William Blair Growth Stock Conference June 4, 2025

Forward-Looking Statements This presentation includes “forward-looking statements” as that term is defined in Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995. These forward-looking statements are based on Neogen’s current expectations and are subject to risks and uncertainties, which could cause actual results to differ from those stated or implied by such forward-looking statements. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary from those indicated or anticipated by such forward-looking statements. The inclusion of forward-looking statements should not be regarded as a representation that such plans, estimates or expectations will be achieved. Important factors that could cause actual results to differ from such forward-looking statements include, among others, the continued integration of the 3M food safety business and the realization of the expected benefits from that acquisition; the relationship with and performance of our transition manufacturing partner; our ability to adequately and timely remediate certain identified material weaknesses in our internal control over financial reporting; competition; recruitment and retention of key employees; impact of weather on agriculture and food production; global business disruption caused by the Russia invasion in Ukraine and related sanctions and the conflict in the Middle East; identification and integration of acquisitions; research and development risks; intellectual property protection; increasing and developing government regulation; the effect of tariffs and trade regulations; and other risks detailed from time to time in the Company’s reports on file at the Securities and Exchange Commission, including Neogen’s Annual Report on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and other documents filed with the Securities and Exchange Commission. The foregoing list of important factors is not exclusive. Any forward-looking statements speak only as of the date of this presentation. Neogen expressly disclaims any obligation to update any forward-looking statements, whether as a result of new information or developments, future events or otherwise, except as required by law. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Disclaimer

Our Purpose We’re fueling a brighter future for global food security. Our Vision We envision a world where everyone has access to a food supply that is safe, sufficient and sustainable. Global food security is a lofty goal. But it’s one we’re uniquely positioned to support. For over 40 years we’ve made it our mission to help keep our food supply safe. To further human and animal well-being. To champion sustainable practices that affect our land, our water, our world. Every decision made on a farm, in a lab, at a processing plant, affects food security. And we’ll be leading every step of the way.

Animal Safety Supporting Wellbeing Develop solutions for animal protein, animal performance and companion animal segments Offer portfolio of biosecurity products to help prevent the spread of disease, as well as veterinary instruments and supplies to enhance animal care Genetic testing and related data capabilities to optimize herd selection and companion animal care Food Safety Helping to Protect the Food Supply Food safety products that reach all segments of the food, beverage and feed industries Solutions include rapid quantification of detected organisms, sanitation verification tools and innovative pathogen tests Data platform with the opportunity to leverage AI to drive aggregation and predictive analytics Global Leader in Food Security Product offerings across Neogen's Food Safety and Animal Safety platforms help solve global food security challenges

