|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$49

|

0.48%

|

|

•

|

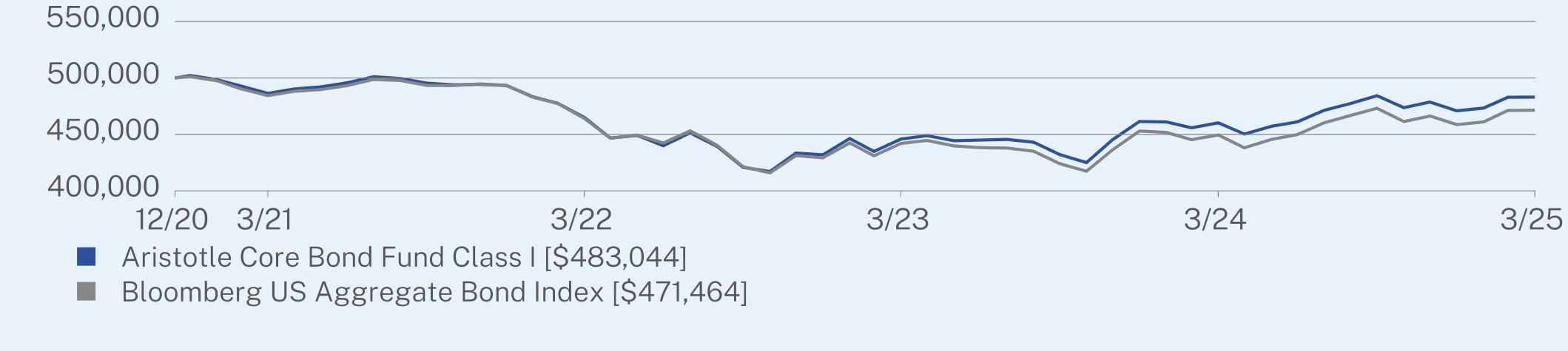

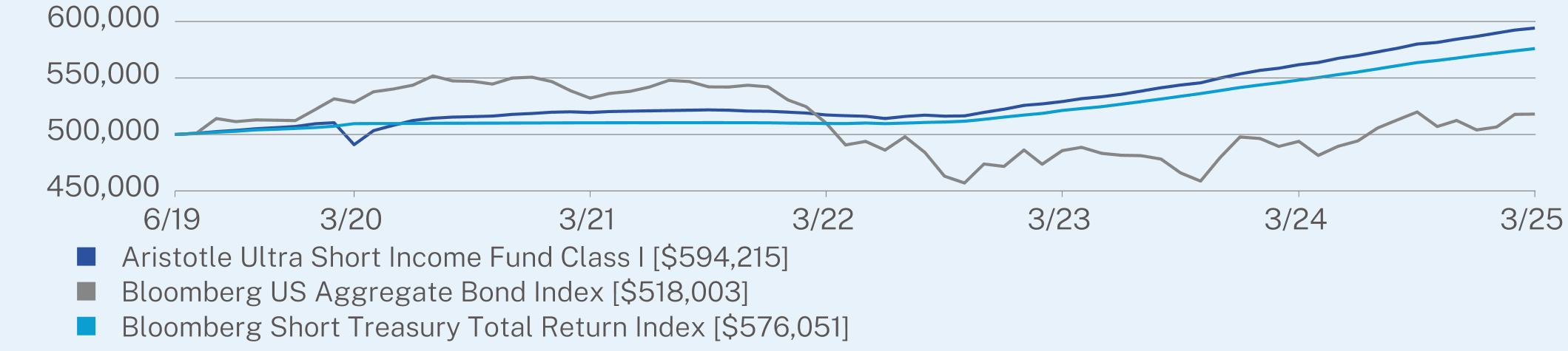

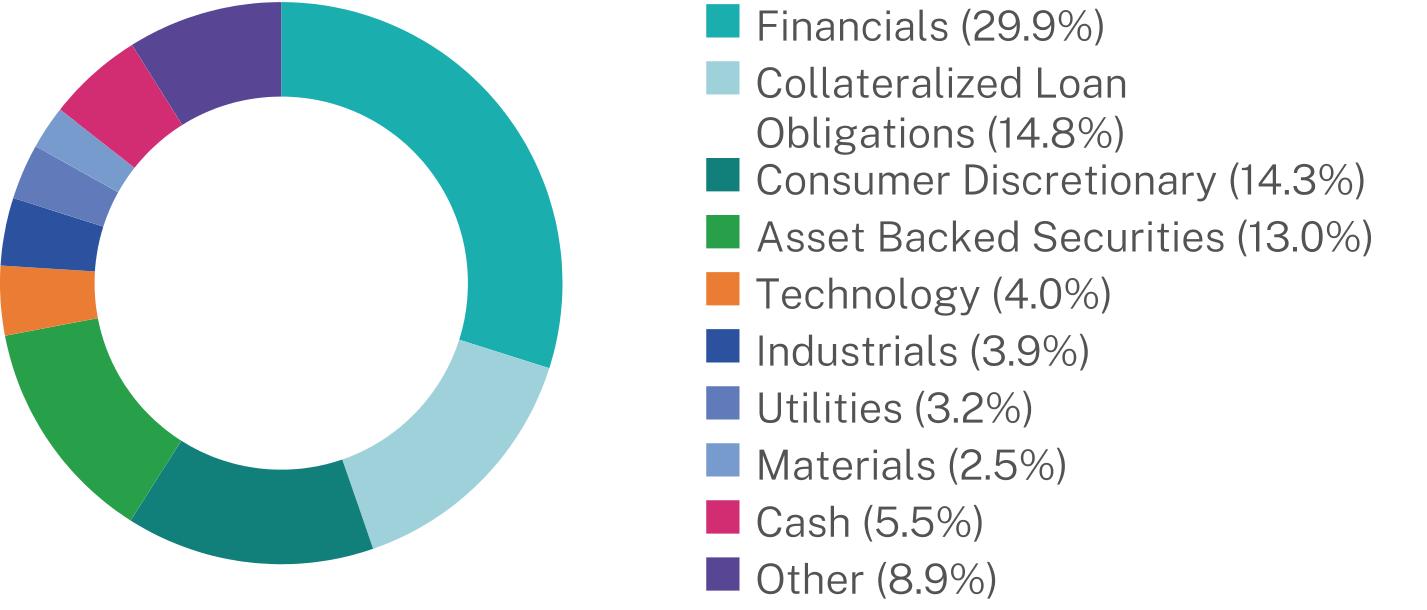

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund primarily invests in a broad range of investment grade debt securities, including corporate bonds, mortgage-related securities, asset-backed securities, debt securities issued by the U.S. government or its related agencies and U.S. dollar-denominated debt securities issued by developed foreign governments and corporation.

|

|

•

|

The front end of the curve and intermediate portions of the curve were supported by the yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated as compared to recent history, which was beneficial to return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, agency mortgage exposure and cash holdings were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation.

|

|

•

|

While duration moved over the last twelve months, the point-to-point Fund duration was nearly flat. The Fund remained roughly inline with benchmark duration. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we materially increased the government, agency and non-agency exposure. The Fund also significantly reduced the investment grade corporate bond and asset-backed security exposure over the period.

|

|

|

1 Year

|

Since Inception

(12/14/2020) |

|

Class I (without sales charge)

|

4.94

|

-0.80

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-1.36

|

|

Net Assets

|

$39,123,189

|

|

Number of Holdings

|

127

|

|

Net Advisory Fee

|

$96,476

|

|

Portfolio Turnover Rate

|

76%

|

|

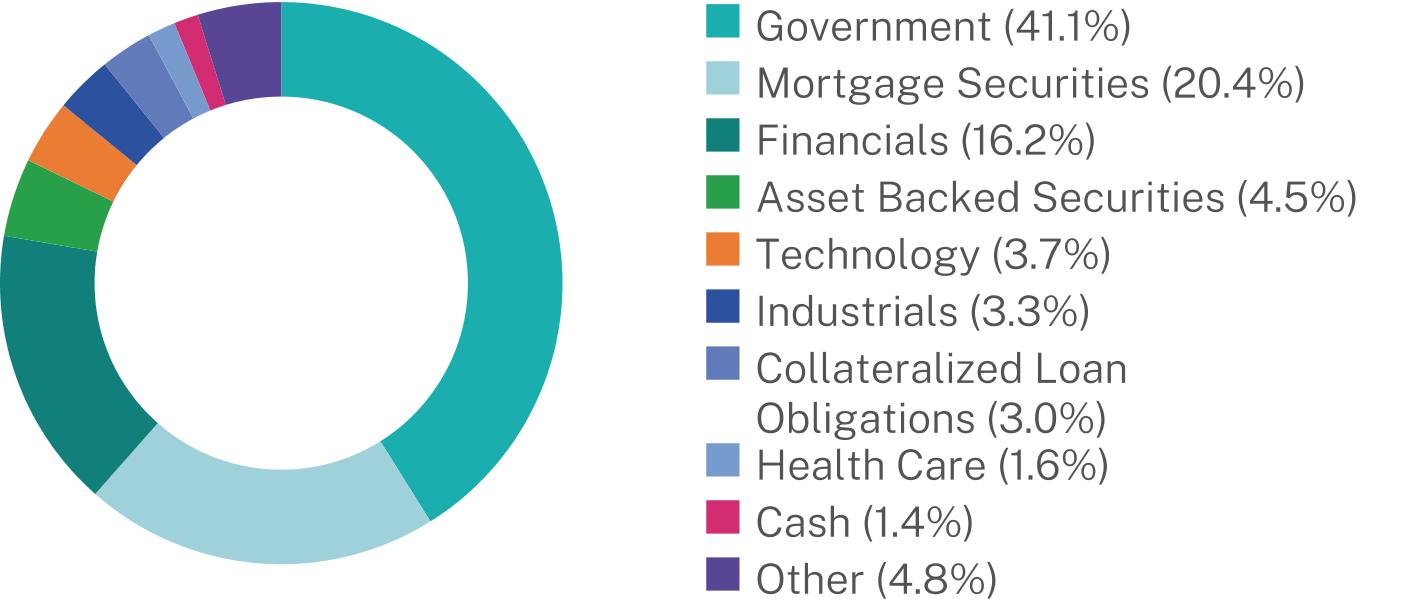

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

41.1%

|

|

Federal National Mortgage Association

|

1.8%

|

|

Bank of America Corp.

|

1.6%

|

|

UBS Group AG

|

1.5%

|

|

Morgan Stanley

|

1.3%

|

|

Federal National Mortgage Association

|

1.3%

|

|

Federal National Mortgage Association

|

1.1%

|

|

Oracle Corp.

|

1.1%

|

|

Goldman Sachs Group, Inc.

