Exhibit 99.2

Management’s Discussion and Analysis

This management’s discussion and analysis (“MD&A”) of operations and financial condition for the second quarter of fiscal 2025, dated June 2, 2025, should be read in conjunction with the unaudited interim consolidated financial statements for the period ended April 30, 2025, which have been prepared in accordance with International Financial Reporting Standards (“IFRS”). This MD&A should also be read in conjunction with VersaBank’s MD&A and Audited Consolidated Financial Statements for the year ended October 31, 2024, which are available on VersaBank’s website at www.versabank.com, SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar. Except as discussed below, all other factors discussed and referred to in the MD&A for the year ended October 31, 2024, remain substantially unchanged. All currency amounts in this document are in Canadian dollars unless otherwise indicated.

|

Cautionary Note Regarding Forward-Looking Statements |

2 |

|

About VersaBank |

3 |

|

Strategy |

4 |

|

Overview of Performance |

7 |

|

Selected Financial Highlights |

10 |

|

Financial Review – Earnings |

11 |

|

Financial Review – Balance Sheet |

17 |

|

Off-Balance Sheet Arrangements |

26 |

|

Related Party Transactions |

27 |

|

Capital Management and Capital Resources |

27 |

|

Results of Operating Segments |

30 |

|

Summary of Quarterly Results |

33 |

|

Non-GAAP and Other Financial Measures |

33 |

|

Material Accounting Policies and Use of Estimates and Judgements |

35 |

|

Controls and Procedures |

36 |

|

Additional Information |

36 |

| VersaBank – Q2 2025 MD&A | 1 |

Cautionary Note Regarding Forward-Looking Statements

VersaBank’s public communications often include written or oral forward-looking statements. Statements of this type are included in this document and may be included in other filings and with Canadian securities regulators or the US Securities and Exchange Commission, or in other communications. All such statements are made pursuant to the “safe harbor” provisions of, and are intended to be forward-looking statements under, the United States Private Securities Litigation Reform Act of 1995 and any applicable Canadian securities legislation. The statements in this management’s discussion and analysis that relate to the future are forward-looking statements. By their very nature, forward-looking statements involve inherent risks and uncertainties, both general and specific, many of which are out of VersaBank’s control. Risks exist that predictions, forecasts, projections and other forward-looking statements will not be achieved. Readers are cautioned not to place undue reliance on these forward-looking statements as a number of important factors could cause actual results to differ materially from the plans, objectives, expectations, estimates and intentions expressed in such forward-looking statements. These factors include, but are not limited to, the strength of the Canadian and US economies in general and the strength of the local economies within Canada and the US in which VersaBank conducts operations; the effects of changes in monetary and fiscal policy, including changes in interest rate policies of the Bank of Canada and the US Federal Reserve; global commodity prices; the effects of competition in the markets in which VersaBank operates; inflation; capital market fluctuations; the timely development and introduction of new products in receptive markets; the impact of changes in the laws, changes in trade laws and tariffs; and regulations pertaining to financial services; changes in tax laws; technological changes; unexpected judicial or regulatory proceedings; unexpected changes in consumer spending and savings habits; the impact of wars or conflicts and the impact of both on global supply chains and markets; the impact of outbreaks of disease or illness that affect local, national or international economies; the possible effects on VersaBank’s business of terrorist activities; natural disasters and disruptions to public infrastructure, such as transportation, communications, power or water supply; and VersaBank’s anticipation of and success in managing the risks implicated by the foregoing.

Completion of VersaBank’s plan to realign its corporate structure to a standard US bank framework is subject to numerous factors, many of which are beyond the Bank’s control, including but not limited to, the failure to obtain required shareholder, regulatory and other approvals, and other important factors disclosed previously and from time to time in the Bank’s filings with the SEC and the securities commissions or similar securities regulatory authorities in each of the provinces or territories of Canada.

The foregoing list of important factors is not exhaustive. When relying on forward-looking statements to make decisions, investors and others should carefully consider the foregoing factors and other uncertainties and potential events. The forward-looking information contained in the management’s discussion and analysis is presented to assist VersaBank shareholders and others in understanding VersaBank’s financial position and may not be appropriate for any other purposes. For a detailed discussion of certain key factors that may affect VersaBank’s future results, please see VersaBank’s annual MD&A for the year ended October 31, 2024. Except as required by securities law, VersaBank does not undertake to update any forward-looking statements that is contained in this management’s discussion and analysis or made from time to time by VersaBank or on its behalf.

| VersaBank – Q2 2025 MD&A | 2 |

About VersaBank

Digital Banking Operations

VersaBank is a North American bank (federally chartered in Canada and the United States) with a difference. VersaBank was the world's first fully digital financial institution and today employs a cloud-based, branchless, business-to-business model based on its proprietary state-of-the-art technology that enables it to profitably address underserved segments of the banking industry. The Bank’s model is based on obtaining its deposits and providing financing digitally through third-party financial intermediaries (referred to as “partners”) who themselves engage with the actual depositors and borrowers. This provides VersaBank with significant operating leverage, which drives efficiency and return on common equity, and significantly reduces risk.

VersaBank’s recent and expected continued growth is the result of its unique Receivable Purchase Program (“RPP”), which invests in cash flow streams generated by credit assets originated and owned by companies that provide financing at the point of sale to consumers and small businesses for “big ticket” purchases. In September 2024, following its acquisition of a US bank, VersaBank broadly launched its US RPP, which has been highly successful in Canada for nearly 15 years, to the underserved multi-trillion-dollar US market.

Digital Meteor Inc.

Through its wholly owned subsidiary, Digital Meteor Inc. (“Digital Meteor”), VersaBank has developed and owns proprietary intellectual property and technology to enable the next generation of digital assets for the banking and financial community, including the Bank’s revolutionary Digital Deposit Receipts (DDRs). The Bank’s DDR are highly encrypted digital assets that represent an actual fiat currency on deposit with a bank. Issued on secure blockchains such as Algorand, Ethereum, and Stellar, DDRs offer superior security, stability, and regulatory compliance compared to traditional stablecoins. As a SOC2 Type 1 compliant digital asset with a continuously known value, DDRs provide a trusted alternative for mainstream financial applications. Additionally, through its proprietary VersaVault® technology, the world’s first digital vault for security conscious organizations looking to secure their highly sensitive and confidential documents, data, code, blockchain-based assets and more, the Bank addresses the need for regulated custody of digital assets with secure platforms.

Cybersecurity Services

VersaBank also owns Washington, DC-based DRT Cyber Inc. (“DRTC”), a North America leader in the provision of cyber security services to address the rapidly growing volume of cyber threats challenging financial institutions, multi-national corporations and government entities. DRTC deploys technology solutions to support the functions of cybersecurity, privacy, and risk management, with experience across numerous sectors to enable it to develop and deploy flexible solutions to partners’ exact requirements.

VersaBank’s common shares trade on the Toronto Stock Exchange and Nasdaq under the symbol VBNK. The underlying drivers of VersaBank’s performance changes for the current and comparative periods are set out in the following sections of this MD&A.

| VersaBank – Q2 2025 MD&A | 3 |

Strategy

VersaBank’s goal is to consistently and sustainably deliver outsized growth in earnings per share by utilizing its proprietary technology and established financial intermediary partner network to deliver innovative digital banking, financial and related solutions to under-served markets, while maintaining its low-risk profile. The Bank’s use of technology in its cloud-based, branchless, business-to-business model enables significant operation leverage, enabling the Bank to grow its assets and resulting revenue at a significantly faster rate than non-interest expenses. A significant portion of VersaBank’s workforce are software engineers and technology support staff who are continuously upgrading and enhancing VersaBank’s software, as well as developing new software to support new business initiatives.

Digital Banking Operations

VersaBank’s largest opportunity and primary focus is growth in revenue (driven primarily by growth in net interest income) from its Digital Banking Operations significantly in excess of growth in non-interest expense. VersaBank expects the majority of revenue growth to be driven by the ramp up of its unique Receivable Purchase Program for the point-of-sale market (previously referred to as its “Point-of-Sale” Financing business), which has driven the majority of its growth in Canada over the past five years, in the underserved US market.

VersaBank's unique Receivable Purchase Program (“RPP”) is an innovative and highly attractive digital funding solution for finance companies that provide loans and leases to consumers and small businesses for "big ticket" purchases (e.g. consumer home improvement/HVAC projects and a wide variety of commercial and recreational equipment). It was specifically designed to address an unmet need by point-of-sale financing companies for consistently available, readily accessible, economically attractive capital using VersaBank's proprietary, state-of-the-art banking technology. Consistent with its branchless, business-to-business, partner-based digital banking strategy, VersaBank's RPP enables it to access the massive and growing consumer and small business financing market in an indirect, efficient and highly risk-mitigated manner.