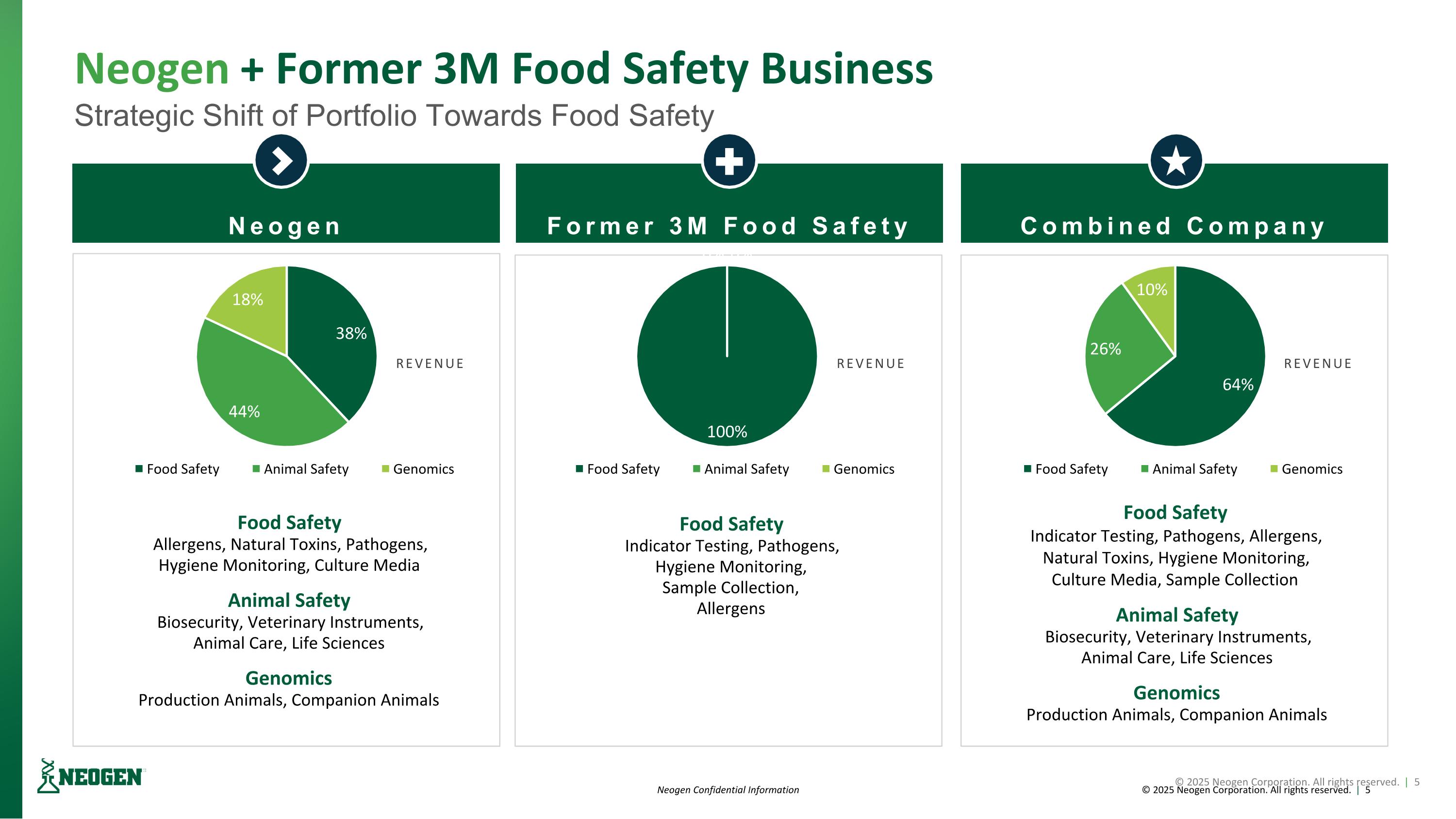

Food Safety Indicator Testing, Pathogens, Allergens, Natural Toxins, Hygiene Monitoring, Culture Media, Sample Collection Animal Safety Biosecurity, Veterinary Instruments, Animal Care, Life Sciences Genomics Production Animals, Companion Animals Food Safety Indicator Testing, Pathogens, Hygiene Monitoring, Sample Collection, Allergens Food Safety Allergens, Natural Toxins, Pathogens, Hygiene Monitoring, Culture Media Animal Safety Biosecurity, Veterinary Instruments, Animal Care, Life Sciences Genomics Production Animals, Companion Animals Combined Company Former 3M Food Safety Neogen Neogen Confidential Information Neogen + Former 3M Food Safety Business Strategic Shift of Portfolio Towards Food Safety revenue revenue revenue

Leading Portfolio of Consumables Companion Animal Veterinary Instruments, Animal Care Production Animal Biosecurity Rapid Indicator Solutions Hygiene Monitoring Culture Media and Sample Handling Indicator Testing and Culture Media Easy-to-use, rapid indication of presence of organisms in a sample Complementary products for accurate sample collection and incubation Allergen Testing Natural Toxin Testing Rapid detection of allergens in food processing lines Rapid detection of mycotoxins, primarily in harvested crops Allergens and Natural Toxins Pathogen Detection Bacterial and General Sanitation Rapid microbiological detection of pathogens in food processing and other facilities Surface test for rapid detection of organic matter Animal Safety Products Animal health delivery systems, as well as veterinary instruments, pharmaceuticals & biologics Products intended to reduce spread of disease from humans, insects & rodents Genetic testing to optimize herd selection and performance Identification of breed(s), diseases and traits for veterinarians, breeders & pet owners Genomics Helping customers protect the global food supply and reduce food waste