|

1.0%

|

|

COLT Funding LLC

|

1.0%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I-2

|

$49

|

0.48%

|

|

•

|

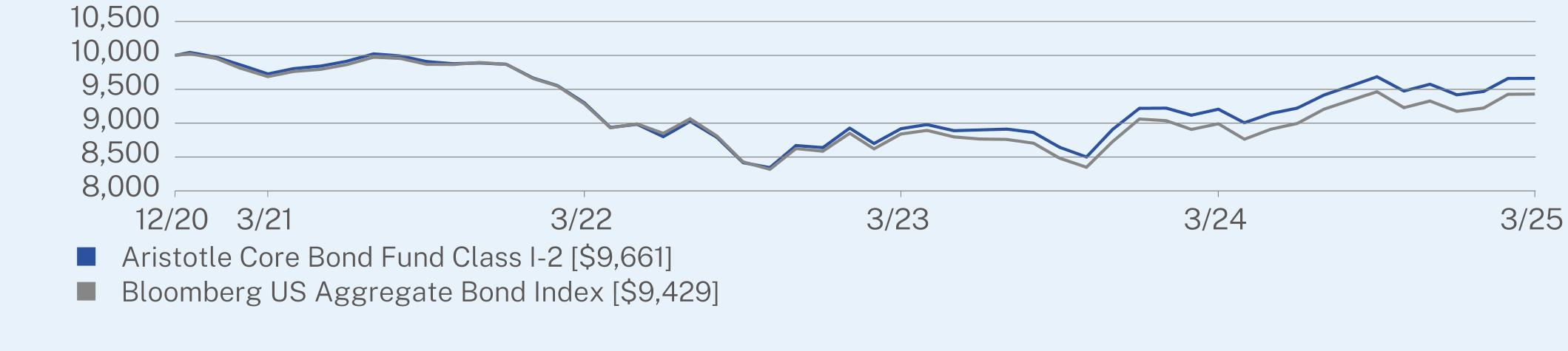

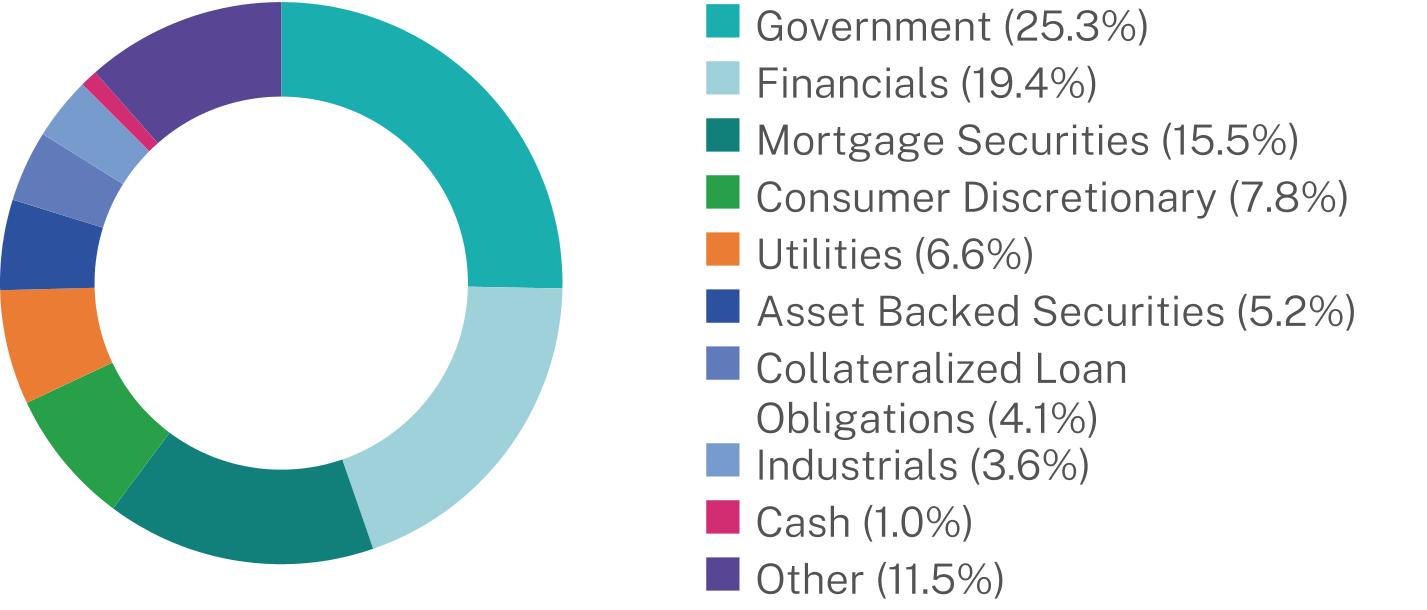

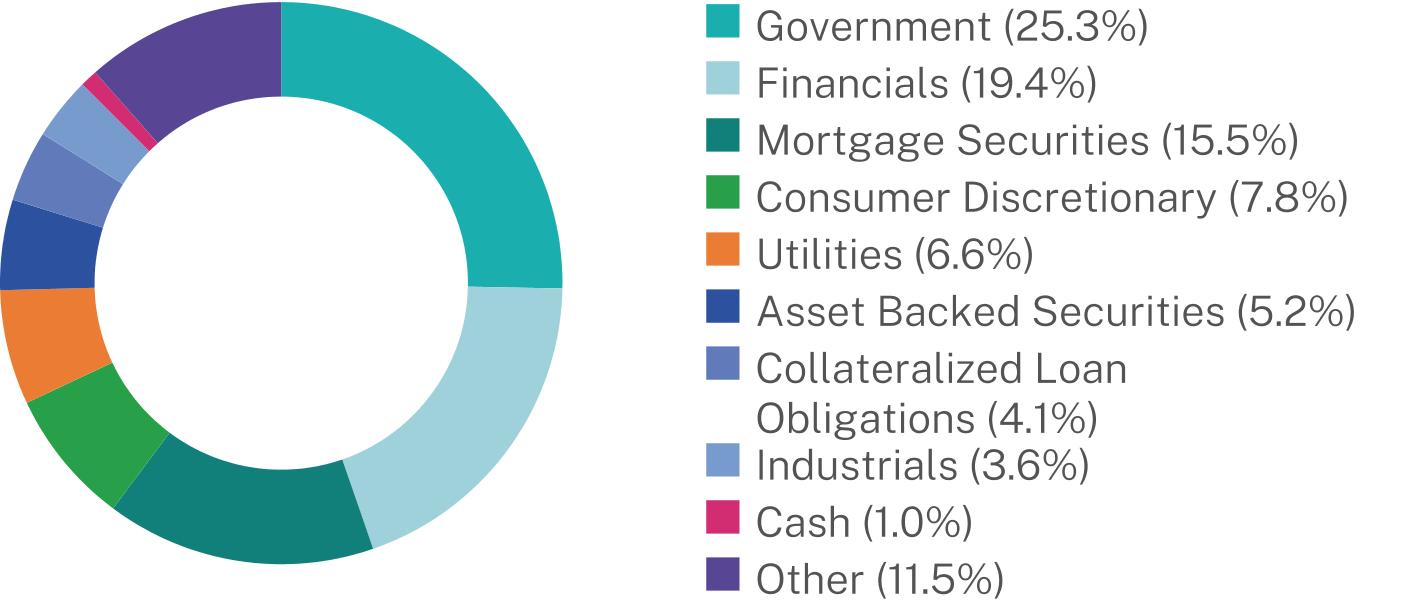

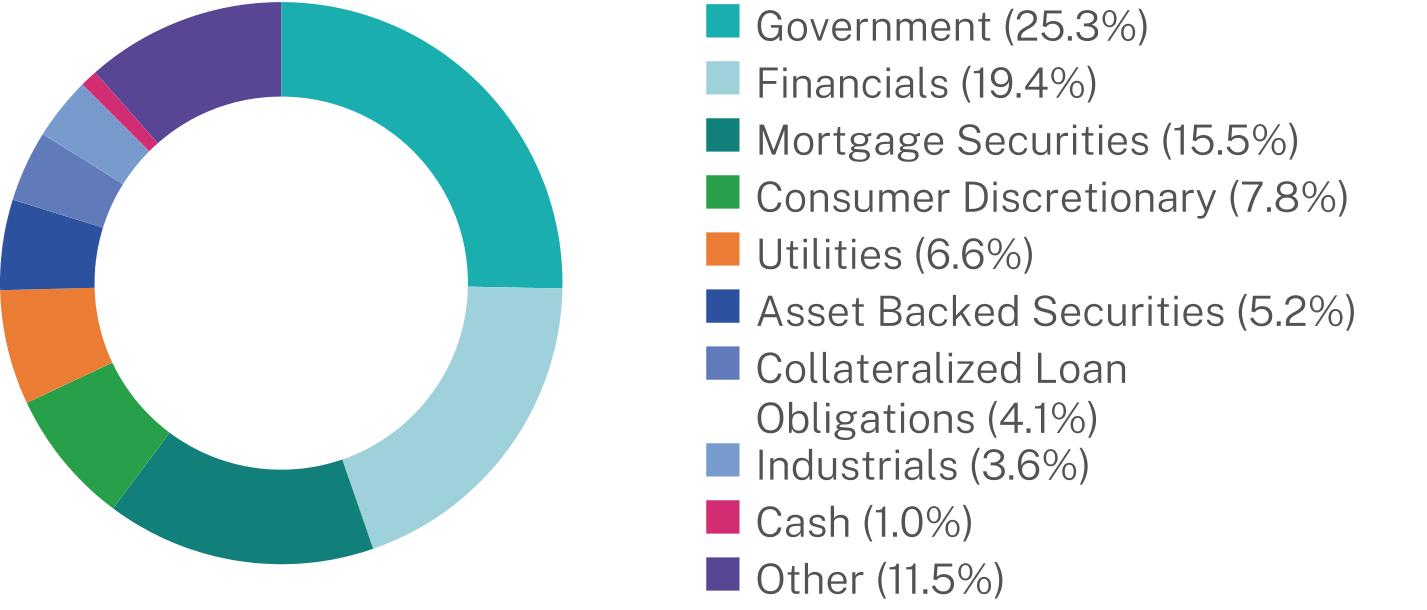

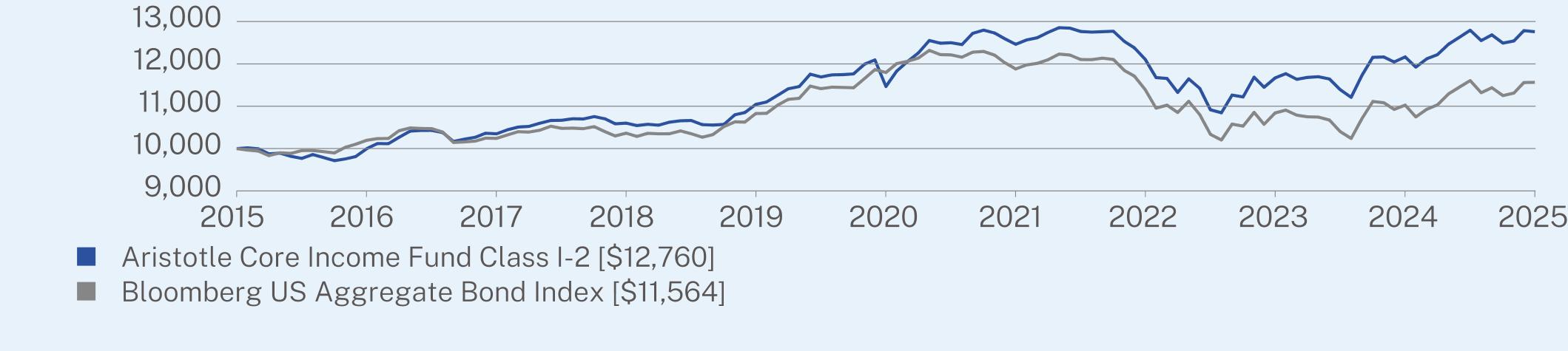

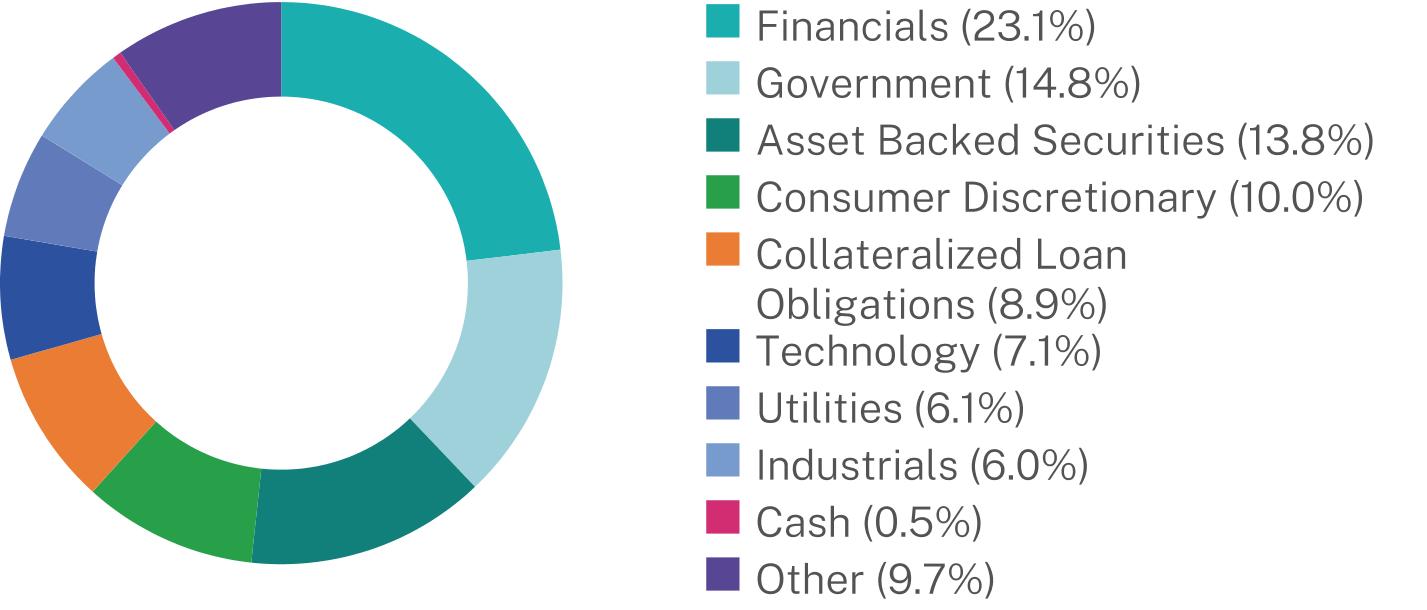

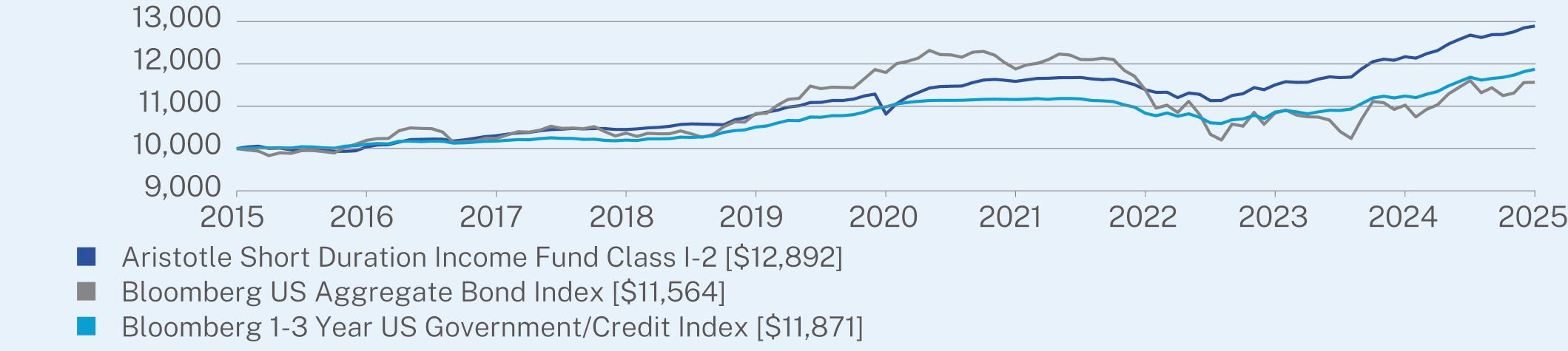

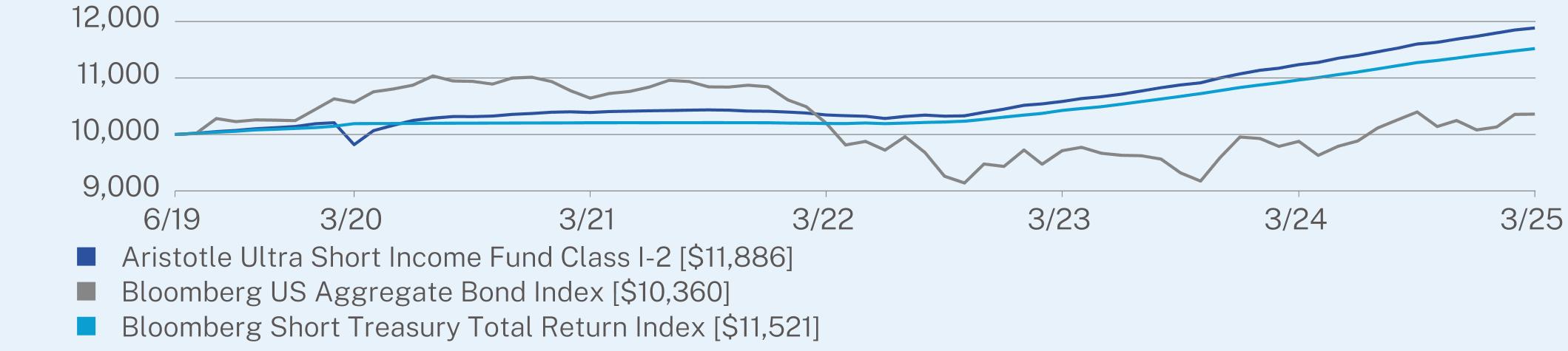

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund primarily invests in a broad range of investment grade debt securities, including corporate bonds, mortgage-related securities, asset-backed securities, debt securities issued by the U.S. government or its related agencies and U.S. dollar-denominated debt securities issued by developed foreign governments and corporation.

|

|

•

|

The front end of the curve and intermediate portions of the curve were supported by the yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated as compared to recent history, which was beneficial to return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, agency mortgage exposure and cash holdings were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation.

|

|

•

|

While duration moved over the last twelve months, the point-to-point Fund duration was nearly flat. The Fund remained roughly inline with benchmark duration. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we materially increased the government, agency and non-agency exposure. The Fund also significantly reduced the investment grade corporate bond and asset-backed security exposure over the period.

|

|

|

1 Year

|

Since Inception

(12/14/2020) |

|

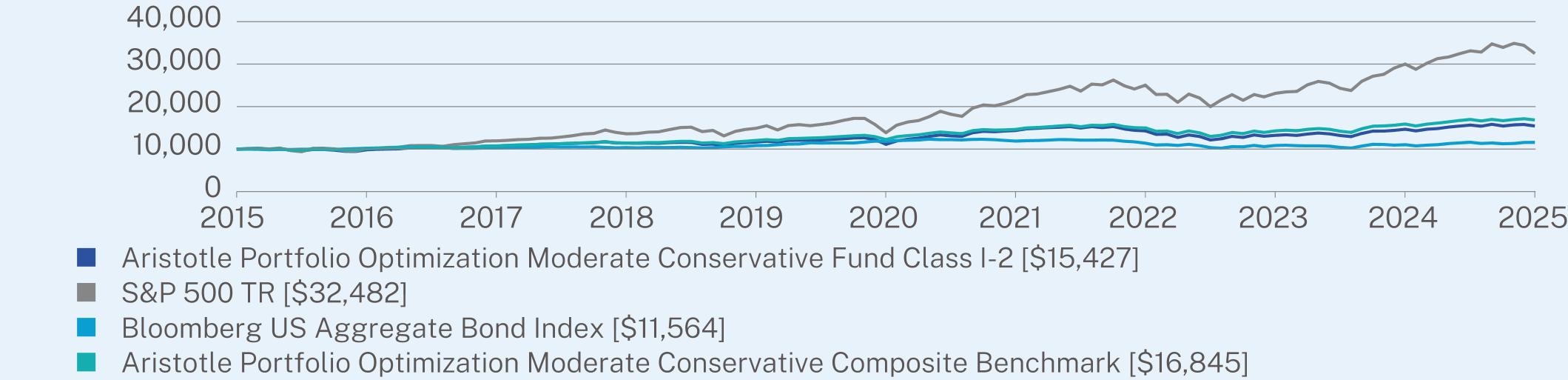

Class I-2 (without sales charge)

|

4.93

|

-0.80

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-1.36

|

|

Net Assets

|

$39,123,189

|

|

Number of Holdings

|

127

|

|

Net Advisory Fee

|

$96,476

|

|

Portfolio Turnover Rate

|

76%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

41.1%

|

|

Federal National Mortgage Association

|

1.8%

|

|

Bank of America Corp.

|

1.6%

|

|

UBS Group AG

|

1.5%

|

|

Morgan Stanley

|

1.3%

|

|

Federal National Mortgage Association

|

1.3%

|

|

Federal National Mortgage Association

|

1.1%

|

|

Oracle Corp.

|

1.1%

|

|

Goldman Sachs Group, Inc.

