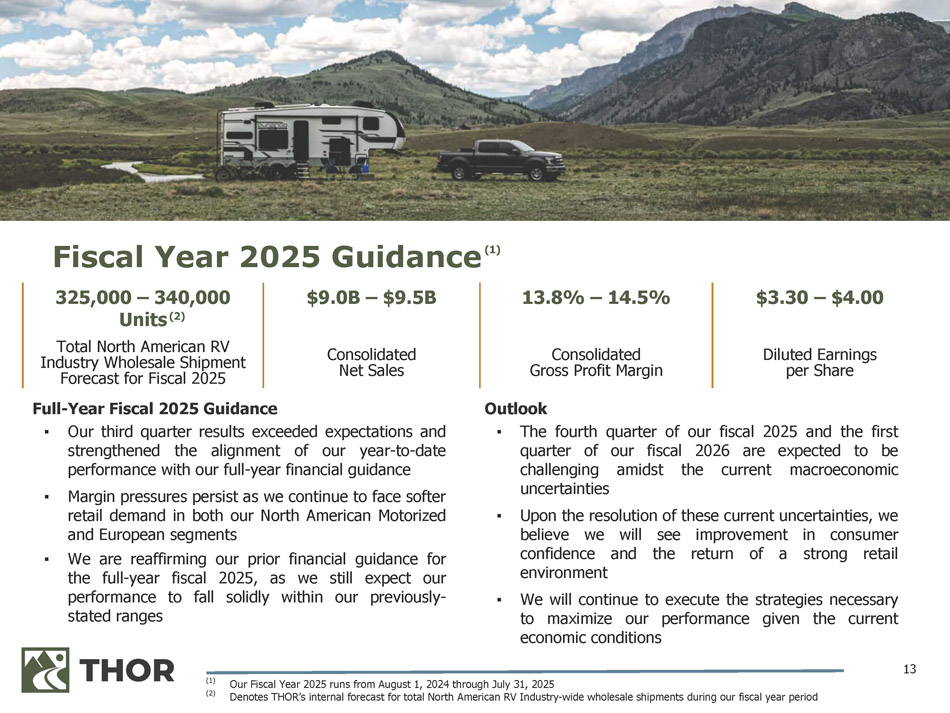

13 Full - Year Fiscal 2025 Guidance ▪ Our third quarter results exceeded expectations and strengthened the alignment of our year - to - date performance with our full - year financial guidance ▪ Margin pressures persist as we continue to face softer retail demand in both our North American Motorized and European segments ▪ We are reaffirming our prior financial guidance for the full - year fiscal 2025 , as we still expect our performance to fall solidly within our previously - stated ranges Fiscal Year 2025 Guidance (1) 325,000 – 340,000 Units (2) Total North American RV Industry Wholesale Shipment Forecast for Fiscal 2025 $9.0B – $9.5B 13.8% – 14.5% $3.30 – $4.00 Consolidated Net Sales Consolidated Gross Profit Margin Diluted Earnings per Share Outlook ▪ The fourth quarter of our fiscal 2025 and the first quarter of our fiscal 2026 are expected to be challenging amidst the current macroeconomic uncertainties ▪ Upon the resolution of these current uncertainties, we believe we will see improvement in consumer confidence and the return of a strong retail environment ▪ We will continue to execute the strategies necessary to maximize our performance given the current economic conditions (1) (2) Our Fiscal Year 2025 runs from August 1, 2024 through July 31, 2025 Denotes THOR’s internal forecast for total North American RV Industry - wide wholesale shipments during our fiscal year period