In the US, following its acquisition of a US bank (including its national US bank charter) in September 2024, VersaBank broadly launched its RPP to the underserved multi-trillion-dollar US market. The Bank has a strong and growing pipeline of prospective RPP partners that it is aggressively pursuing. In January 2025, the Bank entered into its first US RPP partnership and immediately began purchasing cash flow streams from that partner. The Bank expects to continue to steadily add new RPP Partners as it grows its business with existing partners.

In Canada, VersaBank is focused on generating continued strong growth in its RPP portfolio by expanding its business with existing RPP Financing Partners, adding new RPP Financing Partners, as well as broader economic growth.

Also in Canada, VersaBank is pursuing a new near-term and ongoing opportunity in its Multi-Family Residential Construction Real Estate business to address the strong market demand for economical and efficient, CMHC-insured loans by real estate developers of multi-family residential properties. These loans are zero-risk weighted loans for the Bank’s regulatory capital purposes, thus requiring no regulatory capital allocation, and generate an attractive net interest margin, enhancing the Bank’s return on common equity (ROCE). With decades of experience, a strong reputation and extensive relationships in this segment of the market, VersaBank has a competitive advantage to capitalize on this opportunity.

| VersaBank – Q2 2025 MD&A | 4 |

VersaBank has access to sufficient low-cost deposit sources to fund its expected strong growth in credit assets. The Bank’s low-cost deposit sources, combined with the efficiency of its technology-based, business-to-business model, supports its objectives of maintaining a stable net interest margin over the short term and expanding net interest margin over time. Management believes that VersaBank has one of the strongest liquidity risk profiles among North American banks, attributable to the quality, stability and stickiness of its deposit base. The majority of VersaBank’s Canadian and US deposits are sourced through deposit brokers, specifically investment dealers, wealth management firms and financial advisory firms that distribute the Bank’s term deposit products. VersaBank has high visibility into the fixed maturities of these deposits, further enhancing its liquidity risk profile. In Canada, the Bank also sources deposits through Licensed Insolvency Trustee firms, which value the ability to use VersaBank’s proprietary technology to seamlessly and efficiently interface with their administrative software, which results in a lower cost of funds to the Bank compared to conventional deposits. The Bank expects its Insolvency Trustee deposits to increase in the short- to medium-term as the number of insolvency filings in Canada is expected to grow.

Cybersecurity Services

VersaBank’s wholly owned, Washington, DC-based subsidiary, DRT Cyber (“DRTC”), addresses the high-growth market for cybersecurity and related IT privacy services arising from the growing volume of cyber threats and privacy issues challenging businesses of all sizes across all sectors (with a specialty in financial institutions) and government entities on a daily basis. The global cost of cybercrime is projected to reach $10.5 trillion per year in 2025. DRTC has established itself as a North American leader in the markets it serves, with more than 400 clients, including large financial services companies, critical infrastructure companies and indispensable government organizations such as metropolitan police departments. DRTC is focused on growing revenue through offering new products and services to existing clients and adding new clients, capitalizing on the significant expected long-term growth in the cybersecurity and privacy market globally.

Under the US Federal Reserve’s approval of VersaBank’s 2024 acquisition of a US bank, the Bank is required to divest DRTC before September 2026, or such later date as may be permitted. Such divestment could be accomplished through a number of corporate actions and the Bank has initiated a process to identify and evaluate alternatives with the objective to maximize the value derived from the divestiture for shareholders.

Digital Meteor

VersaBank also expects to capitalize on its leading-edge, proprietary technology that enables highly encrypted digital assets that combines the safety of traditional banking with the efficiency, cost savings, security, and flexibility of blockchain technology, providing superior security, stability, and regulatory compliance compared to conventional alternatives. Held within its wholly owned Digital Meteor subsidiary, VersaBank’s DDRs provide a trusted alternative for mainstream financial applications, including efficient payments, addressing the rapidly growing propensity of consumers and businesses to hold assets in e-wallets and engage in financial transactions digitally. VersaBank’s DDRs represent the next step in the evolution of such digital assets.

| VersaBank – Q2 2025 MD&A | 5 |

Management believes that licensed banks, as the trusted, regulated safekeepers of personal and business cash assets and other valuables, are naturally positioned to do the same for digital currencies. VersaBank has established itself as a leader in digital asset innovation. Management believes its trusted and secure solutions, along with the potential for DDRs to be an ultra-low-cost source of deposit funding, will play a meaningful role in enabling US banks and other entities to confidently engage in the rapidly developing field of digital commerce. Management is encouraged by the favorable stance of the new US administration with respect to digital assets and the role they can play in the future of banking and commerce in the United States, as well as around the world. To its knowledge, VersaBank is the first bank to have successfully completed a pilot program with a blockchain-based DDR, in which VersaBank’s DDR provided a secure representation of federally regulated bank deposits on the Algorand, Ethereum and Stellar blockchains. As a SOC2 Type 1 compliant digital asset with a continuously known value, VersaBank’s DDRs provide a trusted alternative for mainstream financial applications and can be seamlessly converted to and from other digital currencies such as Bitcoin.

Although the intellectual property, software and other assets related to the DDR technology currently reside within DRTC, they are not expected to be part of any divestiture of the cybersecurity services business within DRTC.

In addition, VersaBank remains highly committed to, and focused on, further developing and enhancing its technology advantage, a key component of its value proposition that not only provides efficient access to VersaBank’s chosen underserved lending and deposit markets, but also delivers superior financial products and better customer service to its clients.

The underlying drivers of VersaBank’s performance for the current and comparative periods are set out in the following sections of this MD&A.

| VersaBank – Q2 2025 MD&A | 6 |

Overview of Performance

|

|

|

|

|

|

* See definition in the "Non-GAAP and Other Financial Measures" section below.

Q2 2025 vs Q2 2024

|

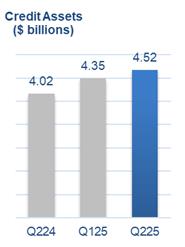

Credit assets increased 13% to $4.52 billion, driven primarily by strong growth in both the US and Canadian RPP portfolios, which, combined, increased the RPP portfolio by 14%, as well as incremental lending assets growth through the acquisition of Stearns Bank Holdingford N.A. (“SBH”); |

|

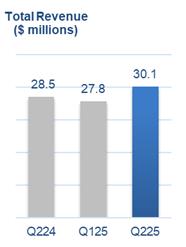

Total revenue increased 6% to $30.1 million, composed of net interest income of $28.0 million and non-interest income of $2.1 million; |

|

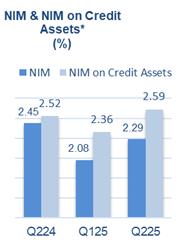

Net interest margin (“NIM”) on credit assets was 2.59% and NIM was 2.29%, an increase of 7 bps and a decrease of 16 bps, respectively. The increase in NIM on credit assets was primarily due to a reduction in cost of funds, attributable to the renewal of maturing deposits at lower interest rates and the diminished impact of the atypically inverted yield curve that existed throughout fiscal 2024 and which is now trending towards normalization. The decrease in overall NIM was primarily due to higher than typical liquidity in the first half of fiscal 2025. The Bank’s NIM remains amongst the highest of the publicly traded Canadian Schedule 1 Banks; |

| VersaBank – Q2 2025 MD&A | 7 |

|

Provision for credit losses (“PCL”) was $889,000 compared with a provision for credit losses of $16,000, with the increase being primarily due to changes in the forward-looking information used by VersaBank in its credit risk models; |

|

Provision for credit losses as a percentage of average credit assets was 0.08% compared with 0.00%, which remains among the lowest of the publicly traded Canadian Schedule I (federally licensed) Banks; |

|

Non-interest expenses were $17.5 million compared with $12.2 million, with the increase reflecting: (i) incremental operating costs associated with the VersaBank USA operations that began on August 30, 2024, (ii) higher operating costs to support current and anticipated increased business activities, (iii) preliminary costs associated with the Bank’s potential plan to realign its corporate structure to that of a standard US bank framework, which remains subject to shareholder, regulatory, and other approvals and, (iv) unrealized foreign exchange translation loss attributable to the USD currency depreciating in the current period; |

|

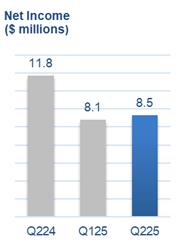

Net income decreased 28% to $8.5 million from $11.8 million, with the decrease being primarily attributable to the non-interest expenses outlined above; |

|

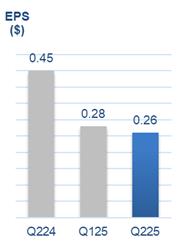

Earnings per share (“EPS”) decreased 42% to $0.26 from $0.45, reflecting in part the impact of the 25% increase in the number of shares outstanding resulting from the December 2024 treasury common share offering; |

|

Return on average common equity decreased to 6.67% from 12.36%; and, |

|

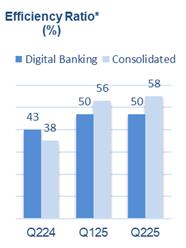

Efficiency ratio for the Digital Banking operations (excluding DRTC) was 52% compared with 38%. |