|

1.0%

|

|

COLT Funding LLC

|

1.0%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$87

|

0.85%

|

|

•

|

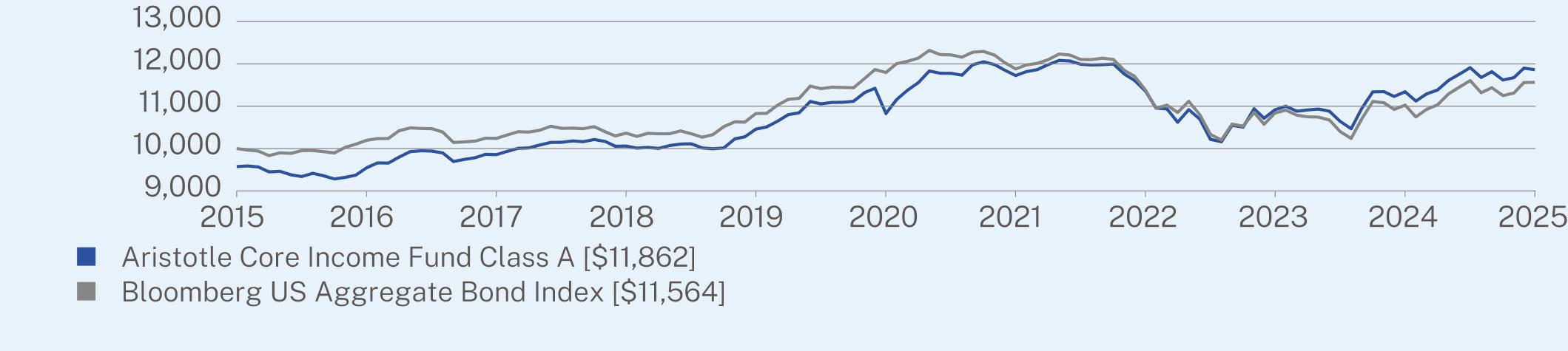

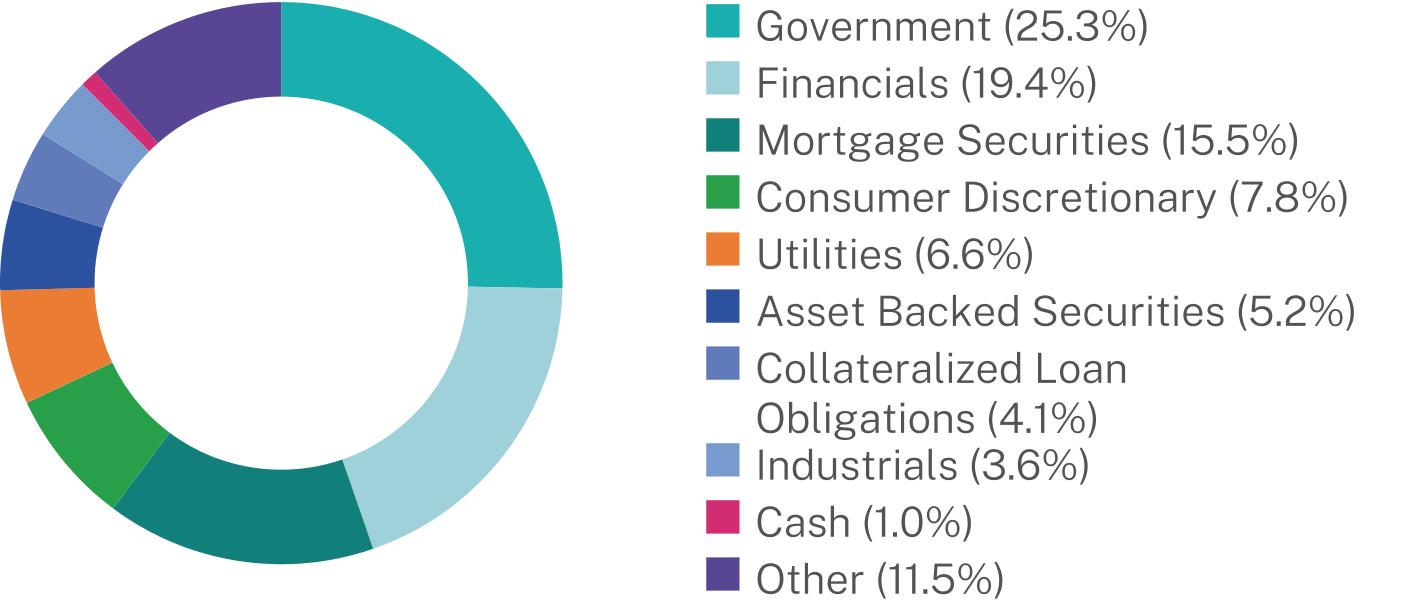

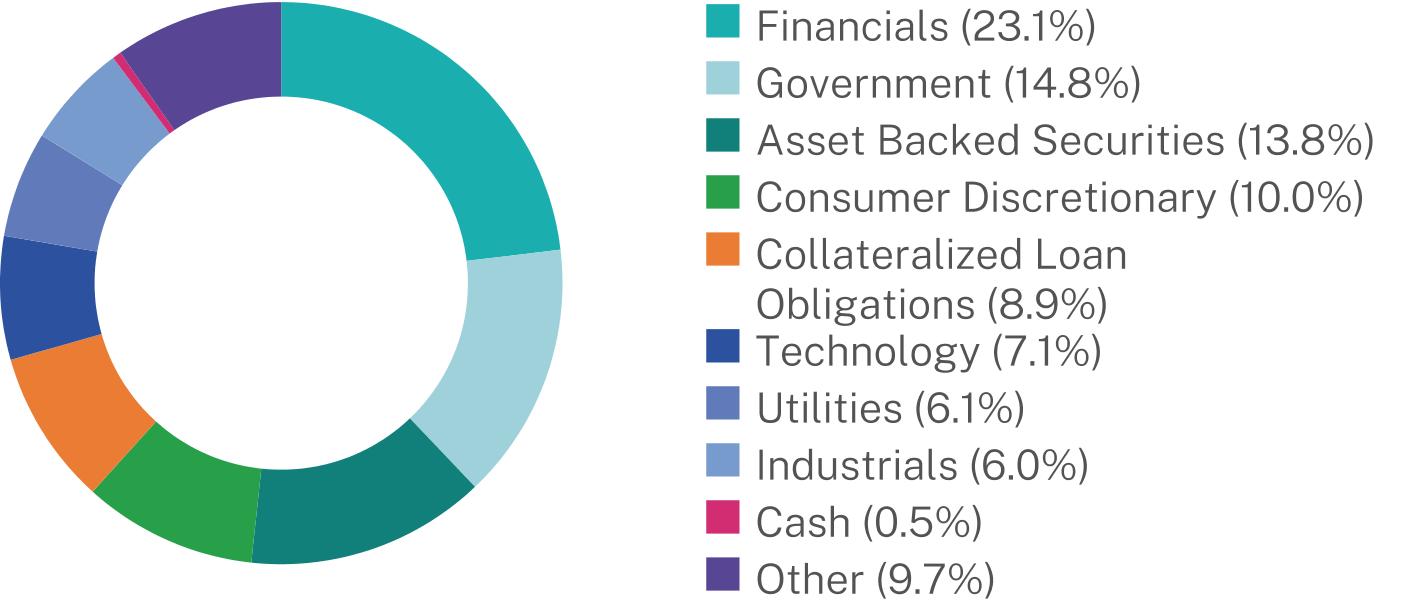

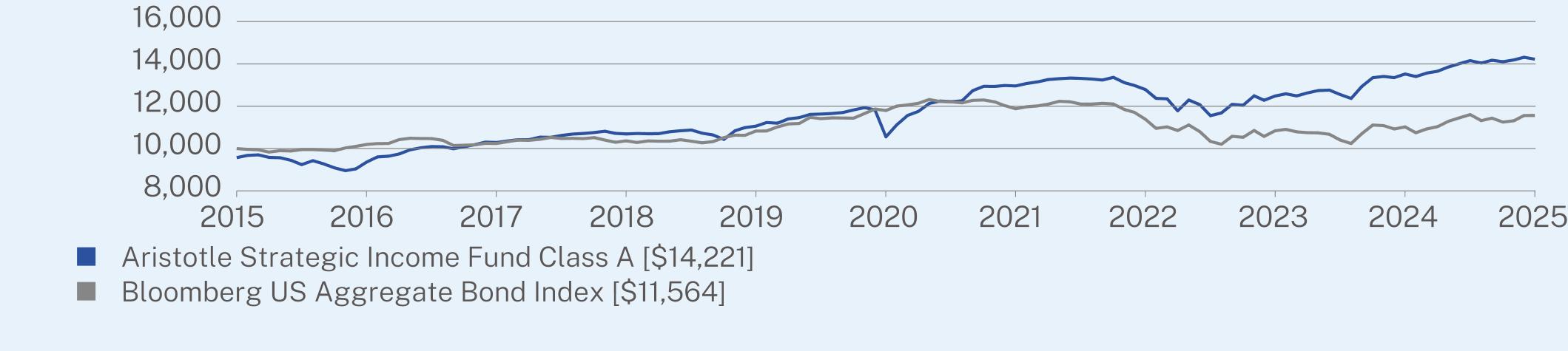

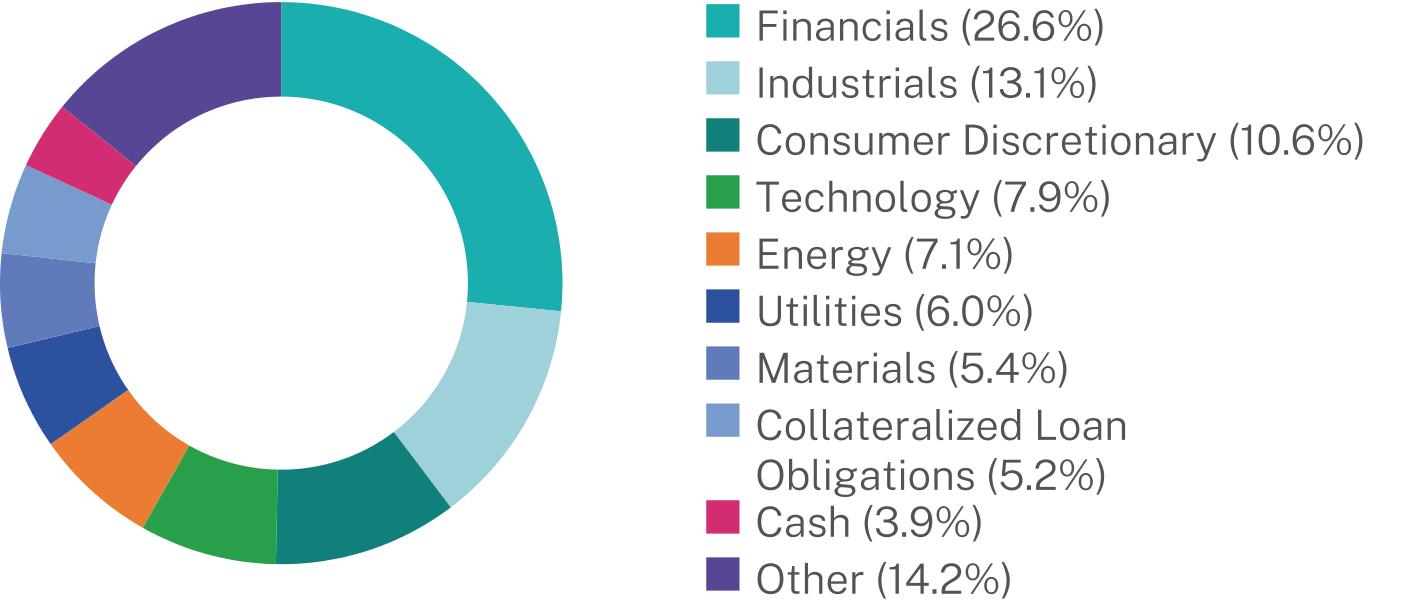

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The front end of the curve and intermediate portions of the curve were supported by the yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated as compared to recent history, which was beneficial to return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, non-U.S. government debt and agency exposures were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration was nearly flat. The Fund did remain slightly short of benchmark duration. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we materially increased agency and non-agency exposure as well as the government exposure. The Fund reduced the securitized, investment grade corporate bond and floating rate loan exposure over the period.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

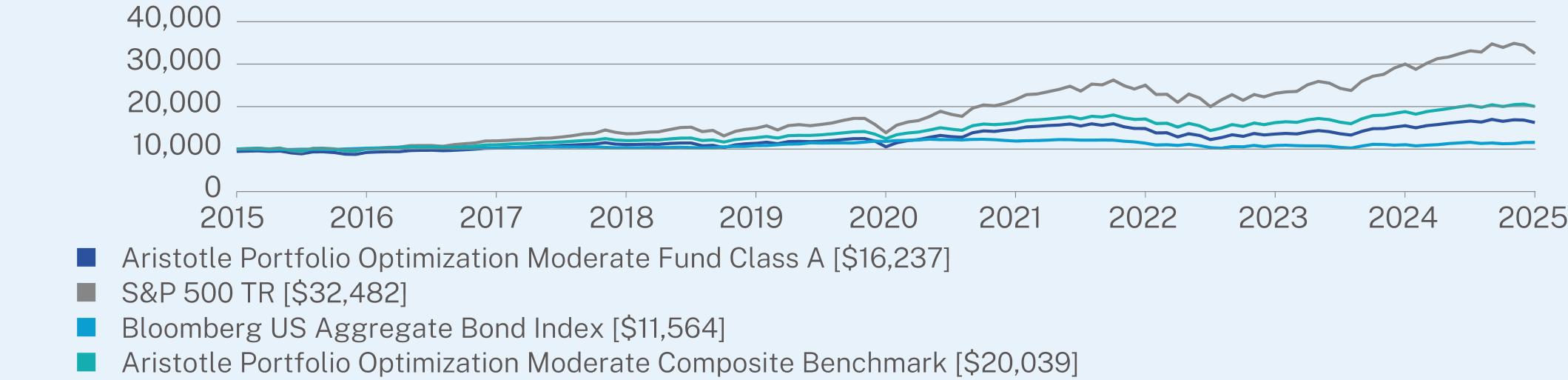

Class A (without sales charge)

|

4.59

|

1.84

|

2.17

|

|

Class A (with sales charge)

|

0.12

|

0.96

|

1.72

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Net Assets

|

$3,162,129,036

|

|

Number of Holdings

|

443

|

|

Net Advisory Fee

|

$11,291,433

|

|

Portfolio Turnover Rate

|

73%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

25.0%

|

|

JPMorgan Chase & Co.

|

1.8%

|

|

Bank of America Corp.

|

1.3%

|

|

Goldman Sachs Group, Inc.