14 Appendix

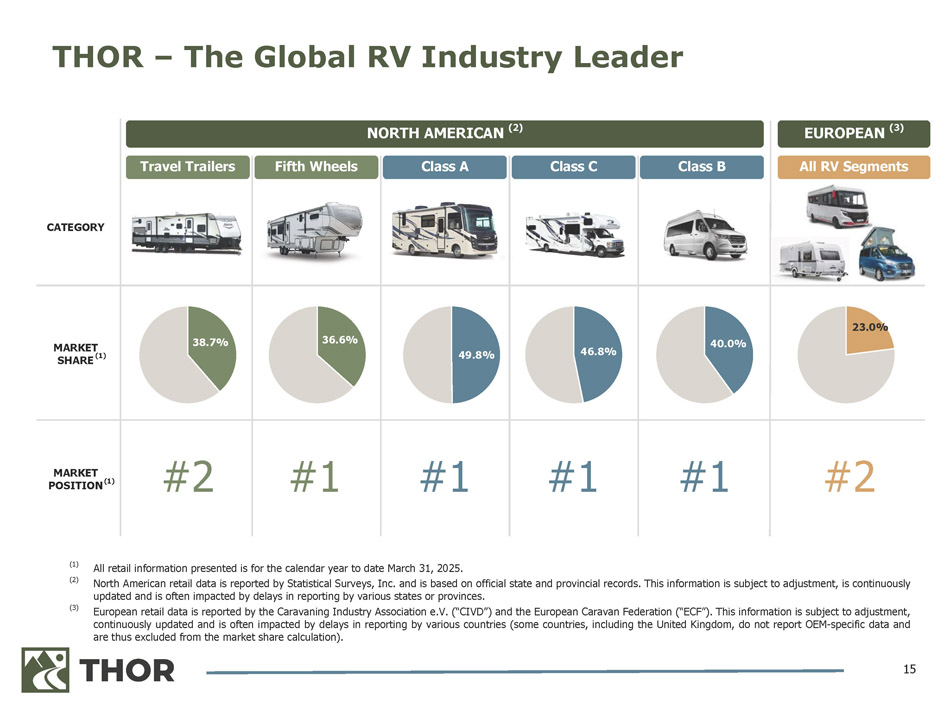

15 (1) All retail information presented is for the calendar year to date March 31 , 2025 . North American retail data is reported by Statistical Surveys, Inc . and is based on official state and provincial records . This information is subject to adjustment, is continuously updated and is often impacted by delays in reporting by various states or provinces . European retail data is reported by the Caravaning Industry Association e . V . (“CIVD”) and the European Caravan Federation (“ECF ” ) . This information is subject to adjustment, continuously updated and is often impacted by delays in reporting by various countries (some countries, including the United Kingdom, do not report OEM - specific data and are thus excluded from the market share calculation) . (2) (3) EUROPEAN (3) All RV Segments NORTH AMERICAN (2) CATEGORY Class B Class C Class A Fifth Wheels Travel Trailers 23.0% 40.0% 46.8% 49.8% 36.6% 38.7% MARKET SHARE (1) #2 #1 #1 #1 #1 #2 MARKET POSITION (1) THOR – The Global RV Industry Leader

