Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Perpetual Americas Funds Trust

|

| Entity Central Index Key |

0001830437

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| C000231392 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

TSW Emerging Markets Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

TSWMX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the TSW Emerging Markets Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

TSW Emerging Markets Fund

(Institutional Shares) |

$49 |

0.99% |

|

| Expenses Paid, Amount |

$ 49

|

| Expense Ratio, Percent |

0.99%

|

| Net Assets |

$ 7,929,501

|

| Holdings Count | Holding |

64

|

| Investment Company Portfolio Turnover |

19.20%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$7,929,501 |

| Total number of portfolio holdings |

64 |

| Portfolio turnover rate as of the end of the reporting period |

19.20% |

|

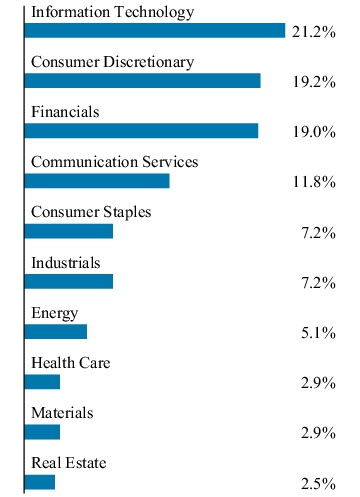

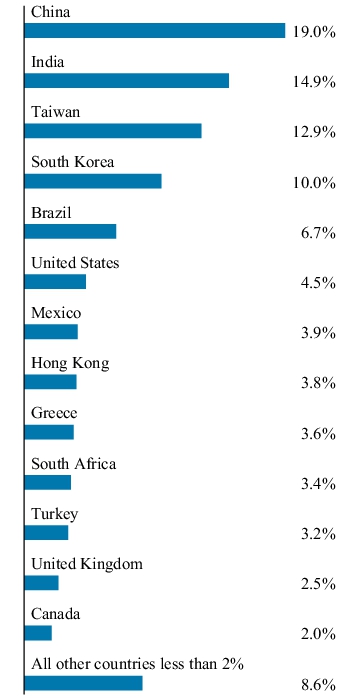

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Taiwan Semiconductor Manufacturing Co. Ltd. |

8.6% |

| Tencent Holdings Ltd. |

5.7% |

| Alibaba Group Holding Ltd. |

4.6% |

| Naspers Ltd. - Class N |

3.4% |

| ICICI Bank Ltd. - ADR |

3.3% |

| Samsung Electronics Co. Ltd. |

3.2% |

| NetEase, Inc. |

3.2% |

| HDFC Bank Ltd. |

2.1% |

| AIA Group Ltd. |

2.1% |

| Fairfax India Holdings Corp. |

2.0% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Taiwan Semiconductor Manufacturing Co. Ltd. |

8.6% |

| Tencent Holdings Ltd. |

5.7% |

| Alibaba Group Holding Ltd. |

4.6% |

| Naspers Ltd. - Class N |

3.4% |

| ICICI Bank Ltd. - ADR |

3.3% |

| Samsung Electronics Co. Ltd. |

3.2% |

| NetEase, Inc. |

3.2% |

| HDFC Bank Ltd. |

2.1% |

| AIA Group Ltd. |

2.1% |

| Fairfax India Holdings Corp. |

2.0% |

|

| C000231395 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

TSW High Yield Bond Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

TSWHX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the TSW High Yield Bond Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

TSW High Yield Bond Fund

(Institutional Shares) |

$33 |

0.65% |

|

| Expenses Paid, Amount |

$ 33

|

| Expense Ratio, Percent |

0.65%

|

| Net Assets |

$ 9,543,942

|

| Holdings Count | Holding |

63

|

| Investment Company Portfolio Turnover |

25.01%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$9,543,942 |

| Total number of portfolio holdings |

63 |

| Portfolio turnover rate as of the end of the reporting period |

25.01% |

|

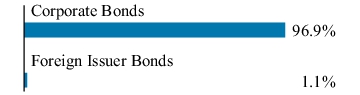

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Fortress Transportation and Infrastructure Investors LLC, 7.00%, 06/15/32 |

