Exhibit 10.28

SHARE PURCHASE AGREEMENT

THIS AGREEMENT made as of May 29 , 2024.

BETWEEN:

EAGLE RIDGE RESOURCES, INC.,

a corporation duly incorporated under the laws of the State of Nevada,

with its head office located at (the “Purchaser”)

-and-

STRATEGIC METALS DEVELOPMENT CORP.,

a corporation duly incorporated under the laws of the Province of Alberta,

with its head office located at Suite 1150, 707 – 7 Avenue SW, Calgary, Alberta T2P 3H6 (the “Corporation”)

-and-

The SHAREHOLDERS of the Corporation,

as described on the execution page to this Agreement (herein referred to as the “Vendors”)

RECITALS:

| A. | The Vendors are the registered and beneficial owners of 100,000,000 Common Shares in the capital of the Corporation on a fully diluted basis and the Vendors wish to sell all of issued and outstanding shares (the “Purchased Shares”) to the Purchaser; |

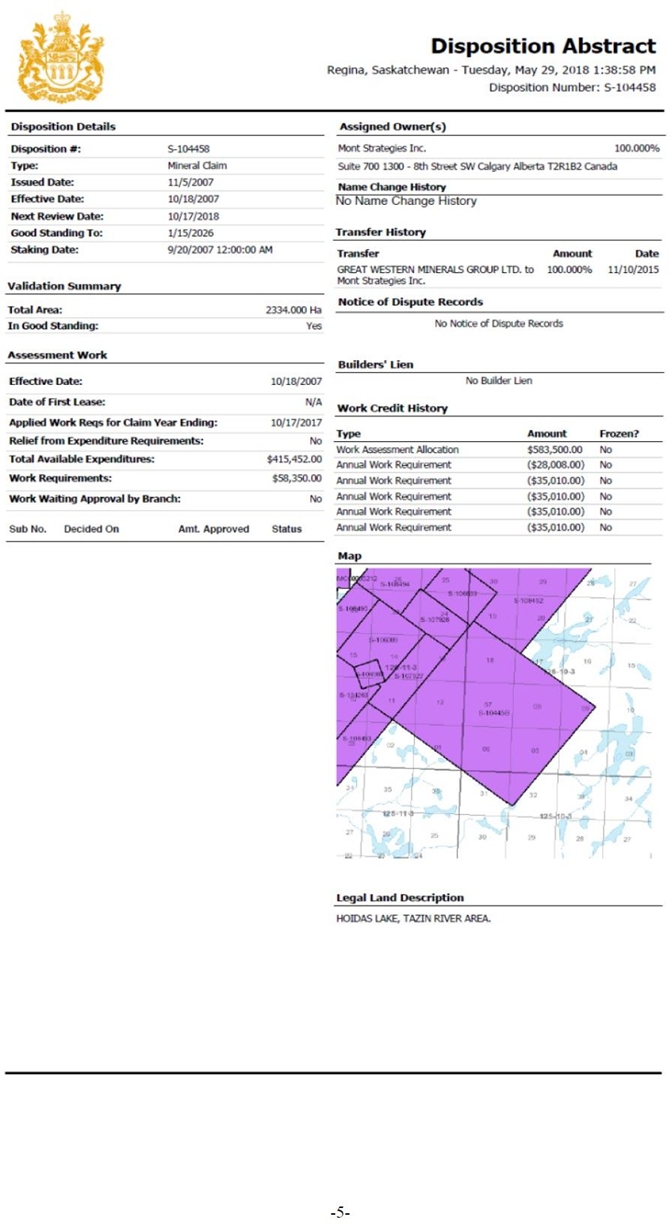