Q2 2025 vs Q1 2025

|

Credit assets increased 4% to $4.52 billion, driven primarily by continued growth in the Bank’s RPP portfolio; |

|

Total revenue increased 8% to $30.1 million from $27.8 million and was composed of net interest income of $28.0 million and non-interest income of $2.1 million; |

|

NIM on credit assets was 2.59%, an increase of 23 bps from 2.36%. The increase in NIM on credit assets was primarily due to a reduction in the Bank’s cost of funds, attributable to the renewal of maturing deposits at lower interest rates and the diminished impact of the atypically inverted yield curve that existed throughout fiscal 2024 and which is now trending towards normalization. Overall NIM was 2.29%, an increase of 21 bps from 2.08%. The Bank’s NIM remains amongst the highest of the publicly traded Canadian Schedule 1 Banks; |

|

Provision for credit losses was $889,000 compared with a provision for credit losses of $1.0 million; |

|

Provision for credit losses as a percentage of average credit assets was 0.08% compared with 0.09%, which remains among the lowest of the publicly traded Canadian Schedule I (federally licensed) Banks; |

|

Non-interest expenses increased 12% to $17.5 million, reflecting incremental operating cost associated with the VersaBank USA operations, higher operating costs to support current and anticipated increased business activities, unrealized foreign exchange translation loss attributable to the USD currency depreciating in the current period, as well as the preliminary costs associated the Bank’s potential plan to realign its corporate structure to that of a standard US bank framework; |

| VersaBank – Q2 2025 MD&A | 8 |

|

Net income increased 5% to $8.5 million from $8.1 million; |

|

EPS decreased 7% to $0.26 from $0.28, reflecting in part the impact of the December 18, 2024, treasury common share offering; |

|

Return on average common equity decreased 35 bps to 6.67% on lower earnings; and, |

|

Efficiency ratio for the Digital Banking operations (excluding DRTC) was 52% compared to 50% last quarter. |

Q2 YTD 2025 vs Q2 YTD 2024

|

Credit assets increased 13% to $4.52 billion, driven primarily by strong growth in the Bank’s RPP portfolio, which increased 14%; |

|

Total revenue increased 1% to $58.0 million from $57.4 million and was composed of net interest income of $53.8 million and non-interest income of $4.2 million; |

|

NIM on credit assets was 2.44%, a decrease of 17 bps. Overall NIM was 2.19%, a decrease of 28 bps. The decreases were attributable, in part, to wider spreads on renewal of maturing deposits, and in part to higher than typical liquidity in the first half of fiscal 2025. The Bank’s NIM remains amongst the highest of the publicly traded Canadian Schedule 1 Banks; |

|

Provision for credit losses was $1.9 million compared with a recovery of credit losses of $111,000; |

|

Provision for credit losses as a percentage of average credit assets was 0.09% compared with -0.01%, which remains among the lowest of the publicly traded Canadian Schedule I (federally licensed) Banks; |

|

Non-interest expenses increased 37% to $33.2 million, reflecting: (i) incremental operating cost associated with the VersaBank USA operations that began on August 30, 2024, and higher operating costs to support current and anticipated increased business activities, (ii) preliminary costs associated the Bank’s potential plan to realign its corporate structure to that of a standard US bank framework, and (iii) unrealized foreign exchange translation loss attributable to the USD currency depreciating in the current period; |

|

Net income decreased 32% to $16.7 million from $24.5 million; |

|

EPS decreased 42% to $0.54 from $0.93, reflecting in part the impact of the 25% increase in the higher number of shares outstanding resulting from the December 2024 treasury common share offering; |

|

Return on average common equity decreased 564 bps to 7.25% from 12.89%; and, |

|

Efficiency ratio for the Digital Banking operations (excluding DRTC) was 51% compared with 39%. |

| VersaBank – Q2 2025 MD&A | 9 |

Selected Financial Highlights

|

(unaudited) |

for the three months ended |

for the six months ended |

||||||||||||||

|

April 30 |

April 30 |

April 30 |

April 30 |

|||||||||||||

|

(thousands of Canadian dollars, except per share amounts) |

2025 |

2024 |

2025 |

2024 |

||||||||||||

|

Results of operations |

||||||||||||||||

|

Interest income |

$ | 70,976 | $ | 71,243 | $ | 144,222 | $ | 140,535 | ||||||||

|

Net interest income |

28,032 | 26,242 | 53,756 | 52,810 | ||||||||||||

|

Non-interest income |

2,107 | 2,259 | 4,210 | 4,542 | ||||||||||||

|

Total revenue |

30,139 | 28,501 | 57,966 | 57,352 | ||||||||||||

|

Provision for (recovery of) credit losses |

889 | 16 | 1,913 | (111 | ) | |||||||||||

|

Non-interest expenses |

17,516 | 12,185 | 33,215 | 24,209 | ||||||||||||

|

Digital Banking |

14,418 | 10,014 | 27,196 | 20,429 | ||||||||||||

|

DRTC |

2,734 | 2,314 | 5,700 | 4,023 | ||||||||||||

|

Digital Meteor |

719 | 196 | 1,028 | 433 | ||||||||||||

|

Net income |

8,529 | 11,828 | 16,672 | 24,527 | ||||||||||||

|

Income per common share: |

||||||||||||||||

|

Basic |

$ | 0.26 | $ | 0.45 | $ | 0.54 | $ | 0.93 | ||||||||

|

Diluted |

$ | 0.26 | $ | 0.45 | $ | 0.54 | $ | 0.93 | ||||||||

|

Dividends paid on preferred shares |

$ | - | $ | 247 | $ | - | $ | 494 | ||||||||

|

Dividends paid on common shares |

$ | 813 | $ | 650 | $ | 1,626 | $ | 1,300 | ||||||||

|

Yield* |

5.81 | % | 6.66 | % | 5.88 | % | 6.58 | % | ||||||||

|

Cost of funds* |

3.52 | % | 4.21 | % | 3.69 | % | 4.11 | % | ||||||||

|

Net interest margin* |

2.29 | % | 2.45 | % | 2.19 | % | 2.47 | % | ||||||||

|

Net interest margin on credit assets* |

2.59 | % | 2.52 | % | 2.44 | % | 2.61 | % | ||||||||

|

Return on average common equity* |

6.67 | % | 12.36 | % | 7.25 | % | 12.89 | % | ||||||||

|

Book value per common share* |

$ | 16.25 | $ | 14.88 | $ | 16.25 | $ | 14.88 | ||||||||

|

Efficiency ratio* |

58 | % | 43 | % | 57 | % | 42 | % | ||||||||

|

Efficiency ratio - Digital Banking* |

52 | % | 38 | % | 51 | % | 39 | % | ||||||||

|

Return on average total assets* |

0.70 | % | 1.08 | % | 0.68 | % | 1.13 | % | ||||||||

|

Provision (recovery) for credit losses as a % of average credit assets* |

0.08 | % | 0.00 | % | 0.09 | % | (0.01% | ) | ||||||||

|

as at |

||||||||||||||||

|

Balance Sheet Summary |

||||||||||||||||

|

Cash |

$ | 340,186 | $ | 198,808 | $ | 340,186 | $ | 198,808 | ||||||||

|

Securities |

104,807 | 103,769 | 104,807 | 103,769 | ||||||||||||

|

Credit assets, net of allowance for credit losses |

4,523,812 | 4,018,458 | 4,523,812 | 4,018,458 | ||||||||||||

|

Average credit assets |

4,435,280 | 4,001,370 | 4,379,964 | 3,934,431 | ||||||||||||

|

Total assets |

5,047,133 | 4,388,320 | 5,047,133 | 4,388,320 | ||||||||||||

|

Deposits |

4,205,185 | 3,693,495 | 4,205,185 | 3,693,495 | ||||||||||||

|

Subordinated notes payable |

101,844 | 101,108 | 101,844 | 101,108 | ||||||||||||

|

Shareholders' equity |

528,306 | 400,103 | 528,306 | 400,103 | ||||||||||||

|

Capital ratios** |

||||||||||||||||

|

Risk-weighted assets |

$ | 3,551,398 | $ | 3,224,822 | $ | 3,551,398 | $ | 3,224,822 | ||||||||

|

Common Equity Tier 1 capital |

507,222 | 375,153 | 507,222 | 375,153 | ||||||||||||

|

Total regulatory capital |

615,770 | 494,297 | 615,770 | 494,297 | ||||||||||||

|

Common Equity Tier 1 (CET1) ratio |

14.28 | % | 11.63 | % | 14.28 | % | 11.63 | % | ||||||||

|

Tier 1 capital ratio |

14.28 | % | 12.06 | % | 14.28 | % | 12.06 | % | ||||||||

|

Total capital ratio |

17.34 | % | 15.33 | % | 17.34 | % | 15.33 | % | ||||||||

|

Leverage ratio |

9.61 | % | 8.55 | % | 9.61 | % | 8.55 | % | ||||||||

| * |

See definition in "Non-GAAP and Other Financial Measures" section below. |

| ** |

Capital management and leverage measures are in accordance with OSFI's Capital Adequacy Requirements and Basel III Accord. |

| VersaBank – Q2 2025 MD&A | 10 |

Financial Review – Earnings

Total Revenue

Total revenue, which consists of net interest income and non-interest income, for the quarter ended April 30, 2025 increased 6% to $30.1 million compared with the same period a year ago and increased 8% compared with the first quarter of fiscal 2025. Total revenue for the six months ended April 30, 2025 increased 1% to $58.0 million compared with the same period last year.