3.2% |

| Bath & Body Works, Inc., 6.88%, 11/01/35 |

3.2% |

| Gen Digital, Inc., 6.25%, 04/01/33 |

2.6% |

| Markel Group, Inc., 6.00%, 06/01/25 |

2.6% |

| Iron Mountain, Inc., 6.25%, 01/15/33 |

2.6% |

| StoneX Group, Inc., 7.88%, 03/01/31 |

2.5% |

| JB Poindexter & Co., Inc., 8.75%, 12/15/31 |

2.1% |

| Burford Capital Global Finance LLC, 6.25%, 04/15/28 |

2.1% |

| Installed Building Products, Inc., 5.75%, 02/01/28 |

2.1% |

| Post Holdings, Inc., 6.38%, 03/01/33 |

2.1% |

ASSET TYPE ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Fortress Transportation and Infrastructure Investors LLC, 7.00%, 06/15/32 |

3.2% |

| Bath & Body Works, Inc., 6.88%, 11/01/35 |

3.2% |

| Gen Digital, Inc., 6.25%, 04/01/33 |

2.6% |

| Markel Group, Inc., 6.00%, 06/01/25 |

2.6% |

| Iron Mountain, Inc., 6.25%, 01/15/33 |

2.6% |

| StoneX Group, Inc., 7.88%, 03/01/31 |

2.5% |

| JB Poindexter & Co., Inc., 8.75%, 12/15/31 |

2.1% |

| Burford Capital Global Finance LLC, 6.25%, 04/15/28 |

2.1% |

| Installed Building Products, Inc., 5.75%, 02/01/28 |

2.1% |

| Post Holdings, Inc., 6.38%, 03/01/33 |

2.1% |

|

| C000231400 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

TSW Large Cap Value Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

TSWEX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the TSW Large Cap Value Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

TSW Large Cap Value Fund

(Institutional Shares) |

$37 |

0.73% |

|

| Expenses Paid, Amount |

$ 37

|

| Expense Ratio, Percent |

0.73%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 37,758,677

|

| Holdings Count | Holding |

41

|

| Investment Company Portfolio Turnover |

26.80%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$37,758,677 |

| Total number of portfolio holdings |

41 |

| Portfolio turnover rate as of the end of the reporting period |

26.80% |

|

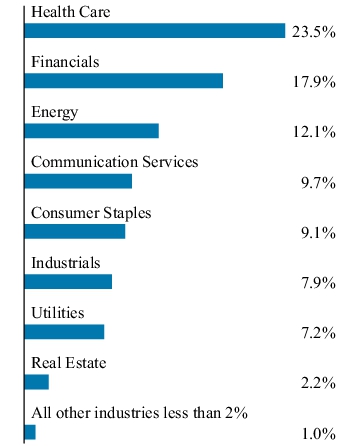

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Anheuser-Busch InBev S.A./N.V. - ADR |

4.7% |

| Kraft Heinz (The) Co. |

4.4% |

| Dominion Energy, Inc. |

4.3% |

| CVS Health Corp. |

3.4% |

| Hess Corp. |

3.4% |

| Liberty Broadband Corp. - Class C |

3.4% |

| McKesson Corp. |

3.2% |

| Bayer A.G. - ADR |

3.2% |

| Evergy, Inc. |

2.9% |

| Kinder Morgan, Inc. |

2.8% |

SECTOR ALLOCATION

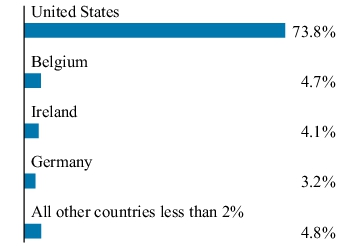

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Anheuser-Busch InBev S.A./N.V. - ADR |