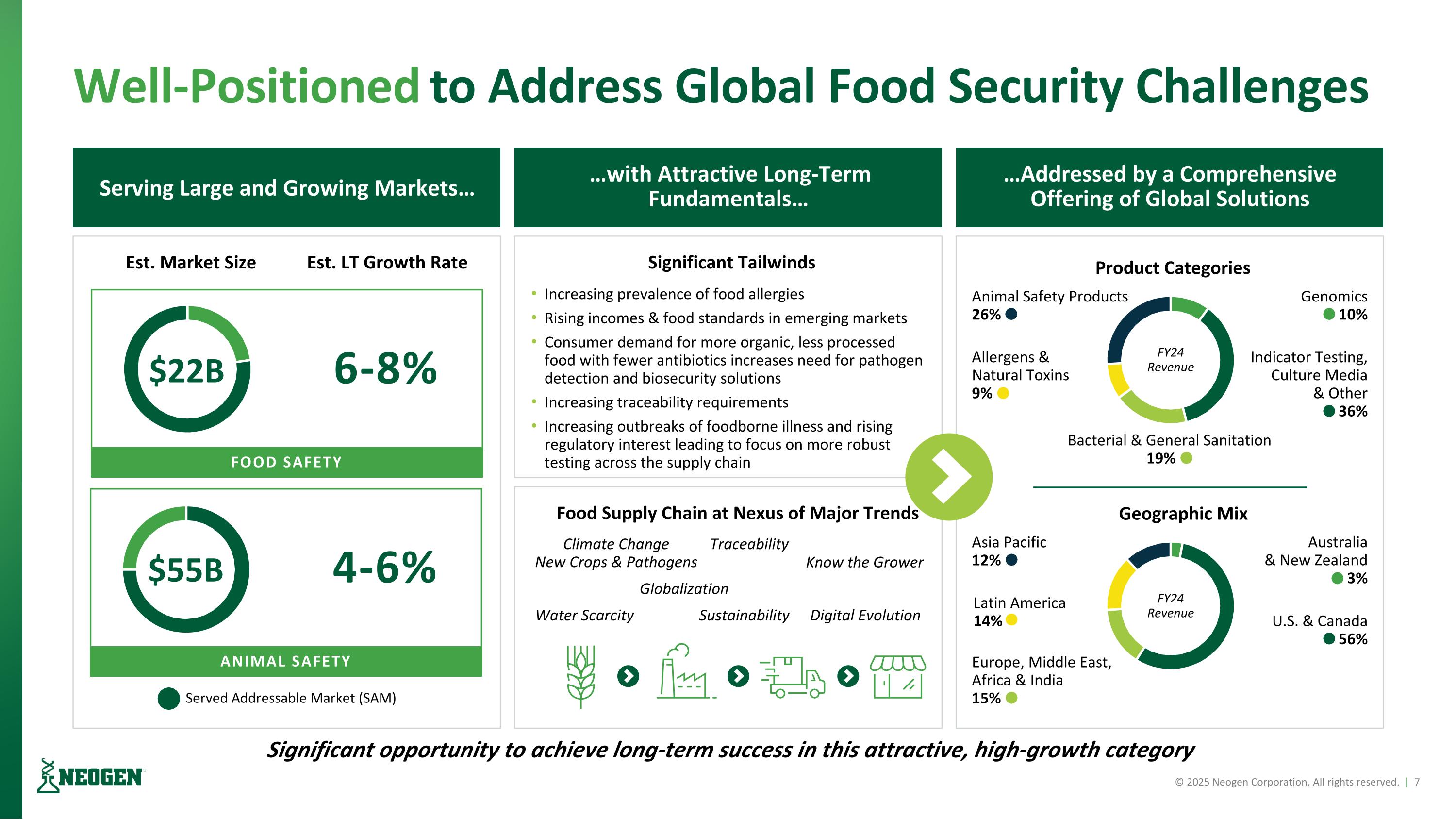

Significant Tailwinds Increasing prevalence of food allergies Rising incomes & food standards in emerging markets Consumer demand for more organic, less processed food with fewer antibiotics increases need for pathogen detection and biosecurity solutions Increasing traceability requirements Increasing outbreaks of foodborne illness and rising regulatory interest leading to focus on more robust testing across the supply chain Well-Positioned to Address Global Food Security Challenges Serving Large and Growing Markets… …with Attractive Long-Term Fundamentals… …Addressed by a Comprehensive Offering of Global Solutions Product Categories Food Supply Chain at Nexus of Major Trends Traceability Climate Change New Crops & Pathogens Know the Grower Globalization Water Scarcity Digital Evolution Sustainability Geographic Mix Genomics 10% Indicator Testing, Culture Media & Other 36% Animal Safety Products 26% Allergens & Natural Toxins 9% Bacterial & General Sanitation 19%00 U.S. & Canada 56% Latin America 14% Asia Pacific 12% Australia & New Zealand 3% Europe, Middle East, Africa & India 15% ANIMAL SAFETY 4-6% $55B Est. Market Size Est. LT Growth Rate FOOD SAFETY 6-8% $22B Served Addressable Market (SAM) Significant opportunity to achieve long-term success in this attractive, high-growth category FY24 Revenue FY24 Revenue

Transformational Journey Significant progress made on Neogen’s transformational journey following the acquisition of the former 3M Food Safety division that made Neogen the leader in Food Safety Approaching three years into an expected integration of roughly four years, six key workstreams have been completed and the final workstream remains on track Integration has had more challenges than anticipated – upgrading of capabilities and business processes has been underway, with the team for the future largely in place Reshaping of the portfolio has begun to further increase focus on the Food Safety market – Cleaners & Disinfectants divestiture announced, Genomics in-process Targeted improvement plan has been implemented, which the Company is committed to executing to maximize the performance of the business

Q4 FY25 Update Preliminary view suggests Q4 revenue will materially approximate guidance Transitory headwinds expected to negatively impact gross margin Adjusted EBITDA margin anticipated to be in the high-teens range Market conditions remained soft as Q3 weakness carried through Q4 Continued macro economic impact on food demand, global trade uncertainty Sample collection production volume improvements have been sustained Focusing on improved production efficiency and reducing stand-up costs Genomics business being marketed as second divestiture; Cleaners and Disinfectants remains on track for Q1 close Annualized direct impact of current tariffs estimated at ~$5M after supply actions, exemption waivers and pricing