Net Interest Income

|

(thousands of Canadian dollars) |

||||||||||||||||||||||||||||||||

|

For the three months ended: |

For the six months ended: |

|||||||||||||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

April 30 |

April 30 |

||||||||||||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

2025 |

2024 |

Change |

|||||||||||||||||||||||||

|

Interest income |

||||||||||||||||||||||||||||||||

|

Receivable purchase program |

$ | 50,584 | $ | 50,455 | 0% | $ | 47,414 | 7% | $ | 101,039 | $ | 92,986 | 9% | |||||||||||||||||||

|

Multi-family residential loans and other |

15,314 | 16,504 | (7%) | 18,682 | (18%) | 31,818 | 38,186 | (17%) | ||||||||||||||||||||||||

|

Other |

5,078 | 6,287 | (19%) | 5,147 | (1%) | 11,365 | 9,363 | 21% | ||||||||||||||||||||||||

|

Interest income |

$ | 70,976 | $ | 73,246 | (3%) | $ | 71,243 | 0% | $ | 144,222 | $ | 140,535 | 3% | |||||||||||||||||||

|

Interest expense |

||||||||||||||||||||||||||||||||

|

Deposit and other |

$ | 41,551 | $ | 46,130 | (10%) | $ | 43,469 | (4%) | $ | 87,681 | $ | 84,740 | 3% | |||||||||||||||||||

|

Subordinated notes |

1,393 | 1,392 | 0% | 1,532 | (9%) | 2,785 | 2,985 | (7%) | ||||||||||||||||||||||||

|

Interest expense |

$ | 42,944 | $ | 47,522 | (10%) | $ | 45,001 | (5%) | $ | 90,466 | $ | 87,725 | 3% | |||||||||||||||||||

|

Net interest income |

$ | 28,032 | $ | 25,724 | 9% | $ | 26,242 | 7% | $ | 53,756 | $ | 52,810 | 2% | |||||||||||||||||||

|

Non-interest income |

$ | 2,107 | $ | 2,103 | 0% | $ | 2,259 | (7%) | $ | 4,210 | $ | 4,542 | (7%) | |||||||||||||||||||

|

Total revenue |

$ | 30,139 | $ | 27,827 | 8% | $ | 28,501 | 6% | $ | 57,966 | $ | 57,352 | 1% | |||||||||||||||||||

Q2 2025 vs Q2 2024

Net interest income increased 7% to $28.0 million due primarily to:

|

Higher interest income attributable to continued RPP portfolio growth and incremental credit assets growth through the acquisition of SBH; and, |

|

Lower interest expense attributable primarily to the renewal of maturing deposits at lower interest rates and the diminished impact of the atypically inverted yield curve that existed throughout fiscal 2024, and which is now trending towards normalization. |

Offset partially by:

|

The impact of the planned transition of some higher yielding, higher risk-weighted MROL to lower yielding, lower risk-weighted MROL as part of the Bank’s strategy to capitalize on opportunities for lower regulatory capital risk-weighted credit assets with a higher return on capital deployed. |

| VersaBank – Q2 2025 MD&A | 11 |

Q2 2025 vs Q1 2025

Net interest income increased 9% due primarily to:

|

Lower interest expense attributable primarily to the renewal of maturing deposits at lower interest rates and the diminished impact of the atypically inverted yield curve that existed throughout fiscal 2024, and which is now trending towards normalization. |

Offset partially by:

|

The impact of the planned transition of some higher yielding, higher risk-weighted MROL to lower yielding, lower risk-weighted MROL as part of the Bank’s strategy to capitalize on opportunities for lower-risk weighted credit assets with a higher return on capital; and, |

|

Lower interest income from cash and securities, primarily due to lower interest rates. |

Q2 YTD 2025 vs Q2 YTD 2024

Net interest income increased 2% to $53.8 million due primarily to:

|

Higher interest income attributable to continued RPP portfolio growth, higher cash and securities balances and incremental contribution associated with the acquisition of SBH. |

Offset partially by:

|

The impact of the planned transition of some higher yielding, higher risk-weighted MROL (defined below) to lower yielding, lower risk-weighted MROL as part of the Bank’s strategy to capitalize on opportunities for lower-risk weighted credit assets with a higher return on capital; and, |

|

Higher interest expense attributable, in part, to wider spreads on renewal of maturing deposits, and in part to higher than typical liquidity in the first half of fiscal 2025. |

Net Interest Margin

|

(thousands of Canadian dollars) |

||||||||||||||||||||||||||||||||

|

For the three months ended: |

For the six months ended: |

|||||||||||||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

April 30 |

April 30 |

||||||||||||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

2025 |

2024 |

Change |

|||||||||||||||||||||||||

|

Interest income |

$ | 70,976 | $ | 73,246 | (3%) | $ | 71,243 | 0% | $ | 144,222 | $ | 140,535 | 3% | |||||||||||||||||||

|

Interest expense |

42,944 | 47,522 | (10%) | 45,001 | (5%) | 90,466 | 87,725 | 3% | ||||||||||||||||||||||||

|

Net interest income |

28,032 | 25,724 | 9% | 26,242 | 7% | 53,756 | 52,810 | 2% | ||||||||||||||||||||||||

|

Average assets |

$ | 5,009,433 | $ | 4,906,828 | 2% | $ | 4,348,978 | 15% | $ | 4,942,809 | $ | 4,294,965 | 15% | |||||||||||||||||||

|

Yield* |

5.81 | % | 5.92 | % | (2%) | 6.66 | % | (13%) | 5.88 | % | 6.58 | % | (11%) | |||||||||||||||||||

|

Cost of funds* |

3.52 | % | 3.84 | % | (8%) | 4.21 | % | (16%) | 3.69 | % | 4.11 | % | (10%) | |||||||||||||||||||

|

Net interest margin* |

2.29 | % | 2.08 | % | 10% | 2.45 | % | (7%) | 2.19 | % | 2.47 | % | (11%) | |||||||||||||||||||

|

Average gross credit assets |

$ | 4,418,243 | $ | 4,273,474 | 3% | $ | 3,982,164 | 11% | $ | 4,362,411 | $ | 3,915,699 | 11% | |||||||||||||||||||

|

Net interest margin on credit assets* |

2.59 | % | 2.36 | % | 10% | 2.52 | % | 3% | 2.44 | % | 2.61 | % | (7%) | |||||||||||||||||||

|

* See definition in "Non-GAAP and Other Financial Measures" section below. |

| VersaBank – Q2 2025 MD&A | 12 |

Q2 2025 vs Q2 2024

Net interest margin decreased 16 bps due primarily to:

|

Continued growth in the RPP portfolio, which is composed of lower risk-weighted, lower yielding assets; |

|

Lower MROL balance and the impact of the planned transition of some higher yielding, higher risk-weighted MROL to lower yielding, lower risk-weighted MROL as part of the Bank’s strategy to capitalize on opportunities for lower-risk weighted credit assets with a higher return on capital; and, |

|

Higher interest expense attributable, in part, to wider spreads on renewal of maturing deposits, and in part to higher than typical liquidity in the first half of fiscal 2025. |

Offset partially by:

|

Reduction in cost of funds resulting from the renewal of maturing deposits at lower interest rates; and, |

|

Lower interest expense attributable primarily due to diminished impact of the atypically inverted yield curve that existed throughout fiscal 2024, and which is now trending towards normalization. |

Q2 2025 vs Q1 2025

Net interest margin increased 21 bps due primarily to:

|

Reduction in cost of funds resulting from the renewal of maturing deposits at lower interest rates; and, |

|

Lower interest expense attributable primarily due to diminished impact of the atypically inverted yield curve that existed throughout fiscal 2024, and which is now trending towards normalization. |

Offset partially by:

|

The impact of the planned transition of some higher yielding, higher risk-weighted MROL to lower yielding, lower risk-weighted MROL as part of the Bank’s strategy to capitalize on opportunities for lower-risk weighted loans with a higher return on capital; and, |

|

Lower interest income from cash and securities, primarily due to lower interest rates. |

Q2 YTD 2025 vs Q2 YTD 2024

Net interest margin decreased 28 bps due primarily to:

|

Continued growth in the RPP portfolio, which is composed of lower risk-weighted, lower yielding assets; |

|

Lower MROL balance and the impact of the planned transition of some higher yielding, higher risk-weighted MROL to lower yielding, lower risk-weighted MROL as part of the Bank’s strategy to capitalize on opportunities for lower-risk weighted credit assets with a higher return on capital; and, |

|

Higher interest expense attributable, in part, to wider spreads on renewal of maturing deposits, and in part to higher than typical liquidity in the first half of fiscal 2025. |

| VersaBank – Q2 2025 MD&A | 13 |

Offset partially by:

|

Reduction in cost of funds resulting from the renewal of maturing deposits at lower interest rates; and, |

|

Lower interest expense attributable primarily due to diminished impact of the atypically inverted yield curve that existed throughout fiscal 2024, and which is now trending towards normalization. |

Non-Interest Income

Non-interest income is composed of revenue generated by DRTC and income derived from miscellaneous transaction fees not directly attributable to credit assets.