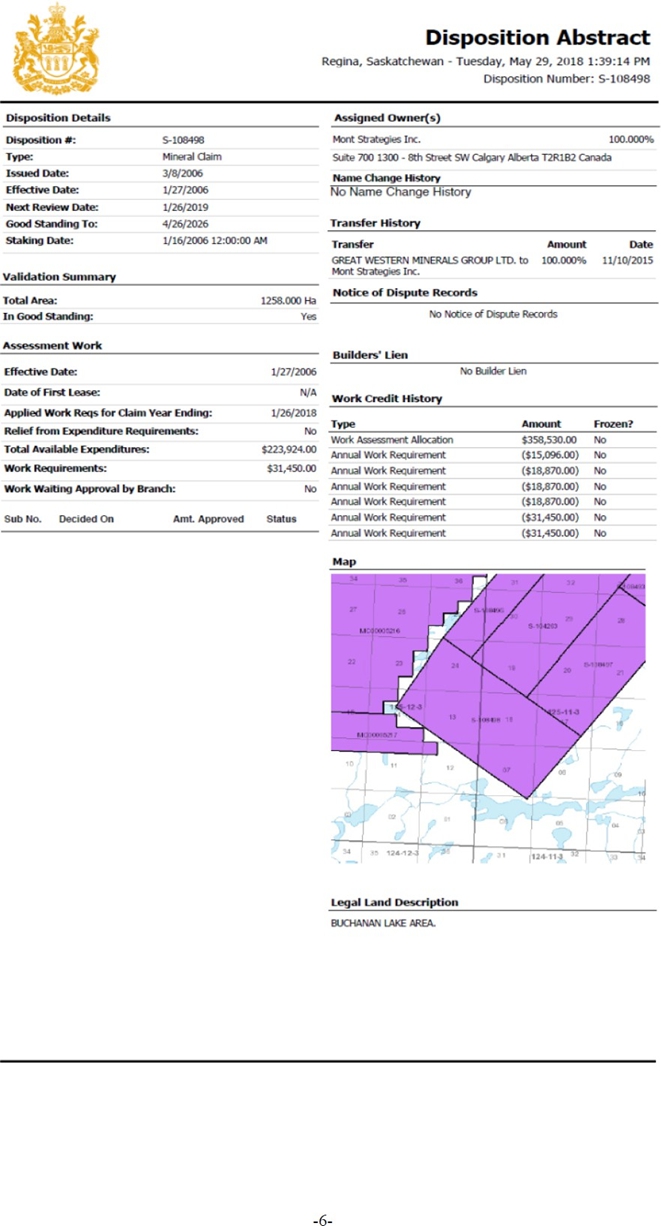

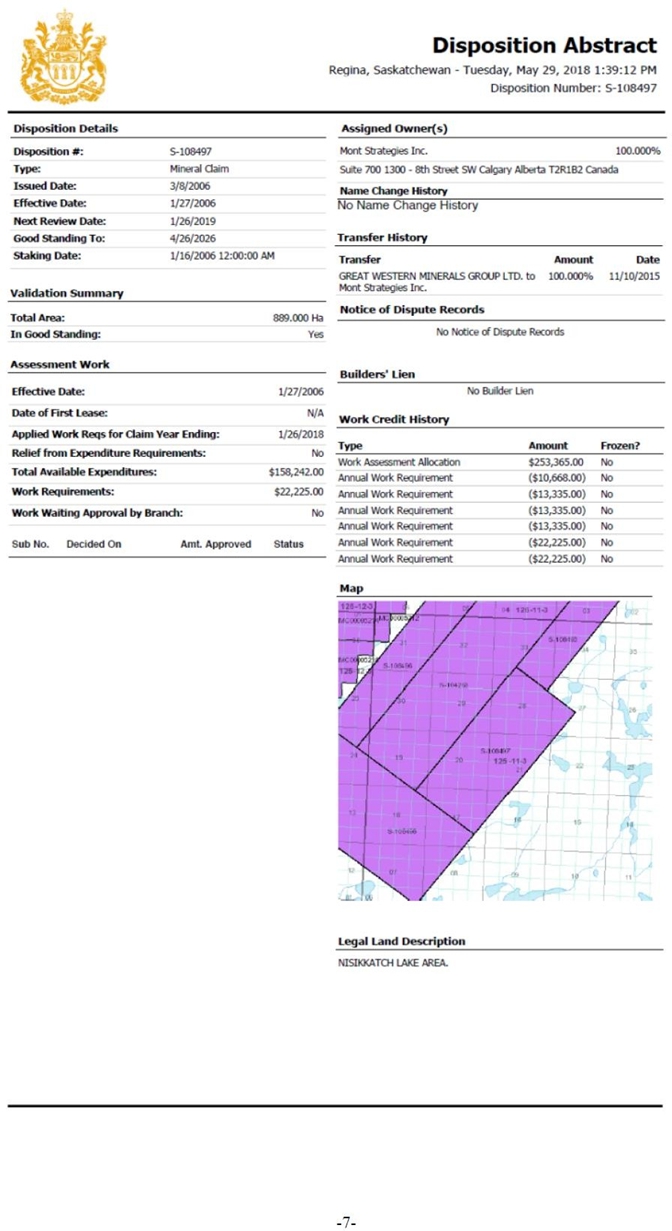

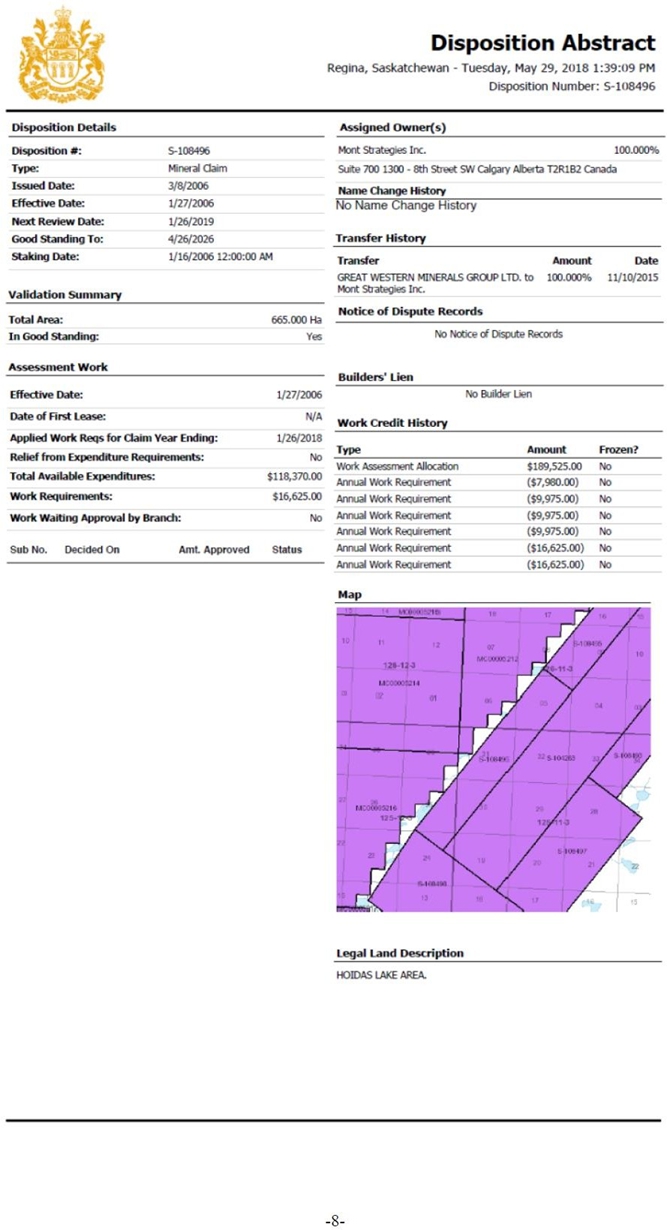

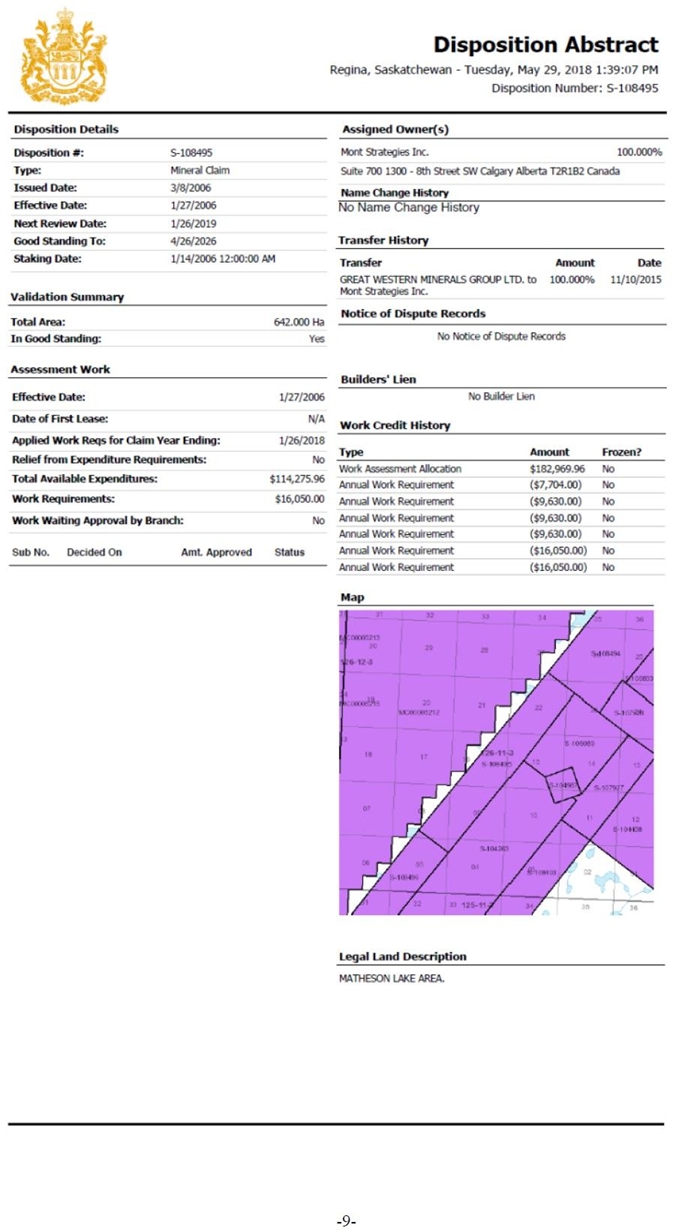

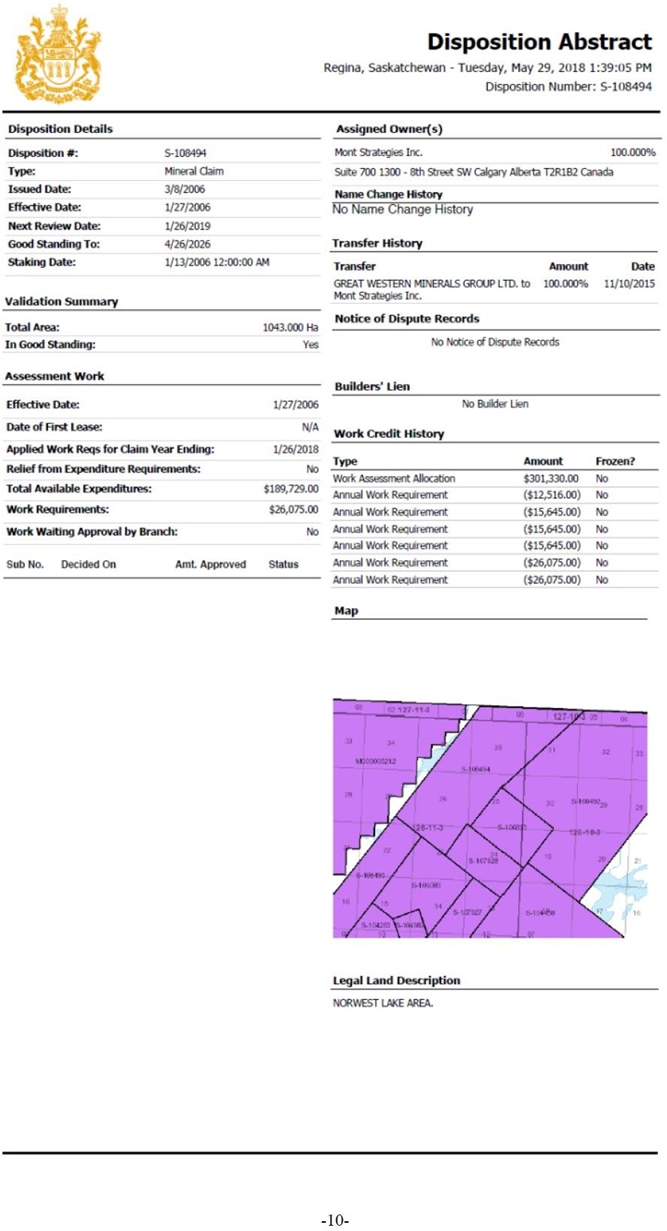

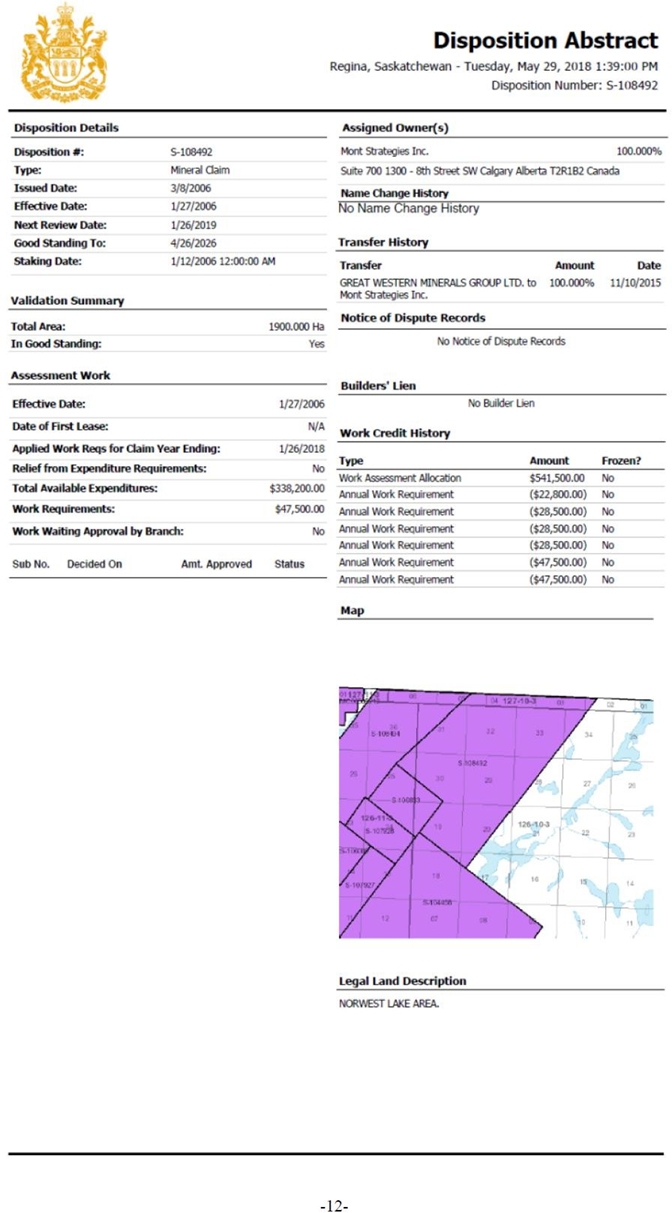

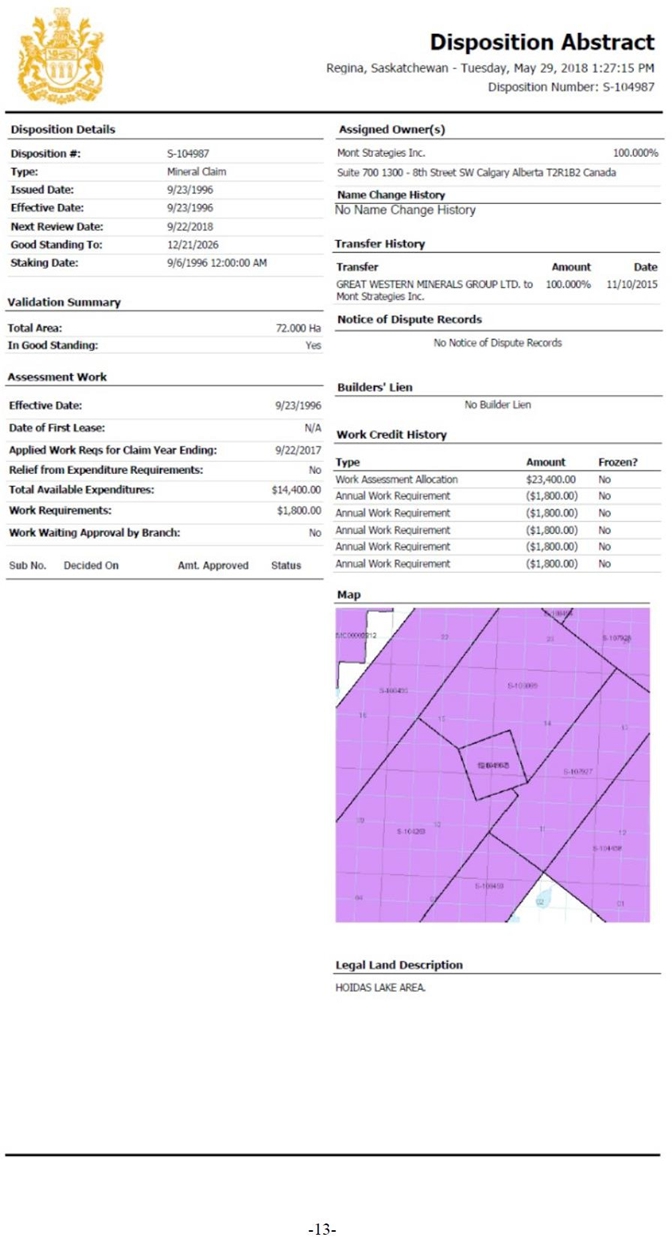

| B. | The Corporation owns 100% of the title, right, and interest to the Hoidas Lake Property in Saskatchewan (hereinafter “Hoidas Lake”), subject to a pre-existing 1.8% net smelter royalty which is capped at $1,000,000 CDN; |

| C. | The Purchaser has agreed to purchase, and the Vendors have agreed to sell, the Purchased Shares in accordance with the provisions of this Agreement; and |

| D. | It is acknowledged by both parties that the completion of the Liquidity Event (as defined herein) by the Purchaser by December 31, 2025 is a significant motivating factor for the Vendors to enter into this Agreement. |

