Shareholder Report

|

6 Months Ended |

|

Mar. 31, 2025

USD ($)

Holding

|

|---|

| Shareholder Report [Line Items] |

|

| Document Type |

N-CSRS

|

| Amendment Flag |

false

|

| Registrant Name |

Perpetual Americas Funds Trust

|

| Entity Central Index Key |

0001830437

|

| Entity Investment Company Type |

N-1A

|

| Document Period End Date |

Mar. 31, 2025

|

| C000244332 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Trillium ESG Global Equity Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

PORIX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Trillium ESG Global Equity Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/Trillium/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/Trillium/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Trillium ESG Global Equity Fund

(Institutional Shares) |

$48 |

1.00% |

|

| Expenses Paid, Amount |

$ 48

|

| Expense Ratio, Percent |

1.00%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 772,440,162

|

| Holdings Count | Holding |

87

|

| Investment Company Portfolio Turnover |

16.34%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$772,440,162 |

| Total number of portfolio holdings |

87 |

| Portfolio turnover rate as of the end of the reporting period |

16.34% |

|

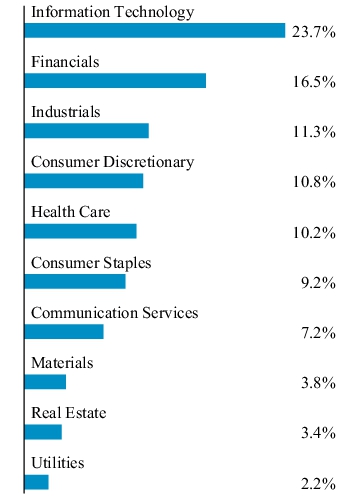

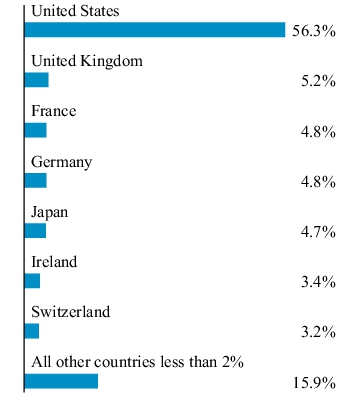

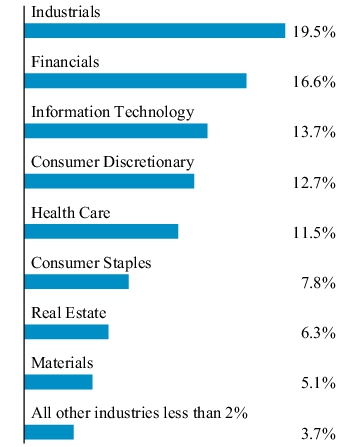

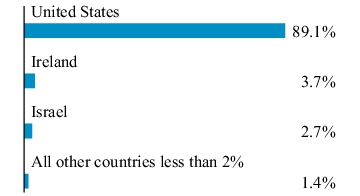

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Microsoft Corp. |

5.0% |

| Alphabet, Inc. - Class A |

4.1% |

| NVIDIA Corp. |

3.8% |

| Apple, Inc. |

3.3% |

| Visa, Inc. - Class A |

2.7% |

| TJX Cos. (The), Inc. |

1.8% |

| Unilever PLC |

1.7% |

| Intercontinental Exchange, Inc. |

1.7% |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR |

1.7% |

| Bank of New York Mellon (The) Corp. |

1.6% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Microsoft Corp. |

5.0% |

| Alphabet, Inc. - Class A |

4.1% |

| NVIDIA Corp. |

3.8% |

| Apple, Inc. |

3.3% |

| Visa, Inc. - Class A |

2.7% |

| TJX Cos. (The), Inc. |

1.8% |

| Unilever PLC |

1.7% |

| Intercontinental Exchange, Inc. |

1.7% |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR |

1.7% |

| Bank of New York Mellon (The) Corp. |

1.6% |

|

| Material Fund Change [Text Block] |

Material Fund Changes Effective February 1, 2025, the Trillium ESG Global Equity Fund modified its investment objective as follows: The Trillium ESG Global Equity Fund seeks long-term capital appreciation by investing in companies that meet Trillium Asset Management, LLC's (“Trillium”) environmental, social, and governance (“ESG”) criteria. The above modification of the investment objective was made to clarify the role of Trillium's ESG criteria in the stock selection process and was not in connection with any change in Trillium's investment process with respect to the Fund. This is a summary of certain changes to the Fund since September 30, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/Trillium/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Objectives [Text Block] |