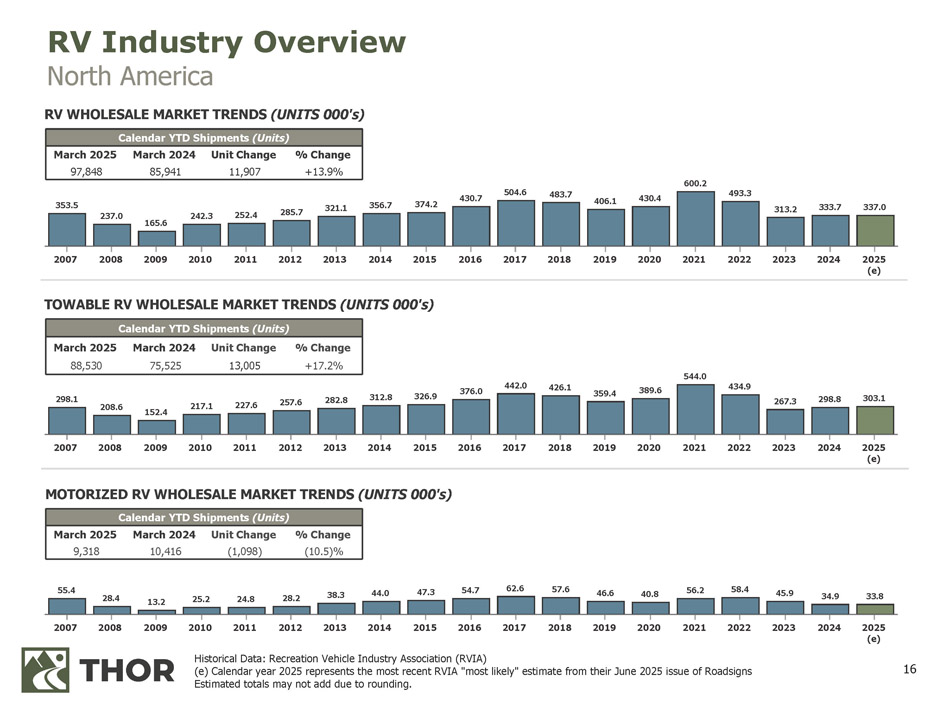

16 55.4 28.4 13.2 25.2 24.8 28.2 38.3 44.0 47.3 54.7 62.6 57.6 46.6 40.8 56.2 58.4 45.9 34.9 33.8 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) 298.1 208.6 152.4 217.1 227.6 257.6 282.8 312.8 326.9 376.0 442.0 426.1 359.4 389.6 544.0 434.9 267.3 298.8 303.1 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) 353.5 237.0 165.6 242.3 252.4 285.7 321.1 356.7 374.2 430.7 504.6 483.7 406.1 430.4 600.2 493.3 313.2 333.7 337.0 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 (e) TOWABLE RV WHOLESALE MARKET TRENDS (UNITS 000's) Calendar YTD Shipments (Units) % Change Unit Change March 2024 March 2025 +13.9% 11,907 85,941 97,848 Calendar YTD Shipments (Units) % Change Unit Change March 2024 March 2025 +17.2% 13,005 75,525 88,530 Calendar YTD Shipments (Units) % Change Unit Change March 2024 March 2025 (10.5)% (1,098) 10,416 9,318 Historical Data: Recreation Vehicle Industry Association (RVIA) (e) Calendar year 2025 represents the most recent RVIA "most likely" estimate from their June 2025 issue of Roadsigns Estimated totals may not add due to rounding. RV Industry Overview North America RV WHOLESALE MARKET TRENDS (UNITS 000's) MOTORIZED RV WHOLESALE MARKET TRENDS (UNITS 000's)