NOW THEREFORE, in consideration of the mutual promises contained in this Agreement and other good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged), the parties hereto agree as follows:

ARTICLE 1

PURCHASE AND SALE

| 1.1 | Purchase and Sale |

Upon the terms and conditions provided for in this Agreement, the Vendors hereby agree to sell, assign and transfer to the Purchaser, and the Purchaser agrees to purchase from the Vendors, the Purchased Shares.

| 1.2 | Purchase Price |

Subject to the terms and conditions of this Agreement and the purchase price adjustment, if any, referred to in Schedule “2” hereto, the purchase price to be paid by the Purchaser to the Vendors for the Purchased Shares shall be an aggregate sum of USD $46,500,000 (the “Purchase Price”).

-1-

| 1.3 | Payment of Purchase Price |

| (a) | The Purchase Price shall be paid by the Purchaser to the Vendors (or as directed by the Vendors), pro ratably in accordance with their respective holdings as set forth in Section 1.3(b) below, as follows: |

| (i) | as to the amount of USD $2,000,000 (the “First Cash Payment”), with payment to be made on or before June 4, 2024 (the “First Closing Date”) in cash or by certified cheque; |

| (ii) | as to the amount of USD $2,750,000, with payment to be made by September 30, 2024 (the “Second Closing Date”) in cash or by certified cheque; |

| (iii) | as to the amount of USD $3,750,000, with payment to be made by December 31, 2024 (the “Third Closing Date”) in cash or by certified cheque; and |

| (iv) | as to the amount of USD $38,000,000, with the issuance on the First Closing Date to the Vendors of USD $38,000,000 worth of special warrants, having the terms and conditions described in the special warrant certificate attached hereto as Schedule “1” (the “Purchase Price Special Warrants”). The Purchase Price Special Warrants shall automatically convert into $38,00,000 worth of the Purchaser’s common shares for no additional consideration upon completion by the Purchaser of a listing or merger, reorganization, business combination, share exchange or acquisition by any person or related group of persons of beneficial ownership of all or substantially all of the Purchased Shares in one or more related transactions, or another similar transaction involving the Purchaser, pursuant to which the shareholders of the Purchaser receive cash or the securities of another issuer that are listed on a national securities exchange in the USA, as full or partial consideration for their common shares (the “Liquidity Event”). For clarity, if the Liquidity Event is $10.00 per common share, the underlying common shares of the Purchaser shall be issued to the Vendors at a price of $8.75 per common share. |

| (b) | Subject to adjustment in section 1.4, the Purchase Price and the Purchase Price Special Warrants shall be paid, allocated and delivered to the Vendors as set out in the following table: |

| Name | Number of Purchased Shares held by the Vendor(s) |

Pro Rata Cash Paid to Vendor(s) |

Number of Purchase Price Special Warrants to be Issued to Vendors |

Aggregate $ Amount of Purchase Price Special Warrants |

||||||||||||||

| 1. | TODD MONTGOMERY | 42,000,000 | $ | 3,570,000 | 15,960,000 | $ | 15,960,000 | |||||||||||

| 2. | GARY BILLINGSLEY | 22,500,000 | $ | 1,912,500 | 8,550,000 | $ | 8,550,000 | |||||||||||

| 3. | MASON DOUGLAS | 19,500,000 | $ | 1,657,500 | 7,410,000 | $ | 7,410,000 | |||||||||||

| 4. | JIM ENGDAHL | 5,000,000 | $ | 425,000 | 1,900,000 | $ | 1,900,000 | |||||||||||

| 5. | DORTHE HOLM ANDERSSON | 5,000,000 | $ | 425,000 | 1,900,000 | $ | 1,900,000 | |||||||||||

| 6. | JEFFREY SCOTT EVANS | 3,000,000 | $ | 255,000 | 1,140,000 | $ | 1,140,000 | |||||||||||

| 7. | IVAN YOUNG | 2,500,000 | $ | 212,500 | 950,000 | $ | 950,000 | |||||||||||

| 8. | DAVID E. T. PINKMAN | 500,000 | $ | 42,500 | 190,000 | $ | 190,000 | |||||||||||

| 100,000,000 | USD$ | 8,500,000 | 38,000,000 | (1) | USD$ | 38,000,000 | ||||||||||||

Note:

| (1) | Final number of Purchase Price Special Warrants to be issued to the Vendors shall be subject to adjustment based on the price of the Liquidity Event. The figures in the chart are for illustrative purposes only and are based on an arbitrary Liquidity Event price of $1.00. |

| 1.4 | Purchase Price Adjustments |

The cash portion of the Purchase Price described above shall be subject to the adjustment, if applicable, described in Schedule “2” attached to this Agreement. The actual number of Purchase Price Special Warrants issued to the Vendors as described in section 1.3(b) shall be adjusted based on the price of the Liquidity Event.

-2-

| 1.5 | Limited Liability |

The Purchaser does not agree to accept or assume, and shall not by this Agreement be deemed to have accepted or assumed, any obligation or responsibility for the payment of any debt, obligation, liability, claim or demand, absolute or contingent, matured or unmatured or determined or determinable, including those arising under any law, cause of action or governmental order and those arising under any contract, agreement, arrangement, commitment or undertaking (collectively, “Liabilities”) of whatsoever nature of or against the Vendors or the Corporation, except for payment of the Purchase Price.

| 1.6 | Delivery of Purchased Shares to be held in Trust by Vendors’ Counsel |

Subject to the fulfilment of all of the terms and conditions hereof (unless waived as herein provided), on the First Closing Date, the Vendors shall deliver (or make arrangements to deliver) all common share certificates representing the Purchased Shares (duly endorsed for transfer) to the Vendors’ legal counsel, together with such other documentation as contemplated in Article 4.2 hereof. The Purchased Shares shall be held in trust by the Vendors’ legal counsel and shall not be released to the Purchaser until such time as the Purchaser has completed the Liquidity Event, and the Vendors have provided written approval to its legal counsel to release the Purchased Shares to the Purchaser (the “Release Notice”). Upon satisfactory completion of the Liquidity Event, and delivery of the Release Notice, the Vendors’ legal counsel shall automatically release the Purchased Shares to the Purchaser or as directed by the Purchaser.

| 1.7 | Delivery of the Purchase Price Special Warrants to be held in Escrow by the Vendors’ Counsel |

Subject to the fulfilment of all of the terms and conditions hereof (unless waived as herein provided), on the First Closing Date, the Purchaser shall issue to the Vendors (or make arrangements to deliver) the Purchase Price Special Warrant certificates in substantially the form attached hereto as Schedule 1 and representing $38,000,000 of consideration under Article 1.3(a)(iv). The parties agree that the certificates representing the Purchase Price Special Warrants will be held in escrow by the Vendors’ legal counsel pursuant to the terms of the Voluntary Escrow Agreement (defined below) and shall not be released until the Purchaser has completed the Liquidity Event.

| 1.8 | Form of Voluntary Escrow Agreement |

The Purchase Price Special Warrants issued to the Vendors, and the underlying common shares issuable upon conversion, shall be issued and held in escrow (the “Escrowed Securities”) in accordance with the terms and conditions of the Voluntary Escrow Agreement between the Vendors, the Corporation, the Purchaser and Heighington Law, to be dated and executed on the First Closing Date (the “Voluntary Escrow Agreement”). A copy of the Voluntary Escrow Agreement is attached to this Agreement as Schedule “3”.

The Voluntary Escrow Agreement provides that thirty-three (33%) of the Escrowed Securities will be released from escrow on the date that is six months after completion of the Liquidity Event and thirty-three percent (33%) of the Escrowed Securities will be released from escrow 12 months after completion of the Liquidity Event and the remaining thirty-four percent (34%) of the Escrowed Securities will be released 18 months following completion of the Liquidity Event.

ARTICLE 2

REPRESENTATIONS, WARRANTIES AND

COVENANTS OF THE VENDORS

| 2.1 | Representations and Warranties of the Vendors |

The Vendors hereby makes the following representations and warranties to the Purchaser and acknowledge that the Purchaser is relying on such representations and warranties in entering into this Agreement and completing the transactions contemplated herein. Each of the representations and warranties shall be true, complete and accurate as of the date of this Agreement, each of the First, Second and Third Closing Dates and the date that the Purchase Price Special Warrants are issued to the Vendors:

| (a) | each of the Vendors and the Corporation has all and full power, authority and capacity to execute and deliver this Agreement and to perform their respective obligations under this Agreement, and has taken all action, corporate or otherwise, necessary in order to execute and deliver this Agreement and all other instruments or agreements to be executed in connection herewith and to consummate the contemplated transaction; |