|

1.0%

|

|

Federal National Mortgage Association

|

0.9%

|

|

Morgan Stanley

|

0.9%

|

|

Energy Transfer LP

|

0.8%

|

|

VICI Properties LP

|

0.7%

|

|

Freddie Mac Seasoned Credit Risk Transfer Trust

|

0.7%

|

|

Federal National Mortgage Association

|

0.7%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

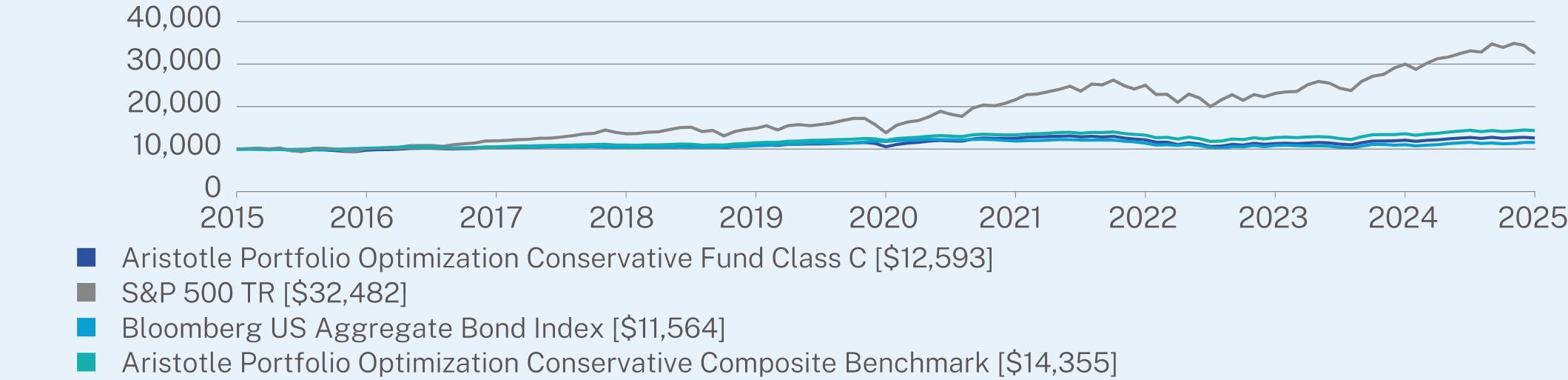

Class C

|

$163

|

1.60%

|

|

•

|

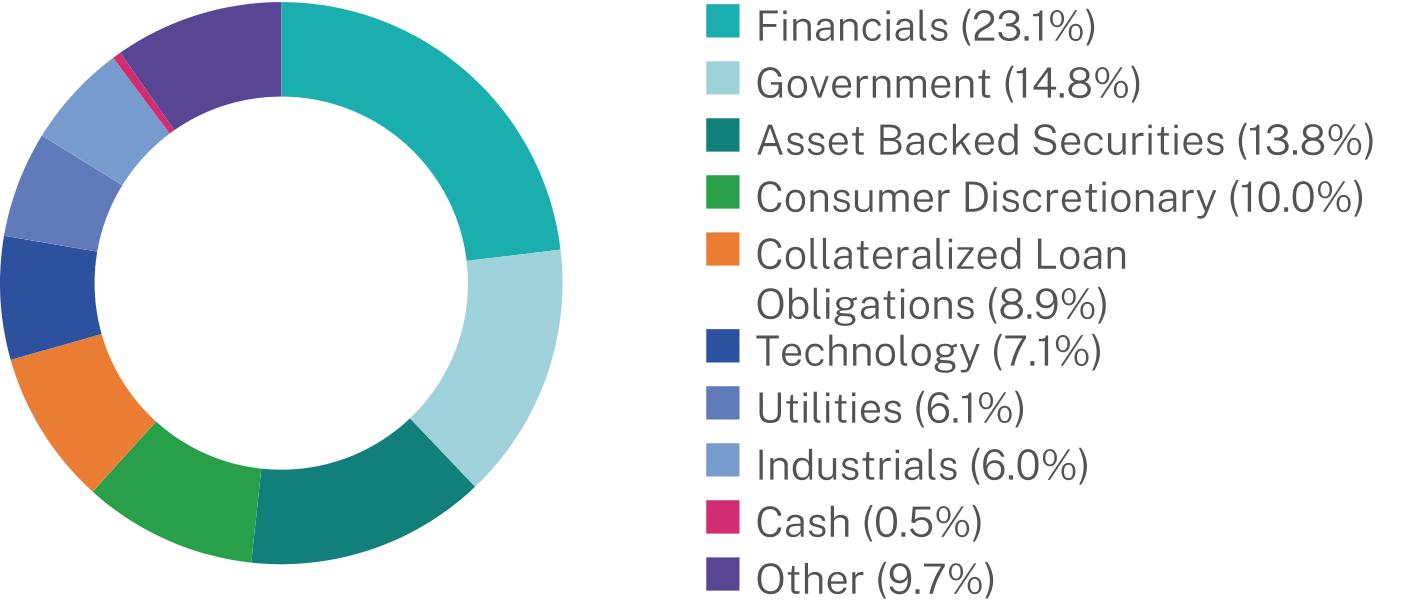

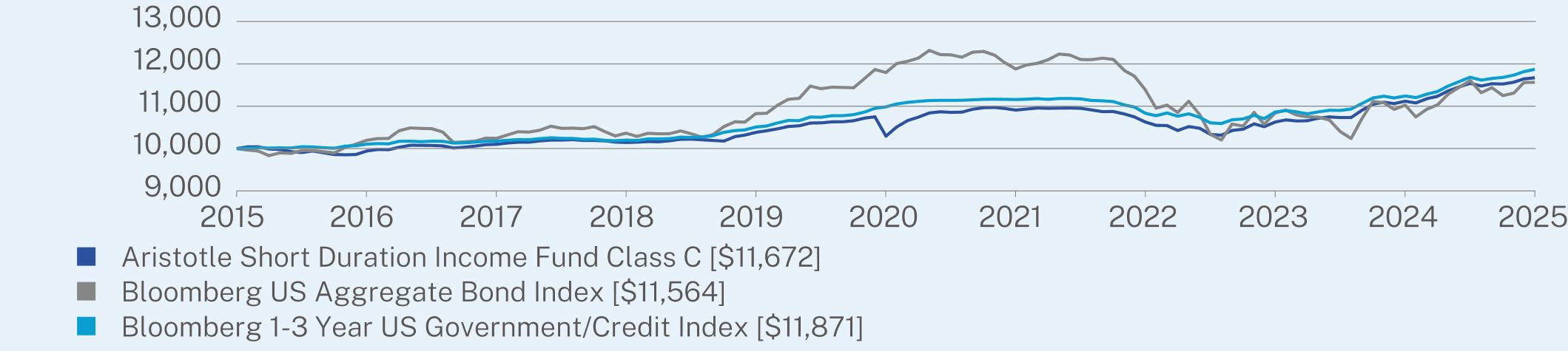

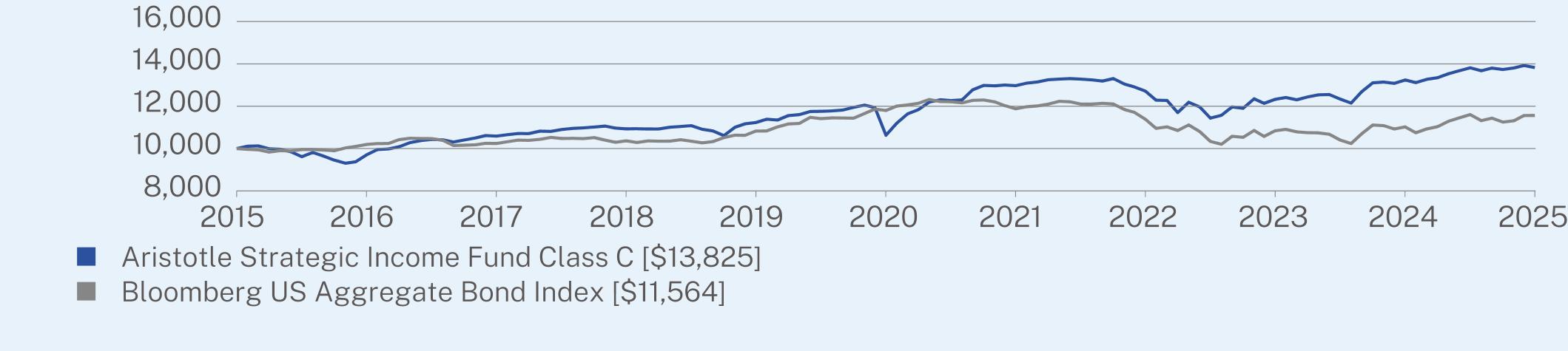

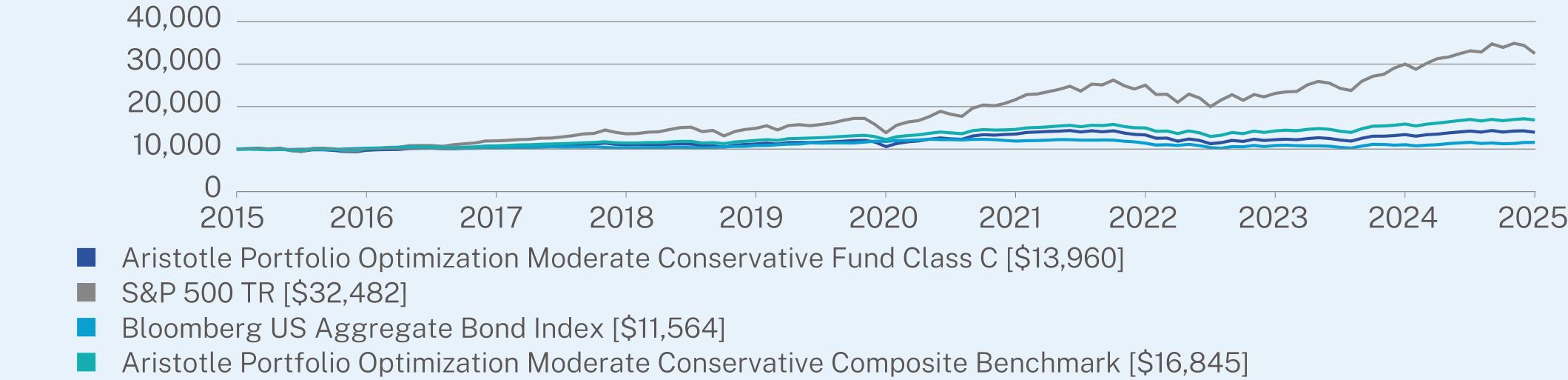

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The front end of the curve and intermediate portions of the curve were supported by the yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated as compared to recent history, which was beneficial to return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, non-U.S. government debt and agency exposures were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration was nearly flat. The Fund did remain slightly short of benchmark duration. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we materially increased agency and non-agency exposure as well as the government exposure. The Fund reduced the securitized, investment grade corporate bond and floating rate loan exposure over the period.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

3.83

|

1.10

|

1.41

|

|

Class C (with sales charge)

|

2.83

|

1.10

|

1.41

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Net Assets

|

$3,162,129,036

|

|

Number of Holdings

|

443

|

|

Net Advisory Fee

|

$11,291,433

|

|

Portfolio Turnover Rate

|

73%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

25.0%

|

|

JPMorgan Chase & Co.

|

1.8%

|

|

Bank of America Corp.

|

1.3%

|

|

Goldman Sachs Group, Inc.

|

1.0%

|

|

Federal National Mortgage Association

|

0.9%

|

|

Morgan Stanley

|

0.9%

|

|

Energy Transfer LP

|

0.8%

|

|

VICI Properties LP

|

0.7%

|

|

Freddie Mac Seasoned Credit Risk Transfer Trust

|

0.7%

|

|

Federal National Mortgage Association

|

0.7%

|

|

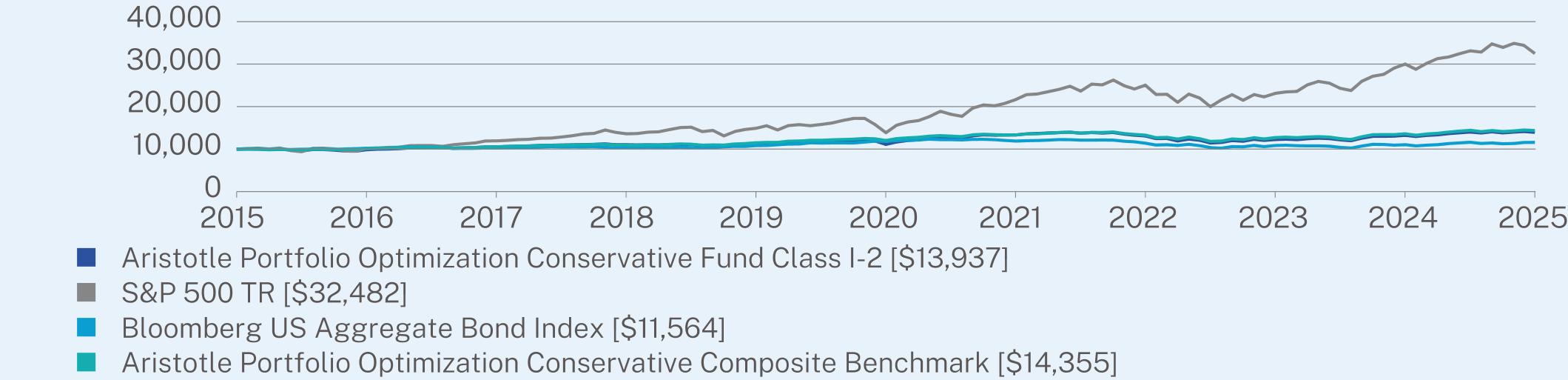

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$46

|

0.45%

|

|

•

|

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The front end of the curve and intermediate portions of the curve were supported by the yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated as compared to recent history, which was beneficial to return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, non-U.S. government debt and agency exposures were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration was nearly flat. The Fund did remain slightly short of benchmark duration. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we materially increased agency and non-agency exposure as well as the government exposure. The Fund reduced the securitized, investment grade corporate bond and floating rate loan exposure over the period.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I (without sales charge)

|

5.00

|

2.16

|

2.48

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Net Assets

|

$3,162,129,036

|

|

Number of Holdings

|

443

|

|

Net Advisory Fee

|

$11,291,433

|

|

Portfolio Turnover Rate

|

73%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

25.0%

|

|

JPMorgan Chase & Co.

|

1.8%

|

|

Bank of America Corp.

|

1.3%

|

|

Goldman Sachs Group, Inc.

|

1.0%

|

|

Federal National Mortgage Association

|

0.9%

|

|

Morgan Stanley

|

0.9%

|

|

Energy Transfer LP

|

0.8%

|

|

VICI Properties LP

|

0.7%

|

|

Freddie Mac Seasoned Credit Risk Transfer Trust

|

0.7%

|

|

Federal National Mortgage Association

|

0.7%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I-2

|

$56

|

0.55%

|

|

•

|

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The front end of the curve and intermediate portions of the curve were supported by the yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated as compared to recent history, which was beneficial to return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, non-U.S. government debt and agency exposures were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration was nearly flat. The Fund did remain slightly short of benchmark duration. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we materially increased agency and non-agency exposure as well as the government exposure. The Fund reduced the securitized, investment grade corporate bond and floating rate loan exposure over the period.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I-2 (without sales charge)

|

4.89

|

2.16

|

2.47

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Net Assets

|

$3,162,129,036

|

|

Number of Holdings

|

443

|

|

Net Advisory Fee

|

$11,291,433

|

|

Portfolio Turnover Rate

|

73%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

25.0%

|

|

JPMorgan Chase & Co.

|

1.8%

|

|

Bank of America Corp.

|

1.3%

|

|

Goldman Sachs Group, Inc.

|

1.0%

|

|

Federal National Mortgage Association

|

0.9%

|

|

Morgan Stanley

|

0.9%

|

|

Energy Transfer LP

|

0.8%

|

|

VICI Properties LP

|

0.7%

|

|

Freddie Mac Seasoned Credit Risk Transfer Trust

|

0.7%

|

|

Federal National Mortgage Association

|

0.7%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$105

|

1.02%

|

|

•

|

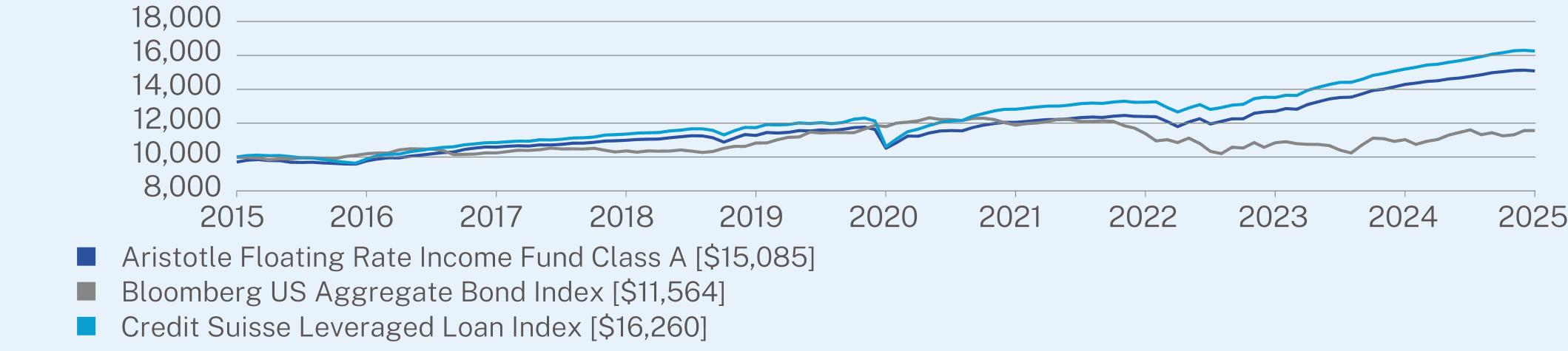

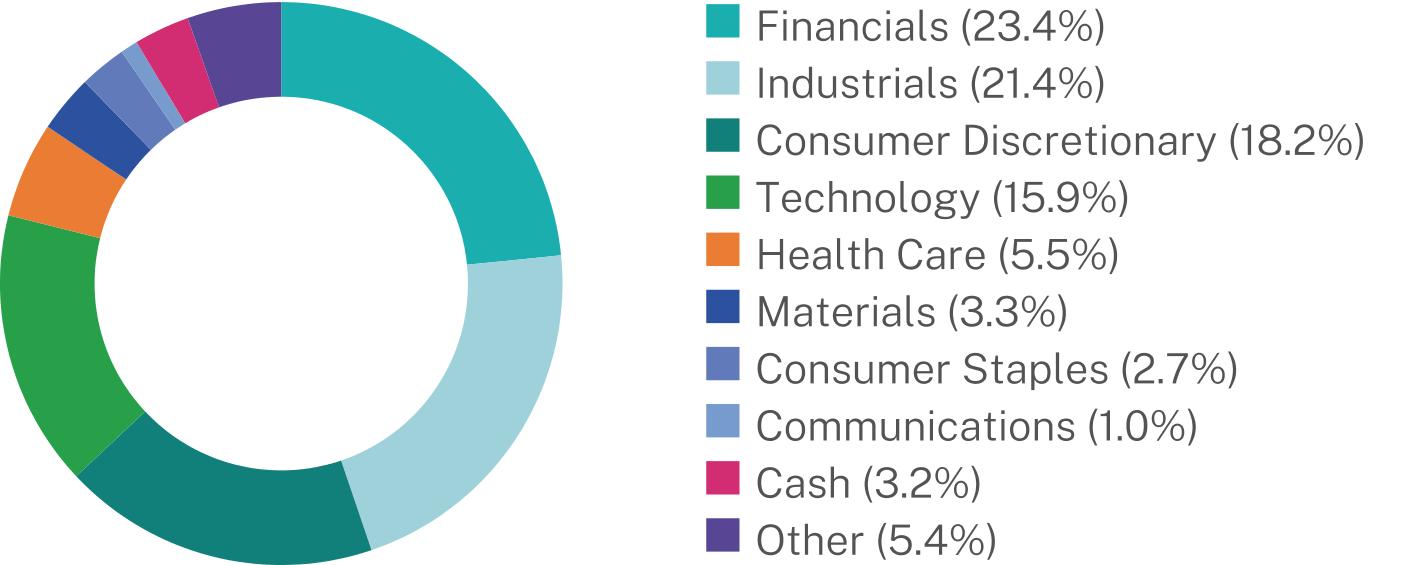

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Credit Suisse Leveraged Loan Index. The Fund invests principally in income-producing floating rate loans and floating rate debt securities.

|

|

•

|

The Fund continues to avoid lower-quality, distressed credits and focuses on large-cap issuers and the performing segment of the loan market. The coupon of the asset class ended the most recent quarter at a historically elevated level (7.6%). We believe loans will continue to provide a ballast during this volatile rate environment.

|

|

•

|

The Fund benefited from largely supportive corporate fundmentals, technicals and an attractive asset class relative value trade. Asset class yields remained elevated as the secured overnight financing rate (SOFR) remained at higher levels.

|

|

•

|

On a year-over-year basis, the Fund maintained its focused exposure inside of the floating rate loan asset class, specifically seeking out the larger more-liquid credits while seeking to avoid deteriorating credits and unfavorable sectors.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

5.57

|

7.48

|

4.51

|

|

Class A (with sales charge)

|

2.35

|

6.83

|

4.20

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Credit Suisse Leveraged Loan Index

|

7.02

|

8.90

|

4.98

|

|

Net Assets

|

$4,284,277,290

|

|

Number of Holdings

|

162

|

|

Net Advisory Fee

|

$23,202,062

|

|

Portfolio Turnover Rate

|

122%

|

|

Top 10 Issuers

|

(%)

|

|

Alliant Holdings Intermediate LLC / Alliant Holdings Co.-Issuer

|

3.6%

|

|

UKG, Inc.

|

3.5%

|

|

TransDigm, Inc.

|

2.8%

|

|

Bausch + Lomb Corp.

|

2.7%

|

|

8th Avenue Food & Provisions, Inc.

|

2.4%

|

|

Deerfield Dakota Holding LLC

|

2.2%

|

|

TIH Insurance Holdings LLC

|

2.2%

|

|

Ellucian Holdings, Inc.

|

2.2%

|

|

ClubCorp Holdings, Inc.

|

2.1%

|

|

Wand NewCo 3, Inc.