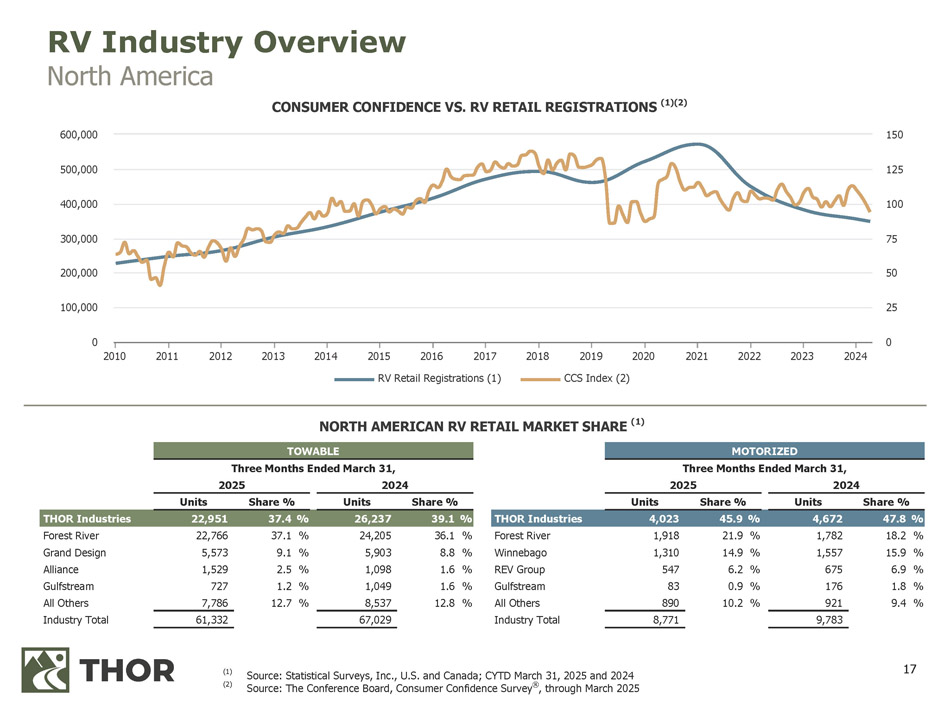

17 RV Industry Overview North America CONSUMER CONFIDENCE VS. RV RETAIL REGISTRATIONS (1)(2) NORTH AMERICAN RV RETAIL MARKET SHARE (1) 2015 2016 2017 RV Retail Registrations (1) CCS Index (2) 2010 2011 2012 2013 2014 2018 2019 2020 2021 2022 2023 2024 0 100,000 200,000 300,000 400,000 500,000 600,000 0 25 50 75 100 125 150 (1) (2) Source: Statistical Surveys, Inc., U.S. and Canada; CYTD March 31, 2025 and 2024 Source: The Conference Board, Consumer Confidence Survey ® , through March 2025 47.8 % 4,672 45.9 % 4,023 THOR Industries 39.1 % 26,237 37.4 % 22,951 THOR Industries % 18.2 1,782 % 21.9 1,918 Forest River % 36.1 24,205 % 37.1 22,766 Forest River % 15.9 1,557 % 14.9 1,310 Winnebago % 8.8 5,903 % 9.1 5,573 Grand Design % 6.9 675 % 6.2 547 REV Group % 1.6 1,098 % 2.5 1,529 Alliance % 1.8 176 % 0.9 83 Gulfstream % 1.6 1,049 % 1.2 727 Gulfstream % 9.4 921 % 10.2 890 All Others % 12.8 8,537 % 12.7 7,786 All Others 9,783 8,771 Industry Total 67,029 61,332 Industry Total TOWABLE Three Months Ended March 31, 2025 2024 Share % Units Units Share % MOTORIZED Three Months Ended March 31, 2025 2024 Share % Units Units Share %