-3-

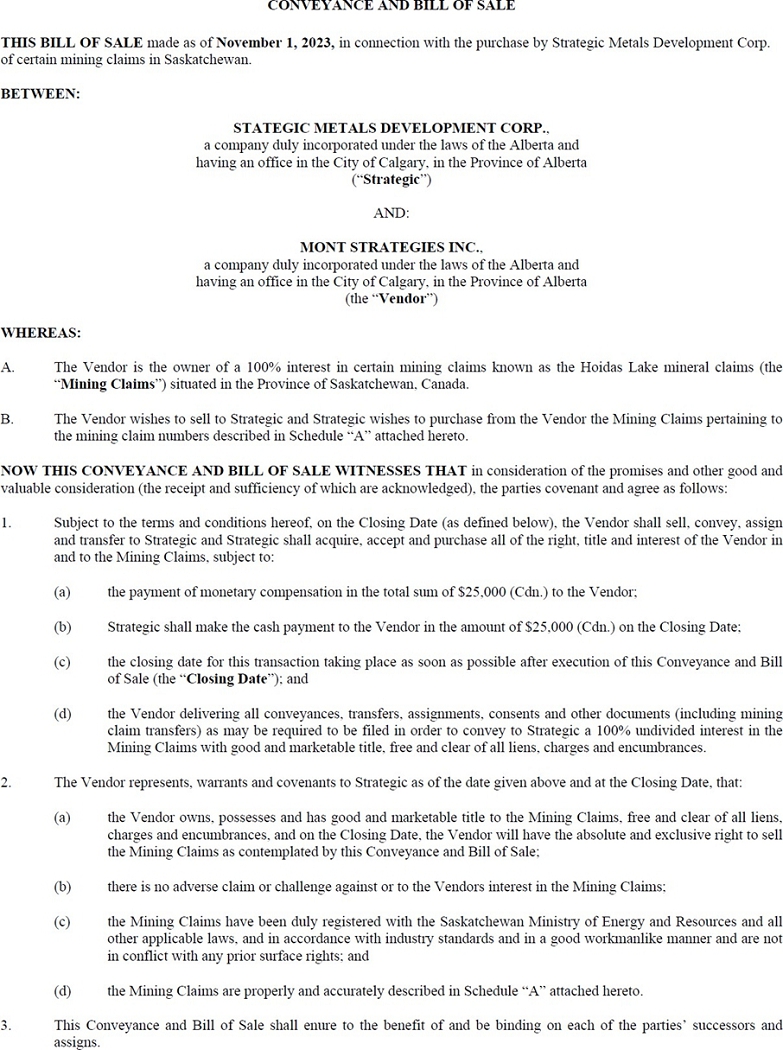

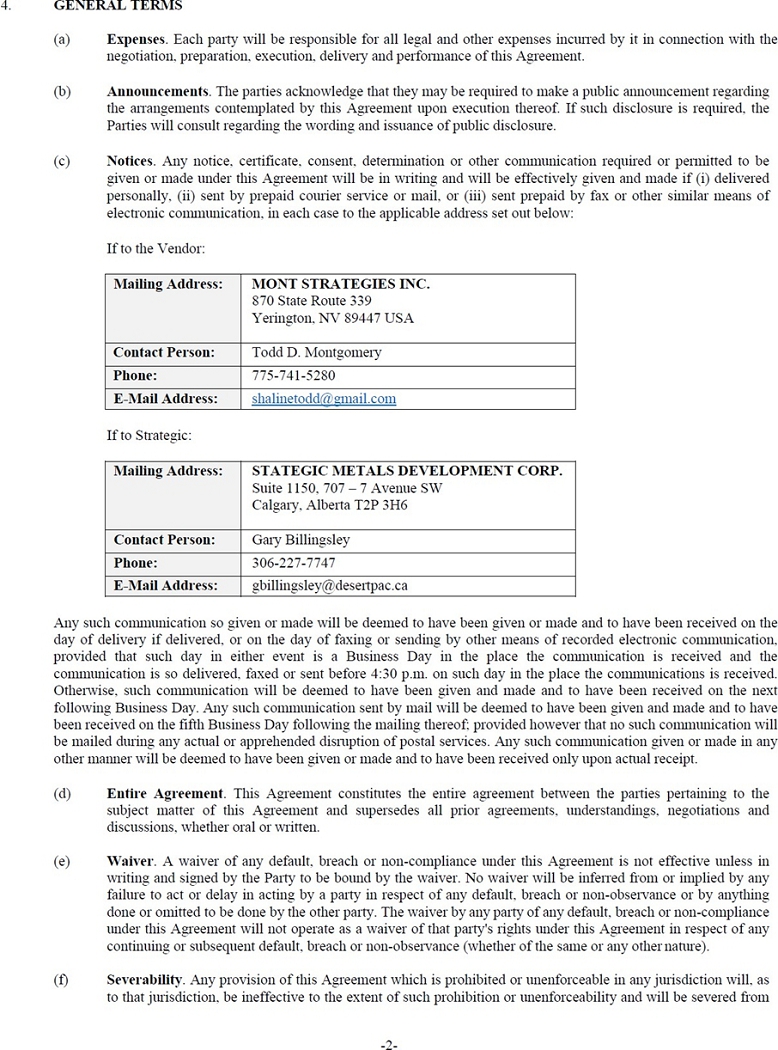

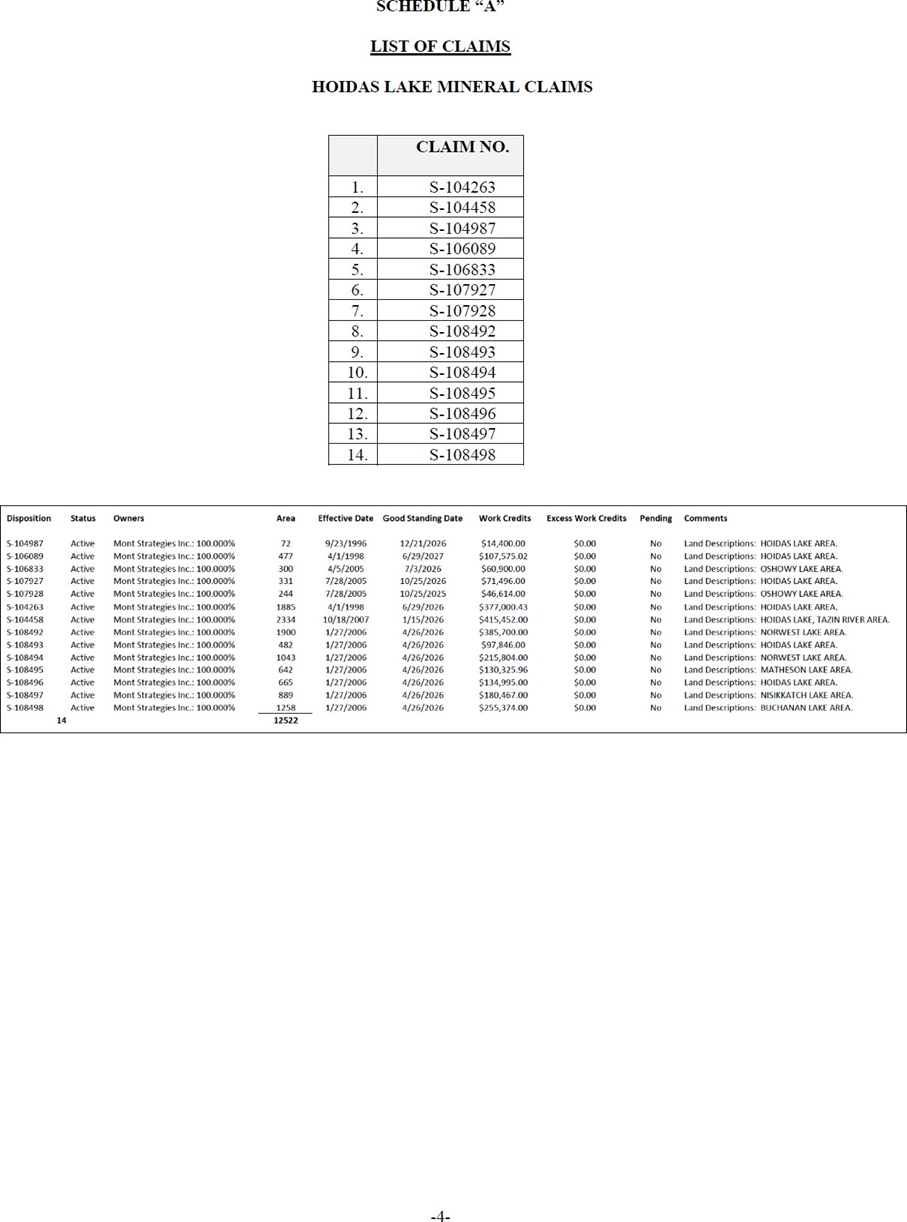

| (b) | the Vendors confirm the Corporation owns 100% of the right, title and interest to Hoidas Lake free and clear of any Liens (as defined below), as provided for in the Conveyance and Bill of Sale dated as of November 1, 2023 (the “Conveyance Agreement”) between the Corporation and Mont Strategies Inc., attached hereto as Schedule “4”. There are no outstanding subscriptions, options, rights, warrants, convertible securities, preemptive rights or other agreements, or understandings with respect to the voting, sale, transfer, rights of first refusal, rights of first offer, proxy or registration or calls, demands or commitments of any kind relating to the issuance, sale or transfer of any shares or other equity securities of the Corporation, whether directly or upon the exercise or conversion of other securities. There are no outstanding contractual obligations of the Corporation or any Vendor to repurchase, redeem or otherwise acquire any shares of their respective capital stock or to provide funds to, or make any investment (in the form of a loan, capital contribution or otherwise) in, any other entity or person. The Corporation does not and has never maintained any stock, partnership, joint venture or any other security or ownership interest in any other entity or person; |

| (c) | each of the Vendors are the sole beneficial and registered owners of the Purchased Shares with good and marketable title thereto, free and clear of any liens, pledges, mortgages, charges, encumbrances or other security interests, adverse claims, preferential arrangement or restriction of any type whatsoever, including without limitation, any voting, transfer, receipt of income or other exercise of any attributes of ownership (collectively, “Liens”). The Purchased Shares represent all the issued and outstanding shares of the Corporation on a fully diluted basis; |

| (d) | this Agreement has been duly executed and delivered by the Vendors and the Corporation and all documents required hereunder to be executed and delivered by the Vendors and the Corporation, and this Agreement does, and such documents and instruments shall, constitute legal, valid and binding obligations of the Vendors and is enforceable in accordance with the terms hereof; |

| (e) | except for the Purchaser’s rights under this Agreement, no person or entity has any written or oral agreement, option, warrant or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming such for the purchase or acquisition from the Vendors or the Corporation of any of the Purchased Shares; |

| (f) | the Corporation is duly organized, validly existing and in good standing under the laws of the Province of Alberta, and has all requisite power to own and operate Hoidas Lake; |

| (g) | the execution and delivery of this Agreement will not (a) violate, conflict with, result in a breach or termination of, constitute a default under or give rise to a right to terminate, amend, cancel or accelerate (or an event which, with notice or lapse of time or both, would constitute the same) (i) any contracts, agreements, commitments, notes, bonds, deeds of trust, indentures, leases, mortgages, arrangements, instruments, documents of any nature or description that the Corporation or any of the Vendors is party to or obligated by (“Contract”) or by which any of its or his respective properties or assets is bound or (ii) any law, order of a governmental body or any other restriction of any kind or character applicable to the Vendors or the Corporation or any of his or its respective properties or assets, or (b) result in the creation or imposition of any Lien upon the Corporation or any property or asset of the Corporation or a Vendor; |

| (h) | no consent, waiver, registration, certificate, approval, grant, franchise, concession, permit, license, exception or authorization of, or declaration or filing with, or notice or report to (a) any governmental body or (b) any other person or entity is required in connection with the execution, delivery and performance of this Agreement; |

| (i) | the Corporation does not have Liabilities; |

| (j) | there is no action, suit, hearing, inquiry, review, proceeding or investigation by or before any court or governmental body pending, or threatened against or involving the Corporation or any Vendor or with respect to the activities of any employee or agent of the Corporation. Neither the Corporation nor a Vendor has received any notice of any event or occurrence which could result in any such action, suit, hearing, inquiry, review, proceeding or investigation; |

| (k) | the Corporation has filed or caused to be filed on a timely basis all tax returns that are or were required to be filed, pursuant to the laws or administrative requirements of each governmental body with taxing power over it. As of the time of filing, all such returns correctly reflected the facts regarding the income, business, assets, operations, activities, status, and other matters of the Corporation and any other information required to be shown thereon. There is no audit, action, suit, claim, proceeding or any investigation or inquiry, whether formal or informal, public or private, now pending or threatened against or with respect to the Corporation in respect of any tax. There are no Encumbrances for taxes upon any of the assets of the Corporation; |