Effective February 1, 2025, the Trillium ESG Global Equity Fund modified its investment objective as follows: The Trillium ESG Global Equity Fund seeks long-term capital appreciation by investing in companies that meet Trillium Asset Management, LLC's (“Trillium”) environmental, social, and governance (“ESG”) criteria. The above modification of the investment objective was made to clarify the role of Trillium's ESG criteria in the stock selection process and was not in connection with any change in Trillium's investment process with respect to the Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since September 30, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/Trillium/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/Trillium/

|

| C000244333 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Trillium ESG Global Equity Fund

|

| Class Name |

Investor Shares

|

| Trading Symbol |

PORTX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Trillium ESG Global Equity Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/Trillium/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/Trillium/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Trillium ESG Global Equity Fund

(Investor Shares) |

$59 |

1.22% |

|

| Expenses Paid, Amount |

$ 59

|

| Expense Ratio, Percent |

1.22%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 772,440,162

|

| Holdings Count | Holding |

87

|

| Investment Company Portfolio Turnover |

16.34%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$772,440,162 |

| Total number of portfolio holdings |

87 |

| Portfolio turnover rate as of the end of the reporting period |

16.34% |

|

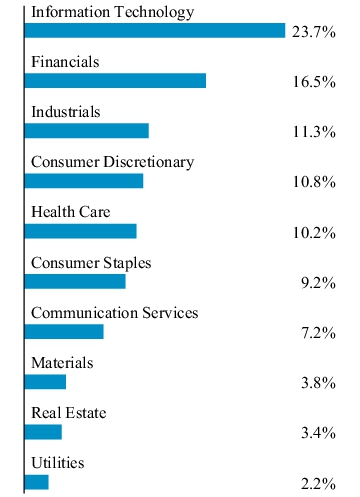

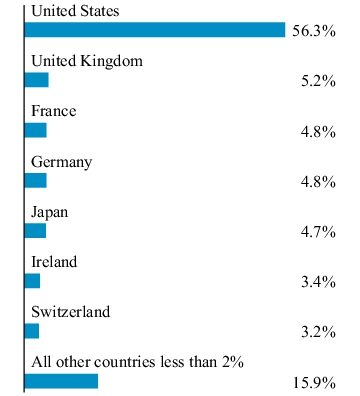

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Microsoft Corp. |

5.0% |

| Alphabet, Inc. - Class A |

4.1% |

| NVIDIA Corp. |

3.8% |

| Apple, Inc. |

3.3% |

| Visa, Inc. - Class A |

2.7% |

| TJX Cos. (The), Inc. |

1.8% |

| Unilever PLC |

1.7% |

| Intercontinental Exchange, Inc. |

1.7% |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR |

1.7% |

| Bank of New York Mellon (The) Corp. |

1.6% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Microsoft Corp. |

5.0% |

| Alphabet, Inc. - Class A |

4.1% |

| NVIDIA Corp. |

3.8% |

| Apple, Inc. |

3.3% |

| Visa, Inc. - Class A |

2.7% |

| TJX Cos. (The), Inc. |

1.8% |

| Unilever PLC |

1.7% |

| Intercontinental Exchange, Inc. |

1.7% |

| Taiwan Semiconductor Manufacturing Co. Ltd. - ADR |

1.7% |

| Bank of New York Mellon (The) Corp. |

1.6% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, the Trillium ESG Global Equity Fund modified its investment objective as follows:

The Trillium ESG Global Equity Fund seeks long-term capital appreciation by investing in companies that meet Trillium Asset Management, LLC's (“Trillium”) environmental, social, and governance (“ESG”) criteria.

The above modification of the investment objective was made to clarify the role of Trillium's ESG criteria in the stock selection process and was not in connection with any change in Trillium's investment process with respect to the Fund.

This is a summary of certain changes to the Fund since September 30, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/Trillium/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Objectives [Text Block] |

Effective February 1, 2025, the Trillium ESG Global Equity Fund modified its investment objective as follows:

The Trillium ESG Global Equity Fund seeks long-term capital appreciation by investing in companies that meet Trillium Asset Management, LLC's (“Trillium”) environmental, social, and governance (“ESG”) criteria.