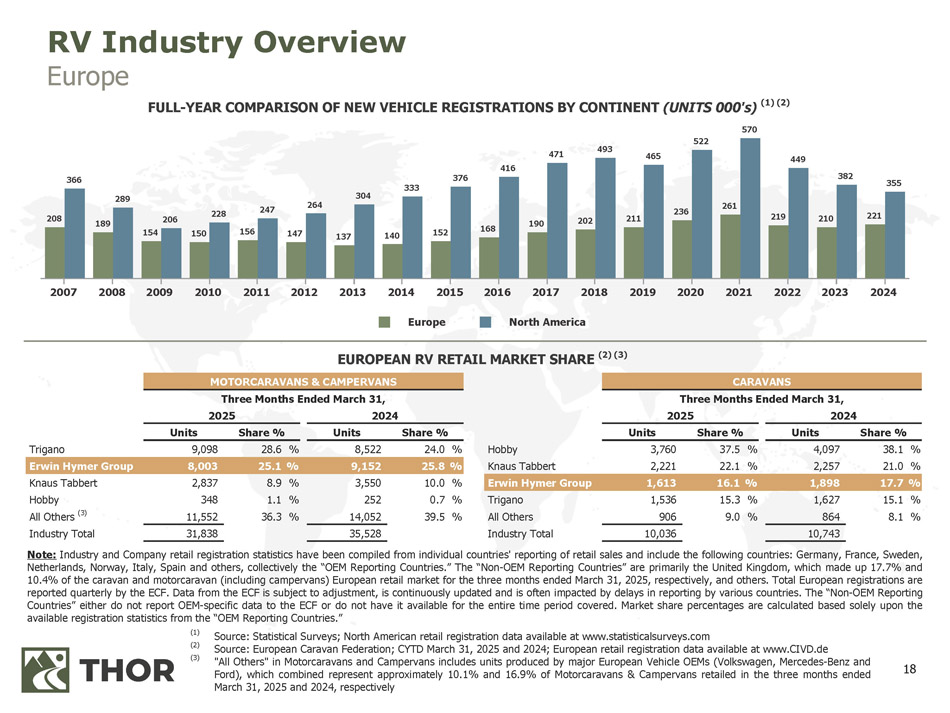

18 EUROPEAN RV RETAIL MARKET SHARE (2) (3) 208 189 154 150 156 147 137 140 152 168 190 202 211 236 261 219 210 221 366 289 206 228 247 264 304 333 376 416 471 493 465 449 382 355 Europe North America 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 (1) (2) (3) Source : Statistical Surveys ; North American retail registration data available at www . statisticalsurveys . com Source : European Caravan Federation ; CYTD March 31 , 2025 and 2024 ; European retail registration data available at www . CIVD . de "All Others" in Motorcaravans and Campervans includes units produced by major European Vehicle OEMs (Volkswagen, Mercedes - Benz and Ford), which combined represent approximately 10 . 1 % and 16 . 9 % of Motorcaravans & Campervans retailed in the three months ended March 31 , 2025 and 2024 , respectively RV Industry Overview Europe FULL - YEAR COMPARISON OF NEW VEHICLE REGISTRATIONS BY CONTINENT (UNITS 000's) (1) (2) 570 522 CARAVANS Units Three Months Ended March 31, 2025 2024 Share % Units Share % MOTORCARAVANS & CAMPERVANS Units Three Months Ended March 31, 2025 2024 Share % Units Share % 38.1 % 4,097 37.5 % 3,760 Hobby 24.0 % 8,522 28.6 % 9,098 Trigano 21.0 % 2,257 22.1 % 2,221 Knaus Tabbert 25.8 % 9,152 25.1 % 8,003 Erwin Hymer Group 17.7 % 1,898 16.1 % 1,613 Erwin Hymer Group 10.0 % 3,550 8.9 % 2,837 Knaus Tabbert 15.1 % 1,627 15.3 % 1,536 Trigano 0.7 % 252 1.1 % 348 Hobby 8.1 % 864 9.0 % 906 All Others 39.5 % 14,052 36.3 % 11,552 All Others (3) 10,743 10,036 Industry Total 35,528 31,838 Industry Total Note : Industry and Company retail registration statistics have been compiled from individual countries' reporting of retail sales and include the following countries : Germany, France, Sweden, Netherlands, Norway, Italy, Spain and others, collectively the “OEM Reporting Countries . ” The “Non - OEM Reporting Countries” are primarily the United Kingdom, which made up 17 . 7 % and 10 . 4 % of the caravan and motorcaravan (including campervans) European retail market for the three months ended March 31 , 2025 , respectively, and others . Total European registrations are reported quarterly by the ECF . Data from the ECF is subject to adjustment, is continuously updated and is often impacted by delays in reporting by various countries . The “Non - OEM Reporting Countries” either do not report OEM - specific data to the ECF or do not have it available for the entire time period covered . Market share percentages are calculated based solely upon the available registration statistics from the “OEM Reporting Countries . ”

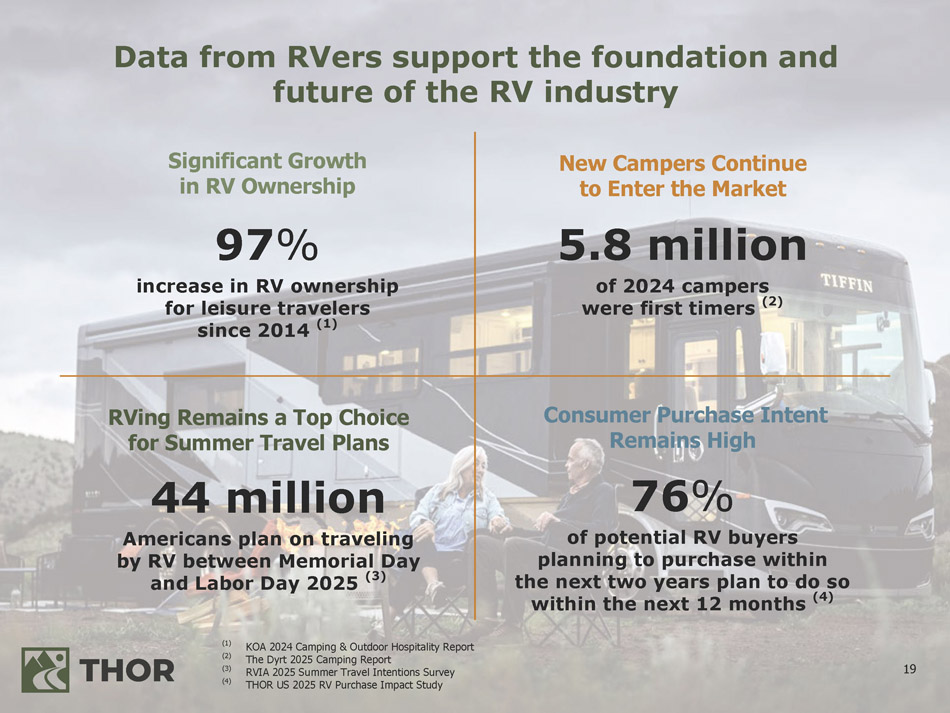

19 Significant Growth in RV Ownership 97 % increase in RV ownership for leisure travelers since 2014 (1) RVing Remains a Top Choice for Summer Travel Plans 44 million Americans plan on traveling by RV between Memorial Day and Labor Day 2025 (3) Consumer Purchase Intent Remains High 76 % of potential RV buyers planning to purchase within the next two years plan to do so within the next 12 months (4) New Campers Continue to Enter the Market 5.8 million of 2024 campers were first timers (2) Data from RVers support the foundation and future of the RV industry (1) (2) (3) (4) KOA 2024 Camping & Outdoor Hospitality Report The Dyrt 2025 Camping Report RVIA 2025 Summer Travel Intentions Survey THOR US 2025 RV Purchase Impact Study