|

2.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class C

|

$181

|

1.77%

|

|

•

|

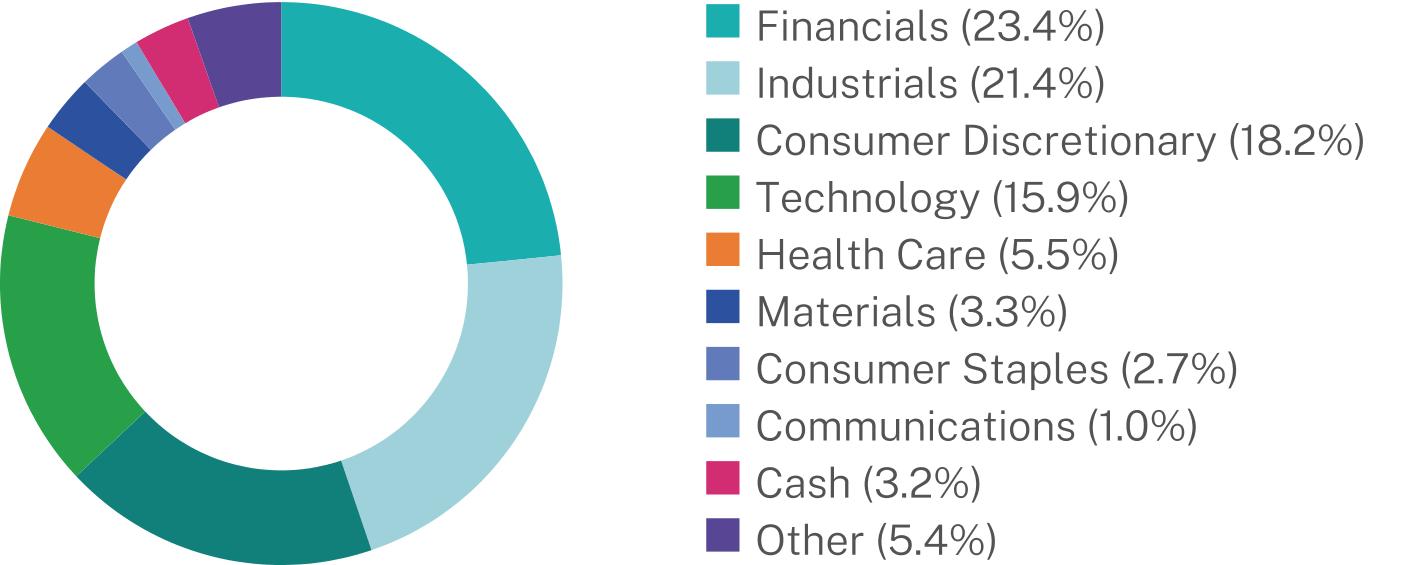

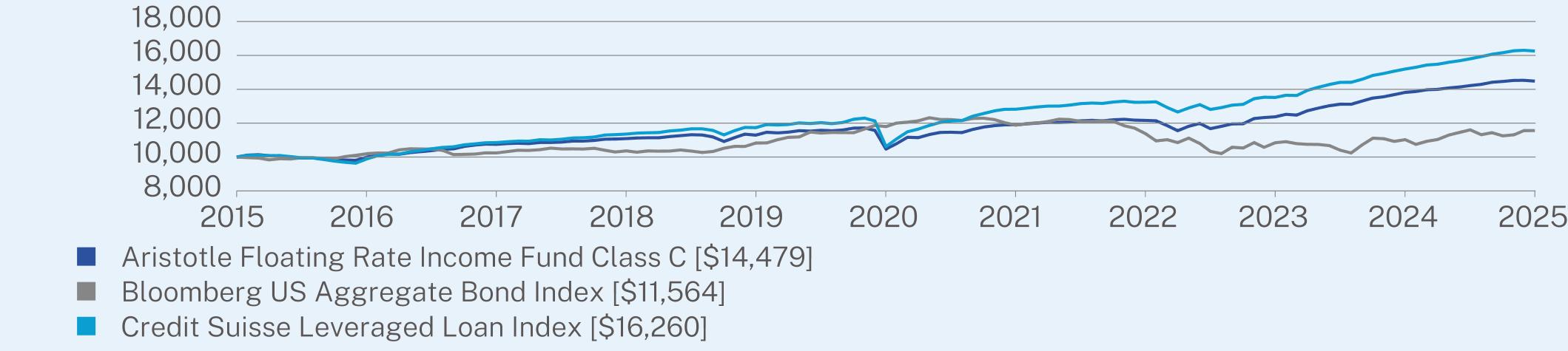

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Credit Suisse Leveraged Loan Index. The Fund invests principally in income-producing floating rate loans and floating rate debt securities.

|

|

•

|

The Fund continues to avoid lower-quality, distressed credits and focuses on large-cap issuers and the performing segment of the loan market. The coupon of the asset class ended the most recent quarter at a historically elevated level (7.6%). We believe loans will continue to provide a ballast during this volatile rate environment.

|

|

•

|

The Fund benefited from largely supportive corporate fundmentals, technicals and an attractive asset class relative value trade. Asset class yields remained elevated as the secured overnight financing rate (SOFR) remained at higher levels.

|

|

•

|

On a year-over-year basis, the Fund maintained its focused exposure inside of the floating rate loan asset class, specifically seeking out the larger more-liquid credits while seeking to avoid deteriorating credits and unfavorable sectors.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

4.78

|

6.70

|

3.77

|

|

Class C (with sales charge)

|

3.80

|

6.70

|

3.77

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Credit Suisse Leveraged Loan Index

|

7.02

|

8.90

|

4.98

|

|

Net Assets

|

$4,284,277,290

|

|

Number of Holdings

|

162

|

|

Net Advisory Fee

|

$23,202,062

|

|

Portfolio Turnover Rate

|

122%

|

|

Top 10 Issuers

|

(%)

|

|

Alliant Holdings Intermediate LLC / Alliant Holdings Co.-Issuer

|

3.6%

|

|

UKG, Inc.

|

3.5%

|

|

TransDigm, Inc.

|

2.8%

|

|

Bausch + Lomb Corp.

|

2.7%

|

|

8th Avenue Food & Provisions, Inc.

|

2.4%

|

|

Deerfield Dakota Holding LLC

|

2.2%

|

|

TIH Insurance Holdings LLC

|

2.2%

|

|

Ellucian Holdings, Inc.

|

2.2%

|

|

ClubCorp Holdings, Inc.

|

2.1%

|

|

Wand NewCo 3, Inc.

|

2.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$71

|

0.69%

|

|

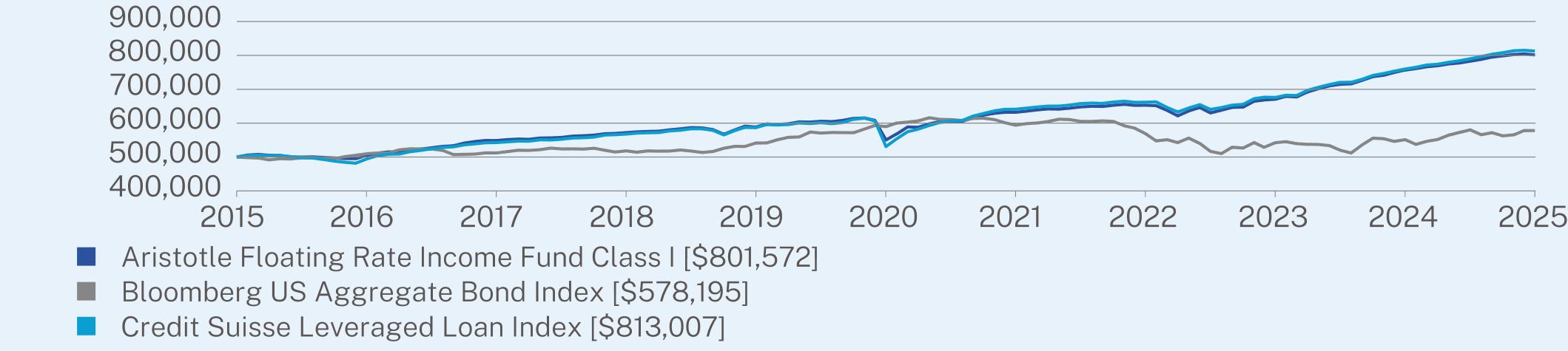

•

|

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Credit Suisse Leveraged Loan Index. The Fund invests principally in income-producing floating rate loans and floating rate debt securities.

|

|

•

|

The Fund continues to avoid lower-quality, distressed credits and focuses on large-cap issuers and the performing segment of the loan market. The coupon of the asset class ended the most recent quarter at a historically elevated level (7.6%). We believe loans will continue to provide a ballast during this volatile rate environment.

|

|

•

|

The Fund benefited from largely supportive corporate fundmentals, technicals and an attractive asset class relative value trade. Asset class yields remained elevated as the secured overnight financing rate (SOFR) remained at higher levels.

|

|

•

|

On a year-over-year basis, the Fund maintained its focused exposure inside of the floating rate loan asset class, specifically seeking out the larger more-liquid credits while seeking to avoid deteriorating credits and unfavorable sectors.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I (without sales charge)

|

5.91

|

7.81

|

4.83

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Credit Suisse Leveraged Loan Index

|

7.02

|

8.90

|

4.98

|

|

Net Assets

|

$4,284,277,290

|

|

Number of Holdings

|

162

|

|

Net Advisory Fee

|

$23,202,062

|

|

Portfolio Turnover Rate

|

122%

|

|

Top 10 Issuers

|

(%)

|

|

Alliant Holdings Intermediate LLC / Alliant Holdings Co.-Issuer

|

3.6%

|

|

UKG, Inc.

|

3.5%

|

|

TransDigm, Inc.

|

2.8%

|

|

Bausch + Lomb Corp.

|

2.7%

|

|

8th Avenue Food & Provisions, Inc.

|

2.4%

|

|

Deerfield Dakota Holding LLC

|

2.2%

|

|

TIH Insurance Holdings LLC

|

2.2%

|

|

Ellucian Holdings, Inc.

|

2.2%

|

|

ClubCorp Holdings, Inc.

|

2.1%

|

|

Wand NewCo 3, Inc.

|

2.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I-2

|

$79

|

0.77%

|

|

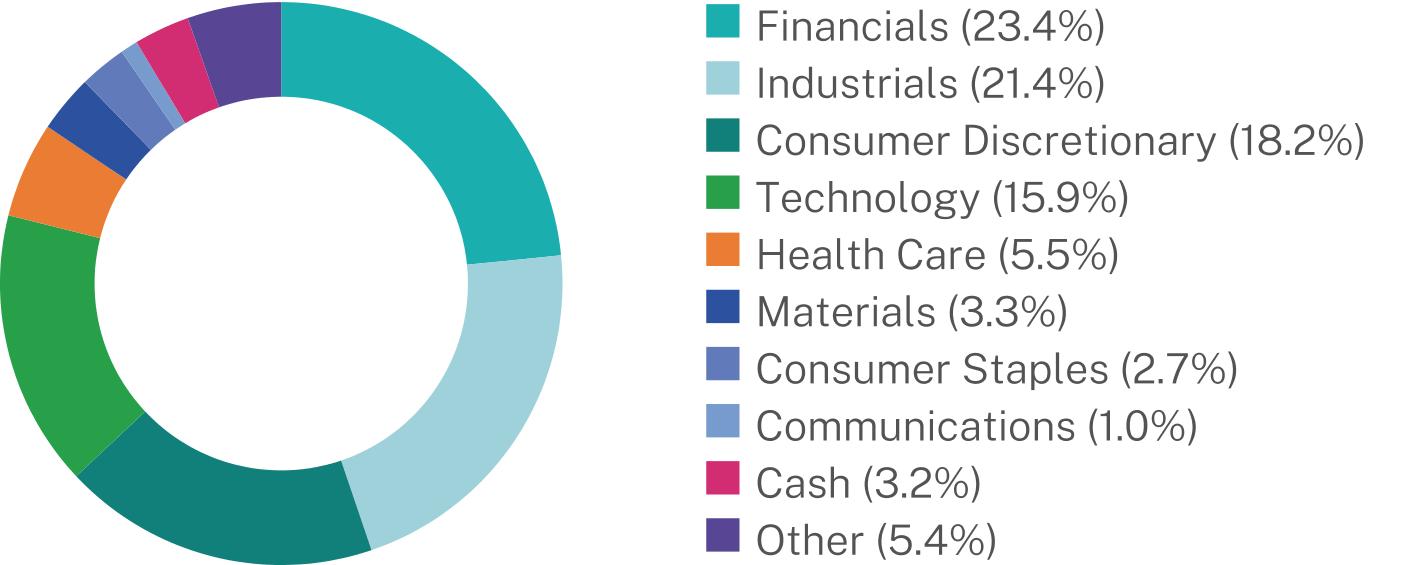

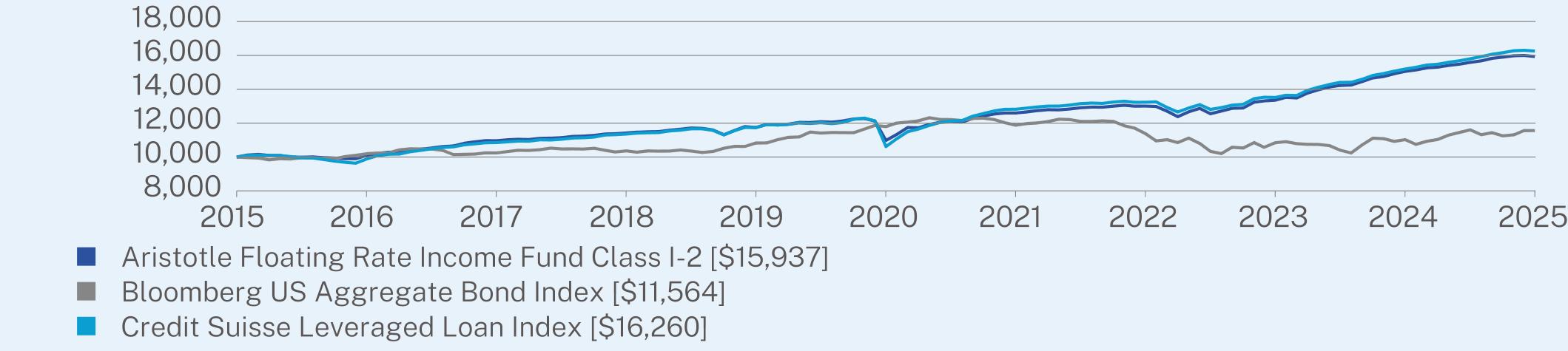

•

|

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Credit Suisse Leveraged Loan Index. The Fund invests principally in income-producing floating rate loans and floating rate debt securities.

|

|

•

|

The Fund continues to avoid lower-quality, distressed credits and focuses on large-cap issuers and the performing segment of the loan market. The coupon of the asset class ended the most recent quarter at a historically elevated level (7.6%). We believe loans will continue to provide a ballast during this volatile rate environment.

|

|

•

|

The Fund benefited from largely supportive corporate fundmentals, technicals and an attractive asset class relative value trade. Asset class yields remained elevated as the secured overnight financing rate (SOFR) remained at higher levels.

|

|

•

|

On a year-over-year basis, the Fund maintained its focused exposure inside of the floating rate loan asset class, specifically seeking out the larger more-liquid credits while seeking to avoid deteriorating credits and unfavorable sectors.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I-2 (without sales charge)

|

5.83

|

7.74

|

4.77

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Credit Suisse Leveraged Loan Index

|

7.02

|

8.90

|

4.98

|

|

Net Assets

|

$4,284,277,290

|

|

Number of Holdings

|

162

|

|

Net Advisory Fee

|

$23,202,062

|

|

Portfolio Turnover Rate

|

122%

|

|

Top 10 Issuers

|

(%)

|

|

Alliant Holdings Intermediate LLC / Alliant Holdings Co.-Issuer

|

3.6%

|

|

UKG, Inc.

|

3.5%

|

|

TransDigm, Inc.

|

2.8%

|

|

Bausch + Lomb Corp.

|

2.7%

|

|

8th Avenue Food & Provisions, Inc.

|

2.4%

|

|

Deerfield Dakota Holding LLC

|

2.2%

|

|

TIH Insurance Holdings LLC

|

2.2%

|

|

Ellucian Holdings, Inc.

|

2.2%

|

|

ClubCorp Holdings, Inc.

|

2.1%

|

|

Wand NewCo 3, Inc.

|

2.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$97

|

0.95%

|

|

•

|

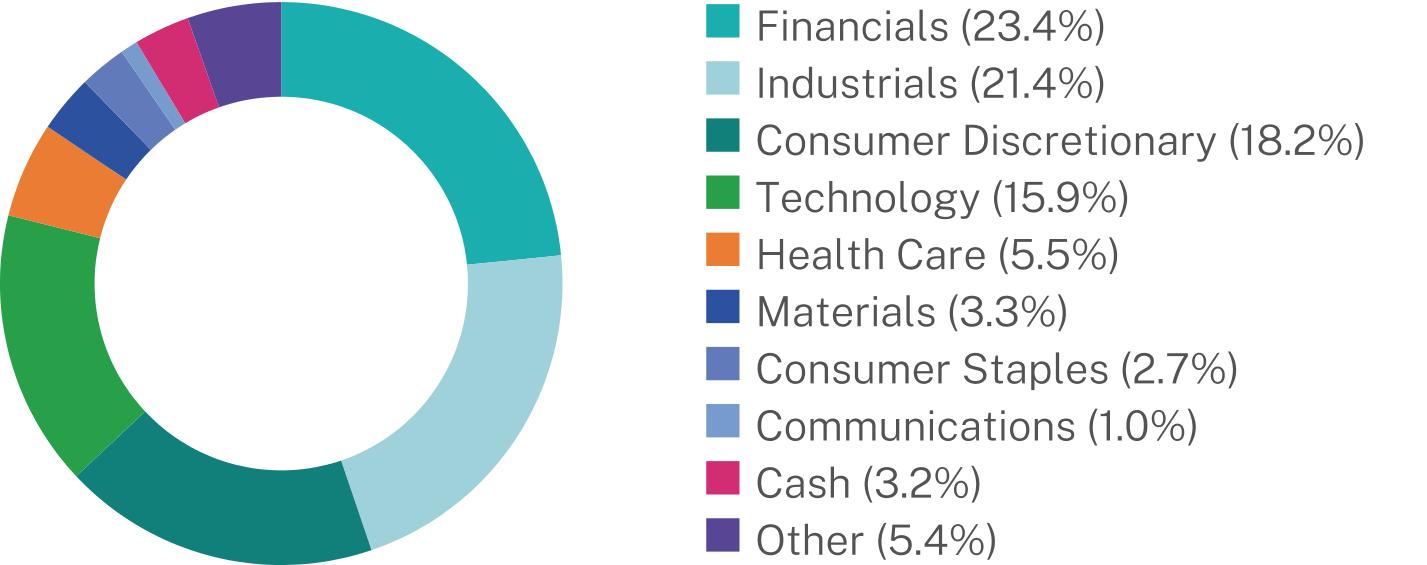

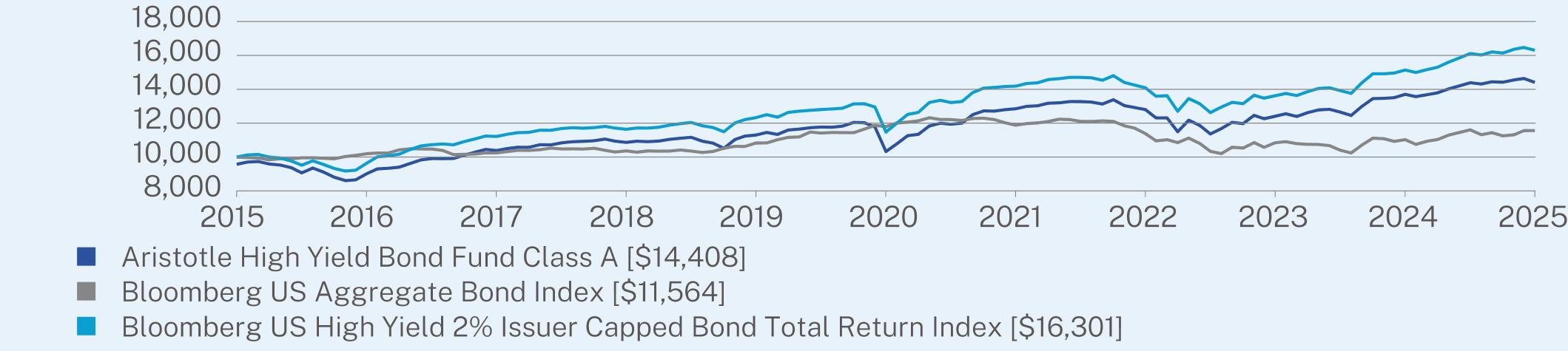

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Bloomberg US High Yield 2% Issuer Capped Bond Total Return Index. The Fund invests at least 80% of its assets in non-investment grade (high yield/high risk, sometimes called “junk bonds”) debt instruments or in instruments with characteristics of non-investment grade debt instruments.