-4-

| (l) | The operations of the Corporation have been conducted in all material respects in accordance with all applicable laws. The Corporation has not have received any notification of any asserted present or past failure to comply with any such laws, and the Corporation is in compliance in all material respects with all limitations, restrictions, conditions, standards, prohibitions, requirements, obligations, schedules and timetables contained in any such laws; |

| (m) | The Corporation holds all licenses, permits, orders, certificates, authorizations or other approvals of governmental bodies required for the operation of Hoidas Lake under all applicable laws. The Corporation is not in violation of any such license. All such licenses are in full force and effect and no suspension or cancellation thereof has been threatened. The only business of the Corporation is Hoidas Lake. The Corporation has good and marketable title to all of its assets, free and clear of all Encumbrances. The Corporation does not own any real property; |

| (n) | The Corporation has no contracts, agreements or arrangements, written or oral, to which the Corporation or its asset is subject other than the Conveyance Agreement, a true, correct and complete copy of which is attached hereto as Schedule 4. The Conveyance Agreement has not been amended or modified and all the obligations of the Corporation pursuant thereto have been satisfied. |

| (o) | The Corporation has no employees. The Corporation has no (i) employee benefit plans and or any other bonus, stock option, stock purchase, restricted stock, incentive, deferred compensation, retiree medical or life insurance, supplemental retirement, severance or other benefit plans, programs or arrangements, and all employment, termination, severance or other contracts or agreements, to which the Corporation has any obligation or which are maintained, contributed to or sponsored by the Corporation for the benefit of any current or former employee, officer or director of the Corporation, (ii) and no contracts, arrangements or understandings between the Corporation and any employee or past employee of the Corporation; and |

| (p) | Neither the Corporation nor any Vendor has, nor have any of their respective affiliates, officers, directors or employees on their behalf, employed any broker or finder or incurred any liability for any brokerage or finder’s fee or commissions or similar payment in connection with this Agreement or the transactions contemplated hereby. |

| 2.2 | Survival of Representations and Warranties |

The representations and warranties set out in Article 2.1 shall survive the closing of the purchase and sale of the Purchased Shares herein provided for, and notwithstanding such closing, shall continue in full force and effect for the benefit of the Purchaser without limitation of time.

| 2.3 | Indemnification |

The Vendors shall indemnify and save harmless the Purchaser for and from any loss, damages or deficiencies suffered by the Purchaser as a result of any breach of representation, warranty or covenant on the part of the Vendors contained in this Agreement.

| 2.4 | No Shop |

From and after the date hereof until terminated in accordance with Article 5 of this Agreement, neither the Corporation nor any Vendors shall directly or indirectly solicit, initiate, encourage or entertain any inquiries or proposals from, discuss or negotiate with, provide any information to or consider the merits of any inquiries or proposals from any person (other than Purchaser) relating to any of the Purchased Shares, any business combination transaction involving the Corporation or any sale or lease of the Conveyance Agreement. The Corporation shall notify the Purchaser of any such inquiry or proposal within twenty-four (24) hours of receipt or awareness of the same by the Corporation or the Vendors.

-5-

ARTICLE 3

REPRESENTATIONS, WARRANTIES AND COVENANTS OF THE PURCHASER

| 3.1 | Representations and Warranties of the Purchaser |

The Purchaser hereby makes the following representations and warranties to the Vendors and acknowledges that the Vendors are relying on such representations and warranties in entering into this Agreement and completing the transactions contemplated herein:

| (a) | the execution and delivery of this Agreement by the Purchaser and the consummation of the transactions contemplated hereby do not constitute a breach of a default under any agreement to which the Purchaser is a party or by which it is bound; |

| (b) | this Agreement has been duly executed and delivered by the Purchaser or its duly appointed power of attorney and representative, and all documents required hereunder to be executed and delivered by the Purchaser shall have been duly executed and delivered by the Purchaser, and this Agreement does, and such documents and instruments shall, constitute legal, valid and binding obligations of the Purchaser and is enforceable in accordance with their respective terms; |

| (c) | the Purchaser is not obligated to obtain the written consent of any person to the transaction contemplated by this Agreement, other than those persons from whom consent has, or prior to the Closing Date, will be obtained; and |

| (d) | the Purchaser has had the opportunity to consult with tax advisors regarding the applicable tax consequences of purchasing the Purchased Shares. |

| 3.2 | Survival of Representations and Warranties |

The representations and warranties set out in Article 3.1 shall survive the closing of the purchase and sale of the Purchased Shares herein provided for, and notwithstanding such closing, shall continue in full force and effect for the benefit of the Vendors without limitation of time.

| 3.3 | Indemnification |

The Purchaser shall indemnify and save harmless the Vendors for and from any loss, damages or deficiencies suffered by the Vendors as a result of any breach of representation, warranty or covenant on the part of the Purchaser contained in this Agreement.

| 3.4 | Positive Covenants |

The Purchaser covenants and agrees with the Vendors as follows:

| (a) | to pay the Purchase Price, in accordance with the terms of this Agreement; |

| (b) | to reserve sufficient number of common shares in the capital of the Purchaser to be issued upon conversion of the Purchase Price Special Warrants; |

| (c) | to cause the Corporation to carry on and continuously conduct its business in a lawful, efficient, diligent and businesslike manner; |

| (d) | to take all reasonable steps and cooperate with the Vendors and the Corporation to amend the structure of the transaction if deemed advisable by the Vendors’ legal counsel to mitigate any tax liability of the Corporation or the Vendors which may arise as a result of payment of the Purchase Price under this Agreement; |

| (e) | to take all reasonable steps to complete the Liquidity Event on or before December 31, 2025; and |

| (f) | in the event that the Purchaser fails to complete the Liquidity Event by March 31, 2026, the Purchaser shall take all necessary corporate steps to issue to the Vendors for no additional consideration that number of voting common shares of the Purchaser such that the Vendors own 75% of the issued and outstanding voting common shares of the Purchaser after giving effect to such issuance. |

-6-

ARTICLE

4

CONDITIONS

| 4.1 | Purchaser’s Conditions |

The obligation of the Purchaser to complete the purchase of the Purchased Shares contemplated herein, is subject to the fulfilment of each of the following conditions precedent, unless waived in writing by the Purchaser.

| (a) | On the First Closing Date, the Vendors shall have executed, delivered and performed all agreements and documents on their part to be performed hereunder; all representations and warranties contained in Article 2.1 shall be true on the First Closing Date, and the Vendors shall deliver certificate(s) executed as of the First Closing Date certifying that all representations and warranties of the Vendors as contained herein are true and correct as of such date, except where a different date is otherwise specified therein, and in such case, at the date specified; |

| (b) | on the First Closing Date, no litigation or proceeding shall be pending or threatened to restrain, set aside or invalidate the transactions contemplated by, or to obtain substantial damages in respect of, this Agreement or the Vendor’s ownership of the Purchased Shares; |

| (c) | the Vendors shall have executed and delivered to the Purchaser all documents as the Purchaser or the Purchaser’s counsel may reasonably request for the purposes of effecting the transfer and delivery of the Purchased Shares in accordance with the terms of this Agreement, including the certificates representing the Purchased Shares, accompanied by stock transfer powers duly executed in blank or duly executed instruments of transfer, and all such other assurances, consents and other documents as the Purchaser may reasonably request to effectively transfer to the Purchaser title to the Purchased Shares free and clear of all Liens; |

| (d) | the shareholders and Board of Directors of the Corporation shall have approved this Agreement; and |

| (e) | there shall have been no material adverse change in the financial condition of the Corporation. |

| 4.2 | Vendors’ Conditions |

The obligation of the Vendors to complete the sale of the Purchased Shares contemplated herein, is subject to the fulfilment of the following conditions precedent, unless waived in writing by the Vendors.

| (a) | On the First Closing Date, the Purchaser shall have executed, delivered and performed all agreements and documents on its part to be performed hereunder; all representations and warranties contained in Article 3.1 shall be true on the First Closing Date, with the same effect as if made on and as of such date and the Purchaser shall deliver a certificate executed as of the First Closing Date certifying that all representations and warranties of the Purchaser as contained herein are true and correct as of such date. The Purchaser shall deliver updated certificates to the Vendors on the Second Closing Date and Third Closing Date; |

| (b) | the Purchaser shall tender the Purchase Price payable by the Purchaser to the Vendors pursuant to Article 1.2 hereof; |

| (c) | the Purchaser shall have executed and delivered to the Corporation all documents as the Vendors or the Vendors’ counsel may reasonably request for the purposes of effecting the payment of the Purchase Price in accordance with the terms of this Agreement; |

| (d) | the shareholders and Board of Directors of the Purchaser shall have approved this Agreement; |

| (e) | there shall have been no material adverse change in the financial condition of the Purchaser, the Purchaser shall have no debt on the First Closing Date, and there shall be no actions, suits or legal proceedings outstanding against the Purchaser on the First Closing Date; and |

| (f) | on the Closing Date, all actions, proceedings, instruments and documents required to implement this Agreement, or instrumental thereto, shall have been approved as to form and legality by the Vendor’s counsel, acting reasonably. |