Non-interest income for the quarter ended April 30, 2025 decreased 7% to $2.1 million from $2.3 million last year and was unchanged from $2.1 million last quarter. The year-over-year decrease was a function primarily of lower client engagements in the current quarter.

Non-interest income for the six months ended April 30, 2025 was $4.2 million compared with $4.5 million for the same period a year ago. The year-over-year trend was due primarily to the timing of client engagements.

Provision for Credit Losses

|

(thousands of Canadian dollars) |

||||||||||||||||||||

|

For the three months ended: |

For the six months ended: |

|||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

April 30 |

April 30 |

||||||||||||||||

|

2025 |

2025 |

2024 |

2025 |

2024 |

||||||||||||||||

|

Provision for (recovery of) credit losses by credit asset: |

||||||||||||||||||||

|

Receivable purchase program |

$ | 1,029 | $ | 1,188 | $ | 142 | $ | 2,217 | $ | 107 | ||||||||||

|

Multi-family residential loans and other |

(140 | ) | (164 | ) | (126 | ) | (304 | ) | (218 | ) | ||||||||||

|

Total provision for (recovery of) credit losses |

$ | 889 | $ | 1,024 | $ | 16 | $ | 1,913 | $ | (111 | ) | |||||||||

Q2 2025 vs Q2 2024

VersaBank recorded a provision for credit losses in the amount of $889,000 in the current quarter compared with a provision for credit losses in the amount of $16,000 last year due primarily to:

|

Changes in the forward-looking information used by the Bank in its credit risk models; |

|

A recalibration of the calculation in the RPP portfolio in the prior year to align more closely with empirical data and general credit performance; and, |

|

Higher credit asset balances. |

| VersaBank – Q2 2025 MD&A | 14 |

Q2 2025 vs Q1 2025

VersaBank recorded a provision for credit losses in the amount of $889,000 in the current quarter compared with a provision for credit losses in the amount of $1.0 million in the first quarter of fiscal 2024, due primarily to:

|

Changes in the forward-looking information used by the Bank in its credit risk models. |

Q2 YTD 2025 vs Q2 YTD 2024

VersaBank recorded a provision for credit losses in the amount of $1.9 million compared with a recovery of credit losses in the amount of $111,000 last year due primarily to:

|

Changes in the forward-looking information used by the Bank in its credit risk models; and, |

|

Higher credit asset balance. |

Non-Interest Expenses

|

(thousands of Canadian dollars) |

||||||||||||||||||||||||||||||||

|

For the three months ended: |

For the six months ended: |

|||||||||||||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

April 30 |

April 30 |

||||||||||||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

2025 |

2024 |

Change |

|||||||||||||||||||||||||

|

Salaries and benefits |

$ | 9,155 | $ | 8,614 | 6% | $ | 7,409 | 24% | $ | 17,769 | $ | 13,947 | 27% | |||||||||||||||||||

|

General and administrative |

6,720 | 5,489 | 22% | 3,557 | 89% | 12,209 | 7,890 | 55% | ||||||||||||||||||||||||

|

Premises and equipment |

1,641 | 1,596 | 3% | 1,219 | 35% | 3,237 | 2,372 | 36% | ||||||||||||||||||||||||

|

Total non-interest expenses |

$ | 17,516 | $ | 15,699 | 12% | $ | 12,185 | 44% | $ | 33,215 | $ | 24,209 | 37% | |||||||||||||||||||

|

Efficiency Ratio |

58 | % | 56 | % | 4% | 43 | % | 36% | 57 | % | 42 | % | 36% | |||||||||||||||||||

Q2 2025 vs Q2 2024

Non-interest expenses increased 44% to $17.5 million due primarily to:

|

Incremental operating cost associated with VersaBank USA operations that began on August 30, 2024; |

|

Higher general operating costs consistent with increased business activities, including costs being incurred ahead of anticipated asset growth and revenue generated by the launch of US RPP through VersaBank USA; |

|

Preliminary costs associated with the Bank's potential plan to realign its corporate structure to that of a standard US bank framework; and, |

|

Unrealized foreign exchange translation loss attributable to the USD currency depreciating in the current period. The Bank maintains a robust foreign exchange hedge program on all material activities, mitigating significant foreign exchange exposures. |

| VersaBank – Q2 2025 MD&A | 15 |

Q2 2025 vs Q1 2025

Non-interest expenses increased 12% due primarily to:

|

Incremental onboarding costs to support the VersaBank USA operations that began on August 30, 2024; |

|

Higher general operating costs consistent with increased business activities, including costs being incurred ahead of anticipated asset growth and revenue generated by the launch of US RPP through VersaBank USA; |

|

Preliminary costs associated with the Bank's potential plan to realign its corporate structure to that of a standard US bank framework; and, |

|

Unrealized foreign exchange translation loss attributable to the USD currency depreciating in the current period. The Bank maintains a robust foreign exchange hedge program on all material activities, mitigating significant foreign exchange exposures. |

Q2 YTD 2025 vs Q1 YTD 2025

Non-interest expenses increased 37% due primarily to:

|

Incremental operating cost associated with VersaBank USA operations that began on August 30, 2024; |

|

Higher general operating costs consistent with increased business activities, including costs being incurred ahead of anticipated asset growth and revenue generated by the launch of US RPP through VersaBank USA; |

|

Preliminary costs associated with the Bank's potential plan to realign its corporate structure to that of a standard US bank framework; and, |

|

Unrealized foreign exchange translation loss attributable to USD currency depreciation in the current period. The Bank maintains a robust foreign exchange hedge program on all material activities, mitigating significant foreign exchange exposures. |

Income Tax Provision

The Bank’s effective tax rate for the current year is estimated to be approximately 27% compared with approximately 27% for fiscal 2024. Any shift in the effective tax rate from the estimated annual tax rate will be primarily attributable to changes in assumptions on non-deductible expenses and other permanent tax differences, as well as changes in earnings allocation between different tax jurisdictions. Provision for income taxes for the current quarter was $3.2 million compared with $4.5 million for the same period a year ago and $3.0 million last quarter. Provision for income taxes for the six months ended April 30, 2025 was $6.2 million compared with $8.7 million for the same period a year ago.

| VersaBank – Q2 2025 MD&A | 16 |

Financial Review – Balance Sheet

|

(thousands of Canadian dollars) |

||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

||||||||||||||||

|

Total assets |

$ | 5,047,133 | $ | 4,971,732 | 2% | $ | 4,388,320 | 15% | ||||||||||||

|

Cash and securities |

444,993 | 545,239 | (18%) | 302,577 | 47% | |||||||||||||||

|

Credit assets, net of allowance for credit losses |

4,523,812 | 4,346,748 | 4% | 4,018,458 | 13% | |||||||||||||||

|

Deposits |

4,205,185 | 4,133,438 | 2% | 3,693,495 | 14% | |||||||||||||||

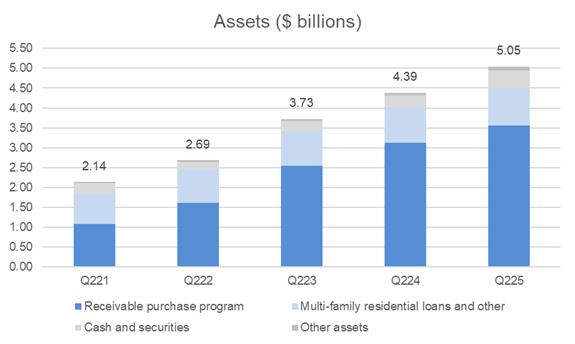

Total Assets

Total assets as at April 30, 2025, were $5.05 billion compared with $4.39 billion a year ago and $4.97 billion last quarter. The year-over-year and sequential increases were due primarily to growth in VersaBank’s RPP Portfolio.