|

|

•

|

A substantial portion of this underperformance is attributable to a lack of exposure to lower-quality distressed credits that benefited during the period. The Fund did benefit from a supportive rate environment elevating entry yields as well as largely compressing credit spreads.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely in favor. The shorter curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis.

|

|

•

|

Positive contribution to relative performance was led by active asset class allocation.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration remained relatively flat. The Fund benefited from an elevated yield environment over the period.

|

|

•

|

On a year-over-year basis, we reduced the limited investment grade bond exposure along with the securitized exposure. Conversely, we increased the corporate high yield bond exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

5.14

|

6.89

|

4.18

|

|

Class A (with sales charge)

|

0.62

|

5.96

|

3.72

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Bloomberg US High Yield 2% Issuer Capped Bond Total Return Index

|

7.69

|

7.28

|

5.01

|

|

Net Assets

|

$113,018,110

|

|

Number of Holdings

|

208

|

|

Net Advisory Fee

|

$473,791

|

|

Portfolio Turnover Rate

|

62%

|

|

Top 10 Issuers

|

(%)

|

|

MajorDrive Holdings IV LLC

|

2.3%

|

|

SPX FLOW, Inc.

|

2.0%

|

|

Venture Global LNG, Inc.

|

1.9%

|

|

Acrisure LLC / Acrisure Finance, Inc.

|

1.9%

|

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

1.8%

|

|

TransDigm, Inc.

|

1.7%

|

|

Allied Universal Holdco LLC

|

1.6%

|

|

Albertsons Cos., Inc. / Safeway, Inc. / New Albertsons LP / Albertsons LLC

|

1.6%

|

|

UKG, Inc.

|

1.6%

|

|

Panther Escrow Issuer LLC

|

1.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class C

|

$174

|

1.70%

|

|

•

|

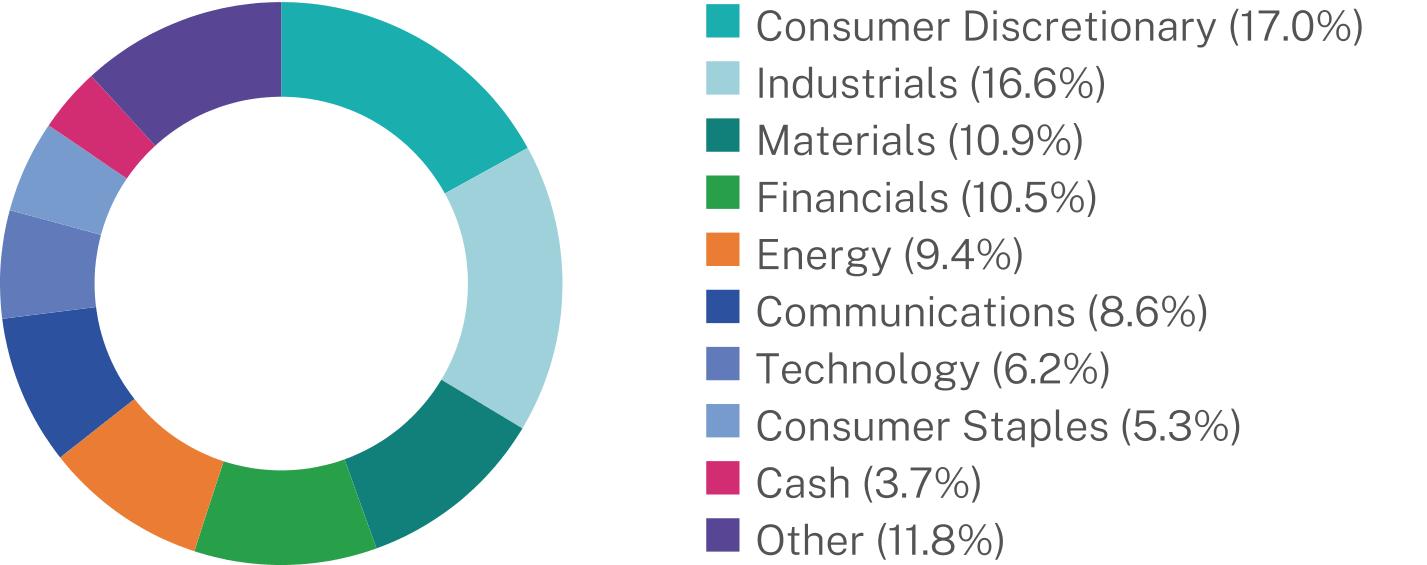

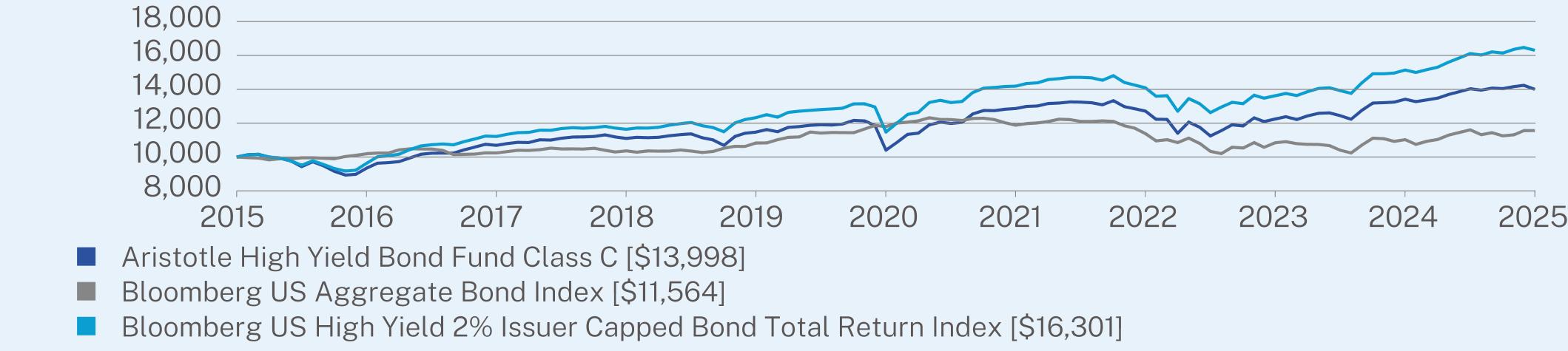

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Bloomberg US High Yield 2% Issuer Capped Bond Total Return Index. The Fund invests at least 80% of its assets in non-investment grade (high yield/high risk, sometimes called “junk bonds”) debt instruments or in instruments with characteristics of non-investment grade debt instruments.

|

|

•

|

A substantial portion of this underperformance is attributable to a lack of exposure to lower-quality distressed credits that benefited during the period. The Fund did benefit from a supportive rate environment elevating entry yields as well as largely compressing credit spreads.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely in favor. The shorter curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis.

|

|

•

|

Positive contribution to relative performance was led by active asset class allocation.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration remained relatively flat. The Fund benefited from an elevated yield environment over the period.

|

|

•

|

On a year-over-year basis, we reduced the limited investment grade bond exposure along with the securitized exposure. Conversely, we increased the corporate high yield bond exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

4.35

|

6.11

|

3.42

|

|

Class C (with sales charge)

|

3.36

|

6.11

|

3.42

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Bloomberg US High Yield 2% Issuer Capped Bond Total Return Index

|

7.69

|

7.28

|

5.01

|

|

Net Assets

|

$113,018,110

|

|

Number of Holdings

|

208

|

|

Net Advisory Fee

|

$473,791

|

|

Portfolio Turnover Rate

|

62%

|

|

Top 10 Issuers

|

(%)

|

|

MajorDrive Holdings IV LLC

|

2.3%

|

|

SPX FLOW, Inc.

|

2.0%

|

|

Venture Global LNG, Inc.

|

1.9%

|

|

Acrisure LLC / Acrisure Finance, Inc.

|

1.9%

|

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

1.8%

|

|

TransDigm, Inc.

|

1.7%

|

|

Allied Universal Holdco LLC

|

1.6%

|

|

Albertsons Cos., Inc. / Safeway, Inc. / New Albertsons LP / Albertsons LLC

|

1.6%

|

|

UKG, Inc.

|

1.6%

|

|

Panther Escrow Issuer LLC

|

1.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$57

|

0.55%

|

|

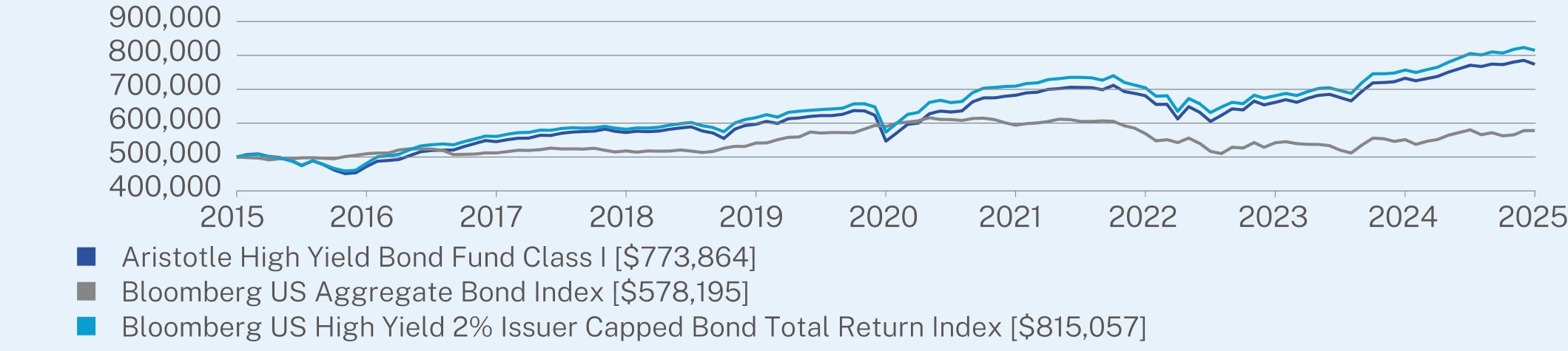

•

|

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Bloomberg US High Yield 2% Issuer Capped Bond Total Return Index. The Fund invests at least 80% of its assets in non-investment grade (high yield/high risk, sometimes called “junk bonds”) debt instruments or in instruments with characteristics of non-investment grade debt instruments.

|

|

•

|

A substantial portion of this underperformance is attributable to a lack of exposure to lower-quality distressed credits that benefited during the period. The Fund did benefit from a supportive rate environment elevating entry yields as well as largely compressing credit spreads.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely in favor. The shorter curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis.

|

|

•

|

Positive contribution to relative performance was led by active asset class allocation.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration remained relatively flat. The Fund benefited from an elevated yield environment over the period.

|

|

•

|

On a year-over-year basis, we reduced the limited investment grade bond exposure along with the securitized exposure. Conversely, we increased the corporate high yield bond exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I (without sales charge)

|

5.64

|

7.19

|

4.46

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Bloomberg US High Yield 2% Issuer Capped Bond Total Return Index

|

7.69

|

7.28

|

5.01

|

|

Net Assets

|

$113,018,110

|

|

Number of Holdings

|

208

|

|

Net Advisory Fee

|

$473,791

|

|

Portfolio Turnover Rate

|

62%

|

|

Top 10 Issuers

|

(%)

|

|

MajorDrive Holdings IV LLC

|

2.3%

|

|

SPX FLOW, Inc.

|

2.0%

|

|

Venture Global LNG, Inc.

|

1.9%

|

|

Acrisure LLC / Acrisure Finance, Inc.

|

1.9%

|

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

1.8%

|

|

TransDigm, Inc.

|

1.7%

|

|

Allied Universal Holdco LLC

|

1.6%

|

|

Albertsons Cos., Inc. / Safeway, Inc. / New Albertsons LP / Albertsons LLC

|

1.6%

|

|

UKG, Inc.

|

1.6%

|

|

Panther Escrow Issuer LLC

|

1.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I-2

|

$67

|

0.65%

|

|

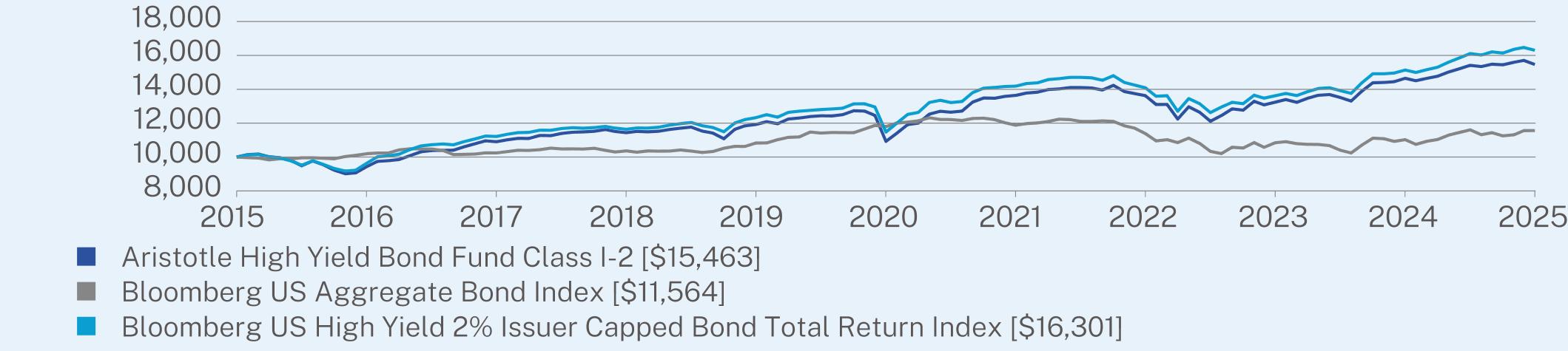

•

|

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Bloomberg US High Yield 2% Issuer Capped Bond Total Return Index. The Fund invests at least 80% of its assets in non-investment grade (high yield/high risk, sometimes called “junk bonds”) debt instruments or in instruments with characteristics of non-investment grade debt instruments.

|

|

•

|

A substantial portion of this underperformance is attributable to a lack of exposure to lower-quality distressed credits that benefited during the period. The Fund did benefit from a supportive rate environment elevating entry yields as well as largely compressing credit spreads.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely in favor. The shorter curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis.

|

|

•

|

Positive contribution to relative performance was led by active asset class allocation.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration remained relatively flat. The Fund benefited from an elevated yield environment over the period.

|

|

•

|

On a year-over-year basis, we reduced the limited investment grade bond exposure along with the securitized exposure. Conversely, we increased the corporate high yield bond exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I-2 (without sales charge)

|

5.55

|

7.20

|

4.46

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Bloomberg US High Yield 2% Issuer Capped Bond Total Return Index

|

7.69

|

7.28

|

5.01

|

|

Net Assets

|

$113,018,110

|

|

Number of Holdings

|

208

|

|

Net Advisory Fee

|

$473,791

|

|

Portfolio Turnover Rate

|

62%

|

|

Top 10 Issuers

|

(%)

|

|

MajorDrive Holdings IV LLC

|

2.3%

|

|

SPX FLOW, Inc.

|

2.0%

|

|

Venture Global LNG, Inc.

|

1.9%

|

|

Acrisure LLC / Acrisure Finance, Inc.

|

1.9%

|

|

CCO Holdings LLC / CCO Holdings Capital Corp.

|

1.8%

|

|

TransDigm, Inc.

|

1.7%

|

|

Allied Universal Holdco LLC

|

1.6%

|

|

Albertsons Cos., Inc. / Safeway, Inc. / New Albertsons LP / Albertsons LLC

|

1.6%

|

|

UKG, Inc.

|

1.6%

|

|

Panther Escrow Issuer LLC

|

1.5%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$77

|

0.75%

|

|

•

|

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg 1-3 Year US Government/Credit Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The front end of the curve was highly favorable due to a yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated compared to recent history, which was beneficial to the return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The front-end positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, U.S. government and non-U.S. government debt were the least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

The Fund duration remained essentially flat on a point-to-point basis. However, this was beneficial as the front end of the rate curve remained largely supportive. On a year-over-year basis, we materially increased shorter duration investment grade rated corporate bond exposure while significantly reducing its floating rate loan exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

5.77

|

3.32

|

2.32

|

|

Class A (with sales charge)

|

2.63

|

2.70

|

2.01

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Bloomberg 1-3 Year US Government/Credit Index

|

5.61

|

1.56

|

1.73

|

|

Net Assets

|

$905,079,417

|

|

Number of Holdings

|

277

|

|

Net Advisory Fee

|

$2,175,233

|

|

Portfolio Turnover Rate

|

66%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

14.8%

|

|

JPMorgan Chase & Co.