4.7% |

| Kraft Heinz (The) Co. |

4.4% |

| Dominion Energy, Inc. |

4.3% |

| CVS Health Corp. |

3.4% |

| Hess Corp. |

3.4% |

| Liberty Broadband Corp. - Class C |

3.4% |

| McKesson Corp. |

3.2% |

| Bayer A.G. - ADR |

3.2% |

| Evergy, Inc. |

2.9% |

| Kinder Morgan, Inc. |

2.8% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, to comply with recent Securities and Exchange Commission rule amendments relating to a fund's name, the TSW Large Cap Value Fund modified its investment policy as follows:

The Fund invests, under normal circumstances, at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in equity securities of “value companies” with large market capitalizations.

A more detailed explanation of how the Fund defines “value companies” and “large market capitalizations” can be found in the Fund's prospectus. In order to satisfy notice requirements related to an investment policy change, the Fund continued to comply with both its old and new investment policies concurrently through May 1, 2025, after which time only the new investment policy applied.

This is a summary of certain changes to the Fund since September 30, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since September 30, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/JOHCM/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/JOHCM/

|

| C000249810 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

TSW Core Plus Bond Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

TSWFX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the TSW Core Plus Bond Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/JOHCM/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/JOHCM/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

TSW Core Plus Bond Fund

(Institutional Shares) |

$25 |

0.50% |

|

| Expenses Paid, Amount |

$ 25

|

| Expense Ratio, Percent |

0.50%

|

| Net Assets |

$ 67,427,776

|

| Holdings Count | Holding |

121

|

| Investment Company Portfolio Turnover |

13.60%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$67,427,776 |

| Total number of portfolio holdings |

121 |

| Portfolio turnover rate as of the end of the reporting period |

13.60% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| U.S. Treasury Notes, 3.88%, 08/15/34 |

4.7% |

| Fannie Mae Pool #MA5313, 5.50%, 03/01/44 |

4.3% |

| U.S. Treasury Bonds, 4.13%, 08/15/44 |

3.3% |

| U.S. Treasury Notes, 4.13%, 11/15/32 |

3.1% |

| Fannie Mae Pool #MA5498, 6.00%, 10/01/54 |

3.0% |

| U.S. Treasury Notes, 4.00%, 01/15/27 |

2.5% |

| U.S. Treasury Notes, 4.13%, 10/31/31 |

2.4% |

| Freddie Mac Pool #SD8233, 5.00%, 07/01/52 |

2.3% |

| U.S. Treasury Notes, 3.50%, 09/30/26 |

2.2% |

| U.S. Treasury Bonds, 4.25%, 08/15/54 |

2.1% |

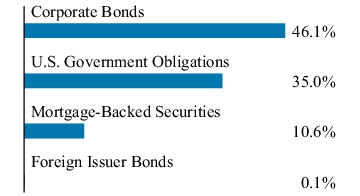

ASSET TYPE ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| U.S. Treasury Notes, 3.88%, 08/15/34 |

4.7% |

| Fannie Mae Pool #MA5313, 5.50%, 03/01/44 |

4.3% |

| U.S. Treasury Bonds, 4.13%, 08/15/44 |

3.3% |

| U.S. Treasury Notes, 4.13%, 11/15/32 |

3.1% |

| Fannie Mae Pool #MA5498, 6.00%, 10/01/54 |

3.0% |

| U.S. Treasury Notes, 4.00%, 01/15/27 |

2.5% |

| U.S. Treasury Notes, 4.13%, 10/31/31 |

2.4% |

| Freddie Mac Pool #SD8233, 5.00%, 07/01/52 |

2.3% |

| U.S. Treasury Notes, 3.50%, 09/30/26 |

2.2% |

| U.S. Treasury Bonds, 4.25%, 08/15/54 |

2.1% |

|