-7-

ARTICLE 5

TERMINATION

| 5.1 | Termination by Purchaser |

If any of the conditions set forth in Article 4.1 have not been fulfilled or waived at or prior to the First Closing Date or any obligation or covenant of the Vendors to be performed at or prior to the First Closing Date has not been observed or performed by such time, then the Purchaser may, in its sole and unfettered discretion, terminate this Agreement by notice in writing to the Vendors, and in such event the Purchaser shall be released from all obligations hereunder. The Vendors shall only be released from their obligations hereunder if the condition or conditions for the non-performance of which the Purchaser has terminated this Agreement are not reasonably capable of being performed or caused to be performed by the Vendors. If the Purchaser waives compliance with any of the conditions, obligations or covenants contained in this Agreement, then such waiver will be without prejudice to any of its rights of termination in the event of non-fulfilment, non- observance or non-performance of any other condition, obligation, or covenant in whole or in part.

| 5.2 | Termination by Vendors |

If any of the conditions set forth in Section 4.2 have not been fulfilled or waived at or prior to the First Closing Date or any of the cash payment obligations of the Purchaser to be performed on the First Closing Date, Second Closing Date, or Third Closing Date, or any of the defaults described in Schedule 2 to this Agreement, have not been observed or performed by such time, then the Vendors may in their sole and unfettered discretion terminate this Agreement by notice in writing to the Purchaser, and in such event the Vendors shall be released from all obligations hereunder and the Purchaser shall return the portion of the Purchased Shares which have not been paid to the Vendors. The Purchaser shall only be released from its obligations hereunder if the condition or conditions for the non-performance of which the Vendors have terminated this Agreement are not reasonably capable of being performed or caused to be performed by the Purchaser. If the Vendors waive compliance with any of the conditions, obligations or covenants contained in this Agreement, then the waiver will be without prejudice to any of their rights of termination in the event of non-fulfilment, non-observance or non-performance of any other condition, obligation or covenant in whole or in part.

ARTICLE 6

GENERAL

| 6.1 | Governing Law |

This Agreement shall be governed by and construed, interpreted and enforced in accordance with the laws of the Province of Alberta.

| 6.2 | Currency |

Unless otherwise indicated, all references to dollar amounts in this Agreement are expressed in U.S. currency.

| 6.3 | Expenses |

Each of the Vendors and the Purchaser shall be responsible for the expenses (including fees and expenses of legal advisers, accountants and other professional advisers) incurred by either of them, respectively, in connection with the negotiation and settlement of this Agreement and the completion of the transactions contemplated herein.

| 6.4 | Further Assurances |

Each of the parties shall promptly do, make, execute, deliver, or cause to be done, made, executed or delivered, all such further acts, documents and things as the other parties may reasonably require from time to time after closing at the expense of the requesting party for the purpose of giving effect to this Agreement.

| 6.5 | Entire Agreement |

This Agreement constitutes the entire agreement between the parties with respect to the subject matter and supersedes all prior agreements, understandings, negotiations and discussions, whether written or oral.

| 6.6 | Enurement |

This Agreement will enure to the benefit of and be binding upon the respective heirs, executors, administrators, other legal representatives, successors and permitted assigns of the parties hereto.

| 6.7 | Counterparts |

This Agreement may be executed in counterparts and delivered in person or by facsimile or other means of electronic communication producing a printed copy, provided that each such counterpart shall be deemed to be an original and the aggregate of such counterparts shall constitute one and the same instrument and each such counterpart shall, notwithstanding its execution date, be deemed to have been executed on the date of this Agreement.

[REMAINDER OF PAGE INTENTIONALLY BLANK. EXECUTION PAGE FOLLOWS]

-8-

IN WITNESS WHEREOF the parties hereto have executed this Agreement.

PURCHASER

EAGLE RIDGE RESOURCES, INC.

| Per: | ||

| Lipi Sternheim, Chief Executive Officer | ||

| CORPORATION | ||

| STRATEGIC METALS DEVELOPMENT CORP. | ||

| Per: |  |

|

| Todd Montgomery, Chief Executive Officer | ||

VENDORS

|

| |

| Todd Montgomery | Witness Name: | |

| Gary Billingsley | Witness Name: | |

| Mason Douglas | Witness Name: | |

| Jim Engdahl | Witness Name: | |

| Dorthe Holm Andersson | Witness Name: | |

| Jeffrey Scott Evans | Witness Name: | |

| Ivan Young | Witness Name: | |

| David E. T. Pinkman | Witness Name: |

-9-

THIS IS SCHEDULE “1” ATTACHED TO AND MADE PART OF THE SHARE PURCHASE AGREEMENT, DATED THE DAY OF MAY, 2024 AMONG EAGLE RIDGE RESOURCES, INC. (THE “PURCHASER”), STRATEGIC METALS DEVELOPMENT CORP. (THE “CORPORATION”) AND THE SHAREHOLDERS OF THE CORPORATION (THE “VENDORS”).

PURCHASE PRICE SPECIAL WARRANT CERTIFICATE

UNLESS PERMITTED UNDER SECURITIES LEGISLATION, THE HOLDER OF THIS SECURITY MUST NOT TRADE THE SECURITY BEFORE ●.

THE SECURITIES REPRESENTED HEREBY AND THE SECURITIES ISSUABLE UPON EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”) OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THE HOLDER HEREOF, BY PURCHASING SUCH SECURITIES, AGREES FOR THE BENEFIT OF THE COMPANY THAT SUCH SECURITIES MAY BE OFFERED, SOLD OR OTHERWISE TRANSFERRED ONLY (A) TO THE COMPANY; (B) OUTSIDE THE UNITED STATES IN ACCORDANCE WITH RULE 904 OF REGULATION S UNDER THE U.S. SECURITIES ACT; (C) IN ACCORDANCE WITH THE EXEMPTION FROM REGISTRATION UNDER THE U.S. SECURITIES ACT PROVIDED BY RULE 144 OR RULE 144A THEREUNDER, IF AVAILABLE, AND IN COMPLIANCE WITH ANY APPLICABLE STATE SECURITIES LAWS; OR (D) IN A TRANSACTION THAT DOES NOT REQUIRE REGISTRATION UNDER THE U.S. SECURITIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS, AND, IN THE CASE OF PARAGRAPH (C) OR (D), THE SELLER FURNISHES TO THE COMPANY AN OPINION OF COUNSEL OF RECOGNIZED STANDING IN FORM AND SUBSTANCE SATISFACTORY TO THE COMPANY TO SUCH EFFECT.

THESE WARRANTS AND THE SECURITIES DELIVERABLE UPON EXERCISE HEREOF HAVE NOT BEEN REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “U.S. SECURITIES ACT”) OR THE SECURITIES LAWS OF ANY STATE OF THE UNITED STATES. THESE WARRANTS MAY NOT BE EXERCISED BY OR ON BEHALF OF A U.S. PERSON OR A PERSON IN THE UNITED STATES UNLESS THE SHARES ISSUABLE UPON EXERCISE OF THESE WARRANTS HAVE BEEN REGISTERED UNDER THE U.S. SECURITIES ACT AND THE APPLICABLE SECURITIES LEGISLATION OF ANY SUCH STATE OR EXEMPTIONS FROM SUCH REGISTRATION REQUIREMENTS ARE AVAILABLE. “UNITED STATES” AND “U.S. PERSON” ARE AS DEFINED BY REGULATION S UNDER THE U.S. SECURITIES ACT.

THIS SPECIAL WARRANT WILL BE VOID AND OF NO VALUE UNLESS CONVERTED WITHIN THE LIMITS HEREIN PROVIDED.

EAGLE RIDGE RESOURCES, INC.

(a Nevada corporation)

Special Warrant No.: SWC-●

Special Warrant convertible into: ● Common Shares

THIS IS TO CERTIFY THAT, for value received, ● (the “Holder”) is entitled to receive $38,000,000 worth of fully paid and non-assessable Common Shares (the “Warrant Shares”) of Eagle Ridge Resources, Inc. (the “Company”) for no consideration upon satisfaction of the performance milestones described in Schedule “A” attached hereto (the “Performance Milestones”). Subject to satisfying the Performance Milestones, this Special Warrant (hereinafter referred to as the “Warrant”) is automatically convertible into the Warrant Shares in accordance with the Performance Milestones up to the close of business on December 31, 2026 (the “Date of Expiry”) subject, however, to the provisions and upon the terms and conditions hereinafter set forth. Any terms not defined herein shall have the same meaning ascribed thereto in the Share Purchase Agreement to which this Special Warrant is attached as Schedule “1”.

The rights represented by this Warrant may be converted by the Holder, in whole or in part (but not as to a fractional share), by surrender of this Warrant at the office of the Company, located at (or such other address in Canada as the Holder may be notified in writing of by the Company), during its normal business hours, together with the conversion form attached hereto completed and signed by the Holder and the Company. Upon conversion of the rights represented by this Warrant in accordance with the terms hereof, the Warrant Shares for which the Holder has subscribed and converted shall be deemed to have been issued and the Holder shall be deemed to have become the holder of record of such shares on the date of such exercise and payment.

In the event of any conversion of the rights represented by this Warrant, certificates for the Warrant Shares so purchased shall be delivered to the Holder within a reasonable time, not exceeding five business days after the rights represented by this Warrant have been duly converted and, unless this Warrant has expired, a new Warrant representing the number of Warrant Shares, if any, with respect to which this Warrant shall not then have been converted shall also be issued to the Holder within such time.

The Company covenants and agrees that the Warrant Shares which may be issued upon the conversion of the rights represented by this Warrant will, upon issuance, be fully paid and non-assessable and free of all liens, charges and encumbrances.

-10-

THE FOLLOWING ARE THE TERMS AND CONDITIONS REFERRED TO IN THIS WARRANT

| 1. | In case the Company shall at any time subdivide its outstanding Common Shares into a greater number of shares, the number of subdivided Warrant Shares entitled to be purchased proportionately increased, and conversely, in case the outstanding Common Shares of the Company shall be consolidated into a smaller number of shares, the number of consolidated Warrant Shares entitled to be purchased hereunder shall be proportionately decreased. |

In case at any time:

| (a) | the Company shall pay any dividend payable in stock upon its Common Shares or make any distribution to the holders of its Common Shares; |

| (b) | the Company shall offer for subscription pro rata to the holders of its Common Shares any additional shares of stock of any class or other rights; |

| (c) | there shall be a merger, amalgamation or arrangement of the Company with, or sale of all or substantially all of its assets to, another corporation; or |

| (d) | there shall be a voluntary or involuntary dissolution, liquidation or winding-up of the Company; |

then, and in any one or more of such cases, the Company shall give to the Holder of this Warrant at least twenty days’ prior written notice of the date on which the books of the Company shall close or a record shall be taken for such dividend, distribution or subscription rights, or for determining rights to vote with respect to such merger, amalgamation, arrangement, sale, dissolution, liquidation or winding-up and, in the case of any such merger, amalgamation, arrangement, sale, dissolution, liquidation or winding-up, at least twenty days’ prior written notice of the date when the same shall take place. Such notice in accordance with the foregoing clause shall also specify, in the case of any such dividend, distribution or subscription rights, the date on which the holders of Common Shares shall be entitled thereto, and such notice in accordance with the foregoing shall also specify the date on which the holders of Common Shares shall be entitled to exchange their Common Shares for securities or other property deliverable upon such merger, amalgamation, arrangement, sale, dissolution, liquidation or winding-up as the case may be. Each such written notice shall be given by first class mail, registered postage prepaid, addressed to the Holder of this Warrant at the address of such Holder, as shown on the books of the Company.