|

3.0%

|

|

Bank of America Corp.

|

2.7%

|

|

Morgan Stanley

|

2.1%

|

|

DTE Energy Co.

|

1.3%

|

|

UBS Group AG

|

1.2%

|

|

Public Service Enterprise Group, Inc.

|

1.1%

|

|

Wells Fargo & Co.

|

1.1%

|

|

Goldman Sachs Group, Inc.

|

1.1%

|

|

TransDigm, Inc.

|

1.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class C

|

$154

|

1.50%

|

|

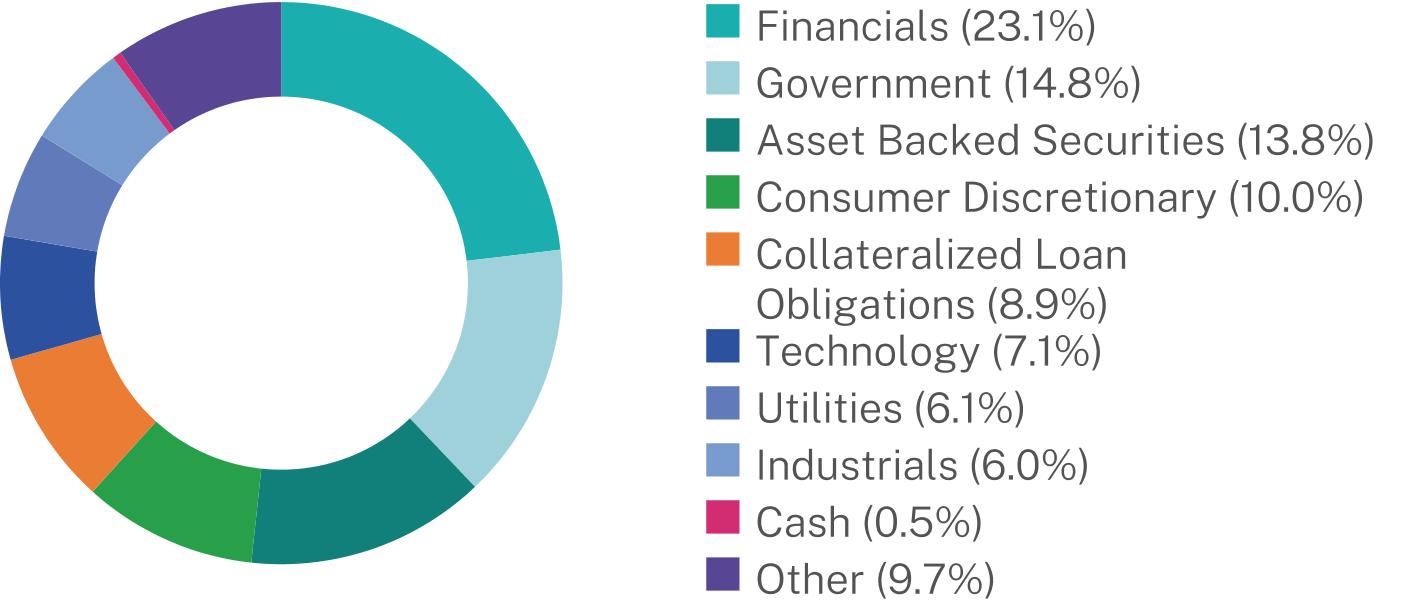

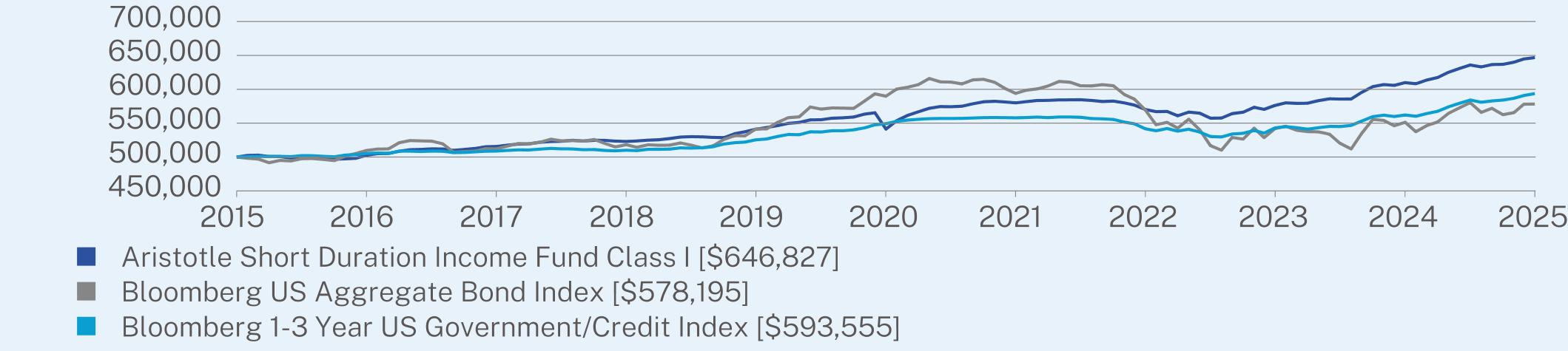

•

|

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Bloomberg 1-3 Year US Government/Credit Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The front end of the curve was highly favorable due to a yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated compared to recent history, which was beneficial to the return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The front-end positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, U.S. government and non-U.S. government debt were the least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

The Fund duration remained essentially flat on a point-to-point basis. However, this was beneficial as the front end of the rate curve remained largely supportive. On a year-over-year basis, we materially increased shorter duration investment grade rated corporate bond exposure while significantly reducing its floating rate loan exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

4.98

|

2.55

|

1.56

|

|

Class C (with sales charge)

|

3.98

|

2.55

|

1.56

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Bloomberg 1-3 Year US Government/Credit Index

|

5.61

|

1.56

|

1.73

|

|

Net Assets

|

$905,079,417

|

|

Number of Holdings

|

277

|

|

Net Advisory Fee

|

$2,175,233

|

|

Portfolio Turnover Rate

|

66%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

14.8%

|

|

JPMorgan Chase & Co.

|

3.0%

|

|

Bank of America Corp.

|

2.7%

|

|

Morgan Stanley

|

2.1%

|

|

DTE Energy Co.

|

1.3%

|

|

UBS Group AG

|

1.2%

|

|

Public Service Enterprise Group, Inc.

|

1.1%

|

|

Wells Fargo & Co.

|

1.1%

|

|

Goldman Sachs Group, Inc.

|

1.1%

|

|

TransDigm, Inc.

|

1.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$40

|

0.39%

|

|

•

|

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg 1-3 Year US Government/Credit Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The front end of the curve was highly favorable due to a yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated compared to recent history, which was beneficial to the return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The front-end positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, U.S. government and non-U.S. government debt were the least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

The Fund duration remained essentially flat on a point-to-point basis. However, this was beneficial as the front end of the rate curve remained largely supportive. On a year-over-year basis, we materially increased shorter duration investment grade rated corporate bond exposure while significantly reducing its floating rate loan exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I (without sales charge)

|

6.06

|

3.63

|

2.61

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Bloomberg 1-3 Year US Government/Credit Index

|

5.61

|

1.56

|

1.73

|

|

Net Assets

|

$905,079,417

|

|

Number of Holdings

|

277

|

|

Net Advisory Fee

|

$2,175,233

|

|

Portfolio Turnover Rate

|

66%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

14.8%

|

|

JPMorgan Chase & Co.

|

3.0%

|

|

Bank of America Corp.

|

2.7%

|

|

Morgan Stanley

|

2.1%

|

|

DTE Energy Co.

|

1.3%

|

|

UBS Group AG

|

1.2%

|

|

Public Service Enterprise Group, Inc.

|

1.1%

|

|

Wells Fargo & Co.

|

1.1%

|

|

Goldman Sachs Group, Inc.

|

1.1%

|

|

TransDigm, Inc.

|

1.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I-2

|

$50

|

0.49%

|

|

•

|

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg 1-3 Year US Government/Credit Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The front end of the curve was highly favorable due to a yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated compared to recent history, which was beneficial to the return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The front-end positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, U.S. government and non-U.S. government debt were the least additive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

The Fund duration remained essentially flat on a point-to-point basis. However, this was beneficial as the front end of the rate curve remained largely supportive. On a year-over-year basis, we materially increased shorter duration investment grade rated corporate bond exposure while significantly reducing its floating rate loan exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I-2 (without sales charge)

|

5.94

|

3.58

|

2.57

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Bloomberg 1-3 Year US Government/Credit Index

|

5.61

|

1.56

|

1.73

|

|

Net Assets

|

$905,079,417

|

|

Number of Holdings

|

277

|

|

Net Advisory Fee

|

$2,175,233

|

|

Portfolio Turnover Rate

|

66%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

14.8%

|

|

JPMorgan Chase & Co.

|

3.0%

|

|

Bank of America Corp.

|

2.7%

|

|

Morgan Stanley

|

2.1%

|

|

DTE Energy Co.

|

1.3%

|

|

UBS Group AG

|

1.2%

|

|

Public Service Enterprise Group, Inc.

|

1.1%

|

|

Wells Fargo & Co.

|

1.1%

|

|

Goldman Sachs Group, Inc.

|

1.1%

|

|

TransDigm, Inc.

|

1.1%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$96

|

0.94%

|

|

•

|

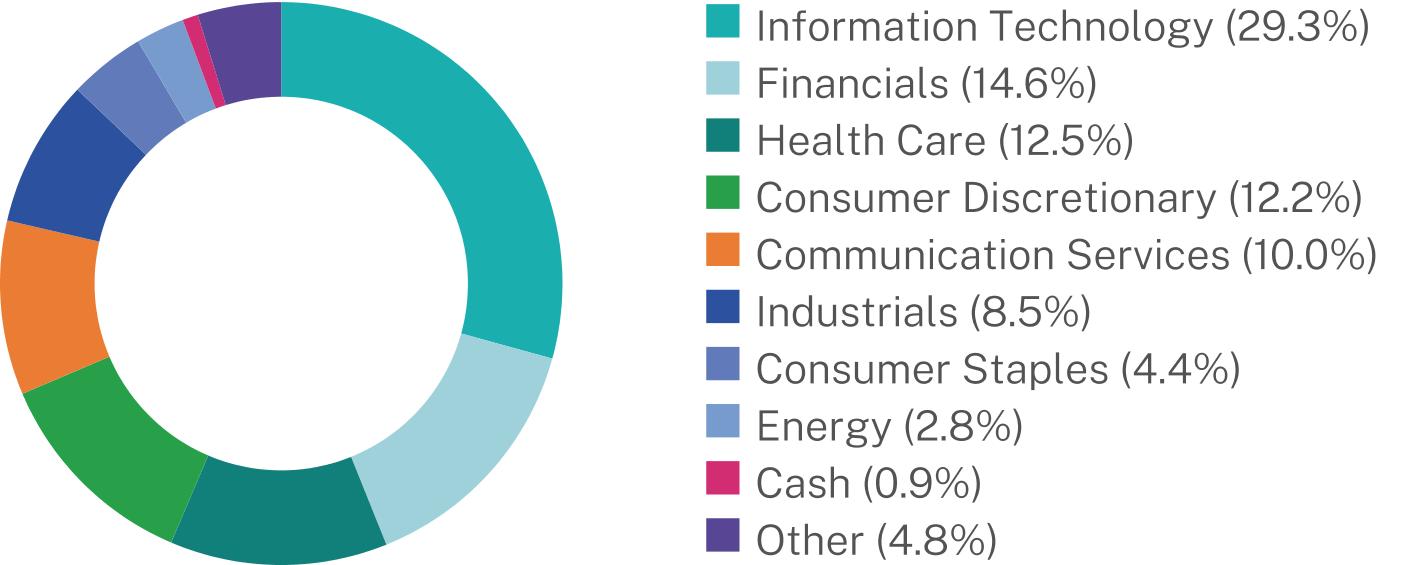

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The Fund benefited from an elevated rate environment supporting all in yields as well as largely supportive credit spreads.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

The Fund benefited across the credit quality spectrum with the exception of lower rated credit exposure (some CCC). On the other hand, cash holdings were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by credit selection and active asset class allocation.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration was slightly below its starting level. The Fund’s shorter-than-benchmark duration profile proved mostly beneficial to performance. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we reduced the investment grade bond exposure. Conversely, we increased the corporate high yield bond exposure along with the floating rate loan exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class A (without sales charge)

|

5.17

|

6.15

|

4.04

|

|

Class A (with sales charge)

|

0.65

|

5.24

|

3.58

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Net Assets

|

$3,791,942,005

|

|

Number of Holdings

|

437

|

|

Net Advisory Fee

|

$16,201,644

|

|

Portfolio Turnover Rate

|

45%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

2.0%

|

|

JPMorgan Chase & Co.

|

1.8%

|

|

Goldman Sachs Group, Inc.

|

1.8%

|

|

Venture Global LNG, Inc.

|

1.7%

|

|

TransDigm, Inc.

|

1.7%

|

|

Citigroup, Inc.

|

1.4%

|

|

Bank of America Corp.

|

1.4%

|

|

Morgan Stanley

|

1.3%

|

|

Energy Transfer LP

|

1.2%

|

|

UKG, Inc.

|

1.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class C

|

$173

|

1.69%

|

|

•

|

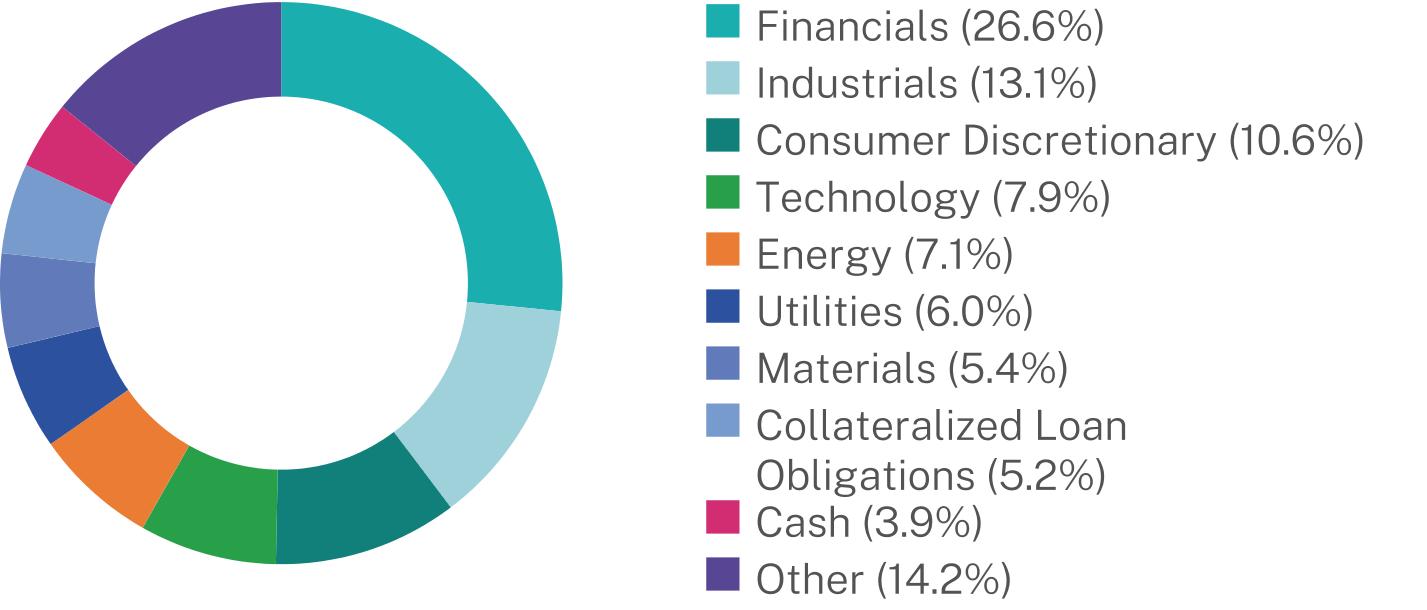

For the 12-month period ended March 31, 2025, the Fund underperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The Fund benefited from an elevated rate environment supporting all in yields as well as largely supportive credit spreads.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

The Fund benefited across the credit quality spectrum with the exception of lower rated credit exposure (some CCC). On the other hand, cash holdings were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by credit selection and active asset class allocation.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration was slightly below its starting level. The Fund’s shorter-than-benchmark duration profile proved mostly beneficial to performance. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we reduced the investment grade bond exposure. Conversely, we increased the corporate high yield bond exposure along with the floating rate loan exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class C (without sales charge)

|

4.41

|

5.40

|

3.29

|

|

Class C (with sales charge)

|

3.41

|

5.40

|

3.29

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Net Assets

|

$3,791,942,005

|

|

Number of Holdings

|

437

|

|

Net Advisory Fee

|

$16,201,644

|

|

Portfolio Turnover Rate

|

45%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

2.0%

|

|

JPMorgan Chase & Co.

|

1.8%

|

|

Goldman Sachs Group, Inc.

|

1.8%

|

|

Venture Global LNG, Inc.

|

1.7%

|

|

TransDigm, Inc.

|

1.7%

|

|

Citigroup, Inc.

|

1.4%

|

|

Bank of America Corp.

|

1.4%

|

|

Morgan Stanley

|

1.3%

|

|

Energy Transfer LP

|

1.2%

|

|

UKG, Inc.