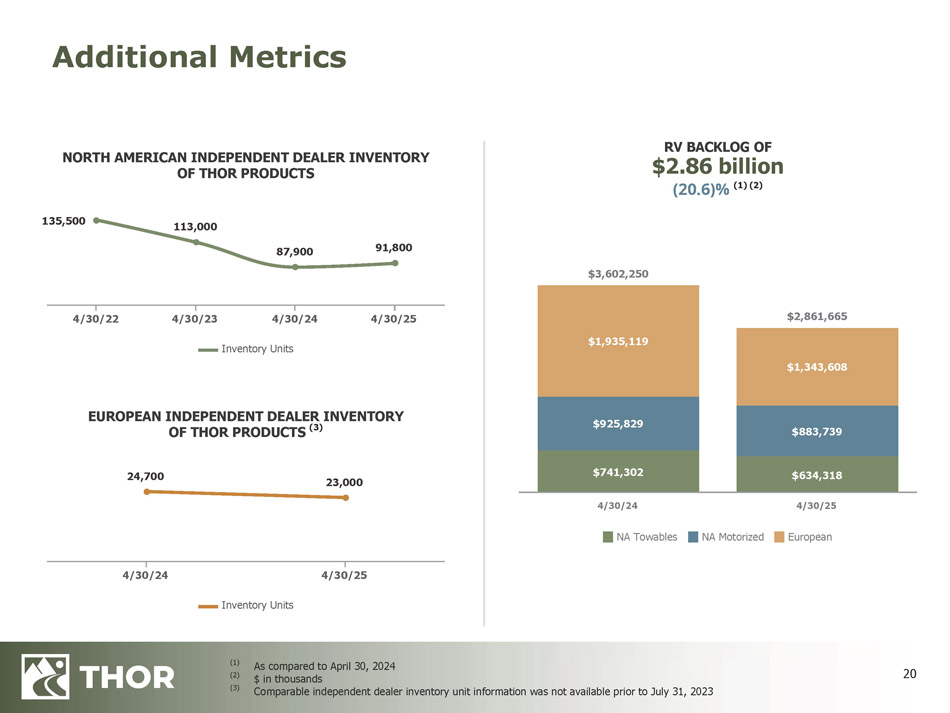

20 Additional Metrics $3,602,250 $2,861,665 $741,302 $634,318 $925,829 $883,739 $1,935,119 $1,343,608 NA Towables NA Motorized European 4/30/24 4/30/25 135,500 113,000 87,900 91,800 Inventory Units 4/30/22 4/30/23 4/30/24 4/30/25 NORTH AMERICAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS RV BACKLOG OF $2.86 billion (20.6)% (1) (2) (1) (2) (3) As compared to April 30, 2024 $ in thousands Comparable independent dealer inventory unit information was not available prior to July 31, 2023 24,700 23,000 Inventory Units 4/30/24 4/30/25 EUROPEAN INDEPENDENT DEALER INVENTORY OF THOR PRODUCTS (3)