Cash and securities

Cash and securities, which are held primarily for liquidity purposes, at April 30, 2025, were $445.0 million, or 9% of total assets, compared with $302.6 million, or 7% of total assets a year ago and $545.2 million, or 11% of total assets last quarter. The increase in liquidity asset balances over a year ago reflects the impact of the additional liquidity held at VersaBank USA.

| VersaBank – Q2 2025 MD&A | 17 |

As at April 30, 2025, the Bank held securities totaling $104.8 million (October 31, 2024 - $299.3 million), including accrued interest, comprised of US Treasury Bills with a carrying value of CAD $98.7 million, Government of Canada bonds with a carrying value of $3.1 million and other securities with a carrying value of $3.0 million.

Credit assets

|

(thousands of Canadian dollars) |

||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

||||||||||||||||

|

Receivable purchase program |

$ | 3,548,931 | $ | 3,401,328 | 4% | $ | 3,114,024 | 14% | ||||||||||||

|

Multi-family residential loans and other |

958,249 | 927,978 | 3% | 885,136 | 8% | |||||||||||||||

| 4,507,180 | 4,329,306 | 4% | 3,999,160 | 13% | ||||||||||||||||

|

Allowance for credit losses |

(4,958 | ) | (4,233 | ) | (2,402 | ) | ||||||||||||||

|

Accrued interest |

21,590 | 21,675 | 21,700 | |||||||||||||||||

|

Total credit assets, net of allowance for credit losses |

$ | 4,523,812 | $ | 4,346,748 | 4% | $ | 4,018,458 | 13% | ||||||||||||

VersaBank organizes its credit asset portfolios into the following two broad asset categories: Receivable Purchase Program (previously referred to as “Receivable Purchase Program/Point-of-Sale Loans & Leases” or “Point-of-Sale Loans & Leases”) and Multi-Family Residential Loans and Other (the amalgamation of what was previously referred to as “Commercial Real Estate Mortgages”, “Commercial Real Estate Loans”, and “Public Sector and Other Financing”). These categories have been established in VersaBank’s proprietary, internally developed asset management system and have been designed to catalogue individual lending assets as a function primarily of their key risk drivers, the nature of the underlying collateral, and the applicable market segment.

The Receivable Purchase Program (“RPP”) category is composed of investments in the expected cash flow streams derived primarily from consumer and small business loans and leases that are originated and owned throughout their lifetime by VersaBank’s RPP partners.

The Multi-Family Residential Loans and Other (“MROL”) category is composed of two sub-segments: Multi-Family Residential Loans, which consists of CMHC-insured (zero-risk weighted) loans and uninsured loans to real estate developers to finance the construction phase of development of multi-family, student residence, condominium and retirement homes properties, as well as term and bridge loans to real estate developers secured by completed aforementioned properties and units. It also includes public sector and infrastructure loans and leases. The majority of these loans are business-to-business loans with the underlying credit risk exposure being primarily residential in nature given that the vast majority (approximately 94% as at October 31, 2024) of the loans are related to properties that are designated primarily for residential use. The portfolio benefits from diversity in its underlying security in the form of a broad range of such collateral properties.

| VersaBank – Q2 2025 MD&A | 18 |

Q2 2025 vs Q2 2024

Credit assets increased 13% to $4.52 billion due primarily to:

|

Higher RPP portfolio balances, which increased 14% year-over-year due primarily to consistent strong demand for home improvement/HVAC receivable financing in Canada and the US; |

|

Incremental lending assets growth through the acquisition of Stearns Bank Holdingford N.A. on August 30, 2024; and, |

|

Higher multi-family residential lending balances, primarily in the lower risk-weighted CMHC-insured portfolio. |

Q2 2025 vs Q1 2025

Credit assets increased 4% due primarily to:

|

Higher RPP portfolio balances, which increased 4% sequentially; and, |

|

Higher multi-family residential lending balances, primarily in the lower risk-weighted CMHC-insured portfolio. |

Residential Mortgage Exposures

In accordance with the OSFI Guideline B-20 – Residential Mortgage Underwriting Practices and Procedures, additional information is provided regarding the Bank’s residential mortgage exposure. For the purposes of the Guideline, a residential mortgage is defined as a loan to an individual that is secured by residential property (one-to-four-unit dwellings) and includes home equity lines of credit (“HELOCs”). This differs from the classification of residential mortgages used by the Bank which also includes multi-family residential mortgages.

Under OSFI’s definition, the Bank’s exposure to residential mortgages at April 30, 2025 was $4.5 million compared with $4.2 million a year ago and $4.1 million last quarter. The Bank does not currently offer residential mortgages to the public. The Bank did not have any HELOCs outstanding at April 30, 2025, last quarter or a year ago.

Credit Quality and Allowance for Credit Losses

VersaBank closely monitors its lending portfolio, the portfolio’s underlying borrowers, as well as its origination partners to ensure that management maintains effective visibility on credit trends that could provide an early warning indication of the emergence of any elevated risk in VersaBank’s credit portfolio.

Allowance for Credit Losses

The Bank maintains an allowance for expected credit losses (or ECL allowance) that is adequate, in management’s opinion, to absorb all credit-related losses in the Bank’s credit asset and treasury portfolios. Under IFRS 9 the Bank’s allowance for expected credit losses is estimated using the expected credit loss methodology and is comprised of expected credit losses recognized on both performing credit assets, and non-performing, or impaired credit assets even if no actual loss event has occurred.

| VersaBank – Q2 2025 MD&A | 19 |

|

(thousands of Canadian dollars) |

||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

||||||||||||||||

|

ECL allowance by lending asset: |

||||||||||||||||||||

|

Receivable purchase program |

$ | 3,000 | $ | 1,971 | 52% | $ | 207 | 1349% | ||||||||||||

|

Multi-family residential loans and other |

1,958 | 2,262 | (13%) | 2,195 | (11%) | |||||||||||||||

|

Total ECL allowance |

$ | 4,958 | $ | 4,233 | 17% | $ | 2,402 | 106% | ||||||||||||

|

(thousands of Canadian dollars) |

||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

||||||||||||||||

|

ECL allowance by stage: |

||||||||||||||||||||

|

ECL allowance stage 1 |

$ | 3,760 | $ | 3,683 | 2% | $ | 2,093 | 80% | ||||||||||||

|

ECL allowance stage 2 |

1,168 | 492 | 137% | 309 | 278% | |||||||||||||||

|

ECL allowance stage 3 |

30 | 58 | (48%) | - | ||||||||||||||||

|

Total ECL allowance |

$ | 4,958 | $ | 4,233 | 17% | $ | 2,402 | 106% | ||||||||||||

Q2 2025 vs Q2 2024

VersaBank’s ECL allowance as at April 30, 2025, was $4.96 million compared with $2.40 million a year ago due primarily to:

|

Changes in the forward-looking information used by the Bank in its credit risk models; |

|

A recalibration of the calculation in the RPP portfolio in the prior year to align more closely with empirical data and general credit performance; and, |

|

Higher credit asset balances. |

Q2 2025 vs Q1 2025

VersaBank’s ECL allowance as at April 30, 2025, was $4.96 million compared with $4.23 million last quarter due primarily to:

|

Changes in the forward-looking information used by the Bank in its credit risk models. |

| VersaBank – Q2 2025 MD&A | 20 |

Forward-looking information

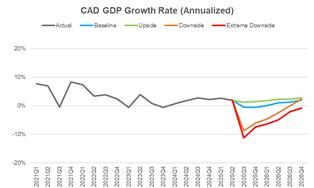

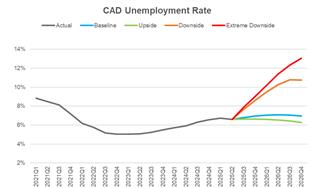

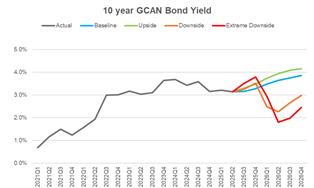

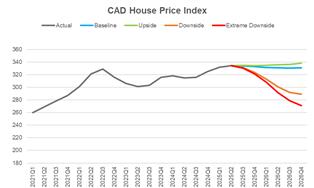

The Bank has sourced credit risk modeling systems and forecast macroeconomic scenario data from Moody’s Analytics, a third-party service provider for the purpose of computing forward-looking credit risk parameters under multiple macroeconomic scenarios that consider both market-wide and idiosyncratic factors and influences. The macroeconomic indicator data utilized by the Bank for the purpose of sensitizing probability of default and loss given default term structure data to forward economic conditions include, but are not limited to: real GDP, the national unemployment rate, long term interest rates, the consumer price index, the S&P/TSX Index and the price of oil. These specific macroeconomic indicators were selected in an attempt to ensure that the spectrum of fundamental macroeconomic influences on the key drivers of the credit risk profile of the Bank’s assets, including: corporate, consumer and real estate market dynamics; corporate, consumer and SME borrower performance; geography; as well as collateral value volatility, are appropriately captured and incorporated into the Bank’s forward macroeconomic sensitivity analysis.