The Company shall not effect any merger, amalgamation or arrangement unless prior to or simultaneously with the consummation thereof the successor corporation (if other than the Company) resulting from such merger, amalgamation or arrangement assumes by written instrument executed and mailed or delivered to the Holder of this Warrant the obligation to deliver to such Holder such shares of stock or securities or other property (including cash) in accordance with the foregoing provisions as such Holder may be entitled to purchase.

| 2. | As used herein, the term “Common Shares” shall mean and include the Company’s authorized Common Shares as constituted as of the date hereof, and shall also include any capital stock of any class of the Company hereafter authorized which shall not be limited to a fixed sum or percentage in respect of the rights of the holders thereof to participate in dividends and in the distribution of assets upon the voluntary or involuntary liquidation, dissolution or winding-up of the Company. |

| 3. | This Warrant shall not entitle the Holder to any rights as a shareholder of the Company, including without limitation, voting rights. |

-11-

| 4. | The underlying Warrant Shares issuable on conversion of the Special Warrant, shall be set aside and held in reserve by the Company for the sole benefit of the Holder and shall automatically convert with no further action required on the part of the Holder into that number of Warrant Shares calculated by dividing the dollar amount of this Special Warrant by the price of the Liquidity Event. For clarity, if Holder’s dollar value of this Special Warrant is $5,000,000 and the price or deemed price of Liquidity Event is $1.00, then the Special Warrant is automatically convertible into 5,000,000 common shares to be registered to the Holder. |

| 5. | This Warrant is exchangeable upon its surrender by the Holder at the Company’s registered office located at for new Warrants of like tenor representing in the aggregate the right to subscribe for and purchase the number of shares which may be subscribed for and purchased hereunder, each of such new Warrants to represent the right to subscribe for and purchase such number of Warrant Shares as shall be designated by the Holder at the time of such surrender. |

| 6. | Any notice or other communication required to be given by the Company under this Warrant, whether to the Holder or otherwise, shall be given by delivery or facsimile to the address of the Holder set out in the register of holders of Warrants maintained by the Company. Any notice or other communication so given shall be deemed to have been given and received when delivered or when sent by facsimile, and if the date of such delivery or faxing is not a business day, on the next ensuing business day. |

| 7. | Time is of the essence hereof. |

| 8. | This Warrant shall be governed by and construed in accordance with the laws of Nevada applicable therein. |

Eagle Ridge Resources, Inc. intending to be contractually bound, has caused this Warrant to be signed by its duly authorized officer and to be dated ●.

| EAGLE RIDGE RESOURCES, INC. | ||

| By: | ||

| Lipi Sternheim, Chief Executive Officer | ||

This electronically signed Warrant is, and will be, the only existing copy, having the value of an original document guaranteed by the Company and will be treated as such upon the exercise of the holder’s rights therein.

-12-

SCHEDULE “A” SPECIAL WARRANT

SPECIAL WARRANT PERFORMANCE

MILESTONE

TRIGGERING AUTOMATIC CONVERSION INTO WARRANT SHARES

| A. | This Special Warrant shall automatically convert into $38,000,000 worth of the Purchaser’s common shares upon completion by the Purchaser of a listing or merger, reorganization, business combination, share exchange or acquisition by any person or related group of persons of beneficial ownership of all or substantially all of the Purchased Shares in one or more related transactions, or another similar transaction involving the Purchaser, pursuant to which the shareholders of the Purchaser receive cash or the securities of another issuer that are listed on a national securities exchange in the USA, as full or partial consideration for their common shares. |

| B. | All unconverted Special Warrants become null and void if not converted on or before December 31, 2026. |

-13-

THIS IS SCHEDULE “2” ATTACHED TO AND MADE PART OF THE SHARE PURCHASE AGREEMENT, DATED THE DAY OF MAY, 2024 AMONG EAGLE RIDGE RESOURCES, INC. (THE “PURCHASER”), STRATEGIC METALS DEVELOPMENT CORP. (THE “CORPORATION”) AND THE SHAREHOLDERS OF THE CORPORATION (THE “VENDORS”).

PURCHASE PRICE ADJUSTMENT FORMULA

(All terms not expressly defined herein shall have the same meaning ascribed to in the Share Purchase Agreement)

The Purchase Price shall be subject to adjustment as follows:

| (a) | If the Purchaser does not deliver USD$2,750,000 to the Vendors by September 30, 2024 in accordance with Section 1.3 |

| (a) | (ii) of the Agreement (the “Second Cash Payment”), the Purchase Price shall be adjusted as follows: |

| (i) | A 3% (USD $60,000) cash penalty will be added to the Second Cash Payment and shall become payable to the Vendors on or before December 31, 2024; and |

| (ii) | If the Purchaser does not deliver the Second Cash Payment and the 3% penalty noted above by December 31, 2024, then the Agreement shall automatically become null and void ab initio and the Purchased Shares shall be returned to the Vendors, title to the Hoidas Lake property will be returned to the Corporation, and the Purchase Price Special Warrants shall be returned to the Purchaser. |

| (b) | If the Purchaser does not deliver USD $3,750,000 to the Vendors by December 31, 2024 in accordance with Section 1.3 |

| (a) | (iii) of the Agreement (the “Third Cash Payment”), the Purchase Price shall be adjusted as follows: |

| (i) | A 3% (USD $112,500) cash penalty will be added to the Third Cash Payment and shall become payable to the Vendors on or before April 30, 2025; |

| (ii) | In addition to the penalty noted in (b) above, if the Purchaser does not deliver the Third Cash Payment to the Vendors on or before December 31, 2024, then the Purchaser shall pay an additional penalty equal to 32% of the total cash consideration under the Agreement, and USD $2,720,000 will be added to the Third Cash Payment. For clarity, after giving effect to the penalties described under (i) and (ii), the Third Cash Payment shall be an aggregate of USD $3,750,000 + USD $112,500 + USD $2,720,000 (the “Third Cash Penalty Payments”); |

| (iii) | If the Purchase does not deliver the Third Cash Pentalty Payments on or before April 30, 2025, the Purchaser shall pay the Vendors an additional USD $500,000 on or before July 31, 2025 (the “Bonus Payment”); and |

| (iv) | If the Purchaser does not deliver the Third Cash Penalty Payments and Bonus Payment by July 31, 2025, then the Agreement shall automatically become null and void ab initio and the Purchased Shares shall be returned to the Vendors, title to the Hoidas Lake property will be returned to the Corporation, and the Purchase Price Special Warrants shall be returned to the Purchaser. |

-14-

THIS IS SCHEDULE “3” ATTACHED TO AND MADE PART OF THE SHARE PURCHASE AGREEMENT, DATED THE DAY OF MAY, 2024 AMONG EAGLE RIDGE RESOURCES, INC. (THE “PURCHASER”), STRATEGIC METALS DEVELOPMENT CORP. (THE “CORPORATION”) AND THE SHAREHOLDERS OF THE CORPORATION (THE “VENDORS”).

VOLUNTARY ESCROW AGREEMENT

THIS AGREEMENT is dated for reference May , 2024 and made

| AMONG: | HEIGHINGTON LAW |

| (the “Escrow Agent”); | |

| AND: | STRATEGIC METALS DEVELOPMENT CORP. |

| (“Strategic”); | |

| AND: | EAGLE RIDGE RESOURCES, INC. |

| (“Eagle Ridge”); | |

| AND: | each SHAREHOLDER, as defined in this Agreement |

| (collectively the “Parties”). |

WHEREAS:

| a) | The Shareholders (as defined herein) own 100% of the outstanding common shares of Strategic. |

| b) | Strategic and the Shareholders have entered into a Share Purchase Agreement (the “SPA”) dated May , 2024 with Eagle Ridge whereby Strategic will become a wholly owned subsidiary of Eagle Ridge and the Shareholders of Strategic will be issued USD$38,000,000 worth of Eagle Ridge purchase price special warrants (the “Securities”) as partial consideration under the SPA; |

| c) | The Shareholders have agreed to enter into this Voluntary Escrow Agreement relating to their respective Securities of Eagle Ridge held by them upon closing of the transaction contemplated under the SPA; and |

| d) | The Escrow Agent, a law firm in Calgary, Alberta, Canada has agreed to act as Escrow Agent in respect of the holding of the Securities pursuant to the terms hereof. |

NOW THEREFORE in consideration of the covenants contained in this agreement and other good and valuable consideration (the receipt and sufficiency of which is acknowledged), the Parties agree as follows:

| 1. | Interpretation |

In this agreement:

| a) | “Strategic” means Strategic Metals Development Corp. and its successor entities; |

| b) | “Exchange” means any exchange based in the U.S.; |

| c) | “News Release” or “Notice” means the news release or such other notice issued by Eagle Ridge announcing the closing of the transaction under the SPA; |

| d) | “Eagle Ridge” means Eagle Ridge Resources, Inc.; |

| e) | “Shareholder” means a holder of common shares of Strategic who executes this agreement; and |

| f) | “Securities” means the purchase price special warrants (the “Warrants”) of Eagle Ridge issued to the Shareholders upon the closing of the SPA, as described in Schedule “A” to this agreement. The term “Securities” shall also include the underlying common shares of Eagle Ridge issuable to the Shareholders upon satisfaction of the performance milestones described in the Warrants, and any replacement Securities that are issued as a result of any adjustments to the number of Securities issued. |

-15-

| 2. | Placement of Securities in Voluntary Escrow Agreement |

The Shareholder hereby irrevocably directs that the certificates representing the Securities shall be delivered from Eagle Ridge to the Escrow Agent to be held and distributed in accordance with the terms herein.