|

1.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$61

|

0.59%

|

|

•

|

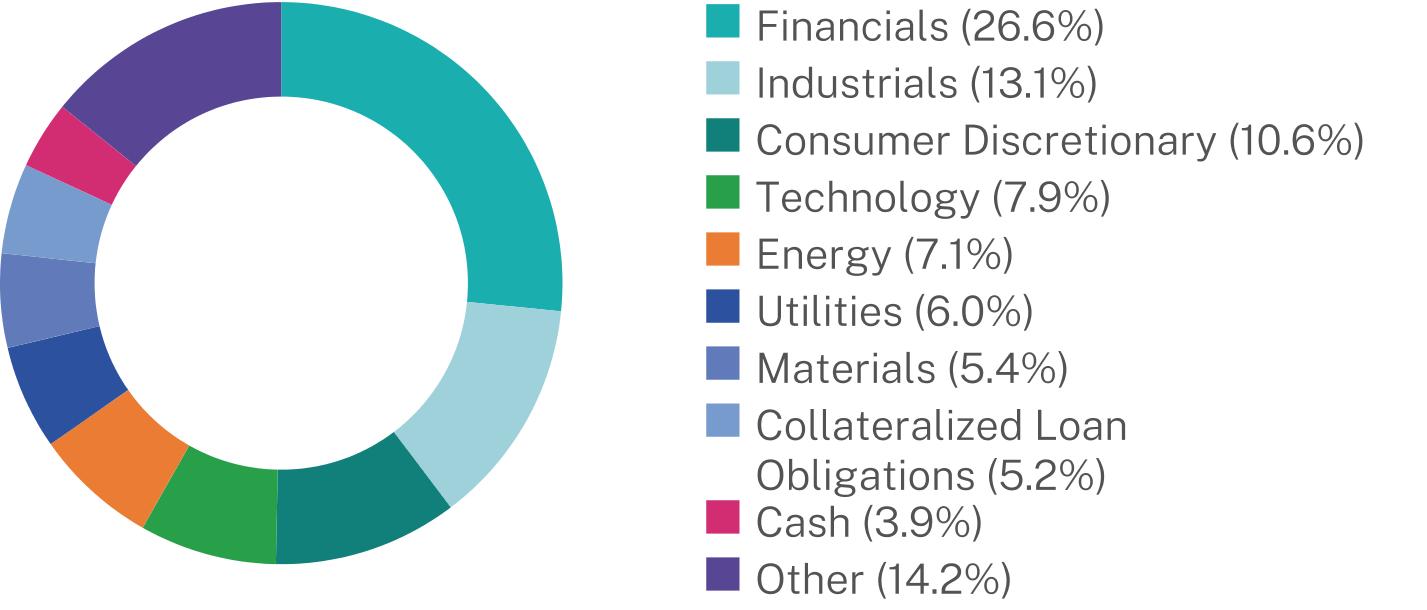

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The Fund benefited from an elevated rate environment supporting all in yields as well as largely supportive credit spreads.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

The Fund benefited across the credit quality spectrum with the exception of lower rated credit exposure (some CCC). On the other hand, cash holdings were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by credit selection and active asset class allocation.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration was slightly below its starting level. The Fund’s shorter-than-benchmark duration profile proved mostly beneficial to performance. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we reduced the investment grade bond exposure. Conversely, we increased the corporate high yield bond exposure along with the floating rate loan exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I (without sales charge)

|

5.68

|

6.50

|

4.36

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Net Assets

|

$3,791,942,005

|

|

Number of Holdings

|

437

|

|

Net Advisory Fee

|

$16,201,644

|

|

Portfolio Turnover Rate

|

45%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

2.0%

|

|

JPMorgan Chase & Co.

|

1.8%

|

|

Goldman Sachs Group, Inc.

|

1.8%

|

|

Venture Global LNG, Inc.

|

1.7%

|

|

TransDigm, Inc.

|

1.7%

|

|

Citigroup, Inc.

|

1.4%

|

|

Bank of America Corp.

|

1.4%

|

|

Morgan Stanley

|

1.3%

|

|

Energy Transfer LP

|

1.2%

|

|

UKG, Inc.

|

1.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I-2

|

$71

|

0.69%

|

|

•

|

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg US Aggregate Bond Index. The Fund invests principally in income-producing debt instruments.

|

|

•

|

The Fund benefited from an elevated rate environment supporting all in yields as well as largely supportive credit spreads.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The intermediate curve positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

The Fund benefited across the credit quality spectrum with the exception of lower rated credit exposure (some CCC). On the other hand, cash holdings were least additive to return.

|

|

•

|

Positive contributions to relative performance were led by credit selection and active asset class allocation.

|

|

•

|

While the Fund duration moved over the last twelve months, the point-to-point duration was slightly below its starting level. The Fund’s shorter-than-benchmark duration profile proved mostly beneficial to performance. The Fund benefited from an elevated yield environment over the period. On a year-over-year basis, we reduced the investment grade bond exposure. Conversely, we increased the corporate high yield bond exposure along with the floating rate loan exposure.

|

|

|

1 Year

|

5 Year

|

10 Year

|

|

Class I-2 (without sales charge)

|

5.53

|

6.43

|

4.29

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

-0.40

|

1.46

|

|

Net Assets

|

$3,791,942,005

|

|

Number of Holdings

|

437

|

|

Net Advisory Fee

|

$16,201,644

|

|

Portfolio Turnover Rate

|

45%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Note/Bond

|

2.0%

|

|

JPMorgan Chase & Co.

|

1.8%

|

|

Goldman Sachs Group, Inc.

|

1.8%

|

|

Venture Global LNG, Inc.

|

1.7%

|

|

TransDigm, Inc.

|

1.7%

|

|

Citigroup, Inc.

|

1.4%

|

|

Bank of America Corp.

|

1.4%

|

|

Morgan Stanley

|

1.3%

|

|

Energy Transfer LP

|

1.2%

|

|

UKG, Inc.

|

1.2%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class A

|

$60

|

0.58%

|

|

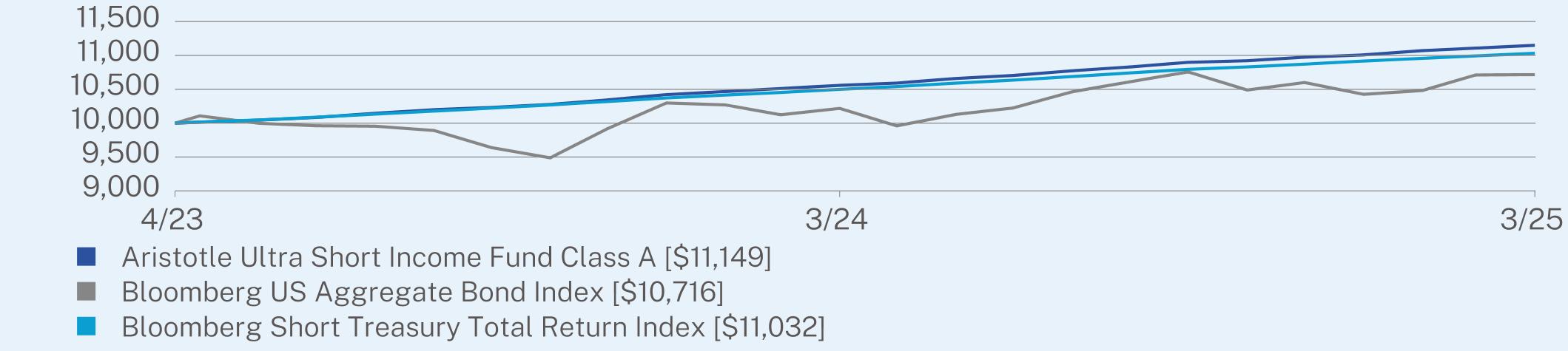

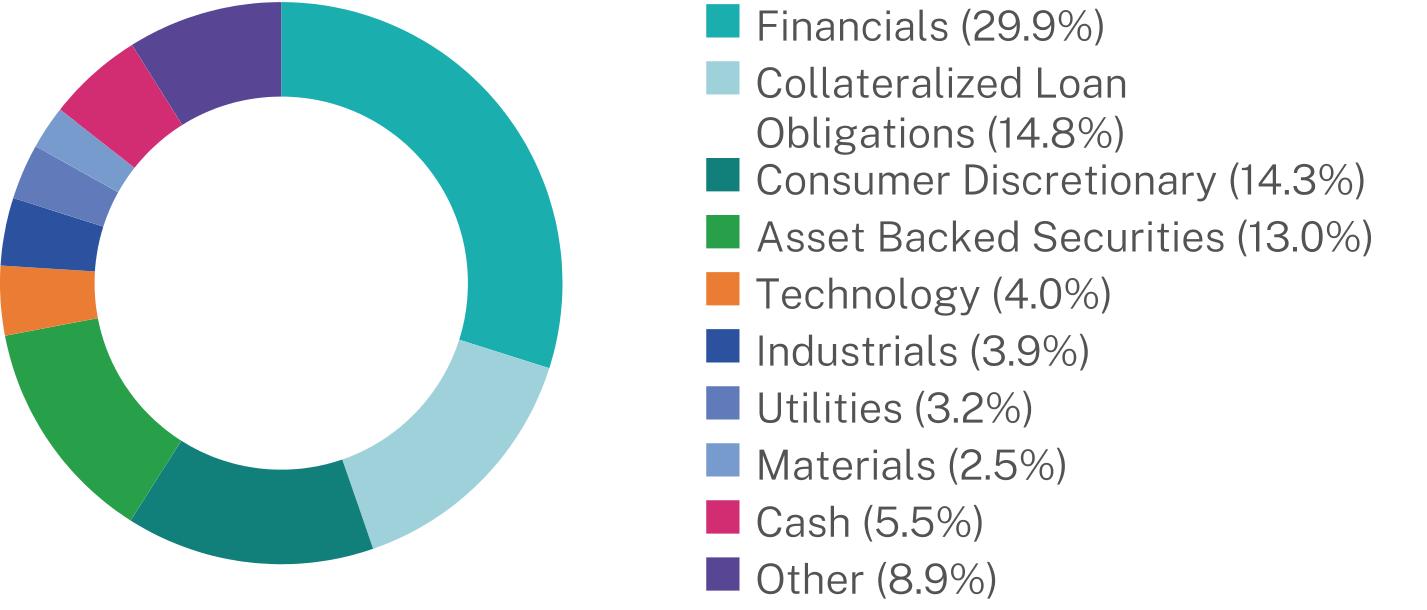

•

|

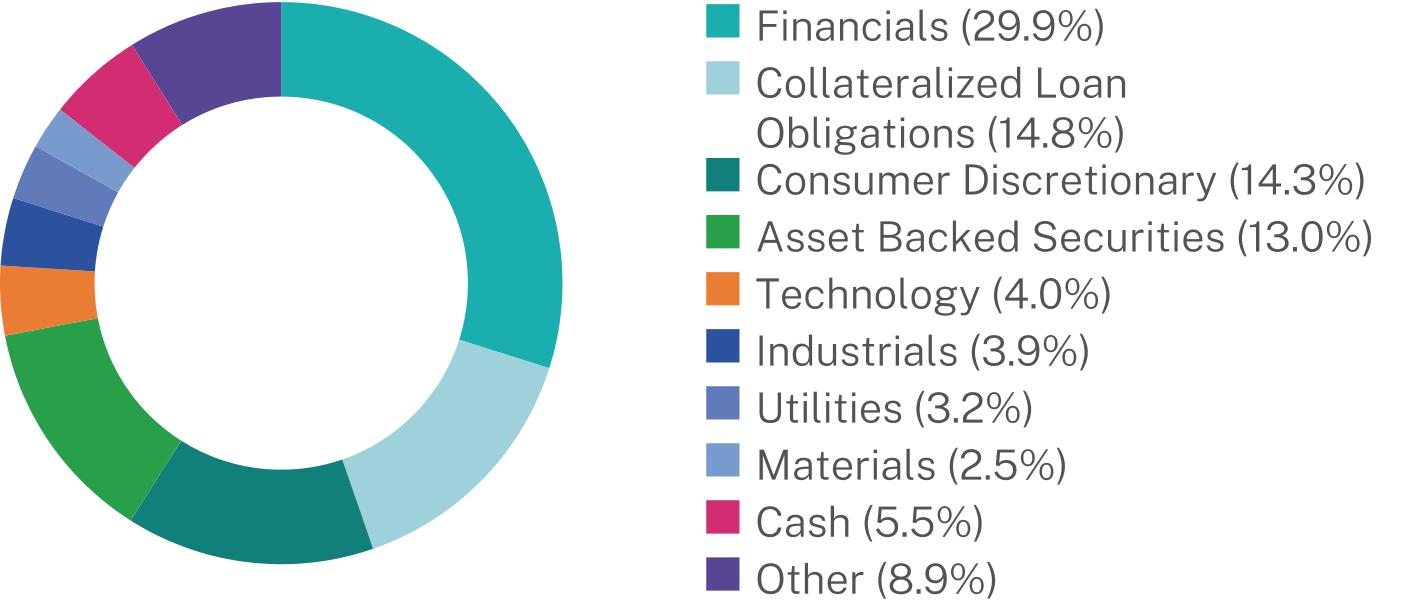

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg Short Treasury Total Return Index. The Fund primarily invests in investment grade, U.S. dollar-denominated short-term fixed and floating rate debt securities, including corporate debt securities, mortgage-related securities, asset-backed securities, U.S. government securities and agency securities and money market instruments such as commercial paper, certificates of deposit, time deposits, deposit notes and bank notes.

|

|

•

|

The front end of the curve was highly favorable due to a yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated compared to recent history, which was beneficial to the return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The front-end positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, U.S. government debt and U.S. corporate high yield debt were the least positive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.

|

|

•

|

The Fund duration remained very front-end pinned which benefited from an attractive rate curve. On a year-over-year basis, we reduced floating rate loan and high yield bond exposure as well as slightly trimmed the asset backed security exposure. We increased cash holdings.

|

|

|

1 Year

|

Since Inception

(04/17/2023) |

|

Class A (without sales charge)

|

5.60

|

5.72

|

|

Bloomberg US Aggregate Bond Index

|

4.88

|

3.60

|

|

Bloomberg Short Treasury Total Return Index

|

5.07

|

5.15

|

|

Net Assets

|

$47,710,925

|

|

Number of Holdings

|

128

|

|

Net Advisory Fee

|

$102,984

|

|

Portfolio Turnover Rate

|

128%

|

|

Top 10 Issuers

|

(%)

|

|

United States Treasury Bill

|

4.2%

|

|

Bank of America Corp.

|

4.0%

|

|

Goldman Sachs Group, Inc.

|

3.3%

|

|

JPMorgan Chase & Co.

|

2.6%

|

|

Morgan Stanley

|

2.4%

|

|

HSBC Holdings PLC

|

2.3%

|

|

Magnetite CLO Ltd.

|

2.2%

|

|

Neuberger Berman CLO Ltd.

|

2.1%

|

|

United Airlines, Inc.

|

2.0%

|

|

Santander Consumer USA Holdings, Inc.

|

1.8%

|

|

Class Name

|

Costs of a $10,000 investment

|

Costs paid as a percentage of a $10,000 investment

|

|

Class I

|

$33

|

0.32%

|

|

•

|

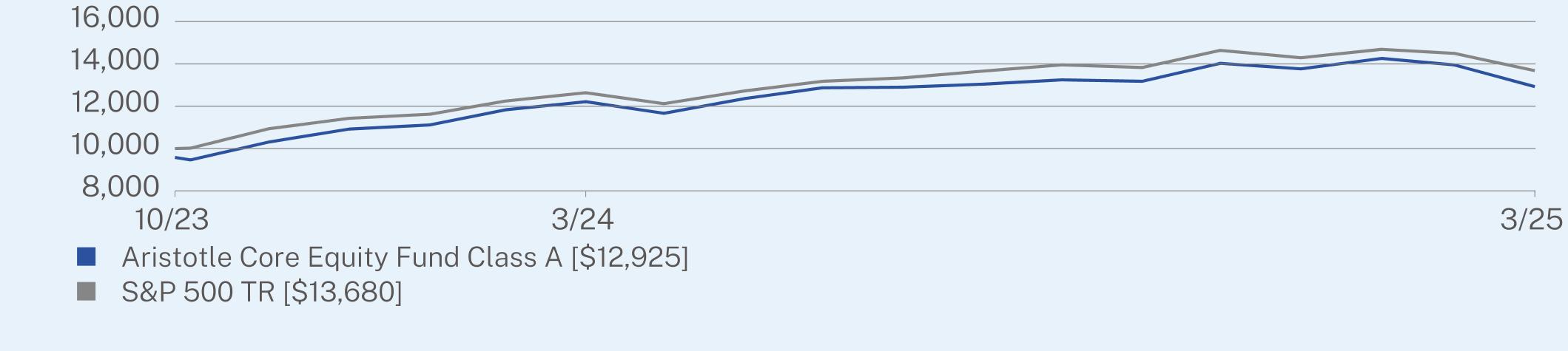

For the 12-month period ended March 31, 2025, the Fund outperformed its performance benchmark, the Bloomberg Short Treasury Total Return Index. The Fund primarily invests in investment grade, U.S. dollar-denominated short-term fixed and floating rate debt securities, including corporate debt securities, mortgage-related securities, asset-backed securities, U.S. government securities and agency securities and money market instruments such as commercial paper, certificates of deposit, time deposits, deposit notes and bank notes.

|

|

•

|

The front end of the curve was highly favorable due to a yield curve inversion seen through September 2024. Even post re-inversion, yields remained elevated compared to recent history, which was beneficial to the return. Additionally, corporate spreads remained quite favorable for most of the period.

|

|

•

|

Exposure to credit-sensitive sectors benefited performance for most of the period as credit remained largely well supported. The front-end positioning and elevated yield profile helped to insulate the full effect of credit spread widening seen on a periodic basis as compared to a long duration based offerings.

|

|

•

|

By credit quality, BBB-rated credits were most beneficial to performance (corporate investment grade bonds) followed by AAA-rated credits (mostly securitized assets). On the other hand, U.S. government debt and U.S. corporate high yield debt were the least positive to return.

|

|

•

|

Positive contributions to relative performance were led by active asset class allocation and credit selectivity.