The key assumptions driving the quarterly outlook for 2025 include global tariff policies and the uncertainty surrounding their size, scope and timing, which may pose challenges to the Canadian and the US economies, potentially leading to reduced economic activity. Reduced export demand could curtail investment and hiring, slowing consumption growth. The economy should avoid recession, but annual GDP growth will likely slow to a standstill by the end of 2025. The unemployment rate forecast has been revised upward in response to a more subdued growth outlook. However, as the elevated tariff levels are expected to be temporary, the impact on employment may be limited. Additionally, upcoming changes to Canadian immigration policy are anticipated to reduce labor force growth in 2025, which could influence the unemployment rate downward. Tariffs may stir inflationary pressure.

Inflation is expected to heat up over the coming quarters, though CPI inflation should not exceed the mid-2% range as demand remains soft. Lower interest rates will likely not be quite enough to overcome weakening consumer sentiment and rising joblessness. New construction should slow, and residential housing prices will likely dip slightly in the second half of 2025. The global tariff policy affecting Canada and US economies and other global economic partners may dampen growth and could contribute to economic slowdowns in both the Canadian and global economies. The impact of tariffs may result in loss in consumer confidence impacting economic growth, home values and wealth. Global trade may experience some disruption as countries adopt more protectionist measures, including adjustments to tariffs involving major trading partners. Disruptions to supply chains, increased volatility in foreign exchange rates, and the direct effects of tariffs may contribute to an upward pressure on inflation.

Management developed ECL estimates using credit risk parameter term structure forecasts sensitized to individual baseline, upside and downside forecast macroeconomic scenarios, each weighted at 100%, and subsequently computed the variance of each to the Bank’s reported ECL as at April 30, 2025 in order to assess the alignment of the Bank’s reported ECL with the Bank’s credit risk profile, and further, to assess the scope, depth and ultimate effectiveness of the credit risk mitigation strategies that the Bank has applied to its lending portfolios.

| VersaBank – Q2 2025 MD&A | 21 |

A summary of the key forecast macroeconomic indicator data trends utilized by VersaBank for the purpose of sensitizing lending asset credit risk parameter term structure forecasts to forward looking information, which in turn are used in the estimation of VersaBank’s reported ECL, as well as in the assessment of same are presented in the charts below.

|

|

|

|

Expected Credit Loss Sensitivity:

The following table presents the sensitivity of the Bank’s estimated ECL to a range of individual forecast macroeconomic scenarios, that in isolation may not reflect the Bank’s actual expected ECL exposure, as well as the variance of each to the Bank’s reported ECL as at April 30, 2025:

|

(thousands of Canadian dollars) |

||||||||||||||||

|

Reported |

100% |

100% |

100% |

|||||||||||||

|

ECL |

Upside |

Baseline |

Downside |

|||||||||||||

|

Allowance for expected credit losses |

$ | 4,958 | $ | 4,349 | $ | 4,549 | $ | 5,184 | ||||||||

|

Provision (recovery) from reported ECL |

(609 | ) | (409 | ) | 226 | |||||||||||

|

Variance from reported ECL (%) |

(12% | ) | (8% | ) | 5 | % | ||||||||||

| VersaBank – Q2 2025 MD&A | 22 |

The uncertainty associated with the directionality, velocity and magnitude of both interest rates and inflation as well as the general uncertainty associated with the broader Canadian and US economies may result in VersaBank’s estimated ECL amounts exhibiting some future volatility which in turn may result in the Bank recognizing higher provisions for credit losses in the coming quarters.

Considering the analysis set out above and based on management’s review of the credit assets and credit data comprising VersaBank’s lending portfolio, combined with management’s interpretation of the available forecast macroeconomic and industry data, management is of the view that its reported ECL allowance represents a reasonable proxy for potential future losses.

Deposits

|

(thousands of Canadian dollars) |

||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

||||||||||||||||

|

Licensed insolvency trustee firms |

$ | 822,260 | $ | 781,962 | 5% | $ | 672,382 | 22% | ||||||||||||

|

Deposit brokers |

3,382,925 | 3,351,476 | 1% | 3,021,113 | 12% | |||||||||||||||

|

Total deposits |

$ | 4,205,185 | $ | 4,133,438 | 2% | $ | 3,693,495 | 14% | ||||||||||||

VersaBank has established three core low-cost deposit funding channels: Deposit brokers (previously referred to as “Personal Deposits”) in Canada and the US, Licensed Insolvency Trustee firms (previously referred to as “Commercial Deposits”) in Canada, and cash reserves retained from VersaBank’s RPP partners, which are classified as other liabilities.

The majority of VersaBank’s Canadian and US deposits are sourced through deposit brokers, specifically investment dealers, wealth management firms and financial advisory firms that distribute the Bank’s term deposit products to their respective end clients.

In Canada, the Bank also sources deposits through Licensed Insolvency Trustee firms that value the ability to use VersaBank’s proprietary technology to seamlessly and efficiently interface with their administrative software, which results in a lower cost of funds to the Bank compared to conventional deposits.

Q2 2025 vs Q2 2024

Deposits increased 14% to $4.2 billion due primarily to:

|

Higher deposits from brokers attributable to VersaBank increasing activity in its broker market network to fund balance sheet growth; and, |

|

Higher deposits from Licensed Insolvency Trustee firms attributable to an increase in the volume of Canadian consumer and commercial bankruptcy and proposal restructuring proceedings year-over-year. |

| VersaBank – Q2 2025 MD&A | 23 |

Q2 2025 vs Q1 2025

Deposits increased 2% due primarily to:

|

Higher deposits from Licensed Insolvency Trustee firms attributable to an increase in the volume of Canadian consumer and commercial bankruptcy and proposal restructuring proceedings in the current quarter. |

Subordinated Notes Payable

|

(thousands of Canadian dollars) |

||||||||||||

|

April 30 |

January 31 |

April 30 |

||||||||||

|

2025 |

2025 |

2024 |

||||||||||

|

Issued April 2021, unsecured, non-viability contingent capital compliant, subordinated notes payable, principal amount of US $75.0 million, fixed effective interest rate of 5.38%, maturing May 2031. The fixed rate applies only until May 1, 2026, at which point the obligation switches to floating rate and the notes are redeemable by the Bank, subject to regulatory approval. |

$ | 101,844 | $ | 106,824 | $ | 101,108 | ||||||

| $ | 101,844 | $ | 106,824 | $ | 101,108 | |||||||

Subordinated notes payable, net of issue costs, were $101.8 million as at April 30, 2025, compared with $101.1 million a year ago and $106.8 million last quarter. The year-over-year and quarter-over-quarter variances were a function primarily attributable to the change in the USD/CAD foreign exchange spot rate related to the US $75.0 million subordinated note.

Shareholders’ Equity

Shareholders’ equity was $528.3 million as at April 30, 2025, compared with $400.1 million a year ago and $521.3 million last quarter.

On December 18, 2024 the Bank completed a treasury offering of 5,660,378 common shares at a price of USD $13.25 per share, the equivalent of CAD $18.95 per share, for gross proceeds of USD $75.0 million. On December 24, 2024, the underwriters of the aforementioned offering exercised their full over-allotment option to purchase an additional 849,056 common shares (15% of the 5,660,378 common shares issued via the base offering referenced above) at a price of USD $13.25 per share, or CAD $19.07 per share, for gross proceeds of USD $11.2 million. Total net cash proceeds from the common share offering was CAD $116.0 million. However, the Bank’s share capital increased by CAD $114.2 million corresponding to the Common Share Offering and tax effected issue costs in the amount of CAD $1.8 million.

At April 30, 2025, there were 32,518,786 common shares outstanding compared with 25,964,424 common shares outstanding a year ago and 32,518,786 common shares outstanding last quarter.

| VersaBank – Q2 2025 MD&A | 24 |

No common shares were issued in connection with the exercise of stock options during the current quarter and in the same period year ago. In the sequential quarter, the Bank issued 6,755 common shares in connection with the exercise of stock options for proceeds of $107,000.