| 3. | Transfer within Voluntary Escrow Agreement |

| i) | The Shareholders shall not assign, deal in, pledge, sell, trade or transfer in any manner whatsoever, or agree to do so in the future, any of the Securities or any beneficial interest in them, except: |

| a) | a transfer of Securities from the Shareholder to a registered retirement savings plan the sole beneficiary of which is the Shareholder; or |

| b) | with the written consent of the other Shareholders. |

| ii) | Subject to the exceptions set out in section 3(i)(a) and (b) above, the Escrow Agent shall not effect or acknowledge any transfer, trade, pledge, hypothecation, assignment, declaration of trust or any other documents evidencing a change in the legal or beneficial ownership of or interest in the Securities. |

| iii) | Upon the death or bankruptcy of a Shareholder, the Escrow Agent shall hold the Securities subject to this agreement for the person that is legally entitled to become the registered owner of the Securities. |

| iv) | Any transfer is subject to the transferee executing an acknowledgement that such transferee is a party to this Agreement. |

| 4. | Release of Securities from Voluntary Escrow Agreement |

| i) | The Shareholder irrevocably directs the Escrow Agent to retain the Securities until the Securities are released from the pool created hereby pursuant to the terms of subsection 4(ii). |

| ii) | The Escrow Agent shall release the Securities from Escrow on the dates as set out in Schedule “B”. |

| iii) | The release from Escrow of any of the Securities shall terminate this agreement only in respect of the Securities so released. |

| iv) | The Escrow Agent shall deliver the Securities on releases from Escrow to the address below for the respective Shareholders, unless advised otherwise before delivery. |

| 5. | No Surrender for Cancellation |

The Shareholder shall not be required to surrender the Securities for cancellation pursuant to this Agreement.

| 6. | Amendment of Agreement |

| i) | Subject to subsection 6(ii), this agreement may be amended only by a written agreement among the Parties. |

| ii) | Schedule “A” to this agreement shall be deemed to be amended upon |

| a) | a transfer of Securities pursuant to section 4; or |

| b) | a release of Securities from the Voluntary Escrow Agreement pursuant to section 4; | |

| and the Escrow Agent shall note the amendment on the Schedule “A” in its possession. | ||

| 7. | Payment and Indemnification of Escrow Agent |

Eagle Ridge and Strategic hereby agree to pay the Escrow Agent for its reasonable legal fees and disbursements, and hereby agree to release, indemnify and save harmless the Escrow Agent from all costs, charges, claims, demands, damages, losses and expenses resulting from administering this Voluntary Escrow Agreement in good faith and in accordance with this agreement.

| 8. | Resignation of Escrow Agent |

| i) | If the Escrow Agent wishes to resign as Escrow Agent in respect of the Securities, the Escrow Agent shall give notice to Eagle Ridge and Strategic. |

| ii) | If the Eagle Ridge or Strategic wish the Escrow Agent to resign as Escrow Agent in respect of the Securities, Eagle Ridge or Strategic shall give notice to the Escrow Agent. |

-16-

| iii) | A notice referred to in subsections 8(i) or 8(ii) shall be in writing and delivered to the party at the address set out below, and the notice shall be deemed to have been received on the date of delivery. Eagle Ridge or the Escrow Agent may change its address for notice by giving notice to the other party in accordance with this subsection: |

For Escrow Agent:

HEIGHINGTON LAW

Suite 1150, 707 – 7 Avenue SW, Calgary, Alberta T2P 3H6, with a copy to david@hlf.ca.

For Strategic:

STRATEGIC METALS DEVELOPMENT CORP.

Suite 1150, 707 – 7 Avenue SW, Calgary, Alberta T2P 3H6, with a copy to toddshaline@gmail.com.

For Eagle Ridge:

EAGLE RIDGE RESOURCES, INC.

| ● | , with a copy to lipi@qlmcorp.com. |

| iv) | The resignation of the Escrow Agent shall be effective and the Escrow Agent shall cease to be bound by this agreement on the date that is 60 days after the date of receipt of the notice referred to in subsections 8(i) or 8(ii) or on such other date as the Escrow Agent and Eagle Ridge may agree upon (the “Resignation Date”). |

| v) | Eagle Ridge shall, before the resignation date appoint another Escrow Agent and that appointment shall be binding on Eagle Ridge and the Shareholders. |

| 9. | Termination |

The obligations of the Shareholders and the Escrow Agent shall terminate on the earlier of:

| a) | the date upon which all the Securities subject to Escrow have been released in accordance with section 4(2) herein; |

| b) | 10 days after the termination of the SPA; |

| c) | The date when Strategic, Eagle Ridge and the Escrow Agent agree to terminate this Agreement and the Escrow Agent is paid in full. |

| 10. | Further Assurance |

The Parties shall execute and deliver any documents and perform any acts necessary to carry out the intent of this agreement.

| 11. | Time |

Time is of the essence of this agreement.

| 12. | Governing Laws |

This agreement shall be construed in accordance with and governed by the laws of Alberta and the laws of Canada applicable in Alberta.

| 13. | Counterparts |

This agreement may be executed in two or more counterparts, each of which shall be deemed to be an original and all of which shall constitute one agreement.

| 14. | Defined Terms. |

All terms not expressly defined in this Agreement shall have the same meaning as ascribed thereto in the SPA.

| 15. | Language |

Wherever a singular expression is used in this agreement, that expression is deemed to include the plural or the body corporate where required by the context.

| 16. | Enurement |

This agreement enures to the benefit of and is binding on the Parties and their heirs, executors, administrators, successors and permitted assigns.

[EXECUTION PAGES FOLLOW]

-17-

The Parties have executed and delivered this agreement as of the date of reference of this agreement.

| HEIGHINGTON LAW | ||

| Per: | ||

| David D. Heighington, Legal Counsel | ||

| EAGLE RIDGE RESOURCES, INC. | ||

| Per: | ||

| Lipi Sternheim, Chief Executive Officer | ||

| STRATEGIC METALS DEVELOPMENT CORP. | ||

| Per: |  |

|

| Todd Montgomery, Chief Executive Officer | ||

-18-

| SHAREHOLDERS | |||

| SIGNED, SEALED and delivered by Todd Montgomery in the presence of: | |||

| Shaline Montgomery |  | ||

| Witness Name | Todd Montgomery | ||

| 870 State Route 339 Yerington, NV 89447 | 15,960,000 | ||

| Address | Number of Securities | ||

| SUITE 1150, 707 – 7 AVENUE SW | |||

| Student | May 29, 2024 | CALGARY, AB T2P 3H6 | |

| Occupation | Address for Delivery | ||

-19-

| SHAREHOLDERS | ||

| SIGNED, SEALED and delivered by Gary Billingsley in the presence of: | ||

| Witness Name | Gary Billingsley | |

| 8,550,000 | ||

| Address | Number of Securities | |

| SITE 203 COMP 167 RR2 LCD MAIN SASKATOON, SK S7K 3J5 | ||

| Occupation | Address for Delivery | |

-20-

| SHAREHOLDERS | ||

| SIGNED, SEALED and delivered by Mason Douglas in the presence of: | ||

| Witness Name | Mason Douglas | |

| 7,410,000 | ||

| Address | Number of Securities | |

| 535 ATTON LANE SASKATOON, SK S7W 0K6 | ||

| Occupation | Address for Delivery | |

-21-

| SHAREHOLDERS | ||

| SIGNED, SEALED and delivered by Jim Engdahl in the presence of: | ||

| Witness Name | Jim Engdahl | |

| 1,900,000 | ||

| Address | Number of Securities | |

| 29 - 437 PALMER CRESCENT WARMAN, SK S0K 4S1 | ||

| Occupation | Address for Delivery | |

-22-

| SHAREHOLDERS | ||

| SIGNED, SEALED and delivered by Dorthe Holm Andersson in the presence of: | ||

| Witness Name | Dorthe Holm Andersson | |

| 1,900,000 | ||

| Address | Number of Securities | |

| 919 – 7A STREET NW CALGARY, AB T2M 3J4 | ||

| Occupation | Address for Delivery | |

-23-

| SHAREHOLDERS | ||

| SIGNED, SEALED and delivered by Jeffrey Scott Evans in the presence of: |

||

| Witness Name | Jeffrey Scott Evans | |

| 1,140,000 | ||

| Address | Number of Securities | |

| 91 IRON BRIDGE PLACE MOOSE JAW, SK S6H 0B4 | ||

| Occupation | Address for Delivery | |

-24-

| SHAREHOLDERS | ||

| SIGNED, SEALED and delivered by Ivan Young in the presence of: | ||

| Witness Name | Ivan Young | |

| 950,000 | ||

| Address | Number of Securities | |

| PO BOX 1343 ROSTHERN, SK S0K 3R0 | ||

| Occupation | Address for Delivery | |

-25-

| SHAREHOLDERS | ||

| SIGNED, SEALED and delivered by David E. T. Pinkman in the presence of: | ||

| Name | David E. T. Pinkman | |

| 190,000 | ||

| Address | Number of Securities | |

| 211 ALANDALE PLACE SW CALGARY, AB T3Z 3L9 | ||

| Occupation | Address for Delivery | |

-26-

SCHEDULE “A”

PURCHASE PRICE SPECIAL WARRANTS

| Name of Shareholder | Number of Purchase Price Special Warrants to be Issued to Vendors |

|||||

| 1. | TODD MONTGOMERY | 15,960,000 | ||||

| 2. | GARY BILLINGSLEY | 8,550,000 | ||||

| 3. | MASON DOUGLAS | 7,410,000 | ||||

| 4. | JIM ENGDAHL | 1,900,000 | ||||

| 5. | DORTHE HOLM ANDERSSON | 1,900,000 | ||||

| 6. | JEFFREY SCOTT EVANS | 1,140,000 | ||||

| 7. | IVAN YOUNG | 950,000 | ||||

| 8. | DAVID E. T. PINKMAN | 190,000 | ||||

| 38,000,000 | (1) | |||||

Note:

| (1) | Final number of Purchase Price Special Warrants to be issued to the Vendors shall be subject to adjustment based on the price of the Liquidity Event. The figures in the chart are for illustrative purposes only and are based on an arbitrary Liquidity Event price of $1.00. |

-27-

SCHEDULE “B”

The Securities held under this Voluntary Escrow Agreement are to be released as follows:

| Release Dates | Percentage of Securities Released | |||

| 6 months from News Release | 33 | % | ||

| 12 months from News | 33 | % | ||

| 18 months from News Release | 34 | % | ||

-28-

THIS IS SCHEDULE “4” ATTACHED TO AND MADE PART OF THE SHARE PURCHASE AGREEMENT, DATED THE DAY OF MAY, 2024 AMONG EAGLE RIDGE RESOURCES, INC. (THE “PURCHASER”), STRATEGIC METALS DEVELOPMENT CORP. (THE “CORPORATION”) AND THE SHAREHOLDERS OF THE CORPORATION (THE “VENDORS”).