The above modification of the investment objective was made to clarify the role of Trillium's ESG criteria in the stock selection process and was not in connection with any change in Trillium's investment process with respect to the Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since September 30, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/Trillium/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/Trillium/

|

| C000244336 [Member] |

|

| Shareholder Report [Line Items] |

|

| Fund Name |

Trillium ESG Small/Mid Cap Fund

|

| Class Name |

Institutional Shares

|

| Trading Symbol |

TSMDX

|

| Annual or Semi-Annual Statement [Text Block] |

This semi-annual shareholder report contains important information about the Trillium ESG Small/Mid Cap Fund (the “Fund”) for the period of October 1, 2024 to March 31, 2025.

|

| Shareholder Report Annual or Semi-Annual |

semi-annual shareholder report

|

| Additional Information [Text Block] |

You can find additional information about the Fund at connect.rightprospectus.com/Trillium/. You can also request this information by contacting us at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Notice [Text Block] |

This report describes changes to the Fund that occurred during the reporting period.

|

| Additional Information Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Additional Information Website |

connect.rightprospectus.com/Trillium/

|

| Expenses [Text Block] |

Fund Expenses for the Last Six Months

(Based on a hypothetical $10,000 investment)

| Fund (Class) |

Cost of a $10,000 investment |

Costs paid as a percentage of a $10,000 investment |

Trillium ESG Small/Mid Cap Fund

(Institutional Shares) |

$47 |

0.97% |

|

| Expenses Paid, Amount |

$ 47

|

| Expense Ratio, Percent |

0.97%

|

| Material Change Date |

Feb. 01, 2025

|

| Net Assets |

$ 31,856,086

|

| Holdings Count | Holding |

67

|

| Investment Company Portfolio Turnover |

11.71%

|

| Additional Fund Statistics [Text Block] |

Key Fund Statistics

The following table outlines key fund statistics that you should pay attention to.

| Fund net assets |

$31,856,086 |

| Total number of portfolio holdings |

67 |

| Portfolio turnover rate as of the end of the reporting period |

11.71% |

|

| Holdings [Text Block] |

Graphical Representation of Holdings

The tables below show the investment makeup of the Fund, excluding short-term investments, represented as a percentage of the total net assets of the Fund.

TOP TEN HOLDINGS

| Merit Medical Systems, Inc. |

2.9% |

| CyberArk Software Ltd. |

2.7% |

| East West Bancorp, Inc. |

2.4% |

| Burlington Stores, Inc. |

2.4% |

| BJ's Wholesale Club Holdings, Inc. |

2.2% |

| Jack Henry & Associates, Inc. |

2.2% |

| Hanover Insurance Group (The), Inc. |

2.1% |

| Paylocity Holding Corp. |

2.1% |

| MYR Group, Inc. |

2.1% |

| Lincoln Electric Holdings, Inc. |

2.1% |

SECTOR ALLOCATION

GEOGRAPHICAL ALLOCATION

|

| Largest Holdings [Text Block] |

TOP TEN HOLDINGS

| Merit Medical Systems, Inc. |

2.9% |

| CyberArk Software Ltd. |

2.7% |

| East West Bancorp, Inc. |

2.4% |

| Burlington Stores, Inc. |

2.4% |

| BJ's Wholesale Club Holdings, Inc. |

2.2% |

| Jack Henry & Associates, Inc. |

2.2% |

| Hanover Insurance Group (The), Inc. |

2.1% |

| Paylocity Holding Corp. |

2.1% |

| MYR Group, Inc. |

2.1% |

| Lincoln Electric Holdings, Inc. |

2.1% |

|

| Material Fund Change [Text Block] |

Material Fund Changes

Effective February 1, 2025, the Trillium ESG Small/Mid Cap Fund modified its investment objective as follows:

The Trillium ESG Small/Mid Cap Fund seeks long-term capital appreciation by investing in companies that meet Trillium Asset Management, LLC's (“Trillium”) environmental, social, and governance (“ESG”) criteria.

The above modification of the investment objective was made to clarify the role of Trillium's ESG criteria in the stock selection process and was not in connection with any change in Trillium's investment process with respect to the Fund.

This is a summary of certain changes to the Fund since September 30, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/Trillium/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Material Fund Change Objectives [Text Block] |

Effective February 1, 2025, the Trillium ESG Small/Mid Cap Fund modified its investment objective as follows:

The Trillium ESG Small/Mid Cap Fund seeks long-term capital appreciation by investing in companies that meet Trillium Asset Management, LLC's (“Trillium”) environmental, social, and governance (“ESG”) criteria.

The above modification of the investment objective was made to clarify the role of Trillium's ESG criteria in the stock selection process and was not in connection with any change in Trillium's investment process with respect to the Fund.

|

| Summary of Change Legend [Text Block] |

This is a summary of certain changes to the Fund since September 30, 2024. For more complete information, you may review the Fund's prospectus dated February 1, 2025, at connect.rightprospectus.com/Trillium/ or upon request at 866-260-9549 (toll free) or 312-557-5913.

|

| Updated Prospectus Phone Number |

866-260-9549 (toll free) or 312-557-5913

|

| Updated Prospectus Web Address |

connect.rightprospectus.com/Trillium/

|