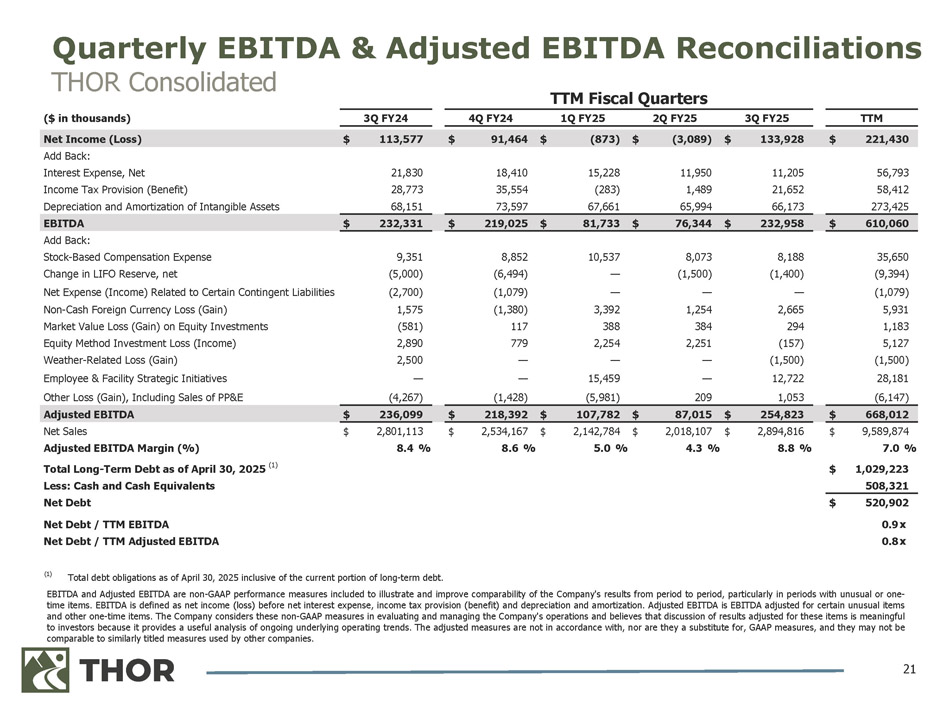

EBITDA and Adjusted EBITDA are non - GAAP performance measures included to illustrate and improve comparability of the Company's results from period to period, particularly in periods with unusual or one - time items . EBITDA is defined as net income (loss) before net interest expense, income tax provision (benefit) and depreciation and amortization . Adjusted EBITDA is EBITDA adjusted for certain unusual items and other one - time items . The Company considers these non - GAAP measures in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends . The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies . 21 Quarterly EBITDA & Adjusted EBITDA Reconciliations THOR Consolidated TTM 3Q FY25 2Q FY25 1Q FY25 4Q FY24 3Q FY24 ($ in thousands) $ 221,430 $ 133,928 $ (3,089) $ (873) $ 91,464 $ 113,577 Net Income (Loss) 56,793 11,205 11,950 15,228 18,410 21,830 Add Back: Interest Expense, Net 58,412 21,652 1,489 (283) 35,554 28,773 Income Tax Provision (Benefit) 273,425 66,173 65,994 67,661 73,597 68,151 Depreciation and Amortization of Intangible Assets $ 610,060 $ 232,958 $ 76,344 $ 81,733 $ 219,025 $ 232,331 EBITDA 35,650 8,188 8,073 10,537 8,852 9,351 Add Back: Stock - Based Compensation Expense (9,394) (1,400) (1,500) — (6,494) (5,000) Change in LIFO Reserve, net (1,079) — — — (1,079) (2,700) Net Expense (Income) Related to Certain Contingent Liabilities 5,931 2,665 1,254 3,392 (1,380) 1,575 Non - Cash Foreign Currency Loss (Gain) 1,183 294 384 388 117 (581) Market Value Loss (Gain) on Equity Investments 5,127 (157) 2,251 2,254 779 2,890 Equity Method Investment Loss (Income) (1,500) (1,500) — — — 2,500 Weather - Related Loss (Gain) 28,181 12,722 — 15,459 — — Employee & Facility Strategic Initiatives (6,147) 1,053 209 (5,981) (1,428) (4,267) Other Loss (Gain), Including Sales of PP&E $ 668,012 $ 254,823 $ 87,015 $ 107,782 $ 218,392 $ 236,099 Adjusted EBITDA $ 9,589,874 $ 2,894,816 $ 2,018,107 $ 2,142,784 $ 2,534,167 $ 2,801,113 Net Sales 7.0 % 8.8 % 4.3 % 5.0 % 8.6 % 8.4 % Adjusted EBITDA Margin (%) $ 1,029,223 Total Long - Term Debt as of April 30, 2025 (1) 508,321 Less: Cash and Cash Equivalents $ 520,902 Net Debt 0.9 x 0.8 x Net Debt / TTM EBITDA Net Debt / TTM Adjusted EBITDA TTM Fiscal Quarters (1) Total debt obligations as of April 30, 2025 inclusive of the current portion of long - term debt.