On April 28, 2025, the Bank received approval from the Toronto Stock Exchange ("TSX") to proceed with a Normal Course Issuer Bid ("NCIB") for its common shares. Pursuant to the NCIB, VersaBank may purchase for cancellation up to 2,000,000 of its common shares representing approximately 8.99% of its public float. As of April 21, 2025, the public float comprised 22,237,283 common shares and there were 32,518,786 issued and outstanding common shares in total. The average daily trading volume ("ADTV") of VersaBank's Common Shares on the TSX for the six months of October 1, 2024 – March 31, 2025 (the "Preceding Six Month Period") was 37,761 shares. Daily purchases under the NCIB will be limited to 25% of the ADTV, which is 9,440 common shares, other than block purchase exceptions. During the Preceding Six-Month Period, 20,321,293 VersaBank common shares were traded on all exchanges. Of that total, 4,720,219 shares were traded on the TSX and the remaining 15,601,074 shares were traded on other exchanges including the Nasdaq.

The purchases may commence on April 30, 2025 and will terminate on April 29, 2026, or such earlier date as VersaBank may complete its purchases pursuant to the NCIB. The purchases will be made by VersaBank through the facilities of the TSX and the Nasdaq and in accordance with the rules of the TSX or the Nasdaq, as applicable, and the prices that VersaBank will pay for any common shares will be the market price of such shares at the time of acquisition. VersaBank will make no purchases of common shares other than open market purchases. All shares purchased under the NCIB will be cancelled.

Q2 2025 vs Q2 2024 vs Q1 2025

Shareholders’ equity increased 32% compared with a year ago and 1% compared with last quarter. The year-over-year increase was due primarily to the December 18, 2024 treasury common share offering and higher retained earnings attributable to net income earned over the current quarter, offset partially by payment of Common Share dividends in the same period. The year-over-year variance also reflects the redemption of the Non-Cumulative Series 1 preferred shares on October 31, 2024.

VersaBank’s book value per common share as at April 30, 2025 was $16.25 compared with $14.88 a year ago and $16.03 last quarter. The year-over-year and sequential increases were due primarily the December 18, 2024 treasury common share offering and to higher retained earnings attributable to net income earned in the current quarter offset partially by the payment of dividends over the same period.

See note 9 to the unaudited interim consolidated financial statements for additional information relating to share capital.

Stock-Based Compensation

Stock options are accounted for using the fair value method which recognizes the fair value of the stock option over the applicable vesting period as an increase in salaries and benefits expense with the same amount being recorded in contributed surplus. VersaBank recognized compensation expense for the current quarter totaling $nil compared with $72,000 for the same period a year ago and $75,000 last quarter, relating to the estimated fair value of stock options granted. The recognized compensation expense for the six-month period ended April 30, 2025, totaled $75,000 compared with $204,000 for the same period a year ago. See note 9 to the unaudited interim consolidated financial statements for additional information relating to stock options.

Updated Share Information

As at June 2, 2025, there were no changes since April 30, 2025 in the number of common shares and common share options outstanding.

Off-Balance Sheet Arrangements

At April 30, 2025, the Bank had an outstanding Interest rate swap, applied through a designated hedge which was established for asset liability management purposes to exchange between fixed and floating interest rates with a notional amount totaling $21.1 million (October 31, 2024 - $22.0 million), of which $21.1 million (October 31, 2024 - $22.0 million) qualified for hedge accounting. The Bank enters into interest rate swap contracts for its own account exclusively and does not act as an intermediary in this market. As required under the accounting standard relating to hedges, at April 30, 2025, a $381,000 (October 31, 2024 - $19,000) liability relating to this contract was included in other liabilities and the offsetting amount included in the carrying values of the assets to which they relate. Approved counterparties are limited to major Canadian chartered banks. The carrying amount of the hedged item recognized in the credit assets was $21.8 million.

| VersaBank – Q2 2025 MD&A | 25 |

As of April 30, 2025, the Bank utilized a foreign exchange forward contract through a designated hedge to mitigate the foreign exchange risk on its net investment in VersaBank USA. This hedging strategy is aimed at minimizing foreign exchange risk related to fluctuations between VersaBank’s functional currency, CAD, and the foreign currency of its net investment, USD. Changes in the fair value of these derivatives, attributable to the effective portion of the hedge, are recognized in other comprehensive income, while the ineffective portion, if any, is recorded in profit or loss. As of April 30, 2025, the outstanding foreign exchange forward contract had a notional value of USD $58.0 million and a fair value of $159,000 (asset), hedging a portion of the USD $98.7 million net investment in VersaBank USA. Since there was no hedge ineffectiveness, there was no impact on profit or loss from this hedge. The hedge was assessed as highly effective, supporting the Bank’s risk management strategy to stabilize the financial impact of foreign exchange movements.

As of April 30, 2025, a designated hedge exists for the remaining USD $40.7 million of the USD $98.7 million net investment in VersaBank USA. This is achieved through the allocation of part of a USD $75.0 million subordinated debt raised by the Bank in April 2021. Both the loan (liability) and the investment (asset) move in equal and opposite directions, with the liability serving as a hedge against rate fluctuations that may affect the valuation of the net investment.

As of April 30, 2025, the Bank utilized a foreign exchange forward contract to mitigate foreign exchange risk associated with the intercompany loan denominated in USD, resulting from the intercompany transfer of assets, which aims to minimize foreign exchange risk related to fluctuations between the Bank’s functional currency, CAD, and the foreign currency denominated loan. As of April 30, 2025, the outstanding foreign exchange forward contract relating to this intercompany loan had a notional value of USD $12.1 million and a fair value of $38,000 (asset). As at April 30, 2025, VersaBank did not have any significant off-balance sheet arrangements other than an interest rate swap contract, a foreign exchange forward contract, loan commitments and letters of credit attributable to normal course business activities. See notes 12 and 13 to the unaudited interim consolidated financial statements for more information.

Related Party Transactions

VersaBank’s related parties include members of the Board of Directors and Senior Executive Officers represented as key management personnel and significant minority shareholders. See note 14 to the unaudited interim consolidated financial statements for additional information on related party transactions and balances.

| VersaBank – Q2 2025 MD&A | 26 |

Capital Management and Capital Resources

The table below presents VersaBank’s regulatory capital position, risk-weighted assets and regulatory capital and leverage ratios for the current and comparative periods.

|

(thousands of Canadian dollars) |

||||||||||||||||||||

|

April 30 |

January 31 |

April 30 |

||||||||||||||||||

|

2025 |

2025 |

Change |

2024 |

Change |

||||||||||||||||

|

Common Equity Tier 1 capital |

$ | 507,222 | $ | 500,158 | 1% | $ | 375,153 | 35% | ||||||||||||

|

Total Tier 1 capital |

$ | 507,222 | $ | 500,158 | 1% | $ | 388,800 | 30% | ||||||||||||

|

Total Tier 2 capital |

$ | 108,548 | $ | 112,863 | (4%) | $ | 105,497 | 3% | ||||||||||||

|

Total regulatory capital |

$ | 615,770 | $ | 613,021 | 0% | $ | 494,297 | 25% | ||||||||||||

|

Total risk-weighted assets |

$ | 3,551,398 | $ | 3,422,768 | 4% | $ | 3,224,822 | 10% | ||||||||||||

|

Capital ratios |

||||||||||||||||||||

|

CET1 capital ratio |

14.28 | % | 14.61 | % | (2%) | 11.63 | % | 23% | ||||||||||||

|

Tier 1 capital ratio |

14.28 | % | 14.61 | % | (2%) | 12.06 | % | 18% | ||||||||||||

|

Total capital ratio |

17.34 | % | 17.91 | % | (3%) | 15.33 | % | 13% | ||||||||||||

|

Leverage ratio |

9.61 | % | 9.67 | % | (1%) | 8.55 | % | 12% | ||||||||||||

VersaBank reports its regulatory capital ratios using the Standardized approach for calculating risk-weighted assets, as defined under Basel III, which may require VersaBank to carry more capital for certain credit exposures compared with requirements under the Advanced Internal Ratings Based (“AIRB”) methodology. As a result, regulatory capital ratios of banks that utilize the Standardized approach are not directly comparable with the large Canadian banks that employ the AIRB methodology.

OSFI requires that all Canadian banks must comply with the Basel III standards on an “all-in” basis for purposes of determining their risk-based capital ratios. Required minimum regulatory capital ratios are a 7.0% Common Equity Tier 1 (“CET1”) capital ratio, an 8.5% Tier 1 capital ratio and a 10.5% total capital ratio, all of which include a 2.5% capital conservation buffer.

The year-over-year and sequential changes exhibited by VersaBank’s reported regulatory capital levels, regulatory capital ratios and leverage ratio were a function primarily of retained earnings growth and changes to VersaBank’s risk-weighted asset balances and composition. The year-over-year variance also reflects the treasury offering of common shares on December 18, 2024 and the redemption of the Non-Cumulative Series 1 preferred shares on October 31, 2024.

| VersaBank – Q2 2025 MD&A | 27 |

For more information regarding capital management, please see note 15 to VersaBank’s April 30, 2025, unaudited interim Consolidated Financial Statements as well as the Capital Management and Capital Resources section of VersaBank’s MD&A for the year ended October 31, 2024.

Liquidity