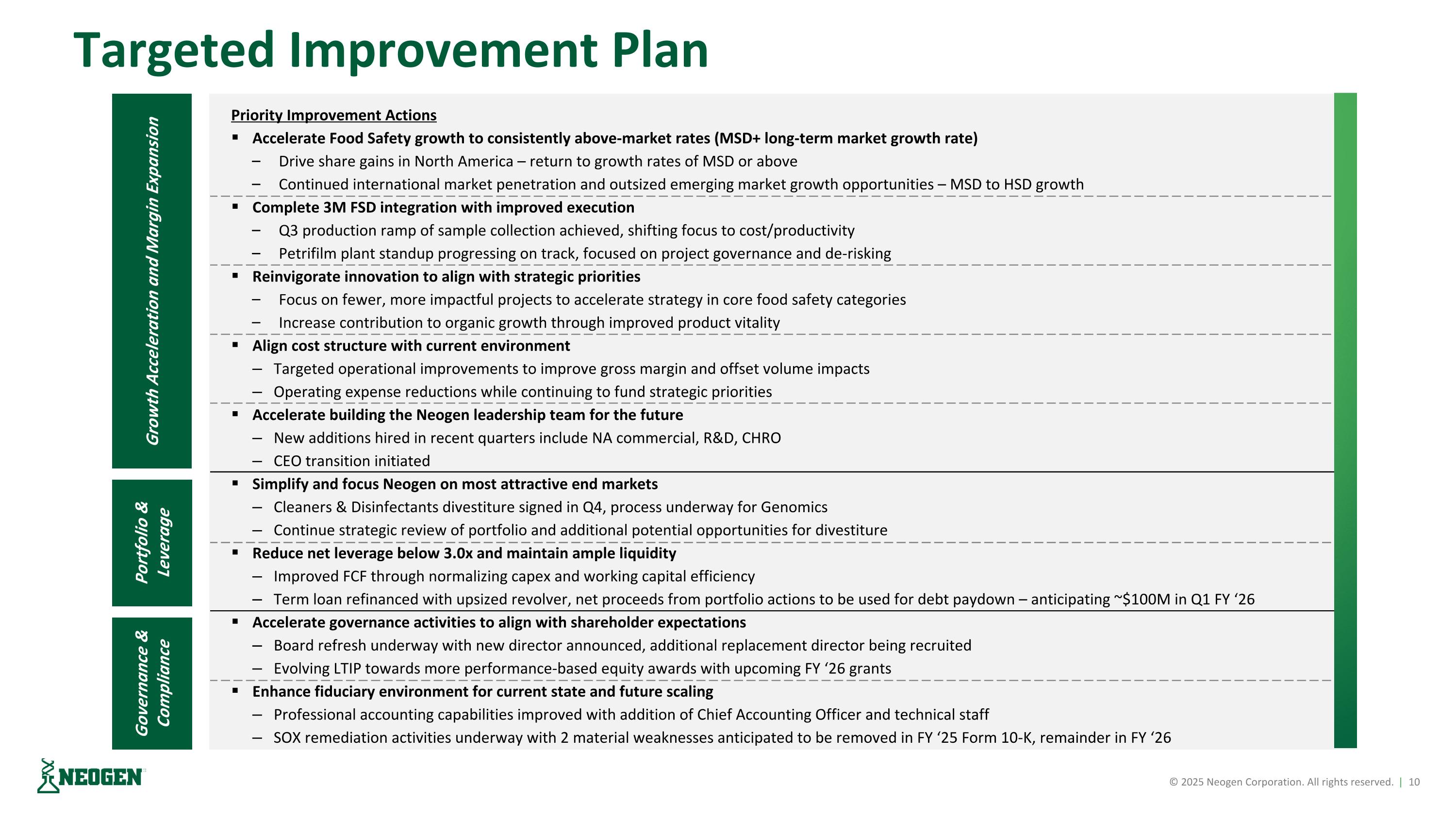

Priority Improvement Actions Accelerate Food Safety growth to consistently above-market rates (MSD+ long-term market growth rate) Drive share gains in North America – return to growth rates of MSD or above Continued international market penetration and outsized emerging market growth opportunities – MSD to HSD growth Complete 3M FSD integration with improved execution Q3 production ramp of sample collection achieved, shifting focus to cost/productivity Petrifilm plant standup progressing on track, focused on project governance and de-risking Reinvigorate innovation to align with strategic priorities Focus on fewer, more impactful projects to accelerate strategy in core food safety categories Increase contribution to organic growth through improved product vitality Align cost structure with current environment Targeted operational improvements to improve gross margin and offset volume impacts Operating expense reductions while continuing to fund strategic priorities Accelerate building the Neogen leadership team for the future New additions hired in recent quarters include NA commercial, R&D, CHRO CEO transition initiated Simplify and focus Neogen on most attractive end markets Cleaners & Disinfectants divestiture signed in Q4, process underway for Genomics Continue strategic review of portfolio and additional potential opportunities for divestiture Reduce net leverage below 3.0x and maintain ample liquidity Improved FCF through normalizing capex and working capital efficiency Term loan refinanced with upsized revolver, net proceeds from portfolio actions to be used for debt paydown – anticipating ~$100M in Q1 FY ‘26 Accelerate governance activities to align with shareholder expectations Board refresh underway with new director announced, additional replacement director being recruited Evolving LTIP towards more performance-based equity awards with upcoming FY ‘26 grants Enhance fiduciary environment for current state and future scaling Professional accounting capabilities improved with addition of Chief Accounting Officer and technical staff SOX remediation activities underway with 2 material weaknesses anticipated to be removed in FY ‘25 Form 10-K, remainder in FY ‘26 Targeted Improvement Plan Growth Acceleration and Margin Expansion Portfolio & Leverage Governance & Compliance

Investment Highlights Clear leader in attractive Food Safety end market with long-term, secular tailwinds, including increasing regulatory interest Portfolio of over 95% consumable products, cost of which is insignificant relative to potential costs resulting from inadequate testing Opportunity to leverage technological expertise, scale and enhanced regional leadership to deliver on focused initiatives and extend the Company’s demonstrated track record of strong historical growth Significant portion of integration of transformational business is complete, providing a path to a compelling level of consistent growth, high profitability and strong free cash flow generation Actions underway to improve profitability and further focus the business on food safety