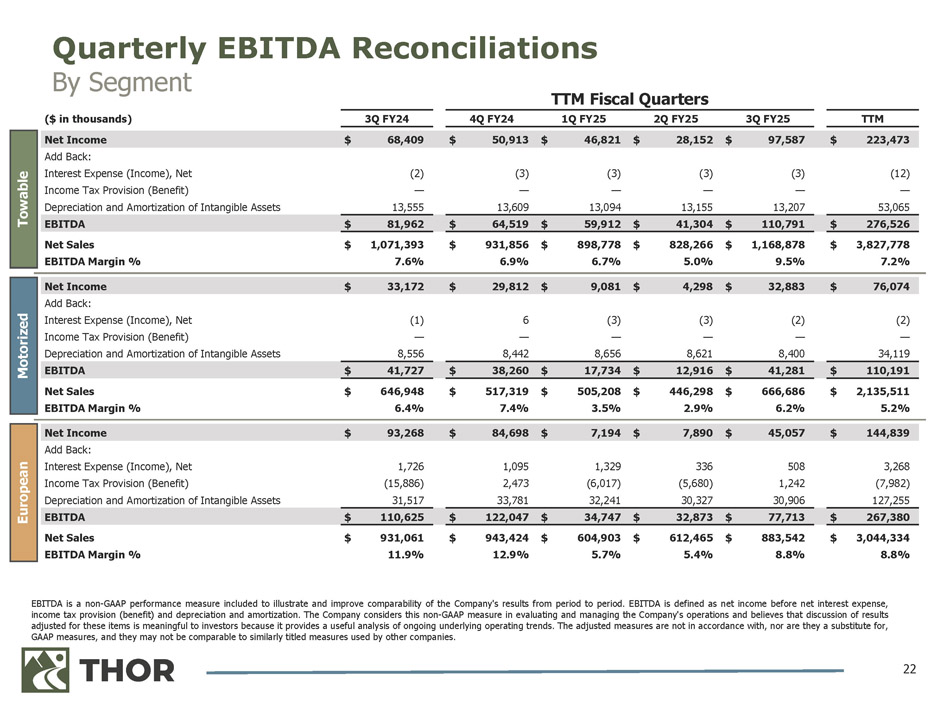

EBITDA is a non - GAAP performance measure included to illustrate and improve comparability of the Company's results from period to period . EBITDA is defined as net income before net interest expense, income tax provision (benefit) and depreciation and amortization . The Company considers this non - GAAP measure in evaluating and managing the Company's operations and believes that discussion of results adjusted for these items is meaningful to investors because it provides a useful analysis of ongoing underlying operating trends . The adjusted measures are not in accordance with, nor are they a substitute for, GAAP measures, and they may not be comparable to similarly titled measures used by other companies . 22 Quarterly EBITDA Reconciliations By Segment ($ in thousands) 3Q FY24 4Q FY24 TTM Fiscal Quarters 1Q FY25 2Q FY25 3Q FY25 TTM $ 223,473 $ 97,587 $ 28,152 $ 46,821 $ 50,913 $ 68,409 Net Income Add Back: (12) (3) (3) (3) (3) (2) Interest Expense (Income), Net — — — — — — Income Tax Provision (Benefit) 53,065 13,207 13,155 13,094 13,609 13,555 Depreciation and Amortization of Intangible Assets $ 276,526 $ 110,791 $ 41,304 $ 59,912 $ 64,519 $ 81,962 EBITDA $ 3,827,778 $ 1,168,878 $ 828,266 $ 898,778 $ 931,856 $ 1,071,393 Net Sales 7.2% 9.5% 5.0% 6.7% 6.9% 7.6% EBITDA Margin % $ 76,074 $ 32,883 $ 4,298 $ 9,081 $ 29,812 $ 33,172 Net Income Add Back: (2) (2) (3) (3) 6 (1) Interest Expense (Income), Net — — — — — — Income Tax Provision (Benefit) 34,119 8,400 8,621 8,656 8,442 8,556 Depreciation and Amortization of Intangible Assets $ 110,191 $ 41,281 $ 12,916 $ 17,734 $ 38,260 $ 41,727 EBITDA $ 2,135,511 $ 666,686 $ 446,298 $ 505,208 $ 517,319 $ 646,948 Net Sales 5.2% 6.2% 2.9% 3.5% 7.4% 6.4% EBITDA Margin % $ 144,839 $ 45,057 $ 7,890 $ 7,194 $ 84,698 $ 93,268 Net Income Add Back: 3,268 508 336 1,329 1,095 1,726 Interest Expense (Income), Net (7,982) 1,242 (5,680) (6,017) 2,473 (15,886) Income Tax Provision (Benefit) 127,255 30,906 30,327 32,241 33,781 31,517 Depreciation and Amortization of Intangible Assets $ 267,380 $ 77,713 $ 32,873 $ 34,747 $ 122,047 $ 110,625 EBITDA $ 3,044,334 $ 883,542 $ 612,465 $ 604,903 $ 943,424 $ 931,061 Net Sales 8.8% 8.8% 5.4% 5.7% 12.9% 11.9% EBITDA Margin % Towable Motorized European

www.thorindustries.com THOR Investor Relations Contact: Seth Woolf Head of Corporate Development & Investor Relations swoolf@thorindustries.com (574) 294 - 7718